Analysis of International Trade, Finance, and Investment Dynamics

VerifiedAdded on 2023/01/19

|20

|4369

|1

Report

AI Summary

This report provides a comprehensive overview of international trade, finance, and investment. It begins by exploring the fundamentals of financial markets, both domestic and international, and delves into the role of capital allocation in the UK. The report then examines key financial investment and trade theories, including Ricardian theory and the concept of comparative advantage, before discussing the contributions of international trade through regional trade agreements and investment treaties. The second part of the report focuses on the challenges faced by developing economies, using the BRICS nations as a case study. A thorough analysis of the Indian economy is provided, highlighting factors such as production and manufacturing, inflation, and employment. The report concludes by analyzing the specific challenges India faces due to WTO trade policies, offering insights into the complexities of international trade and its impact on economic development.

International Trade,

Finance, and

Investment

Finance, and

Investment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

DOMESTIC ECONOMY AND INTERNATIONAL TRADE INVESTMENT AND

DEVELOPMENT:.................................................................................................................3

Background of the financial market:......................................................................................3

National economy and capital allocation in the UK:..............................................................4

International economy and capital allocation.........................................................................5

Financial investment and trade theory....................................................................................6

Contributions of international trade........................................................................................7

TASK 2............................................................................................................................................7

MAJOR CHALLENGES FACED BY DEVELOPING ECONOMY DUE TO

INDUSTRIALIZATION AND TRADE POLICIES:............................................................7

BRICS:...................................................................................................................................7

Thorough analysis of Indian Economy focusing on 4 significant factors:.............................8

Key issues India is facing because of WTO's trade policies:...............................................15

Challenges India is facing because of trade-policies setup by WTO:..................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

DOMESTIC ECONOMY AND INTERNATIONAL TRADE INVESTMENT AND

DEVELOPMENT:.................................................................................................................3

Background of the financial market:......................................................................................3

National economy and capital allocation in the UK:..............................................................4

International economy and capital allocation.........................................................................5

Financial investment and trade theory....................................................................................6

Contributions of international trade........................................................................................7

TASK 2............................................................................................................................................7

MAJOR CHALLENGES FACED BY DEVELOPING ECONOMY DUE TO

INDUSTRIALIZATION AND TRADE POLICIES:............................................................7

BRICS:...................................................................................................................................7

Thorough analysis of Indian Economy focusing on 4 significant factors:.............................8

Key issues India is facing because of WTO's trade policies:...............................................15

Challenges India is facing because of trade-policies setup by WTO:..................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION

International Trade pertains to the exchange of goods, items and services with a

consideration from nation to nation which simply called as importing and exporting. Trade a

wider level generally implies to international trades. While financing and funding for these

international trading operations and related business activities are referred to as international

finance and investments (Anderson and et. al., 2014). This study exhibits key characteristics and

roles of fiscal markets (Domestic or International) in context of trade developments. Further an

emerging economy is critically evaluated along with major issues faced by it due to latest trade

practices policies of WTO.

TASK 1

DOMESTIC ECONOMY AND INTERNATIONAL TRADE INVESTMENT AND

DEVELOPMENT:

Background of the financial market:

Financial market relates to marketplace where fiscal assets like securities, preferred

stock, debt funds, futures, currencies etc. are generated and exchanged. In assigning constrained

resources, it performs a vital part in the economy of a country. By mobilizing capital among

participants, it serves as a channel among investors and stakeholders. In addition, by offering

worthwhile details on financial instruments exchanged on the financial market, it minimises

costs. This saves parties' effort, monies and time as they don't have to spend money and funds to

locate possible stock market participants. Such financial markets are majorly classified as Debt

and Equity Market (Anderson and et. al., 2014).

An Equity market is mainly concerned with the trading of securities. Here shares,

securities are issued into the market as well as further trade may be via stock exchanges or any

OTC markets. This is the most critical area of the financial market since it allows corporations to

issue capital and provide a simple and accessible framework for small and large investors to

make investments in different securities (Armijo, 2012).

While a debt/bond market, implies to market which are dedicated towards promoting

investment in debts/loans which they can buy or sell as securities. No specific exchange has been

setup for exchanging these bonds/debt securities. Mostly transactions take place among large

institutions, brokers or investors (Akhtar and Jones, 2014).

International Trade pertains to the exchange of goods, items and services with a

consideration from nation to nation which simply called as importing and exporting. Trade a

wider level generally implies to international trades. While financing and funding for these

international trading operations and related business activities are referred to as international

finance and investments (Anderson and et. al., 2014). This study exhibits key characteristics and

roles of fiscal markets (Domestic or International) in context of trade developments. Further an

emerging economy is critically evaluated along with major issues faced by it due to latest trade

practices policies of WTO.

TASK 1

DOMESTIC ECONOMY AND INTERNATIONAL TRADE INVESTMENT AND

DEVELOPMENT:

Background of the financial market:

Financial market relates to marketplace where fiscal assets like securities, preferred

stock, debt funds, futures, currencies etc. are generated and exchanged. In assigning constrained

resources, it performs a vital part in the economy of a country. By mobilizing capital among

participants, it serves as a channel among investors and stakeholders. In addition, by offering

worthwhile details on financial instruments exchanged on the financial market, it minimises

costs. This saves parties' effort, monies and time as they don't have to spend money and funds to

locate possible stock market participants. Such financial markets are majorly classified as Debt

and Equity Market (Anderson and et. al., 2014).

An Equity market is mainly concerned with the trading of securities. Here shares,

securities are issued into the market as well as further trade may be via stock exchanges or any

OTC markets. This is the most critical area of the financial market since it allows corporations to

issue capital and provide a simple and accessible framework for small and large investors to

make investments in different securities (Armijo, 2012).

