Finance Assignment: Introduction to Accounting and Finance Analysis

VerifiedAdded on 2022/12/28

|16

|3779

|86

Homework Assignment

AI Summary

This finance assignment solution for UGB163 – Introduction to Accounting and Finance presents a comprehensive analysis of Dexter Plc's financial performance. Part 1 focuses on profit and loss analysis, detailing the profit and loss statement for 2018, including sales, cost of sales, gross profit, expenses, and net profit. Part 2 delves into contribution margin, breakeven point calculations, and examines the impact of changes in sales volume and pricing on profitability. Part 3 addresses investment appraisal techniques, specifically net present value (NPV), payback period, and average rate of return (ARR), offering recommendations based on these evaluations. The assignment also provides an overview of the merits and limitations of each technique, providing a thorough understanding of financial analysis and investment decision-making.

fghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmrtyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwe

rtyuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

Introduction to Accounting and Finance

(Student Name)

klzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmrtyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwe

rtyuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

Introduction to Accounting and Finance

(Student Name)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 1

Table of Contents

Part 1................................................................................................................................................2

Profit and Loss Analysis..............................................................................................................2

Financial Position Analysis..........................................................................................................2

Part 2................................................................................................................................................3

a....................................................................................................................................................3

b....................................................................................................................................................4

c....................................................................................................................................................4

d....................................................................................................................................................4

e....................................................................................................................................................5

Part 3................................................................................................................................................6

a....................................................................................................................................................6

b....................................................................................................................................................8

c..................................................................................................................................................11

References......................................................................................................................................14

Table of Contents

Part 1................................................................................................................................................2

Profit and Loss Analysis..............................................................................................................2

Financial Position Analysis..........................................................................................................2

Part 2................................................................................................................................................3

a....................................................................................................................................................3

b....................................................................................................................................................4

c....................................................................................................................................................4

d....................................................................................................................................................4

e....................................................................................................................................................5

Part 3................................................................................................................................................6

a....................................................................................................................................................6

b....................................................................................................................................................8

c..................................................................................................................................................11

References......................................................................................................................................14

