Taxation Analysis: HI6028 Capital Gains Tax and Fringe Benefits

VerifiedAdded on 2023/06/06

|13

|3178

|308

Homework Assignment

AI Summary

This assignment addresses key aspects of Australian taxation law, specifically focusing on capital gains tax (CGT) and fringe benefits tax (FBT). The first part of the assignment involves analyzing various transactions, including the sale of vacant land, antique items, paintings, shares, and a violin, to determine the CGT implications for an investor. It calculates capital gains or losses, considering cost bases, holding periods, and relevant tax regulations. The second part of the assignment examines fringe benefits provided by an employer to an employee, Jasmine, including a car, a loan, and a heater. It assesses whether these benefits constitute fringe benefits under the Fringe Benefits Tax Assessment Act 1986 (FBTAA86) and calculates the FBT payable by the employer, considering factors such as capital value, statutory percentages, available days, grossed-up factors, and FBT rates. The assignment demonstrates the application of relevant tax provisions and calculations for both CGT and FBT scenarios.

HI6028 Taxation Theory,

Practice & Law

Student Name

[Pick the date]

Practice & Law

Student Name

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

In the present case, client is an investor and also collects antique items and has made numerous

transactions involving disposal of various assets. Here, the main task is to find whether the

proceeds received from the disposal of assets would amount to Capital Gain Tax (CGT) or not.

Further, the net capital loss or capital gains would be calculated for the incurred capital gains or

losses for the given financial year.

1) Transaction made for the sale of block of vacant land

CGT would be applicable only for those assets which are categorised as post- CGT asset that are

purchased after 20 September 1985 under the provisions of s. 149(10) of Income Tax

Assessment Act 1997. Similarly, the assets that are acquired by the concerned taxpayer earlier

than 20 September 1985 are known as pre-CGT asset and are free from CGT implications.

Therefore, it can be said that acquiring date of asset is an imperative aspect for the validation of

CGT (Barkoczy, 2017). In the present case, taxpayer (client) has acquired a block of vacant land

in January 2001. The acquirement of block of vacant land is after 20 September 1985 and

therefore, the sale of CGT asset would amount to capital gains/loss. Further, as per s. 140-5, the

transaction occurred for the sale of CGT asset (block of vacant land) would be classified as A1

event. The capital gain/ loss can easily be calculated with the help of cost base of asset and the

income received from disposal under s. 110-25 ITAA 1997 (Reuters, 2017). The cost base of an

asset includes five essential elements which are defined in s. 110-25 (1) (Deutsch et. al., 2016).

Under s. 110-25(2), amount paid by taxpayer to buy the asset.

Under s. 110-25(3), incident costs paid by taxpayer to acquire or sell the asset.

Under s. 110-25(4), expense occurred in regards to the ownership of asset which includes

interest on loan, land tax, sewerage tax and so forth.

Under s. 110-25(4), capital expenses occurred for the asset value increment or/and for

preservation of asset.

Under s. 110-25(5), capital expenses undertaken for the protection of title of the asset.

Amount paid by taxpayer to buy the block of vacant land = $100,000

Expense occurred in regards to the ownership of block of vacant land = $20,000

1

In the present case, client is an investor and also collects antique items and has made numerous

transactions involving disposal of various assets. Here, the main task is to find whether the

proceeds received from the disposal of assets would amount to Capital Gain Tax (CGT) or not.

Further, the net capital loss or capital gains would be calculated for the incurred capital gains or

losses for the given financial year.

1) Transaction made for the sale of block of vacant land

CGT would be applicable only for those assets which are categorised as post- CGT asset that are

purchased after 20 September 1985 under the provisions of s. 149(10) of Income Tax

Assessment Act 1997. Similarly, the assets that are acquired by the concerned taxpayer earlier

than 20 September 1985 are known as pre-CGT asset and are free from CGT implications.

Therefore, it can be said that acquiring date of asset is an imperative aspect for the validation of

CGT (Barkoczy, 2017). In the present case, taxpayer (client) has acquired a block of vacant land

in January 2001. The acquirement of block of vacant land is after 20 September 1985 and

therefore, the sale of CGT asset would amount to capital gains/loss. Further, as per s. 140-5, the

transaction occurred for the sale of CGT asset (block of vacant land) would be classified as A1

event. The capital gain/ loss can easily be calculated with the help of cost base of asset and the

income received from disposal under s. 110-25 ITAA 1997 (Reuters, 2017). The cost base of an

asset includes five essential elements which are defined in s. 110-25 (1) (Deutsch et. al., 2016).

Under s. 110-25(2), amount paid by taxpayer to buy the asset.

Under s. 110-25(3), incident costs paid by taxpayer to acquire or sell the asset.

Under s. 110-25(4), expense occurred in regards to the ownership of asset which includes

interest on loan, land tax, sewerage tax and so forth.

Under s. 110-25(4), capital expenses occurred for the asset value increment or/and for

preservation of asset.

Under s. 110-25(5), capital expenses undertaken for the protection of title of the asset.