While a debt/bond market, implies to market which are dedicated towards promoting

investment in debts/loans which they can buy or sell as securities. No specific exchange has been

setup for exchanging these bonds/debt securities. Mostly transactions take place among large

institutions, brokers or investors (Akhtar and Jones, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

National economy and capital allocation in the UK:

Banking System:

1. Role of central bank: A central bank implies to a national independent body

conducting monetary & fiscal policy, regulating banking institutions, and offering financial

facilities along with economic analysis. Its aim is to deflate the exchange rate, maintain

employment, and control inflation. Bank of England is the central bank of the UK, which

controls all financial and monetary functions of the country and regulates all banks/financial

institutions (Armijo, 2012).

2. Monetary policy: UK's monetary policy is being determined by a Committee named

Monetary Policy Committee (MPC) and mainly governed by the Bank of England. This

committee is independent it fixes and changes interest rates with the aim to minimise the

country's inflation rate. Bank of England determines the base rate which is the rate at which

different banks get their loans from BOE. Altering the base rate affects entire economy's interest

rates (Chen, 2015).

3. Regulations governing the financial system: BOE the central bank of the UK along

with MPC issue different rules and regulations to regulate the entire UK's financial system.

Banks are required to follow these regulations. These bodies also have power to impose penalties

in case of non compliance of these regulations issued by them (Banks of UK, 2019).

Domestic money market

a) Savings (Short term): The saving facilities of banking institutions like ISA accounts, flex

accounts stands to benefit small companies and individual people. The bankers are also rising

saving rates to fit the market levels in a suitable layout (Chow, 2013).

b) Loans (Long term): In the UK, the functional potential of long-term mortgages is enhanced

by approx 66 percent of residential real estate buyers. Excepting the overly heavy non-crash

periods of entire mortgage, the raising of collaterals is a major step towards property ownership –

as well as personal loans (Vijayakumar, Sridharan and Rao, 2015).

Stock markets

London stock market: The London Stock Exchange (LSE) is UK's leading stock market. And

Europe's greatest. Originating in 1773, the local exchanges were integrated into Great Britain and

Ireland's stock exchange in year 1973, eventually designated as London Stock Exchange (LSE).

The LSE establishes cost-effective exposure to many of the biggest and perhaps most accessible

Banking System:

1. Role of central bank: A central bank implies to a national independent body

conducting monetary & fiscal policy, regulating banking institutions, and offering financial

facilities along with economic analysis. Its aim is to deflate the exchange rate, maintain

employment, and control inflation. Bank of England is the central bank of the UK, which

controls all financial and monetary functions of the country and regulates all banks/financial

institutions (Armijo, 2012).

2. Monetary policy: UK's monetary policy is being determined by a Committee named

Monetary Policy Committee (MPC) and mainly governed by the Bank of England. This

committee is independent it fixes and changes interest rates with the aim to minimise the

country's inflation rate. Bank of England determines the base rate which is the rate at which

different banks get their loans from BOE. Altering the base rate affects entire economy's interest

rates (Chen, 2015).

3. Regulations governing the financial system: BOE the central bank of the UK along

with MPC issue different rules and regulations to regulate the entire UK's financial system.

Banks are required to follow these regulations. These bodies also have power to impose penalties

in case of non compliance of these regulations issued by them (Banks of UK, 2019).

Domestic money market

a) Savings (Short term): The saving facilities of banking institutions like ISA accounts, flex

accounts stands to benefit small companies and individual people. The bankers are also rising

saving rates to fit the market levels in a suitable layout (Chow, 2013).

b) Loans (Long term): In the UK, the functional potential of long-term mortgages is enhanced

by approx 66 percent of residential real estate buyers. Excepting the overly heavy non-crash

periods of entire mortgage, the raising of collaterals is a major step towards property ownership –

as well as personal loans (Vijayakumar, Sridharan and Rao, 2015).

Stock markets

London stock market: The London Stock Exchange (LSE) is UK's leading stock market. And

Europe's greatest. Originating in 1773, the local exchanges were integrated into Great Britain and

Ireland's stock exchange in year 1973, eventually designated as London Stock Exchange (LSE).

The LSE establishes cost-effective exposure to many of the biggest and perhaps most accessible

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

cash reserves in the world via its primary exchanges. It is host to a wide range of industries and

supports listed corporations with digital stock dealing (Desierto, 2015).

AIM (London stock exchange for small business): The Alternative Investment Market (AIM) is

London’s Stock Exchange (LSE) sub-market aimed at helping smaller firms to access stock

market's equity. Through participating in public exchange with far more broader legislative

independence relative to the main market, AIM helps these corporations to acquire money or

raise funds (Ge, 2011).

International economy and capital allocation

International capital markets: International capital market implies financial system that trans-

nationally borrows and invests funds from states, corporations and entities. It is equivalent to

capital market that requires domestic lending and investment by government bodies, corporations

and individuals. Between those who have unnecessary funds as well as those with impaired

funds, all systems take place.

1. Commercial banks: There are 2 significant international-commercial banks that exist

which invest in higher capital markets and Securities are: ICB financial group and Swiss Finance

Luxemburg AG. The saving amenity laws and regulations in such banking institutions are very

stringent. Getting less risk and highly secure stocks are major benefits in opening a saving and

deposit account in these international commercial banks. Account-holders with accounts stay

secure in case of any sort of financial risk (Chow, 2013).

2. Bond Markets: These are also termed as debt or credit markets its commercial

enterprises or fiscal marketplace in which members can easily raise new debts, called primary

debt markets, or trade in debt bonds or stocks, called secondary debt markets. It is commonly

formed of different bonds; however it may be bills, notes, and any authorised instrument

(Swenson, 2012).

