Analyzing Tax Implications in Different Investment Scenarios

VerifiedAdded on 2020/04/01

|12

|3784

|53

AI Summary

The assignment provides a comprehensive examination of taxation law, bridging theoretical understanding with practical applications. By reviewing relevant literature and case studies, students will explore the intricacies of tax collection laws, focusing on issues such as capital receipts and recurring income in specific contexts. The analysis will highlight differences in legal interpretations and practices, enhancing students' ability to apply theoretical knowledge to real-world challenges in taxation.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Taxation

<Student ID>

<Student Name>

<University Name>

Taxation

<Student ID>

<Student Name>

<University Name>

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Contents

Calculation of the net gain or loss in the capital for the current year..............................................4

Loan sanctioned by Brain................................................................................................................6

Regarding loan of Jack and Jill........................................................................................................7

Legal Plan........................................................................................................................................8

Land issue of Bill...........................................................................................................................10

References......................................................................................................................................11

Contents

Calculation of the net gain or loss in the capital for the current year..............................................4

Loan sanctioned by Brain................................................................................................................6

Regarding loan of Jack and Jill........................................................................................................7

Legal Plan........................................................................................................................................8

Land issue of Bill...........................................................................................................................10

References......................................................................................................................................11

3

Taxation is the term which denotes to the coercive or compulsory amount of money that is

collected by any levying authority which basically encompasses the governmental authority.

Taxation is the term which is applicable to all kinds of involuntary levies right from income to

the gains in capital which further leads to the estate taxes. Taxation is very different in approach

as compared to the other forms of payments like the market exchange and different other

services. The governmental organizations are accountable regarding the collection of taxation

through various implicit and explicit ways or threat of action (Aust, 2013). The taxation varies

from the extortion and protection racket as the organization on which taxation is implemented is

a governmental and not private agency. The system of tax varies with the variation on places and

countries which basically denotes to the variations in location. Taxation is found to be imposed

basically on the physical and tangible assets such as the events, transactions of sales and

properties. The devising of tax is one of the most important aspect and issues in the political

arena.

Taxation can be further regarded as the principle on the basis of which the government raises the

revenue. The government of any country will not be able to implement the laws in the states in a

proper which would lead to many issues is the import and export of various products in the

country without the imposition of taxation. Therefore, taxation has a very crucial role in the

delivery of the public goods or products to different communities. There are many ways in which

the government of any country can happen to raise the revenue such as: charging of fees can be

devised by the governmental organizations for rendering services. The governmental

organization can also implement the granting of the license regarding imposing amounts as fines

in the case of breach of various laws and design new rules and laws regarding different

investments and assets (Beatty, 2015). Taxation can be very well differentiated from different

other forms of payments as it does not need any kind of consent and is not associated with any

rendered services. Systems of taxation have varied in a considerable manner across time and

jurisdiction.

Taxes can be further stated as the special systems which are imposed on various communities.

The laws of taxation are denoted as the frameworks of laws which assist in governing the

liabilities of the individuals and the organization for paying the tax. Taxes encompass all the

rules and regulations along with the establishment of the base of the tax and the implementation

Taxation is the term which denotes to the coercive or compulsory amount of money that is

collected by any levying authority which basically encompasses the governmental authority.

Taxation is the term which is applicable to all kinds of involuntary levies right from income to

the gains in capital which further leads to the estate taxes. Taxation is very different in approach

as compared to the other forms of payments like the market exchange and different other

services. The governmental organizations are accountable regarding the collection of taxation

through various implicit and explicit ways or threat of action (Aust, 2013). The taxation varies

from the extortion and protection racket as the organization on which taxation is implemented is

a governmental and not private agency. The system of tax varies with the variation on places and

countries which basically denotes to the variations in location. Taxation is found to be imposed

basically on the physical and tangible assets such as the events, transactions of sales and

properties. The devising of tax is one of the most important aspect and issues in the political

arena.

Taxation can be further regarded as the principle on the basis of which the government raises the

revenue. The government of any country will not be able to implement the laws in the states in a

proper which would lead to many issues is the import and export of various products in the

country without the imposition of taxation. Therefore, taxation has a very crucial role in the

delivery of the public goods or products to different communities. There are many ways in which

the government of any country can happen to raise the revenue such as: charging of fees can be

devised by the governmental organizations for rendering services. The governmental

organization can also implement the granting of the license regarding imposing amounts as fines

in the case of breach of various laws and design new rules and laws regarding different

investments and assets (Beatty, 2015). Taxation can be very well differentiated from different

other forms of payments as it does not need any kind of consent and is not associated with any

rendered services. Systems of taxation have varied in a considerable manner across time and

jurisdiction.

