HND Business Management: Business Decision Making Report Analysis

VerifiedAdded on 2020/10/22

|16

|3686

|298

Report

AI Summary

This report analyzes business decision-making for Hayward Home-style, a bespoke kitchen manufacturer. It begins with descriptive statistics, including a spreadsheet, histograms, and interquartile range analysis of customer data, assessing age, spending, and income. Task 2 outlines a plan for collecting primary and secondary data in a new target market, detailing survey methodology, sampling frames, and questionnaire design. Task 3 focuses on financial analysis, calculating the payback period (both standard and discounted) and net present value of a proposed investment. The report concludes with a Gantt chart to ensure timely project delivery. The analysis uses both primary and secondary data sources and includes a detailed financial assessment to inform strategic business decisions. The report helps in understanding the important aspects of business decision making.

BUSINESS

DECISION MAKING

DECISION MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Framing spreadsheet for descriptive statistics.......................................................................1

Presenting histograms of distribution of age and spend with median income interquartile

range............................................................................................................................................2

Interquartile range of annual income..........................................................................................3

(b) Preparing short presentation on basis of its findings.............................................................3

TASK 2............................................................................................................................................5

(a) Formal plan for conducting robust sample of various potential customers in new target

market..........................................................................................................................................5

(b) Secondary sources.................................................................................................................5

(c) Survey Methodology and sampling Frame............................................................................6

(d) Questionnaire.........................................................................................................................6

TASK 3............................................................................................................................................7

(a) Analysis of payback Period...................................................................................................8

(b) Analysis of net present value.................................................................................................9

(c) Decision based on financial criteria.....................................................................................11

(d) Presenting Gantt chart along with critical pathway for setting processes could be delivered

on time.......................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Framing spreadsheet for descriptive statistics.......................................................................1

Presenting histograms of distribution of age and spend with median income interquartile

range............................................................................................................................................2

Interquartile range of annual income..........................................................................................3

(b) Preparing short presentation on basis of its findings.............................................................3

TASK 2............................................................................................................................................5

(a) Formal plan for conducting robust sample of various potential customers in new target

market..........................................................................................................................................5

(b) Secondary sources.................................................................................................................5

(c) Survey Methodology and sampling Frame............................................................................6

(d) Questionnaire.........................................................................................................................6

TASK 3............................................................................................................................................7

(a) Analysis of payback Period...................................................................................................8

(b) Analysis of net present value.................................................................................................9

(c) Decision based on financial criteria.....................................................................................11

(d) Presenting Gantt chart along with critical pathway for setting processes could be delivered

on time.......................................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Decision making is an important concept of every business whether it is manufacturing,

service or any industry. The organization which is leading in this present era has effectively

taken decision in context of business. This report is based on Hayward Home style which makes

bespoke kitchen in USA for its customers. The present report is creating ability for using various

sources of gathering data from both primary and secondary sources as well. There is

representation of sampling frame and survey methodology which has been adopted along with

questionnaire. Further, various range of techniques for analysing and interpreting data in an

effective manner for purpose of business will be understood. In the same series, data has been

summarised by using descriptive statistics. There is presentation of information which has been

generated in a proper format for organizational context in decision making as well.

TASK 1

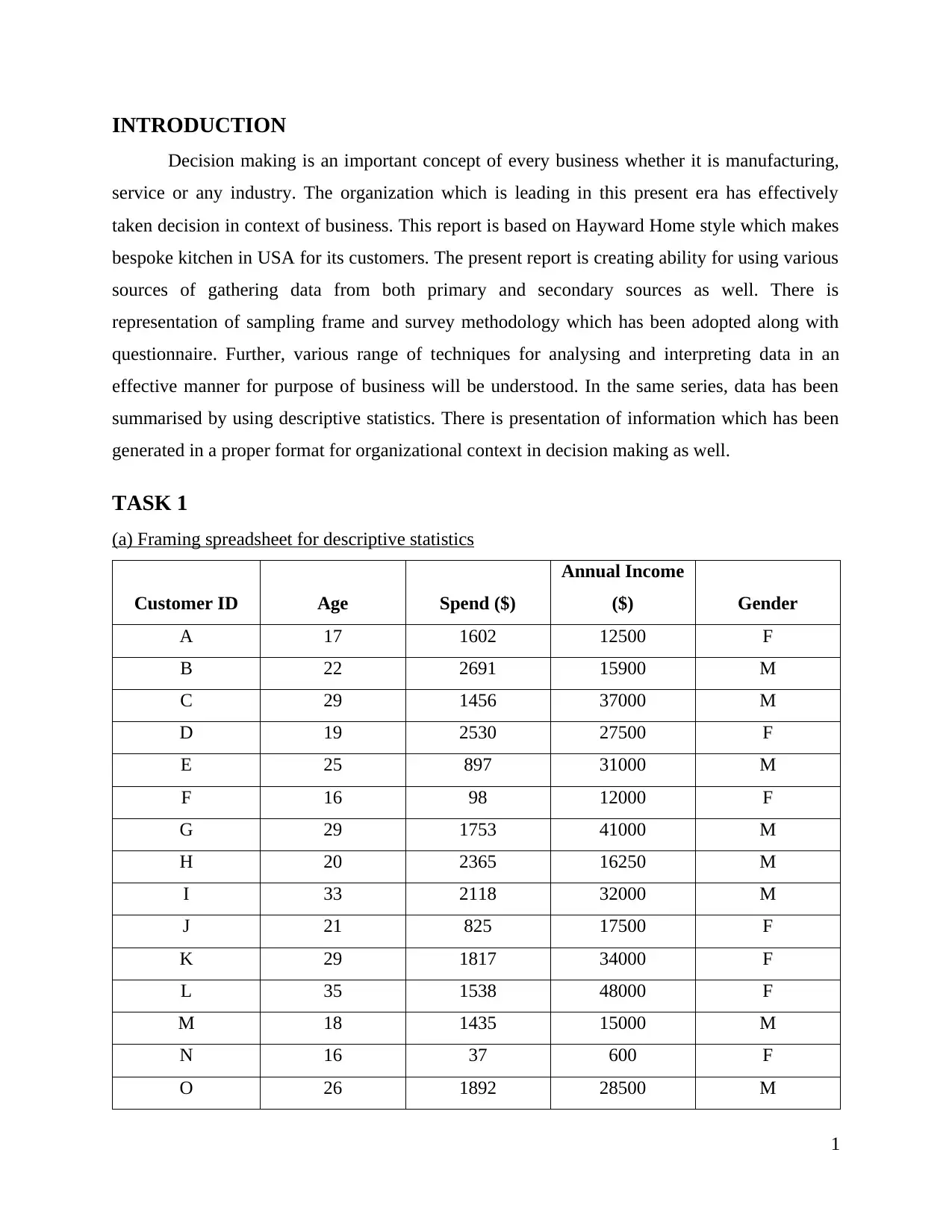

(a) Framing spreadsheet for descriptive statistics

Customer ID Age Spend ($)

