Investment Decision: NPV, IRR, MIRR, Payback Analysis for Alternatives

VerifiedAdded on 2023/06/15

|9

|1109

|470

Report

AI Summary

This report provides a detailed financial analysis of two investment alternatives, focusing on calculating and interpreting key metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), Modified Internal Rate of Return (MIRR), payback period, and discounted payback period. The analysis involves projecting revenues, expenses, depreciation, and taxes for each alternative over a five-year period to determine cash flows. The report concludes that Alternative 2 is the more favorable investment option due to its higher NPV ($30,054.92 vs. $26,153.26), higher IRR (22% vs. 19%), and shorter payback periods (2.12 years vs. 3.15 years, and 2.70 years vs 3.82 years for discounted payback). The report recommends that Clark Upholstery Company adopt Alternative 2 to maximize returns and increase revenue, aligning with investment appraisal techniques that support higher profitability.

\Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Authors Note:

Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

1

Table of Contents

1. Finding NPV, IRR, MIRR, payback and discounted payback for both the alternatives:......2

2. Explaining which alternative should be chosen for investment:............................................6

Reference:..................................................................................................................................8

1

Table of Contents

1. Finding NPV, IRR, MIRR, payback and discounted payback for both the alternatives:......2

2. Explaining which alternative should be chosen for investment:............................................6

Reference:..................................................................................................................................8

FINANCE

2

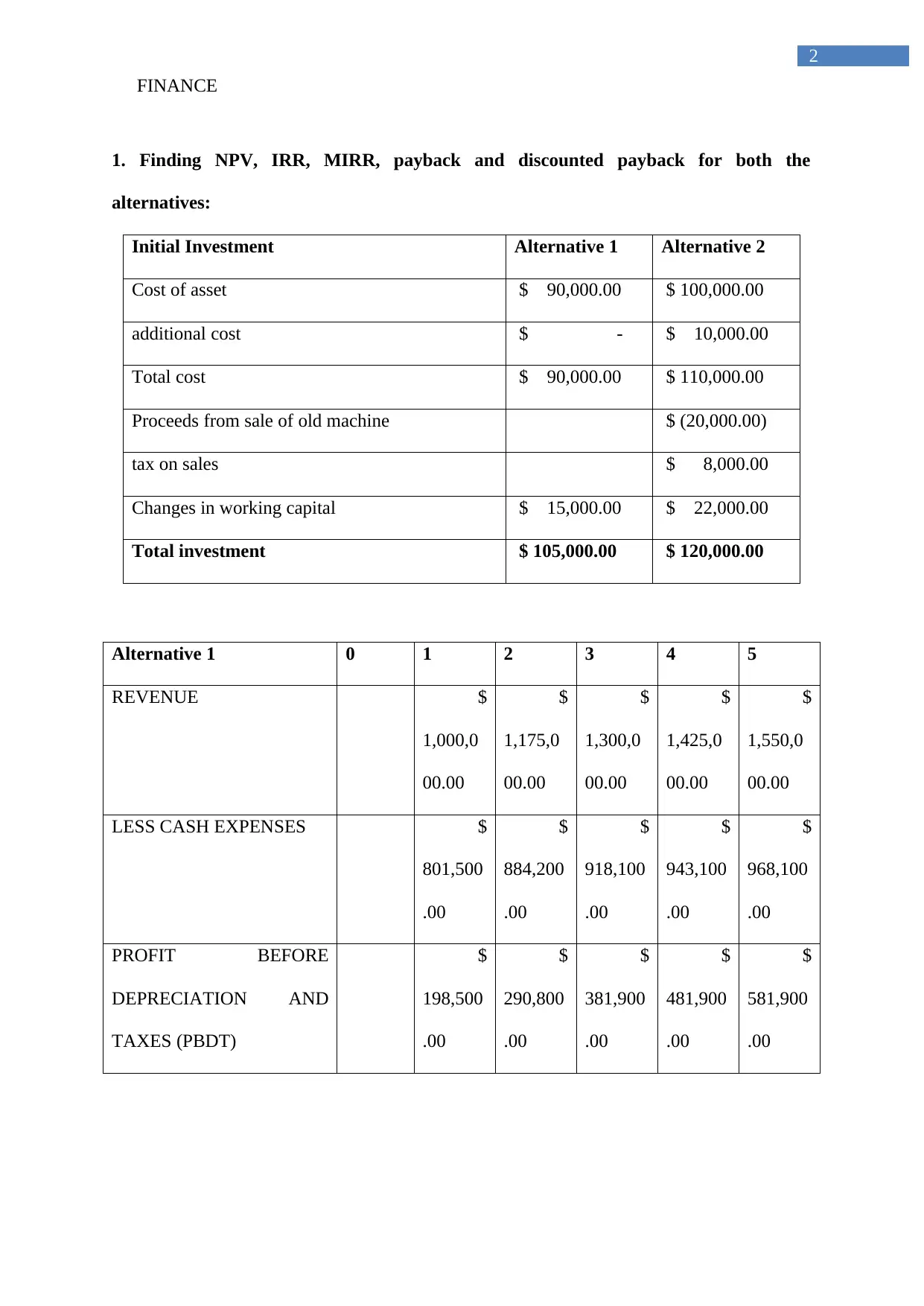

1. Finding NPV, IRR, MIRR, payback and discounted payback for both the

alternatives:

Initial Investment Alternative 1 Alternative 2

Cost of asset $ 90,000.00 $ 100,000.00

additional cost $ - $ 10,000.00

Total cost $ 90,000.00 $ 110,000.00

Proceeds from sale of old machine $ (20,000.00)

tax on sales $ 8,000.00

Changes in working capital $ 15,000.00 $ 22,000.00

Total investment $ 105,000.00 $ 120,000.00

Alternative 1 0 1 2 3 4 5

REVENUE $

1,000,0

00.00

$

1,175,0

00.00

$

1,300,0

00.00

$

1,425,0

00.00

$

1,550,0

00.00

LESS CASH EXPENSES $

801,500

.00

$

884,200

.00

$

918,100

.00

$

943,100

.00

$

968,100

.00

PROFIT BEFORE

DEPRECIATION AND

TAXES (PBDT)

$

198,500

.00

$

290,800

.00

$

381,900

.00

$

481,900

.00

$

581,900

.00

2

1. Finding NPV, IRR, MIRR, payback and discounted payback for both the

alternatives:

Initial Investment Alternative 1 Alternative 2

Cost of asset $ 90,000.00 $ 100,000.00

additional cost $ - $ 10,000.00

Total cost $ 90,000.00 $ 110,000.00

Proceeds from sale of old machine $ (20,000.00)

tax on sales $ 8,000.00

Changes in working capital $ 15,000.00 $ 22,000.00

Total investment $ 105,000.00 $ 120,000.00

Alternative 1 0 1 2 3 4 5

REVENUE $

1,000,0

00.00

$

1,175,0

00.00

$

1,300,0

00.00

$

1,425,0

00.00

$

1,550,0

00.00

LESS CASH EXPENSES $

801,500

.00

$

884,200

.00

$

918,100

.00

$

943,100

.00

$

968,100

.00

PROFIT BEFORE

DEPRECIATION AND

TAXES (PBDT)