Amount paid by taxpayer to buy the block of vacant land = $100,000

Expense occurred in regards to the ownership of block of vacant land = $20,000

1

Cost base of block of vacant land = (Expense occurred in regards to the ownership of block of

vacant land) + (Amount paid by taxpayer to buy the block of vacant land)

Here, one of key aspects is that she has enacted the contract for the sale of block of vacant land

in the existing tax year. However, the payment of contract has not been received by her as the

amount would be received in the next financial year. Hence, it is essential to determine whether

the proceeds would be taxed under CGT in the existing financial current year or in the next

financial year. The relevant provision is defined in TR 94/29 which highlights that proceeds from

the sale of asset would be utilized for CGT in the financial year on which contract of sale has

been enacted irrespective of the fact that taxpayer would get the payment in the next financial

year (Gilders et. al., 2016). Here also, the client would get the payment of $100,000 in net year

while she has signed the contract of sale in the current financial year only. Therefore,

Further, the net balance of capital gains/losses would be the amount that would be found after

settling the previous capital losses incurred (Woellner, 2014).

Client has capital losses of sum $7,000 and therefore, the losses would be settled with the current

year’s capital gains.

50% rebate would be claimed by the taxpayer for the disposal of long term (holding period >1

year) CGT asset. It is apparent that client buys the land in 2001 which indicates that holding

period of land is more than 1 year and hence, 50% rebate on the net capital gains would be

applied (Woellner et. al., 2017).

……………………………………………. (1)

2

vacant land) + (Amount paid by taxpayer to buy the block of vacant land)

Here, one of key aspects is that she has enacted the contract for the sale of block of vacant land

in the existing tax year. However, the payment of contract has not been received by her as the

amount would be received in the next financial year. Hence, it is essential to determine whether

the proceeds would be taxed under CGT in the existing financial current year or in the next

financial year. The relevant provision is defined in TR 94/29 which highlights that proceeds from

the sale of asset would be utilized for CGT in the financial year on which contract of sale has

been enacted irrespective of the fact that taxpayer would get the payment in the next financial

year (Gilders et. al., 2016). Here also, the client would get the payment of $100,000 in net year

while she has signed the contract of sale in the current financial year only. Therefore,

Further, the net balance of capital gains/losses would be the amount that would be found after

settling the previous capital losses incurred (Woellner, 2014).

Client has capital losses of sum $7,000 and therefore, the losses would be settled with the current

year’s capital gains.

50% rebate would be claimed by the taxpayer for the disposal of long term (holding period >1

year) CGT asset. It is apparent that client buys the land in 2001 which indicates that holding

period of land is more than 1 year and hence, 50% rebate on the net capital gains would be

applied (Woellner et. al., 2017).

……………………………………………. (1)

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2) Transaction made for the sale of antique bed

Antique pieces are considered as collectables and as per TD 1999/4, the collectables would be

classified as capital asset and disposal of capital asset would lead to CGT liability on taxpayer

(Gilders et. al., 2016). Further, capital gains or losses subject to the sale of antique pieces would

not lead to CGT when the item has been acquired for lesser than or equal to $500. Further, as

per s. 140-5, the transaction occurred for the sale of CGT asset (antique piece) would be

classified as A1 event. In present case, client has acquired an antique bed on 21 July 1986 which

means the asset would be classified under post-CGT asset category and thus, CGT would be

payable by the taxpayer for the derived capital gains or losses (Barkoczy, 2017).

Under s. 118-25(1), amount paid by client to acquire the bed = $3,500

Under s. 118-25(5), amount spent in the alterations of bed in regards to increase the value =

$1500

Client has not sold the bed rather the bed has been stolen from her house. As a result, the

insurance amount received on the account of stolen of bed would be taken as proceeds from the

disposal of asset. Hence,

Capital gains =$6,000

Further, the net capital gains/losses would be found after settling the previous capital losses

incurred from the same CGT asset. Client has capital losses of sum $1,500 from disposal of

sculpture in previous year and therefore, the losses would be settled with the current year’s

capital gains (Coleman, 2016).

3

Antique pieces are considered as collectables and as per TD 1999/4, the collectables would be

classified as capital asset and disposal of capital asset would lead to CGT liability on taxpayer

(Gilders et. al., 2016). Further, capital gains or losses subject to the sale of antique pieces would

not lead to CGT when the item has been acquired for lesser than or equal to $500. Further, as

per s. 140-5, the transaction occurred for the sale of CGT asset (antique piece) would be

classified as A1 event. In present case, client has acquired an antique bed on 21 July 1986 which

means the asset would be classified under post-CGT asset category and thus, CGT would be

payable by the taxpayer for the derived capital gains or losses (Barkoczy, 2017).

Under s. 118-25(1), amount paid by client to acquire the bed = $3,500

Under s. 118-25(5), amount spent in the alterations of bed in regards to increase the value =

$1500

Client has not sold the bed rather the bed has been stolen from her house. As a result, the

insurance amount received on the account of stolen of bed would be taken as proceeds from the

disposal of asset. Hence,

Capital gains =$6,000

Further, the net capital gains/losses would be found after settling the previous capital losses

incurred from the same CGT asset. Client has capital losses of sum $1,500 from disposal of

sculpture in previous year and therefore, the losses would be settled with the current year’s

capital gains (Coleman, 2016).