Annual Income

($) Gender

A 17 1602 12500 F

B 22 2691 15900 M

C 29 1456 37000 M

D 19 2530 27500 F

E 25 897 31000 M

F 16 98 12000 F

G 29 1753 41000 M

H 20 2365 16250 M

I 33 2118 32000 M

J 21 825 17500 F

K 29 1817 34000 F

L 35 1538 48000 F

M 18 1435 15000 M

N 16 37 600 F

O 26 1892 28500 M

1

Decision making is an important concept of every business whether it is manufacturing,

service or any industry. The organization which is leading in this present era has effectively

taken decision in context of business. This report is based on Hayward Home style which makes

bespoke kitchen in USA for its customers. The present report is creating ability for using various

sources of gathering data from both primary and secondary sources as well. There is

representation of sampling frame and survey methodology which has been adopted along with

questionnaire. Further, various range of techniques for analysing and interpreting data in an

effective manner for purpose of business will be understood. In the same series, data has been

summarised by using descriptive statistics. There is presentation of information which has been

generated in a proper format for organizational context in decision making as well.

TASK 1

(a) Framing spreadsheet for descriptive statistics

Customer ID Age Spend ($)

Annual Income

($) Gender

A 17 1602 12500 F

B 22 2691 15900 M

C 29 1456 37000 M

D 19 2530 27500 F

E 25 897 31000 M

F 16 98 12000 F

G 29 1753 41000 M

H 20 2365 16250 M

I 33 2118 32000 M

J 21 825 17500 F

K 29 1817 34000 F

L 35 1538 48000 F

M 18 1435 15000 M

N 16 37 600 F

O 26 1892 28500 M

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P 41 1539 56000 F

Q 28 1582 37500 F

R 31 1258 37550 M

S 25 2846 31000 F

T 27 1983 33500 M

U 22 1073 27000 M

V 28 1594 38550 F

W 24 682 23000 M

X 22 1005 21500 M

Y 35 1396 46500 F

Z 27 2173 33525 F

Customer ID Age Spend ($) Annual Income ($)

Mean 25.57 1545.57

standard deviation 6.33 707.04

Median 31000

Correlation coefficient

of income and spending 0.29

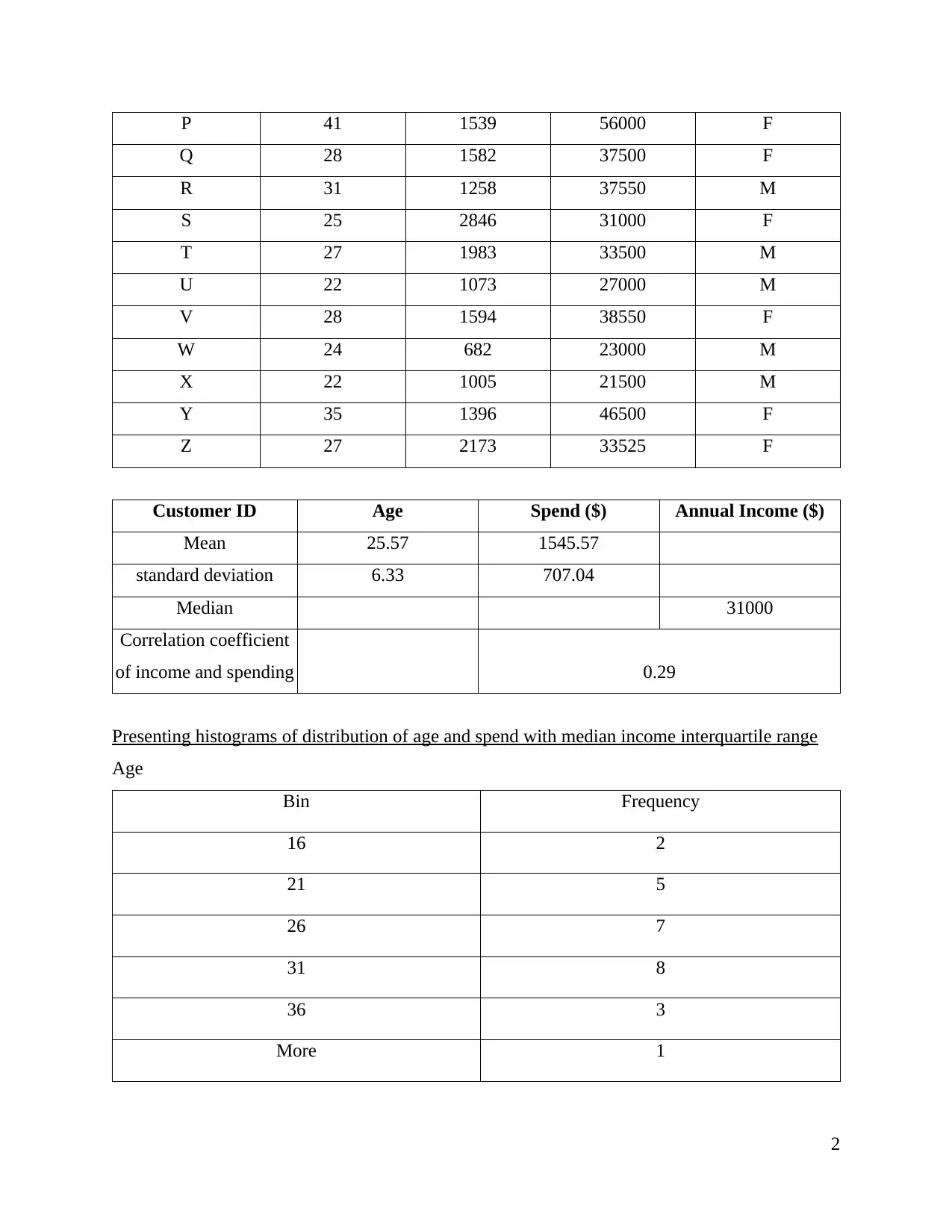

Presenting histograms of distribution of age and spend with median income interquartile range

Age

Bin Frequency

16 2

21 5

26 7

31 8

36 3

More 1

2

Q 28 1582 37500 F

R 31 1258 37550 M

S 25 2846 31000 F

T 27 1983 33500 M

U 22 1073 27000 M

V 28 1594 38550 F

W 24 682 23000 M

X 22 1005 21500 M

Y 35 1396 46500 F

Z 27 2173 33525 F

Customer ID Age Spend ($) Annual Income ($)

Mean 25.57 1545.57

standard deviation 6.33 707.04

Median 31000

Correlation coefficient

of income and spending 0.29

Presenting histograms of distribution of age and spend with median income interquartile range

