Analysis of Investment Portfolio and Management in Emerging Markets

VerifiedAdded on 2019/10/31

|17

|3108

|135

Report

AI Summary

This report provides an in-depth analysis of investment opportunities in the emerging markets of India and Malaysia. It begins with an outline of the political and financial histories of both countries, examining key economic indicators such as GDP, interest rates, and exchange rates to assess their stability and fiscal performance. The report identifies key industries within each nation, evaluating their current accounts and recent performance of cash, fixed interest, and equities. A significant portion of the report is dedicated to evaluating the advantages and disadvantages of establishing a country fund for Australian investors, followed by recommendations for portfolio managers. The analysis considers factors like agricultural influence in India, the stability of the Malaysian government, and the performance of various market indexes to provide a comprehensive overview of the investment landscape in these two emerging economies. The report aims to assist investors in making informed decisions by highlighting the potential risks and rewards associated with investments in India and Malaysia.

Running head: INVESTMENT PORTFOLIO AND MANAGEMENT

Investment Portfolio and Management

Name of Student:

Name of University:

Author’s Note:

Investment Portfolio and Management

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INVESTMENT PORTFOLIO AND MANAGEMENT

Abstract

This report discusses the political and the economic histories of the two emerging

countries namely India and Malaysia. It shows the stability and the patters of investment in the

chosen countries. It also helps in the identification of the key industries in both the countries and

helps to analyses the importance of foraying into their respective markets. It highlights the

positive as well as the negative aspects of the investment in both the countries and also provides

recommendations to the Australian investors for the establishment of country fund and gives

valuable insight to the portfolio managers as well.

Abstract

This report discusses the political and the economic histories of the two emerging

countries namely India and Malaysia. It shows the stability and the patters of investment in the

chosen countries. It also helps in the identification of the key industries in both the countries and

helps to analyses the importance of foraying into their respective markets. It highlights the

positive as well as the negative aspects of the investment in both the countries and also provides

recommendations to the Australian investors for the establishment of country fund and gives

valuable insight to the portfolio managers as well.

2INVESTMENT PORTFOLIO AND MANAGEMENT

Table of Contents

Introduction:....................................................................................................................................3

1.Outline of the political and financial histories of the two chosen emerging countries:...............3

2. Stability of every nation as well as their fiscal performance with reference to the real growth

of the GDP, interest rates, exchanges rates as well as those of employment and un-employment: 6

3. Identification of the key industries and detection of the current account:..................................8

4. Evaluation of the recent performance of cash, fixed interest and equities:.................................9

5. Depiction of the advantages and disadvantages of the establishment of a country fund of the

investments for the Australian Investors:......................................................................................12

6. Providing required recommendations for the portfolio managers:............................................12

Conclusion:....................................................................................................................................13

References:....................................................................................................................................14

Table of Contents

Introduction:....................................................................................................................................3

1.Outline of the political and financial histories of the two chosen emerging countries:...............3

2. Stability of every nation as well as their fiscal performance with reference to the real growth

of the GDP, interest rates, exchanges rates as well as those of employment and un-employment: 6

3. Identification of the key industries and detection of the current account:..................................8

4. Evaluation of the recent performance of cash, fixed interest and equities:.................................9

5. Depiction of the advantages and disadvantages of the establishment of a country fund of the

investments for the Australian Investors:......................................................................................12

6. Providing required recommendations for the portfolio managers:............................................12

Conclusion:....................................................................................................................................13

References:....................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INVESTMENT PORTFOLIO AND MANAGEMENT

Introduction:

The assignment mainly puts light on the identification of two different natures of

emerging markets which can be utilised by the Australian investors as an investment opportunity

that is more or less enough. The suitable factors are needed for the stability of the nation. This is

in turn responsible for making the investors make suitable decisions regarding their necessary

investment. In the assignment the important factors were the valuation of the financial as well as

the political history. The emerging markets that have been chosen for the assignment are those of

India and Malaysia. These have been chosen because it is considered that they are the providers

of the highest return emerging markets all over the World. The suitable assets of the two

emerging markets are also evaluated in the given project for identification of any sort of links

that assist in meeting the requirements of the investment. It also helps in the increase of the

required returns of the said investment. Finally it can be said that an adequate advantage as well

as a disadvantage for the establishment of a country is shown in the study. This also helps in the

identification of the prospects for the Australian investors. Suitable amount of recommendations

help the investors in the identification of the investment opportunities in the emerging markets

and can ultimately adjust their portfolios.

