Analysis of Gross Savings (% of GNI) in Hungary and Morocco vs. World

VerifiedAdded on 2023/05/30

|25

|5304

|494

Report

AI Summary

This report provides a comparative analysis of gross savings as a percentage of Gross National Income (GNI) for Hungary and Morocco in 2013, benchmarked against global averages. The study utilizes descriptive statistics to analyze the distribution of gross savings across countries, revealing that most nations had savings rates below 20% of their GNI. It highlights that both Hungary and Morocco exhibited gross savings rates higher than the global average, with Morocco having a slightly higher rate than Hungary. The report concludes that while both countries performed well in terms of gross savings, sustainable national reserve funds depend on the rate of return on domestic investment relative to external debt, emphasizing the importance of balancing savings with investment opportunities.

Gross savings (% GNI)

Student’s full name:

Student’s programme:

Module:

Academic Year / Semester: 2014/2015 Autumn/Spring

Word Count1:

Seminar leader:

Due Date:

1 Excluding the cover page, table of contents, and references.

Student’s full name:

Student’s programme:

Module:

Academic Year / Semester: 2014/2015 Autumn/Spring

Word Count1:

Seminar leader:

Due Date:

1 Excluding the cover page, table of contents, and references.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Student’s Surname, First name Name of module

Table of Contents

Introduction....................................................................................................................................................... 3

Comparison of gross savings....................................................................................................................... 5

Descriptive statistics...................................................................................................................................... 5

Comparison between gross savings for Morocco and the world.................................................5

Comparison between gross savings for Hungary and the world.................................................6

Comparison between gross savings for Hungary and Morocco....................................................6

Conclusions........................................................................................................................................................ 6

References.......................................................................................................................................................... 7

Appendix 1.......................................................................................................................................................... 8

2

Table of Contents

Introduction....................................................................................................................................................... 3

Comparison of gross savings....................................................................................................................... 5

Descriptive statistics...................................................................................................................................... 5

Comparison between gross savings for Morocco and the world.................................................5

Comparison between gross savings for Hungary and the world.................................................6

Comparison between gross savings for Hungary and Morocco....................................................6

Conclusions........................................................................................................................................................ 6

References.......................................................................................................................................................... 7

Appendix 1.......................................................................................................................................................... 8

2

Student’s Surname, First name Name of module

Introduction

The gross national income (GNI) alludes to the aggregate local and outside yield guaranteed

by inhabitants of a nation (Omondi-Ochieng, 2015)which is calculated as;

GNI=Gross Domestic Product (GDP)+factor salaries earned by outside inhabitants –

salary earned ∈the nation by nonnatives

As opposed to the Gross Domestic Product which just estimates the income of people inside a

specific nation, Gross National Income estimates all the pay of a nation's occupants and

organizations, paying little respect to where it is created (Victor Levin, 2012).

As opposed to the GDP, GNI gives a decent gauge of a nation's national earnings (Naizhuo

Zhao, 2011). In many developing markets, inhabitants move to different nations where they

can procure a superior living. They send loads of cash back to their families in their home

district. This income is sufficient to drive financial development. It's tallied in Gross National

Income (GNI) and Gross National Product (GNP), however not in Gross Domestic Product

(GDP). Subsequently, correlations of GDP by nation will downplay the measure of these

nations' economies (COLEMAN, 2008).

The World Bank gives GNI information to all nations. To think about income between

countries, it expels the impacts of money trade rates (Hodges, 2014). For most countries there

is little distinction among GDP and GNI, since the contrast between income gotten by the

nation versus income made from other parts of the world tends not to be noteworthy

(Chukwu, 2010). For example, the U.S's. GNI was just about 1.5% higher than its GDP in

2011, as indicated by the World Bank.

For a few nations, in any case, the thing that matters is huge: GNI can be a lot higher than

GDP if a nation gets a lot of remote assistance, just like the case with East Timor. It very well

3

Introduction

The gross national income (GNI) alludes to the aggregate local and outside yield guaranteed

by inhabitants of a nation (Omondi-Ochieng, 2015)which is calculated as;

GNI=Gross Domestic Product (GDP)+factor salaries earned by outside inhabitants –

salary earned ∈the nation by nonnatives

As opposed to the Gross Domestic Product which just estimates the income of people inside a

specific nation, Gross National Income estimates all the pay of a nation's occupants and

organizations, paying little respect to where it is created (Victor Levin, 2012).

As opposed to the GDP, GNI gives a decent gauge of a nation's national earnings (Naizhuo

Zhao, 2011). In many developing markets, inhabitants move to different nations where they

can procure a superior living. They send loads of cash back to their families in their home

district. This income is sufficient to drive financial development. It's tallied in Gross National

Income (GNI) and Gross National Product (GNP), however not in Gross Domestic Product

(GDP). Subsequently, correlations of GDP by nation will downplay the measure of these

nations' economies (COLEMAN, 2008).

The World Bank gives GNI information to all nations. To think about income between

countries, it expels the impacts of money trade rates (Hodges, 2014). For most countries there

is little distinction among GDP and GNI, since the contrast between income gotten by the

nation versus income made from other parts of the world tends not to be noteworthy

(Chukwu, 2010). For example, the U.S's. GNI was just about 1.5% higher than its GDP in

2011, as indicated by the World Bank.

For a few nations, in any case, the thing that matters is huge: GNI can be a lot higher than

GDP if a nation gets a lot of remote assistance, just like the case with East Timor. It very well

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Student’s Surname, First name Name of module

may be much lower if outsiders control a vast extent of a nation's creation, just like the case

with Ireland, a low-impose ward where the European backups of a few global organizations

(ostensibly) are domiciled.

Estimating GNI per capita might be the most ideal approach to think about GNI between nations. This

technique calls for partitioning a nation's monetary yield by its populace (Cebula, 2014).

GNI per capita is an estimation of income partitioned by the quantity of individuals in the nation. It

contrasts the GNI of nations and distinctive populace sizes and ways of life.