Age

Bin Frequency

16 2

21 5

26 7

31 8

36 3

More 1

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

15/01/1900

20/01/1900

25/01/1900

30/01/1900

04/02/1900

More

0

4

8

Histogram

Column J

Bin

Frequency

Spending

Bin Frequency

37 1

598.8 1

1160.6 5

1722.4 9

2284.2 6

More 4

05/02/1900

20/08/1901

05/03/1903

17/09/1904

02/04/1906

More

0

4

8

Histogram

Column F

Bin

Frequency

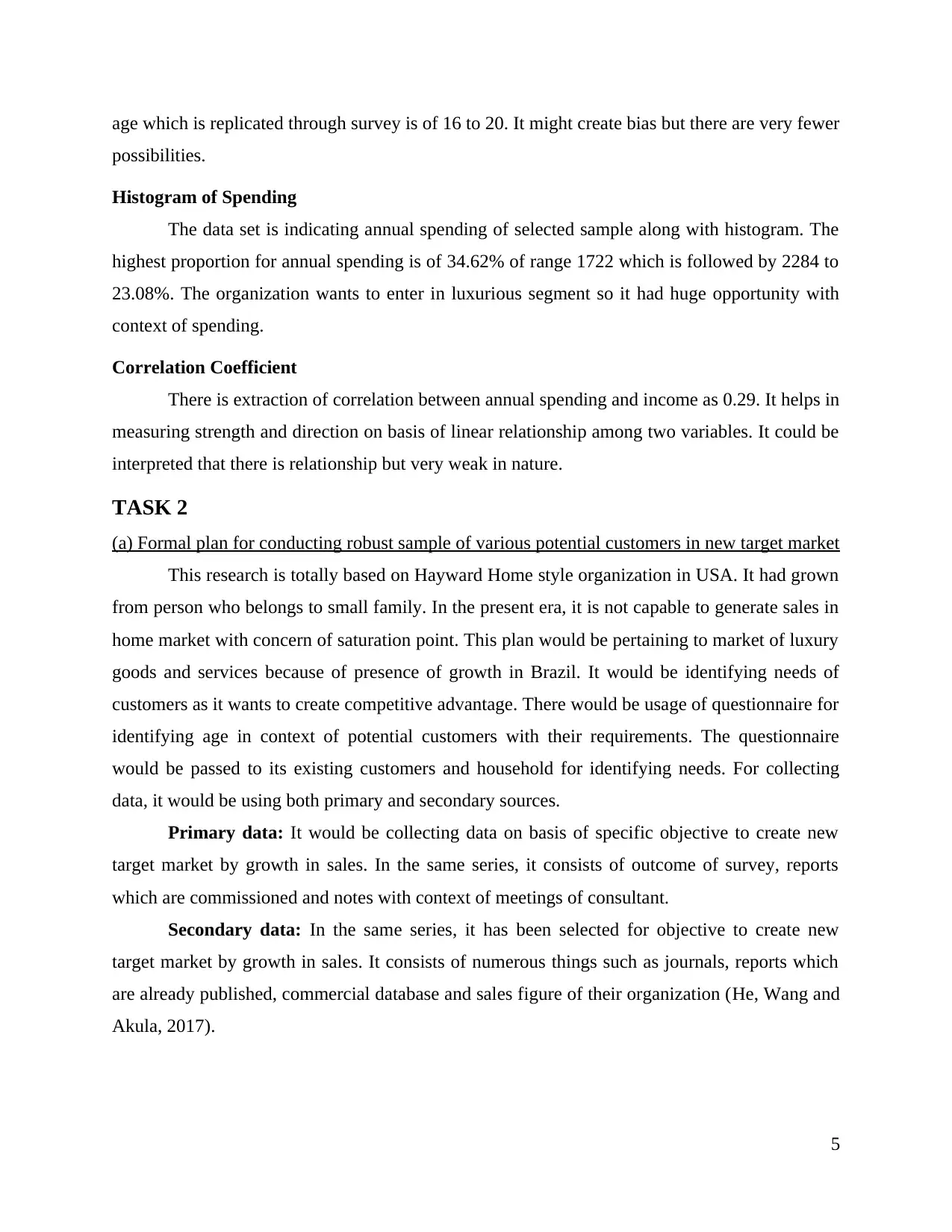

Interquartile range of annual income

Quartile 1 18500

3

20/01/1900

25/01/1900

30/01/1900

04/02/1900

More

0

4

8

Histogram

Column J

Bin

Frequency

Spending

Bin Frequency

37 1

598.8 1

1160.6 5

1722.4 9

2284.2 6

More 4

05/02/1900

20/08/1901

05/03/1903

17/09/1904

02/04/1906

More

0

4

8

Histogram

Column F

Bin

Frequency

Interquartile range of annual income

Quartile 1 18500

3

Quartile 2 31000

Quartile 3 37375

Inter quartile range 18875

(b) Preparing short presentation on basis of its findings

Analysis of Descriptive statistics

The findings have been interpreted by the survey outcomes of 26 households. Every

customer has allotted his/her customer ID from A to Z. There is identification of their age,

gender, spend and annual income (Reymen and et. al., 2017).

Mean

There is extraction of mean of age and spending. Generally, there products are majorly

used by consumers at age of approx 25 to 26.

The average spending of consumer had been extracted as approx. 1545 which reflects

annual spending of consumers.

It could be justified from trend line as if consumer’s annual income is increased it would

give similar impact to their spending level.

Hayward Home-style wants to grow in context of Luxurious segment. It should provide

attractive products because of presence of opportunity.

Standard deviation

It helps in measuring that how data is concentrated around its mean, if it is in

concentrated highly then it would replicate low standard deviation.

In the data set of age and spend, both are very small as compared to its arithmetic mean

then it is concentrated in huge aspect.

In simple words it could be interpreted that it is representing data set in well manner

aspect. The standard deviation of both variable is low which identifies that specific data

set is clustered in close aspect with context of mean (García-Peñalvo and Conde, 2014).

