International Financial Reporting Standards: A Detailed Examination

VerifiedAdded on 2021/02/19

|16

|4195

|25

Report

AI Summary

This report offers a comprehensive analysis of financial reporting, beginning with its purpose and the importance of providing financial information to various stakeholders, including investors, employees, and creditors. It delves into the conceptual and regulatory frameworks that govern financial reporting, emphasizing the need for accurate, reliable, and comparable information. The report identifies and explains the roles of internal and external stakeholders, highlighting their specific interests in financial data. It then explores the necessity of financial information in achieving organizational objectives and fostering growth, including financial planning, benchmarking, and decision-making. The report also includes examples of financial statements like the statement of profit and loss, statement of changes in equity, and statement of financial position, providing a practical understanding of how financial information is presented. Finally, it discusses the benefits of IFRS and the differences between IFRS and IAS, emphasizing the importance of adhering to these standards for effective financial reporting. The report concludes by touching upon the varying degrees of compliance with IFRS.

International Financial

Reporting

Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Conceptual and regulatory framework....................................................................................2

3. Different kinds of stakeholders in the organization................................................................4

4. Need of financial information to meet the organizational objective and growth....................5

5. presenting financial statements of the company.....................................................................6

6. Interpretation and communication of financial information by using ratio analysis..............8

7. Difference between IFRS and International Accounting standard (IAS).............................10

8. Benefits of IFRS....................................................................................................................10

9. Varying degree of compliance with IFRS.............................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Conceptual and regulatory framework....................................................................................2

3. Different kinds of stakeholders in the organization................................................................4

4. Need of financial information to meet the organizational objective and growth....................5

5. presenting financial statements of the company.....................................................................6

6. Interpretation and communication of financial information by using ratio analysis..............8

7. Difference between IFRS and International Accounting standard (IAS).............................10

8. Benefits of IFRS....................................................................................................................10

9. Varying degree of compliance with IFRS.............................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Financial reporting is the process of disclosing and communicate all the financial

information or the information related to the finance to the management and different users such

as investors, employee, customers, creditors, lenders, regulators, government etc. and inform

them about the growth and performance of the company. The aim of the accountancy firm is to

provide the financial information to their client and support their performance through efficient

decision making process. The report present the various role and purpose of financial reporting

achieving the target of the company. The different conceptual and regulatory framework

provides the set of rules ans regulation to regulate the performance of the company and the

various qualitative characteristics to help the organization to provide the information with the

accuracy and reliability. The report explains the different users of the financial information and

the benefits from the financial information. It also explains the different financial statement such

as income statement, balance sheet, ratio analysis etc. it highlights the benefits of IFRS and the

various financial standards like IFRS, IAS etc. in the organization to achieve the goal and

objective.

MAIN BODY

1. Purpose of financial reporting

Meaning : Financial reporting is the process of communicate the financial information to the

different external and internal users to evaluate the performance of the organization and improve

the productivity and profitability (Williams and Dobelman, 2017). Financial reporting helps the

company to analyses the various financial report to support the decisions of the management

team.

Purpose of financial reporting

Provide financial information : The main purpose of financial reporting is to provide the

financial information. It helps them to evaluate the financial position and the changes in the

financial position due to the internal and external changes in the company. It provides the various

information such as profit, revenue, sales, expenses, operating expenses etc.

1

Financial reporting is the process of disclosing and communicate all the financial

information or the information related to the finance to the management and different users such

as investors, employee, customers, creditors, lenders, regulators, government etc. and inform

them about the growth and performance of the company. The aim of the accountancy firm is to

provide the financial information to their client and support their performance through efficient

decision making process. The report present the various role and purpose of financial reporting

achieving the target of the company. The different conceptual and regulatory framework

provides the set of rules ans regulation to regulate the performance of the company and the

various qualitative characteristics to help the organization to provide the information with the

accuracy and reliability. The report explains the different users of the financial information and

the benefits from the financial information. It also explains the different financial statement such

as income statement, balance sheet, ratio analysis etc. it highlights the benefits of IFRS and the

various financial standards like IFRS, IAS etc. in the organization to achieve the goal and

objective.

MAIN BODY

1. Purpose of financial reporting

Meaning : Financial reporting is the process of communicate the financial information to the

different external and internal users to evaluate the performance of the organization and improve

the productivity and profitability (Williams and Dobelman, 2017). Financial reporting helps the

company to analyses the various financial report to support the decisions of the management

team.

Purpose of financial reporting

Provide financial information : The main purpose of financial reporting is to provide the

financial information. It helps them to evaluate the financial position and the changes in the

financial position due to the internal and external changes in the company. It provides the various

information such as profit, revenue, sales, expenses, operating expenses etc.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Provide legal support : It keeps the financial report legal. Financial report is governed

and regulated by different accounting standard such as GAAP, IFRS, IAS etc. which

provides the legal support to the information and protect the information and company from the

various scandals (Bonsall and et.al., 2017).

Analyze the information : It helps the users to analyses the information regarding the

company performance and position in the market and provide the information that whether the

company is able to sustain in the market or not. Stakeholders can get the information through

various accounting statements such as balance sheet, profit and loss account, cash flow, ratio

analysis etc. from the annual report from the organization.

2. Conceptual and regulatory framework

Conceptual frameworks : Conceptual frameworks help the company to analyses the

performance by setting objectives and policies for the organization. The aim of conceptual

framework to set fundamental concepts for the financial reporting system (Schram and et.al.,

2018). It helps to ensure that the standard are consistent and the all similar transaction are treated

in same manner so the investor can easily get the information and understand them in more

precise form.

