Hilton Worldwide: Optimizing Revenue Through Hospitality Operations

VerifiedAdded on 2024/05/14

|17

|4244

|335

Report

AI Summary

This report examines Hilton Worldwide's revenue management strategies within its hospitality operations. It highlights the financial contributions of room revenue, emphasizing the importance of occupancy rate, RevPAR, and ADR. The report analyzes Hilton's pricing principles, including premium pricing and demand pricing, and evaluates their potential benefits to profitability. It also discusses methods to optimize profitability under fixed capacity inventory, considering the dynamic growth in the hospitality sector. The impact of codes of conduct and customer expectations are addressed, followed by recommendations for enhancing Hilton's revenue management practices. The report concludes by summarizing the key findings and suggesting further areas for improvement, emphasizing the need for a balanced approach to pricing, occupancy, and customer satisfaction to ensure sustainable business growth.

Hospitality Operations and Revenue Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

This report has analysed the scope and significance of revenue management in regards to

cases scenario of Hilton Worldwide. Hotel owners or managers have to maintain proper

pricing strategy towards perishable inventory for meeting demand. In this landscape, Hilton

hoteliers are also responsible to incorporate such strategic movement for revenue

management. Report has highlighted financial contribution and its impact, where approx 56%

system wide occupancy helps the organisation to gain revenue over $17 billion in the year

2016. Based on the increase and decrease in hotel room, occupancy level in room rates are

recognised by the hotel owners through economic cycle. Code of conduct has been mentioned

to maintain ethics in pricing as well as accommodation. Conclusion has been evaluated based

on the provided recommendation.

2

This report has analysed the scope and significance of revenue management in regards to

cases scenario of Hilton Worldwide. Hotel owners or managers have to maintain proper

pricing strategy towards perishable inventory for meeting demand. In this landscape, Hilton

hoteliers are also responsible to incorporate such strategic movement for revenue

management. Report has highlighted financial contribution and its impact, where approx 56%

system wide occupancy helps the organisation to gain revenue over $17 billion in the year

2016. Based on the increase and decrease in hotel room, occupancy level in room rates are

recognised by the hotel owners through economic cycle. Code of conduct has been mentioned

to maintain ethics in pricing as well as accommodation. Conclusion has been evaluated based

on the provided recommendation.

2

Table of Contents

1.0 Introduction..........................................................................................................................4

2.0 Financial contribution within room’s revenue producing areas for making sustainable

business unit...............................................................................................................................5

3.0 Demonstrate and apply principles of pricing to the room’s product and evaluate the

potential benefits of effective practices to profitability.............................................................7

4.0 Method to optimize profitability under fixed capacity inventory for recognizing dynamic

growth........................................................................................................................................9

5.0 Impact of ‘codes of conduct’, legislation and best practice on accommodation Procedures

..................................................................................................................................................11

6.0 Expectations of customers from diverse markets and explanation on accommodation

service approach in regards to quality management................................................................12

7.0 Recommendation................................................................................................................13

8.0 Conclusion..........................................................................................................................14

Reference list............................................................................................................................15

Appendices...............................................................................................................................17

3

1.0 Introduction..........................................................................................................................4

2.0 Financial contribution within room’s revenue producing areas for making sustainable

business unit...............................................................................................................................5

3.0 Demonstrate and apply principles of pricing to the room’s product and evaluate the

potential benefits of effective practices to profitability.............................................................7

4.0 Method to optimize profitability under fixed capacity inventory for recognizing dynamic

growth........................................................................................................................................9

5.0 Impact of ‘codes of conduct’, legislation and best practice on accommodation Procedures

..................................................................................................................................................11

6.0 Expectations of customers from diverse markets and explanation on accommodation

service approach in regards to quality management................................................................12

7.0 Recommendation................................................................................................................13

8.0 Conclusion..........................................................................................................................14

Reference list............................................................................................................................15

Appendices...............................................................................................................................17

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.0 Introduction

In this globalised business platform, organisations are not only prioritised their focus on

synchronised administrative system but also in revenue management for maintaining

sustainable growth. For any hotel operation, revenue management is a vital part to maximise

the overall profit. Various key factors such as sales price, occupancy and capacity in terms of

availability are concerned within the elasticity of consumer demand. Therefore, hotel owners

or managers have to maintain proper pricing strategy towards perishable inventory for

meeting demand. In this landscape, Hilton hoteliers are also responsible to incorporate such

strategic movement for revenue management. They are known as global brand of full service

hotels and resorts. Due to their innovative approach to amenities, products and services they

are become leader of hospitality in global perimeter. The current report will enlighten their

financial contribution on room revenue as per the principle of pricing. Legal obligation as

well as supervision will also be addressed to maintain overall accommodation or services as

per customer’s expectation.

