An Analysis of Growth Planning and Funding for Checkout.com

VerifiedAdded on 2021/02/20

|17

|5027

|109

Report

AI Summary

This report comprehensively examines growth planning strategies, utilizing Checkout.com as a case study. It begins by outlining key considerations for evaluating growth opportunities, including Porter's competitive strategies and PESTLE analysis. The report then applies Ansoff's growth matrix to assess market penetration, market development, product development, and diversification strategies. It further explores various sources of funding available to small and medium-sized businesses, such as SBA loans and angel investors, detailing their advantages and disadvantages. A business plan for growth is developed, incorporating financial planning, monitoring, and control measures. Finally, the report analyzes exit or succession options for small businesses, evaluating the benefits and drawbacks of each approach. The analysis provides a holistic view of the challenges and opportunities associated with business growth and development.

PLANNING FOR

GROWTH

GROWTH

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

P 1 Key considerations for evaluating growth opportunities......................................................1

P2 Applying Ansoff's growth matrix for the evaluation of opportunities for growth.................3

LO2..................................................................................................................................................5

P3 sources of funding and their advantages and disadvantages.................................................5

LO3..................................................................................................................................................8

P 4 Business plan for growth .....................................................................................................8

LO5................................................................................................................................................11

P5 Assessing exit or succession option for a small business and the benefits and drawbacks of

each option................................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

P 1 Key considerations for evaluating growth opportunities......................................................1

P2 Applying Ansoff's growth matrix for the evaluation of opportunities for growth.................3

LO2..................................................................................................................................................5

P3 sources of funding and their advantages and disadvantages.................................................5

LO3..................................................................................................................................................8

P 4 Business plan for growth .....................................................................................................8

LO5................................................................................................................................................11

P5 Assessing exit or succession option for a small business and the benefits and drawbacks of

each option................................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Growth planning is an economic activity that every organization adopt whether it is a large scale,

medium or small scale organization. It allows to keep a track record on company's growth and

development. It help an organization in allocating the limited resources in such a manner that the

focus and efforts are centralized toward the change in the business that is influenced by new

digital technology and differentiation from competitors. Checkout.com founded in 2009 by

Guillaume Pousaz (CEO and founder). It is a medium scale enterprise. And in the past 6 years

the company's journey from a start-up to an international company that deals in processing

billions of payment. The study includes techniques for evaluating growth opportunities, further it

evaluates the growth opportunities by using Ansoff Matrix Model. Sources of funding available

for a business, business plan prepared for growth with all the financial planning and monitoring

and control. In last study analyse the exit option from the business.

LO1

P 1 Key considerations for evaluating growth opportunities

The goal for every business irrespective of their sizes is working for profit maximization.

Growth can be achieved through effective planning and then monitoring and controlling the

growth.

Porter's competitive strategies-

Cost leadership- This strategy target price-sensitive customers and by targeting their

market. The company will lower the price of its products in the target market. To be

successful in offering this low price and still have high return on investment and achieve

the desired profit, the company should able to have low operating cost of their product

compare to their rivalry firms. If an medium or scale size organization aim to achieve the

competitive advantage over other firms, the company should implement this strategy by

lowering the cost of production and it can be be done by having the latest technological

up-gradation, bulk purchasing,economies of scale and by exploring all other means of

cost advantage. Checkout.com being an medium scale organization focuses on this

strategy to capture the target market, to achieve growth and earn higher profits and thus

converting in an large scale organisation.

1

Growth planning is an economic activity that every organization adopt whether it is a large scale,

medium or small scale organization. It allows to keep a track record on company's growth and

development. It help an organization in allocating the limited resources in such a manner that the

focus and efforts are centralized toward the change in the business that is influenced by new

digital technology and differentiation from competitors. Checkout.com founded in 2009 by

Guillaume Pousaz (CEO and founder). It is a medium scale enterprise. And in the past 6 years

the company's journey from a start-up to an international company that deals in processing

billions of payment. The study includes techniques for evaluating growth opportunities, further it

evaluates the growth opportunities by using Ansoff Matrix Model. Sources of funding available

for a business, business plan prepared for growth with all the financial planning and monitoring

and control. In last study analyse the exit option from the business.

LO1

P 1 Key considerations for evaluating growth opportunities

The goal for every business irrespective of their sizes is working for profit maximization.

