Intel Corporation: Funding Proposal and Innovation Strategy

VerifiedAdded on 2023/01/13

|6

|986

|36

Report

AI Summary

This report focuses on Intel Corporation's strategic plan to expand its business by innovating cell phone processors. The introduction highlights the importance of continuous innovation in the dynamic business environment. The main body of the report addresses the crucial aspect of funding, exploring different sources like debt and equity, and emphasizes the need to analyze the most appropriate mix. It delves into the calculation of the Weighted Average Cost of Capital (WACC) for Intel, both currently and with the proposed capital structure for the innovation project. The report highlights that the company plans to raise funds through equity and bonds to maintain an optimal cost of capital, and discusses the financial implications of the expansion. The conclusion underscores the potential increase in market share and revenues due to the new innovation. The report includes references to academic journals and Intel's annual report to support its analysis.

PROPOSAL

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

CONCLUSION ...............................................................................................................................3

REFERENCES................................................................................................................................4

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

CONCLUSION ...............................................................................................................................3

REFERENCES................................................................................................................................4

INTRODUCTION

Present report is based on the Intel corporation. In this dynamic business environment

companies cannot survive bringing continuous innovations in its product and services. Company

performance is strong and is serving the industry from years successfully. In this project

company is planning to expand its business by bringing innovations for cell phone processors.

Previously company was producing processors for only computers and laptops. It has a brought a

new idea for making cell phone processors. This report covers the sources of funds and other

issues and challenges that will be faced.

MAIN BODY

The company for making investment and bringing new innovations requires funds. They

are the essential source for any project without this it could not be achieved. There are various

sources of funds available to an enterprise. Before raising the funds it is required to analyse the

most appropriate source i.e. debt or equity. Company can raise loans through both the sources

(Phills, Deiglmeier and Miller, 2018). It should have ensure that it is having the most

appropriate mix of debt and capital. It has to analyse the cost of capital before the investments

and that will be after raising funds from different sources. Weighted average cost of capital

should be such that the profits of company are not highly affected.

