Islamic Banking in Theory and Practice: A Comprehensive Analysis

VerifiedAdded on 2023/01/17

|17

|4078

|79

Report

AI Summary

This report provides a comprehensive overview of Islamic banking, exploring its theoretical foundations and practical applications. It begins with an introduction to Islamic banking, emphasizing its adherence to Sharia law and its growing significance in the financial world. The main body of the report is divided into three tasks. Task 1 details the central Islamic banking products, such as Murabaha, Ijara, Musharaka, and Diminishing Musharaka, explaining their functionalities and advantages. Task 2 focuses on the ethical values of Islamic banking, specifically facilitation & cooperation, and communication, and discusses the economic and legal challenges associated with these values. Task 3 analyzes the regulatory frameworks of Islamic banking in two countries, providing insights into corporate governance in this sector. The report concludes by summarizing the key findings and emphasizing the unique aspects of Islamic banking and its role in the global financial landscape.

Islamic Banking in

theory and practice

theory and practice

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1............................................................................................................................................3

1. Describe the central Islamic banking products based on fundamental techniques of Islamic

banking.........................................................................................................................................3

TASK 2............................................................................................................................................9

1. Describe the two ethical values of Islamic banking products and justify the economic or

legal challenges of any one ethical value.....................................................................................9

TASK 3..........................................................................................................................................10

1. Analysis the Islamic banking government within regulatory framework of two countries...10

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1............................................................................................................................................3

1. Describe the central Islamic banking products based on fundamental techniques of Islamic

banking.........................................................................................................................................3

TASK 2............................................................................................................................................9

1. Describe the two ethical values of Islamic banking products and justify the economic or

legal challenges of any one ethical value.....................................................................................9

TASK 3..........................................................................................................................................10

1. Analysis the Islamic banking government within regulatory framework of two countries...10

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION

Islamic banking is an financial activity which complies with Sharia that is Islamic Law

and it includes the various practical applications for the development of Islamic economics.

Sharia is based on the God's immutable divine law and the religious perspective (Abdel-Baki and

Leone Sciabolazza, 2014). There are various factors which strengthening the Islamic banking

such as high demand, financial instrument, regulatory framework, diversification in the banking

services, investment related products etc. Basically Muslim countries and communities follow

Islamic banking, so the late 20th century these principles implement by the private or semi-

private commercial institute. After 2009, there was around 300 banks and 250 mutual funds

complying with Islamic principles and by 2014 it was around $ 2 trillion Sharia compliant.

Sharia represent the total approx. 1% of total world assets which are from some Islamic countries

such as Gulf Cooperation Council (GCC), Iran and Malaysia. This report cover the various topics

such as central Islamic banking products that is based on the fundamental techniques of Islamic

banking, also cover the pros & cons of every technique. In addition, it includes the two ethical

values in Islamic finance and what are the economic or legal challenges they faces. It covers the

Islamic banking governance in the regulatory framework of two countries.

MAIN BODY

TASK 1

1. Describe the central Islamic banking products based on fundamental techniques of Islamic

banking

Islamic banking offer the huge range of Sharia Compliant products & services which is

implemented in the Muslim countries. Murabaha is overlooking the financial portfolio of Islamic

Banking Institute (IBI). Other than this, Ijara, Musharaka and Diminishing Musharaka used in

financing of IBI (Ahmed, 2014). There are various product & services which Islamic banking

offer and they follow the Islamic principles as well. These products offer in order to meet the

customer expectation and they offer in the various range such as.

Islamic banking is an financial activity which complies with Sharia that is Islamic Law

and it includes the various practical applications for the development of Islamic economics.

Sharia is based on the God's immutable divine law and the religious perspective (Abdel-Baki and

Leone Sciabolazza, 2014). There are various factors which strengthening the Islamic banking

such as high demand, financial instrument, regulatory framework, diversification in the banking

services, investment related products etc. Basically Muslim countries and communities follow

Islamic banking, so the late 20th century these principles implement by the private or semi-

private commercial institute. After 2009, there was around 300 banks and 250 mutual funds

complying with Islamic principles and by 2014 it was around $ 2 trillion Sharia compliant.

Sharia represent the total approx. 1% of total world assets which are from some Islamic countries

such as Gulf Cooperation Council (GCC), Iran and Malaysia. This report cover the various topics

such as central Islamic banking products that is based on the fundamental techniques of Islamic

banking, also cover the pros & cons of every technique. In addition, it includes the two ethical

values in Islamic finance and what are the economic or legal challenges they faces. It covers the

Islamic banking governance in the regulatory framework of two countries.

MAIN BODY

TASK 1

1. Describe the central Islamic banking products based on fundamental techniques of Islamic

banking

Islamic banking offer the huge range of Sharia Compliant products & services which is

implemented in the Muslim countries. Murabaha is overlooking the financial portfolio of Islamic

Banking Institute (IBI). Other than this, Ijara, Musharaka and Diminishing Musharaka used in

financing of IBI (Ahmed, 2014). There are various product & services which Islamic banking

offer and they follow the Islamic principles as well. These products offer in order to meet the

customer expectation and they offer in the various range such as.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