Growth can be achieved through effective planning and then monitoring and controlling the

growth.

Porter's competitive strategies-

Cost leadership- This strategy target price-sensitive customers and by targeting their

market. The company will lower the price of its products in the target market. To be

successful in offering this low price and still have high return on investment and achieve

the desired profit, the company should able to have low operating cost of their product

compare to their rivalry firms. If an medium or scale size organization aim to achieve the

competitive advantage over other firms, the company should implement this strategy by

lowering the cost of production and it can be be done by having the latest technological

up-gradation, bulk purchasing,economies of scale and by exploring all other means of

cost advantage. Checkout.com being an medium scale organization focuses on this

strategy to capture the target market, to achieve growth and earn higher profits and thus

converting in an large scale organisation.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Differentiation Strategy – This strategy focus on capturing the market by offering

something different and unique. It can be applicable and successful when the target

segment is not cost conscious, customers have specific demands, market is competitive

and the organization has some new or unique resources and capabilities which help it

fulfil the demand those are possibly served but are unsatisfactory and are hard to copy.

The differentiated product will help the company in getting the competitive advantage.

Checkout.com adopted some new and unique techniques to grab a bigger market share.

Focus Strategy – This strategy is not for large scale organizations due to small market

situations. Focus strategy is divided into two parts:-

Cost focus- If company wants to have an cost advantage and capture the target market, this

strategy is adopted.

Differentiation focus- This strategy is followed by the company's when they offer differentiated

products.(Duncombe, 2017.)

P.E.S.T.L.E. Analysis -

Political factors- Government intervention are included in political factor like labour law,

environmental law, tariffs and political stability. Political factors also involve some goods

and services which are provided by government(merit goods) and some goods that

government does not want to provide. Government has a high influencing power on

health, education of the nation. The political factors, mostly the government policies

influence small scale and medium scale enterprises. These policies can either affect

directly or indirectly. Governments taxation policy, rules & regulations and import export

duties are major factors that affect SME business adversely.

Economic factors- It includes economic growth, inflation rate and exchange rates. These

factors affect the operation of business and their decision making. This can help the

organization in achieving an competitive advantage. Lower unemployment rate, tariff

rates, inflation rates will help Checkout.com to gain an upper hand over other firms. The

growth and development of Checkout.com depends on economic period, if the economy

is on boom the business will flourish and if there is depression it will block the ways for

the growth of business.

2

something different and unique. It can be applicable and successful when the target

segment is not cost conscious, customers have specific demands, market is competitive

and the organization has some new or unique resources and capabilities which help it

fulfil the demand those are possibly served but are unsatisfactory and are hard to copy.

The differentiated product will help the company in getting the competitive advantage.

Checkout.com adopted some new and unique techniques to grab a bigger market share.

Focus Strategy – This strategy is not for large scale organizations due to small market

situations. Focus strategy is divided into two parts:-

Cost focus- If company wants to have an cost advantage and capture the target market, this

strategy is adopted.

Differentiation focus- This strategy is followed by the company's when they offer differentiated

products.(Duncombe, 2017.)

P.E.S.T.L.E. Analysis -

Political factors- Government intervention are included in political factor like labour law,

environmental law, tariffs and political stability. Political factors also involve some goods

and services which are provided by government(merit goods) and some goods that

government does not want to provide. Government has a high influencing power on

health, education of the nation. The political factors, mostly the government policies

influence small scale and medium scale enterprises. These policies can either affect

directly or indirectly. Governments taxation policy, rules & regulations and import export

duties are major factors that affect SME business adversely.

Economic factors- It includes economic growth, inflation rate and exchange rates. These

factors affect the operation of business and their decision making. This can help the

organization in achieving an competitive advantage. Lower unemployment rate, tariff

rates, inflation rates will help Checkout.com to gain an upper hand over other firms. The

growth and development of Checkout.com depends on economic period, if the economy

is on boom the business will flourish and if there is depression it will block the ways for

the growth of business.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Social factors- This includes population growth rate, health & safety. These factors affect

the demand of a product and the operations of company. The lifestyle of people, size of

family, purchasing power affect the company(Checkout.com).

Legal factors- Every company needs to comply with legal policies to avoid any kind of

trouble. If the company does not comply with legal rules and regulations , then they to

suffer legal charges or penalties. Through this company name will suffer. Legal laws are

employment law, health and safety laws, consumer protection act should be implemented

strictly by every organisation irrespective of their size to successfully survive in the

market.

