Management Accounting Assignment Solution - UGB106, Term 1, 2020/21

VerifiedAdded on 2023/01/05

|16

|3709

|76

Homework Assignment

AI Summary

This assignment solution addresses key concepts in management accounting through three comprehensive questions. Question 1 focuses on Woodrock Limited, requiring the preparation of a cash budget, analysis of cash flow, and a discussion of the behavioral aspects of budgeting, including dysfunctional behavior, participative budgeting, and budgetary slack. Question 2 examines Plaistead Plc, calculating contribution margin, break-even point, margin of safety, profit, and analyzing the impact of changes in fixed costs and selling prices, along with a discussion of break-even model assumptions. Question 4 centers on Jayrod Plc, involving the preparation of original, flexed, and actual budgets, total variance analysis, and an assessment of the relevance of these budgets. The solution provides detailed calculations and explanations to aid in understanding the core principles of management accounting.

Introduction to

Management Accounting

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1: Woodrock Limited...................................................................................................3

Question 2: Plaistead Plc ............................................................................................................6

Question 4: Jayrod Plc..............................................................................................................10

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1: Woodrock Limited...................................................................................................3

Question 2: Plaistead Plc ............................................................................................................6

Question 4: Jayrod Plc..............................................................................................................10

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting can be defined as a process of recording and managing both

kinds of information including financial & non financial for internal reports (Burritt, Schaltegger

and Viere, 2019). These internal reports are used by managers in order to take effective decisions

by offering necessary information to company. The report is based on three distinct tasks which

are addressed. These tasks are related to preparation of cash budget, break even point etc.

MAIN BODY

Question 1: Woodrock Limited

(a) Cash budget-During the time, a cash budget is a budget or plan of planned cash receipts and

payments. Such financial statements include taxes earned, expenses charged, receipts and fees

for loans. In other words, an approximate expectation of the financial position of a company in

the potential is a cash budget. Typically, management creates the cash budget after the plans for

revenue, acquisitions, and capital investments are already produced. In order to reliably predict

how cash will be impacted over the time, these budgets need to be rendered before the financial

plan (Hiebl and Mayrleitner, 2019). For starters, before it can determine how often capital will be

earned over the time , management has to know a revenue forecast. The cash budget is used by

executives to handle a company's cash flows. In other terms, management should make sure that

when they are due, the company has enough cash to cover its bills. Payroll, for example, needs to

be charged every two weeks and expenses have to be paid every month. The cash budget makes

it easier for managers to foresee short falls in the cash flow of the business and fix the concerns

before bill is due.

On the basis of given data set, below a cash budget is presented that is as follows:

Particul

ars

Month

1

Month

2

Month

3

Month

4

Month

5

Month

6

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tot

al

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tot

al

De

sk

Ca

bin

Tota

l of

Management accounting can be defined as a process of recording and managing both

kinds of information including financial & non financial for internal reports (Burritt, Schaltegger

and Viere, 2019). These internal reports are used by managers in order to take effective decisions

by offering necessary information to company. The report is based on three distinct tasks which

are addressed. These tasks are related to preparation of cash budget, break even point etc.

MAIN BODY

Question 1: Woodrock Limited

(a) Cash budget-During the time, a cash budget is a budget or plan of planned cash receipts and

payments. Such financial statements include taxes earned, expenses charged, receipts and fees

for loans. In other words, an approximate expectation of the financial position of a company in

the potential is a cash budget. Typically, management creates the cash budget after the plans for

revenue, acquisitions, and capital investments are already produced. In order to reliably predict

how cash will be impacted over the time, these budgets need to be rendered before the financial

plan (Hiebl and Mayrleitner, 2019). For starters, before it can determine how often capital will be

earned over the time , management has to know a revenue forecast. The cash budget is used by

executives to handle a company's cash flows. In other terms, management should make sure that

when they are due, the company has enough cash to cover its bills. Payroll, for example, needs to

be charged every two weeks and expenses have to be paid every month. The cash budget makes

it easier for managers to foresee short falls in the cash flow of the business and fix the concerns

before bill is due.

On the basis of given data set, below a cash budget is presented that is as follows:

Particul

ars

Month

1

Month

2

Month

3

Month

4

Month

5

Month

6

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tot

al

De

sk

Ca

bin

Tota

l of

De

sk

Ca

bin

Tot

al

De

sk

Ca

bin

Tota

l of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

et

mon

th 1 et

mon

th 2 et

of

mo

nth

3 et

mon

th 4 et

of

mo

nth

5 et

mon

th 6

sales

21

00

0

20

00

0

410

00

15

00

0

15

00

0

300

00

Total

receipts 0 0 0

410

00 0

300

00

Cash

paymen

ts

Material

70

00

48

00

118

00 0

50

00

36

00

860

0

60

00

42

00

102

00

Rent

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

Machine

ry

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

Marketi

ng and

advertis

ement

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0 0 0

Manage

r's

salary

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

Insuranc 40 400 0 0 0

mon

th 1 et

mon

th 2 et

of

mo

nth

3 et

mon

th 4 et

of

mo

nth

5 et

mon

th 6

sales

21

00

0

20

00

0

410

00

15

00

0

15

00

0

300

00

Total

receipts 0 0 0

410

00 0

300

00

Cash

paymen

ts

Material

70

00

48

00

118

00 0

50

00

36

00

860

0

60

00

42

00

102

00

Rent

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0

Machine

ry

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

25

00

250

0

Marketi

ng and

advertis

ement

20

00

200

0

20

00

200

0

20

00

200

0

20

00

200

0 0 0

Manage

r's

salary

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

30

00

300

0

Insuranc 40 400 0 0 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

e 00 0

Labour

cost

42

00

32

00

740

0

30

00

24

00

540

0

18

00

0

28

00

208

00

48

00

32

00

800

0

60

00

52

00

112

00

66

00

64

00

130

00

Total

payment

s

209

00

149

00

421

00

175

00

273

00

307

00

Net

cash

flow

-

209

00

-

149

00

-

421

00

235

00

-

273

00 -700

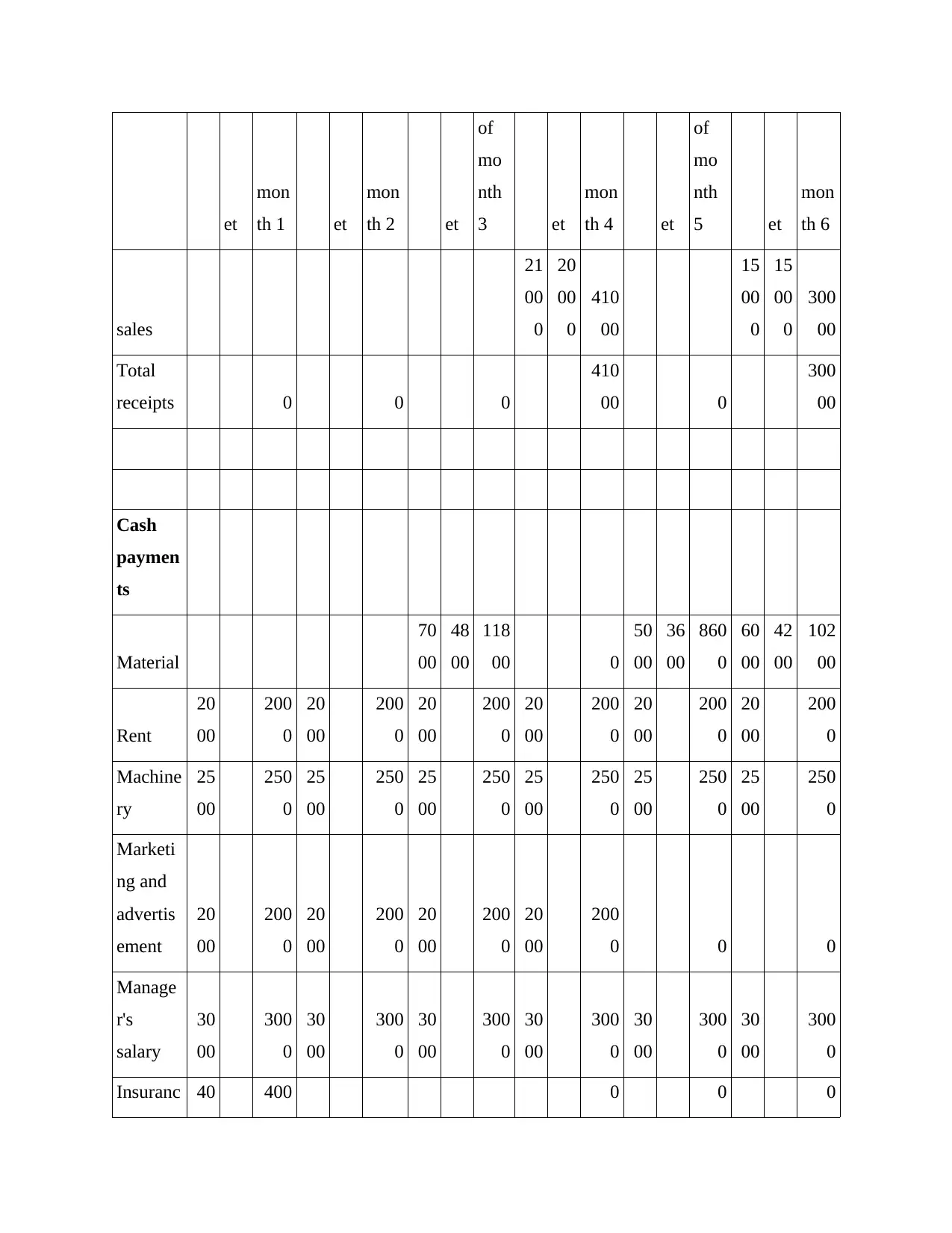

(b) Comment on cash position

On the basis of above table, this can be stated that company is not able to produce positive cash

flows in each month. This is so because there is only one activity for cash receipt that is sales

revenue. While there are more number of activities which are resulting in cash payments.

(c) Issues of relevance in behavioural aspects of behavioural aspects of budgeting.

Budgeting: The method of designing, executing and financing decisions is budgeting. That is the

managerial method of preparing and coordination of the budget, fiscal monitoring and associated

processes. Budgeting is the highest degree of future accounting, suggesting a clear plan of action

and not just reporting (NGUYEN and LE, 2020). It is an important part of long-range planning,

cash flow, capital spending and budget management of those development strategies. An official

budget might seem like an impartial, logical text, but it's always anything other than. Budgeting

is a central aspect of management accounting, which relies on the use of scheduling and

decision-making financial knowledge. In comparison to financial accounting, when bringing

together a schedule, planners have to understand human nature, not just statistics. The executives

who draw up a schedule, for example, may have personal preferences that distort the numbers.

The workers who live with the budget can dislike the limitations that it places on them

Behavioural aspect of budgeting: There are a range of behavioural aspect of budgeting and some

of them are mentioned below in such manner:

Labour

cost

42

00

32

00

740

0

30

00

24

00

540

0

18

00

0

28

00

208

00

48

00

32

00

800

0

60

00

52

00

112

00

66

00

64

00

130

00

Total

payment

s

209

00

149

00

421

00

175

00

273

00

307

00

Net

cash

flow

-

209

00

-

149

00

-

421

00

235

00

-

273

00 -700

(b) Comment on cash position

On the basis of above table, this can be stated that company is not able to produce positive cash

flows in each month. This is so because there is only one activity for cash receipt that is sales

revenue. While there are more number of activities which are resulting in cash payments.

(c) Issues of relevance in behavioural aspects of behavioural aspects of budgeting.

Budgeting: The method of designing, executing and financing decisions is budgeting. That is the

managerial method of preparing and coordination of the budget, fiscal monitoring and associated

processes. Budgeting is the highest degree of future accounting, suggesting a clear plan of action

and not just reporting (NGUYEN and LE, 2020). It is an important part of long-range planning,

cash flow, capital spending and budget management of those development strategies. An official

budget might seem like an impartial, logical text, but it's always anything other than. Budgeting

is a central aspect of management accounting, which relies on the use of scheduling and

decision-making financial knowledge. In comparison to financial accounting, when bringing

together a schedule, planners have to understand human nature, not just statistics. The executives

who draw up a schedule, for example, may have personal preferences that distort the numbers.

The workers who live with the budget can dislike the limitations that it places on them

Behavioural aspect of budgeting: There are a range of behavioural aspect of budgeting and some

of them are mentioned below in such manner:

Dysfunctional behaviour- Budgets may bring good action to individuals where the goals

of individual managers are found to be in consistent with the organization 's objectives.

The exact matching (or close perfect matching) between the priorities of the company

and management is often referred to as objective congruence. In terms of corporate

priorities and goals, administrators who engage in the budgeting process may be happy to

generate a reasonable budget. Such a plan will induce and inspire others to put success in

their performance. However, often the response of subordinates is found to be

unfavourable due to incorrect execution of the budget and unreasonable managerial goals,

which in turn has a negative influence on the accomplishment of organisational

objectives. Such a detrimental action is considered as unstable behaviour, described as an

individual behaviour that is in profound conflict with the strategic goals.

Participative budgeting: Participation in the planning of the budget by subordinates is

perceived to increase the morale of workers and minimise internal tension. The

development of good superior-subordinate connections nurtured by regular person-to -

person interaction (ii) the use of feedback in performance evaluation (iii) the use of

individual departments meetings to discuss actual outcomes and (iv) the formation of a

"game" spirit (margin for error, patience and slack) is one sign that an agency promotes

active employee involvement.