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

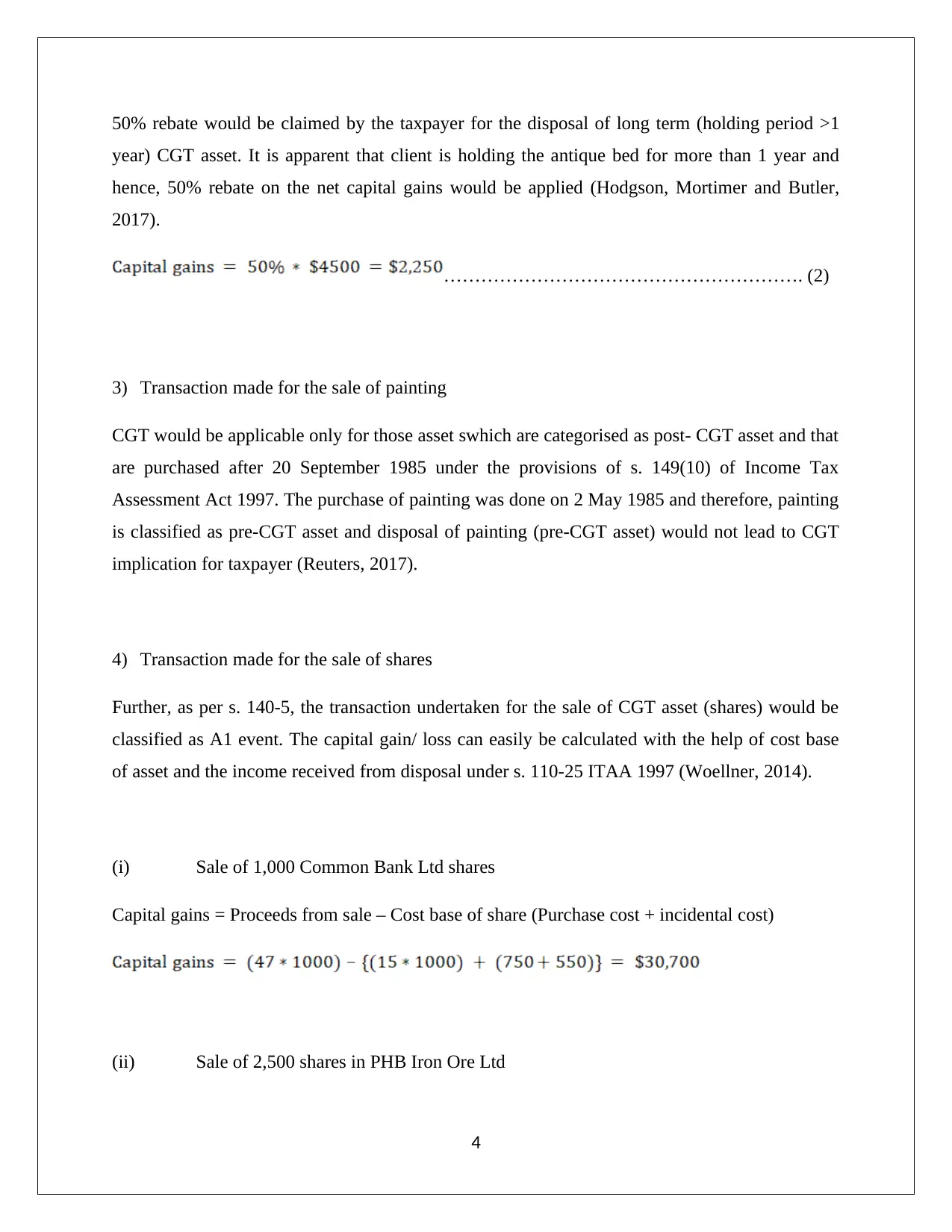

50% rebate would be claimed by the taxpayer for the disposal of long term (holding period >1

year) CGT asset. It is apparent that client is holding the antique bed for more than 1 year and

hence, 50% rebate on the net capital gains would be applied (Hodgson, Mortimer and Butler,

2017).

…………………………………………………. (2)

3) Transaction made for the sale of painting

CGT would be applicable only for those asset swhich are categorised as post- CGT asset and that

are purchased after 20 September 1985 under the provisions of s. 149(10) of Income Tax

Assessment Act 1997. The purchase of painting was done on 2 May 1985 and therefore, painting

is classified as pre-CGT asset and disposal of painting (pre-CGT asset) would not lead to CGT

implication for taxpayer (Reuters, 2017).

4) Transaction made for the sale of shares

Further, as per s. 140-5, the transaction undertaken for the sale of CGT asset (shares) would be

classified as A1 event. The capital gain/ loss can easily be calculated with the help of cost base

of asset and the income received from disposal under s. 110-25 ITAA 1997 (Woellner, 2014).

(i) Sale of 1,000 Common Bank Ltd shares

Capital gains = Proceeds from sale – Cost base of share (Purchase cost + incidental cost)

(ii) Sale of 2,500 shares in PHB Iron Ore Ltd

4

year) CGT asset. It is apparent that client is holding the antique bed for more than 1 year and

hence, 50% rebate on the net capital gains would be applied (Hodgson, Mortimer and Butler,

2017).

…………………………………………………. (2)

3) Transaction made for the sale of painting

CGT would be applicable only for those asset swhich are categorised as post- CGT asset and that

are purchased after 20 September 1985 under the provisions of s. 149(10) of Income Tax

Assessment Act 1997. The purchase of painting was done on 2 May 1985 and therefore, painting

is classified as pre-CGT asset and disposal of painting (pre-CGT asset) would not lead to CGT

implication for taxpayer (Reuters, 2017).

