PGBM65 Module: International Financial Statement Analysis Report

VerifiedAdded on 2023/01/23

|19

|4268

|66

Report

AI Summary

This report analyzes international financial statements, focusing on the convergence project between the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB). It explains the objectives of the convergence project, aiming to eliminate inconsistencies and enhance the comparability and transparency of financial reports. The report details the current status of various projects, including short-term and major joint projects, and discusses the benefits of IFRS implementation, such as increased comparability, cheaper capital, and reduced auditing complexity. The analysis includes a balance sheet statement for Ketsu Department Stores and explores provisions, liabilities, and equity, as well as the impact of IFRS on global organizations and governments. Furthermore, the report addresses the implications of IFRS adoption, highlighting advantages for investors, multinational organizations, and regional economic groupings. The report also includes working notes and calculations to support the financial analysis, providing a comprehensive understanding of the subject matter.

Running head: INTERNATIONAL FINANCIAL STATEMENT

Name of the Student:

Student Registration Number:

Programme of Study:

Word Count: 3,029

Name of the Module Leader: Caesar Nurokina

Name of the Tutor:

Name of the Student:

Student Registration Number:

Programme of Study:

Word Count: 3,029

Name of the Module Leader: Caesar Nurokina

Name of the Tutor:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INTERNATIONAL FINANCIAL STATEMENT

Table of Contents

Question One:..................................................................................................................................2

Requirement (a):..........................................................................................................................2

Requirement (b):..........................................................................................................................5

Question Two:.................................................................................................................................9

Requirement 1:.............................................................................................................................9

Requirement 2:...........................................................................................................................11

Question Three:.............................................................................................................................13

References:....................................................................................................................................17

Table of Contents

Question One:..................................................................................................................................2

Requirement (a):..........................................................................................................................2

Requirement (b):..........................................................................................................................5

Question Two:.................................................................................................................................9

Requirement 1:.............................................................................................................................9

Requirement 2:...........................................................................................................................11

Question Three:.............................................................................................................................13

References:....................................................................................................................................17

2INTERNATIONAL FINANCIAL STATEMENT

Question One:

Requirement (a):

Intention of IASB and FASB convergence project:

With the rising completion and pressure for organisations to disclose favourable reports of

earnings, there has been potential for fraud owing to the ambiguity in revenue recognition

guidance. Therefore, it has become increasingly necessary for IASB and FASB in establishing a

unified group of accounting standards (Tschopp and Nastanski 2014). In January 2002, the

FASB initiated discussions on a main project for overhauling the current standards of revenue

recognition. The discussions started identification of the scope and objectives of the project,

which would lead to comprehensive guidelines for revenue recognition in different industries. In

June 2002, there has been addition of revenue recognition by IASB in its technical agenda. In

September 2002, a formal agreement was made between IASB and FASB for working in

collaboration on the project of revenue recognition along with sharing staff resources (Hashim,

Li and O’Hanlon 2016). The significant objectives of this convergence project are listed down as

follows:

Elimination of weaknesses and inconsistencies in the revenue requirements

To form international accounting standards needing comparability, transparency and

increased quality in financial reports (Angeloni 2016)

At the time of implementing international accounting standards, the needs of emerging

markets are to be taken into consideration

Convergence of different national accounting standards with the international accounting

standards

Creation of a robust framework so that revenue issues could be addressed effectively

(Moldovan 2014)

Enhancement in comparability of revenue recognition practices throughout industries,

organisations, capital markets and jurisdictions

Delivery of beneficial information to the financial statement users by using enhanced

disclosure requirements

Question One:

Requirement (a):

Intention of IASB and FASB convergence project:

With the rising completion and pressure for organisations to disclose favourable reports of

earnings, there has been potential for fraud owing to the ambiguity in revenue recognition

guidance. Therefore, it has become increasingly necessary for IASB and FASB in establishing a

unified group of accounting standards (Tschopp and Nastanski 2014). In January 2002, the

FASB initiated discussions on a main project for overhauling the current standards of revenue

recognition. The discussions started identification of the scope and objectives of the project,

which would lead to comprehensive guidelines for revenue recognition in different industries. In

June 2002, there has been addition of revenue recognition by IASB in its technical agenda. In

September 2002, a formal agreement was made between IASB and FASB for working in

collaboration on the project of revenue recognition along with sharing staff resources (Hashim,

Li and O’Hanlon 2016). The significant objectives of this convergence project are listed down as

follows:

Elimination of weaknesses and inconsistencies in the revenue requirements

To form international accounting standards needing comparability, transparency and

increased quality in financial reports (Angeloni 2016)

At the time of implementing international accounting standards, the needs of emerging

markets are to be taken into consideration

Convergence of different national accounting standards with the international accounting

standards

Creation of a robust framework so that revenue issues could be addressed effectively

(Moldovan 2014)

Enhancement in comparability of revenue recognition practices throughout industries,

organisations, capital markets and jurisdictions

Delivery of beneficial information to the financial statement users by using enhanced

disclosure requirements

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INTERNATIONAL FINANCIAL STATEMENT

Simplification of the preparation of financial statements by minimising the requirements

to be referred by an organisation (Ball 2016)