Requirement of conceptual frameworks

To set the general rules and regulation for the financial reporting.

Set standard to measure the performance and provide the information in same manner to

the stakeholders.

To treat the all similar transaction in same manner and methods.

Regulatory frameworks : Regulatory frameworks are used to set the rules and

regulation for the company to treat the financial transaction in the books of account (Laubichler

and Renn, 2015). It helps the company to decide that what should be recorded in the company's

account.

Requirement of regulatory frameworks

It helps the company to follow the accounting standard in the organization.

2

and regulated by different accounting standard such as GAAP, IFRS, IAS etc. which

provides the legal support to the information and protect the information and company from the

various scandals (Bonsall and et.al., 2017).

Analyze the information : It helps the users to analyses the information regarding the

company performance and position in the market and provide the information that whether the

company is able to sustain in the market or not. Stakeholders can get the information through

various accounting statements such as balance sheet, profit and loss account, cash flow, ratio

analysis etc. from the annual report from the organization.

2. Conceptual and regulatory framework

Conceptual frameworks : Conceptual frameworks help the company to analyses the

performance by setting objectives and policies for the organization. The aim of conceptual

framework to set fundamental concepts for the financial reporting system (Schram and et.al.,

2018). It helps to ensure that the standard are consistent and the all similar transaction are treated

in same manner so the investor can easily get the information and understand them in more

precise form.

Requirement of conceptual frameworks

To set the general rules and regulation for the financial reporting.

Set standard to measure the performance and provide the information in same manner to

the stakeholders.

To treat the all similar transaction in same manner and methods.

Regulatory frameworks : Regulatory frameworks are used to set the rules and

regulation for the company to treat the financial transaction in the books of account (Laubichler

and Renn, 2015). It helps the company to decide that what should be recorded in the company's

account.

Requirement of regulatory frameworks

It helps the company to follow the accounting standard in the organization.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It provides the sustainable growth of the company and help them to evaluate the

performance of the organization via different accounting statements.

Qualitative characteristics of financial report

Fundamental qualitative characteristics

Relevance : It refers to provide the relevant information regarding the financial

transaction to t eh different stakeholders and minimize all the unnecessary information (Ioannou

and Serafeim, 2017). It helps the investors and lenders to concentrate on the specific subject area

and evaluate the relevant information to take the decisions of lending and investing the money in

the particular company.

Faithfulness : it states that the presented data are must be faithful which present the true

and accurate position and information of the company (The qualitative characteristics of

financial statements, 2019). It helps to ensure that the user can rely on the information and use

them for the further analyses of the data.

Enhancing qualitative characteristics

Understand-ability : It ensures that the information must be understandable to the

financial user so they can get the information in same manner in which they are presented. The

information must be presented with some additional information as in footnotes so the user can

understand the origin of the information and evaluate them according to their need.

Comparability : The information provided by the finance manager must be comparable

to the different accounting years of the same company or other competitive companies (Perego,

Kennedy and Whiteman, 2016). It helps the stakeholders to evaluate the financial position and

performance of the company in different financial year and evaluate the trend of change in profit

and revenue of the organization. It elaborates the position of the company in the market.

Verifiability : It means that the information presented in the financial report must be

ready to verify with different methods such as internal and external audit. It ensures the

credibility and reliability of the data and provide the accurate information to the internal and

external stakeholders.

3

performance of the organization via different accounting statements.

Qualitative characteristics of financial report

Fundamental qualitative characteristics

Relevance : It refers to provide the relevant information regarding the financial

transaction to t eh different stakeholders and minimize all the unnecessary information (Ioannou

and Serafeim, 2017). It helps the investors and lenders to concentrate on the specific subject area

and evaluate the relevant information to take the decisions of lending and investing the money in

the particular company.

Faithfulness : it states that the presented data are must be faithful which present the true

and accurate position and information of the company (The qualitative characteristics of

financial statements, 2019). It helps to ensure that the user can rely on the information and use

them for the further analyses of the data.

Enhancing qualitative characteristics

Understand-ability : It ensures that the information must be understandable to the

financial user so they can get the information in same manner in which they are presented. The

information must be presented with some additional information as in footnotes so the user can

understand the origin of the information and evaluate them according to their need.

Comparability : The information provided by the finance manager must be comparable

to the different accounting years of the same company or other competitive companies (Perego,

Kennedy and Whiteman, 2016). It helps the stakeholders to evaluate the financial position and

performance of the company in different financial year and evaluate the trend of change in profit

and revenue of the organization. It elaborates the position of the company in the market.

Verifiability : It means that the information presented in the financial report must be

ready to verify with different methods such as internal and external audit. It ensures the

credibility and reliability of the data and provide the accurate information to the internal and

external stakeholders.

3

3. Different kinds of stakeholders in the organization

Internal stakeholder : Internal stakeholder are the person who directly affect the

business of the organization. They require the information to prepare the financial statements

and evaluate the information to get the accurate outcomes. There are different internal and

external stakeholders such as employees, manager and owner.

Employees : Employees are interested in the financial information of the company to

evaluate the data and present the transaction in different financial statements such as profit and

loss account, sales ledger, purchase ledger, cash flow statement etc. The benefited by getting

salary from the organization on the basis of their knowledge and performance.

Managers : They use the financial information to evaluate the trend of performance of

the company and also evaluate the financial position in the market. They require the information

for setting the policies and methods in computation of the results. They get benefit from the

company in the form of share in profit or getting dividend on the shares.