Budgetary slack: Budgetary slack, often known as budget stuffing, happens where a

planner purposely underestimates sales, overestimates expenses, and calls for additional

funds than required to cover the amount of activities total budget. The discrepancy is

called budgetary slack between the revenue and expense estimates that a individual offers

and a reasonable estimation of the revenue or cost (Aureli, Del Baldo, and Lombardi,

2019). There is a desire to incorporate slack or a buffer into the budget in both

companies. For example , on the basis of previous interactions, subordinate executives

can recognise that their budget plans would be slashed by senior executives and may thus

be inclined to pad those costs or make low-revenue projections. In the opposite, senior

managers who are aware of their lower managers' padding practises can be tempted to

maximise the amount of projected profits and decrease the budgetary costs. Likewise, the

sales representatives neglect their sales expectations; by keeping excessive cash reserves,

etc., the controller adds slack. In good years, the amount of slack continues to increase,

of individual managers are found to be in consistent with the organization 's objectives.

The exact matching (or close perfect matching) between the priorities of the company

and management is often referred to as objective congruence. In terms of corporate

priorities and goals, administrators who engage in the budgeting process may be happy to

generate a reasonable budget. Such a plan will induce and inspire others to put success in

their performance. However, often the response of subordinates is found to be

unfavourable due to incorrect execution of the budget and unreasonable managerial goals,

which in turn has a negative influence on the accomplishment of organisational

objectives. Such a detrimental action is considered as unstable behaviour, described as an

individual behaviour that is in profound conflict with the strategic goals.

Participative budgeting: Participation in the planning of the budget by subordinates is

perceived to increase the morale of workers and minimise internal tension. The

development of good superior-subordinate connections nurtured by regular person-to -

person interaction (ii) the use of feedback in performance evaluation (iii) the use of

individual departments meetings to discuss actual outcomes and (iv) the formation of a

"game" spirit (margin for error, patience and slack) is one sign that an agency promotes

active employee involvement.

Budgetary slack: Budgetary slack, often known as budget stuffing, happens where a

planner purposely underestimates sales, overestimates expenses, and calls for additional

funds than required to cover the amount of activities total budget. The discrepancy is

called budgetary slack between the revenue and expense estimates that a individual offers

and a reasonable estimation of the revenue or cost (Aureli, Del Baldo, and Lombardi,

2019). There is a desire to incorporate slack or a buffer into the budget in both

companies. For example , on the basis of previous interactions, subordinate executives

can recognise that their budget plans would be slashed by senior executives and may thus

be inclined to pad those costs or make low-revenue projections. In the opposite, senior

managers who are aware of their lower managers' padding practises can be tempted to

maximise the amount of projected profits and decrease the budgetary costs. Likewise, the

sales representatives neglect their sales expectations; by keeping excessive cash reserves,

etc., the controller adds slack. In good years, the amount of slack continues to increase,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

where satisfactory earnings are quickly attained, slack is willingly decreased all through

the company in bad years.

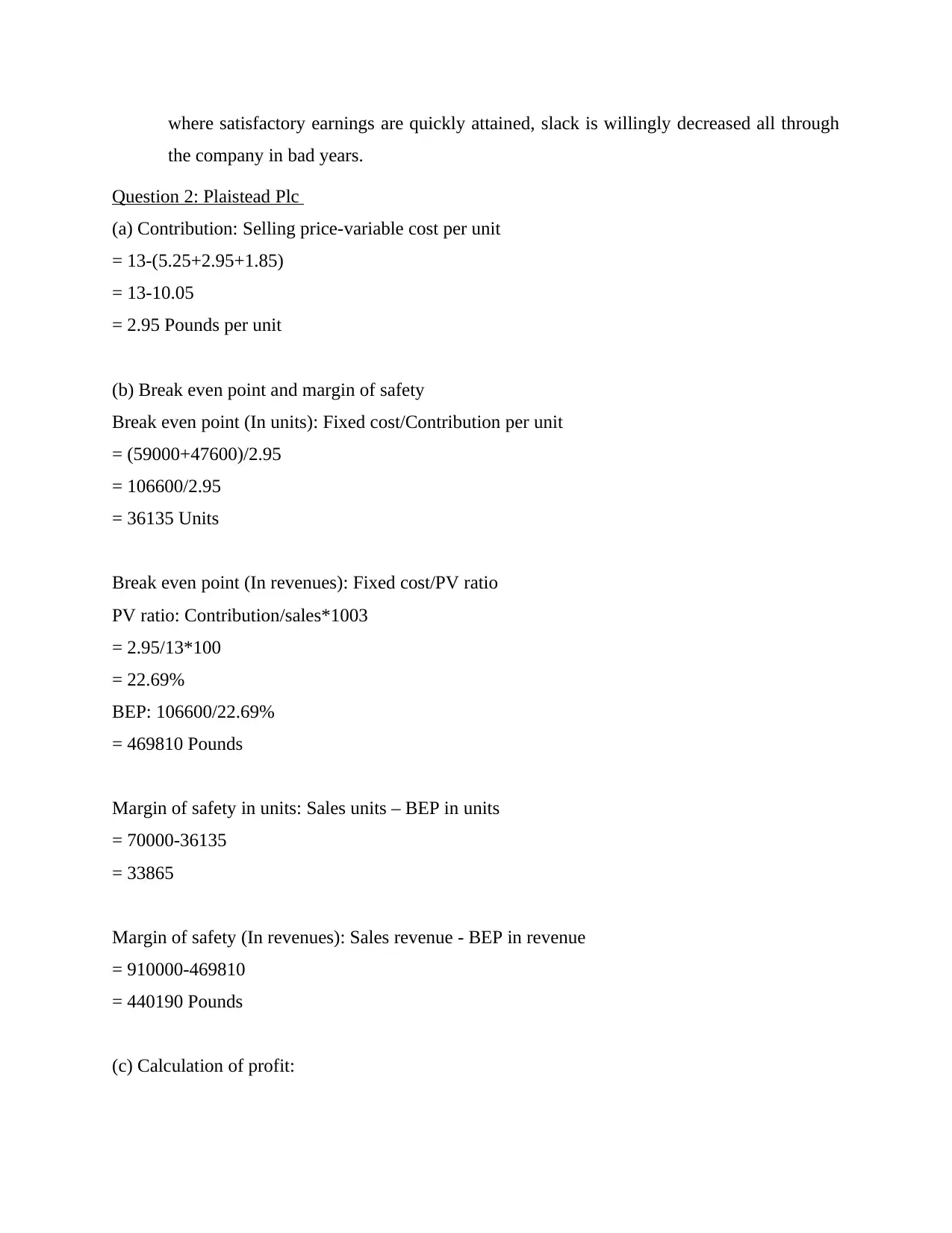

Question 2: Plaistead Plc

(a) Contribution: Selling price-variable cost per unit

= 13-(5.25+2.95+1.85)

= 13-10.05

= 2.95 Pounds per unit

(b) Break even point and margin of safety

Break even point (In units): Fixed cost/Contribution per unit

= (59000+47600)/2.95

= 106600/2.95

= 36135 Units

Break even point (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/sales*1003

= 2.95/13*100

= 22.69%

BEP: 106600/22.69%

= 469810 Pounds

Margin of safety in units: Sales units – BEP in units

= 70000-36135

= 33865

Margin of safety (In revenues): Sales revenue - BEP in revenue

= 910000-469810

= 440190 Pounds

(c) Calculation of profit:

the company in bad years.

