Kaplan Professional: CIVMBv3A3 Finance and Mortgage Broking Assignment

VerifiedAdded on 2020/05/11

|58

|14633

|472

Homework Assignment

AI Summary

This assignment solution addresses a case study involving Clinton and Jennifer Andrews, who are seeking finance for an investment property. The assignment requires assessing the clients' financial situation, including their assets, liabilities, income, and expenditure, and understanding their borrowing needs. It covers tasks such as initial disclosures, gathering client information, assessing their situation, considering the use of equity, making reasonable inquiries, providing recommendations, and understanding interest rates and settlement processes. The assignment also includes a second case study with Tony and Lorraine Denton, focusing on establishing their financial knowledge, responsible lending obligations, self-employed special considerations, advising on strategies, the impact of credit history, external dispute resolution, and effective access to files. The solution demonstrates the application of financial principles and mortgage broking practices, including the use of a client information collection tool and a serviceability calculator to determine the best financial solutions for the clients. The document is a comprehensive response to the assignment brief, demonstrating a deep understanding of the subject matter and a practical approach to the tasks presented.

Assignment

Certificate IV in Finance and Mortgage Broking

(CIVMB_AS_v3A3)

Student identification(student to complete)

Please complete the fields shaded grey.

Student number

Assignment result (assessor to complete)

Result — first submission (Details for each activity are shown in the table below)

Parts that must be resubmitted:

Result — resubmission (if applicable)

CIVMB_AS_v3A3

Certificate IV in Finance and Mortgage Broking

(CIVMB_AS_v3A3)

Student identification(student to complete)

Please complete the fields shaded grey.

Student number

Assignment result (assessor to complete)

Result — first submission (Details for each activity are shown in the table below)

Parts that must be resubmitted:

Result — resubmission (if applicable)