External stakeholders : External stakeholders directly or indirectly affect the business

of the company and interested in the financial information to get the profit from the organization

performance. There are different external stakeholders such as suppliers, creditors, customer,

shareholders, government, lenders etc.

Suppliers : They supply the raw material and information to the organization. Suppliers

are interested in the financial information of the company to evaluate the credit worthiness and

the capacity of the organization to pay the debt (Barrett, Oborn and Orlikowski, 2016). The

financial information is required by the suppliers to take the decision regarding the supply of raw

material on credit.

Creditors : Creditors and lenders lend the money to the company against charging

interest. They are interested in the financial information of the firm to measure and evaluate the

performance and position of the company in the market and take the decision of lending the

money.

Government : Government enforces the set of rules and regulation to the companies to

evaluate their performance and legal action. Government evaluates the performance of the

4

Internal stakeholder : Internal stakeholder are the person who directly affect the

business of the organization. They require the information to prepare the financial statements

and evaluate the information to get the accurate outcomes. There are different internal and

external stakeholders such as employees, manager and owner.

Employees : Employees are interested in the financial information of the company to

evaluate the data and present the transaction in different financial statements such as profit and

loss account, sales ledger, purchase ledger, cash flow statement etc. The benefited by getting

salary from the organization on the basis of their knowledge and performance.

Managers : They use the financial information to evaluate the trend of performance of

the company and also evaluate the financial position in the market. They require the information

for setting the policies and methods in computation of the results. They get benefit from the

company in the form of share in profit or getting dividend on the shares.

External stakeholders : External stakeholders directly or indirectly affect the business

of the company and interested in the financial information to get the profit from the organization

performance. There are different external stakeholders such as suppliers, creditors, customer,

shareholders, government, lenders etc.

Suppliers : They supply the raw material and information to the organization. Suppliers

are interested in the financial information of the company to evaluate the credit worthiness and

the capacity of the organization to pay the debt (Barrett, Oborn and Orlikowski, 2016). The

financial information is required by the suppliers to take the decision regarding the supply of raw

material on credit.

Creditors : Creditors and lenders lend the money to the company against charging

interest. They are interested in the financial information of the firm to measure and evaluate the

performance and position of the company in the market and take the decision of lending the

money.

Government : Government enforces the set of rules and regulation to the companies to

evaluate their performance and legal action. Government evaluates the performance of the

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company by measuring the financial position through the financial statements. It helps them to

collect the taxes and duties to the different companies (Zahra and Wright, 2016).

Customer : Customer are the most influencing stakeholder of the company. They

influence the company to set the lower price to the customer. They require the financial

information to measure the sales, revenue and profit of the company. It helps them to evaluate

the cost of the production and profit margin of the company. The financial information help the

customer to take the effective and efficient decisions to purchase the product and provide a brief

knowledge of the organization activity. It also helps the company to compete with the

competitors in the market.

4. Need of financial information to meet the organizational objective and growth

Financial reporting are required by each organization to meet the organizational objective and

growth. Financial information include different financial transaction and provide the brief

knowledge about the organizational activities. It helps the organization to analyse the ROC,

profit margin, expenses, revenue of the company to analyse it financial position in the market.

It helps the investor and lenders to know the financial position and invest in the company which

help the company to attain the objective (Bushee, Goodman and Sunder, 2018). The availability

of finance in the organization provide support to accomplish the activities and earn the income in

the market to achieve the goal and objectives of the company.

Financial reporting also facilitate the audit in the organization. Internal and external audit help

the company to analyse the different aspects of the company and provide the variety of strategy

and methods to improve the financial position which help them to grow in market. Financial

report helps in financial planning, benchmarking, analysis and decision making. It provide the

variety of data to the accountancy firm to meet the demand of their client and help them to plan

the financial activity.

Financial reporting also increases the capital of the company which help them to meet the

objective and growth of the company. It provides the information to the different shareholders

like the revenue, profit, expenses, cash flow etc. to take the decision of whether to invest the

profit in the company or distribute the profit among the shareholder as dividend. Investment of

profit in company help them to improve the performance of the employees and company.

5

collect the taxes and duties to the different companies (Zahra and Wright, 2016).

Customer : Customer are the most influencing stakeholder of the company. They

influence the company to set the lower price to the customer. They require the financial

information to measure the sales, revenue and profit of the company. It helps them to evaluate

the cost of the production and profit margin of the company. The financial information help the

customer to take the effective and efficient decisions to purchase the product and provide a brief

knowledge of the organization activity. It also helps the company to compete with the

competitors in the market.

4. Need of financial information to meet the organizational objective and growth

Financial reporting are required by each organization to meet the organizational objective and

growth. Financial information include different financial transaction and provide the brief

knowledge about the organizational activities. It helps the organization to analyse the ROC,

profit margin, expenses, revenue of the company to analyse it financial position in the market.

It helps the investor and lenders to know the financial position and invest in the company which

help the company to attain the objective (Bushee, Goodman and Sunder, 2018). The availability

of finance in the organization provide support to accomplish the activities and earn the income in

the market to achieve the goal and objectives of the company.

Financial reporting also facilitate the audit in the organization. Internal and external audit help

the company to analyse the different aspects of the company and provide the variety of strategy

and methods to improve the financial position which help them to grow in market. Financial

report helps in financial planning, benchmarking, analysis and decision making. It provide the

variety of data to the accountancy firm to meet the demand of their client and help them to plan

the financial activity.