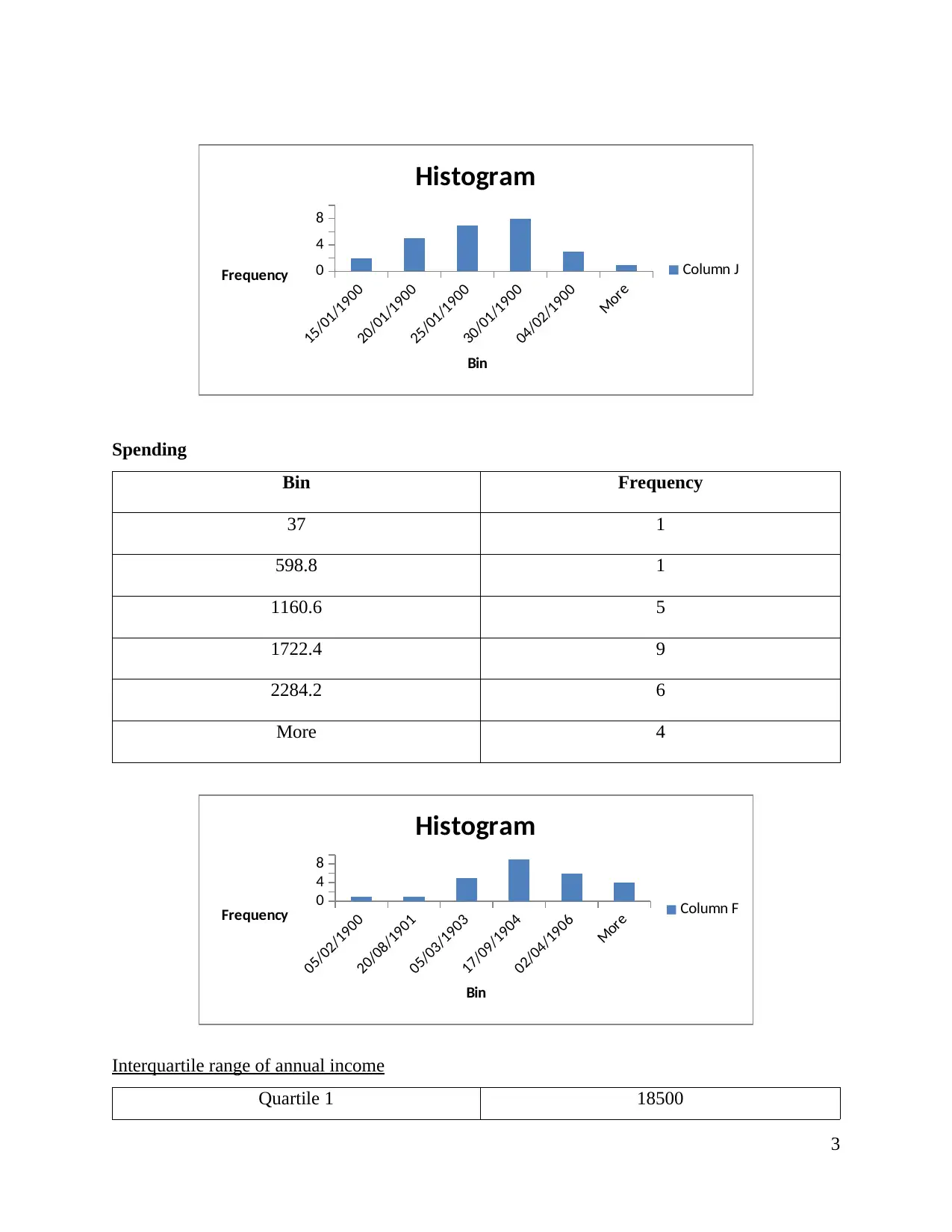

Histogram of Age

The data set is indicating age of respondents in which huge proportion has been gained

by range of 31 to 35 of 32%. It is followed by age of range of 26 to 30 of 28%. The minimum

4

Quartile 3 37375

Inter quartile range 18875

(b) Preparing short presentation on basis of its findings

Analysis of Descriptive statistics

The findings have been interpreted by the survey outcomes of 26 households. Every

customer has allotted his/her customer ID from A to Z. There is identification of their age,

gender, spend and annual income (Reymen and et. al., 2017).

Mean

There is extraction of mean of age and spending. Generally, there products are majorly

used by consumers at age of approx 25 to 26.

The average spending of consumer had been extracted as approx. 1545 which reflects

annual spending of consumers.

It could be justified from trend line as if consumer’s annual income is increased it would

give similar impact to their spending level.

Hayward Home-style wants to grow in context of Luxurious segment. It should provide

attractive products because of presence of opportunity.

Standard deviation

It helps in measuring that how data is concentrated around its mean, if it is in

concentrated highly then it would replicate low standard deviation.

In the data set of age and spend, both are very small as compared to its arithmetic mean

then it is concentrated in huge aspect.

In simple words it could be interpreted that it is representing data set in well manner

aspect. The standard deviation of both variable is low which identifies that specific data

set is clustered in close aspect with context of mean (García-Peñalvo and Conde, 2014).

Histogram of Age

The data set is indicating age of respondents in which huge proportion has been gained

by range of 31 to 35 of 32%. It is followed by age of range of 26 to 30 of 28%. The minimum

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

age which is replicated through survey is of 16 to 20. It might create bias but there are very fewer

possibilities.