4

In this globalised business platform, organisations are not only prioritised their focus on

synchronised administrative system but also in revenue management for maintaining

sustainable growth. For any hotel operation, revenue management is a vital part to maximise

the overall profit. Various key factors such as sales price, occupancy and capacity in terms of

availability are concerned within the elasticity of consumer demand. Therefore, hotel owners

or managers have to maintain proper pricing strategy towards perishable inventory for

meeting demand. In this landscape, Hilton hoteliers are also responsible to incorporate such

strategic movement for revenue management. They are known as global brand of full service

hotels and resorts. Due to their innovative approach to amenities, products and services they

are become leader of hospitality in global perimeter. The current report will enlighten their

financial contribution on room revenue as per the principle of pricing. Legal obligation as

well as supervision will also be addressed to maintain overall accommodation or services as

per customer’s expectation.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.0 Financial contribution within room’s revenue producing areas for making

sustainable business unit

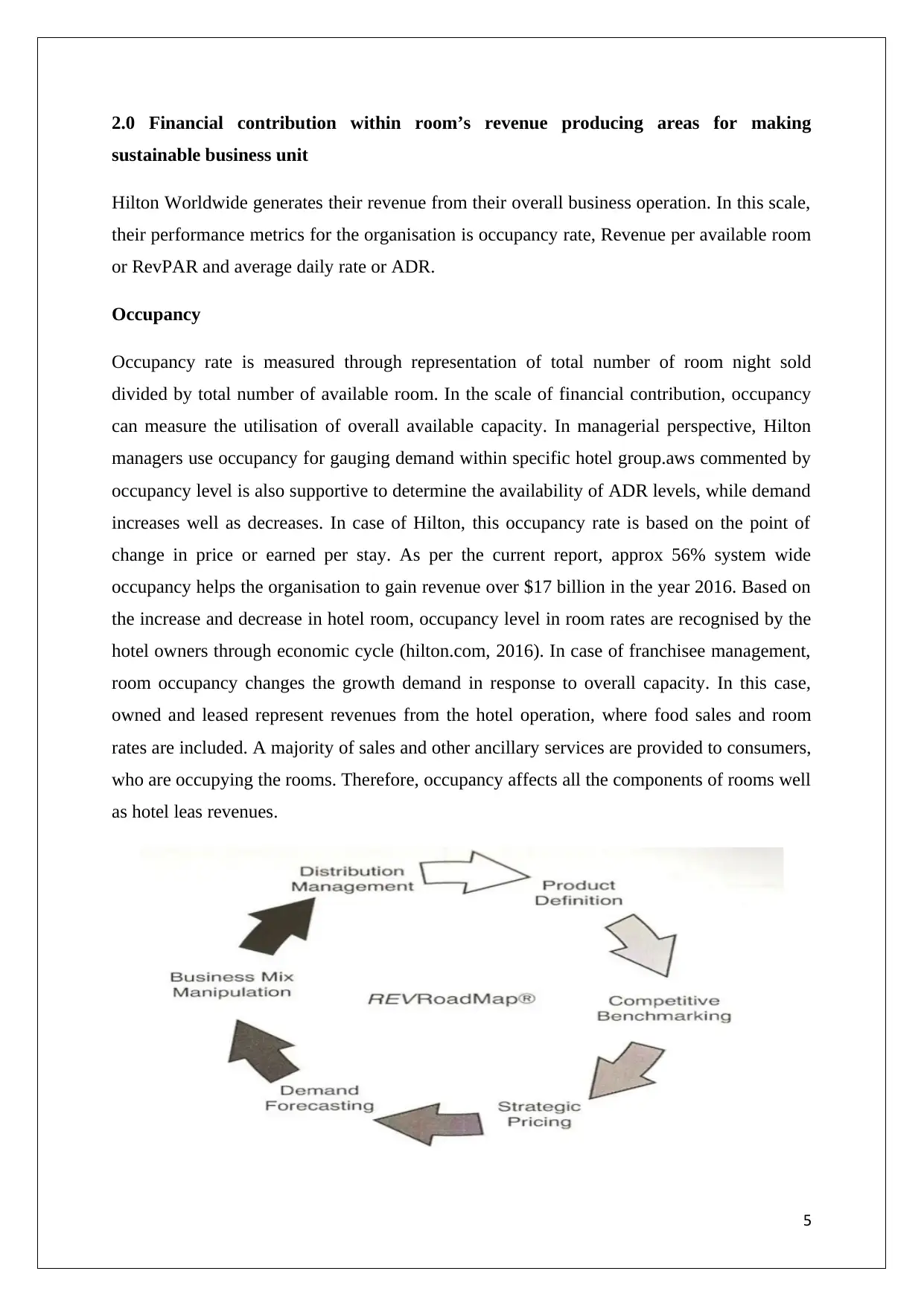

Hilton Worldwide generates their revenue from their overall business operation. In this scale,

their performance metrics for the organisation is occupancy rate, Revenue per available room

or RevPAR and average daily rate or ADR.

Occupancy

Occupancy rate is measured through representation of total number of room night sold

divided by total number of available room. In the scale of financial contribution, occupancy

can measure the utilisation of overall available capacity. In managerial perspective, Hilton

managers use occupancy for gauging demand within specific hotel group.aws commented by

occupancy level is also supportive to determine the availability of ADR levels, while demand

increases well as decreases. In case of Hilton, this occupancy rate is based on the point of

change in price or earned per stay. As per the current report, approx 56% system wide

occupancy helps the organisation to gain revenue over $17 billion in the year 2016. Based on

the increase and decrease in hotel room, occupancy level in room rates are recognised by the

hotel owners through economic cycle (hilton.com, 2016). In case of franchisee management,

room occupancy changes the growth demand in response to overall capacity. In this case,

owned and leased represent revenues from the hotel operation, where food sales and room

rates are included. A majority of sales and other ancillary services are provided to consumers,

who are occupying the rooms. Therefore, occupancy affects all the components of rooms well

as hotel leas revenues.

5

sustainable business unit

Hilton Worldwide generates their revenue from their overall business operation. In this scale,

their performance metrics for the organisation is occupancy rate, Revenue per available room

or RevPAR and average daily rate or ADR.

