Investment Analysis and Portfolio Management: Detailed Report

VerifiedAdded on 2020/05/28

|18

|3971

|39

Report

AI Summary

This report provides a comprehensive analysis of investment strategies and portfolio management. It begins with an overview of various investment fund types, including cash, fixed rate, shares, and property, along with their associated risks and benefits. The report then delves into the investment process, detailing the steps from investment identification and investor preferences to management approach and portfolio performance evaluation. It includes specific investment plans for a 35-year-old professional and a 65-year-old retiree, with detailed analysis of selected shares, secured investments, and property market considerations. The report also includes charts representing market fluctuations and P/E ratios, providing a visual and analytical basis for the investment recommendations. Finally, the report concludes with recommendations based on the analysis, offering insights into portfolio diversification and risk management.

Investment Analysis and Portfolio

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Overview of types of funds available for investment................................................................4

Analysis of Investment Process..................................................................................................5

Allocation Decision................................................................................................................5

Portfolio Performance Evaluation..........................................................................................6

Review Stage..........................................................................................................................7

Analysis of performance of investments....................................................................................7

Investment plan for 35 year old professional client...............................................................7

Chart representing fluctuation in rating of above investment................................................8

Portfolio for 65 year old retiree............................................................................................10

Recommendations................................................................................................................15

References................................................................................................................................18

Overview of types of funds available for investment................................................................4

Analysis of Investment Process..................................................................................................5

Allocation Decision................................................................................................................5

Portfolio Performance Evaluation..........................................................................................6

Review Stage..........................................................................................................................7

Analysis of performance of investments....................................................................................7

Investment plan for 35 year old professional client...............................................................7

Chart representing fluctuation in rating of above investment................................................8

Portfolio for 65 year old retiree............................................................................................10

Recommendations................................................................................................................15

References................................................................................................................................18

LIST OF FIGURES

Figure 1: Investment Process.....................................................................................................5

Figure 2: Chart representing movement in price of Bingo Industries Ltd (BIN. AX)...............8

Figure 3: Chart representing movement in price of Web jet Limited........................................8

Figure 4 Chart representing movement in price of Class Ltd....................................................9

Figure 5: Chart representing fluctuation in Market Price of the shares of AGL Ltd...............10

Figure 6: P/E Ratio of AGL Limited and the Industry (Source: AGL Energy Ltd

(AGL.AX).Financials. (2018)..................................................................................................11

Figure 7: Price Fluctuations in ResMed Inc.............................................................................12

Figure 8: P/E Ratio of ResMed. Inc and the Industry (Source: ResMed. Financials. (2018). .13

Figure 9: Chart representing fluctuation in Market Price of the shares of Aristocrat Leisure.13

Figure 10: P/E Ratio of Aristocrat Leisure and the Industry (Source: P/E Ratio of Aristocrat

Leisure Financials. (2018).......................................................................................................14

Figure 1: Investment Process.....................................................................................................5

Figure 2: Chart representing movement in price of Bingo Industries Ltd (BIN. AX)...............8

Figure 3: Chart representing movement in price of Web jet Limited........................................8

Figure 4 Chart representing movement in price of Class Ltd....................................................9

Figure 5: Chart representing fluctuation in Market Price of the shares of AGL Ltd...............10

Figure 6: P/E Ratio of AGL Limited and the Industry (Source: AGL Energy Ltd

(AGL.AX).Financials. (2018)..................................................................................................11

Figure 7: Price Fluctuations in ResMed Inc.............................................................................12

Figure 8: P/E Ratio of ResMed. Inc and the Industry (Source: ResMed. Financials. (2018). .13

Figure 9: Chart representing fluctuation in Market Price of the shares of Aristocrat Leisure.13

Figure 10: P/E Ratio of Aristocrat Leisure and the Industry (Source: P/E Ratio of Aristocrat

Leisure Financials. (2018).......................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

OVERVIEW OF TYPES OF FUNDS AVAILABLE FOR

INVESTMENT

A diversified portfolio can assist in protecting wealth from ups and downs of the market.

There are usually four major types of investment also known as asset classes, having own

risks and benefits which are; Cash, fixed rate, shares and property. An investor can directly

invest in these assets or might prefer a managed fund that can provide various investments.

Defensive investments: These investments are focused on producing general income,

as opposed to increasing in value. Defensive investments have two types in common

which are; cash and fixed interest (Bodie and et al. 2014).

Cash investment: It comprises high-interest saving accounts. The major benefit of

cash investment is stability. However, it offers security and is less risky. The value of

cash can reduce; this might take place in the situation of inflation where the cost of

products and services increases. For most of the investors, cash investments are

appropriate for keeping cash-on-hand for urgencies and expenses and using it as a

transaction account.

Fixed interest investment: It is inclusive of corporate bonds, government bonds and

term deposits. Deposit allows in earning interest in savings at the same or a slightly

high rate compared to a cash account. On the other hand, bonds usually act as loans to

corporate or government, who put them in to sell to investors for a set amount of time

at a determined rate of interest. Chance and Brooks (2015), asserted that risk of

investment in bond depends upon company it can be highly risk, stable or low risk,

some types can make a deduction in value, by considering this aspect investor can

possibly get less money than they initially paid.

Shares: In simple words, a single share shows a single ownership unit in a corporate.

When a share is purchased, then the investor becomes a part of company (as an owner)

and is entitled to share in future profits. Shares are said to be the growth investments as

their value rises over time. Investor can make money by put these shares into sale for high

prices. Chandra and Leong (2016) specified that shares are best complimented when

investors want to construct solid funds for medium as well long-term savings goals and

having a long-investment timeframe. If an investors holds a share, then they might get

income from dividends which are a part of company’s profit been paid to shareholders.

INVESTMENT

A diversified portfolio can assist in protecting wealth from ups and downs of the market.

There are usually four major types of investment also known as asset classes, having own

risks and benefits which are; Cash, fixed rate, shares and property. An investor can directly

invest in these assets or might prefer a managed fund that can provide various investments.

Defensive investments: These investments are focused on producing general income,

as opposed to increasing in value. Defensive investments have two types in common

which are; cash and fixed interest (Bodie and et al. 2014).

