International Accounting Standards & Financial Reporting Analysis

VerifiedAdded on 2023/06/03

|7

|648

|399

Report

AI Summary

This report provides an analysis of international accounting practices, focusing on consolidated income statements, financial statement analysis, and equity. It examines key elements such as fair value adjustments, resource employment, and retained earnings, referencing the annual report of a major company. The analysis includes a review of changes in retained earnings, dividend payments, and other comprehensive income, offering insights into the financial health and reporting practices of international corporations. Desklib offers more solved assignments and resources for students.

INTERNATIONAL ACCOUNTING 1

INTERNATIONAL

ACCOUNTING

INTERNATIONAL

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL ACCOUNTING 2

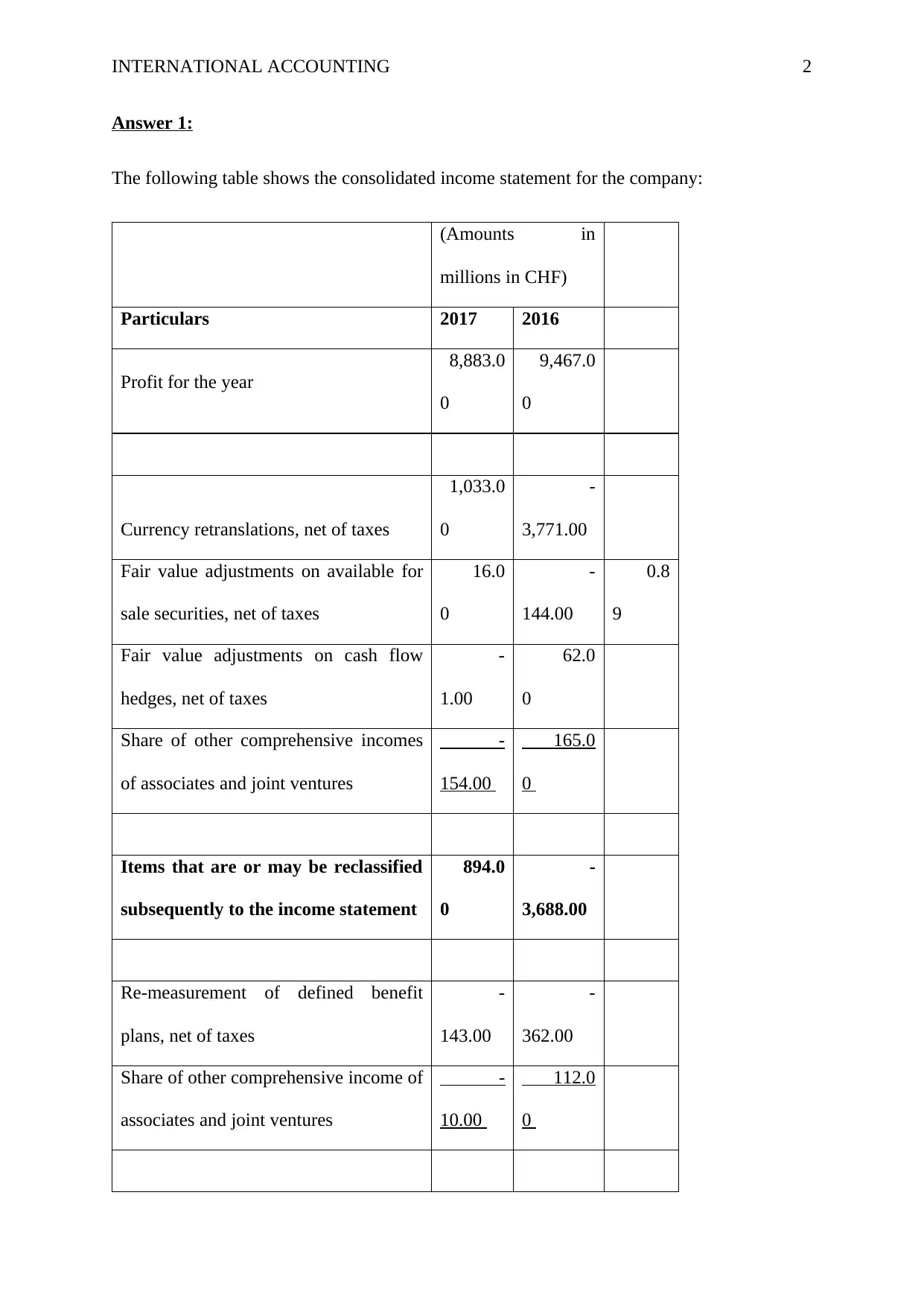

Answer 1:

The following table shows the consolidated income statement for the company:

(Amounts in

millions in CHF)

Particulars 2017 2016

Profit for the year

8,883.0

0

9,467.0

0

Currency retranslations, net of taxes

1,033.0

0

-

3,771.00

Fair value adjustments on available for

sale securities, net of taxes

16.0

0

-

144.00

0.8

9

Fair value adjustments on cash flow

hedges, net of taxes

-

1.00

62.0

0

Share of other comprehensive incomes

of associates and joint ventures

-

154.00

165.0

0

Items that are or may be reclassified

subsequently to the income statement

894.0

0

-

3,688.00

Re-measurement of defined benefit

plans, net of taxes

-

143.00

-

362.00

Share of other comprehensive income of

associates and joint ventures

-

10.00

112.0

0

Answer 1:

The following table shows the consolidated income statement for the company:

(Amounts in

millions in CHF)

Particulars 2017 2016

Profit for the year

8,883.0

0

9,467.0

0

Currency retranslations, net of taxes

1,033.0

0

-

3,771.00

Fair value adjustments on available for

sale securities, net of taxes

16.0

0

-

144.00

0.8

9

Fair value adjustments on cash flow

hedges, net of taxes

-

1.00

62.0

0

Share of other comprehensive incomes

of associates and joint ventures

-

154.00

165.0

0

Items that are or may be reclassified

subsequently to the income statement

894.0

0

-

3,688.00

Re-measurement of defined benefit

plans, net of taxes

-

143.00

-

362.00

Share of other comprehensive income of

associates and joint ventures

-

10.00

112.0

0

INTERNATIONAL ACCOUNTING 3

Items that may never be reclassified

in the income of associates or joint

ventures

-

153.00

-

250.00

Other comprehensive income for the

year

9,624.0

0

5,529.0

0

From the above, I would choose the fair value adjustments on the available for sale securities,

net of taxes. This is because these are the investments that are purchased by the company for

investment purposes. These are the securities that could be sold by the company at any point

of time. This just means that the company would earn a gain or loss if it goes into the market

and sells this investment or the security.

The stated item has undergone a change to the tune of 89%. This merely means that during

the year of 2015, the company had earned a loss on its securities which could be due to the

decrease in the value of that’s security and in the eyar 2016, the company ahs earned an

unrelaised gain on those securities or invetsments.