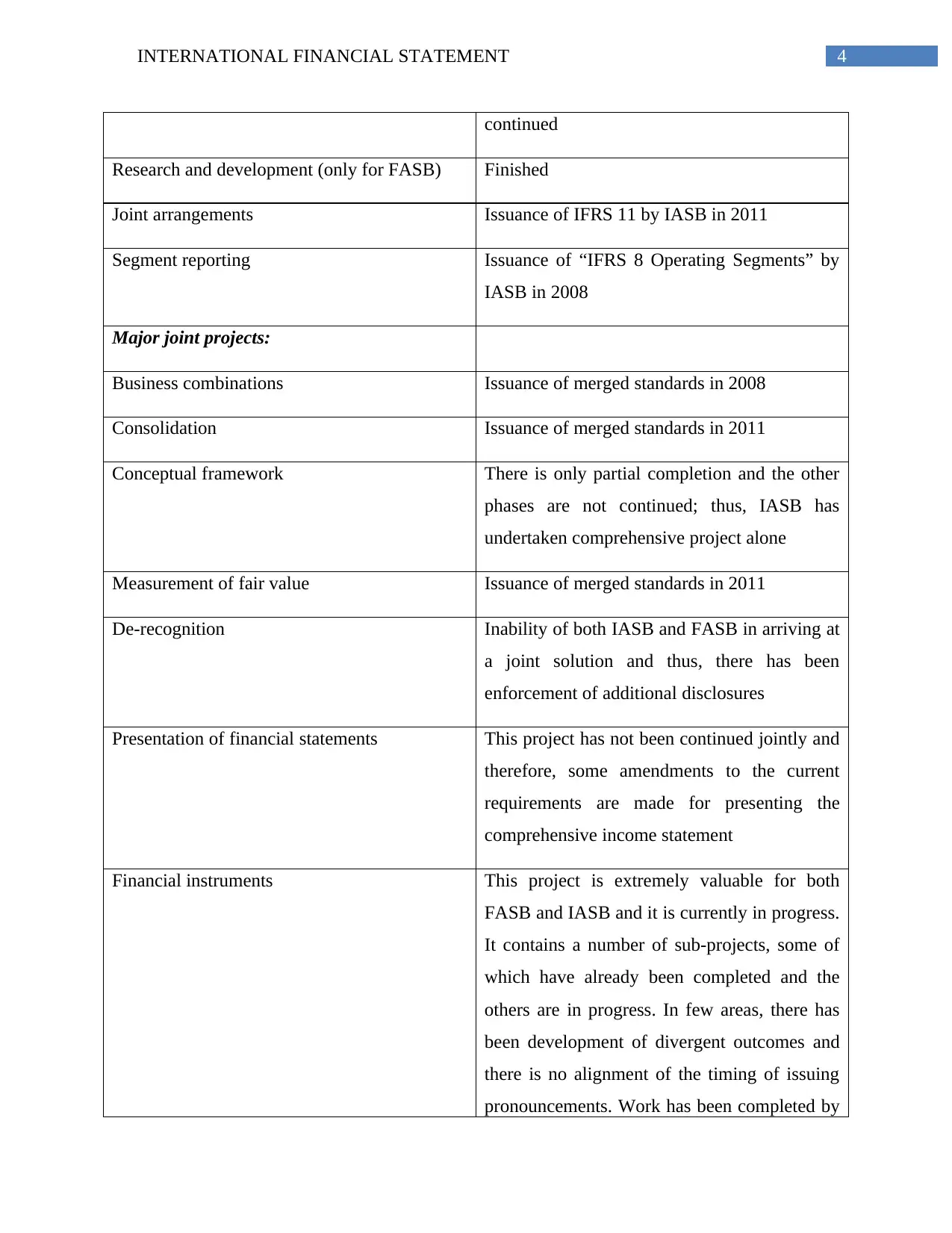

Current status of the project:

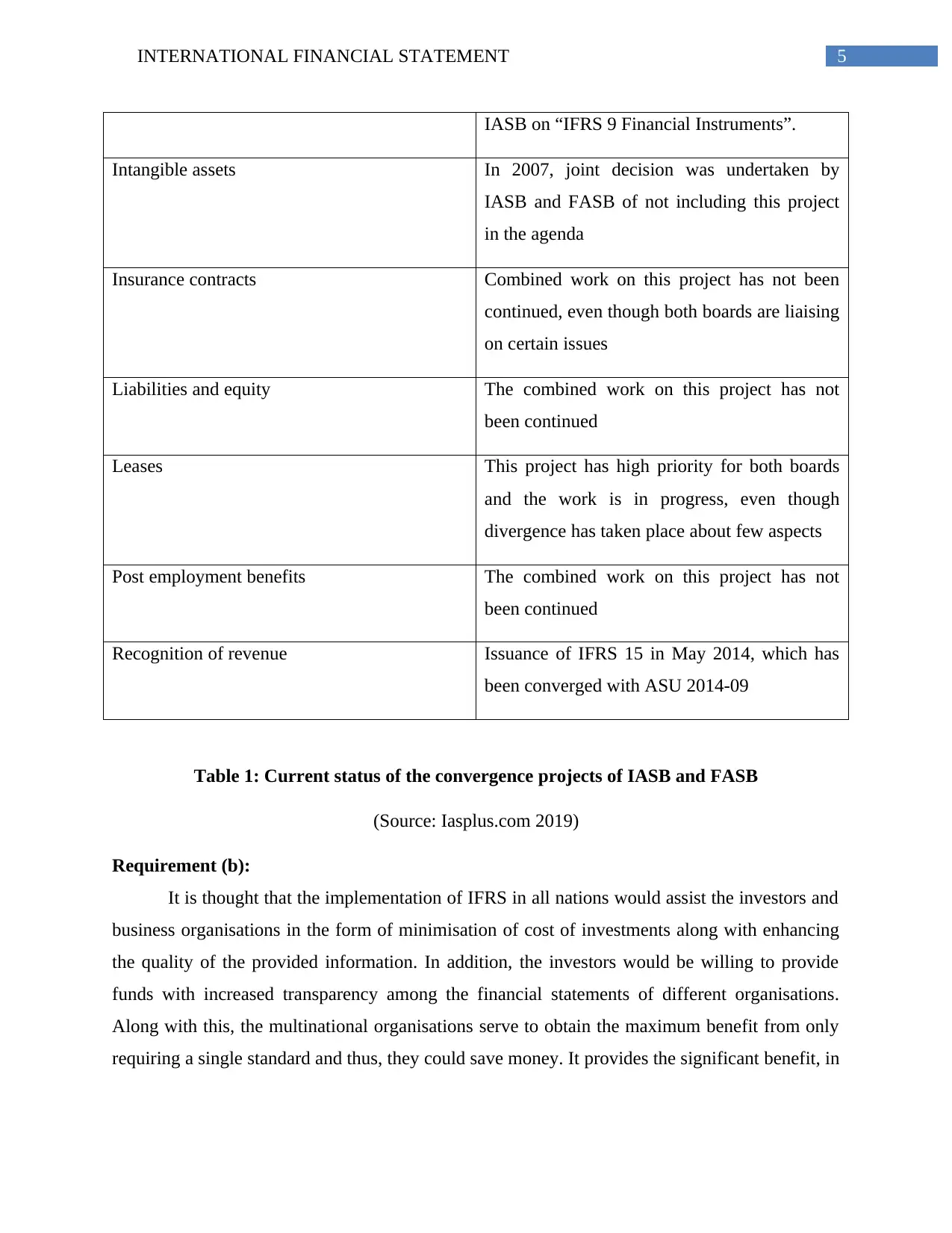

The scope of the convergence project has evolved with the passage of time. The

following table would show the present situation with the different projects. Some of the listed

projects are joint FASB-IASB projects, which are unofficially portion of the “Memorandum of

Understanding (MoU)” between the two boards. However, both the boards have agreed to work

in collaboration on the projects. On certain occasions, the projects have not been continued in the

form of joint projects and the IASB is carrying on with the project with its own right or it would

be taken into account for a longer-term research project of IASB. It is noteworthy to mention that

the convergence projects are on the verge of completion and there would not be any addition of

new projects on the agenda (Iasplus.com 2019).

Projects Status

Short-term convergence projects:

Cost of borrowings Reissuance of “IAS 23 Borrowing Costs” in

2008

Discontinued operations (only for IASB) Issuance of “IFRS 5 Non-Current Assets Held

for Sale and Discontinued Operations” in

March 2004

Fair value option related to financial

instruments (only for FASB)

Finished

Impairment Combined work on the project has not been

continued

Government grants Combined work on the project has not been

continued

Investment properties Active involvement of FASB in the project

Impairment Combined work on the project has not been

Simplification of the preparation of financial statements by minimising the requirements

to be referred by an organisation (Ball 2016)

Current status of the project:

The scope of the convergence project has evolved with the passage of time. The

following table would show the present situation with the different projects. Some of the listed

projects are joint FASB-IASB projects, which are unofficially portion of the “Memorandum of

Understanding (MoU)” between the two boards. However, both the boards have agreed to work

in collaboration on the projects. On certain occasions, the projects have not been continued in the

form of joint projects and the IASB is carrying on with the project with its own right or it would

be taken into account for a longer-term research project of IASB. It is noteworthy to mention that

the convergence projects are on the verge of completion and there would not be any addition of

new projects on the agenda (Iasplus.com 2019).

Projects Status

Short-term convergence projects:

Cost of borrowings Reissuance of “IAS 23 Borrowing Costs” in

2008

Discontinued operations (only for IASB) Issuance of “IFRS 5 Non-Current Assets Held

for Sale and Discontinued Operations” in

March 2004

Fair value option related to financial

instruments (only for FASB)

Finished

Impairment Combined work on the project has not been

continued

Government grants Combined work on the project has not been

continued

Investment properties Active involvement of FASB in the project

Impairment Combined work on the project has not been

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INTERNATIONAL FINANCIAL STATEMENT

continued

Research and development (only for FASB) Finished

Joint arrangements Issuance of IFRS 11 by IASB in 2011

Segment reporting Issuance of “IFRS 8 Operating Segments” by

IASB in 2008

Major joint projects:

Business combinations Issuance of merged standards in 2008

Consolidation Issuance of merged standards in 2011

Conceptual framework There is only partial completion and the other

phases are not continued; thus, IASB has

undertaken comprehensive project alone

Measurement of fair value Issuance of merged standards in 2011

De-recognition Inability of both IASB and FASB in arriving at

a joint solution and thus, there has been

enforcement of additional disclosures

Presentation of financial statements This project has not been continued jointly and

therefore, some amendments to the current

requirements are made for presenting the

comprehensive income statement

Financial instruments This project is extremely valuable for both

FASB and IASB and it is currently in progress.