The World Bank gives this information too. For this situation, it changes over income to U.S. dollars

utilizing the official conversion standard. It at that point applies the Atlas transformation strategy to

smooth out swapping scale unpredictability. It then partitions the GNI by the nation's populace to get

GNI per capita. This is done utilizing the nation's information from the center of the year to eliminate

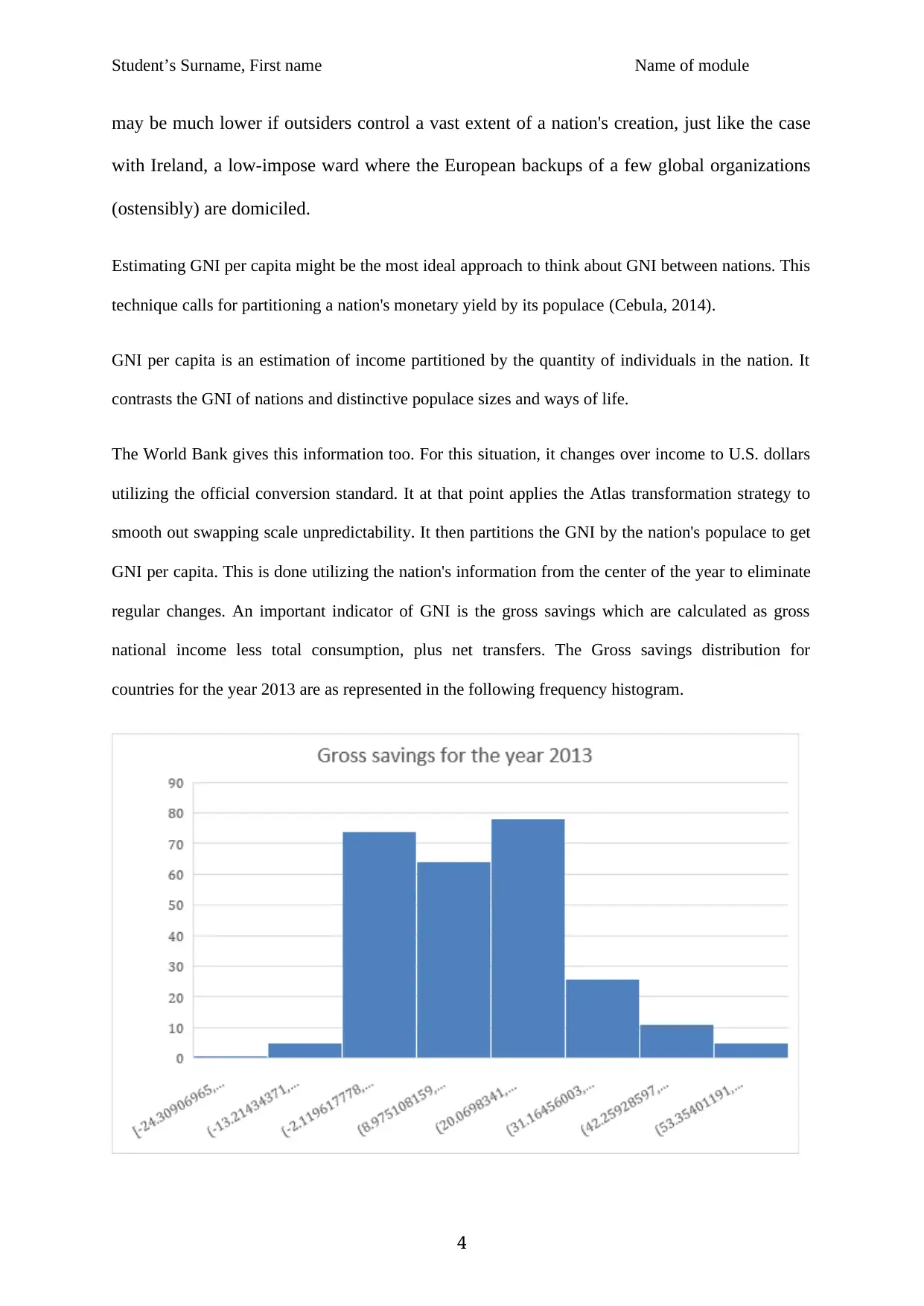

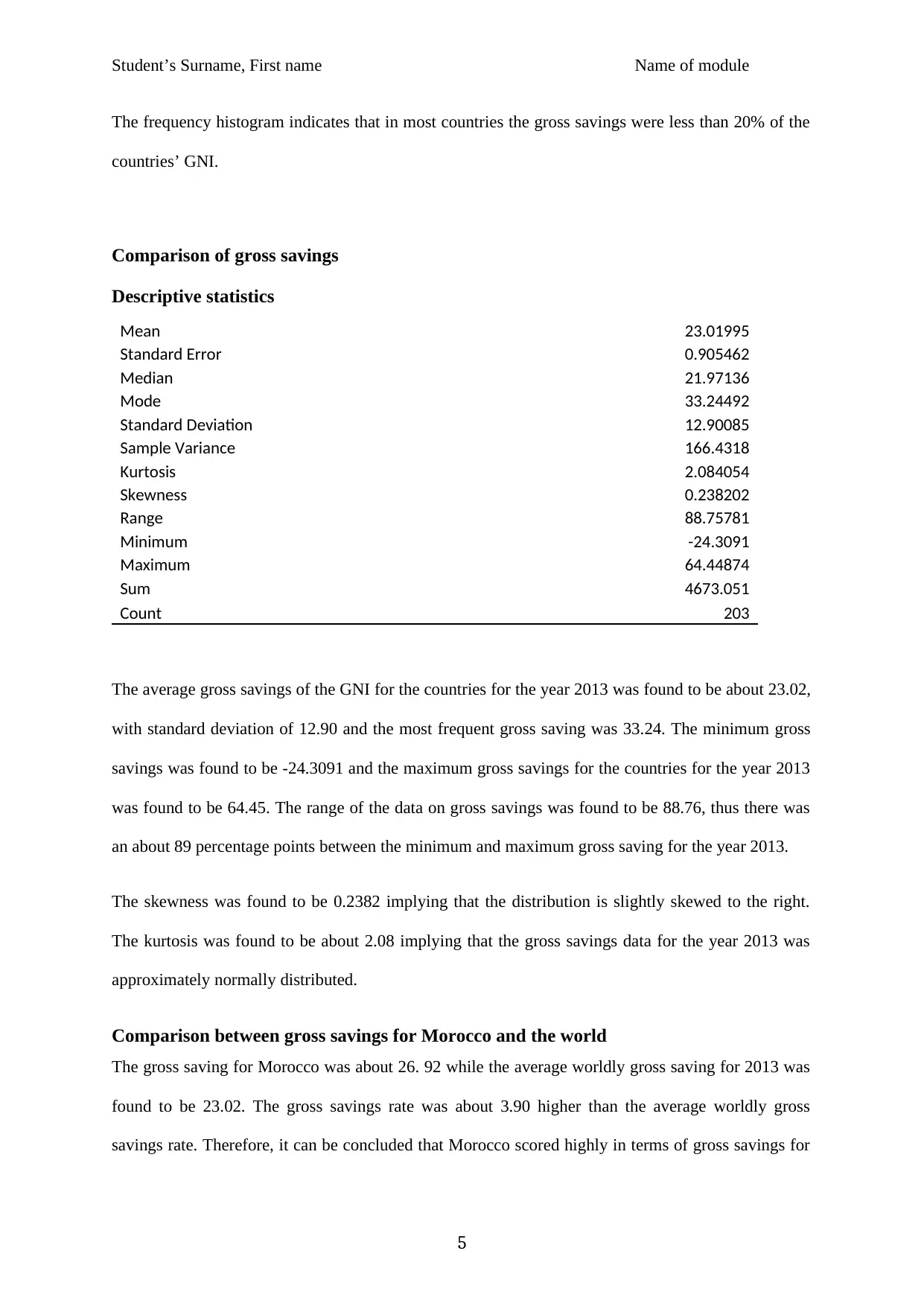

regular changes. An important indicator of GNI is the gross savings which are calculated as gross

national income less total consumption, plus net transfers. The Gross savings distribution for

countries for the year 2013 are as represented in the following frequency histogram.