Taxes can be further stated as the special systems which are imposed on various communities.

The laws of taxation are denoted as the frameworks of laws which assist in governing the

liabilities of the individuals and the organization for paying the tax. Taxes encompass all the

rules and regulations along with the establishment of the base of the tax and the implementation

4

of the taxes. It is observed as the Australia comprises of a vast structure of laws of taxation. The

key source of Australia is based on regarding finding hundreds of pages consisting the

legislation of taxes which are enacted by the territory parliaments , commonwealth and the

federal state (Brigham, 2014).

Calculation of the net gain or loss in the capital for the current year

Issue

The laws of taxation are implemented and regulated by the commonwealth constitution along

with the international treaties which encompass the Double Tax Agreements to associate with the

foreign countries. Taxation is very important and useful regarding various challenges and studies

associated with the society due to the vast and expanded nature along with the complexities in

technologies (Brigham & Ehrhardt, 2013). Right from the last years, it was observed that many

steps and attempts were taken by Eric who involved many attempts for the solicitation of some

of the assets. In accordance to the question, the assumption had been made that he had those

specific assets since one year. The capital’s taxability is found to increase when there is an

increase in the selling price of the specific assets right from the base cost. The cost of indexation

will not valid in the case of Eric as he had not made any reservations of the assets for more

duration of time than just a year.

Rule

1) Assets are the material and tangible things that are brought by the customers for their

personal use and pleasures. This personal usage does not encompass the collectibles. These

tangible assets are sold again to a different individual and the taxability does not play into the

case in which the costs of acquisition of the considered assets are found to be less than $10000.

The item that was acquired by Eric initially is the sound system for his home which was

supposed to have the cost of acquisition as $ 12000. The asset which was bought by Eric

secondly is the share of a company which had the cost of acquisition to be less than the previous

one which is $15000 (Dafflon, 2015).

2) Assets which were brought by Eric for personal pleasures and enjoyment do not involve

the taxability of the gain in the capital as the costs of procurement of the assets is very much less

of the taxes. It is observed as the Australia comprises of a vast structure of laws of taxation. The

key source of Australia is based on regarding finding hundreds of pages consisting the

legislation of taxes which are enacted by the territory parliaments , commonwealth and the

federal state (Brigham, 2014).

Calculation of the net gain or loss in the capital for the current year

Issue

The laws of taxation are implemented and regulated by the commonwealth constitution along

with the international treaties which encompass the Double Tax Agreements to associate with the

foreign countries. Taxation is very important and useful regarding various challenges and studies

associated with the society due to the vast and expanded nature along with the complexities in

technologies (Brigham & Ehrhardt, 2013). Right from the last years, it was observed that many

steps and attempts were taken by Eric who involved many attempts for the solicitation of some

of the assets. In accordance to the question, the assumption had been made that he had those

specific assets since one year. The capital’s taxability is found to increase when there is an

increase in the selling price of the specific assets right from the base cost. The cost of indexation

will not valid in the case of Eric as he had not made any reservations of the assets for more

duration of time than just a year.

Rule

1) Assets are the material and tangible things that are brought by the customers for their

personal use and pleasures. This personal usage does not encompass the collectibles. These

tangible assets are sold again to a different individual and the taxability does not play into the

case in which the costs of acquisition of the considered assets are found to be less than $10000.

The item that was acquired by Eric initially is the sound system for his home which was

supposed to have the cost of acquisition as $ 12000. The asset which was bought by Eric

secondly is the share of a company which had the cost of acquisition to be less than the previous

one which is $15000 (Dafflon, 2015).

2) Assets which were brought by Eric for personal pleasures and enjoyment do not involve

the taxability of the gain in the capital as the costs of procurement of the assets is very much less

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

than or equivalent to $500. On the basis of this information, Eric had taken over the collectibles.

The asset which was taken over by Eric at first is the painting which has cost of acquisition as

$90000 (Filatova, 2014). The asset that was secondly captured by Eric is the antique chair which

has cost of acquisition as $30000. The last asset which was acquired by Eric is the antique vase.

It had acquisition costs of $2000 correspondingly.

