Analysis of Indirect Tax VAT Report: Requirements and Implications

VerifiedAdded on 2020/12/24

|15

|4241

|374

Report

AI Summary

This report provides a comprehensive analysis of Value Added Tax (VAT), an indirect tax levied on goods and services. It begins with an introduction to VAT, its historical context, and its role in government revenue. The report then delves into the sources of information on VAT, explaining how organizations should interact with the relevant government agency, HMRC. It outlines VAT registration requirements, the information required on business documentation, and the requirements and frequency of reporting for various VAT schemes, including annual accounting, cash accounting, flat-rate, and standard schemes. The report also covers maintaining up-to-date knowledge of changes to codes of practice, regulations, and legislation. Furthermore, it examines relevant data from accounting systems for VAT calculations, including inputs, outputs, and VAT due to or from the tax authority. The report discusses VAT returns, associated payments, and the implications of non-compliance, including penalties. It concludes with a discussion on informing managers of the impact of VAT on cash flow and financial forecasts, and the importance of communicating changes in VAT legislation to relevant personnel.

Indirect Tax

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 sources of information on VAT............................................................................................1

1.2 How an organisation should interact with the relevant government agency........................1

1.3 VAT registration requirements.............................................................................................2

1.4 The information that must be included on business documentation of VAT......................3

registered businesses...................................................................................................................3

1.5 The requirements and the frequency of reporting for VAT schemes...................................4

1.6 Maintain an up-to-date knowledge of changes to codes of practice, regulation or

legislation....................................................................................................................................5

TASK 2............................................................................................................................................5

2.1 Relevant data for a specific period from the accounting system..........................................5

2.2 Relevant inputs and outputs using these VAT classifications..............................................6

2.3 VAT due to, or from, the relevant tax authority...................................................................8

2.4 VAT return and any associated payment within the statutory time limits...........................8

TASK 3............................................................................................................................................9

3.1 The implications and penalties for an organisation resulting from failure to abide by VAT

regulations...................................................................................................................................9

3.2 Adjustments and declarations for any errors or omissions identified in previous VAT

periods.......................................................................................................................................10

TASK 4..........................................................................................................................................11

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 sources of information on VAT............................................................................................1

1.2 How an organisation should interact with the relevant government agency........................1

1.3 VAT registration requirements.............................................................................................2

1.4 The information that must be included on business documentation of VAT......................3

registered businesses...................................................................................................................3

1.5 The requirements and the frequency of reporting for VAT schemes...................................4

1.6 Maintain an up-to-date knowledge of changes to codes of practice, regulation or

legislation....................................................................................................................................5

TASK 2............................................................................................................................................5

2.1 Relevant data for a specific period from the accounting system..........................................5

2.2 Relevant inputs and outputs using these VAT classifications..............................................6

2.3 VAT due to, or from, the relevant tax authority...................................................................8

2.4 VAT return and any associated payment within the statutory time limits...........................8

TASK 3............................................................................................................................................9

3.1 The implications and penalties for an organisation resulting from failure to abide by VAT

regulations...................................................................................................................................9

3.2 Adjustments and declarations for any errors or omissions identified in previous VAT

periods.......................................................................................................................................10

TASK 4..........................................................................................................................................11

4.1 Inform managers of the impact that the VAT payment may have on an organisation’s cash

flow and financial forecasts......................................................................................................11

4.2 Relevant people of changes in VAT legislation which would have an effect on an

organisation’s recording systems..............................................................................................11

CONCLUSION..............................................................................................................................11

REFRENCESS...............................................................................................................................12

.......................................................................................................................................................12

flow and financial forecasts......................................................................................................11

4.2 Relevant people of changes in VAT legislation which would have an effect on an

organisation’s recording systems..............................................................................................11

CONCLUSION..............................................................................................................................11

REFRENCESS...............................................................................................................................12

.......................................................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Indirect tax is levied on goods and services rather than on income and profits. VAT refers

to the value added tax, which is imposed on goods only not on services (Emran and Stiglitz,

2005). It is introduced in 1973 , which became third largest source of Govt. revenue. VAT is an

indirect tax because the tax is paid to the government by the seller (the business) rather than the

person who ultimately bears the economic burden of the tax (the consumer). Opponents of VAT

claim it is a regressive tax because the poorest people spend a higher proportion of their

disposable income on VAT than the richest people. Before that tax the income tax and national

insurance are largest sources of Govt. revenue. It is collected through HM revenue and custom

department. This report is going to analysis the sources and requirements of VAT registration.

The requirements and frequency also reported differently as per distinct VAT schemes. This

report also clarify VAT penalties and return in appropriate manner with a relevant data.

TASK 1

1.1 sources of information on VAT

The HMRC pages of the UK Government website www.gov.uk are a source of

information covering all taxes, where opinions about what could or should be done about a

situation notes, guidance and books, magazines, etc. are available to download. HMRC usually

expect taxpayers to find the answers to any questions on their website, however there is a

telephone question/request for information line and a web chat facility that can deal with

unanswered problems. Taxpayers can also use an online question/request for information form or

write to HMRC by post for opinions about what could or should be done about a situation or

guidance. HMRC refers to HM revenue and custom department (Boadway, March and Pestieau,

1994). Returns of taxpayers also its main source, because if cross checking is done by help of a

filled return then 2nd parties tax information can be acquired.