Technological factors- As Checkout.com is an medium scale enterprise, technological

change impact company's operations. Advancement in technology will influence costs,

quality, efficiency and innovation. By using latest technology, an organization can have

low production cost and that gives them a competitive advantage.

Environmental factors- This factor includes environmental aspect like climate, and

weather change which influence mostly tourism industry. This factors affect how

organizations operate the products. Geographical location, climate are the factors that

affect the business. Companies should find some ways to discharge wastes so that can

minimize their effect on environment. Find a way to recycle the waste. Analysing these

factors and then take mandatory actions will help organization grow.(Rudolf and et.al.,

2018.)

P2 Applying Ansoff's growth matrix for the evaluation of opportunities for growth

The Ansoff's matrix was developed by Igor Ansoff in 1957. It is a planning tool which helps

senior executives, managers and marketers develop strategies for future growth. It process

development with the existing products &new products and existing markets &new markets.

Ansoff's matrix provides four different growth strategies:

Market penetration: the market penetration strategy is used to develop the existing

resources and capabilities. It is the least risky growth strategy. It is a strategy in which a

company tries to increase its market share using existing opportunities. This occurs when

the competitors reach their capacity limits too (ANSOFF MATRIX, 2013). The growth

3

the demand of a product and the operations of company. The lifestyle of people, size of

family, purchasing power affect the company(Checkout.com).

Legal factors- Every company needs to comply with legal policies to avoid any kind of

trouble. If the company does not comply with legal rules and regulations , then they to

suffer legal charges or penalties. Through this company name will suffer. Legal laws are

employment law, health and safety laws, consumer protection act should be implemented

strictly by every organisation irrespective of their size to successfully survive in the

market.

Technological factors- As Checkout.com is an medium scale enterprise, technological

change impact company's operations. Advancement in technology will influence costs,

quality, efficiency and innovation. By using latest technology, an organization can have

low production cost and that gives them a competitive advantage.

Environmental factors- This factor includes environmental aspect like climate, and

weather change which influence mostly tourism industry. This factors affect how

organizations operate the products. Geographical location, climate are the factors that

affect the business. Companies should find some ways to discharge wastes so that can

minimize their effect on environment. Find a way to recycle the waste. Analysing these

factors and then take mandatory actions will help organization grow.(Rudolf and et.al.,

2018.)

P2 Applying Ansoff's growth matrix for the evaluation of opportunities for growth

The Ansoff's matrix was developed by Igor Ansoff in 1957. It is a planning tool which helps

senior executives, managers and marketers develop strategies for future growth. It process

development with the existing products &new products and existing markets &new markets.

Ansoff's matrix provides four different growth strategies:

Market penetration: the market penetration strategy is used to develop the existing

resources and capabilities. It is the least risky growth strategy. It is a strategy in which a

company tries to increase its market share using existing opportunities. This occurs when

the competitors reach their capacity limits too (ANSOFF MATRIX, 2013). The growth

3

can be increased by selling more products and services to the existing customers or new

customers within the existing markets. The company can increase its sale by aggressive

promotion and distribution of products to its customers. Market penetration by a

company can be done by reducing the price of the product, increasing promotion and

providing good customer service etc. Checkout.com had penetrated market by applying

their service in all domestic markets and in different countries like Hong Kong, USA,

Australia, Singapore etc. The company is trying to launch other payment method also in

future.(Wu, 2015.)

Market development: Market development means when a firm tries to enter into new

market like in a new country or different area using the resources which it has and with

minimum product development. Market development can be achieved by:

Different customer segments: When a firm has customers scattered in different markets

or areas, it need to have shops in different places so that it can supply goods and services

easily. Checkout.com has its branches in different parts of the world so that it can have

proper control over all the places where the company works.

Foreign market: the competition in the market is very high today. If a firm wants to stay

in the market then it should have a place in different areas where people can get good

service related to the company.