3. Foreign exchange markets: These markets are mainly associated with buying and

selling of foreign currencies of different nations. Investors may invest in any currency and can

make gain with help from fluctuation in rates of foreign currencies. This is a most volatile

market as foreign currency rates fluctuate with minor events in the global and domestic economy

(Frederic S. Mishkin, Stanley Eakins, 2012).

supports listed corporations with digital stock dealing (Desierto, 2015).

AIM (London stock exchange for small business): The Alternative Investment Market (AIM) is

London’s Stock Exchange (LSE) sub-market aimed at helping smaller firms to access stock

market's equity. Through participating in public exchange with far more broader legislative

independence relative to the main market, AIM helps these corporations to acquire money or

raise funds (Ge, 2011).

International economy and capital allocation

International capital markets: International capital market implies financial system that trans-

nationally borrows and invests funds from states, corporations and entities. It is equivalent to

capital market that requires domestic lending and investment by government bodies, corporations

and individuals. Between those who have unnecessary funds as well as those with impaired

funds, all systems take place.

1. Commercial banks: There are 2 significant international-commercial banks that exist

which invest in higher capital markets and Securities are: ICB financial group and Swiss Finance

Luxemburg AG. The saving amenity laws and regulations in such banking institutions are very

stringent. Getting less risk and highly secure stocks are major benefits in opening a saving and

deposit account in these international commercial banks. Account-holders with accounts stay

secure in case of any sort of financial risk (Chow, 2013).

2. Bond Markets: These are also termed as debt or credit markets its commercial

enterprises or fiscal marketplace in which members can easily raise new debts, called primary

debt markets, or trade in debt bonds or stocks, called secondary debt markets. It is commonly

formed of different bonds; however it may be bills, notes, and any authorised instrument

(Swenson, 2012).

3. Foreign exchange markets: These markets are mainly associated with buying and

selling of foreign currencies of different nations. Investors may invest in any currency and can

make gain with help from fluctuation in rates of foreign currencies. This is a most volatile

market as foreign currency rates fluctuate with minor events in the global and domestic economy

(Frederic S. Mishkin, Stanley Eakins, 2012).

4. Global stock market: Refers to a cluster of different stock markets like NASDAQ or

US markets, Asian Markets and European stock-markets (DAX, FTSE and CAC). It combines

different indexes from different stock markets together (Vijayakumar, Sridharan and Rao, 2015).

5. Derivatives: A derivative is a financial arrangement dependent on any underlying

securities. The purchaser offers to buy assets at a particular price on even a particular date.

Derivatives e.g. coal, petrol, and silver, is substituted for items. Exchange rates are yet another

investment option, almost always U.S. dollar. There are portfolios or bond-based options. Still

others using rates, like interest on Treasury bonds or Note for 10 years.

6. Non-bank financial institutions: It is also recognised as non-bank financial companies

(NBFC). These are financial institutions or corporations which don't have complete banking

license and not primarily governed by any international/domestic banking authority or regulatory

federal agency. These facilitate all banking and financial services or facilities like investing,

savings on a contractual basis. Pooling risks and brokering. Instances of such corporations

involves insurance corporations, cashier's cheque issuers, pawn shops, cheque cashing turn up,

lending, currencies exchanges and investment advisory companies (Shenkar, 2012).

Financial investment and trade theory

Ricardian theory:

The English classical economist named David Ricardo initially formed a theory in year

1817 with an aim to provide a complete explanation upon nature/origin as well as economical

rent. He applied rent and economical aspects to evaluate specific issues. Ricardian's theory

provides that agriculture and related activities are core variable in order to enhance overall

economical growth level. This theory mainly classifies effective capital allocation and funding

concepts into 3 major parts: workers, landowners and business or commercial.

Opportunity cost: This theory relates agriculture sector to term opportunity costs which

means that how much individual or business entities can earn if it operates with full capacity

during a specific period of time. Ricardian's theory's mainly focuses on what the effect has on a

country's economy (Swenson, 2012).

Comparative advantages: In context of comparative advantages theory demonstrates that

in case 2 nations are able to produce any specific 2 commodities and are engaged in free market.

Then each nation should enhance their overall consumptions through exporting commodities for

US markets, Asian Markets and European stock-markets (DAX, FTSE and CAC). It combines

different indexes from different stock markets together (Vijayakumar, Sridharan and Rao, 2015).

5. Derivatives: A derivative is a financial arrangement dependent on any underlying

securities. The purchaser offers to buy assets at a particular price on even a particular date.

Derivatives e.g. coal, petrol, and silver, is substituted for items. Exchange rates are yet another

investment option, almost always U.S. dollar. There are portfolios or bond-based options. Still

others using rates, like interest on Treasury bonds or Note for 10 years.

6. Non-bank financial institutions: It is also recognised as non-bank financial companies

(NBFC). These are financial institutions or corporations which don't have complete banking

license and not primarily governed by any international/domestic banking authority or regulatory

federal agency. These facilitate all banking and financial services or facilities like investing,

savings on a contractual basis. Pooling risks and brokering. Instances of such corporations

involves insurance corporations, cashier's cheque issuers, pawn shops, cheque cashing turn up,

lending, currencies exchanges and investment advisory companies (Shenkar, 2012).

Financial investment and trade theory

Ricardian theory:

The English classical economist named David Ricardo initially formed a theory in year

1817 with an aim to provide a complete explanation upon nature/origin as well as economical

rent. He applied rent and economical aspects to evaluate specific issues. Ricardian's theory

provides that agriculture and related activities are core variable in order to enhance overall

economical growth level. This theory mainly classifies effective capital allocation and funding

concepts into 3 major parts: workers, landowners and business or commercial.