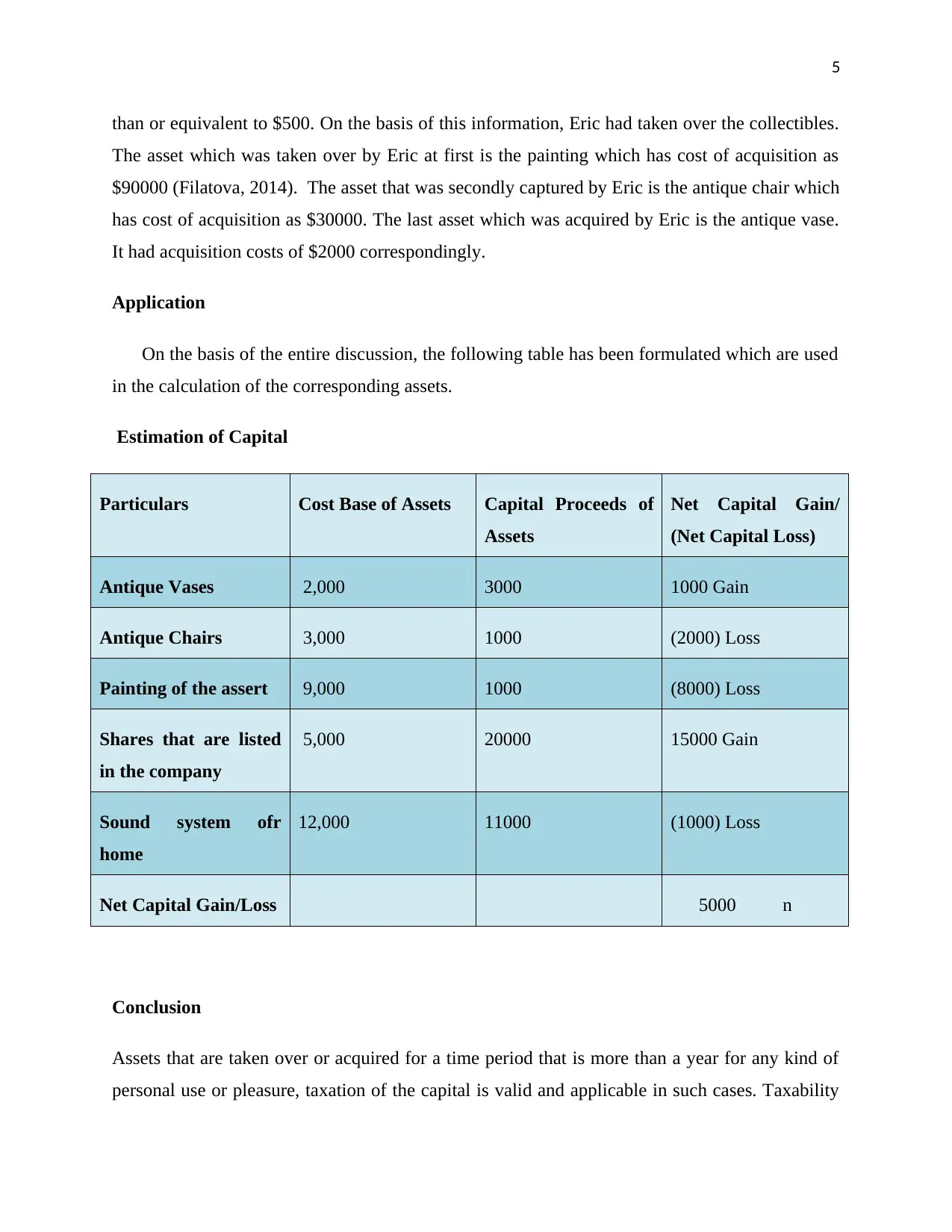

Application

On the basis of the entire discussion, the following table has been formulated which are used

in the calculation of the corresponding assets.

Estimation of Capital

Particulars Cost Base of Assets Capital Proceeds of

Assets

Net Capital Gain/

(Net Capital Loss)

Antique Vases 2,000 3000 1000 Gain

Antique Chairs 3,000 1000 (2000) Loss

Painting of the assert 9,000 1000 (8000) Loss

Shares that are listed

in the company

5,000 20000 15000 Gain

Sound system ofr

home

12,000 11000 (1000) Loss

Net Capital Gain/Loss 5000 n

Conclusion

Assets that are taken over or acquired for a time period that is more than a year for any kind of

personal use or pleasure, taxation of the capital is valid and applicable in such cases. Taxability

than or equivalent to $500. On the basis of this information, Eric had taken over the collectibles.

The asset which was taken over by Eric at first is the painting which has cost of acquisition as

$90000 (Filatova, 2014). The asset that was secondly captured by Eric is the antique chair which

has cost of acquisition as $30000. The last asset which was acquired by Eric is the antique vase.