CIVMB_AS_v3A3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

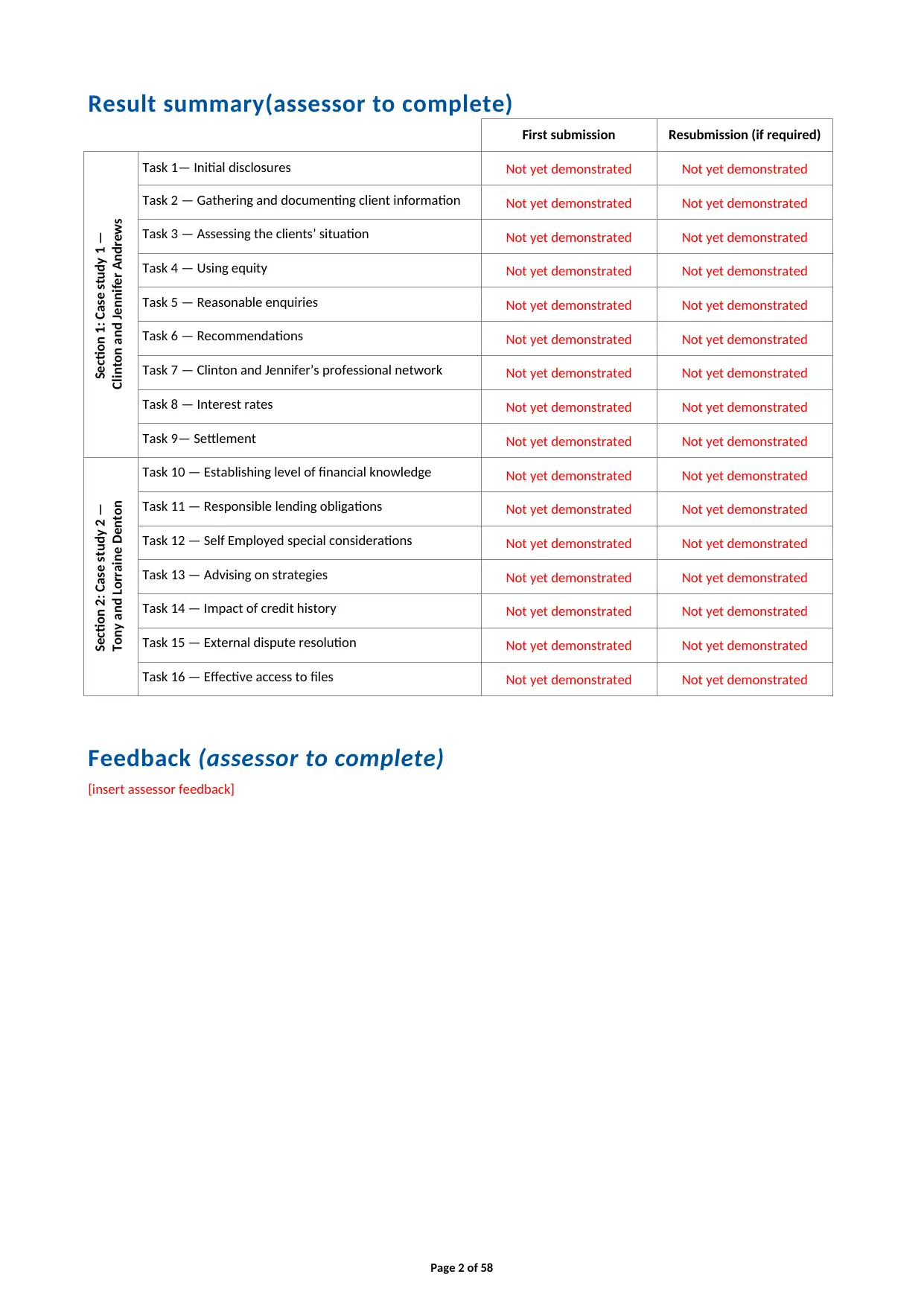

Result summary(assessor to complete)

First submission Resubmission (if required)

Section 1: Case study 1 —

Clinton and Jennifer Andrews

Task 1— Initial disclosures Not yet demonstrated Not yet demonstrated

Task 2 — Gathering and documenting client information Not yet demonstrated Not yet demonstrated

Task 3 — Assessing the clients’ situation Not yet demonstrated Not yet demonstrated

Task 4 — Using equity Not yet demonstrated Not yet demonstrated

Task 5 — Reasonable enquiries Not yet demonstrated Not yet demonstrated

Task 6 — Recommendations Not yet demonstrated Not yet demonstrated

Task 7 — Clinton and Jennifer’s professional network Not yet demonstrated Not yet demonstrated

Task 8 — Interest rates Not yet demonstrated Not yet demonstrated

Task 9— Settlement Not yet demonstrated Not yet demonstrated

Section 2: Case study 2 —

Tony and Lorraine Denton

Task 10 — Establishing level of financial knowledge Not yet demonstrated Not yet demonstrated

Task 11 — Responsible lending obligations Not yet demonstrated Not yet demonstrated

Task 12 — Self Employed special considerations Not yet demonstrated Not yet demonstrated

Task 13 — Advising on strategies Not yet demonstrated Not yet demonstrated

Task 14 — Impact of credit history Not yet demonstrated Not yet demonstrated

Task 15 — External dispute resolution Not yet demonstrated Not yet demonstrated

Task 16 — Effective access to files Not yet demonstrated Not yet demonstrated

Feedback (assessor to complete)

[insert assessor feedback]

Page 2 of 58

First submission Resubmission (if required)

Section 1: Case study 1 —

Clinton and Jennifer Andrews

Task 1— Initial disclosures Not yet demonstrated Not yet demonstrated

Task 2 — Gathering and documenting client information Not yet demonstrated Not yet demonstrated

Task 3 — Assessing the clients’ situation Not yet demonstrated Not yet demonstrated

Task 4 — Using equity Not yet demonstrated Not yet demonstrated

Task 5 — Reasonable enquiries Not yet demonstrated Not yet demonstrated

Task 6 — Recommendations Not yet demonstrated Not yet demonstrated

Task 7 — Clinton and Jennifer’s professional network Not yet demonstrated Not yet demonstrated

Task 8 — Interest rates Not yet demonstrated Not yet demonstrated

Task 9— Settlement Not yet demonstrated Not yet demonstrated

Section 2: Case study 2 —

Tony and Lorraine Denton

Task 10 — Establishing level of financial knowledge Not yet demonstrated Not yet demonstrated

Task 11 — Responsible lending obligations Not yet demonstrated Not yet demonstrated

Task 12 — Self Employed special considerations Not yet demonstrated Not yet demonstrated

Task 13 — Advising on strategies Not yet demonstrated Not yet demonstrated

Task 14 — Impact of credit history Not yet demonstrated Not yet demonstrated

Task 15 — External dispute resolution Not yet demonstrated Not yet demonstrated

Task 16 — Effective access to files Not yet demonstrated Not yet demonstrated

Feedback (assessor to complete)

[insert assessor feedback]

Page 2 of 58

Before you begin

Read everything in this document before you start your assignment forCertificate IV in Finance and

Mortgage Broking (CIVMB_AS_v3A3).

About this document

This document includes the following parts:

• Part 1: Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Clinton and JenniferAndrews

– Task 1 — Initial disclosures

– Task 2 — Gathering and documenting client information

– Task 3 — Assessing the clients’ situation

– Task 4 — Using equity

– Task 5 — Reasonable enquiries

– Task 6 — Recommendations

– Task 7 — Clinton and Jennifer’s professional network

– Task 8 — Interest rates

– Task 9 — Settlement

• Section 2: Case study 2 — Tony and Lorraine Denton

– Task 10 — Establishing level of financial knowledge

– Task 11 — Responsible lending obligations

– Task 12 — Self Employed special considerations

– Task 13 — Advising on strategies

– Task 14 — Impact of credit history

– Task 15 — External dispute resolution

– Task 16 — Effective access to files

• Appendix 1:Client information collection tool/Fact Finder.