4) Transaction made for the sale of shares

Further, as per s. 140-5, the transaction undertaken for the sale of CGT asset (shares) would be

classified as A1 event. The capital gain/ loss can easily be calculated with the help of cost base

of asset and the income received from disposal under s. 110-25 ITAA 1997 (Woellner, 2014).

(i) Sale of 1,000 Common Bank Ltd shares

Capital gains = Proceeds from sale – Cost base of share (Purchase cost + incidental cost)

(ii) Sale of 2,500 shares in PHB Iron Ore Ltd

4

(iii) Sale of 1,200 shares in Young Kids Learning Ltd

For all the above three shares, the holding time is higher than 12 months and therefore, 50%

discount would be applied for the calculation of capital gains.

(iv) Sale of 10,000 shares in Share Build Ltd

In this case, taxpayer holds the share for lesser than 12 months and hence, the short term asset

would not be eligible for 50% rebate.

Capital gains from short term shares =$13,000

Hence,

…………….………………… (4)

5) Transaction made for the sale of violin

Personal use assets would not be considered as collectibles. However, the disposal of personal

use asset would give rise to CGT implication on the derived capital gains or losses only when the

5

For all the above three shares, the holding time is higher than 12 months and therefore, 50%

discount would be applied for the calculation of capital gains.

(iv) Sale of 10,000 shares in Share Build Ltd

In this case, taxpayer holds the share for lesser than 12 months and hence, the short term asset

would not be eligible for 50% rebate.

Capital gains from short term shares =$13,000

Hence,

…………….………………… (4)

5) Transaction made for the sale of violin

Personal use assets would not be considered as collectibles. However, the disposal of personal

use asset would give rise to CGT implication on the derived capital gains or losses only when the

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

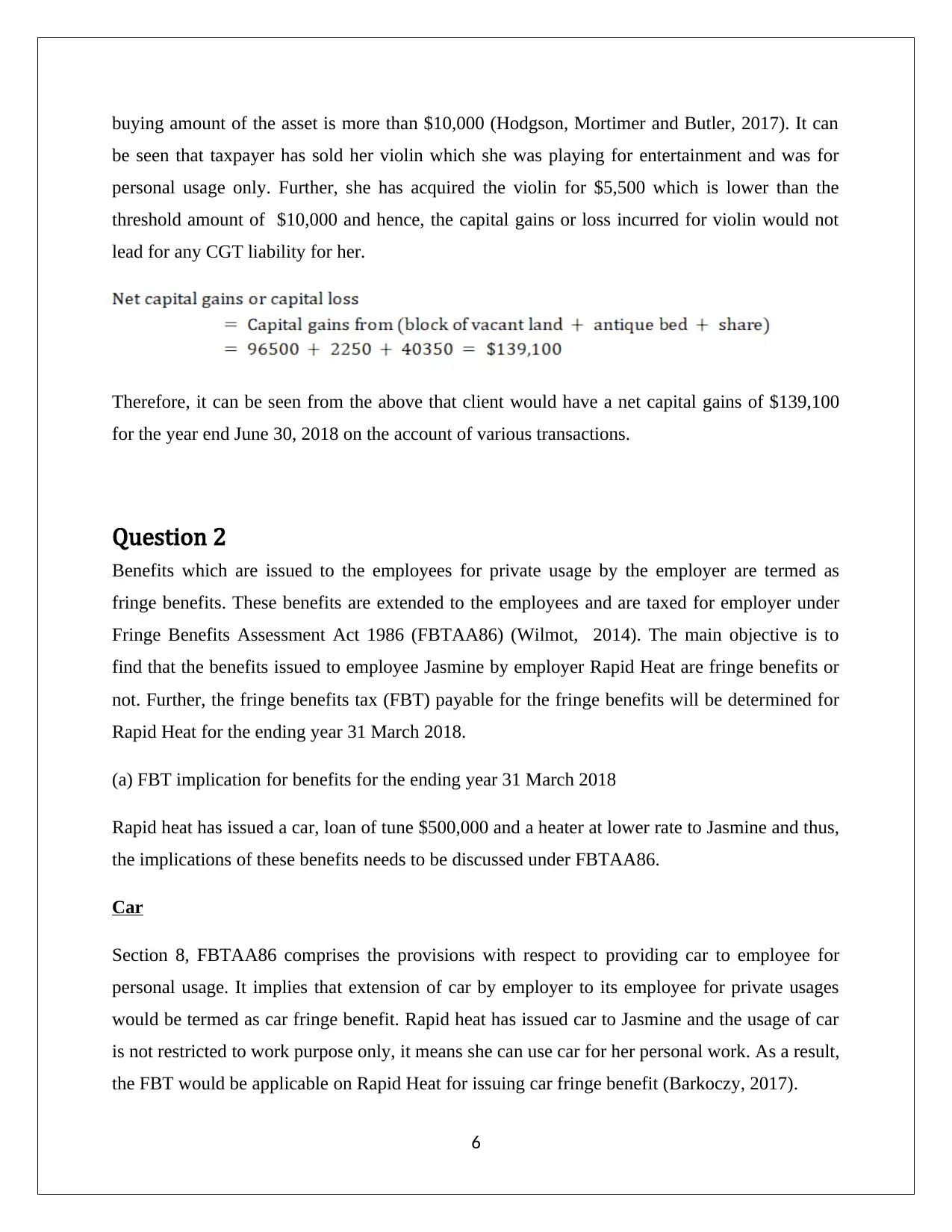

buying amount of the asset is more than $10,000 (Hodgson, Mortimer and Butler, 2017). It can

be seen that taxpayer has sold her violin which she was playing for entertainment and was for

personal usage only. Further, she has acquired the violin for $5,500 which is lower than the

threshold amount of $10,000 and hence, the capital gains or loss incurred for violin would not

lead for any CGT liability for her.

