Financial Analysis: Balance Scorecard, Cash Flow, and Investments

VerifiedAdded on 2022/12/19

|9

|1945

|51

Homework Assignment

AI Summary

This assignment solution addresses several key aspects of financial analysis and environmental management. It begins by identifying barriers to implementing environmental management accounting practices, including financial, attitudinal, informational, institutional, and management-related obstacles. The solution then examines the impact of human rights, environmental, social, and governance (ESG) policies on an organization. The assignment also includes a memo discussing the benefits of a balance scorecard for reducing employee turnover and an analysis of its drawbacks. Finally, the solution presents a financial analysis involving cash flow forecasting, net present value (NPV) calculations, and a comparison of NPV and real options analysis (ROA) as investment appraisal techniques, highlighting the limitations of ROA compared to NPV.

ONLINE EXAM

(METHDOLOGY AND

PRACTICAL

KNOWLEDGE)

(METHDOLOGY AND

PRACTICAL

KNOWLEDGE)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

QUESTION ONE......................................................................................................................................3

a) Barriers to Environmental management accounting practices and its implementation........................3

b) Impact of human rights, environmental, social and governance policies on the organization.............4

QUESTION TWO.......................................................................................................................................4

a) Memo..............................................................................................................................................4

b) Describing drawbacks of balance scorecard........................................................................................5

Question FOUR.........................................................................................................................................6

(a)............................................................................................................................................................6

(b)............................................................................................................................................................8

REFERENCES..........................................................................................................................................9

QUESTION ONE......................................................................................................................................3

a) Barriers to Environmental management accounting practices and its implementation........................3

b) Impact of human rights, environmental, social and governance policies on the organization.............4

QUESTION TWO.......................................................................................................................................4

a) Memo..............................................................................................................................................4

b) Describing drawbacks of balance scorecard........................................................................................5

Question FOUR.........................................................................................................................................6

(a)............................................................................................................................................................6

(b)............................................................................................................................................................8

REFERENCES..........................................................................................................................................9

QUESTION ONE

a) Barriers to Environmental management accounting practices and its implementation

The Environmental management accounting is focused upon gathering the information

that is pertaining organizational impact on environment, utilization of the resources like water

and energy, preventive costs incurred for its protection, investments in respect of environmental

compliance procedures etc. and with the help of these information the internal decision making is

done by the management. But there are certain barriers to the implementation of these

environmental management practices which are:-

Financial barriers:- The financial barriers are posing slow implementation of the

environmental management accounting in the organization because of the resource

constraints like energy, fuel, water etc. and also lack of the availability of alternative

sources. Also the environmental costs that are incurred to prevent and protect the

surroundings are insignificant and shall not be deriving returns for the company (Latan,

and et.al., 2018).

Attitudinal barriers:- The attitudinal barriers that are associated with the

implementation of the environmental friendly practices is the human nature resisting the

change. It is difficult to introduce new policies pertaining to the same as the employees of

the company are resistant towards it. Also the management is with the attitude of

providing less priority to these environmental costs which are only to satisfy the society

and better positioning of the business.

Informational barriers:- The informational barriers are associated with lack of

knowledge pertaining to the prevention of environment, requirement of high degree

research for generating alternative source of energy, difficulty in allocation of the

environmental costs and the uncertainties in the physical environment.

Institutional barriers:- There are several institutional barriers associated with

environment protection in relation to the power that is exercised by the shareholders and

the major stakeholders of the company. The shareholders are focused to maximize their

wealth by not incurring much expenses in the protection of the environment. The

institutional pressures are also significantly less as the society at large is not the top

priority of the business.

a) Barriers to Environmental management accounting practices and its implementation

The Environmental management accounting is focused upon gathering the information

that is pertaining organizational impact on environment, utilization of the resources like water

and energy, preventive costs incurred for its protection, investments in respect of environmental

compliance procedures etc. and with the help of these information the internal decision making is

done by the management. But there are certain barriers to the implementation of these

environmental management practices which are:-

Financial barriers:- The financial barriers are posing slow implementation of the

environmental management accounting in the organization because of the resource

constraints like energy, fuel, water etc. and also lack of the availability of alternative

sources. Also the environmental costs that are incurred to prevent and protect the

surroundings are insignificant and shall not be deriving returns for the company (Latan,

and et.al., 2018).