1.Outline of the political and financial histories of the two chosen emerging countries:

Financial and Political History of India:

Introduction:

The assignment mainly puts light on the identification of two different natures of

emerging markets which can be utilised by the Australian investors as an investment opportunity

that is more or less enough. The suitable factors are needed for the stability of the nation. This is

in turn responsible for making the investors make suitable decisions regarding their necessary

investment. In the assignment the important factors were the valuation of the financial as well as

the political history. The emerging markets that have been chosen for the assignment are those of

India and Malaysia. These have been chosen because it is considered that they are the providers

of the highest return emerging markets all over the World. The suitable assets of the two

emerging markets are also evaluated in the given project for identification of any sort of links

that assist in meeting the requirements of the investment. It also helps in the increase of the

required returns of the said investment. Finally it can be said that an adequate advantage as well

as a disadvantage for the establishment of a country is shown in the study. This also helps in the

identification of the prospects for the Australian investors. Suitable amount of recommendations

help the investors in the identification of the investment opportunities in the emerging markets

and can ultimately adjust their portfolios.

1.Outline of the political and financial histories of the two chosen emerging countries:

Financial and Political History of India:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INVESTMENT PORTFOLIO AND MANAGEMENT

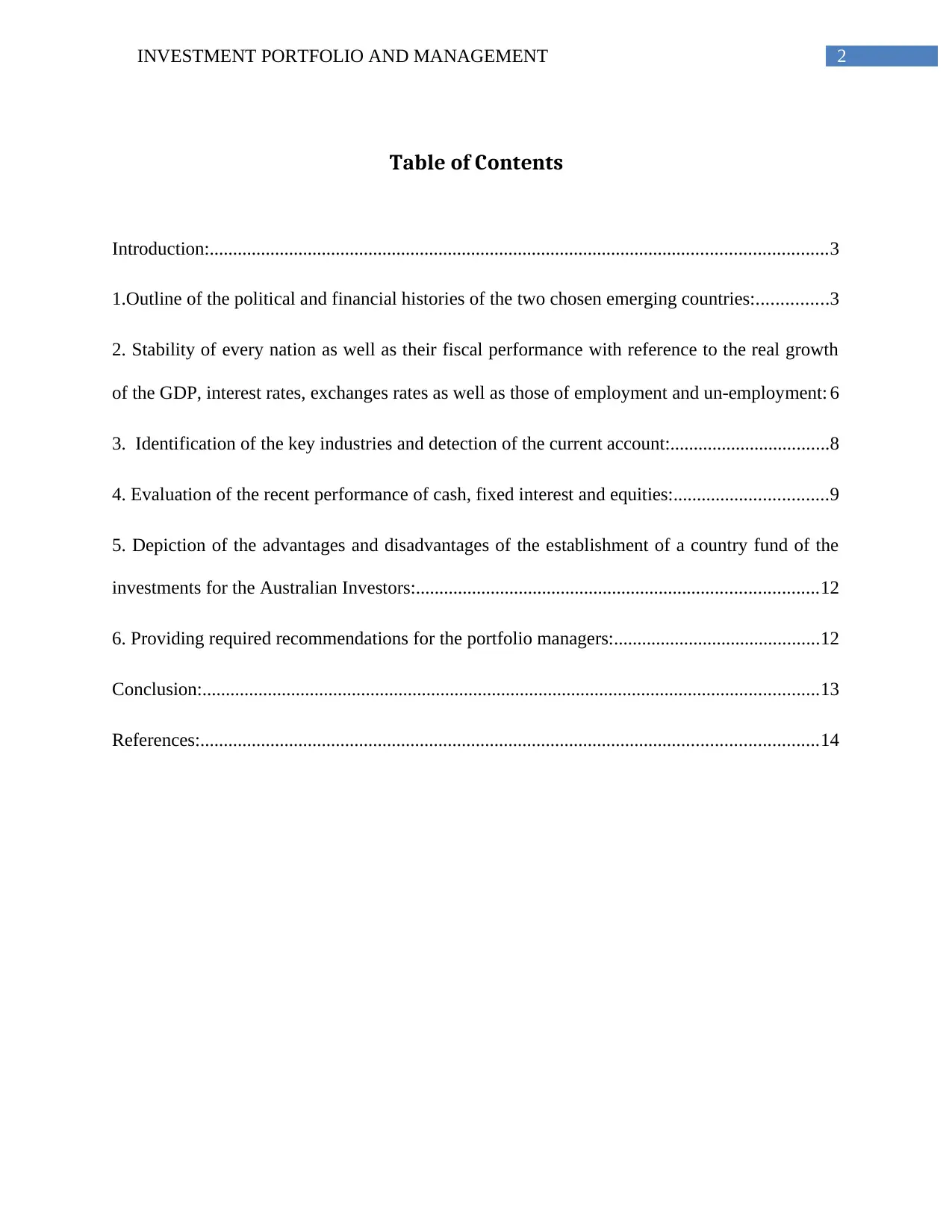

Figure 1: Depiction of the GDP of India

(Source: Tradingeconomics.com 2017)

In case of India, more than 50% of the Indian Economy is influenced by the agriculture of the

