The Impact of Digital Money on Central Banking in the Modern Era

VerifiedAdded on 2022/11/22

|36

|8951

|2

Report

AI Summary

This report delves into the evolving landscape of money in the digital age and its profound effects on central banking. It begins by tracing the historical evolution of money from barter systems to the introduction of digital currencies, including the rise of electronic money and its impact on financial transactions. The research explores the emergence of Central Bank Digital Currencies (CBDC) and their implications for traditional banking systems, examining both centralized and decentralized models. A comprehensive literature review covers account and token-based systems, the actual performance of central bank money in various economies, and the definition of money in the context of electronic transactions. The report further addresses the issues and challenges that central banks face with the increasing utilization of digital money, including security concerns, the impact on monetary policies, and the need for adaptation in the face of technological advancements. The theoretical perspectives and research methodology are outlined, providing a structured approach to understanding the complex interplay between digital money and central banking. This report aims to provide a critical analysis of the transformation of the financial sector.

Money in modern time and how it affects central banking in the digital age

Name of the Student

Name of the University

Name of the Student

Name of the University

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

I ABSTRACT..................................................................................................................................3

II RESEARCH STATEMENT........................................................................................................4

III LITERATURE REVIEW...........................................................................................................5

Account and Token based systems..............................................................................................8

Actual performance of Central Bank Money in Advanced and Emerging Economies...............9

Definition of money after emergence of electronic money.......................................................11

Issues faced with digital money.................................................................................................18

IV THEORITICAL PERPESCTIVES..........................................................................................22

V RESEARCH QUESTIONS.......................................................................................................29

VI RESEARCH METHODOLOGY.............................................................................................29

VII RESEARCH STRUCTURE....................................................................................................31

References......................................................................................................................................34

I ABSTRACT..................................................................................................................................3

II RESEARCH STATEMENT........................................................................................................4

III LITERATURE REVIEW...........................................................................................................5

Account and Token based systems..............................................................................................8

Actual performance of Central Bank Money in Advanced and Emerging Economies...............9

Definition of money after emergence of electronic money.......................................................11

Issues faced with digital money.................................................................................................18

IV THEORITICAL PERPESCTIVES..........................................................................................22

V RESEARCH QUESTIONS.......................................................................................................29

VI RESEARCH METHODOLOGY.............................................................................................29

VII RESEARCH STRUCTURE....................................................................................................31

References......................................................................................................................................34

I ABSTRACT

This research has focused on money in modern time and hoe it has been affects central bank in

the digital age. Money is a financial instrument that has been fulfilling basic function of

exchange and standard of deferred payment. The function has been a medium of exchange that

allows efficient transactions of goods and services in barter system. Commercial banking

emerged as a form of financial link between depositors and borrowers. Economic development

exchange took place in the form of barter that can be exchange of goods to goods. However,

economy of barter system has been facing difficulties then money need to introduce for the

exchange of goods. Money has been most import part of modern economy. This research focuses

on impact of money in the digital age. The use of money in the central banking has been

discussed in the research.

This research has focused on money in modern time and hoe it has been affects central bank in

the digital age. Money is a financial instrument that has been fulfilling basic function of

exchange and standard of deferred payment. The function has been a medium of exchange that

allows efficient transactions of goods and services in barter system. Commercial banking

emerged as a form of financial link between depositors and borrowers. Economic development

exchange took place in the form of barter that can be exchange of goods to goods. However,

economy of barter system has been facing difficulties then money need to introduce for the

exchange of goods. Money has been most import part of modern economy. This research focuses

on impact of money in the digital age. The use of money in the central banking has been

discussed in the research.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

II RESEARCH STATEMENT

This research has focused on importance of money in the digital age. The impact of money in

modern time in central banking has been related in this research. The technological and

economic development has helped in introducing Digital Currency. It is a form of currency

which can be available in the digital form. It helps in immediate and fast transaction. This

research has been focused on utilization of digital money in the digital age.1 The central bank

digital currency can be known as CBDC which can be centralized and decentralized. The main

research issue is based on fact that the traditional central banking system has been affected by the

new concept of digital money. The technological changes in the central banking has affected

traditional method of banking. The main focus of the research is to survey on problems that the

central banks have been facing with the increase in utilization of digital money. There are several

general properties of digital money. Digital money used to breaks barriers of time and place.2 It

helps in making economic transactions more convenient. The emergence of digital money has

created various business model and effectively promoted business practices including online

platforms. The contemporary monetary system has sole right to link cash with money. The

change in the trend has led to conversion of traditional money into digital currency. Mary Brophy

Marcus, "Crowdfunding" (2015) 37(5) Oncology Times.

