International Trade Finance and Investment: A UK Economy Perspective

VerifiedAdded on 2022/12/30

|13

|3451

|1

Report

AI Summary

This report delves into the realm of international trade finance and investment, with a specific focus on the United Kingdom's economic landscape. It begins by examining the role of financial markets in allocating capital domestically and internationally, highlighting the significance of the UK as a global financial hub. The report then explores the UK's mixed economy, outlining the interplay between free markets and government intervention. It analyzes the allocation of capital within the domestic economy, the impact of inflation and exchange rates, and the role of financial institutions. The report further investigates the challenges posed by industrialization and trade policies, including the implications of Brexit. It also discusses the trade agreements and policies adopted by the UK, providing a comprehensive overview of the nation's approach to international trade and investment. The report offers a detailed analysis of the UK's financial system and its impact on international trade.

INTERNATIONAL TRADE

FINANCE AND INVESTMENT

FINANCE AND INVESTMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

MAIN BODY...................................................................................................................................1

1........................................................................................................................................................2

a) Allocation of capital within domestic economy and internationally for trade, investment

and development purpose with the help of financial market.......................................................2

Background of financial market...................................................................................................2

1b. Mixed Economy of United Kingdom....................................................................................5

Challenges faced by UK due to industrialization and trade policies...........................................6

CONCLUSION................................................................................................................................8

RECOMMENDATIONS.................................................................................................................8

REFERENCES..............................................................................................................................10

MAIN BODY...................................................................................................................................1

1........................................................................................................................................................2

a) Allocation of capital within domestic economy and internationally for trade, investment

and development purpose with the help of financial market.......................................................2

Background of financial market...................................................................................................2

1b. Mixed Economy of United Kingdom....................................................................................5

Challenges faced by UK due to industrialization and trade policies...........................................6

CONCLUSION................................................................................................................................8

RECOMMENDATIONS.................................................................................................................8

REFERENCES..............................................................................................................................10

MAIN BODY

1

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.

a) Allocation of capital within domestic economy and internationally for trade, investment and

development purpose with the help of financial market

Background of financial market

Financial market is crucial part of any economy that help the country to be in position of

efficient flow of money, increment of capital and growth of economy can take place. The

current report give emphasis on UK which is mixed economy. UK is hub for financial institution

for fund management. it has become such a centre for banks and investors that it is first priority

to invest in financial market.

The word financial securities' industry refers to the market where securities are traded by

investors. In economy of money creation and flow is undertaken by financial Service Authority

(FSA). All the Important decision regarding financial service industry is taken by FSA. British

government has took the action of making complex group. In which FSA is on top that deals

with top major financial establishment and regulatory bodies.

All policies related to money floating and creating is done by the bank of England in UK

as it is the central bank. In Mixed economy like UK the money flow is process based on the

policies made by central bank. Commercial banks take money from general public of UK in form

of deposits and use this money to grand loan to capitalist and needed Common people of UK

with fixed interest rate. The global crises help the every economy to understand how incorporate

financial nature of modern world can result in financial shocks for both domestic and

international economy.

