ECON1086 International Trade Analysis: Italy and Sweden Report

VerifiedAdded on 2022/12/26

|10

|1369

|88

Report

AI Summary

This report presents an in-depth analysis of international trade conditions in Italy and Sweden, focusing on trade openness, the Gini index, and the application of economic models. The analysis includes graphical representations of openness and the Gini index, calculating the correlation coefficient between these variables for both countries. The report validates the Stolper-Samuelson theorem based on the data and provides a technical analysis of the trade scenario, including relative demand and supply curves, free trade equilibrium, and the gains from trade, utilizing the Ricardian model to determine comparative advantages. The report concludes with a discussion of the benefits of free trade for both nations, highlighting the impact on labor and living standards. The assignment adheres to the guidelines provided by the university for ECON1086 International Trade analysis.

Running head: INTERNATIONAL TRADE

International Trade

Name of the Student

Name of the University

Course ID

Student ID

International Trade

Name of the Student

Name of the University

Course ID

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INTERNATIONAL TRADE

Table of Contents

Data analysis....................................................................................................................................2

Graphical representation of openness and Gini index.................................................................2

Correlation coefficient between Openness and Gini Index.........................................................3

Validation of Stolper-Samuelson theorem...................................................................................3

Technical Analysis...........................................................................................................................4

a. Relative demand curve.............................................................................................................5

b. Relative supply curve..............................................................................................................6

c. Free trade equilibrium..............................................................................................................7

d. Line of Specialization..............................................................................................................8

e. Gains from trade......................................................................................................................8

List of references.............................................................................................................................9

Table of Contents

Data analysis....................................................................................................................................2

Graphical representation of openness and Gini index.................................................................2

Correlation coefficient between Openness and Gini Index.........................................................3

Validation of Stolper-Samuelson theorem...................................................................................3

Technical Analysis...........................................................................................................................4

a. Relative demand curve.............................................................................................................5

b. Relative supply curve..............................................................................................................6

c. Free trade equilibrium..............................................................................................................7

d. Line of Specialization..............................................................................................................8

e. Gains from trade......................................................................................................................8

List of references.............................................................................................................................9