It contains a number of sub-projects, some of

which have already been completed and the

others are in progress. In few areas, there has

been development of divergent outcomes and

there is no alignment of the timing of issuing

pronouncements. Work has been completed by

continued

Research and development (only for FASB) Finished

Joint arrangements Issuance of IFRS 11 by IASB in 2011

Segment reporting Issuance of “IFRS 8 Operating Segments” by

IASB in 2008

Major joint projects:

Business combinations Issuance of merged standards in 2008

Consolidation Issuance of merged standards in 2011

Conceptual framework There is only partial completion and the other

phases are not continued; thus, IASB has

undertaken comprehensive project alone

Measurement of fair value Issuance of merged standards in 2011

De-recognition Inability of both IASB and FASB in arriving at

a joint solution and thus, there has been

enforcement of additional disclosures

Presentation of financial statements This project has not been continued jointly and

therefore, some amendments to the current

requirements are made for presenting the

comprehensive income statement

Financial instruments This project is extremely valuable for both

FASB and IASB and it is currently in progress.

It contains a number of sub-projects, some of

which have already been completed and the

others are in progress. In few areas, there has

been development of divergent outcomes and

there is no alignment of the timing of issuing

pronouncements. Work has been completed by

5INTERNATIONAL FINANCIAL STATEMENT

IASB on “IFRS 9 Financial Instruments”.

Intangible assets In 2007, joint decision was undertaken by

IASB and FASB of not including this project

in the agenda

Insurance contracts Combined work on this project has not been

continued, even though both boards are liaising

on certain issues

Liabilities and equity The combined work on this project has not

been continued

Leases This project has high priority for both boards

and the work is in progress, even though

divergence has taken place about few aspects

Post employment benefits The combined work on this project has not

been continued

Recognition of revenue Issuance of IFRS 15 in May 2014, which has

been converged with ASU 2014-09

Table 1: Current status of the convergence projects of IASB and FASB

(Source: Iasplus.com 2019)

Requirement (b):

It is thought that the implementation of IFRS in all nations would assist the investors and

business organisations in the form of minimisation of cost of investments along with enhancing

the quality of the provided information. In addition, the investors would be willing to provide

funds with increased transparency among the financial statements of different organisations.

Along with this, the multinational organisations serve to obtain the maximum benefit from only

requiring a single standard and thus, they could save money. It provides the significant benefit, in

IASB on “IFRS 9 Financial Instruments”.

Intangible assets In 2007, joint decision was undertaken by

IASB and FASB of not including this project

in the agenda

Insurance contracts Combined work on this project has not been

continued, even though both boards are liaising

on certain issues

Liabilities and equity The combined work on this project has not

been continued

Leases This project has high priority for both boards

and the work is in progress, even though

divergence has taken place about few aspects

Post employment benefits The combined work on this project has not

been continued

Recognition of revenue Issuance of IFRS 15 in May 2014, which has

been converged with ASU 2014-09

Table 1: Current status of the convergence projects of IASB and FASB

(Source: Iasplus.com 2019)

Requirement (b):

It is thought that the implementation of IFRS in all nations would assist the investors and

business organisations in the form of minimisation of cost of investments along with enhancing

the quality of the provided information. In addition, the investors would be willing to provide

funds with increased transparency among the financial statements of different organisations.

Along with this, the multinational organisations serve to obtain the maximum benefit from only

requiring a single standard and thus, they could save money. It provides the significant benefit, in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INTERNATIONAL FINANCIAL STATEMENT

which it is utilised in above 120 different nations, while US GAAP is utilised only in a single

nation.

There are certain advantages of convergence that the investors and global organisations

could enjoy and they are enumerated briefly as follows:

Increased comparability:

The investors, including both corporate entities and individuals, would be able to

distinguish the financial outcomes of the various domestic and global companies and industries

for undertaking investment decisions. The single group of financial reporting standards

harmonising international accounting allow the investors regardless of their understanding of the

financial results of various global organisations to compare the performance of these

organisations for arriving at investment decisions (McEnroe and Sullivan 2014).

Cheaper capital in the public market:

The organisations adhering to the IFRS guidelines could obtain large and cheaper public

funding both domestically and globally by listing on different global stock exchanges like

London Stock Exchange, New York Stock Exchange and others. They draw the foreign investors

as well. The reason is that the application of IFRS assures accurate investigation of the financial

results of business organisations with the help of auditing (Satin and Huffman 2015). As a result,

the integrity of the financial outcomes is assured and they could be maintained and represented

faithfully for reposing the confidence of the investors in financial reporting.

Minimisation in cost of capital:

The organisations accessing funding in different nations are required to restate their

financial statements with adherence to the GAAP requirements of such nations. This increases

the cost of obtaining such funding. The international harmonisation of IFRS would imply that

such organisations could represent the same financial statements in all main global markets

without any sort of conversion and as a result, there would be minimisation in the cost of capital

(Sedki, Smith and Strickland 2014).

Minimised complexity in auditing:

which it is utilised in above 120 different nations, while US GAAP is utilised only in a single

nation.