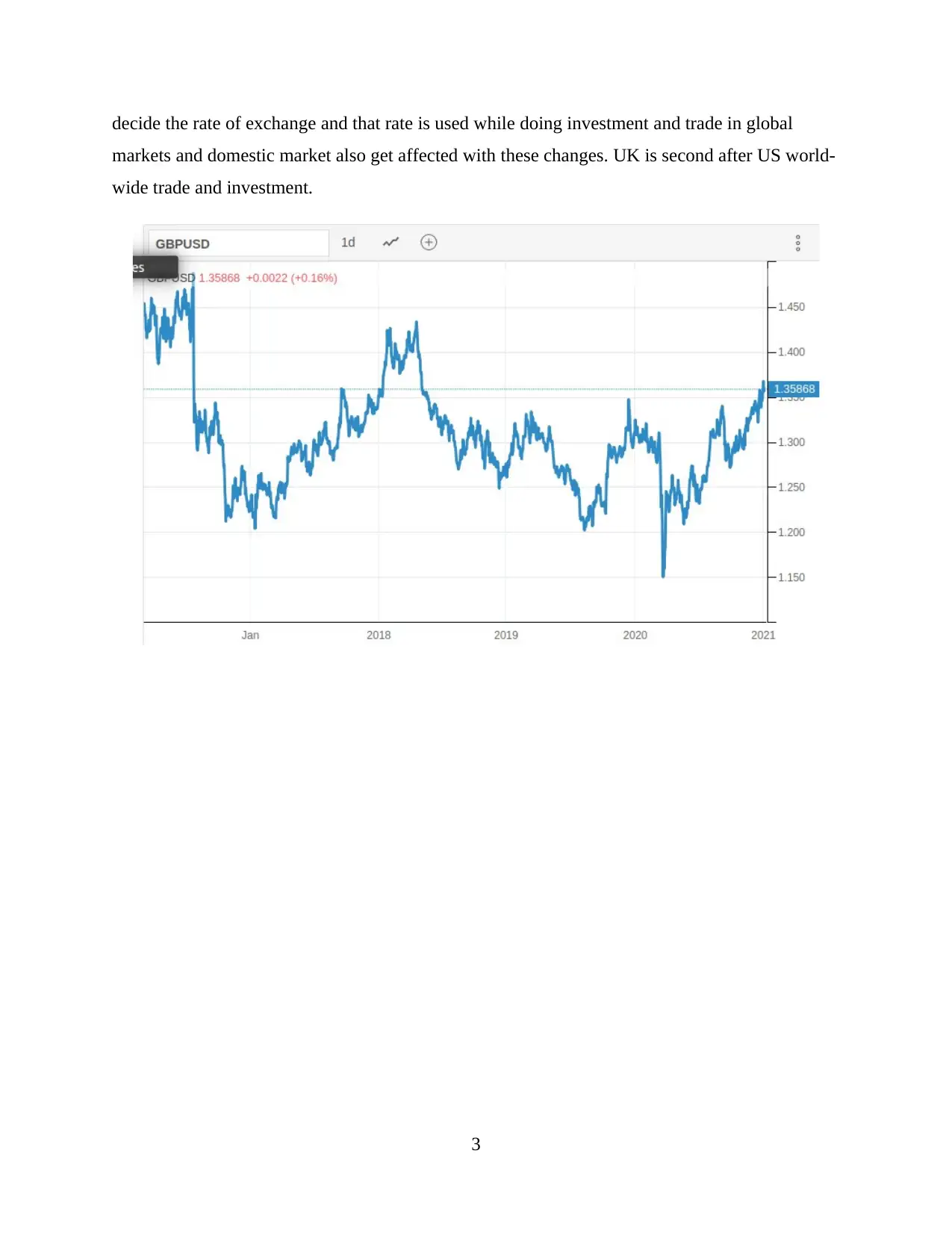

Inflation rate is measured by comparing the price rate that has increased from previous

year. Increase in inflation rate decreases purchasing power of the economy. The below graphical

presentation of data shows the current scenario of UK. In the below graph there is presentation of

Inflation rate change in UK economy. Data also represents that various policies made by the

government to low down the inflation rate for well being of society. In 2018 the statistic show

rate was 2.48% and in 2019 it declined to 1.79% and it further decline to 1.19%. which is

positive for development of economy. For the purpose of investment and trade it a beneficiary

part.

UK is very powerful nation as its currency has become powerful in global economy it exchange

rate fluctuates every seconds with reference to international economy. The international factors

2

a) Allocation of capital within domestic economy and internationally for trade, investment and

development purpose with the help of financial market

Background of financial market

Financial market is crucial part of any economy that help the country to be in position of

efficient flow of money, increment of capital and growth of economy can take place. The

current report give emphasis on UK which is mixed economy. UK is hub for financial institution

for fund management. it has become such a centre for banks and investors that it is first priority

to invest in financial market.

The word financial securities' industry refers to the market where securities are traded by

investors. In economy of money creation and flow is undertaken by financial Service Authority

(FSA). All the Important decision regarding financial service industry is taken by FSA. British

government has took the action of making complex group. In which FSA is on top that deals

with top major financial establishment and regulatory bodies.

All policies related to money floating and creating is done by the bank of England in UK

as it is the central bank. In Mixed economy like UK the money flow is process based on the

policies made by central bank. Commercial banks take money from general public of UK in form

of deposits and use this money to grand loan to capitalist and needed Common people of UK

with fixed interest rate. The global crises help the every economy to understand how incorporate

financial nature of modern world can result in financial shocks for both domestic and

international economy.

