Investment Portfolio Project

VerifiedAdded on 2019/09/18

|7

|424

|234

Project

AI Summary

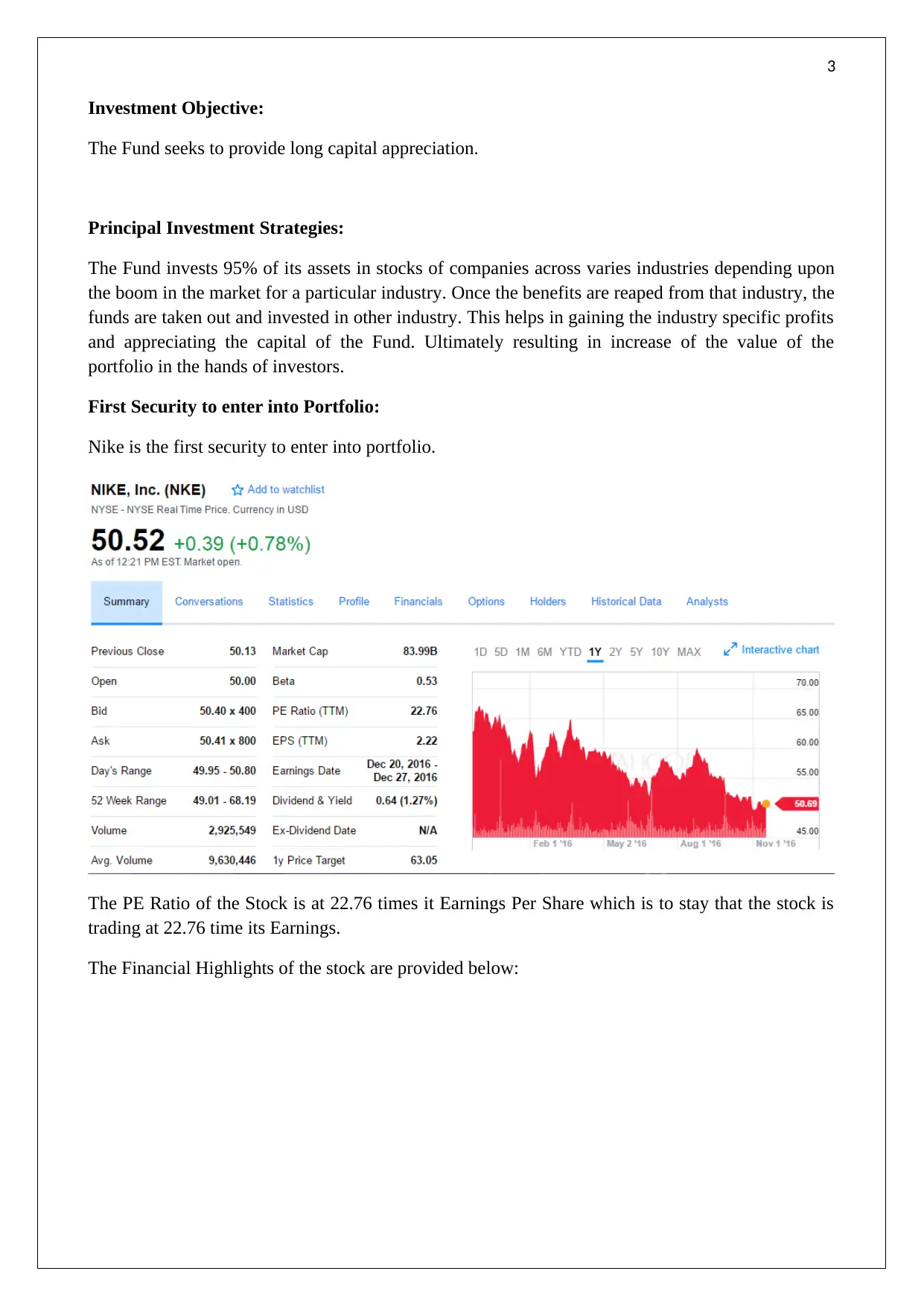

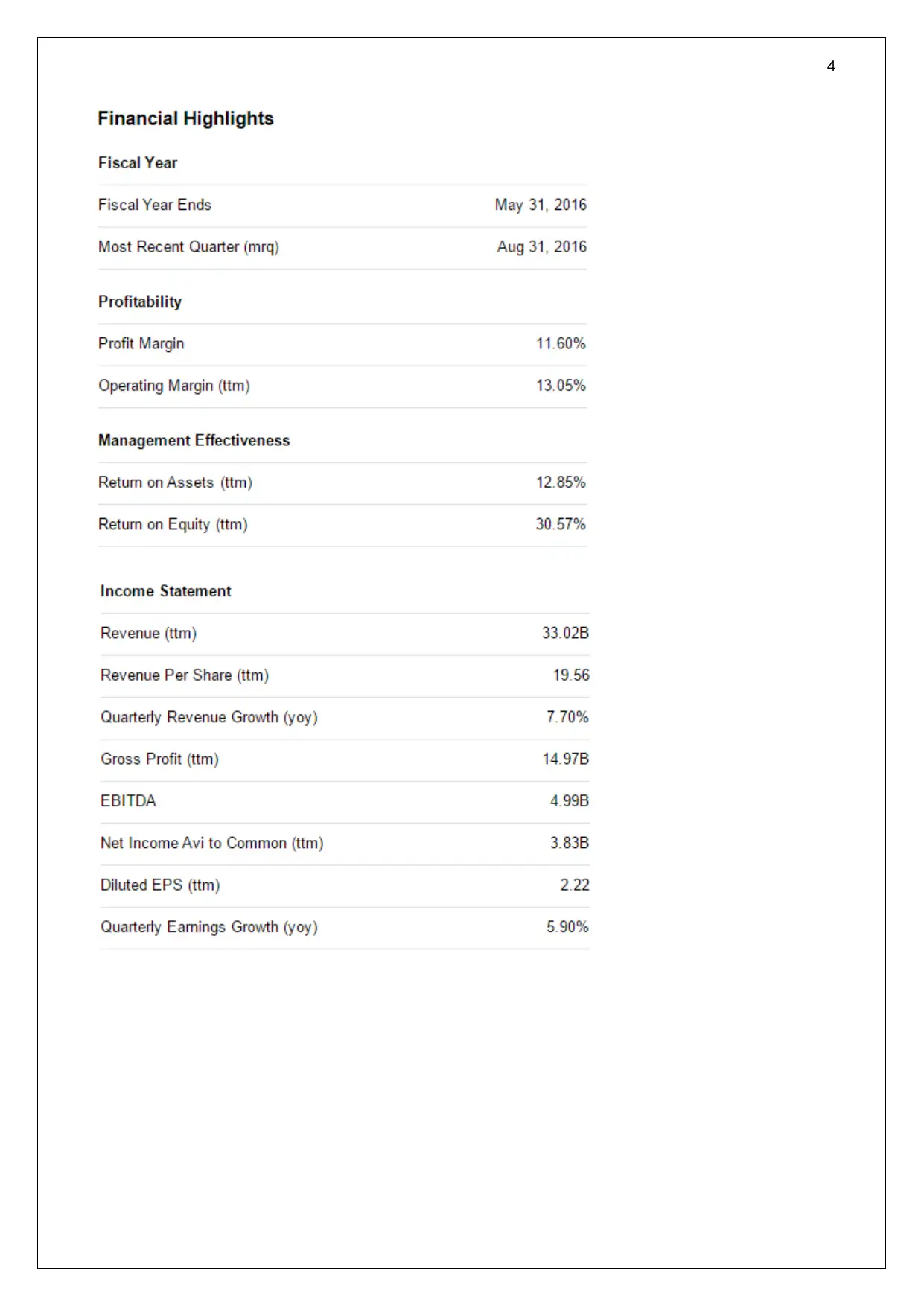

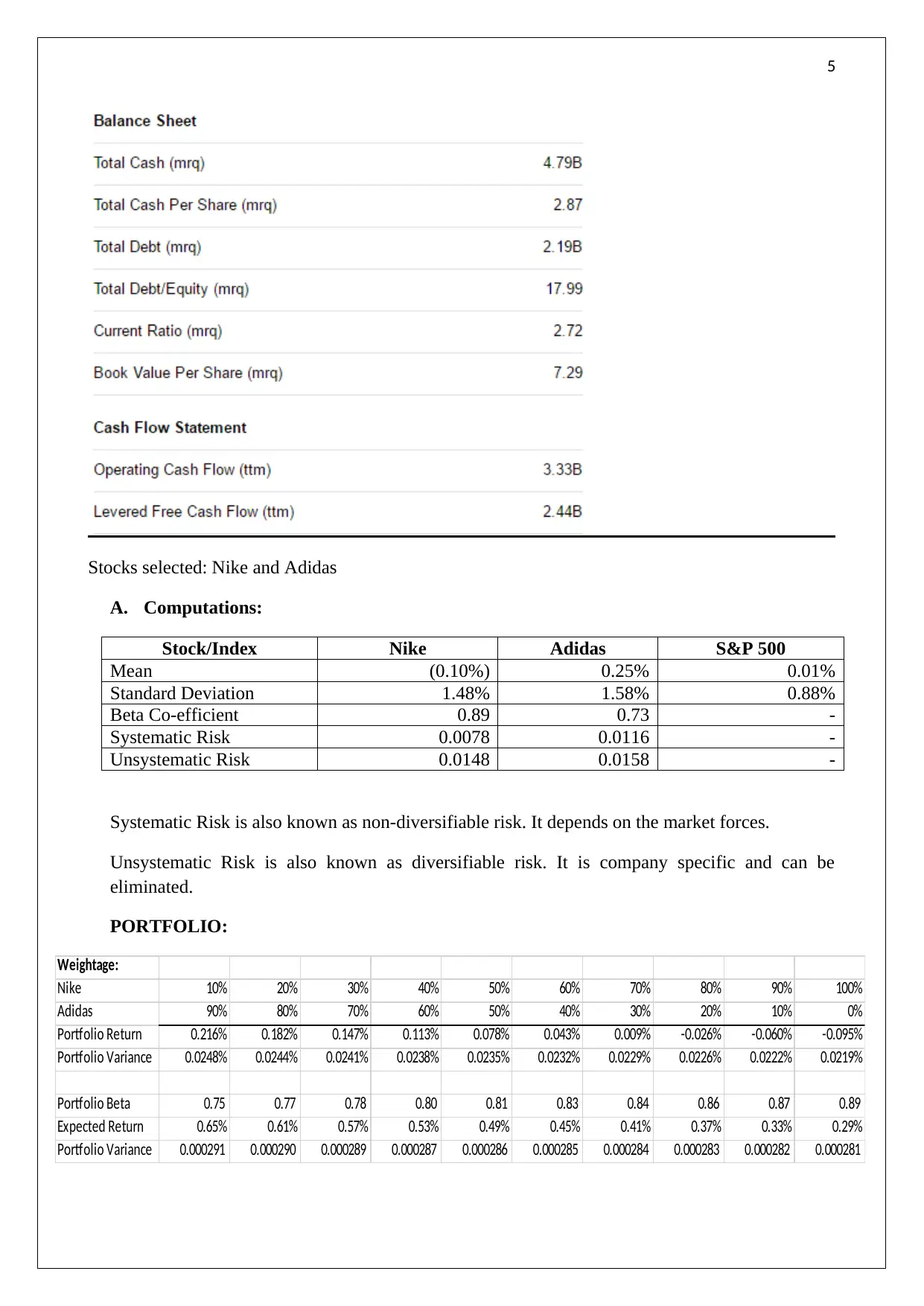

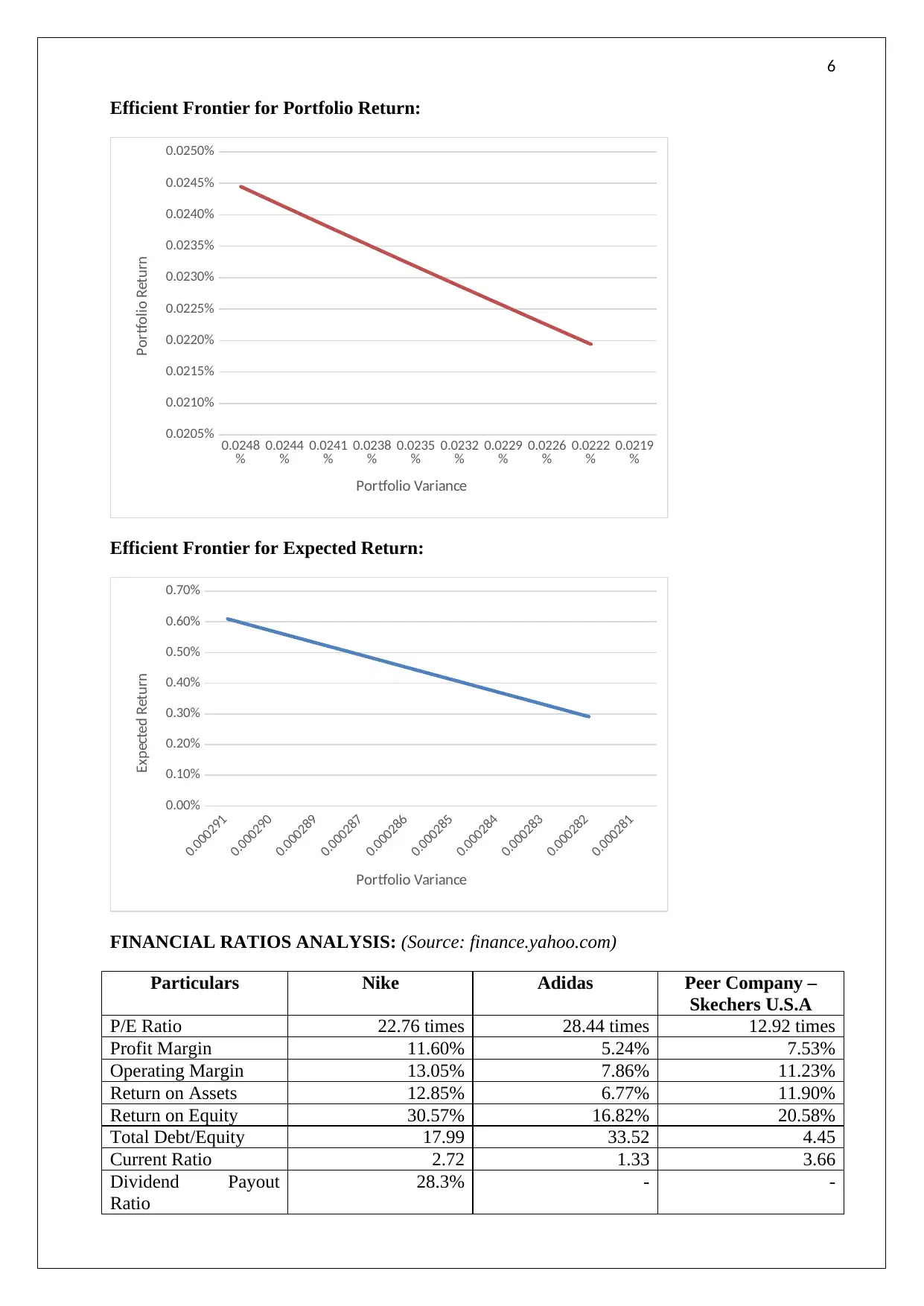