It had acquisition costs of $2000 correspondingly.

Application

On the basis of the entire discussion, the following table has been formulated which are used

in the calculation of the corresponding assets.

Estimation of Capital

Particulars Cost Base of Assets Capital Proceeds of

Assets

Net Capital Gain/

(Net Capital Loss)

Antique Vases 2,000 3000 1000 Gain

Antique Chairs 3,000 1000 (2000) Loss

Painting of the assert 9,000 1000 (8000) Loss

Shares that are listed

in the company

5,000 20000 15000 Gain

Sound system ofr

home

12,000 11000 (1000) Loss

Net Capital Gain/Loss 5000 n

Conclusion

Assets that are taken over or acquired for a time period that is more than a year for any kind of

personal use or pleasure, taxation of the capital is valid and applicable in such cases. Taxability

6

is valid and applicable on the collectibles which are acquired with the costs more than $500. The

losses in the capital for the entire year have been fixed with the required net worth of loss or

gain.

Loan sanctioned by Brain

Issue

Brian has recommended a new and innovative system to the employees in which he was offering

loan for time duration of three years with the rate of interest being one percent on a monthly

basis. Because of this idea which involves $ 1 million, many individuals turned up to open a

bank account and receive the benefits and advantages of the loans which were offered to the

employees by Brian (Francks & Francks, 2015). He was making the offer of the rate of interest

that was less than the rate of interest that was offered in the market.

Rule

Apart from this offer, in order to calculate the taxability of such kinds of benefits, the rate of the

statutory interest need to be considered. In accordance to the question, the interest rate of

statutory will be accounted as 5.56 percent as the loan was made to be offered on the date of 1st

April, 2016.

Application

In the first step, the benefits of the loan will be computed after the eradication of the rule. The

loan interests are determined on the basis of the actual interest rate that should be deducted from

the loan which is determined due to the statutory rate of interest. The rate of interest which are

based on the statutory interest = $ 1000000 * 5.65 percent = $ 56,500. The interest which are

based in the actual interest = $ 1000000 * 1 percent= $10000. The taxation is varying in both the

scenarios, which is $ 56, 500 - $ 10,000 = $ 46,500. In the second step, Brian needs to follow the

next step. He must compute the rate of statutory interest after the acceptance of the amount to be

payable and real. The interest rate is $1000000 * 5.65 percent = $56,500. In the third step, from

the whole percent, only 40 percent was utilized in the implementation of the meeting for the

upcoming events, where Brian has calculated the costs from which tax was deducted manually

is valid and applicable on the collectibles which are acquired with the costs more than $500. The

losses in the capital for the entire year have been fixed with the required net worth of loss or

gain.

Loan sanctioned by Brain

Issue

Brian has recommended a new and innovative system to the employees in which he was offering

loan for time duration of three years with the rate of interest being one percent on a monthly

basis. Because of this idea which involves $ 1 million, many individuals turned up to open a

bank account and receive the benefits and advantages of the loans which were offered to the

employees by Brian (Francks & Francks, 2015). He was making the offer of the rate of interest

that was less than the rate of interest that was offered in the market.

Rule

Apart from this offer, in order to calculate the taxability of such kinds of benefits, the rate of the

statutory interest need to be considered. In accordance to the question, the interest rate of

statutory will be accounted as 5.56 percent as the loan was made to be offered on the date of 1st

April, 2016.

Application

In the first step, the benefits of the loan will be computed after the eradication of the rule. The

loan interests are determined on the basis of the actual interest rate that should be deducted from

the loan which is determined due to the statutory rate of interest. The rate of interest which are

based on the statutory interest = $ 1000000 * 5.65 percent = $ 56,500. The interest which are

based in the actual interest = $ 1000000 * 1 percent= $10000. The taxation is varying in both the

scenarios, which is $ 56, 500 - $ 10,000 = $ 46,500. In the second step, Brian needs to follow the

next step. He must compute the rate of statutory interest after the acceptance of the amount to be

payable and real. The interest rate is $1000000 * 5.65 percent = $56,500. In the third step, from

the whole percent, only 40 percent was utilized in the implementation of the meeting for the

upcoming events, where Brian has calculated the costs from which tax was deducted manually

7

which is $ 56,500 * 40 percent = $ 22, 600. According to the fourth step, from the entire amount

of the loan, 40 percent was utilized in the meeting for the near future by Brian which involves

the real amount that amounts to as $10000 * 40 percent = $4,000. In the fourth step, apart from

the above mentioned steps, the actual amount is then computed in this step from the manual

amount so as to arrive at the desired conclusion. Hence, $22,600 - $4,000 = $ 18,600. The final

amount, in the final step, needs to be calculated by subtracting the amount from the first step

after calculating the amount till 5th step. Hence, $46,500 - $ 18,600 = $ 27,900.