Opportunity cost: This theory relates agriculture sector to term opportunity costs which

means that how much individual or business entities can earn if it operates with full capacity

during a specific period of time. Ricardian's theory's mainly focuses on what the effect has on a

country's economy (Swenson, 2012).

Comparative advantages: In context of comparative advantages theory demonstrates that

in case 2 nations are able to produce any specific 2 commodities and are engaged in free market.

Then each nation should enhance their overall consumptions through exporting commodities for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which has such comparative advantages while making import with other commodities except that

are differences in their labour productivity rates (Shenkar, 2012).

Contributions of international trade

Regional trade agreements: A Regional Trade Agreement (RTA) refers to a treaty which

defines trading rules with respect to all signers among two or more governing bodies Instances of

different regional trade deals involve CAFTA-DR, Asia-Pacific Economic Cooperation (APEC),

European Union (EU), North American Free Trade Agreement (NAFTA). Negotiations in so

many trade/business agreements currently go outside of tariffs to cover-up multiple policies areas

that impact international trade in products and services, along with sub-border legislation like

competitiveness legislation, public procurement guidelines, intellectual property law etc.

Investment treaties between states: Investment treaties implies to agreements for sealing with

investments produced by people or firms from some other as state by state. They are managed to

negotiate bilaterally, multilaterally and sector-wise and can be either a hang-alone treaty or

portion of free-trade agreement. Most of such instrumentation produce clauses that enable

settlement of conflicts between investor and state under auspices of ICSID or any other alternate

dispute settlement structures (Lin, 2011).

TASK 2

MAJOR CHALLENGES FACED BY DEVELOPING ECONOMY DUE TO

INDUSTRIALIZATION AND TRADE POLICIES:

BRICS:

The nations of BRIC are heterogeneous. They vary in their fundamentals, economical and

geostrategic attributes. India and China are categorized by managed capital and fiscal markets

and huge proportions of their village or rural population. Their infrastructure models are based

on different export operations, while principally natural or non-renewable resource-based

economies as well as good commodity exporters are Russia and Brazil. Their capital markets,

while evolving at very different times and at different rates, are much more open and subject to

relatively less state control at the moment. These countries capital markets, whilst being

developed at distinct times as well as at varying rates, are far more accessible and relatively have

lower federal controls (Swenson, 2012).

are differences in their labour productivity rates (Shenkar, 2012).

Contributions of international trade

Regional trade agreements: A Regional Trade Agreement (RTA) refers to a treaty which

defines trading rules with respect to all signers among two or more governing bodies Instances of

different regional trade deals involve CAFTA-DR, Asia-Pacific Economic Cooperation (APEC),

European Union (EU), North American Free Trade Agreement (NAFTA). Negotiations in so

many trade/business agreements currently go outside of tariffs to cover-up multiple policies areas

that impact international trade in products and services, along with sub-border legislation like

competitiveness legislation, public procurement guidelines, intellectual property law etc.

Investment treaties between states: Investment treaties implies to agreements for sealing with

investments produced by people or firms from some other as state by state. They are managed to

negotiate bilaterally, multilaterally and sector-wise and can be either a hang-alone treaty or

portion of free-trade agreement. Most of such instrumentation produce clauses that enable

settlement of conflicts between investor and state under auspices of ICSID or any other alternate

dispute settlement structures (Lin, 2011).

TASK 2

MAJOR CHALLENGES FACED BY DEVELOPING ECONOMY DUE TO

INDUSTRIALIZATION AND TRADE POLICIES:

BRICS:

The nations of BRIC are heterogeneous. They vary in their fundamentals, economical and

geostrategic attributes. India and China are categorized by managed capital and fiscal markets

and huge proportions of their village or rural population. Their infrastructure models are based

on different export operations, while principally natural or non-renewable resource-based

economies as well as good commodity exporters are Russia and Brazil. Their capital markets,

while evolving at very different times and at different rates, are much more open and subject to

relatively less state control at the moment. These countries capital markets, whilst being

developed at distinct times as well as at varying rates, are far more accessible and relatively have

lower federal controls (Swenson, 2012).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Thorough analysis of Indian Economy focusing on 4 significant factors:

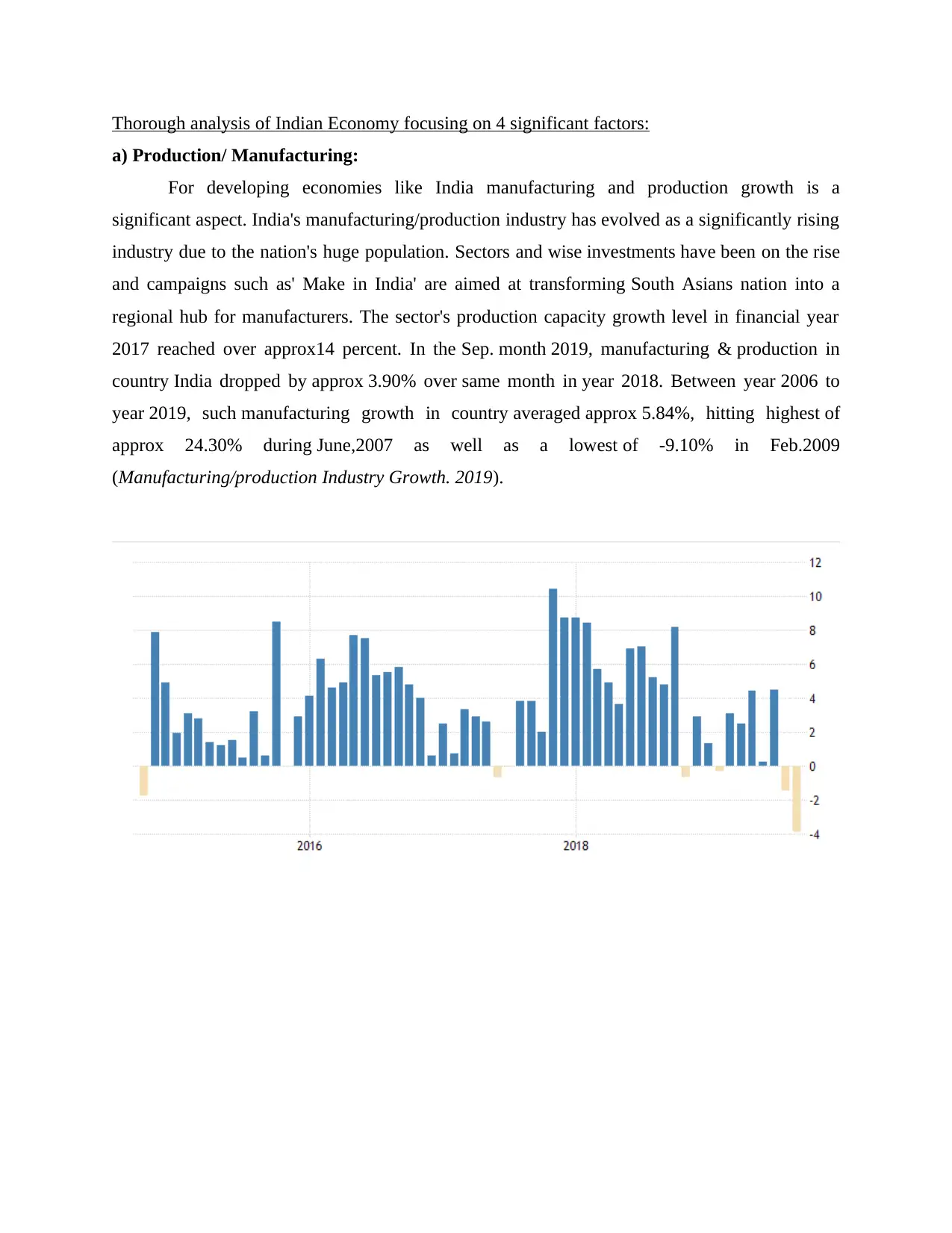

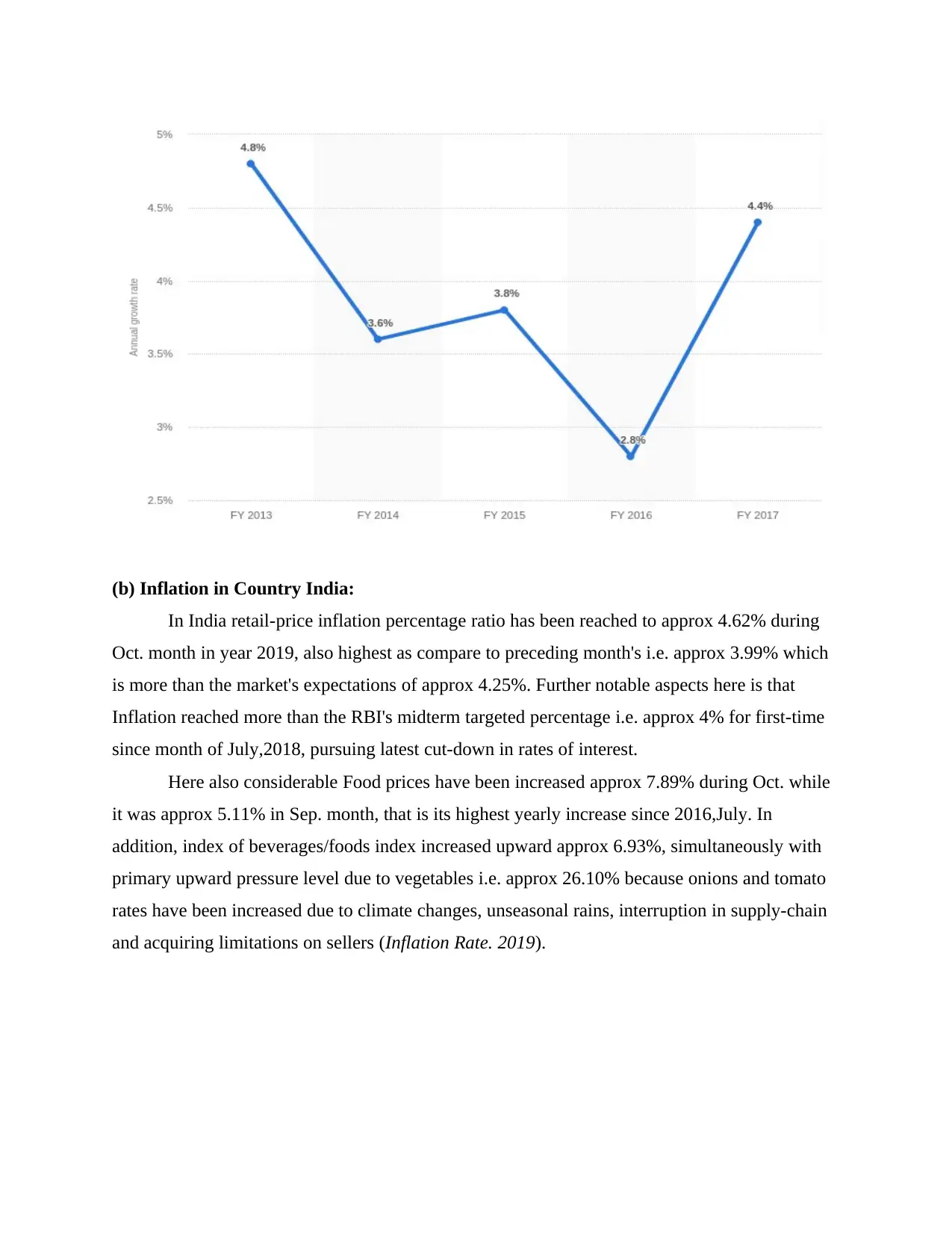

a) Production/ Manufacturing:

For developing economies like India manufacturing and production growth is a

significant aspect. India's manufacturing/production industry has evolved as a significantly rising

industry due to the nation's huge population. Sectors and wise investments have been on the rise

and campaigns such as' Make in India' are aimed at transforming South Asians nation into a

regional hub for manufacturers. The sector's production capacity growth level in financial year

2017 reached over approx14 percent. In the Sep. month 2019, manufacturing & production in

country India dropped by approx 3.90% over same month in year 2018. Between year 2006 to

year 2019, such manufacturing growth in country averaged approx 5.84%, hitting highest of

approx 24.30% during June,2007 as well as a lowest of -9.10% in Feb.2009

(Manufacturing/production Industry Growth. 2019).

a) Production/ Manufacturing:

For developing economies like India manufacturing and production growth is a

significant aspect. India's manufacturing/production industry has evolved as a significantly rising

industry due to the nation's huge population. Sectors and wise investments have been on the rise

and campaigns such as' Make in India' are aimed at transforming South Asians nation into a

regional hub for manufacturers. The sector's production capacity growth level in financial year

2017 reached over approx14 percent. In the Sep. month 2019, manufacturing & production in

country India dropped by approx 3.90% over same month in year 2018. Between year 2006 to

year 2019, such manufacturing growth in country averaged approx 5.84%, hitting highest of

approx 24.30% during June,2007 as well as a lowest of -9.10% in Feb.2009

(Manufacturing/production Industry Growth. 2019).

