HI5017 Managerial Accounting Case Study: Cost Analysis and Innovation

VerifiedAdded on 2023/04/23

|17

|4592

|66

Case Study

AI Summary

This assignment comprises two parts: Part A involves analyzing cost concepts and their application to Nanna's House, a service-based company, including fixed costs, variable costs, relevant vs. irrelevant costs, and decision-making based on different laundry service alternatives. It also assesses the profitability of accepting additional students and expanding the day care facility. Part B requires a critical evaluation of a journal article on innovation management, focusing on identifying components of the management accounting system, describing the innovation process as information creation, and extracting useful research findings for management accountants in Australian companies. The analysis includes detailed cost calculations and recommendations based on the financial implications of each scenario.

MANAGERIAL ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Part A.........................................................................................................................................3

Answer1.................................................................................................................................3

Answer2.................................................................................................................................3

Answer3.................................................................................................................................4

Answer4.................................................................................................................................6

Answer5.................................................................................................................................7

Part B........................................................................................................................................11

Identification of the components of the management accounting system...........................11

Description of the innovation process in a firm as ‘a process of information creation’, and a

firm needs to organize them ‘to transmit the new information.’..........................................12

Learning from the article’s research finding useful for management accountants in

Australian companies...........................................................................................................13

References................................................................................................................................15

Part A.........................................................................................................................................3

Answer1.................................................................................................................................3

Answer2.................................................................................................................................3

Answer3.................................................................................................................................4

Answer4.................................................................................................................................6

Answer5.................................................................................................................................7

Part B........................................................................................................................................11

Identification of the components of the management accounting system...........................11

Description of the innovation process in a firm as ‘a process of information creation’, and a

firm needs to organize them ‘to transmit the new information.’..........................................12

Learning from the article’s research finding useful for management accountants in

Australian companies...........................................................................................................13

References................................................................................................................................15

Part A

Answer1

A cost does have relationship with output produced by an organization. The manner of

categorization of cost is dependent on the relationship with output as well as the context in

which same is used by the organization (Johnson and Folkes, 2015). Every factor of

production of goods and services is associated with cost. Thus it is necessary to make these

expenditures in order to run business in appropriate manner. Fixed and variable cost is basic

cost which is incurred by any organization. Another cost which is applied in budgets is

controllable and uncontrollable cost for drafting of budgets (Piao and Kleiner, 2015). Further,

sunk cost is the cost which has been incurred and does not have any impact on the decision of

the manager. Explanation relating to three cost have been provided below in detail manner

with examples.

Fixed Cost: It is a cost which does not change or fluctuate with the change in volume of

output (O’Keeffe, Ozuem, and Lancaster, 2016). Further, they are incurred on a regular basis

and they tend to represent little fluctuation from period to period. It is incurred by the

management regardless of the level of production. For example payment relating to rent,

rates, taxes etc (Więcek-Janka., etal. 2017). In present case of Nanna’s House payment made

as license fees i.e. annual fees of $225 is fixed cost.

Variable Cost: The specified cost changes or fluctuates in direct proportion with change in

output (Otley, 2016). In other words it can be stated that variable cost depends on the output

generated by the organization (Bhattacharya, 2016). Thus, increase in output leads to increase

in cost and on the other hand decrease in output leads to decrease in variable cost (Day,

2015). In present cost of meal and snack are variable expenses.

Operating cost: These costs are relating to day to day operations of the business. It could be

fixed as well as variable (Lees, 2017). Thus, operating cot is not relating to production of a

product but are relating to selling, administration and overhead expenses (Chenhall and

Moers, 2015). For example: rent, marketing expenses etc. In present case laundry and washer

expenses can be stated as operating cost.

Answer1

A cost does have relationship with output produced by an organization. The manner of

categorization of cost is dependent on the relationship with output as well as the context in

which same is used by the organization (Johnson and Folkes, 2015). Every factor of

production of goods and services is associated with cost. Thus it is necessary to make these

expenditures in order to run business in appropriate manner. Fixed and variable cost is basic

cost which is incurred by any organization. Another cost which is applied in budgets is

controllable and uncontrollable cost for drafting of budgets (Piao and Kleiner, 2015). Further,

sunk cost is the cost which has been incurred and does not have any impact on the decision of

the manager. Explanation relating to three cost have been provided below in detail manner

with examples.

Fixed Cost: It is a cost which does not change or fluctuate with the change in volume of

output (O’Keeffe, Ozuem, and Lancaster, 2016). Further, they are incurred on a regular basis

and they tend to represent little fluctuation from period to period. It is incurred by the

management regardless of the level of production. For example payment relating to rent,

rates, taxes etc (Więcek-Janka., etal. 2017). In present case of Nanna’s House payment made

as license fees i.e. annual fees of $225 is fixed cost.

Variable Cost: The specified cost changes or fluctuates in direct proportion with change in

output (Otley, 2016). In other words it can be stated that variable cost depends on the output

generated by the organization (Bhattacharya, 2016). Thus, increase in output leads to increase

in cost and on the other hand decrease in output leads to decrease in variable cost (Day,

2015). In present cost of meal and snack are variable expenses.

Operating cost: These costs are relating to day to day operations of the business. It could be

fixed as well as variable (Lees, 2017). Thus, operating cot is not relating to production of a

product but are relating to selling, administration and overhead expenses (Chenhall and

Moers, 2015). For example: rent, marketing expenses etc. In present case laundry and washer

expenses can be stated as operating cost.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