Product Development: Product development means developing a new product or

investing in the old product and making it better. It is done to maintain the interest of

existing customers in the company or introduction of new customers in the company. It

can be done by:

a) Investment in Research and development of additional products: funds are invested in

research and development of new products so that customers are attracted towards the

company. Innovation can be done to the existing products too so that sales can be

increased.(Mason, 2015.)

b) Acquiring rights to produce other's products: There are various goods which are made by

joining two or more items to create a single one. The different items are acquired from

4

customers within the existing markets. The company can increase its sale by aggressive

promotion and distribution of products to its customers. Market penetration by a

company can be done by reducing the price of the product, increasing promotion and

providing good customer service etc. Checkout.com had penetrated market by applying

their service in all domestic markets and in different countries like Hong Kong, USA,

Australia, Singapore etc. The company is trying to launch other payment method also in

future.(Wu, 2015.)

Market development: Market development means when a firm tries to enter into new

market like in a new country or different area using the resources which it has and with

minimum product development. Market development can be achieved by:

Different customer segments: When a firm has customers scattered in different markets

or areas, it need to have shops in different places so that it can supply goods and services

easily. Checkout.com has its branches in different parts of the world so that it can have

proper control over all the places where the company works.

Foreign market: the competition in the market is very high today. If a firm wants to stay

in the market then it should have a place in different areas where people can get good

service related to the company.

Product Development: Product development means developing a new product or

investing in the old product and making it better. It is done to maintain the interest of

existing customers in the company or introduction of new customers in the company. It

can be done by:

a) Investment in Research and development of additional products: funds are invested in

research and development of new products so that customers are attracted towards the

company. Innovation can be done to the existing products too so that sales can be

increased.(Mason, 2015.)

b) Acquiring rights to produce other's products: There are various goods which are made by

joining two or more items to create a single one. The different items are acquired from

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

different places by the company. If the company wants to manufacture all its products at

one place than it has to take rights from the company.

c) Buying product and giving your own name.: The company many time has a excellent

goodwill in the market and it wants to use it for profits, then it purchases goods from

other companies at low price and sells it to on the brand name. This increases profits of

the company as additional sales are made.

d) Jointly doing business and making use of each others strength: Many time companies

come in joint venture to use the strong points of other company like if one business

strong point is good client network and other person's strong point is efficient machinery

then they can come together and manufacture products which will benefit them both.

Diversification: In Diversification, the organisation tries to grow its market share by

introducing new product in the new market. Diversification is the most risky growth

strategy because both new product and new market development is required.

Diversification can be a good choice if the company is getting high profit for high risk.

Diversification gives a good space to your in competitive market where there are various

attractive industries. This quadrant of matrix as also been referred as “suicide cell”.

(Pugalis and et.al., 2015.)

LO2

P3 sources of funding and their advantages and disadvantages

There are various sources of funding for small and medium sized organisation. They get help

from different places. It includes government, banks, family, relatives etc. The person should

first decide the source of funding which he will use. He must choose it properly, then approach

the investor with proper documentation. The person should have proper knowledge of the

business that he is going to start so that he can convince the investor to invest in his business.

Various sources of funding are:

1. Small Business Administration(SBA): SBA is a government administration established

to help the small business to achieve its goal. The main function of SBA are:

It helps small businesses to obtain capital but SBA does not actually lend money but it

acts as a guarantor on loans.

It helps entrepreneurs by developing their various skills. Eg. education, training.

5

one place than it has to take rights from the company.

c) Buying product and giving your own name.: The company many time has a excellent

goodwill in the market and it wants to use it for profits, then it purchases goods from

other companies at low price and sells it to on the brand name. This increases profits of

the company as additional sales are made.

d) Jointly doing business and making use of each others strength: Many time companies

come in joint venture to use the strong points of other company like if one business

strong point is good client network and other person's strong point is efficient machinery

then they can come together and manufacture products which will benefit them both.

Diversification: In Diversification, the organisation tries to grow its market share by

introducing new product in the new market. Diversification is the most risky growth

strategy because both new product and new market development is required.

Diversification can be a good choice if the company is getting high profit for high risk.

Diversification gives a good space to your in competitive market where there are various

attractive industries. This quadrant of matrix as also been referred as “suicide cell”.

(Pugalis and et.al., 2015.)

LO2

P3 sources of funding and their advantages and disadvantages

There are various sources of funding for small and medium sized organisation. They get help

from different places. It includes government, banks, family, relatives etc. The person should

first decide the source of funding which he will use. He must choose it properly, then approach

the investor with proper documentation. The person should have proper knowledge of the

business that he is going to start so that he can convince the investor to invest in his business.