Conclusion

However, if there happens to be any kind of system if repayment of such loans right before the

period of termination, in that case, instead of the conventional system of repayment, the period

deemed of the loan will be considered from starting period of the interest or become payable

(Leigh & Blakely, 2016). Other than this, the obligation is on the section of the repaying mode

of the interests, then in these kinds of scenarios, the calculation need to be conducted in a very

similar way such as the actual rate of interest that is considered as 0.

Regarding loan of Jack and Jill

Issue

Both Jack and Jill have made an agreement for borrowing the money for the house which they

have rented. In the agreement it has been structured that Jack was allotted to receive ten percent

of the profits, on the other hand, Jill was eligible to receive ninety percent of the profit deriving

out of the whole property.

Rule

In accordance to the agreement made on between Jack and Jill, in any scenario which would

involve any kind of loss in the property, the entire amount of loss, that is 100 percent, will be

handled by Jack. Jack and Jill, in previous year, had sustained a loss of around $1000 that was

completely paid by Jack with no obligation of any of the losses on Jill who is Jack’s wife (Meese

& Oman, 2013). The loss resulted in a set off on the other different forms of incomes of Jack

that would determine the net loss or profit for the whole year. Jack, apart from this specific

which is $ 56,500 * 40 percent = $ 22, 600. According to the fourth step, from the entire amount

of the loan, 40 percent was utilized in the meeting for the near future by Brian which involves

the real amount that amounts to as $10000 * 40 percent = $4,000. In the fourth step, apart from

the above mentioned steps, the actual amount is then computed in this step from the manual

amount so as to arrive at the desired conclusion. Hence, $22,600 - $4,000 = $ 18,600. The final

amount, in the final step, needs to be calculated by subtracting the amount from the first step

after calculating the amount till 5th step. Hence, $46,500 - $ 18,600 = $ 27,900.

Conclusion

However, if there happens to be any kind of system if repayment of such loans right before the

period of termination, in that case, instead of the conventional system of repayment, the period

deemed of the loan will be considered from starting period of the interest or become payable

(Leigh & Blakely, 2016). Other than this, the obligation is on the section of the repaying mode

of the interests, then in these kinds of scenarios, the calculation need to be conducted in a very

similar way such as the actual rate of interest that is considered as 0.

Regarding loan of Jack and Jill

Issue

Both Jack and Jill have made an agreement for borrowing the money for the house which they

have rented. In the agreement it has been structured that Jack was allotted to receive ten percent

of the profits, on the other hand, Jill was eligible to receive ninety percent of the profit deriving

out of the whole property.

Rule

In accordance to the agreement made on between Jack and Jill, in any scenario which would

involve any kind of loss in the property, the entire amount of loss, that is 100 percent, will be

handled by Jack. Jack and Jill, in previous year, had sustained a loss of around $1000 that was

completely paid by Jack with no obligation of any of the losses on Jill who is Jack’s wife (Meese

& Oman, 2013). The loss resulted in a set off on the other different forms of incomes of Jack

that would determine the net loss or profit for the whole year. Jack, apart from this specific

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

option, has one more choice which is regarding carrying the whole loss in the forward direction

for the upcoming year.

Application

In any scenario where Jack is confronting any kind of loss, and then he has the complete right to

bear the complete amount and can take the amount forward in the future years so as to maintain

the net loss in the amount or the net income. In the second scenario, is there is any amount of

gain, and then the particular amount will be categorized between Jack and his wife Jill

effectively in the ratio of 10:90. In such cases, Jack has the complete right for setting off the total

loss of $1000 which resulted after the sale of the property.

Conclusion

Hence, from the whole discussion, it was decided that Jack was able to handle the losses which

had occurred in the last year and he is obtaining the amount in the current year after the sale of

the property (Mumford, 2017). The conclusion was made which stated that if Jack happens to not

have any gain in the recent year, he, in such case, has to be accountable to pay for the entire loss

with no involvement of his wife Jill. Hence, this process has been a great assistance to Jill for

staying away from the effects of taxation where as Jack is only accountable to bear the entire

loss.