country. This is due to the fact that this is basically the major source of income for a large

percentage of the population. The present economic growth of India, can be identified taking the

help of the rise of the GDP which is clearly shown in the figure 1. The concerned GDP of India,

relatively increased from the year 2008 to the year 2016, directly indicating a particular nature of

increase in the purchasing power of the citizens (Buckley 2017).

Mainly, India utilizes the Government for ruling the overall people of India, where the

BJP are in position of control. The Prime Minister and his method of thought assists the

investment of the investors because of his capability to think industrially. The present scenario in

India, where most of the Indians are focussed on the development of the country as well as

getting more and more opportunities for the purpose of investment.

Figure 1: Depiction of the GDP of India

(Source: Tradingeconomics.com 2017)

In case of India, more than 50% of the Indian Economy is influenced by the agriculture of the

country. This is due to the fact that this is basically the major source of income for a large

percentage of the population. The present economic growth of India, can be identified taking the

help of the rise of the GDP which is clearly shown in the figure 1. The concerned GDP of India,

relatively increased from the year 2008 to the year 2016, directly indicating a particular nature of

increase in the purchasing power of the citizens (Buckley 2017).

Mainly, India utilizes the Government for ruling the overall people of India, where the

BJP are in position of control. The Prime Minister and his method of thought assists the

investment of the investors because of his capability to think industrially. The present scenario in

India, where most of the Indians are focussed on the development of the country as well as

getting more and more opportunities for the purpose of investment.