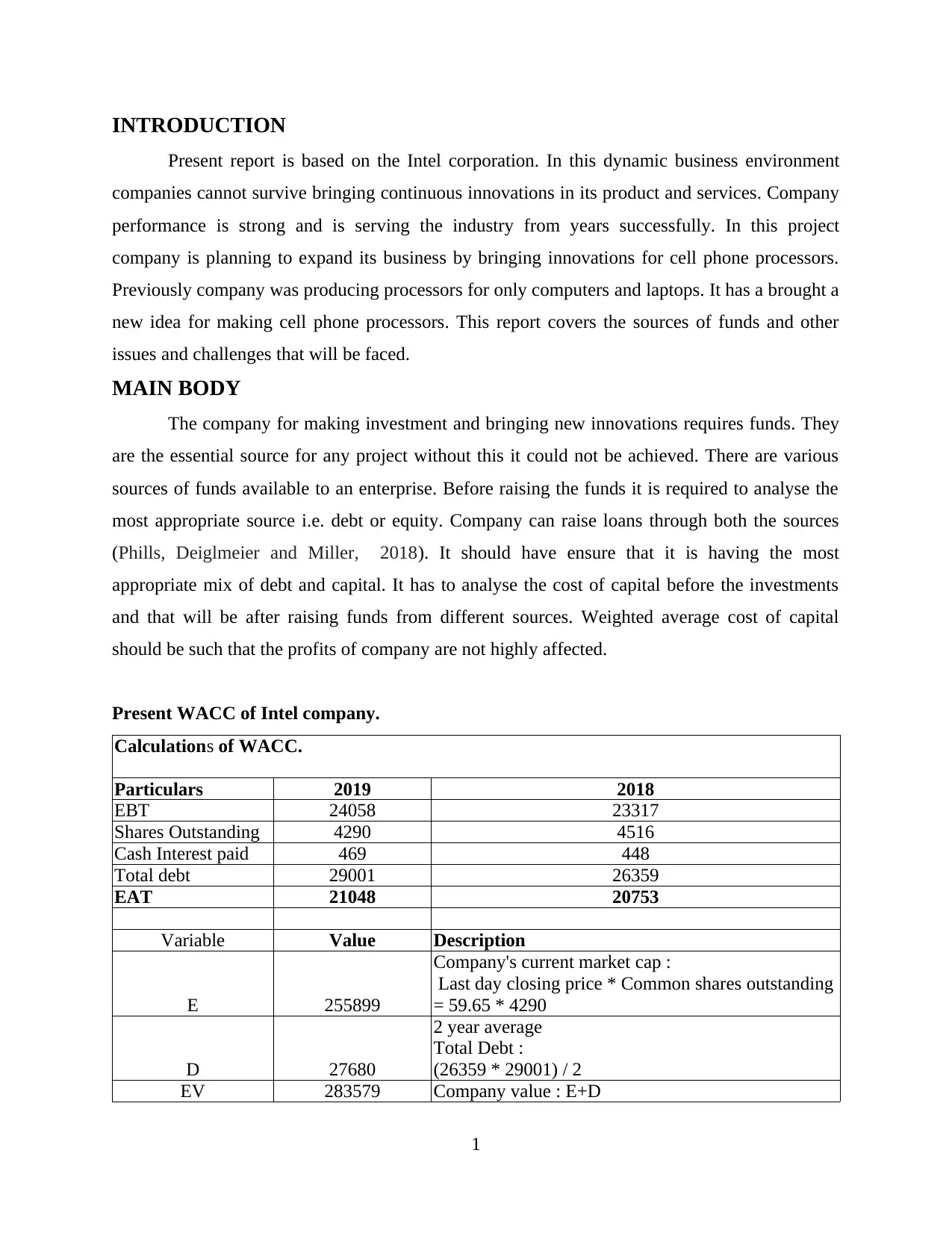

Present WACC of Intel company.

Calculations of WACC.

Particulars 2019 2018

EBT 24058 23317

Shares Outstanding 4290 4516

Cash Interest paid 469 448

Total debt 29001 26359

EAT 21048 20753

Variable Value Description

E 255899

Company's current market cap :

Last day closing price * Common shares outstanding

= 59.65 * 4290

D 27680

2 year average

Total Debt :

(26359 * 29001) / 2

EV 283579 Company value : E+D

1

Present report is based on the Intel corporation. In this dynamic business environment

companies cannot survive bringing continuous innovations in its product and services. Company

performance is strong and is serving the industry from years successfully. In this project

company is planning to expand its business by bringing innovations for cell phone processors.

Previously company was producing processors for only computers and laptops. It has a brought a

new idea for making cell phone processors. This report covers the sources of funds and other

issues and challenges that will be faced.

MAIN BODY

The company for making investment and bringing new innovations requires funds. They

are the essential source for any project without this it could not be achieved. There are various

sources of funds available to an enterprise. Before raising the funds it is required to analyse the

most appropriate source i.e. debt or equity. Company can raise loans through both the sources

(Phills, Deiglmeier and Miller, 2018). It should have ensure that it is having the most

appropriate mix of debt and capital. It has to analyse the cost of capital before the investments

and that will be after raising funds from different sources. Weighted average cost of capital

should be such that the profits of company are not highly affected.

Present WACC of Intel company.

Calculations of WACC.

Particulars 2019 2018

EBT 24058 23317

Shares Outstanding 4290 4516

Cash Interest paid 469 448

Total debt 29001 26359

EAT 21048 20753

Variable Value Description

E 255899

Company's current market cap :

Last day closing price * Common shares outstanding

= 59.65 * 4290

D 27680

2 year average

Total Debt :