Inflation rate is measured by comparing the price rate that has increased from previous

year. Increase in inflation rate decreases purchasing power of the economy. The below graphical

presentation of data shows the current scenario of UK. In the below graph there is presentation of

Inflation rate change in UK economy. Data also represents that various policies made by the

government to low down the inflation rate for well being of society. In 2018 the statistic show

rate was 2.48% and in 2019 it declined to 1.79% and it further decline to 1.19%. which is

positive for development of economy. For the purpose of investment and trade it a beneficiary

part.

UK is very powerful nation as its currency has become powerful in global economy it exchange

rate fluctuates every seconds with reference to international economy. The international factors

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

decide the rate of exchange and that rate is used while doing investment and trade in global

markets and domestic market also get affected with these changes. UK is second after US world-

wide trade and investment.

3

markets and domestic market also get affected with these changes. UK is second after US world-

wide trade and investment.

3

Financial theory teaches that worth of equity share is resolute by the fundamental amount

. The theory focuses on how the rate is determined and explains the relationship among market in

domestic and global economy. Financial theories help the banks and financial institution to get

the thumb print and modification of those theory accordance with changing circumstances.

Capital Allocation with Domestic Economy

Capital market is the place where buyers ad sellers of bonds and shares come together to

meet common objectives. Capital allocation is related to floating of shares, bond and securities in

domestic economy. In UK bank gets well amount of deposits that used to provide loan. In capital

market financing is done for more than one yearn or may be for long period. The primary

allocation of capital is done in federal bank, corporations and government.

According to Burton, (2020) Economy of UK government focuses on how efficiently it

allocates its resources that is increase country's efficiency. The economy's authorities try to

manage the capital of economy in such way that it can balance both side of balance of payment

and balance of trade. An efficient allocation of resources is key element for success of UK

system. UK is second largest economic system as it mobilizes private capital to finance. Internal

capital play important role n domestic development of nation.

With the views of Endres and Harper, (2020) Theories related to allocation of capital

plays essential role in development of economy performance. There are different theories that are

suitable to nations according to their type, their position of handling funds, growth of country,

policies and structure of government etc. the common theory to manage capital flow in economy

is balanced growth theory that contribute in worldwide economic development. The theory states

that there should be balanced number of industry generation so that it can create market for one

another. This concept is also suitable for mixed system scheme of United Kingdom.

There are other theories also that represents different ways of allocating resources that are

essential for well-prosperity and development of any nation. Roston is also concept that provide

assistance to developed country to developed more and get more advancement in every sector of

their economy. The theory support each sector of industries like agriculture, infrastructure and

manufacturing etc. capital allocation in proper manner with accord to fulfil enough requirement

of each segment will lead to alteration in process of activeness. All this will outcomes

improvement f market situation of United Kingdom.

according to Maggiori, Neiman and Schreger, (2020) Being mixed economy UK has

4

. The theory focuses on how the rate is determined and explains the relationship among market in

domestic and global economy. Financial theories help the banks and financial institution to get

the thumb print and modification of those theory accordance with changing circumstances.

Capital Allocation with Domestic Economy

Capital market is the place where buyers ad sellers of bonds and shares come together to

meet common objectives. Capital allocation is related to floating of shares, bond and securities in

domestic economy. In UK bank gets well amount of deposits that used to provide loan. In capital

market financing is done for more than one yearn or may be for long period. The primary

allocation of capital is done in federal bank, corporations and government.

According to Burton, (2020) Economy of UK government focuses on how efficiently it

allocates its resources that is increase country's efficiency. The economy's authorities try to

manage the capital of economy in such way that it can balance both side of balance of payment

and balance of trade. An efficient allocation of resources is key element for success of UK

system. UK is second largest economic system as it mobilizes private capital to finance. Internal

capital play important role n domestic development of nation.

With the views of Endres and Harper, (2020) Theories related to allocation of capital

plays essential role in development of economy performance. There are different theories that are

suitable to nations according to their type, their position of handling funds, growth of country,

policies and structure of government etc. the common theory to manage capital flow in economy

is balanced growth theory that contribute in worldwide economic development. The theory states

that there should be balanced number of industry generation so that it can create market for one

another. This concept is also suitable for mixed system scheme of United Kingdom.