Cash investment: It comprises high-interest saving accounts. The major benefit of

cash investment is stability. However, it offers security and is less risky. The value of

cash can reduce; this might take place in the situation of inflation where the cost of

products and services increases. For most of the investors, cash investments are

appropriate for keeping cash-on-hand for urgencies and expenses and using it as a

transaction account.

Fixed interest investment: It is inclusive of corporate bonds, government bonds and

term deposits. Deposit allows in earning interest in savings at the same or a slightly

high rate compared to a cash account. On the other hand, bonds usually act as loans to

corporate or government, who put them in to sell to investors for a set amount of time

at a determined rate of interest. Chance and Brooks (2015), asserted that risk of

investment in bond depends upon company it can be highly risk, stable or low risk,

some types can make a deduction in value, by considering this aspect investor can

possibly get less money than they initially paid.

Shares: In simple words, a single share shows a single ownership unit in a corporate.

When a share is purchased, then the investor becomes a part of company (as an owner)

and is entitled to share in future profits. Shares are said to be the growth investments as

their value rises over time. Investor can make money by put these shares into sale for high

prices. Chandra and Leong (2016) specified that shares are best complimented when

investors want to construct solid funds for medium as well long-term savings goals and

having a long-investment timeframe. If an investors holds a share, then they might get

income from dividends which are a part of company’s profit been paid to shareholders.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Property investments: It includes of hotels, residential property, industrial property, retail

premises and commercial property. Property investments provide value to investors in

two key ways; properties rise in capital value, investors gain rental income from their

tenants. Same like shares, the property’s value might rise, and the investor might be able

to earn money on the medium to the long basis by putting the property into sale and get

more than they have paid them initially (DeFusco and et al. 2015). However, the prices

and to assured to increase, and property can be complex as compared to other investment

types to be put into sale rapidly.

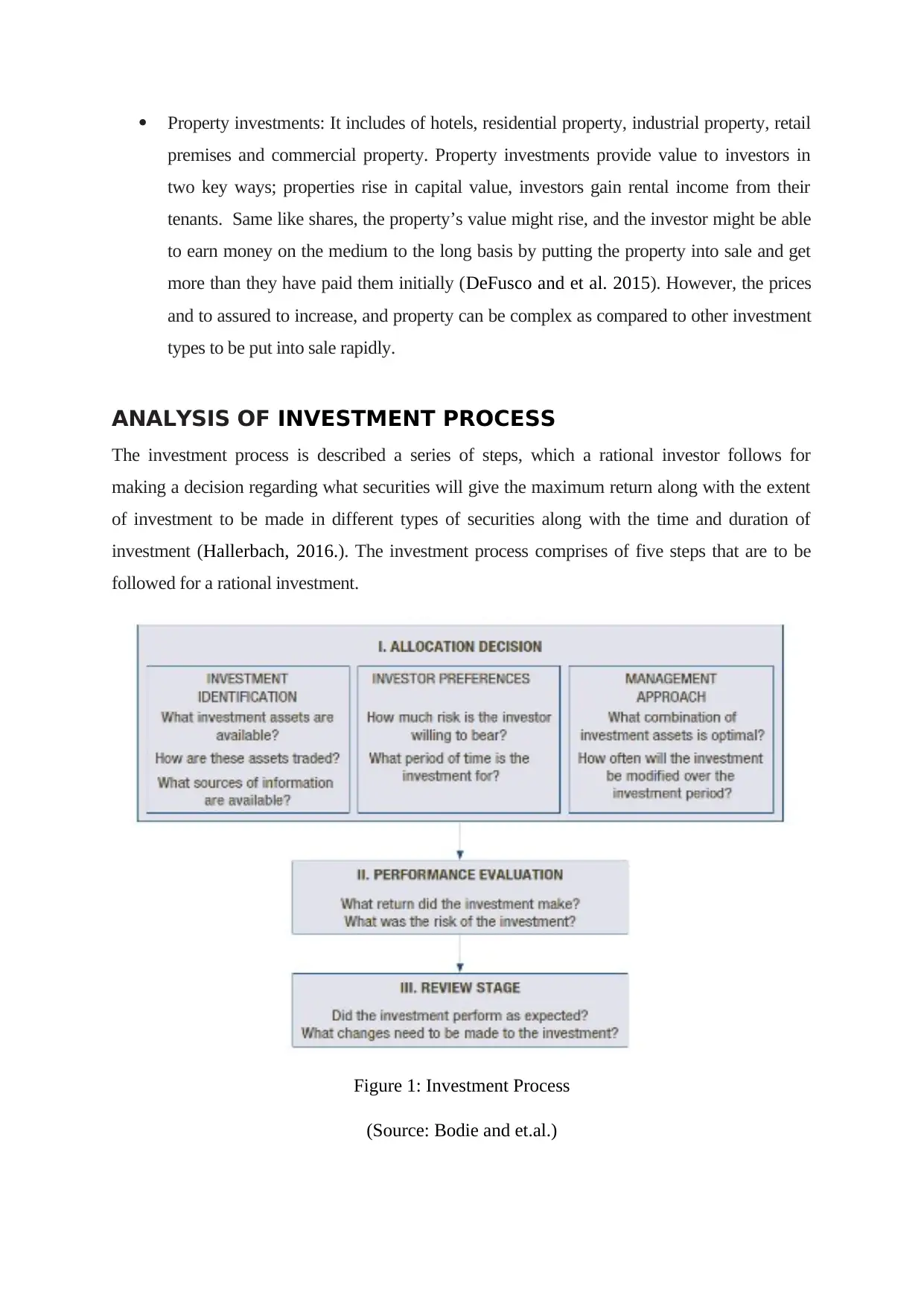

ANALYSIS OF INVESTMENT PROCESS

The investment process is described a series of steps, which a rational investor follows for

making a decision regarding what securities will give the maximum return along with the extent

of investment to be made in different types of securities along with the time and duration of

investment (Hallerbach, 2016.). The investment process comprises of five steps that are to be

followed for a rational investment.

