Investment Appraisal, Cost Behavior & Budgeting for Benetton Plc

VerifiedAdded on 2023/04/21

|14

|3050

|368

Report

AI Summary

This report provides a comprehensive analysis of investment appraisal methods, including Net Present Value (NPV), Payback Period, and Internal Rate of Return (IRR), to evaluate the suitability of a project for Benetton Plc. It recommends accepting the project based on the positive outcomes of these methods. The report also discusses the strengths and weaknesses of each appraisal technique. Furthermore, it examines the impact of cost and cost behavior on budget preparation, categorizing costs into fixed, variable, and mixed costs, and explains how managers use cost behavior analysis for effective cost control. Lastly, it highlights how break-even analysis supports management in budget preparation by providing insights into sales levels needed to avoid losses and make informed decisions about selling costs and prices.

Running head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING

Table of Contents

Part A:..............................................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Requirement c:.............................................................................................................................3

Requirement d:.............................................................................................................................3

Requirement e:.............................................................................................................................5

Part B:..............................................................................................................................................8

Requirement a:.............................................................................................................................8

Requirement b:...........................................................................................................................10

References:....................................................................................................................................12

Table of Contents

Part A:..............................................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Requirement c:.............................................................................................................................3

Requirement d:.............................................................................................................................3

Requirement e:.............................................................................................................................5

Part B:..............................................................................................................................................8

Requirement a:.............................................................................................................................8

Requirement b:...........................................................................................................................10

References:....................................................................................................................................12