1.2 How an organisation should interact with the relevant government agency.

An organisation while working in country should work according to the rules and

regulations as specified by the government. It is the main task of the company to adhere to

established rules for paying their tax liability and to compute tax responsibility that is on

company for the current year. UK government has established an institution which is named as

HMRC, that helps the taxpayers to pay the tax and ask the questions which are related to

1

Indirect tax is levied on goods and services rather than on income and profits. VAT refers

to the value added tax, which is imposed on goods only not on services (Emran and Stiglitz,

2005). It is introduced in 1973 , which became third largest source of Govt. revenue. VAT is an

indirect tax because the tax is paid to the government by the seller (the business) rather than the

person who ultimately bears the economic burden of the tax (the consumer). Opponents of VAT

claim it is a regressive tax because the poorest people spend a higher proportion of their

disposable income on VAT than the richest people. Before that tax the income tax and national

insurance are largest sources of Govt. revenue. It is collected through HM revenue and custom

department. This report is going to analysis the sources and requirements of VAT registration.

The requirements and frequency also reported differently as per distinct VAT schemes. This

report also clarify VAT penalties and return in appropriate manner with a relevant data.

TASK 1

1.1 sources of information on VAT

The HMRC pages of the UK Government website www.gov.uk are a source of

information covering all taxes, where opinions about what could or should be done about a

situation notes, guidance and books, magazines, etc. are available to download. HMRC usually

expect taxpayers to find the answers to any questions on their website, however there is a

telephone question/request for information line and a web chat facility that can deal with

unanswered problems. Taxpayers can also use an online question/request for information form or

write to HMRC by post for opinions about what could or should be done about a situation or

guidance. HMRC refers to HM revenue and custom department (Boadway, March and Pestieau,

1994). Returns of taxpayers also its main source, because if cross checking is done by help of a

filled return then 2nd parties tax information can be acquired.

1.2 How an organisation should interact with the relevant government agency.

An organisation while working in country should work according to the rules and

regulations as specified by the government. It is the main task of the company to adhere to

established rules for paying their tax liability and to compute tax responsibility that is on

company for the current year. UK government has established an institution which is named as

HMRC, that helps the taxpayers to pay the tax and ask the questions which are related to

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

payment and collection of tax. The organisation is able to interact with the government agency

through various departments which are made by HMRC. They made 25 ministerial departments

that helps company to administer and pay the debts. Also if company has any problems regarding

calculation or levy of tax then they can check the site and the rules that defines the tax rate on

particular item. If this process does not help company then company can write a letter or an

Email to department seeking their advise on particular situation by paying relevant fees. They

have also issued a website for letting the taxpayers have a knowledge about various rules and

regulations, which is timely updated as and when required. The working hours are fixed for the

department of tax revenue and holidays time it will be closed as per the rules of Govt.

1.3 VAT registration requirements

A business must register for VAT with HM Revenue and Customs ( HMRC ) if its VAT

taxable turnover is more than £85,000 per financial year (Virmani, 1989). Organization/person

would also need to register for VAT if receive products that are bought and sold in the UK from

the EU worth more than British pounds 83,000 or expect to go over the dividing line/point where

something begins or changes in a single 30 day period. A separate definition is stated by the

HMRC department, if any business entity doesn't meet that definition then it can't be registered

under VAT scheme. Business entities which are engaged in the business of goods and services

those exempted from tax also exempted from VAT registration. There are always need of

supporting evidence such as invoices, bank statement etc. for registration under VAT. The

registration under VAT may be voluntary or compulsory as per the rules of department.

Following documents/information are needed to register for VAT:

National Insurance (NI) number.

Tax identifier i.e. Unique Taxpayer’s reference (UTR) number.

Certificate of incorporation/incorporation details.

Business bank accounts details.

Information on all associated businesses within the last two years.

Zero rated supplier not required to register under VAT.

2

through various departments which are made by HMRC. They made 25 ministerial departments

that helps company to administer and pay the debts. Also if company has any problems regarding

calculation or levy of tax then they can check the site and the rules that defines the tax rate on

particular item. If this process does not help company then company can write a letter or an

Email to department seeking their advise on particular situation by paying relevant fees. They

have also issued a website for letting the taxpayers have a knowledge about various rules and

regulations, which is timely updated as and when required. The working hours are fixed for the

department of tax revenue and holidays time it will be closed as per the rules of Govt.

1.3 VAT registration requirements

A business must register for VAT with HM Revenue and Customs ( HMRC ) if its VAT

taxable turnover is more than £85,000 per financial year (Virmani, 1989). Organization/person

would also need to register for VAT if receive products that are bought and sold in the UK from

the EU worth more than British pounds 83,000 or expect to go over the dividing line/point where

something begins or changes in a single 30 day period. A separate definition is stated by the

HMRC department, if any business entity doesn't meet that definition then it can't be registered

under VAT scheme. Business entities which are engaged in the business of goods and services

those exempted from tax also exempted from VAT registration. There are always need of

supporting evidence such as invoices, bank statement etc. for registration under VAT. The

registration under VAT may be voluntary or compulsory as per the rules of department.

Following documents/information are needed to register for VAT:

National Insurance (NI) number.

Tax identifier i.e. Unique Taxpayer’s reference (UTR) number.

Certificate of incorporation/incorporation details.

Business bank accounts details.

Information on all associated businesses within the last two years.

Zero rated supplier not required to register under VAT.

2

1.4 The information that must be included on business documentation of VAT

registered businesses

A VAT registered business making a supply to another VAT registered person then it

must have to issue a VAT invoice within 30 days of tax point (Hatzipanayotou, Michael and

Miller, 1994). VAT registered businesses includes various informations in documentation which

are as followings:

Registration number provided at time of VAT registration.

The date of issuing invoices.

VAT rate for each supply.