Figure 1: Investment Process

(Source: Bodie and et.al.)

premises and commercial property. Property investments provide value to investors in

two key ways; properties rise in capital value, investors gain rental income from their

tenants. Same like shares, the property’s value might rise, and the investor might be able

to earn money on the medium to the long basis by putting the property into sale and get

more than they have paid them initially (DeFusco and et al. 2015). However, the prices

and to assured to increase, and property can be complex as compared to other investment

types to be put into sale rapidly.

ANALYSIS OF INVESTMENT PROCESS

The investment process is described a series of steps, which a rational investor follows for

making a decision regarding what securities will give the maximum return along with the extent

of investment to be made in different types of securities along with the time and duration of

investment (Hallerbach, 2016.). The investment process comprises of five steps that are to be

followed for a rational investment.

Figure 1: Investment Process

(Source: Bodie and et.al.)

Allocation Decision

Investment Identification

Investment identification is concerned with identifying specific assets to invest in by

determining the amount of the wealth to invest in each category (Mbogo and et.al. 2017).

This step considers the selection, time and diversification of each category. The assets to be

kept in the portfolio are decided by this step. The portfolio is constructed with an aim to

maximise return while minimizing the risk. This step also involves gathering related

information to all the investor. This process reveals the potential category of investment in

which the investor can invest.

Investor Preferences

This step involves determining the objective for which the investor wants to invest their

investable wealth. There is always a positive relationship between risk and return earned on

investment; thus for justifiable investment strategies, the investors have to decide their

objective keeping in mind the risk and return of each investment. Apart from the objective of

investment, there are some other factors like time and duration to be considered for deciding

the investment policy. McNeil and et al. (2015) asserted that this decision also depends upon

many other things like the transaction costs incurred in making modifications to the existing

portfolio along with the extent of expected improvement in the outlook of investment in the

revised portfolio.

Management approach

This step is concerned with the managing of assets. This is because with time the investment

objective is changed or the current portfolio may not be optimal in current conditions. Thus

the investor may make some modifications in the portfolio by selling some old securities and

purchasing others. Another motive behind revising the portfolio is because the security prices

may change over time and some securities can now be more attractive than the other, and

those who were fascinating initially may not be the same anymore.

Portfolio Performance Evaluation

Evaluation of portfolio performance includes assessing the performance of portfolio on a

regular basis. This is measured not only in terms return but also in the context of risk incurred

by the investor (Wolke, 2017). Thus, it is important that the investor implies some suitable

Investment Identification

Investment identification is concerned with identifying specific assets to invest in by

determining the amount of the wealth to invest in each category (Mbogo and et.al. 2017).

This step considers the selection, time and diversification of each category. The assets to be

kept in the portfolio are decided by this step. The portfolio is constructed with an aim to

maximise return while minimizing the risk. This step also involves gathering related

information to all the investor. This process reveals the potential category of investment in

which the investor can invest.

Investor Preferences

This step involves determining the objective for which the investor wants to invest their

investable wealth. There is always a positive relationship between risk and return earned on

investment; thus for justifiable investment strategies, the investors have to decide their

objective keeping in mind the risk and return of each investment. Apart from the objective of

investment, there are some other factors like time and duration to be considered for deciding

the investment policy. McNeil and et al. (2015) asserted that this decision also depends upon

many other things like the transaction costs incurred in making modifications to the existing

portfolio along with the extent of expected improvement in the outlook of investment in the

revised portfolio.

Management approach

This step is concerned with the managing of assets. This is because with time the investment

objective is changed or the current portfolio may not be optimal in current conditions. Thus

the investor may make some modifications in the portfolio by selling some old securities and

purchasing others. Another motive behind revising the portfolio is because the security prices

may change over time and some securities can now be more attractive than the other, and

those who were fascinating initially may not be the same anymore.

Portfolio Performance Evaluation

Evaluation of portfolio performance includes assessing the performance of portfolio on a

regular basis. This is measured not only in terms return but also in the context of risk incurred

by the investor (Wolke, 2017). Thus, it is important that the investor implies some suitable

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

measures to evaluate the return and risk according to some relevant standards that are

required to be formed at the initial stage of investment.

Review Stage

It is the most crucial phase of investment process. The purpose of this review is identifying

securities for their profitability. The review can be undertaken by two approaches depending

upon the nature of the investment. The first is a technical analysis that comprises of

conducting research on the prices of stocks with the aim of predicting the future movements

in price. For this, the past prices are evaluated to identify the trends in the movements of

price. The recent stock prices are also evaluated for assessing emerging patterns.

The other approach is a fundamental analysis which is concerned with the intrinsic value of

any investment and compares it with the current value of cash flows which the investor

expects out of the investment. This approach makes an attempt not only to estimate the rate

of discount but also measures the dividends that a particular stock may provide in future

based on the EPS and payout ratio of the stock.

ANALYSIS OF PERFORMANCE OF INVESTMENTS

Investment plan for 35-year-old professional client

For estimating the future rate of return, it is important to consider the rate of return. The true

value of each stock is to be made known, and then a comparison is made with the current

market price of the stock in order to judge their fair price. This will reveal the overvalued

stocks and those who are undervalued. Thus, present analysis has been done on the basis of

analysing past three to five-year rate of return and future. This information will serve as the

expected return.

Shares Current market

price

Expected

percentage change

in rate

Average EPS of 3

to 5 yrs

Bingo Industries Ltd

(BIN. AX)

2.63 AUD $0.1 14.53%

Web jet Limited 10.07 AUD $0.07 23.37%

Class Ltd 2.99 AUD $-.03 43.31%

required to be formed at the initial stage of investment.

Review Stage

It is the most crucial phase of investment process. The purpose of this review is identifying

securities for their profitability. The review can be undertaken by two approaches depending

upon the nature of the investment. The first is a technical analysis that comprises of

conducting research on the prices of stocks with the aim of predicting the future movements

in price. For this, the past prices are evaluated to identify the trends in the movements of

price. The recent stock prices are also evaluated for assessing emerging patterns.