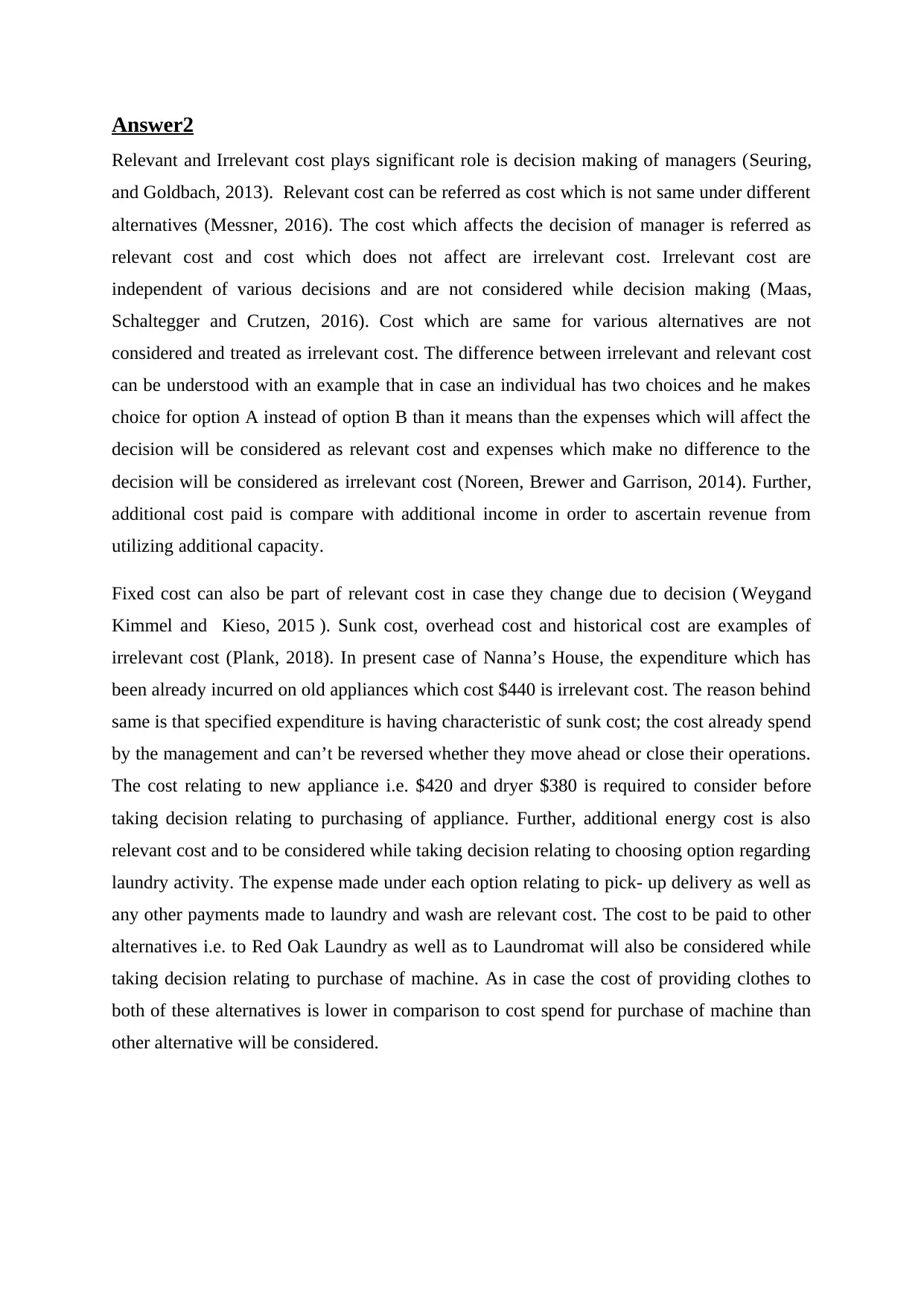

Answer2

Relevant and Irrelevant cost plays significant role is decision making of managers (Seuring,

and Goldbach, 2013). Relevant cost can be referred as cost which is not same under different

alternatives (Messner, 2016). The cost which affects the decision of manager is referred as

relevant cost and cost which does not affect are irrelevant cost. Irrelevant cost are

independent of various decisions and are not considered while decision making (Maas,

Schaltegger and Crutzen, 2016). Cost which are same for various alternatives are not

considered and treated as irrelevant cost. The difference between irrelevant and relevant cost

can be understood with an example that in case an individual has two choices and he makes

choice for option A instead of option B than it means than the expenses which will affect the

decision will be considered as relevant cost and expenses which make no difference to the

decision will be considered as irrelevant cost (Noreen, Brewer and Garrison, 2014). Further,

additional cost paid is compare with additional income in order to ascertain revenue from

utilizing additional capacity.

Fixed cost can also be part of relevant cost in case they change due to decision (Weygand

Kimmel and Kieso, 2015 ). Sunk cost, overhead cost and historical cost are examples of

irrelevant cost (Plank, 2018). In present case of Nanna’s House, the expenditure which has

been already incurred on old appliances which cost $440 is irrelevant cost. The reason behind

same is that specified expenditure is having characteristic of sunk cost; the cost already spend

by the management and can’t be reversed whether they move ahead or close their operations.

The cost relating to new appliance i.e. $420 and dryer $380 is required to consider before

taking decision relating to purchasing of appliance. Further, additional energy cost is also

relevant cost and to be considered while taking decision relating to choosing option regarding

laundry activity. The expense made under each option relating to pick- up delivery as well as

any other payments made to laundry and wash are relevant cost. The cost to be paid to other

alternatives i.e. to Red Oak Laundry as well as to Laundromat will also be considered while

taking decision relating to purchase of machine. As in case the cost of providing clothes to

both of these alternatives is lower in comparison to cost spend for purchase of machine than

other alternative will be considered.

Relevant and Irrelevant cost plays significant role is decision making of managers (Seuring,

and Goldbach, 2013). Relevant cost can be referred as cost which is not same under different

alternatives (Messner, 2016). The cost which affects the decision of manager is referred as

relevant cost and cost which does not affect are irrelevant cost. Irrelevant cost are

independent of various decisions and are not considered while decision making (Maas,

Schaltegger and Crutzen, 2016). Cost which are same for various alternatives are not

considered and treated as irrelevant cost. The difference between irrelevant and relevant cost

can be understood with an example that in case an individual has two choices and he makes

choice for option A instead of option B than it means than the expenses which will affect the

decision will be considered as relevant cost and expenses which make no difference to the

decision will be considered as irrelevant cost (Noreen, Brewer and Garrison, 2014). Further,

additional cost paid is compare with additional income in order to ascertain revenue from

utilizing additional capacity.

Fixed cost can also be part of relevant cost in case they change due to decision (Weygand

Kimmel and Kieso, 2015 ). Sunk cost, overhead cost and historical cost are examples of

irrelevant cost (Plank, 2018). In present case of Nanna’s House, the expenditure which has

been already incurred on old appliances which cost $440 is irrelevant cost. The reason behind

same is that specified expenditure is having characteristic of sunk cost; the cost already spend

by the management and can’t be reversed whether they move ahead or close their operations.

