LCBB6002 International Financial Management: UPS Analysis & Review

VerifiedAdded on 2023/06/17

|9

|1914

|233

Report

AI Summary

This report provides a comprehensive analysis of United Parcel Service (UPS) within the context of international financial management. It critically evaluates UPS's dividend distribution policy, examining the dividend yield, payout ratio, and historical dividend adjustments. The report also analyzes the efficient market hypothesis (EMH) in relation to UPS's operations, considering factors such as market share, e-commerce growth, and logistical technologies. Furthermore, it evaluates UPS's methods of appraising projects, focusing on cost-benefit analysis and its application in transportation planning. The report references various academic sources and online resources to support its analysis and conclusions.

International Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Critically analyses and evaluate chosen multinational corporation’s dividend distribution policy..........3

Critically analyse the efficient market hypothesis theory in the context of your chosen multinational

corporation’s operations.........................................................................................................................5

Critically analyse and evaluate your chosen multinational corporation’s methods of appraising

projects....................................................................................................................................................6

REFERENCES................................................................................................................................................8

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Critically analyses and evaluate chosen multinational corporation’s dividend distribution policy..........3

Critically analyse the efficient market hypothesis theory in the context of your chosen multinational

corporation’s operations.........................................................................................................................5

Critically analyse and evaluate your chosen multinational corporation’s methods of appraising

projects....................................................................................................................................................6

REFERENCES................................................................................................................................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The research of financial relations between multiple countries is known as international

finance. Foreign direct investment and monetary system currency markets are among the topics

covered by international finance. The relevance of global banking has grown as a result of

growing globalization. This report based on the United Parcel Service (UPS, stylised as ups) is a

worldwide transshipment and inventory control corporation headquartered in the United States. It

was formed in 1907. UPS began as the United Messenger Firm, a telegraph corporation, and has

since evolved becoming a Successful business and one of the nation's biggest transportation

services. UPS will be the nation's biggest messenger firm by income in 2020, with yearly

revenue of roughly US$85 billion, above of rivals DHL and FedEx. In this report consist of

dividend distribution policy and analysis efficient market hypothesis theory in the context of

UPS. In addition evaluate multinational corporation’s methods of appraising projects.

MAIN BODY

Critically analyses and evaluate chosen multinational corporation’s dividend distribution policy

The UPS dividend yield is 2.5 percent depending on the present company's stock of UPS.

The UPS payout ratio is large. It is approaching the intended dividend yield objective of 3 to 5%.

UPS distributes dividend each 3 months or four times a year. UPS distributes dividends in the

months of March, June, July, and December each year. Several American businesses follow this

income distribution strategy. The corporation has a longstanding experience of increasing its

dividend every year. Since 2010, the UPS dividend has been adjusted on a yearly basis. It's

possible that the yearly rise streak may continue for a long time. However, in 2009, the

corporation put a halt to dividend increases. It did so in order to get through the hardships of the

downturn at the moment.

A purchaser must consummate their acquisition of UPS shares well before ex-dividend

date in order to be granted the next UPS annual dividend. The UPS former date is usually all

around 20th of the month before dividends are paid. UPS's latest current dividend rise was only

1%. On August 20, 2021, United Parcel Service, Inc. (UPS) will cease trading ex-dividend. On

Sept 9, 2021, the company will issue a dividend payment of $1.02 per shares. The cash special

dividend is available to UPS investors who acquired the stock before the ex-dividend date. UPS

The research of financial relations between multiple countries is known as international

finance. Foreign direct investment and monetary system currency markets are among the topics

covered by international finance. The relevance of global banking has grown as a result of

growing globalization. This report based on the United Parcel Service (UPS, stylised as ups) is a

worldwide transshipment and inventory control corporation headquartered in the United States. It

was formed in 1907. UPS began as the United Messenger Firm, a telegraph corporation, and has

since evolved becoming a Successful business and one of the nation's biggest transportation

services. UPS will be the nation's biggest messenger firm by income in 2020, with yearly

revenue of roughly US$85 billion, above of rivals DHL and FedEx. In this report consist of

dividend distribution policy and analysis efficient market hypothesis theory in the context of

UPS. In addition evaluate multinational corporation’s methods of appraising projects.