Question 2: Plaistead Plc

(a) Contribution: Selling price-variable cost per unit

= 13-(5.25+2.95+1.85)

= 13-10.05

= 2.95 Pounds per unit

(b) Break even point and margin of safety

Break even point (In units): Fixed cost/Contribution per unit

= (59000+47600)/2.95

= 106600/2.95

= 36135 Units

Break even point (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/sales*1003

= 2.95/13*100

= 22.69%

BEP: 106600/22.69%

= 469810 Pounds

Margin of safety in units: Sales units – BEP in units

= 70000-36135

= 33865

Margin of safety (In revenues): Sales revenue - BEP in revenue

= 910000-469810

= 440190 Pounds

(c) Calculation of profit:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

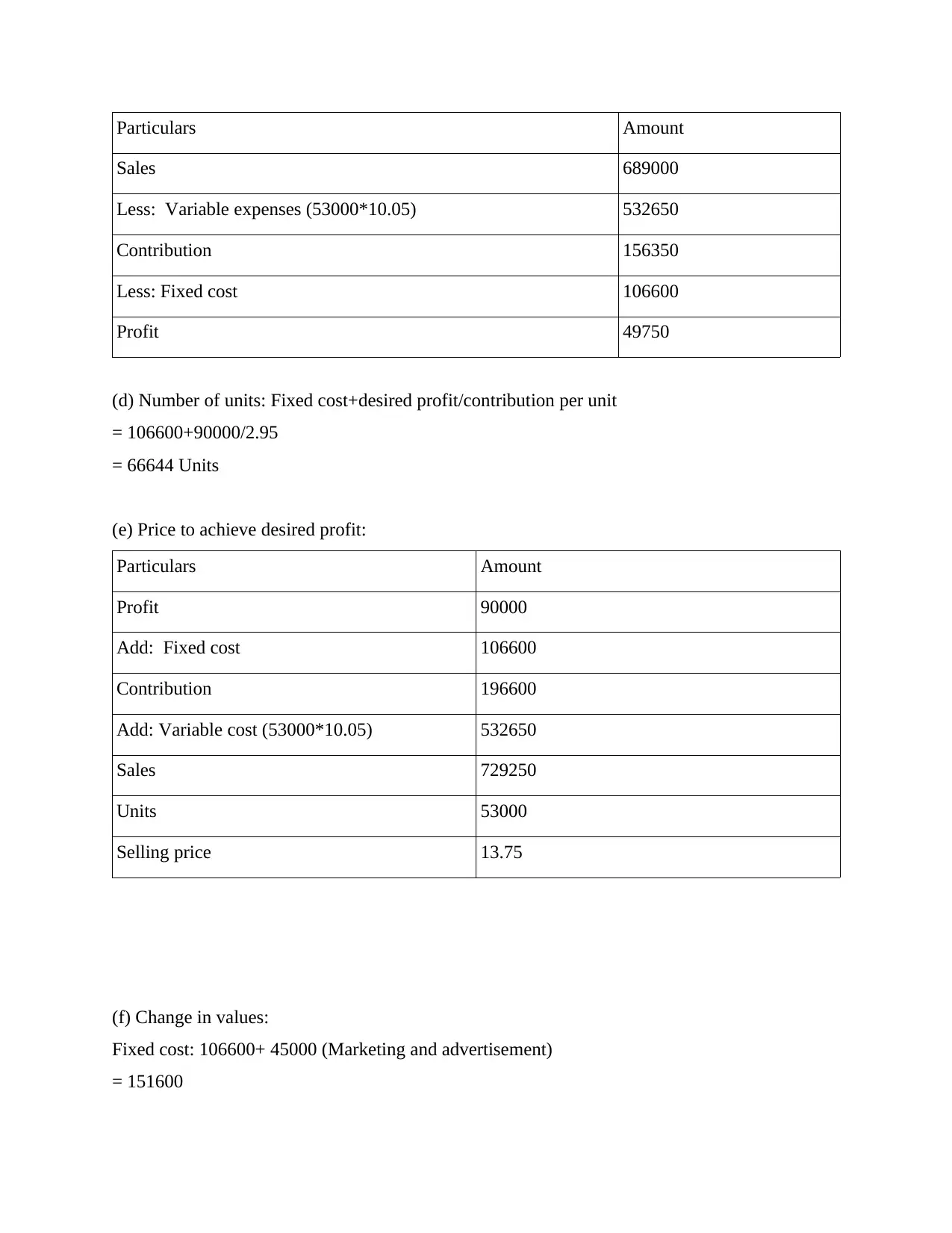

Particulars Amount

Sales 689000

Less: Variable expenses (53000*10.05) 532650

Contribution 156350

Less: Fixed cost 106600

Profit 49750

(d) Number of units: Fixed cost+desired profit/contribution per unit

= 106600+90000/2.95

= 66644 Units

(e) Price to achieve desired profit:

Particulars Amount

Profit 90000

Add: Fixed cost 106600

Contribution 196600

Add: Variable cost (53000*10.05) 532650

Sales 729250

Units 53000

Selling price 13.75

(f) Change in values:

Fixed cost: 106600+ 45000 (Marketing and advertisement)

= 151600

Sales 689000

Less: Variable expenses (53000*10.05) 532650

Contribution 156350

Less: Fixed cost 106600

Profit 49750

(d) Number of units: Fixed cost+desired profit/contribution per unit

= 106600+90000/2.95

= 66644 Units

(e) Price to achieve desired profit:

Particulars Amount

Profit 90000

Add: Fixed cost 106600

Contribution 196600

Add: Variable cost (53000*10.05) 532650

Sales 729250

Units 53000

Selling price 13.75

(f) Change in values:

Fixed cost: 106600+ 45000 (Marketing and advertisement)