There are other theories also that represents different ways of allocating resources that are

essential for well-prosperity and development of any nation. Roston is also concept that provide

assistance to developed country to developed more and get more advancement in every sector of

their economy. The theory support each sector of industries like agriculture, infrastructure and

manufacturing etc. capital allocation in proper manner with accord to fulfil enough requirement

of each segment will lead to alteration in process of activeness. All this will outcomes

improvement f market situation of United Kingdom.

according to Maggiori, Neiman and Schreger, (2020) Being mixed economy UK has

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

stable GDP, it has enabled to boost its economy by diversifying its capital resource. Proper

management of resources has made the nation to generate employment opportunities. Two

methods for allocation are adopted by nation to maintain accuracy with WTO. In UK lenders

give money to borrowers on the condition of paying back on maturity date with decided interest

amount. And other way is that in which lender of money is ready to accept payment of his own

money from borrowers on fixed payment in each month. This is totally dependent on borrowers'

capacity to pay e.g.- monthly, quarterly and yearly. This is part of monetary system of mixed

economy which decides rates of interests for lending and borrowing money. Using theories for

domestic allocation of funds is best way to design economic structure for development and

growth of UK economy.

1b. Mixed Economy of United Kingdom

The economy of United Kingdom is considered to be mixed which involves free trade as well as

government intervention in some sectors. Majorly it can be referred as the capitalist economy as

there are free markets and global economy and the major decisions also are based on the free

market forces. But certain decisions like building hospitals, schools, roads, bridges etc. lie in the

hands of the government and approximately 35% of the GDP is the government spendings done

for the development of the economy (Powell, 2019). It can be defined as the mix of both market

and planned economies where market is allowed to operate freely and decide the optimum

allocation of resources but government intervenes when market fails.

Currently the pattern of trade in UK is free for all the entrepreneurs who can produce and sell

whatever they want to and also allocate the resources as per their free will. The trade comprises

both domestic and international including the exports and imports made globally. The inter

industry trade is governed by technology and the factors of production and intra industry is

governed by the competition and the economies of scale (Greer, 2020). Over the years the trade

growth in both the intensive and the extensive forms has lead to a lot of development of the

nation. The change has been in the range of goods and services that are being traded which

intensively considers the increased volume and extensively considers the expansion of the range

of products for the exports and the imports. It shows the extensive growth of bilateral trade with

various countries and intensive growth of trade value with the existing trade partners.

5

management of resources has made the nation to generate employment opportunities. Two

methods for allocation are adopted by nation to maintain accuracy with WTO. In UK lenders

give money to borrowers on the condition of paying back on maturity date with decided interest

amount. And other way is that in which lender of money is ready to accept payment of his own

money from borrowers on fixed payment in each month. This is totally dependent on borrowers'

capacity to pay e.g.- monthly, quarterly and yearly. This is part of monetary system of mixed

economy which decides rates of interests for lending and borrowing money. Using theories for

domestic allocation of funds is best way to design economic structure for development and

growth of UK economy.

1b. Mixed Economy of United Kingdom

The economy of United Kingdom is considered to be mixed which involves free trade as well as

government intervention in some sectors. Majorly it can be referred as the capitalist economy as

there are free markets and global economy and the major decisions also are based on the free

market forces. But certain decisions like building hospitals, schools, roads, bridges etc. lie in the

hands of the government and approximately 35% of the GDP is the government spendings done

for the development of the economy (Powell, 2019). It can be defined as the mix of both market

and planned economies where market is allowed to operate freely and decide the optimum

allocation of resources but government intervenes when market fails.

Currently the pattern of trade in UK is free for all the entrepreneurs who can produce and sell

whatever they want to and also allocate the resources as per their free will. The trade comprises

both domestic and international including the exports and imports made globally. The inter

industry trade is governed by technology and the factors of production and intra industry is

governed by the competition and the economies of scale (Greer, 2020). Over the years the trade

growth in both the intensive and the extensive forms has lead to a lot of development of the

nation. The change has been in the range of goods and services that are being traded which

intensively considers the increased volume and extensively considers the expansion of the range

of products for the exports and the imports. It shows the extensive growth of bilateral trade with

various countries and intensive growth of trade value with the existing trade partners.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The major trade partners for UK has been United States, Germany, The Netherlands, China and

France which constitute 46% of the total trade of UK in goods and services (Giersch, 2019). The

international trade of UK has been a major source of income for the economy and can be further

developed to ensure sustainable development.