2MANAGEMENT ACCOUNTING

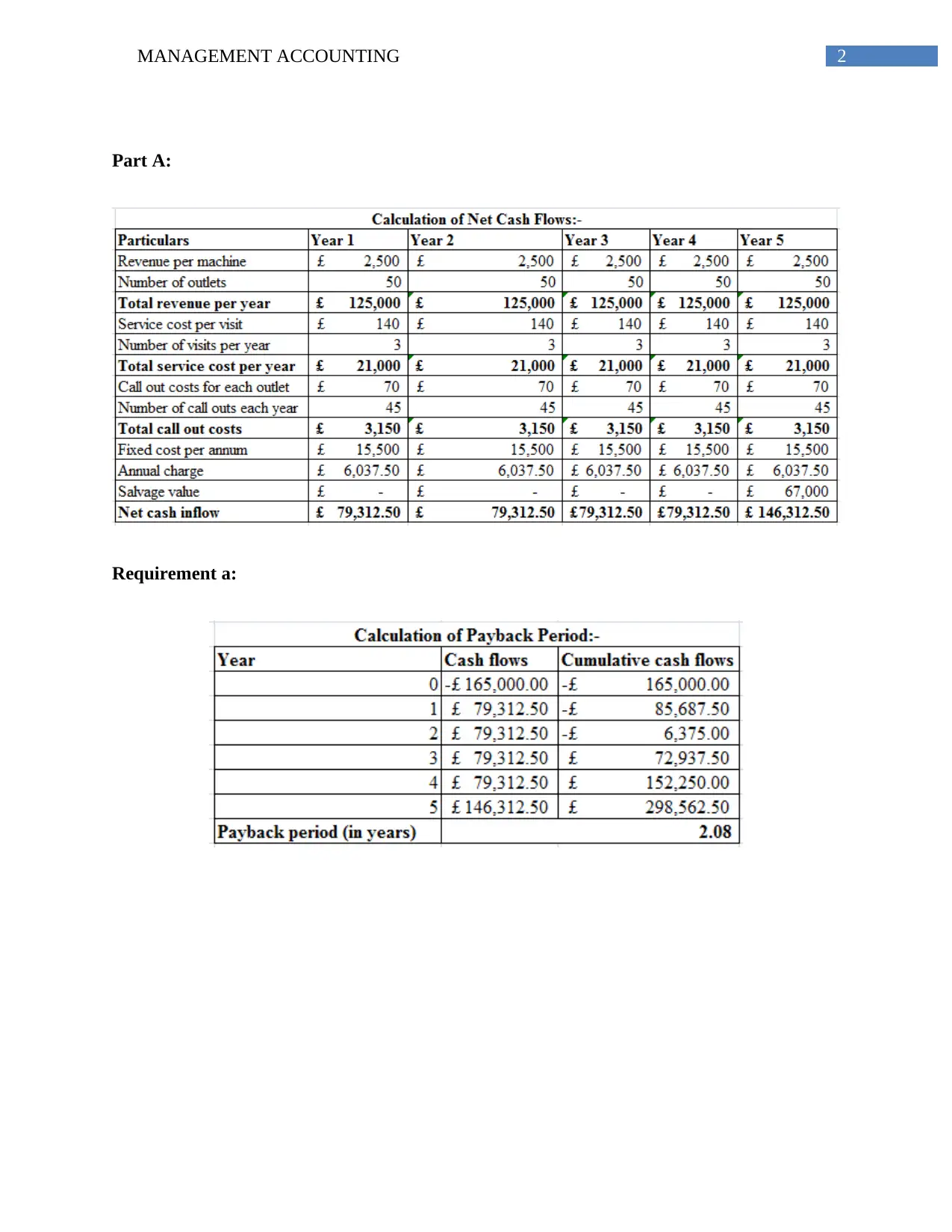

Part A:

Requirement a:

Part A:

Requirement a:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING

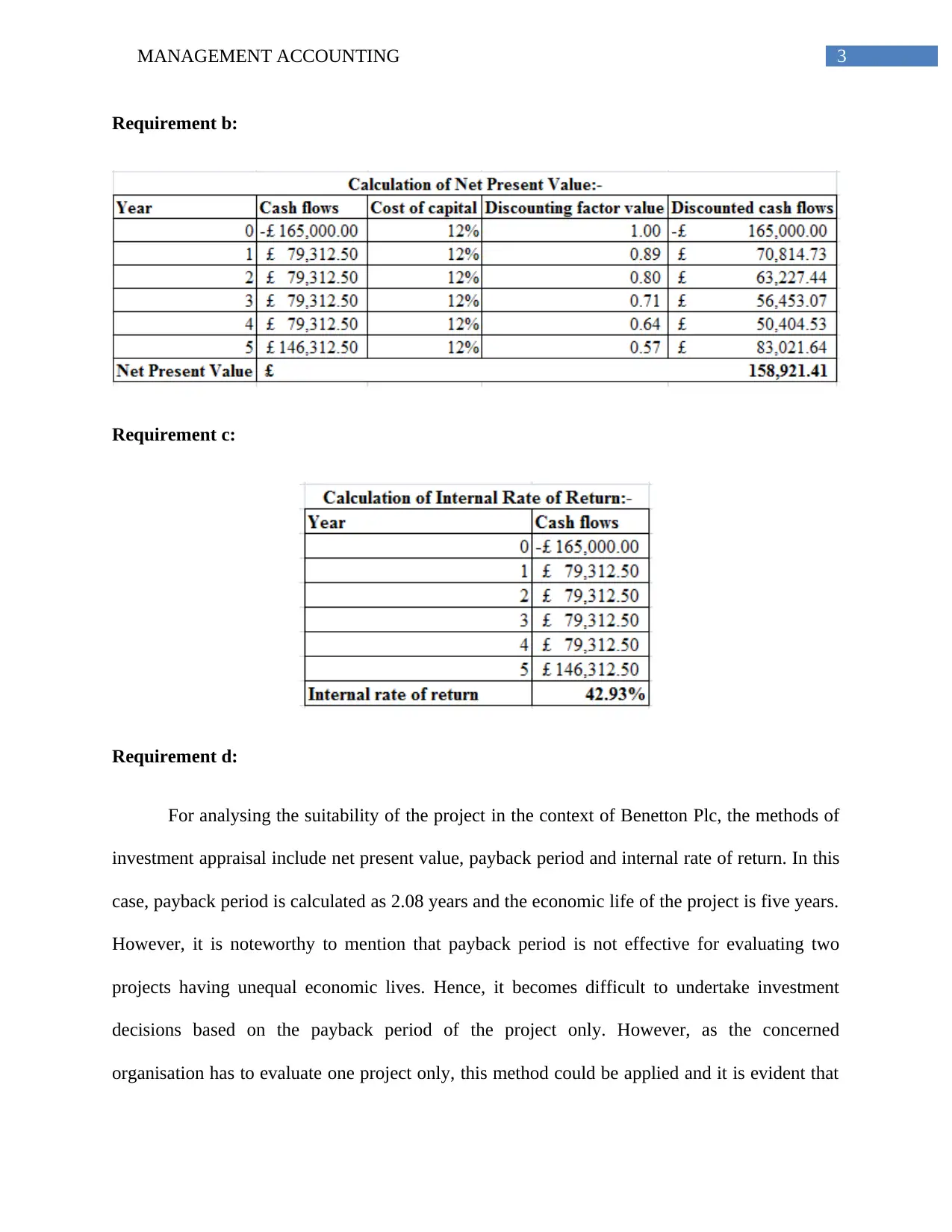

Requirement b:

Requirement c:

Requirement d:

For analysing the suitability of the project in the context of Benetton Plc, the methods of

investment appraisal include net present value, payback period and internal rate of return. In this

case, payback period is calculated as 2.08 years and the economic life of the project is five years.

However, it is noteworthy to mention that payback period is not effective for evaluating two

projects having unequal economic lives. Hence, it becomes difficult to undertake investment

decisions based on the payback period of the project only. However, as the concerned

organisation has to evaluate one project only, this method could be applied and it is evident that

Requirement b:

Requirement c:

Requirement d:

For analysing the suitability of the project in the context of Benetton Plc, the methods of

investment appraisal include net present value, payback period and internal rate of return. In this

case, payback period is calculated as 2.08 years and the economic life of the project is five years.

However, it is noteworthy to mention that payback period is not effective for evaluating two

projects having unequal economic lives. Hence, it becomes difficult to undertake investment

decisions based on the payback period of the project only. However, as the concerned

organisation has to evaluate one project only, this method could be applied and it is evident that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING

the project would prove profitable. This is because Benetton Plc would be able to recover its

initial outlay within 2.8 years, which is well below the economic life of the project.

Net present value is another investment appraisal method used for analysing the

feasibility of the proposed project for Benetton Plc. As this method considers time factor, initial

monetary flows as well as succeeding monetary flows over the project lifecycle, it is considered

as the superior investment appraisal method (Langfield-Smith et al. 2017). In addition, it

provides adequate attention to the various risk aspects and profitability associated with the

project. In case of the concerned project, NPV is obtained as £158,921.41. If the NPV is positive

and it has higher value, the project is deemed to be favourable for the organisation. In this case,

NPV has both aspects and hence, accepting this project would assist in increasing the overall

profitability for Benetton Plc.

The final technique that has been taken into consideration for analysing the proposed

project is internal rate of return. One of the most interesting aspects of this method is that it

becomes simple to explain after its computation. When the cost of capital is lower than internal

rate of return, it implies that the project has the ability of generating favourable returns and vice-

versa (Otley 2016). It has been observed that it becomes quite difficult to ascertain the hurdle

rate. In case of IRR, hurdle rate is not needed in order to compute it. For this project, IRR is

obtained as 42.93% and the cost of capital is provided as 12%. This clearly implies that the

internal rate of return is higher than the cost of capital. Hence, based on this technique, it could

be said that the project would prove to be profitable for Benetton Plc.

the project would prove profitable. This is because Benetton Plc would be able to recover its

initial outlay within 2.8 years, which is well below the economic life of the project.

Net present value is another investment appraisal method used for analysing the

feasibility of the proposed project for Benetton Plc. As this method considers time factor, initial

monetary flows as well as succeeding monetary flows over the project lifecycle, it is considered

as the superior investment appraisal method (Langfield-Smith et al. 2017). In addition, it

provides adequate attention to the various risk aspects and profitability associated with the

project. In case of the concerned project, NPV is obtained as £158,921.41. If the NPV is positive

and it has higher value, the project is deemed to be favourable for the organisation. In this case,

NPV has both aspects and hence, accepting this project would assist in increasing the overall

profitability for Benetton Plc.