1 Lisa Adkins, "What Can Money Do? Feminist Theory In Austere Times" (2015) 109(1) Feminist Review.

2 Mark Barrow, "Debate: Managing Motivation In Hard Times" (2015) 35(5) Public Money & Management.

This research has focused on importance of money in the digital age. The impact of money in

modern time in central banking has been related in this research. The technological and

economic development has helped in introducing Digital Currency. It is a form of currency

which can be available in the digital form. It helps in immediate and fast transaction. This

research has been focused on utilization of digital money in the digital age.1 The central bank

digital currency can be known as CBDC which can be centralized and decentralized. The main

research issue is based on fact that the traditional central banking system has been affected by the

new concept of digital money. The technological changes in the central banking has affected

traditional method of banking. The main focus of the research is to survey on problems that the

central banks have been facing with the increase in utilization of digital money. There are several

general properties of digital money. Digital money used to breaks barriers of time and place.2 It

helps in making economic transactions more convenient. The emergence of digital money has

created various business model and effectively promoted business practices including online

platforms. The contemporary monetary system has sole right to link cash with money. The

change in the trend has led to conversion of traditional money into digital currency. Mary Brophy

Marcus, "Crowdfunding" (2015) 37(5) Oncology Times.

1 Lisa Adkins, "What Can Money Do? Feminist Theory In Austere Times" (2015) 109(1) Feminist Review.

2 Mark Barrow, "Debate: Managing Motivation In Hard Times" (2015) 35(5) Public Money & Management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The digital age has seen invention of digital currency that has helped in easy transaction.

The shift in currency has changed upcoming banking system. Systematic development of

electronic money in the market has led top drastic changes in the business scenario.

Various online companies have started in the market which has been based on the digital

money. Various identity of digital money has detected in the form of crypto currencies and bit

coins. Banks have been facing issues related to the emergence of digital currencies. These

digital currencies have been important to track and maintain their transactions. The digital

currency contains reference number which cannot be repeated and different human resource.

The prepaid and post-paid payment mechanism has been enabling digital payments with the help

of the internet. The digital money has been termed as the online currency that can be transferred

or transacted using the internet.3 The use of digital currency has been helping in providing an

edge to the banking systems. The traditional banking systems have been facing challenges in the

digital age. The banking systems have been outdated and do not support online banking systems.

The possible influence of e-money has created a professional interest in the banking systems.

Money has changed a lot in the digital age. The value of money has been increasing with

increase in time period.

III LITERATURE REVIEW

Digitalization has redesigned economic and financial activity in the banking systems.

Social changes have been modifying the basic accordance of the banking systems. Monetary

policies in financial industries have been changing their effect in the market. The financial

3 Seyed Mohammadreza Davoodalhosseini, "Central Bank Digital Currency And Monetary Policy" [2017] SSRN

Electronic Journal.

The shift in currency has changed upcoming banking system. Systematic development of

electronic money in the market has led top drastic changes in the business scenario.

Various online companies have started in the market which has been based on the digital

money. Various identity of digital money has detected in the form of crypto currencies and bit

coins. Banks have been facing issues related to the emergence of digital currencies. These

digital currencies have been important to track and maintain their transactions. The digital

currency contains reference number which cannot be repeated and different human resource.

The prepaid and post-paid payment mechanism has been enabling digital payments with the help

of the internet. The digital money has been termed as the online currency that can be transferred

or transacted using the internet.3 The use of digital currency has been helping in providing an

edge to the banking systems. The traditional banking systems have been facing challenges in the

digital age. The banking systems have been outdated and do not support online banking systems.

The possible influence of e-money has created a professional interest in the banking systems.

Money has changed a lot in the digital age. The value of money has been increasing with

increase in time period.

III LITERATURE REVIEW

Digitalization has redesigned economic and financial activity in the banking systems.

