Investment Appraisal Techniques: A Case Study of Victoria Babies Ltd

VerifiedAdded on 2023/03/21

|29

|1953

|20

Report

AI Summary

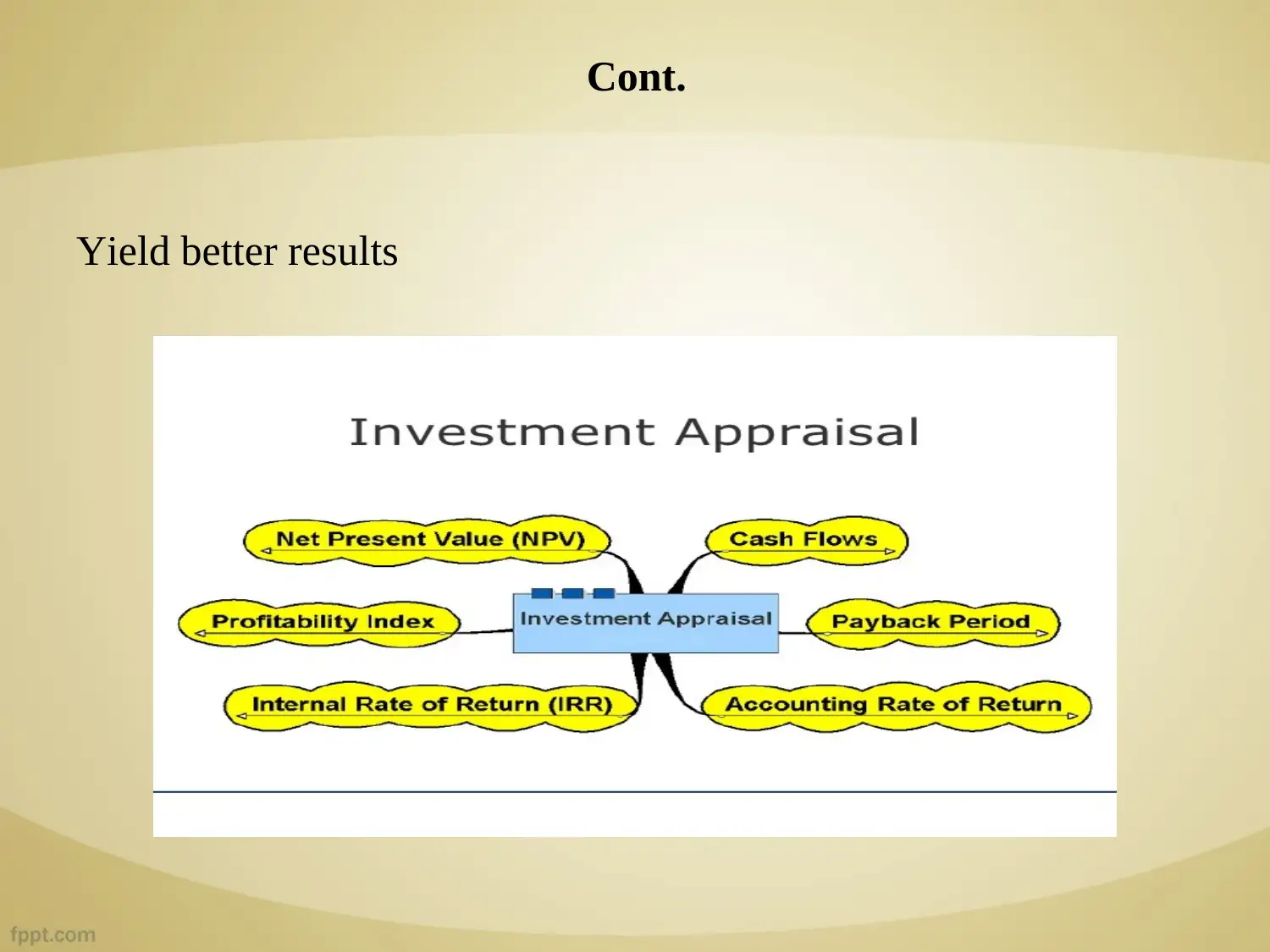

This report provides a comprehensive analysis of investment appraisal techniques, including Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Accounting Rate of Return (ARR). It discusses the advantages and disadvantages of each technique, highlighting their importance in making informed investment decisions. The report applies these techniques to a case study of Victoria Babies Ltd, which is considering various expansion options. Through detailed calculations and findings, the report recommends the most suitable investment option based on the appraisal results, emphasizing the significance of positive NPV and higher IRR for maximizing profitability and shareholder value. The analysis incorporates discounted cash flow methods and considers the time value of money to provide a robust evaluation of potential investment projects.

1 out of 29

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)