Occupancy

Occupancy rate is measured through representation of total number of room night sold

divided by total number of available room. In the scale of financial contribution, occupancy

can measure the utilisation of overall available capacity. In managerial perspective, Hilton

managers use occupancy for gauging demand within specific hotel group.aws commented by

occupancy level is also supportive to determine the availability of ADR levels, while demand

increases well as decreases. In case of Hilton, this occupancy rate is based on the point of

change in price or earned per stay. As per the current report, approx 56% system wide

occupancy helps the organisation to gain revenue over $17 billion in the year 2016. Based on

the increase and decrease in hotel room, occupancy level in room rates are recognised by the

hotel owners through economic cycle (hilton.com, 2016). In case of franchisee management,

room occupancy changes the growth demand in response to overall capacity. In this case,

owned and leased represent revenues from the hotel operation, where food sales and room

rates are included. A majority of sales and other ancillary services are provided to consumers,

who are occupying the rooms. Therefore, occupancy affects all the components of rooms well

as hotel leas revenues.

5

Figure 1: Revenue management map

(Source: Elbanna, 2016)

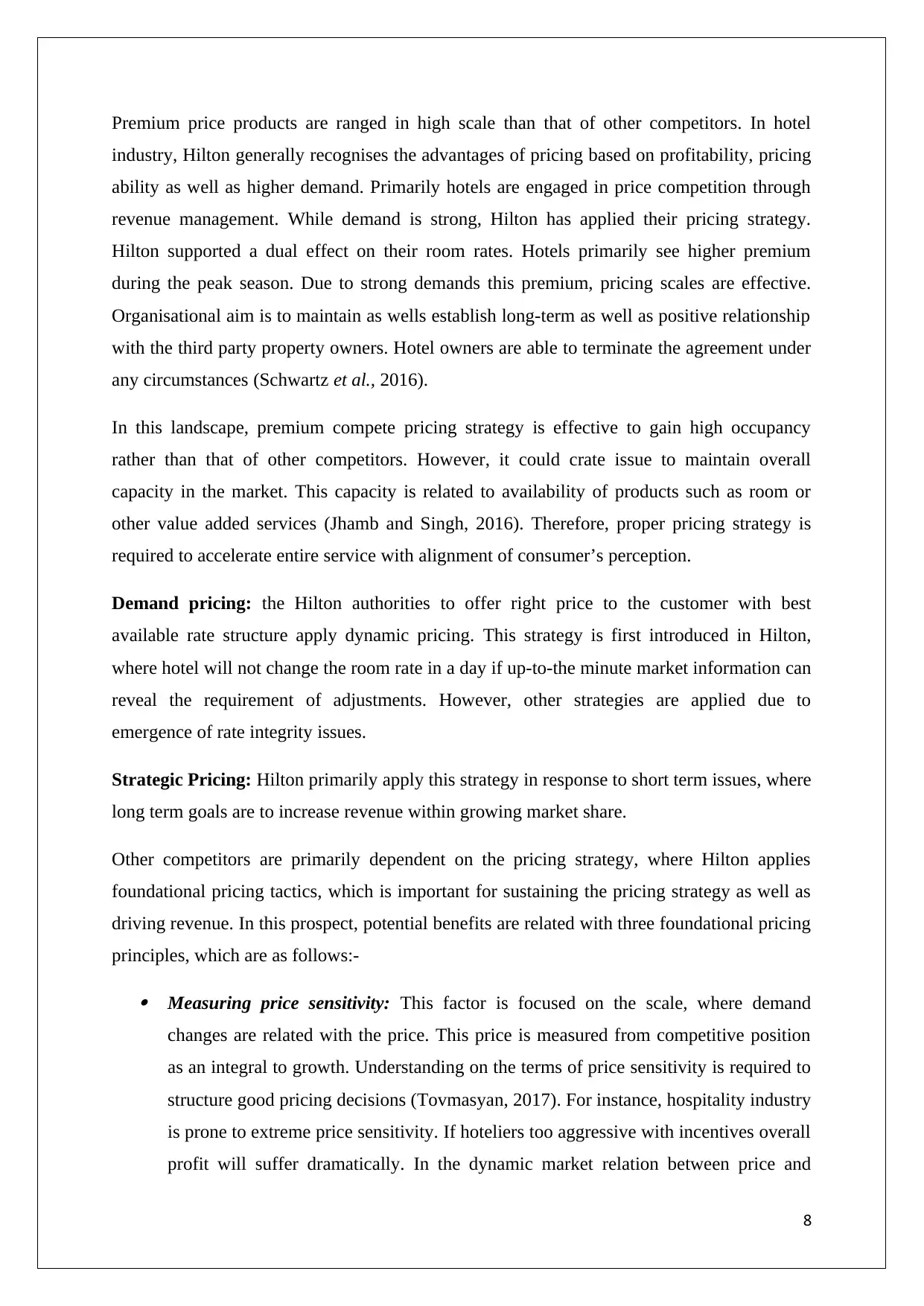

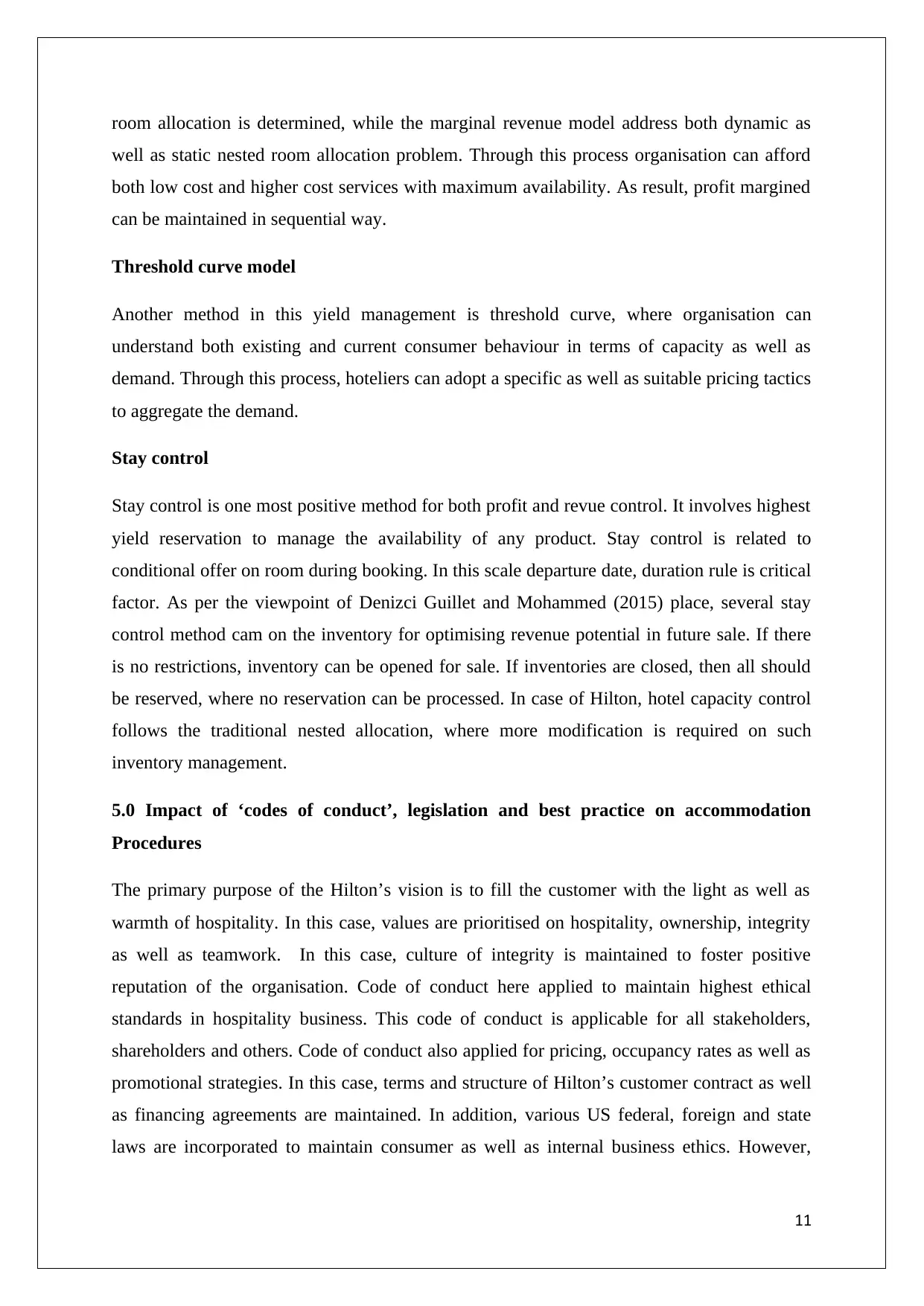

RevPAR

RevPAR is represented by calculation of hotel room revenue divided by Room nights

available for a specific time scale. Hilton mangers consider RevPAR as a supportive indicator

of overall performance, where provided metric is related to key drivers and two primary

factors of operations over all performance of the hotel during the comparable period,

occupancy of any ADR RevPAR are useful indicators. In every financial scale, RevPAR, and

occupancy is represented as comparable basis. In 2016, organisation has experienced