4

may be much lower if outsiders control a vast extent of a nation's creation, just like the case

with Ireland, a low-impose ward where the European backups of a few global organizations

(ostensibly) are domiciled.

Estimating GNI per capita might be the most ideal approach to think about GNI between nations. This

technique calls for partitioning a nation's monetary yield by its populace (Cebula, 2014).

GNI per capita is an estimation of income partitioned by the quantity of individuals in the nation. It

contrasts the GNI of nations and distinctive populace sizes and ways of life.

The World Bank gives this information too. For this situation, it changes over income to U.S. dollars

utilizing the official conversion standard. It at that point applies the Atlas transformation strategy to

smooth out swapping scale unpredictability. It then partitions the GNI by the nation's populace to get

GNI per capita. This is done utilizing the nation's information from the center of the year to eliminate

regular changes. An important indicator of GNI is the gross savings which are calculated as gross

national income less total consumption, plus net transfers. The Gross savings distribution for

countries for the year 2013 are as represented in the following frequency histogram.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Student’s Surname, First name Name of module

The frequency histogram indicates that in most countries the gross savings were less than 20% of the

countries’ GNI.

Comparison of gross savings

Descriptive statistics

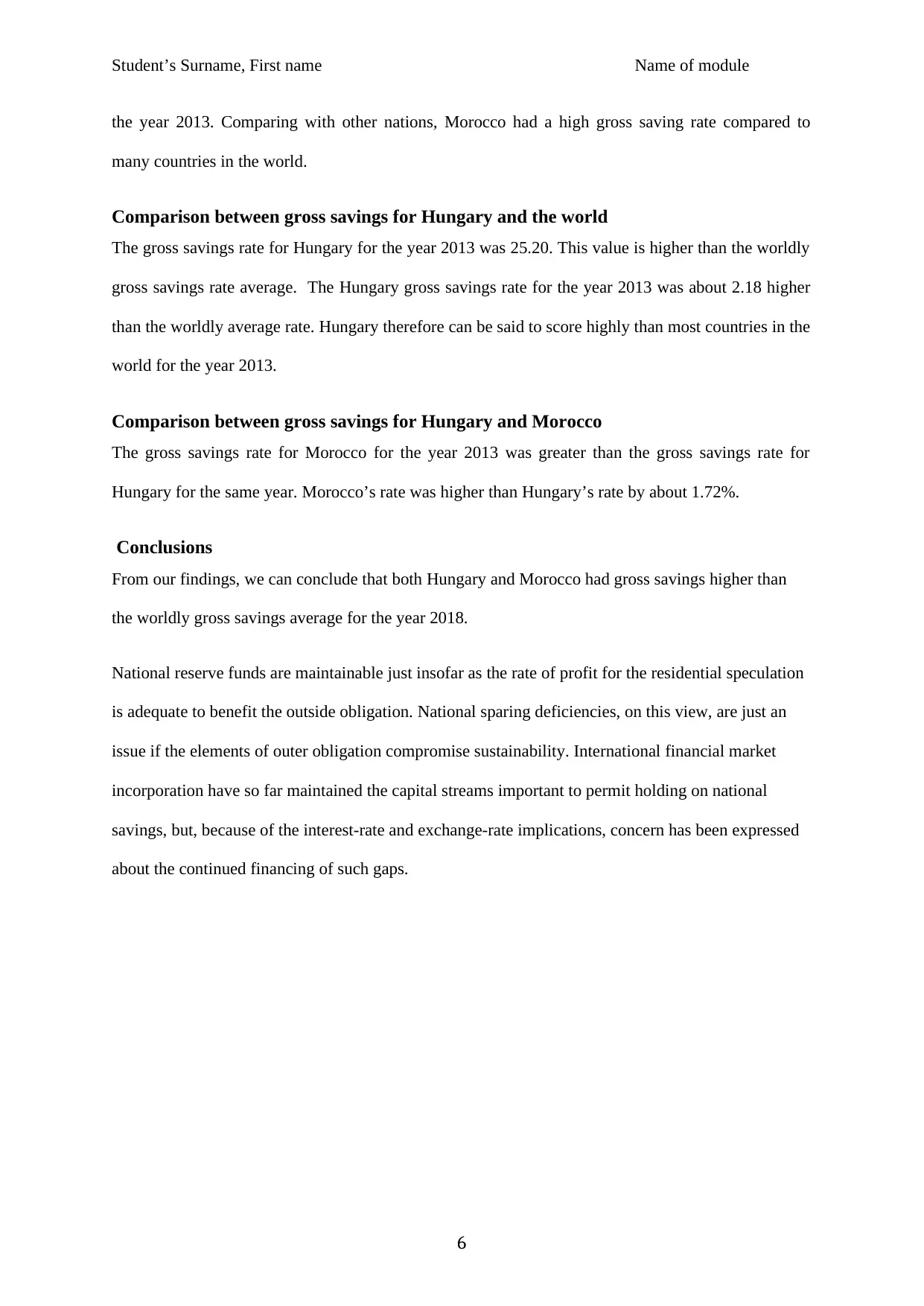

Mean 23.01995

Standard Error 0.905462

Median 21.97136

Mode 33.24492

Standard Deviation 12.90085

Sample Variance 166.4318

Kurtosis 2.084054

Skewness 0.238202

Range 88.75781

Minimum -24.3091

Maximum 64.44874

Sum 4673.051

Count 203

The average gross savings of the GNI for the countries for the year 2013 was found to be about 23.02,

with standard deviation of 12.90 and the most frequent gross saving was 33.24. The minimum gross

savings was found to be -24.3091 and the maximum gross savings for the countries for the year 2013

was found to be 64.45. The range of the data on gross savings was found to be 88.76, thus there was

an about 89 percentage points between the minimum and maximum gross saving for the year 2013.

The skewness was found to be 0.2382 implying that the distribution is slightly skewed to the right.

The kurtosis was found to be about 2.08 implying that the gross savings data for the year 2013 was

approximately normally distributed.