Finance 2

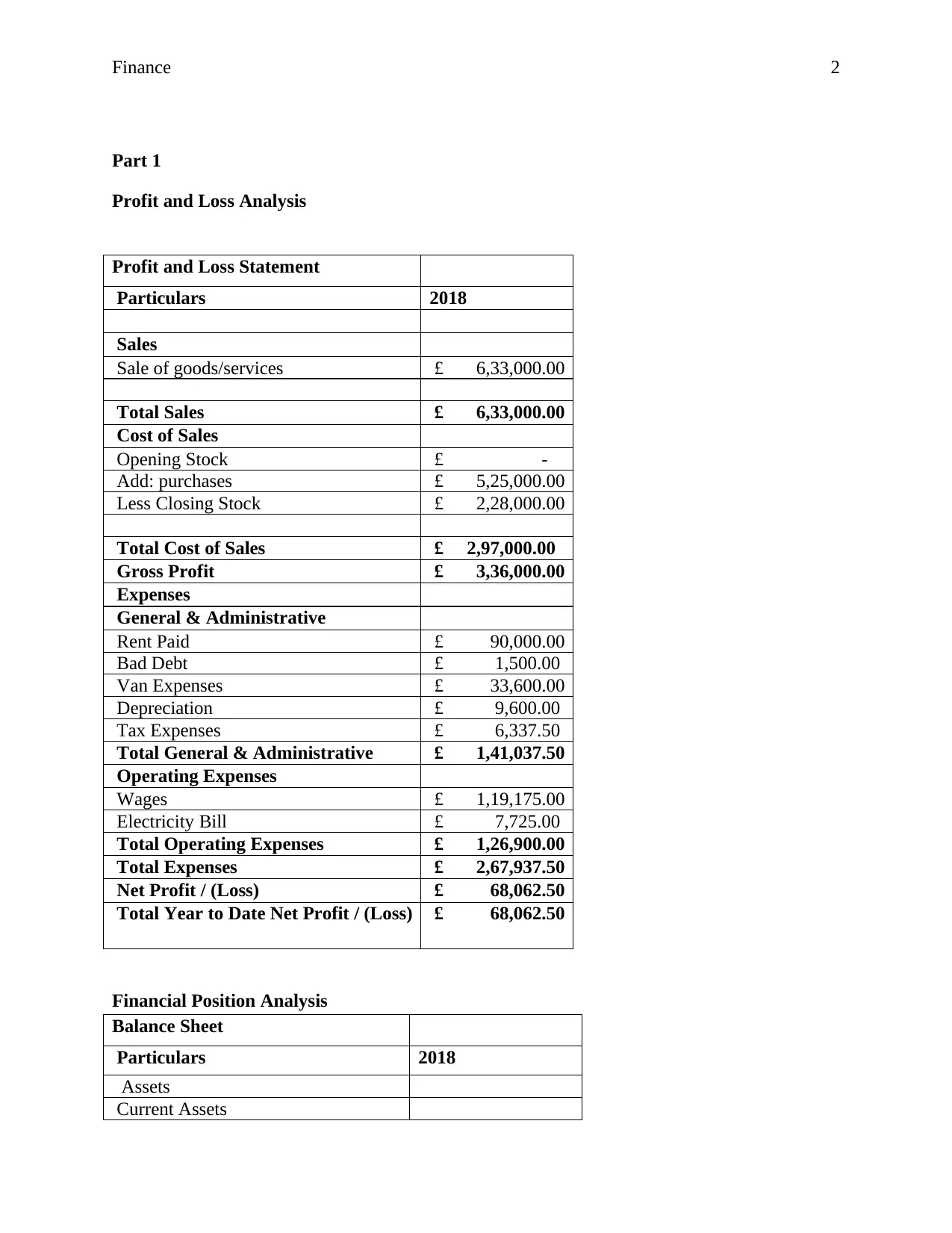

Part 1

Profit and Loss Analysis

Profit and Loss Statement

Particulars 2018

Sales

Sale of goods/services £ 6,33,000.00

Total Sales £ 6,33,000.00

Cost of Sales

Opening Stock £ -

Add: purchases £ 5,25,000.00

Less Closing Stock £ 2,28,000.00

Total Cost of Sales £ 2,97,000.00

Gross Profit £ 3,36,000.00

Expenses

General & Administrative

Rent Paid £ 90,000.00

Bad Debt £ 1,500.00

Van Expenses £ 33,600.00

Depreciation £ 9,600.00

Tax Expenses £ 6,337.50

Total General & Administrative £ 1,41,037.50

Operating Expenses

Wages £ 1,19,175.00

Electricity Bill £ 7,725.00

Total Operating Expenses £ 1,26,900.00

Total Expenses £ 2,67,937.50

Net Profit / (Loss) £ 68,062.50

Total Year to Date Net Profit / (Loss) £ 68,062.50

Financial Position Analysis

Balance Sheet

Particulars 2018

Assets

Current Assets

Part 1

Profit and Loss Analysis

Profit and Loss Statement

Particulars 2018

Sales

Sale of goods/services £ 6,33,000.00

Total Sales £ 6,33,000.00

Cost of Sales

Opening Stock £ -

Add: purchases £ 5,25,000.00

Less Closing Stock £ 2,28,000.00

Total Cost of Sales £ 2,97,000.00

Gross Profit £ 3,36,000.00

Expenses

General & Administrative

Rent Paid £ 90,000.00

Bad Debt £ 1,500.00

Van Expenses £ 33,600.00

Depreciation £ 9,600.00

Tax Expenses £ 6,337.50

Total General & Administrative £ 1,41,037.50

Operating Expenses

Wages £ 1,19,175.00

Electricity Bill £ 7,725.00

Total Operating Expenses £ 1,26,900.00

Total Expenses £ 2,67,937.50

Net Profit / (Loss) £ 68,062.50

Total Year to Date Net Profit / (Loss) £ 68,062.50

Financial Position Analysis

Balance Sheet

Particulars 2018

Assets

Current Assets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

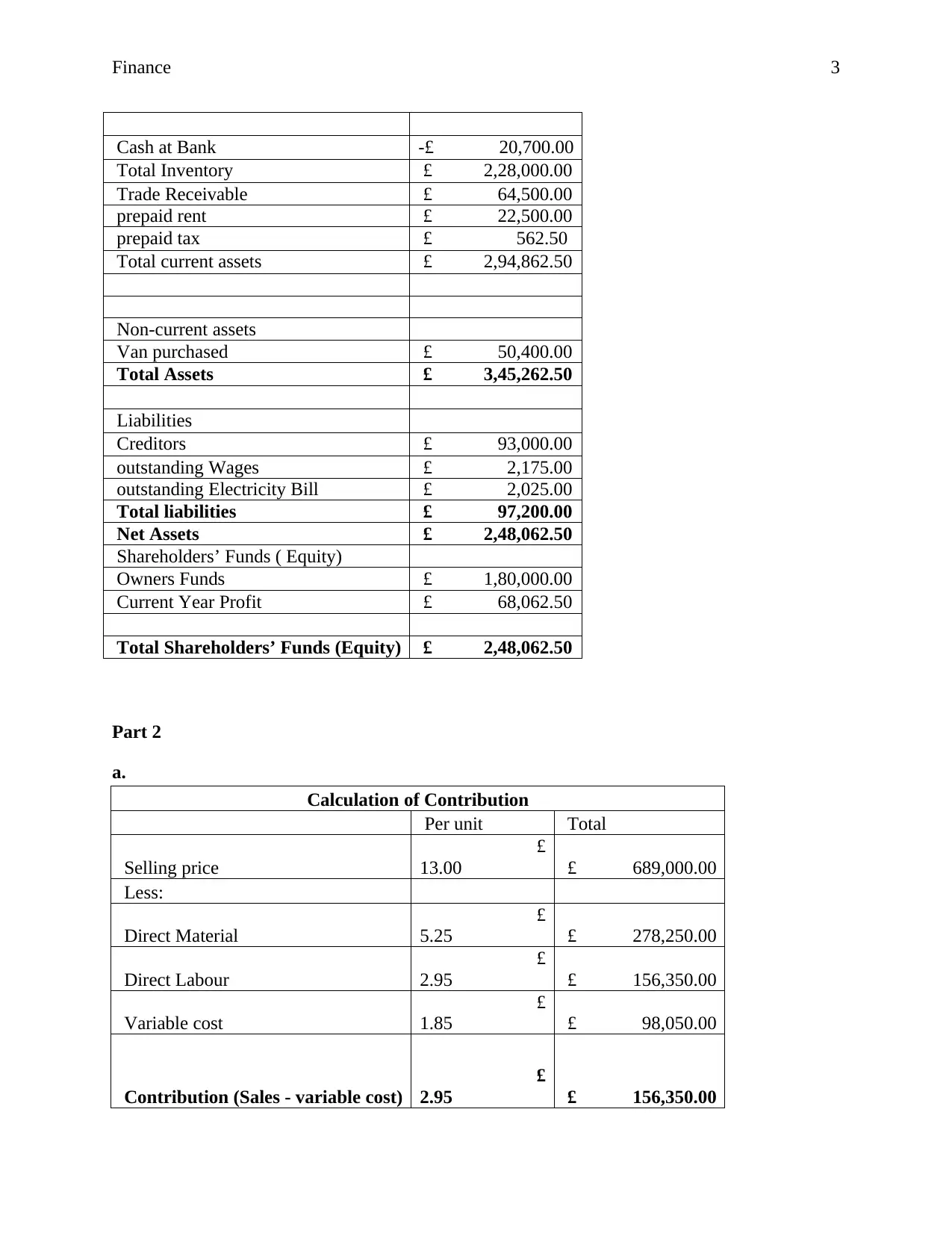

Finance 3

Cash at Bank -£ 20,700.00

Total Inventory £ 2,28,000.00

Trade Receivable £ 64,500.00

prepaid rent £ 22,500.00

prepaid tax £ 562.50

Total current assets £ 2,94,862.50

Non-current assets

Van purchased £ 50,400.00

Total Assets £ 3,45,262.50

Liabilities

Creditors £ 93,000.00

outstanding Wages £ 2,175.00

outstanding Electricity Bill £ 2,025.00

Total liabilities £ 97,200.00

Net Assets £ 2,48,062.50

Shareholders’ Funds ( Equity)

Owners Funds £ 1,80,000.00

Current Year Profit £ 68,062.50

Total Shareholders’ Funds (Equity) £ 2,48,062.50

Part 2

a.

Calculation of Contribution

Per unit Total

Selling price

£

13.00 £ 689,000.00

Less:

Direct Material

£

5.25 £ 278,250.00

Direct Labour

£

2.95 £ 156,350.00

Variable cost

£

1.85 £ 98,050.00

Contribution (Sales - variable cost)

£

2.95 £ 156,350.00

Cash at Bank -£ 20,700.00

Total Inventory £ 2,28,000.00

Trade Receivable £ 64,500.00

prepaid rent £ 22,500.00

prepaid tax £ 562.50

Total current assets £ 2,94,862.50

Non-current assets

Van purchased £ 50,400.00

Total Assets £ 3,45,262.50

Liabilities

Creditors £ 93,000.00

outstanding Wages £ 2,175.00

outstanding Electricity Bill £ 2,025.00

Total liabilities £ 97,200.00

Net Assets £ 2,48,062.50

Shareholders’ Funds ( Equity)

Owners Funds £ 1,80,000.00

Current Year Profit £ 68,062.50

Total Shareholders’ Funds (Equity) £ 2,48,062.50

Part 2

a.

Calculation of Contribution

Per unit Total

Selling price

£

13.00 £ 689,000.00

Less:

Direct Material

£

5.25 £ 278,250.00

Direct Labour

£

2.95 £ 156,350.00

Variable cost

£

1.85 £ 98,050.00

Contribution (Sales - variable cost)