= 151600

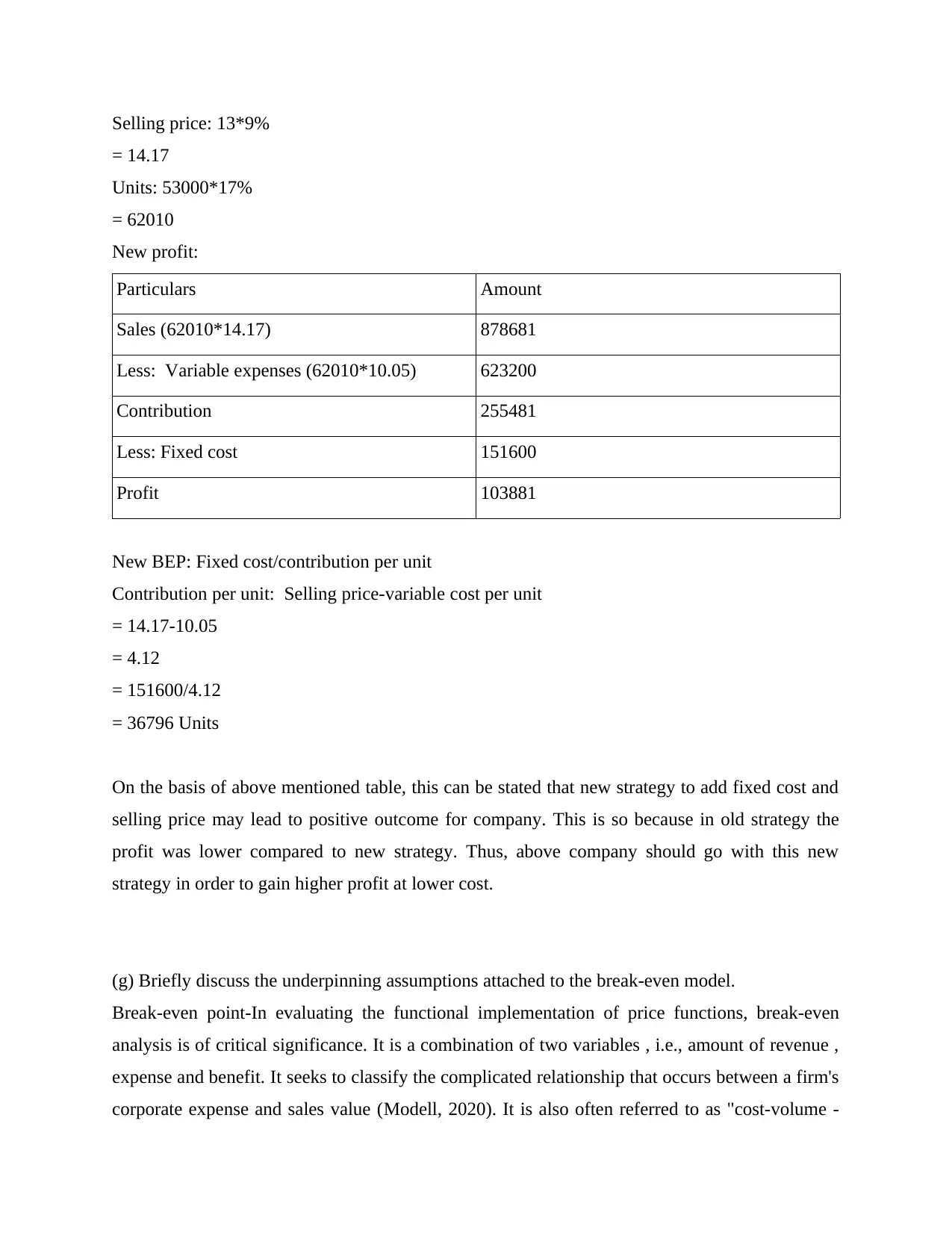

Selling price: 13*9%

= 14.17

Units: 53000*17%

= 62010

New profit:

Particulars Amount

Sales (62010*14.17) 878681

Less: Variable expenses (62010*10.05) 623200

Contribution 255481

Less: Fixed cost 151600

Profit 103881

New BEP: Fixed cost/contribution per unit

Contribution per unit: Selling price-variable cost per unit

= 14.17-10.05

= 4.12

= 151600/4.12

= 36796 Units

On the basis of above mentioned table, this can be stated that new strategy to add fixed cost and

selling price may lead to positive outcome for company. This is so because in old strategy the

profit was lower compared to new strategy. Thus, above company should go with this new

strategy in order to gain higher profit at lower cost.

(g) Briefly discuss the underpinning assumptions attached to the break-even model.

Break-even point-In evaluating the functional implementation of price functions, break-even

analysis is of critical significance. It is a combination of two variables , i.e., amount of revenue ,

expense and benefit. It seeks to classify the complicated relationship that occurs between a firm's

corporate expense and sales value (Modell, 2020). It is also often referred to as "cost-volume -

= 14.17

Units: 53000*17%

= 62010

New profit:

Particulars Amount

Sales (62010*14.17) 878681

Less: Variable expenses (62010*10.05) 623200

Contribution 255481

Less: Fixed cost 151600

Profit 103881

New BEP: Fixed cost/contribution per unit

Contribution per unit: Selling price-variable cost per unit

= 14.17-10.05

= 4.12

= 151600/4.12

= 36796 Units

On the basis of above mentioned table, this can be stated that new strategy to add fixed cost and

selling price may lead to positive outcome for company. This is so because in old strategy the

profit was lower compared to new strategy. Thus, above company should go with this new

strategy in order to gain higher profit at lower cost.

(g) Briefly discuss the underpinning assumptions attached to the break-even model.

Break-even point-In evaluating the functional implementation of price functions, break-even

analysis is of critical significance. It is a combination of two variables , i.e., amount of revenue ,

expense and benefit. It seeks to classify the complicated relationship that occurs between a firm's

corporate expense and sales value (Modell, 2020). It is also often referred to as "cost-volume -

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

profit research". It helps to consider the working situation that occurs when a corporation

'breaks-even', that's also, when profits hit a point equivalent to all costs incurred in reaching that

selling price. A break-even point is the place that, by the income it receives from revenues, a

corporate company can recover its expenses. Here, we may assume that, with its sales income,

the corporation is now able to cover its expenses. Break-even analysis is the way to identify the

effects on the cost, income and productivity of a project or a commodity of variance in market

volume. It consists of multiple equations on the basis of which the companies assess the viability

and feasibility of beginning a new project or manufacturing a new product.

Assumptions:

(I) It is important to divide the overall costs into fixed and variable costs. It ignores costs that are

semi-variable.

(ii) The functions of expense and income remain sequential.

(iii) It is presumed that the price of the good is constant.

(iv) The revenue volume and the output volume are equivalent.

(v) The operating costs are constant with respect to the volume under consideration.

(vi) A steady rate of growth in variable costs is assumed.

(vii) It implies consistent technology and little change in the productivity of labour.

(viii) It is assumed that the commodity price is constant.

(ix) The pricing strategy remains unaltered.

