University Economics Report: GST Impact on Batteries, EVs, and Petrol

VerifiedAdded on 2020/03/01

|8

|1550

|17

Report

AI Summary

This report examines the economic implications of reducing the Goods and Services Tax (GST) on batteries in India. It analyzes the impact on battery prices, quantity demanded, consumer and producer surplus, and the electric vehicle (EV) market. The study investigates how a GST reduction from 28% to 5% affects the demand for EVs as a complementary good and petrol vehicles as substitutes. The report further assesses the long-term effects on EV profitability and the Indian government's goal of achieving 100% EV adoption by 2030, considering infrastructure limitations. The analysis uses economic principles to demonstrate how tax policies can influence market dynamics and consumer behavior within the context of sustainable business practices.

Running Head: ECONOMICS FOR SUSTAINABLE BUSINESS 1

Economics for Sustainable Business

Following the guidelines of the Course ID guidelines

Student’s Name

University

Economics for Sustainable Business

Following the guidelines of the Course ID guidelines

Student’s Name

University

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR SUSTAINABLE BUSINESS 2

Introduction

On the subject of implementing the Goods and Services Tax (GST) in India, the study

identifies the impact of lowering the GST levy on batteries from 28 percent to 5 percent on the

Indian battery market in terms of price, quantity demanded, consumer and producer surplus

(Mishra, 2017). Also, the study evaluates the impact of the same on Electric Vehicle market as

well as the petrol vehicle market in India. Lastly, the influence of the proposal of lowering the

GST on batteries on the Indian government’s target of 100 percent EV nation by 2030 has been

discussed in the essay paper as well.