Legal Plan

Issue

In accordance to the law, every person has the power regarding the legal strategies and plans

which assist them in decreasing the net amount of income at the end of each year, according to

the case scenario study of the IRC versus Duke of Westminster [1936] AC 1 (Seyoum, 2013).

After getting into the details of the case after analyzing the case properly, it was clarified that

each individual obtains the right of utilizing the benefits and rights which are attached to the

overall income.

Rule

option, has one more choice which is regarding carrying the whole loss in the forward direction

for the upcoming year.

Application

In any scenario where Jack is confronting any kind of loss, and then he has the complete right to

bear the complete amount and can take the amount forward in the future years so as to maintain

the net loss in the amount or the net income. In the second scenario, is there is any amount of

gain, and then the particular amount will be categorized between Jack and his wife Jill

effectively in the ratio of 10:90. In such cases, Jack has the complete right for setting off the total

loss of $1000 which resulted after the sale of the property.

Conclusion

Hence, from the whole discussion, it was decided that Jack was able to handle the losses which

had occurred in the last year and he is obtaining the amount in the current year after the sale of

the property (Mumford, 2017). The conclusion was made which stated that if Jack happens to not

have any gain in the recent year, he, in such case, has to be accountable to pay for the entire loss

with no involvement of his wife Jill. Hence, this process has been a great assistance to Jill for

staying away from the effects of taxation where as Jack is only accountable to bear the entire

loss.

Legal Plan

Issue

In accordance to the law, every person has the power regarding the legal strategies and plans

which assist them in decreasing the net amount of income at the end of each year, according to

the case scenario study of the IRC versus Duke of Westminster [1936] AC 1 (Seyoum, 2013).

After getting into the details of the case after analyzing the case properly, it was clarified that

each individual obtains the right of utilizing the benefits and rights which are attached to the

overall income.

Rule

9

In the terms which are familiar, the rights which are valid only in the scenarios where they are

used in a very fair manner and the appropriate methods which are applied to it , that is

supposed for the reduction of the income costs and the values to a tax at the end of that

particular year (Valente, 2017).

The following principles are categorized from the above scenario of the case study:

Principles 1:

The entire authority has been awarded to the individual for using the strategic plans and methods

for the reduction of the total income by regulating their own individual accounts.

Principles 2:

There will be no extra taxes levies or implemented if the process will be carried out in an

appropriate manner without any methods or means that are illegal.

Principles 3:

When an individual follows the legal and fair way for reduction of the rate of tax and amount,

then they will not be enforced for paying the extra rate of tax in the near future.

Application

The point number can be stated as valid unless any new kind of law is executed in the nation.

The ideology is very different from each other and keeps varying from the previous year. The

key objective of these rules has a prominent role and importance in the present circumstance in

different manners (Vatn, 2015). Considering an instance, in the scenario in which a business is

confronted with great deal of losses in a specific year that attends to its obligations, in such

conditions, the business has the chance for the alterations in the amount and balance sheets. The

business can make preparations regarding the new one with the assets that are fixed and the value

of the assets. In certain cases, the business did not happen to provide the documents that are

relevant but however, they can carry out the implementation further.

Conclusion

In the terms which are familiar, the rights which are valid only in the scenarios where they are

used in a very fair manner and the appropriate methods which are applied to it , that is

supposed for the reduction of the income costs and the values to a tax at the end of that

particular year (Valente, 2017).

The following principles are categorized from the above scenario of the case study:

Principles 1:

The entire authority has been awarded to the individual for using the strategic plans and methods

for the reduction of the total income by regulating their own individual accounts.

Principles 2:

There will be no extra taxes levies or implemented if the process will be carried out in an

appropriate manner without any methods or means that are illegal.

Principles 3:

When an individual follows the legal and fair way for reduction of the rate of tax and amount,

then they will not be enforced for paying the extra rate of tax in the near future.

Application

The point number can be stated as valid unless any new kind of law is executed in the nation.

The ideology is very different from each other and keeps varying from the previous year. The

key objective of these rules has a prominent role and importance in the present circumstance in

different manners (Vatn, 2015). Considering an instance, in the scenario in which a business is

confronted with great deal of losses in a specific year that attends to its obligations, in such

conditions, the business has the chance for the alterations in the amount and balance sheets. The

business can make preparations regarding the new one with the assets that are fixed and the value

of the assets. In certain cases, the business did not happen to provide the documents that are

relevant but however, they can carry out the implementation further.

Conclusion

10

However, specific restrictions are appropriate for them (Verdier & Voeten, 2014). They must not

follow any kind of illegal ways for achieving so. Summarizing the entire discussion, it is clearly

evident that the business organization has to function in a very transparent and legal manner for

achieving the business target and need to follow the rules and laws along with its procedures.