The other approach is a fundamental analysis which is concerned with the intrinsic value of

any investment and compares it with the current value of cash flows which the investor

expects out of the investment. This approach makes an attempt not only to estimate the rate

of discount but also measures the dividends that a particular stock may provide in future

based on the EPS and payout ratio of the stock.

ANALYSIS OF PERFORMANCE OF INVESTMENTS

Investment plan for 35-year-old professional client

For estimating the future rate of return, it is important to consider the rate of return. The true

value of each stock is to be made known, and then a comparison is made with the current

market price of the stock in order to judge their fair price. This will reveal the overvalued

stocks and those who are undervalued. Thus, present analysis has been done on the basis of

analysing past three to five-year rate of return and future. This information will serve as the

expected return.

Shares Current market

price

Expected

percentage change

in rate

Average EPS of 3

to 5 yrs

Bingo Industries Ltd

(BIN. AX)

2.63 AUD $0.1 14.53%

Web jet Limited 10.07 AUD $0.07 23.37%

Class Ltd 2.99 AUD $-.03 43.31%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

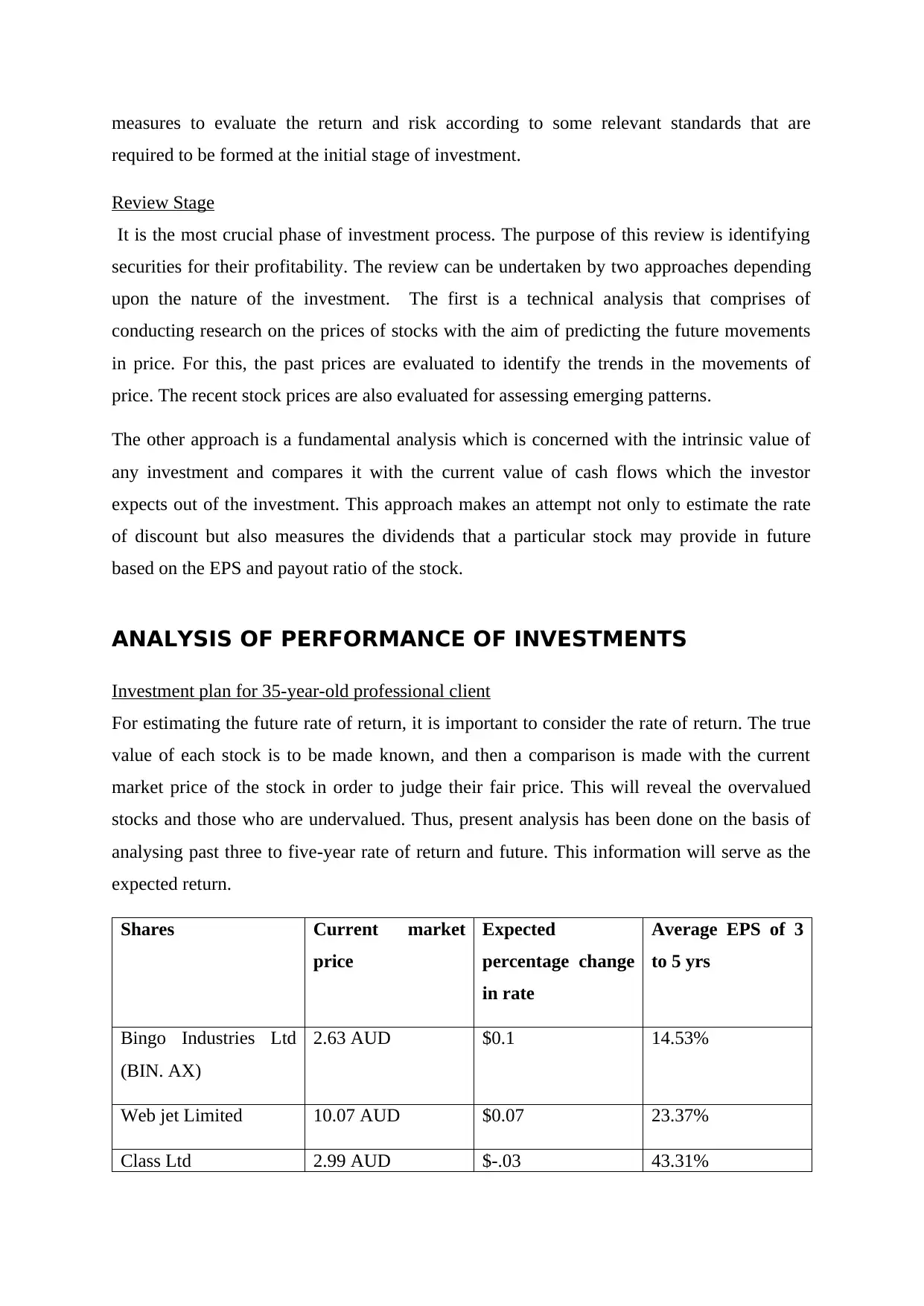

From above figures, it can be assessed that appropriate returns have been earned by the

companies in last few years and on the basis of same these equity shares have been selected.

The companies belong to different industries so that advantage relating to a diversified

portfolio can be gained by the investor.

Chart representing fluctuation in rating of above investment

Bingo Industries Ltd (BIN. AX)

Figure 2: Chart representing movement in price of Bingo Industries Ltd (BIN. AX)

(Source: Bingo Industries Ltd (BIN.AX). Charts. (2018))