The cost relating to new appliance i.e. $420 and dryer $380 is required to consider before

taking decision relating to purchasing of appliance. Further, additional energy cost is also

relevant cost and to be considered while taking decision relating to choosing option regarding

laundry activity. The expense made under each option relating to pick- up delivery as well as

any other payments made to laundry and wash are relevant cost. The cost to be paid to other

alternatives i.e. to Red Oak Laundry as well as to Laundromat will also be considered while

taking decision relating to purchase of machine. As in case the cost of providing clothes to

both of these alternatives is lower in comparison to cost spend for purchase of machine than

other alternative will be considered.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

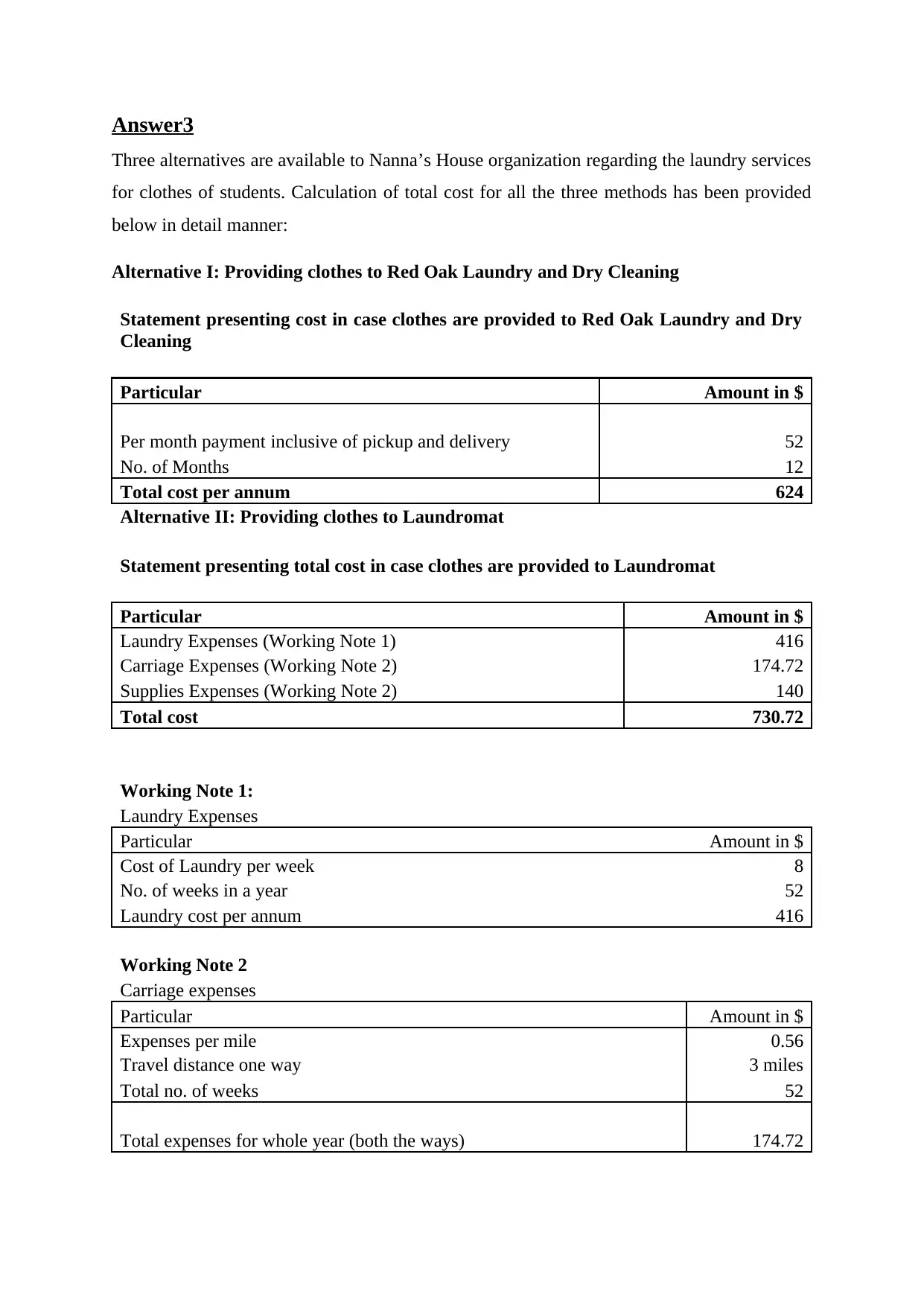

Answer3

Three alternatives are available to Nanna’s House organization regarding the laundry services

for clothes of students. Calculation of total cost for all the three methods has been provided

below in detail manner:

Alternative I: Providing clothes to Red Oak Laundry and Dry Cleaning

Statement presenting cost in case clothes are provided to Red Oak Laundry and Dry

Cleaning

Particular Amount in $

Per month payment inclusive of pickup and delivery 52

No. of Months 12

Total cost per annum 624

Alternative II: Providing clothes to Laundromat

Statement presenting total cost in case clothes are provided to Laundromat

Particular Amount in $

Laundry Expenses (Working Note 1) 416

Carriage Expenses (Working Note 2) 174.72

Supplies Expenses (Working Note 2) 140

Total cost 730.72

Working Note 1:

Laundry Expenses

Particular Amount in $

Cost of Laundry per week 8

No. of weeks in a year 52

Laundry cost per annum 416

Working Note 2

Carriage expenses

Particular Amount in $

Expenses per mile 0.56

Travel distance one way 3 miles

Total no. of weeks 52

Total expenses for whole year (both the ways) 174.72

Three alternatives are available to Nanna’s House organization regarding the laundry services

for clothes of students. Calculation of total cost for all the three methods has been provided

below in detail manner:

Alternative I: Providing clothes to Red Oak Laundry and Dry Cleaning

Statement presenting cost in case clothes are provided to Red Oak Laundry and Dry

Cleaning

Particular Amount in $

Per month payment inclusive of pickup and delivery 52

No. of Months 12

Total cost per annum 624

Alternative II: Providing clothes to Laundromat

Statement presenting total cost in case clothes are provided to Laundromat

Particular Amount in $

Laundry Expenses (Working Note 1) 416

Carriage Expenses (Working Note 2) 174.72

Supplies Expenses (Working Note 2) 140

Total cost 730.72

Working Note 1:

Laundry Expenses

Particular Amount in $

Cost of Laundry per week 8

No. of weeks in a year 52

Laundry cost per annum 416

Working Note 2

Carriage expenses

Particular Amount in $

Expenses per mile 0.56

Travel distance one way 3 miles

Total no. of weeks 52

Total expenses for whole year (both the ways) 174.72

Note : $0.56 is cost of one way per mile; thus in order to calculate the total

cost same has been multiplied with two.

Working Note 3

Cost of utilities

Particular Amount in $

Laundry supplies per quarter 35

No. of quarter in a year 4

Total expenses per annum 140

Alternative III: Purchase of machine

Particular Amount

Purchase cost of washer 420

Purchase cost of dryer 380

Delivery Cost 35

Additional Appliances 43.72

Increase in energy cost due to washer 120

Increase in energy cost due to dryer 145

Total cost 1143.72

Note: The cost relating to old machine of $440 is sunk cost. Thus, same is not considered

while calculating the cost in case new machine is purchased. Further, installation of machine

has been done in free, thus same has not been considered.