Attitudinal barriers:- The attitudinal barriers that are associated with the

implementation of the environmental friendly practices is the human nature resisting the

change. It is difficult to introduce new policies pertaining to the same as the employees of

the company are resistant towards it. Also the management is with the attitude of

providing less priority to these environmental costs which are only to satisfy the society

and better positioning of the business.

Informational barriers:- The informational barriers are associated with lack of

knowledge pertaining to the prevention of environment, requirement of high degree

research for generating alternative source of energy, difficulty in allocation of the

environmental costs and the uncertainties in the physical environment.

Institutional barriers:- There are several institutional barriers associated with

environment protection in relation to the power that is exercised by the shareholders and

the major stakeholders of the company. The shareholders are focused to maximize their

wealth by not incurring much expenses in the protection of the environment. The

institutional pressures are also significantly less as the society at large is not the top

priority of the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management barriers:- The management oriented barriers are regarding the lack of

their responsibility and accountability related to the environmental protection. Also the

management is concentrated to lower down the costs strategically plan to achieve the

organizational objectives of the company.

b) Impact of human rights, environmental, social and governance policies on the organization

The policies and compliances that are made by the organization in respect of the human

rights, environmental protection, social responsibilities and corporate governance plays a

significant role in establishing the brand image and reputation, better positioning in the minds of

people, satisfaction among the society and avoid any legal or the governmental interferences. It

is very necessary for the organization to meet its responsibilities and comply with all the

necessary regulations so that effectively the operations of the business can be undertaken.

Properly following the human rights and managing the people of the organizations shall in turn

contribute to boost the operational efficiency and achieve the organizational objectives of the

business. The environmental protection and social responsibility by managing the sustainable

development through optimizing its business operations will build its brand in the market. The

corporate governance will maintain equality and fairness in the company satisfying the

employees to perform to the best of their capabilities.

QUESTION TWO

a) Memo

To: owner

Date: May 5, 2021

Subject: regarding potential benefits of balance scorecard for reducing employee

turnover

I am writing this to inform that there are various situations in hotel which are

changing and leading to increased employee turnover. Similar organization have

adopted the balance scorecard for measuring performance of employees. It is a

strategic tool for evaluating performance of staff which provides base for assessing

actual efforts shared by employees. The hotel would be benefited by implementing

balance scorecard in many patterns. The biggest advantage is related with obtaining of

systematic business structure. Communicating becomes easy by executive this

technique into managerial process as employees can get transparency regarding what is

expected from them. Facilitates better alignment in all division of hotel which will

coordinate all efforts for reaching end outcome (Koesomowidjojo, 2017). All workers

their responsibility and accountability related to the environmental protection. Also the

management is concentrated to lower down the costs strategically plan to achieve the

organizational objectives of the company.

b) Impact of human rights, environmental, social and governance policies on the organization

The policies and compliances that are made by the organization in respect of the human

rights, environmental protection, social responsibilities and corporate governance plays a

significant role in establishing the brand image and reputation, better positioning in the minds of

people, satisfaction among the society and avoid any legal or the governmental interferences. It

is very necessary for the organization to meet its responsibilities and comply with all the

necessary regulations so that effectively the operations of the business can be undertaken.

Properly following the human rights and managing the people of the organizations shall in turn

contribute to boost the operational efficiency and achieve the organizational objectives of the

business. The environmental protection and social responsibility by managing the sustainable

development through optimizing its business operations will build its brand in the market. The

corporate governance will maintain equality and fairness in the company satisfying the

employees to perform to the best of their capabilities.

QUESTION TWO

a) Memo

To: owner

Date: May 5, 2021

Subject: regarding potential benefits of balance scorecard for reducing employee

turnover

I am writing this to inform that there are various situations in hotel which are

changing and leading to increased employee turnover. Similar organization have

adopted the balance scorecard for measuring performance of employees. It is a

strategic tool for evaluating performance of staff which provides base for assessing

actual efforts shared by employees. The hotel would be benefited by implementing

balance scorecard in many patterns. The biggest advantage is related with obtaining of

systematic business structure. Communicating becomes easy by executive this

technique into managerial process as employees can get transparency regarding what is

expected from them. Facilitates better alignment in all division of hotel which will

coordinate all efforts for reaching end outcome (Koesomowidjojo, 2017). All workers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

can get belongingness feeling as their performance is fairly evaluated in turn both

personal & organizational goal can be achieved. Management information is circulated

to all departments which encourages the improved performance. Modified pattern of

having full potential motivates employees that their efforts are valuable for attaining

business goals. Staff will be able to provide high quality performance when

organization will take measures to evaluate performance. It is requested to give focus

on these benefits for gaining competitive advantages.

b) Describing drawbacks of balance scorecard

There are various accountants that have different opinions regarding the usage of

balance scorecard tool. The technique has its own pros and cons which has affect both

positive & negatively to company performance.