Financial reporting also increases the capital of the company which help them to meet the

objective and growth of the company. It provides the information to the different shareholders

like the revenue, profit, expenses, cash flow etc. to take the decision of whether to invest the

profit in the company or distribute the profit among the shareholder as dividend. Investment of

profit in company help them to improve the performance of the employees and company.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial reporting provide the different measures to compare the financial statement of

one company to other company and one accounting year to another accounting year. It helps the

company to change the accounting techniques and method to choose the best method to improve

the performance. It also helps to prepare the budget of the company and compare it with the

standard budget and analyse the different activities to minimize the variances in the organization.

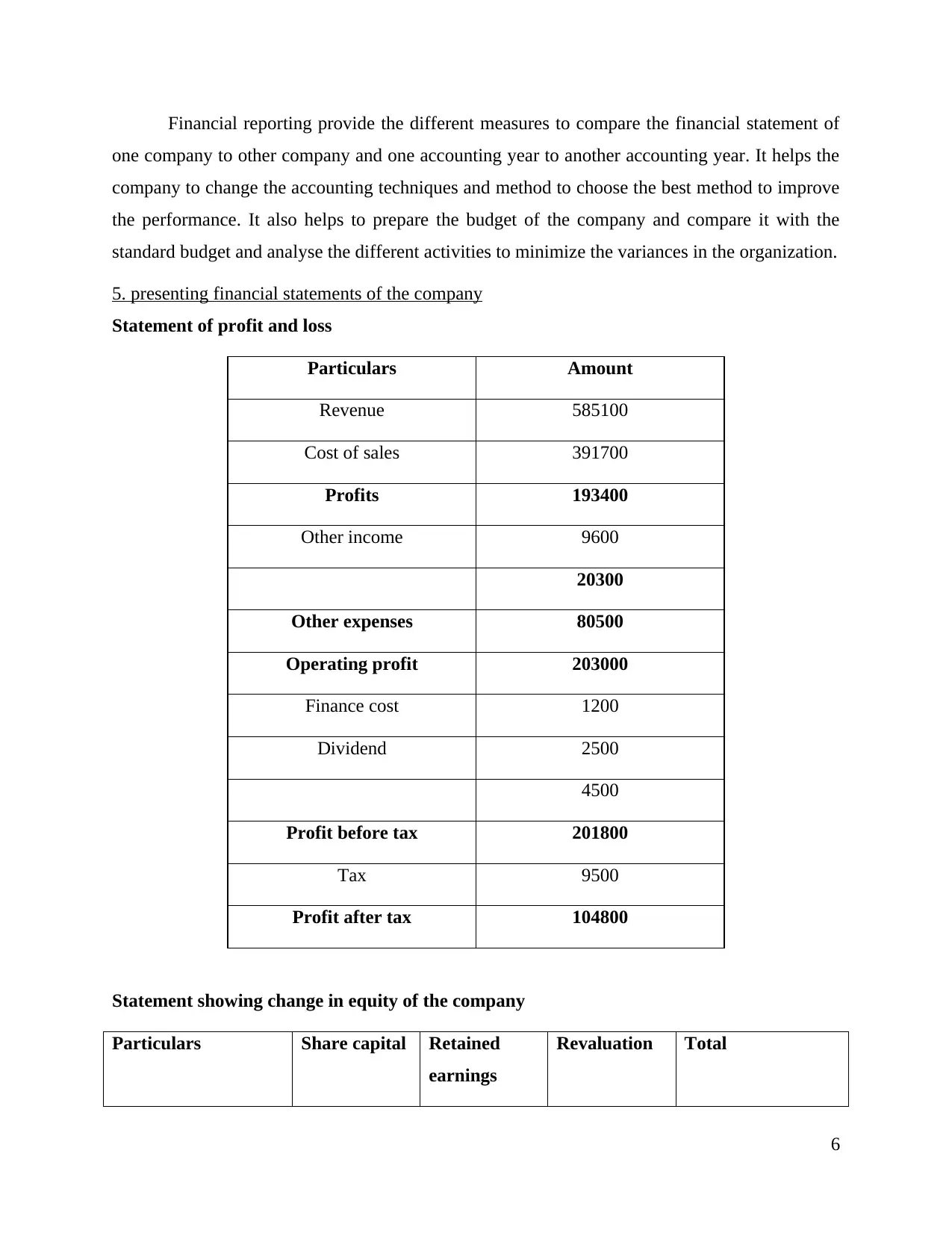

5. presenting financial statements of the company

Statement of profit and loss

Particulars Amount

Revenue 585100

Cost of sales 391700

Profits 193400

Other income 9600

20300

Other expenses 80500

Operating profit 203000

Finance cost 1200

Dividend 2500

4500

Profit before tax 201800

Tax 9500

Profit after tax 104800

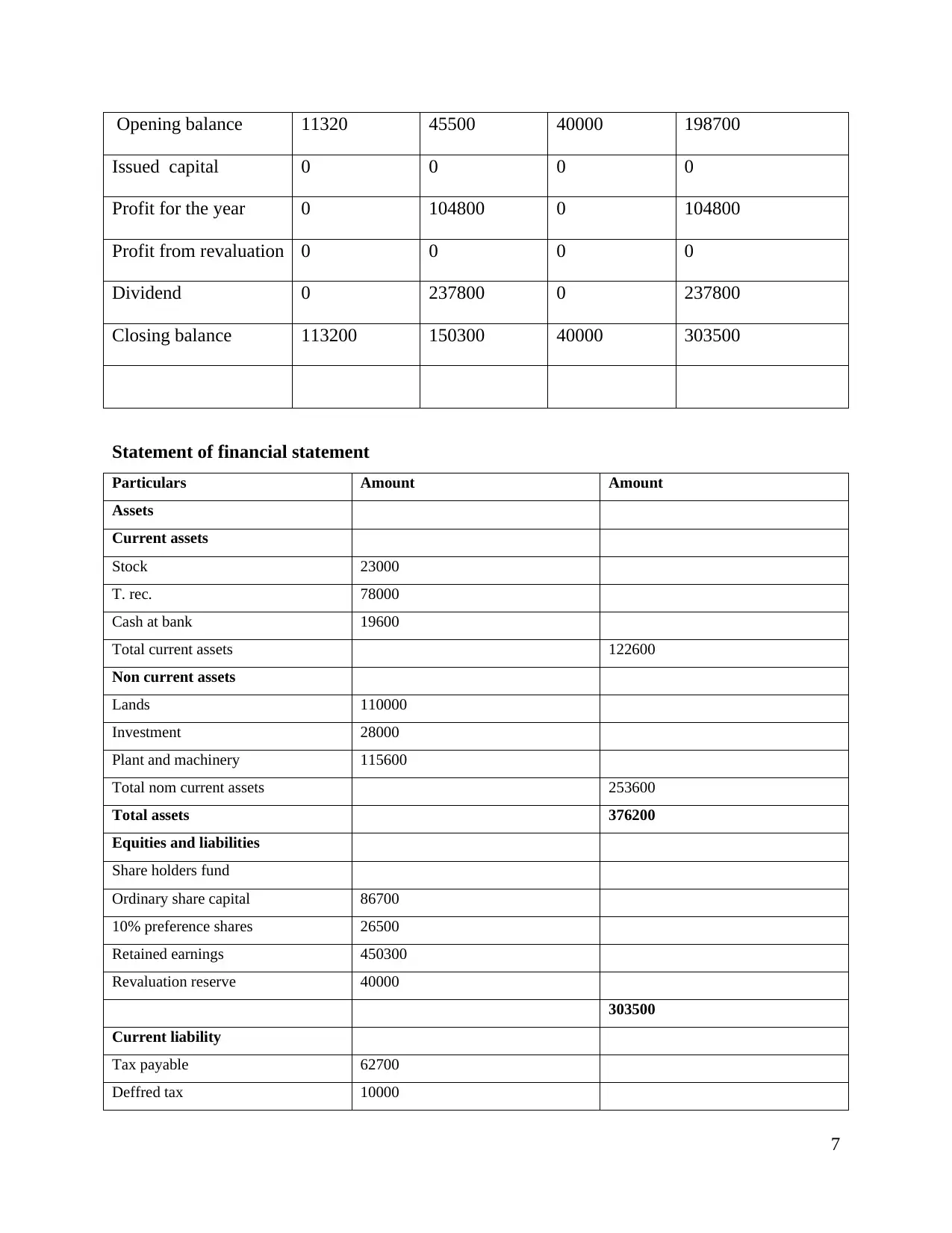

Statement showing change in equity of the company

Particulars Share capital Retained

earnings

Revaluation Total

6

one company to other company and one accounting year to another accounting year. It helps the

company to change the accounting techniques and method to choose the best method to improve

the performance. It also helps to prepare the budget of the company and compare it with the

standard budget and analyse the different activities to minimize the variances in the organization.

5. presenting financial statements of the company