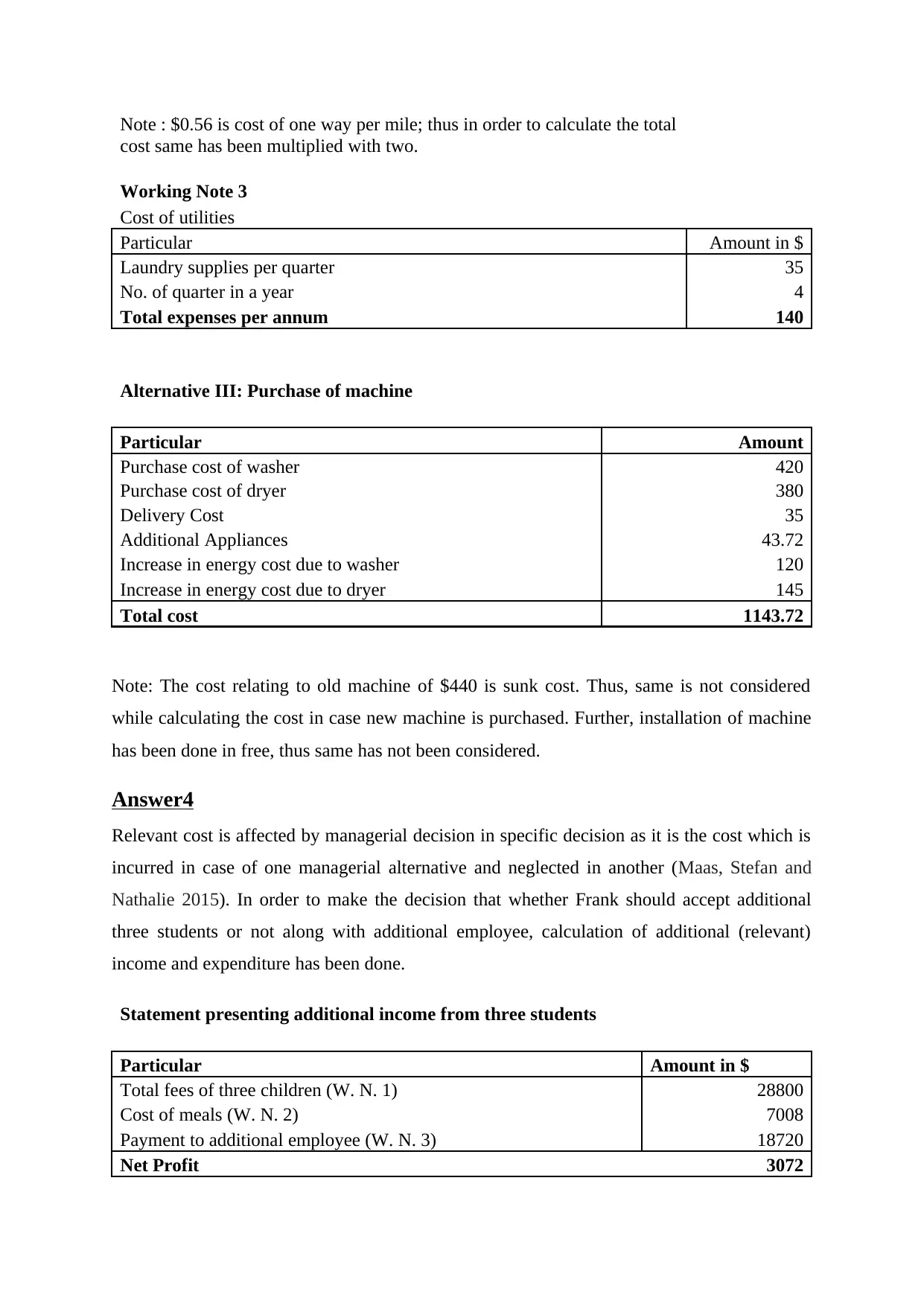

Answer4

Relevant cost is affected by managerial decision in specific decision as it is the cost which is

incurred in case of one managerial alternative and neglected in another (Maas, Stefan and

Nathalie 2015). In order to make the decision that whether Frank should accept additional

three students or not along with additional employee, calculation of additional (relevant)

income and expenditure has been done.

Statement presenting additional income from three students

Particular Amount in $

Total fees of three children (W. N. 1) 28800

Cost of meals (W. N. 2) 7008

Payment to additional employee (W. N. 3) 18720

Net Profit 3072

cost same has been multiplied with two.

Working Note 3

Cost of utilities

Particular Amount in $

Laundry supplies per quarter 35

No. of quarter in a year 4

Total expenses per annum 140

Alternative III: Purchase of machine

Particular Amount

Purchase cost of washer 420

Purchase cost of dryer 380

Delivery Cost 35

Additional Appliances 43.72

Increase in energy cost due to washer 120

Increase in energy cost due to dryer 145

Total cost 1143.72

Note: The cost relating to old machine of $440 is sunk cost. Thus, same is not considered

while calculating the cost in case new machine is purchased. Further, installation of machine

has been done in free, thus same has not been considered.

Answer4

Relevant cost is affected by managerial decision in specific decision as it is the cost which is

incurred in case of one managerial alternative and neglected in another (Maas, Stefan and

Nathalie 2015). In order to make the decision that whether Frank should accept additional

three students or not along with additional employee, calculation of additional (relevant)

income and expenditure has been done.