Comparison between gross savings for Morocco and the world

The gross saving for Morocco was about 26. 92 while the average worldly gross saving for 2013 was

found to be 23.02. The gross savings rate was about 3.90 higher than the average worldly gross

savings rate. Therefore, it can be concluded that Morocco scored highly in terms of gross savings for

5

The frequency histogram indicates that in most countries the gross savings were less than 20% of the

countries’ GNI.

Comparison of gross savings

Descriptive statistics

Mean 23.01995

Standard Error 0.905462

Median 21.97136

Mode 33.24492

Standard Deviation 12.90085

Sample Variance 166.4318

Kurtosis 2.084054

Skewness 0.238202

Range 88.75781

Minimum -24.3091

Maximum 64.44874

Sum 4673.051

Count 203

The average gross savings of the GNI for the countries for the year 2013 was found to be about 23.02,

with standard deviation of 12.90 and the most frequent gross saving was 33.24. The minimum gross

savings was found to be -24.3091 and the maximum gross savings for the countries for the year 2013

was found to be 64.45. The range of the data on gross savings was found to be 88.76, thus there was

an about 89 percentage points between the minimum and maximum gross saving for the year 2013.

The skewness was found to be 0.2382 implying that the distribution is slightly skewed to the right.

The kurtosis was found to be about 2.08 implying that the gross savings data for the year 2013 was

approximately normally distributed.

Comparison between gross savings for Morocco and the world

The gross saving for Morocco was about 26. 92 while the average worldly gross saving for 2013 was

found to be 23.02. The gross savings rate was about 3.90 higher than the average worldly gross

savings rate. Therefore, it can be concluded that Morocco scored highly in terms of gross savings for

5

Student’s Surname, First name Name of module

the year 2013. Comparing with other nations, Morocco had a high gross saving rate compared to

many countries in the world.

Comparison between gross savings for Hungary and the world

The gross savings rate for Hungary for the year 2013 was 25.20. This value is higher than the worldly

gross savings rate average. The Hungary gross savings rate for the year 2013 was about 2.18 higher

than the worldly average rate. Hungary therefore can be said to score highly than most countries in the

world for the year 2013.

Comparison between gross savings for Hungary and Morocco

The gross savings rate for Morocco for the year 2013 was greater than the gross savings rate for

Hungary for the same year. Morocco’s rate was higher than Hungary’s rate by about 1.72%.

Conclusions

From our findings, we can conclude that both Hungary and Morocco had gross savings higher than

the worldly gross savings average for the year 2018.

National reserve funds are maintainable just insofar as the rate of profit for the residential speculation

is adequate to benefit the outside obligation. National sparing deficiencies, on this view, are just an

issue if the elements of outer obligation compromise sustainability. International financial market

incorporation have so far maintained the capital streams important to permit holding on national

savings, but, because of the interest-rate and exchange-rate implications, concern has been expressed

about the continued financing of such gaps.

6

the year 2013. Comparing with other nations, Morocco had a high gross saving rate compared to

many countries in the world.

Comparison between gross savings for Hungary and the world

The gross savings rate for Hungary for the year 2013 was 25.20. This value is higher than the worldly

gross savings rate average. The Hungary gross savings rate for the year 2013 was about 2.18 higher

than the worldly average rate. Hungary therefore can be said to score highly than most countries in the

world for the year 2013.

Comparison between gross savings for Hungary and Morocco

The gross savings rate for Morocco for the year 2013 was greater than the gross savings rate for

Hungary for the same year. Morocco’s rate was higher than Hungary’s rate by about 1.72%.

Conclusions

From our findings, we can conclude that both Hungary and Morocco had gross savings higher than

the worldly gross savings average for the year 2018.

National reserve funds are maintainable just insofar as the rate of profit for the residential speculation

is adequate to benefit the outside obligation. National sparing deficiencies, on this view, are just an

issue if the elements of outer obligation compromise sustainability. International financial market

incorporation have so far maintained the capital streams important to permit holding on national

savings, but, because of the interest-rate and exchange-rate implications, concern has been expressed

about the continued financing of such gaps.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Student’s Surname, First name Name of module

References

Cebula, R. J. C. J. R., 2014. The effects of economic freedom, regulatory quality

and taxation on the level of per capita real income: a preliminary analysis for

OECD nations and non-G8 OECD nation. Applied Economics, p. 6.

Chukwu, E., 2010. Cooperation and competition in modeling the dynamics of

gross-domestic products of nations. p. 11.

COLEMAN, D. W., 2008. GAUGING ECONOMIC PERFORMANCE UNDER CHANGING

TERMS OF TRADE: REAL GROSS DOMESTIC INCOME OR REAL GROSS DOMESTIC

PRODUCT?. p. 14.

Hodges, J. E. N. V. R. H. C. R. M. M. T. P. O. R., 2014. Combining high-resolution

gross domestic product data with home and personal care product market

research data to generate a subnational emission inventory for Asia. Integrated

Environmental Assessment and Management, p. 10.

Naizhuo Zhao, N. C. E. S., 2011. Net primary production and gross domestic

product in China derived from satellite imagery. p. 8.

Omondi-Ochieng, P., 2015. Gross national income, football workers and national

football team performances. Team Performance Management: An International

Journal, p. 13.

Victor Levin, H. T., 2012. Gross national income per capita as a significant factor.

p. 2.

7

References

Cebula, R. J. C. J. R., 2014. The effects of economic freedom, regulatory quality

and taxation on the level of per capita real income: a preliminary analysis for

OECD nations and non-G8 OECD nation. Applied Economics, p. 6.

Chukwu, E., 2010. Cooperation and competition in modeling the dynamics of

gross-domestic products of nations. p. 11.

COLEMAN, D. W., 2008. GAUGING ECONOMIC PERFORMANCE UNDER CHANGING

TERMS OF TRADE: REAL GROSS DOMESTIC INCOME OR REAL GROSS DOMESTIC

PRODUCT?. p. 14.

Hodges, J. E. N. V. R. H. C. R. M. M. T. P. O. R., 2014. Combining high-resolution

gross domestic product data with home and personal care product market

research data to generate a subnational emission inventory for Asia. Integrated

Environmental Assessment and Management, p. 10.

Naizhuo Zhao, N. C. E. S., 2011. Net primary production and gross domestic

product in China derived from satellite imagery. p. 8.

Omondi-Ochieng, P., 2015. Gross national income, football workers and national

football team performances. Team Performance Management: An International

Journal, p. 13.