Q1

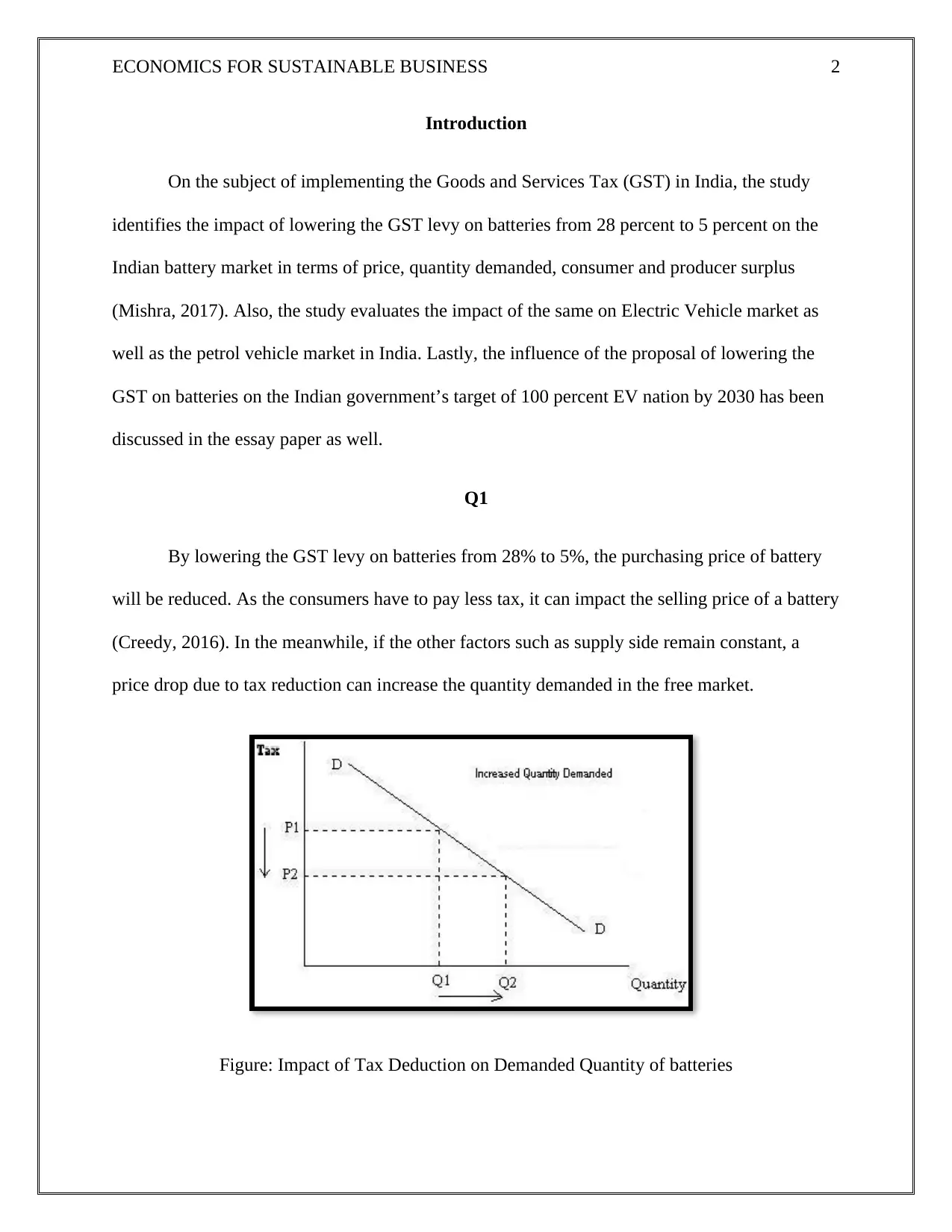

By lowering the GST levy on batteries from 28% to 5%, the purchasing price of battery

will be reduced. As the consumers have to pay less tax, it can impact the selling price of a battery

(Creedy, 2016). In the meanwhile, if the other factors such as supply side remain constant, a

price drop due to tax reduction can increase the quantity demanded in the free market.

Figure: Impact of Tax Deduction on Demanded Quantity of batteries

Introduction

On the subject of implementing the Goods and Services Tax (GST) in India, the study

identifies the impact of lowering the GST levy on batteries from 28 percent to 5 percent on the

Indian battery market in terms of price, quantity demanded, consumer and producer surplus

(Mishra, 2017). Also, the study evaluates the impact of the same on Electric Vehicle market as

well as the petrol vehicle market in India. Lastly, the influence of the proposal of lowering the

GST on batteries on the Indian government’s target of 100 percent EV nation by 2030 has been

discussed in the essay paper as well.

Q1

By lowering the GST levy on batteries from 28% to 5%, the purchasing price of battery

will be reduced. As the consumers have to pay less tax, it can impact the selling price of a battery

(Creedy, 2016). In the meanwhile, if the other factors such as supply side remain constant, a

price drop due to tax reduction can increase the quantity demanded in the free market.

Figure: Impact of Tax Deduction on Demanded Quantity of batteries

ECONOMICS FOR SUSTAINABLE BUSINESS 3

Source: (Forstater, 2017)

As described in the above figure, decrease in the GST levy on batteries from P1 to P2

will also reduce the price of batteries. Therefore, the quantity of battery demanded will increase

from Q1 to Q2. Evidently, the consumer and producer surplus of battery market will be affected

due to decline in the GST levy. Clearly, lower price of batteries due to tax deduction should

increase consumer surplus. In the meanwhile, due to price fall in batteries, the quantity

demanded of the product will be increased. Hence, the consumer surplus will be increased

(Cowan, 2012). On the other hand, lower price of batteries will reduce the producer surplus if

other factors remain constant. Invariably, if the cut down on the GST levy reduce the price, it

contributes towards lower potential producer surplus as goods supplied will be reduced (Ma,

2015). Therefore, the triangle of producer surplus will be smaller indicating lower producer

surplus.