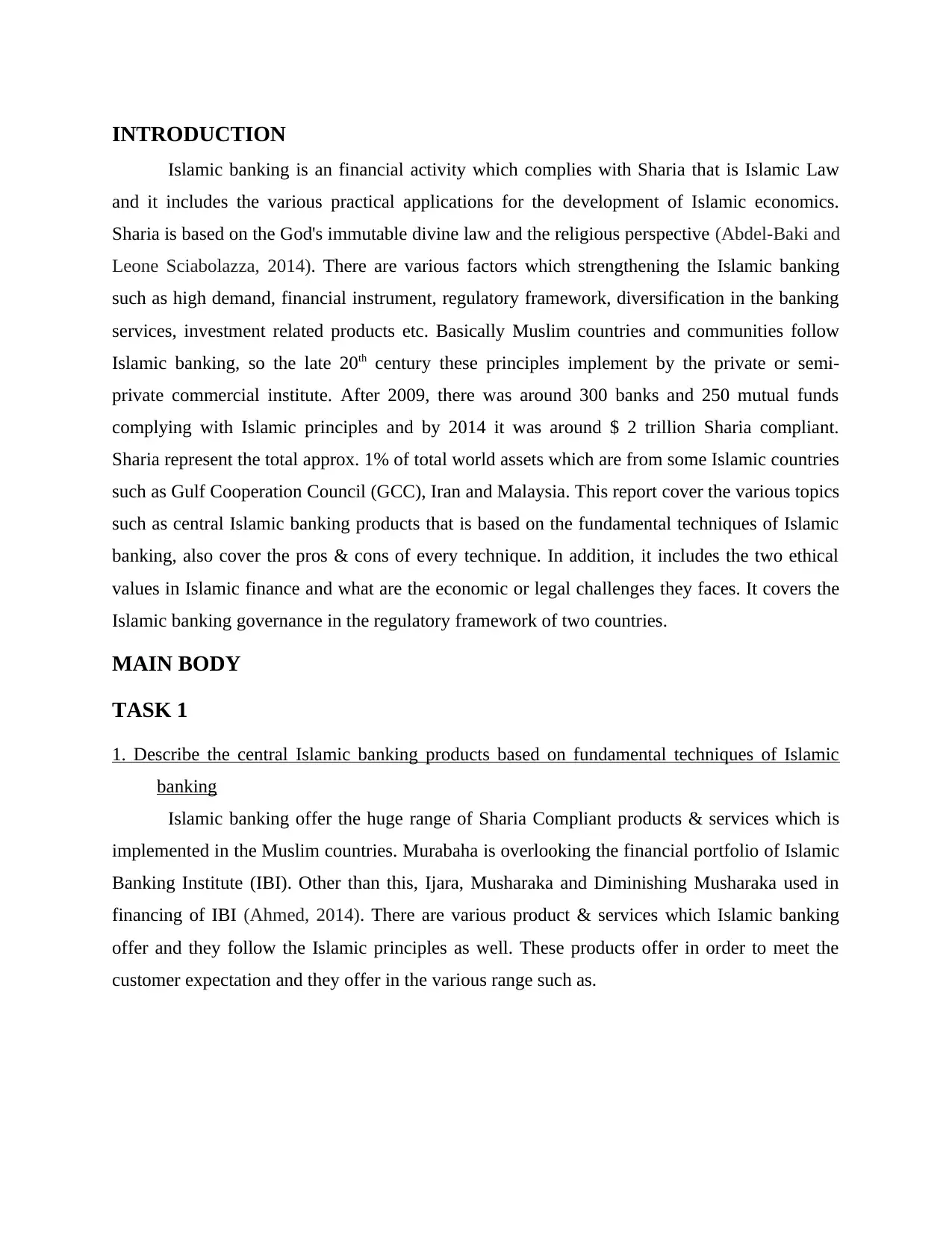

Illustration 1: Mode of Finance, 2008.

Above mention picture represent the mode of finance which offer by the Sharia Banking.

According to Sharia, products & services of Islamic banking will be managed separately from

the Conventional banking side. Above mention mode of finance will be covered in the major two

categories such as deposit products & financing products. All the funds will be released on the

basis of Halal modes or under the supervision of Sharia Advisor. Some of the Islamic banking

products are mentioned below:

Deposit products: It includes the money which deposited by the customers in the banks

for safekeeping. It will maintained under deposit accounts which allow the citizens to secure

their money into banks or they can withdraw anytime according to their wish. In the deposit

products it includes the various accounts such as current & savings account which is called

Wadiah Dhamanah under the Sharia concepts (Alamer and et.al., 2015). It also contain general,

special or specific investment accounts which is called Mudarabah. Other these products, Islamic

banking also deals in money market where they issue Negotiable Islamic Debt Certificate

(NIDC), Islamic Negotiable Instrument of Deposit (INID) which is called Mudharabha or profit

sharing under Sharia concept of Islamic banking.

Above mention picture represent the mode of finance which offer by the Sharia Banking.

According to Sharia, products & services of Islamic banking will be managed separately from

the Conventional banking side. Above mention mode of finance will be covered in the major two

categories such as deposit products & financing products. All the funds will be released on the

basis of Halal modes or under the supervision of Sharia Advisor. Some of the Islamic banking

products are mentioned below:

Deposit products: It includes the money which deposited by the customers in the banks

for safekeeping. It will maintained under deposit accounts which allow the citizens to secure

their money into banks or they can withdraw anytime according to their wish. In the deposit

products it includes the various accounts such as current & savings account which is called

Wadiah Dhamanah under the Sharia concepts (Alamer and et.al., 2015). It also contain general,

special or specific investment accounts which is called Mudarabah. Other these products, Islamic

banking also deals in money market where they issue Negotiable Islamic Debt Certificate

(NIDC), Islamic Negotiable Instrument of Deposit (INID) which is called Mudharabha or profit

sharing under Sharia concept of Islamic banking.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