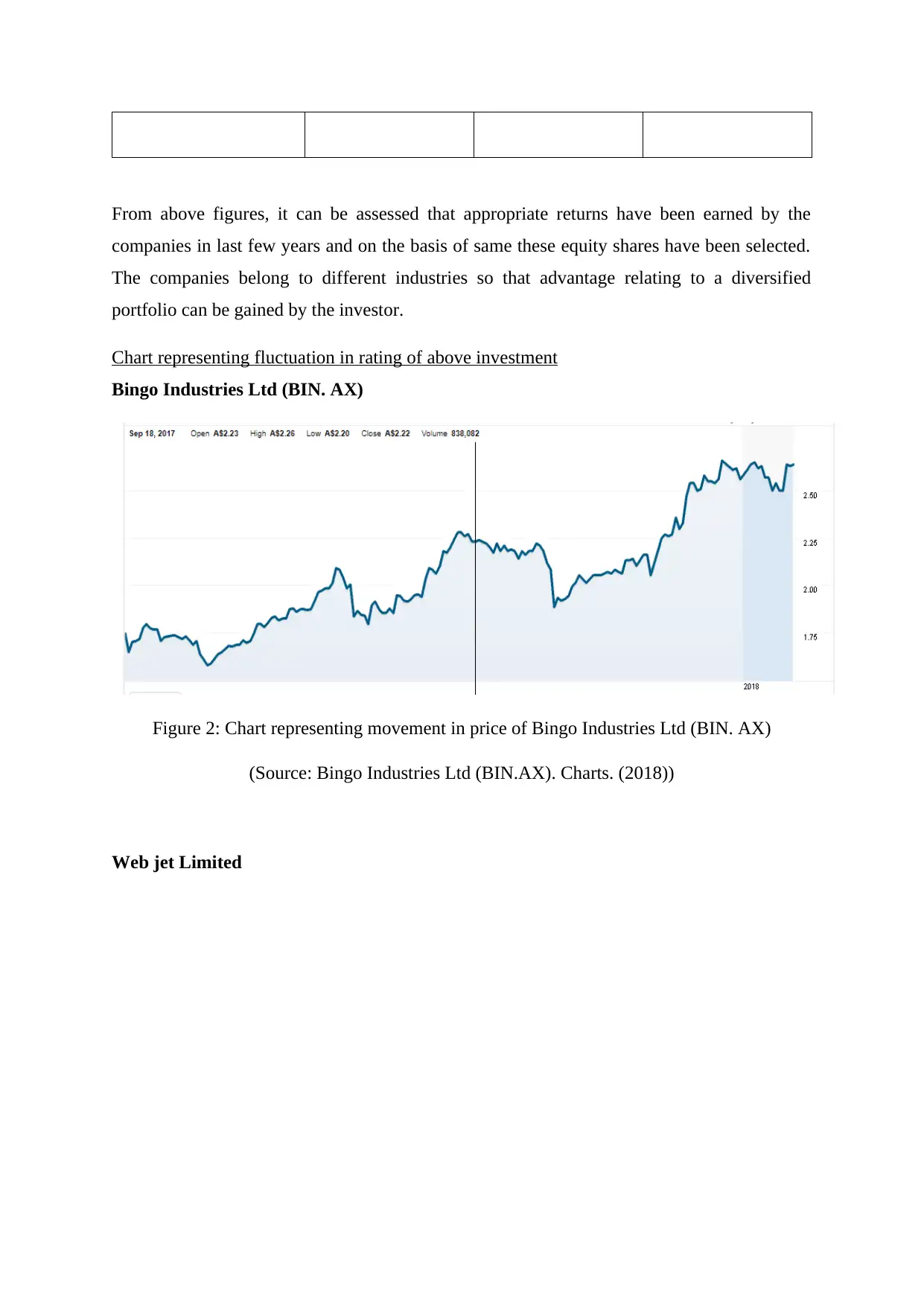

Web jet Limited

companies in last few years and on the basis of same these equity shares have been selected.

The companies belong to different industries so that advantage relating to a diversified

portfolio can be gained by the investor.

Chart representing fluctuation in rating of above investment

Bingo Industries Ltd (BIN. AX)

Figure 2: Chart representing movement in price of Bingo Industries Ltd (BIN. AX)

(Source: Bingo Industries Ltd (BIN.AX). Charts. (2018))

Web jet Limited

Figure 3: Chart representing movement in price of Web jet Limited

(Source: Web jet Limited. Charts. (2018))

