Strategic Business Management Report: International Business Analysis

VerifiedAdded on 2022/08/22

|22

|4720

|22

Report

AI Summary

This report provides a strategic analysis of Lidl's potential international expansion, focusing on the comparative evaluation of Mexico and Norway. The analysis begins with a PESTLE analysis of both countries, assessing their political, economic, social, technological, legal, and environmental factors. The report then uses a scoring system to compare the two countries, ultimately recommending Norway as the more suitable location for Lidl's expansion. The rationale for this selection is detailed, highlighting Norway's stable political environment, economic freedom, and favorable business regulations. The report further employs Porter's Five Forces model to analyze the competitive landscape in Norway, examining the bargaining power of consumers and suppliers, the threat of substitutes, the level of competition, and barriers to entry. A VRIO framework is also applied to assess Lidl's resources and capabilities within the context of the Norwegian market. Finally, the report concludes with recommendations on the most appropriate modes of entry for Lidl into the Norwegian market.

Running head: STRATEGIC BUSINESS MANAGEMENT

STRATEGIC BUSINESS MANAGEMENT

Student’s Name

University Name

Author note

STRATEGIC BUSINESS MANAGEMENT

Student’s Name

University Name

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC BUSINESS MANAGEMENT

Table of Contents

Introduction –.............................................................................................................................2

TASK 1. : Comparative Pestle analysis of Mexico and Norway...............................................3

Scoring systems of two countries...............................................................................................5

TASK 2. : Rationale for the selected country............................................................................7

TASK 3. : 5-Forces model.........................................................................................................8

TASK 4. : VRIO framework)...................................................................................................10

TASK 5: Modes of Entry.........................................................................................................12

Conclusion................................................................................................................................14

References................................................................................................................................15

Table of Contents

Introduction –.............................................................................................................................2

TASK 1. : Comparative Pestle analysis of Mexico and Norway...............................................3

Scoring systems of two countries...............................................................................................5

TASK 2. : Rationale for the selected country............................................................................7

TASK 3. : 5-Forces model.........................................................................................................8

TASK 4. : VRIO framework)...................................................................................................10

TASK 5: Modes of Entry.........................................................................................................12

Conclusion................................................................................................................................14

References................................................................................................................................15

2STRATEGIC BUSINESS MANAGEMENT

Introduction –

Lidl is a discount supermarket which aims to expand its business operations in the

global market. In the domestic market, the business organization has gained much success

and fame. Therefore, presently, the company has been planning to expand its operations in

the foreign market to gain exposure and increase its presence in the international market. In

order to expand its business operations in the global market, the company has chosen two

countries that are Mexico and Norway (Lidl.com. 2020). The purpose of this report is to

analyze and determine which among the two countries are most appropriate for business

organization to carry out its operations. The report will be taking into consideration the

political, economical, social, technological, environmental and legal aspects of both the

countries. The two countries will be scored on the various business aspects and one country

will be selected for business expansion. Further, the report will provide a rationale for the

selected country and state the reasons for the chosen country. The competitive environment

of the selected country will be determined with the help of five force analysis. This model

will provide a detailed description of the competitive environment prevailing in the country.

It will provide a VIRO framework to determine the feasibility of the company and its ability

to operate in the foreign country. Lastly, the report will provide recommendations on the

modes of entry into the foreign country. The most appropriate modes of entry will be

suggested for the company to expand its operations. Lastly, it will sum up the main points

and conclude the report.

Introduction –

Lidl is a discount supermarket which aims to expand its business operations in the

global market. In the domestic market, the business organization has gained much success

and fame. Therefore, presently, the company has been planning to expand its operations in

the foreign market to gain exposure and increase its presence in the international market. In

order to expand its business operations in the global market, the company has chosen two

countries that are Mexico and Norway (Lidl.com. 2020). The purpose of this report is to

analyze and determine which among the two countries are most appropriate for business

organization to carry out its operations. The report will be taking into consideration the

political, economical, social, technological, environmental and legal aspects of both the

countries. The two countries will be scored on the various business aspects and one country

will be selected for business expansion. Further, the report will provide a rationale for the

selected country and state the reasons for the chosen country. The competitive environment

of the selected country will be determined with the help of five force analysis. This model

will provide a detailed description of the competitive environment prevailing in the country.