MAIN BODY

Critically analyses and evaluate chosen multinational corporation’s dividend distribution policy

The UPS dividend yield is 2.5 percent depending on the present company's stock of UPS.

The UPS payout ratio is large. It is approaching the intended dividend yield objective of 3 to 5%.

UPS distributes dividend each 3 months or four times a year. UPS distributes dividends in the

months of March, June, July, and December each year. Several American businesses follow this

income distribution strategy. The corporation has a longstanding experience of increasing its

dividend every year. Since 2010, the UPS dividend has been adjusted on a yearly basis. It's

possible that the yearly rise streak may continue for a long time. However, in 2009, the

corporation put a halt to dividend increases. It did so in order to get through the hardships of the

downturn at the moment.

A purchaser must consummate their acquisition of UPS shares well before ex-dividend

date in order to be granted the next UPS annual dividend. The UPS former date is usually all

around 20th of the month before dividends are paid. UPS's latest current dividend rise was only

1%. On August 20, 2021, United Parcel Service, Inc. (UPS) will cease trading ex-dividend. On

Sept 9, 2021, the company will issue a dividend payment of $1.02 per shares. The cash special

dividend is available to UPS investors who acquired the stock before the ex-dividend date. UPS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

has awarded this very same dividend for the third quarter in a row. The payout ratio is 2.09

percent at the value of the stock of $194.8. UPS's latest selling was $194.8, down -11.29 percent

from the 52-week high of $219.59 and up 25.98 percent from the 52-week low of $154.63.