$

198,500

.00

$

290,800

.00

$

381,900

.00

$

481,900

.00

$

581,900

.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

3

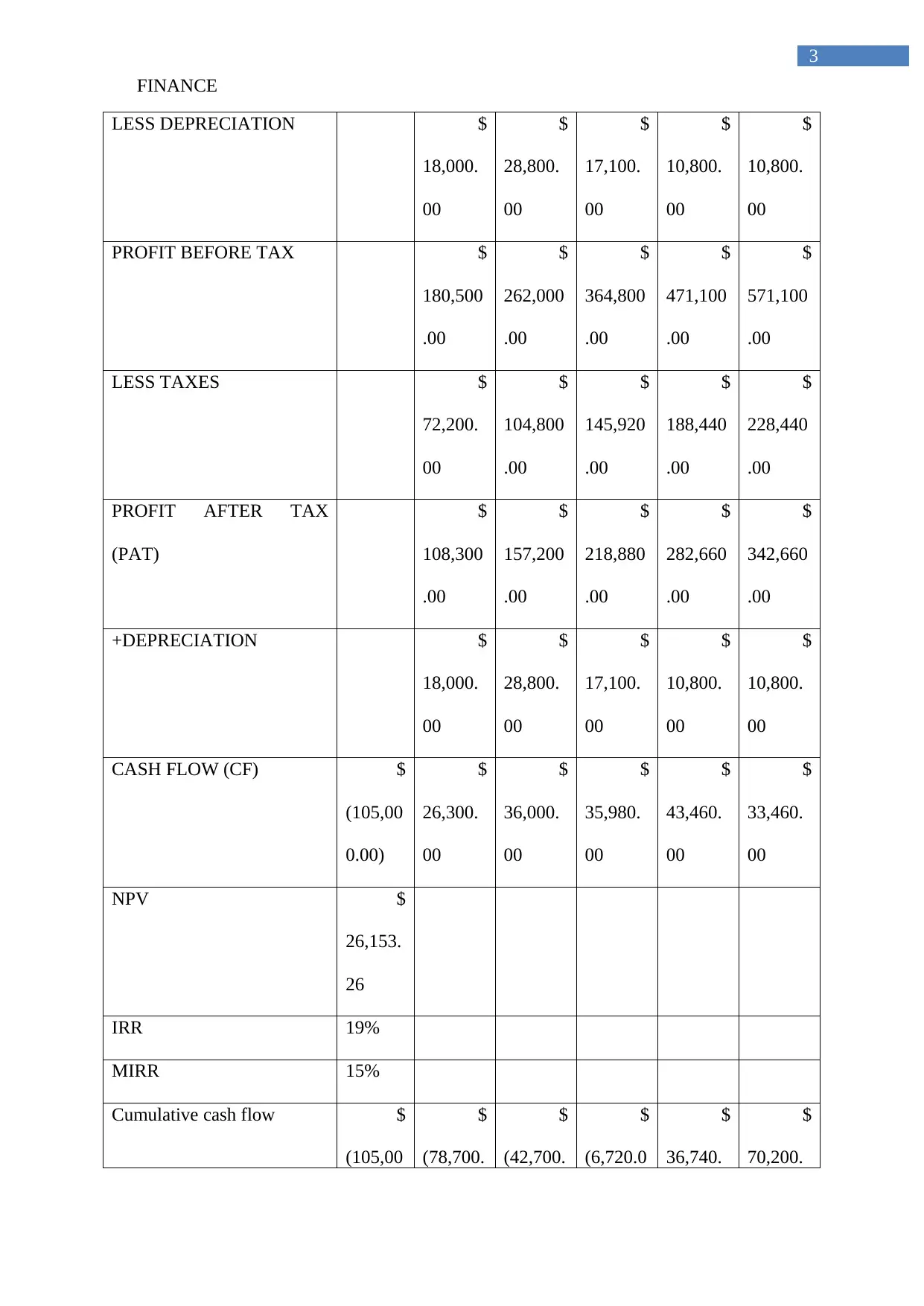

LESS DEPRECIATION $

18,000.

00

$

28,800.

00

$

17,100.

00

$

10,800.

00

$

10,800.

00

PROFIT BEFORE TAX $

180,500

.00

$

262,000

.00

$

364,800

.00

$

471,100

.00

$

571,100

.00

LESS TAXES $

72,200.

00

$

104,800

.00

$

145,920

.00

$

188,440

.00

$

228,440

.00

PROFIT AFTER TAX

(PAT)

$

108,300

.00

$

157,200

.00

$

218,880

.00

$

282,660

.00

$

342,660

.00

+DEPRECIATION $

18,000.

00

$

28,800.

00

$

17,100.

00

$

10,800.

00

$

10,800.

00

CASH FLOW (CF) $

(105,00

0.00)

$

26,300.

00

$

36,000.

00

$

35,980.

00

$

43,460.

00

$

33,460.

00

NPV $

26,153.

26

IRR 19%

MIRR 15%

Cumulative cash flow $

(105,00

$

(78,700.

$

(42,700.

$

(6,720.0

$

36,740.

$

70,200.

3

LESS DEPRECIATION $

18,000.

00

$

28,800.

00

$

17,100.

00

$

10,800.

00

$

10,800.

00

PROFIT BEFORE TAX $

180,500

.00

$

262,000

.00

$

364,800

.00

$

471,100

.00

$

571,100

.00

LESS TAXES $

72,200.

00

$

104,800

.00

$

145,920

.00

$

188,440

.00

$

228,440

.00

PROFIT AFTER TAX

(PAT)

$

108,300

.00

$

157,200

.00

$

218,880

.00

$

282,660

.00

$

342,660

.00

+DEPRECIATION $

18,000.

00

$

28,800.

00

$

17,100.

00

$

10,800.

00

$

10,800.

00

CASH FLOW (CF) $

(105,00

0.00)

$

26,300.

00

$

36,000.

00

$

35,980.

00

$

43,460.

00

$

33,460.

00

NPV $

26,153.

26

IRR 19%

MIRR 15%

Cumulative cash flow $

(105,00

$

(78,700.

$

(42,700.

$

(6,720.0

$

36,740.

$

70,200.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

4

0.00) 00) 00) 0) 00 00

Payback period

3.15

Discounting rate

1.00 0.91 0.83 0.75 0.68 0.62

Dis cash flow (105

,000.00

)

2

3,909.0

9

2

9,752.0

7

2

7,032.3

1

2

9,683.7

6

2

0,776.0

3

Dis cumulative cash flow (105

,000.00

)

(8

1,090.9

1)

(5

1,338.8

4)

(2

4,306.5

4)

5,377.2

3

2

6,153.2

6

Discounted payback period

3.82

Alternative 2 0 1 2 3 4 5

REVENUE $

1,000,0

00.00

$

1,175,0

00.00

$

1,300,0

00.00

$

1,425,0

00.00

$

1,550,0

00.00

LESS CASH EXPENSES $

764,500

.00

$

839,900

.00

$

914,900

.00

$

989,900

.00

$

998,900

.00

PROFIT BEFORE

DEPRECIATION AND

TAXES (PBDT)

