Intermediate Accounting-I Assignment 1 Solution for Bremeur Corp.

VerifiedAdded on 2022/10/18

|5

|593

|13

Homework Assignment

AI Summary

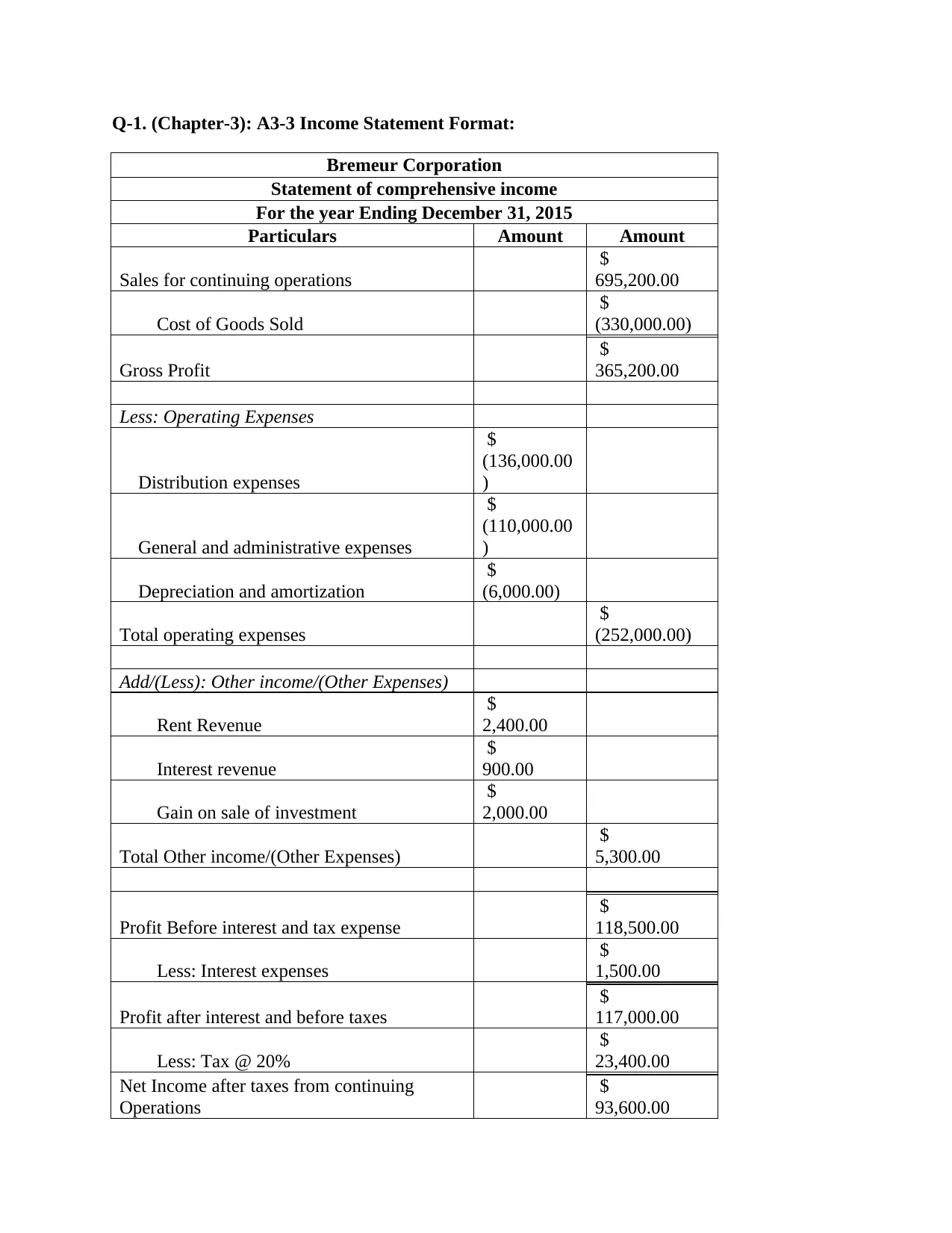

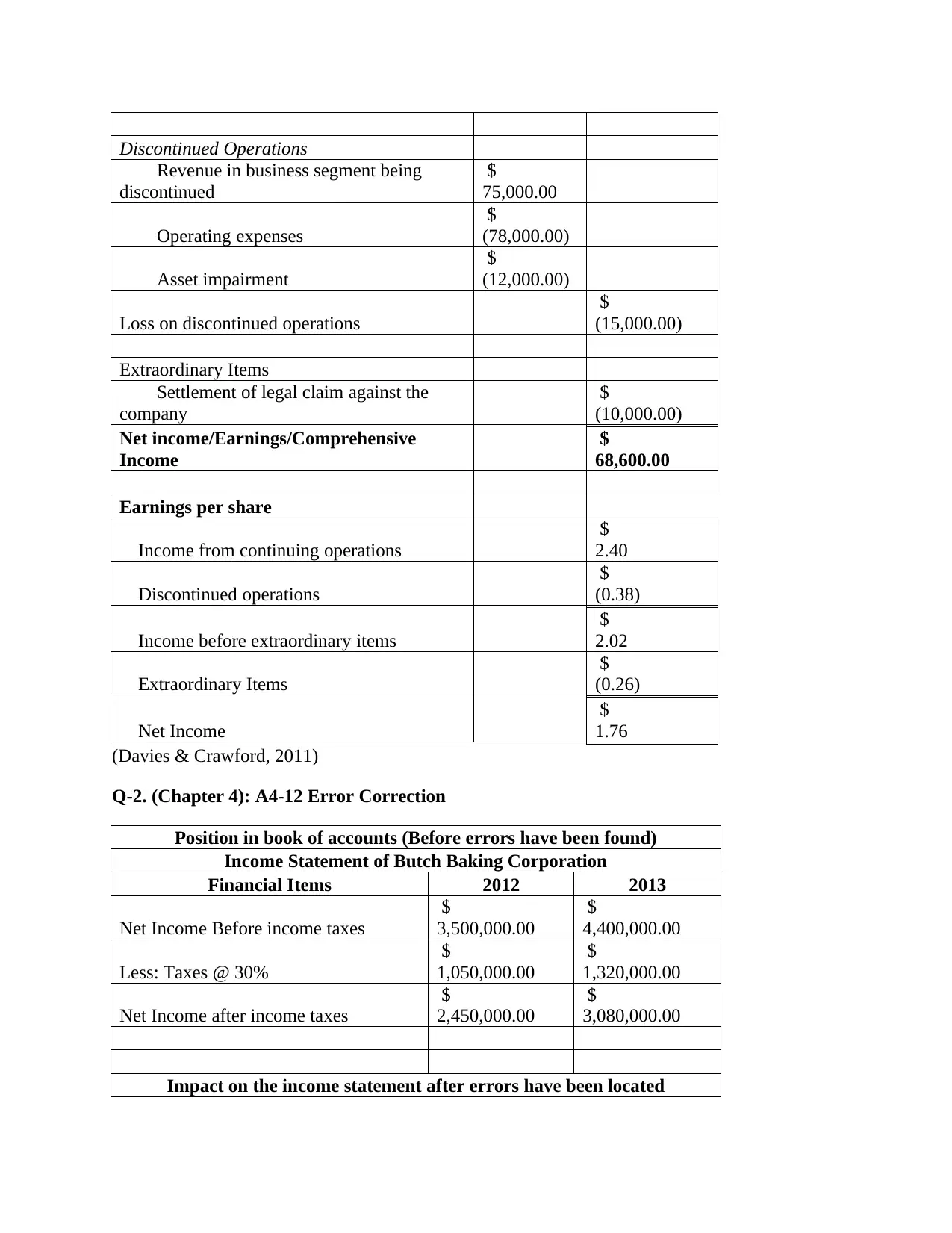

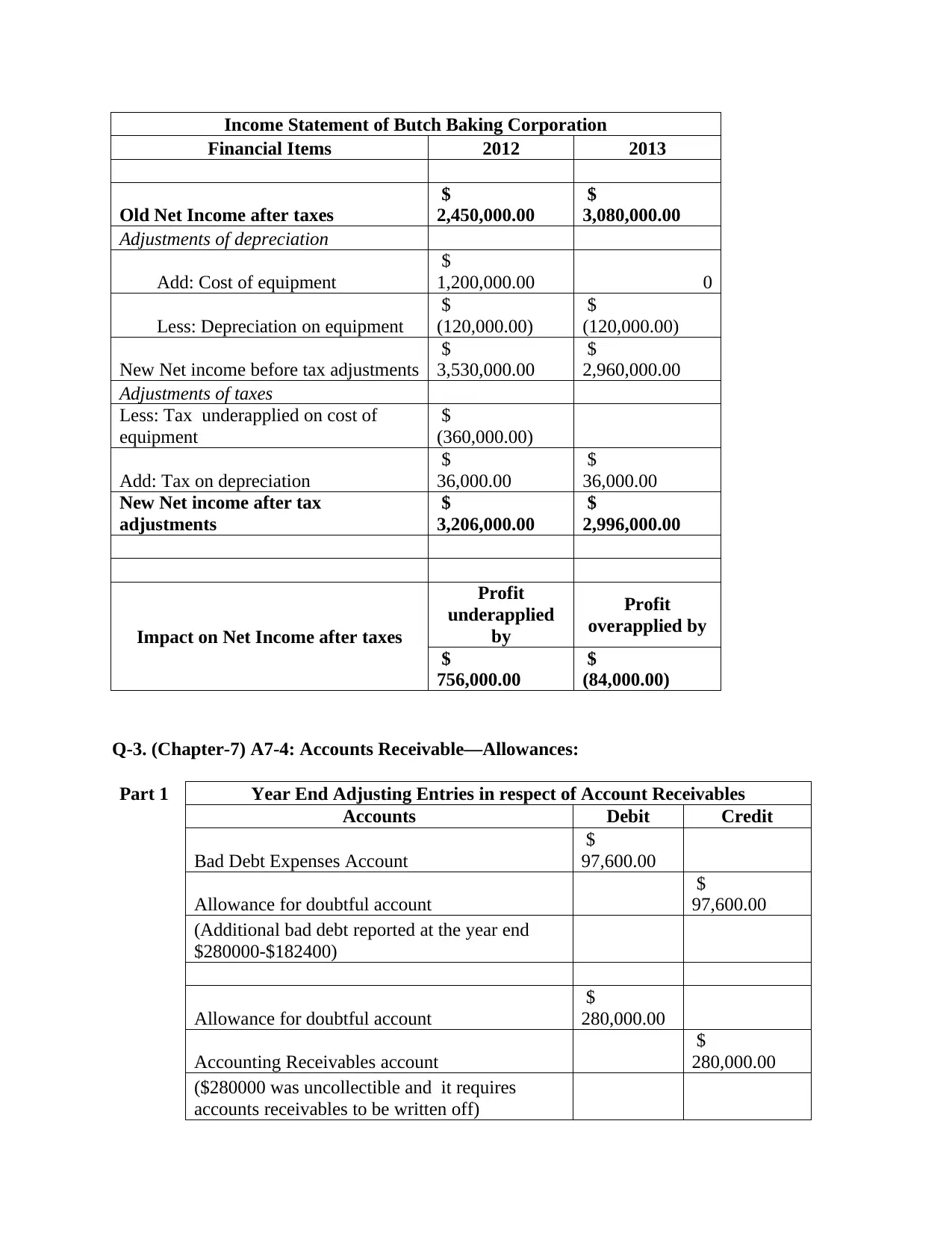

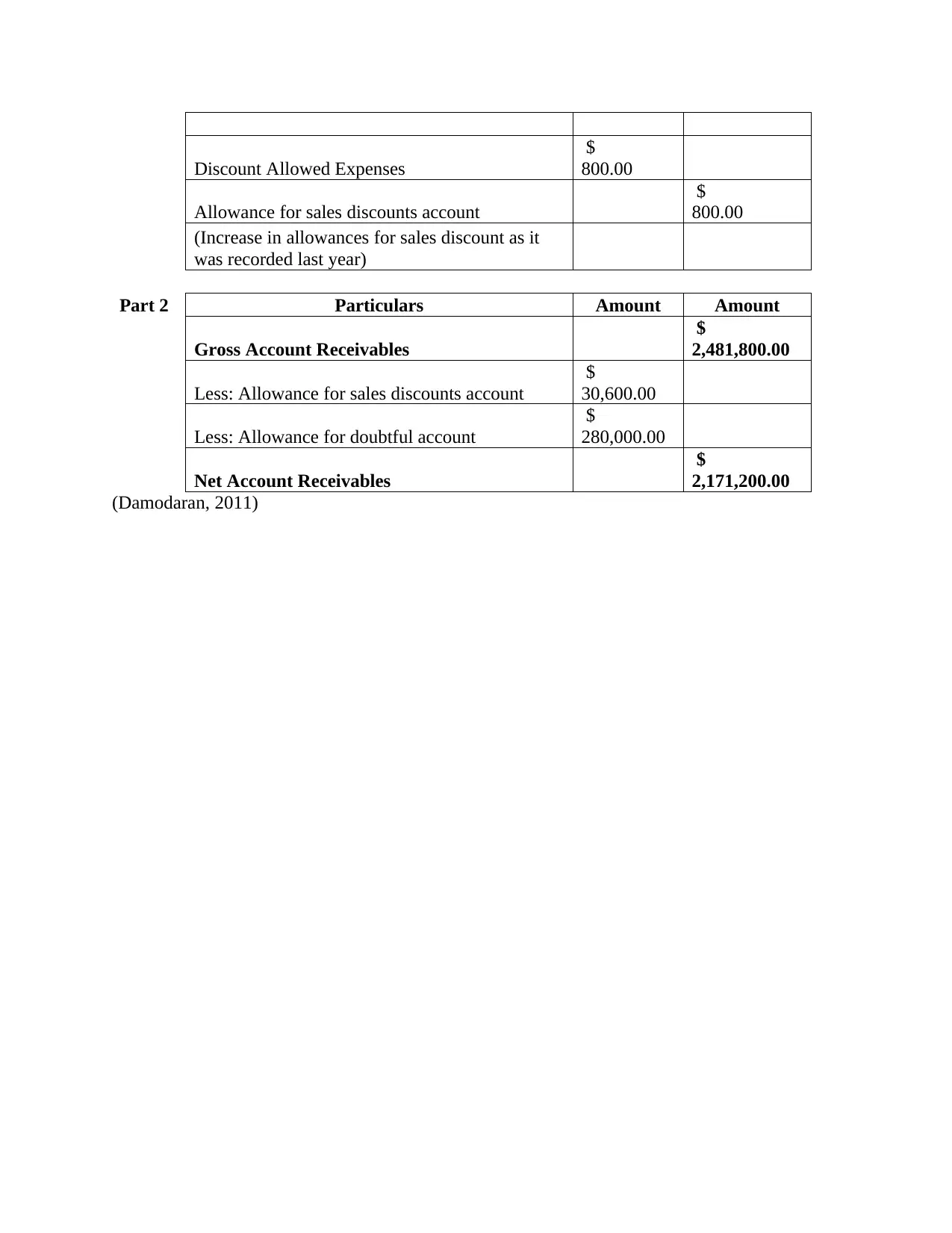

This document presents the complete solutions for Intermediate Accounting-I Assignment 1. The assignment covers three key areas of financial accounting. Question 1 focuses on the preparation of a comprehensive income statement for Bremeur Corporation, including the calculation of earnings per share, and proper classification of items like discontinued operations and extraordinary items. Question 2 deals with error correction within the income statement of Butch Baking Corporation, analyzing the impact of depreciation and tax adjustments on net income for 2012 and 2013. Finally, Question 3 addresses the accounting treatment of accounts receivable, specifically the year-end adjusting entries for bad debt expenses, allowance for doubtful accounts, and sales discounts, including the calculation of net accounts receivables.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)