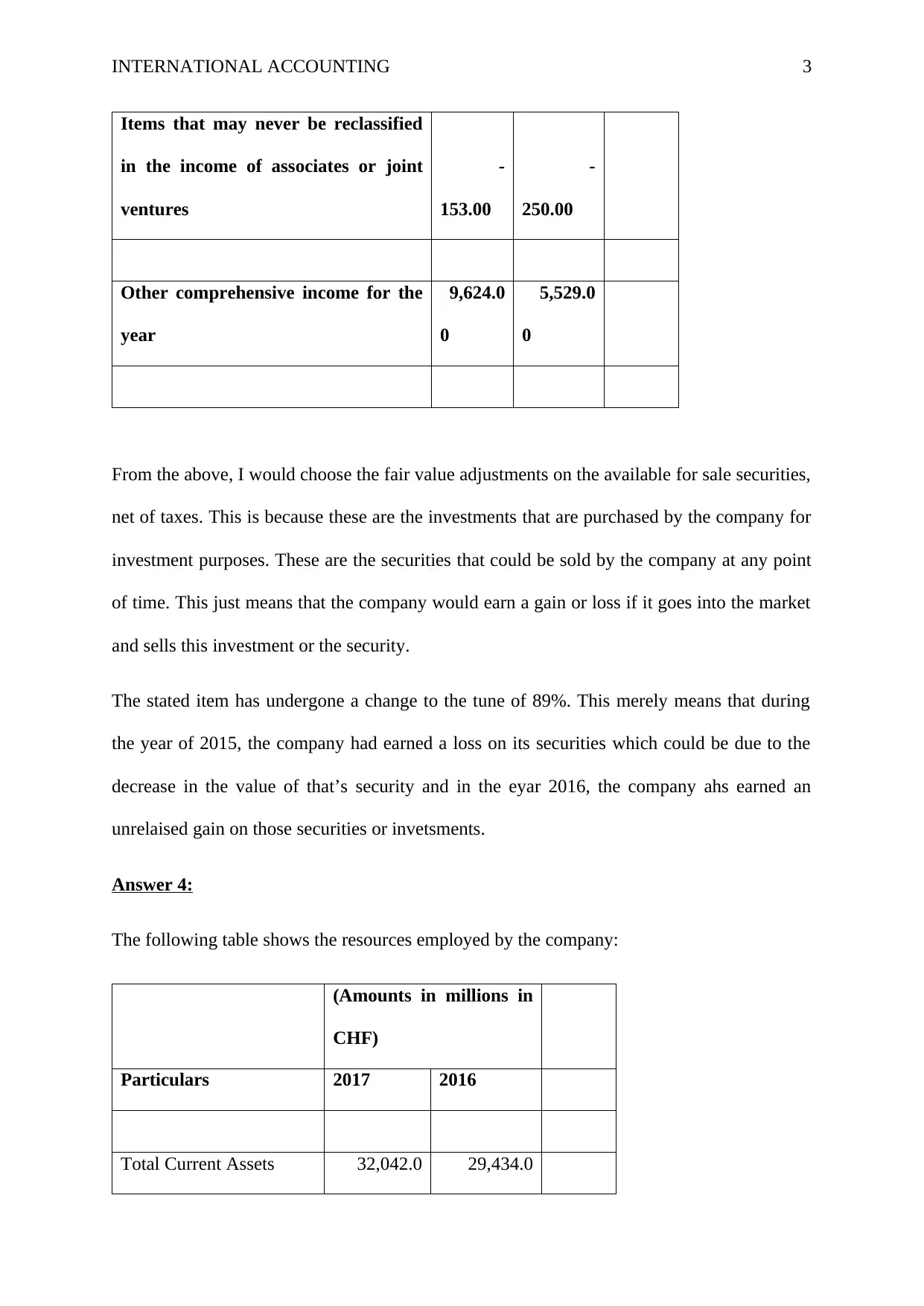

Answer 4:

The following table shows the resources employed by the company:

(Amounts in millions in

CHF)

Particulars 2017 2016

Total Current Assets 32,042.0 29,434.0

Items that may never be reclassified

in the income of associates or joint

ventures

-

153.00

-

250.00

Other comprehensive income for the

year

9,624.0

0

5,529.0

0

From the above, I would choose the fair value adjustments on the available for sale securities,

net of taxes. This is because these are the investments that are purchased by the company for

investment purposes. These are the securities that could be sold by the company at any point

of time. This just means that the company would earn a gain or loss if it goes into the market

and sells this investment or the security.

The stated item has undergone a change to the tune of 89%. This merely means that during

the year of 2015, the company had earned a loss on its securities which could be due to the

decrease in the value of that’s security and in the eyar 2016, the company ahs earned an

unrelaised gain on those securities or invetsments.

