Comprehensive Analysis of Management Accounting at JCW Recruitment

VerifiedAdded on 2020/06/04

|19

|5432

|123

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices at JCW Recruitment, a global recruitment services provider. The report begins with an introduction to management accounting and its role in decision-making, focusing on how JCW utilizes accounting information. Task 1 explores the essential requirements of different management accounting systems, including traditional cost accounting, throughput accounting, lean accounting, and transfer pricing, illustrating their application within JCW. Task 2 delves into various methods used in management accounting reporting, such as cost reports, budgets, and performance reports. The report then moves on to Task 3, where it examines cost calculation techniques and prepares income statements using both marginal and absorption costing methods, highlighting the key differences between them. Finally, the report discusses the advantages and disadvantages of different planning tools used in budgetary control and compares how JCW adapts its management accounting system to respond to financial problems, concluding with a summary of the key findings and insights.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

LO 1.................................................................................................................................................1

P1 Management accounting system which demonstrate essential requirement of different

types of management accounting system ...................................................................................1

P2 Different methods used in the management accounting reporting .......................................3

TASK 2............................................................................................................................................4

LO 2.................................................................................................................................................4

P3 Calculation cost with using techniques of cost analysis and prepare income statements of

marginal and absorption costing and differences in it................................................................4

TASK 3............................................................................................................................................7

LO 3.................................................................................................................................................7

P4 Advantages and disadvantage of different planning tools used in budgetary control ..........7

LO 4...............................................................................................................................................13

P5 Compare how enterprise adapt management accounting system to respond towards the

financial problem......................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

LO 1.................................................................................................................................................1

P1 Management accounting system which demonstrate essential requirement of different

types of management accounting system ...................................................................................1

P2 Different methods used in the management accounting reporting .......................................3

TASK 2............................................................................................................................................4

LO 2.................................................................................................................................................4

P3 Calculation cost with using techniques of cost analysis and prepare income statements of

marginal and absorption costing and differences in it................................................................4

TASK 3............................................................................................................................................7

LO 3.................................................................................................................................................7

P4 Advantages and disadvantage of different planning tools used in budgetary control ..........7

LO 4...............................................................................................................................................13

P5 Compare how enterprise adapt management accounting system to respond towards the

financial problem......................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting is the process of preparing reports of management and accounts

which assists to gather relevant information towards the aims and objectives. Further, it is also

helps to provide accurate and timely information to managers to determines short and long term

decisions (Melnyk, Bititci and Andersen, 2014). In this context, report based on the JCW which

is provided excellent and world leading recruitment services in different areas of the world. They

determine their services in more than 100 recruitment consultants in UK. For gaining insight

knowledge of the report, it covers management accounting which demonstrate essential

requirement of the accounting system. Furthermore, it includes different methods that are used

for management accounting reporting for the selected business. In addition to this, it includes

advantages and disadvantages of the planning tools for the budgetary control. At last, it

determines comparison of the organisation which adopt management accounting system to

respond financial problem.

TASK 1

LO 1

P1 Management accounting system which demonstrate essential requirement of different types

of management accounting system

In respect to analysis, interpreting and presenting the information, management

accounting play very important to demonstrate effective functioning. With this regard,

information gathered with using costing and accounting information which helps to make

decisions for short term goals. In addition to this, in JCW it determines day to day operations in

systematic way to undertake activities. In the process of management accounting includes

measurement of the business performance, preparation of financial statements, assessment of the

risk, etc. (Bennett, Schaltegger and Zvezdov, 2013). There are three major aspects included such

as management, accounts and finance, etc. With the help of management report, different kinds

of information in relation to business strategies and making financial status of the company in

systematic manner. These helps to the chosen organisation to take corrective decisions that are

needed at workplace.

Further, in respect to take decisions, there are different types of management accounting

system exists that used by the company to collect and present effective financial information at

1

Management accounting is the process of preparing reports of management and accounts

which assists to gather relevant information towards the aims and objectives. Further, it is also

helps to provide accurate and timely information to managers to determines short and long term

decisions (Melnyk, Bititci and Andersen, 2014). In this context, report based on the JCW which

is provided excellent and world leading recruitment services in different areas of the world. They

determine their services in more than 100 recruitment consultants in UK. For gaining insight

knowledge of the report, it covers management accounting which demonstrate essential

requirement of the accounting system. Furthermore, it includes different methods that are used

for management accounting reporting for the selected business. In addition to this, it includes

advantages and disadvantages of the planning tools for the budgetary control. At last, it

determines comparison of the organisation which adopt management accounting system to

respond financial problem.

TASK 1

LO 1

P1 Management accounting system which demonstrate essential requirement of different types

of management accounting system

In respect to analysis, interpreting and presenting the information, management

accounting play very important to demonstrate effective functioning. With this regard,

information gathered with using costing and accounting information which helps to make

decisions for short term goals. In addition to this, in JCW it determines day to day operations in

systematic way to undertake activities. In the process of management accounting includes

measurement of the business performance, preparation of financial statements, assessment of the

risk, etc. (Bennett, Schaltegger and Zvezdov, 2013). There are three major aspects included such

as management, accounts and finance, etc. With the help of management report, different kinds

of information in relation to business strategies and making financial status of the company in

systematic manner. These helps to the chosen organisation to take corrective decisions that are

needed at workplace.

Further, in respect to take decisions, there are different types of management accounting

system exists that used by the company to collect and present effective financial information at

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

workplace. The selected business unit used different system of management accounting which

includes several factors like cost of production, services given by JCW, etc. Management

accounting system in the business determines as follows:

Traditional cost accounting system: This method is used and carry conventional

methods of accounting. It includes direct and indirect costs that considered in the

traditional accounting system (Pavlatos and Kostakis, 2015). Therefore, it assists to

demonstrate cause and effect relationship. Costs incurred in the production allocated to

assign unit in the production process. In the JCW, basis of accounting system includes

volume of production and overhead that are related to the production and direct labour

overhead. According to the traditional costing, average overhead basis of allocation of

products cost. All the indirect expenses also pooled together and assign equally per the

appropriate cost drive. It includes labour hours, machine hours, etc. The chosen business

use this method to take account cause and effect relationship (Quinn and Jackson, 2014).

Hence, it is beneficial to managers to take appropriate decisions with direct and indirect

cost.

