Analyzing Asset Impairment in Corporate Accounting and Reporting

VerifiedAdded on 2023/06/07

|6

|1312

|478

Homework Assignment

AI Summary

This assignment delves into the concept of asset impairment within corporate accounting and reporting. Part A defines impairment as the process of identifying assets with carrying amounts exceeding their recoverable amounts, emphasizing the use of cash-generating units (CGUs) for impairment loss calculations when fair values are difficult to determine. It discusses factors influencing cash flow generation, including asset utilization and pricing policies, and highlights the importance of disclosing information related to impaired assets and CGUs. Part B presents a practical application, calculating the total impairment loss, allocating it across various assets, and providing the corresponding journal entries. The assignment covers goodwill impairment, distribution of impairment loss, and the impact on asset values. The solution also incorporates the relevant bibliography for the concepts discussed.

CORPORATE ACCOUNTING AND REPORTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part A:

The procedure in which those assets are identified whose Carrying amount is higher than the

recoverable amount is known as impairment. We can also say that impairment means

recording assets at their fair value (Berry, 2009).

For the calculation of impairment loss, the recoverable amount for each asset that is

contained in the cash generating unit is required individually. Many times it becomes very

difficult to determine the fair value of the assets separately and so the cash generating unit is

used as a whole for the determination of impairment loss (Girard, 2014). Such situation of

non identification might occur when there is any asset in the CGU whose usage is dependent

on any other unit of the same CGU.

All the assets that help to generate cash inflow is contained in the cash generating unit. The

cash flows depend on the efficiency by which the management utilises the assets that are held

by them. However, there are different factors on which the revenue generation depends. Few

of the factors are acquisition and disposal of the assets, optimum utilisation of the resources.

Such cash inflows should be from third parties (Holtzman, 2013).

The products that are produced on the consumption of such assets should be capable of being

sold in the active market or should be capable enough to be consumed in the organisation

itself. If neither of this is satisfied then the asset cannot form part of the cash generating unit.

The generation of cash inflow is very much affected by the pricing policies of the company

that are set up internally. The value of cash generated from a particular CGU must be known.

It is important for the company to apply arms length price for the purpose of determining the

value of cash inflow.

The company that accounts for impairment loss has to keep the users of the financial

statements updated by providing them information regarding the assets that are comprised in

the cash generating units. If the company decides to transfer any specific asset from one cash

generating unit to another then there is a requirement of disclosure (Horngren, 2012). Any

adjustments whether relating to impairment loss or reversal of impairment loss has to be

recorded in the books of accounts.

As we know, we can know the exact amount of impairment loss when we have information

about the recoverable amount of the assets. The companies usually deduct any selling

expenses that incurs from the fair value of the asset. All the assets that help the company to

The procedure in which those assets are identified whose Carrying amount is higher than the

recoverable amount is known as impairment. We can also say that impairment means

recording assets at their fair value (Berry, 2009).

For the calculation of impairment loss, the recoverable amount for each asset that is

contained in the cash generating unit is required individually. Many times it becomes very

difficult to determine the fair value of the assets separately and so the cash generating unit is

used as a whole for the determination of impairment loss (Girard, 2014). Such situation of

non identification might occur when there is any asset in the CGU whose usage is dependent

on any other unit of the same CGU.

All the assets that help to generate cash inflow is contained in the cash generating unit. The

cash flows depend on the efficiency by which the management utilises the assets that are held

by them. However, there are different factors on which the revenue generation depends. Few

of the factors are acquisition and disposal of the assets, optimum utilisation of the resources.

Such cash inflows should be from third parties (Holtzman, 2013).

The products that are produced on the consumption of such assets should be capable of being

sold in the active market or should be capable enough to be consumed in the organisation

itself. If neither of this is satisfied then the asset cannot form part of the cash generating unit.

The generation of cash inflow is very much affected by the pricing policies of the company

that are set up internally. The value of cash generated from a particular CGU must be known.

It is important for the company to apply arms length price for the purpose of determining the

value of cash inflow.