The final technique that has been taken into consideration for analysing the proposed

project is internal rate of return. One of the most interesting aspects of this method is that it

becomes simple to explain after its computation. When the cost of capital is lower than internal

rate of return, it implies that the project has the ability of generating favourable returns and vice-

versa (Otley 2016). It has been observed that it becomes quite difficult to ascertain the hurdle

rate. In case of IRR, hurdle rate is not needed in order to compute it. For this project, IRR is

obtained as 42.93% and the cost of capital is provided as 12%. This clearly implies that the

internal rate of return is higher than the cost of capital. Hence, based on this technique, it could

be said that the project would prove to be profitable for Benetton Plc.

5MANAGEMENT ACCOUNTING

By considering the outcomes of all the three chosen methods of investment appraisal,

Benetton Plc is recommended to accept the project, as it would help in maximising its

profitability level through which further expansion opportunities could arise in future.

Requirement e:

The strengths and weaknesses of "payback period" are discussed below-

Strengths:

A significant proportion of companies provide employment to newcomers who come from

various backgrounds for examining their financial projects, which are not only prejudicial but

also very difficult to understand (Risinger et al. 2015). Moreover, payback discusses the ('n' of

years), it also allows the newcomers to understand this method with ease.

Authenticating which projects could generate quicker earnings is vital to those organisations,

which do not have adequate resources. The managers utilise the method to produce quicker

analysis regarding to the projects with minimum investment and a restricted payback period

(Carvalho, Meier and Wang 2016).

Weaknesses:

The most noteworthy drawback of this process is the ignorance of time factor while

analysing the suitability of a project. The cash flows generated from the initial years of a project

are generally more than those generated in the later years (Eberhardt, Bruine De Bruin and

Strough 2017). The payback period could be identical for many projects; however, two projects

could generate more cash flows in the initial years and later years respectively. Therefore, using

By considering the outcomes of all the three chosen methods of investment appraisal,

Benetton Plc is recommended to accept the project, as it would help in maximising its

profitability level through which further expansion opportunities could arise in future.

Requirement e:

The strengths and weaknesses of "payback period" are discussed below-

Strengths:

A significant proportion of companies provide employment to newcomers who come from

various backgrounds for examining their financial projects, which are not only prejudicial but

also very difficult to understand (Risinger et al. 2015). Moreover, payback discusses the ('n' of

years), it also allows the newcomers to understand this method with ease.

Authenticating which projects could generate quicker earnings is vital to those organisations,

which do not have adequate resources. The managers utilise the method to produce quicker

analysis regarding to the projects with minimum investment and a restricted payback period

(Carvalho, Meier and Wang 2016).

Weaknesses:

The most noteworthy drawback of this process is the ignorance of time factor while

analysing the suitability of a project. The cash flows generated from the initial years of a project

are generally more than those generated in the later years (Eberhardt, Bruine De Bruin and

Strough 2017). The payback period could be identical for many projects; however, two projects

could generate more cash flows in the initial years and later years respectively. Therefore, using

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING

only the payback period for project selection or investment decision might not be a feasible

option.

For specific projects, the highest cash flows would not take place after the completion of

payback time. Such projects would fetch better return on investment and they would be suitable

to projects having restricted payback periods (Goetsch and Davis 2014).

The strengths and weaknesses of "net present value" (NPV) are discussed below-

Strengths:

NPV puts emphasis on time value of money.

During the calculation of NPV, preliminary cash flows and following cash flows over the

duration of the project is taken into account (Hirshleifer, Jian and Zhang 2016).

Proper focus is given to the benefit and risk elements associated with the project.

The value of the company rises owing to the implementation of this method.

Weaknesses:

Implementation of this method is not always possible.

NPV declines to give accurate decision if the total of the investment of conflicting

projects are not similar (Ingram et al. 2015).

Calculation of authentic discount rate is not always possible.

This method declines to provide feasible decisions when the duration of the projects are

not identical.

The strengths and weaknesses of "internal rate of return" (IRR) are discussed below-

Strengths:

only the payback period for project selection or investment decision might not be a feasible

option.

For specific projects, the highest cash flows would not take place after the completion of

payback time. Such projects would fetch better return on investment and they would be suitable

to projects having restricted payback periods (Goetsch and Davis 2014).