Statement presenting additional income from three students

Particular Amount in $

Total fees of three children (W. N. 1) 28800

Cost of meals (W. N. 2) 7008

Payment to additional employee (W. N. 3) 18720

Net Profit 3072

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

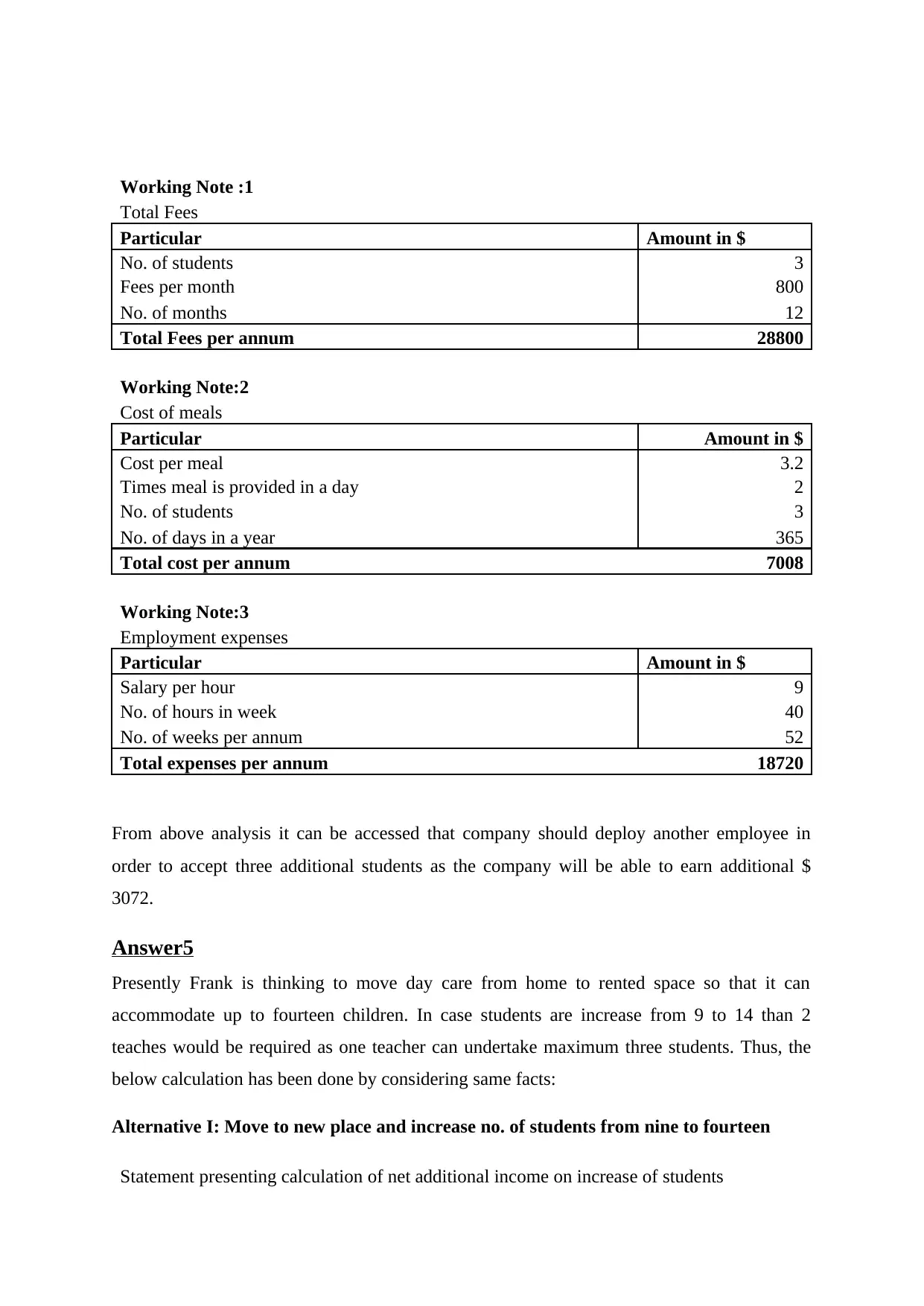

Working Note :1

Total Fees

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

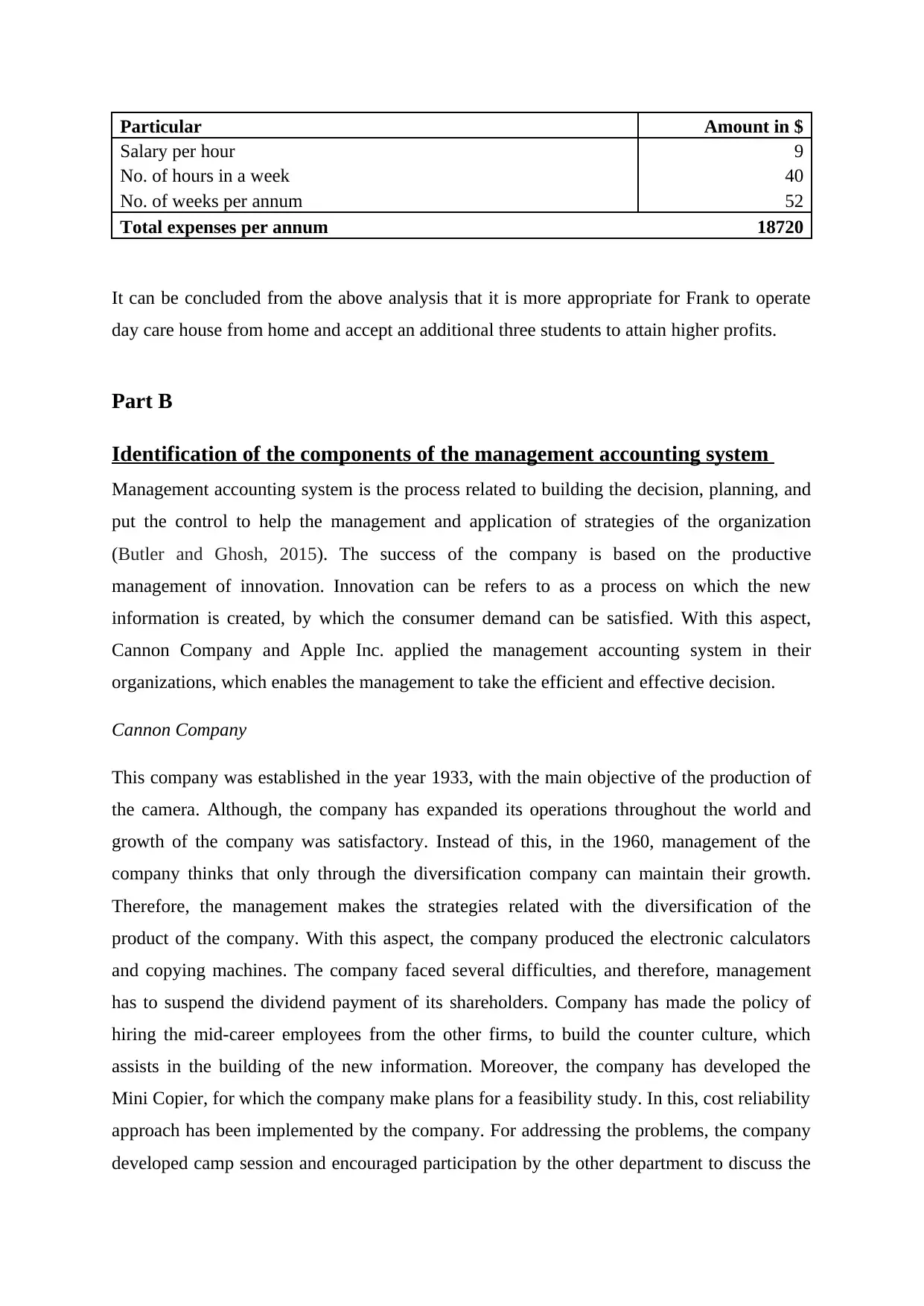

Working Note:3

Employment expenses

Particular Amount in $

Salary per hour 9

No. of hours in week 40

No. of weeks per annum 52

Total expenses per annum 18720

From above analysis it can be accessed that company should deploy another employee in

order to accept three additional students as the company will be able to earn additional $

3072.