$

235,500

.00

$

335,100

.00

$

385,100

.00

$

435,100

.00

$

551,100

.00

4

0.00) 00) 00) 0) 00 00

Payback period

3.15

Discounting rate

1.00 0.91 0.83 0.75 0.68 0.62

Dis cash flow (105

,000.00

)

2

3,909.0

9

2

9,752.0

7

2

7,032.3

1

2

9,683.7

6

2

0,776.0

3

Dis cumulative cash flow (105

,000.00

)

(8

1,090.9

1)

(5

1,338.8

4)

(2

4,306.5

4)

5,377.2

3

2

6,153.2

6

Discounted payback period

3.82

Alternative 2 0 1 2 3 4 5

REVENUE $

1,000,0

00.00

$

1,175,0

00.00

$

1,300,0

00.00

$

1,425,0

00.00

$

1,550,0

00.00

LESS CASH EXPENSES $

764,500

.00

$

839,900

.00

$

914,900

.00

$

989,900

.00

$

998,900

.00

PROFIT BEFORE

DEPRECIATION AND

TAXES (PBDT)

$

235,500

.00

$

335,100

.00

$

385,100

.00

$

435,100

.00

$

551,100

.00

FINANCE

5

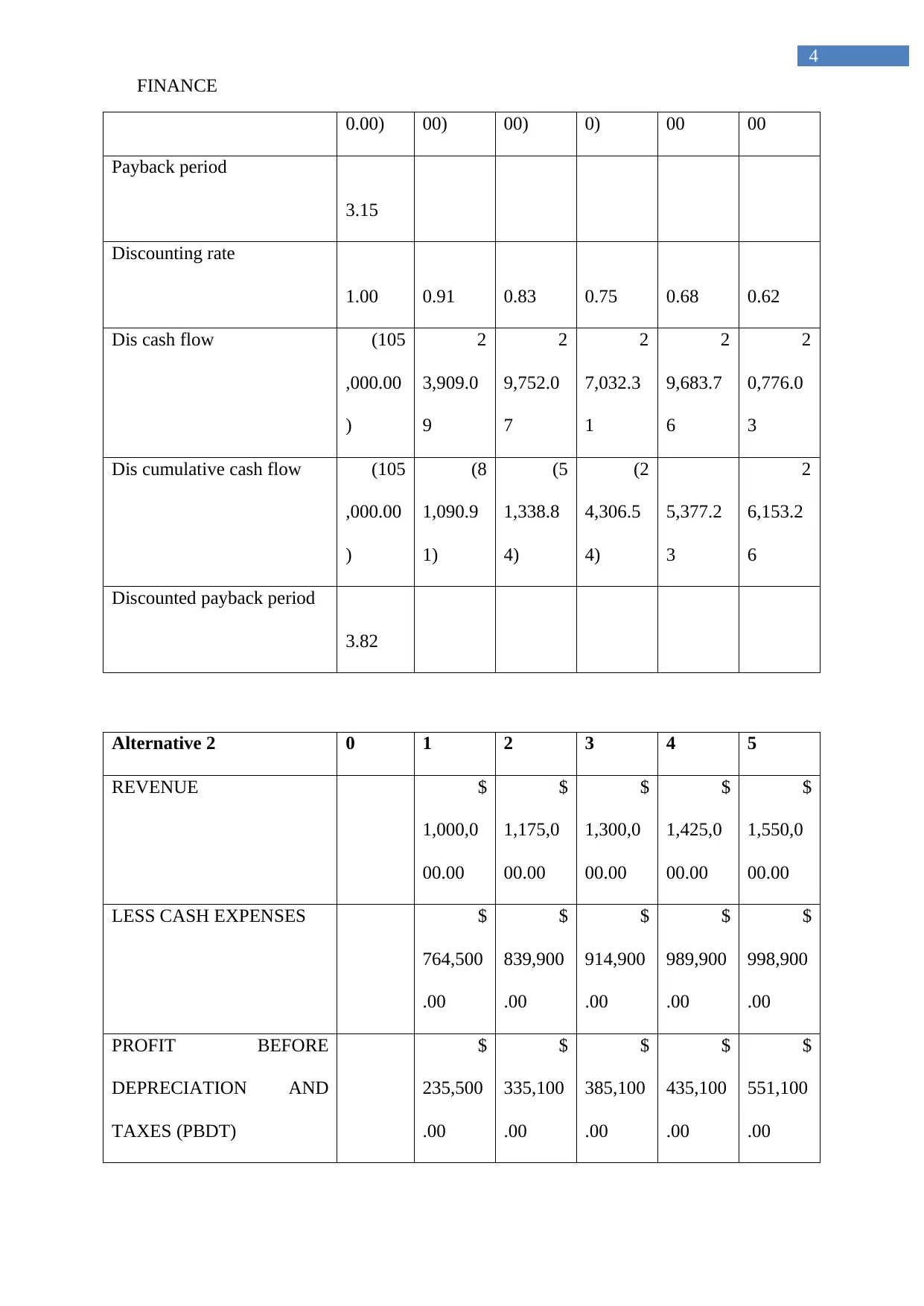

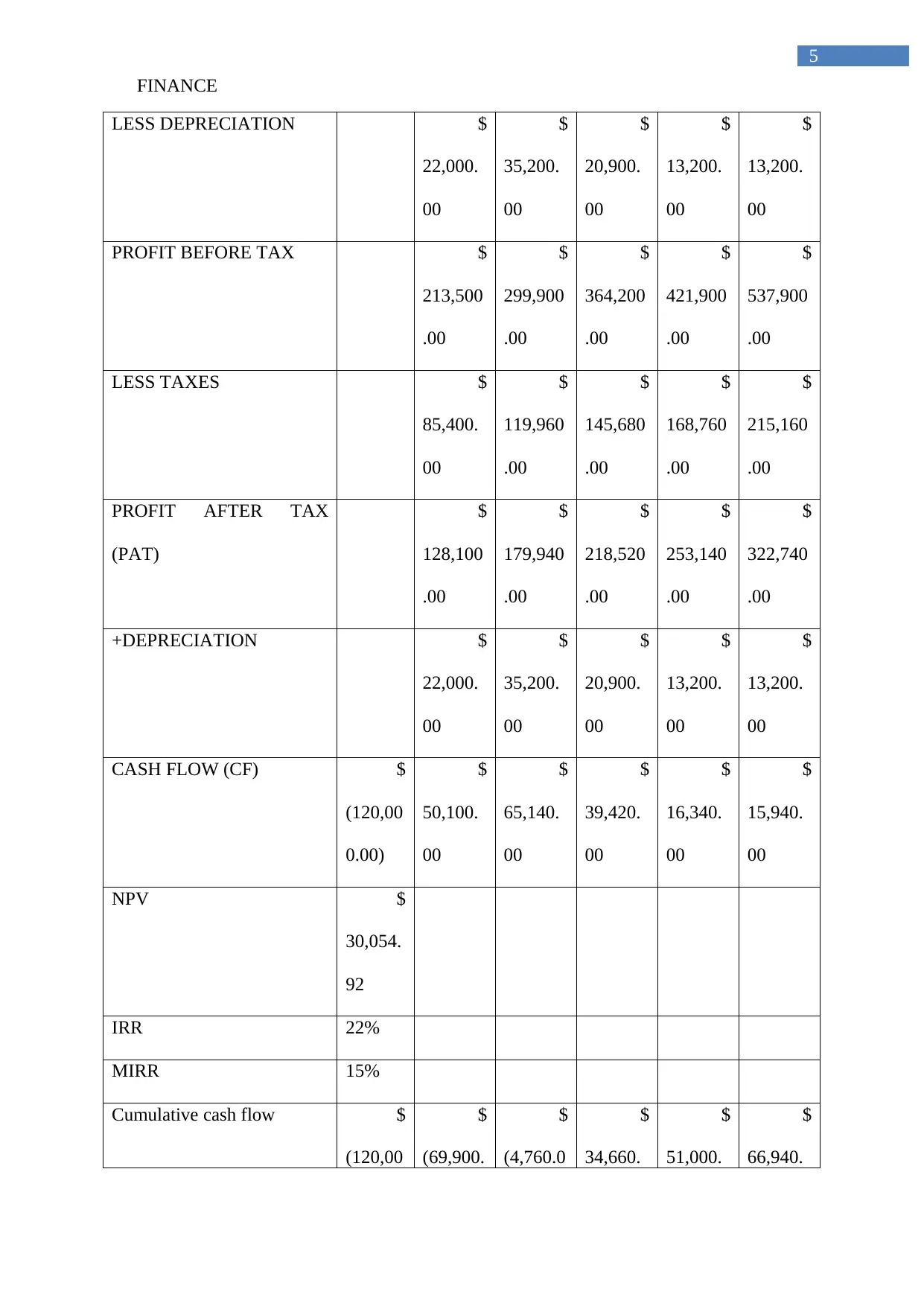

LESS DEPRECIATION $

22,000.

00

$

35,200.

00

$

20,900.

00

$

13,200.

00

$

13,200.

00

PROFIT BEFORE TAX $

213,500

.00

$

299,900

.00

$

364,200

.00

$

421,900

.00

$

537,900

.00

LESS TAXES $

85,400.