RevPAR growth in proportion to ADR growth at hotel segments. In both UK and US,

RevPAR growth has been visualised due to increase average daily rate growth. In Asia

Pacific, this RevPAR is driven by the increased occupancy. In world region, Hilton

Worldwide RevPAR growth leads to 9.3% due to increased occupancy. Based on the

demand, RevPAR still increased through demand outpacing supply growth, which is primary

case of long-term average rate.

ADR Occupancy RevPAR

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

2%

14%

9%

Interrelation of Occupancy,ADR &

RevPAR in regards to Hilton case

Financial Contribution

Percentage growth

Figure 2: Interrelation of Occupancy, ADR & RevPAR in regards to Hilton case

(Source; hilton.com, 2016)

In franchisee management, global transition business it has proper impact to create balance

between the occupancy as well as overall capacity. For the international business, hotel

authorities have to understand the importance of creating right balance between rate and

6

(Source: Elbanna, 2016)

RevPAR

RevPAR is represented by calculation of hotel room revenue divided by Room nights

available for a specific time scale. Hilton mangers consider RevPAR as a supportive indicator

of overall performance, where provided metric is related to key drivers and two primary

factors of operations over all performance of the hotel during the comparable period,

occupancy of any ADR RevPAR are useful indicators. In every financial scale, RevPAR, and

occupancy is represented as comparable basis. In 2016, organisation has experienced

RevPAR growth in proportion to ADR growth at hotel segments. In both UK and US,

RevPAR growth has been visualised due to increase average daily rate growth. In Asia

Pacific, this RevPAR is driven by the increased occupancy. In world region, Hilton

Worldwide RevPAR growth leads to 9.3% due to increased occupancy. Based on the

demand, RevPAR still increased through demand outpacing supply growth, which is primary

case of long-term average rate.