It will provide a VIRO framework to determine the feasibility of the company and its ability

to operate in the foreign country. Lastly, the report will provide recommendations on the

modes of entry into the foreign country. The most appropriate modes of entry will be

suggested for the company to expand its operations. Lastly, it will sum up the main points

and conclude the report.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC BUSINESS MANAGEMENT

TASK 1. : Comparative Pestle analysis of Mexico and Norway

In order to have a better understanding of the business environment in Mexico and

Norway, PESTLE analysis has been implemented to understand the political, social,

economic, technological, and legal and environment aspects (Arslan, Tarba and Larimo

2015).

Comparative pestle

Political environment:

Barutçu and Tunca (2015), suggests that Norway has a stable political landscape with

low rate of opposition from other parties. The citizens of the country have stable lifestyle

with the current political landscape of the country. Hence this makes it suitable for the

country as there is no political corruption involved in the country. Further, the country is a

member of European Free Trade Association (EFTA) and European Union (EU), which

provides tariff rates to the members of European Economic Area (EEA) members. The

country has favorable rules and regulations as per EU (Eckstein 2015). On the other hand,

Mexico has a presidential democracy with good trading relations with Canada and USA as

evidenced by NAFTA agreement. However, there is strained relationship with USA.

Moreover, there are growing concerns over assertion of leaders in the region. This suggests

an unstable political environment as compared to Norway (Foladori and Lau 2014).

Economic factors:

Availability of rich resources in Norway contributes to economy financial. The

country has low unemployment rate as compared to other countries like Sweden. The

economy of the country is mixed with high standard of living. The country is financially

comfortable with good welfare system (Foladori and Lau 2014). However, the country is

TASK 1. : Comparative Pestle analysis of Mexico and Norway

In order to have a better understanding of the business environment in Mexico and

Norway, PESTLE analysis has been implemented to understand the political, social,

economic, technological, and legal and environment aspects (Arslan, Tarba and Larimo

2015).

Comparative pestle

Political environment:

Barutçu and Tunca (2015), suggests that Norway has a stable political landscape with

low rate of opposition from other parties. The citizens of the country have stable lifestyle

with the current political landscape of the country. Hence this makes it suitable for the

country as there is no political corruption involved in the country. Further, the country is a

member of European Free Trade Association (EFTA) and European Union (EU), which

provides tariff rates to the members of European Economic Area (EEA) members. The

country has favorable rules and regulations as per EU (Eckstein 2015). On the other hand,

Mexico has a presidential democracy with good trading relations with Canada and USA as

evidenced by NAFTA agreement. However, there is strained relationship with USA.

Moreover, there are growing concerns over assertion of leaders in the region. This suggests

an unstable political environment as compared to Norway (Foladori and Lau 2014).

Economic factors:

Availability of rich resources in Norway contributes to economy financial. The

country has low unemployment rate as compared to other countries like Sweden. The

economy of the country is mixed with high standard of living. The country is financially

comfortable with good welfare system (Foladori and Lau 2014). However, the country is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC BUSINESS MANAGEMENT

dependent on the oil and gas industries. The GDP of the country is $395.9 billion (2019).

Norway has a population of 5.3 million with 1.4% growth rate. The inflation rate of the

country is 2.8% (Heritage.org. 2020).. On the other Mexico, has a population of the country

is 124.7 million with 2.0% growth rate. The inflation rate of the country 4.9%. However, the

economic freedom of Mexico is 66.0 and Norway scores 73.4 (Heritage.org. 2020). This

makes Norway rank 28th freest economy as per 2020 index (Heritage.org. 2020).

Social Factors:

It has been identified by Laufs, Bembom and Schwens (2016), that Mexico faces

some social challenges due to economic affluence with high rate of disparity between the rich

and the poor. There is high gap between poverty and richness in the country. As per statistics,

53% of the country’s population is poor with widespread corruption (Laufs, Bembom and

Schwens 2016). On the other hand, Norway has a rich lifestyle supported with stable political

environment. The country also has a beautiful landscape with majority of the population

speaks in English.