• Appendix 2:Serviceability calculator.

How to use the study plan

We recommend that you use the study plan for this subject; it will help you manage your time

effectively and complete the assignment within your enrolment period. Your study plan is in the

KapLearn Certificate IV in Finance and Mortgage Broking (CIVMBv3) subject room.

Page 3 of 58

Read everything in this document before you start your assignment forCertificate IV in Finance and

Mortgage Broking (CIVMB_AS_v3A3).

About this document

This document includes the following parts:

• Part 1: Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Clinton and JenniferAndrews

– Task 1 — Initial disclosures

– Task 2 — Gathering and documenting client information

– Task 3 — Assessing the clients’ situation

– Task 4 — Using equity

– Task 5 — Reasonable enquiries

– Task 6 — Recommendations

– Task 7 — Clinton and Jennifer’s professional network

– Task 8 — Interest rates

– Task 9 — Settlement

• Section 2: Case study 2 — Tony and Lorraine Denton

– Task 10 — Establishing level of financial knowledge

– Task 11 — Responsible lending obligations

– Task 12 — Self Employed special considerations

– Task 13 — Advising on strategies

– Task 14 — Impact of credit history

– Task 15 — External dispute resolution

– Task 16 — Effective access to files

• Appendix 1:Client information collection tool/Fact Finder.

• Appendix 2:Serviceability calculator.

How to use the study plan

We recommend that you use the study plan for this subject; it will help you manage your time

effectively and complete the assignment within your enrolment period. Your study plan is in the

KapLearn Certificate IV in Finance and Mortgage Broking (CIVMBv3) subject room.

Page 3 of 58

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Part 1: Instructions for completing and submitting

this assignment

Completing the assignment

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Submissionnumber

(e.g. 12345678_CIVMBv3A3_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

The assignment

This assignment is split into 16 Tasks, over 3 Sections. To finish this assignment, you must complete

all 16 tasks.

The information and data needed to complete Sections 1 and 2 is presented in case studies at the

beginning of those sections.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding the

suggested word count. Please do not include additional information which is outside the scope of the

question.

Additional research

When completing the Client Information Collection Tool in Appendix 1, assumptions are permitted,

although they must not be in conflict with the information provided in the Case Study.

You may also be required to source additional information from other organisations in the finance industry

to find the right products or services to meet your client’s requirements or to calculate any service fees that

may be applicable.

Page 4 of 58

this assignment

Completing the assignment

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Submissionnumber

(e.g. 12345678_CIVMBv3A3_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

The assignment

This assignment is split into 16 Tasks, over 3 Sections. To finish this assignment, you must complete

all 16 tasks.

The information and data needed to complete Sections 1 and 2 is presented in case studies at the

beginning of those sections.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding the

suggested word count. Please do not include additional information which is outside the scope of the

question.

Additional research

When completing the Client Information Collection Tool in Appendix 1, assumptions are permitted,

although they must not be in conflict with the information provided in the Case Study.

You may also be required to source additional information from other organisations in the finance industry

to find the right products or services to meet your client’s requirements or to calculate any service fees that

may be applicable.

Page 4 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Submitting the assignment

You must submit the completed assignment in acompatible Microsoft Word document.

You need to save and submit this entire document.

Do not delete/remove any sections of the document template.

Do not save your completed assignment as a PDF.

The assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete assignments will be returned to you unmarked.

The maximum file size is 5MB. Once you submit your assignment for marking you will be unable to make

any further changes to it.

You are able to submit your assignment earlier than the deadline if you are confident you have completed

all parts and have prepared a quality submission.

The assignment marking process

You have 26 weeks from the date of your enrolment in this subject to submit your completed assignment.

Should your assignment be deemed ‘not yet competent’ you will be given an additional four (4) weeks to

resubmit your assignment.

Your assessor will mark your assignment and return it to you in the Certificate IV in Finance and

Mortgage Broking (CIVMBv3)subject room in KapLearnunder the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your assignment. Failure to do so will mean that your assignment will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed assignment.

How your assignment is graded

Assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent.

Your assessor will follow the below process when marking your assignment:

• Assessing your responses to each question (and sub-parts if applicable)then determining whether you

have demonstrated competence in each question.

• Determining if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

Page 5 of 58

You must submit the completed assignment in acompatible Microsoft Word document.

You need to save and submit this entire document.

Do not delete/remove any sections of the document template.

Do not save your completed assignment as a PDF.

The assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete assignments will be returned to you unmarked.

The maximum file size is 5MB. Once you submit your assignment for marking you will be unable to make

any further changes to it.