Throughput accounting: Throughput accounting system assist to determine quantity of

products and raw material that is passed through the process and system. In this kind of

management accounting system includes costing activity which helps to focus on the

determination of constraint that are arises in the manufacturing of units. In the JCW, it

demonstrates relation to labour turnover, raw material, wastage in the capacity of plant,

etc. Basically, it includes focuses on the eliminating such constraints which insist to

ensure that quantity and quality of production will be increases (Fayard, Lee and

Kettinger, 2014). In this way, direct material is only allocated to the cost of inventory that

make effective functioning in the business. In addition to this, selling and distribution

overhead also charged in the period cost under the method. This method also ensure that

costing also minimised for every unit of production. It enables to create effective and

efficient production in order to work in the line with job and process costing. This

method ensures that constraints of the chosen business diminish through each unit

produced (Mitter, Mitter and Hiebl, 2017). Therefore, it assists to make effective and

efficient working system with job and process costing.

2

includes several factors like cost of production, services given by JCW, etc. Management

accounting system in the business determines as follows:

Traditional cost accounting system: This method is used and carry conventional

methods of accounting. It includes direct and indirect costs that considered in the

traditional accounting system (Pavlatos and Kostakis, 2015). Therefore, it assists to

demonstrate cause and effect relationship. Costs incurred in the production allocated to

assign unit in the production process. In the JCW, basis of accounting system includes

volume of production and overhead that are related to the production and direct labour

overhead. According to the traditional costing, average overhead basis of allocation of

products cost. All the indirect expenses also pooled together and assign equally per the

appropriate cost drive. It includes labour hours, machine hours, etc. The chosen business

use this method to take account cause and effect relationship (Quinn and Jackson, 2014).

Hence, it is beneficial to managers to take appropriate decisions with direct and indirect

cost.

Throughput accounting: Throughput accounting system assist to determine quantity of

products and raw material that is passed through the process and system. In this kind of

management accounting system includes costing activity which helps to focus on the

determination of constraint that are arises in the manufacturing of units. In the JCW, it

demonstrates relation to labour turnover, raw material, wastage in the capacity of plant,

etc. Basically, it includes focuses on the eliminating such constraints which insist to

ensure that quantity and quality of production will be increases (Fayard, Lee and

Kettinger, 2014). In this way, direct material is only allocated to the cost of inventory that

make effective functioning in the business. In addition to this, selling and distribution

overhead also charged in the period cost under the method. This method also ensure that

costing also minimised for every unit of production. It enables to create effective and

efficient production in order to work in the line with job and process costing. This

method ensures that constraints of the chosen business diminish through each unit

produced (Mitter, Mitter and Hiebl, 2017). Therefore, it assists to make effective and

efficient working system with job and process costing.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Lean accounting: It is new and other concept which include in the field of management

accounting that differs from the other accounting system. In the conventional method of

costing, allocation of cost is needed that incurred in the process. Lean accounting also

focuses on diminish the cost through maintain control on wastage which is caused in the

production process (Chan, 2015). There are several tactical methods combined under the

technique which is also emphasizes on eliminating of non value added activities. Further,

it also assists to JCW to recruit qualitative and skilled employees in the business. It also

includes value streaming assessment, measurement of the profits to take decisions at

workplace. Excess costs also cut down with ascertain information that are mentioned in

categories. Main advantages of this is increasing revenue through sales due to reduction

of waste material (Endenich, Hoffjan and Trapp, 2016). Therefore, capacity will be

increasing of the organisation to utilise proper resources at workplace. Further, it

generates effective results at workplace to demonstrate money saving. Main benefits

includes in the lean accounting is increasing revenue that generate high sales due to

reduction of the waste material. It also helps to increase capacity of plant that reduce

capacity utilisation in the generation of waste material. It assists to save the cost and

money that develop at workplace (Klemstine and Maher, 2014).

Transfer pricing: Transfer pricing is the effective element that assists to generate

effective results at workplace from the department. In this process, recruitment will be

ascertain through shifting one place to another. Hence, it leads to generation with some

extra costs due to transfer. It includes pricing of shifting and opportunities price which

involve amount that is outsourcing of goods and services in the business (Rosli, Said and

Mohd, 2014).

P2 Different methods used in the management accounting reporting

Management accounting is the process of preparing management reports and accounts. It

helps to provide accurate and timely information regarding financial status of the company. It

includes different strategies of the company that helps to manage decisions on time in JCW.

There are several methods has been implemented in the management accounting reporting that

determines in the following manner:

Cost report: In respect to provide the useful information, cost to the manager is related

and enable to management in respect to control future cost (Stergiou, Ashraf and Uddin,

3

accounting that differs from the other accounting system. In the conventional method of

costing, allocation of cost is needed that incurred in the process. Lean accounting also

focuses on diminish the cost through maintain control on wastage which is caused in the

production process (Chan, 2015). There are several tactical methods combined under the

technique which is also emphasizes on eliminating of non value added activities. Further,

it also assists to JCW to recruit qualitative and skilled employees in the business. It also

includes value streaming assessment, measurement of the profits to take decisions at

workplace. Excess costs also cut down with ascertain information that are mentioned in

categories. Main advantages of this is increasing revenue through sales due to reduction

of waste material (Endenich, Hoffjan and Trapp, 2016). Therefore, capacity will be

increasing of the organisation to utilise proper resources at workplace. Further, it

generates effective results at workplace to demonstrate money saving. Main benefits

includes in the lean accounting is increasing revenue that generate high sales due to

reduction of the waste material. It also helps to increase capacity of plant that reduce

capacity utilisation in the generation of waste material. It assists to save the cost and

money that develop at workplace (Klemstine and Maher, 2014).

Transfer pricing: Transfer pricing is the effective element that assists to generate

effective results at workplace from the department. In this process, recruitment will be

ascertain through shifting one place to another. Hence, it leads to generation with some

extra costs due to transfer. It includes pricing of shifting and opportunities price which

involve amount that is outsourcing of goods and services in the business (Rosli, Said and

Mohd, 2014).

P2 Different methods used in the management accounting reporting

Management accounting is the process of preparing management reports and accounts. It

helps to provide accurate and timely information regarding financial status of the company. It

includes different strategies of the company that helps to manage decisions on time in JCW.

There are several methods has been implemented in the management accounting reporting that

determines in the following manner:

Cost report: In respect to provide the useful information, cost to the manager is related

and enable to management in respect to control future cost (Stergiou, Ashraf and Uddin,

3

2013). It is known as the accounting system in which cost is computed on the basis of

raw material, labour, overhead and other additional cost. In the cost of per unit, total cost

is incurred in the production which is divided by the number of unit produced. Cost

report also summarised information that assists to ascertain manufactured products in the

internal report system.

Budget: Budget are also prepared as the internal part which assists to managers to

compare actual results of the business with estimated one (Nørreklit, 2017). It assists to

measure the business performances in the specific period of time.