Technological factors:

Norway is a country that is most desirable for technologically advanced companies;

the economy thrives in tech industry with abundant availability of 'A' grade software

engineers and other talents (Barutçu and Tunca 2015). Abundant availability of skilled and

talented labors in the country makes it situated for business expansion. On the other hand,

Mexico has recently turned into a global center for research and development (Foladori and

Lau 2014). However, the country has various barriers and uncertainty regarding technologies

and crowd funding.

Legal Factors:

dependent on the oil and gas industries. The GDP of the country is $395.9 billion (2019).

Norway has a population of 5.3 million with 1.4% growth rate. The inflation rate of the

country is 2.8% (Heritage.org. 2020).. On the other Mexico, has a population of the country

is 124.7 million with 2.0% growth rate. The inflation rate of the country 4.9%. However, the

economic freedom of Mexico is 66.0 and Norway scores 73.4 (Heritage.org. 2020). This

makes Norway rank 28th freest economy as per 2020 index (Heritage.org. 2020).

Social Factors:

It has been identified by Laufs, Bembom and Schwens (2016), that Mexico faces

some social challenges due to economic affluence with high rate of disparity between the rich

and the poor. There is high gap between poverty and richness in the country. As per statistics,

53% of the country’s population is poor with widespread corruption (Laufs, Bembom and

Schwens 2016). On the other hand, Norway has a rich lifestyle supported with stable political

environment. The country also has a beautiful landscape with majority of the population

speaks in English.

Technological factors:

Norway is a country that is most desirable for technologically advanced companies;

the economy thrives in tech industry with abundant availability of 'A' grade software

engineers and other talents (Barutçu and Tunca 2015). Abundant availability of skilled and

talented labors in the country makes it situated for business expansion. On the other hand,

Mexico has recently turned into a global center for research and development (Foladori and

Lau 2014). However, the country has various barriers and uncertainty regarding technologies

and crowd funding.

Legal Factors:

5STRATEGIC BUSINESS MANAGEMENT

Norway has been accused on various issues with legal system. However, as per there

local businesses, the country has a strong banking systems, pensions systems and welfare

systems. On the other hand, Mexico is free and independent (Foladori and Lau 2014).

However, the image of the country is questioned due to high level of corruption and political

instability.

Environment Factors:

As per research, it has been identified that Norway has higher environmental goals

with hefty promises to be carbon neutral by the year 2050 (Foladori and Lau 2014). The

country also aims to reduce gas emissions to 100% (Hallenstvedt 2014). Therefore, the

companies need to be takes measures and act accordingly. On the other hand, Mexico faces

various environmental challenges. High pollution in the country makes it potentially

dangerous for both businesses and human health.