Various types of issues that concerns an accountant to implement a balance

scorecard approach in business for fulfilling organizational objectives and goals. The

biggest issue is related with its misleading term which confuses the actual

implementation of tool. Financial performance may not be accurately measured due to

lack of ability of paying attention on external factors and competitions. It is gives

emphasis on internal components mainly which hinder it to focus on competition

prevailing in industry. Risk analysis is not possible with usage of this approach as it

largely concentrate on performance evaluation. In addition to this, the biggest challenge

is that it diverts the attention from risk measurement which does not permit organization

to shape appropriate strategy. It does not allow firm to focus on unforeseen situation in

turn better financial performance cannot be planned. Lack of time dimension lacks firm

to adopt changing business environment, specific goals, etc.

It is a vogue approach so setting standards for efforts evaluation becomes difficult

for firm. In addition to this, recommendations for improving performance is not obtained

through executing BSC approach (Debnath and et.al., 2018). Other perspective rather

than financial, customers, etc are ignored which reduces its capacity of data collection for

proper formulation regarding accurate approaches for attaining desirable position. . It

personal & organizational goal can be achieved. Management information is circulated

to all departments which encourages the improved performance. Modified pattern of

having full potential motivates employees that their efforts are valuable for attaining

business goals. Staff will be able to provide high quality performance when

organization will take measures to evaluate performance. It is requested to give focus

on these benefits for gaining competitive advantages.

b) Describing drawbacks of balance scorecard

There are various accountants that have different opinions regarding the usage of

balance scorecard tool. The technique has its own pros and cons which has affect both

positive & negatively to company performance.

Various types of issues that concerns an accountant to implement a balance

scorecard approach in business for fulfilling organizational objectives and goals. The

biggest issue is related with its misleading term which confuses the actual

implementation of tool. Financial performance may not be accurately measured due to

lack of ability of paying attention on external factors and competitions. It is gives

emphasis on internal components mainly which hinder it to focus on competition

prevailing in industry. Risk analysis is not possible with usage of this approach as it

largely concentrate on performance evaluation. In addition to this, the biggest challenge

is that it diverts the attention from risk measurement which does not permit organization

to shape appropriate strategy. It does not allow firm to focus on unforeseen situation in

turn better financial performance cannot be planned. Lack of time dimension lacks firm

to adopt changing business environment, specific goals, etc.

It is a vogue approach so setting standards for efforts evaluation becomes difficult

for firm. In addition to this, recommendations for improving performance is not obtained

through executing BSC approach (Debnath and et.al., 2018). Other perspective rather

than financial, customers, etc are ignored which reduces its capacity of data collection for

proper formulation regarding accurate approaches for attaining desirable position. . It

takes a lot of time in order to identify recommendations which do not improve financial

performance. High implementation of cost leads to reduce its efficiency by lowering

profit margins. These are BSC’s limitations which served as barrier in achieving success.