Answer5

Presently Frank is thinking to move day care from home to rented space so that it can

accommodate up to fourteen children. In case students are increase from 9 to 14 than 2

teaches would be required as one teacher can undertake maximum three students. Thus, the

below calculation has been done by considering same facts:

Alternative I: Move to new place and increase no. of students from nine to fourteen

Statement presenting calculation of net additional income on increase of students

Total Fees

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

Working Note:3

Employment expenses

Particular Amount in $

Salary per hour 9

No. of hours in week 40

No. of weeks per annum 52

Total expenses per annum 18720

From above analysis it can be accessed that company should deploy another employee in

order to accept three additional students as the company will be able to earn additional $

3072.

Answer5

Presently Frank is thinking to move day care from home to rented space so that it can

accommodate up to fourteen children. In case students are increase from 9 to 14 than 2

teaches would be required as one teacher can undertake maximum three students. Thus, the

below calculation has been done by considering same facts:

Alternative I: Move to new place and increase no. of students from nine to fourteen

Statement presenting calculation of net additional income on increase of students

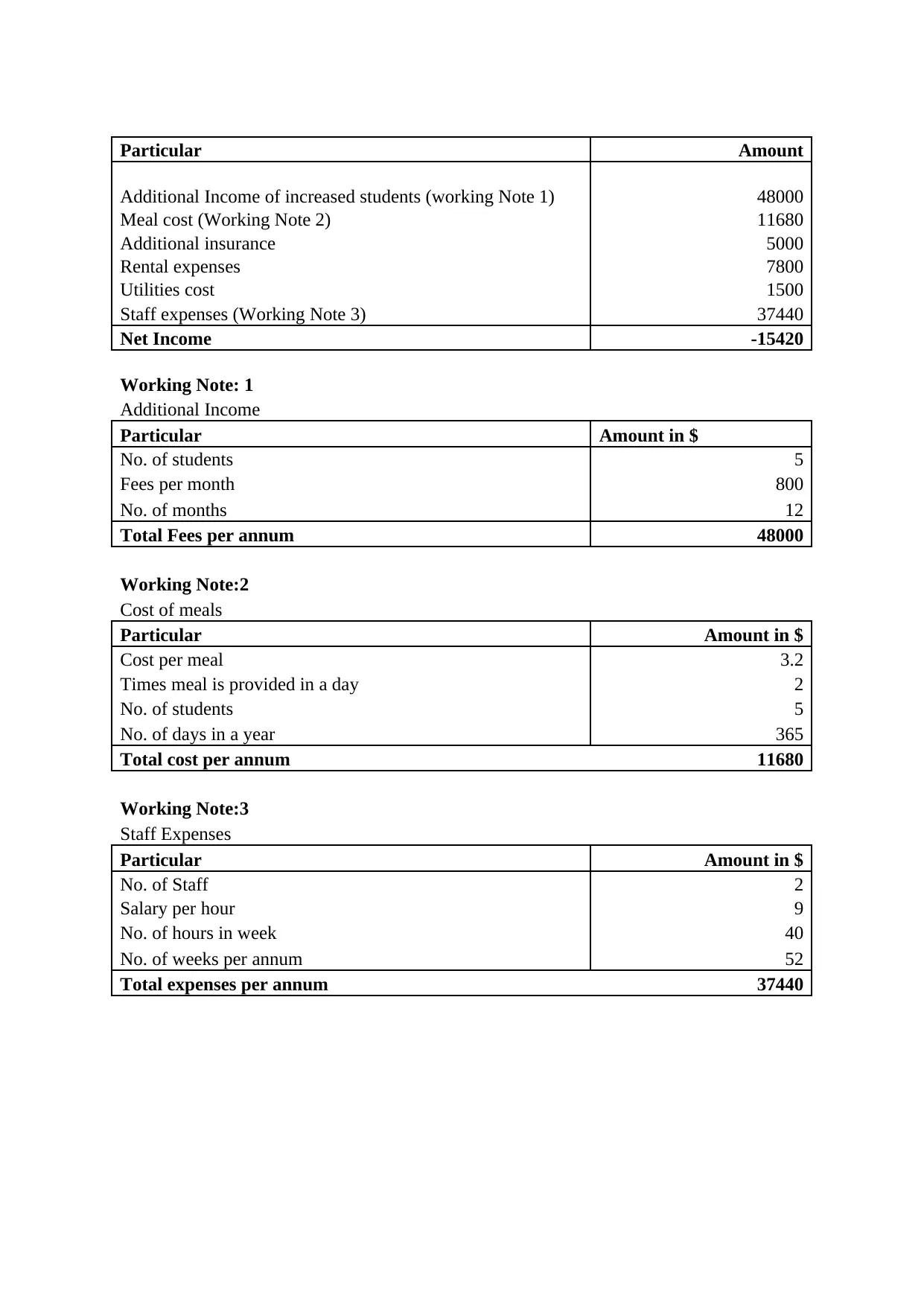

Particular Amount

Additional Income of increased students (working Note 1) 48000

Meal cost (Working Note 2) 11680

Additional insurance 5000

Rental expenses 7800

Utilities cost 1500

Staff expenses (Working Note 3) 37440

Net Income -15420

Working Note: 1

Additional Income

Particular Amount in $

No. of students 5

Fees per month 800

No. of months 12

Total Fees per annum 48000

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 5

No. of days in a year 365

Total cost per annum 11680

Working Note:3

Staff Expenses

Particular Amount in $

No. of Staff 2

Salary per hour 9

No. of hours in week 40

No. of weeks per annum 52

Total expenses per annum 37440

Additional Income of increased students (working Note 1) 48000

Meal cost (Working Note 2) 11680

Additional insurance 5000

Rental expenses 7800

Utilities cost 1500