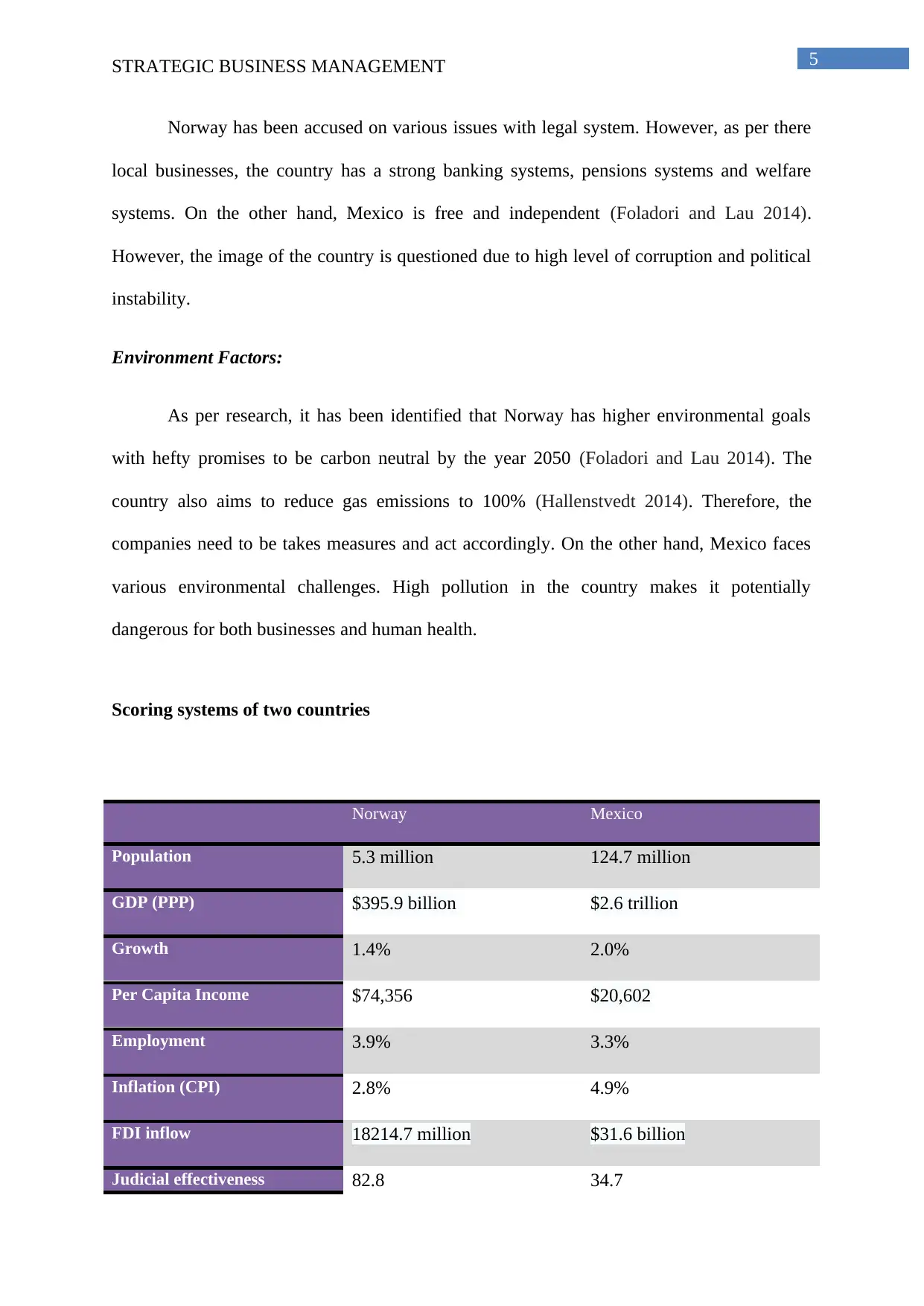

Scoring systems of two countries

Norway Mexico

Population 5.3 million 124.7 million

GDP (PPP) $395.9 billion $2.6 trillion

Growth 1.4% 2.0%

Per Capita Income $74,356 $20,602

Employment 3.9% 3.3%

Inflation (CPI) 2.8% 4.9%

FDI inflow 18214.7 million $31.6 billion

Judicial effectiveness 82.8 34.7

Norway has been accused on various issues with legal system. However, as per there

local businesses, the country has a strong banking systems, pensions systems and welfare

systems. On the other hand, Mexico is free and independent (Foladori and Lau 2014).

However, the image of the country is questioned due to high level of corruption and political

instability.

Environment Factors:

As per research, it has been identified that Norway has higher environmental goals

with hefty promises to be carbon neutral by the year 2050 (Foladori and Lau 2014). The

country also aims to reduce gas emissions to 100% (Hallenstvedt 2014). Therefore, the

companies need to be takes measures and act accordingly. On the other hand, Mexico faces

various environmental challenges. High pollution in the country makes it potentially

dangerous for both businesses and human health.

Scoring systems of two countries

Norway Mexico

Population 5.3 million 124.7 million

GDP (PPP) $395.9 billion $2.6 trillion

Growth 1.4% 2.0%

Per Capita Income $74,356 $20,602

Employment 3.9% 3.3%

Inflation (CPI) 2.8% 4.9%

FDI inflow 18214.7 million $31.6 billion

Judicial effectiveness 82.8 34.7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC BUSINESS MANAGEMENT

Monetary Freedom

(Regulatory efficiency)

74.8 70.9

Tax Burden 57.7 76.1

World rank 28 67

OVERALL SCORE: 73.4 (avg.) 66.0 (avg.)

Source: (Www3.weforum.org. 2020).

Source: (Www3.weforum.org. 2020).

Monetary Freedom

(Regulatory efficiency)

74.8 70.9

Tax Burden 57.7 76.1

World rank 28 67

OVERALL SCORE: 73.4 (avg.) 66.0 (avg.)

Source: (Www3.weforum.org. 2020).