Q2

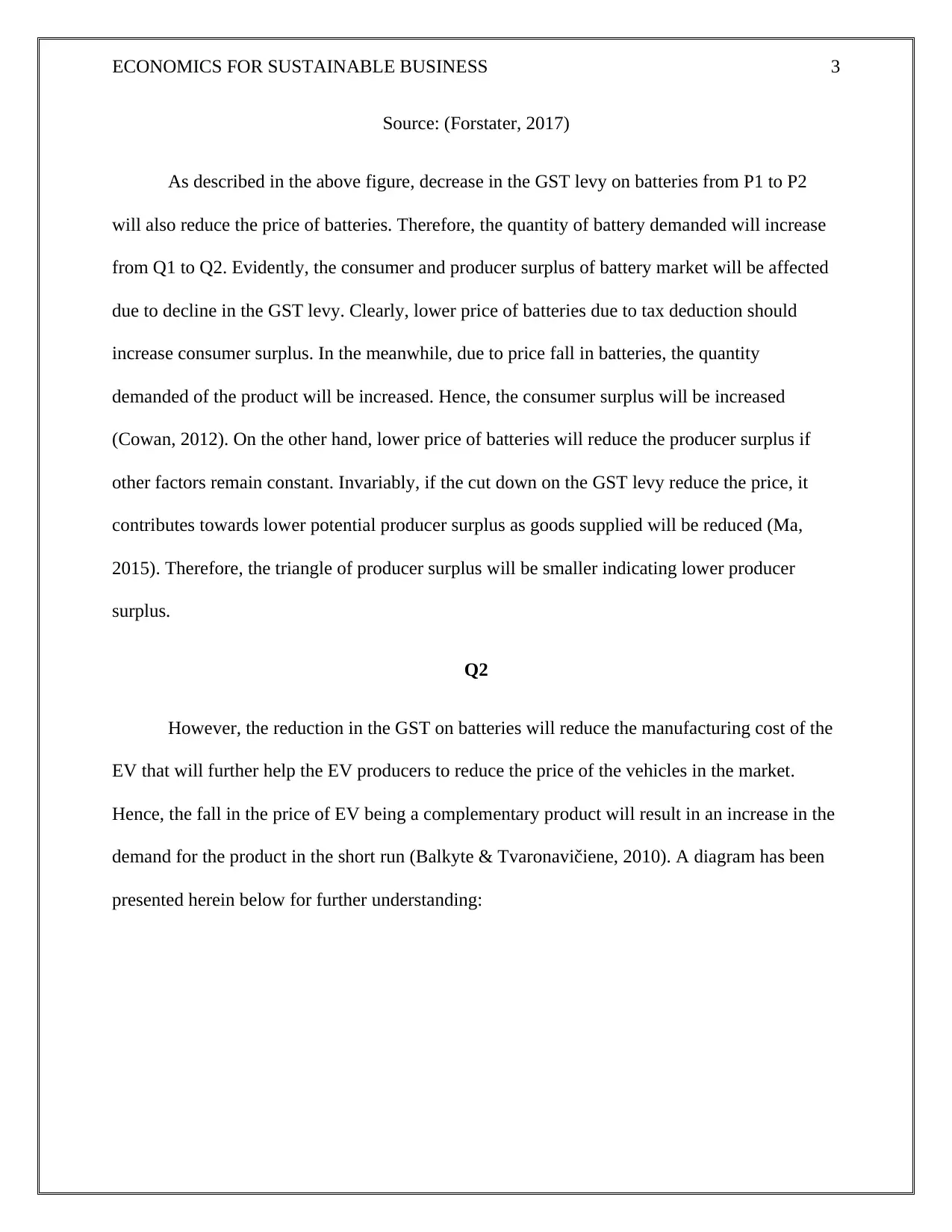

However, the reduction in the GST on batteries will reduce the manufacturing cost of the

EV that will further help the EV producers to reduce the price of the vehicles in the market.

Hence, the fall in the price of EV being a complementary product will result in an increase in the

demand for the product in the short run (Balkyte & Tvaronavičiene, 2010). A diagram has been

presented herein below for further understanding:

Source: (Forstater, 2017)

As described in the above figure, decrease in the GST levy on batteries from P1 to P2

will also reduce the price of batteries. Therefore, the quantity of battery demanded will increase

from Q1 to Q2. Evidently, the consumer and producer surplus of battery market will be affected

due to decline in the GST levy. Clearly, lower price of batteries due to tax deduction should

increase consumer surplus. In the meanwhile, due to price fall in batteries, the quantity

demanded of the product will be increased. Hence, the consumer surplus will be increased

(Cowan, 2012). On the other hand, lower price of batteries will reduce the producer surplus if

other factors remain constant. Invariably, if the cut down on the GST levy reduce the price, it

contributes towards lower potential producer surplus as goods supplied will be reduced (Ma,

2015). Therefore, the triangle of producer surplus will be smaller indicating lower producer

surplus.

Q2

However, the reduction in the GST on batteries will reduce the manufacturing cost of the

EV that will further help the EV producers to reduce the price of the vehicles in the market.

Hence, the fall in the price of EV being a complementary product will result in an increase in the

demand for the product in the short run (Balkyte & Tvaronavičiene, 2010). A diagram has been

presented herein below for further understanding:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR SUSTAINABLE BUSINESS 4

Figure: Demand for EV in short run

Source: (Taylor, Stonebarger & Leven, 2015)

It can be seen from the above diagram that reduction in the tax on battery will reduce the

price of EV in the short run. However, the demand curve will stick at D and there will be no

change in the quantity supplied in the short run. Hence, an increase in the quantity demanded for

EV can be evident from Q1 to Q2. Therefore a rise in the profitability will be seen in the case of

EV as no change is occurring in the profit margin for the EV producers (Bochet, İlkılıç, Moulin