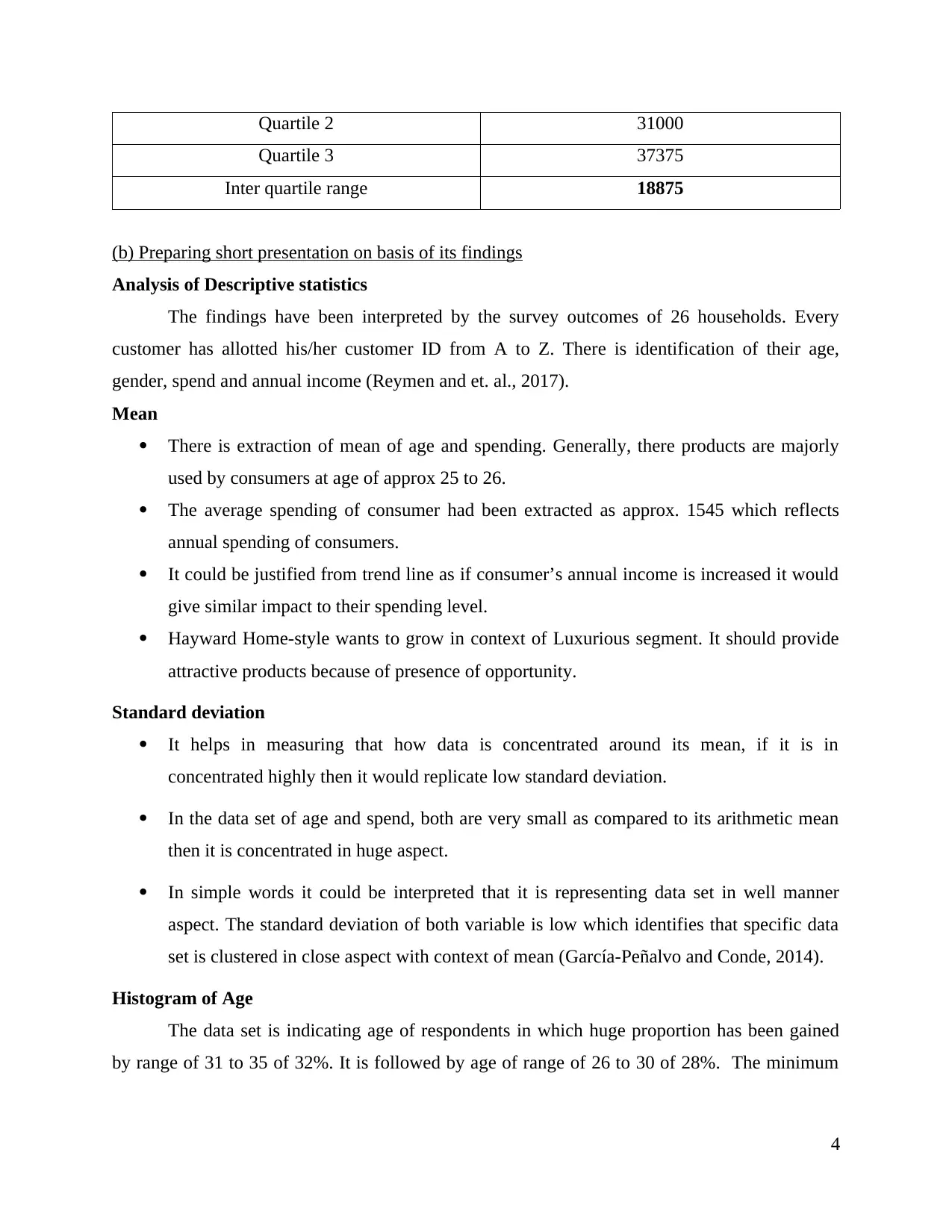

Histogram of Spending

The data set is indicating annual spending of selected sample along with histogram. The

highest proportion for annual spending is of 34.62% of range 1722 which is followed by 2284 to

23.08%. The organization wants to enter in luxurious segment so it had huge opportunity with

context of spending.

Correlation Coefficient

There is extraction of correlation between annual spending and income as 0.29. It helps in

measuring strength and direction on basis of linear relationship among two variables. It could be

interpreted that there is relationship but very weak in nature.

TASK 2

(a) Formal plan for conducting robust sample of various potential customers in new target market

This research is totally based on Hayward Home style organization in USA. It had grown

from person who belongs to small family. In the present era, it is not capable to generate sales in

home market with concern of saturation point. This plan would be pertaining to market of luxury

goods and services because of presence of growth in Brazil. It would be identifying needs of

customers as it wants to create competitive advantage. There would be usage of questionnaire for

identifying age in context of potential customers with their requirements. The questionnaire

would be passed to its existing customers and household for identifying needs. For collecting

data, it would be using both primary and secondary sources.

Primary data: It would be collecting data on basis of specific objective to create new

target market by growth in sales. In the same series, it consists of outcome of survey, reports

which are commissioned and notes with context of meetings of consultant.

Secondary data: In the same series, it has been selected for objective to create new

target market by growth in sales. It consists of numerous things such as journals, reports which

are already published, commercial database and sales figure of their organization (He, Wang and

Akula, 2017).

5

possibilities.

Histogram of Spending

The data set is indicating annual spending of selected sample along with histogram. The

highest proportion for annual spending is of 34.62% of range 1722 which is followed by 2284 to

23.08%. The organization wants to enter in luxurious segment so it had huge opportunity with

context of spending.

Correlation Coefficient

There is extraction of correlation between annual spending and income as 0.29. It helps in

measuring strength and direction on basis of linear relationship among two variables. It could be

interpreted that there is relationship but very weak in nature.

TASK 2

(a) Formal plan for conducting robust sample of various potential customers in new target market

This research is totally based on Hayward Home style organization in USA. It had grown

from person who belongs to small family. In the present era, it is not capable to generate sales in

home market with concern of saturation point. This plan would be pertaining to market of luxury

goods and services because of presence of growth in Brazil. It would be identifying needs of

customers as it wants to create competitive advantage. There would be usage of questionnaire for

identifying age in context of potential customers with their requirements. The questionnaire

would be passed to its existing customers and household for identifying needs. For collecting

data, it would be using both primary and secondary sources.

Primary data: It would be collecting data on basis of specific objective to create new

target market by growth in sales. In the same series, it consists of outcome of survey, reports

which are commissioned and notes with context of meetings of consultant.

Secondary data: In the same series, it has been selected for objective to create new

target market by growth in sales. It consists of numerous things such as journals, reports which

are already published, commercial database and sales figure of their organization (He, Wang and

Akula, 2017).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(b) Secondary sources

There would be collection of data which has been collected for their specific purpose. It

consists of various things such as published reports, commercial data base and internal figure for

sales. It would be considered as very quick for its applications because of its easy availability. It

is cheaper as compared to primary data because it is already available and time savvy. Company

would be applying various secondary sources like facts and figures which are gathered by other

departments in context of trend. It would be using reference books, journals, newspapers,

published reports, government statistics and database which are available through online

(Pollmann and et. al., 2016).

(c) Survey Methodology and sampling Frame

Survey methodology: The organization would be using online survey methodology to its

existing customers for entering in luxurious segment of kitchen appliances. It would be also

passing this specific questionnaire to h in potential format for composing new target market.

Sampling frame: It is considered as specific source material or device on which there

would be selection of sample. In the particular research it would be selecting households because

its products are largely used their only. There would be usage of random sampling method. The

households would be selected from urban area as it wants to enter in luxurious segment. Its

universe would be of one locality which is dispersed with huge dispersed area.