There are certain advantages of convergence that the investors and global organisations

could enjoy and they are enumerated briefly as follows:

Increased comparability:

The investors, including both corporate entities and individuals, would be able to

distinguish the financial outcomes of the various domestic and global companies and industries

for undertaking investment decisions. The single group of financial reporting standards

harmonising international accounting allow the investors regardless of their understanding of the

financial results of various global organisations to compare the performance of these

organisations for arriving at investment decisions (McEnroe and Sullivan 2014).

Cheaper capital in the public market:

The organisations adhering to the IFRS guidelines could obtain large and cheaper public

funding both domestically and globally by listing on different global stock exchanges like

London Stock Exchange, New York Stock Exchange and others. They draw the foreign investors

as well. The reason is that the application of IFRS assures accurate investigation of the financial

results of business organisations with the help of auditing (Satin and Huffman 2015). As a result,

the integrity of the financial outcomes is assured and they could be maintained and represented

faithfully for reposing the confidence of the investors in financial reporting.

Minimisation in cost of capital:

The organisations accessing funding in different nations are required to restate their

financial statements with adherence to the GAAP requirements of such nations. This increases

the cost of obtaining such funding. The international harmonisation of IFRS would imply that

such organisations could represent the same financial statements in all main global markets

without any sort of conversion and as a result, there would be minimisation in the cost of capital

(Sedki, Smith and Strickland 2014).

Minimised complexity in auditing:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INTERNATIONAL FINANCIAL STATEMENT

Under GAAP, the audit work of multinational organisations is quite complex, since the

auditor needs to be accustomed to the required accounting regulations and frameworks of the

countries where the subsidiaries are located. This has increased the pressure on external audit

work and as a result, it leads to increased audit fees (McCarthy and McCarthy 2014). The IFRS

convergence eases auditing and accounting of multinational organisations, since the parent

organisations and their subsidiaries apply similar accounting standards.

Attraction of foreign direct investment:

The application of different domestic GAAP has restricted foreign direct investments in

some nations, particularly in the developing markets, to some extent. Assisting foreign investors

to list in the home country makes the domestic market busier and therefore, it encourages

additional investment. This could be accomplished in an easier way, if the nation is adhering to

IFRS norms and guidelines (Wingard, Bosman and Amisi 2016).

Increased flexibility for governments:

The governments of different nations would save money and time, if they implement

IFRS. Moreover, if the same is used internally, the governments of the developing nations could

undertake efforts for controlling the activities of the cross-border multinational organisations in

their own nations. Therefore, these organisations could not take shelter behind foreign

accounting practices, which are complex and difficult in terms of understanding.

Promotion of regional economic grouping:

The regional economic groups are generally involved in promoting trade within a

particular geographical area. The soundness of these groups relies on the available structures like

building blocks and accounting framework (Steinbach and Tang 2014). The implementation of a

single accounting practice like IFRS helps sound and cohesive regional grouping. At present, the

regional groupings like the EU, ECOWAS and others have implemented IFRS.

Central authoritative body:

From the perspective of policy-making, shifting to a single set of global accounting

standards is set within each nation by each standard-setting body as well as by a global group. A

single set of standards would minimise disagreement between nations and global regulators and

Under GAAP, the audit work of multinational organisations is quite complex, since the

auditor needs to be accustomed to the required accounting regulations and frameworks of the

countries where the subsidiaries are located. This has increased the pressure on external audit

work and as a result, it leads to increased audit fees (McCarthy and McCarthy 2014). The IFRS

convergence eases auditing and accounting of multinational organisations, since the parent

organisations and their subsidiaries apply similar accounting standards.

Attraction of foreign direct investment:

The application of different domestic GAAP has restricted foreign direct investments in

some nations, particularly in the developing markets, to some extent. Assisting foreign investors

to list in the home country makes the domestic market busier and therefore, it encourages

additional investment. This could be accomplished in an easier way, if the nation is adhering to

IFRS norms and guidelines (Wingard, Bosman and Amisi 2016).

Increased flexibility for governments:

The governments of different nations would save money and time, if they implement

IFRS. Moreover, if the same is used internally, the governments of the developing nations could

undertake efforts for controlling the activities of the cross-border multinational organisations in

their own nations. Therefore, these organisations could not take shelter behind foreign

accounting practices, which are complex and difficult in terms of understanding.

Promotion of regional economic grouping:

The regional economic groups are generally involved in promoting trade within a

particular geographical area. The soundness of these groups relies on the available structures like

building blocks and accounting framework (Steinbach and Tang 2014). The implementation of a

single accounting practice like IFRS helps sound and cohesive regional grouping. At present, the

regional groupings like the EU, ECOWAS and others have implemented IFRS.

Central authoritative body:

From the perspective of policy-making, shifting to a single set of global accounting

standards is set within each nation by each standard-setting body as well as by a global group. A

single set of standards would minimise disagreement between nations and global regulators and

8INTERNATIONAL FINANCIAL STATEMENT

it might reduce costs. In some nations, businesses are needed to incur reporting fees, which move

to finance these standard-setting bodies (Macve 2014). Although the costs might not affect large

organisations, they could have significant effect on small businesses. By shifting to a central

authoritative body, these costs could be minimised massively.