£

2.95 £ 156,350.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 4

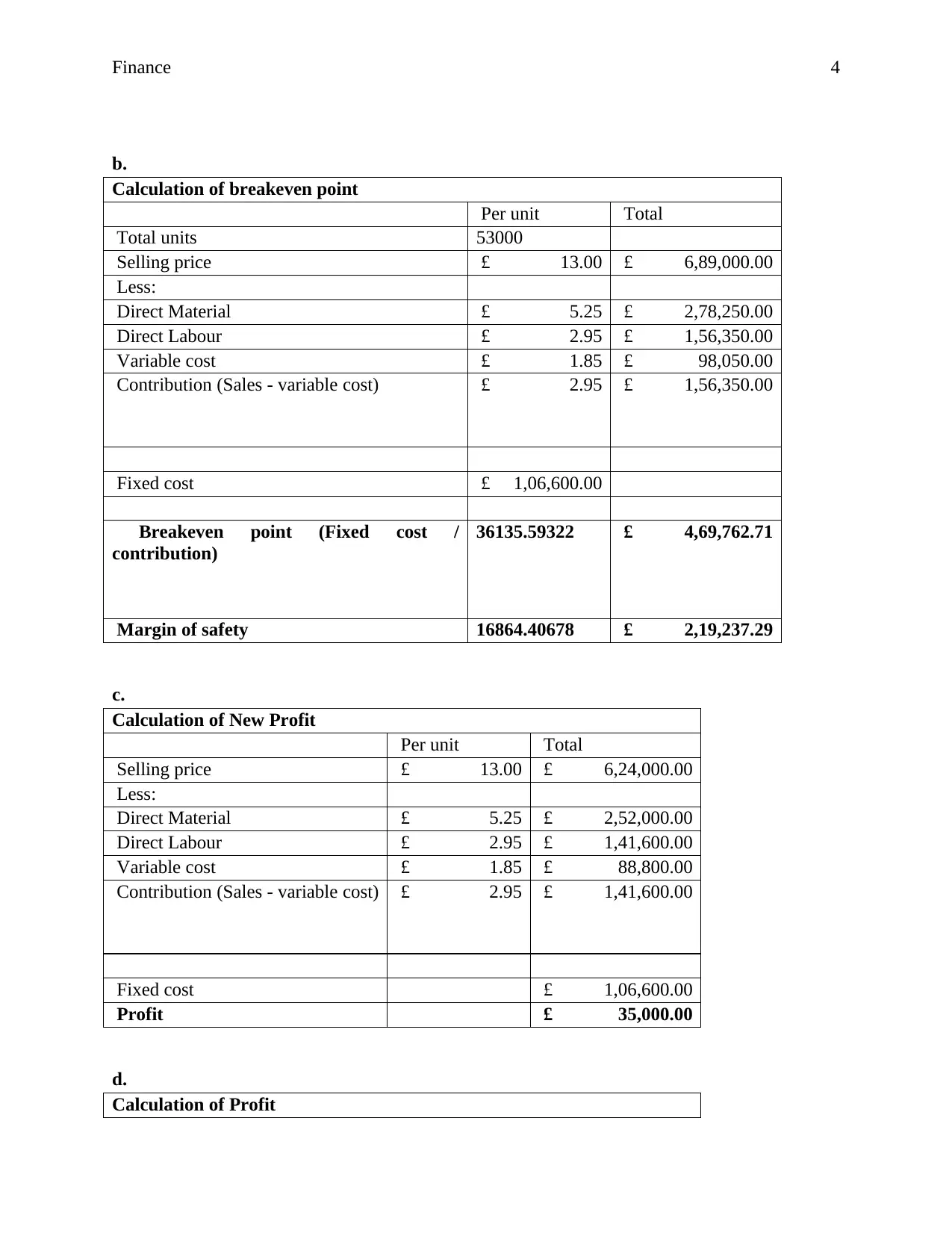

b.

Calculation of breakeven point

Per unit Total

Total units 53000

Selling price £ 13.00 £ 6,89,000.00

Less:

Direct Material £ 5.25 £ 2,78,250.00

Direct Labour £ 2.95 £ 1,56,350.00

Variable cost £ 1.85 £ 98,050.00

Contribution (Sales - variable cost) £ 2.95 £ 1,56,350.00

Fixed cost £ 1,06,600.00

Breakeven point (Fixed cost /

contribution)

36135.59322 £ 4,69,762.71

Margin of safety 16864.40678 £ 2,19,237.29

c.

Calculation of New Profit

Per unit Total

Selling price £ 13.00 £ 6,24,000.00

Less:

Direct Material £ 5.25 £ 2,52,000.00

Direct Labour £ 2.95 £ 1,41,600.00

Variable cost £ 1.85 £ 88,800.00

Contribution (Sales - variable cost) £ 2.95 £ 1,41,600.00

Fixed cost £ 1,06,600.00

Profit £ 35,000.00

d.

Calculation of Profit

b.

Calculation of breakeven point

Per unit Total

Total units 53000

Selling price £ 13.00 £ 6,89,000.00

Less:

Direct Material £ 5.25 £ 2,78,250.00

Direct Labour £ 2.95 £ 1,56,350.00

Variable cost £ 1.85 £ 98,050.00

Contribution (Sales - variable cost) £ 2.95 £ 1,56,350.00

Fixed cost £ 1,06,600.00

Breakeven point (Fixed cost /

contribution)

36135.59322 £ 4,69,762.71

Margin of safety 16864.40678 £ 2,19,237.29

c.

Calculation of New Profit

Per unit Total

Selling price £ 13.00 £ 6,24,000.00

Less:

Direct Material £ 5.25 £ 2,52,000.00

Direct Labour £ 2.95 £ 1,41,600.00

Variable cost £ 1.85 £ 88,800.00

Contribution (Sales - variable cost) £ 2.95 £ 1,41,600.00

Fixed cost £ 1,06,600.00

Profit £ 35,000.00

d.

Calculation of Profit

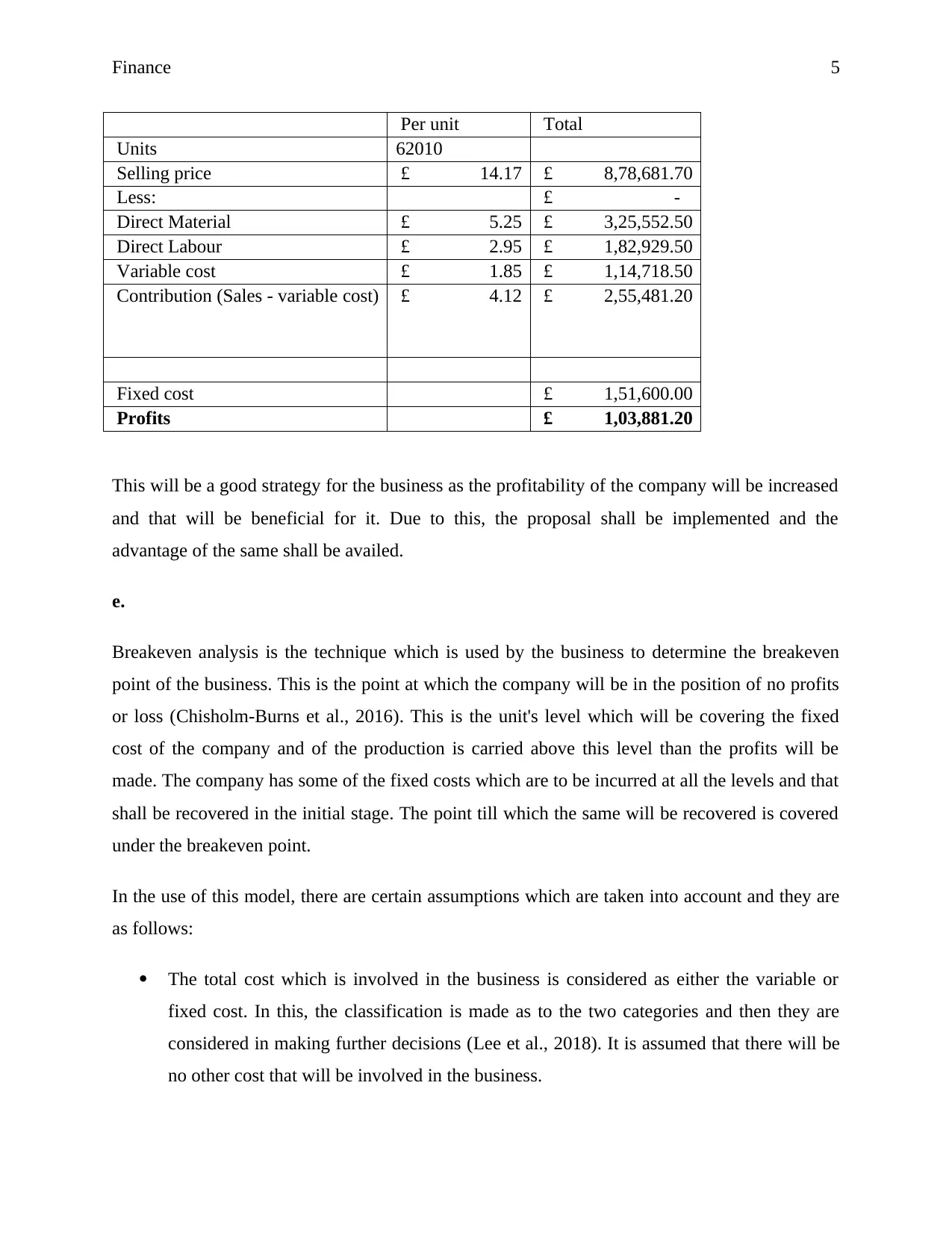

Finance 5

Per unit Total

Units 62010

Selling price £ 14.17 £ 8,78,681.70

Less: £ -

Direct Material £ 5.25 £ 3,25,552.50

Direct Labour £ 2.95 £ 1,82,929.50

Variable cost £ 1.85 £ 1,14,718.50

Contribution (Sales - variable cost) £ 4.12 £ 2,55,481.20

Fixed cost £ 1,51,600.00

Profits £ 1,03,881.20

This will be a good strategy for the business as the profitability of the company will be increased

and that will be beneficial for it. Due to this, the proposal shall be implemented and the

advantage of the same shall be availed.

e.