Therefore, it can be seen from the above that client would have a net capital gains of $139,100

for the year end June 30, 2018 on the account of various transactions.

Question 2

Benefits which are issued to the employees for private usage by the employer are termed as

fringe benefits. These benefits are extended to the employees and are taxed for employer under

Fringe Benefits Assessment Act 1986 (FBTAA86) (Wilmot, 2014). The main objective is to

find that the benefits issued to employee Jasmine by employer Rapid Heat are fringe benefits or

not. Further, the fringe benefits tax (FBT) payable for the fringe benefits will be determined for

Rapid Heat for the ending year 31 March 2018.

(a) FBT implication for benefits for the ending year 31 March 2018

Rapid heat has issued a car, loan of tune $500,000 and a heater at lower rate to Jasmine and thus,

the implications of these benefits needs to be discussed under FBTAA86.

Car

Section 8, FBTAA86 comprises the provisions with respect to providing car to employee for

personal usage. It implies that extension of car by employer to its employee for private usages

would be termed as car fringe benefit. Rapid heat has issued car to Jasmine and the usage of car

is not restricted to work purpose only, it means she can use car for her personal work. As a result,

the FBT would be applicable on Rapid Heat for issuing car fringe benefit (Barkoczy, 2017).

6

be seen that taxpayer has sold her violin which she was playing for entertainment and was for

personal usage only. Further, she has acquired the violin for $5,500 which is lower than the

threshold amount of $10,000 and hence, the capital gains or loss incurred for violin would not

lead for any CGT liability for her.

Therefore, it can be seen from the above that client would have a net capital gains of $139,100

for the year end June 30, 2018 on the account of various transactions.

Question 2

Benefits which are issued to the employees for private usage by the employer are termed as

fringe benefits. These benefits are extended to the employees and are taxed for employer under

Fringe Benefits Assessment Act 1986 (FBTAA86) (Wilmot, 2014). The main objective is to

find that the benefits issued to employee Jasmine by employer Rapid Heat are fringe benefits or

not. Further, the fringe benefits tax (FBT) payable for the fringe benefits will be determined for

Rapid Heat for the ending year 31 March 2018.

(a) FBT implication for benefits for the ending year 31 March 2018

Rapid heat has issued a car, loan of tune $500,000 and a heater at lower rate to Jasmine and thus,

the implications of these benefits needs to be discussed under FBTAA86.

Car

Section 8, FBTAA86 comprises the provisions with respect to providing car to employee for

personal usage. It implies that extension of car by employer to its employee for private usages

would be termed as car fringe benefit. Rapid heat has issued car to Jasmine and the usage of car

is not restricted to work purpose only, it means she can use car for her personal work. As a result,

the FBT would be applicable on Rapid Heat for issuing car fringe benefit (Barkoczy, 2017).

