Downhill Ski Tows Pty. Ltd. - Capital Budgeting and Finance Analysis

VerifiedAdded on 2020/01/07

|22

|4156

|148

Project

AI Summary

This project report focuses on strategic finance and capital budgeting techniques, crucial for making sound investment decisions. It examines the application of Net Present Value (NPV) and Internal Rate of Return (IRR) methods to evaluate the financial feasibility of a new ski run project for Downhill Ski Tows Pty. Ltd. The analysis includes detailed calculations of NPV and IRR, along with interpretations of the results to advise management on the project's viability. Furthermore, the report delves into sensitivity analysis, exploring how changes in tax rates, discount rates, and price increases affect the project's profitability. The report also discusses the risks involved in investment appraisal and provides recommendations based on the financial analysis. The report concludes with a discussion on financing options, incorrect and omitted items in the list, and the preparation of cash flow items, ensuring a comprehensive understanding of the financial aspects of the project.

Strategic finance for managers

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................3

Capital budgeting..................................................................................................................................3

Calculation of NPV and IRR............................................................................................................3

Interpretation..................................................................................................................................7

Sensitivity analysis with change in tax rate, rate of return and price increase.................................8

Decrease in discounting rates...........................................................................................................9

Decrease in tax rate @ 25%............................................................................................................10

Risk involved in investment appraisal............................................................................................11

Question 1...........................................................................................................................................12

Calculation of discounting rate.......................................................................................................12

Calculation of payback period and net present value.....................................................................12

Advise to FX about suitable project...............................................................................................14

Financing through debt capital.......................................................................................................14

Sensitivity analysis and its uses in project evaluation....................................................................15

QUESTION 2.....................................................................................................................................15

Incorrect items included in the list and its reasons.........................................................................16

Omitted items in the list..................................................................................................................17

Preparation of cash flow items.......................................................................................................17

Calculation of NPV.........................................................................................................................18

CONCLUSION..................................................................................................................................19

REFERENCES...................................................................................................................................21

APPENDIX........................................................................................................................................22

2

INTRODUCTION................................................................................................................................3

Capital budgeting..................................................................................................................................3

Calculation of NPV and IRR............................................................................................................3

Interpretation..................................................................................................................................7

Sensitivity analysis with change in tax rate, rate of return and price increase.................................8

Decrease in discounting rates...........................................................................................................9

Decrease in tax rate @ 25%............................................................................................................10

Risk involved in investment appraisal............................................................................................11

Question 1...........................................................................................................................................12

Calculation of discounting rate.......................................................................................................12

Calculation of payback period and net present value.....................................................................12

Advise to FX about suitable project...............................................................................................14

Financing through debt capital.......................................................................................................14

Sensitivity analysis and its uses in project evaluation....................................................................15

QUESTION 2.....................................................................................................................................15

Incorrect items included in the list and its reasons.........................................................................16

Omitted items in the list..................................................................................................................17

Preparation of cash flow items.......................................................................................................17

Calculation of NPV.........................................................................................................................18

CONCLUSION..................................................................................................................................19

REFERENCES...................................................................................................................................21

APPENDIX........................................................................................................................................22

2

INTRODUCTION

Finance is regarded as the soul of the business because none of the entity can survive in the market without sufficient availability of

monetary resources. It is the duty of finance manager to maintain adequate cash funds to support routine operations and manage business cost

through regular monitoring and controlling so as to make corporation financially strong. Financial manager are not only liable to administrate

daily functioning but also need to monitor their capital expenditures because they have a huge impact on overall operations. Capital budgeting

decisions are of great significance as it enables manager to make viable and strategic decisions about investment in fixed assets. The present

project report lay emphasizes on the application of different investment appraisal techniques, including both discounting and non-discounting

methods to make viable and qualitative investment decisions for the business success. Moreover, it also highlights the key factors that an entity

should address while considering to invest funds in any capital project.

CAPITAL BUDGETING

Every corporation needs to make long-term capital expenditures in the fixed assets, such as property, acquisition of new machinery, new

plant, and designing new product etc. It requires huge amount of capital to invest in the assets and affect corporation to a large extent. Therefore,

proper precautions should be taken while investing money in such kind of assets otherwise it may lead to business failure. In such regards, capital

budgeting techniques helps establishments to determine the most suitable or appropriate investment project which will deliver greater return to

the organization (Echanis and Kester, 2016). These techniques are also known as project appraisal which is regarded as a process of evaluating

and examining relative profitability and return of each and every proposal so as to find out the best among these. In the given scenario, it has

been stated that Downhill Ski Tows Pty. Ltd operates ski tows and chair lifts at N.S.W. winter sort for a number of years. Due to sudden increase

in skiers and sightseers, directors are considering to install a new ski run. There are number of appraisal methods available to the board members

to determine that whether this project will deliver sufficient yield or not in the future.

Calculation of NPV and IRR

Net present value: It can be computed by discounting all the forecasted cash flows at a cost of capital and total of it is subtracted from the

3

Finance is regarded as the soul of the business because none of the entity can survive in the market without sufficient availability of

monetary resources. It is the duty of finance manager to maintain adequate cash funds to support routine operations and manage business cost

through regular monitoring and controlling so as to make corporation financially strong. Financial manager are not only liable to administrate

daily functioning but also need to monitor their capital expenditures because they have a huge impact on overall operations. Capital budgeting

decisions are of great significance as it enables manager to make viable and strategic decisions about investment in fixed assets. The present

project report lay emphasizes on the application of different investment appraisal techniques, including both discounting and non-discounting

methods to make viable and qualitative investment decisions for the business success. Moreover, it also highlights the key factors that an entity

should address while considering to invest funds in any capital project.

CAPITAL BUDGETING

Every corporation needs to make long-term capital expenditures in the fixed assets, such as property, acquisition of new machinery, new

plant, and designing new product etc. It requires huge amount of capital to invest in the assets and affect corporation to a large extent. Therefore,

proper precautions should be taken while investing money in such kind of assets otherwise it may lead to business failure. In such regards, capital

budgeting techniques helps establishments to determine the most suitable or appropriate investment project which will deliver greater return to

the organization (Echanis and Kester, 2016). These techniques are also known as project appraisal which is regarded as a process of evaluating

and examining relative profitability and return of each and every proposal so as to find out the best among these. In the given scenario, it has

been stated that Downhill Ski Tows Pty. Ltd operates ski tows and chair lifts at N.S.W. winter sort for a number of years. Due to sudden increase

in skiers and sightseers, directors are considering to install a new ski run. There are number of appraisal methods available to the board members

to determine that whether this project will deliver sufficient yield or not in the future.