Statement of profit and loss

Particulars Amount

Revenue 585100

Cost of sales 391700

Profits 193400

Other income 9600

20300

Other expenses 80500

Operating profit 203000

Finance cost 1200

Dividend 2500

4500

Profit before tax 201800

Tax 9500

Profit after tax 104800

Statement showing change in equity of the company

Particulars Share capital Retained

earnings

Revaluation Total

6

Opening balance 11320 45500 40000 198700

Issued capital 0 0 0 0

Profit for the year 0 104800 0 104800

Profit from revaluation 0 0 0 0

Dividend 0 237800 0 237800

Closing balance 113200 150300 40000 303500

Statement of financial statement

Particulars Amount Amount

Assets

Current assets

Stock 23000

T. rec. 78000

Cash at bank 19600

Total current assets 122600

Non current assets

Lands 110000

Investment 28000

Plant and machinery 115600

Total nom current assets 253600

Total assets 376200

Equities and liabilities

Share holders fund

Ordinary share capital 86700

10% preference shares 26500

Retained earnings 450300

Revaluation reserve 40000

303500

Current liability

Tax payable 62700

Deffred tax 10000

7

Issued capital 0 0 0 0

Profit for the year 0 104800 0 104800

Profit from revaluation 0 0 0 0

Dividend 0 237800 0 237800

Closing balance 113200 150300 40000 303500

Statement of financial statement

Particulars Amount Amount

Assets

Current assets

Stock 23000

T. rec. 78000

Cash at bank 19600

Total current assets 122600

Non current assets

Lands 110000

Investment 28000

Plant and machinery 115600

Total nom current assets 253600

Total assets 376200

Equities and liabilities

Share holders fund

Ordinary share capital 86700

10% preference shares 26500

Retained earnings 450300

Revaluation reserve 40000

303500

Current liability

Tax payable 62700

Deffred tax 10000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total current liabilities 72700