Breakeven analysis is the technique which is used by the business to determine the breakeven

point of the business. This is the point at which the company will be in the position of no profits

or loss (Chisholm-Burns et al., 2016). This is the unit's level which will be covering the fixed

cost of the company and of the production is carried above this level than the profits will be

made. The company has some of the fixed costs which are to be incurred at all the levels and that

shall be recovered in the initial stage. The point till which the same will be recovered is covered

under the breakeven point.

In the use of this model, there are certain assumptions which are taken into account and they are

as follows:

The total cost which is involved in the business is considered as either the variable or

fixed cost. In this, the classification is made as to the two categories and then they are

considered in making further decisions (Lee et al., 2018). It is assumed that there will be

no other cost that will be involved in the business.

Per unit Total

Units 62010

Selling price £ 14.17 £ 8,78,681.70

Less: £ -

Direct Material £ 5.25 £ 3,25,552.50

Direct Labour £ 2.95 £ 1,82,929.50

Variable cost £ 1.85 £ 1,14,718.50

Contribution (Sales - variable cost) £ 4.12 £ 2,55,481.20

Fixed cost £ 1,51,600.00

Profits £ 1,03,881.20

This will be a good strategy for the business as the profitability of the company will be increased

and that will be beneficial for it. Due to this, the proposal shall be implemented and the

advantage of the same shall be availed.

e.

Breakeven analysis is the technique which is used by the business to determine the breakeven

point of the business. This is the point at which the company will be in the position of no profits

or loss (Chisholm-Burns et al., 2016). This is the unit's level which will be covering the fixed

cost of the company and of the production is carried above this level than the profits will be

made. The company has some of the fixed costs which are to be incurred at all the levels and that

shall be recovered in the initial stage. The point till which the same will be recovered is covered

under the breakeven point.

In the use of this model, there are certain assumptions which are taken into account and they are

as follows:

The total cost which is involved in the business is considered as either the variable or

fixed cost. In this, the classification is made as to the two categories and then they are

considered in making further decisions (Lee et al., 2018). It is assumed that there will be

no other cost that will be involved in the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance 6

It is assumed that the fixed cost which has been ascertained in the initial stage will remain

constant and there will be no change which will be taking place in the same. It will

remain the same at all levels.

There is no fluctuation which is made for the sales price and it will be remaining the

same at all the levels of the outputs made by the company.

The per-unit cost which is considered will remain the same and the change will be made

in the total amount as per the production but the per-unit cost will be constant.

It is considered that the sales and cost are affected by the volume of sales only and there

is no other cost or factor which will be making the change in the same.

It is considered that businesses will be using the same level of efficiency and technology.

It is assumed that there will be no change which will be incorporated in the business and

production at all the levels will be made with the same resources.

The production which is made in any period is consumed in the same period and there

will be no opening or closing stock which will be available. The business considers that

there is no stock which is left unused and all will be used in the same time frame for

which it has been produced which is not a practical situation.

There are various businesses that are involved and they can use the breakeven analysis for

various purposes in a successful manner. There are various assumptions that are not possible

practically but then also the technique will be of benefit to the business (van Asseldonk et al.,

2017). In this, the pint is determined after which the business will be making the profit. This will

be helping the company in maintaining the production at the level so that the losses are not faced

and there is maintained profitability. This will help them in avoiding any adverse situation which

may arise and helps in keeping the margin of safety which is essential for all the businesses.

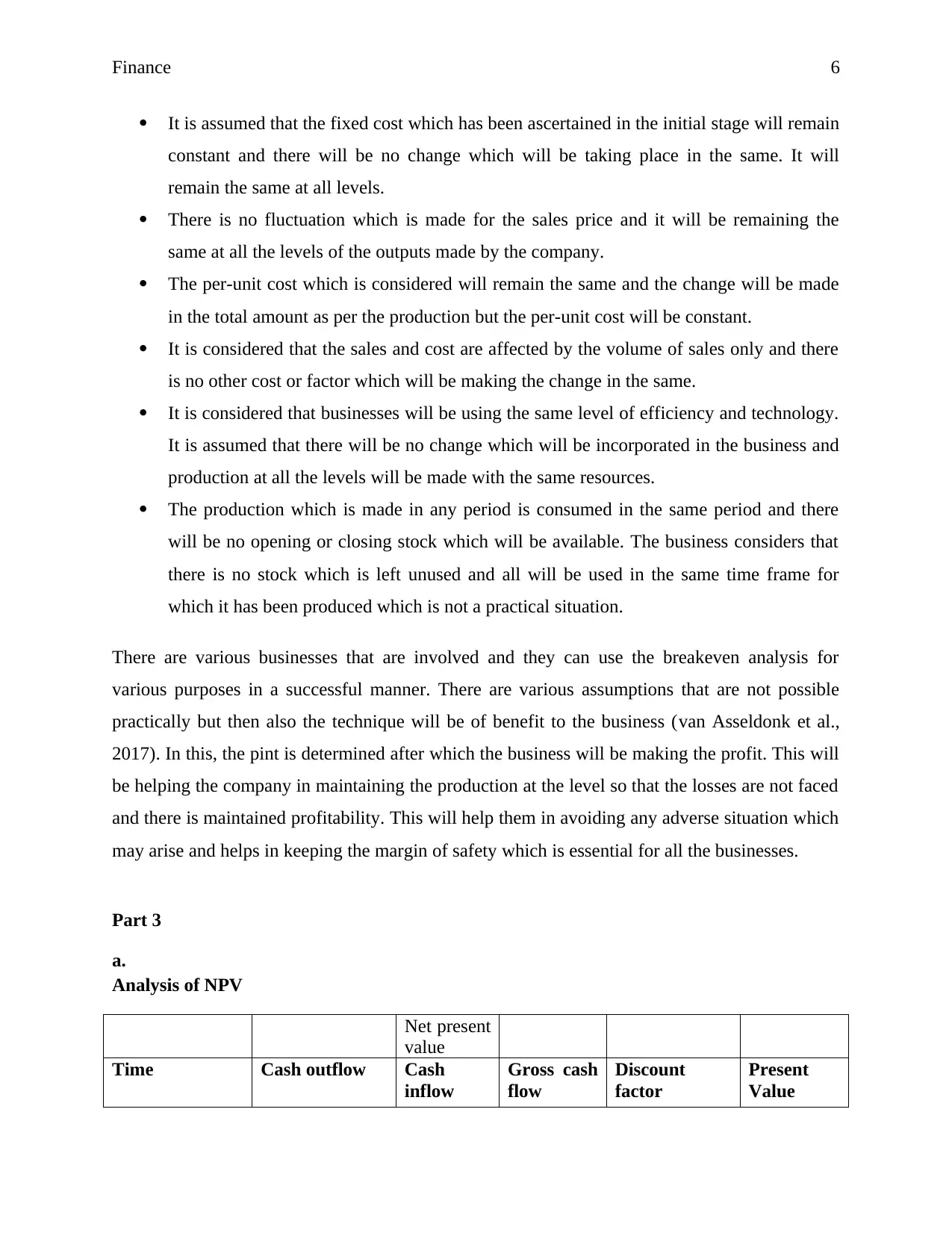

Part 3

a.

Analysis of NPV

Net present

value

Time Cash outflow Cash

inflow

Gross cash

flow

Discount

factor

Present

Value

It is assumed that the fixed cost which has been ascertained in the initial stage will remain

constant and there will be no change which will be taking place in the same. It will

remain the same at all levels.

There is no fluctuation which is made for the sales price and it will be remaining the

same at all the levels of the outputs made by the company.

The per-unit cost which is considered will remain the same and the change will be made

in the total amount as per the production but the per-unit cost will be constant.

It is considered that the sales and cost are affected by the volume of sales only and there

is no other cost or factor which will be making the change in the same.

It is considered that businesses will be using the same level of efficiency and technology.

It is assumed that there will be no change which will be incorporated in the business and

production at all the levels will be made with the same resources.