The VAT exclusive amount for each supply

The total VAT exclusive amount

The amount of VAT payable

The invoice date and invoice number

The type of supply

The quantity and description of the goods supplied

The company’s name and address

The name and address of the customer

If a sales invoice is meant to be valid for VAT purposes i.e. a separate VAT invoice does

not need to be issued, then all of the above needs to be included in the sales invoice.

Otherwise, a separate VAT invoice will need to be issued. A less detailed invoice is also issued

by a taxable person which include less information than a full documented invoice. In that

situation the invoice is for a total including VAT of up to £250. The less informational invoice

include only necessary information such as :

The supplier’s name, address and registration number.

The date of the supply.

A description of the goods or services supplied.

The rate of VAT chargeable.

The total amount chargeable including VAT.

1.5 The requirements and the frequency of reporting for VAT schemes

Some of the special schemes are available to small business for reducing work and

payable amount of VAT. These schemes are such as Annual accounting, Cash accounting, Flat-

3

registered businesses

A VAT registered business making a supply to another VAT registered person then it

must have to issue a VAT invoice within 30 days of tax point (Hatzipanayotou, Michael and

Miller, 1994). VAT registered businesses includes various informations in documentation which

are as followings:

Registration number provided at time of VAT registration.

The date of issuing invoices.

VAT rate for each supply.

The VAT exclusive amount for each supply

The total VAT exclusive amount

The amount of VAT payable

The invoice date and invoice number

The type of supply

The quantity and description of the goods supplied

The company’s name and address

The name and address of the customer

If a sales invoice is meant to be valid for VAT purposes i.e. a separate VAT invoice does

not need to be issued, then all of the above needs to be included in the sales invoice.

Otherwise, a separate VAT invoice will need to be issued. A less detailed invoice is also issued

by a taxable person which include less information than a full documented invoice. In that

situation the invoice is for a total including VAT of up to £250. The less informational invoice

include only necessary information such as :

The supplier’s name, address and registration number.

The date of the supply.

A description of the goods or services supplied.

The rate of VAT chargeable.

The total amount chargeable including VAT.

1.5 The requirements and the frequency of reporting for VAT schemes

Some of the special schemes are available to small business for reducing work and

payable amount of VAT. These schemes are such as Annual accounting, Cash accounting, Flat-

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

rate scheme and Standard scheme. These schemes includes different standards and operations.

Category wise description of VAT special schemes as follows:

Annual accounting scheme: The Once-a-year Annual accounting scheme allows you to

complete just one VAT return each year, instead of four (Creedy, 2001). VAT is paid by

instalments, either three quarterly instalments or nine monthly instalments. These must be paid

by direct debit, standing order or other electronic means. After joining the big plan, HMRC

calculates and tells the business of the instalment amounts and the dates they are due. The

business can pay added something you choose to do, but is not required payments. At the end of

the year the business submits its VAT return and any balance outstanding. If too much money

has been paid throughout the year, HMRC will refund the excess. The due date for once-a-year

returns is in a common and regular way two months after the end of the once-a-year accounting

year. Both the dates for the start and end of the VAT period and the due dates will be shown on

the VAT return. The ability to be picked to participate conditions are just like the 'cash

accounting scheme' in that the big plan is available if taxable supplies will be no more than

British pounds 1,350,000 in the next year. The business will need to leave the big plan if its

taxable sales keeping out VAT go beyond British pounds 1,600,000 for the year.

Flat rate scheme : The big layout plan allows a business to apply a fixed flat-rate

percentage to the gross turnover to arrive at the at due. Fixed-rate percentages change/differ

depending on the type of business. Subject to certain conditions, the layout is for businesses with

turnover of no more than British pounds 150,000 a year, leaving out VAT. The business will

stop to be able to participate to use the big layout if the total value of income for the year ending

is more than British pounds 230,000. Farmers also certified under that scheme not account for

VAT, or require to submit return. They may have to be charge flat 4% rate. The farmer will not

be eligible to join the flat-rate scheme unless:

The non-farming activities are zero-rated, in which case the farmer may ask for

exemption from registration and join the scheme; or

The non-farming business is run as a separate business by a different legal entity (eg a

person could run his farming activities as a sole proprietor and a bed and breakfast

business in partnership with another person).

Standard scheme: Under this scheme VAT is paid on the time when invoices are issued.

VAT return is filled four times per year under that scheme. VAT amount is calculate for payment

4

Category wise description of VAT special schemes as follows:

Annual accounting scheme: The Once-a-year Annual accounting scheme allows you to

complete just one VAT return each year, instead of four (Creedy, 2001). VAT is paid by

instalments, either three quarterly instalments or nine monthly instalments. These must be paid

by direct debit, standing order or other electronic means. After joining the big plan, HMRC

calculates and tells the business of the instalment amounts and the dates they are due. The

business can pay added something you choose to do, but is not required payments. At the end of

the year the business submits its VAT return and any balance outstanding. If too much money

has been paid throughout the year, HMRC will refund the excess. The due date for once-a-year

returns is in a common and regular way two months after the end of the once-a-year accounting

year. Both the dates for the start and end of the VAT period and the due dates will be shown on

the VAT return. The ability to be picked to participate conditions are just like the 'cash

accounting scheme' in that the big plan is available if taxable supplies will be no more than

British pounds 1,350,000 in the next year. The business will need to leave the big plan if its

taxable sales keeping out VAT go beyond British pounds 1,600,000 for the year.