Other reasons:

There are certain other reasons for convergence to IFRS, which mainly constitute of the

following:

Vast sources of funds to foreign organisations while allowing smaller organisations for

accessing funding domestically and hopefully at lower cost

Straightforward appraisal of foreign organisations for mergers and takeovers

Allowing the shift of accounting staffs throughout the national borders due to the usage

of similar accounting standards in all nations

Development of group accounts would be easier owing to the application of similar

accounting standards (Pelger 2016)

Easy calculation of tax liability of the multinational organisations and investors receiving

income from foreign nations to eliminate tax evasion and fraud

it might reduce costs. In some nations, businesses are needed to incur reporting fees, which move

to finance these standard-setting bodies (Macve 2014). Although the costs might not affect large

organisations, they could have significant effect on small businesses. By shifting to a central

authoritative body, these costs could be minimised massively.

Other reasons:

There are certain other reasons for convergence to IFRS, which mainly constitute of the

following:

Vast sources of funds to foreign organisations while allowing smaller organisations for

accessing funding domestically and hopefully at lower cost

Straightforward appraisal of foreign organisations for mergers and takeovers

Allowing the shift of accounting staffs throughout the national borders due to the usage

of similar accounting standards in all nations

Development of group accounts would be easier owing to the application of similar

accounting standards (Pelger 2016)

Easy calculation of tax liability of the multinational organisations and investors receiving

income from foreign nations to eliminate tax evasion and fraud

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INTERNATIONAL FINANCIAL STATEMENT

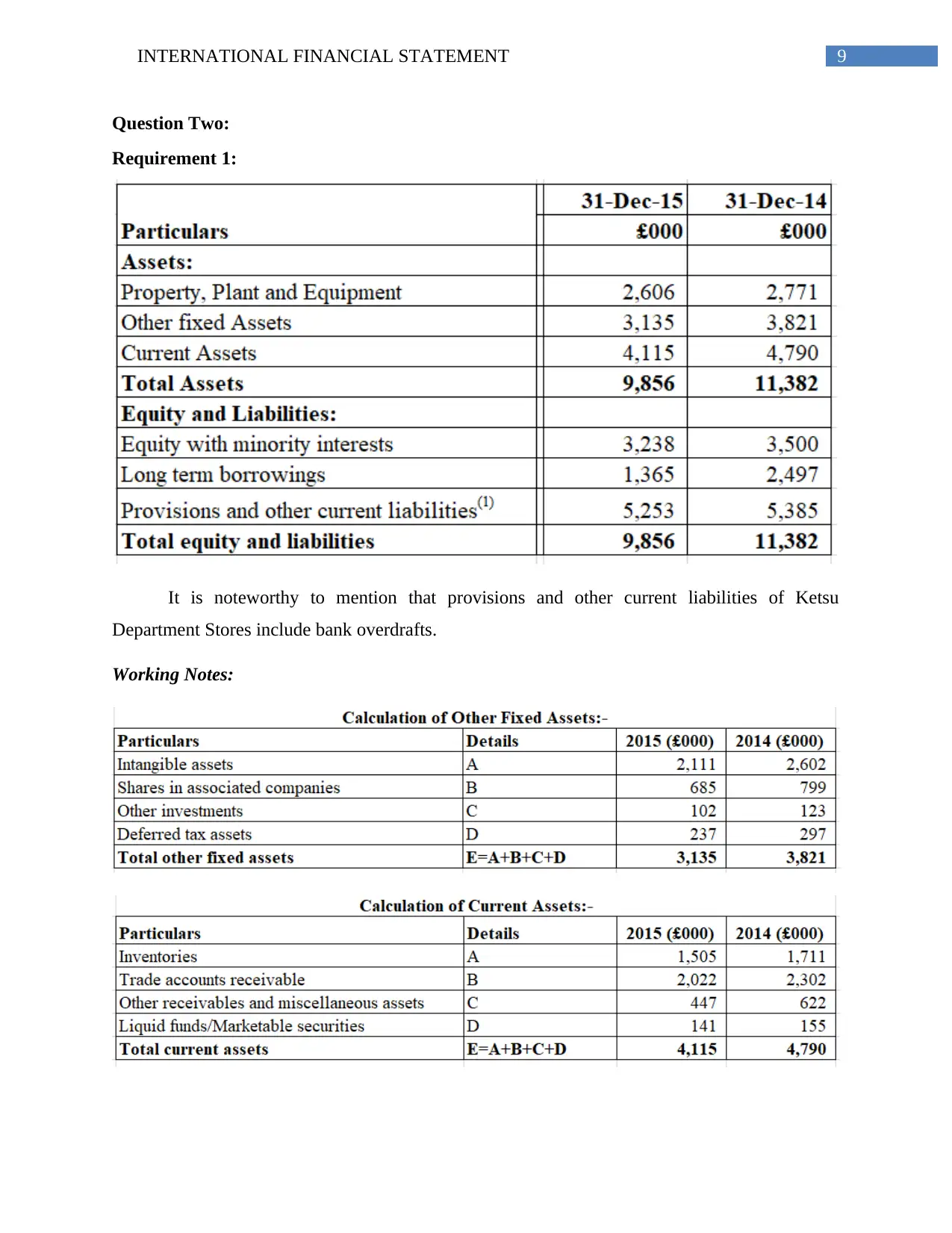

Question Two:

Requirement 1:

It is noteworthy to mention that provisions and other current liabilities of Ketsu

Department Stores include bank overdrafts.