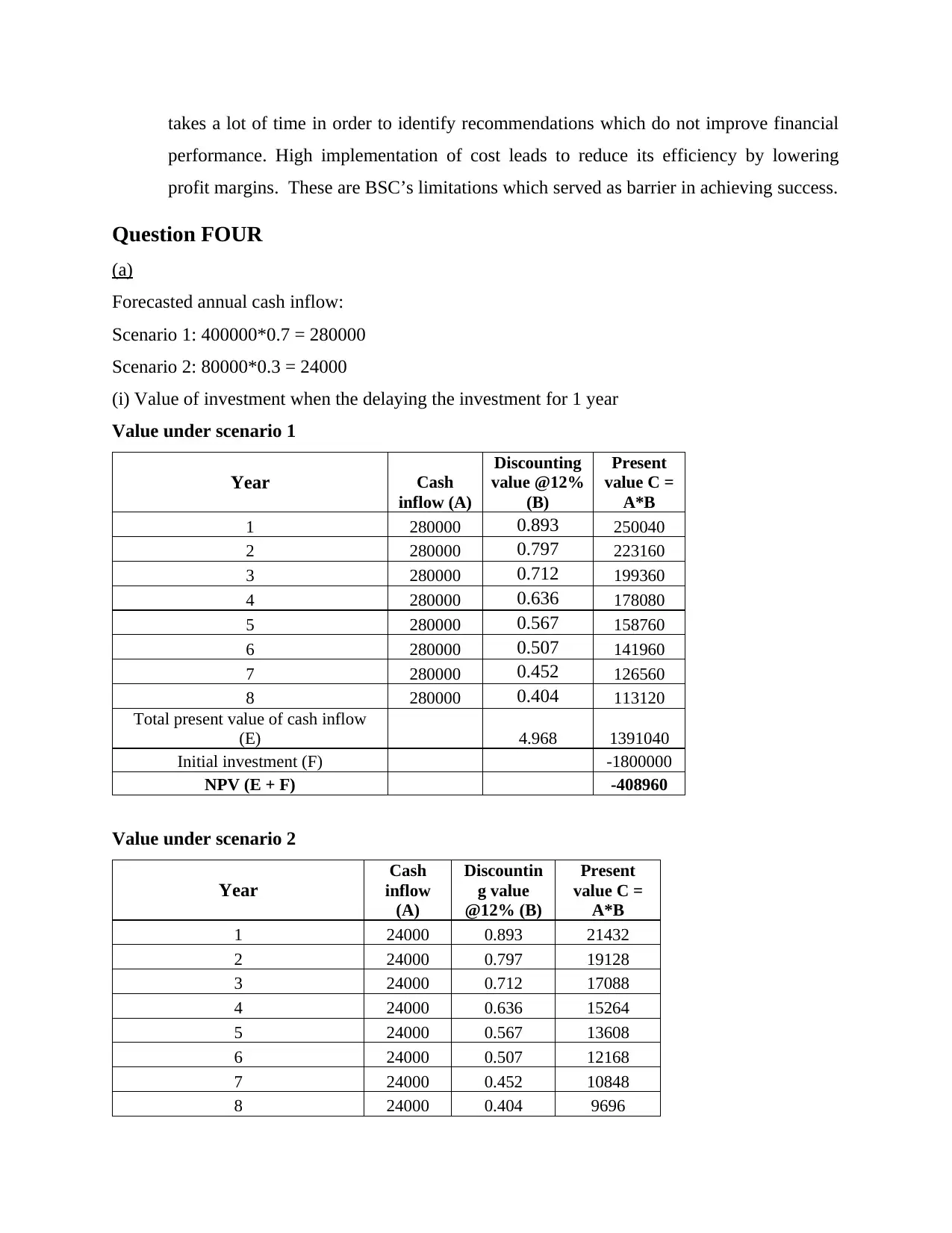

Question FOUR

(a)

Forecasted annual cash inflow:

Scenario 1: 400000*0.7 = 280000

Scenario 2: 80000*0.3 = 24000

(i) Value of investment when the delaying the investment for 1 year

Value under scenario 1

Year Cash

inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 280000 0.893 250040

2 280000 0.797 223160

3 280000 0.712 199360

4 280000 0.636 178080

5 280000 0.567 158760

6 280000 0.507 141960

7 280000 0.452 126560

8 280000 0.404 113120

Total present value of cash inflow

(E) 4.968 1391040

Initial investment (F) -1800000

NPV (E + F) -408960

Value under scenario 2

Year

Cash

inflow

(A)

Discountin

g value

@12% (B)

Present

value C =

A*B

1 24000 0.893 21432

2 24000 0.797 19128

3 24000 0.712 17088

4 24000 0.636 15264

5 24000 0.567 13608

6 24000 0.507 12168

7 24000 0.452 10848

8 24000 0.404 9696

performance. High implementation of cost leads to reduce its efficiency by lowering

profit margins. These are BSC’s limitations which served as barrier in achieving success.