5INVESTMENT PORTFOLIO AND MANAGEMENT

Economic and Political history of Malaysia

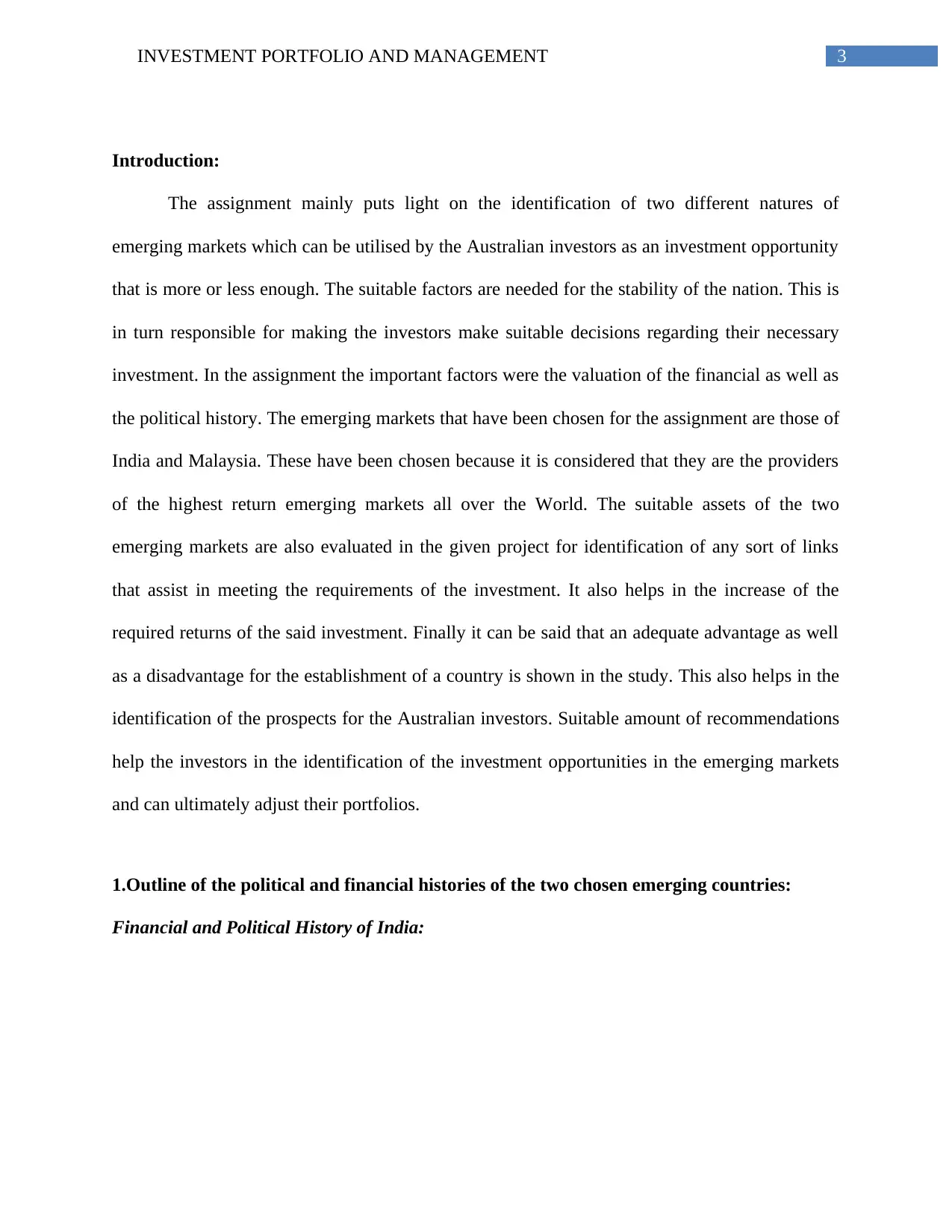

Figure 2: Graphical representation of the GDP of Malaysia

(Source: Tradingeconomics.com 2017)

At present the GDP of Malaysia majorly depicts a rising trend which is the most

important factor for the investment opportunities for the investors in the country. The rise of the

GDP majorly indicates that the financial condition of the country is stable and can provide more

amount of returns from the investments in case the FDIs are conducted in adequate number.

Malaysia is considered to be one of the emerging countries of the world that allows the

International Trades. This directly assists the generation of the required level of the profitability

for the investors. In addition to this Malaysia also allows the distinct industries which directly

help in the improvement of the industrial growth (Bodie 2013).

The scenario of Malaysia at present with reference to the political nature is more or less

stable because the government is ruled by a multinational democratic country. Apart from this

Economic and Political history of Malaysia

Figure 2: Graphical representation of the GDP of Malaysia

(Source: Tradingeconomics.com 2017)

At present the GDP of Malaysia majorly depicts a rising trend which is the most

important factor for the investment opportunities for the investors in the country. The rise of the

GDP majorly indicates that the financial condition of the country is stable and can provide more

amount of returns from the investments in case the FDIs are conducted in adequate number.

Malaysia is considered to be one of the emerging countries of the world that allows the

International Trades. This directly assists the generation of the required level of the profitability

for the investors. In addition to this Malaysia also allows the distinct industries which directly

help in the improvement of the industrial growth (Bodie 2013).

The scenario of Malaysia at present with reference to the political nature is more or less

stable because the government is ruled by a multinational democratic country. Apart from this

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INVESTMENT PORTFOLIO AND MANAGEMENT

the party that has been in power for more than 25 years is the Barisan National party, thereby

increasing the overall political stability. This stability in the political scenario can eventually help

in the foreign investors to get better returns from the required investments (Anzbusiness.com.

2017).

2. Stability of every nation as well as their fiscal performance with reference to the real

growth of the GDP, interest rates, exchanges rates as well as those of employment and un-

employment:

Figure 3: Depicting the GDP, exchange rates and interest rates for Malaysia

(Source: Agility.com 2017)

From the figure 3, a careful study shows that the relevant GDP, interest rates as well as

the interest rates of Malaysia could be found clearly. In addition to this, the Malaysian GDP has

been rising adequately and reached to 296.359 Billion USD as of 2016. This sort of rise in the

the party that has been in power for more than 25 years is the Barisan National party, thereby

increasing the overall political stability. This stability in the political scenario can eventually help

in the foreign investors to get better returns from the required investments (Anzbusiness.com.