Calculation of NPV and IRR

Net present value: It can be computed by discounting all the forecasted cash flows at a cost of capital and total of it is subtracted from the

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

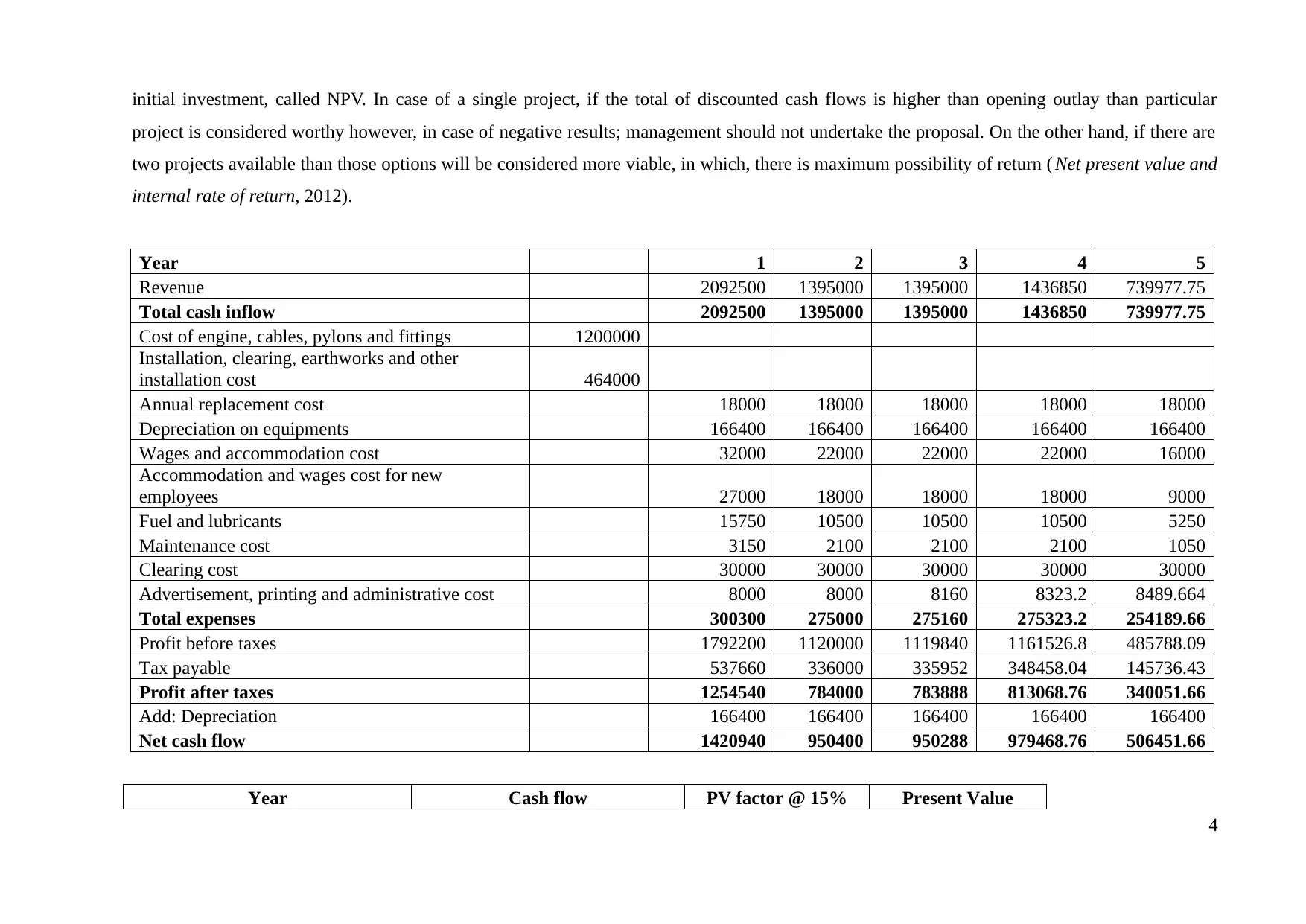

initial investment, called NPV. In case of a single project, if the total of discounted cash flows is higher than opening outlay than particular

project is considered worthy however, in case of negative results; management should not undertake the proposal. On the other hand, if there are

two projects available than those options will be considered more viable, in which, there is maximum possibility of return ( Net present value and

internal rate of return, 2012).

Year 1 2 3 4 5

Revenue 2092500 1395000 1395000 1436850 739977.75

Total cash inflow 2092500 1395000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other

installation cost 464000

Annual replacement cost 18000 18000 18000 18000 18000

Depreciation on equipments 166400 166400 166400 166400 166400

Wages and accommodation cost 32000 22000 22000 22000 16000

Accommodation and wages cost for new

employees 27000 18000 18000 18000 9000

Fuel and lubricants 15750 10500 10500 10500 5250

Maintenance cost 3150 2100 2100 2100 1050

Clearing cost 30000 30000 30000 30000 30000

Advertisement, printing and administrative cost 8000 8000 8160 8323.2 8489.664

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1792200 1120000 1119840 1161526.8 485788.09

Tax payable 537660 336000 335952 348458.04 145736.43

Profit after taxes 1254540 784000 783888 813068.76 340051.66

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1420940 950400 950288 979468.76 506451.66

Year Cash flow PV factor @ 15% Present Value

4

project is considered worthy however, in case of negative results; management should not undertake the proposal. On the other hand, if there are

two projects available than those options will be considered more viable, in which, there is maximum possibility of return ( Net present value and

internal rate of return, 2012).

Year 1 2 3 4 5

Revenue 2092500 1395000 1395000 1436850 739977.75

Total cash inflow 2092500 1395000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other

installation cost 464000

Annual replacement cost 18000 18000 18000 18000 18000

Depreciation on equipments 166400 166400 166400 166400 166400

Wages and accommodation cost 32000 22000 22000 22000 16000

Accommodation and wages cost for new

employees 27000 18000 18000 18000 9000

Fuel and lubricants 15750 10500 10500 10500 5250

Maintenance cost 3150 2100 2100 2100 1050

Clearing cost 30000 30000 30000 30000 30000

Advertisement, printing and administrative cost 8000 8000 8160 8323.2 8489.664

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1792200 1120000 1119840 1161526.8 485788.09

Tax payable 537660 336000 335952 348458.04 145736.43

Profit after taxes 1254540 784000 783888 813068.76 340051.66

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1420940 950400 950288 979468.76 506451.66