The company that accounts for impairment loss has to keep the users of the financial

statements updated by providing them information regarding the assets that are comprised in

the cash generating units. If the company decides to transfer any specific asset from one cash

generating unit to another then there is a requirement of disclosure (Horngren, 2012). Any

adjustments whether relating to impairment loss or reversal of impairment loss has to be

recorded in the books of accounts.

As we know, we can know the exact amount of impairment loss when we have information

about the recoverable amount of the assets. The companies usually deduct any selling

expenses that incurs from the fair value of the asset. All the assets that help the company to

generate revenues should be taken into consideration and all remaining assets should be

excluded. If there is any liability against any specific asset then such liability also has to be

accounted (McLaney & Adril, 2016).

The calculation of the impairment loss of a normal asset and a cash generating asset is very

similar to each other. If the carrying value of any asset exceeds the fair value then the loss has

to be recognised. Goodwill is written off wholly and the remaining impairment loss is

distributed among the rest of the assets in the ratio of their carrying amounts. The treatment

of impairment of the assets is done by deducting the amount of loss from its carrying value.

This leads to reduction of the value of an asset.

While distributing the impairment loss to all the assets it is important to consider the

following point. The carrying value of the assets should not be reduced more than the figure

which is highest of the following three:

- Fair value less selling expense

- Value in use

- Zero

The remaining impairment loss has to be distributed on the basis of pro rate among all the

assets that are contained in the cash generating unit (Parrino, 2013).

In usual terms, it is observed that all the assets that are a part of CGU contribute in cash

inflows. But sometimes there are some non cash generating assets also that are included in

CGU. If such non cash generating asset is being impaired then it can be treated by adding its

carrying amount to the carrying amount of the unit. The determination of carrying amount

can be done by determining the services used that is provided by the asset.

It is not possible to ascertain recoverable amount for such non cash generating assets and

therefore the treatment of impairment can be done by comparing the carrying value to the fair

value net of impairment loss. If such CGU has not being impaired then the company must not

make any adjustments to the carrying amount, even if the asset is impaired individually.

An impairment test is carried out in order to get the amount of impairment loss and record it

in the books of accounts (Siciliano, 2015). All the steps that have to be adopted in order to

calculate and record the impairment loss have been discussed in this assignment. The

impairment loss and other details regarding the impairment of the last reporting period has to

excluded. If there is any liability against any specific asset then such liability also has to be

accounted (McLaney & Adril, 2016).

The calculation of the impairment loss of a normal asset and a cash generating asset is very

similar to each other. If the carrying value of any asset exceeds the fair value then the loss has

to be recognised. Goodwill is written off wholly and the remaining impairment loss is

distributed among the rest of the assets in the ratio of their carrying amounts. The treatment

of impairment of the assets is done by deducting the amount of loss from its carrying value.

This leads to reduction of the value of an asset.

While distributing the impairment loss to all the assets it is important to consider the

following point. The carrying value of the assets should not be reduced more than the figure

which is highest of the following three:

- Fair value less selling expense

- Value in use

- Zero

The remaining impairment loss has to be distributed on the basis of pro rate among all the

assets that are contained in the cash generating unit (Parrino, 2013).

In usual terms, it is observed that all the assets that are a part of CGU contribute in cash

inflows. But sometimes there are some non cash generating assets also that are included in

CGU. If such non cash generating asset is being impaired then it can be treated by adding its

carrying amount to the carrying amount of the unit. The determination of carrying amount

can be done by determining the services used that is provided by the asset.

It is not possible to ascertain recoverable amount for such non cash generating assets and

therefore the treatment of impairment can be done by comparing the carrying value to the fair

value net of impairment loss. If such CGU has not being impaired then the company must not

make any adjustments to the carrying amount, even if the asset is impaired individually.

An impairment test is carried out in order to get the amount of impairment loss and record it

in the books of accounts (Siciliano, 2015). All the steps that have to be adopted in order to

calculate and record the impairment loss have been discussed in this assignment. The

impairment loss and other details regarding the impairment of the last reporting period has to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

be disclosed by the company in its financial reports. The company must report about the

reversal of impairment loss also. The procedure by which the impairment loss is distributed

and the impairment loss is reversed is very similar i.e. on pro rata basis.