You are able to submit your assignment earlier than the deadline if you are confident you have completed

all parts and have prepared a quality submission.

The assignment marking process

You have 26 weeks from the date of your enrolment in this subject to submit your completed assignment.

Should your assignment be deemed ‘not yet competent’ you will be given an additional four (4) weeks to

resubmit your assignment.

Your assessor will mark your assignment and return it to you in the Certificate IV in Finance and

Mortgage Broking (CIVMBv3)subject room in KapLearnunder the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your assignment. Failure to do so will mean that your assignment will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed assignment.

How your assignment is graded

Assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent.

Your assessor will follow the below process when marking your assignment:

• Assessing your responses to each question (and sub-parts if applicable)then determining whether you

have demonstrated competence in each question.

• Determining if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

Page 5 of 58

‘Not yet competent’ and resubmissions

Should sections of your assignment be marked as ‘not yet competent’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need to amend those

sections where the assessor has determined you are ‘not yet competent’.

When making changes to your original submission, use a different text colour for your

resubmission.This way, your assessor will be in a better position to gauge the quality and nature of your

changes. Ensure you leave your first assessor’s comments in your assignment, so your second assessor can

see the instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

We are here to help

If you have any questions about this assignment you can post your query at the ‘Ask your Tutor’ forum in

your subject room.

Before you submit your assignment

If you have any queries about the assignment questions, please use the ‘Ask your Tutor’ forum in your

subject room. You can expect an answer from your Tutor within 24 hours of posting your question.

Remember, your online tutor cannot preview or check your assignment answers, or provide specific answer

guidance. Please ensure that your questions are about clarification of the intent of an assignment question.

After your assignment has been assessed

If you have questions about your assessor’s feedback, please

email:<studentadviser@kaplan.edu.au>and include a copy of your assessed assignment. Never post your

assignment answers or assessor comments in the ‘Ask Your Tutor’ forum.

Page 6 of 58

Should sections of your assignment be marked as ‘not yet competent’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need to amend those

sections where the assessor has determined you are ‘not yet competent’.

When making changes to your original submission, use a different text colour for your

resubmission.This way, your assessor will be in a better position to gauge the quality and nature of your

changes. Ensure you leave your first assessor’s comments in your assignment, so your second assessor can

see the instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

We are here to help

If you have any questions about this assignment you can post your query at the ‘Ask your Tutor’ forum in

your subject room.

Before you submit your assignment

If you have any queries about the assignment questions, please use the ‘Ask your Tutor’ forum in your

subject room. You can expect an answer from your Tutor within 24 hours of posting your question.

Remember, your online tutor cannot preview or check your assignment answers, or provide specific answer

guidance. Please ensure that your questions are about clarification of the intent of an assignment question.

After your assignment has been assessed

If you have questions about your assessor’s feedback, please

email:<studentadviser@kaplan.edu.au>and include a copy of your assessed assignment. Never post your

assignment answers or assessor comments in the ‘Ask Your Tutor’ forum.