Social changes have been modifying the basic accordance of the banking systems. Monetary

policies in financial industries have been changing their effect in the market. The financial

3 Seyed Mohammadreza Davoodalhosseini, "Central Bank Digital Currency And Monetary Policy" [2017] SSRN

Electronic Journal.

institution has helped in providing keen approach in the market. The digital transformation has

affected customers in their buying behaviour. The offline mode of transaction has been depleted

in the digital age. The online transaction has been helping in attracting various numbers of

customers in the banking institution. The payment system in banks have changed a lot with

influence of digital money in the market. The Central Bank Digital Currency (CBDC) has been

widely accessible digital platform for a legal tender.4 A huge number of Central banks have

issued digital money in the form of reserves. The use of various methods in the digital money

transformation has been maintained in the banks. The digital money has been the key focus of

the central banks all over the world. A brief introduction of the digital money has been started in

beginning of 21st century. Various drivers in CBDC have been based on technological

opportunities in the banking systems. The crash in the monetary policies of banking systems.

However, Central banks continues providing a legal tender in case cash is not present ion the

bank. Previous studies based on the money control have reflected that the change in the value of

money has been the main effect for the digital transaction in the market.5

The monetary policies in the banks have been affected by the invention of digital money

in the market. The cashless transaction in the market has led to the use of digital money in the

market. There has been decrease in the use of cash money in the market. The innovation in

market has been due to the technological impact in the market. The future of central banks have

4 Greg N. Gregoriou and Lam Pak Nian, "Handbook Of Digital Currency: Bitcoin, Innovation, Financial

Instruments, And Big Data" (2015) 18(2) The Journal of Wealth Management.

5 KiHoon Jimmy Hong, Kyounghoon Park and Jongmin Yu, "Crowding Out In A Dual Currency Regime? Digital

Versus Fiat Currency" [2017] SSRN Electronic Journal.

affected customers in their buying behaviour. The offline mode of transaction has been depleted

in the digital age. The online transaction has been helping in attracting various numbers of

customers in the banking institution. The payment system in banks have changed a lot with

influence of digital money in the market. The Central Bank Digital Currency (CBDC) has been

widely accessible digital platform for a legal tender.4 A huge number of Central banks have

issued digital money in the form of reserves. The use of various methods in the digital money

transformation has been maintained in the banks. The digital money has been the key focus of

the central banks all over the world. A brief introduction of the digital money has been started in

beginning of 21st century. Various drivers in CBDC have been based on technological

opportunities in the banking systems. The crash in the monetary policies of banking systems.

However, Central banks continues providing a legal tender in case cash is not present ion the

bank. Previous studies based on the money control have reflected that the change in the value of

money has been the main effect for the digital transaction in the market.5

The monetary policies in the banks have been affected by the invention of digital money

in the market. The cashless transaction in the market has led to the use of digital money in the

market. There has been decrease in the use of cash money in the market. The innovation in

market has been due to the technological impact in the market. The future of central banks have

4 Greg N. Gregoriou and Lam Pak Nian, "Handbook Of Digital Currency: Bitcoin, Innovation, Financial

Instruments, And Big Data" (2015) 18(2) The Journal of Wealth Management.

5 KiHoon Jimmy Hong, Kyounghoon Park and Jongmin Yu, "Crowding Out In A Dual Currency Regime? Digital

Versus Fiat Currency" [2017] SSRN Electronic Journal.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

been based on the amount of transaction in the banks. Customers have been looking for the

digital transaction of money with the help of internet. A survey says that amount of cashless

transaction has increased by 14 % in last two years.6 The bank has faced issues with the

involvement of e-money by customers. The possible effects of electronic payment have been

distinct from conventional payment system on central banks and their policies. Various values

have been utilized for exchange of commodities and goods since existence of civilians. It has

been uncontroversial that central banks plays a role in giving accounts to financial institutions to

allow them safely settle interbank transactions. There is less agreement of central banks need to

operate and oversee infrastructure with these systems. Access policy has been an important lever

that central banks need to manage threats and risks of these systems. Limitations of access of

financial institution for high value payment systems providing rise to the systems. A new form of

money of central bank has implications for competitions of means related to payments. The

transmission of monetary policy and welfare have been competing with other form of money in

the market. E-money was not possible till 1990s and later on new technologies in the

commercialization have helped in making it possible by the need of 20th century.7 Central bank e-

money need directly compete with commercial banks deposit which need both modes of

payments and store of value. Previously there have been some examples of new financial

technologies and infrastructure having adverse effects on financial stability.