Year Cash flow PV factor @ 15% Present Value

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

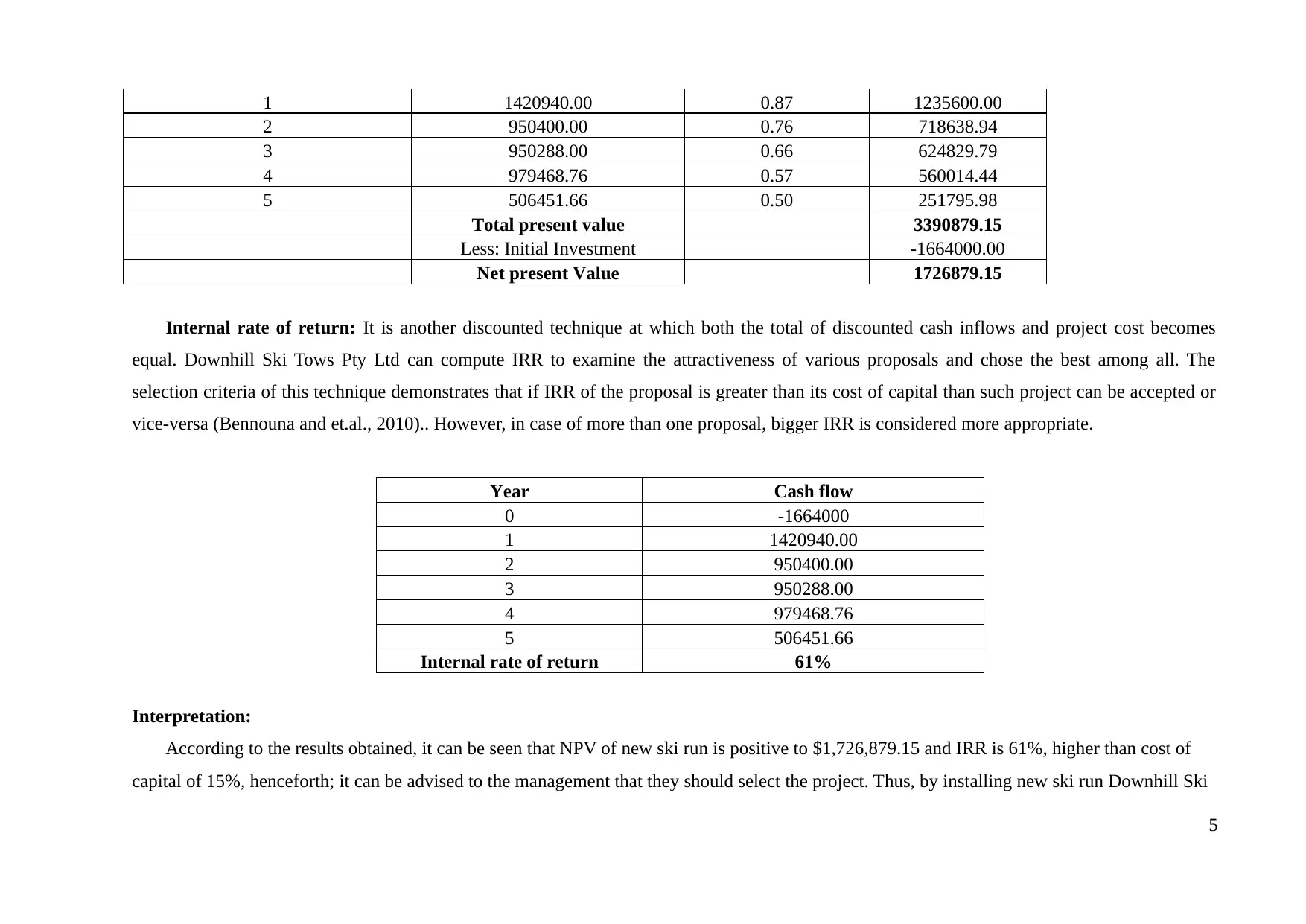

1 1420940.00 0.87 1235600.00

2 950400.00 0.76 718638.94

3 950288.00 0.66 624829.79

4 979468.76 0.57 560014.44

5 506451.66 0.50 251795.98

Total present value 3390879.15

Less: Initial Investment -1664000.00

Net present Value 1726879.15

Internal rate of return: It is another discounted technique at which both the total of discounted cash inflows and project cost becomes

equal. Downhill Ski Tows Pty Ltd can compute IRR to examine the attractiveness of various proposals and chose the best among all. The

selection criteria of this technique demonstrates that if IRR of the proposal is greater than its cost of capital than such project can be accepted or

vice-versa (Bennouna and et.al., 2010).. However, in case of more than one proposal, bigger IRR is considered more appropriate.

Year Cash flow

0 -1664000

1 1420940.00

2 950400.00

3 950288.00

4 979468.76

5 506451.66

Internal rate of return 61%

Interpretation:

According to the results obtained, it can be seen that NPV of new ski run is positive to $1,726,879.15 and IRR is 61%, higher than cost of

capital of 15%, henceforth; it can be advised to the management that they should select the project. Thus, by installing new ski run Downhill Ski

5

2 950400.00 0.76 718638.94

3 950288.00 0.66 624829.79

4 979468.76 0.57 560014.44

5 506451.66 0.50 251795.98

Total present value 3390879.15

Less: Initial Investment -1664000.00

Net present Value 1726879.15

Internal rate of return: It is another discounted technique at which both the total of discounted cash inflows and project cost becomes

equal. Downhill Ski Tows Pty Ltd can compute IRR to examine the attractiveness of various proposals and chose the best among all. The

selection criteria of this technique demonstrates that if IRR of the proposal is greater than its cost of capital than such project can be accepted or

vice-versa (Bennouna and et.al., 2010).. However, in case of more than one proposal, bigger IRR is considered more appropriate.

Year Cash flow

0 -1664000

1 1420940.00

2 950400.00

3 950288.00

4 979468.76

5 506451.66

Internal rate of return 61%

Interpretation:

According to the results obtained, it can be seen that NPV of new ski run is positive to $1,726,879.15 and IRR is 61%, higher than cost of

capital of 15%, henceforth; it can be advised to the management that they should select the project. Thus, by installing new ski run Downhill Ski

5

Tows Pty. Ltd can maximize their profitability and reach targets.

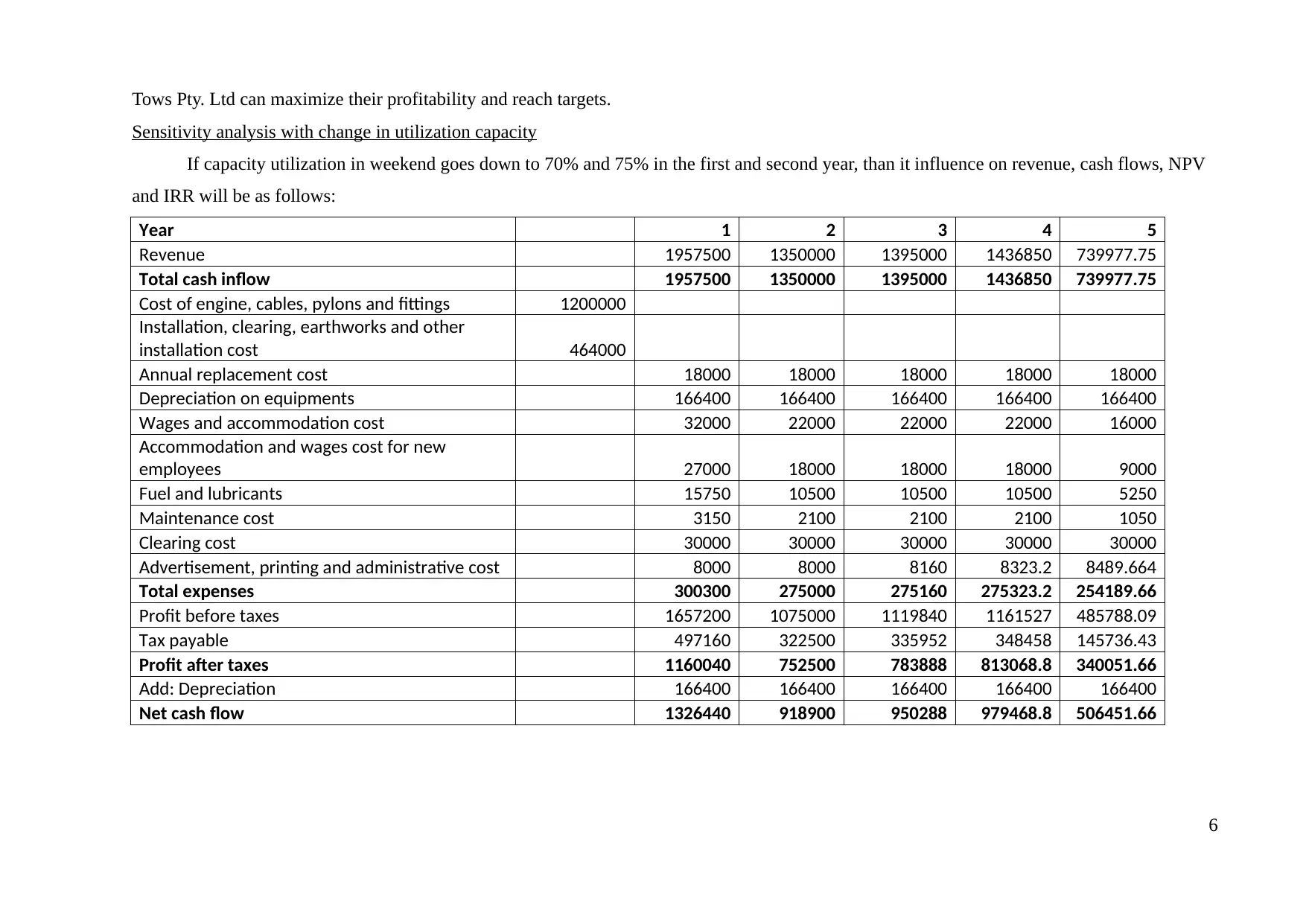

Sensitivity analysis with change in utilization capacity

If capacity utilization in weekend goes down to 70% and 75% in the first and second year, than it influence on revenue, cash flows, NPV

and IRR will be as follows:

Year 1 2 3 4 5

Revenue 1957500 1350000 1395000 1436850 739977.75

Total cash inflow 1957500 1350000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other

installation cost 464000

Annual replacement cost 18000 18000 18000 18000 18000

Depreciation on equipments 166400 166400 166400 166400 166400

Wages and accommodation cost 32000 22000 22000 22000 16000

Accommodation and wages cost for new

employees 27000 18000 18000 18000 9000

Fuel and lubricants 15750 10500 10500 10500 5250

Maintenance cost 3150 2100 2100 2100 1050

Clearing cost 30000 30000 30000 30000 30000

Advertisement, printing and administrative cost 8000 8000 8160 8323.2 8489.664

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1657200 1075000 1119840 1161527 485788.09

Tax payable 497160 322500 335952 348458 145736.43

Profit after taxes 1160040 752500 783888 813068.8 340051.66

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1326440 918900 950288 979468.8 506451.66

6

Sensitivity analysis with change in utilization capacity

If capacity utilization in weekend goes down to 70% and 75% in the first and second year, than it influence on revenue, cash flows, NPV

and IRR will be as follows:

Year 1 2 3 4 5

Revenue 1957500 1350000 1395000 1436850 739977.75

Total cash inflow 1957500 1350000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other

installation cost 464000

Annual replacement cost 18000 18000 18000 18000 18000

Depreciation on equipments 166400 166400 166400 166400 166400

Wages and accommodation cost 32000 22000 22000 22000 16000

Accommodation and wages cost for new

employees 27000 18000 18000 18000 9000

Fuel and lubricants 15750 10500 10500 10500 5250

Maintenance cost 3150 2100 2100 2100 1050

Clearing cost 30000 30000 30000 30000 30000

Advertisement, printing and administrative cost 8000 8000 8160 8323.2 8489.664

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1657200 1075000 1119840 1161527 485788.09

Tax payable 497160 322500 335952 348458 145736.43

Profit after taxes 1160040 752500 783888 813068.8 340051.66

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1326440 918900 950288 979468.8 506451.66

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Year Cash flow PV factor @ 15% Present Value

1 1326440.00 0.87 1153426.09

2 918900.00 0.76 694820.42

3 950288.00 0.66 624829.79

4 979468.76 0.57 560014.44

5 506451.66 0.50 251795.98

Total present value 3284886.71

Less: Initial Investment -1664000.00

Net present Value (NPV) 1620886.71

Year Cash flow

0 -1664000

1 1326440.00

2 918900.00

3 950288.00

4 979468.76

5 506451.66

Internal rate of return (IRR) 58%

Interpretation

Above table clearly presents that if maximum capacity utilization of skiing run decreased than NPV and IRR will be decline to

$1,620,886.71 and 58% which are adverse changes. Therefore, it can be suggested to the corporation that they need to ensure maximum

utilization of the avail capacity so that project return can be maximized.

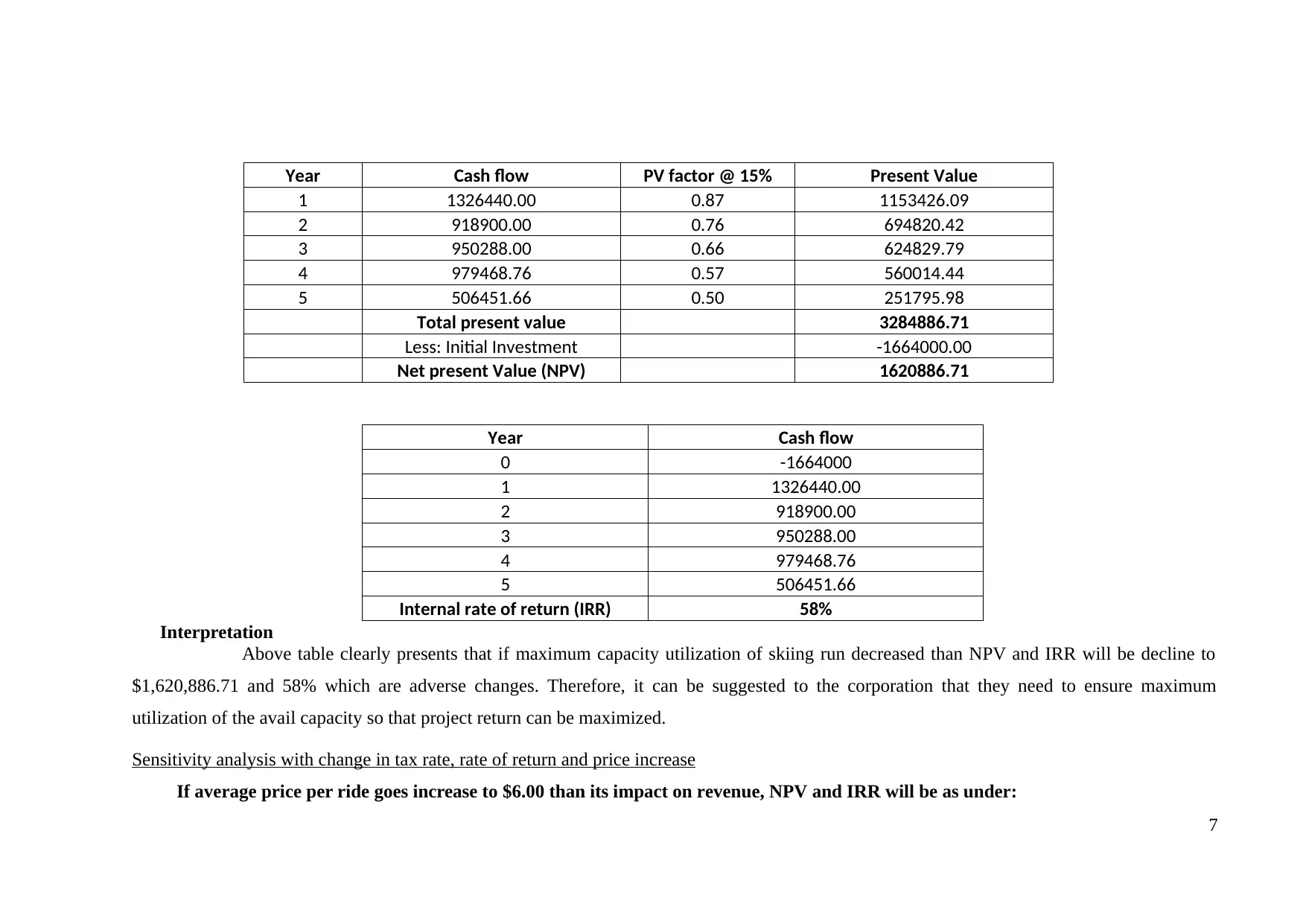

Sensitivity analysis with change in tax rate, rate of return and price increase

If average price per ride goes increase to $6.00 than its impact on revenue, NPV and IRR will be as under:

7

1 1326440.00 0.87 1153426.09

2 918900.00 0.76 694820.42

3 950288.00 0.66 624829.79

4 979468.76 0.57 560014.44

5 506451.66 0.50 251795.98

Total present value 3284886.71

Less: Initial Investment -1664000.00

Net present Value (NPV) 1620886.71

Year Cash flow

0 -1664000

1 1326440.00

2 918900.00

3 950288.00

4 979468.76

5 506451.66

Internal rate of return (IRR) 58%

Interpretation

Above table clearly presents that if maximum capacity utilization of skiing run decreased than NPV and IRR will be decline to

$1,620,886.71 and 58% which are adverse changes. Therefore, it can be suggested to the corporation that they need to ensure maximum

utilization of the avail capacity so that project return can be maximized.