Page 6 of 58

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

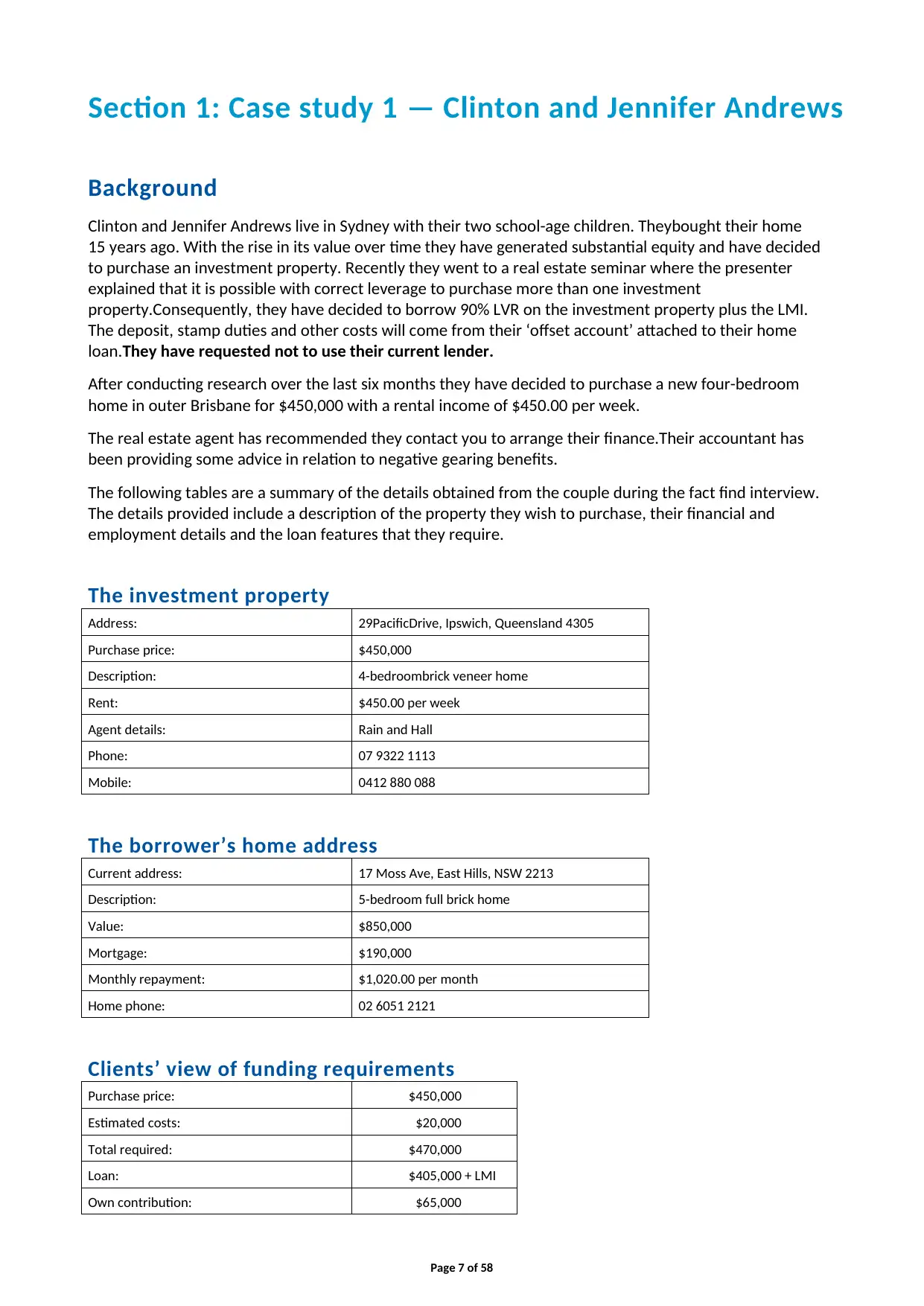

Section 1: Case study 1 — Clinton and Jennifer Andrews

Background

Clinton and Jennifer Andrews live in Sydney with their two school-age children. Theybought their home

15 years ago. With the rise in its value over time they have generated substantial equity and have decided

to purchase an investment property. Recently they went to a real estate seminar where the presenter

explained that it is possible with correct leverage to purchase more than one investment

property.Consequently, they have decided to borrow 90% LVR on the investment property plus the LMI.

The deposit, stamp duties and other costs will come from their ‘offset account’ attached to their home

loan.They have requested not to use their current lender.

After conducting research over the last six months they have decided to purchase a new four-bedroom

home in outer Brisbane for $450,000 with a rental income of $450.00 per week.

The real estate agent has recommended they contact you to arrange their finance.Their accountant has

been providing some advice in relation to negative gearing benefits.

The following tables are a summary of the details obtained from the couple during the fact find interview.

The details provided include a description of the property they wish to purchase, their financial and

employment details and the loan features that they require.

The investment property

Address: 29PacificDrive, Ipswich, Queensland 4305

Purchase price: $450,000

Description: 4-bedroombrick veneer home

Rent: $450.00 per week

Agent details: Rain and Hall

Phone: 07 9322 1113

Mobile: 0412 880 088

The borrower’s home address

Current address: 17 Moss Ave, East Hills, NSW 2213

Description: 5-bedroom full brick home

Value: $850,000

Mortgage: $190,000

Monthly repayment: $1,020.00 per month

Home phone: 02 6051 2121

Clients’ view of funding requirements

Purchase price: $450,000

Estimated costs: $20,000

Total required: $470,000

Loan: $405,000 + LMI

Own contribution: $65,000

Page 7 of 58

Background

Clinton and Jennifer Andrews live in Sydney with their two school-age children. Theybought their home

15 years ago. With the rise in its value over time they have generated substantial equity and have decided

to purchase an investment property. Recently they went to a real estate seminar where the presenter

explained that it is possible with correct leverage to purchase more than one investment

property.Consequently, they have decided to borrow 90% LVR on the investment property plus the LMI.

The deposit, stamp duties and other costs will come from their ‘offset account’ attached to their home

loan.They have requested not to use their current lender.

After conducting research over the last six months they have decided to purchase a new four-bedroom

home in outer Brisbane for $450,000 with a rental income of $450.00 per week.

The real estate agent has recommended they contact you to arrange their finance.Their accountant has

been providing some advice in relation to negative gearing benefits.

The following tables are a summary of the details obtained from the couple during the fact find interview.

The details provided include a description of the property they wish to purchase, their financial and

employment details and the loan features that they require.