Flat rate scheme : The big layout plan allows a business to apply a fixed flat-rate

percentage to the gross turnover to arrive at the at due. Fixed-rate percentages change/differ

depending on the type of business. Subject to certain conditions, the layout is for businesses with

turnover of no more than British pounds 150,000 a year, leaving out VAT. The business will

stop to be able to participate to use the big layout if the total value of income for the year ending

is more than British pounds 230,000. Farmers also certified under that scheme not account for

VAT, or require to submit return. They may have to be charge flat 4% rate. The farmer will not

be eligible to join the flat-rate scheme unless:

The non-farming activities are zero-rated, in which case the farmer may ask for

exemption from registration and join the scheme; or

The non-farming business is run as a separate business by a different legal entity (eg a

person could run his farming activities as a sole proprietor and a bed and breakfast

business in partnership with another person).

Standard scheme: Under this scheme VAT is paid on the time when invoices are issued.

VAT return is filled four times per year under that scheme. VAT amount is calculate for payment

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

by comparing the VAT due on the cost and owed on sales volume. HMRC will refund and

acquire the due VAT amount after comparing the above terms.

1.6 Maintain an up-to-date knowledge of changes to codes of practice, regulation or legislation

Maintaining an up to date knowledge of changes to code of practice, regulations or

legislation will help the business organization at a wider context (Kakwani, 1977). HMRC

announces various changes VAT regulation and legislation, some of are as follows:

Digital records maintenance will be compulsory for VAT calculation, manual records

are not further valid. So if a businesses organization keep it in consideration with up to

date then it have to very easy to face challenges in future.

Changes are announced in VAT return submission that returns must be submitted to

HMRC by means of a business’s functional compatible software communicating

digitally via HMRC’s API platform, and not by manually entering the VAT return

figures onto the HMRC portal. So VAT registered business organization must be

considered this upcoming change so that in future return can be submitted very easily

and without any errors.

TASK 2

2.1 Relevant data for a specific period from the accounting system

In the UK, VAT returns can be submitted either monthly or quarterly. Most of the returns

are completed on a quarterly basis. Once registered, a business will be assigned to a “VAT

stagger group” (Joseph, 1939). Let us assume stagger group on which quarters ends on March,

June, September and December. Following are the details for the extraction of relevant data for

filing the return of the VAT for the quarter ending 31st December, 2018:

Accounting Information

For VAT payable:

Sales Book £ 256658

Less: Credit Note £ 2762

Total £ 253896

Cash Book £ 9858

EU Acquisitions £ 21630

Correction of error £ 1763

5

acquire the due VAT amount after comparing the above terms.

1.6 Maintain an up-to-date knowledge of changes to codes of practice, regulation or legislation

Maintaining an up to date knowledge of changes to code of practice, regulations or

legislation will help the business organization at a wider context (Kakwani, 1977). HMRC

announces various changes VAT regulation and legislation, some of are as follows:

Digital records maintenance will be compulsory for VAT calculation, manual records

are not further valid. So if a businesses organization keep it in consideration with up to

date then it have to very easy to face challenges in future.

Changes are announced in VAT return submission that returns must be submitted to

HMRC by means of a business’s functional compatible software communicating

digitally via HMRC’s API platform, and not by manually entering the VAT return

figures onto the HMRC portal. So VAT registered business organization must be

considered this upcoming change so that in future return can be submitted very easily

and without any errors.

TASK 2

2.1 Relevant data for a specific period from the accounting system

In the UK, VAT returns can be submitted either monthly or quarterly. Most of the returns

are completed on a quarterly basis. Once registered, a business will be assigned to a “VAT

stagger group” (Joseph, 1939). Let us assume stagger group on which quarters ends on March,

June, September and December. Following are the details for the extraction of relevant data for

filing the return of the VAT for the quarter ending 31st December, 2018:

Accounting Information

For VAT payable:

Sales Book £ 256658

Less: Credit Note £ 2762

Total £ 253896

Cash Book £ 9858

EU Acquisitions £ 21630

Correction of error £ 1763

5

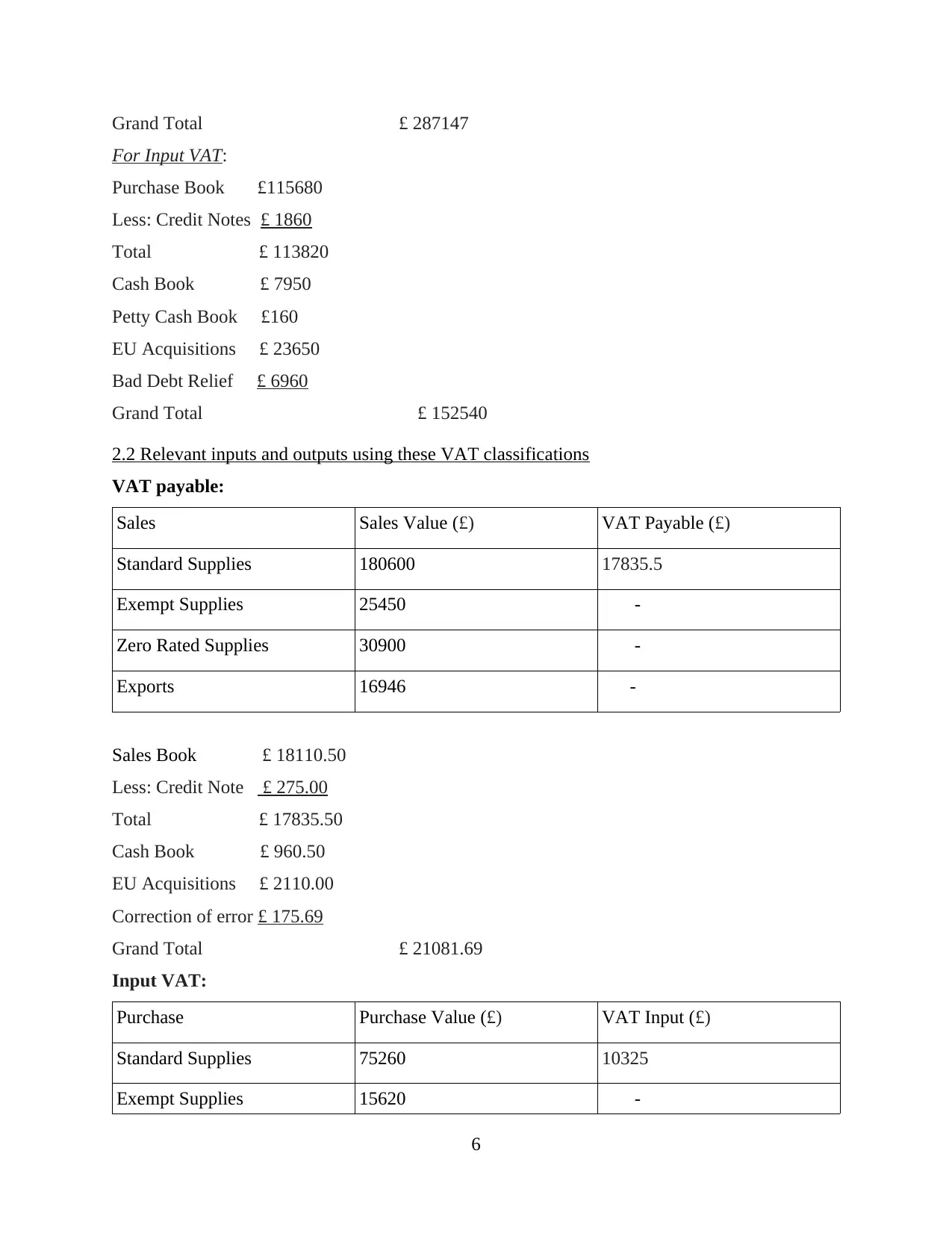

Grand Total £ 287147

For Input VAT:

Purchase Book £115680

Less: Credit Notes £ 1860

Total £ 113820

Cash Book £ 7950

Petty Cash Book £160

EU Acquisitions £ 23650

Bad Debt Relief £ 6960

Grand Total £ 152540

2.2 Relevant inputs and outputs using these VAT classifications

VAT payable:

Sales Sales Value (£) VAT Payable (£)

Standard Supplies 180600 17835.5

Exempt Supplies 25450 -

Zero Rated Supplies 30900 -

Exports 16946 -

Sales Book £ 18110.50

Less: Credit Note £ 275.00

Total £ 17835.50

Cash Book £ 960.50

EU Acquisitions £ 2110.00

Correction of error £ 175.69

Grand Total £ 21081.69

Input VAT:

Purchase Purchase Value (£) VAT Input (£)

Standard Supplies 75260 10325

Exempt Supplies 15620 -

6

For Input VAT:

Purchase Book £115680

Less: Credit Notes £ 1860

Total £ 113820

Cash Book £ 7950

Petty Cash Book £160

EU Acquisitions £ 23650

Bad Debt Relief £ 6960

Grand Total £ 152540

2.2 Relevant inputs and outputs using these VAT classifications

VAT payable:

Sales Sales Value (£) VAT Payable (£)

Standard Supplies 180600 17835.5

Exempt Supplies 25450 -

Zero Rated Supplies 30900 -

Exports 16946 -

Sales Book £ 18110.50

Less: Credit Note £ 275.00

Total £ 17835.50

Cash Book £ 960.50

EU Acquisitions £ 2110.00

Correction of error £ 175.69

Grand Total £ 21081.69

Input VAT:

Purchase Purchase Value (£) VAT Input (£)