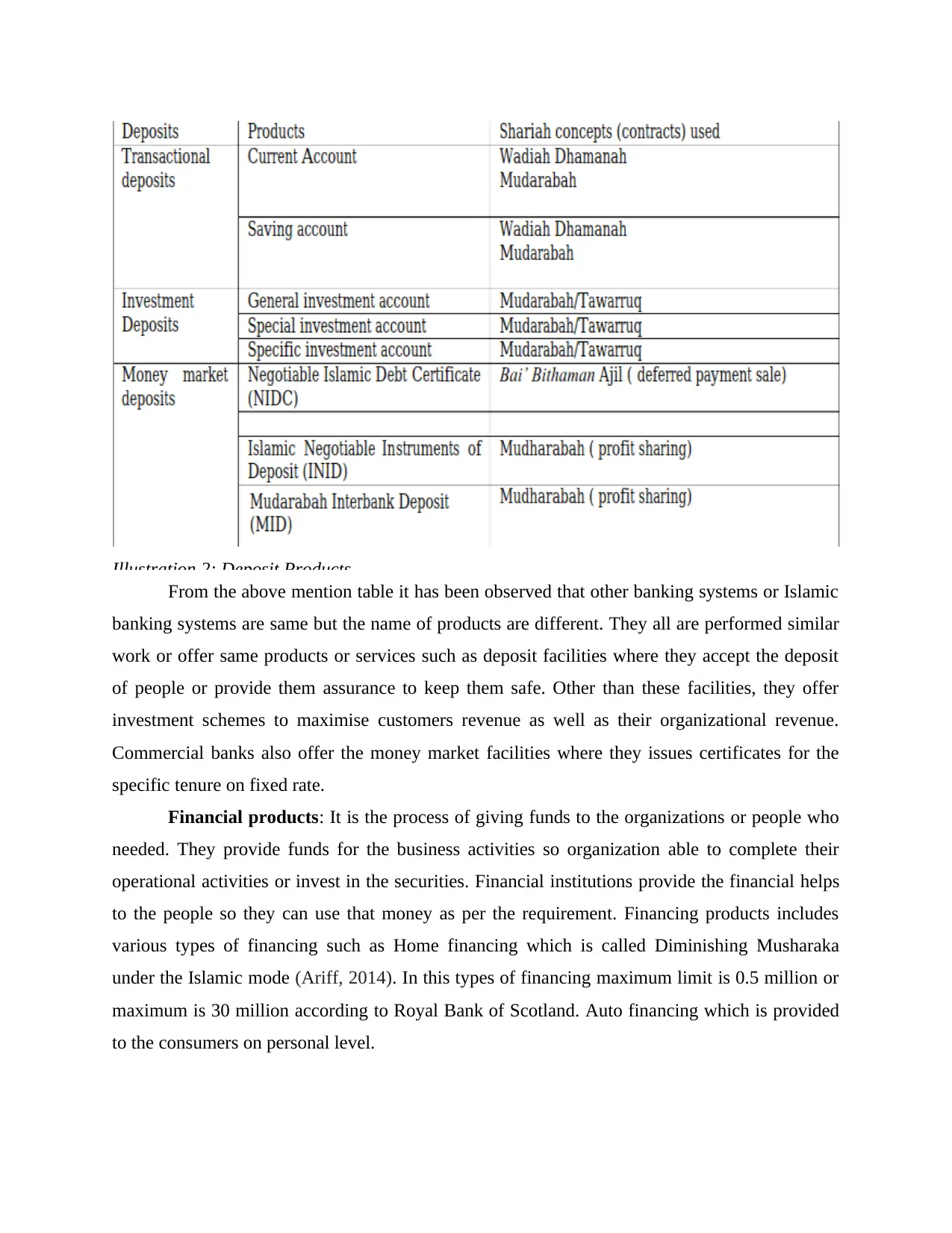

Illustration 2: Deposit Products.

From the above mention table it has been observed that other banking systems or Islamic

banking systems are same but the name of products are different. They all are performed similar

work or offer same products or services such as deposit facilities where they accept the deposit

of people or provide them assurance to keep them safe. Other than these facilities, they offer

investment schemes to maximise customers revenue as well as their organizational revenue.

Commercial banks also offer the money market facilities where they issues certificates for the

specific tenure on fixed rate.