Performance report: Further, performance report assists to concluded the differences

projected in budget which helps to managers to prepare new program and budget at

workplace.

Management accounting system and report assists to determine link closely which

depend on each other. In order to prepare the management reports, JCW need to concentrate on

the possible outcomes with system and utilise time to considered accurate information. It helps to

make decision in systematic aspect (Zaleha Abdul Rasid, Ruhana Isa and Khairuzzaman Wan

Ismail, 2014). Preparation of the management report is not useful without integrated

management accounting system. Hence, the organisation need to concentrate on accomplishment

of the goals and objectives.

TASK 2

LO 2

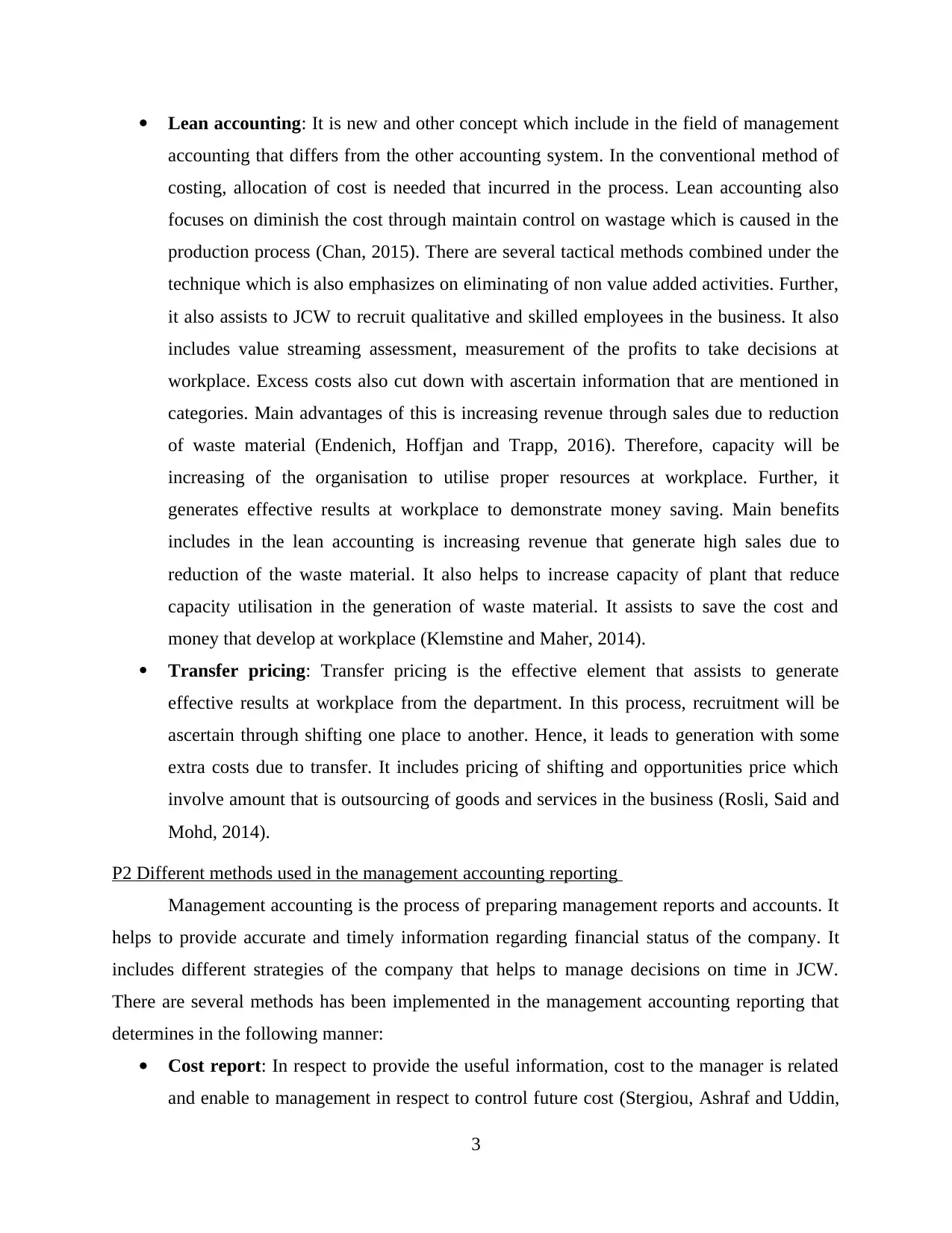

P3 Calculation cost with using techniques of cost analysis and prepare income statements of

marginal and absorption costing and differences in it

In order to prepare the income statement for marginal costing, following information will

be used:

Particulars Amount Amount

Sales (600*35)

Less: Variable cost of the sales

Opening stock

Production (700 units price 13 per unit)

COGS

Nil

9100

2100

4

raw material, labour, overhead and other additional cost. In the cost of per unit, total cost

is incurred in the production which is divided by the number of unit produced. Cost

report also summarised information that assists to ascertain manufactured products in the

internal report system.

Budget: Budget are also prepared as the internal part which assists to managers to

compare actual results of the business with estimated one (Nørreklit, 2017). It assists to

measure the business performances in the specific period of time.

Performance report: Further, performance report assists to concluded the differences

projected in budget which helps to managers to prepare new program and budget at

workplace.

Management accounting system and report assists to determine link closely which

depend on each other. In order to prepare the management reports, JCW need to concentrate on

the possible outcomes with system and utilise time to considered accurate information. It helps to

make decision in systematic aspect (Zaleha Abdul Rasid, Ruhana Isa and Khairuzzaman Wan

Ismail, 2014). Preparation of the management report is not useful without integrated

management accounting system. Hence, the organisation need to concentrate on accomplishment

of the goals and objectives.

TASK 2

LO 2

P3 Calculation cost with using techniques of cost analysis and prepare income statements of

marginal and absorption costing and differences in it

In order to prepare the income statement for marginal costing, following information will

be used:

Particulars Amount Amount

Sales (600*35)

Less: Variable cost of the sales

Opening stock

Production (700 units price 13 per unit)

COGS

Nil

9100

2100

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Closing stock (100*13)

COGS

Contribution

less: Fixed cost

Fixed manufacturing expenses

Admn. Exp.