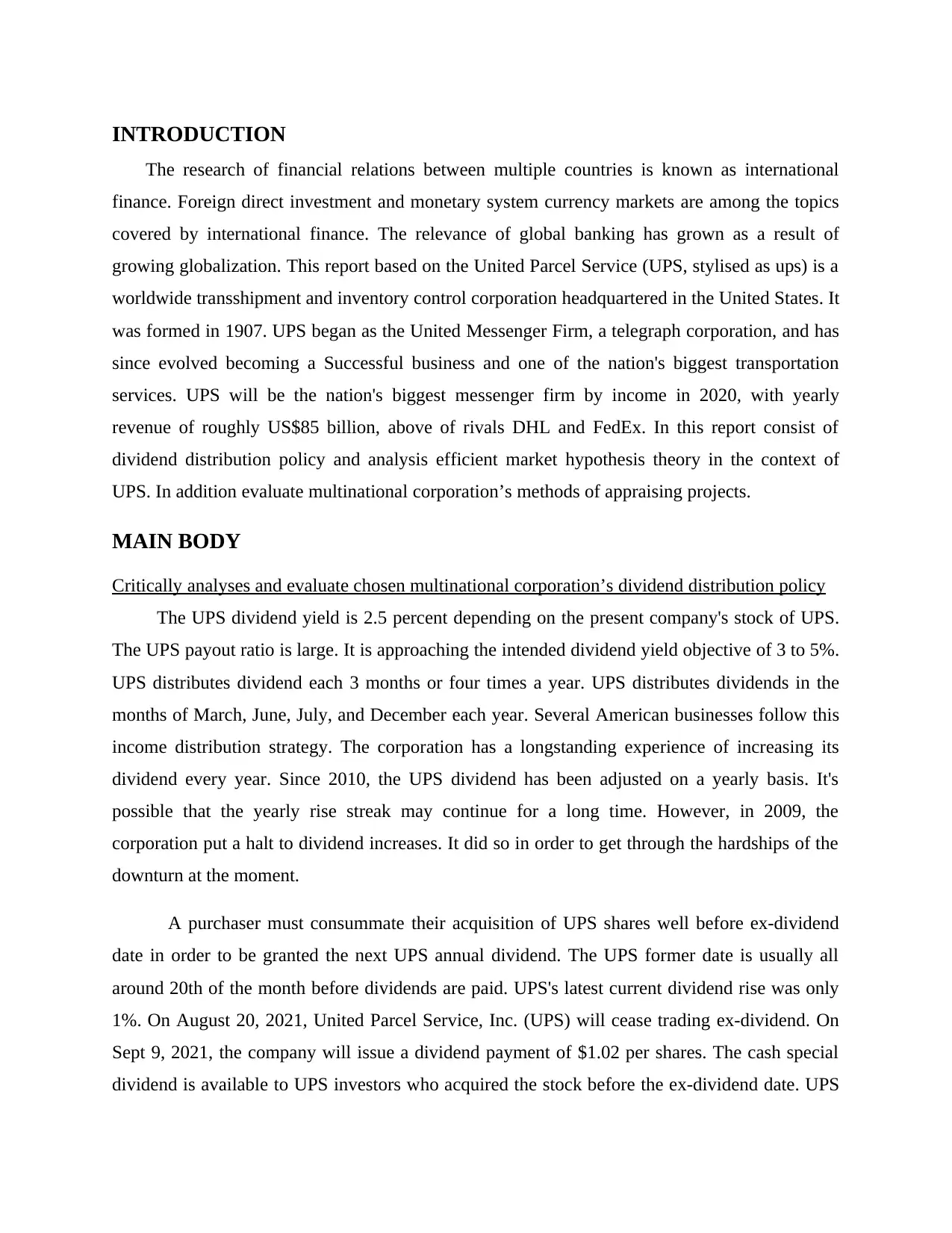

Statics for 5 years

Compound Annual Dividend growth

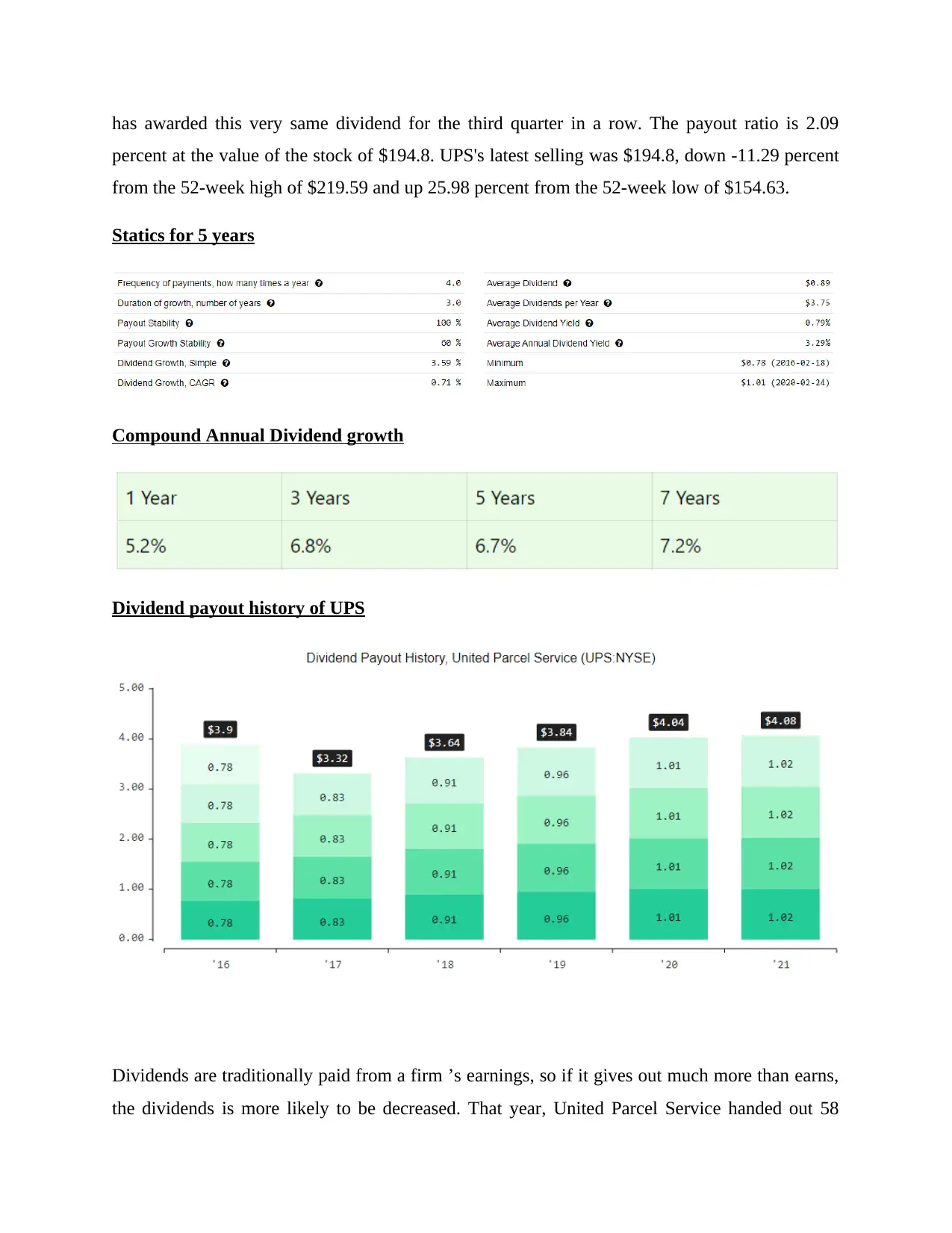

Dividend payout history of UPS

Dividends are traditionally paid from a firm ’s earnings, so if it gives out much more than earns,

the dividends is more likely to be decreased. That year, United Parcel Service handed out 58

percent at the value of the stock of $194.8. UPS's latest selling was $194.8, down -11.29 percent

from the 52-week high of $219.59 and up 25.98 percent from the 52-week low of $154.63.

Statics for 5 years

Compound Annual Dividend growth

Dividend payout history of UPS

Dividends are traditionally paid from a firm ’s earnings, so if it gives out much more than earns,

the dividends is more likely to be decreased. That year, United Parcel Service handed out 58

percent of its revenues to shareholders, which is typical for most corporations. A further

examination may be to see if United Parcel Service earned adequate free cash flow to pay its

dividend. However, it only handed out 43% of its net income in the previous quarter. It's nice to

see both income and working capital support the dividend. This shows that the dividend will be

sustained as provided as profits do not fall dramatically.

Critically analyse the efficient market hypothesis theory in the context of your chosen

multinational corporation’s operations

The efficient market hypothesis (EMH), often referred as the efficient market hypothesis,

asserts that asset values represent all existing knowledge and that persistent alpha production is

unlikely. Companies constantly move at their fair value on marketplaces, as per the EMH,

making it very difficult for buyers to invest cheap shares or buy for ridiculous prices. As a result,

skilled taking orders or timing the market should be difficult to exceed the entire market, and the

only way an individual can earn better returns is to buy hazardous investments.

UPS has a Buy assessment based on a $129.47 price target, which is a 23.3 percent level of

security over the trading price of $104.99 per share on April 7, 2017. Three reasons have

influenced our suggestion the most:

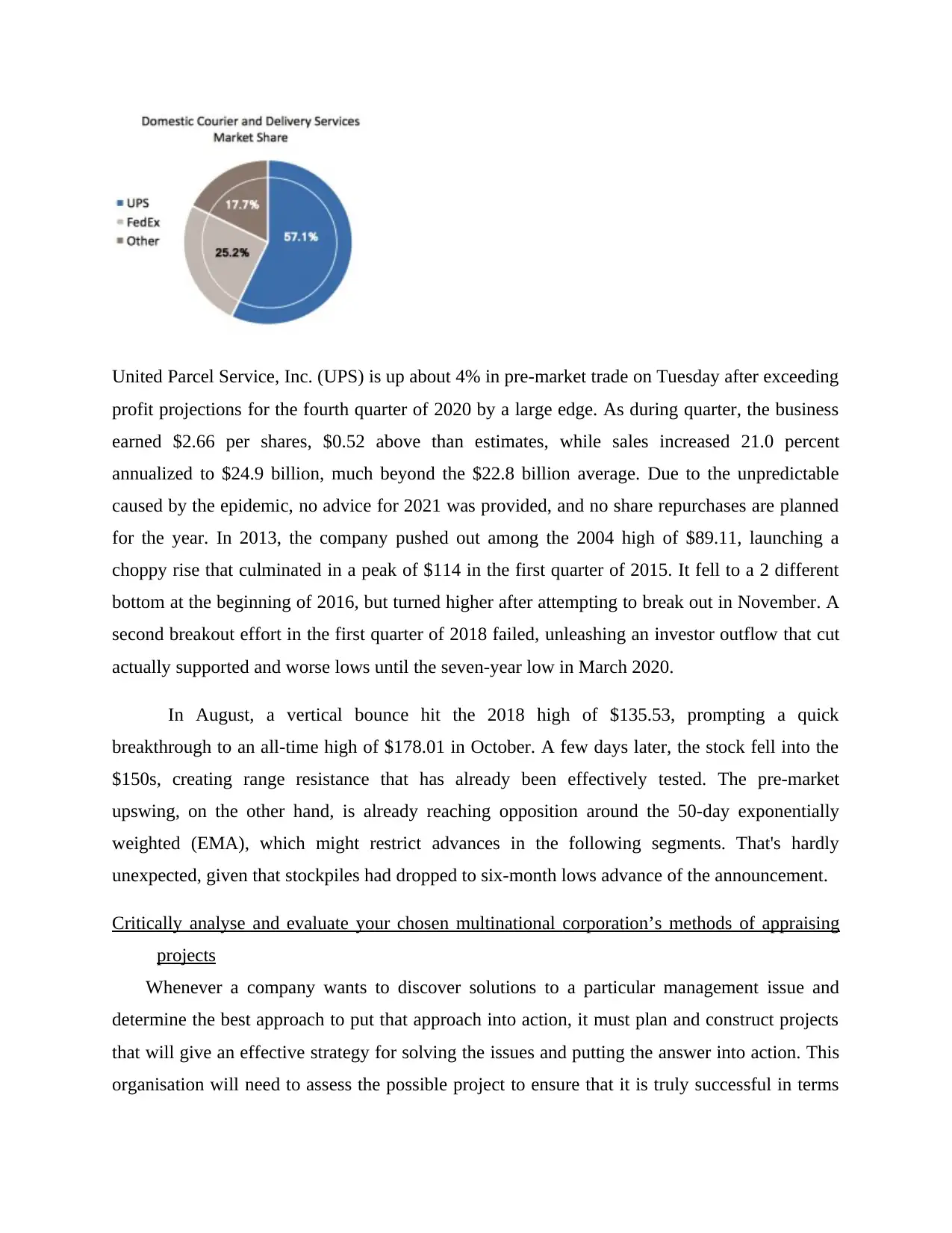

1. High obstacles to entrance into the sector - UPS has a 57 percent market share in home

couriers and delivery companies, compared to FedEx and USPS, which are its two primary

rivals.

2. E-commerce and medical transportation development — UPS is poised to benefit from of the

spike in e-commerce both locally and globally, resulting in greater revenue and profit.

Similarly, its recent purchases in the medical logistics area will allow it to profit from the global

biologics industry's expansion.

3. Cost-effective innovation in the field — UPS's ORION logistical technologies will try to

lower expenses, enhance profits, and broaden the scope of its logistical solution company

throughout its Supply Chain and Warehousing Services division.

examination may be to see if United Parcel Service earned adequate free cash flow to pay its

dividend. However, it only handed out 43% of its net income in the previous quarter. It's nice to

see both income and working capital support the dividend. This shows that the dividend will be

sustained as provided as profits do not fall dramatically.

Critically analyse the efficient market hypothesis theory in the context of your chosen

multinational corporation’s operations

The efficient market hypothesis (EMH), often referred as the efficient market hypothesis,

asserts that asset values represent all existing knowledge and that persistent alpha production is

unlikely. Companies constantly move at their fair value on marketplaces, as per the EMH,

making it very difficult for buyers to invest cheap shares or buy for ridiculous prices. As a result,

skilled taking orders or timing the market should be difficult to exceed the entire market, and the

only way an individual can earn better returns is to buy hazardous investments.

UPS has a Buy assessment based on a $129.47 price target, which is a 23.3 percent level of

security over the trading price of $104.99 per share on April 7, 2017. Three reasons have

influenced our suggestion the most:

1. High obstacles to entrance into the sector - UPS has a 57 percent market share in home

couriers and delivery companies, compared to FedEx and USPS, which are its two primary

rivals.

2. E-commerce and medical transportation development — UPS is poised to benefit from of the

spike in e-commerce both locally and globally, resulting in greater revenue and profit.

Similarly, its recent purchases in the medical logistics area will allow it to profit from the global

biologics industry's expansion.