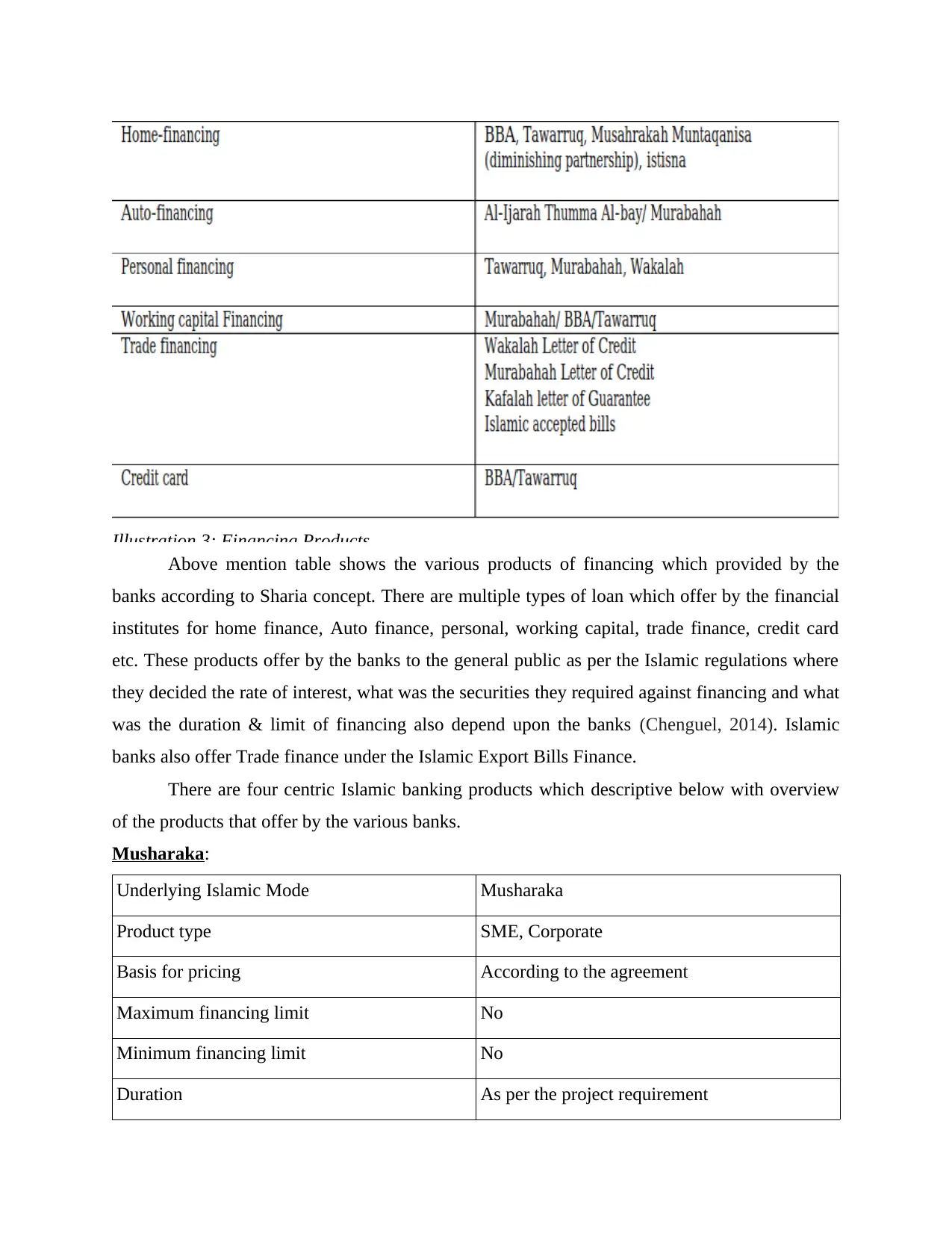

Financial products: It is the process of giving funds to the organizations or people who

needed. They provide funds for the business activities so organization able to complete their

operational activities or invest in the securities. Financial institutions provide the financial helps

to the people so they can use that money as per the requirement. Financing products includes

various types of financing such as Home financing which is called Diminishing Musharaka

under the Islamic mode (Ariff, 2014). In this types of financing maximum limit is 0.5 million or

maximum is 30 million according to Royal Bank of Scotland. Auto financing which is provided

to the consumers on personal level.

From the above mention table it has been observed that other banking systems or Islamic

banking systems are same but the name of products are different. They all are performed similar

work or offer same products or services such as deposit facilities where they accept the deposit

of people or provide them assurance to keep them safe. Other than these facilities, they offer

investment schemes to maximise customers revenue as well as their organizational revenue.

Commercial banks also offer the money market facilities where they issues certificates for the

specific tenure on fixed rate.

Financial products: It is the process of giving funds to the organizations or people who

needed. They provide funds for the business activities so organization able to complete their

operational activities or invest in the securities. Financial institutions provide the financial helps

to the people so they can use that money as per the requirement. Financing products includes

various types of financing such as Home financing which is called Diminishing Musharaka

under the Islamic mode (Ariff, 2014). In this types of financing maximum limit is 0.5 million or

maximum is 30 million according to Royal Bank of Scotland. Auto financing which is provided

to the consumers on personal level.

Illustration 3: Financing Products.

Above mention table shows the various products of financing which provided by the

banks according to Sharia concept. There are multiple types of loan which offer by the financial

institutes for home finance, Auto finance, personal, working capital, trade finance, credit card

etc. These products offer by the banks to the general public as per the Islamic regulations where

they decided the rate of interest, what was the securities they required against financing and what

was the duration & limit of financing also depend upon the banks (Chenguel, 2014). Islamic

banks also offer Trade finance under the Islamic Export Bills Finance.

There are four centric Islamic banking products which descriptive below with overview

of the products that offer by the various banks.