Selling cost

Sales overheads

Net profit/ loss

(1300)

2000

700

600

600

(7800)

13200

10800

(3900)

9300

Working note: 1

Direct material £6.00

Direct labour £5.00

Variable cost £2.00

Total £13.00

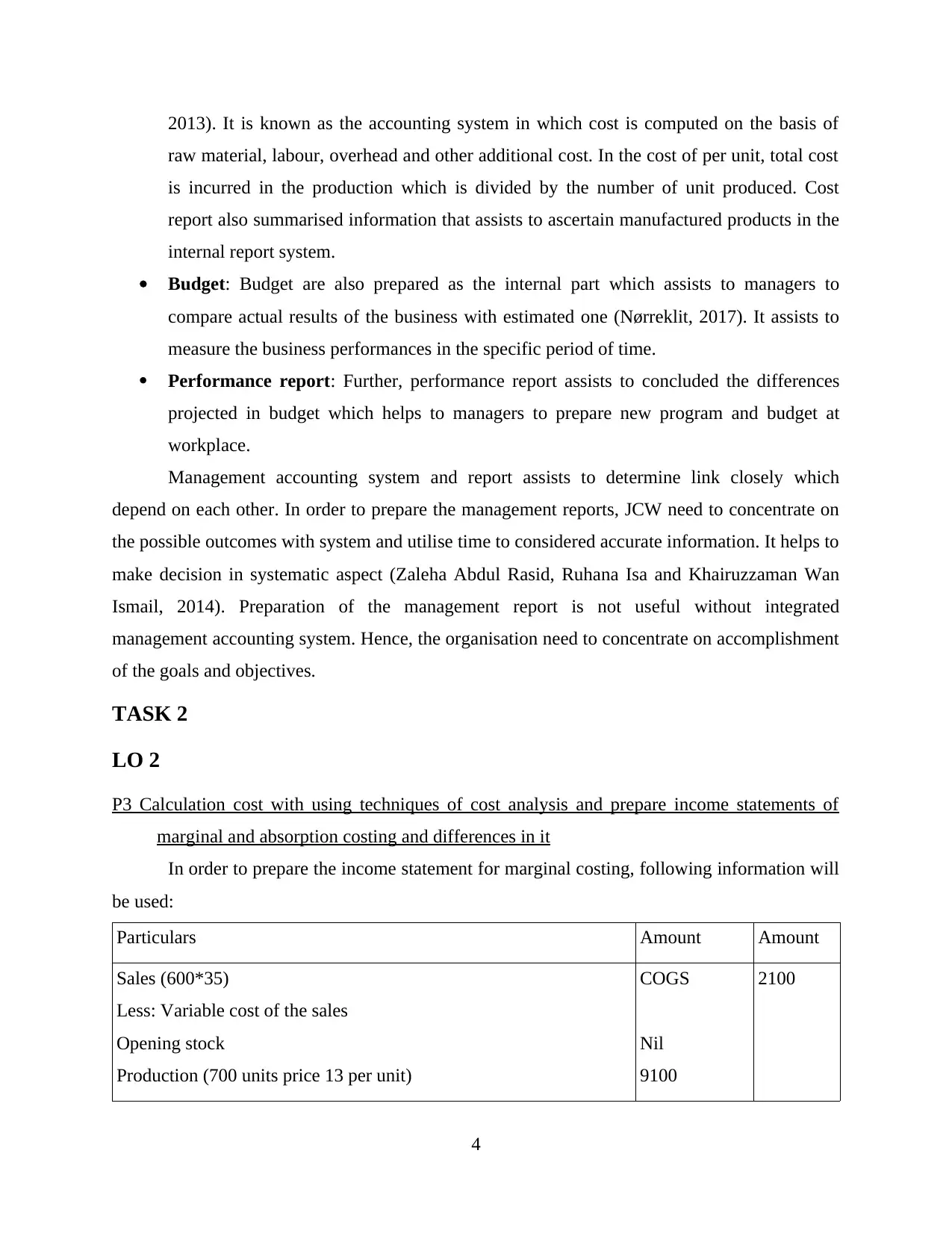

Income statement for absorption costing

Particulars Amount Amount

Sales (600*35) 21000

Less: Cost of sales

Opening stock

production (16*700)

Closing stock (16*100)

Less: over absorbed of fixed production overhead (2000-2100)

COGS

Gross profit:

Less: Other expenses

Admn exp.

Selling overhead

Nil

11200

(16200)

700

600

(9600)

100

9500

11500

5

COGS

Contribution

less: Fixed cost

Fixed manufacturing expenses

Admn. Exp.

Selling cost

Sales overheads

Net profit/ loss

(1300)

2000

700

600

600

(7800)

13200

10800

(3900)

9300

Working note: 1

Direct material £6.00

Direct labour £5.00

Variable cost £2.00

Total £13.00

Income statement for absorption costing

Particulars Amount Amount

Sales (600*35) 21000

Less: Cost of sales

Opening stock

production (16*700)

Closing stock (16*100)

Less: over absorbed of fixed production overhead (2000-2100)

COGS

Gross profit:

Less: Other expenses

Admn exp.

Selling overhead

Nil

11200

(16200)

700

600

(9600)