2017).

2. Stability of every nation as well as their fiscal performance with reference to the real

growth of the GDP, interest rates, exchanges rates as well as those of employment and un-

employment:

Figure 3: Depicting the GDP, exchange rates and interest rates for Malaysia

(Source: Agility.com 2017)

From the figure 3, a careful study shows that the relevant GDP, interest rates as well as

the interest rates of Malaysia could be found clearly. In addition to this, the Malaysian GDP has

been rising adequately and reached to 296.359 Billion USD as of 2016. This sort of rise in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INVESTMENT PORTFOLIO AND MANAGEMENT

GDP indicates that the industries in the country get more and more income from their

investments. Thus the financial stability of the economy is viable and is possible to be utilised by

the foreign investors in order to better the economy further to increase the return for the

investment. The stability of the interest rates helps in boosting the industrial stability of the

country. The exchange rates of Malaysia against that of Australia have risen relatively

(Agility.com. 2017). This shows that more number of Malaysian Ringgits could be generated

with one Australian dollar. Thus it can be stated that the present stability of Malaysia is relatively

viable.

Figure 4: Depicts the GDP, interest rate and Exchange rates of India

(Source: Nayak 2017)

GDP indicates that the industries in the country get more and more income from their

investments. Thus the financial stability of the economy is viable and is possible to be utilised by

the foreign investors in order to better the economy further to increase the return for the

investment. The stability of the interest rates helps in boosting the industrial stability of the

country. The exchange rates of Malaysia against that of Australia have risen relatively

(Agility.com. 2017). This shows that more number of Malaysian Ringgits could be generated

with one Australian dollar. Thus it can be stated that the present stability of Malaysia is relatively

viable.

Figure 4: Depicts the GDP, interest rate and Exchange rates of India

(Source: Nayak 2017)

8INVESTMENT PORTFOLIO AND MANAGEMENT

After proper evaluation of the figure 4, the GDP, interest rate as well as the exchange rate

of India are evaluated relatively for the investment purposes. The relevant amount of the interest

rates are identified at the level of 6% that directly accommodates the rise of the exchange rate

and which is used against other countries (Francis et al. 2013). The currency exchange rate of

India with comparison to Australia has been decreasing since 2015. Further, the GDP of India

has grown to 2.264 Trillion which states directly that the growth of the Business in India is

increasing relatively overtime. Thus overall the factors help to show that the investments in India

would ultimately help in the generation of the relevant income for an Australian Investor

(Bhaumik, Driffield and Zhou 2016).

3. Identification of the key industries and detection of the current account:

Numerous industries exist in India, including the Pharmaceuticals, Banks, Automobiles,

as well as real estate. These are considered to be the driving force of the economy. Thus the

overall investment in all the factors could eventually help the investors to generate the returns

from the overall investments. In addition to this, the sectors could also help in the reduction of

the risk form the investment (Jakovljevic 2014). This is possible because the identification of the

relative risk is possible from the volume. Thus in case of India, the investments in the different

sectors namely real estate, banks, pharmaceuticals, automobiles are most preferred. In India,

majority of the banks are government linked thus directly helping in the securing of the

investment fund investor (Buckley 2017).

The present account is mainly at a deficiency as it records at 0.65 or an amount of $3.4

Billion in Q4, 2017. The significant increase in the current account deficit was due to the

increasing import conductor in India. It could however be said that the current market scene

After proper evaluation of the figure 4, the GDP, interest rate as well as the exchange rate

of India are evaluated relatively for the investment purposes. The relevant amount of the interest

rates are identified at the level of 6% that directly accommodates the rise of the exchange rate

and which is used against other countries (Francis et al. 2013). The currency exchange rate of

India with comparison to Australia has been decreasing since 2015. Further, the GDP of India

has grown to 2.264 Trillion which states directly that the growth of the Business in India is

increasing relatively overtime. Thus overall the factors help to show that the investments in India

would ultimately help in the generation of the relevant income for an Australian Investor

(Bhaumik, Driffield and Zhou 2016).