Total liabilities 376200

6. Interpretation and communication of financial information by using ratio analysis

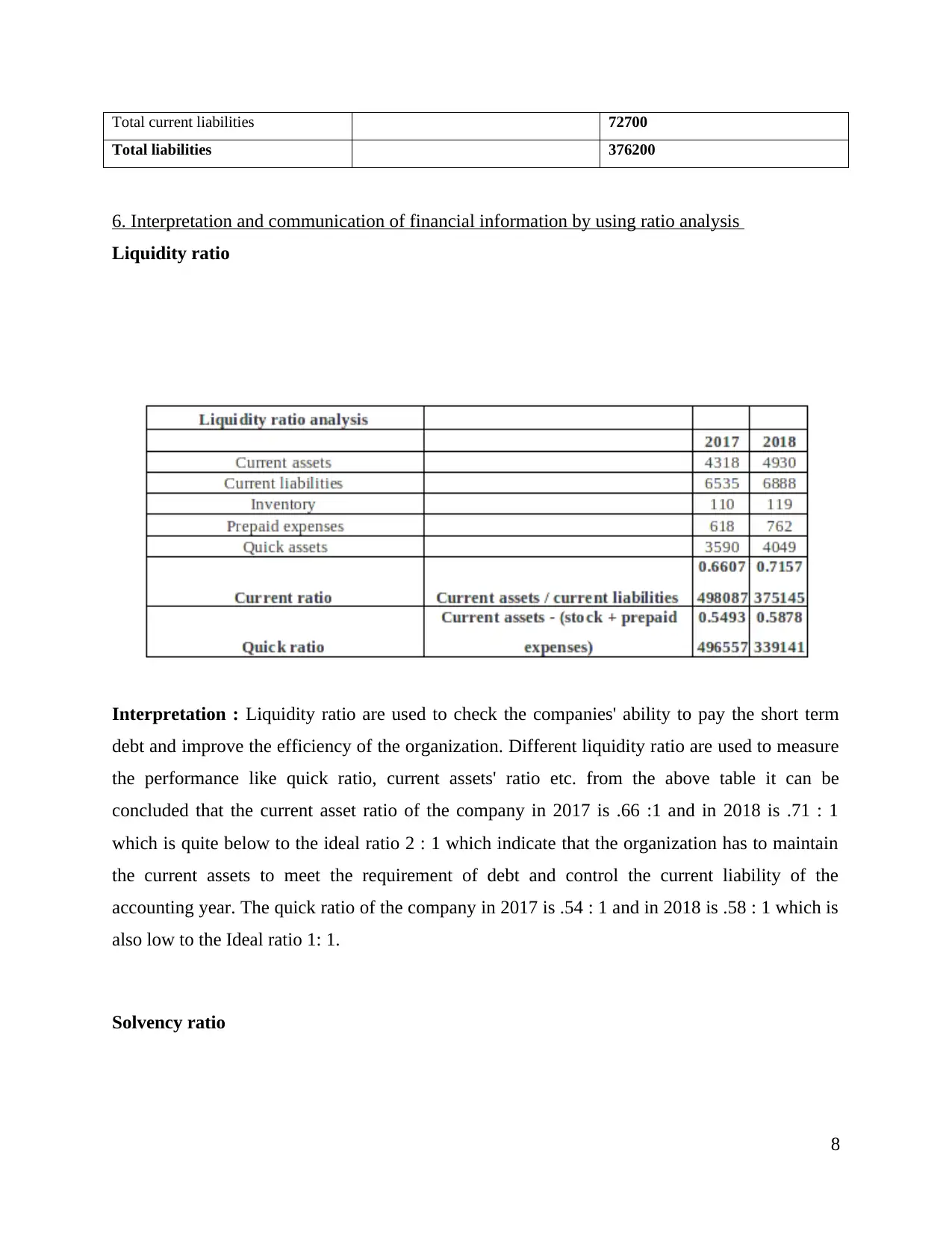

Liquidity ratio

Interpretation : Liquidity ratio are used to check the companies' ability to pay the short term

debt and improve the efficiency of the organization. Different liquidity ratio are used to measure

the performance like quick ratio, current assets' ratio etc. from the above table it can be

concluded that the current asset ratio of the company in 2017 is .66 :1 and in 2018 is .71 : 1

which is quite below to the ideal ratio 2 : 1 which indicate that the organization has to maintain

the current assets to meet the requirement of debt and control the current liability of the

accounting year. The quick ratio of the company in 2017 is .54 : 1 and in 2018 is .58 : 1 which is

also low to the Ideal ratio 1: 1.

Solvency ratio

8

Total liabilities 376200

6. Interpretation and communication of financial information by using ratio analysis

Liquidity ratio

Interpretation : Liquidity ratio are used to check the companies' ability to pay the short term

debt and improve the efficiency of the organization. Different liquidity ratio are used to measure

the performance like quick ratio, current assets' ratio etc. from the above table it can be

concluded that the current asset ratio of the company in 2017 is .66 :1 and in 2018 is .71 : 1

which is quite below to the ideal ratio 2 : 1 which indicate that the organization has to maintain

the current assets to meet the requirement of debt and control the current liability of the

accounting year. The quick ratio of the company in 2017 is .54 : 1 and in 2018 is .58 : 1 which is

also low to the Ideal ratio 1: 1.