The state of the economy in UK is poor as it has lost its momentum since the pandemic broke

globally. Also, because of the limited access to the markets of European Union post Brexit

policy the trade has been robust. The chances of recovery are estimated in the coming years with

the help of redesigning of the fiscal and the monetary policies. The deal with the EU is also

finalized such that the damage can be minimized and the employment levels can be improved.

Various rates and measures can measure the state of economy and determine the competitive

advantage that it persists as compared with other economies (Jenkins, 2016). The rate of interest

is currently 0.1% which has been dropped by Bank of England in order to meet the disruption

done by coronavirus. The unemployment rate currently is 4.9% which has increased over the

previous year in which it was 3.8%. The rate of inflation has also decreased as compared to

previous year's data.

The competitive advantage that the economy of UK has over the other global economies is the

political and economic stability, lower rates of taxation and inflation and commitment of the

government to establish a healthy competition with privatization (Bartlett, 2019). All these

positive aspects of the UK economy helps to attract a lot of foreign investment which ultimately

boosts its employment levels, per capita income and develops the nation as a whole.

There are certain trade agreements that UK has signed with the rest of the world in order to

facilitate the terms of the trade that are to be undertaken. UK is planning the trade negotiations

and signing of the new trade agreements with US, Australia and New Zealand. A free trade

agreement with Japan named UK-Japan Comprehensive Economic Partnership Agreement

(CEPA). The trade policies post Brexit with the EU is also a trade agreement that is signed by

UK.

Challenges faced by UK due to industrialization and trade policies

The industrial revolution has its roots in the past, but over the years it has evolved as largest

manufacturer of many products through setting up large industries, technological advancements

and foreign investments. Industrialization has helped UK tremendously in its growth and

development. It has been so effective because of the flexible trade policies that are followed in

6

France which constitute 46% of the total trade of UK in goods and services (Giersch, 2019). The

international trade of UK has been a major source of income for the economy and can be further

developed to ensure sustainable development.

The state of the economy in UK is poor as it has lost its momentum since the pandemic broke

globally. Also, because of the limited access to the markets of European Union post Brexit

policy the trade has been robust. The chances of recovery are estimated in the coming years with

the help of redesigning of the fiscal and the monetary policies. The deal with the EU is also

finalized such that the damage can be minimized and the employment levels can be improved.

Various rates and measures can measure the state of economy and determine the competitive

advantage that it persists as compared with other economies (Jenkins, 2016). The rate of interest

is currently 0.1% which has been dropped by Bank of England in order to meet the disruption

done by coronavirus. The unemployment rate currently is 4.9% which has increased over the

previous year in which it was 3.8%. The rate of inflation has also decreased as compared to

previous year's data.

The competitive advantage that the economy of UK has over the other global economies is the

political and economic stability, lower rates of taxation and inflation and commitment of the

government to establish a healthy competition with privatization (Bartlett, 2019). All these

positive aspects of the UK economy helps to attract a lot of foreign investment which ultimately

boosts its employment levels, per capita income and develops the nation as a whole.

There are certain trade agreements that UK has signed with the rest of the world in order to

facilitate the terms of the trade that are to be undertaken. UK is planning the trade negotiations

and signing of the new trade agreements with US, Australia and New Zealand. A free trade

agreement with Japan named UK-Japan Comprehensive Economic Partnership Agreement

(CEPA). The trade policies post Brexit with the EU is also a trade agreement that is signed by

UK.

Challenges faced by UK due to industrialization and trade policies

The industrial revolution has its roots in the past, but over the years it has evolved as largest

manufacturer of many products through setting up large industries, technological advancements

and foreign investments. Industrialization has helped UK tremendously in its growth and

development. It has been so effective because of the flexible trade policies that are followed in

6

UK economy. UK follows a free and fair trade policy which helps in higher wages, wider range

of goods and services and increase household incomes. After separating from the EU it has

assumed greater powers and an independent trade policy (Hussain and Haque, 2016). Various

negotiations and the trade agreements have been undertaken so that international trade can be

flourished.