3. Identification of the key industries and detection of the current account:

Numerous industries exist in India, including the Pharmaceuticals, Banks, Automobiles,

as well as real estate. These are considered to be the driving force of the economy. Thus the

overall investment in all the factors could eventually help the investors to generate the returns

from the overall investments. In addition to this, the sectors could also help in the reduction of

the risk form the investment (Jakovljevic 2014). This is possible because the identification of the

relative risk is possible from the volume. Thus in case of India, the investments in the different

sectors namely real estate, banks, pharmaceuticals, automobiles are most preferred. In India,

majority of the banks are government linked thus directly helping in the securing of the

investment fund investor (Buckley 2017).

The present account is mainly at a deficiency as it records at 0.65 or an amount of $3.4

Billion in Q4, 2017. The significant increase in the current account deficit was due to the

increasing import conductor in India. It could however be said that the current market scene

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9INVESTMENT PORTFOLIO AND MANAGEMENT

prospects could help in the improvement of the generation of the relative income for the

investors (Koepke 2015).

The present account surplus is mainly at 2.1% in 2016. This basically indicates that the

positive scenario for the investor because the country possesses a certain amount of surplus in

the present account. This could eventually assist in the increase of the returns of the foreign

investors in the Malaysian economy (Nseindia.com. 2017).

Electronic, petroleum, liquefied natural gas, wood palm oil and rubber are the major

industries in the Malaysian economy. These industries are the major economic players in the

Malaysian economy. This is also responsible for the direct strengthening of resolve of the

investors (Sauvant 2017). The present education as well as the biotechnology industries is also

an emerging sector that can increase the chances of the investors to gain higher return from the

investment in future. Thus it can be concluded that the investment in Malaysia could eventually

help the Australian investment for the generation of the revenue. This are conducted in the

sectors namely Electronic, Petroleum, Liquefied natural gas, wood palm oil and rubber.

prospects could help in the improvement of the generation of the relative income for the

investors (Koepke 2015).

The present account surplus is mainly at 2.1% in 2016. This basically indicates that the

positive scenario for the investor because the country possesses a certain amount of surplus in

the present account. This could eventually assist in the increase of the returns of the foreign

investors in the Malaysian economy (Nseindia.com. 2017).

Electronic, petroleum, liquefied natural gas, wood palm oil and rubber are the major

industries in the Malaysian economy. These industries are the major economic players in the

Malaysian economy. This is also responsible for the direct strengthening of resolve of the

investors (Sauvant 2017). The present education as well as the biotechnology industries is also

an emerging sector that can increase the chances of the investors to gain higher return from the

investment in future. Thus it can be concluded that the investment in Malaysia could eventually

help the Australian investment for the generation of the revenue. This are conducted in the

sectors namely Electronic, Petroleum, Liquefied natural gas, wood palm oil and rubber.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10INVESTMENT PORTFOLIO AND MANAGEMENT