Solvency ratio

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

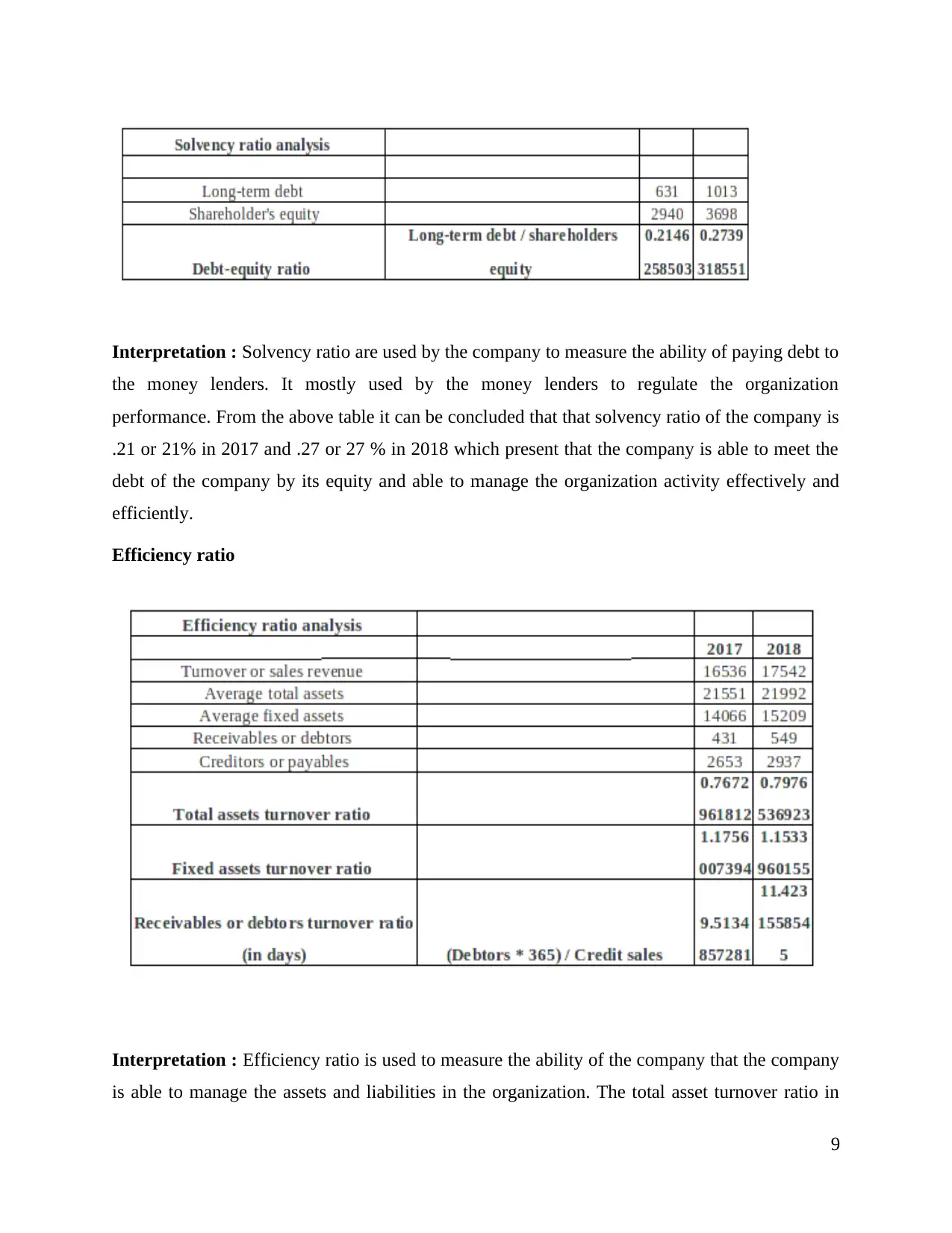

Interpretation : Solvency ratio are used by the company to measure the ability of paying debt to

the money lenders. It mostly used by the money lenders to regulate the organization

performance. From the above table it can be concluded that that solvency ratio of the company is

.21 or 21% in 2017 and .27 or 27 % in 2018 which present that the company is able to meet the

debt of the company by its equity and able to manage the organization activity effectively and

efficiently.

Efficiency ratio

Interpretation : Efficiency ratio is used to measure the ability of the company that the company

is able to manage the assets and liabilities in the organization. The total asset turnover ratio in

9

the money lenders. It mostly used by the money lenders to regulate the organization

performance. From the above table it can be concluded that that solvency ratio of the company is

.21 or 21% in 2017 and .27 or 27 % in 2018 which present that the company is able to meet the

debt of the company by its equity and able to manage the organization activity effectively and

efficiently.

Efficiency ratio

Interpretation : Efficiency ratio is used to measure the ability of the company that the company

is able to manage the assets and liabilities in the organization. The total asset turnover ratio in

9

2017 is .76 and in 2018 is .79 which present that the company efficiently manage the assets over

the sales. The fixed asset turnover ratio in 2017 is 1.17 and 2018 is 1.15 and the debtor turnover

ratio is 9.15 in 2017 and 11.42 in 2018. From the debtor turnover ratio it can be concluded that

the debt of the company is too high so they have to manage their debt in the company.