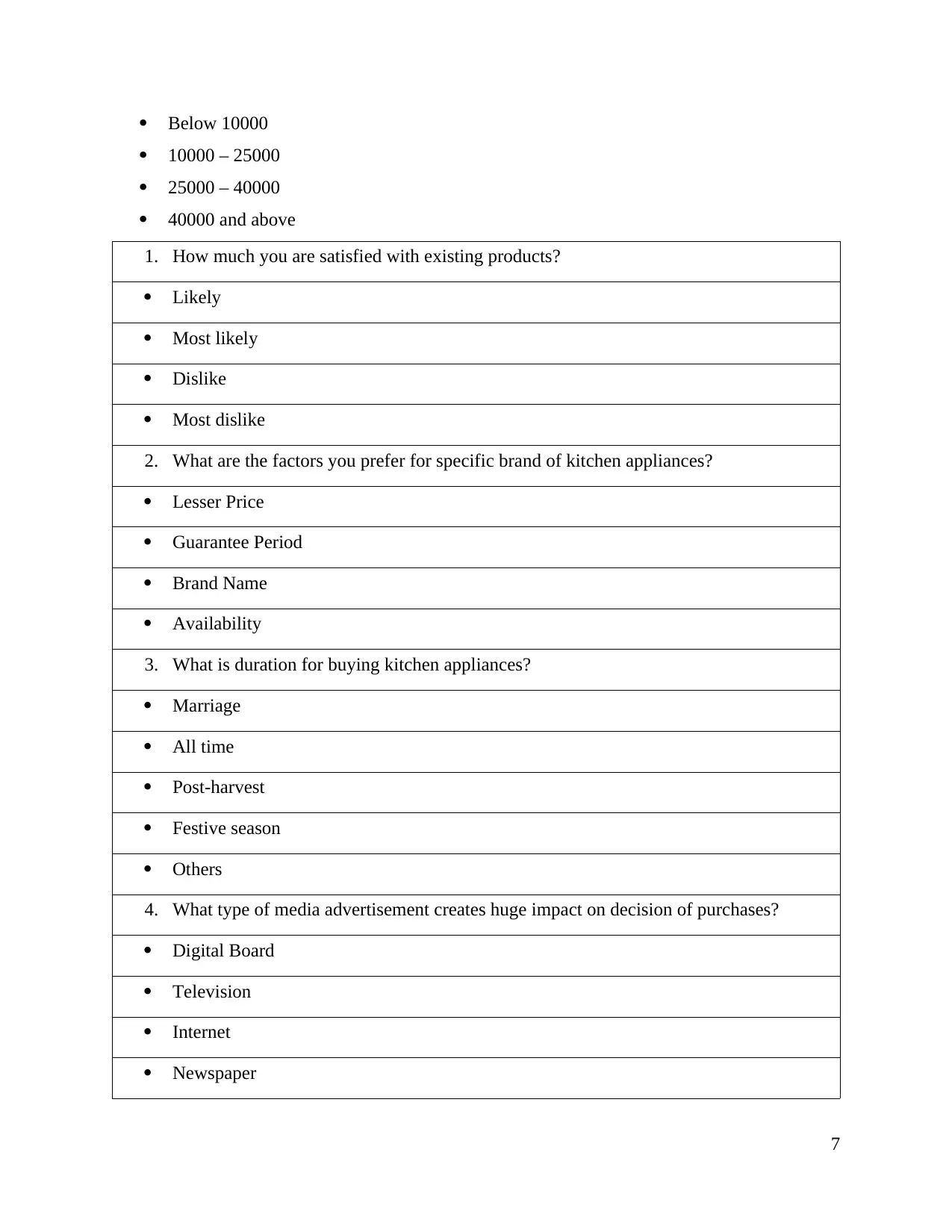

(d) Questionnaire

Demographic variable

Gender:

Male

Female

Others

Age:

15– 30

31 – 45

46 – 60

60 and above

Annual income:

6

There would be collection of data which has been collected for their specific purpose. It

consists of various things such as published reports, commercial data base and internal figure for

sales. It would be considered as very quick for its applications because of its easy availability. It

is cheaper as compared to primary data because it is already available and time savvy. Company

would be applying various secondary sources like facts and figures which are gathered by other

departments in context of trend. It would be using reference books, journals, newspapers,

published reports, government statistics and database which are available through online

(Pollmann and et. al., 2016).

(c) Survey Methodology and sampling Frame

Survey methodology: The organization would be using online survey methodology to its

existing customers for entering in luxurious segment of kitchen appliances. It would be also

passing this specific questionnaire to h in potential format for composing new target market.

Sampling frame: It is considered as specific source material or device on which there

would be selection of sample. In the particular research it would be selecting households because

its products are largely used their only. There would be usage of random sampling method. The

households would be selected from urban area as it wants to enter in luxurious segment. Its

universe would be of one locality which is dispersed with huge dispersed area.

(d) Questionnaire

Demographic variable

Gender:

Male

Female

Others

Age:

15– 30

31 – 45

46 – 60

60 and above

Annual income:

6

Below 10000

10000 – 25000

25000 – 40000

40000 and above

1. How much you are satisfied with existing products?

Likely

Most likely

Dislike

Most dislike

2. What are the factors you prefer for specific brand of kitchen appliances?

Lesser Price

Guarantee Period

Brand Name

Availability

3. What is duration for buying kitchen appliances?

Marriage

All time

Post-harvest

Festive season

Others

4. What type of media advertisement creates huge impact on decision of purchases?

Digital Board

Television

Internet

Newspaper

7

10000 – 25000

25000 – 40000

40000 and above

1. How much you are satisfied with existing products?

Likely

Most likely

Dislike

Most dislike

2. What are the factors you prefer for specific brand of kitchen appliances?

Lesser Price

Guarantee Period

Brand Name

Availability

3. What is duration for buying kitchen appliances?

Marriage

All time

Post-harvest

Festive season

Others

4. What type of media advertisement creates huge impact on decision of purchases?

Digital Board

Television

Internet

Newspaper

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Others

5. Would you recommend others with context of favourite brand to others?

Yes

No

6. If yes, then on what criteria?

Availability

High Quality

Price

Others

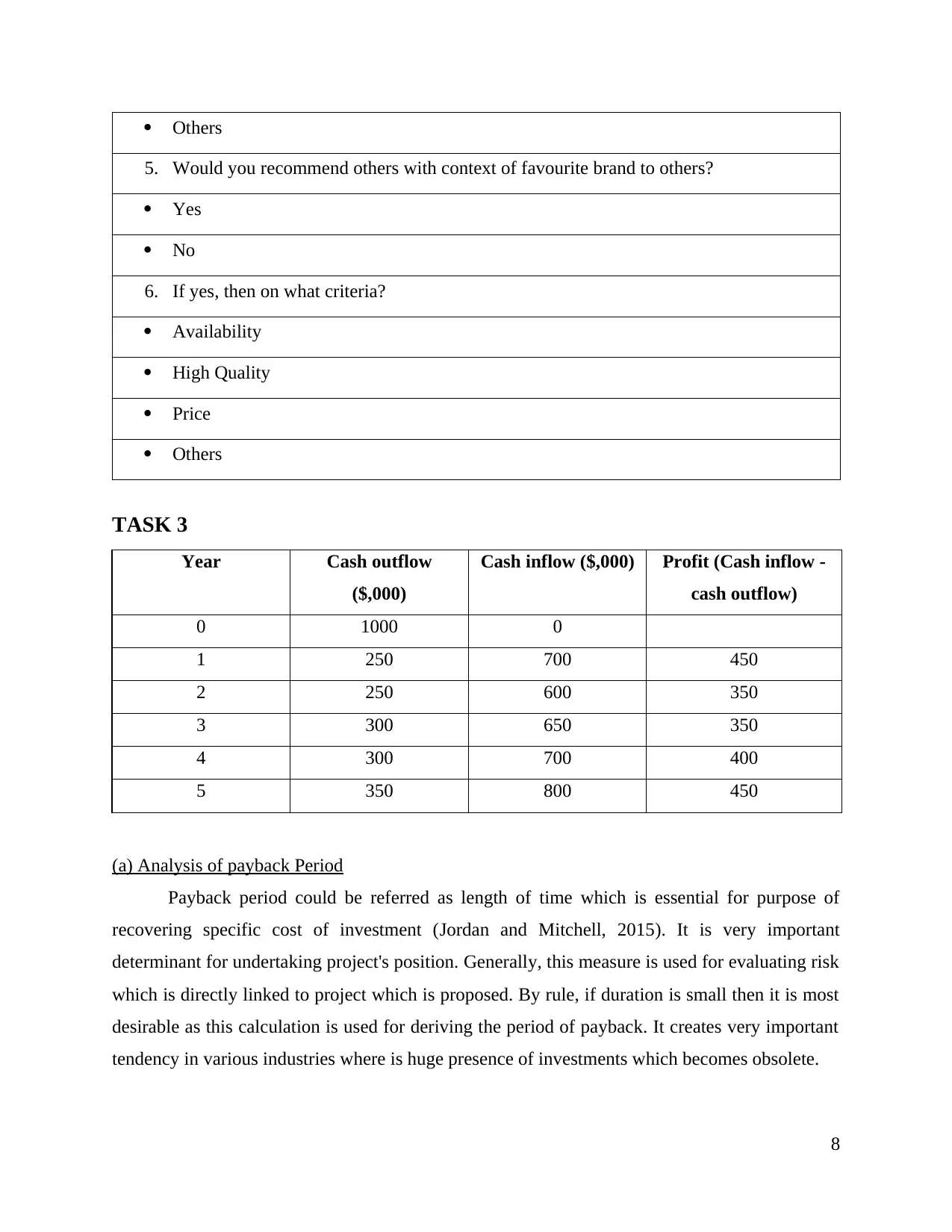

TASK 3

Year Cash outflow

($,000)

Cash inflow ($,000) Profit (Cash inflow -

cash outflow)

0 1000 0

1 250 700 450

2 250 600 350

3 300 650 350

4 300 700 400

5 350 800 450

(a) Analysis of payback Period

Payback period could be referred as length of time which is essential for purpose of

recovering specific cost of investment (Jordan and Mitchell, 2015). It is very important

determinant for undertaking project's position. Generally, this measure is used for evaluating risk

which is directly linked to project which is proposed. By rule, if duration is small then it is most

desirable as this calculation is used for deriving the period of payback. It creates very important

tendency in various industries where is huge presence of investments which becomes obsolete.

8

5. Would you recommend others with context of favourite brand to others?

Yes

No

6. If yes, then on what criteria?

Availability

High Quality

Price

Others

TASK 3

Year Cash outflow

($,000)

Cash inflow ($,000) Profit (Cash inflow -

cash outflow)

0 1000 0

1 250 700 450

2 250 600 350

3 300 650 350

4 300 700 400

5 350 800 450

(a) Analysis of payback Period

Payback period could be referred as length of time which is essential for purpose of

recovering specific cost of investment (Jordan and Mitchell, 2015). It is very important

determinant for undertaking project's position. Generally, this measure is used for evaluating risk

which is directly linked to project which is proposed. By rule, if duration is small then it is most

desirable as this calculation is used for deriving the period of payback. It creates very important

tendency in various industries where is huge presence of investments which becomes obsolete.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

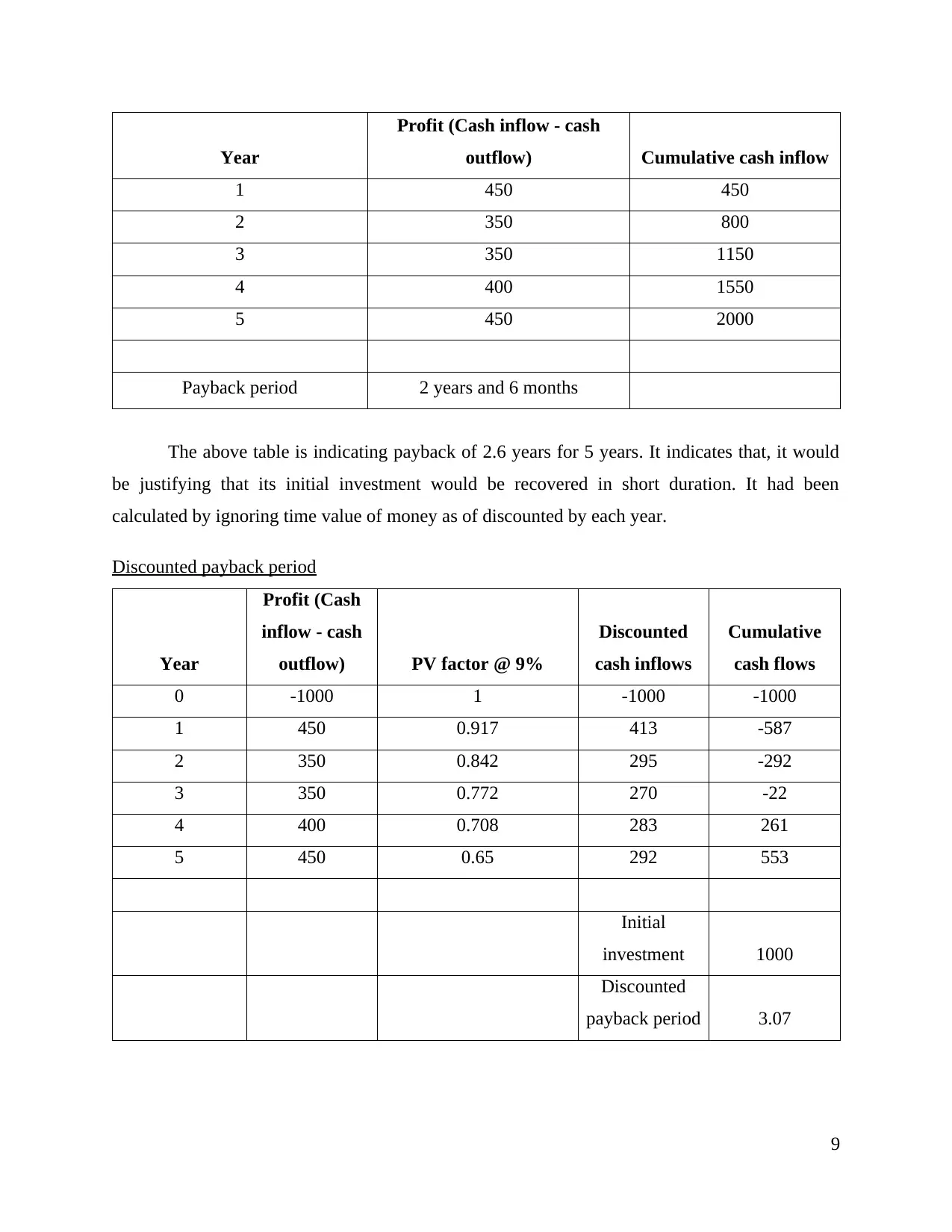

Year

Profit (Cash inflow - cash

outflow) Cumulative cash inflow

1 450 450

2 350 800

3 350 1150

4 400 1550

5 450 2000

Payback period 2 years and 6 months

The above table is indicating payback of 2.6 years for 5 years. It indicates that, it would

be justifying that its initial investment would be recovered in short duration. It had been

calculated by ignoring time value of money as of discounted by each year.