Land issue of Bill

Issue

In this case, Bill acquired a piece of land that he has considered for using it for the purpose of

grazing by the sheep. So as to fulfill his wishes, the whole land requires to be cleared as much

number of trees was planted over there. Hence, he had hired a company that provides logging

services for clearing the entire land (Wagner, 2013).

Rule

The logging company has charged Bill with $ 1000 for every 100 meters of the timber. However,

the key question that arises in this case is that whether the tax is applicable on the company

providing logging services for the whole amount. In accordance to the given situation, there are

no presences of any fact on the receipts which are received from the logging company that is

considered as the object of revenue or might not be assumed to be an object. The highest degree

of uncertainty states that the rules that are associated to the gains in the capital are not suitable

and applicable in the recent circumstances of Bill (Yan & Luo, 2016).

Application

When the Bill is making an investment of the entire amount of $50000 to the company providing

logging services for the removal of the trees for getting the timbers, the equal and entire amount

is transferred to the hands of Bill in the form of the receipt of capital. This happens because of

the reason in which the entire amount is considered as a lump sum and there is more recurring

receipt for the reason. Again, the transaction which has occurred facilitates the provision of the

right to the specific authority for the removal of the trees from the particular land. Hence, after

the complete scenario, the case was assumed to be as the receipt of lump sum along with the net

capital receipt. Hence, taxation of the capital is in the responsibility of Bill.

However, specific restrictions are appropriate for them (Verdier & Voeten, 2014). They must not

follow any kind of illegal ways for achieving so. Summarizing the entire discussion, it is clearly

evident that the business organization has to function in a very transparent and legal manner for

achieving the business target and need to follow the rules and laws along with its procedures.

Land issue of Bill

Issue

In this case, Bill acquired a piece of land that he has considered for using it for the purpose of

grazing by the sheep. So as to fulfill his wishes, the whole land requires to be cleared as much

number of trees was planted over there. Hence, he had hired a company that provides logging

services for clearing the entire land (Wagner, 2013).

Rule

The logging company has charged Bill with $ 1000 for every 100 meters of the timber. However,

the key question that arises in this case is that whether the tax is applicable on the company

providing logging services for the whole amount. In accordance to the given situation, there are

no presences of any fact on the receipts which are received from the logging company that is

considered as the object of revenue or might not be assumed to be an object. The highest degree

of uncertainty states that the rules that are associated to the gains in the capital are not suitable

and applicable in the recent circumstances of Bill (Yan & Luo, 2016).

Application

When the Bill is making an investment of the entire amount of $50000 to the company providing

logging services for the removal of the trees for getting the timbers, the equal and entire amount

is transferred to the hands of Bill in the form of the receipt of capital. This happens because of

the reason in which the entire amount is considered as a lump sum and there is more recurring

receipt for the reason. Again, the transaction which has occurred facilitates the provision of the

right to the specific authority for the removal of the trees from the particular land. Hence, after

the complete scenario, the case was assumed to be as the receipt of lump sum along with the net

capital receipt. Hence, taxation of the capital is in the responsibility of Bill.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

Conclusion

Therefore, in the above scenarios, the value of, money that was put into investment has played a

great role and has a key significance in the laws of taxation. These two cases are very much

different from each other. In the first case scenario, the receipt is in the accountability of Bill and

is recurring. On the other hand, the receipt is in the accountability of Bill, however, it is not

recurring which provides the right of receiving the payments from the logging of the tress in the

upcoming situations. He will receive the same receipt in a bigger investment and that will be

taken into consideration as the receipt in one- time (Verdier & Voeten, 2014). These are the

considerations as the receipt in the kind of one-time as when they are made to be removed from

the land, it will consume more time for growing the trees again on the same section of land.

Thus, in the next upcoming situation, Bill is getting sufficient amount of money from the other

side. This act is regarded as a lump sum by making the assets getting sold. When one of the

parties sells the product to the opposition party, then the same receipt has to be considered along

with the taxation. When the observation was made regarding the first case, it did not attract any

gain in the tax, and then it needs to be treated as a normal and conventional gain and no gain in

capital.

References

Aust, A., 2013. Modern treaty law and practice. Cambridge University Press.

Beatty, D.M., 2015. Constitutional law in theory and practice. University of Toronto Press.

Brigham, E.F., 2014. Financial management theory and practice. Atlantic Publishers & Distri.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice. Cengage

Learning.