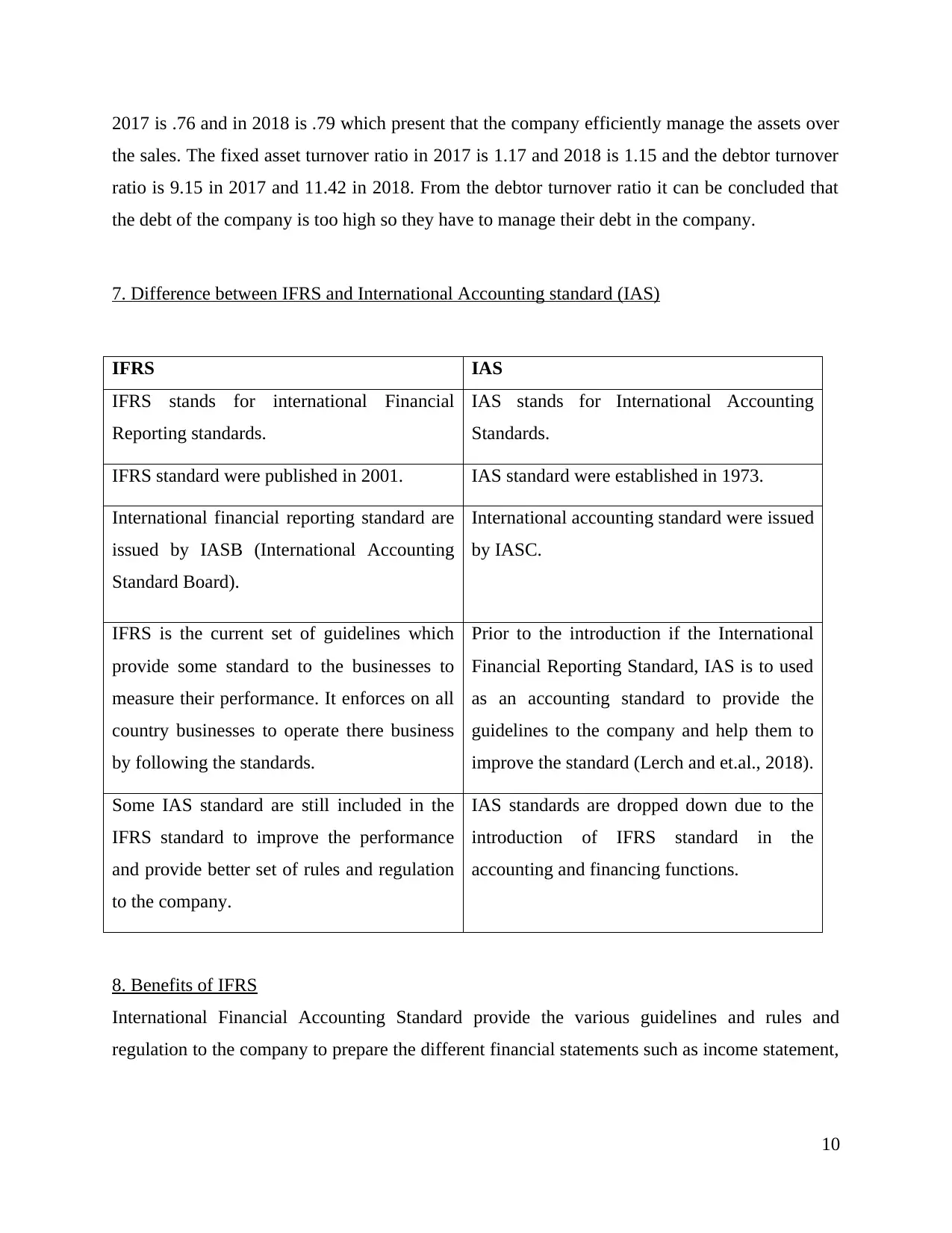

7. Difference between IFRS and International Accounting standard (IAS)

IFRS IAS

IFRS stands for international Financial

Reporting standards.

IAS stands for International Accounting

Standards.

IFRS standard were published in 2001. IAS standard were established in 1973.

International financial reporting standard are

issued by IASB (International Accounting

Standard Board).

International accounting standard were issued

by IASC.

IFRS is the current set of guidelines which

provide some standard to the businesses to

measure their performance. It enforces on all

country businesses to operate there business

by following the standards.

Prior to the introduction if the International

Financial Reporting Standard, IAS is to used

as an accounting standard to provide the

guidelines to the company and help them to

improve the standard (Lerch and et.al., 2018).

Some IAS standard are still included in the

IFRS standard to improve the performance

and provide better set of rules and regulation

to the company.

IAS standards are dropped down due to the

introduction of IFRS standard in the

accounting and financing functions.

8. Benefits of IFRS

International Financial Accounting Standard provide the various guidelines and rules and

regulation to the company to prepare the different financial statements such as income statement,

10

the sales. The fixed asset turnover ratio in 2017 is 1.17 and 2018 is 1.15 and the debtor turnover

ratio is 9.15 in 2017 and 11.42 in 2018. From the debtor turnover ratio it can be concluded that

the debt of the company is too high so they have to manage their debt in the company.

7. Difference between IFRS and International Accounting standard (IAS)

IFRS IAS

IFRS stands for international Financial

Reporting standards.

IAS stands for International Accounting

Standards.

IFRS standard were published in 2001. IAS standard were established in 1973.

International financial reporting standard are

issued by IASB (International Accounting

Standard Board).

International accounting standard were issued

by IASC.

IFRS is the current set of guidelines which

provide some standard to the businesses to

measure their performance. It enforces on all

country businesses to operate there business

by following the standards.

Prior to the introduction if the International

Financial Reporting Standard, IAS is to used

as an accounting standard to provide the

guidelines to the company and help them to

improve the standard (Lerch and et.al., 2018).

Some IAS standard are still included in the

IFRS standard to improve the performance

and provide better set of rules and regulation

to the company.

IAS standards are dropped down due to the

introduction of IFRS standard in the

accounting and financing functions.

8. Benefits of IFRS

International Financial Accounting Standard provide the various guidelines and rules and

regulation to the company to prepare the different financial statements such as income statement,

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.