Question FOUR

(a)

Forecasted annual cash inflow:

Scenario 1: 400000*0.7 = 280000

Scenario 2: 80000*0.3 = 24000

(i) Value of investment when the delaying the investment for 1 year

Value under scenario 1

Year Cash

inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 280000 0.893 250040

2 280000 0.797 223160

3 280000 0.712 199360

4 280000 0.636 178080

5 280000 0.567 158760

6 280000 0.507 141960

7 280000 0.452 126560

8 280000 0.404 113120

Total present value of cash inflow

(E) 4.968 1391040

Initial investment (F) -1800000

NPV (E + F) -408960

Value under scenario 2

Year

Cash

inflow

(A)

Discountin

g value

@12% (B)

Present

value C =

A*B

1 24000 0.893 21432

2 24000 0.797 19128

3 24000 0.712 17088

4 24000 0.636 15264

5 24000 0.567 13608

6 24000 0.507 12168

7 24000 0.452 10848

8 24000 0.404 9696

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

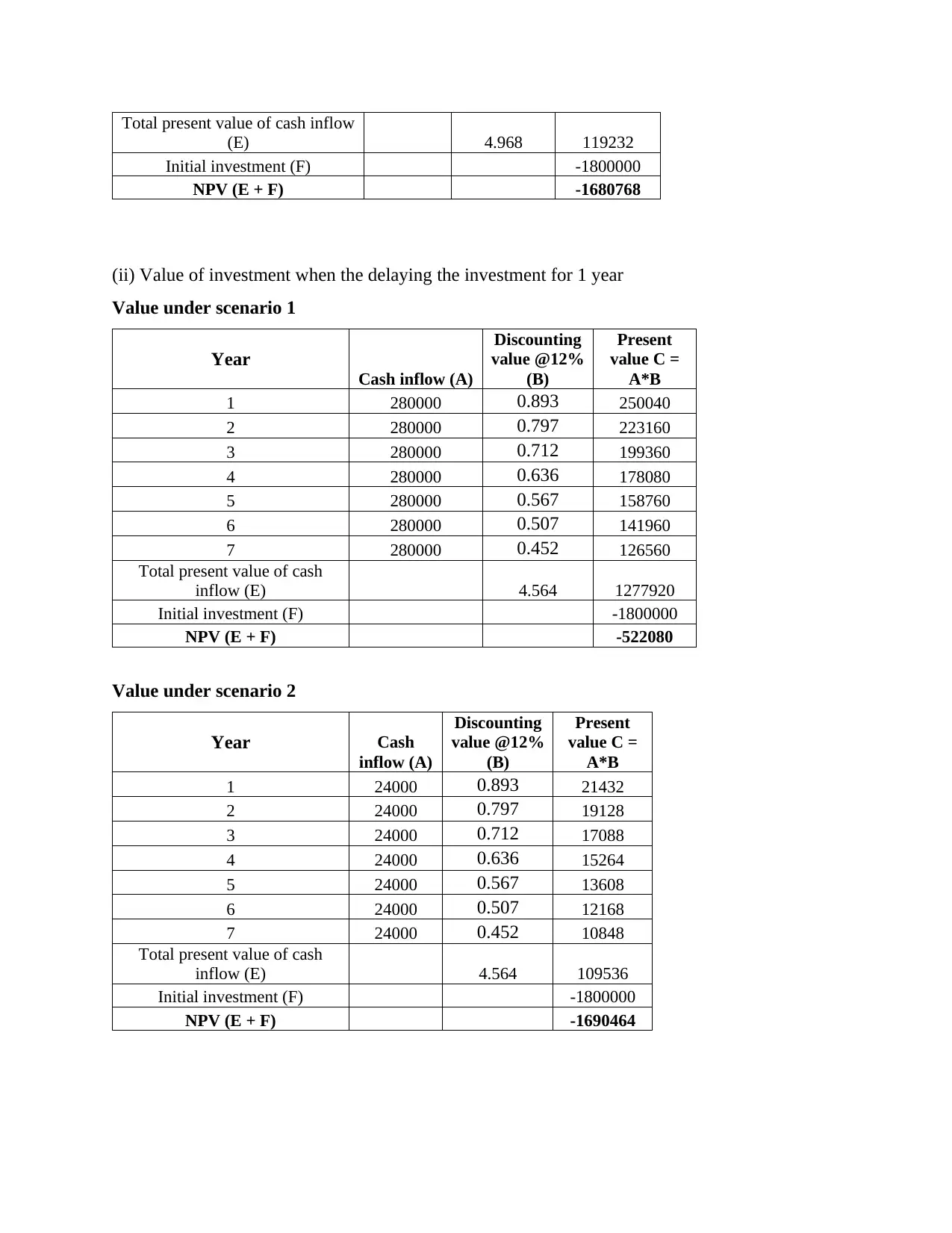

Total present value of cash inflow

(E) 4.968 119232

Initial investment (F) -1800000

NPV (E + F) -1680768

(ii) Value of investment when the delaying the investment for 1 year

Value under scenario 1

Year

Cash inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 280000 0.893 250040

2 280000 0.797 223160

3 280000 0.712 199360

4 280000 0.636 178080

5 280000 0.567 158760

6 280000 0.507 141960

7 280000 0.452 126560

Total present value of cash

inflow (E) 4.564 1277920

Initial investment (F) -1800000

NPV (E + F) -522080

Value under scenario 2

Year Cash

inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 24000 0.893 21432

2 24000 0.797 19128

3 24000 0.712 17088

4 24000 0.636 15264

5 24000 0.567 13608

6 24000 0.507 12168

7 24000 0.452 10848

Total present value of cash

inflow (E) 4.564 109536

Initial investment (F) -1800000

NPV (E + F) -1690464

(E) 4.968 119232

Initial investment (F) -1800000

NPV (E + F) -1680768

(ii) Value of investment when the delaying the investment for 1 year

Value under scenario 1

Year

Cash inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 280000 0.893 250040

2 280000 0.797 223160

3 280000 0.712 199360

4 280000 0.636 178080

5 280000 0.567 158760

6 280000 0.507 141960

7 280000 0.452 126560

Total present value of cash

inflow (E) 4.564 1277920

Initial investment (F) -1800000

NPV (E + F) -522080

Value under scenario 2

Year Cash

inflow (A)

Discounting

value @12%

(B)