It is the responsibility of the management of the company to determine the impairment loss

correctly, record such losses properly and also provide the required disclosures in the

financial reports in relation to impairment loss or its reversal (Taillard, 2013).

reversal of impairment loss also. The procedure by which the impairment loss is distributed

and the impairment loss is reversed is very similar i.e. on pro rata basis.

It is the responsibility of the management of the company to determine the impairment loss

correctly, record such losses properly and also provide the required disclosures in the

financial reports in relation to impairment loss or its reversal (Taillard, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part B:

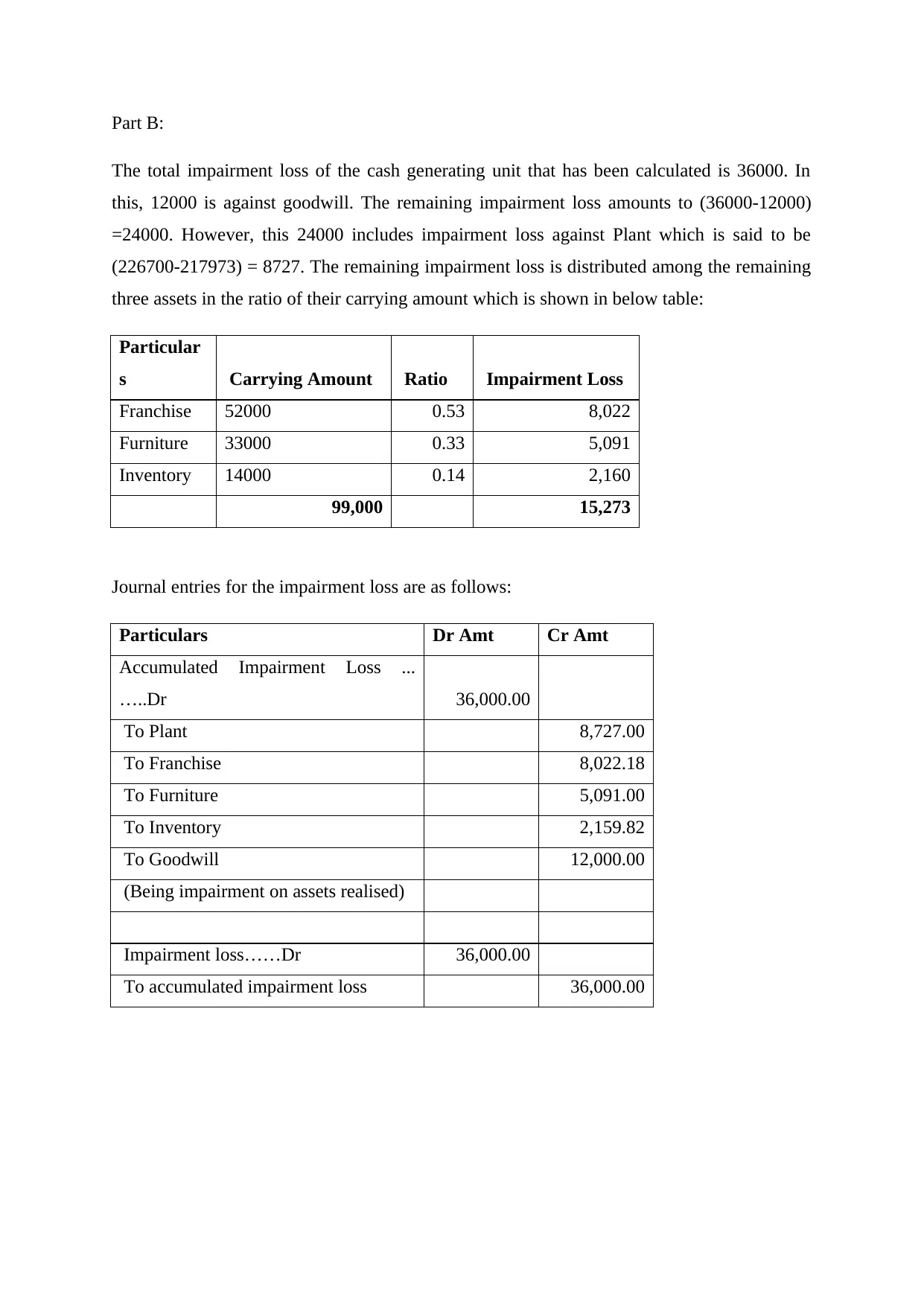

The total impairment loss of the cash generating unit that has been calculated is 36000. In

this, 12000 is against goodwill. The remaining impairment loss amounts to (36000-12000)