Staff expenses (Working Note 3) 37440

Net Income -15420

Working Note: 1

Additional Income

Particular Amount in $

No. of students 5

Fees per month 800

No. of months 12

Total Fees per annum 48000

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 5

No. of days in a year 365

Total cost per annum 11680

Working Note:3

Staff Expenses

Particular Amount in $

No. of Staff 2

Salary per hour 9

No. of hours in week 40

No. of weeks per annum 52

Total expenses per annum 37440

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

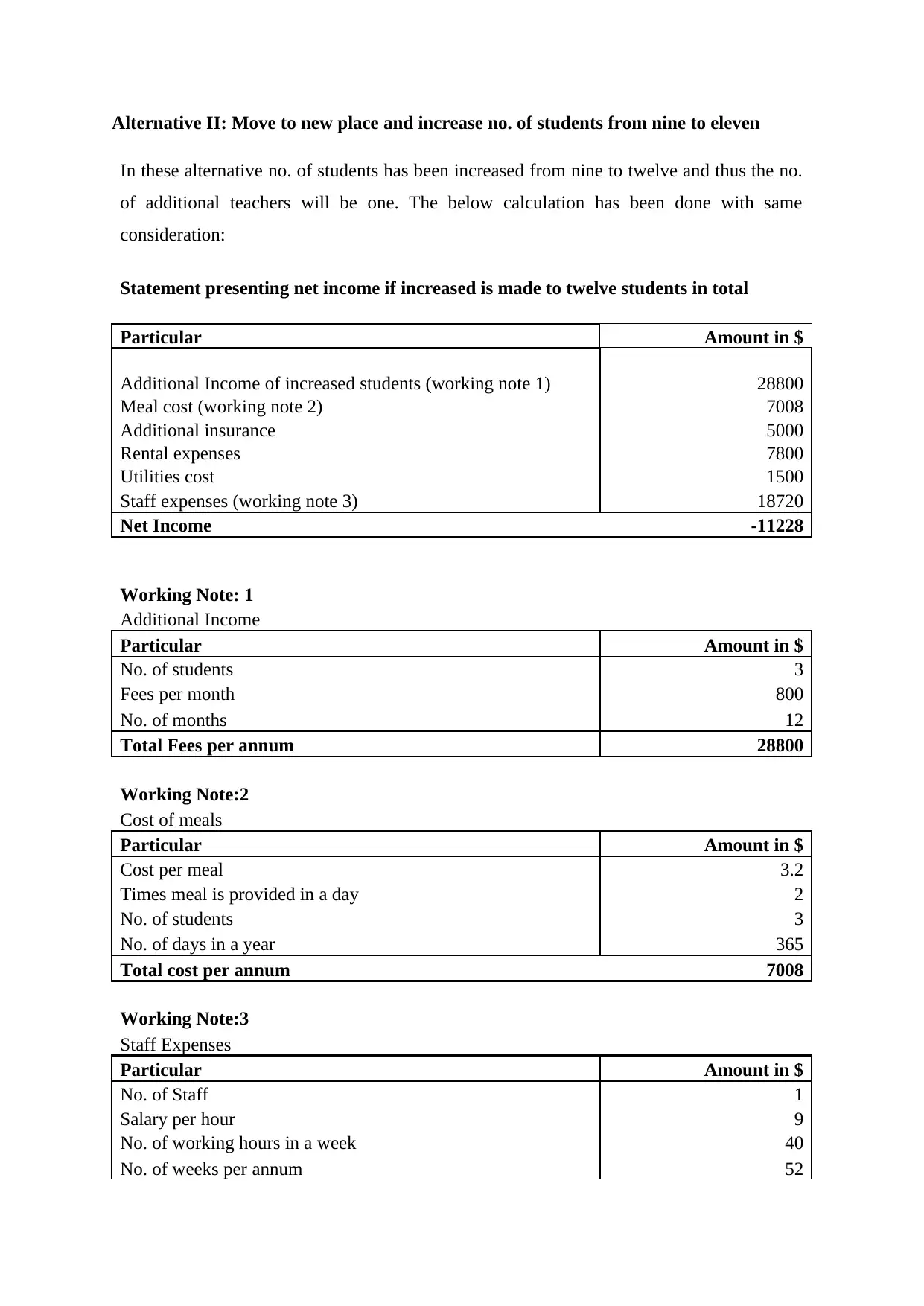

Alternative II: Move to new place and increase no. of students from nine to eleven

In these alternative no. of students has been increased from nine to twelve and thus the no.

of additional teachers will be one. The below calculation has been done with same

consideration:

Statement presenting net income if increased is made to twelve students in total

Particular Amount in $

Additional Income of increased students (working note 1) 28800

Meal cost (working note 2) 7008

Additional insurance 5000

Rental expenses 7800

Utilities cost 1500

Staff expenses (working note 3) 18720

Net Income -11228

Working Note: 1

Additional Income

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

Working Note:3

Staff Expenses

Particular Amount in $

No. of Staff 1

Salary per hour 9

No. of working hours in a week 40

No. of weeks per annum 52

In these alternative no. of students has been increased from nine to twelve and thus the no.

of additional teachers will be one. The below calculation has been done with same

consideration:

Statement presenting net income if increased is made to twelve students in total

Particular Amount in $

Additional Income of increased students (working note 1) 28800

Meal cost (working note 2) 7008

Additional insurance 5000

Rental expenses 7800

Utilities cost 1500

Staff expenses (working note 3) 18720

Net Income -11228

Working Note: 1

Additional Income

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

Working Note:3

Staff Expenses

Particular Amount in $

No. of Staff 1

Salary per hour 9

No. of working hours in a week 40

No. of weeks per annum 52

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total expenses per annum 18720