The production which is made in any period is consumed in the same period and there

will be no opening or closing stock which will be available. The business considers that

there is no stock which is left unused and all will be used in the same time frame for

which it has been produced which is not a practical situation.

There are various businesses that are involved and they can use the breakeven analysis for

various purposes in a successful manner. There are various assumptions that are not possible

practically but then also the technique will be of benefit to the business (van Asseldonk et al.,

2017). In this, the pint is determined after which the business will be making the profit. This will

be helping the company in maintaining the production at the level so that the losses are not faced

and there is maintained profitability. This will help them in avoiding any adverse situation which

may arise and helps in keeping the margin of safety which is essential for all the businesses.

Part 3

a.

Analysis of NPV

Net present

value

Time Cash outflow Cash

inflow

Gross cash

flow

Discount

factor

Present

Value

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 7

£ Million 7% £'000

0 -40000000 -40000000 1.000 -

40000000.0

0

1 -6400000 17000000 10600000 0.935 9906542.06

2 -6400000 17000000 10600000 0.873 9258450.52

3 -6400000 17000000 10600000 0.816 8652757.50

4 -6400000 17000000 10600000 0.763 8086689.25

5 -6400000 17000000 10600000 0.713 7557653.50

5 5000000 5000000 0.713 3564930.90

NPV 7027023.72

Analysis of Pay Back Period

Payback period

Time Cash outflow Cash inflow Gross cash flow Cumulative Factor

£ Million

0 -40000000 -40000000 -40000000

1 -6400000 17000000 10600000 -29400000

2 -6400000 17000000 10600000 -18800000

3 -6400000 17000000 10600000 -8200000

4 -6400000 17000000 10600000 2400000

5 -6400000 17000000 10600000 13000000

5 5000000 5000000 18000000

Payback Period 3.77 Years

Analysis of Average Rate of Return

Average Rate of

Return

Year Cash outflow Cash inflow Gross cash

flow

£ Million

0 -40000000 -40000000

1 -6400000 17000000 10600000

2 -6400000 17000000 10600000

3 -6400000 17000000 10600000

4 -6400000 17000000 10600000

5 -6400000 17000000 10600000

5 5000000 5000000

£ Million 7% £'000

0 -40000000 -40000000 1.000 -

40000000.0

0

1 -6400000 17000000 10600000 0.935 9906542.06

2 -6400000 17000000 10600000 0.873 9258450.52

3 -6400000 17000000 10600000 0.816 8652757.50

4 -6400000 17000000 10600000 0.763 8086689.25

5 -6400000 17000000 10600000 0.713 7557653.50

5 5000000 5000000 0.713 3564930.90

NPV 7027023.72

Analysis of Pay Back Period

Payback period

Time Cash outflow Cash inflow Gross cash flow Cumulative Factor

£ Million

0 -40000000 -40000000 -40000000

1 -6400000 17000000 10600000 -29400000

2 -6400000 17000000 10600000 -18800000

3 -6400000 17000000 10600000 -8200000

4 -6400000 17000000 10600000 2400000

5 -6400000 17000000 10600000 13000000

5 5000000 5000000 18000000

Payback Period 3.77 Years

Analysis of Average Rate of Return

Average Rate of

Return

Year Cash outflow Cash inflow Gross cash

flow

£ Million

0 -40000000 -40000000

1 -6400000 17000000 10600000

2 -6400000 17000000 10600000

3 -6400000 17000000 10600000

4 -6400000 17000000 10600000

5 -6400000 17000000 10600000

5 5000000 5000000

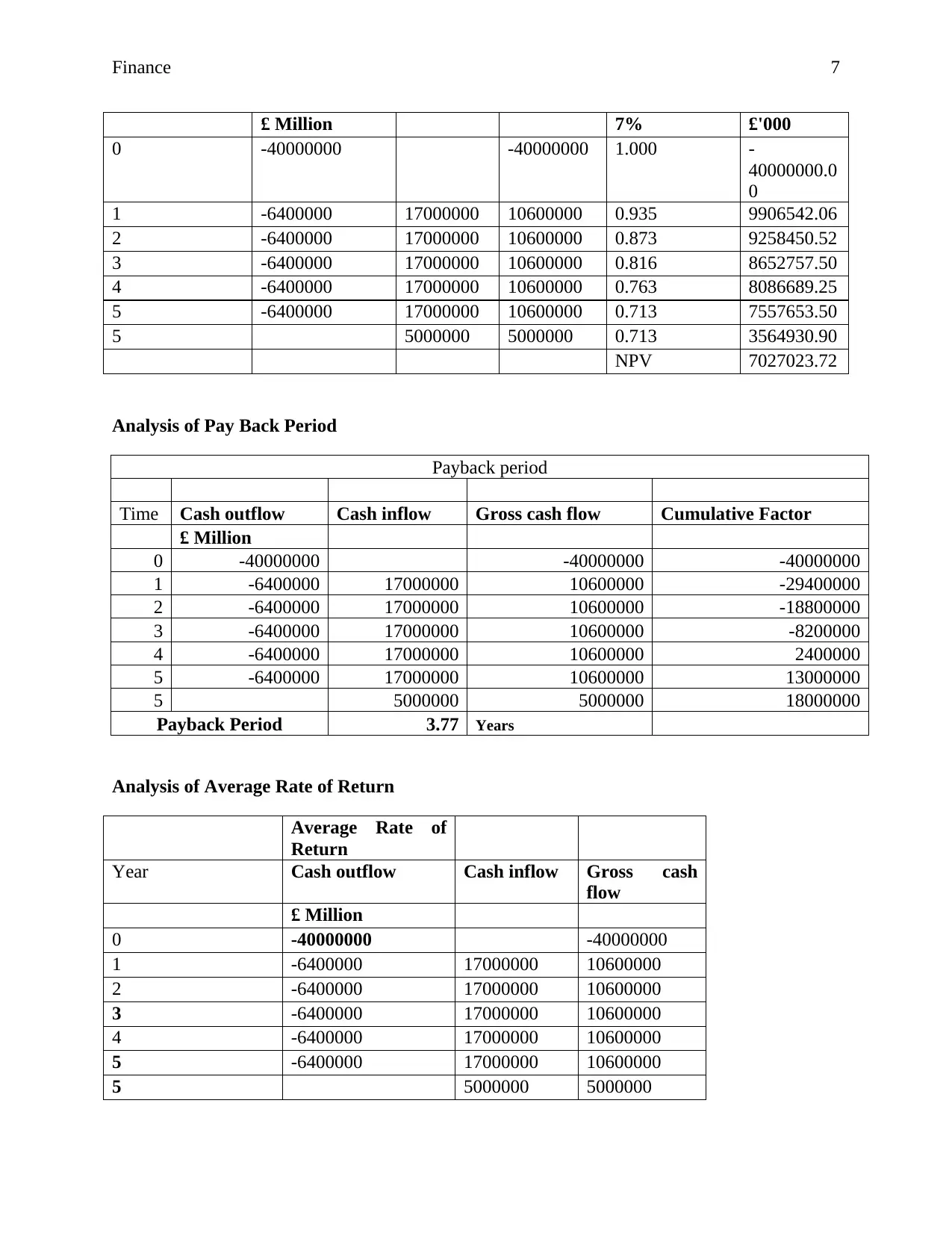

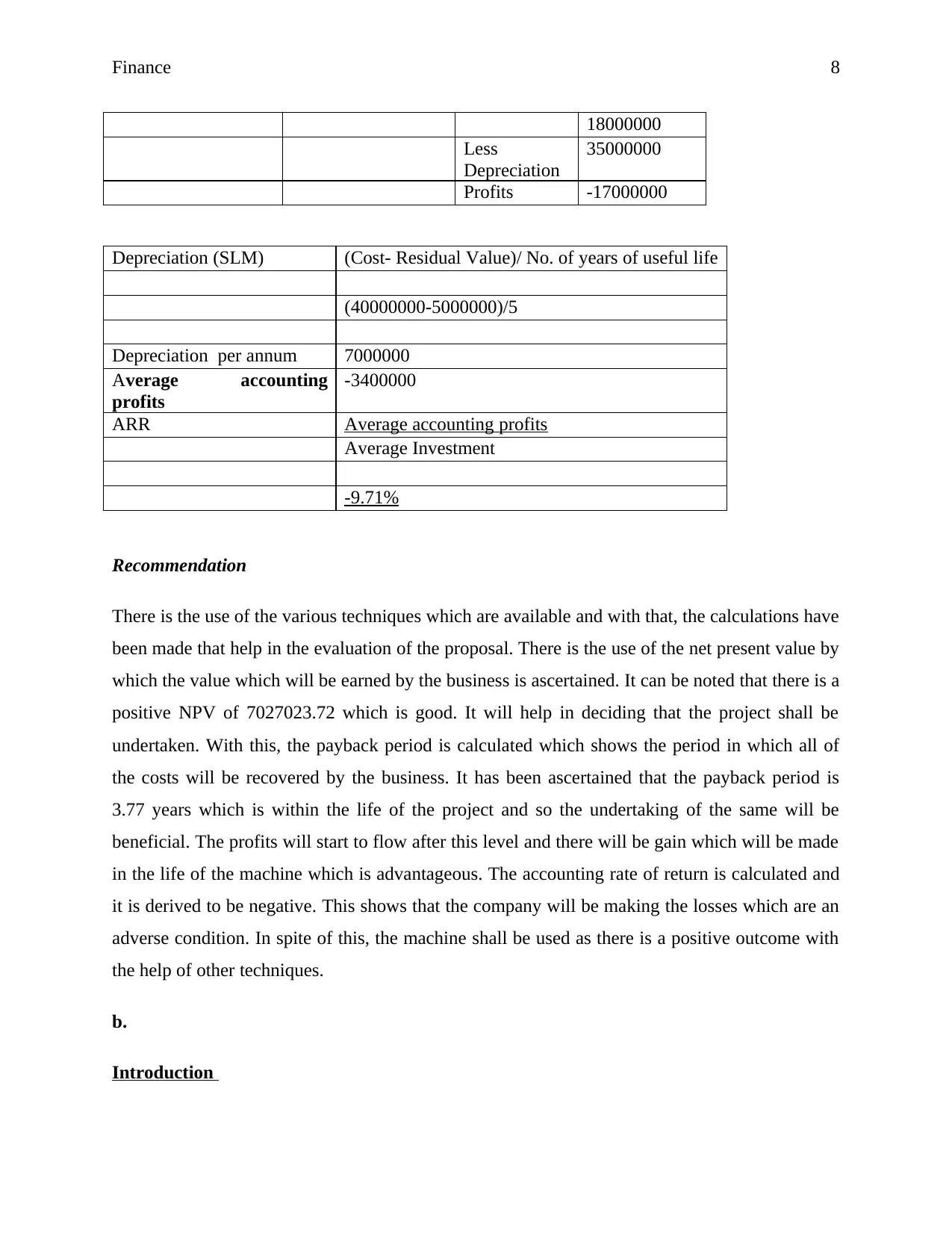