Victor Levin, H. T., 2012. Gross national income per capita as a significant factor.

p. 2.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Student’s Surname, First name Name of module

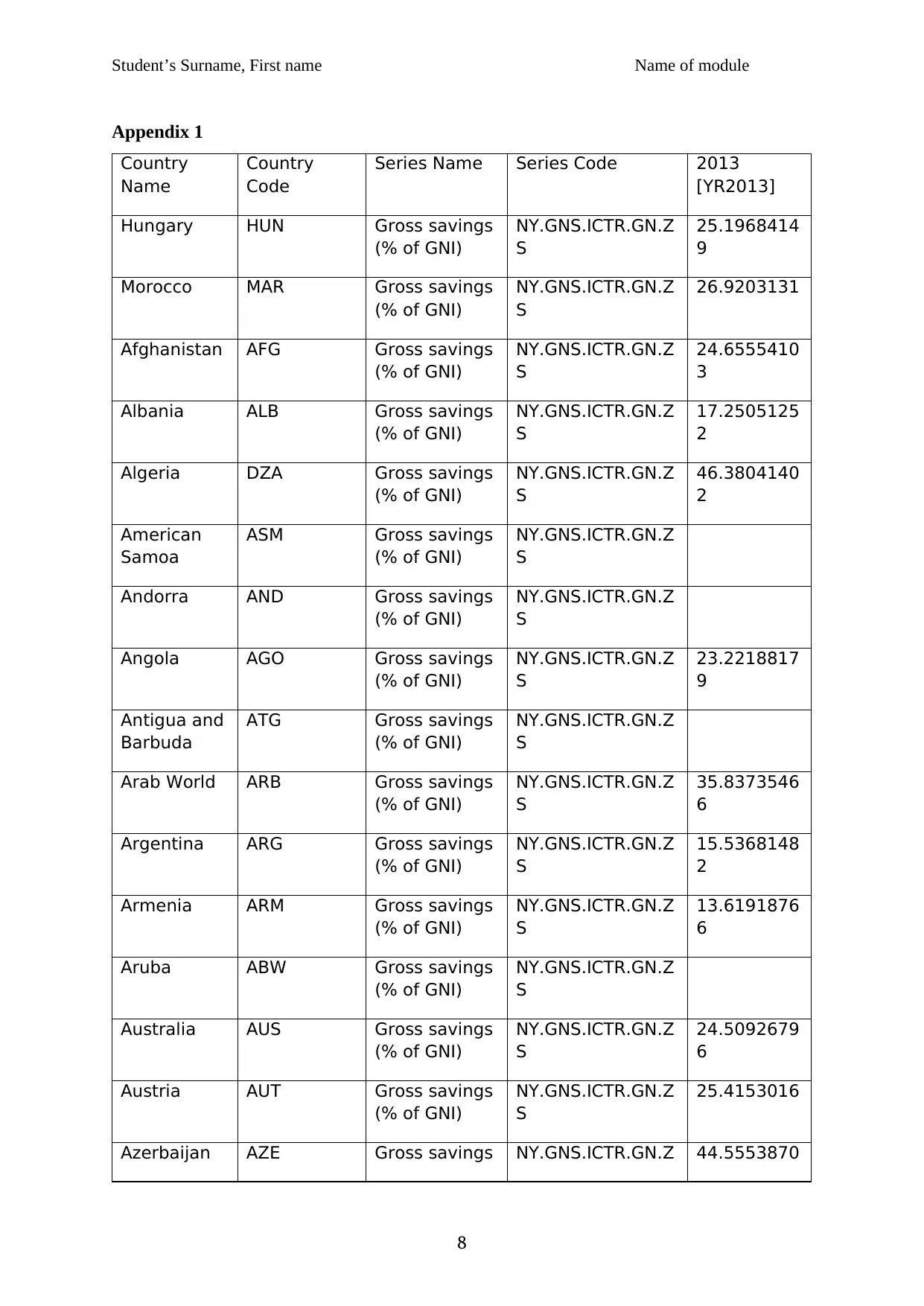

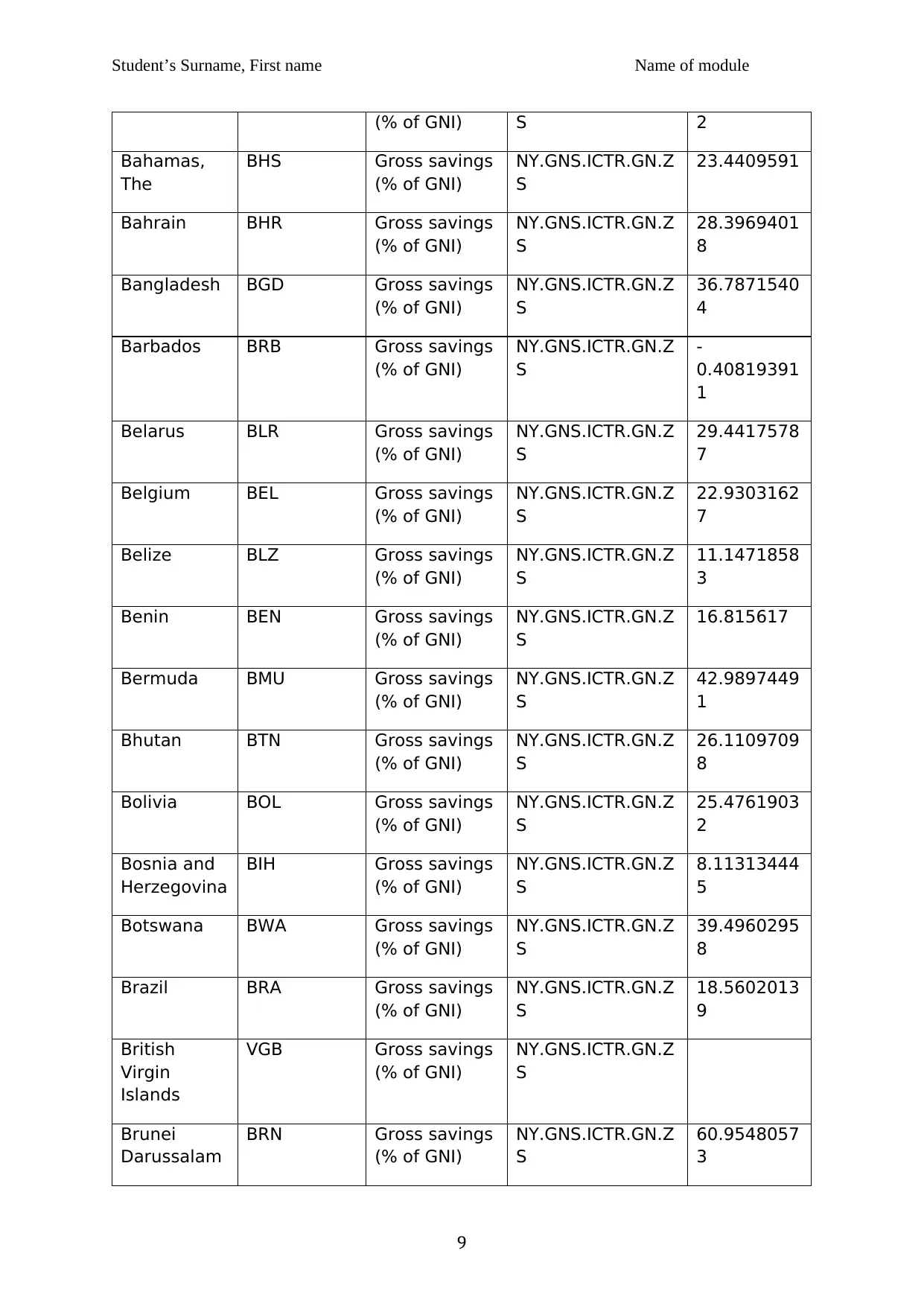

Appendix 1

Country

Name

Country

Code

Series Name Series Code 2013

[YR2013]

Hungary HUN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.1968414

9

Morocco MAR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.9203131

Afghanistan AFG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.6555410

3

Albania ALB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.2505125

2

Algeria DZA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

46.3804140

2

American

Samoa

ASM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Andorra AND Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Angola AGO Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.2218817

9

Antigua and

Barbuda

ATG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Arab World ARB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

35.8373546

6

Argentina ARG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

15.5368148

2

Armenia ARM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.6191876

6

Aruba ABW Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Australia AUS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.5092679

6

Austria AUT Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.4153016

Azerbaijan AZE Gross savings NY.GNS.ICTR.GN.Z 44.5553870

8

Appendix 1

Country

Name

Country

Code

Series Name Series Code 2013

[YR2013]

Hungary HUN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.1968414

9

Morocco MAR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.9203131

Afghanistan AFG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.6555410

3

Albania ALB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.2505125

2

Algeria DZA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

46.3804140

2

American

Samoa

ASM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Andorra AND Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Angola AGO Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.2218817

9

Antigua and

Barbuda

ATG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Arab World ARB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

35.8373546

6

Argentina ARG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

15.5368148

2

Armenia ARM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.6191876

6

Aruba ABW Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Australia AUS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.5092679