Sensitivity analysis with change in tax rate, rate of return and price increase

If average price per ride goes increase to $6.00 than its impact on revenue, NPV and IRR will be as under:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Year Weeks

Demand on

weekends

Demand on

week days Total demand

Selling price per

ride Revenue

1 15 216000 202500 418500 6.00 2511000

2 10 144000 135000 279000 6.00 1674000

3 10 144000 135000 279000 6.00 1674000

4 10 144000 135000 279000 6.18 1724220

5 5 72000 67500 139500 6.37 887973.3

Year 1 2 3 4 5

Revenue 2511000 1674000 1674000 1724220 887973.3

Total cash inflow 2511000 1674000 1674000 1724220 887973.3

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other installation

cost 464000

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 2210700 1399000 1398840 1448896.8 633783.64

Tax payable 663210 419700 419652 434669.04 190135.09

Profit after taxes 1547490 979300 979188 1014227.76 443648.55

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1713890 1145700 1145588 1180627.76 610048.55

Year Cash flow

PV factor

@ 15% Present Value

1 1713890.00 0.87 1490339.13

2 1145700.00 0.76 866313.80

3 1145588.00 0.66 753242.71

4 1180627.76 0.57 675027.75

8

Demand on

weekends

Demand on

week days Total demand

Selling price per

ride Revenue

1 15 216000 202500 418500 6.00 2511000

2 10 144000 135000 279000 6.00 1674000

3 10 144000 135000 279000 6.00 1674000

4 10 144000 135000 279000 6.18 1724220

5 5 72000 67500 139500 6.37 887973.3

Year 1 2 3 4 5

Revenue 2511000 1674000 1674000 1724220 887973.3

Total cash inflow 2511000 1674000 1674000 1724220 887973.3

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other installation

cost 464000

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 2210700 1399000 1398840 1448896.8 633783.64

Tax payable 663210 419700 419652 434669.04 190135.09

Profit after taxes 1547490 979300 979188 1014227.76 443648.55

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1713890 1145700 1145588 1180627.76 610048.55