Answer 4:

The following table shows the resources employed by the company:

(Amounts in millions in

CHF)

Particulars 2017 2016

Total Current Assets 32,042.0 29,434.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTERNATIONAL ACCOUNTING 4

0 0

Total Non-current assets

99,859.0

0

94,558.0

0

Total assets

1,31,901.0

0

1,23,992.0

0

Current liabilities

37,517.0

0

33,321.0

0

Total non-current

liabilities

28,403.0

0

26,685.0

0

Shareholders equity

65,981.0

0

63,988.0

0

Total liabilities and

shareholders equity

1,31,901.0

0

1,23,994.0

0

The company has employed the total resources of an amount of CHF 131901 million.

The following is the desired accounting equation:

Assets

Equal

s

Shareholde

rs equity Plus

Liabiliti

es

1,31,901.0 65,981.00 65,920.0

0 0

Total Non-current assets

99,859.0

0

94,558.0

0

Total assets

1,31,901.0

0

1,23,992.0

0

Current liabilities

37,517.0

0

33,321.0

0

Total non-current

liabilities

28,403.0

0

26,685.0

0

Shareholders equity

65,981.0

0

63,988.0

0

Total liabilities and

shareholders equity

1,31,901.0

0

1,23,994.0

0

The company has employed the total resources of an amount of CHF 131901 million.

The following is the desired accounting equation:

Assets

Equal

s

Shareholde

rs equity Plus

Liabiliti

es

1,31,901.0 65,981.00 65,920.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL ACCOUNTING 5