6

Austria AUT Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.4153016

Azerbaijan AZE Gross savings NY.GNS.ICTR.GN.Z 44.5553870

8

Student’s Surname, First name Name of module

(% of GNI) S 2

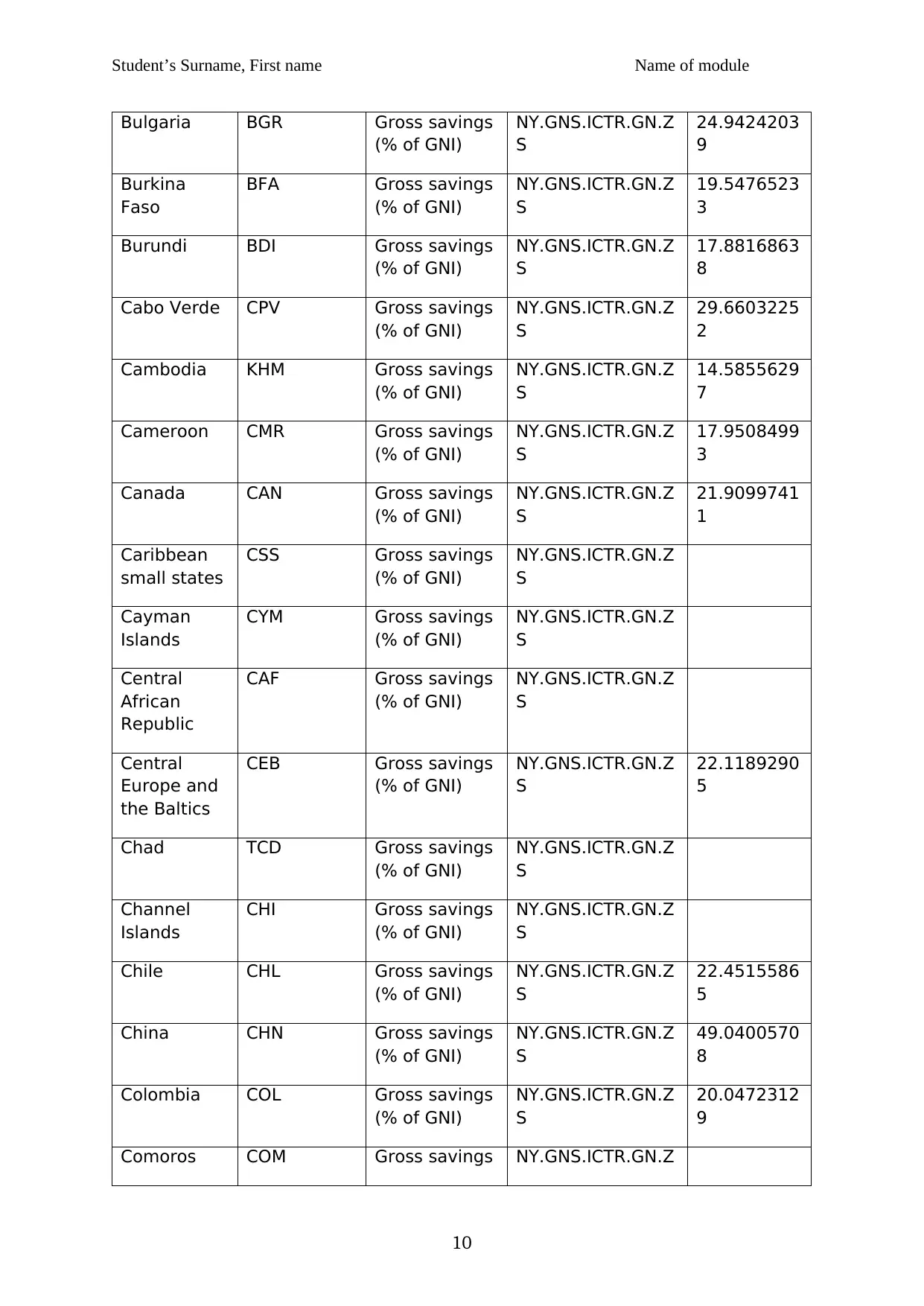

Bahamas,

The

BHS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.4409591

Bahrain BHR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.3969401

8

Bangladesh BGD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

36.7871540

4

Barbados BRB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

-

0.40819391

1

Belarus BLR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

29.4417578

7

Belgium BEL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.9303162

7

Belize BLZ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

11.1471858

3

Benin BEN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

16.815617

Bermuda BMU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

42.9897449

1

Bhutan BTN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.1109709

8

Bolivia BOL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.4761903

2

Bosnia and

Herzegovina

BIH Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

8.11313444

5

Botswana BWA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

39.4960295

8

Brazil BRA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.5602013

9

British

Virgin

Islands

VGB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Brunei

Darussalam

BRN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

60.9548057

3

9

(% of GNI) S 2

Bahamas,

The

BHS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.4409591

Bahrain BHR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.3969401

8

Bangladesh BGD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

36.7871540

4

Barbados BRB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

-

0.40819391

1

Belarus BLR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

29.4417578

7

Belgium BEL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.9303162

7

Belize BLZ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

11.1471858

3

Benin BEN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

16.815617

Bermuda BMU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

42.9897449

1

Bhutan BTN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.1109709

8

Bolivia BOL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.4761903

2

Bosnia and

Herzegovina

BIH Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

8.11313444

5

Botswana BWA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

39.4960295

8

Brazil BRA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.5602013

9

British

Virgin

Islands

VGB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Brunei

Darussalam

BRN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

60.9548057

3