Various sources of funding are:

1. Small Business Administration(SBA): SBA is a government administration established

to help the small business to achieve its goal. The main function of SBA are:

It helps small businesses to obtain capital but SBA does not actually lend money but it

acts as a guarantor on loans.

It helps entrepreneurs by developing their various skills. Eg. education, training.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The main benefit of taking loan from SBA is that it ensure that 23% of government

contracts are given to small businesses.

It stands behind small business to support it in every case.

Advantages: Proper treatment of SBA loan increases the chances of getting bank loan. SBA

also help in improving the relations of the local lender and local borrower.

Disadvantages: The guide lines of small business administration are strict as they look at the

data of 2-3 years and which are normally the distressed years.

2. Angel investors: Angel investors are those wealthy people who are ready to invest their

money in exchange of some share in equity of the company. The investment done is

usually not more than 1 million$. Angel investors generally work in groups and they

choose those projects which have good profit and is known to them. They don't like to

take risk with their money so they do investment in small firms only.(Wynn, 2017.)

Advantages: Angel investors are usually experienced in various fields and so can provide

guidelines related to the business. They are less hard than VC so flexible business conversation

can be done.

Disadvantages: If you are not able to manage the business properly then you may be forced to

give your company to the investors. Due to their nature of risk-free investment, they generally do

investment in less places.

3. Friends & Family: This is the most common source of funding a small business.

Entrepreneur can easily convince their friends, family and relatives to invest money in the

business. They accept because of your relations with them. They generally do investment

just to start their business and so the businesses can get loan from bank or VC.

Advantages: Funding is usually very easily obtained because of your personal relations with him.

The investment terms are more flexible and payback of money is also not rigid.

Disadvantages: There is too much pressure to succeed in the business as many known people

have invested in the business. Due to their stake in the business they frequently gives unwanted

advices related to the business.

4. Venture Capital Funding(VC): Venture capital is the said to be the best finance for

small business. Venture capitalist are those investors who are ready to invest a large

6

contracts are given to small businesses.

It stands behind small business to support it in every case.

Advantages: Proper treatment of SBA loan increases the chances of getting bank loan. SBA

also help in improving the relations of the local lender and local borrower.

Disadvantages: The guide lines of small business administration are strict as they look at the

data of 2-3 years and which are normally the distressed years.

2. Angel investors: Angel investors are those wealthy people who are ready to invest their

money in exchange of some share in equity of the company. The investment done is

usually not more than 1 million$. Angel investors generally work in groups and they

choose those projects which have good profit and is known to them. They don't like to

take risk with their money so they do investment in small firms only.(Wynn, 2017.)

Advantages: Angel investors are usually experienced in various fields and so can provide

guidelines related to the business. They are less hard than VC so flexible business conversation

can be done.

Disadvantages: If you are not able to manage the business properly then you may be forced to

give your company to the investors. Due to their nature of risk-free investment, they generally do

investment in less places.

3. Friends & Family: This is the most common source of funding a small business.

Entrepreneur can easily convince their friends, family and relatives to invest money in the

business. They accept because of your relations with them. They generally do investment

just to start their business and so the businesses can get loan from bank or VC.

Advantages: Funding is usually very easily obtained because of your personal relations with him.

The investment terms are more flexible and payback of money is also not rigid.

Disadvantages: There is too much pressure to succeed in the business as many known people

have invested in the business. Due to their stake in the business they frequently gives unwanted

advices related to the business.

4. Venture Capital Funding(VC): Venture capital is the said to be the best finance for

small business. Venture capitalist are those investors who are ready to invest a large

6

amount of money in the business in return of equity but they do invest only when the

business is acquired or goes public. Venture Capitalist are professional investors and

know where to do investment. They only do investment in those company which gives

them 6 times return of their investment. The amount invested by them is big but the risk

associated with it is also big. Checkout.com is also funded by venture capitalist. The fund

invested is big but carries high risk too.(Daniels and Lapping, 2016.)

Advantages: Venture Capitalist provide a large sum of money at once and can provide

professional guidelines for the growth of business. The credibility of company also increases if it

gets funded by venture capitalists. The network of VC is very strong and they can also provide

future investors for business.

Disadvantages: They are extremely serious about there money and can force you to quit if you

are not able to manage the company properly. They are also called as Vulture Capitalist because

of there nature for money. They can direct your business in any direction if they feel business is

not going properly as they are more experienced than any other.