Finance 8

18000000

Less

Depreciation

35000000

Profits -17000000

Depreciation (SLM) (Cost- Residual Value)/ No. of years of useful life

(40000000-5000000)/5

Depreciation per annum 7000000

Average accounting

profits

-3400000

ARR Average accounting profits

Average Investment

-9.71%

Recommendation

There is the use of the various techniques which are available and with that, the calculations have

been made that help in the evaluation of the proposal. There is the use of the net present value by

which the value which will be earned by the business is ascertained. It can be noted that there is a

positive NPV of 7027023.72 which is good. It will help in deciding that the project shall be

undertaken. With this, the payback period is calculated which shows the period in which all of

the costs will be recovered by the business. It has been ascertained that the payback period is

3.77 years which is within the life of the project and so the undertaking of the same will be

beneficial. The profits will start to flow after this level and there will be gain which will be made

in the life of the machine which is advantageous. The accounting rate of return is calculated and

it is derived to be negative. This shows that the company will be making the losses which are an

adverse condition. In spite of this, the machine shall be used as there is a positive outcome with

the help of other techniques.

b.

Introduction

18000000

Less

Depreciation

35000000

Profits -17000000

Depreciation (SLM) (Cost- Residual Value)/ No. of years of useful life

(40000000-5000000)/5

Depreciation per annum 7000000

Average accounting

profits

-3400000

ARR Average accounting profits

Average Investment

-9.71%

Recommendation

There is the use of the various techniques which are available and with that, the calculations have

been made that help in the evaluation of the proposal. There is the use of the net present value by

which the value which will be earned by the business is ascertained. It can be noted that there is a

positive NPV of 7027023.72 which is good. It will help in deciding that the project shall be

undertaken. With this, the payback period is calculated which shows the period in which all of

the costs will be recovered by the business. It has been ascertained that the payback period is

3.77 years which is within the life of the project and so the undertaking of the same will be

beneficial. The profits will start to flow after this level and there will be gain which will be made

in the life of the machine which is advantageous. The accounting rate of return is calculated and

it is derived to be negative. This shows that the company will be making the losses which are an

adverse condition. In spite of this, the machine shall be used as there is a positive outcome with

the help of other techniques.

b.

Introduction

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance 9

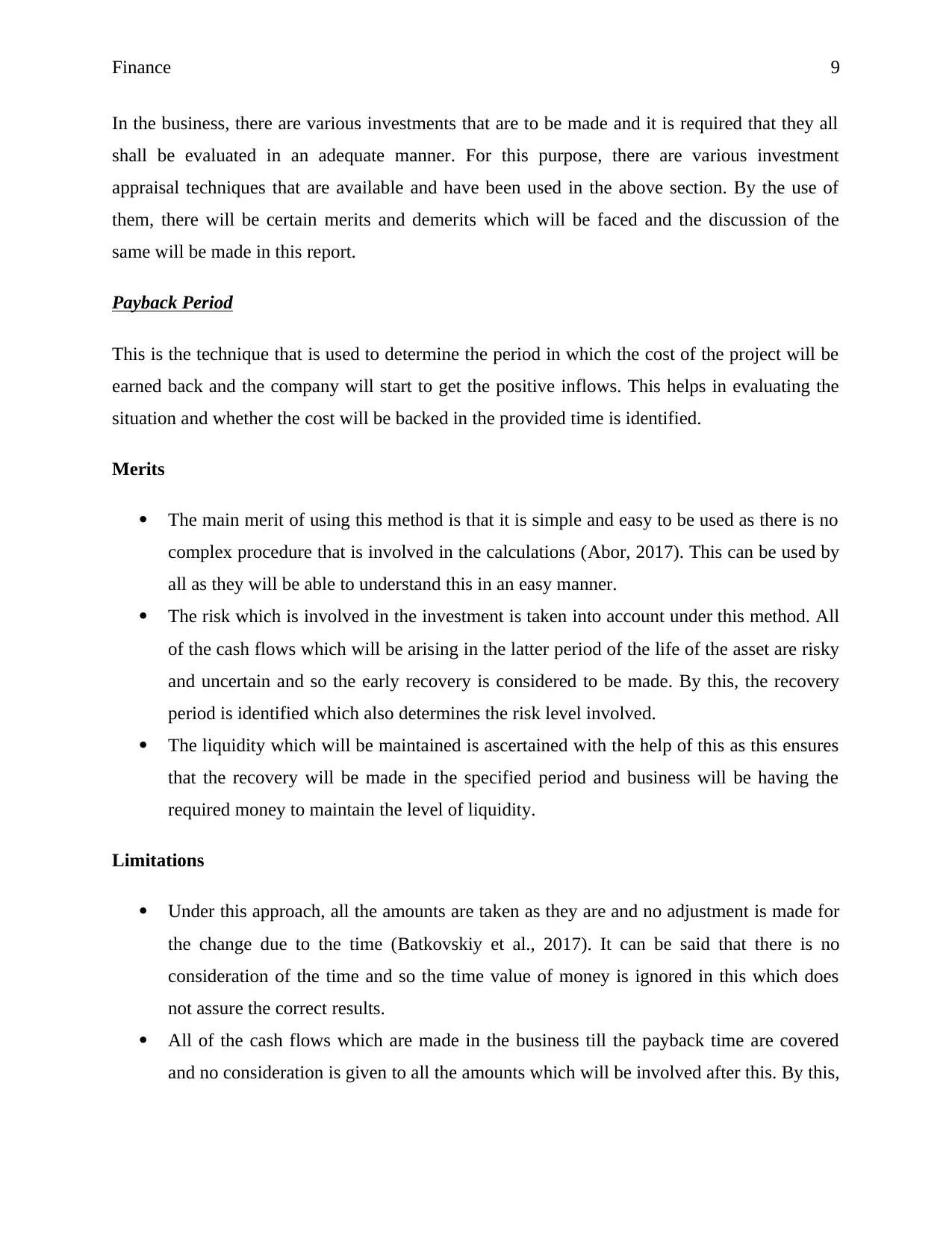

In the business, there are various investments that are to be made and it is required that they all

shall be evaluated in an adequate manner. For this purpose, there are various investment

appraisal techniques that are available and have been used in the above section. By the use of

them, there will be certain merits and demerits which will be faced and the discussion of the

same will be made in this report.