Pros and cons of the nation's economy:-

The free trade agreements that UK has signed with several countries across the globe has

lead to both positive as well negative impact on its economy. It has brought a

comparative increase in the economic growth and development of the country,

advancement in the technology and achieving the economies of scale (Dhingra and et.al.

2016).

Some negative outcomes of this policy could be exploitation of the natural resources,

poor working conditions and outsourcing of the jobs.

Brexit the other nation's policy involves the Britain to exit from the European Union.

This policy was formed to achieve certain benefits like assuming greater power, seat at

the World Trade Organization, trade with the major economies like Japan, US, China and

India and the flexible terms of the business (Steven, 2016).

But on the contrary some demerits it has caused for the British are risk to millions of

jobs, trade barriers with European Union and greater impact in the international market as

part of EU.

The financial system and its regulations in UK is not completely left in the hands of the

market forces but there is required level of government intervention. When the economy

fails the fiscal and monetary policies as formulated by the authority works as the

stimulus. Other than that a proper check on the job security, overexploitation of resources

and monopoly creation, pollution levels etc. is kept.

The cons of this policy are that the economy shall be affected by the inefficiencies of the

public sector, lead to collision and shall snatch the freedom.

Agency Theory:- The agency theory of UK has been developed to improve the statutory audit of

the businesses. It says that an agency relationship must be established between the directors and

the stakeholders of the company. This theory also includes better accounting practices so that the

frauds can be subsequently minimized (Dhingra and et.al. 2018).

7

of goods and services and increase household incomes. After separating from the EU it has

assumed greater powers and an independent trade policy (Hussain and Haque, 2016). Various

negotiations and the trade agreements have been undertaken so that international trade can be

flourished.

Pros and cons of the nation's economy:-

The free trade agreements that UK has signed with several countries across the globe has

lead to both positive as well negative impact on its economy. It has brought a

comparative increase in the economic growth and development of the country,

advancement in the technology and achieving the economies of scale (Dhingra and et.al.

2016).

Some negative outcomes of this policy could be exploitation of the natural resources,

poor working conditions and outsourcing of the jobs.

Brexit the other nation's policy involves the Britain to exit from the European Union.

This policy was formed to achieve certain benefits like assuming greater power, seat at

the World Trade Organization, trade with the major economies like Japan, US, China and

India and the flexible terms of the business (Steven, 2016).

But on the contrary some demerits it has caused for the British are risk to millions of

jobs, trade barriers with European Union and greater impact in the international market as

part of EU.

The financial system and its regulations in UK is not completely left in the hands of the

market forces but there is required level of government intervention. When the economy

fails the fiscal and monetary policies as formulated by the authority works as the

stimulus. Other than that a proper check on the job security, overexploitation of resources

and monopoly creation, pollution levels etc. is kept.

The cons of this policy are that the economy shall be affected by the inefficiencies of the

public sector, lead to collision and shall snatch the freedom.

Agency Theory:- The agency theory of UK has been developed to improve the statutory audit of

the businesses. It says that an agency relationship must be established between the directors and

the stakeholders of the company. This theory also includes better accounting practices so that the

frauds can be subsequently minimized (Dhingra and et.al. 2018).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Risk and Return Theory- This is the most prominent theory which means higher the risk higher

shall be the returns of the investment. It is used in almost all the concepts of economic policy the

priorities are set accordingly.

CONCLUSION

It can be concluded that due to the breakdown of coronavirus the economy has become stagnant,

for which UK has to find the path of recovery. This can be efficiently achieved by prioritizing

the activities which are to be performed while keeping in mind the investments and the trade that

is provided by the FDI. The various trade agreements are to be designed such that it boosts up

the trade and development of the country. The uncertainties that are posed by the Brexit policy

shall also be reviewed such that trade barriers are not established and country can access its

market. The fees for the membership of EU which is now saved, should be used effectively so

that the newer opportunities for the success can be established.

RECOMMENDATIONS

There are several recommendations for the development of the UK economy which has to be

undertaken so that the future success is ensured.

More investment in the department of research so that the dependence for tech support

over the other countries can be reduced.

Exploitation of natural resources should be reduced by the government such that the

sustainable development of the economy can be ensured.

Maximize the employment levels in the country and provide job security for the jobs

which are endangered with the Brexit policy.