=24000. However, this 24000 includes impairment loss against Plant which is said to be

(226700-217973) = 8727. The remaining impairment loss is distributed among the remaining

three assets in the ratio of their carrying amount which is shown in below table:

Particular

s Carrying Amount Ratio Impairment Loss

Franchise 52000 0.53 8,022

Furniture 33000 0.33 5,091

Inventory 14000 0.14 2,160

99,000 15,273

Journal entries for the impairment loss are as follows:

Particulars Dr Amt Cr Amt

Accumulated Impairment Loss ...

…..Dr 36,000.00

To Plant 8,727.00

To Franchise 8,022.18

To Furniture 5,091.00

To Inventory 2,159.82

To Goodwill 12,000.00

(Being impairment on assets realised)

Impairment loss……Dr 36,000.00

To accumulated impairment loss 36,000.00

The total impairment loss of the cash generating unit that has been calculated is 36000. In

this, 12000 is against goodwill. The remaining impairment loss amounts to (36000-12000)

=24000. However, this 24000 includes impairment loss against Plant which is said to be

(226700-217973) = 8727. The remaining impairment loss is distributed among the remaining

three assets in the ratio of their carrying amount which is shown in below table:

Particular

s Carrying Amount Ratio Impairment Loss

Franchise 52000 0.53 8,022

Furniture 33000 0.33 5,091

Inventory 14000 0.14 2,160

99,000 15,273

Journal entries for the impairment loss are as follows:

Particulars Dr Amt Cr Amt

Accumulated Impairment Loss ...

…..Dr 36,000.00

To Plant 8,727.00

To Franchise 8,022.18

To Furniture 5,091.00

To Inventory 2,159.82

To Goodwill 12,000.00

(Being impairment on assets realised)

Impairment loss……Dr 36,000.00

To accumulated impairment loss 36,000.00

Bibliography

Berry, L. E. (2009). Management accounting demystified. New York: McGraw-Hill.

Girard, S. L. (2014). Business finance basics. Pompton Plains, NJ: Career Press.

Holtzman, M. (2013). Managerial Accounting For Dummies. Hoboken, NJ: Wiley.

Horngren, C. (2012). Cost accounting. Upper Saddle River, N.J.: Pearson/Prentice Hall.

McLaney, E., & Adril, D. P. (2016). Accounting and Finance: An Introduction. United

Kingdom: Pearson.

Parrino, R. (2013). Fundamentals of Corporate Finance, 2nd Edition. Milton: John Wiley &

Sons.

Siciliano, G. (2015). Finance for Nonfinancial Managers. New York: McGraw-Hill.

Taillard, M. (2013). Corporate finance for dummies. Hoboken, N.J.: Wiley.

Berry, L. E. (2009). Management accounting demystified. New York: McGraw-Hill.

Girard, S. L. (2014). Business finance basics. Pompton Plains, NJ: Career Press.

Holtzman, M. (2013). Managerial Accounting For Dummies. Hoboken, NJ: Wiley.

Horngren, C. (2012). Cost accounting. Upper Saddle River, N.J.: Pearson/Prentice Hall.

McLaney, E., & Adril, D. P. (2016). Accounting and Finance: An Introduction. United

Kingdom: Pearson.

Parrino, R. (2013). Fundamentals of Corporate Finance, 2nd Edition. Milton: John Wiley &

Sons.

Siciliano, G. (2015). Finance for Nonfinancial Managers. New York: McGraw-Hill.

Taillard, M. (2013). Corporate finance for dummies. Hoboken, N.J.: Wiley.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.