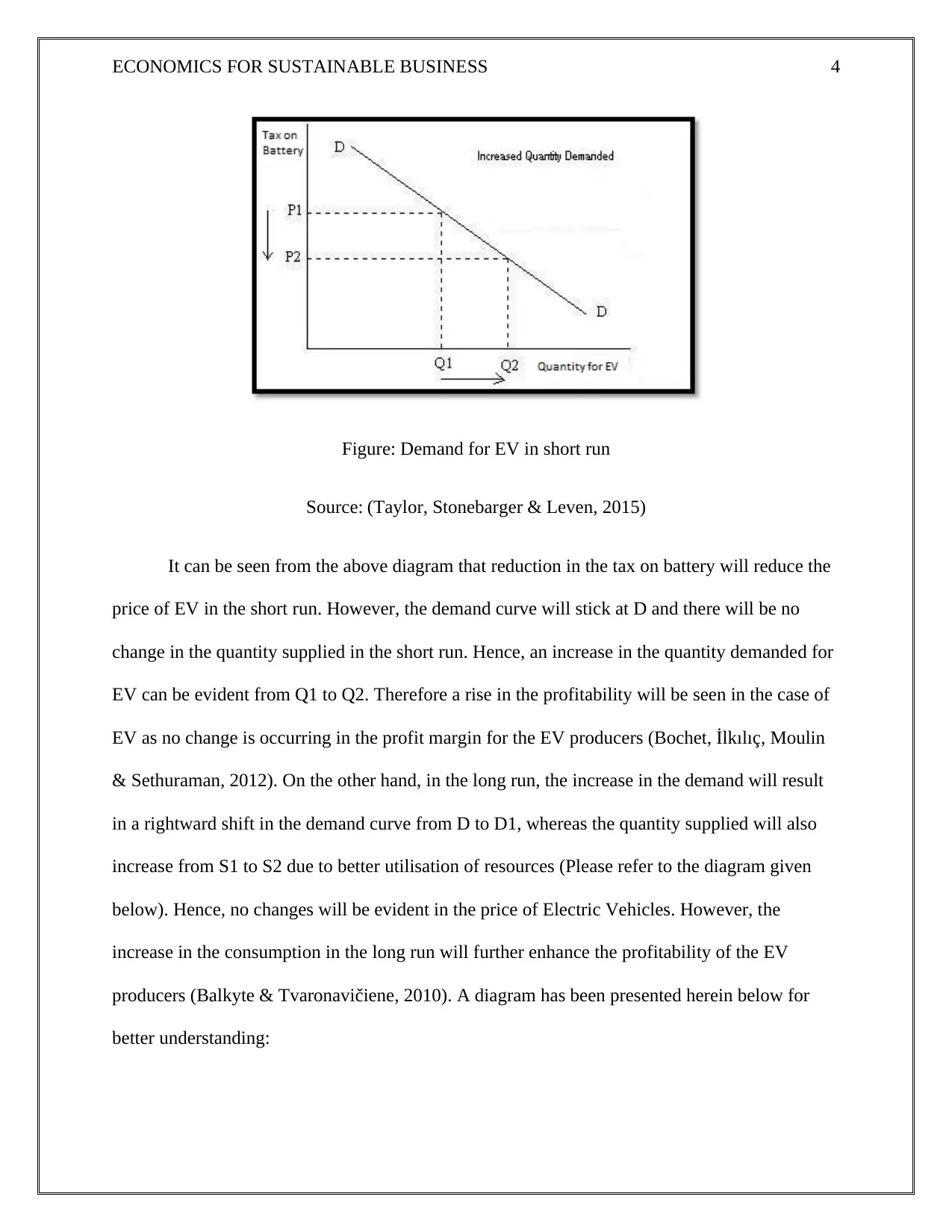

& Sethuraman, 2012). On the other hand, in the long run, the increase in the demand will result

in a rightward shift in the demand curve from D to D1, whereas the quantity supplied will also

increase from S1 to S2 due to better utilisation of resources (Please refer to the diagram given

below). Hence, no changes will be evident in the price of Electric Vehicles. However, the

increase in the consumption in the long run will further enhance the profitability of the EV

producers (Balkyte & Tvaronavičiene, 2010). A diagram has been presented herein below for

better understanding:

Figure: Demand for EV in short run

Source: (Taylor, Stonebarger & Leven, 2015)

It can be seen from the above diagram that reduction in the tax on battery will reduce the

price of EV in the short run. However, the demand curve will stick at D and there will be no

change in the quantity supplied in the short run. Hence, an increase in the quantity demanded for

EV can be evident from Q1 to Q2. Therefore a rise in the profitability will be seen in the case of

EV as no change is occurring in the profit margin for the EV producers (Bochet, İlkılıç, Moulin

& Sethuraman, 2012). On the other hand, in the long run, the increase in the demand will result

in a rightward shift in the demand curve from D to D1, whereas the quantity supplied will also

increase from S1 to S2 due to better utilisation of resources (Please refer to the diagram given

below). Hence, no changes will be evident in the price of Electric Vehicles. However, the

increase in the consumption in the long run will further enhance the profitability of the EV

producers (Balkyte & Tvaronavičiene, 2010). A diagram has been presented herein below for

better understanding:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR SUSTAINABLE BUSINESS 5

Figure: Demand and Supply of EV in long run

Source: (Taylor, Stonebarger & Leven, 2015)