Year Cash flow

PV factor

@ 15% Present Value

1 1713890.00 0.87 1490339.13

2 1145700.00 0.76 866313.80

3 1145588.00 0.66 753242.71

4 1180627.76 0.57 675027.75

8

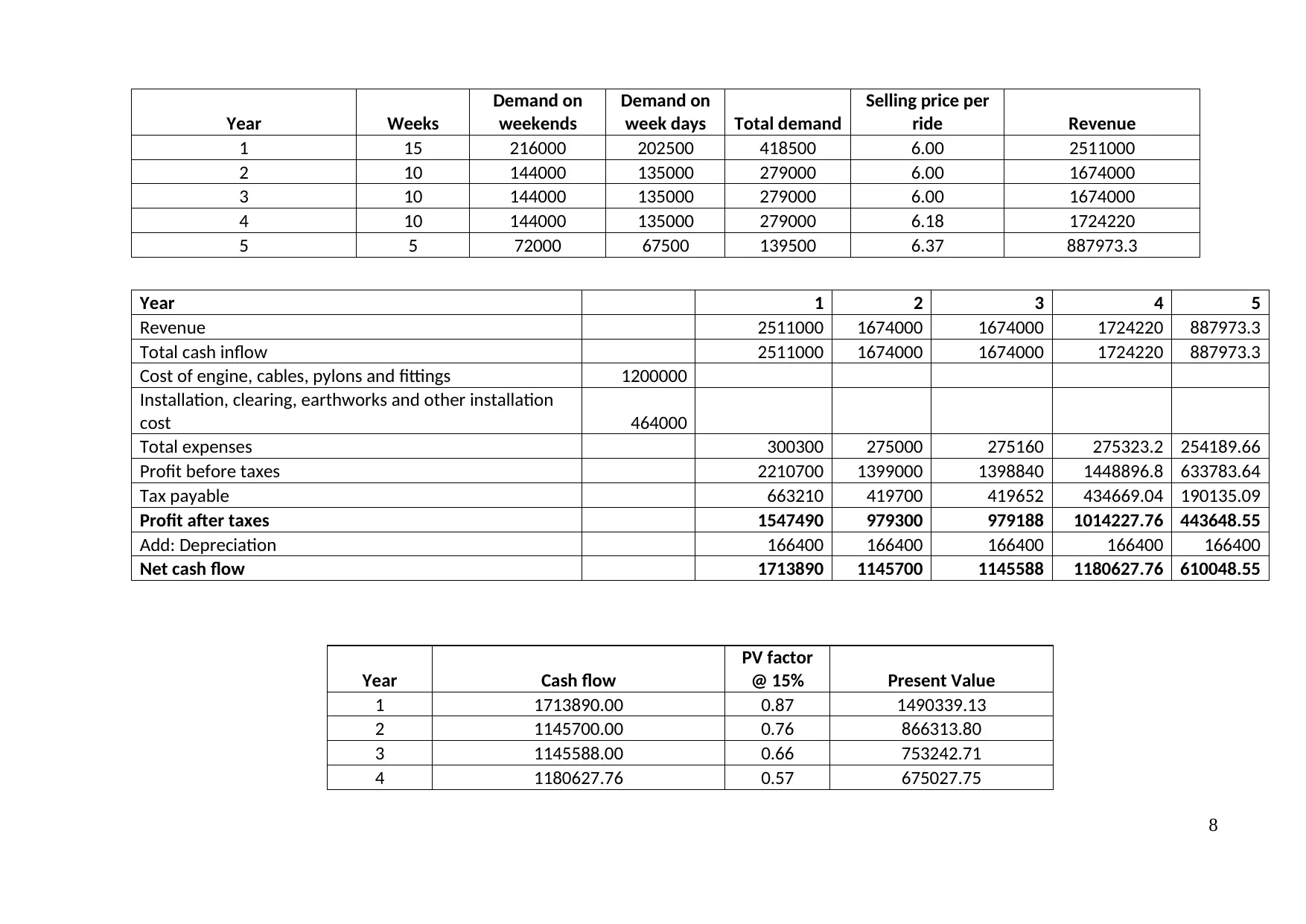

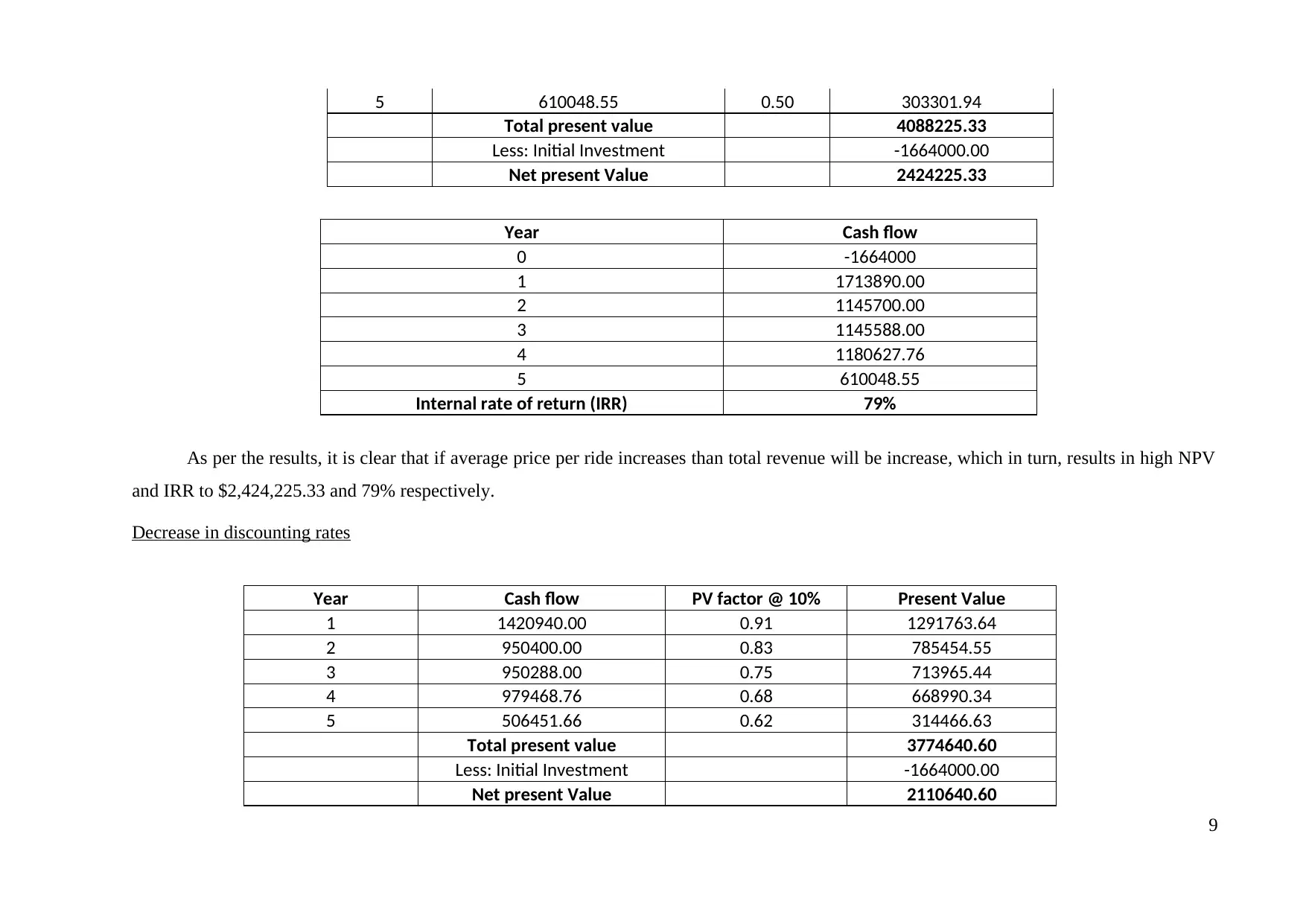

5 610048.55 0.50 303301.94

Total present value 4088225.33

Less: Initial Investment -1664000.00

Net present Value 2424225.33

Year Cash flow

0 -1664000

1 1713890.00

2 1145700.00

3 1145588.00

4 1180627.76

5 610048.55

Internal rate of return (IRR) 79%

As per the results, it is clear that if average price per ride increases than total revenue will be increase, which in turn, results in high NPV

and IRR to $2,424,225.33 and 79% respectively.

Decrease in discounting rates

Year Cash flow PV factor @ 10% Present Value

1 1420940.00 0.91 1291763.64

2 950400.00 0.83 785454.55

3 950288.00 0.75 713965.44

4 979468.76 0.68 668990.34

5 506451.66 0.62 314466.63

Total present value 3774640.60

Less: Initial Investment -1664000.00

Net present Value 2110640.60

9

Total present value 4088225.33

Less: Initial Investment -1664000.00

Net present Value 2424225.33

Year Cash flow

0 -1664000

1 1713890.00

2 1145700.00

3 1145588.00

4 1180627.76

5 610048.55

Internal rate of return (IRR) 79%

As per the results, it is clear that if average price per ride increases than total revenue will be increase, which in turn, results in high NPV

and IRR to $2,424,225.33 and 79% respectively.

Decrease in discounting rates

Year Cash flow PV factor @ 10% Present Value

1 1420940.00 0.91 1291763.64

2 950400.00 0.83 785454.55

3 950288.00 0.75 713965.44

4 979468.76 0.68 668990.34

5 506451.66 0.62 314466.63

Total present value 3774640.60

Less: Initial Investment -1664000.00

Net present Value 2110640.60

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

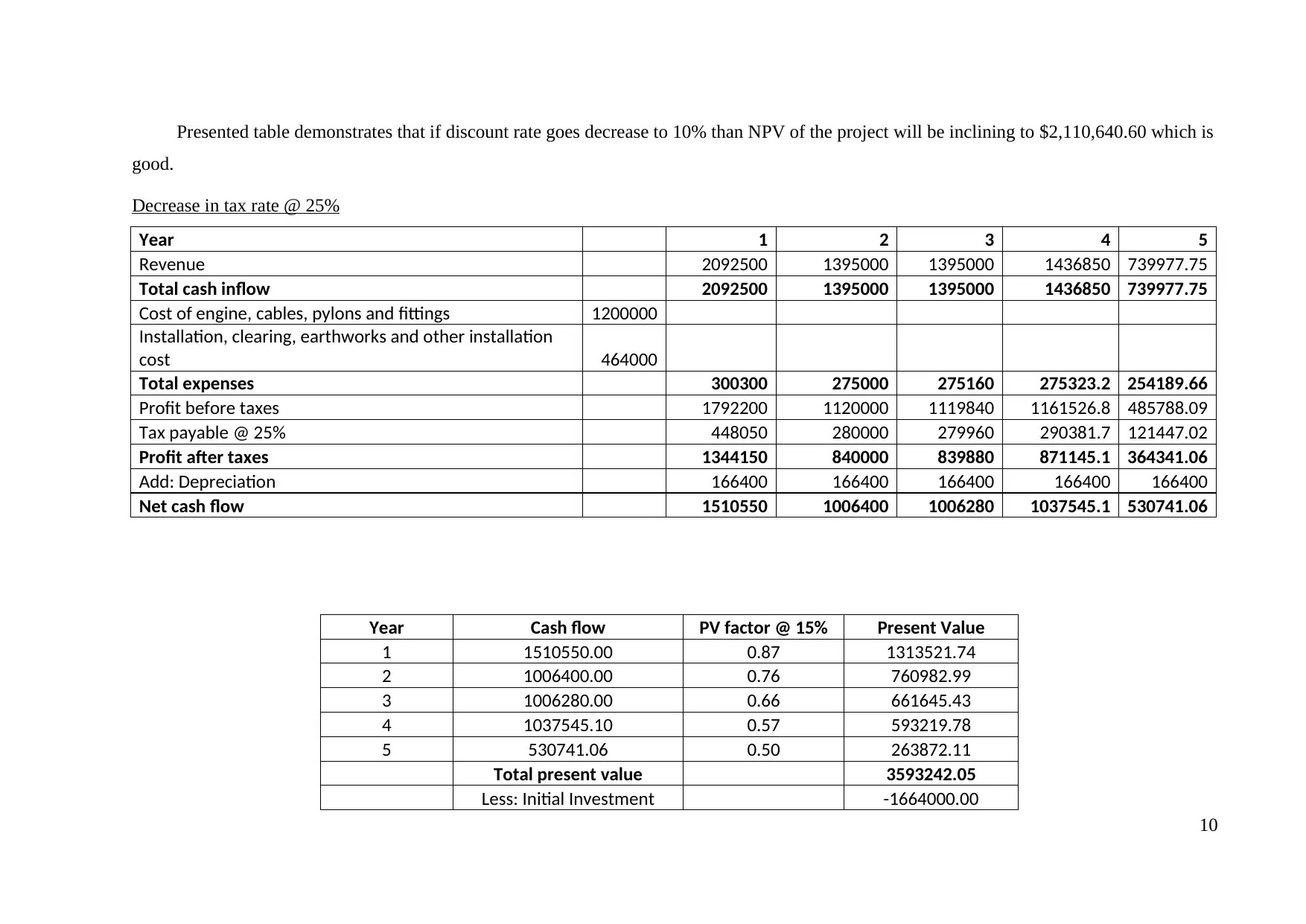

Presented table demonstrates that if discount rate goes decrease to 10% than NPV of the project will be inclining to $2,110,640.60 which is

good.