ADR Occupancy RevPAR

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

2%

14%

9%

Interrelation of Occupancy,ADR &

RevPAR in regards to Hilton case

Financial Contribution

Percentage growth

Figure 2: Interrelation of Occupancy, ADR & RevPAR in regards to Hilton case

(Source; hilton.com, 2016)

In franchisee management, global transition business it has proper impact to create balance

between the occupancy as well as overall capacity. For the international business, hotel

authorities have to understand the importance of creating right balance between rate and

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

occupancy. In this case, often hotel productivity is evaluated based on the on such factors

(Gray et al., 2015). In many cases, hoteliers have higher occupancy rate in response to their

operational target. However, such higher occupancy can lead to lower profit. RevPAR gives

accurate picture of the performance to enhance overall growth.

ADR

ADR or average daily rate can be calculated through reprinting the hotel room revenue

divided by the total number of room nights within a specific period. It primarily measures the

average room process, which are attained by the hotels. In Hilton, ADR trends provide proper

information is concerned with customer base as well as pricing environment. In order to

measuring the performance, ADR is utilised to assess the pricing level, where Hilton Group is

able to generate customer types for changing the rates. These rates are transformed based on

incremental profitability and overall revues rather than the changes in occupancy. As per the

report of 2016, ADR increase was up to 2.1% that is responsible for decreasing the

occupancy up to 14% points.

In the landscape of fixed capacity inventory program, safety and base stockes need to be

maintained for getting a measurement scale against the impact of uncertainty. This status can

be raised while occupancy rate is very high. Therefore, such factors in room revue area have

both positive and negative impact to maintain business sustainability for Hilton.

3.0 Demonstrate and apply principles of pricing to the room’s product and evaluate the

potential benefits of effective practices to profitability

Hilton authorities are primarily dependent on franchise pricing trends, which have created

adverse impact on maintaining existing management practice. Their pricing strategy is

determined by Black-Scholes-Merton option-pricing model. Embassy suites bundled pricing

of Hilton ensures that guest will receive all the amenities with proper affordable offer range.

In the scale of hospitality business, there are various pricing strategies such as premium

pricing, economy pricing, penetration, psychological pricing, price skimming as well as

bundle pricing. In case of room’s products, pricing has significant impact to maintain

competitive position.

Premium Price Products

7

(Gray et al., 2015). In many cases, hoteliers have higher occupancy rate in response to their

operational target. However, such higher occupancy can lead to lower profit. RevPAR gives

accurate picture of the performance to enhance overall growth.

ADR

ADR or average daily rate can be calculated through reprinting the hotel room revenue

divided by the total number of room nights within a specific period. It primarily measures the

average room process, which are attained by the hotels. In Hilton, ADR trends provide proper

information is concerned with customer base as well as pricing environment. In order to

measuring the performance, ADR is utilised to assess the pricing level, where Hilton Group is

able to generate customer types for changing the rates. These rates are transformed based on

incremental profitability and overall revues rather than the changes in occupancy. As per the

report of 2016, ADR increase was up to 2.1% that is responsible for decreasing the

occupancy up to 14% points.

In the landscape of fixed capacity inventory program, safety and base stockes need to be

maintained for getting a measurement scale against the impact of uncertainty. This status can

be raised while occupancy rate is very high. Therefore, such factors in room revue area have

both positive and negative impact to maintain business sustainability for Hilton.

3.0 Demonstrate and apply principles of pricing to the room’s product and evaluate the

potential benefits of effective practices to profitability

Hilton authorities are primarily dependent on franchise pricing trends, which have created

adverse impact on maintaining existing management practice. Their pricing strategy is

determined by Black-Scholes-Merton option-pricing model. Embassy suites bundled pricing

of Hilton ensures that guest will receive all the amenities with proper affordable offer range.

In the scale of hospitality business, there are various pricing strategies such as premium

pricing, economy pricing, penetration, psychological pricing, price skimming as well as

bundle pricing. In case of room’s products, pricing has significant impact to maintain

competitive position.

Premium Price Products

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Premium price products are ranged in high scale than that of other competitors. In hotel

industry, Hilton generally recognises the advantages of pricing based on profitability, pricing

ability as well as higher demand. Primarily hotels are engaged in price competition through

revenue management. While demand is strong, Hilton has applied their pricing strategy.

Hilton supported a dual effect on their room rates. Hotels primarily see higher premium

during the peak season. Due to strong demands this premium, pricing scales are effective.

Organisational aim is to maintain as wells establish long-term as well as positive relationship

with the third party property owners. Hotel owners are able to terminate the agreement under

any circumstances (Schwartz et al., 2016).

In this landscape, premium compete pricing strategy is effective to gain high occupancy

rather than that of other competitors. However, it could crate issue to maintain overall

capacity in the market. This capacity is related to availability of products such as room or

other value added services (Jhamb and Singh, 2016). Therefore, proper pricing strategy is

required to accelerate entire service with alignment of consumer’s perception.

Demand pricing: the Hilton authorities to offer right price to the customer with best

available rate structure apply dynamic pricing. This strategy is first introduced in Hilton,

where hotel will not change the room rate in a day if up-to-the minute market information can

reveal the requirement of adjustments. However, other strategies are applied due to

emergence of rate integrity issues.

Strategic Pricing: Hilton primarily apply this strategy in response to short term issues, where

long term goals are to increase revenue within growing market share.