The strengths and weaknesses of "net present value" (NPV) are discussed below-

Strengths:

NPV puts emphasis on time value of money.

During the calculation of NPV, preliminary cash flows and following cash flows over the

duration of the project is taken into account (Hirshleifer, Jian and Zhang 2016).

Proper focus is given to the benefit and risk elements associated with the project.

The value of the company rises owing to the implementation of this method.

Weaknesses:

Implementation of this method is not always possible.

NPV declines to give accurate decision if the total of the investment of conflicting

projects are not similar (Ingram et al. 2015).

Calculation of authentic discount rate is not always possible.

This method declines to provide feasible decisions when the duration of the projects are

not identical.

The strengths and weaknesses of "internal rate of return" (IRR) are discussed below-

Strengths:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING

The most interesting fact about this method is that it is well defined after the (IRR) has been

calculated. If IRR surpasses cost of capital, then the project would be accepted (Levin, James and

Nolan 2014). It could be very easily understood by the managers and that is why it is accepted

till the period they arrive at a specific point when the projects are conflicting and so on.

The (hurdle rate) is a very difficult and one sided element to regulate. In "IRR", this rate or

the (required rate of return) is not required for computing the "IRR". It is not based on this rate

and hence, the danger of an inappropriate calculation of (hurdle rate) could take place (Williams

et al. 2015). Calculation of (NPV), (Profitability) rate require (hurdle rate).

Weaknesses:

Generally, finance managers arrive at positions when the project under examination produces

a compulsion of investing in various projects. For example, if a person invests in an expensive

car, they would need to arrange a place for parking also. These projects are defined as dependent

upon or unpredicted projects, which need to be taken into account by the manager (Chambers,

Echenique and Saito 2016). IRR could approve of purchasing the vehicle, furthermore, if the

total anticipated benefits are excluded in arranging the parking space, there is no point investing.

Periodically the investors would encounter conflicting projects, which implies that if one is

accepted, then the other cannot be accepted. Constructing a hotel or commercial penthouses on a

particular piece of land is an example of conflicting projects. In such a situation, predicting

whether it would be good for investing would not be enough (Frydman and Camerer 2016). The

problem is to know which one is the best. IRR would give a proportional explanation value

which would not be enough.

The most interesting fact about this method is that it is well defined after the (IRR) has been

calculated. If IRR surpasses cost of capital, then the project would be accepted (Levin, James and

Nolan 2014). It could be very easily understood by the managers and that is why it is accepted

till the period they arrive at a specific point when the projects are conflicting and so on.

The (hurdle rate) is a very difficult and one sided element to regulate. In "IRR", this rate or

the (required rate of return) is not required for computing the "IRR". It is not based on this rate

and hence, the danger of an inappropriate calculation of (hurdle rate) could take place (Williams

et al. 2015). Calculation of (NPV), (Profitability) rate require (hurdle rate).

Weaknesses:

Generally, finance managers arrive at positions when the project under examination produces

a compulsion of investing in various projects. For example, if a person invests in an expensive

car, they would need to arrange a place for parking also. These projects are defined as dependent

upon or unpredicted projects, which need to be taken into account by the manager (Chambers,

Echenique and Saito 2016). IRR could approve of purchasing the vehicle, furthermore, if the

total anticipated benefits are excluded in arranging the parking space, there is no point investing.

Periodically the investors would encounter conflicting projects, which implies that if one is

accepted, then the other cannot be accepted. Constructing a hotel or commercial penthouses on a

particular piece of land is an example of conflicting projects. In such a situation, predicting

whether it would be good for investing would not be enough (Frydman and Camerer 2016). The

problem is to know which one is the best. IRR would give a proportional explanation value

which would not be enough.

8MANAGEMENT ACCOUNTING

Part B:

Requirement a:

The "impact of cost and cost behaviour on the preparation of budget" is depicted below:

Cost behaviour analysis discusses the ways through which certain costs behave in a

particular business environment. Thus, the managers are required to understand cost behaviour

for ensuring effective cost control. In this relation, a brief discussion of cost behaviour and the

different types of costs a manager needs to examine is depicted here.