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

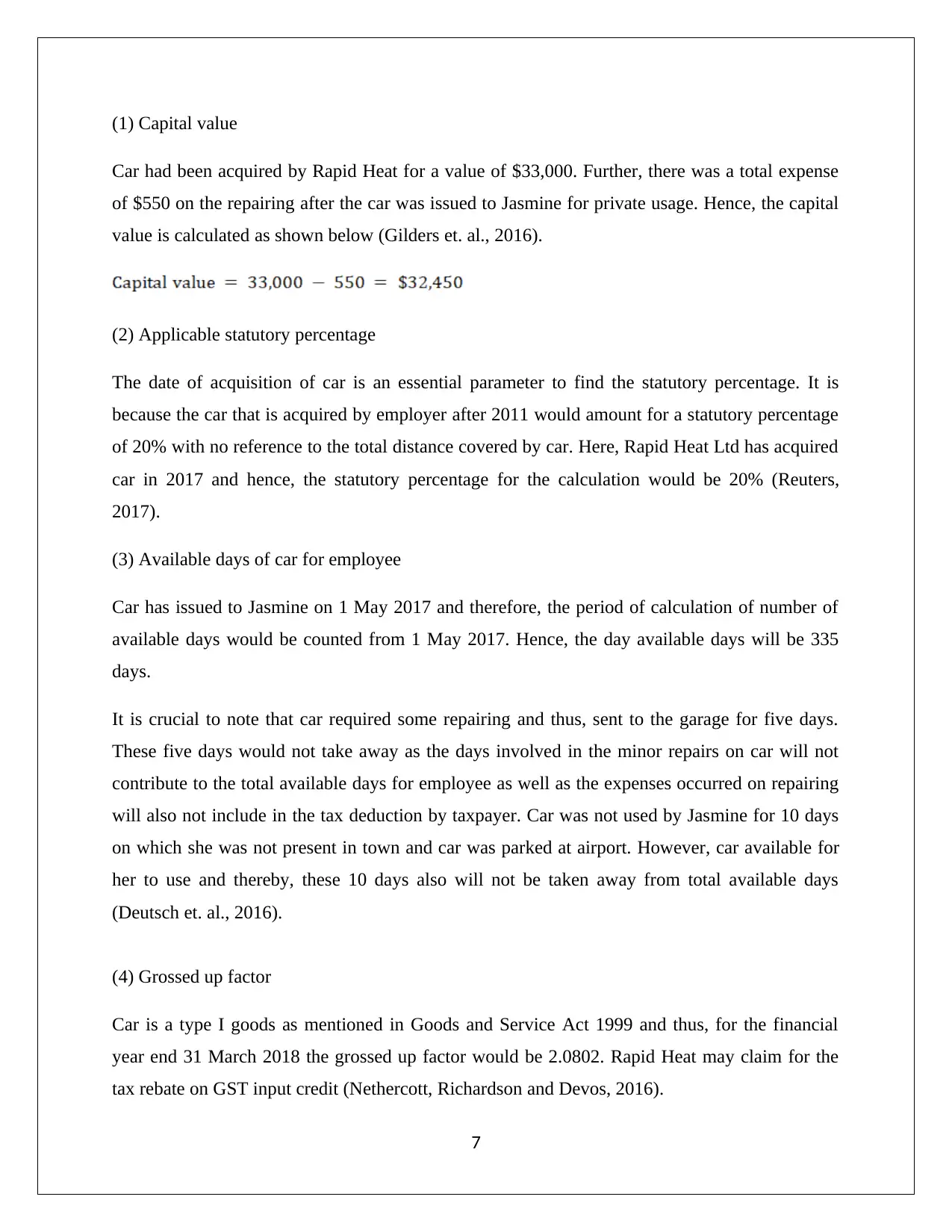

(1) Capital value

Car had been acquired by Rapid Heat for a value of $33,000. Further, there was a total expense

of $550 on the repairing after the car was issued to Jasmine for private usage. Hence, the capital

value is calculated as shown below (Gilders et. al., 2016).

(2) Applicable statutory percentage

The date of acquisition of car is an essential parameter to find the statutory percentage. It is

because the car that is acquired by employer after 2011 would amount for a statutory percentage

of 20% with no reference to the total distance covered by car. Here, Rapid Heat Ltd has acquired

car in 2017 and hence, the statutory percentage for the calculation would be 20% (Reuters,

2017).

(3) Available days of car for employee

Car has issued to Jasmine on 1 May 2017 and therefore, the period of calculation of number of

available days would be counted from 1 May 2017. Hence, the day available days will be 335

days.

It is crucial to note that car required some repairing and thus, sent to the garage for five days.

These five days would not take away as the days involved in the minor repairs on car will not

contribute to the total available days for employee as well as the expenses occurred on repairing

will also not include in the tax deduction by taxpayer. Car was not used by Jasmine for 10 days

on which she was not present in town and car was parked at airport. However, car available for

her to use and thereby, these 10 days also will not be taken away from total available days

(Deutsch et. al., 2016).

(4) Grossed up factor

Car is a type I goods as mentioned in Goods and Service Act 1999 and thus, for the financial

year end 31 March 2018 the grossed up factor would be 2.0802. Rapid Heat may claim for the

tax rebate on GST input credit (Nethercott, Richardson and Devos, 2016).

7

Car had been acquired by Rapid Heat for a value of $33,000. Further, there was a total expense

of $550 on the repairing after the car was issued to Jasmine for private usage. Hence, the capital

value is calculated as shown below (Gilders et. al., 2016).

(2) Applicable statutory percentage

The date of acquisition of car is an essential parameter to find the statutory percentage. It is

because the car that is acquired by employer after 2011 would amount for a statutory percentage

of 20% with no reference to the total distance covered by car. Here, Rapid Heat Ltd has acquired

car in 2017 and hence, the statutory percentage for the calculation would be 20% (Reuters,

2017).

(3) Available days of car for employee

Car has issued to Jasmine on 1 May 2017 and therefore, the period of calculation of number of

available days would be counted from 1 May 2017. Hence, the day available days will be 335

days.

It is crucial to note that car required some repairing and thus, sent to the garage for five days.

These five days would not take away as the days involved in the minor repairs on car will not

contribute to the total available days for employee as well as the expenses occurred on repairing

will also not include in the tax deduction by taxpayer. Car was not used by Jasmine for 10 days

on which she was not present in town and car was parked at airport. However, car available for

her to use and thereby, these 10 days also will not be taken away from total available days

(Deutsch et. al., 2016).

(4) Grossed up factor

Car is a type I goods as mentioned in Goods and Service Act 1999 and thus, for the financial

year end 31 March 2018 the grossed up factor would be 2.0802. Rapid Heat may claim for the

tax rebate on GST input credit (Nethercott, Richardson and Devos, 2016).

7

(5) Taxable value

It can be calculated based on the relevant formula as highlighted in s. 9F of FBTAA86.

Taxable value = capital value * statutory percentage * total available days * grossed up factor

(6) FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Loan

Loan fringe benefits would be issued when the employer has decided to provide loan at zero

interest or lower interest rate as compared with the interest rate set by Reserve Bank of Australia

(RBA). The interest rate defined by RBA is termed as statutory interest rate and any interest rate

below this rate would raise the extension of fringe benefits by employer. Rapid Heat extends

loan to Jasmine at 4.25% against the statutory interest rate of RBA is 5.25. Thus, the loan would

be classified as loan fringe benefits. The saving of interest because of discounted interest rate

will be taken into note for calculating the FBT payable (Nethercott, Richardson and Devos,

2016).