00

$

119,960

.00

$

145,680

.00

$

168,760

.00

$

215,160

.00

PROFIT AFTER TAX

(PAT)

$

128,100

.00

$

179,940

.00

$

218,520

.00

$

253,140

.00

$

322,740

.00

+DEPRECIATION $

22,000.

00

$

35,200.

00

$

20,900.

00

$

13,200.

00

$

13,200.

00

CASH FLOW (CF) $

(120,00

0.00)

$

50,100.

00

$

65,140.

00

$

39,420.

00

$

16,340.

00

$

15,940.

00

NPV $

30,054.

92

IRR 22%

MIRR 15%

Cumulative cash flow $

(120,00

$

(69,900.

$

(4,760.0

$

34,660.

$

51,000.

$

66,940.

5

LESS DEPRECIATION $

22,000.

00

$

35,200.

00

$

20,900.

00

$

13,200.

00

$

13,200.

00

PROFIT BEFORE TAX $

213,500

.00

$

299,900

.00

$

364,200

.00

$

421,900

.00

$

537,900

.00

LESS TAXES $

85,400.

00

$

119,960

.00

$

145,680

.00

$

168,760

.00

$

215,160

.00

PROFIT AFTER TAX

(PAT)

$

128,100

.00

$

179,940

.00

$

218,520

.00

$

253,140

.00

$

322,740

.00

+DEPRECIATION $

22,000.

00

$

35,200.

00

$

20,900.

00

$

13,200.

00

$

13,200.

00

CASH FLOW (CF) $

(120,00

0.00)

$

50,100.

00

$

65,140.

00

$

39,420.

00

$

16,340.

00

$

15,940.

00

NPV $

30,054.

92

IRR 22%

MIRR 15%

Cumulative cash flow $

(120,00

$

(69,900.

$

(4,760.0

$

34,660.

$

51,000.