The investment property

Address: 29PacificDrive, Ipswich, Queensland 4305

Purchase price: $450,000

Description: 4-bedroombrick veneer home

Rent: $450.00 per week

Agent details: Rain and Hall

Phone: 07 9322 1113

Mobile: 0412 880 088

The borrower’s home address

Current address: 17 Moss Ave, East Hills, NSW 2213

Description: 5-bedroom full brick home

Value: $850,000

Mortgage: $190,000

Monthly repayment: $1,020.00 per month

Home phone: 02 6051 2121

Clients’ view of funding requirements

Purchase price: $450,000

Estimated costs: $20,000

Total required: $470,000

Loan: $405,000 + LMI

Own contribution: $65,000

Page 7 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

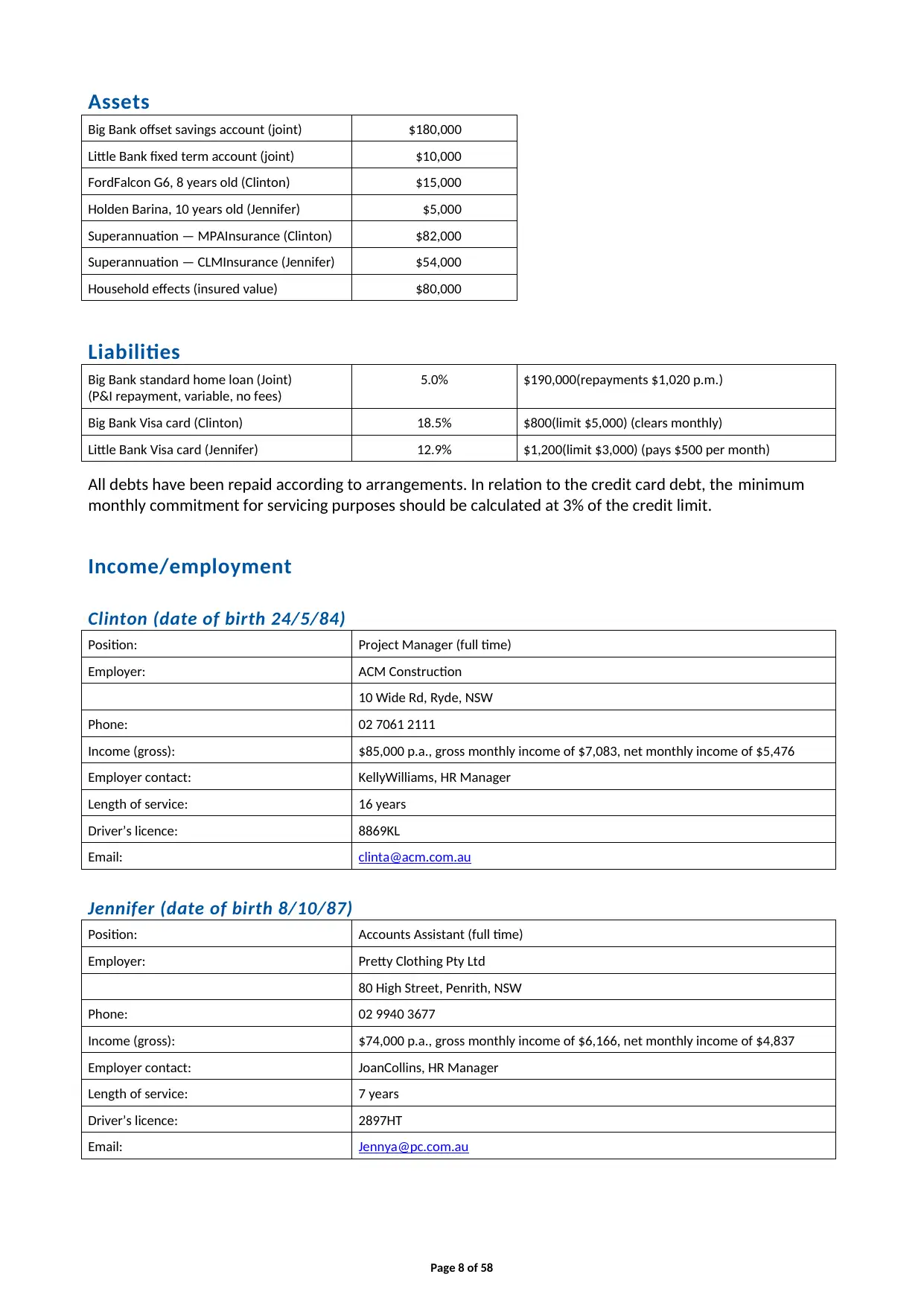

Assets

Big Bank offset savings account (joint) $180,000

Little Bank fixed term account (joint) $10,000

FordFalcon G6, 8 years old (Clinton) $15,000

Holden Barina, 10 years old (Jennifer) $5,000

Superannuation — MPAInsurance (Clinton) $82,000

Superannuation — CLMInsurance (Jennifer) $54,000

Household effects (insured value) $80,000

Liabilities

Big Bank standard home loan (Joint)

(P&I repayment, variable, no fees)

5.0% $190,000(repayments $1,020 p.m.)