The transport and the energy sector requires huge investment to build the infrastructure

that is desired by the foreign investors (Pradhan and et.al. 2017).

Improve the inefficiencies in the public sector due to which important aspects like health,

education and infrastructure of the country is lagging behind. The government spendings

should be increased in these areas so that the overall development can be ascertained.

Industrial revolution has been in action since long in UK but still the levels of

productivity are unsatisfactory. The economy must ensure higher levels of productivity so

that economies of scale can be attained.

In order to meet the demographic challenges that are posed in the industries they need to

incorporate the old age people in the workforce.

8

shall be the returns of the investment. It is used in almost all the concepts of economic policy the

priorities are set accordingly.

CONCLUSION

It can be concluded that due to the breakdown of coronavirus the economy has become stagnant,

for which UK has to find the path of recovery. This can be efficiently achieved by prioritizing

the activities which are to be performed while keeping in mind the investments and the trade that

is provided by the FDI. The various trade agreements are to be designed such that it boosts up

the trade and development of the country. The uncertainties that are posed by the Brexit policy

shall also be reviewed such that trade barriers are not established and country can access its

market. The fees for the membership of EU which is now saved, should be used effectively so

that the newer opportunities for the success can be established.

RECOMMENDATIONS

There are several recommendations for the development of the UK economy which has to be

undertaken so that the future success is ensured.

More investment in the department of research so that the dependence for tech support

over the other countries can be reduced.

Exploitation of natural resources should be reduced by the government such that the

sustainable development of the economy can be ensured.

Maximize the employment levels in the country and provide job security for the jobs

which are endangered with the Brexit policy.

The transport and the energy sector requires huge investment to build the infrastructure

that is desired by the foreign investors (Pradhan and et.al. 2017).

Improve the inefficiencies in the public sector due to which important aspects like health,

education and infrastructure of the country is lagging behind. The government spendings

should be increased in these areas so that the overall development can be ascertained.

Industrial revolution has been in action since long in UK but still the levels of

productivity are unsatisfactory. The economy must ensure higher levels of productivity so

that economies of scale can be attained.

In order to meet the demographic challenges that are posed in the industries they need to

incorporate the old age people in the workforce.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Increase in the ratio of government debt is also a point of concern for the UK economy.

The burden of the government is also to be reduced simultaneously with better exports

and increasing the GDP.

9

The burden of the government is also to be reduced simultaneously with better exports

and increasing the GDP.

9

REFERENCES

Books and Journals

Alexiou, C., Trachanas, E. and Vogiazas, S., 2021. Income inequality and financialization: a not

so straightforward relationship. Journal of Economic Studies.

Bartlett, D. L., 2019. Banking and Financial Reform in a Mixed Economy: The Case of

Hungary. In Capitalist Goals, Socialist Past (pp. 169-192). Routledge.

Burton, J., 2020. Supporting entrepreneurs when it matters: optimising capital allocation for

impact. Journal of Entrepreneurship and Public Policy.

Dhingra, S. and et.al. 2016. The impact of Brexit on foreign investment in the UK. BREXIT

2016. 24(2).

Dhingra, S. and et.al. 2018. UK trade and FDI: A post‐Brexit perspective. Papers in Regional

Science. 97(1). pp.9-24.

Endres, A. M. and Harper, D. A., 2020. Economic development and complexity: the role of

recombinant capital. Cambridge Journal of Economics. 44(1). pp.157-180.

Evdokimova, Y., 2020, December. Digitalization of the Financial Sector: Background and

Specifics. In 2nd International Scientific and Practical Conference on Digital Economy

(ISCDE 2020) (pp. 179-183). Atlantis Press.

Giersch, H., 2019. Reassessing the role of government in the mixed economy: Symposium 1982.

Routledge.

Greenbaum, S. I., Thakor, A. V. and Boot, A. W., 2019. Contemporary financial intermediation.

Academic Press.

Greer, S., 2020. Funding resilience: market rationalism and the UK’s “mixed economy” for the

arts. Cultural Trends, pp.1-19.

Hussain, M. E. and Haque, M., 2016. Foreign direct investment, trade, and economic growth:

An empirical analysis of Bangladesh. Economies. 4(2). p.7.