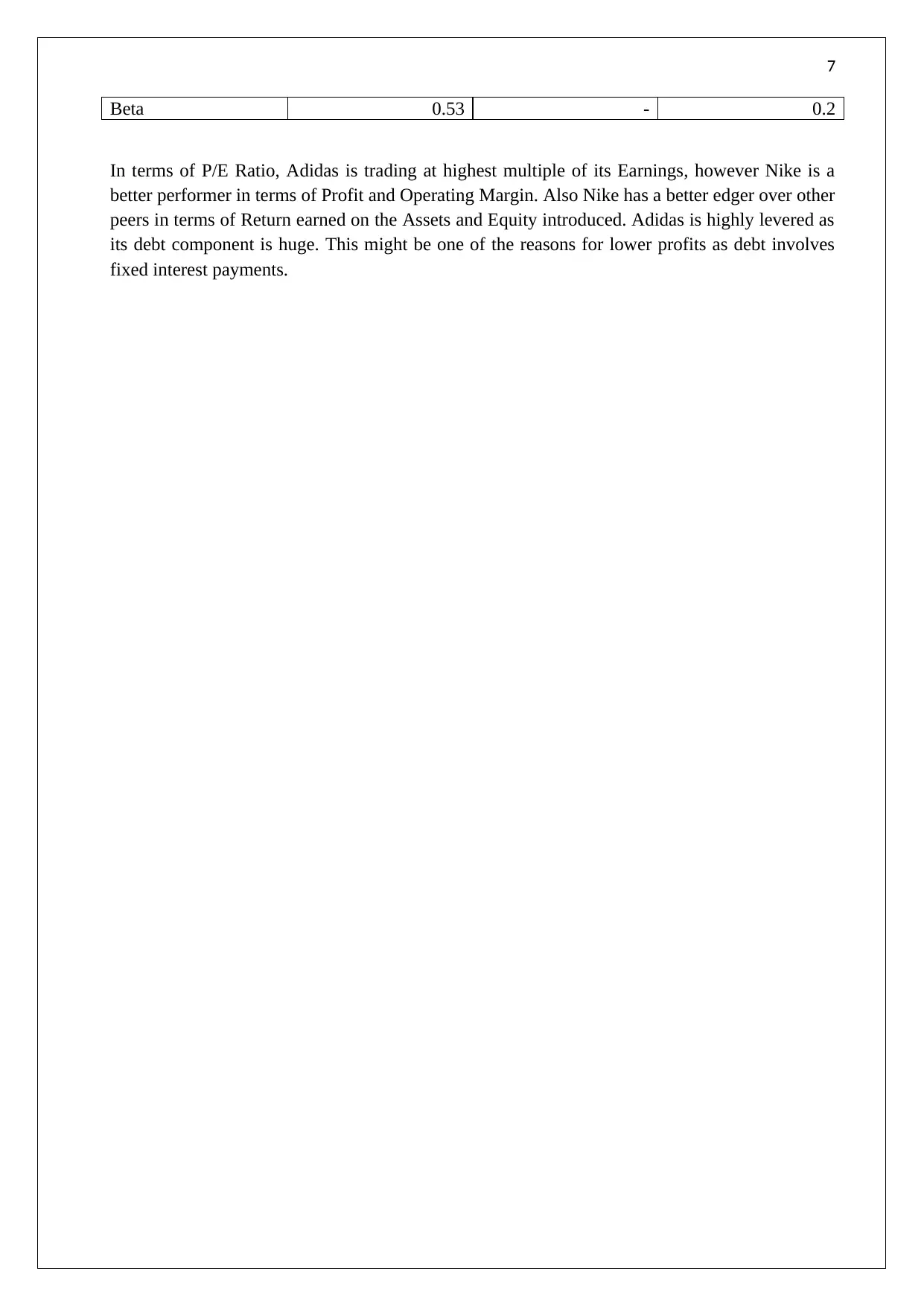

This document presents an investment portfolio project focused on long-term capital appreciation. The strategy involves investing in stocks across various industries, capitalizing on market booms, and reallocating funds for optimal returns. The portfolio initially includes Nike, with a detailed analysis of its financial highlights, followed by computations of mean, standard deviation, beta coefficient, systematic risk, and unsystematic risk for Nike and Adidas. The project also includes a financial ratio analysis comparing Nike, Adidas, and Skechers, evaluating P/E ratio, profit margin, operating margin, return on assets, return on equity, debt-to-equity ratio, current ratio, dividend payout ratio, and beta. The analysis concludes that while Adidas has a higher P/E ratio, Nike demonstrates better performance in profitability and returns, with Adidas being more leveraged.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)