2INTERNATIONAL TRADE

Data analysis

Graphical representation of openness and Gini index

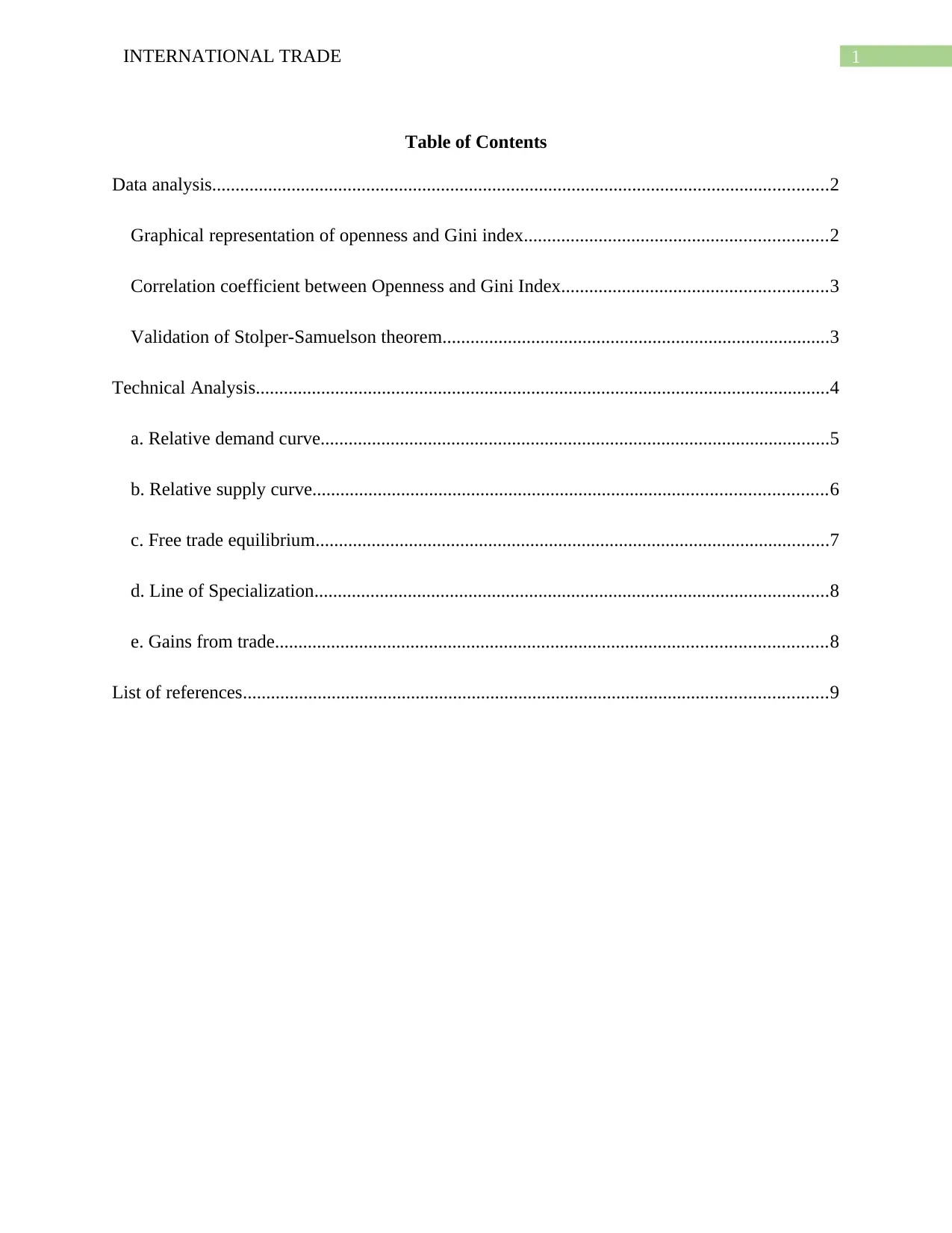

Italy

32.5 33 33.5 34 34.5 35 35.5 36

40%

42%

44%

46%

48%

50%

52%

54%

56%

58%

Opennes and Gini Index

Gini Index

Openness

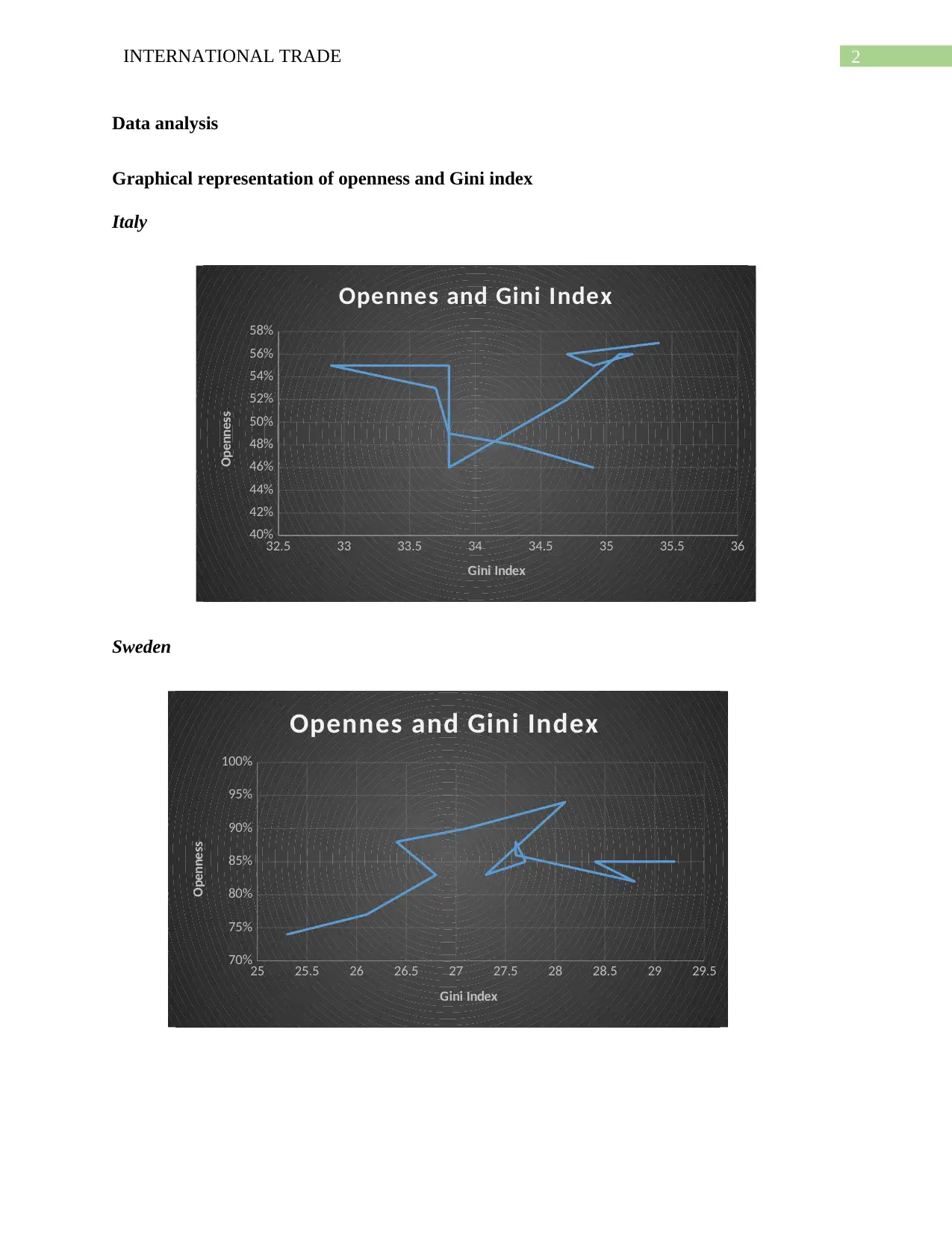

Sweden

25 25.5 26 26.5 27 27.5 28 28.5 29 29.5

70%

75%

80%

85%

90%

95%

100%

Opennes and Gini Index

Gini Index

Openness

Data analysis

Graphical representation of openness and Gini index

Italy

32.5 33 33.5 34 34.5 35 35.5 36

40%

42%

44%

46%

48%

50%

52%

54%

56%

58%

Opennes and Gini Index

Gini Index

Openness

Sweden

25 25.5 26 26.5 27 27.5 28 28.5 29 29.5

70%

75%

80%

85%

90%

95%

100%

Opennes and Gini Index

Gini Index

Openness

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INTERNATIONAL TRADE

Correlation coefficient between Openness and Gini Index

The correlation coefficient shows association between two variables. Computed

correlation coefficient between Gini Index and openness in Italy is 0.27. The correlation

coefficient is positive having a relatively smaller value. The positive correlation means there is a

positive association between inequality and openness. As openness is measured in terms of

proportion of trade volume in total GDP, positive association implies that with increasing

participation in trade inequality in Italy increases. As Gini index also represents the ratio of

skilled to unskilled wage this can also be interpreted as with increase in openness relative wage

to skilled labor increase as compared to unskilled labor (Grossman and Helpman 2018). The

association however is weak as reflected from a smaller correlation coefficient. The computed

correlation coefficient for Sweden is 0.49. This value of the coefficient implies a moderately

strong positively association between Gini index and openness of Sweden. Like Italy, Sweden

also suffers from the problem of increasing inequality with increase in the degree of openness.