Standard Supplies 75260 10325

Exempt Supplies 15620 -

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

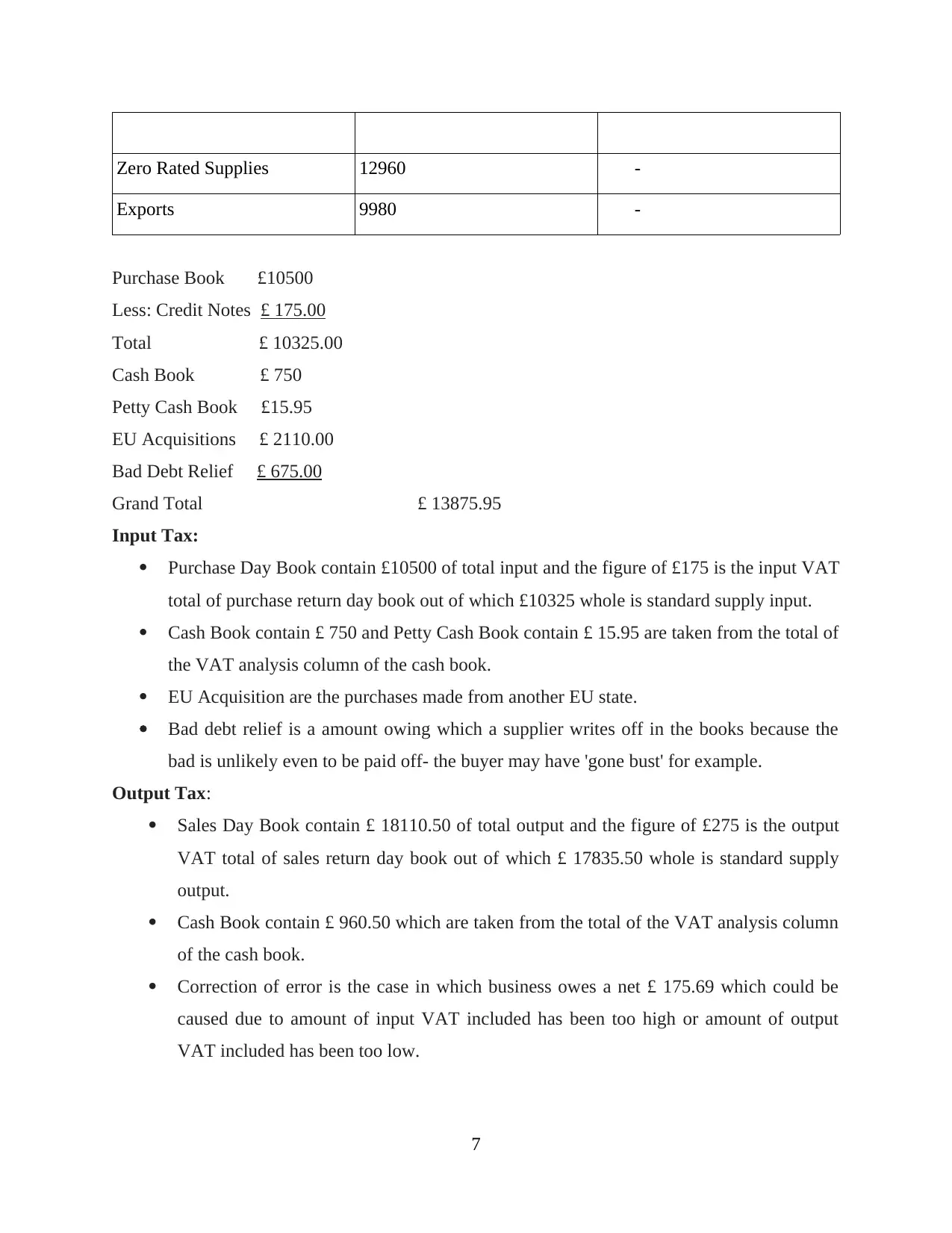

Zero Rated Supplies 12960 -

Exports 9980 -

Purchase Book £10500

Less: Credit Notes £ 175.00

Total £ 10325.00

Cash Book £ 750

Petty Cash Book £15.95

EU Acquisitions £ 2110.00

Bad Debt Relief £ 675.00

Grand Total £ 13875.95

Input Tax:

Purchase Day Book contain £10500 of total input and the figure of £175 is the input VAT

total of purchase return day book out of which £10325 whole is standard supply input.

Cash Book contain £ 750 and Petty Cash Book contain £ 15.95 are taken from the total of

the VAT analysis column of the cash book.

EU Acquisition are the purchases made from another EU state.

Bad debt relief is a amount owing which a supplier writes off in the books because the

bad is unlikely even to be paid off- the buyer may have 'gone bust' for example.

Output Tax:

Sales Day Book contain £ 18110.50 of total output and the figure of £275 is the output

VAT total of sales return day book out of which £ 17835.50 whole is standard supply

output.

Cash Book contain £ 960.50 which are taken from the total of the VAT analysis column

of the cash book.

Correction of error is the case in which business owes a net £ 175.69 which could be

caused due to amount of input VAT included has been too high or amount of output

VAT included has been too low.

7

Exports 9980 -

Purchase Book £10500

Less: Credit Notes £ 175.00

Total £ 10325.00

Cash Book £ 750

Petty Cash Book £15.95

EU Acquisitions £ 2110.00

Bad Debt Relief £ 675.00

Grand Total £ 13875.95

Input Tax:

Purchase Day Book contain £10500 of total input and the figure of £175 is the input VAT

total of purchase return day book out of which £10325 whole is standard supply input.

Cash Book contain £ 750 and Petty Cash Book contain £ 15.95 are taken from the total of

the VAT analysis column of the cash book.

EU Acquisition are the purchases made from another EU state.

Bad debt relief is a amount owing which a supplier writes off in the books because the

bad is unlikely even to be paid off- the buyer may have 'gone bust' for example.

Output Tax:

Sales Day Book contain £ 18110.50 of total output and the figure of £275 is the output

VAT total of sales return day book out of which £ 17835.50 whole is standard supply

output.

Cash Book contain £ 960.50 which are taken from the total of the VAT analysis column

of the cash book.

Correction of error is the case in which business owes a net £ 175.69 which could be

caused due to amount of input VAT included has been too high or amount of output

VAT included has been too low.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