Firstly, analysing costs requires understanding and examining main operations of the

company. The operating levels are explained in financial location and they might be in the form

of miles driven, sales dollars and others. The operation level would be incorporated with changes

in costs. The operational indicators identify the operation, which leads to variation in cost

behaviour. Hence, the managers undertake decisions so that costs could further be controlled.

Costs could be categorised into fixed cost, variable cost and mixed cost.

They are discussed briefly as follows:

Variable cost:

Variable costs are prices of a company that would vary in aggregate directly and

additionally with the changes in a functional level. For example, with the increase in functional

level by 20%, there would be rise in variable costs by the same percentage. The proportion

would be the same with the downfall in functional level. Variable costs mainly include direct

materials and direct labour. For instance, if an organisation uses its vehicles more, it would have

to bear additional fuel expenses. Thus, if the functional level driving increases by 25%, the costs

Part B:

Requirement a:

The "impact of cost and cost behaviour on the preparation of budget" is depicted below:

Cost behaviour analysis discusses the ways through which certain costs behave in a

particular business environment. Thus, the managers are required to understand cost behaviour

for ensuring effective cost control. In this relation, a brief discussion of cost behaviour and the

different types of costs a manager needs to examine is depicted here.

Firstly, analysing costs requires understanding and examining main operations of the

company. The operating levels are explained in financial location and they might be in the form

of miles driven, sales dollars and others. The operation level would be incorporated with changes

in costs. The operational indicators identify the operation, which leads to variation in cost

behaviour. Hence, the managers undertake decisions so that costs could further be controlled.

Costs could be categorised into fixed cost, variable cost and mixed cost.

They are discussed briefly as follows:

Variable cost:

Variable costs are prices of a company that would vary in aggregate directly and

additionally with the changes in a functional level. For example, with the increase in functional

level by 20%, there would be rise in variable costs by the same percentage. The proportion

would be the same with the downfall in functional level. Variable costs mainly include direct

materials and direct labour. For instance, if an organisation uses its vehicles more, it would have

to bear additional fuel expenses. Thus, if the functional level driving increases by 25%, the costs

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGEMENT ACCOUNTING

for fuel and other driving expenses would increase by 25% as well (Lu, Won and Cheng 2016).

In order to compute variable costs, least square regression method is deemed to be suitable.

Computer spreadsheet program is needed like calculator or MS Excel, as it uses all points of data

instead of two points such as high-low method.

Fixed cost:

Fixed costs are prices that have identical aggregate despite the functional level

modifications. Examples include rent, salary, property taxes, insurance and so on (Shahid,

Ahmad and Badar 2017). As fixed costs would not change with functional level and quantity

increases, there would be decline in cost per unit. For instance, it is assumed that an organisation

incur $10,000 as rent per month. Even though the rent expense is fixed irrespective of

production, the unit price of per commodity produced would decline in cost with rise in quantity.

When there is production of additional 10% each month, the aggregate cost per commodity

manufactured would decline by 10%.

Mixed cost:

Mixed costs include those costs, which have both variable costs and fixed costs. A truck

rental is sound example of mixed cost (Shepherd, Williams and Patzelt 2015). For instance,

leasing a truck might bear variable cost of $0.50 per kilometre and $100 as fixed cost. The

managers of business organisations use high-low method for categorising and evaluating mixed

costs. This method is involved in utilising the aggregate prices incurred at both low and high

levels of functions for mixed cost classification into fixed factor and variable factor. The cost

difference between low and high levels provides variable costs, as only the variable cost could

for fuel and other driving expenses would increase by 25% as well (Lu, Won and Cheng 2016).

In order to compute variable costs, least square regression method is deemed to be suitable.

Computer spreadsheet program is needed like calculator or MS Excel, as it uses all points of data

instead of two points such as high-low method.

Fixed cost:

Fixed costs are prices that have identical aggregate despite the functional level

modifications. Examples include rent, salary, property taxes, insurance and so on (Shahid,

Ahmad and Badar 2017). As fixed costs would not change with functional level and quantity

increases, there would be decline in cost per unit. For instance, it is assumed that an organisation

incur $10,000 as rent per month. Even though the rent expense is fixed irrespective of

production, the unit price of per commodity produced would decline in cost with rise in quantity.