(26359 * 29001) / 2

EV 283579 Company value : E+D

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

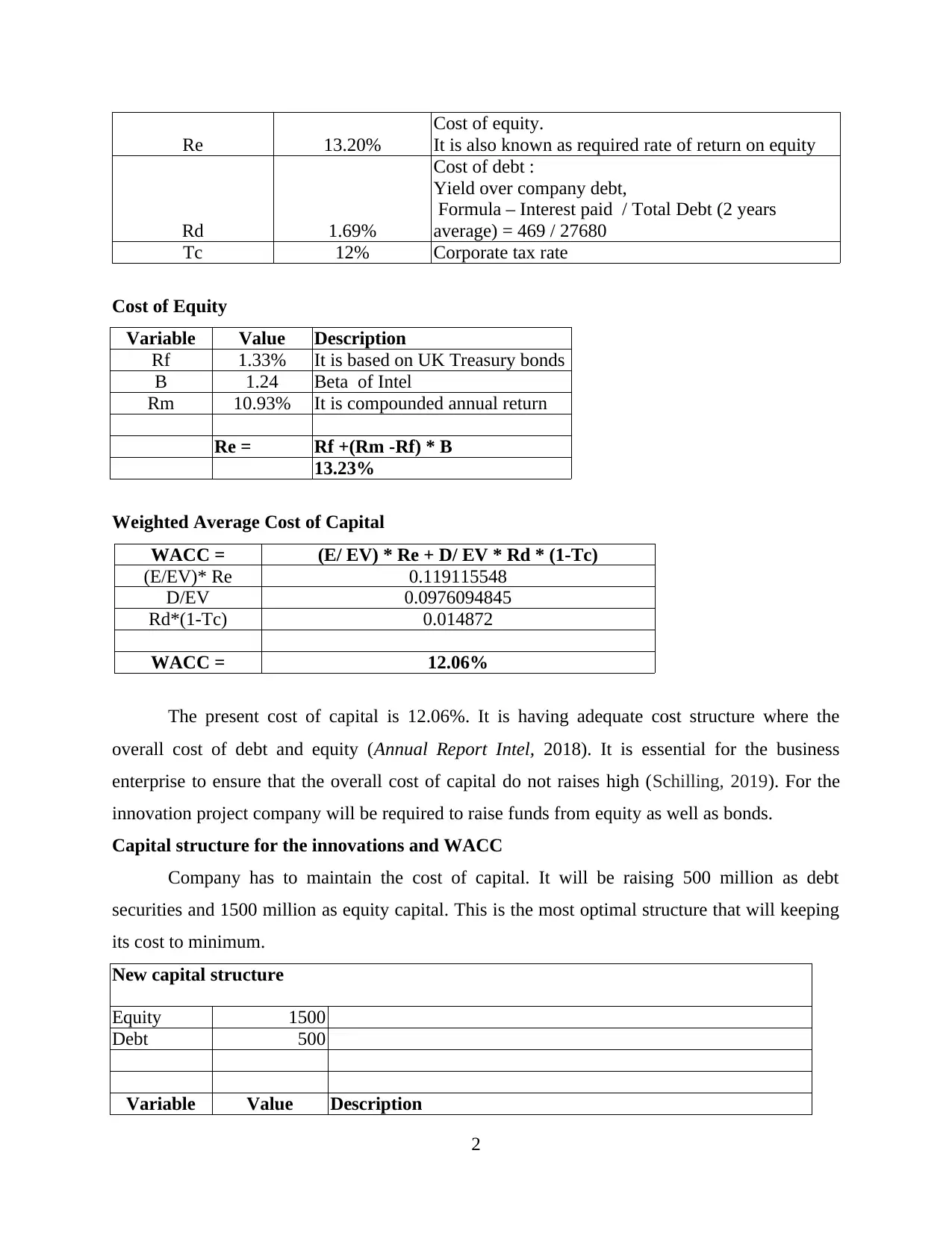

Re 13.20%

Cost of equity.

It is also known as required rate of return on equity

Rd 1.69%

Cost of debt :

Yield over company debt,

Formula – Interest paid / Total Debt (2 years

average) = 469 / 27680

Tc 12% Corporate tax rate

Cost of Equity

Variable Value Description

Rf 1.33% It is based on UK Treasury bonds

B 1.24 Beta of Intel

Rm 10.93% It is compounded annual return

Re = Rf +(Rm -Rf) * B

13.23%

Weighted Average Cost of Capital

WACC = (E/ EV) * Re + D/ EV * Rd * (1-Tc)

(E/EV)* Re 0.119115548

D/EV 0.0976094845

Rd*(1-Tc) 0.014872

WACC = 12.06%

The present cost of capital is 12.06%. It is having adequate cost structure where the

overall cost of debt and equity (Annual Report Intel, 2018). It is essential for the business

enterprise to ensure that the overall cost of capital do not raises high (Schilling, 2019). For the

innovation project company will be required to raise funds from equity as well as bonds.