Q3

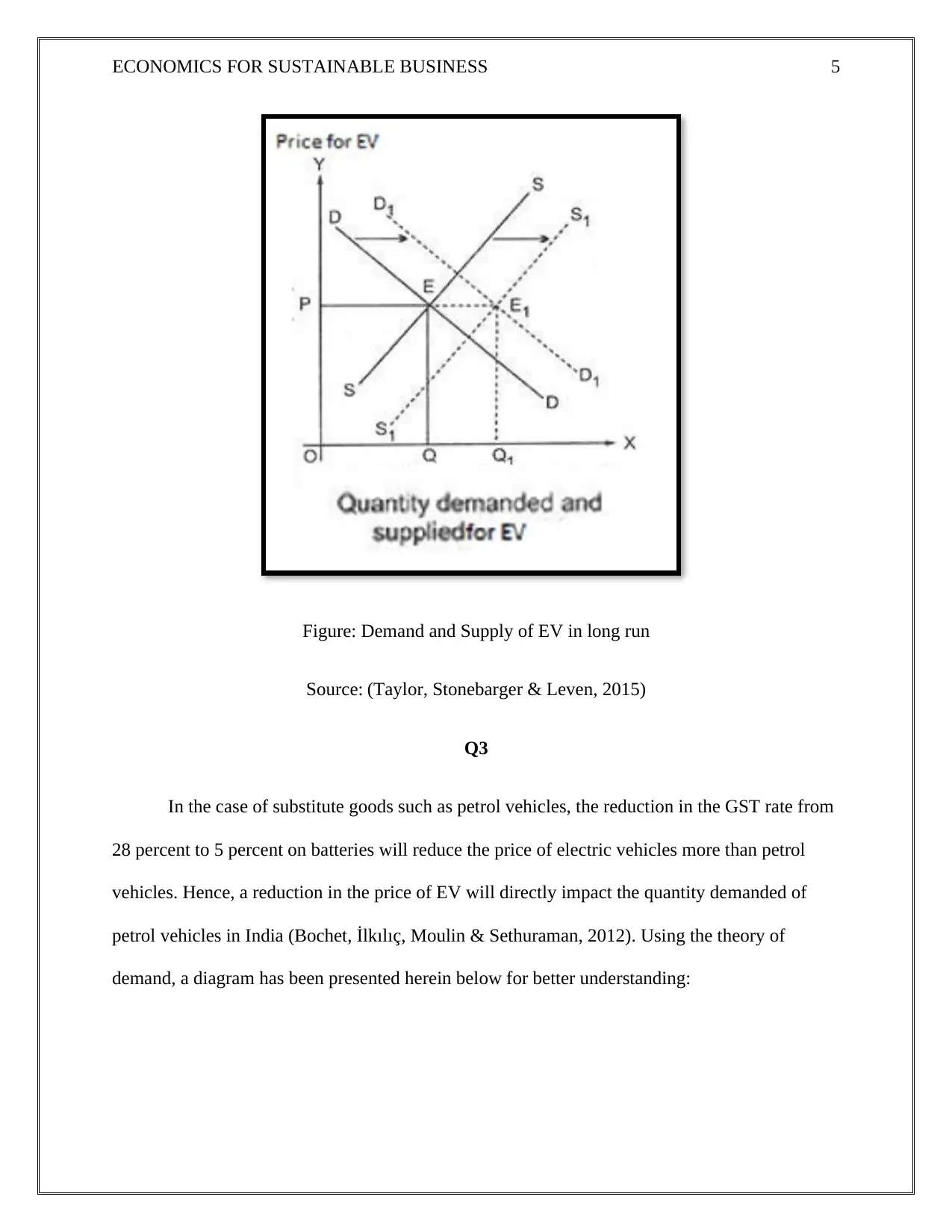

In the case of substitute goods such as petrol vehicles, the reduction in the GST rate from

28 percent to 5 percent on batteries will reduce the price of electric vehicles more than petrol

vehicles. Hence, a reduction in the price of EV will directly impact the quantity demanded of

petrol vehicles in India (Bochet, İlkılıç, Moulin & Sethuraman, 2012). Using the theory of

demand, a diagram has been presented herein below for better understanding:

Figure: Demand and Supply of EV in long run

Source: (Taylor, Stonebarger & Leven, 2015)

Q3

In the case of substitute goods such as petrol vehicles, the reduction in the GST rate from

28 percent to 5 percent on batteries will reduce the price of electric vehicles more than petrol

vehicles. Hence, a reduction in the price of EV will directly impact the quantity demanded of

petrol vehicles in India (Bochet, İlkılıç, Moulin & Sethuraman, 2012). Using the theory of

demand, a diagram has been presented herein below for better understanding:

ECONOMICS FOR SUSTAINABLE BUSINESS 6

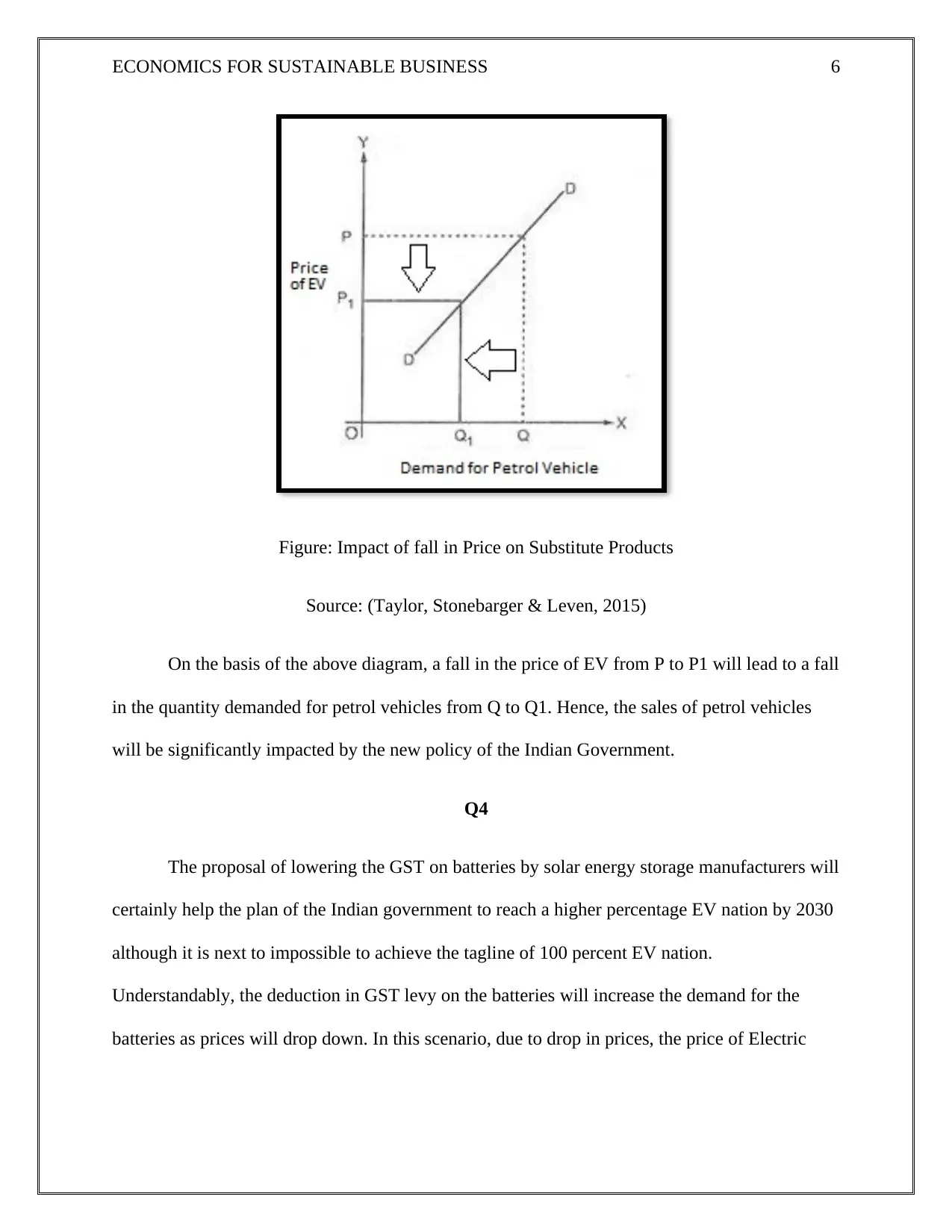

Figure: Impact of fall in Price on Substitute Products

Source: (Taylor, Stonebarger & Leven, 2015)

On the basis of the above diagram, a fall in the price of EV from P to P1 will lead to a fall

in the quantity demanded for petrol vehicles from Q to Q1. Hence, the sales of petrol vehicles

will be significantly impacted by the new policy of the Indian Government.