3. Cost-effective innovation in the field — UPS's ORION logistical technologies will try to

lower expenses, enhance profits, and broaden the scope of its logistical solution company

throughout its Supply Chain and Warehousing Services division.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

United Parcel Service, Inc. (UPS) is up about 4% in pre-market trade on Tuesday after exceeding

profit projections for the fourth quarter of 2020 by a large edge. As during quarter, the business

earned $2.66 per shares, $0.52 above than estimates, while sales increased 21.0 percent

annualized to $24.9 billion, much beyond the $22.8 billion average. Due to the unpredictable

caused by the epidemic, no advice for 2021 was provided, and no share repurchases are planned

for the year. In 2013, the company pushed out among the 2004 high of $89.11, launching a

choppy rise that culminated in a peak of $114 in the first quarter of 2015. It fell to a 2 different

bottom at the beginning of 2016, but turned higher after attempting to break out in November. A

second breakout effort in the first quarter of 2018 failed, unleashing an investor outflow that cut

actually supported and worse lows until the seven-year low in March 2020.

In August, a vertical bounce hit the 2018 high of $135.53, prompting a quick

breakthrough to an all-time high of $178.01 in October. A few days later, the stock fell into the

$150s, creating range resistance that has already been effectively tested. The pre-market

upswing, on the other hand, is already reaching opposition around the 50-day exponentially

weighted (EMA), which might restrict advances in the following segments. That's hardly

unexpected, given that stockpiles had dropped to six-month lows advance of the announcement.

Critically analyse and evaluate your chosen multinational corporation’s methods of appraising

projects

Whenever a company wants to discover solutions to a particular management issue and

determine the best approach to put that approach into action, it must plan and construct projects

that will give an effective strategy for solving the issues and putting the answer into action. This

organisation will need to assess the possible project to ensure that it is truly successful in terms

profit projections for the fourth quarter of 2020 by a large edge. As during quarter, the business

earned $2.66 per shares, $0.52 above than estimates, while sales increased 21.0 percent

annualized to $24.9 billion, much beyond the $22.8 billion average. Due to the unpredictable

caused by the epidemic, no advice for 2021 was provided, and no share repurchases are planned

for the year. In 2013, the company pushed out among the 2004 high of $89.11, launching a

choppy rise that culminated in a peak of $114 in the first quarter of 2015. It fell to a 2 different

bottom at the beginning of 2016, but turned higher after attempting to break out in November. A

second breakout effort in the first quarter of 2018 failed, unleashing an investor outflow that cut

actually supported and worse lows until the seven-year low in March 2020.

In August, a vertical bounce hit the 2018 high of $135.53, prompting a quick

breakthrough to an all-time high of $178.01 in October. A few days later, the stock fell into the

$150s, creating range resistance that has already been effectively tested. The pre-market

upswing, on the other hand, is already reaching opposition around the 50-day exponentially

weighted (EMA), which might restrict advances in the following segments. That's hardly

unexpected, given that stockpiles had dropped to six-month lows advance of the announcement.

Critically analyse and evaluate your chosen multinational corporation’s methods of appraising

projects

Whenever a company wants to discover solutions to a particular management issue and

determine the best approach to put that approach into action, it must plan and construct projects

that will give an effective strategy for solving the issues and putting the answer into action. This

organisation will need to assess the possible project to ensure that it is truly successful in terms

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of supporting the satisfactory answer and resolving the issue. Project assessment management is

a significant method of reviewing and assessing the program in this context. Discounted

methodologies for project assessment include (a) Net Present Worth (b) Cost Benefit Ratio, (c)

Internal Rate of Return and (d) Sensitivity Analysis, which take into consideration the time value

of currency.

United parcel service use cost benefits analysis for appraised their project in effective

manner. Most of the transportation companies use this method because it provides accuracy to

understand project in broad way. For evaluating proposed transportation projects, cost-benefit

analysis has become a commonly utilized and very well methodology. This study gives our

perspective on the function and placement of CBA in the transportation planning process in UPS,

which is partially based on a research of many nations where CBA has a defined significance in

judgment. According to the report, methodology, values, and possible applications are essentially

comparable across nations. The CBA results are included into a complete assessment procedure

that encompasses various sorts of non-monetized payments in UPS. CBA has a number of

benefits, including the struggle to transcend mental, physical, and procedure constraints and

prejudices in judgment. The socioeconomic and legal environment is some of the most

significant obstacles to CBA and independent economic in particular. CBA frequently runs the

danger of arriving too early in the planning phase to have a significant impact. Whenever

planning activities are focused around with a perceived "issue," this risk appears to rise.