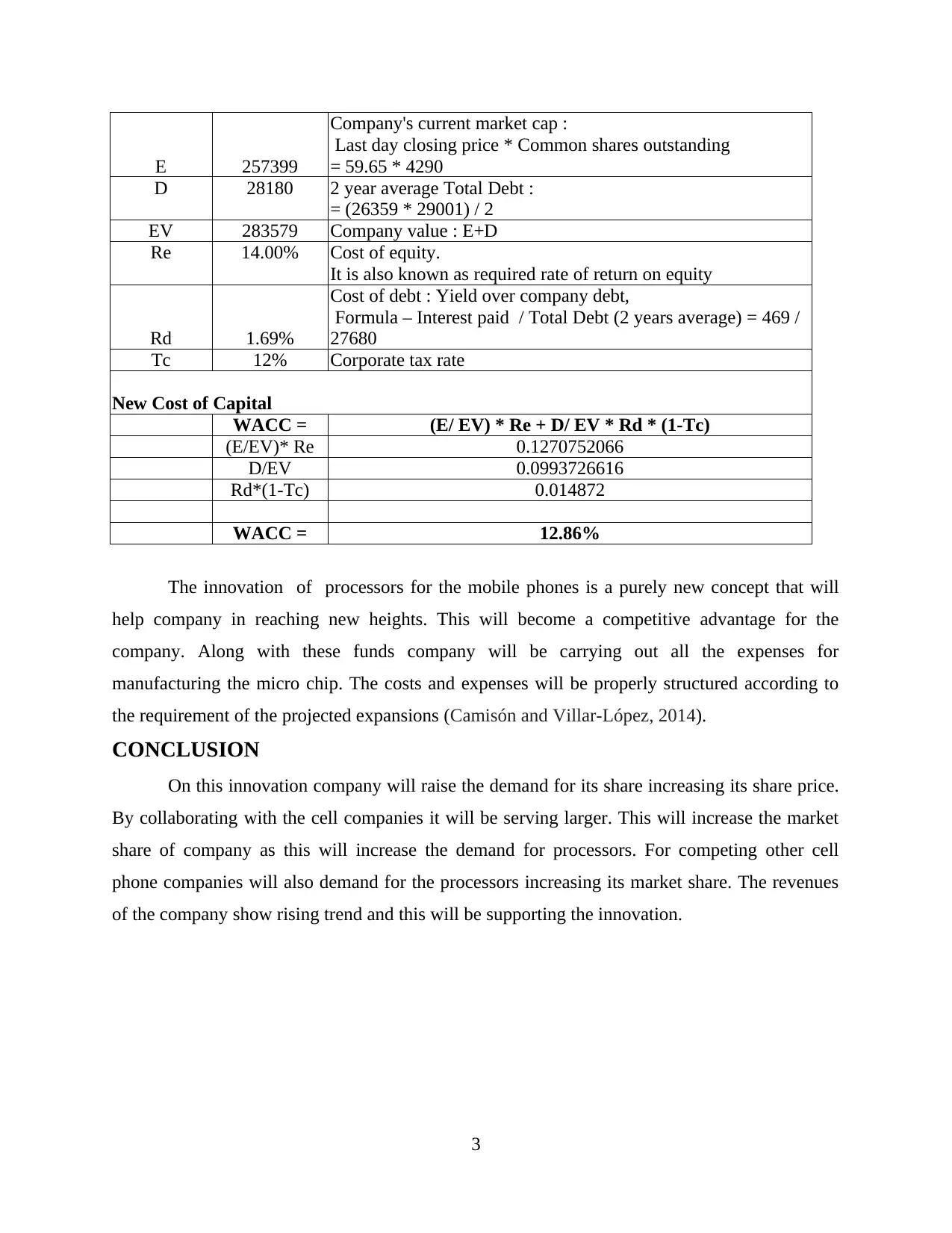

Capital structure for the innovations and WACC

Company has to maintain the cost of capital. It will be raising 500 million as debt

securities and 1500 million as equity capital. This is the most optimal structure that will keeping

its cost to minimum.

New capital structure

Equity 1500

Debt 500

Variable Value Description

2

Cost of equity.

It is also known as required rate of return on equity

Rd 1.69%

Cost of debt :

Yield over company debt,

Formula – Interest paid / Total Debt (2 years

average) = 469 / 27680

Tc 12% Corporate tax rate

Cost of Equity

Variable Value Description

Rf 1.33% It is based on UK Treasury bonds

B 1.24 Beta of Intel

Rm 10.93% It is compounded annual return

Re = Rf +(Rm -Rf) * B

13.23%

Weighted Average Cost of Capital

WACC = (E/ EV) * Re + D/ EV * Rd * (1-Tc)

(E/EV)* Re 0.119115548

D/EV 0.0976094845

Rd*(1-Tc) 0.014872

WACC = 12.06%

The present cost of capital is 12.06%. It is having adequate cost structure where the

overall cost of debt and equity (Annual Report Intel, 2018). It is essential for the business

enterprise to ensure that the overall cost of capital do not raises high (Schilling, 2019). For the

innovation project company will be required to raise funds from equity as well as bonds.