100

9500

11500

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed selling costs

Net earnings

600 1900

9600

Working note: 2

Direct material £6.00

Direct labour £5.00

Variable cost £2.00

Fixed cost £3.00

Total £16.00

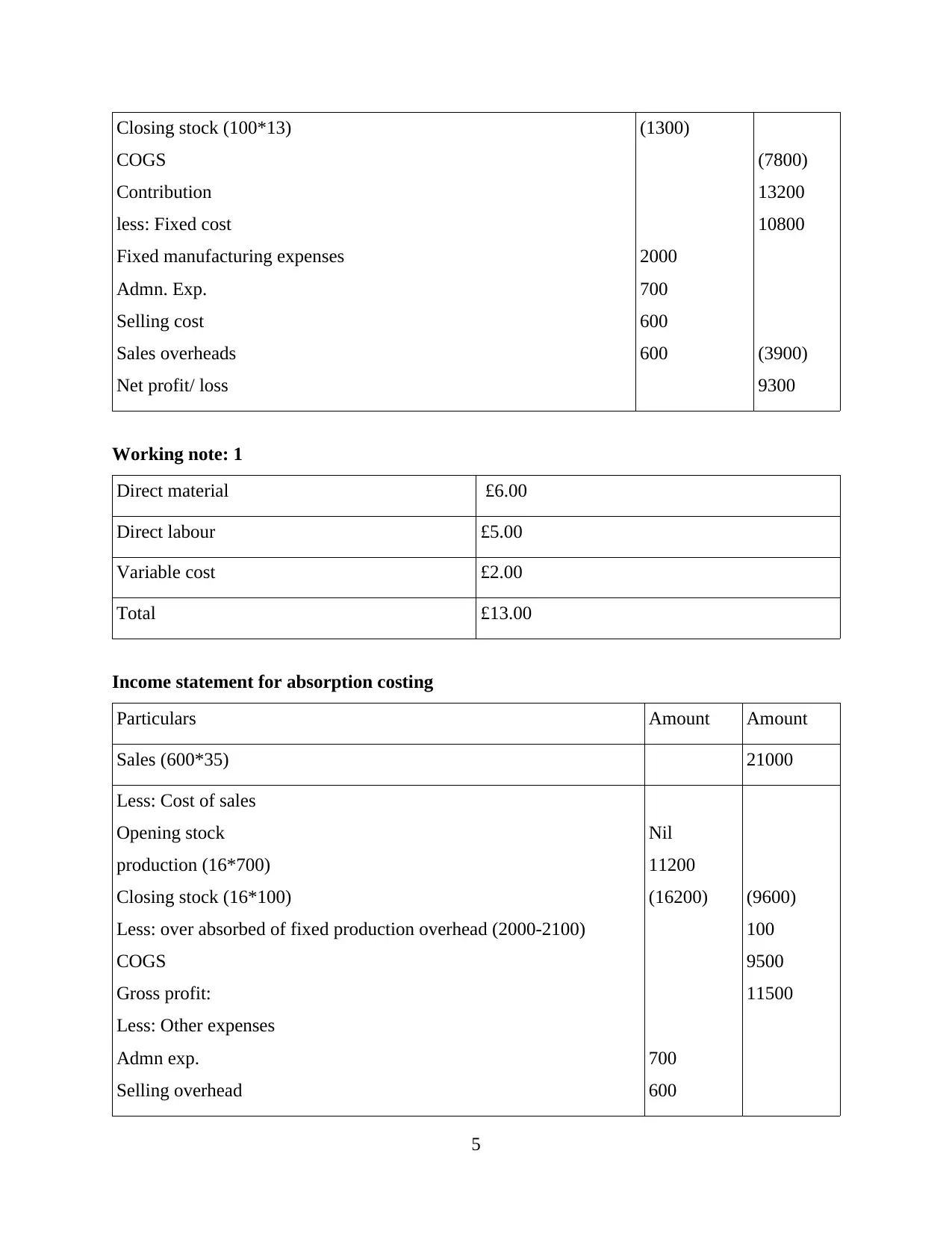

From the above, it can be interpret that income statement is assists to generate high profit

in the month ending. Net profit as per the method of absorption costing is £9600. However, in

the marginal costing it is £9300. This is differences in the profits ascertain in the RCW. Main

reason is to assess the difference between two elements that are taken as absorption costing

method which is taken in the account of fixed and variable. It is also considered as the variable

cost in marginal method. The chosen company is also used absorption costing method because it

provides appropriate and clear financial performance in the business through includes different

types of cost (Soheilirad and Sofian, 2016).

Differences between marginal and absorption costing method

Absorption costing Marginal costing

In order to compute the net profit, there are

different cost has been implemented such as

fixed and variable.

In this kind of method, there are several

elements not considered. It includes only direct

and variable cost only.

Both fixed and variable costs considered

period cost.

Variable cost is the product cost and other

fixed cost in considered as the period cost.

At the end of the year, stock has been carried

which is valued on the total production.

Stock is not carried forward in the next year

but it is considered as the total experience of

the production cost (Mikes and Morhart,

6

Net earnings

600 1900

9600

Working note: 2

Direct material £6.00

Direct labour £5.00

Variable cost £2.00

Fixed cost £3.00

Total £16.00

From the above, it can be interpret that income statement is assists to generate high profit

in the month ending. Net profit as per the method of absorption costing is £9600. However, in

the marginal costing it is £9300. This is differences in the profits ascertain in the RCW. Main

reason is to assess the difference between two elements that are taken as absorption costing

method which is taken in the account of fixed and variable. It is also considered as the variable

cost in marginal method. The chosen company is also used absorption costing method because it

provides appropriate and clear financial performance in the business through includes different

types of cost (Soheilirad and Sofian, 2016).

Differences between marginal and absorption costing method

Absorption costing Marginal costing

In order to compute the net profit, there are

different cost has been implemented such as

fixed and variable.

In this kind of method, there are several

elements not considered. It includes only direct

and variable cost only.

Both fixed and variable costs considered

period cost.

Variable cost is the product cost and other

fixed cost in considered as the period cost.

At the end of the year, stock has been carried

which is valued on the total production.

Stock is not carried forward in the next year

but it is considered as the total experience of

the production cost (Mikes and Morhart,

6

2017).

In respect to perform effective functioning, there are several elements exists that need to

be taken as the important sources. With this regard, JCW can use different kinds of financial

statements and cost accounting. It helps to make profitable business and effective results in

systematic manner. Main aim of the organisation is to increases their profits so financial

planning considered in the good manner (Bobryshev, Yakovenko and Glushko, 2015). In

addition to this, cost accounting is the cost accounting is important aspect that provide and carry

cost structure to manage business results and performances. The organisation has responsibilities

to perform effective functions with proper statement. In this regard, different range of account

has been carried which included in the report. Therefore, it can be specify type of account that

grouping in the report. It is major duty and responsibilities of the chosen business to considered

right balance between their results and performance. Hence, their profits and revenue will be

increasing in systematic manner (AbRahman, Omar and Ramli, 2016).

TASK 3

LO 3

P4 Advantages and disadvantage of different planning tools used in budgetary control

In respect to develop effective functioning, JCW has several tools and techniques that

helps to increase their effectiveness in the market. In this regard, the company need to control

disposal in the business environment (Hirsch, Seubert and Sohn, 2015). With this regard,

following are different techniques exists that assists to generate high revenue in the business:

Capital budgeting technique: It is the important planning tool that assists to make

effective functions and operations with performance development. Investment decisions

are also undertaken that helps to enhance return of JCW in systematic manner. This is

because, manager of the selected business maintain their high position in business

through choose appropriate resources and best alternative from various options. There are

different project exists in which selection needed of the best one to gain high profits and

revenue (Melnyk, Bititci and Andersen, 2014). With this regard, different elements create

effective functioning through implement payback period, NPV, post payback, IRR, etc.