Decrease in tax rate @ 25%

Year 1 2 3 4 5

Revenue 2092500 1395000 1395000 1436850 739977.75

Total cash inflow 2092500 1395000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other installation

cost 464000

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1792200 1120000 1119840 1161526.8 485788.09

Tax payable @ 25% 448050 280000 279960 290381.7 121447.02

Profit after taxes 1344150 840000 839880 871145.1 364341.06

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1510550 1006400 1006280 1037545.1 530741.06

Year Cash flow PV factor @ 15% Present Value

1 1510550.00 0.87 1313521.74

2 1006400.00 0.76 760982.99

3 1006280.00 0.66 661645.43

4 1037545.10 0.57 593219.78

5 530741.06 0.50 263872.11

Total present value 3593242.05

Less: Initial Investment -1664000.00

10

good.

Decrease in tax rate @ 25%

Year 1 2 3 4 5

Revenue 2092500 1395000 1395000 1436850 739977.75

Total cash inflow 2092500 1395000 1395000 1436850 739977.75

Cost of engine, cables, pylons and fittings 1200000

Installation, clearing, earthworks and other installation

cost 464000

Total expenses 300300 275000 275160 275323.2 254189.66

Profit before taxes 1792200 1120000 1119840 1161526.8 485788.09

Tax payable @ 25% 448050 280000 279960 290381.7 121447.02

Profit after taxes 1344150 840000 839880 871145.1 364341.06

Add: Depreciation 166400 166400 166400 166400 166400

Net cash flow 1510550 1006400 1006280 1037545.1 530741.06

Year Cash flow PV factor @ 15% Present Value

1 1510550.00 0.87 1313521.74

2 1006400.00 0.76 760982.99

3 1006280.00 0.66 661645.43

4 1037545.10 0.57 593219.78

5 530741.06 0.50 263872.11

Total present value 3593242.05

Less: Initial Investment -1664000.00

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

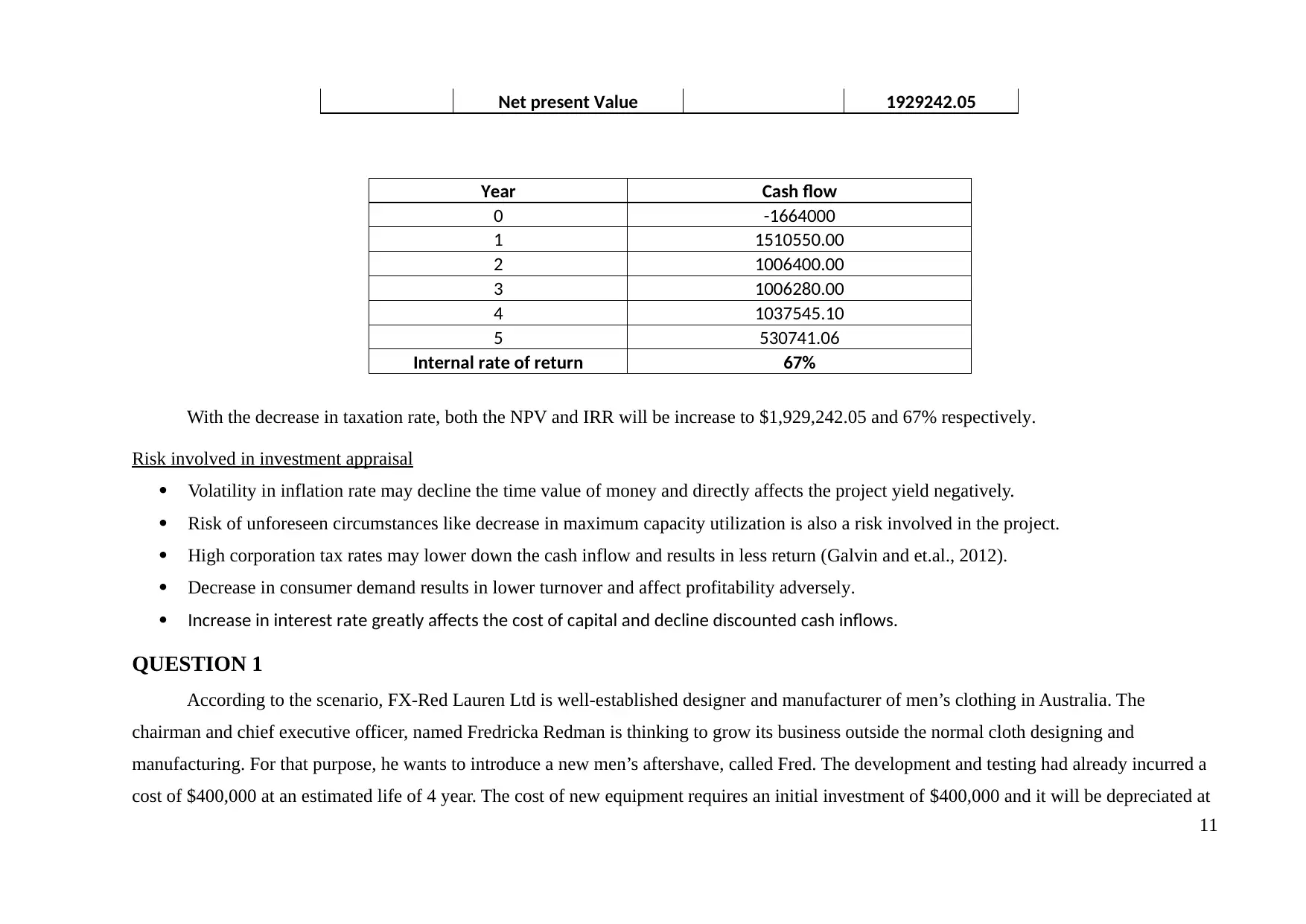

Net present Value 1929242.05

Year Cash flow

0 -1664000

1 1510550.00

2 1006400.00

3 1006280.00

4 1037545.10

5 530741.06

Internal rate of return 67%

With the decrease in taxation rate, both the NPV and IRR will be increase to $1,929,242.05 and 67% respectively.

Risk involved in investment appraisal

Volatility in inflation rate may decline the time value of money and directly affects the project yield negatively.

Risk of unforeseen circumstances like decrease in maximum capacity utilization is also a risk involved in the project.

High corporation tax rates may lower down the cash inflow and results in less return (Galvin and et.al., 2012).

Decrease in consumer demand results in lower turnover and affect profitability adversely.

Increase in interest rate greatly affects the cost of capital and decline discounted cash inflows.