That is skilled workers gain a higher wage than unskilled workers are as the country becomes

more open.

Validation of Stolper-Samuelson theorem

Stopler-Samuelson theorem is one fundamental theorems of Heckscher Ohlin theory of

international trade. Purpose of the theory is to model the relationship between relative price of

good and reward to the factor especially return to capital and real wages. Under specific

assumption such as perfect competition, constant return to scale and equality between number of

factors and number of products, when relative price of a good increase, there is an increase in

return to the factor input that is most intensively used in the production (Kurose and Yoshihara

2015). The correlation estimates indicate a positive association between openness and that of the

Correlation coefficient between Openness and Gini Index

The correlation coefficient shows association between two variables. Computed

correlation coefficient between Gini Index and openness in Italy is 0.27. The correlation

coefficient is positive having a relatively smaller value. The positive correlation means there is a

positive association between inequality and openness. As openness is measured in terms of

proportion of trade volume in total GDP, positive association implies that with increasing

participation in trade inequality in Italy increases. As Gini index also represents the ratio of

skilled to unskilled wage this can also be interpreted as with increase in openness relative wage

to skilled labor increase as compared to unskilled labor (Grossman and Helpman 2018). The

association however is weak as reflected from a smaller correlation coefficient. The computed

correlation coefficient for Sweden is 0.49. This value of the coefficient implies a moderately

strong positively association between Gini index and openness of Sweden. Like Italy, Sweden

also suffers from the problem of increasing inequality with increase in the degree of openness.