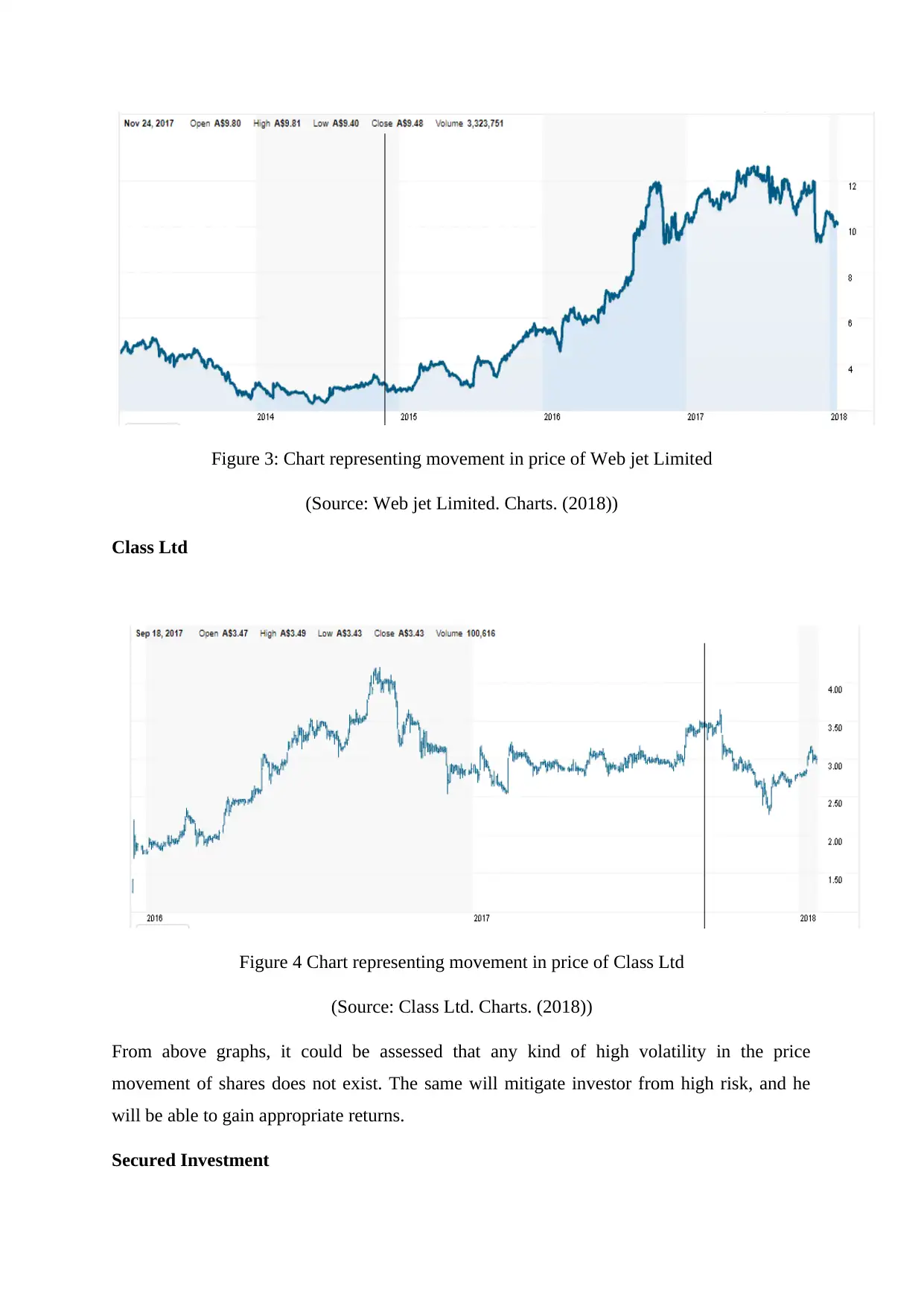

Class Ltd

Figure 4 Chart representing movement in price of Class Ltd

(Source: Class Ltd. Charts. (2018))

From above graphs, it could be assessed that any kind of high volatility in the price

movement of shares does not exist. The same will mitigate investor from high risk, and he

will be able to gain appropriate returns.

Secured Investment

(Source: Web jet Limited. Charts. (2018))

Class Ltd

Figure 4 Chart representing movement in price of Class Ltd

(Source: Class Ltd. Charts. (2018))

From above graphs, it could be assessed that any kind of high volatility in the price

movement of shares does not exist. The same will mitigate investor from high risk, and he

will be able to gain appropriate returns.

Secured Investment

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

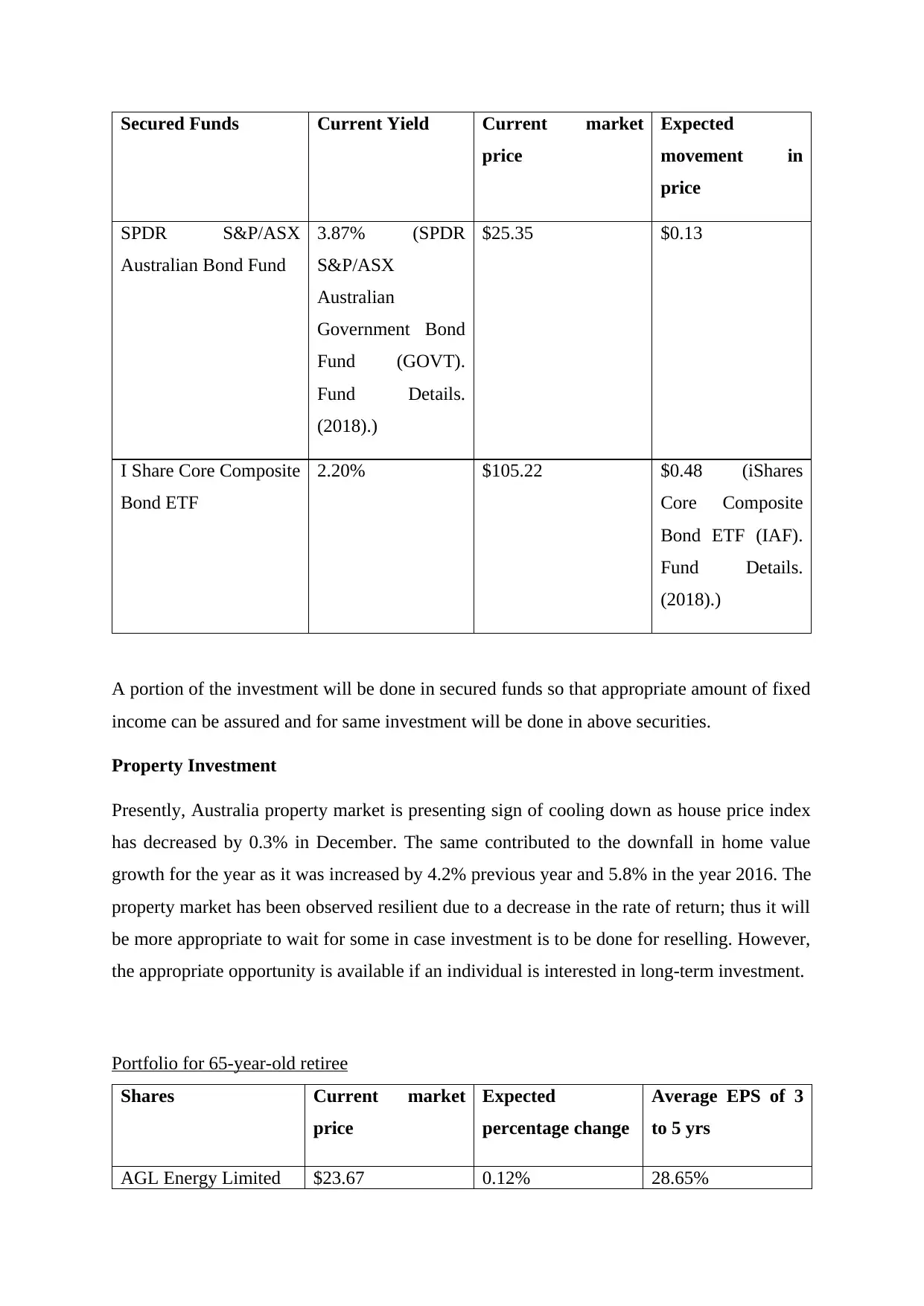

Secured Funds Current Yield Current market

price

Expected

movement in

price

SPDR S&P/ASX

Australian Bond Fund

3.87% (SPDR

S&P/ASX

Australian

Government Bond

Fund (GOVT).