Source: (Www3.weforum.org. 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC BUSINESS MANAGEMENT

TASK 2. : Rationale for the selected country

Therefore, from the comparative analysis of both the countries, it is evident that the

Norway overall score is higher than Mexico. Henceforth, Norway is appropriate country for

business expansion. The overall score of the country is supported with stable political

environment with no opposition from other parties involved (Hallenstvedt 2014). The country

is a member of European Free Trade Association (EFTA) and European Union (EU), which

makes it favorable for business operations due to favorable tariff rates. The laws and

regulations of the country are as per EU (Hallenstvedt 2014). Although the GDP rate, per

capita income and the growth rate is higher in Mexico as compared to Norway, the economic

freedom is higher in Norway. This suggests high level of regulatory efficiency and

governmental spending (Lin and Tsai 2016). Moreover, the tax burden is higher in Mexico as

compared to Norway. This suggests that Lidl will have to pay less business taxation in

Norway as compared to Mexico. The operations of Lidl Company can contribute

significantly to the GDP of the country which suggests that Norwegian government will be

highly supportive of the business operations. Most importantly, Norway stands at a world

rank of 28 as compared to 67 world rank of Mexico (Heritage.org. 2020).. The economic

freedom of Norway is 73.4 which makes it 28th freest economy in 2020 (Heritage.org. 2020)..

The country has higher labor freedom. The overall score is higher as compared to Mexico as

suggested in the graph. Greater economic freedom of Norway is supported with higher

government spending (Musso and Francioni 2014). The governmental budget is structured

with better environmental regulations. There has been a growth rate of 2% in the GDP of the

country which suggests that the economy is the country is growing significantly

(Heritage.org. 2020).. Norway has a strong banking systems and welfare systems which

TASK 2. : Rationale for the selected country

Therefore, from the comparative analysis of both the countries, it is evident that the

Norway overall score is higher than Mexico. Henceforth, Norway is appropriate country for

business expansion. The overall score of the country is supported with stable political

environment with no opposition from other parties involved (Hallenstvedt 2014). The country

is a member of European Free Trade Association (EFTA) and European Union (EU), which

makes it favorable for business operations due to favorable tariff rates. The laws and

regulations of the country are as per EU (Hallenstvedt 2014). Although the GDP rate, per

capita income and the growth rate is higher in Mexico as compared to Norway, the economic

freedom is higher in Norway. This suggests high level of regulatory efficiency and

governmental spending (Lin and Tsai 2016). Moreover, the tax burden is higher in Mexico as

compared to Norway. This suggests that Lidl will have to pay less business taxation in

Norway as compared to Mexico. The operations of Lidl Company can contribute

significantly to the GDP of the country which suggests that Norwegian government will be

highly supportive of the business operations. Most importantly, Norway stands at a world

rank of 28 as compared to 67 world rank of Mexico (Heritage.org. 2020).. The economic

freedom of Norway is 73.4 which makes it 28th freest economy in 2020 (Heritage.org. 2020)..

The country has higher labor freedom. The overall score is higher as compared to Mexico as

suggested in the graph. Greater economic freedom of Norway is supported with higher

government spending (Musso and Francioni 2014). The governmental budget is structured

with better environmental regulations. There has been a growth rate of 2% in the GDP of the

country which suggests that the economy is the country is growing significantly

(Heritage.org. 2020).. Norway has a strong banking systems and welfare systems which

8STRATEGIC BUSINESS MANAGEMENT

makes it favorable for business operations in the country. The country is free from

corruptions and political instability unlike Mexican economy. Furthermore, Norway is

technologically advanced country with abundant availability of 'A' grade software

personnel’s and other talented people (Musso and Francioni 2014). Henceforth, Norway has

been selected for business expansion.

TASK 3. : 5-Forces model

Competitive analysis of Norway

In order to analysis the competitive environment in Norway, Porters five force analysis has

been taken into consideration. The power of the suppliers, customers, level of competition

prevailing in the country and barrier to entry will be assessed (Porter 2018).

Bargaining power of consumers –

As per Porter (2018), the consumers demand for high quality products and services at

a lower cost. This pressurizes the company to reduce the cost of the products and increase

sales. The bargaining power of the consumers in the country is high as there are presence of

similar supermarkets offering similar products and services of Lidl. Therefore, the consumers

have the power to switch products and services with the competitor’s offerings (Rhodes and

Brien 2014). This might reduce the profitability of the Lidl in the Norwegian market.