Big Bank Visa card (Clinton) 18.5% $800(limit $5,000) (clears monthly)

Little Bank Visa card (Jennifer) 12.9% $1,200(limit $3,000) (pays $500 per month)

All debts have been repaid according to arrangements. In relation to the credit card debt, the minimum

monthly commitment for servicing purposes should be calculated at 3% of the credit limit.

Income/employment

Clinton (date of birth 24/5/84)

Position: Project Manager (full time)

Employer: ACM Construction

10 Wide Rd, Ryde, NSW

Phone: 02 7061 2111

Income (gross): $85,000 p.a., gross monthly income of $7,083, net monthly income of $5,476

Employer contact: KellyWilliams, HR Manager

Length of service: 16 years

Driver’s licence: 8869KL

Email: clinta@acm.com.au

Jennifer (date of birth 8/10/87)

Position: Accounts Assistant (full time)

Employer: Pretty Clothing Pty Ltd

80 High Street, Penrith, NSW

Phone: 02 9940 3677

Income (gross): $74,000 p.a., gross monthly income of $6,166, net monthly income of $4,837

Employer contact: JoanCollins, HR Manager

Length of service: 7 years

Driver’s licence: 2897HT

Email: Jennya@pc.com.au

Page 8 of 58

Big Bank offset savings account (joint) $180,000

Little Bank fixed term account (joint) $10,000

FordFalcon G6, 8 years old (Clinton) $15,000

Holden Barina, 10 years old (Jennifer) $5,000

Superannuation — MPAInsurance (Clinton) $82,000

Superannuation — CLMInsurance (Jennifer) $54,000

Household effects (insured value) $80,000

Liabilities

Big Bank standard home loan (Joint)

(P&I repayment, variable, no fees)

5.0% $190,000(repayments $1,020 p.m.)

Big Bank Visa card (Clinton) 18.5% $800(limit $5,000) (clears monthly)

Little Bank Visa card (Jennifer) 12.9% $1,200(limit $3,000) (pays $500 per month)

All debts have been repaid according to arrangements. In relation to the credit card debt, the minimum

monthly commitment for servicing purposes should be calculated at 3% of the credit limit.

Income/employment

Clinton (date of birth 24/5/84)

Position: Project Manager (full time)

Employer: ACM Construction

10 Wide Rd, Ryde, NSW

Phone: 02 7061 2111

Income (gross): $85,000 p.a., gross monthly income of $7,083, net monthly income of $5,476

Employer contact: KellyWilliams, HR Manager

Length of service: 16 years

Driver’s licence: 8869KL

Email: clinta@acm.com.au

Jennifer (date of birth 8/10/87)

Position: Accounts Assistant (full time)

Employer: Pretty Clothing Pty Ltd

80 High Street, Penrith, NSW

Phone: 02 9940 3677

Income (gross): $74,000 p.a., gross monthly income of $6,166, net monthly income of $4,837

Employer contact: JoanCollins, HR Manager

Length of service: 7 years

Driver’s licence: 2897HT

Email: Jennya@pc.com.au

Page 8 of 58

Interest income

Approximately $30 per month from the $10,000 term deposit,interest of 3.5% p.a.

Expenditure

Monthly expenditure for living expenses— $3,200.

Solicitor’s details

Jackson & Williams

28West Street, Yagoona, NSW

Phone: 02 9283 1365

Fax: 02 9283 1802

Note:The solicitor has quoted $1,500 to cover estimates costs.

Proposed loan details

• application fee— $600.00 (includes valuation)

• 30-year term

• principal and interest

• residentialinvestment loan

• standard variable interest rate of 5.68% (comparison 5.82%), special offer rate of 4.78%

(5.16% comparison) (Note: Clinton& Jennifer will qualify for this special loan offer.)

• proposed settlement date — 6 weeks’ time

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• internet banking.

Page 9 of 58

Approximately $30 per month from the $10,000 term deposit,interest of 3.5% p.a.

Expenditure

Monthly expenditure for living expenses— $3,200.

Solicitor’s details

Jackson & Williams

28West Street, Yagoona, NSW

Phone: 02 9283 1365

Fax: 02 9283 1802

Note:The solicitor has quoted $1,500 to cover estimates costs.

Proposed loan details

• application fee— $600.00 (includes valuation)

• 30-year term

• principal and interest

• residentialinvestment loan

• standard variable interest rate of 5.68% (comparison 5.82%), special offer rate of 4.78%

(5.16% comparison) (Note: Clinton& Jennifer will qualify for this special loan offer.)

• proposed settlement date — 6 weeks’ time

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• internet banking.