(1)Number of days

Loan has been issued to Jasmine on 1 September 2017 by Rapid Heat and thus, Jasmine has sum

of 213 days after taking the loan.

(2)Difference of interest payment

8

It can be calculated based on the relevant formula as highlighted in s. 9F of FBTAA86.

Taxable value = capital value * statutory percentage * total available days * grossed up factor

(6) FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Loan

Loan fringe benefits would be issued when the employer has decided to provide loan at zero

interest or lower interest rate as compared with the interest rate set by Reserve Bank of Australia

(RBA). The interest rate defined by RBA is termed as statutory interest rate and any interest rate

below this rate would raise the extension of fringe benefits by employer. Rapid Heat extends

loan to Jasmine at 4.25% against the statutory interest rate of RBA is 5.25. Thus, the loan would

be classified as loan fringe benefits. The saving of interest because of discounted interest rate

will be taken into note for calculating the FBT payable (Nethercott, Richardson and Devos,

2016).

(1)Number of days

Loan has been issued to Jasmine on 1 September 2017 by Rapid Heat and thus, Jasmine has sum

of 213 days after taking the loan.

(2)Difference of interest payment

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

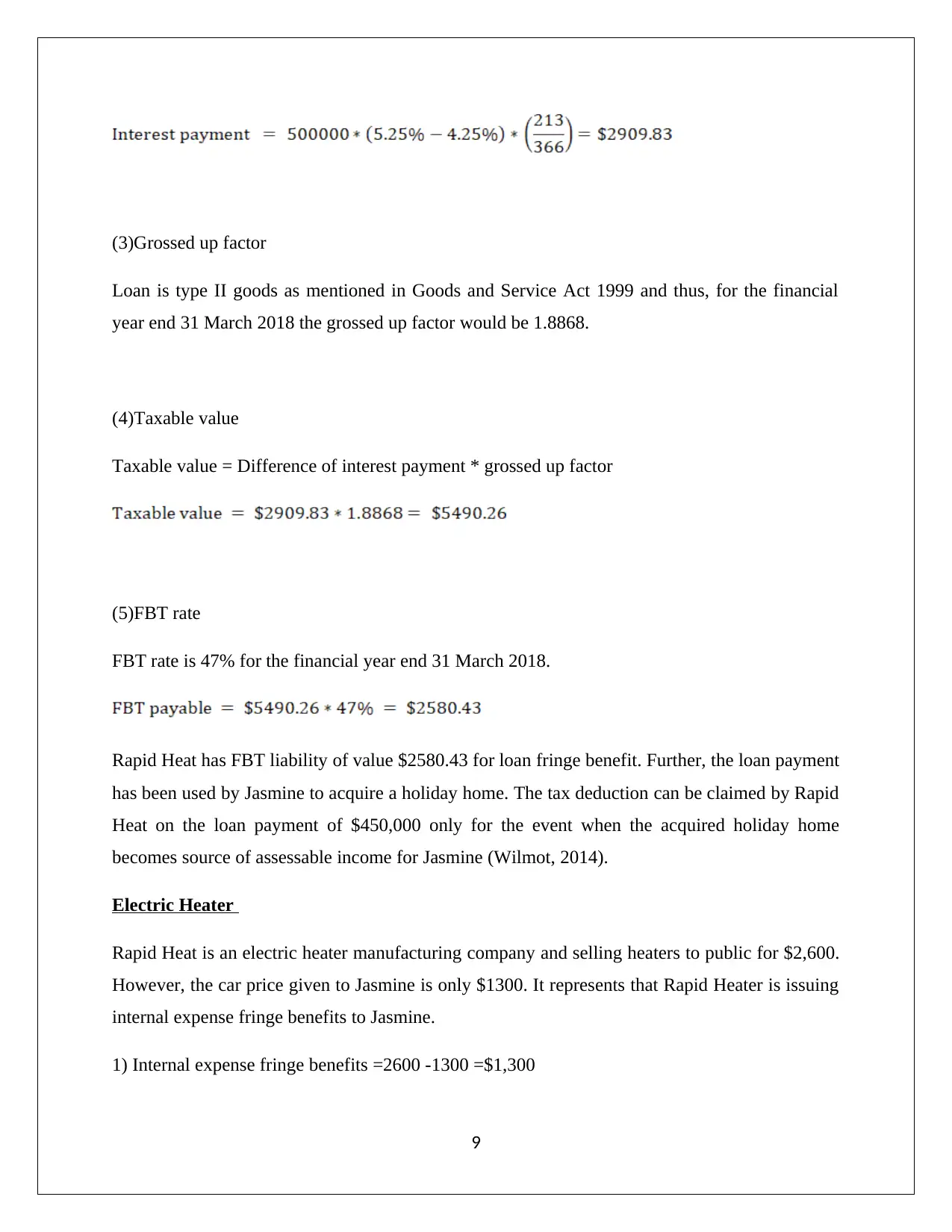

(3)Grossed up factor

Loan is type II goods as mentioned in Goods and Service Act 1999 and thus, for the financial

year end 31 March 2018 the grossed up factor would be 1.8868.