Payback Period

This is the technique that is used to determine the period in which the cost of the project will be

earned back and the company will start to get the positive inflows. This helps in evaluating the

situation and whether the cost will be backed in the provided time is identified.

Merits

The main merit of using this method is that it is simple and easy to be used as there is no

complex procedure that is involved in the calculations (Abor, 2017). This can be used by

all as they will be able to understand this in an easy manner.

The risk which is involved in the investment is taken into account under this method. All

of the cash flows which will be arising in the latter period of the life of the asset are risky

and uncertain and so the early recovery is considered to be made. By this, the recovery

period is identified which also determines the risk level involved.

The liquidity which will be maintained is ascertained with the help of this as this ensures

that the recovery will be made in the specified period and business will be having the

required money to maintain the level of liquidity.

Limitations

Under this approach, all the amounts are taken as they are and no adjustment is made for

the change due to the time (Batkovskiy et al., 2017). It can be said that there is no

consideration of the time and so the time value of money is ignored in this which does

not assure the correct results.

All of the cash flows which are made in the business till the payback time are covered

and no consideration is given to all the amounts which will be involved after this. By this,

In the business, there are various investments that are to be made and it is required that they all

shall be evaluated in an adequate manner. For this purpose, there are various investment

appraisal techniques that are available and have been used in the above section. By the use of

them, there will be certain merits and demerits which will be faced and the discussion of the

same will be made in this report.

Payback Period

This is the technique that is used to determine the period in which the cost of the project will be

earned back and the company will start to get the positive inflows. This helps in evaluating the

situation and whether the cost will be backed in the provided time is identified.

Merits

The main merit of using this method is that it is simple and easy to be used as there is no

complex procedure that is involved in the calculations (Abor, 2017). This can be used by

all as they will be able to understand this in an easy manner.

The risk which is involved in the investment is taken into account under this method. All

of the cash flows which will be arising in the latter period of the life of the asset are risky

and uncertain and so the early recovery is considered to be made. By this, the recovery

period is identified which also determines the risk level involved.

The liquidity which will be maintained is ascertained with the help of this as this ensures

that the recovery will be made in the specified period and business will be having the

required money to maintain the level of liquidity.

Limitations

Under this approach, all the amounts are taken as they are and no adjustment is made for

the change due to the time (Batkovskiy et al., 2017). It can be said that there is no

consideration of the time and so the time value of money is ignored in this which does

not assure the correct results.

All of the cash flows which are made in the business till the payback time are covered

and no consideration is given to all the amounts which will be involved after this. By this,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 10

the true position is not reflected as the period after the recovery is completely ignored

even though there may be some big flows that are involved.

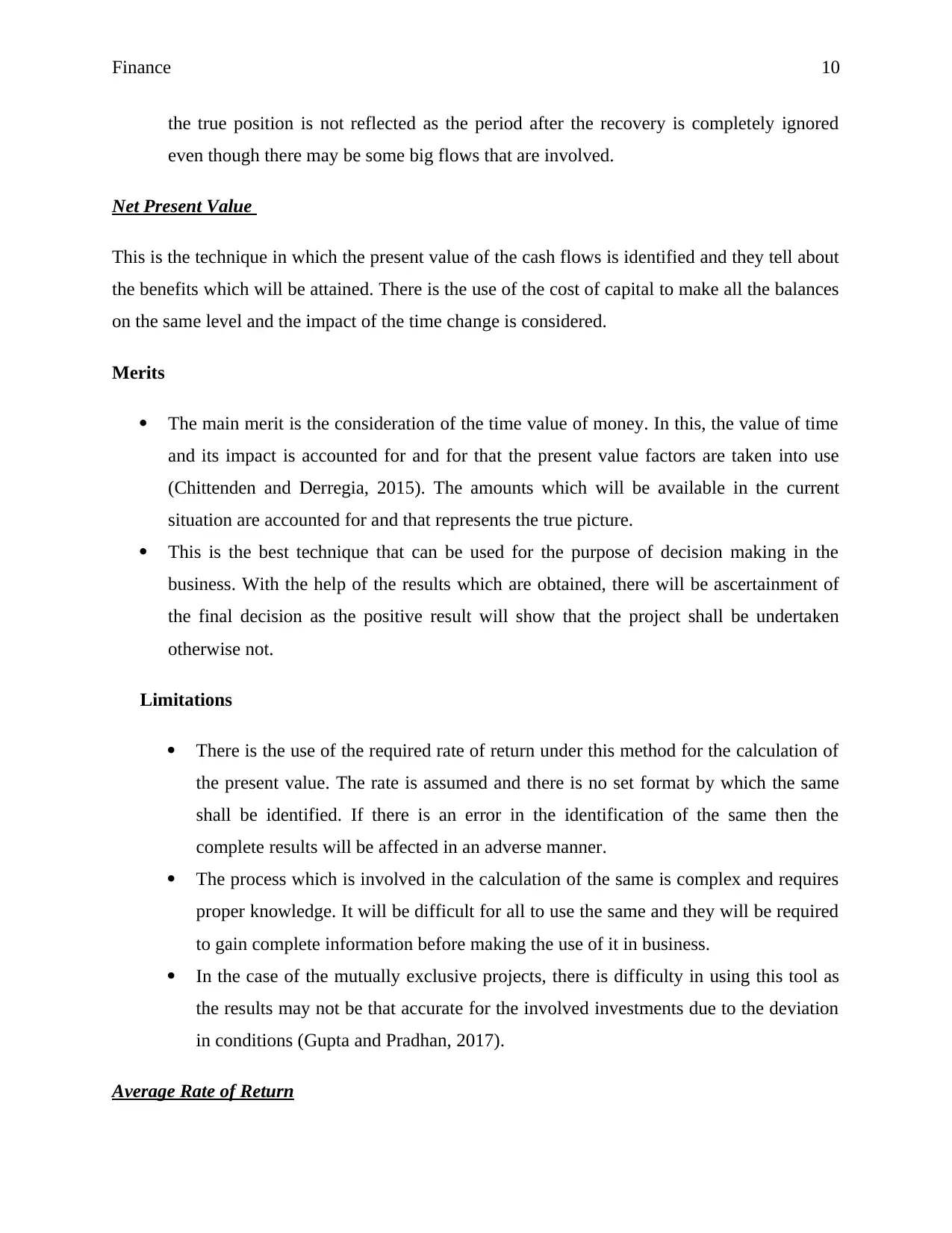

Net Present Value

This is the technique in which the present value of the cash flows is identified and they tell about

the benefits which will be attained. There is the use of the cost of capital to make all the balances

on the same level and the impact of the time change is considered.

Merits

The main merit is the consideration of the time value of money. In this, the value of time

and its impact is accounted for and for that the present value factors are taken into use

(Chittenden and Derregia, 2015). The amounts which will be available in the current

situation are accounted for and that represents the true picture.

This is the best technique that can be used for the purpose of decision making in the

business. With the help of the results which are obtained, there will be ascertainment of

the final decision as the positive result will show that the project shall be undertaken

otherwise not.