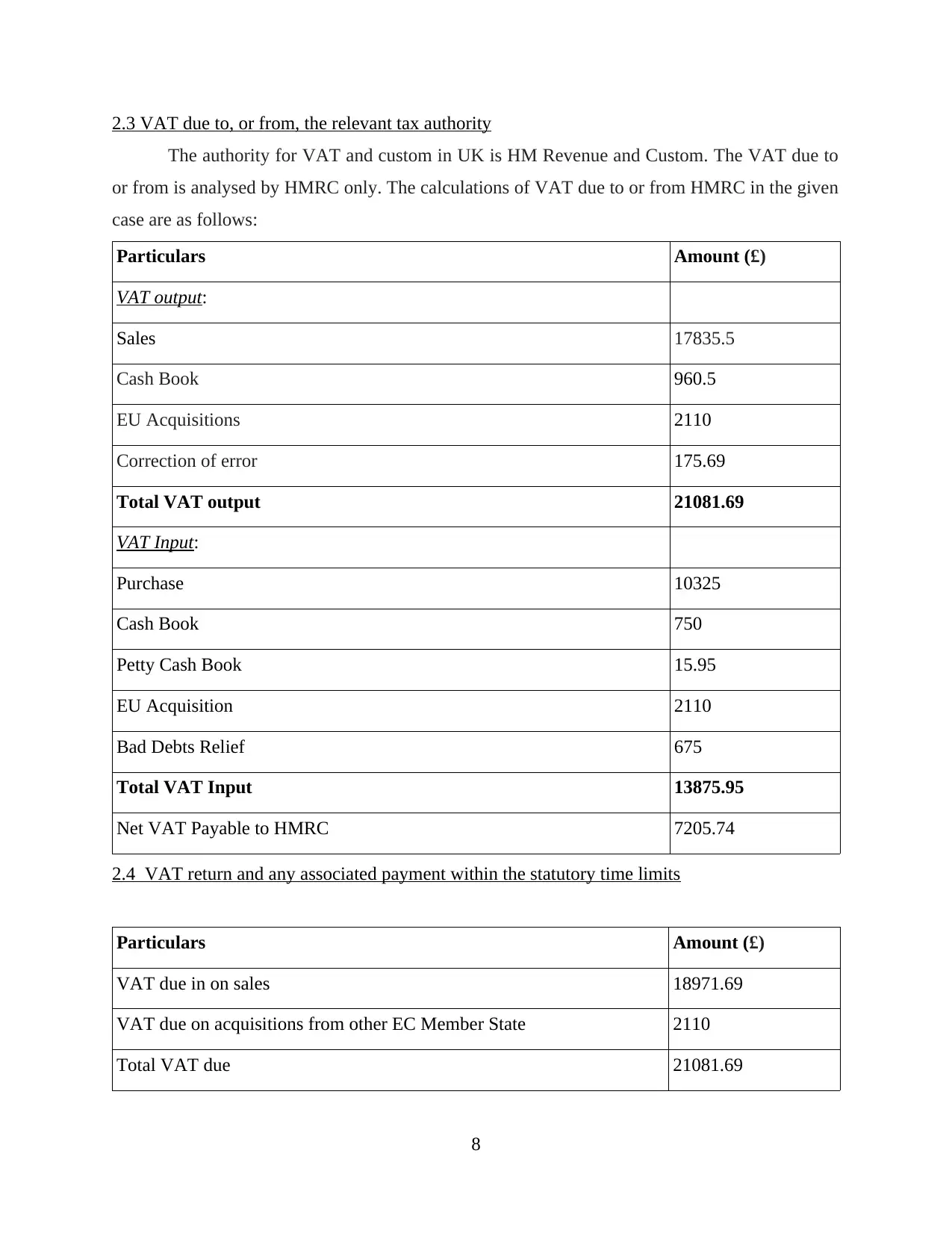

2.3 VAT due to, or from, the relevant tax authority

The authority for VAT and custom in UK is HM Revenue and Custom. The VAT due to

or from is analysed by HMRC only. The calculations of VAT due to or from HMRC in the given

case are as follows:

Particulars Amount (£)

VAT output:

Sales 17835.5

Cash Book 960.5

EU Acquisitions 2110

Correction of error 175.69

Total VAT output 21081.69

VAT Input:

Purchase 10325

Cash Book 750

Petty Cash Book 15.95

EU Acquisition 2110

Bad Debts Relief 675

Total VAT Input 13875.95

Net VAT Payable to HMRC 7205.74

2.4 VAT return and any associated payment within the statutory time limits

Particulars Amount (£)

VAT due in on sales 18971.69

VAT due on acquisitions from other EC Member State 2110

Total VAT due 21081.69

8

The authority for VAT and custom in UK is HM Revenue and Custom. The VAT due to

or from is analysed by HMRC only. The calculations of VAT due to or from HMRC in the given

case are as follows:

Particulars Amount (£)

VAT output:

Sales 17835.5

Cash Book 960.5

EU Acquisitions 2110

Correction of error 175.69

Total VAT output 21081.69

VAT Input:

Purchase 10325

Cash Book 750

Petty Cash Book 15.95

EU Acquisition 2110

Bad Debts Relief 675

Total VAT Input 13875.95

Net VAT Payable to HMRC 7205.74

2.4 VAT return and any associated payment within the statutory time limits

Particulars Amount (£)