5. Bank Finance: Bank loans are the most common source of funds and can be pursued by

lending money from any near financial institution. They are known to be complex

because there are different options available and every option has different interest rates.

It is important that you should know the option you are about to avail before only.

Advantages: Bank finance are easy to acquire and usually take less time to process. There are

different types of finance option available which can help the company. The most important

advantage of using bank as finance source is that you don't have to give your equity share to the

bank.

Disadvantages: The loan is not easily available and the criteria also changes continuously. The

bank does not care if you earned profit or loss, they just want their money back with interest. The

bank is time consuming as it takes time to complete all documentation process. If the chosen

source of fund is wrong then it will create an unfavourable deal which will create problem in

paying back. (Denton and et.al., 2017.)

7

business is acquired or goes public. Venture Capitalist are professional investors and

know where to do investment. They only do investment in those company which gives

them 6 times return of their investment. The amount invested by them is big but the risk

associated with it is also big. Checkout.com is also funded by venture capitalist. The fund

invested is big but carries high risk too.(Daniels and Lapping, 2016.)

Advantages: Venture Capitalist provide a large sum of money at once and can provide

professional guidelines for the growth of business. The credibility of company also increases if it

gets funded by venture capitalists. The network of VC is very strong and they can also provide

future investors for business.

Disadvantages: They are extremely serious about there money and can force you to quit if you

are not able to manage the company properly. They are also called as Vulture Capitalist because

of there nature for money. They can direct your business in any direction if they feel business is

not going properly as they are more experienced than any other.

5. Bank Finance: Bank loans are the most common source of funds and can be pursued by

lending money from any near financial institution. They are known to be complex

because there are different options available and every option has different interest rates.

It is important that you should know the option you are about to avail before only.

Advantages: Bank finance are easy to acquire and usually take less time to process. There are

different types of finance option available which can help the company. The most important

advantage of using bank as finance source is that you don't have to give your equity share to the

bank.

Disadvantages: The loan is not easily available and the criteria also changes continuously. The

bank does not care if you earned profit or loss, they just want their money back with interest. The

bank is time consuming as it takes time to complete all documentation process. If the chosen

source of fund is wrong then it will create an unfavourable deal which will create problem in

paying back. (Denton and et.al., 2017.)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO3

P 4 Business plan for growth

Executive Summary

Checkout.com has achieved new heights in the previous 6 years. So now the company is

planning to expand and grow further so can accomplish new goals and reach their vision as soon

as possible. The company excels in their particular field as in 2018 they tripled their processing

volume as compared to the previous year and it is ranked as the fastest growing FinTech.

Company obtained issuing license for visa and master card. The company has scattered all over

UK, so now the company is planning to cover Asian Market, invest in their security system so

that the minor technical errors that are affecting their operations can be solved. Company wants

to capture Asian market develop the digital payments their like Paytm, Google Pay, Phone PE.

Vision

Company wants to be a leading international provider of online payment solutions. Have a

transparency across the payment value chain.(Trasobares and et.al., 2016)

Mission

Company's mission is to collaborate with smart business of all size to enhance their payment,

maximize revenues and fulfil the demands of their customers.

Objectives

To expand the company's growth by 20% till the end of year 2022 and increase the profitability

of the company by 30% till the end of 2021.

SWOT Analysis

Strength

The company has a well known name in their industry. The firm already has recognition in UK

market. For being an start-up to now being the fastest growing FinTech. Company soon became

the member of Visa. Launched a hub, proprietary authorization. Opened offices in Berlin and

Paris. Used the most advanced technology that competitors can't copy.

Weaknesses

Many competitors come up with technologies that affect the operations of the company. Work

Environment is not flexible as compared to the competitors.

Opportunity

8

P 4 Business plan for growth

Executive Summary

Checkout.com has achieved new heights in the previous 6 years. So now the company is

planning to expand and grow further so can accomplish new goals and reach their vision as soon

as possible. The company excels in their particular field as in 2018 they tripled their processing

volume as compared to the previous year and it is ranked as the fastest growing FinTech.

Company obtained issuing license for visa and master card. The company has scattered all over

UK, so now the company is planning to cover Asian Market, invest in their security system so

that the minor technical errors that are affecting their operations can be solved. Company wants

to capture Asian market develop the digital payments their like Paytm, Google Pay, Phone PE.