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Student’s Surname, First name Name of module

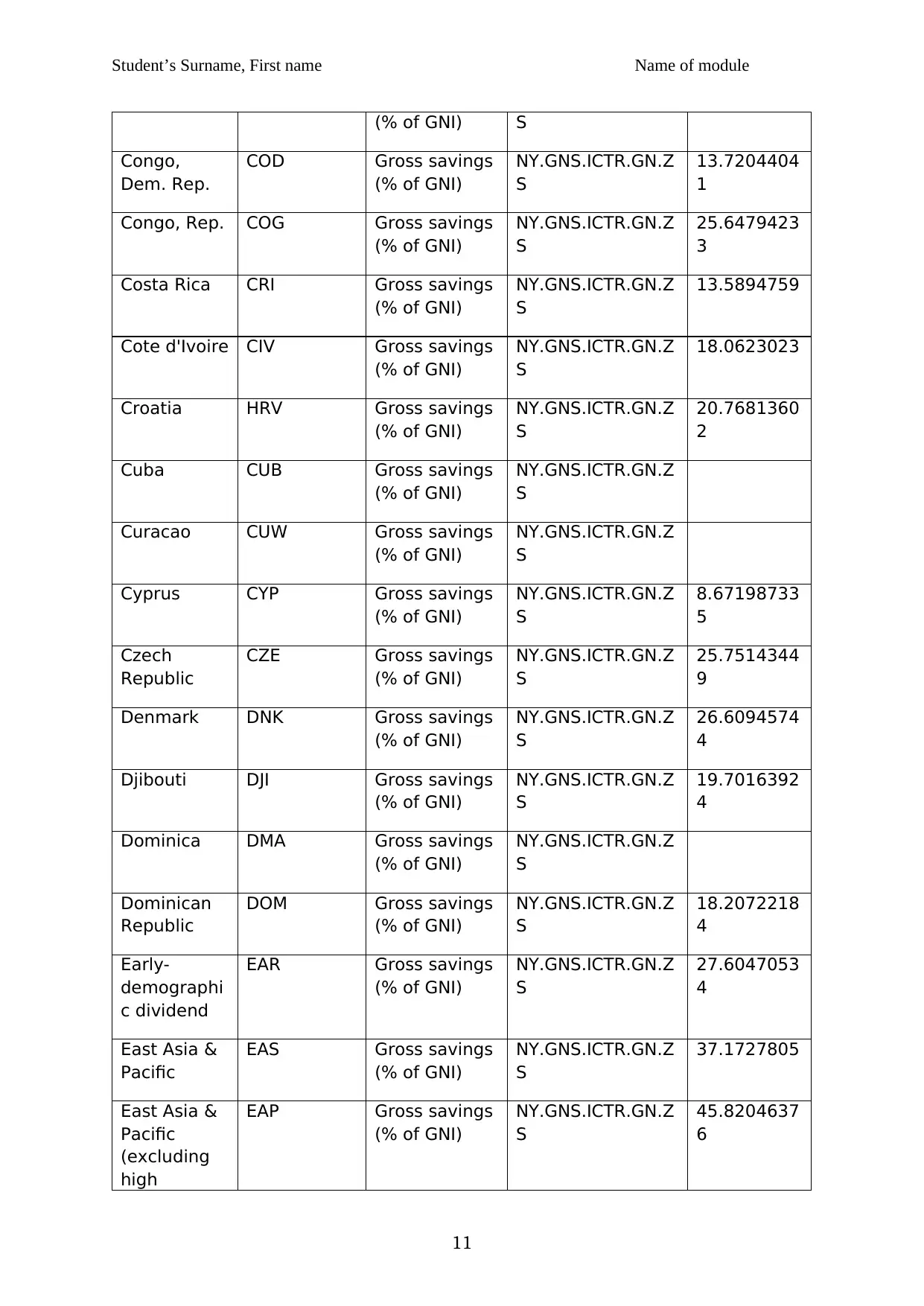

Bulgaria BGR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.9424203

9

Burkina

Faso

BFA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.5476523

3

Burundi BDI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.8816863

8

Cabo Verde CPV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

29.6603225

2

Cambodia KHM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

14.5855629

7

Cameroon CMR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.9508499

3

Canada CAN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

21.9099741

1

Caribbean

small states

CSS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Cayman

Islands

CYM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Central

African

Republic

CAF Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Central

Europe and

the Baltics

CEB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.1189290

5

Chad TCD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Channel

Islands

CHI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Chile CHL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.4515586

5

China CHN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

49.0400570

8

Colombia COL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.0472312

9

Comoros COM Gross savings NY.GNS.ICTR.GN.Z

10

Bulgaria BGR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.9424203

9

Burkina

Faso

BFA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.5476523

3

Burundi BDI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.8816863

8

Cabo Verde CPV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

29.6603225

2

Cambodia KHM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

14.5855629

7

Cameroon CMR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

17.9508499

3

Canada CAN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

21.9099741

1

Caribbean

small states

CSS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Cayman

Islands

CYM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Central

African

Republic

CAF Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Central

Europe and

the Baltics

CEB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.1189290

5

Chad TCD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Channel

Islands

CHI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Chile CHL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.4515586

5

China CHN Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

49.0400570

8

Colombia COL Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.0472312

9

Comoros COM Gross savings NY.GNS.ICTR.GN.Z

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Student’s Surname, First name Name of module