Bargaining power of suppliers –

There is large number of suppliers present in the market which reduces the power of

the suppliers in the market (Schryer 2014). This is a favorable situation for Lidl as war

materials and other suppliers can be acquired at stipulated rates. Due to presence of large

makes it favorable for business operations in the country. The country is free from

corruptions and political instability unlike Mexican economy. Furthermore, Norway is

technologically advanced country with abundant availability of 'A' grade software

personnel’s and other talented people (Musso and Francioni 2014). Henceforth, Norway has

been selected for business expansion.

TASK 3. : 5-Forces model

Competitive analysis of Norway

In order to analysis the competitive environment in Norway, Porters five force analysis has

been taken into consideration. The power of the suppliers, customers, level of competition

prevailing in the country and barrier to entry will be assessed (Porter 2018).

Bargaining power of consumers –

As per Porter (2018), the consumers demand for high quality products and services at

a lower cost. This pressurizes the company to reduce the cost of the products and increase

sales. The bargaining power of the consumers in the country is high as there are presence of

similar supermarkets offering similar products and services of Lidl. Therefore, the consumers

have the power to switch products and services with the competitor’s offerings (Rhodes and

Brien 2014). This might reduce the profitability of the Lidl in the Norwegian market.

Bargaining power of suppliers –

There is large number of suppliers present in the market which reduces the power of

the suppliers in the market (Schryer 2014). This is a favorable situation for Lidl as war

materials and other suppliers can be acquired at stipulated rates. Due to presence of large

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC BUSINESS MANAGEMENT

number of suppliers in the market, the company has the power to switch the suppliers as per

the convenience of Lidl. This situation is profitable for the company (Schryer 2014). The

power of the suppliers in the Norwegian market is low.

Threat of substitute products in the market-

Presence of substitute in the Norwegian market is high due to presence of stiff

competition in the market offering similar products and services to the consumers. The

consumers can easily switch the products and services (Hallenstvedt 2014). High availability

of subsides in the market can reduce the profitability of the business organization. The

products and services needs to be sold at a lower price so as to increase the sales

(Hallenstvedt 2014). Presence of substitute’s products in the market also increases the level

of competition prevailing in the market. In order to retain the consumers, additional

marketing efforts, discounts and offers are needed to be provided to the consumers which

might reduce the profitability of the business organization (Lin and Tsai 2016).

Level of competition -

Due to the presence of substitute products and services in the market, the level of

competition is higher. There is high level of rivalry among the existing players in the market.

The actions of one competitor might impact other competitors in the market. As per statistics,

the supermarket growth rate in Norway has increased by 4.0%. This suggests high level of

competition in the market. Presence of competitors such as 'Norges Gruppen' captures

maximum shares in the retail industry.

Barrier to entry -

According to Minaker et al. (2016), the barrier to entry is high due to the presence of

already existing strong players in the retail industry. The new firms require high level of

number of suppliers in the market, the company has the power to switch the suppliers as per

the convenience of Lidl. This situation is profitable for the company (Schryer 2014). The

power of the suppliers in the Norwegian market is low.

Threat of substitute products in the market-

Presence of substitute in the Norwegian market is high due to presence of stiff

competition in the market offering similar products and services to the consumers. The

consumers can easily switch the products and services (Hallenstvedt 2014). High availability

of subsides in the market can reduce the profitability of the business organization. The

products and services needs to be sold at a lower price so as to increase the sales

(Hallenstvedt 2014). Presence of substitute’s products in the market also increases the level

of competition prevailing in the market. In order to retain the consumers, additional

marketing efforts, discounts and offers are needed to be provided to the consumers which

might reduce the profitability of the business organization (Lin and Tsai 2016).

Level of competition -

Due to the presence of substitute products and services in the market, the level of

competition is higher. There is high level of rivalry among the existing players in the market.

The actions of one competitor might impact other competitors in the market. As per statistics,

the supermarket growth rate in Norway has increased by 4.0%. This suggests high level of

competition in the market. Presence of competitors such as 'Norges Gruppen' captures

maximum shares in the retail industry.