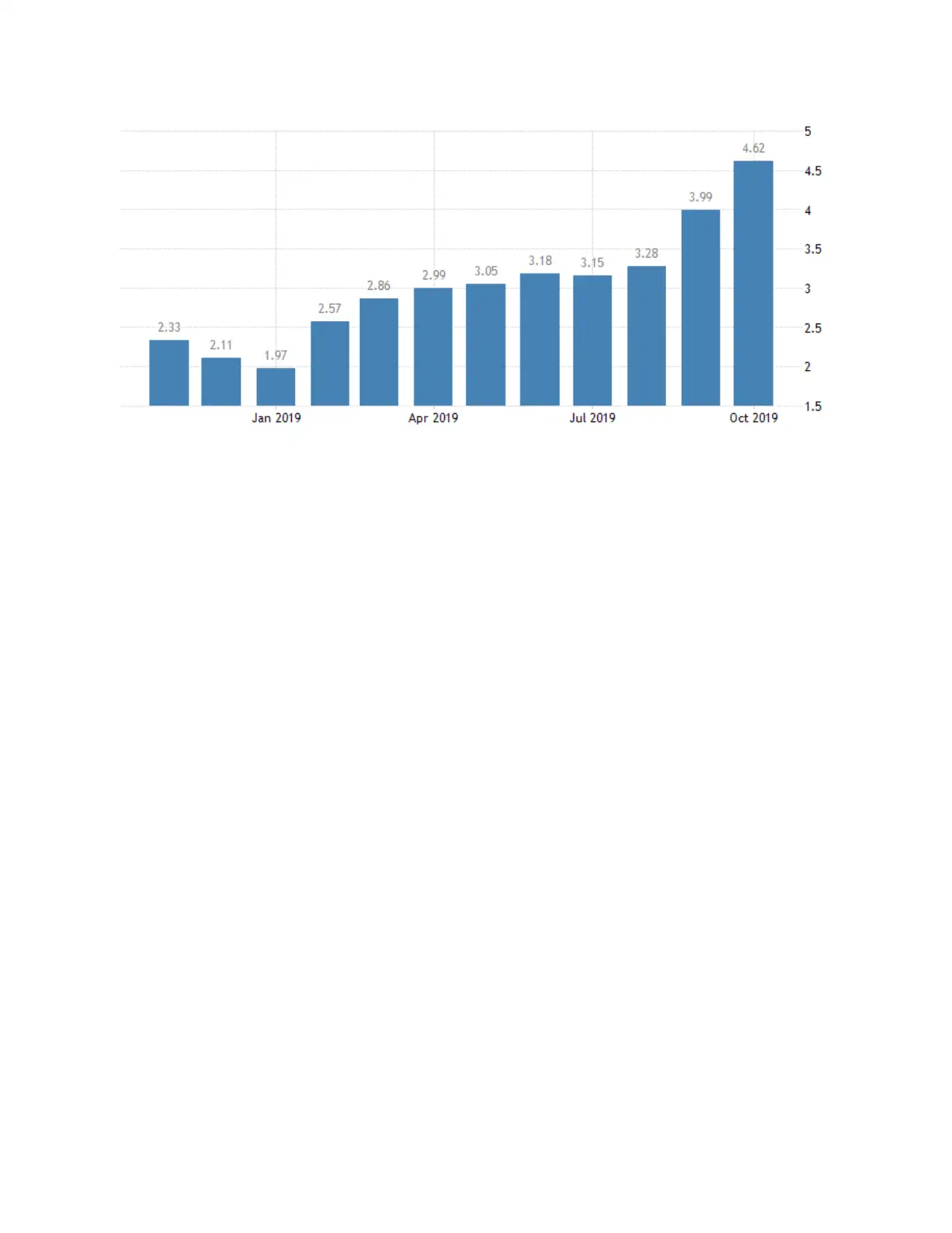

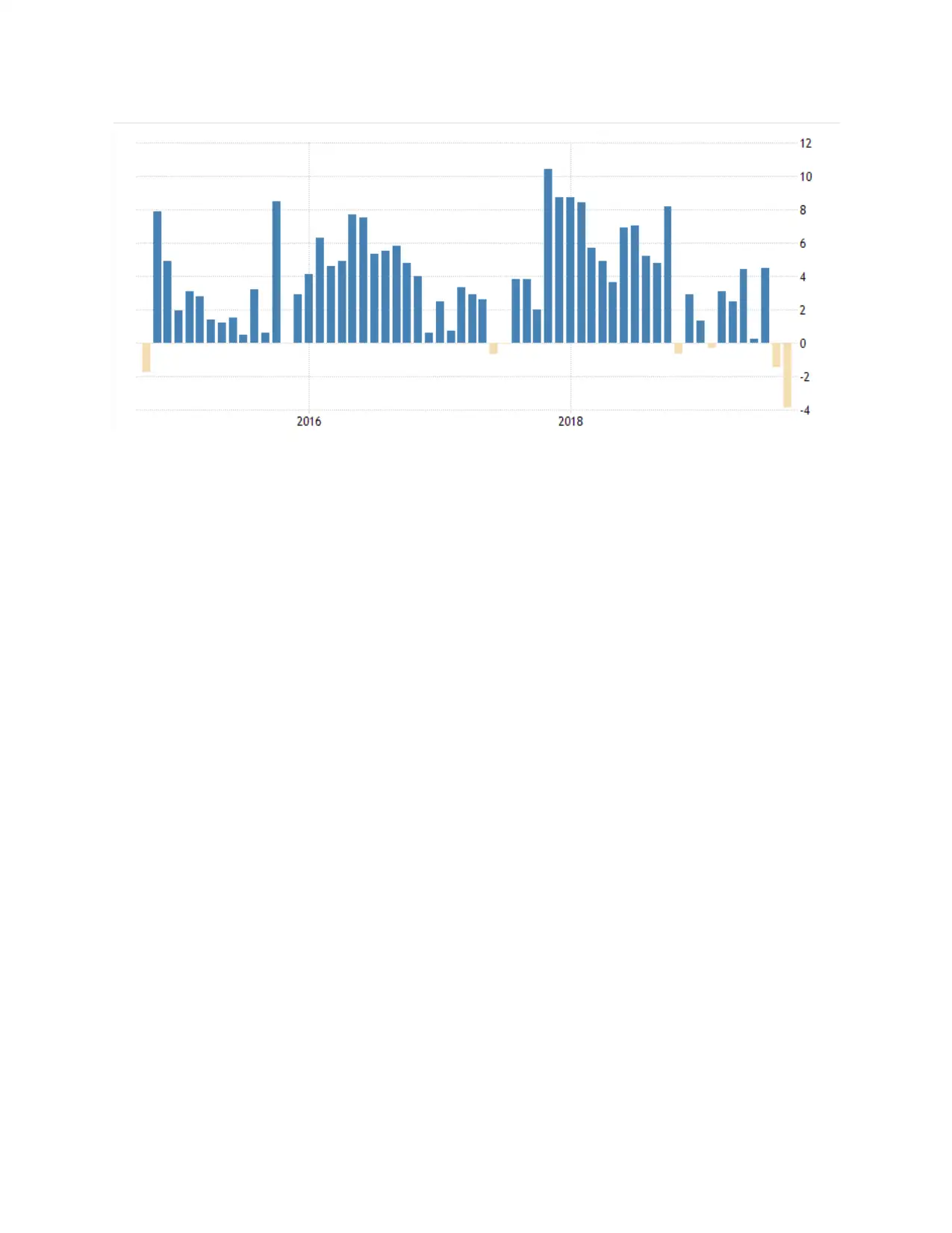

(b) Inflation in Country India:

In India retail-price inflation percentage ratio has been reached to approx 4.62% during

Oct. month in year 2019, also highest as compare to preceding month's i.e. approx 3.99% which

is more than the market's expectations of approx 4.25%. Further notable aspects here is that

Inflation reached more than the RBI's midterm targeted percentage i.e. approx 4% for first-time

since month of July,2018, pursuing latest cut-down in rates of interest.

Here also considerable Food prices have been increased approx 7.89% during Oct. while

it was approx 5.11% in Sep. month, that is its highest yearly increase since 2016,July. In

addition, index of beverages/foods index increased upward approx 6.93%, simultaneously with

primary upward pressure level due to vegetables i.e. approx 26.10% because onions and tomato

rates have been increased due to climate changes, unseasonal rains, interruption in supply-chain

and acquiring limitations on sellers (Inflation Rate. 2019).

In India retail-price inflation percentage ratio has been reached to approx 4.62% during

Oct. month in year 2019, also highest as compare to preceding month's i.e. approx 3.99% which

is more than the market's expectations of approx 4.25%. Further notable aspects here is that

Inflation reached more than the RBI's midterm targeted percentage i.e. approx 4% for first-time

since month of July,2018, pursuing latest cut-down in rates of interest.