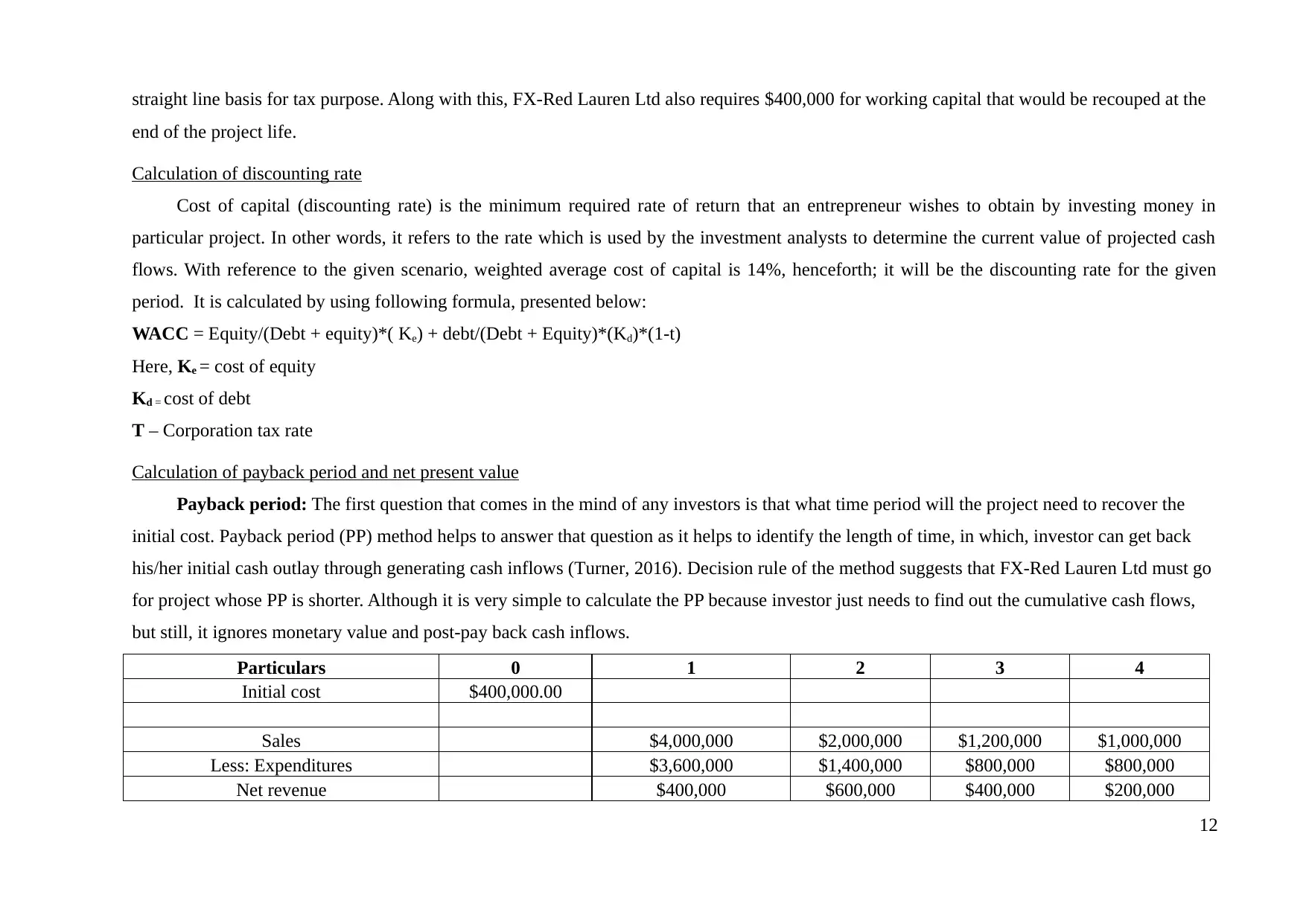

QUESTION 1

According to the scenario, FX-Red Lauren Ltd is well-established designer and manufacturer of men’s clothing in Australia. The

chairman and chief executive officer, named Fredricka Redman is thinking to grow its business outside the normal cloth designing and

manufacturing. For that purpose, he wants to introduce a new men’s aftershave, called Fred. The development and testing had already incurred a

cost of $400,000 at an estimated life of 4 year. The cost of new equipment requires an initial investment of $400,000 and it will be depreciated at

11

Year Cash flow

0 -1664000

1 1510550.00

2 1006400.00

3 1006280.00

4 1037545.10

5 530741.06

Internal rate of return 67%

With the decrease in taxation rate, both the NPV and IRR will be increase to $1,929,242.05 and 67% respectively.

Risk involved in investment appraisal

Volatility in inflation rate may decline the time value of money and directly affects the project yield negatively.

Risk of unforeseen circumstances like decrease in maximum capacity utilization is also a risk involved in the project.

High corporation tax rates may lower down the cash inflow and results in less return (Galvin and et.al., 2012).

Decrease in consumer demand results in lower turnover and affect profitability adversely.

Increase in interest rate greatly affects the cost of capital and decline discounted cash inflows.

QUESTION 1

According to the scenario, FX-Red Lauren Ltd is well-established designer and manufacturer of men’s clothing in Australia. The

chairman and chief executive officer, named Fredricka Redman is thinking to grow its business outside the normal cloth designing and

manufacturing. For that purpose, he wants to introduce a new men’s aftershave, called Fred. The development and testing had already incurred a

cost of $400,000 at an estimated life of 4 year. The cost of new equipment requires an initial investment of $400,000 and it will be depreciated at

11

straight line basis for tax purpose. Along with this, FX-Red Lauren Ltd also requires $400,000 for working capital that would be recouped at the

end of the project life.

Calculation of discounting rate

Cost of capital (discounting rate) is the minimum required rate of return that an entrepreneur wishes to obtain by investing money in

particular project. In other words, it refers to the rate which is used by the investment analysts to determine the current value of projected cash

flows. With reference to the given scenario, weighted average cost of capital is 14%, henceforth; it will be the discounting rate for the given

period. It is calculated by using following formula, presented below:

WACC = Equity/(Debt + equity)*( Ke) + debt/(Debt + Equity)*(Kd)*(1-t)

Here, Ke = cost of equity

Kd = cost of debt

T – Corporation tax rate

Calculation of payback period and net present value

Payback period: The first question that comes in the mind of any investors is that what time period will the project need to recover the

initial cost. Payback period (PP) method helps to answer that question as it helps to identify the length of time, in which, investor can get back

his/her initial cash outlay through generating cash inflows (Turner, 2016). Decision rule of the method suggests that FX-Red Lauren Ltd must go

for project whose PP is shorter. Although it is very simple to calculate the PP because investor just needs to find out the cumulative cash flows,

but still, it ignores monetary value and post-pay back cash inflows.

Particulars 0 1 2 3 4

Initial cost $400,000.00

Sales $4,000,000 $2,000,000 $1,200,000 $1,000,000

Less: Expenditures $3,600,000 $1,400,000 $800,000 $800,000

Net revenue $400,000 $600,000 $400,000 $200,000

12

end of the project life.

Calculation of discounting rate

Cost of capital (discounting rate) is the minimum required rate of return that an entrepreneur wishes to obtain by investing money in

particular project. In other words, it refers to the rate which is used by the investment analysts to determine the current value of projected cash

flows. With reference to the given scenario, weighted average cost of capital is 14%, henceforth; it will be the discounting rate for the given

period. It is calculated by using following formula, presented below:

WACC = Equity/(Debt + equity)*( Ke) + debt/(Debt + Equity)*(Kd)*(1-t)

Here, Ke = cost of equity

Kd = cost of debt

T – Corporation tax rate

Calculation of payback period and net present value

Payback period: The first question that comes in the mind of any investors is that what time period will the project need to recover the

initial cost. Payback period (PP) method helps to answer that question as it helps to identify the length of time, in which, investor can get back

his/her initial cash outlay through generating cash inflows (Turner, 2016). Decision rule of the method suggests that FX-Red Lauren Ltd must go

for project whose PP is shorter. Although it is very simple to calculate the PP because investor just needs to find out the cumulative cash flows,

but still, it ignores monetary value and post-pay back cash inflows.

Particulars 0 1 2 3 4

Initial cost $400,000.00

Sales $4,000,000 $2,000,000 $1,200,000 $1,000,000

Less: Expenditures $3,600,000 $1,400,000 $800,000 $800,000

Net revenue $400,000 $600,000 $400,000 $200,000

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.