$

66,940.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

6

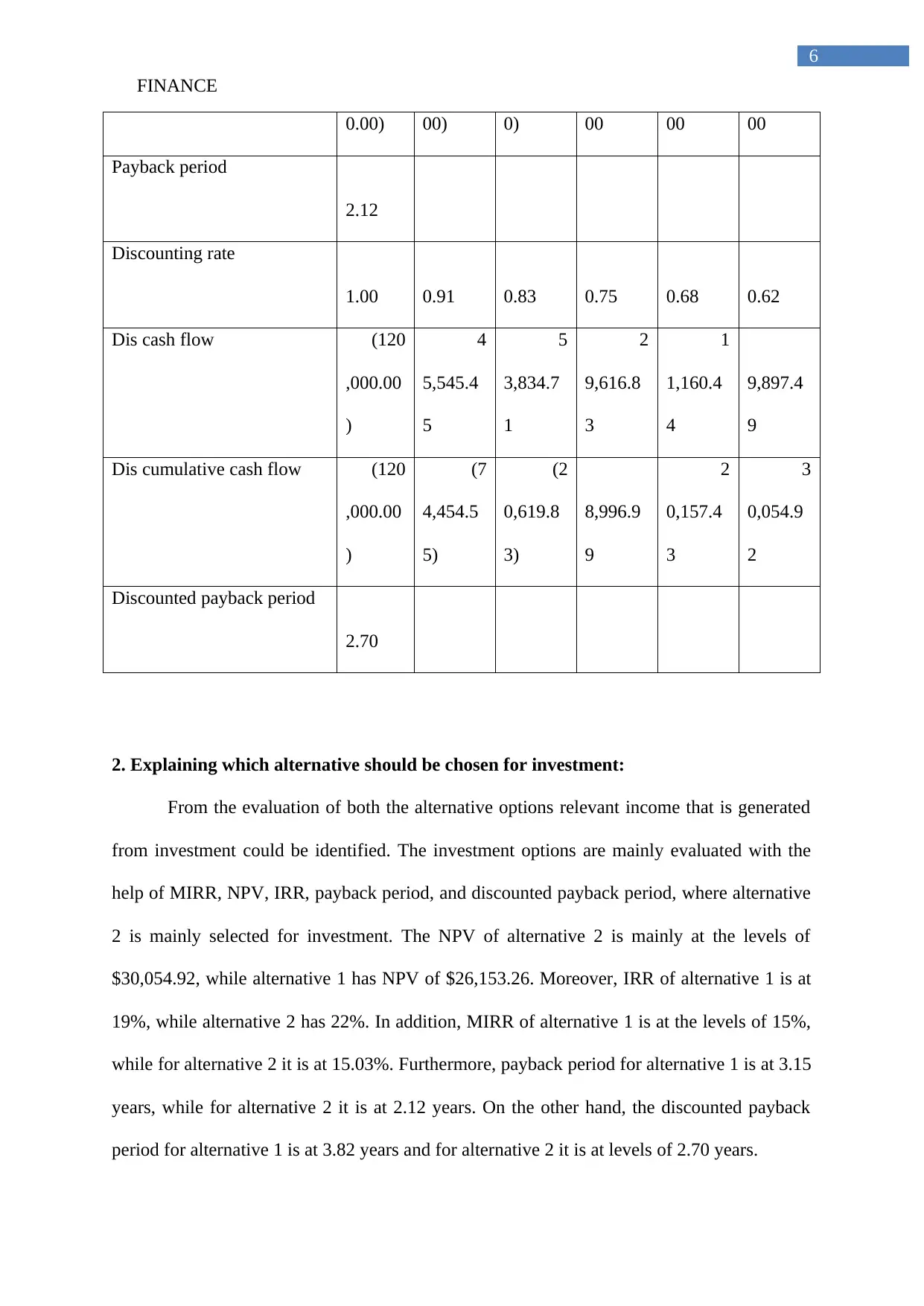

0.00) 00) 0) 00 00 00

Payback period

2.12

Discounting rate

1.00 0.91 0.83 0.75 0.68 0.62

Dis cash flow (120

,000.00

)

4

5,545.4

5

5

3,834.7

1

2

9,616.8

3

1

1,160.4

4

9,897.4

9

Dis cumulative cash flow (120

,000.00

)

(7

4,454.5

5)

(2

0,619.8

3)

8,996.9

9

2

0,157.4

3

3

0,054.9

2

Discounted payback period

2.70

2. Explaining which alternative should be chosen for investment:

From the evaluation of both the alternative options relevant income that is generated

from investment could be identified. The investment options are mainly evaluated with the

help of MIRR, NPV, IRR, payback period, and discounted payback period, where alternative

2 is mainly selected for investment. The NPV of alternative 2 is mainly at the levels of

$30,054.92, while alternative 1 has NPV of $26,153.26. Moreover, IRR of alternative 1 is at

19%, while alternative 2 has 22%. In addition, MIRR of alternative 1 is at the levels of 15%,

while for alternative 2 it is at 15.03%. Furthermore, payback period for alternative 1 is at 3.15

years, while for alternative 2 it is at 2.12 years. On the other hand, the discounted payback

period for alternative 1 is at 3.82 years and for alternative 2 it is at levels of 2.70 years.

6

0.00) 00) 0) 00 00 00

Payback period

2.12

Discounting rate

1.00 0.91 0.83 0.75 0.68 0.62

Dis cash flow (120

,000.00

)

4

5,545.4

5

5

3,834.7

1

2

9,616.8

3

1

1,160.4

4

9,897.4

9

Dis cumulative cash flow (120

,000.00

)

(7

4,454.5

5)

(2

0,619.8

3)

8,996.9

9

2

0,157.4

3

3

0,054.9

2

Discounted payback period

2.70

2. Explaining which alternative should be chosen for investment:

From the evaluation of both the alternative options relevant income that is generated

from investment could be identified. The investment options are mainly evaluated with the

help of MIRR, NPV, IRR, payback period, and discounted payback period, where alternative

2 is mainly selected for investment. The NPV of alternative 2 is mainly at the levels of

$30,054.92, while alternative 1 has NPV of $26,153.26. Moreover, IRR of alternative 1 is at

19%, while alternative 2 has 22%. In addition, MIRR of alternative 1 is at the levels of 15%,

while for alternative 2 it is at 15.03%. Furthermore, payback period for alternative 1 is at 3.15

years, while for alternative 2 it is at 2.12 years. On the other hand, the discounted payback

period for alternative 1 is at 3.82 years and for alternative 2 it is at levels of 2.70 years.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