Vision

Company wants to be a leading international provider of online payment solutions. Have a

transparency across the payment value chain.(Trasobares and et.al., 2016)

Mission

Company's mission is to collaborate with smart business of all size to enhance their payment,

maximize revenues and fulfil the demands of their customers.

Objectives

To expand the company's growth by 20% till the end of year 2022 and increase the profitability

of the company by 30% till the end of 2021.

SWOT Analysis

Strength

The company has a well known name in their industry. The firm already has recognition in UK

market. For being an start-up to now being the fastest growing FinTech. Company soon became

the member of Visa. Launched a hub, proprietary authorization. Opened offices in Berlin and

Paris. Used the most advanced technology that competitors can't copy.

Weaknesses

Many competitors come up with technologies that affect the operations of the company. Work

Environment is not flexible as compared to the competitors.

Opportunity

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The company can develop in Asian Market as they are mostly working in UK market. They can

capture the Asian market as they have scope to flourish in this area as well. Let people know the

importance of digital payments.

Threat

Employees due to less flexible working environment can leave the company and it would

difficult for the organisation to retain them. Due to technological advancements company may

fear from being copied by other competitive firms.

PESTLE

Political Factor

The prevailing political factors can affect the growth of Checkout.com as government taxation

policy is changing and that affect the new business plan of the company. The firm has to keep

analyse the situation prevailing and then successfully implement the decisions in the firm.

Economical Factor

This factor affect the company's new business as exchange rates are increasing and decreasing.

The market is not stable so that the company can take any decisions, so in this case the firm has

to focus on analysing the market and then implement the changes in the business plan.

Social Factor

This factor includes the social beliefs, cultures and attitudes followed by the employees in the

organization. This is possible that company's employees don't accept the changes of new

business plan. They don't like the idea or it consists handwork that they don't want. The plan

needs their total support.

Technological Factor

New technological advancements can affect the business plan as the company has to invest in the

new technologies has they want to lower their operations cost so that they can maximize their

profits. It has a benefit also that after adopting the new innovation the working will like smooth

flow. (Pugalis and et.al., 2015.)

Legal Factor

The company has to comply with all the rules and regulations that are compulsory to be followed

as they will help in keeping the company away from any legal penalties.

Environmental Factor

9

capture the Asian market as they have scope to flourish in this area as well. Let people know the

importance of digital payments.

Threat

Employees due to less flexible working environment can leave the company and it would

difficult for the organisation to retain them. Due to technological advancements company may

fear from being copied by other competitive firms.

PESTLE

Political Factor

The prevailing political factors can affect the growth of Checkout.com as government taxation

policy is changing and that affect the new business plan of the company. The firm has to keep

analyse the situation prevailing and then successfully implement the decisions in the firm.

Economical Factor

This factor affect the company's new business as exchange rates are increasing and decreasing.

The market is not stable so that the company can take any decisions, so in this case the firm has

to focus on analysing the market and then implement the changes in the business plan.

Social Factor

This factor includes the social beliefs, cultures and attitudes followed by the employees in the

organization. This is possible that company's employees don't accept the changes of new

business plan. They don't like the idea or it consists handwork that they don't want. The plan

needs their total support.

Technological Factor

New technological advancements can affect the business plan as the company has to invest in the

new technologies has they want to lower their operations cost so that they can maximize their

profits. It has a benefit also that after adopting the new innovation the working will like smooth

flow. (Pugalis and et.al., 2015.)

Legal Factor

The company has to comply with all the rules and regulations that are compulsory to be followed

as they will help in keeping the company away from any legal penalties.

Environmental Factor

9

These factors can affect the new business plan as due to any weather change or any kind of

natural occurrence. The weather forecast department has to analyse and then implement the

strategy.