4. Evaluation of the recent performance of cash, fixed interest and equities:

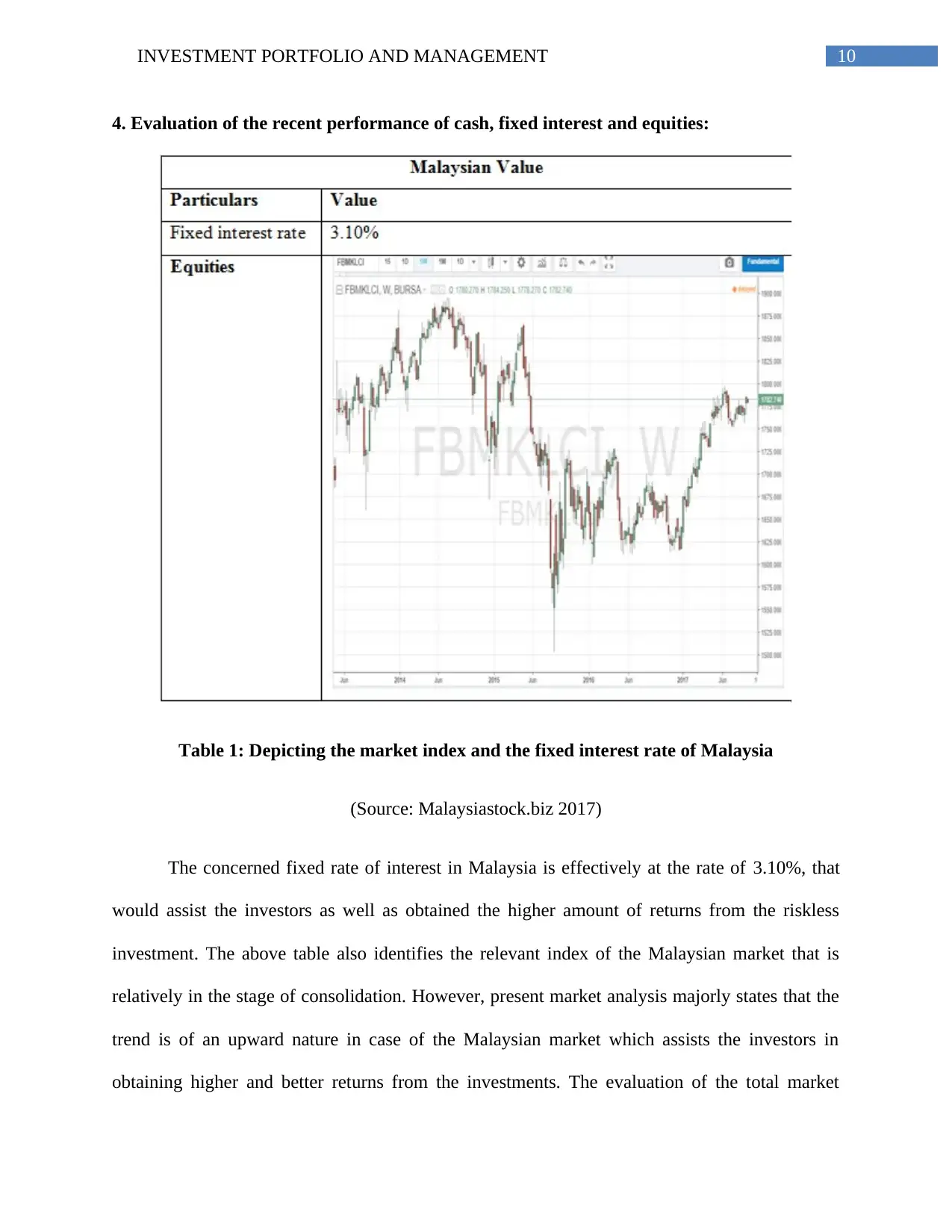

Table 1: Depicting the market index and the fixed interest rate of Malaysia

(Source: Malaysiastock.biz 2017)

The concerned fixed rate of interest in Malaysia is effectively at the rate of 3.10%, that

would assist the investors as well as obtained the higher amount of returns from the riskless

investment. The above table also identifies the relevant index of the Malaysian market that is

relatively in the stage of consolidation. However, present market analysis majorly states that the

trend is of an upward nature in case of the Malaysian market which assists the investors in

obtaining higher and better returns from the investments. The evaluation of the total market

4. Evaluation of the recent performance of cash, fixed interest and equities:

Table 1: Depicting the market index and the fixed interest rate of Malaysia

(Source: Malaysiastock.biz 2017)

The concerned fixed rate of interest in Malaysia is effectively at the rate of 3.10%, that

would assist the investors as well as obtained the higher amount of returns from the riskless

investment. The above table also identifies the relevant index of the Malaysian market that is

relatively in the stage of consolidation. However, present market analysis majorly states that the

trend is of an upward nature in case of the Malaysian market which assists the investors in

obtaining higher and better returns from the investments. The evaluation of the total market

11INVESTMENT PORTFOLIO AND MANAGEMENT

trends would ultimately assist in the generation of higher returns. The total petroleum market is

declining that can reflect the portfolio in a negative way. Thus the Australian investor can avoid

the investments in the petroleum companies (Tradingeconomics.com. 2017).