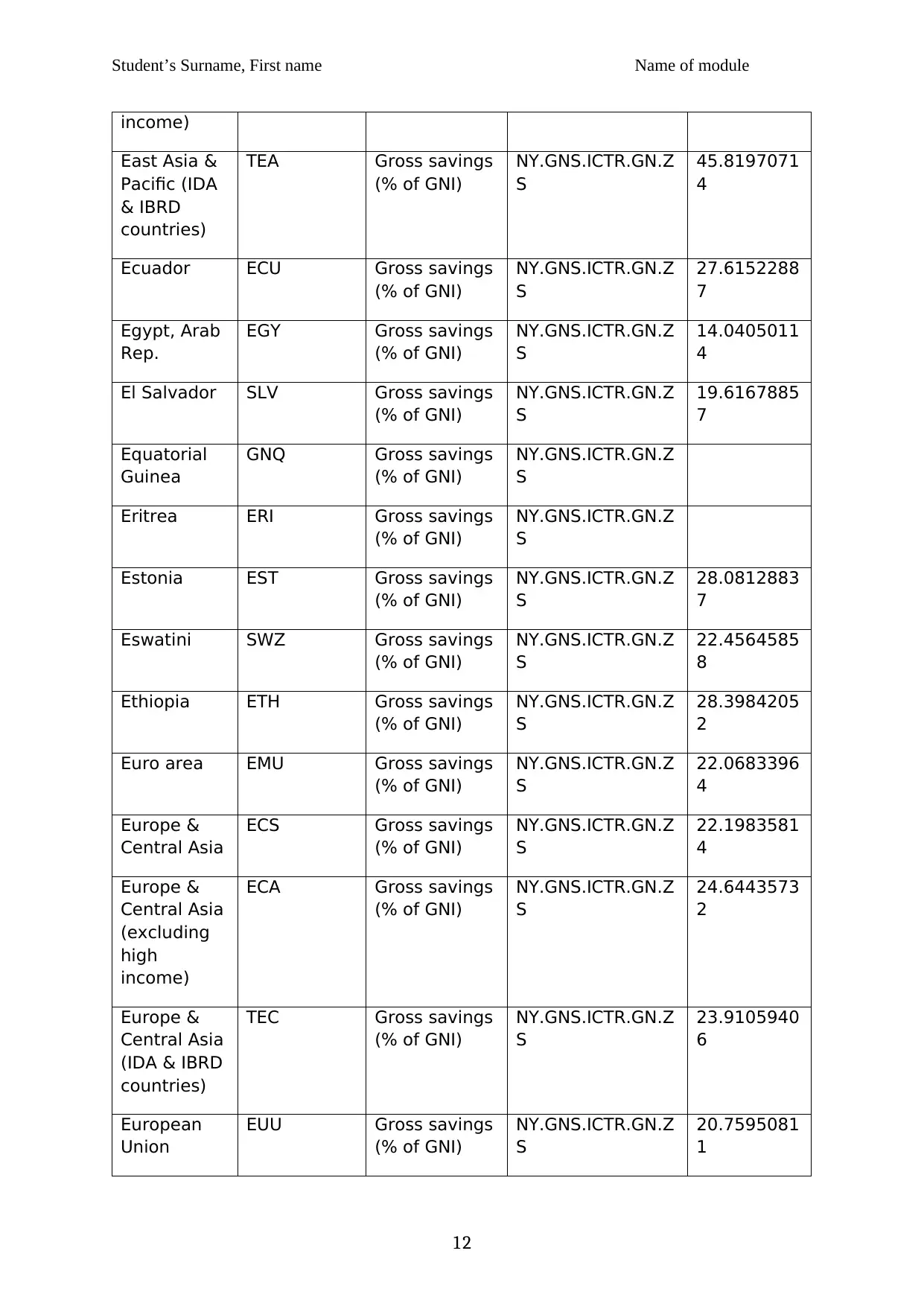

(% of GNI) S

Congo,

Dem. Rep.

COD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.7204404

1

Congo, Rep. COG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.6479423

3

Costa Rica CRI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.5894759

Cote d'Ivoire CIV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.0623023

Croatia HRV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.7681360

2

Cuba CUB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Curacao CUW Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Cyprus CYP Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

8.67198733

5

Czech

Republic

CZE Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.7514344

9

Denmark DNK Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.6094574

4

Djibouti DJI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.7016392

4

Dominica DMA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Dominican

Republic

DOM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.2072218

4

Early-

demographi

c dividend

EAR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

27.6047053

4

East Asia &

Pacific

EAS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

37.1727805

East Asia &

Pacific

(excluding

high

EAP Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

45.8204637

6

11

(% of GNI) S

Congo,

Dem. Rep.

COD Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.7204404

1

Congo, Rep. COG Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.6479423

3

Costa Rica CRI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

13.5894759

Cote d'Ivoire CIV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.0623023

Croatia HRV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.7681360

2

Cuba CUB Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Curacao CUW Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Cyprus CYP Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

8.67198733

5

Czech

Republic

CZE Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

25.7514344

9

Denmark DNK Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

26.6094574

4

Djibouti DJI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.7016392

4

Dominica DMA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Dominican

Republic

DOM Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

18.2072218

4

Early-

demographi

c dividend

EAR Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

27.6047053

4

East Asia &

Pacific

EAS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

37.1727805

East Asia &

Pacific

(excluding

high

EAP Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

45.8204637

6

11

Student’s Surname, First name Name of module

income)

East Asia &

Pacific (IDA

& IBRD

countries)

TEA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

45.8197071

4

Ecuador ECU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

27.6152288

7

Egypt, Arab

Rep.

EGY Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

14.0405011

4

El Salvador SLV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.6167885

7

Equatorial

Guinea

GNQ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Eritrea ERI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Estonia EST Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.0812883

7

Eswatini SWZ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.4564585

8

Ethiopia ETH Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.3984205

2

Euro area EMU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.0683396

4

Europe &

Central Asia

ECS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.1983581

4

Europe &

Central Asia

(excluding

high

income)

ECA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.6443573

2

Europe &

Central Asia

(IDA & IBRD

countries)

TEC Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.9105940

6

European

Union

EUU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.7595081

1

12

income)

East Asia &

Pacific (IDA

& IBRD

countries)

TEA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

45.8197071

4

Ecuador ECU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

27.6152288

7

Egypt, Arab

Rep.

EGY Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

14.0405011

4

El Salvador SLV Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

19.6167885

7

Equatorial

Guinea

GNQ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Eritrea ERI Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

Estonia EST Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.0812883

7

Eswatini SWZ Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.4564585

8

Ethiopia ETH Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

28.3984205

2

Euro area EMU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.0683396

4

Europe &

Central Asia

ECS Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

22.1983581

4

Europe &

Central Asia

(excluding

high

income)

ECA Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

24.6443573

2

Europe &

Central Asia

(IDA & IBRD

countries)

TEC Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

23.9105940

6

European

Union

EUU Gross savings

(% of GNI)

NY.GNS.ICTR.GN.Z

S

20.7595081

1

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.