6 Dejun Li, Jianbao Huang and Lingcong Wang, "The Impact Of Digital Currency On The Financial System:

Universal Decentralized Digital Currency, Is It Possible?" (2019) 5(2) Journal of Economics and Public Finance.

7 Yuhan Liu, Xiaowei Chen and Dan A. Ralescu, "Uncertain Currency Model And Currency Option Pricing" (2014)

30(1) International Journal of Intelligent Systems.

digital transaction of money with the help of internet. A survey says that amount of cashless

transaction has increased by 14 % in last two years.6 The bank has faced issues with the

involvement of e-money by customers. The possible effects of electronic payment have been

distinct from conventional payment system on central banks and their policies. Various values

have been utilized for exchange of commodities and goods since existence of civilians. It has

been uncontroversial that central banks plays a role in giving accounts to financial institutions to

allow them safely settle interbank transactions. There is less agreement of central banks need to

operate and oversee infrastructure with these systems. Access policy has been an important lever

that central banks need to manage threats and risks of these systems. Limitations of access of

financial institution for high value payment systems providing rise to the systems. A new form of

money of central bank has implications for competitions of means related to payments. The

transmission of monetary policy and welfare have been competing with other form of money in

the market. E-money was not possible till 1990s and later on new technologies in the

commercialization have helped in making it possible by the need of 20th century.7 Central bank e-

money need directly compete with commercial banks deposit which need both modes of

payments and store of value. Previously there have been some examples of new financial

technologies and infrastructure having adverse effects on financial stability.

6 Dejun Li, Jianbao Huang and Lingcong Wang, "The Impact Of Digital Currency On The Financial System:

Universal Decentralized Digital Currency, Is It Possible?" (2019) 5(2) Journal of Economics and Public Finance.

7 Yuhan Liu, Xiaowei Chen and Dan A. Ralescu, "Uncertain Currency Model And Currency Option Pricing" (2014)

30(1) International Journal of Intelligent Systems.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Account and Token based systems

Account and token based payment system that are largely distributed by their

requirements. A transaction need to be satisfactory in an account based system payer need to be

identified as holder of the account from which payment have been made. Record keeping

arrangements include two features including access permission to the records and protocol to

update the records. These features helps in determining which parties in system need to access

records and update it properly. Cash is a type of token system. Cash summarizes past production,

trade and consumption decisions.8 Crypto currencies including Bit coins are token systems in

which records are decentralized as they are distributed in the network. The records of bitcoin

system is called as blockchain that is updated in a distributed form. Financial infrastructures

including high value payment systems (HVPS) are centralized in sense that operator of the

infrastructure has control over the records. This infrastructures have been based on the records of

trusted customers updated by a single party.9

Record keeping systems are trade-offs in their level of access, security and privacy. In

case of expansion of access to system, security become less from admitting dishonest

participants in the banking systems. The digital platform has been increasing in a daily basis

from customer, employer and worker. The online transaction of money has increased in the

scenario. The digital age has experienced the effect of digital currency in the market. The

8 Justin Merrill, "Wixle: An Elastic Digital Currency" [2014] SSRN Electronic Journal.

9 CHRISTIANE NICKEL and ANDREAS TUDYKA, "Fiscal Stimulus In Times Of High Debt: Reconsidering

Multipliers And Twin Deficits" (2014) 46(7) Journal of Money, Credit and Banking.