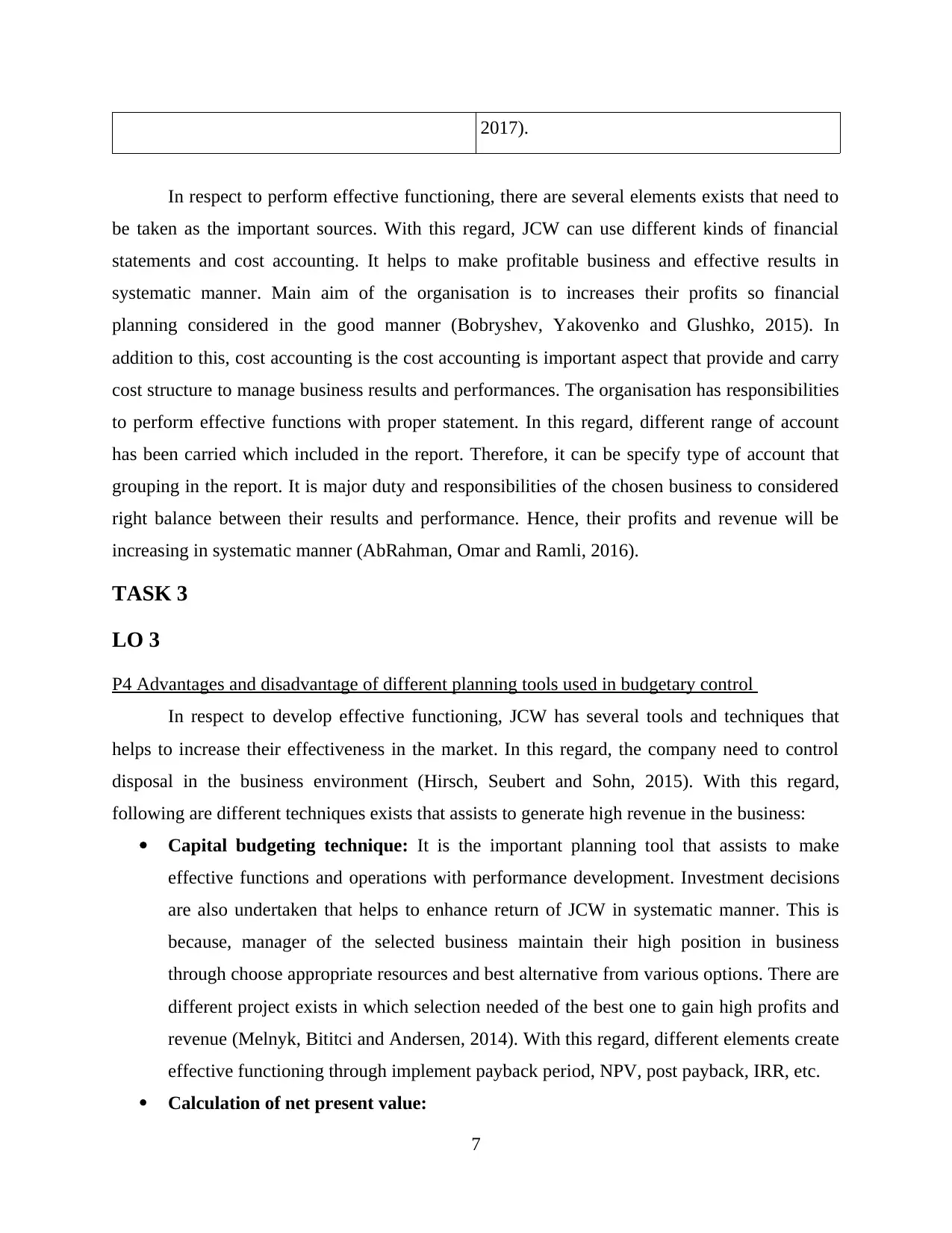

Calculation of net present value:

7

In respect to perform effective functioning, there are several elements exists that need to

be taken as the important sources. With this regard, JCW can use different kinds of financial

statements and cost accounting. It helps to make profitable business and effective results in

systematic manner. Main aim of the organisation is to increases their profits so financial

planning considered in the good manner (Bobryshev, Yakovenko and Glushko, 2015). In

addition to this, cost accounting is the cost accounting is important aspect that provide and carry

cost structure to manage business results and performances. The organisation has responsibilities

to perform effective functions with proper statement. In this regard, different range of account

has been carried which included in the report. Therefore, it can be specify type of account that

grouping in the report. It is major duty and responsibilities of the chosen business to considered

right balance between their results and performance. Hence, their profits and revenue will be

increasing in systematic manner (AbRahman, Omar and Ramli, 2016).

TASK 3

LO 3

P4 Advantages and disadvantage of different planning tools used in budgetary control

In respect to develop effective functioning, JCW has several tools and techniques that

helps to increase their effectiveness in the market. In this regard, the company need to control

disposal in the business environment (Hirsch, Seubert and Sohn, 2015). With this regard,

following are different techniques exists that assists to generate high revenue in the business:

Capital budgeting technique: It is the important planning tool that assists to make

effective functions and operations with performance development. Investment decisions

are also undertaken that helps to enhance return of JCW in systematic manner. This is

because, manager of the selected business maintain their high position in business

through choose appropriate resources and best alternative from various options. There are

different project exists in which selection needed of the best one to gain high profits and

revenue (Melnyk, Bititci and Andersen, 2014). With this regard, different elements create

effective functioning through implement payback period, NPV, post payback, IRR, etc.

Calculation of net present value:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