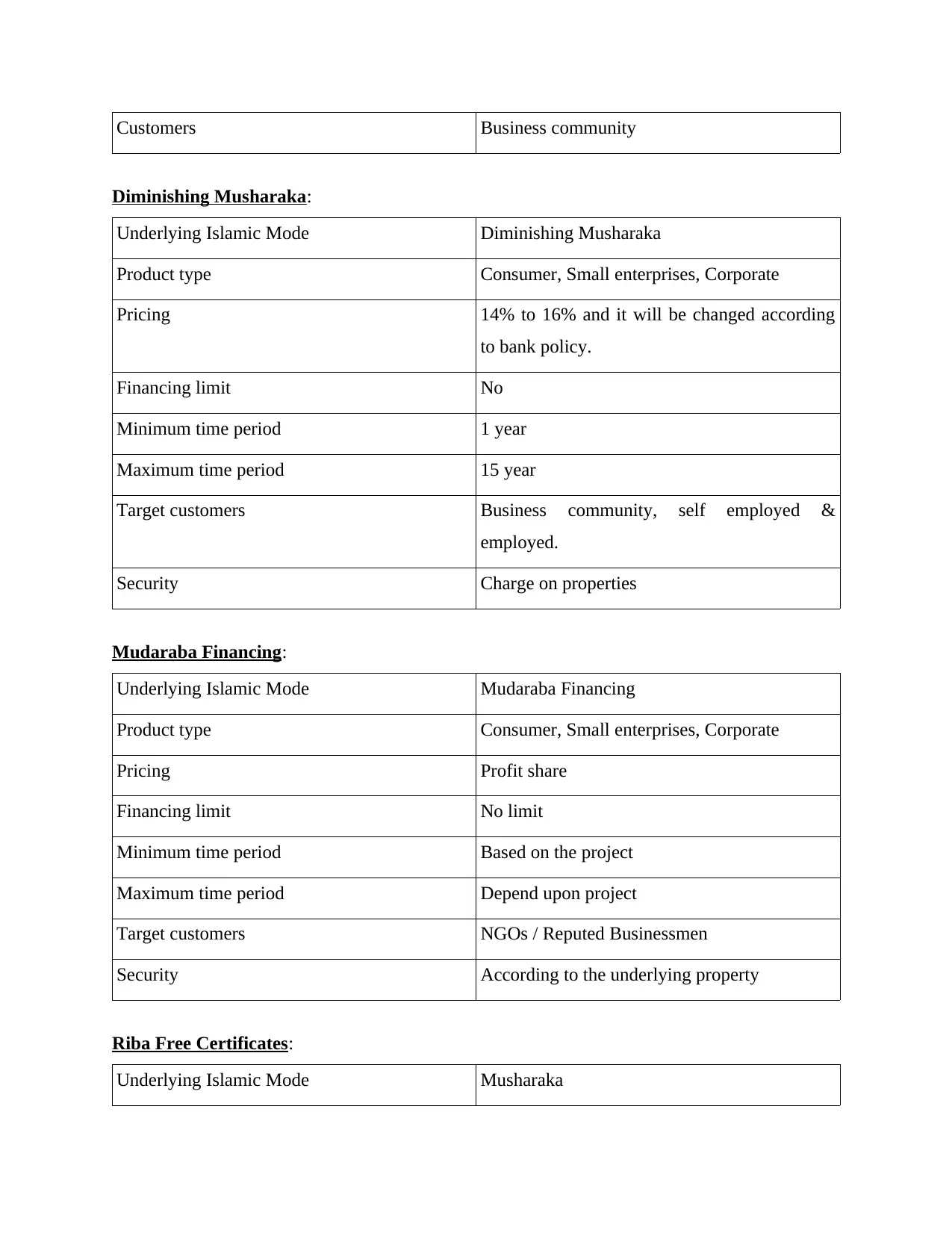

Musharaka:

Underlying Islamic Mode Musharaka

Product type SME, Corporate

Basis for pricing According to the agreement

Maximum financing limit No

Minimum financing limit No

Duration As per the project requirement

Above mention table shows the various products of financing which provided by the

banks according to Sharia concept. There are multiple types of loan which offer by the financial

institutes for home finance, Auto finance, personal, working capital, trade finance, credit card

etc. These products offer by the banks to the general public as per the Islamic regulations where

they decided the rate of interest, what was the securities they required against financing and what

was the duration & limit of financing also depend upon the banks (Chenguel, 2014). Islamic

banks also offer Trade finance under the Islamic Export Bills Finance.

There are four centric Islamic banking products which descriptive below with overview

of the products that offer by the various banks.

Musharaka:

Underlying Islamic Mode Musharaka

Product type SME, Corporate

Basis for pricing According to the agreement

Maximum financing limit No

Minimum financing limit No

Duration As per the project requirement

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Customers Business community

Diminishing Musharaka:

Underlying Islamic Mode Diminishing Musharaka

Product type Consumer, Small enterprises, Corporate

Pricing 14% to 16% and it will be changed according

to bank policy.

Financing limit No

Minimum time period 1 year

Maximum time period 15 year

Target customers Business community, self employed &

employed.

Security Charge on properties

Mudaraba Financing:

Underlying Islamic Mode Mudaraba Financing

Product type Consumer, Small enterprises, Corporate

Pricing Profit share

Financing limit No limit

Minimum time period Based on the project

Maximum time period Depend upon project

Target customers NGOs / Reputed Businessmen

Security According to the underlying property

Riba Free Certificates:

Underlying Islamic Mode Musharaka

Diminishing Musharaka:

Underlying Islamic Mode Diminishing Musharaka

Product type Consumer, Small enterprises, Corporate

Pricing 14% to 16% and it will be changed according

to bank policy.

Financing limit No

Minimum time period 1 year

Maximum time period 15 year

Target customers Business community, self employed &

employed.

Security Charge on properties

Mudaraba Financing:

Underlying Islamic Mode Mudaraba Financing

Product type Consumer, Small enterprises, Corporate

Pricing Profit share

Financing limit No limit

Minimum time period Based on the project

Maximum time period Depend upon project

Target customers NGOs / Reputed Businessmen

Security According to the underlying property

Riba Free Certificates:

Underlying Islamic Mode Musharaka

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Product type Saving

Accepting currency Based on the country

Minimum balance 10000

Minimum time period 6 months

Maximum time period 5 years

Calculation of profit Average basis

Target customer General public or government deposits

Service charge NA

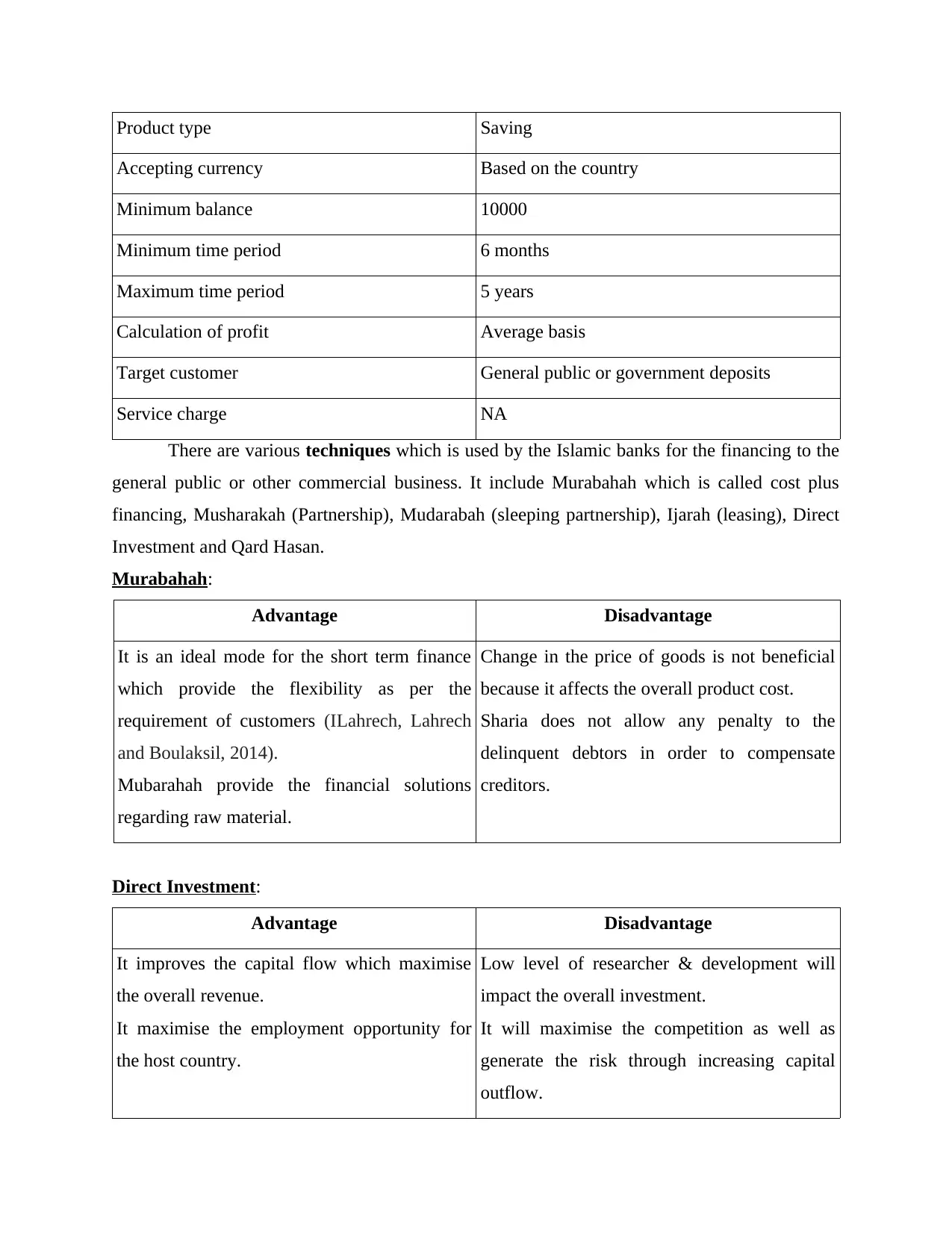

There are various techniques which is used by the Islamic banks for the financing to the

general public or other commercial business. It include Murabahah which is called cost plus

financing, Musharakah (Partnership), Mudarabah (sleeping partnership), Ijarah (leasing), Direct

Investment and Qard Hasan.

Murabahah:

Advantage Disadvantage

It is an ideal mode for the short term finance

which provide the flexibility as per the

requirement of customers (ILahrech, Lahrech

and Boulaksil, 2014).

Mubarahah provide the financial solutions

regarding raw material.

Change in the price of goods is not beneficial

because it affects the overall product cost.

Sharia does not allow any penalty to the

delinquent debtors in order to compensate

creditors.

Direct Investment:

Advantage Disadvantage

It improves the capital flow which maximise

the overall revenue.

It maximise the employment opportunity for

the host country.

Low level of researcher & development will

impact the overall investment.

It will maximise the competition as well as

generate the risk through increasing capital

outflow.

Accepting currency Based on the country

Minimum balance 10000

Minimum time period 6 months

Maximum time period 5 years

Calculation of profit Average basis

Target customer General public or government deposits

Service charge NA

There are various techniques which is used by the Islamic banks for the financing to the

general public or other commercial business. It include Murabahah which is called cost plus

financing, Musharakah (Partnership), Mudarabah (sleeping partnership), Ijarah (leasing), Direct

Investment and Qard Hasan.

Murabahah:

Advantage Disadvantage

It is an ideal mode for the short term finance

which provide the flexibility as per the

requirement of customers (ILahrech, Lahrech

and Boulaksil, 2014).

Mubarahah provide the financial solutions

regarding raw material.

Change in the price of goods is not beneficial

because it affects the overall product cost.

Sharia does not allow any penalty to the

delinquent debtors in order to compensate

creditors.

Direct Investment:

Advantage Disadvantage

It improves the capital flow which maximise

the overall revenue.

It maximise the employment opportunity for

the host country.

Low level of researcher & development will

impact the overall investment.

It will maximise the competition as well as

generate the risk through increasing capital

outflow.

Musharakah (Partnership):

Advantage Disadvantage

Musharakah represent themselves as long term

or medium term financing source which is

beneficial for the banks.

They fulfil the financial need of small

organizations.

Both parties required to present at the time of

completing transaction.

They should accept the principle of

participation in the profit margin and the other

activities as well.

Ijarah:

Advantage Disadvantage

It provide tax benefits to the parties which

maximise the overall balance of profit (Bizri,

2014).

There is no ownership on the assets or their

purchasing items.

TASK 2

1. Describe the two ethical values of Islamic banking products and justify the economic or legal

challenges of any one ethical value

The set of formulated principles which are liable for governing virtuous behaviour is

referred to as ethical values. For assuring that, Islamic banks maintain impelling reputation,

managers are obsessed for public relations which can be developed as well as promoting

appropriate set of ethical values for their employees (Majeed & Zainab, Md Husin and Ab

Rahman, 2016). Basically, they assist within identification of what is right and wrong with

respect to different situations which prevails within the working environment. Islamic banking is

dependent on Islamic Sharia law and committees have been formulated with respect to this so

that there has to be uniformity within practices as well as views. The ethical values with respect

to Islamic banking has been illustrated below: Facilitation & Cooperation: For encouraging ethical banking practices, cost of ethics

within business must be minimised. Resistance for ethics might be impaired in case it is

made accordant with longer run of interest for economic agents (Reviving the Ethics of

Advantage Disadvantage

Musharakah represent themselves as long term

or medium term financing source which is

beneficial for the banks.

They fulfil the financial need of small

organizations.

Both parties required to present at the time of

completing transaction.

They should accept the principle of

participation in the profit margin and the other

activities as well.