Jenkins, S. P., 2016. The Income Distribution in the UK. Social Advantage and Disadvantage,

ed. by H. Dean, and L. Platt, pp.135-160.

Lekavičius, V., Galinis, A. and Miškinis, V., 2019. Long-term economic impacts of energy

development scenarios: The role of domestic electricity generation. Applied Energy.

253. p.113527.

Lo, A. W., 2019. Adaptive markets: Financial evolution at the speed of thought. Princeton

University Press.

Lun, Z. and Fu, Q., 2019, January. Research on the Development of Inclusive Finance in

Poverty-stricken Areas under the Background of Precise Poverty Alleviation. In 3rd

International Seminar on Education Innovation and Economic Management (SEIEM

2018). Atlantis Press.

Maggiori, M., Neiman, B. and Schreger, J., 2020. International currencies and capital

allocation. Journal of Political Economy. 128(6). pp.2019-2066.

Powell, M. ed., 2019. Understanding the mixed economy of welfare. Policy Press.

Pradhan, R. P. and et.al. 2017. Trade openness, foreign direct investment, and finance-growth

nexus in the Eurozone countries. The Journal of International Trade & Economic

Development. 26(3). pp.336-360.

Steven, R., 2016. Japan and the new world order: global investments, trade and finance.

Springer.

10

Books and Journals

Alexiou, C., Trachanas, E. and Vogiazas, S., 2021. Income inequality and financialization: a not

so straightforward relationship. Journal of Economic Studies.

Bartlett, D. L., 2019. Banking and Financial Reform in a Mixed Economy: The Case of

Hungary. In Capitalist Goals, Socialist Past (pp. 169-192). Routledge.

Burton, J., 2020. Supporting entrepreneurs when it matters: optimising capital allocation for

impact. Journal of Entrepreneurship and Public Policy.

Dhingra, S. and et.al. 2016. The impact of Brexit on foreign investment in the UK. BREXIT

2016. 24(2).

Dhingra, S. and et.al. 2018. UK trade and FDI: A post‐Brexit perspective. Papers in Regional

Science. 97(1). pp.9-24.

Endres, A. M. and Harper, D. A., 2020. Economic development and complexity: the role of

recombinant capital. Cambridge Journal of Economics. 44(1). pp.157-180.

Evdokimova, Y., 2020, December. Digitalization of the Financial Sector: Background and

Specifics. In 2nd International Scientific and Practical Conference on Digital Economy

(ISCDE 2020) (pp. 179-183). Atlantis Press.

Giersch, H., 2019. Reassessing the role of government in the mixed economy: Symposium 1982.

Routledge.

Greenbaum, S. I., Thakor, A. V. and Boot, A. W., 2019. Contemporary financial intermediation.

Academic Press.

Greer, S., 2020. Funding resilience: market rationalism and the UK’s “mixed economy” for the

arts. Cultural Trends, pp.1-19.

Hussain, M. E. and Haque, M., 2016. Foreign direct investment, trade, and economic growth:

An empirical analysis of Bangladesh. Economies. 4(2). p.7.

Jenkins, S. P., 2016. The Income Distribution in the UK. Social Advantage and Disadvantage,

ed. by H. Dean, and L. Platt, pp.135-160.

Lekavičius, V., Galinis, A. and Miškinis, V., 2019. Long-term economic impacts of energy

development scenarios: The role of domestic electricity generation. Applied Energy.

253. p.113527.

Lo, A. W., 2019. Adaptive markets: Financial evolution at the speed of thought. Princeton

University Press.

Lun, Z. and Fu, Q., 2019, January. Research on the Development of Inclusive Finance in

Poverty-stricken Areas under the Background of Precise Poverty Alleviation. In 3rd

International Seminar on Education Innovation and Economic Management (SEIEM

2018). Atlantis Press.

Maggiori, M., Neiman, B. and Schreger, J., 2020. International currencies and capital

allocation. Journal of Political Economy. 128(6). pp.2019-2066.

Powell, M. ed., 2019. Understanding the mixed economy of welfare. Policy Press.

Pradhan, R. P. and et.al. 2017. Trade openness, foreign direct investment, and finance-growth

nexus in the Eurozone countries. The Journal of International Trade & Economic

Development. 26(3). pp.336-360.

Steven, R., 2016. Japan and the new world order: global investments, trade and finance.

Springer.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.