VAT due in on sales 18971.69

VAT due on acquisitions from other EC Member State 2110

Total VAT due 21081.69

8

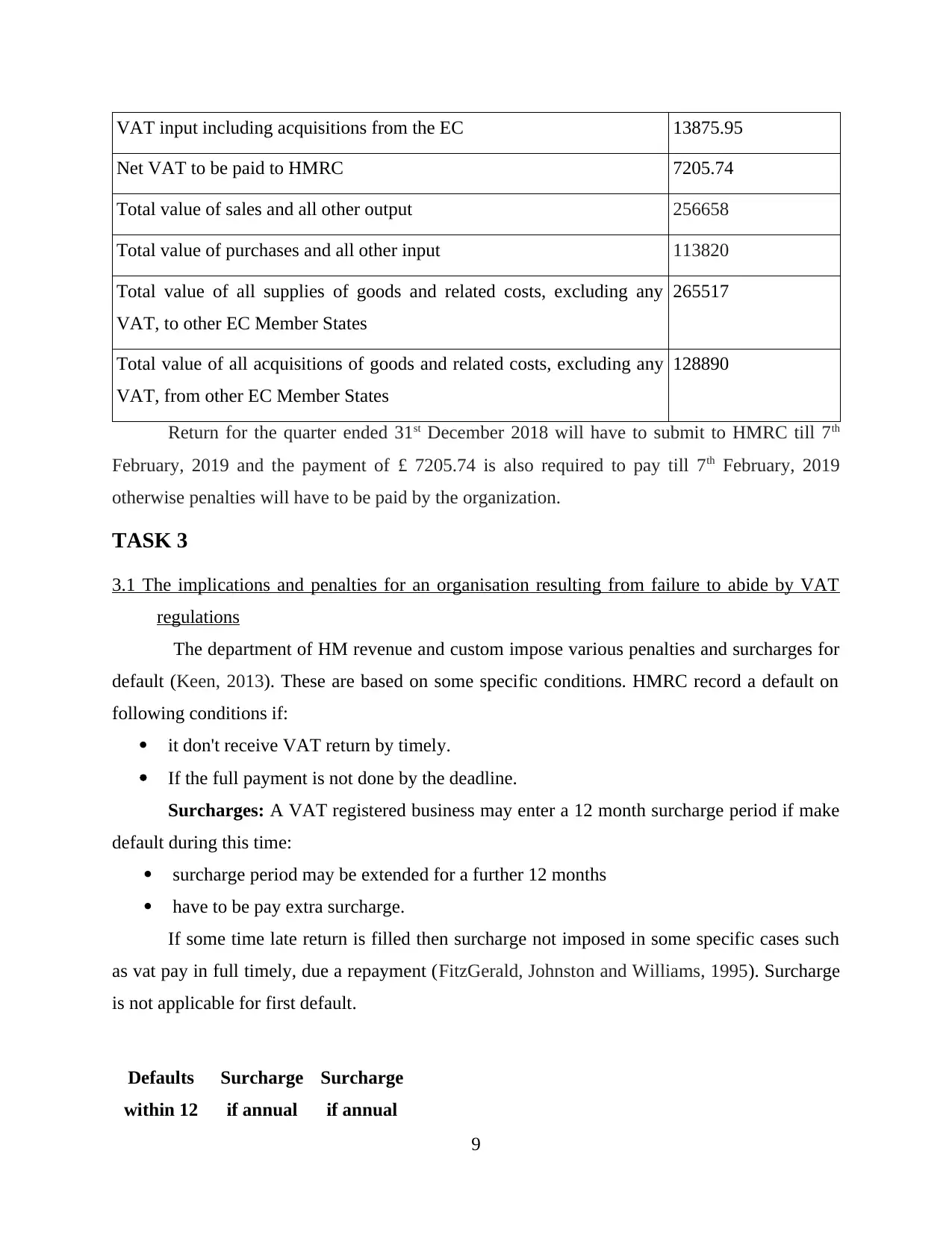

VAT input including acquisitions from the EC 13875.95

Net VAT to be paid to HMRC 7205.74

Total value of sales and all other output 256658

Total value of purchases and all other input 113820

Total value of all supplies of goods and related costs, excluding any

VAT, to other EC Member States

265517

Total value of all acquisitions of goods and related costs, excluding any

VAT, from other EC Member States

128890

Return for the quarter ended 31st December 2018 will have to submit to HMRC till 7th

February, 2019 and the payment of £ 7205.74 is also required to pay till 7th February, 2019

otherwise penalties will have to be paid by the organization.

TASK 3

3.1 The implications and penalties for an organisation resulting from failure to abide by VAT

regulations

The department of HM revenue and custom impose various penalties and surcharges for

default (Keen, 2013). These are based on some specific conditions. HMRC record a default on

following conditions if:

it don't receive VAT return by timely.

If the full payment is not done by the deadline.

Surcharges: A VAT registered business may enter a 12 month surcharge period if make

default during this time:

surcharge period may be extended for a further 12 months

have to be pay extra surcharge.

If some time late return is filled then surcharge not imposed in some specific cases such

as vat pay in full timely, due a repayment (FitzGerald, Johnston and Williams, 1995). Surcharge

is not applicable for first default.

Defaults

within 12

Surcharge

if annual

Surcharge

if annual

9

Net VAT to be paid to HMRC 7205.74

Total value of sales and all other output 256658

Total value of purchases and all other input 113820

Total value of all supplies of goods and related costs, excluding any

VAT, to other EC Member States

265517

Total value of all acquisitions of goods and related costs, excluding any

VAT, from other EC Member States

128890

Return for the quarter ended 31st December 2018 will have to submit to HMRC till 7th

February, 2019 and the payment of £ 7205.74 is also required to pay till 7th February, 2019

otherwise penalties will have to be paid by the organization.

TASK 3

3.1 The implications and penalties for an organisation resulting from failure to abide by VAT

regulations

The department of HM revenue and custom impose various penalties and surcharges for

default (Keen, 2013). These are based on some specific conditions. HMRC record a default on

following conditions if:

it don't receive VAT return by timely.

If the full payment is not done by the deadline.

Surcharges: A VAT registered business may enter a 12 month surcharge period if make

default during this time:

surcharge period may be extended for a further 12 months

have to be pay extra surcharge.

If some time late return is filled then surcharge not imposed in some specific cases such

as vat pay in full timely, due a repayment (FitzGerald, Johnston and Williams, 1995). Surcharge

is not applicable for first default.

Defaults

within 12

Surcharge

if annual

Surcharge

if annual

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.