Account and token based payment system that are largely distributed by their

requirements. A transaction need to be satisfactory in an account based system payer need to be

identified as holder of the account from which payment have been made. Record keeping

arrangements include two features including access permission to the records and protocol to

update the records. These features helps in determining which parties in system need to access

records and update it properly. Cash is a type of token system. Cash summarizes past production,

trade and consumption decisions.8 Crypto currencies including Bit coins are token systems in

which records are decentralized as they are distributed in the network. The records of bitcoin

system is called as blockchain that is updated in a distributed form. Financial infrastructures

including high value payment systems (HVPS) are centralized in sense that operator of the

infrastructure has control over the records. This infrastructures have been based on the records of

trusted customers updated by a single party.9

Record keeping systems are trade-offs in their level of access, security and privacy. In

case of expansion of access to system, security become less from admitting dishonest

participants in the banking systems. The digital platform has been increasing in a daily basis

from customer, employer and worker. The online transaction of money has increased in the

scenario. The digital age has experienced the effect of digital currency in the market. The

8 Justin Merrill, "Wixle: An Elastic Digital Currency" [2014] SSRN Electronic Journal.

9 CHRISTIANE NICKEL and ANDREAS TUDYKA, "Fiscal Stimulus In Times Of High Debt: Reconsidering

Multipliers And Twin Deficits" (2014) 46(7) Journal of Money, Credit and Banking.

emergence of electronic money increased in recent times. The emergence of money has

increased the demand of money in the market. The development of electronic money has been

helping in the dependency of the money control market. The market has been growing rapidly in

the recent times. The online transaction of goods and services have been increased in the recent

market. Electronic money has more impact on the money supply. The real market has been

based on the money supply in the market.

Actual performance of Central Bank Money in Advanced and Emerging Economies

The performance of central bank money has analysed by examining focus on cash and

reserve deposit. Cash need to rise in economic activities by reflecting transaction demand.

Reserve deposit need to be trending in the market as the value of money has been increasing in

the market. The use of different activities in money market has been helping in providing a keen

approach in digital age. The digital age has between facing issues with the cyber issues in the

online transaction of money. The nominal cash flow has been given rise in GDP ratios over the

time.10 The rising trends in the massive conventional monetary include proper analysis in the rise

of the money supply. The central bank money has been flourishing in the market. The value of

money need not to be changed in the market which clarifies importance of money in the market.

Electronic money has been a new form of money that characterizes properties that paper

currency do not have. Electronic money have the same value as paper currency bother. Value has

been an important feature of money. Therefore, digital currency need to have same value as of

paper currency.

10 Sayuri Shirai, "Money And Central Bank Digital Currency" [2019] SSRN Electronic Journal.

increased the demand of money in the market. The development of electronic money has been

helping in the dependency of the money control market. The market has been growing rapidly in

the recent times. The online transaction of goods and services have been increased in the recent

market. Electronic money has more impact on the money supply. The real market has been

based on the money supply in the market.

Actual performance of Central Bank Money in Advanced and Emerging Economies

The performance of central bank money has analysed by examining focus on cash and

reserve deposit. Cash need to rise in economic activities by reflecting transaction demand.

Reserve deposit need to be trending in the market as the value of money has been increasing in

the market. The use of different activities in money market has been helping in providing a keen

approach in digital age. The digital age has between facing issues with the cyber issues in the

online transaction of money. The nominal cash flow has been given rise in GDP ratios over the

time.10 The rising trends in the massive conventional monetary include proper analysis in the rise

of the money supply. The central bank money has been flourishing in the market. The value of

money need not to be changed in the market which clarifies importance of money in the market.

Electronic money has been a new form of money that characterizes properties that paper

currency do not have. Electronic money have the same value as paper currency bother. Value has

been an important feature of money. Therefore, digital currency need to have same value as of

paper currency.

10 Sayuri Shirai, "Money And Central Bank Digital Currency" [2019] SSRN Electronic Journal.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

There have been emergence of electronic money products in the digital age. Customers

have been looking for ecommerce websites for shopping purposes. The emergence of

ecommerce companies and websites have increased in the market. Customers used to pay their

money over the online payment gateway that are linked to their bank accounts. Therefore,

central banking systems plays an important role in the online businesses.11 The payment gateway

is directly linked with the banking systems which clears out the payment as required in the

website. The central banking system has to look after online transaction and ensure secure

transactions in the medium. Electronic money is offered by monetary authorities and credit can

be determined by law and named as legal money. Access approach has been a significant switch

that national banks need to oversee dangers and dangers of these frameworks. Confinements of

access of money related organization for high esteem installment frameworks giving ascent to

the frameworks. Another type of cash of national bank has suggestions for rivalries of methods

identified with installments. The transmission of financial strategy and welfare have been

rivaling other type of cash in the market. E-cash was impractical till 1990s and later on new

advances in the commercialization have helped in making it conceivable by the need of twentieth

century.12 National bank e-cash need straightforwardly contend with business banks store which

need the two methods of installments and store of significant worth. Beforehand there have been

a few instances of new money related advancements and framework effects affecting monetary

steadiness.Perfect financial systems ensures that electronic money and traditional currency need

to be exchange with equal value at any time. Electronic currency is depended on bank cards