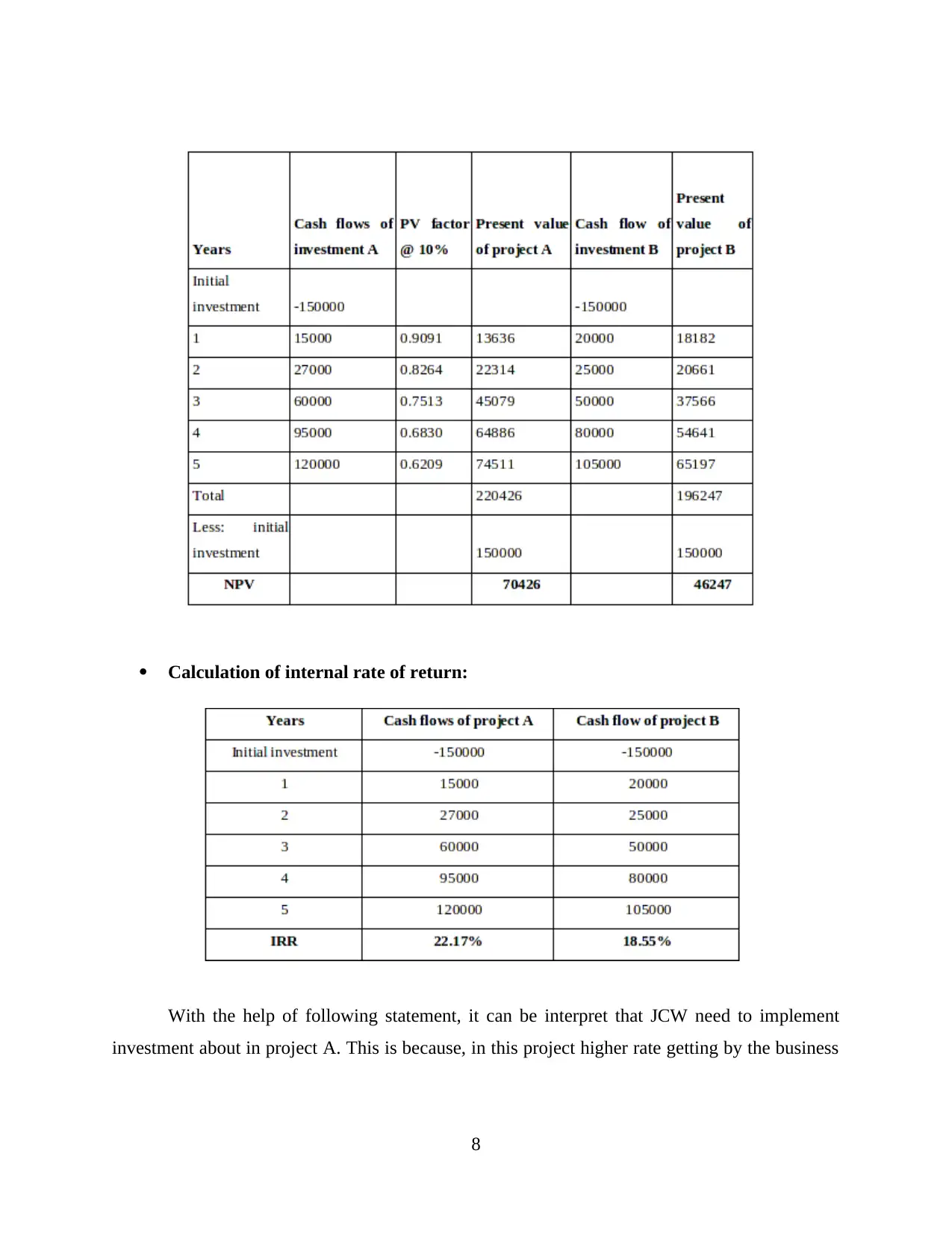

Calculation of internal rate of return:

With the help of following statement, it can be interpret that JCW need to implement

investment about in project A. This is because, in this project higher rate getting by the business

8

With the help of following statement, it can be interpret that JCW need to implement

investment about in project A. This is because, in this project higher rate getting by the business

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

as compare to the project B. Furthermore, there are several advantages and disadvantage are

exists with the using the above techniques which defines as follows:

Advantages

Capital budgeting is the useful aspect to JCW to invest their money in project which

gives several benefits in it. It assists to gain high return with determines potential

investment in the selected business.

It is the systematic tool that demonstrate several important decisions for the particular

project in systematic manner (Chan, 2015).

Along with this, profitability at workplace also develop with project and outcomes that

are requires in JCW.

Calculation is very simple and short so that this technique is very useful and easily

understandable in the selected business environment.

Disadvantage

Apart from this, in the capital budgeting, there are several tools exists that require more

time to calculate such as payback period, etc. Hence, it is time consuming process.

For calculation, this tools in JCW needed skilled people.

Wrong calculation in the chosen business interpret wrong results which could be affect to

its long term profits and outcomes. Therefore, it remains as the high risk that take place in

the business (Melnyk, Bititci and Andersen, 2014).

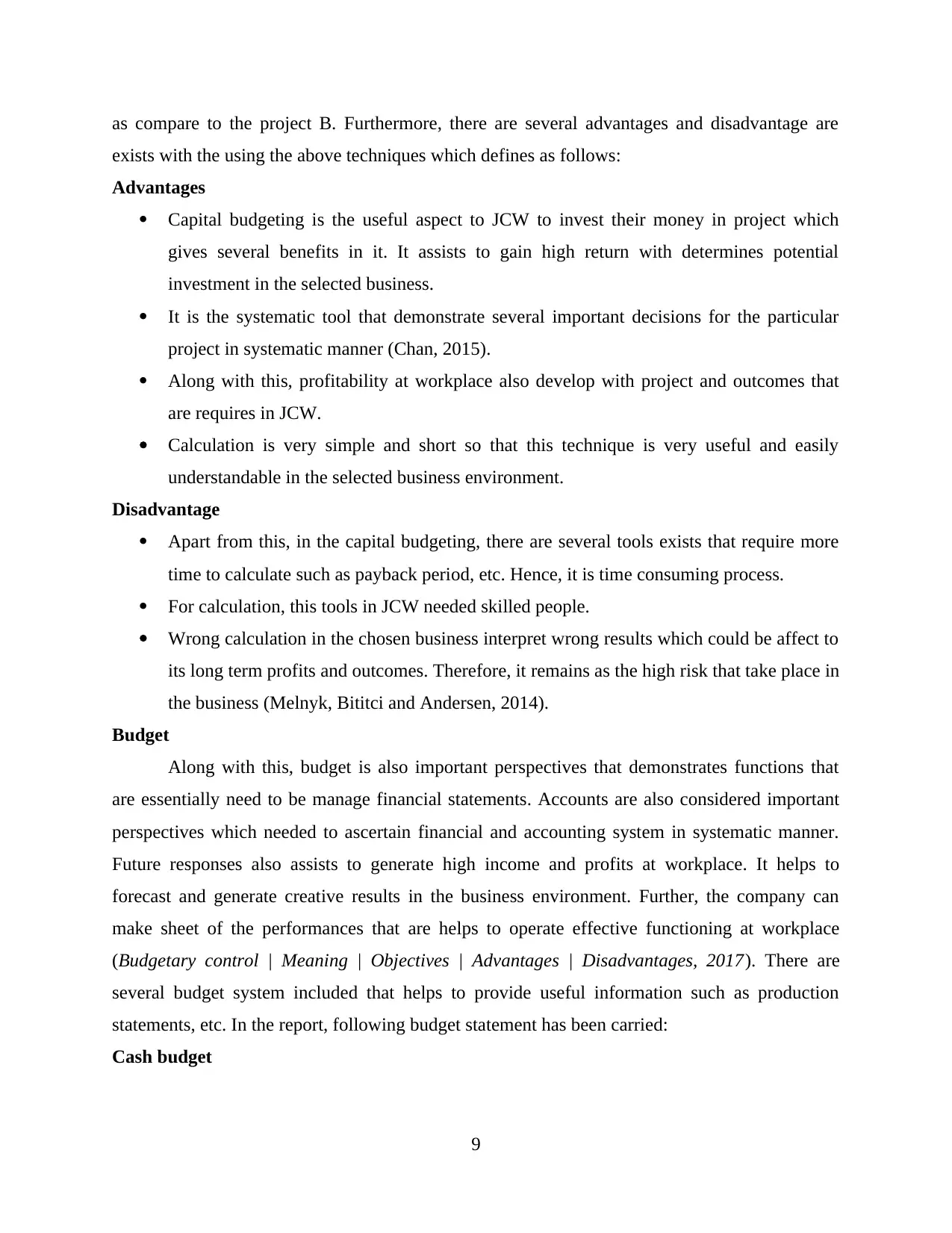

Budget

Along with this, budget is also important perspectives that demonstrates functions that

are essentially need to be manage financial statements. Accounts are also considered important

perspectives which needed to ascertain financial and accounting system in systematic manner.