0 0

1,31,901.0

0 1,31,901.00

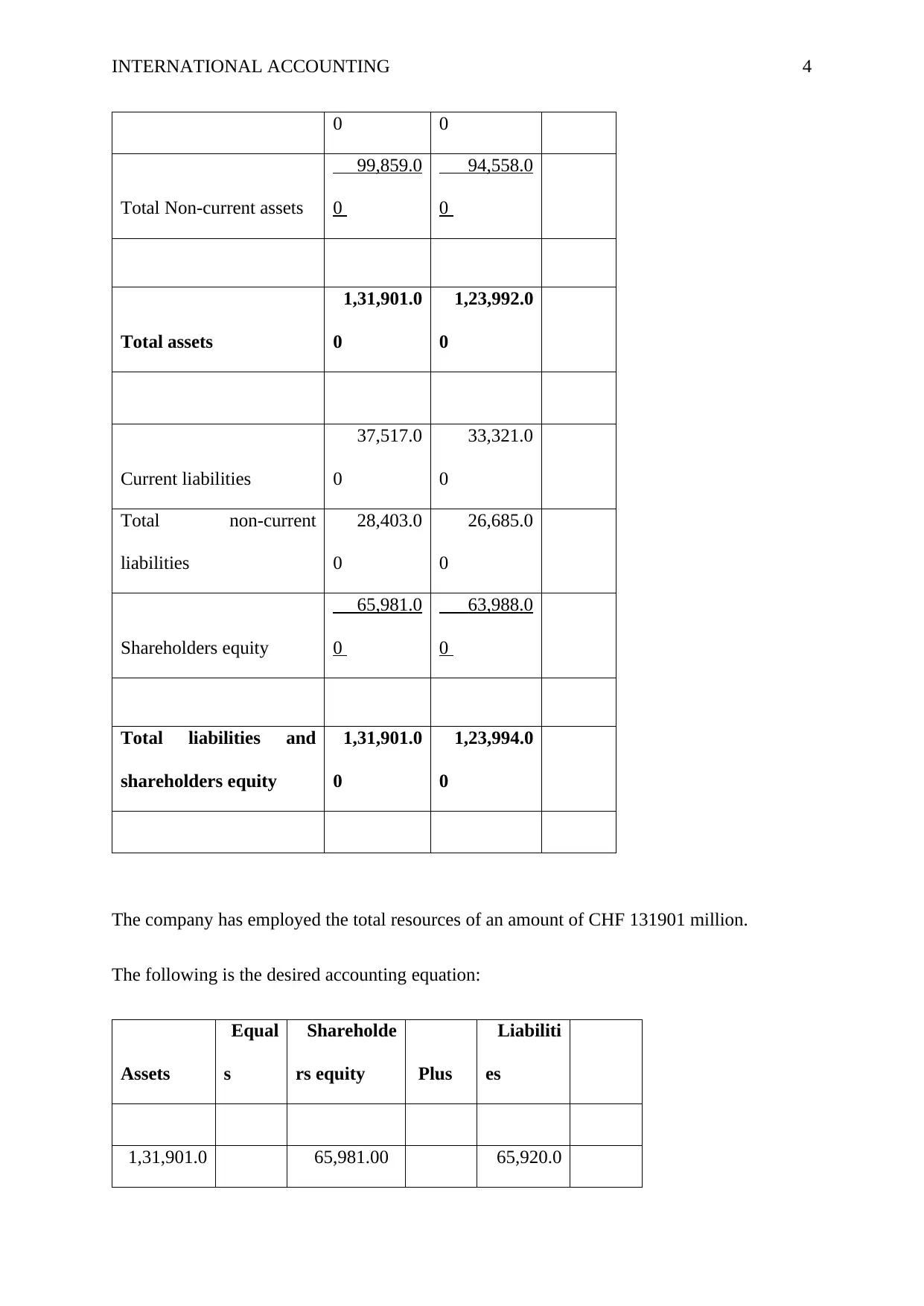

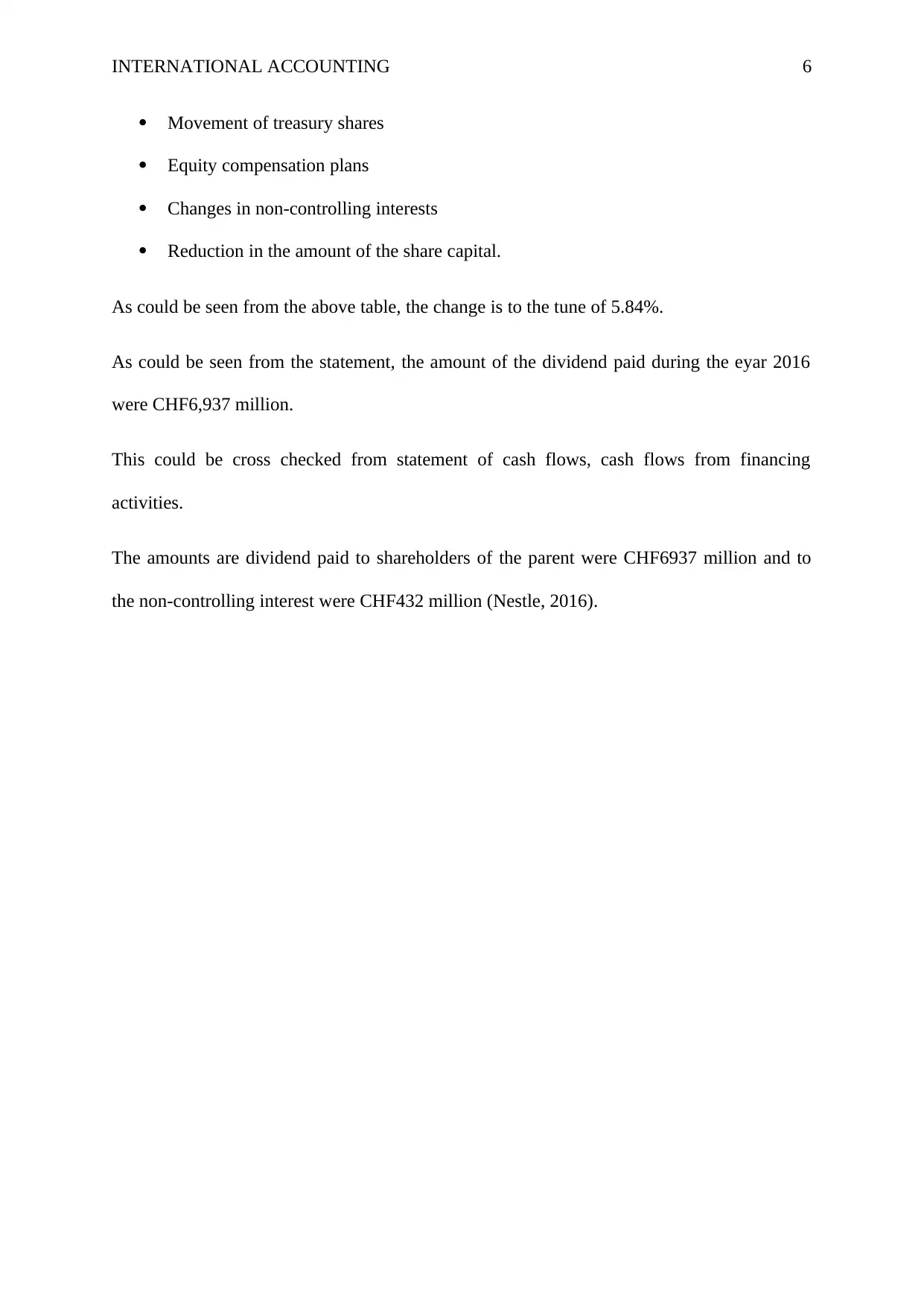

Answer 5:

The following statement shows the retained earnings section of the statement of changes in

equity:

(Amounts in millions

in CHF)

Particulars 2017 2016

Retained

earnings

82,870.0

0

88,014.0

0 5.84%

The amounts as on December 31, 2017 were CHF 82,870 while the same as on December 31,

2016 were CHF 88,014.

The change is mainly due to the following factors:

Profit for the year

Other comprehensive income for the year

Dividends

0 0

1,31,901.0

0 1,31,901.00

Answer 5:

The following statement shows the retained earnings section of the statement of changes in

equity:

(Amounts in millions

in CHF)

Particulars 2017 2016

Retained

earnings

82,870.0

0

88,014.0

0 5.84%

The amounts as on December 31, 2017 were CHF 82,870 while the same as on December 31,

2016 were CHF 88,014.

The change is mainly due to the following factors:

Profit for the year

Other comprehensive income for the year

Dividends

INTERNATIONAL ACCOUNTING 6

Movement of treasury shares

Equity compensation plans

Changes in non-controlling interests

Reduction in the amount of the share capital.

As could be seen from the above table, the change is to the tune of 5.84%.

As could be seen from the statement, the amount of the dividend paid during the eyar 2016

were CHF6,937 million.

This could be cross checked from statement of cash flows, cash flows from financing

activities.

The amounts are dividend paid to shareholders of the parent were CHF6937 million and to

the non-controlling interest were CHF432 million (Nestle, 2016).

Movement of treasury shares

Equity compensation plans

Changes in non-controlling interests

Reduction in the amount of the share capital.

As could be seen from the above table, the change is to the tune of 5.84%.

As could be seen from the statement, the amount of the dividend paid during the eyar 2016

were CHF6,937 million.

This could be cross checked from statement of cash flows, cash flows from financing

activities.

The amounts are dividend paid to shareholders of the parent were CHF6937 million and to

the non-controlling interest were CHF432 million (Nestle, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTERNATIONAL ACCOUNTING 7

References:

Annual report 2016. (2018). Retrieved from

https://www.nestle.com/asset-library/documents/library/documents/financial_statements/

2016-financial-statements-en.pdf

References:

Annual report 2016. (2018). Retrieved from

https://www.nestle.com/asset-library/documents/library/documents/financial_statements/

2016-financial-statements-en.pdf

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.