That is skilled workers gain a higher wage than unskilled workers are as the country becomes

more open.

Validation of Stolper-Samuelson theorem

Stopler-Samuelson theorem is one fundamental theorems of Heckscher Ohlin theory of

international trade. Purpose of the theory is to model the relationship between relative price of

good and reward to the factor especially return to capital and real wages. Under specific

assumption such as perfect competition, constant return to scale and equality between number of

factors and number of products, when relative price of a good increase, there is an increase in

return to the factor input that is most intensively used in the production (Kurose and Yoshihara

2015). The correlation estimates indicate a positive association between openness and that of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INTERNATIONAL TRADE

ratio of skilled to unskilled wage. Both Italy and Sweden are abundant in skilled labor. Both

therefore uses skilled labor intensively in producing the exported goods. Countries export a good

only when the world relative price is greater than domestic relative price. An increase in

openness implies a higher trade volume. Increase in relative price of exported goods thus

associated with an increase in wages of skilled labor force which is used intensively in priding

the good. The obtained result therefore support claim of Stolper-Samuelson theory.

Technical Analysis

Given the hypothetical scenario, the capacity of workers in Italy and Sweden to produce

shoes and calculators are given in the following table.

Number of units /unit of time Shoe Calculator

Italy 1 2

Sweden 4 2

Using the labor requirement, the opportunity cost of production of shoes and calculators

are presented in the following table.

Opportunity Cost Shoe Calculator

Italy 2/1 = 2 ½

Sweden 2/4 = 1/2 4/2 = 2

Following the assumption of Ricardian model, Italy has a comparative advantage in

Calculator and Sweden has a comparative advantage in Shoes (Ruffin 2017).

ratio of skilled to unskilled wage. Both Italy and Sweden are abundant in skilled labor. Both

therefore uses skilled labor intensively in producing the exported goods. Countries export a good

only when the world relative price is greater than domestic relative price. An increase in

openness implies a higher trade volume. Increase in relative price of exported goods thus

associated with an increase in wages of skilled labor force which is used intensively in priding

the good. The obtained result therefore support claim of Stolper-Samuelson theory.

Technical Analysis

Given the hypothetical scenario, the capacity of workers in Italy and Sweden to produce

shoes and calculators are given in the following table.

Number of units /unit of time Shoe Calculator

Italy 1 2

Sweden 4 2

Using the labor requirement, the opportunity cost of production of shoes and calculators

are presented in the following table.

Opportunity Cost Shoe Calculator

Italy 2/1 = 2 ½

Sweden 2/4 = 1/2 4/2 = 2

Following the assumption of Ricardian model, Italy has a comparative advantage in

Calculator and Sweden has a comparative advantage in Shoes (Ruffin 2017).

5INTERNATIONAL TRADE

a. Relative demand curve

Relative demand for calculators= Total demand for calculators

Total demand for shoes

¿ QC

I + QC

S

QS

I + QS

S

¿ QC

QS

Using the inverse relation between relative demand and relative price, the relative demand

equation can be expressed as

RDC= 1

PC

PS

¿ , QC

QS

= 1

PC

PS

¿ , QC

QS

× PC

PS

¿ 1

The above equation indicate that shape of relative demand cure should be a rectangular

hyperbola (Feenstra 2015).

a. Relative demand curve

Relative demand for calculators= Total demand for calculators

Total demand for shoes

¿ QC

I + QC

S

QS

I + QS

S

¿ QC

QS

Using the inverse relation between relative demand and relative price, the relative demand

equation can be expressed as

RDC= 1

PC

PS

¿ , QC

QS

= 1

PC

PS

¿ , QC

QS

× PC

PS

¿ 1

The above equation indicate that shape of relative demand cure should be a rectangular

hyperbola (Feenstra 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INTERNATIONAL TRADE