Future responses also assists to generate high income and profits at workplace. It helps to

forecast and generate creative results in the business environment. Further, the company can

make sheet of the performances that are helps to operate effective functioning at workplace

(Budgetary control | Meaning | Objectives | Advantages | Disadvantages, 2017). There are

several budget system included that helps to provide useful information such as production

statements, etc. In the report, following budget statement has been carried:

Cash budget

9

exists with the using the above techniques which defines as follows:

Advantages

Capital budgeting is the useful aspect to JCW to invest their money in project which

gives several benefits in it. It assists to gain high return with determines potential

investment in the selected business.

It is the systematic tool that demonstrate several important decisions for the particular

project in systematic manner (Chan, 2015).

Along with this, profitability at workplace also develop with project and outcomes that

are requires in JCW.

Calculation is very simple and short so that this technique is very useful and easily

understandable in the selected business environment.

Disadvantage

Apart from this, in the capital budgeting, there are several tools exists that require more

time to calculate such as payback period, etc. Hence, it is time consuming process.

For calculation, this tools in JCW needed skilled people.

Wrong calculation in the chosen business interpret wrong results which could be affect to

its long term profits and outcomes. Therefore, it remains as the high risk that take place in

the business (Melnyk, Bititci and Andersen, 2014).

Budget

Along with this, budget is also important perspectives that demonstrates functions that

are essentially need to be manage financial statements. Accounts are also considered important

perspectives which needed to ascertain financial and accounting system in systematic manner.

Future responses also assists to generate high income and profits at workplace. It helps to

forecast and generate creative results in the business environment. Further, the company can

make sheet of the performances that are helps to operate effective functioning at workplace

(Budgetary control | Meaning | Objectives | Advantages | Disadvantages, 2017). There are

several budget system included that helps to provide useful information such as production

statements, etc. In the report, following budget statement has been carried:

Cash budget

9

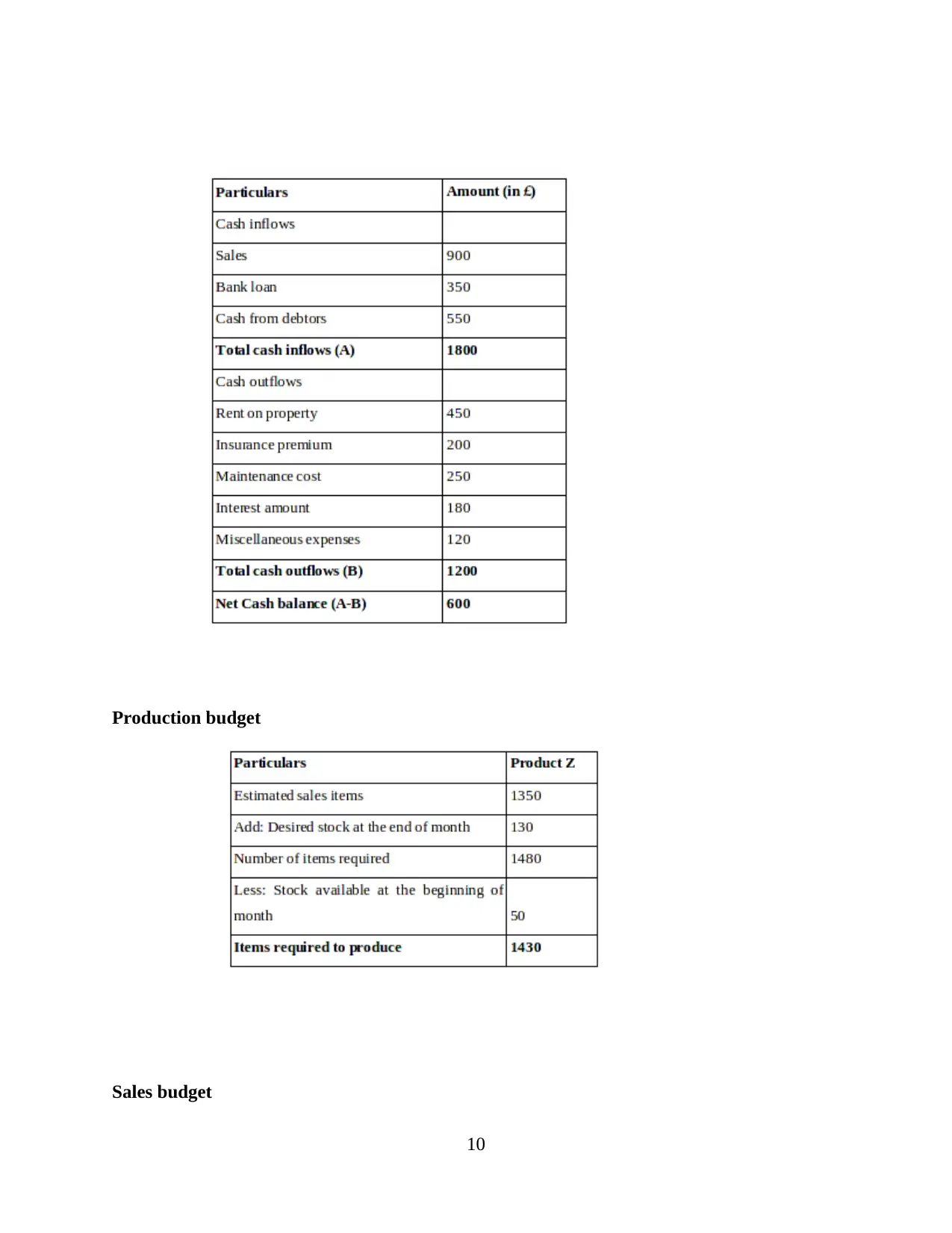

Production budget

Sales budget

10

Sales budget

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.