Here also considerable Food prices have been increased approx 7.89% during Oct. while

it was approx 5.11% in Sep. month, that is its highest yearly increase since 2016,July. In

addition, index of beverages/foods index increased upward approx 6.93%, simultaneously with

primary upward pressure level due to vegetables i.e. approx 26.10% because onions and tomato

rates have been increased due to climate changes, unseasonal rains, interruption in supply-chain

and acquiring limitations on sellers (Inflation Rate. 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

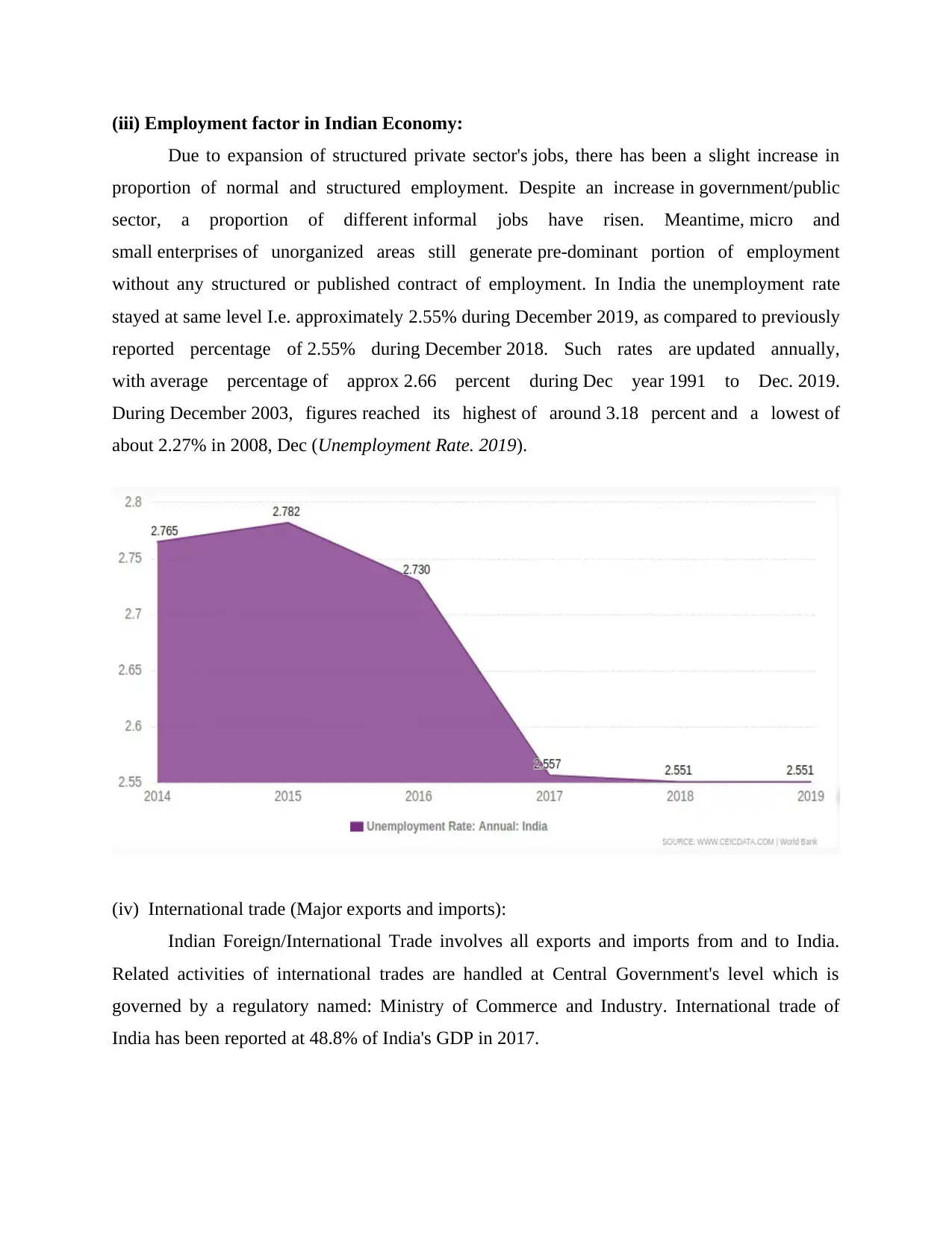

(iii) Employment factor in Indian Economy:

Due to expansion of structured private sector's jobs, there has been a slight increase in

proportion of normal and structured employment. Despite an increase in government/public

sector, a proportion of different informal jobs have risen. Meantime, micro and

small enterprises of unorganized areas still generate pre-dominant portion of employment

without any structured or published contract of employment. In India the unemployment rate

stayed at same level I.e. approximately 2.55% during December 2019, as compared to previously

reported percentage of 2.55% during December 2018. Such rates are updated annually,

with average percentage of approx 2.66 percent during Dec year 1991 to Dec. 2019.

During December 2003, figures reached its highest of around 3.18 percent and a lowest of

about 2.27% in 2008, Dec (Unemployment Rate. 2019).

(iv) International trade (Major exports and imports):

Indian Foreign/International Trade involves all exports and imports from and to India.

Related activities of international trades are handled at Central Government's level which is

governed by a regulatory named: Ministry of Commerce and Industry. International trade of

India has been reported at 48.8% of India's GDP in 2017.

Due to expansion of structured private sector's jobs, there has been a slight increase in

proportion of normal and structured employment. Despite an increase in government/public

sector, a proportion of different informal jobs have risen. Meantime, micro and

small enterprises of unorganized areas still generate pre-dominant portion of employment

without any structured or published contract of employment. In India the unemployment rate

stayed at same level I.e. approximately 2.55% during December 2019, as compared to previously

reported percentage of 2.55% during December 2018. Such rates are updated annually,

with average percentage of approx 2.66 percent during Dec year 1991 to Dec. 2019.

During December 2003, figures reached its highest of around 3.18 percent and a lowest of

about 2.27% in 2008, Dec (Unemployment Rate. 2019).

(iv) International trade (Major exports and imports):

Indian Foreign/International Trade involves all exports and imports from and to India.

Related activities of international trades are handled at Central Government's level which is

governed by a regulatory named: Ministry of Commerce and Industry. International trade of

India has been reported at 48.8% of India's GDP in 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.