Other competitors are primarily dependent on the pricing strategy, where Hilton applies

foundational pricing tactics, which is important for sustaining the pricing strategy as well as

driving revenue. In this prospect, potential benefits are related with three foundational pricing

principles, which are as follows:-

Measuring price sensitivity: This factor is focused on the scale, where demand

changes are related with the price. This price is measured from competitive position

as an integral to growth. Understanding on the terms of price sensitivity is required to

structure good pricing decisions (Tovmasyan, 2017). For instance, hospitality industry

is prone to extreme price sensitivity. If hoteliers too aggressive with incentives overall

profit will suffer dramatically. In the dynamic market relation between price and

8

industry, Hilton generally recognises the advantages of pricing based on profitability, pricing

ability as well as higher demand. Primarily hotels are engaged in price competition through

revenue management. While demand is strong, Hilton has applied their pricing strategy.

Hilton supported a dual effect on their room rates. Hotels primarily see higher premium

during the peak season. Due to strong demands this premium, pricing scales are effective.

Organisational aim is to maintain as wells establish long-term as well as positive relationship

with the third party property owners. Hotel owners are able to terminate the agreement under

any circumstances (Schwartz et al., 2016).

In this landscape, premium compete pricing strategy is effective to gain high occupancy

rather than that of other competitors. However, it could crate issue to maintain overall

capacity in the market. This capacity is related to availability of products such as room or

other value added services (Jhamb and Singh, 2016). Therefore, proper pricing strategy is

required to accelerate entire service with alignment of consumer’s perception.

Demand pricing: the Hilton authorities to offer right price to the customer with best

available rate structure apply dynamic pricing. This strategy is first introduced in Hilton,

where hotel will not change the room rate in a day if up-to-the minute market information can

reveal the requirement of adjustments. However, other strategies are applied due to

emergence of rate integrity issues.

Strategic Pricing: Hilton primarily apply this strategy in response to short term issues, where

long term goals are to increase revenue within growing market share.

Other competitors are primarily dependent on the pricing strategy, where Hilton applies

foundational pricing tactics, which is important for sustaining the pricing strategy as well as

driving revenue. In this prospect, potential benefits are related with three foundational pricing

principles, which are as follows:-

Measuring price sensitivity: This factor is focused on the scale, where demand

changes are related with the price. This price is measured from competitive position

as an integral to growth. Understanding on the terms of price sensitivity is required to

structure good pricing decisions (Tovmasyan, 2017). For instance, hospitality industry

is prone to extreme price sensitivity. If hoteliers too aggressive with incentives overall

profit will suffer dramatically. In the dynamic market relation between price and

8

demand is difficult, where Hilton mages their revenue isolating sensitivity along with

better pricing decisions. Measuring demand vs. inventory/capacity: in this scale, hoteliers have to understand

that room product or services are always dependent on the demand. Higher premium

price point can give scope to competitor to reduce the price for retailing consumers

with maximum number (Molina-Azorín et al., 2015). Hoteliers also need to sell

remaining inventory at higher price points. Therefore, capacity vs demand field is

critical. If organisation increase their price, occupancy rate will be high but it will

give a scope to other companies to lower the occupancy and avail more inventory or

capacity.

Measuring competitor price positioning: In the context of price transparency, Hilton

has made easy for the consumers. They have applied it as function for competitive

charging rather than seeing the price in a vacuum. Through competitive pricing,

Hilton can maintain the transparency for creating market that is more dynamic while

competition level is high at all level.

Therefore, pricing strategy has been properly applied to gain higher profitability at all level.

If the hotel applied this three dimensional factors, they can utilise both manual and advanced

approach to pricing.

4.0 Method to optimize profitability under fixed capacity inventory for recognizing

dynamic growth

In the hospitality business, fixed capacity is related to create balance within the demand as

well as overall capacity, which is dependent on occupancy and RevPER. In the following

section a short scenario of Hilton is displayed for creating the balance between occupancy,

profit and capacity.

Hilton case Room rate calculation in terms of Revenue management

% Revenue Achieved = Actual revenue/Potential revenue

As per the Hilton, case study

Average Room Rates = $ 1155.10

Revenue achieved = 8,477,890

9

better pricing decisions. Measuring demand vs. inventory/capacity: in this scale, hoteliers have to understand

that room product or services are always dependent on the demand. Higher premium

price point can give scope to competitor to reduce the price for retailing consumers

with maximum number (Molina-Azorín et al., 2015). Hoteliers also need to sell

remaining inventory at higher price points. Therefore, capacity vs demand field is

critical. If organisation increase their price, occupancy rate will be high but it will

give a scope to other companies to lower the occupancy and avail more inventory or

capacity.

Measuring competitor price positioning: In the context of price transparency, Hilton

has made easy for the consumers. They have applied it as function for competitive

charging rather than seeing the price in a vacuum. Through competitive pricing,

Hilton can maintain the transparency for creating market that is more dynamic while

competition level is high at all level.

Therefore, pricing strategy has been properly applied to gain higher profitability at all level.

If the hotel applied this three dimensional factors, they can utilise both manual and advanced

approach to pricing.

4.0 Method to optimize profitability under fixed capacity inventory for recognizing

dynamic growth

In the hospitality business, fixed capacity is related to create balance within the demand as

well as overall capacity, which is dependent on occupancy and RevPER. In the following

section a short scenario of Hilton is displayed for creating the balance between occupancy,

profit and capacity.