Figure 3: Relative demand curve for calculators

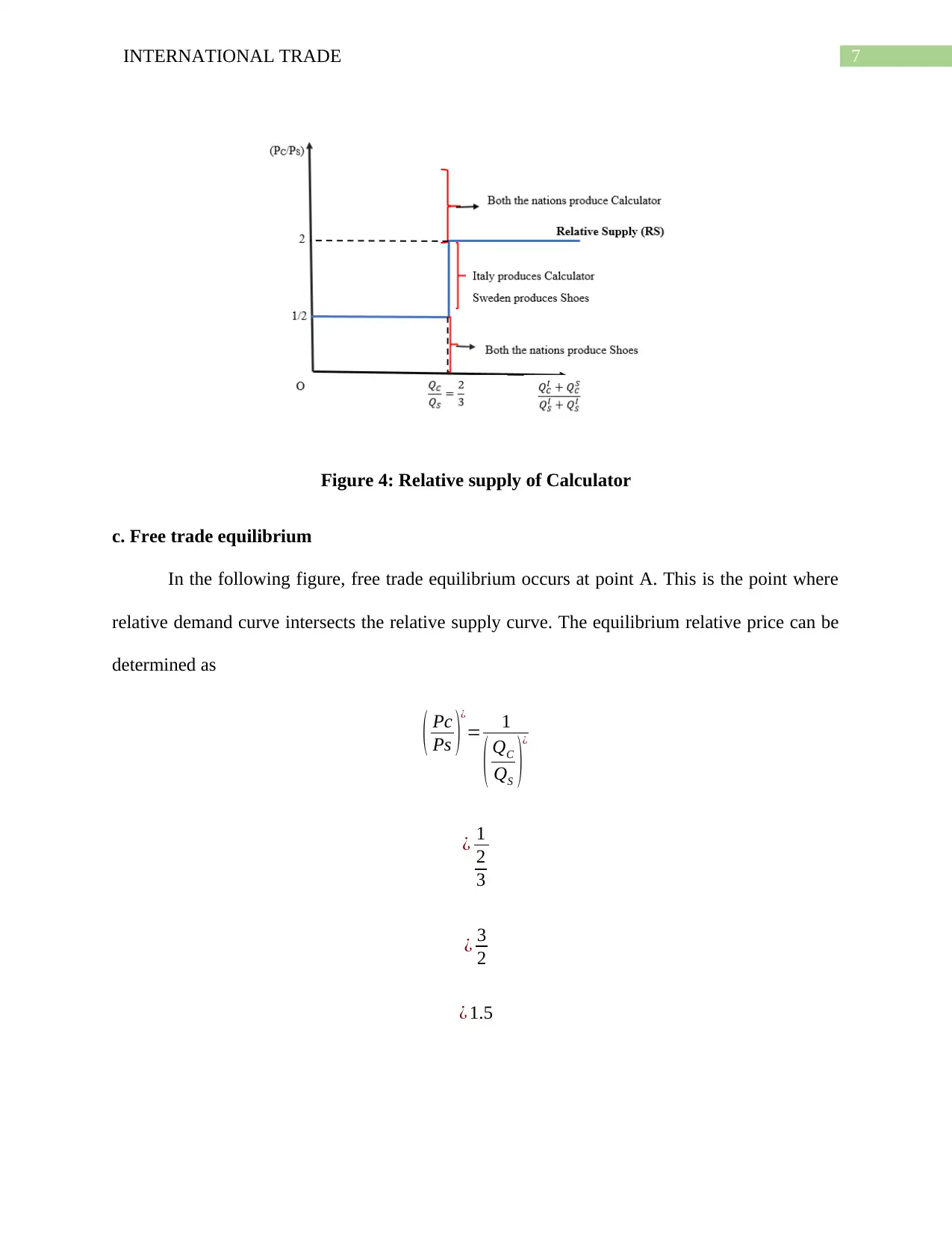

b. Relative supply curve

The shape of relative supply curve depends on the relation between relative price of

calculators with the relative quantity of calculators. In autarky, domestic relative price of

calculator in Italy is ½ (opportunity cost of calculator in Italy). Italy therefore will specialize and

export calculator if price is above the domestic relative price ratio (Senga, Fujimoto and Tabuchi

2017). In Sweden, the domestic relative price of calculator is 2. Sweden therefore will import

calculators is world relative price is below 2. The trade between two nation occurs when world

relative price is somewhere between ½ and 2. At this price the relative quantity of calculator is

(160/240) = 2/3. The relative supply curve of calculator is shown in the following figure.