Present

value C =

A*B

1 24000 0.893 21432

2 24000 0.797 19128

3 24000 0.712 17088

4 24000 0.636 15264

5 24000 0.567 13608

6 24000 0.507 12168

7 24000 0.452 10848

Total present value of cash

inflow (E) 4.564 109536

Initial investment (F) -1800000

NPV (E + F) -1690464

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

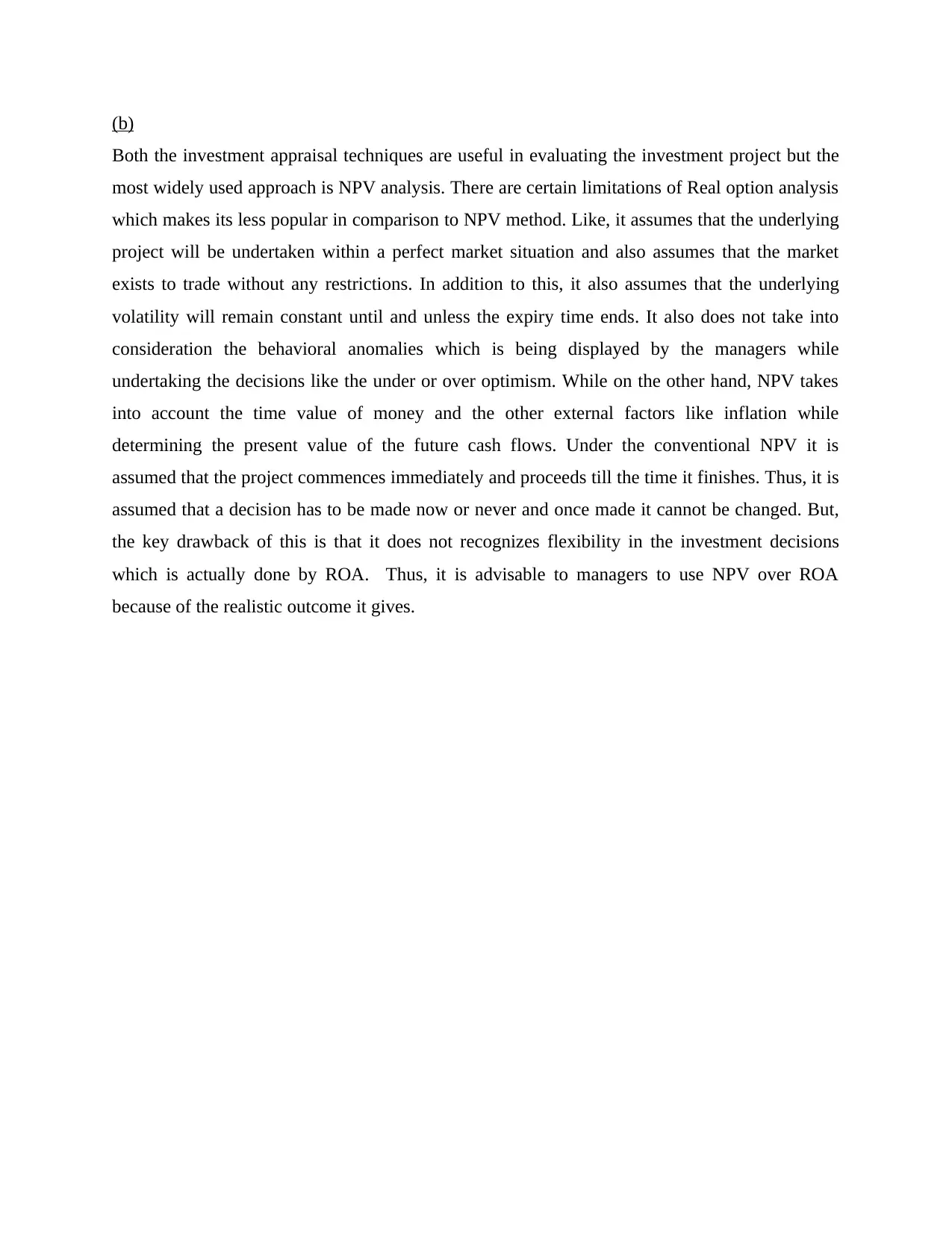

(b)

Both the investment appraisal techniques are useful in evaluating the investment project but the

most widely used approach is NPV analysis. There are certain limitations of Real option analysis

which makes its less popular in comparison to NPV method. Like, it assumes that the underlying

project will be undertaken within a perfect market situation and also assumes that the market

exists to trade without any restrictions. In addition to this, it also assumes that the underlying

volatility will remain constant until and unless the expiry time ends. It also does not take into

consideration the behavioral anomalies which is being displayed by the managers while

undertaking the decisions like the under or over optimism. While on the other hand, NPV takes

into account the time value of money and the other external factors like inflation while

determining the present value of the future cash flows. Under the conventional NPV it is

assumed that the project commences immediately and proceeds till the time it finishes. Thus, it is

assumed that a decision has to be made now or never and once made it cannot be changed. But,

the key drawback of this is that it does not recognizes flexibility in the investment decisions

which is actually done by ROA. Thus, it is advisable to managers to use NPV over ROA

because of the realistic outcome it gives.

Both the investment appraisal techniques are useful in evaluating the investment project but the

most widely used approach is NPV analysis. There are certain limitations of Real option analysis

which makes its less popular in comparison to NPV method. Like, it assumes that the underlying

project will be undertaken within a perfect market situation and also assumes that the market