Dafflon, B., 2015. The assignment of functions to decentralized government: from theory to

practice. Handbook of multilevel finance, Edward Elgar, Cheltenham, pp.163-199.

Filatova, T., 2014. Market-based instruments for flood risk management: a review of theory,

practice and perspectives for climate adaptation policy. Environmental science & policy, 37,

pp.227-242.

Conclusion

Therefore, in the above scenarios, the value of, money that was put into investment has played a

great role and has a key significance in the laws of taxation. These two cases are very much

different from each other. In the first case scenario, the receipt is in the accountability of Bill and

is recurring. On the other hand, the receipt is in the accountability of Bill, however, it is not

recurring which provides the right of receiving the payments from the logging of the tress in the

upcoming situations. He will receive the same receipt in a bigger investment and that will be

taken into consideration as the receipt in one- time (Verdier & Voeten, 2014). These are the

considerations as the receipt in the kind of one-time as when they are made to be removed from

the land, it will consume more time for growing the trees again on the same section of land.

Thus, in the next upcoming situation, Bill is getting sufficient amount of money from the other

side. This act is regarded as a lump sum by making the assets getting sold. When one of the

parties sells the product to the opposition party, then the same receipt has to be considered along

with the taxation. When the observation was made regarding the first case, it did not attract any

gain in the tax, and then it needs to be treated as a normal and conventional gain and no gain in

capital.

References

Aust, A., 2013. Modern treaty law and practice. Cambridge University Press.

Beatty, D.M., 2015. Constitutional law in theory and practice. University of Toronto Press.

Brigham, E.F., 2014. Financial management theory and practice. Atlantic Publishers & Distri.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice. Cengage

Learning.

Dafflon, B., 2015. The assignment of functions to decentralized government: from theory to

practice. Handbook of multilevel finance, Edward Elgar, Cheltenham, pp.163-199.

Filatova, T., 2014. Market-based instruments for flood risk management: a review of theory,

practice and perspectives for climate adaptation policy. Environmental science & policy, 37,

pp.227-242.

12

Francks, P. and Francks, P., 2015. Japanese economic development: theory and practice.

Routledge.

Leigh, N.G. and Blakely, E.J., 2016. Planning local economic development: Theory and

practice. Sage Publications.

Meese, A.J. and Oman, N.B., 2013. Hobby Lobby, Corporate Law, and the Theory of the Firm:

Why For-Profit Corporations Are RFRA Persons. Harv. L. Rev. F., 127, p.273.

Mumford, A., 2017. Taxing culture: towards a theory of tax collection law. Routledge.

Seyoum, B., 2013. Export-Import theory, practices, and procedures. Routledge.

Valente, C., 2017. The theory and practice of revolt in medieval England. Routledge.

Vatn, A., 2015. Markets in environmental governance. From theory to practice. Ecological

Economics, 117, pp.225-233.

Verdier, P.H. and Voeten, E., 2014. Precedent, compliance, and change in customary

international law: An explanatory theory. American Journal of International Law, 108(3),

pp.389-434.

Wagner, R.E., 2013. Charging for Government (Routledge Revivals): User Charges and

Earmarked Taxes in Principle and Practice. Routledge.

Yan, A. and Luo, Y., 2016. International joint ventures: Theory and practice. Routledge.

Francks, P. and Francks, P., 2015. Japanese economic development: theory and practice.

Routledge.

Leigh, N.G. and Blakely, E.J., 2016. Planning local economic development: Theory and

practice. Sage Publications.

Meese, A.J. and Oman, N.B., 2013. Hobby Lobby, Corporate Law, and the Theory of the Firm:

Why For-Profit Corporations Are RFRA Persons. Harv. L. Rev. F., 127, p.273.

Mumford, A., 2017. Taxing culture: towards a theory of tax collection law. Routledge.

Seyoum, B., 2013. Export-Import theory, practices, and procedures. Routledge.

Valente, C., 2017. The theory and practice of revolt in medieval England. Routledge.

Vatn, A., 2015. Markets in environmental governance. From theory to practice. Ecological

Economics, 117, pp.225-233.

Verdier, P.H. and Voeten, E., 2014. Precedent, compliance, and change in customary

international law: An explanatory theory. American Journal of International Law, 108(3),

pp.389-434.

Wagner, R.E., 2013. Charging for Government (Routledge Revivals): User Charges and

Earmarked Taxes in Principle and Practice. Routledge.

Yan, A. and Luo, Y., 2016. International joint ventures: Theory and practice. Routledge.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.