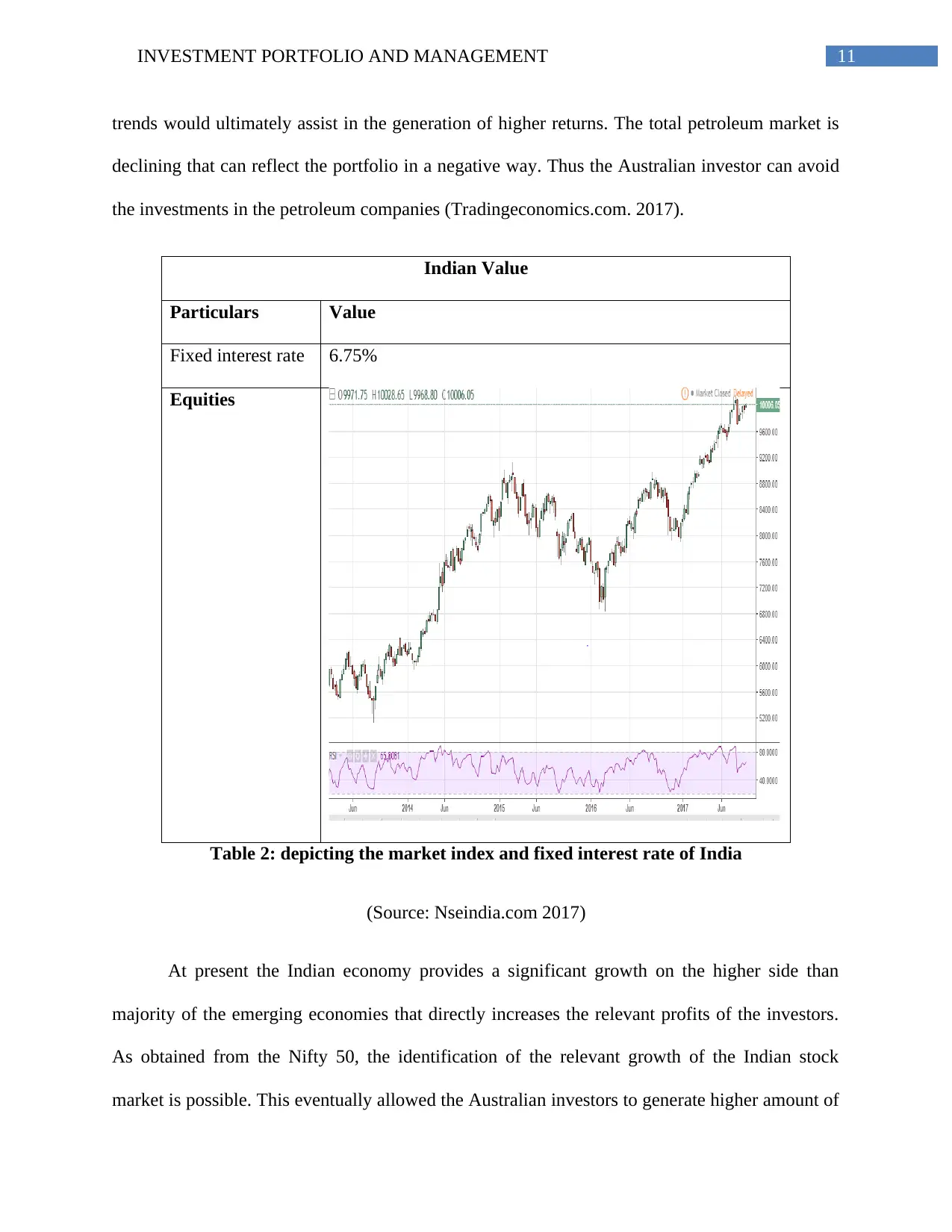

Indian Value

Particulars Value

Fixed interest rate 6.75%

Equities

Table 2: depicting the market index and fixed interest rate of India

(Source: Nseindia.com 2017)

At present the Indian economy provides a significant growth on the higher side than

majority of the emerging economies that directly increases the relevant profits of the investors.

As obtained from the Nifty 50, the identification of the relevant growth of the Indian stock

market is possible. This eventually allowed the Australian investors to generate higher amount of

trends would ultimately assist in the generation of higher returns. The total petroleum market is

declining that can reflect the portfolio in a negative way. Thus the Australian investor can avoid

the investments in the petroleum companies (Tradingeconomics.com. 2017).

Indian Value

Particulars Value

Fixed interest rate 6.75%

Equities

Table 2: depicting the market index and fixed interest rate of India

(Source: Nseindia.com 2017)

At present the Indian economy provides a significant growth on the higher side than

majority of the emerging economies that directly increases the relevant profits of the investors.

As obtained from the Nifty 50, the identification of the relevant growth of the Indian stock

market is possible. This eventually allowed the Australian investors to generate higher amount of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.