Working Notes:

Question Two:

Requirement 1:

It is noteworthy to mention that provisions and other current liabilities of Ketsu

Department Stores include bank overdrafts.

Working Notes:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INTERNATIONAL FINANCIAL STATEMENT

From the above table accompanied by working note tables, a simplified balance sheet

statement for Ketsu Department Stores and the statement is segregated into two sections, which

include assets and equity and liabilities. The three sub-headings in the asset section constitute of

property, plant and equipment, current assets and other fixed assets. In order to current assets, the

accounts that have been taken into consideration are inventories, trade accounts receivable, other

receivables and miscellaneous assets and liquid funds or marketable securities. For computing

other fixed assets, the accounts considered include intangible assets, deferred tax assets, shares in

associated companies and other investments. By computing these three main accounts, the total

assets of Ketsu Department Stores have been £9,856,000 in 2015 compared to £11,382,000 in

2014.

From the above table accompanied by working note tables, a simplified balance sheet

statement for Ketsu Department Stores and the statement is segregated into two sections, which

include assets and equity and liabilities. The three sub-headings in the asset section constitute of

property, plant and equipment, current assets and other fixed assets. In order to current assets, the

accounts that have been taken into consideration are inventories, trade accounts receivable, other

receivables and miscellaneous assets and liquid funds or marketable securities. For computing

other fixed assets, the accounts considered include intangible assets, deferred tax assets, shares in

associated companies and other investments. By computing these three main accounts, the total

assets of Ketsu Department Stores have been £9,856,000 in 2015 compared to £11,382,000 in

2014.

11INTERNATIONAL FINANCIAL STATEMENT

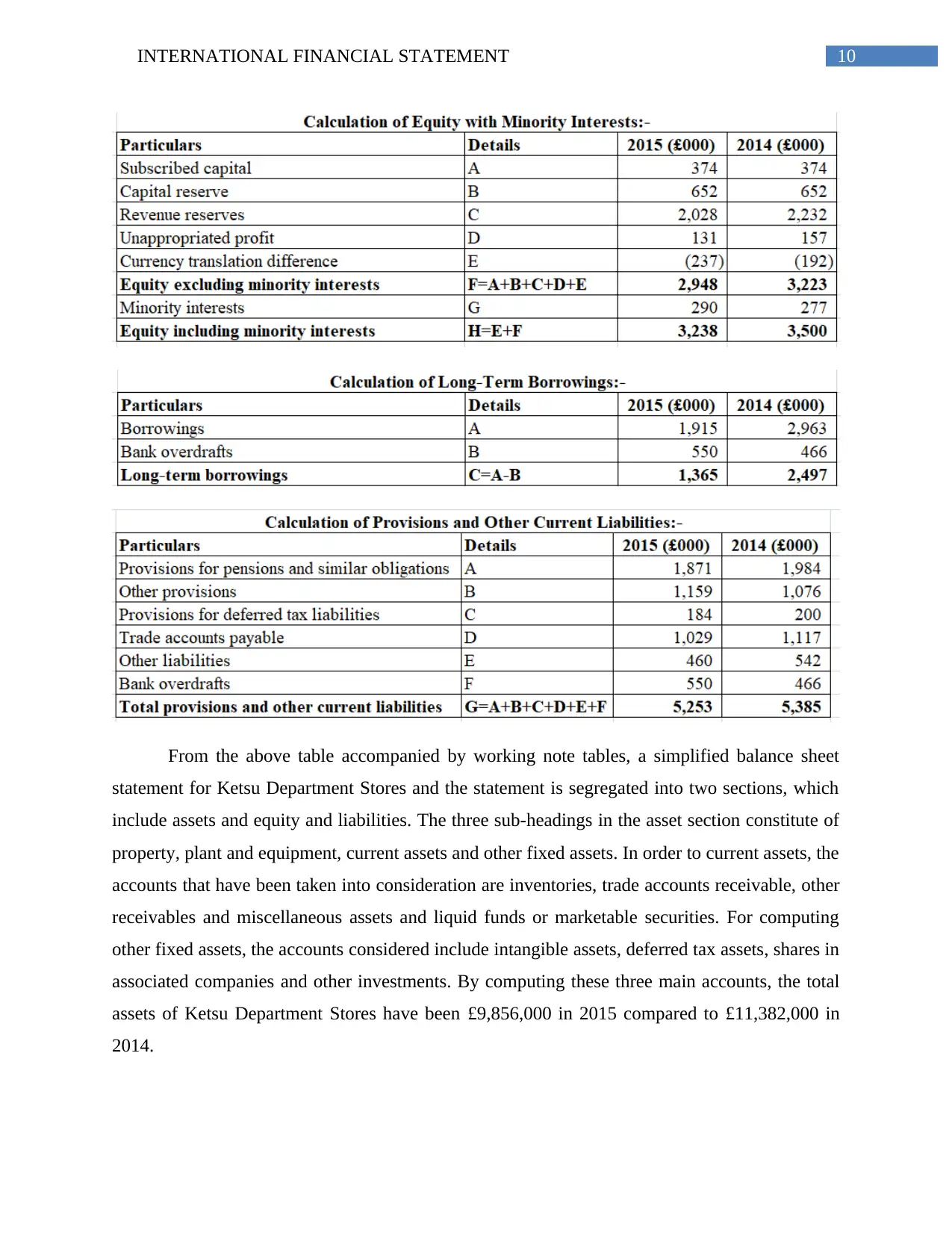

In order to compute equity with minority interests, the considered accounts include

capital reserve, subscribed capital, unappropriated profit, revenue reserves, currency translation

difference and minority interests. For calculating long-term borrowings, bank overdrafts have

been deducted from gross borrowings to arrive at the desired figure (Bekaert and Hodrick 2017).