Ijarah:

Advantage Disadvantage

It provide tax benefits to the parties which

maximise the overall balance of profit (Bizri,

2014).

There is no ownership on the assets or their

purchasing items.

TASK 2

1. Describe the two ethical values of Islamic banking products and justify the economic or legal

challenges of any one ethical value

The set of formulated principles which are liable for governing virtuous behaviour is

referred to as ethical values. For assuring that, Islamic banks maintain impelling reputation,

managers are obsessed for public relations which can be developed as well as promoting

appropriate set of ethical values for their employees (Majeed & Zainab, Md Husin and Ab

Rahman, 2016). Basically, they assist within identification of what is right and wrong with

respect to different situations which prevails within the working environment. Islamic banking is

dependent on Islamic Sharia law and committees have been formulated with respect to this so

that there has to be uniformity within practices as well as views. The ethical values with respect

to Islamic banking has been illustrated below: Facilitation & Cooperation: For encouraging ethical banking practices, cost of ethics

within business must be minimised. Resistance for ethics might be impaired in case it is

made accordant with longer run of interest for economic agents (Reviving the Ethics of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Islamic Finance, 2010). This acts as one of the important asset for religiously dependent

ethical standards as they keep the promise for reward. For an instance if someone excel

within rendering their operations in Islamic banking then they are liable to be paid some

reward. The ultimate goal behind this is for making ethics profitable in which rewards

will be given materially and they will be less costly. Along with this, Islamic finance or

banking must be a part within international collective action for facilitating applications

related with ethical standards in a global manner.

Communication: In this context, two prime lines of communication are needed in which

one is with Islamic banking for learning more about ethical dilemmas which are being

faced along with practical possibilities for enhancing the ethical standards . This acts as a

prerequisite for articulation and it is imperative. The second line of communication lies

with rest of world while rendering their services. Muslims can make there effectual

contribution within global ethic.

Islamic finance is dependent on religious roots that are being associated with Islamic

teachings. The Islamic banking concept has became on of the most reliable within longer run

within economic complexities which takes place. For this, Islamic banking has started taking

pragmatic steps by mimicking the conventional banks but they ensure that they maintain the

communication by adhering to sharia compliant contracts. This concept comes into light by

problems that occur with respect to money laundering (Gheeraert, 2014). The other challenge

which might occur while implementation of ethics or core values of Islamic Finance lies within

conjunctive theory of risk sharing as well as rationale behind prohibition of uncertainty (Gharar)

and usury (Riba) (eSecurity The First Line of Digital Defense Begins with Knowledge, 2016).

Apart from this, the other objection within practicing Islamic Finance comprises of relationship

which prevails among Sharia as well as common civil laws in which litigation of financial

contracts must be handled either by Sharia Court or by the national law. While facing many

challenges, they still managed to rise the pillar of Islamic ethical values within their economy,

peculiarly for the banking sector.

ethical standards as they keep the promise for reward. For an instance if someone excel

within rendering their operations in Islamic banking then they are liable to be paid some

reward. The ultimate goal behind this is for making ethics profitable in which rewards

will be given materially and they will be less costly. Along with this, Islamic finance or

banking must be a part within international collective action for facilitating applications

related with ethical standards in a global manner.

Communication: In this context, two prime lines of communication are needed in which

one is with Islamic banking for learning more about ethical dilemmas which are being

faced along with practical possibilities for enhancing the ethical standards . This acts as a

prerequisite for articulation and it is imperative. The second line of communication lies

with rest of world while rendering their services. Muslims can make there effectual

contribution within global ethic.

Islamic finance is dependent on religious roots that are being associated with Islamic

teachings. The Islamic banking concept has became on of the most reliable within longer run

within economic complexities which takes place. For this, Islamic banking has started taking

pragmatic steps by mimicking the conventional banks but they ensure that they maintain the

communication by adhering to sharia compliant contracts. This concept comes into light by

problems that occur with respect to money laundering (Gheeraert, 2014). The other challenge

which might occur while implementation of ethics or core values of Islamic Finance lies within

conjunctive theory of risk sharing as well as rationale behind prohibition of uncertainty (Gharar)

and usury (Riba) (eSecurity The First Line of Digital Defense Begins with Knowledge, 2016).

Apart from this, the other objection within practicing Islamic Finance comprises of relationship

which prevails among Sharia as well as common civil laws in which litigation of financial

contracts must be handled either by Sharia Court or by the national law. While facing many

challenges, they still managed to rise the pillar of Islamic ethical values within their economy,

peculiarly for the banking sector.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