Capital structure for the innovations and WACC

Company has to maintain the cost of capital. It will be raising 500 million as debt

securities and 1500 million as equity capital. This is the most optimal structure that will keeping

its cost to minimum.

New capital structure

Equity 1500

Debt 500

Variable Value Description

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

E 257399

Company's current market cap :

Last day closing price * Common shares outstanding

= 59.65 * 4290

D 28180 2 year average Total Debt :

= (26359 * 29001) / 2

EV 283579 Company value : E+D

Re 14.00% Cost of equity.

It is also known as required rate of return on equity

Rd 1.69%

Cost of debt : Yield over company debt,

Formula – Interest paid / Total Debt (2 years average) = 469 /

27680

Tc 12% Corporate tax rate

New Cost of Capital

WACC = (E/ EV) * Re + D/ EV * Rd * (1-Tc)

(E/EV)* Re 0.1270752066

D/EV 0.0993726616

Rd*(1-Tc) 0.014872

WACC = 12.86%

The innovation of processors for the mobile phones is a purely new concept that will

help company in reaching new heights. This will become a competitive advantage for the

company. Along with these funds company will be carrying out all the expenses for

manufacturing the micro chip. The costs and expenses will be properly structured according to

the requirement of the projected expansions (Camisón and Villar-López, 2014).

CONCLUSION

On this innovation company will raise the demand for its share increasing its share price.

By collaborating with the cell companies it will be serving larger. This will increase the market

share of company as this will increase the demand for processors. For competing other cell

phone companies will also demand for the processors increasing its market share. The revenues

of the company show rising trend and this will be supporting the innovation.

3

Company's current market cap :

Last day closing price * Common shares outstanding

= 59.65 * 4290

D 28180 2 year average Total Debt :

= (26359 * 29001) / 2

EV 283579 Company value : E+D

Re 14.00% Cost of equity.

It is also known as required rate of return on equity

Rd 1.69%

Cost of debt : Yield over company debt,

Formula – Interest paid / Total Debt (2 years average) = 469 /

27680

Tc 12% Corporate tax rate

New Cost of Capital

WACC = (E/ EV) * Re + D/ EV * Rd * (1-Tc)

(E/EV)* Re 0.1270752066

D/EV 0.0993726616

Rd*(1-Tc) 0.014872

WACC = 12.86%

The innovation of processors for the mobile phones is a purely new concept that will

help company in reaching new heights. This will become a competitive advantage for the

company. Along with these funds company will be carrying out all the expenses for

manufacturing the micro chip. The costs and expenses will be properly structured according to

the requirement of the projected expansions (Camisón and Villar-López, 2014).

CONCLUSION

On this innovation company will raise the demand for its share increasing its share price.

By collaborating with the cell companies it will be serving larger. This will increase the market

share of company as this will increase the demand for processors. For competing other cell

phone companies will also demand for the processors increasing its market share. The revenues

of the company show rising trend and this will be supporting the innovation.

3

REFERENCES

Books and Journals

Phills, J.A., Deiglmeier, K. and Miller, D.T., 2018. Rediscovering social innovation. Stanford

Social Innovation Review. 6(4). pp.34-43.

Schilling, M.A., 2019. Strategic management of technological innovation. Tata McGraw-Hill

Education.

Camisón, C. and Villar-López, A., 2014. Organizational innovation as an enabler of

technological innovation capabilities and firm performance. Journal of business

research. 67(1). pp.2891-2902.

Online

Annual Report Intel. 2018. [Online]. Available through :

<https://s21.q4cdn.com/600692695/files/doc_financials/2018/Annual/Intel-2018-Annual-

Report_INTC.pdf>.

4

Books and Journals

Phills, J.A., Deiglmeier, K. and Miller, D.T., 2018. Rediscovering social innovation. Stanford

Social Innovation Review. 6(4). pp.34-43.

Schilling, M.A., 2019. Strategic management of technological innovation. Tata McGraw-Hill

Education.

Camisón, C. and Villar-López, A., 2014. Organizational innovation as an enabler of

technological innovation capabilities and firm performance. Journal of business

research. 67(1). pp.2891-2902.

Online

Annual Report Intel. 2018. [Online]. Available through :

<https://s21.q4cdn.com/600692695/files/doc_financials/2018/Annual/Intel-2018-Annual-

Report_INTC.pdf>.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.