Hilton case Room rate calculation in terms of Revenue management

% Revenue Achieved = Actual revenue/Potential revenue

As per the Hilton, case study

Average Room Rates = $ 1155.10

Revenue achieved = 8,477,890

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Occupancy Rates = 64.4%

Therefore, to calculate the REVPAR we need to put the variables in the given formulas.

Calculation of RevPar = Average rate × Occupancy %

$1155.10 X 64.4%= $ 46.43

These activities are made to calculate the budget and the forecasted budget of the hotel in

order to make proper implementation of the budget in the future. These activities can enhance

the financial strategy used by the hotel management to generate revenue and the minimize

wastage of resources.

Yield Management is a toll for capacity-constrained activity to get profit in revenue

management. Hilton primarily sells their seats for the variety of different fares. Low room

rate is available if customers make reservations early (Tussyadiah, 2016). However, last

minute reservation is process; the offer will not be available. In this case, yield management

is effective method to management capacity profitability. Through this process, hoteliers can

get proper support to sell the inventory to right type of customers. In this scale, proper

methods are applied through understanding the myriad of problems such as demand patters,

demand elasticity, overbooking policy as well as information system. There are various

methods to get dynamic growth in fixed capacity inventory.

Dynamic Programming

Due to sequential, repetitive and probabilistic nature of yield management, often researcher

expressed their view to use model through stochastic dynamic programming. This method

can maximise the expected revenue through resolving operating constraints (Prayag and

Hosany, 2015). Therefore, it is effective to maintain demand with hand of service

availability. Often transitional probabilities are based on the probability distribution in

regards to reservation, service offerings and other factors. Through this method, proper

inventory can be managed.

Economics Approaches

Marginal revenue model is effective approach to maintain the balance between occupancy

and service capacity. During potential high fare demand, Hilton can protect a certain number

of services in terms of capacity or availability (Pereira-Moliner et al., 2016). The optimal

10

Therefore, to calculate the REVPAR we need to put the variables in the given formulas.

Calculation of RevPar = Average rate × Occupancy %

$1155.10 X 64.4%= $ 46.43

These activities are made to calculate the budget and the forecasted budget of the hotel in

order to make proper implementation of the budget in the future. These activities can enhance

the financial strategy used by the hotel management to generate revenue and the minimize

wastage of resources.

Yield Management is a toll for capacity-constrained activity to get profit in revenue

management. Hilton primarily sells their seats for the variety of different fares. Low room

rate is available if customers make reservations early (Tussyadiah, 2016). However, last

minute reservation is process; the offer will not be available. In this case, yield management

is effective method to management capacity profitability. Through this process, hoteliers can

get proper support to sell the inventory to right type of customers. In this scale, proper

methods are applied through understanding the myriad of problems such as demand patters,

demand elasticity, overbooking policy as well as information system. There are various

methods to get dynamic growth in fixed capacity inventory.

Dynamic Programming

Due to sequential, repetitive and probabilistic nature of yield management, often researcher

expressed their view to use model through stochastic dynamic programming. This method

can maximise the expected revenue through resolving operating constraints (Prayag and

Hosany, 2015). Therefore, it is effective to maintain demand with hand of service

availability. Often transitional probabilities are based on the probability distribution in

regards to reservation, service offerings and other factors. Through this method, proper

inventory can be managed.

Economics Approaches

Marginal revenue model is effective approach to maintain the balance between occupancy

and service capacity. During potential high fare demand, Hilton can protect a certain number

of services in terms of capacity or availability (Pereira-Moliner et al., 2016). The optimal

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

room allocation is determined, while the marginal revenue model address both dynamic as

well as static nested room allocation problem. Through this process organisation can afford

both low cost and higher cost services with maximum availability. As result, profit margined

can be maintained in sequential way.

Threshold curve model

Another method in this yield management is threshold curve, where organisation can

understand both existing and current consumer behaviour in terms of capacity as well as

demand. Through this process, hoteliers can adopt a specific as well as suitable pricing tactics

to aggregate the demand.

Stay control

Stay control is one most positive method for both profit and revue control. It involves highest

yield reservation to manage the availability of any product. Stay control is related to

conditional offer on room during booking. In this scale departure date, duration rule is critical

factor. As per the viewpoint of Denizci Guillet and Mohammed (2015) place, several stay

control method cam on the inventory for optimising revenue potential in future sale. If there

is no restrictions, inventory can be opened for sale. If inventories are closed, then all should

be reserved, where no reservation can be processed. In case of Hilton, hotel capacity control

follows the traditional nested allocation, where more modification is required on such

inventory management.

5.0 Impact of ‘codes of conduct’, legislation and best practice on accommodation

Procedures

The primary purpose of the Hilton’s vision is to fill the customer with the light as well as

warmth of hospitality. In this case, values are prioritised on hospitality, ownership, integrity

as well as teamwork. In this case, culture of integrity is maintained to foster positive

reputation of the organisation. Code of conduct here applied to maintain highest ethical

standards in hospitality business. This code of conduct is applicable for all stakeholders,

shareholders and others. Code of conduct also applied for pricing, occupancy rates as well as

promotional strategies. In this case, terms and structure of Hilton’s customer contract as well

as financing agreements are maintained. In addition, various US federal, foreign and state

laws are incorporated to maintain consumer as well as internal business ethics. However,

11

well as static nested room allocation problem. Through this process organisation can afford

both low cost and higher cost services with maximum availability. As result, profit margined

can be maintained in sequential way.