11 Joseph V. Simone, "Simoneʼs Oncopinion" (2014) 36(2) Oncology Times.

12 David R. Skeie, "Digital Currency Runs" [2018] SSRN Electronic Journal.

have been looking for ecommerce websites for shopping purposes. The emergence of

ecommerce companies and websites have increased in the market. Customers used to pay their

money over the online payment gateway that are linked to their bank accounts. Therefore,

central banking systems plays an important role in the online businesses.11 The payment gateway

is directly linked with the banking systems which clears out the payment as required in the

website. The central banking system has to look after online transaction and ensure secure

transactions in the medium. Electronic money is offered by monetary authorities and credit can

be determined by law and named as legal money. Access approach has been a significant switch

that national banks need to oversee dangers and dangers of these frameworks. Confinements of

access of money related organization for high esteem installment frameworks giving ascent to

the frameworks. Another type of cash of national bank has suggestions for rivalries of methods

identified with installments. The transmission of financial strategy and welfare have been

rivaling other type of cash in the market. E-cash was impractical till 1990s and later on new

advances in the commercialization have helped in making it conceivable by the need of twentieth

century.12 National bank e-cash need straightforwardly contend with business banks store which

need the two methods of installments and store of significant worth. Beforehand there have been

a few instances of new money related advancements and framework effects affecting monetary

steadiness.Perfect financial systems ensures that electronic money and traditional currency need

to be exchange with equal value at any time. Electronic currency is depended on bank cards

11 Joseph V. Simone, "Simoneʼs Oncopinion" (2014) 36(2) Oncology Times.

12 David R. Skeie, "Digital Currency Runs" [2018] SSRN Electronic Journal.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

including credit cards and debit cards which are easy to carry and allow fast transaction.

Electronic money has been based on currency that can be easily exchanged with traditional

money.13 The payment functions of electronic money systems has been verified and made easy

for transaction.