(4)Taxable value

Taxable value = Difference of interest payment * grossed up factor

(5)FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Rapid Heat has FBT liability of value $2580.43 for loan fringe benefit. Further, the loan payment

has been used by Jasmine to acquire a holiday home. The tax deduction can be claimed by Rapid

Heat on the loan payment of $450,000 only for the event when the acquired holiday home

becomes source of assessable income for Jasmine (Wilmot, 2014).

Electric Heater

Rapid Heat is an electric heater manufacturing company and selling heaters to public for $2,600.

However, the car price given to Jasmine is only $1300. It represents that Rapid Heater is issuing

internal expense fringe benefits to Jasmine.

1) Internal expense fringe benefits =2600 -1300 =$1,300

9

Loan is type II goods as mentioned in Goods and Service Act 1999 and thus, for the financial

year end 31 March 2018 the grossed up factor would be 1.8868.

(4)Taxable value

Taxable value = Difference of interest payment * grossed up factor

(5)FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Rapid Heat has FBT liability of value $2580.43 for loan fringe benefit. Further, the loan payment

has been used by Jasmine to acquire a holiday home. The tax deduction can be claimed by Rapid

Heat on the loan payment of $450,000 only for the event when the acquired holiday home

becomes source of assessable income for Jasmine (Wilmot, 2014).

Electric Heater

Rapid Heat is an electric heater manufacturing company and selling heaters to public for $2,600.

However, the car price given to Jasmine is only $1300. It represents that Rapid Heater is issuing

internal expense fringe benefits to Jasmine.

1) Internal expense fringe benefits =2600 -1300 =$1,300

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2) 75% of selling price of electric heater = 75%* 2,600 =$1,950

(3)Grossed up factor

Electric heater is a type I goods as mentioned in Goods and Service Act 1999 and thus, for the

financial year end 31 March 2018 the grossed up factor would be 2.0802.

(4)Taxable value

Taxable value = ($1,950-$1,300)*2.0802=$1352.13

(5)FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Rapid Heat has FBT liability of value $635.50 for internal expense fringe benefit.

(b)Jasmine herself used $50,000 to acquire shares of Telstra

Difference of interest payment on remaining $50,000 would also be taken into consideration for

tax deduction by Rapid Heat when Jasmine herself used $50,000 to acquire shares of Telstra.

The underlying reason is that the shares acquired by Jasmine would generate income for her and

thus, loan payment would be deductible on behalf of Rapid Heat (Woellner et. al., 2017).

The net FBT payable computed in part a) would be reduced by $500 when the shares have been

acquired by Jasmine.

10

(3)Grossed up factor

Electric heater is a type I goods as mentioned in Goods and Service Act 1999 and thus, for the

financial year end 31 March 2018 the grossed up factor would be 2.0802.

(4)Taxable value

Taxable value = ($1,950-$1,300)*2.0802=$1352.13

(5)FBT rate

FBT rate is 47% for the financial year end 31 March 2018.

Rapid Heat has FBT liability of value $635.50 for internal expense fringe benefit.

(b)Jasmine herself used $50,000 to acquire shares of Telstra

Difference of interest payment on remaining $50,000 would also be taken into consideration for

tax deduction by Rapid Heat when Jasmine herself used $50,000 to acquire shares of Telstra.

The underlying reason is that the shares acquired by Jasmine would generate income for her and

thus, loan payment would be deductible on behalf of Rapid Heat (Woellner et. al., 2017).

The net FBT payable computed in part a) would be reduced by $500 when the shares have been

acquired by Jasmine.

10

References

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2016) Australian tax handbook.

8th ed. Pymont: Thomson Reuters.

Gilders, F, Taylor, J, Walpole, M, Burton, M. and Ciro, T (2016) Understanding taxation law

2016. 6th ed. Sydney: LexisNexis/Butterworths

Hodgson, H., Mortimer, C. and Butler, J. (2017) Tax Questions and Answers 2016. 6th ed.

Sydney: Thomson Reuters.

Nethercott, L., Richardson, G., and Devos, K. (2016) Australian Taxation Study Manual 2016.

8th ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS

Wilmot, C. (2014) FBT Compliance guide. 6th ed. North Ryde: CCH Australia Limited.

Woellner, R. (2014) Australian taxation law 2014. 8th ed. North Ryde: CCH Australia.

Woellner, R., Barkoczy, S., Murphy, S. and Pinto, D. (2017) Australian Taxation Law 2017 27th

ed. Sydney: Oxford University Press Australia.

11

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2016) Australian tax handbook.

8th ed. Pymont: Thomson Reuters.

Gilders, F, Taylor, J, Walpole, M, Burton, M. and Ciro, T (2016) Understanding taxation law

2016. 6th ed. Sydney: LexisNexis/Butterworths

Hodgson, H., Mortimer, C. and Butler, J. (2017) Tax Questions and Answers 2016. 6th ed.

Sydney: Thomson Reuters.

Nethercott, L., Richardson, G., and Devos, K. (2016) Australian Taxation Study Manual 2016.

8th ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS

Wilmot, C. (2014) FBT Compliance guide. 6th ed. North Ryde: CCH Australia Limited.

Woellner, R. (2014) Australian taxation law 2014. 8th ed. North Ryde: CCH Australia.

Woellner, R., Barkoczy, S., Murphy, S. and Pinto, D. (2017) Australian Taxation Law 2017 27th

ed. Sydney: Oxford University Press Australia.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.