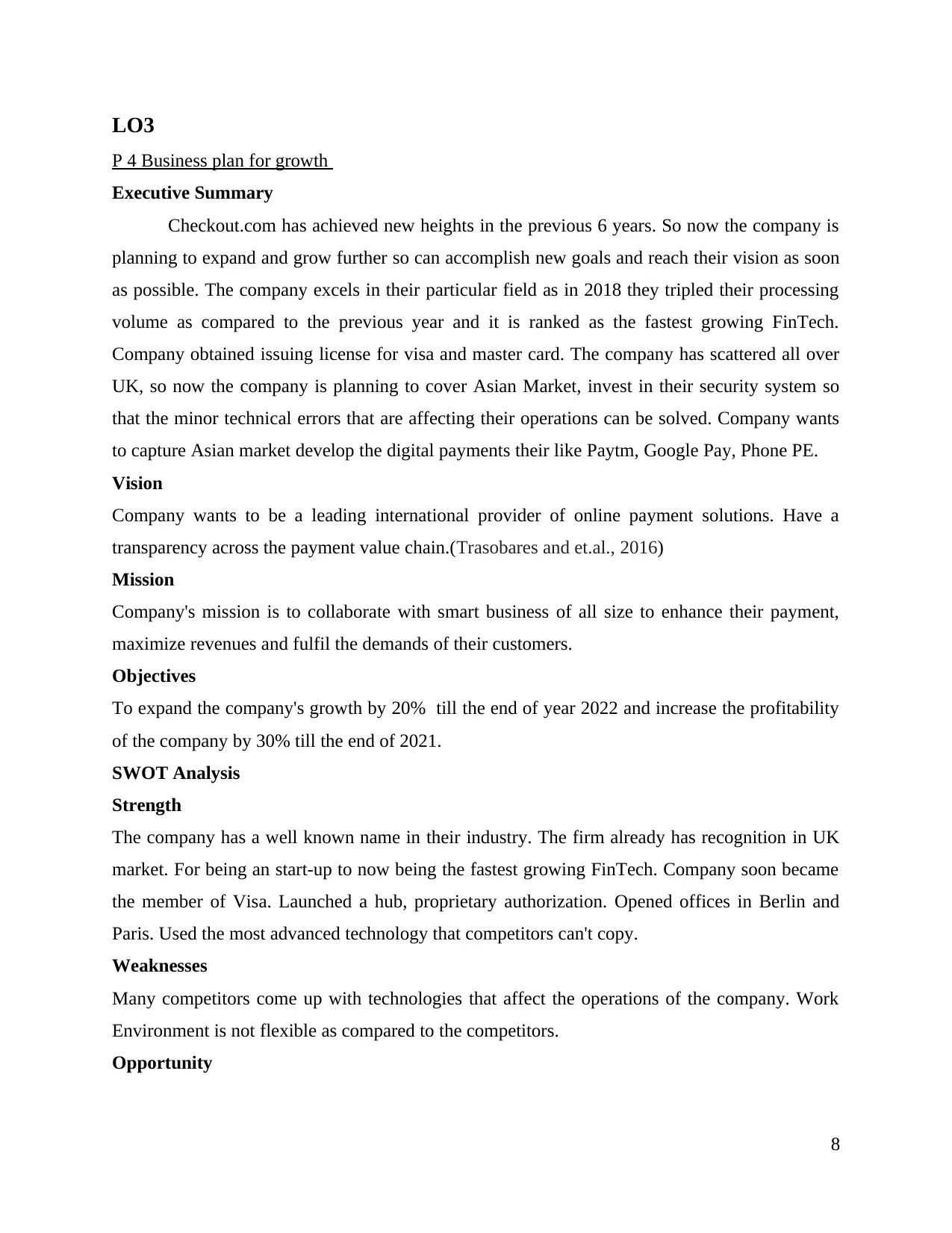

Financial planning

Control and Monitoring

Key Performance Indicators

Revenue – Increased from GBP 100.41 million to 316.6 million in just three quarter

Profit – Profit before taxes from GBP130.9 million in first quarter to GBP 141.3 million till

third quarter.

Customer Base – With a satisfied customer base company has attained 20000 thousands

customers.

Expansion – Company has successfully established three new plants in western region of the

company.

Services – The services of the company, the company immediately worked on the problem faced

by the customers and try to resolve them as soon as possible.

10

natural occurrence. The weather forecast department has to analyse and then implement the

strategy.

Financial planning

Control and Monitoring

Key Performance Indicators

Revenue – Increased from GBP 100.41 million to 316.6 million in just three quarter

Profit – Profit before taxes from GBP130.9 million in first quarter to GBP 141.3 million till

third quarter.

Customer Base – With a satisfied customer base company has attained 20000 thousands

customers.

Expansion – Company has successfully established three new plants in western region of the

company.

Services – The services of the company, the company immediately worked on the problem faced

by the customers and try to resolve them as soon as possible.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.