Barrier to entry -

According to Minaker et al. (2016), the barrier to entry is high due to the presence of

already existing strong players in the retail industry. The new firms require high level of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC BUSINESS MANAGEMENT

capital and research to reach to the level of competitors in the markets. However, as stated by

Musso and Francioni (2014), the technologically advanced state of the country makes it

favorable for new companies to offer innovative products and services to the consumers. The

entry of new firms in the market might reduce sales and profitability of the existing firms in

the industry. In order to combat this threat in the Norwegian market, the company can

introduce innovative products and services in the market to gain new customers and retail old

customers in the market (Minaker et al. 2016).

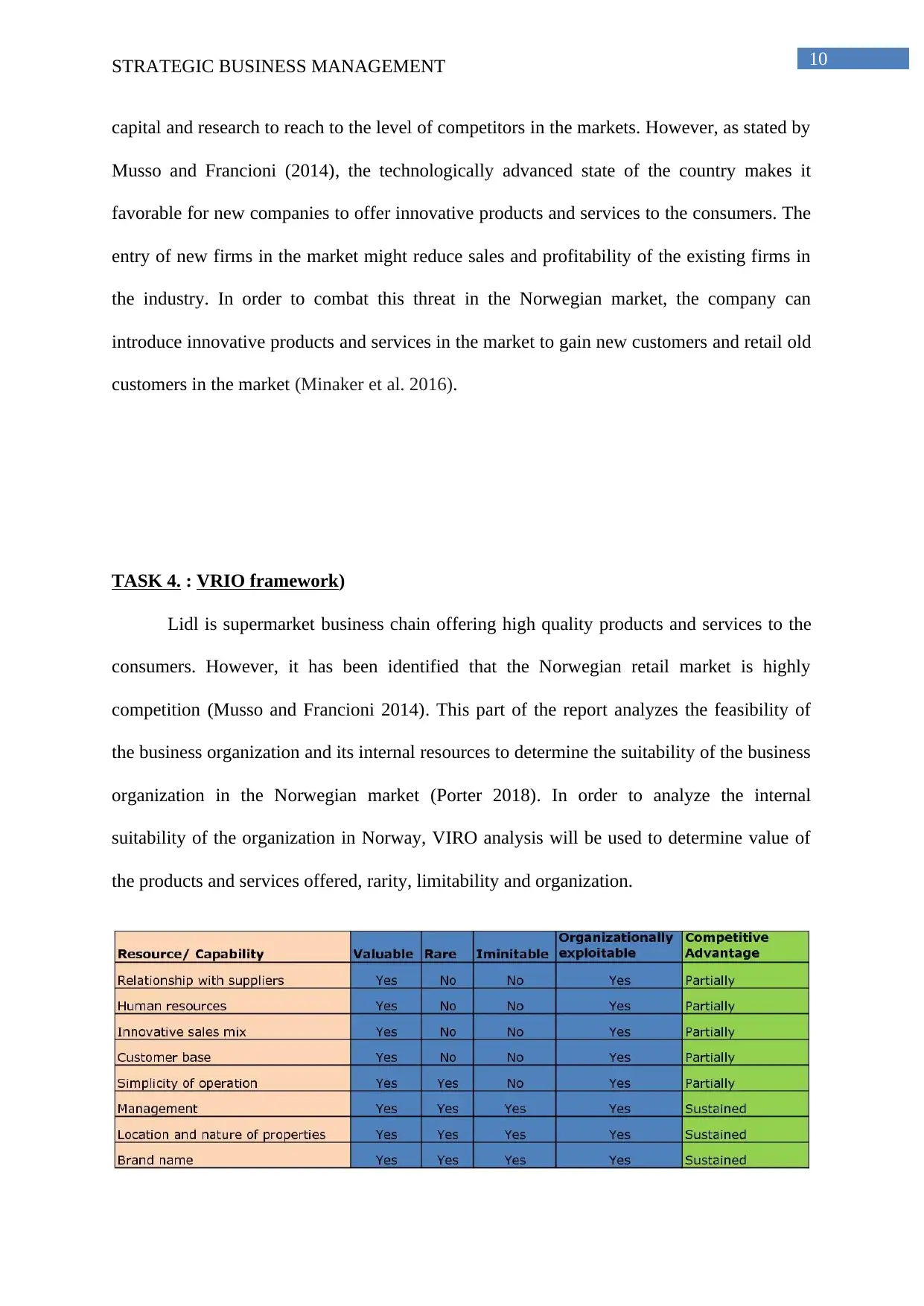

TASK 4. : VRIO framework)