Limitations

There is the use of the required rate of return under this method for the calculation of

the present value. The rate is assumed and there is no set format by which the same

shall be identified. If there is an error in the identification of the same then the

complete results will be affected in an adverse manner.

The process which is involved in the calculation of the same is complex and requires

proper knowledge. It will be difficult for all to use the same and they will be required

to gain complete information before making the use of it in business.

In the case of the mutually exclusive projects, there is difficulty in using this tool as

the results may not be that accurate for the involved investments due to the deviation

in conditions (Gupta and Pradhan, 2017).

Average Rate of Return

the true position is not reflected as the period after the recovery is completely ignored

even though there may be some big flows that are involved.

Net Present Value

This is the technique in which the present value of the cash flows is identified and they tell about

the benefits which will be attained. There is the use of the cost of capital to make all the balances

on the same level and the impact of the time change is considered.

Merits

The main merit is the consideration of the time value of money. In this, the value of time

and its impact is accounted for and for that the present value factors are taken into use

(Chittenden and Derregia, 2015). The amounts which will be available in the current

situation are accounted for and that represents the true picture.

This is the best technique that can be used for the purpose of decision making in the

business. With the help of the results which are obtained, there will be ascertainment of

the final decision as the positive result will show that the project shall be undertaken

otherwise not.

Limitations

There is the use of the required rate of return under this method for the calculation of

the present value. The rate is assumed and there is no set format by which the same

shall be identified. If there is an error in the identification of the same then the

complete results will be affected in an adverse manner.

The process which is involved in the calculation of the same is complex and requires

proper knowledge. It will be difficult for all to use the same and they will be required

to gain complete information before making the use of it in business.

In the case of the mutually exclusive projects, there is difficulty in using this tool as

the results may not be that accurate for the involved investments due to the deviation

in conditions (Gupta and Pradhan, 2017).

Average Rate of Return

Finance 11

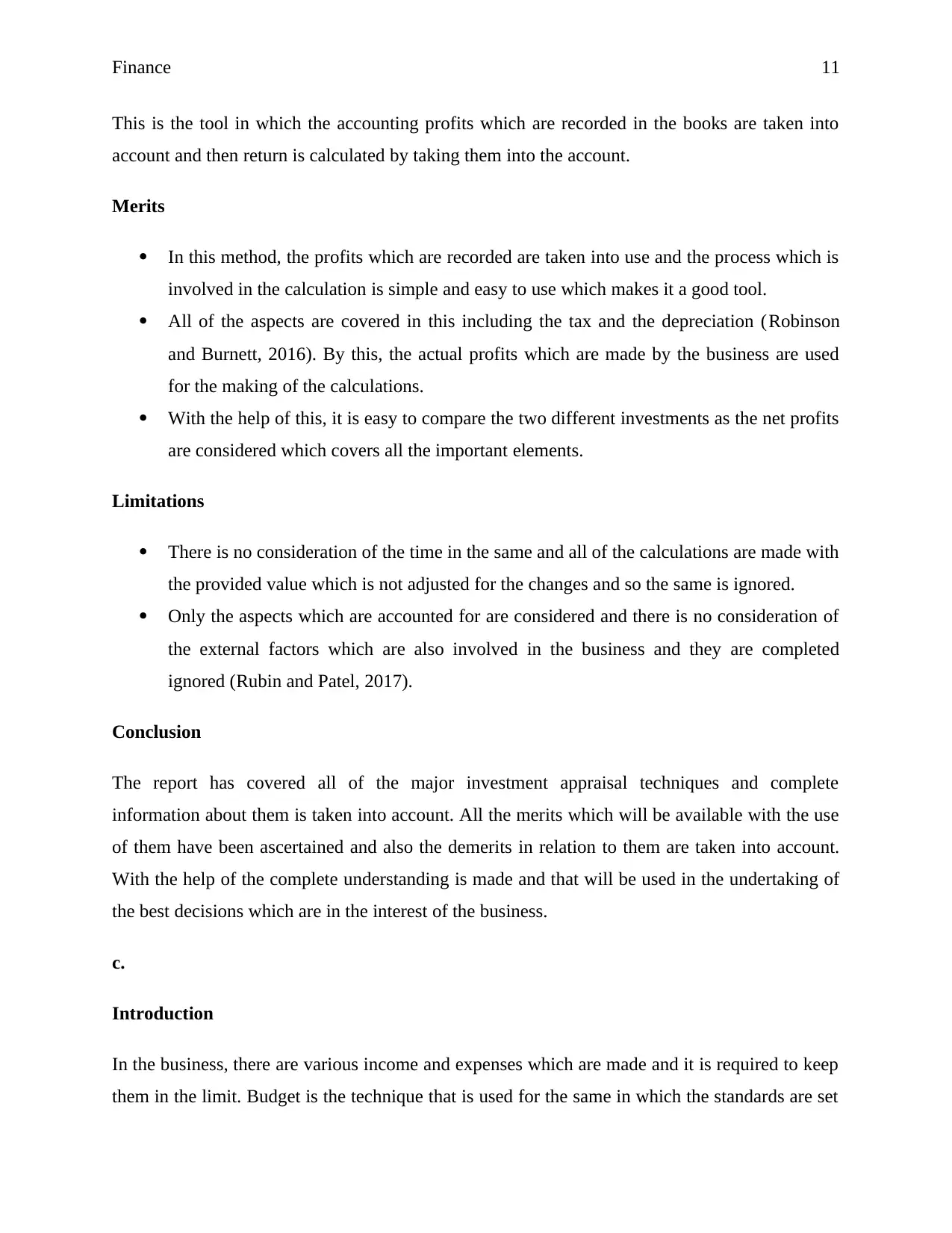

This is the tool in which the accounting profits which are recorded in the books are taken into

account and then return is calculated by taking them into the account.

Merits

In this method, the profits which are recorded are taken into use and the process which is

involved in the calculation is simple and easy to use which makes it a good tool.

All of the aspects are covered in this including the tax and the depreciation (Robinson

and Burnett, 2016). By this, the actual profits which are made by the business are used

for the making of the calculations.

With the help of this, it is easy to compare the two different investments as the net profits

are considered which covers all the important elements.

Limitations

There is no consideration of the time in the same and all of the calculations are made with

the provided value which is not adjusted for the changes and so the same is ignored.

Only the aspects which are accounted for are considered and there is no consideration of

the external factors which are also involved in the business and they are completed

ignored (Rubin and Patel, 2017).

Conclusion

The report has covered all of the major investment appraisal techniques and complete

information about them is taken into account. All the merits which will be available with the use

of them have been ascertained and also the demerits in relation to them are taken into account.

With the help of the complete understanding is made and that will be used in the undertaking of

the best decisions which are in the interest of the business.

c.

Introduction

In the business, there are various income and expenses which are made and it is required to keep

them in the limit. Budget is the technique that is used for the same in which the standards are set

This is the tool in which the accounting profits which are recorded in the books are taken into

account and then return is calculated by taking them into the account.

Merits

In this method, the profits which are recorded are taken into use and the process which is

involved in the calculation is simple and easy to use which makes it a good tool.

All of the aspects are covered in this including the tax and the depreciation (Robinson

and Burnett, 2016). By this, the actual profits which are made by the business are used

for the making of the calculations.

With the help of this, it is easy to compare the two different investments as the net profits

are considered which covers all the important elements.

Limitations

There is no consideration of the time in the same and all of the calculations are made with

the provided value which is not adjusted for the changes and so the same is ignored.

Only the aspects which are accounted for are considered and there is no consideration of

the external factors which are also involved in the business and they are completed

ignored (Rubin and Patel, 2017).

Conclusion

The report has covered all of the major investment appraisal techniques and complete

information about them is taken into account. All the merits which will be available with the use

of them have been ascertained and also the demerits in relation to them are taken into account.

With the help of the complete understanding is made and that will be used in the undertaking of

the best decisions which are in the interest of the business.

c.

Introduction

In the business, there are various income and expenses which are made and it is required to keep

them in the limit. Budget is the technique that is used for the same in which the standards are set

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.