Q4

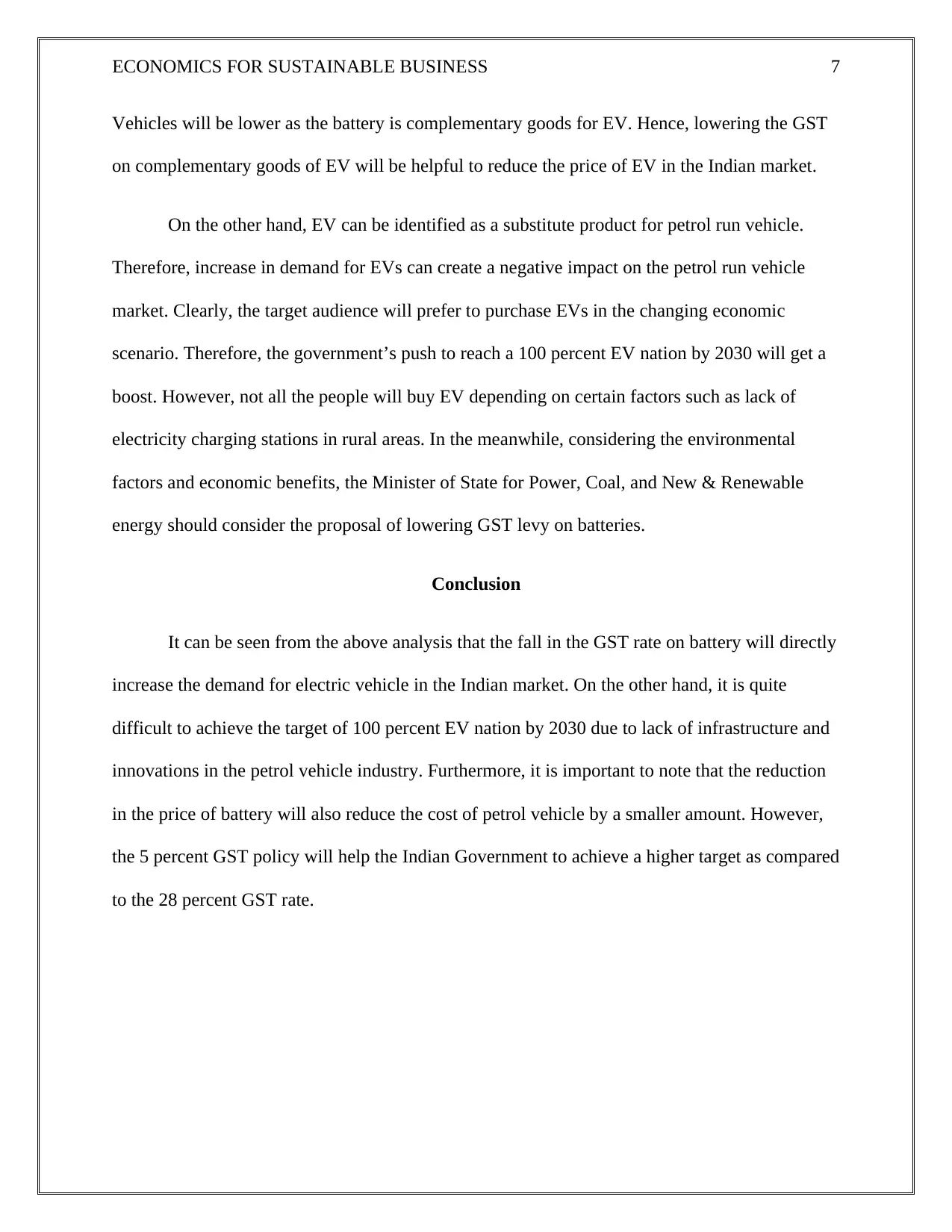

The proposal of lowering the GST on batteries by solar energy storage manufacturers will

certainly help the plan of the Indian government to reach a higher percentage EV nation by 2030

although it is next to impossible to achieve the tagline of 100 percent EV nation.

Understandably, the deduction in GST levy on the batteries will increase the demand for the

batteries as prices will drop down. In this scenario, due to drop in prices, the price of Electric

Figure: Impact of fall in Price on Substitute Products

Source: (Taylor, Stonebarger & Leven, 2015)

On the basis of the above diagram, a fall in the price of EV from P to P1 will lead to a fall

in the quantity demanded for petrol vehicles from Q to Q1. Hence, the sales of petrol vehicles

will be significantly impacted by the new policy of the Indian Government.

Q4

The proposal of lowering the GST on batteries by solar energy storage manufacturers will

certainly help the plan of the Indian government to reach a higher percentage EV nation by 2030

although it is next to impossible to achieve the tagline of 100 percent EV nation.

Understandably, the deduction in GST levy on the batteries will increase the demand for the

batteries as prices will drop down. In this scenario, due to drop in prices, the price of Electric

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR SUSTAINABLE BUSINESS 7

Vehicles will be lower as the battery is complementary goods for EV. Hence, lowering the GST

on complementary goods of EV will be helpful to reduce the price of EV in the Indian market.

On the other hand, EV can be identified as a substitute product for petrol run vehicle.