Figure 3: Relative demand curve for calculators

b. Relative supply curve

The shape of relative supply curve depends on the relation between relative price of

calculators with the relative quantity of calculators. In autarky, domestic relative price of

calculator in Italy is ½ (opportunity cost of calculator in Italy). Italy therefore will specialize and

export calculator if price is above the domestic relative price ratio (Senga, Fujimoto and Tabuchi

2017). In Sweden, the domestic relative price of calculator is 2. Sweden therefore will import

calculators is world relative price is below 2. The trade between two nation occurs when world

relative price is somewhere between ½ and 2. At this price the relative quantity of calculator is

(160/240) = 2/3. The relative supply curve of calculator is shown in the following figure.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INTERNATIONAL TRADE

Figure 4: Relative supply of Calculator

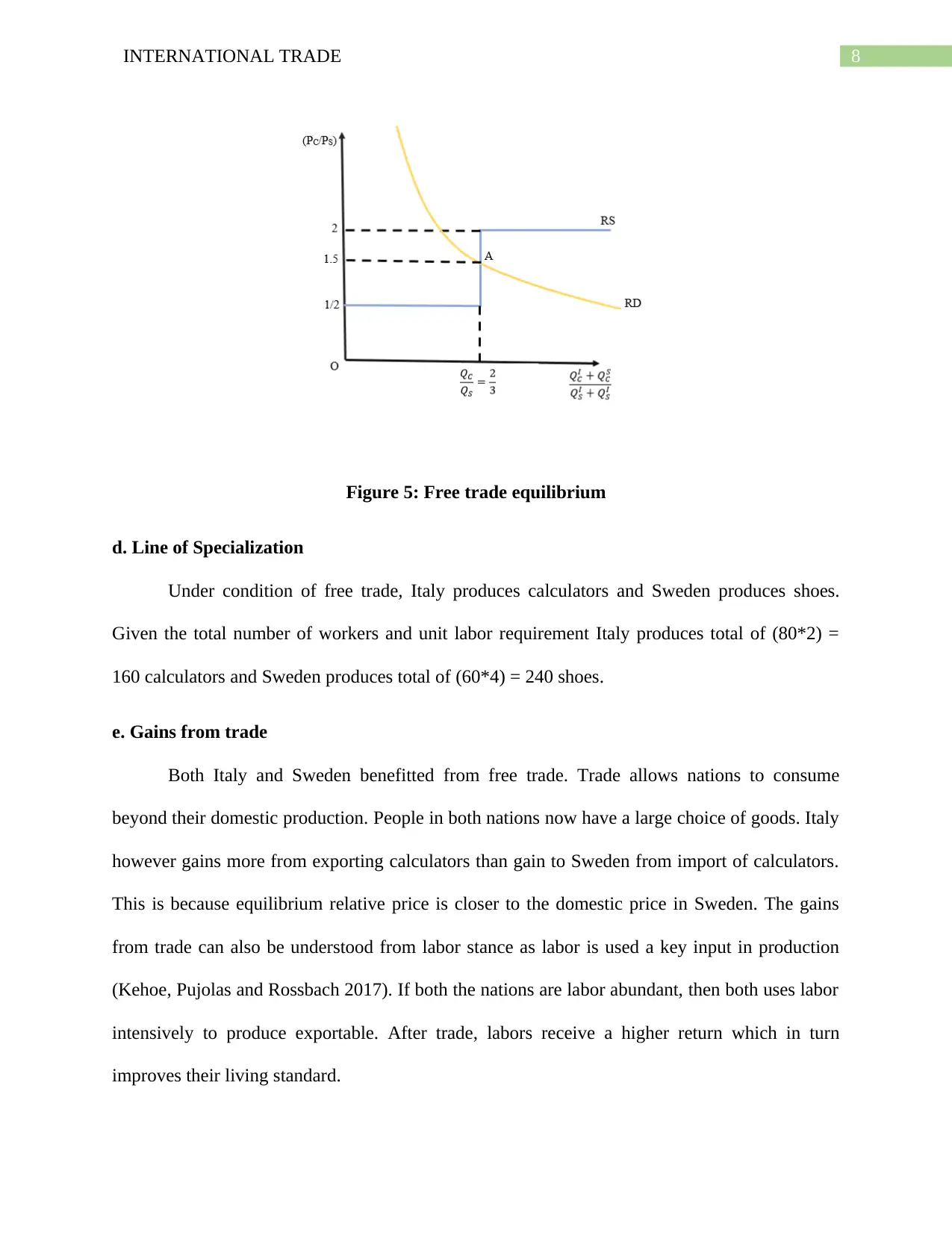

c. Free trade equilibrium

In the following figure, free trade equilibrium occurs at point A. This is the point where

relative demand curve intersects the relative supply curve. The equilibrium relative price can be

determined as

( Pc

Ps )