Lidl is supermarket business chain offering high quality products and services to the

consumers. However, it has been identified that the Norwegian retail market is highly

competition (Musso and Francioni 2014). This part of the report analyzes the feasibility of

the business organization and its internal resources to determine the suitability of the business

organization in the Norwegian market (Porter 2018). In order to analyze the internal

suitability of the organization in Norway, VIRO analysis will be used to determine value of

the products and services offered, rarity, limitability and organization.

capital and research to reach to the level of competitors in the markets. However, as stated by

Musso and Francioni (2014), the technologically advanced state of the country makes it

favorable for new companies to offer innovative products and services to the consumers. The

entry of new firms in the market might reduce sales and profitability of the existing firms in

the industry. In order to combat this threat in the Norwegian market, the company can

introduce innovative products and services in the market to gain new customers and retail old

customers in the market (Minaker et al. 2016).

TASK 4. : VRIO framework)

Lidl is supermarket business chain offering high quality products and services to the

consumers. However, it has been identified that the Norwegian retail market is highly

competition (Musso and Francioni 2014). This part of the report analyzes the feasibility of

the business organization and its internal resources to determine the suitability of the business

organization in the Norwegian market (Porter 2018). In order to analyze the internal

suitability of the organization in Norway, VIRO analysis will be used to determine value of

the products and services offered, rarity, limitability and organization.

11STRATEGIC BUSINESS MANAGEMENT

Valuable –

Being a global business organization, Lidl has a strong financial position, which makes it

suitable for expanding its operations and business activities. The company offers wide range

of food products and provides services to the consumers (Rhodes and Brien 2014). It has

global presence and brand image. The company recruits skilled workforce to operate

efficiently, the workforce is valuable for the company (Schryer 2014). However, the products

and services offered by the business organization are similar to the products and services

offered by other retailers in the market. Hence the service or the products are not valuable in

the market (Lidl.com. 2020). The relationship with the suppliers is valuable, however it is

not rare. This is not imitable either and can be a sustainable advantage to the company.

Rarity –

The positive brand image due to global presence, goodwill, reputation and financial position

of the business organization is rare among other competitors in the market. This provides a

competitive advantage to the business organizations (Hallenstvedt 2014). The skilled and

well trained labors in the organization are rare in the market. The financial status and patents

as well as its research and development are rare in the market. The brand image is rare and

valuable in the market (Foladori and Lau 2014). However, the products and services offered

are not rare in the market. The management of the organization is valuable and rare.

Imitable -

The services and the products and services provided by the business organization are easily

imitable by other players in the market (Minaker et al. 2016). However, its brand image,

reputation and its position in the global market is not imitable by other players in the market.

The position acquired by Lidl is not imitable by other players in the market. However, the

Valuable –

Being a global business organization, Lidl has a strong financial position, which makes it

suitable for expanding its operations and business activities. The company offers wide range

of food products and provides services to the consumers (Rhodes and Brien 2014). It has

global presence and brand image. The company recruits skilled workforce to operate

efficiently, the workforce is valuable for the company (Schryer 2014). However, the products

and services offered by the business organization are similar to the products and services

offered by other retailers in the market. Hence the service or the products are not valuable in

the market (Lidl.com. 2020). The relationship with the suppliers is valuable, however it is

not rare. This is not imitable either and can be a sustainable advantage to the company.

Rarity –

The positive brand image due to global presence, goodwill, reputation and financial position

of the business organization is rare among other competitors in the market. This provides a

competitive advantage to the business organizations (Hallenstvedt 2014). The skilled and

well trained labors in the organization are rare in the market. The financial status and patents

as well as its research and development are rare in the market. The brand image is rare and

valuable in the market (Foladori and Lau 2014). However, the products and services offered

are not rare in the market. The management of the organization is valuable and rare.

Imitable -

The services and the products and services provided by the business organization are easily

imitable by other players in the market (Minaker et al. 2016). However, its brand image,

reputation and its position in the global market is not imitable by other players in the market.

The position acquired by Lidl is not imitable by other players in the market. However, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.