Fund Details.

(2018).)

$25.35 $0.13

I Share Core Composite

Bond ETF

2.20% $105.22 $0.48 (iShares

Core Composite

Bond ETF (IAF).

Fund Details.

(2018).)

A portion of the investment will be done in secured funds so that appropriate amount of fixed

income can be assured and for same investment will be done in above securities.

Property Investment

Presently, Australia property market is presenting sign of cooling down as house price index

has decreased by 0.3% in December. The same contributed to the downfall in home value

growth for the year as it was increased by 4.2% previous year and 5.8% in the year 2016. The

property market has been observed resilient due to a decrease in the rate of return; thus it will

be more appropriate to wait for some in case investment is to be done for reselling. However,

the appropriate opportunity is available if an individual is interested in long-term investment.

Portfolio for 65-year-old retiree

Shares Current market

price

Expected

percentage change

Average EPS of 3

to 5 yrs

AGL Energy Limited $23.67 0.12% 28.65%

price

Expected

movement in

price

SPDR S&P/ASX

Australian Bond Fund

3.87% (SPDR

S&P/ASX

Australian

Government Bond

Fund (GOVT).

Fund Details.

(2018).)

$25.35 $0.13

I Share Core Composite

Bond ETF

2.20% $105.22 $0.48 (iShares

Core Composite

Bond ETF (IAF).

Fund Details.

(2018).)

A portion of the investment will be done in secured funds so that appropriate amount of fixed

income can be assured and for same investment will be done in above securities.

Property Investment

Presently, Australia property market is presenting sign of cooling down as house price index

has decreased by 0.3% in December. The same contributed to the downfall in home value

growth for the year as it was increased by 4.2% previous year and 5.8% in the year 2016. The

property market has been observed resilient due to a decrease in the rate of return; thus it will

be more appropriate to wait for some in case investment is to be done for reselling. However,

the appropriate opportunity is available if an individual is interested in long-term investment.

Portfolio for 65-year-old retiree

Shares Current market

price

Expected

percentage change

Average EPS of 3

to 5 yrs

AGL Energy Limited $23.67 0.12% 28.65%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ResMed Inc. 88.68 USD -0.11% 7.08%

Aristocrat Leisure 23.50 AUD 1.29% 55.41

Analysis of AGL Energy Limited

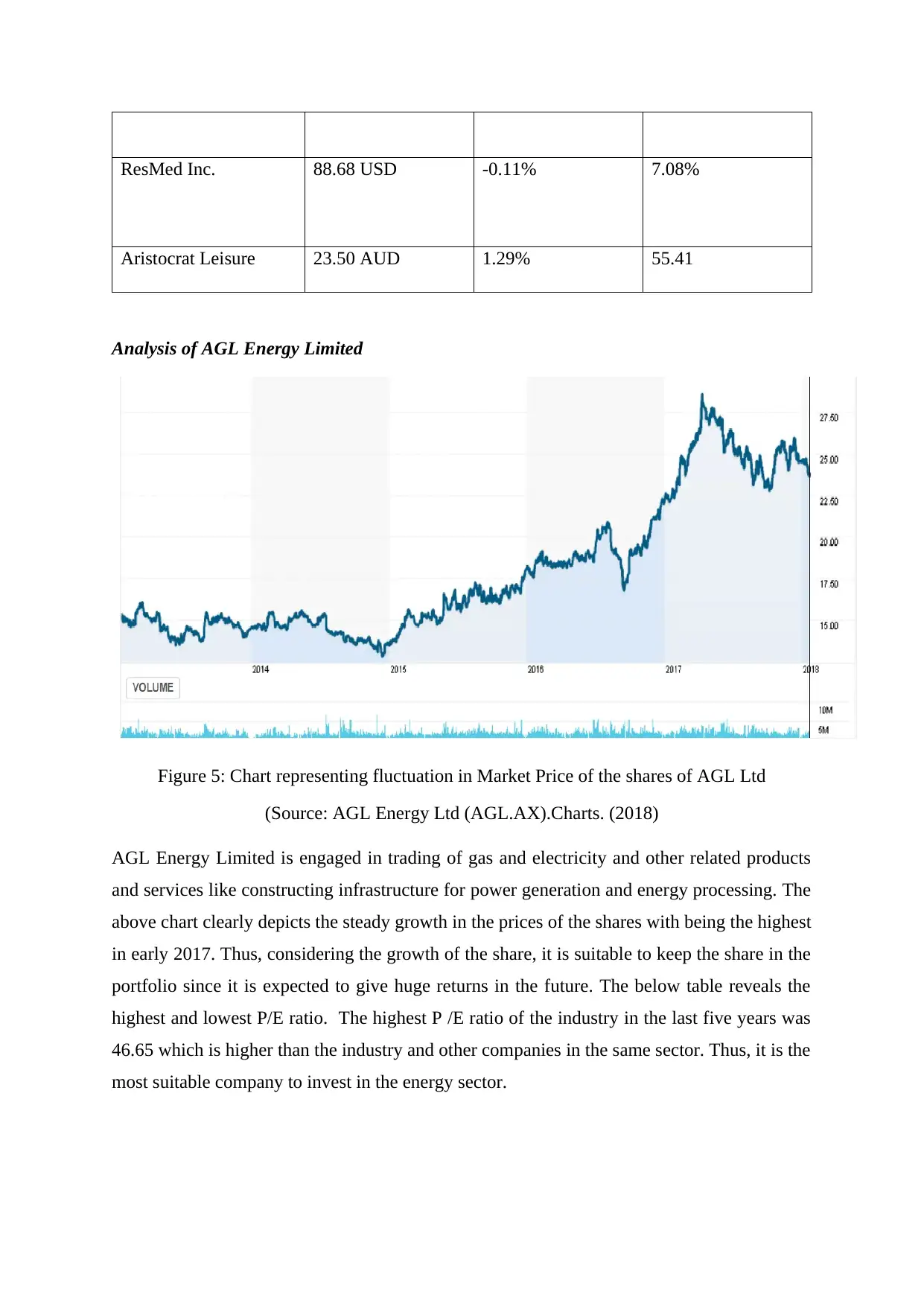

Figure 5: Chart representing fluctuation in Market Price of the shares of AGL Ltd