¿

= 1

( QC

QS )

¿

¿ 1

2

3

¿ 3

2

¿ 1.5

Figure 4: Relative supply of Calculator

c. Free trade equilibrium

In the following figure, free trade equilibrium occurs at point A. This is the point where

relative demand curve intersects the relative supply curve. The equilibrium relative price can be

determined as

( Pc

Ps )

¿

= 1

( QC

QS )

¿

¿ 1

2

3

¿ 3

2

¿ 1.5

8INTERNATIONAL TRADE

Figure 5: Free trade equilibrium

d. Line of Specialization

Under condition of free trade, Italy produces calculators and Sweden produces shoes.

Given the total number of workers and unit labor requirement Italy produces total of (80*2) =

160 calculators and Sweden produces total of (60*4) = 240 shoes.

e. Gains from trade

Both Italy and Sweden benefitted from free trade. Trade allows nations to consume

beyond their domestic production. People in both nations now have a large choice of goods. Italy

however gains more from exporting calculators than gain to Sweden from import of calculators.

This is because equilibrium relative price is closer to the domestic price in Sweden. The gains

from trade can also be understood from labor stance as labor is used a key input in production

(Kehoe, Pujolas and Rossbach 2017). If both the nations are labor abundant, then both uses labor

intensively to produce exportable. After trade, labors receive a higher return which in turn

improves their living standard.

Figure 5: Free trade equilibrium

d. Line of Specialization

Under condition of free trade, Italy produces calculators and Sweden produces shoes.

Given the total number of workers and unit labor requirement Italy produces total of (80*2) =

160 calculators and Sweden produces total of (60*4) = 240 shoes.

e. Gains from trade

Both Italy and Sweden benefitted from free trade. Trade allows nations to consume

beyond their domestic production. People in both nations now have a large choice of goods. Italy

however gains more from exporting calculators than gain to Sweden from import of calculators.

This is because equilibrium relative price is closer to the domestic price in Sweden. The gains

from trade can also be understood from labor stance as labor is used a key input in production

(Kehoe, Pujolas and Rossbach 2017). If both the nations are labor abundant, then both uses labor

intensively to produce exportable. After trade, labors receive a higher return which in turn

improves their living standard.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INTERNATIONAL TRADE

List of references

Feenstra, R.C., 2015. Advanced international trade: theory and evidence. Princeton university

press.

Grossman, G.M. and Helpman, E., 2018. Growth, trade, and inequality. Econometrica, 86(1),

pp.37-83.

Kehoe, T.J., Pujolas, P.S. and Rossbach, J., 2017. Quantitative trade models: developments and

challenges. Annual Review of Economics, 9, pp.295-325.

Kurose, K. and Yoshihara, N., 2015. The Heckscher-Ohlin-Samuelson (HOS) Trade Theory and

Capital Theory. Economic Review, 66(2), pp.169-189.

Ruffin, R.J., 2017. Ricardo and international trade theory. In Ricardo and International

Trade (pp. 20-32). Routledge.

Senga, S., Fujimoto, M. and Tabuchi, T. eds., 2017. Ricardo and International Trade. Taylor &

Francis.

List of references

Feenstra, R.C., 2015. Advanced international trade: theory and evidence. Princeton university

press.

Grossman, G.M. and Helpman, E., 2018. Growth, trade, and inequality. Econometrica, 86(1),

pp.37-83.

Kehoe, T.J., Pujolas, P.S. and Rossbach, J., 2017. Quantitative trade models: developments and

challenges. Annual Review of Economics, 9, pp.295-325.

Kurose, K. and Yoshihara, N., 2015. The Heckscher-Ohlin-Samuelson (HOS) Trade Theory and

Capital Theory. Economic Review, 66(2), pp.169-189.

Ruffin, R.J., 2017. Ricardo and international trade theory. In Ricardo and International

Trade (pp. 20-32). Routledge.

Senga, S., Fujimoto, M. and Tabuchi, T. eds., 2017. Ricardo and International Trade. Taylor &

Francis.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.