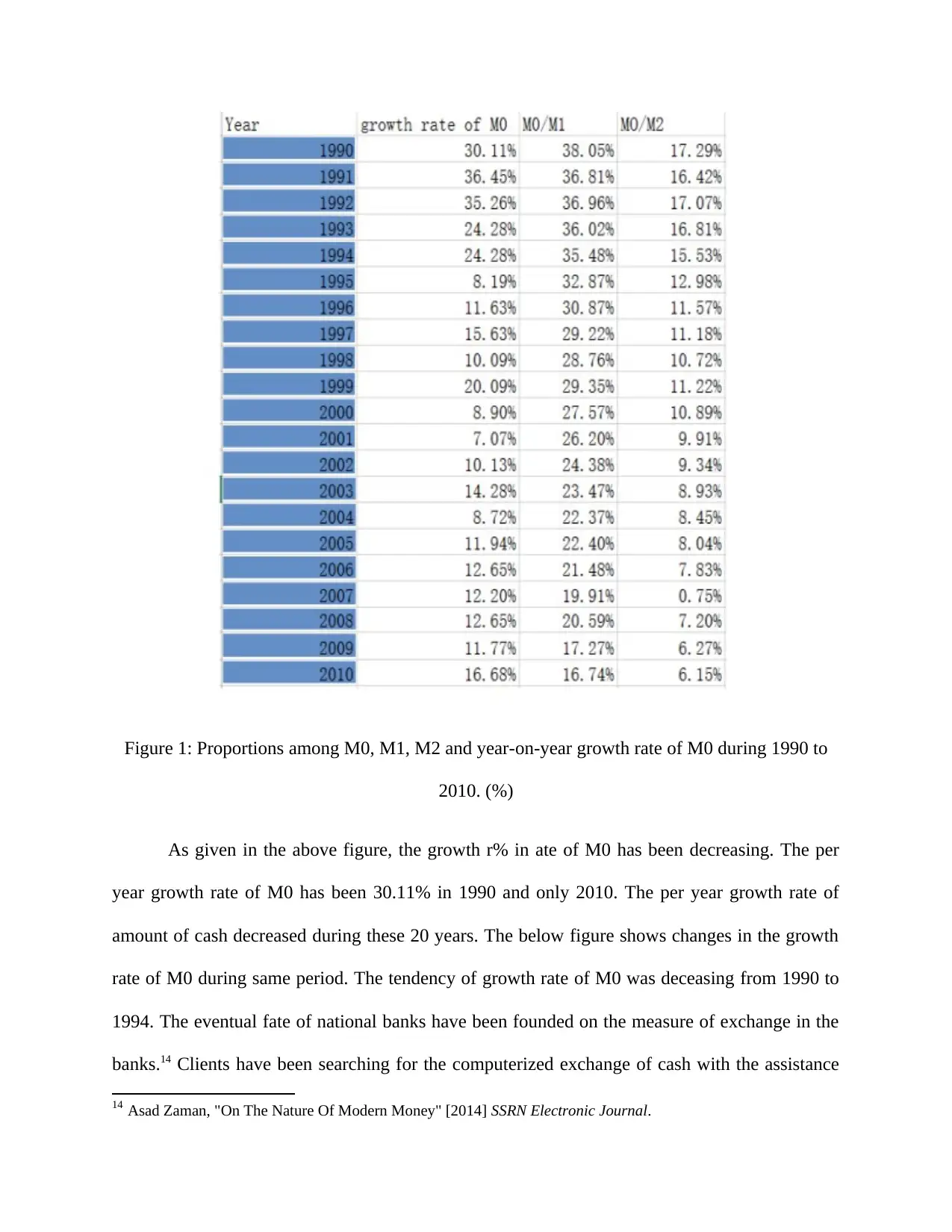

Definition of money after emergence of electronic money

As per volatility of currency, currency can be classified at several levels including M0,

M1 and M2. M0 refers to cash in circulation, M1 include M0 notes in circulation and other

money can be easily convertible into cash. M2 include M1 which is short term deposits in banks.

13 Jeannette Taylor and Ranald Taylor, "Does The Economy Matter? Tough Times, Good Times, And Public

Service Motivation" (2015) 35(5) Public Money & Management.

Electronic money has been based on currency that can be easily exchanged with traditional

money.13 The payment functions of electronic money systems has been verified and made easy

for transaction.

Definition of money after emergence of electronic money

As per volatility of currency, currency can be classified at several levels including M0,

M1 and M2. M0 refers to cash in circulation, M1 include M0 notes in circulation and other

money can be easily convertible into cash. M2 include M1 which is short term deposits in banks.

13 Jeannette Taylor and Ranald Taylor, "Does The Economy Matter? Tough Times, Good Times, And Public

Service Motivation" (2015) 35(5) Public Money & Management.

Figure 1: Proportions among M0, M1, M2 and year-on-year growth rate of M0 during 1990 to

2010. (%)

As given in the above figure, the growth r% in ate of M0 has been decreasing. The per

year growth rate of M0 has been 30.11% in 1990 and only 2010. The per year growth rate of

amount of cash decreased during these 20 years. The below figure shows changes in the growth

rate of M0 during same period. The tendency of growth rate of M0 was deceasing from 1990 to

1994. The eventual fate of national banks have been founded on the measure of exchange in the

banks.14 Clients have been searching for the computerized exchange of cash with the assistance

14 Asad Zaman, "On The Nature Of Modern Money" [2014] SSRN Electronic Journal.

2010. (%)

As given in the above figure, the growth r% in ate of M0 has been decreasing. The per

year growth rate of M0 has been 30.11% in 1990 and only 2010. The per year growth rate of

amount of cash decreased during these 20 years. The below figure shows changes in the growth

rate of M0 during same period. The tendency of growth rate of M0 was deceasing from 1990 to

1994. The eventual fate of national banks have been founded on the measure of exchange in the

banks.14 Clients have been searching for the computerized exchange of cash with the assistance

14 Asad Zaman, "On The Nature Of Modern Money" [2014] SSRN Electronic Journal.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 36

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.