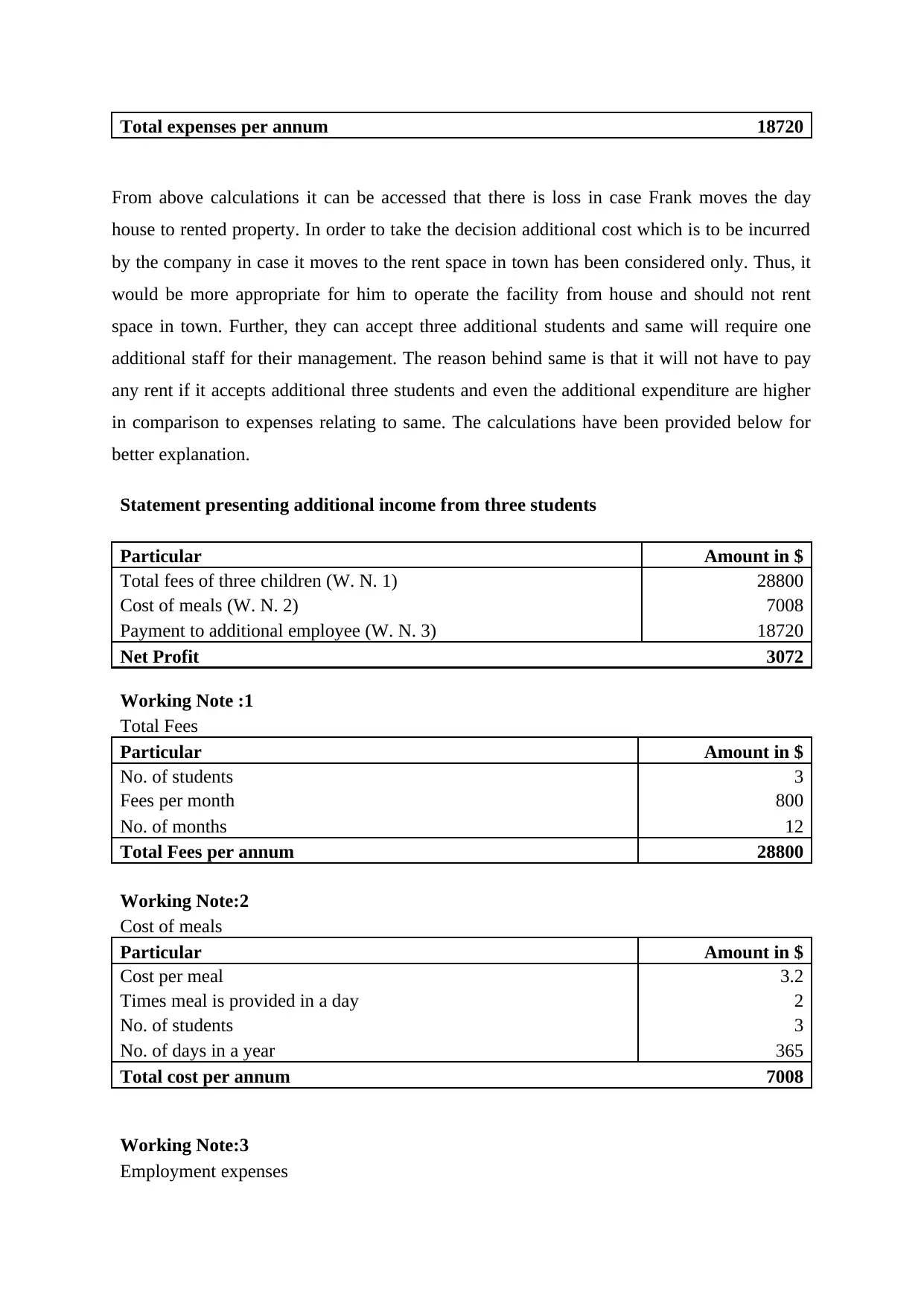

From above calculations it can be accessed that there is loss in case Frank moves the day

house to rented property. In order to take the decision additional cost which is to be incurred

by the company in case it moves to the rent space in town has been considered only. Thus, it

would be more appropriate for him to operate the facility from house and should not rent

space in town. Further, they can accept three additional students and same will require one

additional staff for their management. The reason behind same is that it will not have to pay

any rent if it accepts additional three students and even the additional expenditure are higher

in comparison to expenses relating to same. The calculations have been provided below for

better explanation.

Statement presenting additional income from three students

Particular Amount in $

Total fees of three children (W. N. 1) 28800

Cost of meals (W. N. 2) 7008

Payment to additional employee (W. N. 3) 18720

Net Profit 3072

Working Note :1

Total Fees

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

Working Note:3

Employment expenses

From above calculations it can be accessed that there is loss in case Frank moves the day

house to rented property. In order to take the decision additional cost which is to be incurred

by the company in case it moves to the rent space in town has been considered only. Thus, it

would be more appropriate for him to operate the facility from house and should not rent

space in town. Further, they can accept three additional students and same will require one

additional staff for their management. The reason behind same is that it will not have to pay

any rent if it accepts additional three students and even the additional expenditure are higher

in comparison to expenses relating to same. The calculations have been provided below for

better explanation.

Statement presenting additional income from three students

Particular Amount in $

Total fees of three children (W. N. 1) 28800

Cost of meals (W. N. 2) 7008

Payment to additional employee (W. N. 3) 18720

Net Profit 3072

Working Note :1

Total Fees

Particular Amount in $

No. of students 3

Fees per month 800

No. of months 12

Total Fees per annum 28800

Working Note:2

Cost of meals

Particular Amount in $

Cost per meal 3.2

Times meal is provided in a day 2

No. of students 3

No. of days in a year 365

Total cost per annum 7008

Working Note:3

Employment expenses

Particular Amount in $

Salary per hour 9

No. of hours in a week 40

No. of weeks per annum 52

Total expenses per annum 18720

It can be concluded from the above analysis that it is more appropriate for Frank to operate

day care house from home and accept an additional three students to attain higher profits.

Part B

Identification of the components of the management accounting system

Management accounting system is the process related to building the decision, planning, and

put the control to help the management and application of strategies of the organization

(Butler and Ghosh, 2015). The success of the company is based on the productive

management of innovation. Innovation can be refers to as a process on which the new

information is created, by which the consumer demand can be satisfied. With this aspect,

Cannon Company and Apple Inc. applied the management accounting system in their

organizations, which enables the management to take the efficient and effective decision.

Cannon Company

This company was established in the year 1933, with the main objective of the production of

the camera. Although, the company has expanded its operations throughout the world and

growth of the company was satisfactory. Instead of this, in the 1960, management of the

company thinks that only through the diversification company can maintain their growth.

Therefore, the management makes the strategies related with the diversification of the

product of the company. With this aspect, the company produced the electronic calculators

and copying machines. The company faced several difficulties, and therefore, management

has to suspend the dividend payment of its shareholders. Company has made the policy of

hiring the mid-career employees from the other firms, to build the counter culture, which

assists in the building of the new information. Moreover, the company has developed the

Mini Copier, for which the company make plans for a feasibility study. In this, cost reliability

approach has been implemented by the company. For addressing the problems, the company

developed camp session and encouraged participation by the other department to discuss the

Salary per hour 9

No. of hours in a week 40

No. of weeks per annum 52

Total expenses per annum 18720

It can be concluded from the above analysis that it is more appropriate for Frank to operate

day care house from home and accept an additional three students to attain higher profits.

Part B

Identification of the components of the management accounting system

Management accounting system is the process related to building the decision, planning, and

put the control to help the management and application of strategies of the organization

(Butler and Ghosh, 2015). The success of the company is based on the productive

management of innovation. Innovation can be refers to as a process on which the new

information is created, by which the consumer demand can be satisfied. With this aspect,

Cannon Company and Apple Inc. applied the management accounting system in their

organizations, which enables the management to take the efficient and effective decision.

Cannon Company

This company was established in the year 1933, with the main objective of the production of

the camera. Although, the company has expanded its operations throughout the world and

growth of the company was satisfactory. Instead of this, in the 1960, management of the

company thinks that only through the diversification company can maintain their growth.

Therefore, the management makes the strategies related with the diversification of the

product of the company. With this aspect, the company produced the electronic calculators

and copying machines. The company faced several difficulties, and therefore, management

has to suspend the dividend payment of its shareholders. Company has made the policy of

hiring the mid-career employees from the other firms, to build the counter culture, which

assists in the building of the new information. Moreover, the company has developed the

Mini Copier, for which the company make plans for a feasibility study. In this, cost reliability

approach has been implemented by the company. For addressing the problems, the company

developed camp session and encouraged participation by the other department to discuss the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.