(x) Increases in input costs will be removed (Dobroszek, Almasan, and Circa, 2019).

(xi) The commodity balance is constant in the case of multi-product companies.

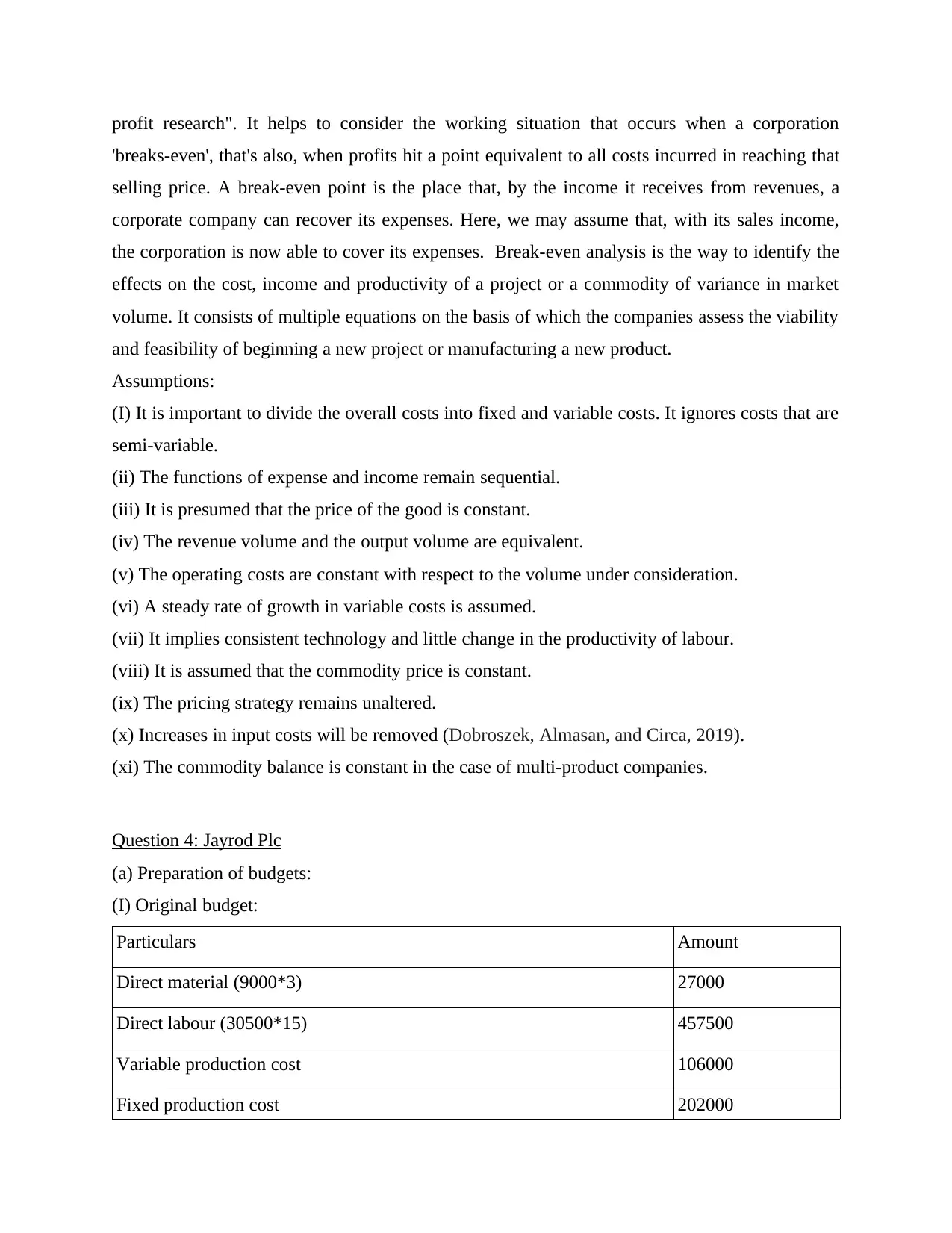

Question 4: Jayrod Plc

(a) Preparation of budgets:

(I) Original budget:

Particulars Amount

Direct material (9000*3) 27000

Direct labour (30500*15) 457500

Variable production cost 106000

Fixed production cost 202000

'breaks-even', that's also, when profits hit a point equivalent to all costs incurred in reaching that

selling price. A break-even point is the place that, by the income it receives from revenues, a

corporate company can recover its expenses. Here, we may assume that, with its sales income,

the corporation is now able to cover its expenses. Break-even analysis is the way to identify the

effects on the cost, income and productivity of a project or a commodity of variance in market

volume. It consists of multiple equations on the basis of which the companies assess the viability

and feasibility of beginning a new project or manufacturing a new product.

Assumptions:

(I) It is important to divide the overall costs into fixed and variable costs. It ignores costs that are

semi-variable.

(ii) The functions of expense and income remain sequential.

(iii) It is presumed that the price of the good is constant.

(iv) The revenue volume and the output volume are equivalent.

(v) The operating costs are constant with respect to the volume under consideration.

(vi) A steady rate of growth in variable costs is assumed.

(vii) It implies consistent technology and little change in the productivity of labour.

(viii) It is assumed that the commodity price is constant.

(ix) The pricing strategy remains unaltered.

(x) Increases in input costs will be removed (Dobroszek, Almasan, and Circa, 2019).

(xi) The commodity balance is constant in the case of multi-product companies.

Question 4: Jayrod Plc

(a) Preparation of budgets:

(I) Original budget:

Particulars Amount

Direct material (9000*3) 27000

Direct labour (30500*15) 457500

Variable production cost 106000

Fixed production cost 202000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total 792500

(ii) Flexed budget:

Particulars Amount

Direct material (10000*3) 30000

Direct labour (10000*15) 150000

Variable production cost 120000

Fixed production cost 200000

Total 500000

(iii) Actual budget

Particulars Amount

Direct material 579500

Direct labour 451400

Variable production cost 106000

Fixed production cost 202000

Total 1338900

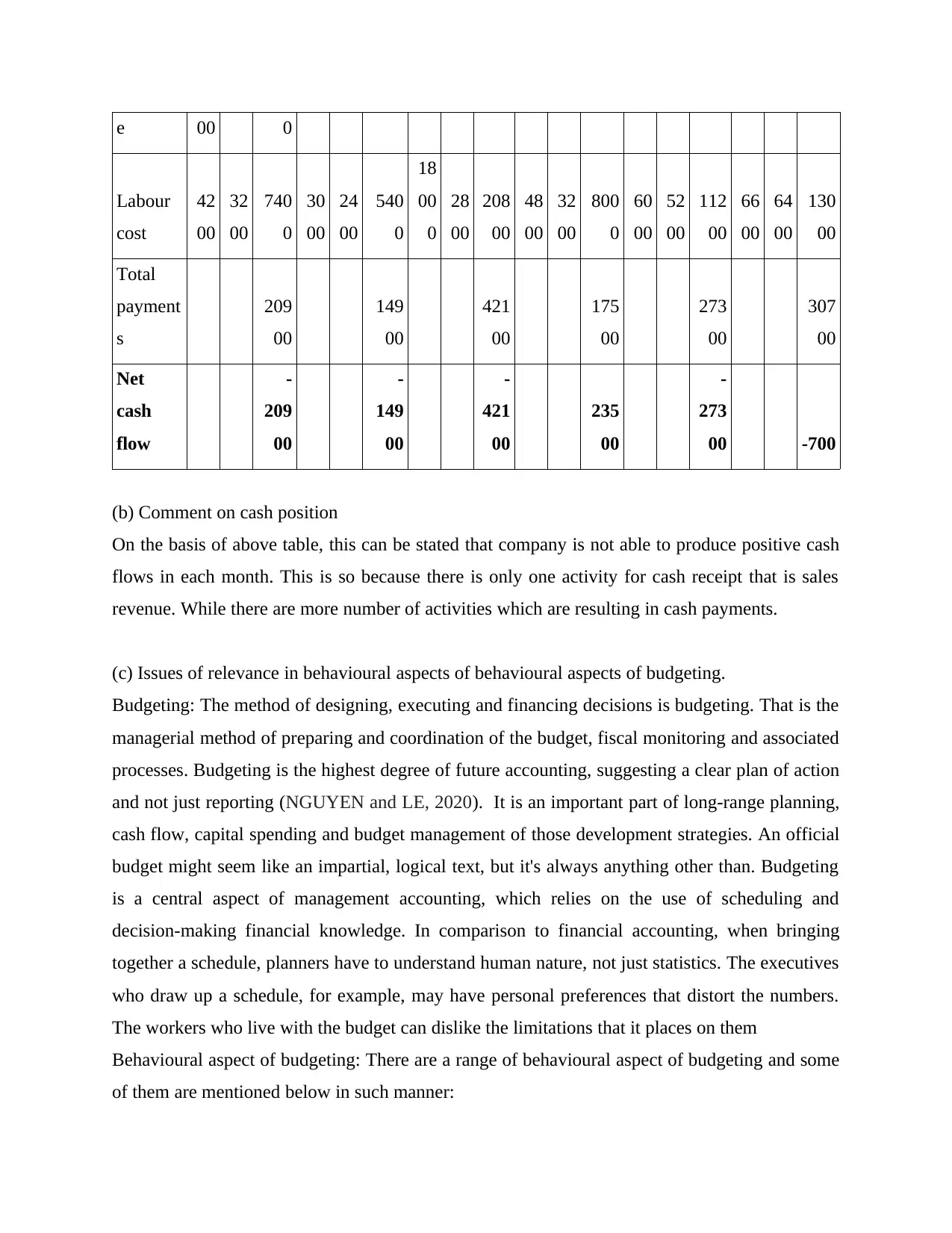

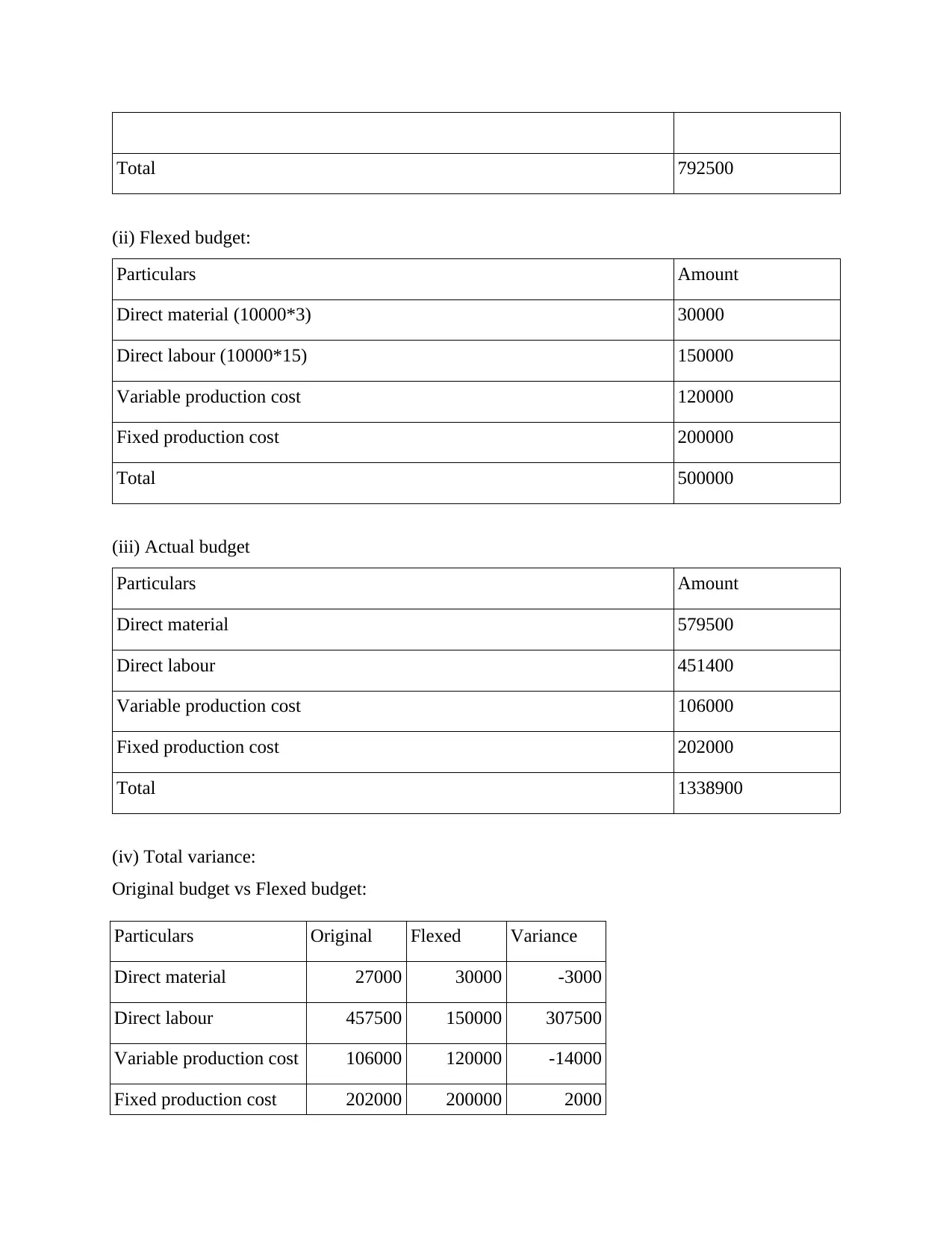

(iv) Total variance:

Original budget vs Flexed budget:

Particulars Original Flexed Variance

Direct material 27000 30000 -3000

Direct labour 457500 150000 307500

Variable production cost 106000 120000 -14000

Fixed production cost 202000 200000 2000

(ii) Flexed budget:

Particulars Amount

Direct material (10000*3) 30000

Direct labour (10000*15) 150000

Variable production cost 120000

Fixed production cost 200000

Total 500000

(iii) Actual budget

Particulars Amount

Direct material 579500

Direct labour 451400

Variable production cost 106000

Fixed production cost 202000

Total 1338900

(iv) Total variance:

Original budget vs Flexed budget:

Particulars Original Flexed Variance

Direct material 27000 30000 -3000

Direct labour 457500 150000 307500

Variable production cost 106000 120000 -14000

Fixed production cost 202000 200000 2000

Total 792500 500000 292500

Actual budget vs flexed budget:

Particulars Original Flexed Variance

Direct material 579500 30000 549500

Direct labour 451400 150000 301400

Variable production cost 106000 120000 -14000

Fixed production cost 202000 200000 2000

Total 1338900 500000 838900

(b) Sub-divide the variances for direct material and direct labour:

Original vs flexible in terms of quantity used:

Particulars Original Flexed Variance

Direct material 9000 10000 -1000

Direct labour 30500 10000 20500

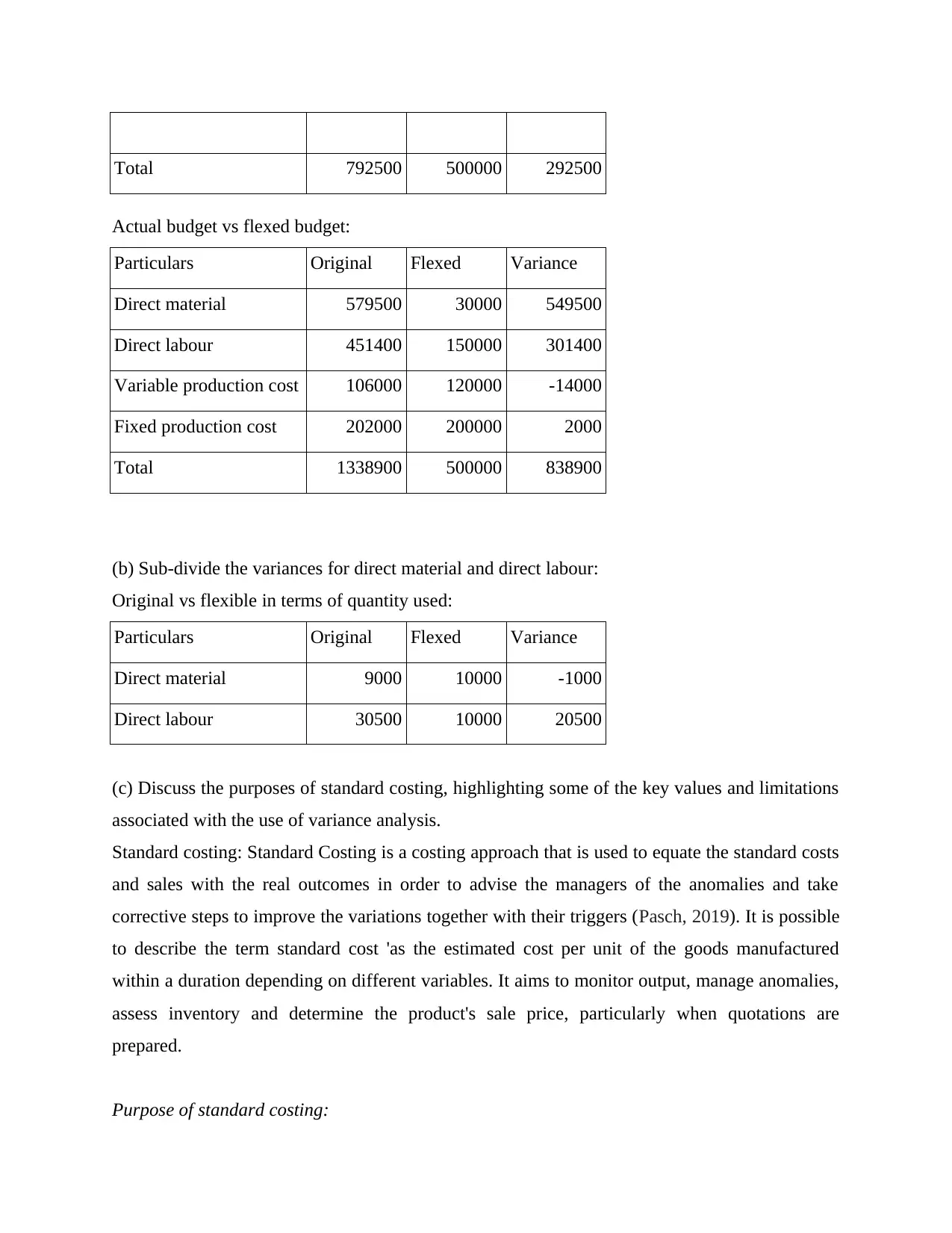

(c) Discuss the purposes of standard costing, highlighting some of the key values and limitations

associated with the use of variance analysis.

Standard costing: Standard Costing is a costing approach that is used to equate the standard costs

and sales with the real outcomes in order to advise the managers of the anomalies and take

corrective steps to improve the variations together with their triggers (Pasch, 2019). It is possible

to describe the term standard cost 'as the estimated cost per unit of the goods manufactured

within a duration depending on different variables. It aims to monitor output, manage anomalies,

assess inventory and determine the product's sale price, particularly when quotations are

prepared.

Purpose of standard costing:

Actual budget vs flexed budget:

Particulars Original Flexed Variance

Direct material 579500 30000 549500

Direct labour 451400 150000 301400

Variable production cost 106000 120000 -14000

Fixed production cost 202000 200000 2000

Total 1338900 500000 838900

(b) Sub-divide the variances for direct material and direct labour:

Original vs flexible in terms of quantity used:

Particulars Original Flexed Variance

Direct material 9000 10000 -1000

Direct labour 30500 10000 20500

(c) Discuss the purposes of standard costing, highlighting some of the key values and limitations

associated with the use of variance analysis.

Standard costing: Standard Costing is a costing approach that is used to equate the standard costs

and sales with the real outcomes in order to advise the managers of the anomalies and take

corrective steps to improve the variations together with their triggers (Pasch, 2019). It is possible

to describe the term standard cost 'as the estimated cost per unit of the goods manufactured

within a duration depending on different variables. It aims to monitor output, manage anomalies,

assess inventory and determine the product's sale price, particularly when quotations are

prepared.

Purpose of standard costing:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.