Although expensive remedies may be considered as better than nothing unless situation is

deemed serious sufficient, regardless of the fact that the definition of "issue" is sometimes

subjective.

a significant method of reviewing and assessing the program in this context. Discounted

methodologies for project assessment include (a) Net Present Worth (b) Cost Benefit Ratio, (c)

Internal Rate of Return and (d) Sensitivity Analysis, which take into consideration the time value

of currency.

United parcel service use cost benefits analysis for appraised their project in effective

manner. Most of the transportation companies use this method because it provides accuracy to

understand project in broad way. For evaluating proposed transportation projects, cost-benefit

analysis has become a commonly utilized and very well methodology. This study gives our

perspective on the function and placement of CBA in the transportation planning process in UPS,

which is partially based on a research of many nations where CBA has a defined significance in

judgment. According to the report, methodology, values, and possible applications are essentially

comparable across nations. The CBA results are included into a complete assessment procedure

that encompasses various sorts of non-monetized payments in UPS. CBA has a number of

benefits, including the struggle to transcend mental, physical, and procedure constraints and

prejudices in judgment. The socioeconomic and legal environment is some of the most

significant obstacles to CBA and independent economic in particular. CBA frequently runs the

danger of arriving too early in the planning phase to have a significant impact. Whenever

planning activities are focused around with a perceived "issue," this risk appears to rise.

Although expensive remedies may be considered as better than nothing unless situation is

deemed serious sufficient, regardless of the fact that the definition of "issue" is sometimes

subjective.

REFERENCES

Books and Journal

Siriopoulos, C., 2021. Financial Markets are Not Efficient: Financial Literacy as an Effective

Risk Management Tool. The International Journal of Business and Management

Research, 9(1), p.65.

Bolzan, G. and et..al, 2020. Enseñanza de ciencias contables y el proceso de convergencia a las

international financial reporting standards. REVISTA AMBIENTE CONTÁBIL-

Universidade Federal do Rio Grande do Norte-ISSN 2176-9036, 12(1).

Banerjee, A. and et.al, 2020. E-governance, accountability, and leakage in public programs:

Experimental evidence from a financial management reform in india. American

Economic Journal: Applied Economics, 12(4), pp.39-72.

Abuselidze, G., 2021. The Impact of Banking Competition on Economic Growth and Financial

Stability: An Empirical Investigation. European Journal of Sustainable

Development, 10(1), pp.203-203.

Ercegovac, R., Klinac, I. and Zdrilić, I., 2020. Bank specific determinants of EU banks

profitability after 2007 financial crisis. Management: Journal of Contemporary

Management Issues, 25(1), pp.89-102.

Online

Compound annual dividend growth, 2021. [Online]. Available through; <

https://dividendsdiversify.com/ups-stock-dividend-analysis/>

Dividend payout history, 2021. [Online]. Available through;

<https://a2-finance.com/en/issuers/united-parcel-service/dividends>

Books and Journal

Siriopoulos, C., 2021. Financial Markets are Not Efficient: Financial Literacy as an Effective

Risk Management Tool. The International Journal of Business and Management

Research, 9(1), p.65.

Bolzan, G. and et..al, 2020. Enseñanza de ciencias contables y el proceso de convergencia a las

international financial reporting standards. REVISTA AMBIENTE CONTÁBIL-

Universidade Federal do Rio Grande do Norte-ISSN 2176-9036, 12(1).

Banerjee, A. and et.al, 2020. E-governance, accountability, and leakage in public programs:

Experimental evidence from a financial management reform in india. American

Economic Journal: Applied Economics, 12(4), pp.39-72.

Abuselidze, G., 2021. The Impact of Banking Competition on Economic Growth and Financial

Stability: An Empirical Investigation. European Journal of Sustainable

Development, 10(1), pp.203-203.

Ercegovac, R., Klinac, I. and Zdrilić, I., 2020. Bank specific determinants of EU banks

profitability after 2007 financial crisis. Management: Journal of Contemporary

Management Issues, 25(1), pp.89-102.

Online

Compound annual dividend growth, 2021. [Online]. Available through; <

https://dividendsdiversify.com/ups-stock-dividend-analysis/>

Dividend payout history, 2021. [Online]. Available through;

<https://a2-finance.com/en/issuers/united-parcel-service/dividends>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.