Threshold curve model

Another method in this yield management is threshold curve, where organisation can

understand both existing and current consumer behaviour in terms of capacity as well as

demand. Through this process, hoteliers can adopt a specific as well as suitable pricing tactics

to aggregate the demand.

Stay control

Stay control is one most positive method for both profit and revue control. It involves highest

yield reservation to manage the availability of any product. Stay control is related to

conditional offer on room during booking. In this scale departure date, duration rule is critical

factor. As per the viewpoint of Denizci Guillet and Mohammed (2015) place, several stay

control method cam on the inventory for optimising revenue potential in future sale. If there

is no restrictions, inventory can be opened for sale. If inventories are closed, then all should

be reserved, where no reservation can be processed. In case of Hilton, hotel capacity control

follows the traditional nested allocation, where more modification is required on such

inventory management.

5.0 Impact of ‘codes of conduct’, legislation and best practice on accommodation

Procedures

The primary purpose of the Hilton’s vision is to fill the customer with the light as well as

warmth of hospitality. In this case, values are prioritised on hospitality, ownership, integrity

as well as teamwork. In this case, culture of integrity is maintained to foster positive

reputation of the organisation. Code of conduct here applied to maintain highest ethical

standards in hospitality business. This code of conduct is applicable for all stakeholders,

shareholders and others. Code of conduct also applied for pricing, occupancy rates as well as

promotional strategies. In this case, terms and structure of Hilton’s customer contract as well

as financing agreements are maintained. In addition, various US federal, foreign and state

laws are incorporated to maintain consumer as well as internal business ethics. However,

11

such laws supervision has reduced the revenue as well as profitability growth. Law and

restrictions are imposed through Foreign Corrupt Practices Act (hilton.com, 2016).

UK’s Bribery Act 2010 has been applied for maintain restriction on corrupt business

activities. In case of business in UK, hoteliers have to abide by Data Protection Act 1998 and

Credit Card Order 1990 (hilton.com, 2016). Therefore, in both accommodation and pricing

strategies this ‘Code of Conduct’ has effective role. It is not only required for ethical booking

and service transparency but also it is important to foster standardised component for pricing

principles. It has been mentioned earlier that organisation objective is create proper balance

between occupancy and capacity. Here Hilton managers have to maintain code of ethics to

provide discounts, inventory allocation and other operational factors. In the scale of fiduciary

standard and principles of agency law, organisation has applied proper standard. However, in

case of promotional offers consumers cannot get equal service if they not achieve that within

specific time. Therefore, in accommodation service, their code of conduct has been

maintained properly to structure the pricing principles. However, legal obligations are still

eating issue to maintain standard revenue.

6.0 Expectations of customers from diverse markets and explanation on accommodation

service approach in regards to quality management

Hilton is now a largest global hospitality company and they have applied various strategies to

innovate customers quickly. They have applied tech innovation to improve the consumer’s

experience. The organisation now prioritised on broader set of demand. Through putting the

tight price point, organisation has fulfilled their consumer’s expectation in a disciplinary

manner. In case of accommodation, emotion, service quality expectation and pricing is

playing important role is customer’s assessments. However, little attention on such factor can

create issue in capacity inventory allocation.

In Hilton, based on the proper code of conduct they are applying the structural equation

modelling. They are sincere to maintain consumer’s emotions, higher predictive expectations

in regards to service quality. However, currently organisation is facing trouble to structure

this pricing strategy due to misbalance in occupancy rate and RevPER. It affects the overall

capacity, where consumers cannot afford the service, while the demand rate is too high

(Tuntirattanasoontorn, 2018). In this case, high occupancy rate can reduce the availability

12

restrictions are imposed through Foreign Corrupt Practices Act (hilton.com, 2016).

UK’s Bribery Act 2010 has been applied for maintain restriction on corrupt business

activities. In case of business in UK, hoteliers have to abide by Data Protection Act 1998 and

Credit Card Order 1990 (hilton.com, 2016). Therefore, in both accommodation and pricing

strategies this ‘Code of Conduct’ has effective role. It is not only required for ethical booking

and service transparency but also it is important to foster standardised component for pricing

principles. It has been mentioned earlier that organisation objective is create proper balance

between occupancy and capacity. Here Hilton managers have to maintain code of ethics to

provide discounts, inventory allocation and other operational factors. In the scale of fiduciary

standard and principles of agency law, organisation has applied proper standard. However, in

case of promotional offers consumers cannot get equal service if they not achieve that within

specific time. Therefore, in accommodation service, their code of conduct has been

maintained properly to structure the pricing principles. However, legal obligations are still

eating issue to maintain standard revenue.

6.0 Expectations of customers from diverse markets and explanation on accommodation

service approach in regards to quality management

Hilton is now a largest global hospitality company and they have applied various strategies to

innovate customers quickly. They have applied tech innovation to improve the consumer’s

experience. The organisation now prioritised on broader set of demand. Through putting the

tight price point, organisation has fulfilled their consumer’s expectation in a disciplinary

manner. In case of accommodation, emotion, service quality expectation and pricing is

playing important role is customer’s assessments. However, little attention on such factor can

create issue in capacity inventory allocation.

In Hilton, based on the proper code of conduct they are applying the structural equation

modelling. They are sincere to maintain consumer’s emotions, higher predictive expectations

in regards to service quality. However, currently organisation is facing trouble to structure

this pricing strategy due to misbalance in occupancy rate and RevPER. It affects the overall

capacity, where consumers cannot afford the service, while the demand rate is too high

(Tuntirattanasoontorn, 2018). In this case, high occupancy rate can reduce the availability

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.