Discounted payback period

Year

Profit (Cash

inflow - cash

outflow) PV factor @ 9%

Discounted

cash inflows

Cumulative

cash flows

0 -1000 1 -1000 -1000

1 450 0.917 413 -587

2 350 0.842 295 -292

3 350 0.772 270 -22

4 400 0.708 283 261

5 450 0.65 292 553

Initial

investment 1000

Discounted

payback period 3.07

9

Profit (Cash inflow - cash

outflow) Cumulative cash inflow

1 450 450

2 350 800

3 350 1150

4 400 1550

5 450 2000

Payback period 2 years and 6 months

The above table is indicating payback of 2.6 years for 5 years. It indicates that, it would

be justifying that its initial investment would be recovered in short duration. It had been

calculated by ignoring time value of money as of discounted by each year.

Discounted payback period

Year

Profit (Cash

inflow - cash

outflow) PV factor @ 9%

Discounted

cash inflows

Cumulative

cash flows

0 -1000 1 -1000 -1000

1 450 0.917 413 -587

2 350 0.842 295 -292

3 350 0.772 270 -22

4 400 0.708 283 261

5 450 0.65 292 553

Initial

investment 1000

Discounted

payback period 3.07

9

The discounted payback period is considered as measure for criticism of payback period

which ignore time factor, so by considering, it had framed discounted payback period. The above

table is indicating discounted payback period is of 3.07 years which is actual duration for

recovering its initial investment (Payback period, 2013).

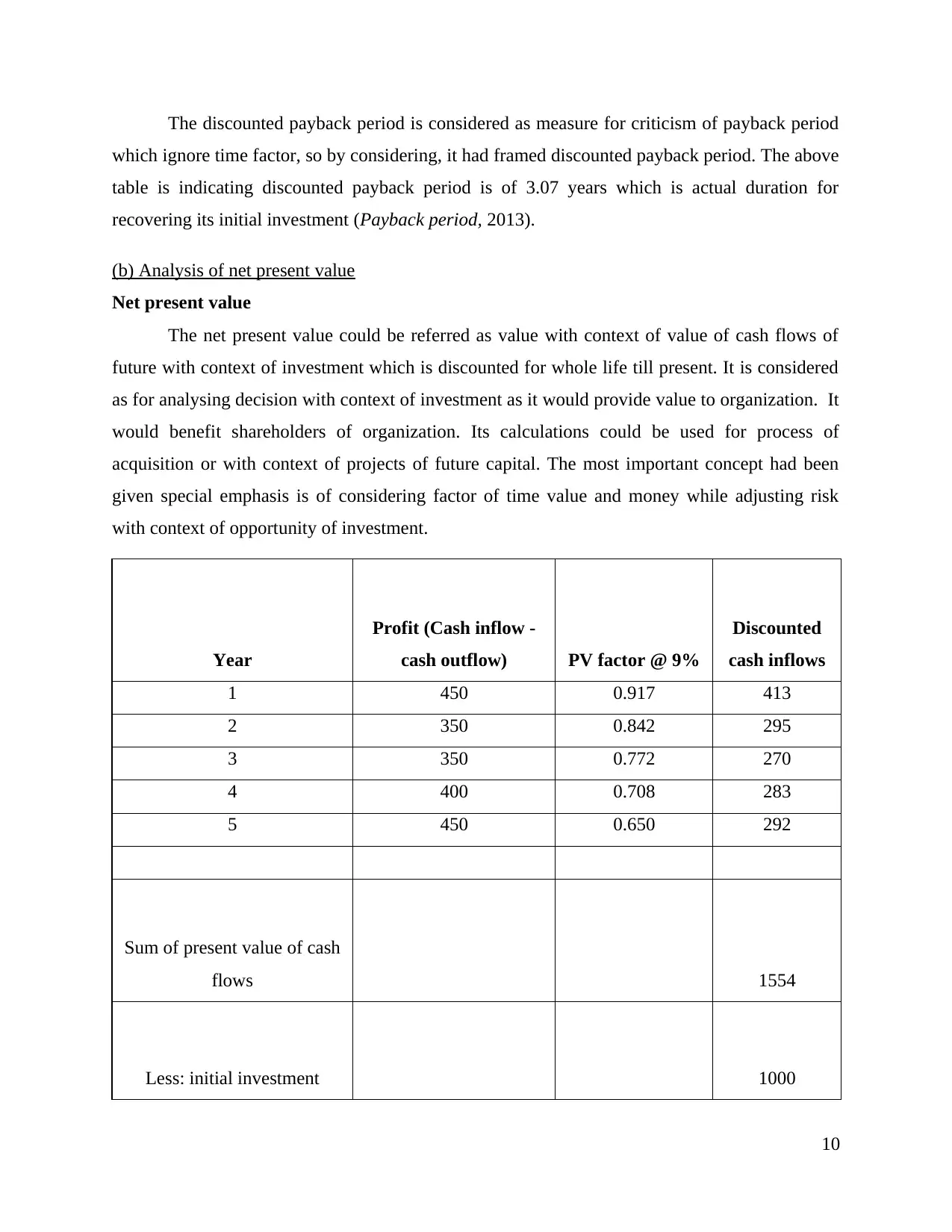

(b) Analysis of net present value

Net present value

The net present value could be referred as value with context of value of cash flows of

future with context of investment which is discounted for whole life till present. It is considered

as for analysing decision with context of investment as it would provide value to organization. It

would benefit shareholders of organization. Its calculations could be used for process of

acquisition or with context of projects of future capital. The most important concept had been

given special emphasis is of considering factor of time value and money while adjusting risk

with context of opportunity of investment.

Year

Profit (Cash inflow -

cash outflow) PV factor @ 9%

Discounted

cash inflows

1 450 0.917 413

2 350 0.842 295

3 350 0.772 270

4 400 0.708 283

5 450 0.650 292

Sum of present value of cash

flows 1554

Less: initial investment 1000

10

which ignore time factor, so by considering, it had framed discounted payback period. The above

table is indicating discounted payback period is of 3.07 years which is actual duration for

recovering its initial investment (Payback period, 2013).

(b) Analysis of net present value

Net present value

The net present value could be referred as value with context of value of cash flows of

future with context of investment which is discounted for whole life till present. It is considered

as for analysing decision with context of investment as it would provide value to organization. It

would benefit shareholders of organization. Its calculations could be used for process of

acquisition or with context of projects of future capital. The most important concept had been

given special emphasis is of considering factor of time value and money while adjusting risk

with context of opportunity of investment.

Year

Profit (Cash inflow -

cash outflow) PV factor @ 9%

Discounted

cash inflows

1 450 0.917 413

2 350 0.842 295

3 350 0.772 270

4 400 0.708 283

5 450 0.650 292

Sum of present value of cash

flows 1554

Less: initial investment 1000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.