exists to trade without any restrictions. In addition to this, it also assumes that the underlying

volatility will remain constant until and unless the expiry time ends. It also does not take into

consideration the behavioral anomalies which is being displayed by the managers while

undertaking the decisions like the under or over optimism. While on the other hand, NPV takes

into account the time value of money and the other external factors like inflation while

determining the present value of the future cash flows. Under the conventional NPV it is

assumed that the project commences immediately and proceeds till the time it finishes. Thus, it is

assumed that a decision has to be made now or never and once made it cannot be changed. But,

the key drawback of this is that it does not recognizes flexibility in the investment decisions

which is actually done by ROA. Thus, it is advisable to managers to use NPV over ROA

because of the realistic outcome it gives.

REFERENCES

Books and Journals

Koesomowidjojo, S. R., 2017. Balance scorecard. Raih Asa sukses.

Debnath, A and et.al., 2018. Measuring corporate social responsibility based on fuzzy analytic

networking process-based balance scorecard model. International journal of information

technology & decision making. 17(04). pp.1203-1235.

Latan, H. and et.al., 2018. Effects of environmental strategy, environmental uncertainty and top

management's commitment on corporate environmental performance: The role of environmental

management accounting. Journal of Cleaner Production, 180, pp.297-306.

Books and Journals

Koesomowidjojo, S. R., 2017. Balance scorecard. Raih Asa sukses.

Debnath, A and et.al., 2018. Measuring corporate social responsibility based on fuzzy analytic

networking process-based balance scorecard model. International journal of information

technology & decision making. 17(04). pp.1203-1235.

Latan, H. and et.al., 2018. Effects of environmental strategy, environmental uncertainty and top

management's commitment on corporate environmental performance: The role of environmental

management accounting. Journal of Cleaner Production, 180, pp.297-306.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.