When there is production of additional 10% each month, the aggregate cost per commodity

manufactured would decline by 10%.

Mixed cost:

Mixed costs include those costs, which have both variable costs and fixed costs. A truck

rental is sound example of mixed cost (Shepherd, Williams and Patzelt 2015). For instance,

leasing a truck might bear variable cost of $0.50 per kilometre and $100 as fixed cost. The

managers of business organisations use high-low method for categorising and evaluating mixed

costs. This method is involved in utilising the aggregate prices incurred at both low and high

levels of functions for mixed cost classification into fixed factor and variable factor. The cost

difference between low and high levels provides variable costs, as only the variable cost could

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT ACCOUNTING

change with the variation in functional levels. Steps in computing fixed and variable prices

utilising high-low method are discussed as follows:

Helps in controlling variable costs each unit.

Helps in authenticating the fixed prices by decreasing the total variable costs at either the

high or low functional level from the aggregate costs at that functional level.

Requirement b:

The support management gains from "break-even analysis" while preparing budget is

discussed below:

Break-even analysis is used in giving answers to question such as "what is the basic level

of sales that ensures the company would not sustain loss" or "how much care sales be decreased

and the company would still keep on earning revenues". Break-even analysis is very crucial

before initiating a new business or launching a new commodity, as it gives answers to essential

questions such as- "how exquisite is the revenue to the company, to either decrease its sales or

increase the costs". This analysis could be also extended to initial level of business in order to

check how accurate the first prediction was and monitor whether the company is on the correct

track or not. Even global companies require to take into account their current break-even point

along with finding quick-fix to reduce that standard in order to increase revenue (Rick et al.

2018).

Entrepreneurs and managers constantly face with issues related to decisions regarding

selling costs and controlling prices. Break- even analysis is the examination of the level of sales

at which a company or a project would make no profit. This method controls the sales needed for

break-even. Break-even analysis could be very useful in the following practical conditions:

change with the variation in functional levels. Steps in computing fixed and variable prices

utilising high-low method are discussed as follows:

Helps in controlling variable costs each unit.

Helps in authenticating the fixed prices by decreasing the total variable costs at either the

high or low functional level from the aggregate costs at that functional level.

Requirement b:

The support management gains from "break-even analysis" while preparing budget is

discussed below:

Break-even analysis is used in giving answers to question such as "what is the basic level

of sales that ensures the company would not sustain loss" or "how much care sales be decreased

and the company would still keep on earning revenues". Break-even analysis is very crucial

before initiating a new business or launching a new commodity, as it gives answers to essential

questions such as- "how exquisite is the revenue to the company, to either decrease its sales or

increase the costs". This analysis could be also extended to initial level of business in order to

check how accurate the first prediction was and monitor whether the company is on the correct

track or not. Even global companies require to take into account their current break-even point

along with finding quick-fix to reduce that standard in order to increase revenue (Rick et al.

2018).

Entrepreneurs and managers constantly face with issues related to decisions regarding

selling costs and controlling prices. Break- even analysis is the examination of the level of sales

at which a company or a project would make no profit. This method controls the sales needed for

break-even. Break-even analysis could be very useful in the following practical conditions:

11MANAGEMENT ACCOUNTING

1. Setting a new function.

2. While preparing new commodities into manufacturing, such a situation could authenticate the

yield for the new commodity.

3. When expanding basic level of functions of the company.

4. When developing projects in fixed assets and so on.

A company could use break-even analysis to answer the above questions from a pure cost

and from the point of view of profit and when marketing departments are developing strategies,

which involve approving discounts or carrying out promotional campaigns (Diabat et al. 2016).

1. Setting a new function.

2. While preparing new commodities into manufacturing, such a situation could authenticate the

yield for the new commodity.

3. When expanding basic level of functions of the company.

4. When developing projects in fixed assets and so on.

A company could use break-even analysis to answer the above questions from a pure cost

and from the point of view of profit and when marketing departments are developing strategies,

which involve approving discounts or carrying out promotional campaigns (Diabat et al. 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.