7

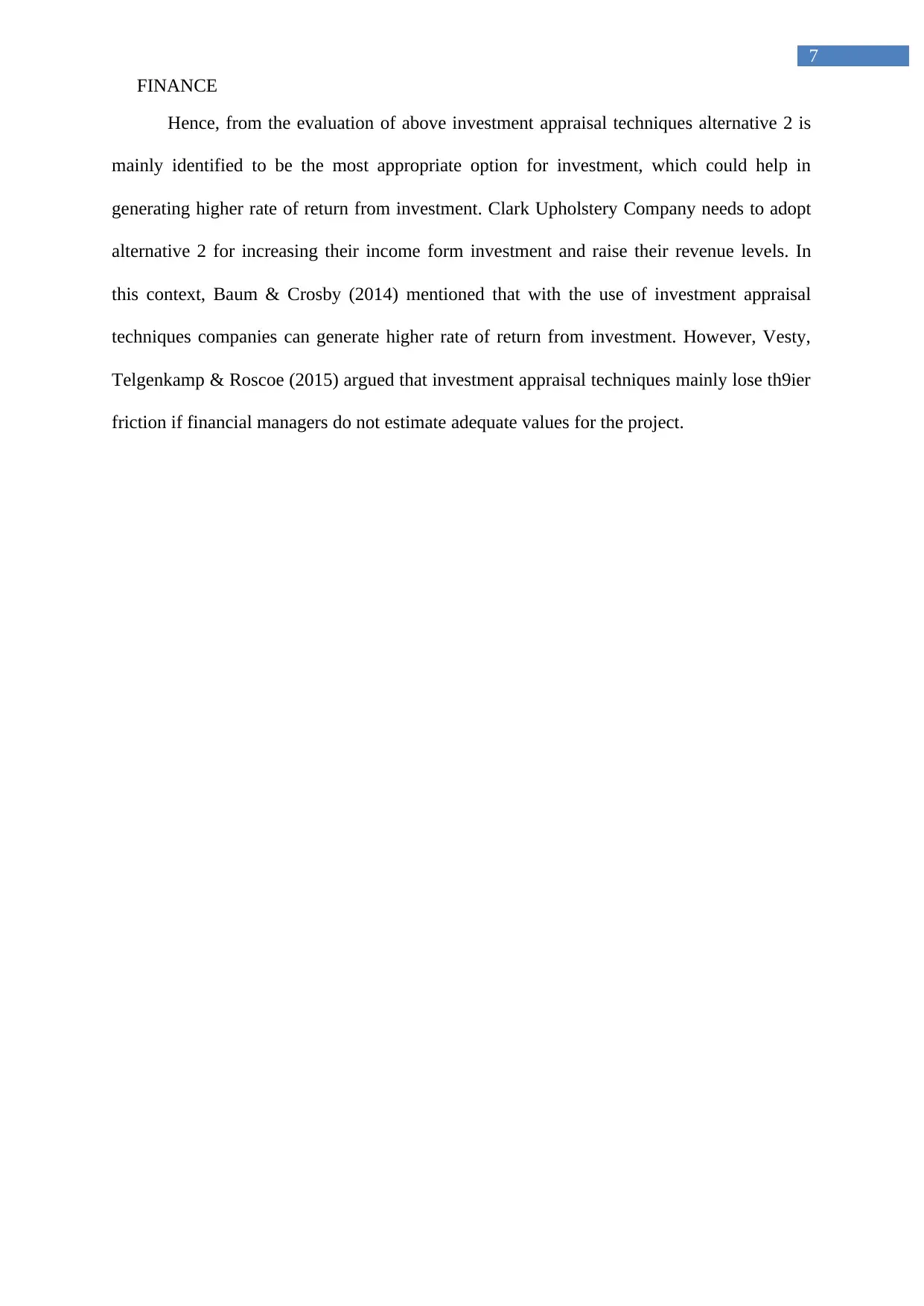

Hence, from the evaluation of above investment appraisal techniques alternative 2 is

mainly identified to be the most appropriate option for investment, which could help in

generating higher rate of return from investment. Clark Upholstery Company needs to adopt

alternative 2 for increasing their income form investment and raise their revenue levels. In

this context, Baum & Crosby (2014) mentioned that with the use of investment appraisal

techniques companies can generate higher rate of return from investment. However, Vesty,

Telgenkamp & Roscoe (2015) argued that investment appraisal techniques mainly lose th9ier

friction if financial managers do not estimate adequate values for the project.

7

Hence, from the evaluation of above investment appraisal techniques alternative 2 is

mainly identified to be the most appropriate option for investment, which could help in

generating higher rate of return from investment. Clark Upholstery Company needs to adopt

alternative 2 for increasing their income form investment and raise their revenue levels. In

this context, Baum & Crosby (2014) mentioned that with the use of investment appraisal

techniques companies can generate higher rate of return from investment. However, Vesty,

Telgenkamp & Roscoe (2015) argued that investment appraisal techniques mainly lose th9ier

friction if financial managers do not estimate adequate values for the project.

FINANCE

8

Reference:

Baum, A. E., & Crosby, N. (2014). Property investment appraisal. John Wiley & Sons.

Vesty, G. M., Telgenkamp, A., & Roscoe, P. J. (2015). Creating numbers: carbon and capital

investment. Accounting, Auditing & Accountability Journal, 28(3), 302-324.

8

Reference:

Baum, A. E., & Crosby, N. (2014). Property investment appraisal. John Wiley & Sons.

Vesty, G. M., Telgenkamp, A., & Roscoe, P. J. (2015). Creating numbers: carbon and capital

investment. Accounting, Auditing & Accountability Journal, 28(3), 302-324.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.