1. Analysis the Islamic banking government within regulatory framework of two countries

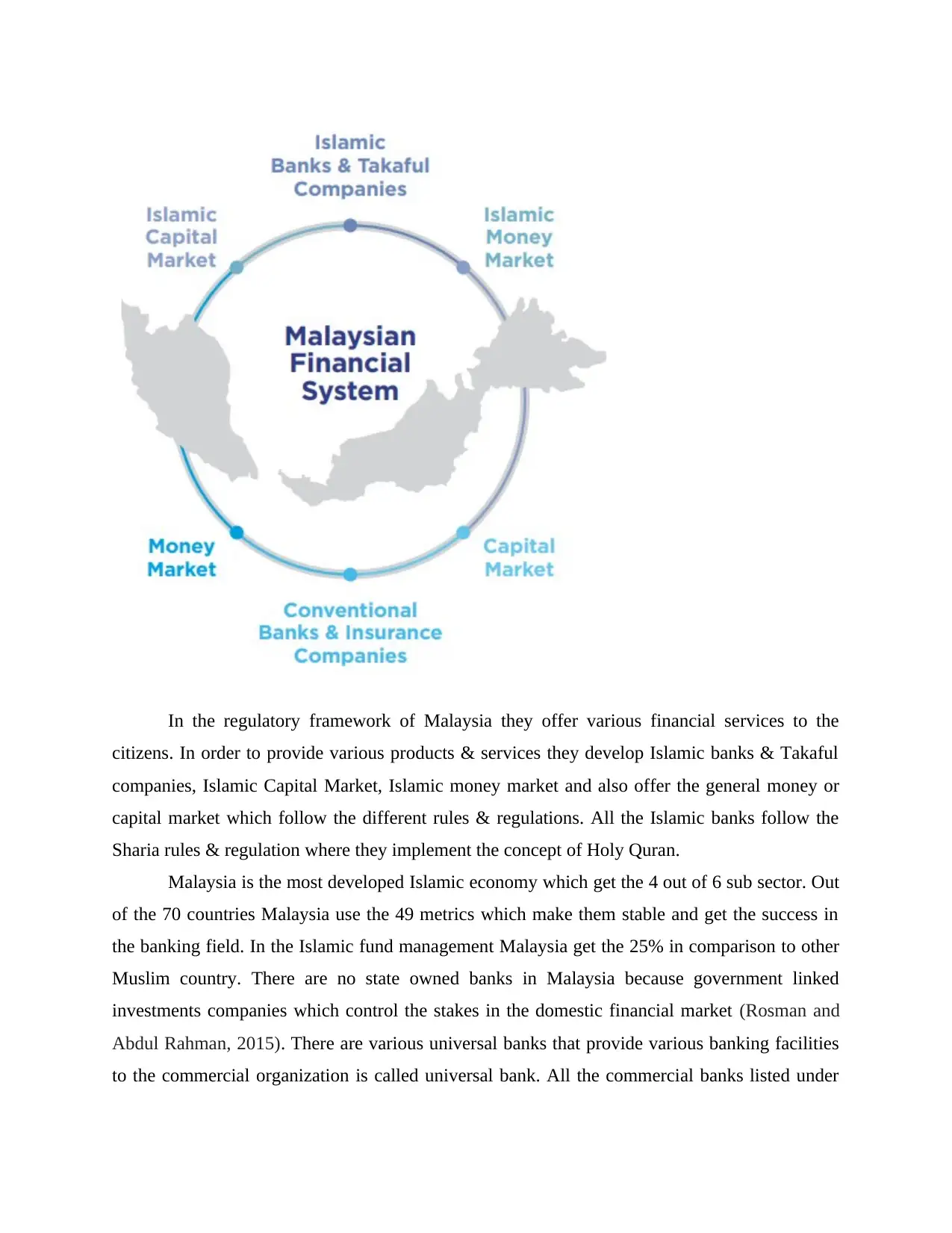

Corporate governance is the set of rules or regulations which is prepared by the

regulatory framework of particular country. In Islamic banking, regulatory framework follow the

Sharia principles which is based on the Holy Quran which is essential for the Islamic banking

sector.

Islamic banking regulation in the Malaysia:

In the Malaysia, they follow the Islamic banking and they build rules, regulations and

legislation accordingly. There are various act which formulate by the Malaysian government

such as Islamic banking act 1983 which include the banking rules and regulations for the banks

and the products & services which they offer in the market and it should by according to the

standards which they mentioned in this act. Takaful Act 1984 which is formulated for the

purpose of providing insurance to the offices or subsidiary (Moisseron, Moschetto and Teulon,

2015). There are other government funding act 1983 which provide the variety of finances to the

organizations so they perform their activities accordingly.

1. Analysis the Islamic banking government within regulatory framework of two countries

Corporate governance is the set of rules or regulations which is prepared by the

regulatory framework of particular country. In Islamic banking, regulatory framework follow the

Sharia principles which is based on the Holy Quran which is essential for the Islamic banking

sector.

Islamic banking regulation in the Malaysia:

In the Malaysia, they follow the Islamic banking and they build rules, regulations and

legislation accordingly. There are various act which formulate by the Malaysian government

such as Islamic banking act 1983 which include the banking rules and regulations for the banks

and the products & services which they offer in the market and it should by according to the

standards which they mentioned in this act. Takaful Act 1984 which is formulated for the

purpose of providing insurance to the offices or subsidiary (Moisseron, Moschetto and Teulon,

2015). There are other government funding act 1983 which provide the variety of finances to the

organizations so they perform their activities accordingly.

In the regulatory framework of Malaysia they offer various financial services to the

citizens. In order to provide various products & services they develop Islamic banks & Takaful

companies, Islamic Capital Market, Islamic money market and also offer the general money or

capital market which follow the different rules & regulations. All the Islamic banks follow the

Sharia rules & regulation where they implement the concept of Holy Quran.

Malaysia is the most developed Islamic economy which get the 4 out of 6 sub sector. Out

of the 70 countries Malaysia use the 49 metrics which make them stable and get the success in

the banking field. In the Islamic fund management Malaysia get the 25% in comparison to other

Muslim country. There are no state owned banks in Malaysia because government linked

investments companies which control the stakes in the domestic financial market (Rosman and

Abdul Rahman, 2015). There are various universal banks that provide various banking facilities

to the commercial organization is called universal bank. All the commercial banks listed under

citizens. In order to provide various products & services they develop Islamic banks & Takaful

companies, Islamic Capital Market, Islamic money market and also offer the general money or

capital market which follow the different rules & regulations. All the Islamic banks follow the

Sharia rules & regulation where they implement the concept of Holy Quran.

Malaysia is the most developed Islamic economy which get the 4 out of 6 sub sector. Out

of the 70 countries Malaysia use the 49 metrics which make them stable and get the success in

the banking field. In the Islamic fund management Malaysia get the 25% in comparison to other

Muslim country. There are no state owned banks in Malaysia because government linked

investments companies which control the stakes in the domestic financial market (Rosman and

Abdul Rahman, 2015). There are various universal banks that provide various banking facilities

to the commercial organization is called universal bank. All the commercial banks listed under

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.