Investment Management Exam: Comprehensive Solution to Mock Test 1

VerifiedAdded on 2023/06/12

|7

|746

|351

Homework Assignment

AI Summary

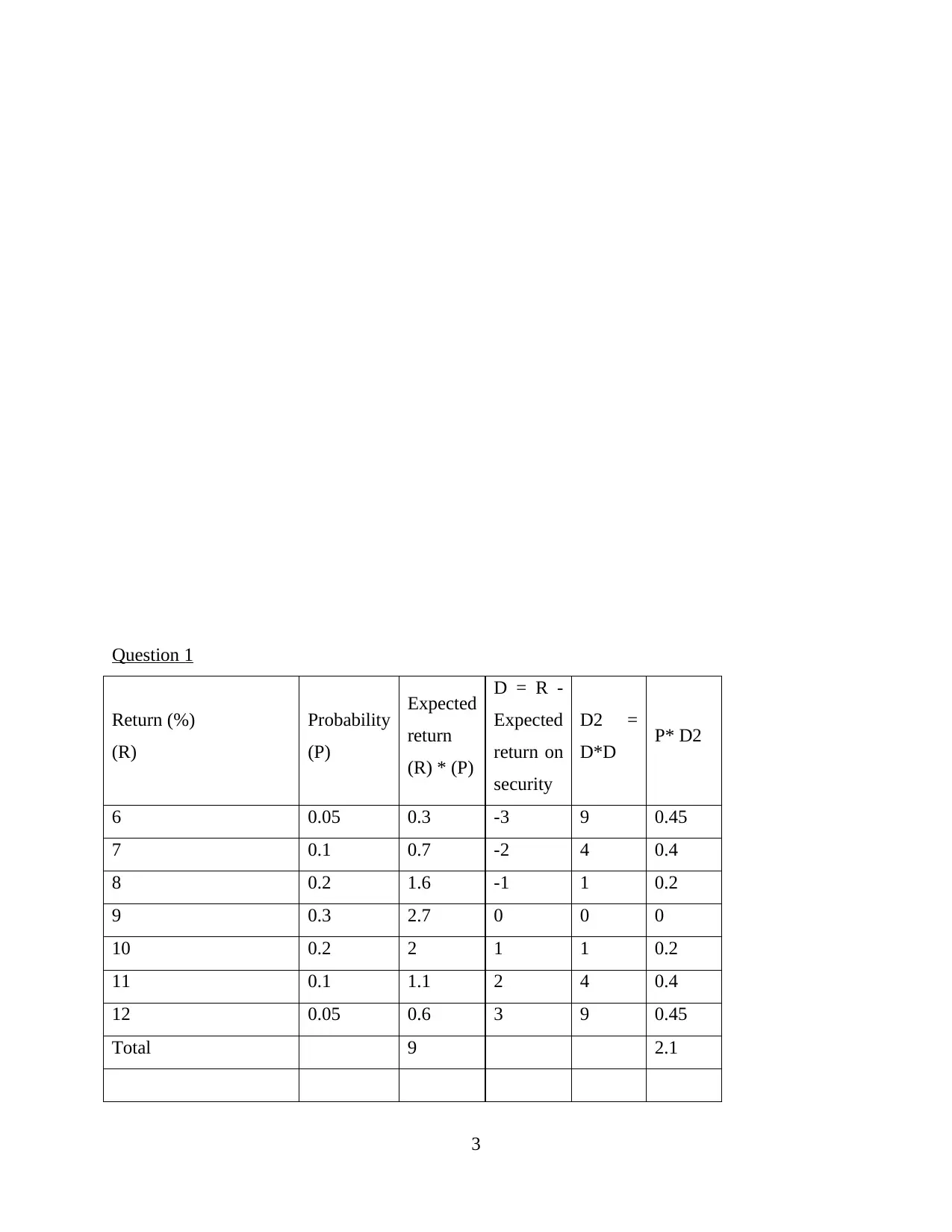

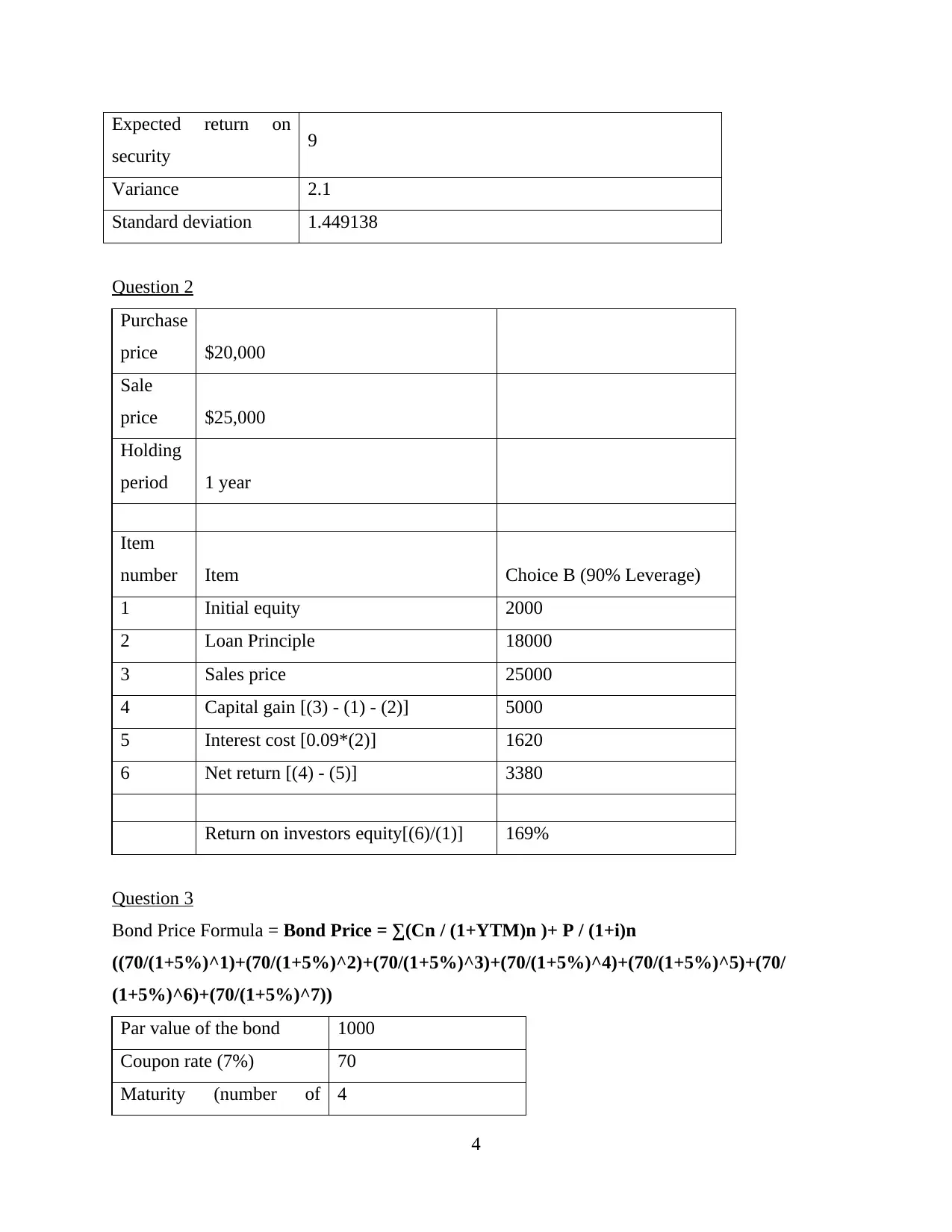

This document presents a detailed solution to an Investment Management mock exam, covering various key concepts and calculations. It includes problems related to expected return and standard deviation of securities, return on investment with leverage, bond pricing using the present value formula, and the application of the Capital Asset Pricing Model (CAPM) to determine the required rate of return and fair value of stocks under different dividend growth scenarios. Furthermore, the solution addresses option pricing, including the calculation of intrinsic value and time value for call options, and concludes with an analysis of daily stock price fluctuations. This comprehensive solution aims to aid students in understanding and mastering investment management principles, and similar resources can be found on Desklib.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)