Finally, for computing provisions and other current liabilities, the accounts taken into account

include provisions for deferred tax liabilities, provisions for pensions and similar obligations,

other provisions, trade accounts payable, bank overdrafts and other liabilities. By computing

these three main accounts, the total equity and liabilities of Ketsu Department Stores have been

£9,856,000 in 2015 compared to £11,382,000 in 2014.

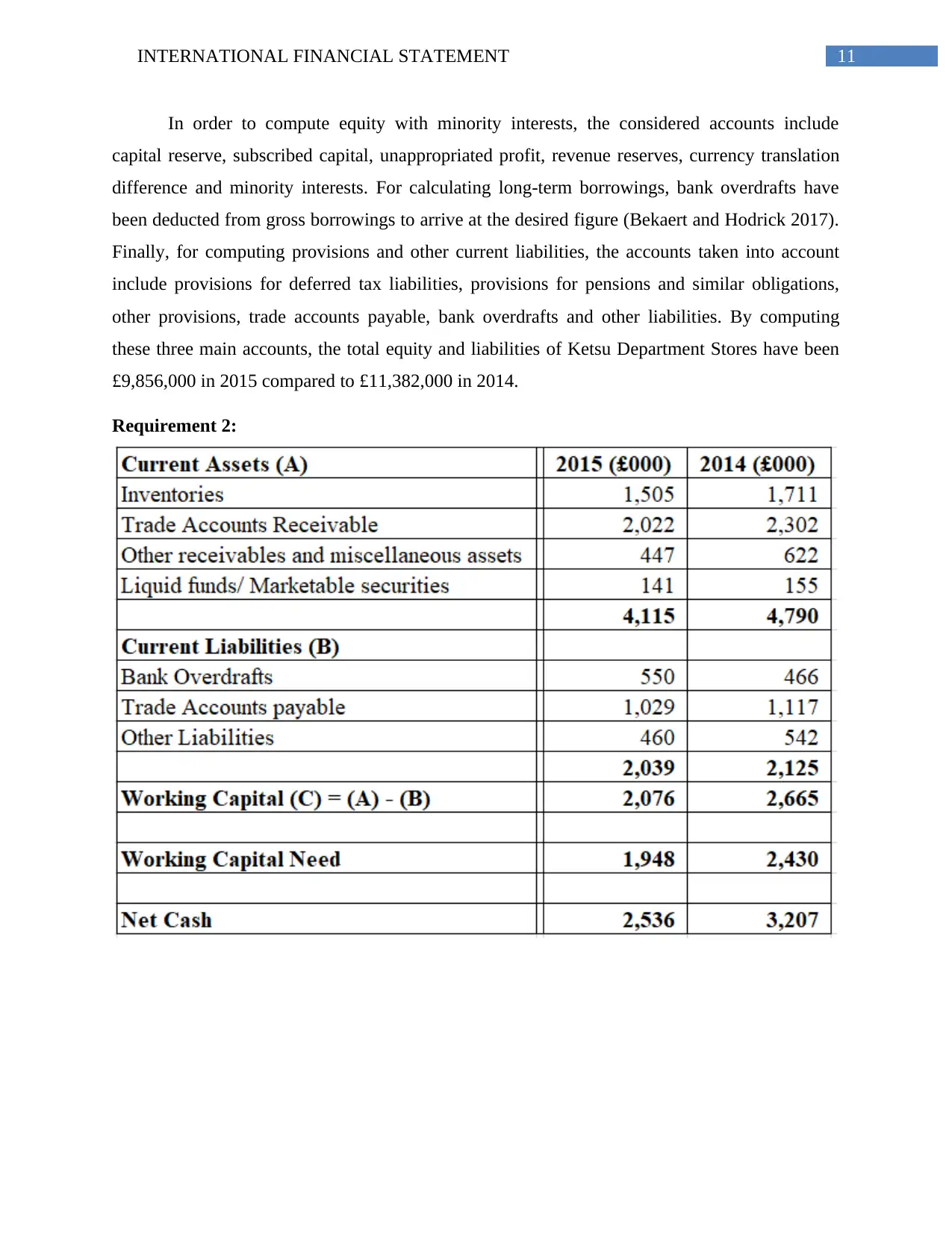

Requirement 2:

In order to compute equity with minority interests, the considered accounts include

capital reserve, subscribed capital, unappropriated profit, revenue reserves, currency translation

difference and minority interests. For calculating long-term borrowings, bank overdrafts have

been deducted from gross borrowings to arrive at the desired figure (Bekaert and Hodrick 2017).

Finally, for computing provisions and other current liabilities, the accounts taken into account

include provisions for deferred tax liabilities, provisions for pensions and similar obligations,

other provisions, trade accounts payable, bank overdrafts and other liabilities. By computing

these three main accounts, the total equity and liabilities of Ketsu Department Stores have been

£9,856,000 in 2015 compared to £11,382,000 in 2014.

Requirement 2:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.