Therefore, increase in demand for EVs can create a negative impact on the petrol run vehicle

market. Clearly, the target audience will prefer to purchase EVs in the changing economic

scenario. Therefore, the government’s push to reach a 100 percent EV nation by 2030 will get a

boost. However, not all the people will buy EV depending on certain factors such as lack of

electricity charging stations in rural areas. In the meanwhile, considering the environmental

factors and economic benefits, the Minister of State for Power, Coal, and New & Renewable

energy should consider the proposal of lowering GST levy on batteries.

Conclusion

It can be seen from the above analysis that the fall in the GST rate on battery will directly

increase the demand for electric vehicle in the Indian market. On the other hand, it is quite

difficult to achieve the target of 100 percent EV nation by 2030 due to lack of infrastructure and

innovations in the petrol vehicle industry. Furthermore, it is important to note that the reduction

in the price of battery will also reduce the cost of petrol vehicle by a smaller amount. However,

the 5 percent GST policy will help the Indian Government to achieve a higher target as compared

to the 28 percent GST rate.

Vehicles will be lower as the battery is complementary goods for EV. Hence, lowering the GST

on complementary goods of EV will be helpful to reduce the price of EV in the Indian market.

On the other hand, EV can be identified as a substitute product for petrol run vehicle.

Therefore, increase in demand for EVs can create a negative impact on the petrol run vehicle

market. Clearly, the target audience will prefer to purchase EVs in the changing economic

scenario. Therefore, the government’s push to reach a 100 percent EV nation by 2030 will get a

boost. However, not all the people will buy EV depending on certain factors such as lack of

electricity charging stations in rural areas. In the meanwhile, considering the environmental

factors and economic benefits, the Minister of State for Power, Coal, and New & Renewable

energy should consider the proposal of lowering GST levy on batteries.

Conclusion

It can be seen from the above analysis that the fall in the GST rate on battery will directly

increase the demand for electric vehicle in the Indian market. On the other hand, it is quite

difficult to achieve the target of 100 percent EV nation by 2030 due to lack of infrastructure and

innovations in the petrol vehicle industry. Furthermore, it is important to note that the reduction

in the price of battery will also reduce the cost of petrol vehicle by a smaller amount. However,

the 5 percent GST policy will help the Indian Government to achieve a higher target as compared

to the 28 percent GST rate.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR SUSTAINABLE BUSINESS 8

References

Balkyte, A., & Tvaronavičiene, M. (2010). Perception of competitiveness in the context of

sustainable development: Facets of “sustainable competitiveness”. Journal Of Business

Economics And Management, 11(2), 341-365.

Bochet, O., İlkılıç, R., Moulin, H., & Sethuraman, J. (2012). Balancing supply and demand under

bilateral constraints. Theoretical Economics, 7(3), 395-423.

Cowan, S. (2012). Third-Degree Price Discrimination and Consumer Surplus. The Journal Of

Industrial Economics, 60(2), 333-345.

Creedy, J. (2016). Measuring welfare changes and tax burdens (4th ed.). Cheltenham, UK:

Edward Elgar.

Forstater, M. (2017). Economics (6th ed.). London: A. & C. Black.

Ma, T. (2015). Long-Run Industry Supply Curve and Producer Surplus. Journal Of Economics

And Development Studies, 3(2).

Mishra, T. (2017). Solar energy storage manufacturers want lower GST levy on batteries. The

Hindu Business Line. Retrieved August 2017, from

http://www.thehindubusinessline.com/economy/policy/solar-energy-battery-gst/

article9758357.ece

Taylor, T., Stonebarger, T., & Leven, J. (2015). Economics (5th ed.). Chantilly, VA: Teaching

Co.

References

Balkyte, A., & Tvaronavičiene, M. (2010). Perception of competitiveness in the context of

sustainable development: Facets of “sustainable competitiveness”. Journal Of Business

Economics And Management, 11(2), 341-365.

Bochet, O., İlkılıç, R., Moulin, H., & Sethuraman, J. (2012). Balancing supply and demand under

bilateral constraints. Theoretical Economics, 7(3), 395-423.

Cowan, S. (2012). Third-Degree Price Discrimination and Consumer Surplus. The Journal Of

Industrial Economics, 60(2), 333-345.

Creedy, J. (2016). Measuring welfare changes and tax burdens (4th ed.). Cheltenham, UK:

Edward Elgar.

Forstater, M. (2017). Economics (6th ed.). London: A. & C. Black.

Ma, T. (2015). Long-Run Industry Supply Curve and Producer Surplus. Journal Of Economics

And Development Studies, 3(2).

Mishra, T. (2017). Solar energy storage manufacturers want lower GST levy on batteries. The

Hindu Business Line. Retrieved August 2017, from

http://www.thehindubusinessline.com/economy/policy/solar-energy-battery-gst/

article9758357.ece

Taylor, T., Stonebarger, T., & Leven, J. (2015). Economics (5th ed.). Chantilly, VA: Teaching

Co.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.