(Source: AGL Energy Ltd (AGL.AX).Charts. (2018)

AGL Energy Limited is engaged in trading of gas and electricity and other related products

and services like constructing infrastructure for power generation and energy processing. The

above chart clearly depicts the steady growth in the prices of the shares with being the highest

in early 2017. Thus, considering the growth of the share, it is suitable to keep the share in the

portfolio since it is expected to give huge returns in the future. The below table reveals the

highest and lowest P/E ratio. The highest P /E ratio of the industry in the last five years was

46.65 which is higher than the industry and other companies in the same sector. Thus, it is the

most suitable company to invest in the energy sector.

Aristocrat Leisure 23.50 AUD 1.29% 55.41

Analysis of AGL Energy Limited

Figure 5: Chart representing fluctuation in Market Price of the shares of AGL Ltd

(Source: AGL Energy Ltd (AGL.AX).Charts. (2018)

AGL Energy Limited is engaged in trading of gas and electricity and other related products

and services like constructing infrastructure for power generation and energy processing. The

above chart clearly depicts the steady growth in the prices of the shares with being the highest

in early 2017. Thus, considering the growth of the share, it is suitable to keep the share in the

portfolio since it is expected to give huge returns in the future. The below table reveals the

highest and lowest P/E ratio. The highest P /E ratio of the industry in the last five years was

46.65 which is higher than the industry and other companies in the same sector. Thus, it is the

most suitable company to invest in the energy sector.

Figure 6: P/E Ratio of AGL Limited and the Industry

(Source: AGL Energy Ltd (AGL.AX).Financials. (2018)

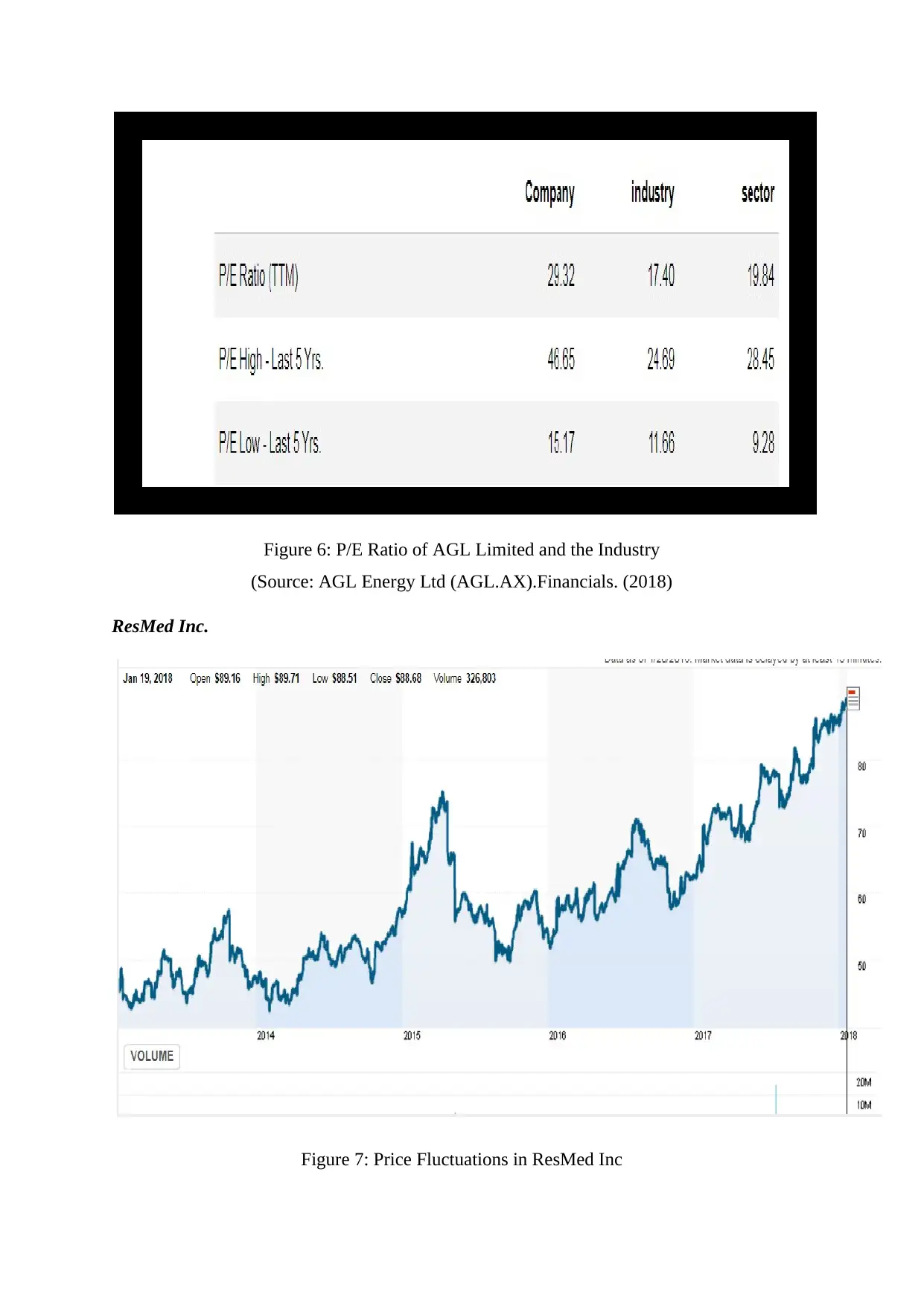

ResMed Inc.

Figure 7: Price Fluctuations in ResMed Inc

(Source: AGL Energy Ltd (AGL.AX).Financials. (2018)

ResMed Inc.

Figure 7: Price Fluctuations in ResMed Inc

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.