Page 9 of 58

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assignment tasks (student to complete)

Task 1 — Initial disclosures

Following a personal introduction and before you begin gathering information about the clients’ existing

financial situation or needs, there are certain disclosures you are required to make as a finance

broker.These disclosures include the way you are remunerated and the range and limitation of your

services.

1. There are four (4) documents listed in ASIC Information sheet INFO 146 ‘Responsible lending disclosure

obligations – Overview for credit licensees and representatives’that must be provided to customers.

Refer to this Information sheet and the information contained in your topic notes to answer part (a) and

(b) below.

(a) Identify which of these four (4) documents you must provide your client before you commence

providing credit assistance and explain the main disclosures relevant tothat document. (40 words)

Student response to Task 1: Question 1(a)

The documents that needs to be provided to the client are as given below:

1) Credit Guide

2) Quote

3) Poposal Document

4) Written assessment

(b) Identify which of these four documents you will provide the client should you intend to charge a

broker fee and explain what is required for it to be valid. (40 words)

Student response to Task 1: Question 1(b)

The documents that are to be given to the client for levying the fees for brokerage are as follows:

Name of the licensee and the contact details

The brokerage percentage that is to be levied from the client and the basis of the calculation.

The explanation and the details of the services for which the brokerage fees would be charged

The maximum amount that can be levied as brokerage.

The advisor should also explain whether the brokerage fee is to be paid one time or in a periodical manner.

Assessor feedback: Resubmission required?

No

Page 10 of 58

Task 1 — Initial disclosures

Following a personal introduction and before you begin gathering information about the clients’ existing

financial situation or needs, there are certain disclosures you are required to make as a finance

broker.These disclosures include the way you are remunerated and the range and limitation of your

services.

1. There are four (4) documents listed in ASIC Information sheet INFO 146 ‘Responsible lending disclosure

obligations – Overview for credit licensees and representatives’that must be provided to customers.

Refer to this Information sheet and the information contained in your topic notes to answer part (a) and

(b) below.

(a) Identify which of these four (4) documents you must provide your client before you commence

providing credit assistance and explain the main disclosures relevant tothat document. (40 words)

Student response to Task 1: Question 1(a)

The documents that needs to be provided to the client are as given below:

1) Credit Guide

2) Quote

3) Poposal Document

4) Written assessment

(b) Identify which of these four documents you will provide the client should you intend to charge a

broker fee and explain what is required for it to be valid. (40 words)

Student response to Task 1: Question 1(b)

The documents that are to be given to the client for levying the fees for brokerage are as follows:

Name of the licensee and the contact details

The brokerage percentage that is to be levied from the client and the basis of the calculation.

The explanation and the details of the services for which the brokerage fees would be charged

The maximum amount that can be levied as brokerage.

The advisor should also explain whether the brokerage fee is to be paid one time or in a periodical manner.

Assessor feedback: Resubmission required?

No

Page 10 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 2 — Gathering and documenting client information

Complete the Client Information Collection Tool (located at the end of the assignment in

Appendix 1)using the information provided in Case Study 1.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback: Resubmission required?

No

Task 3 — Assessing the clients’ situation

1. Using theExcel or Online version of the Genworth Serviceability Calculator,calculate the Genworth NDI

for the borrowers. This will require you to enter all the data, including their future rental income.

<http://www.genworth.com.au/online-tools-forms-and-reports/lmi-tools/serviceability-calculator>.

Once you have completed the calculations, copy the data into the Serviceability Calculator

(located at the end of this assignment in Appendix 2).

Do not upload the Excel spreadsheet as a separate file.

Assessor feedback: Resubmission required?

No

Page 11 of 58

Complete the Client Information Collection Tool (located at the end of the assignment in

Appendix 1)using the information provided in Case Study 1.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback: Resubmission required?

No

Task 3 — Assessing the clients’ situation

1. Using theExcel or Online version of the Genworth Serviceability Calculator,calculate the Genworth NDI

for the borrowers. This will require you to enter all the data, including their future rental income.

<http://www.genworth.com.au/online-tools-forms-and-reports/lmi-tools/serviceability-calculator>.

Once you have completed the calculations, copy the data into the Serviceability Calculator

(located at the end of this assignment in Appendix 2).

Do not upload the Excel spreadsheet as a separate file.

Assessor feedback: Resubmission required?

No

Page 11 of 58

2. Based on the information provided in the case study and using the tools available to you

(e.g. loan calculators, including those available on lenders’ websites), provide an assessment

of the clients’ borrowing ability. Consider and comment on the following issues:

(a) the maximum loan using the Genworth calculator

(b) deposit requirements for the loan required

(c) combined net monthly income, less cost of living expense as specified by the borrower

(d) do they require Lenders Mortgage Insurance (LMI) and if so, how much will it cost?

Refer to Genworth LMI estimator for this figure

(e) any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions.

(No word count requirement for questions (a) to (d)).

Question (e) (100 words)

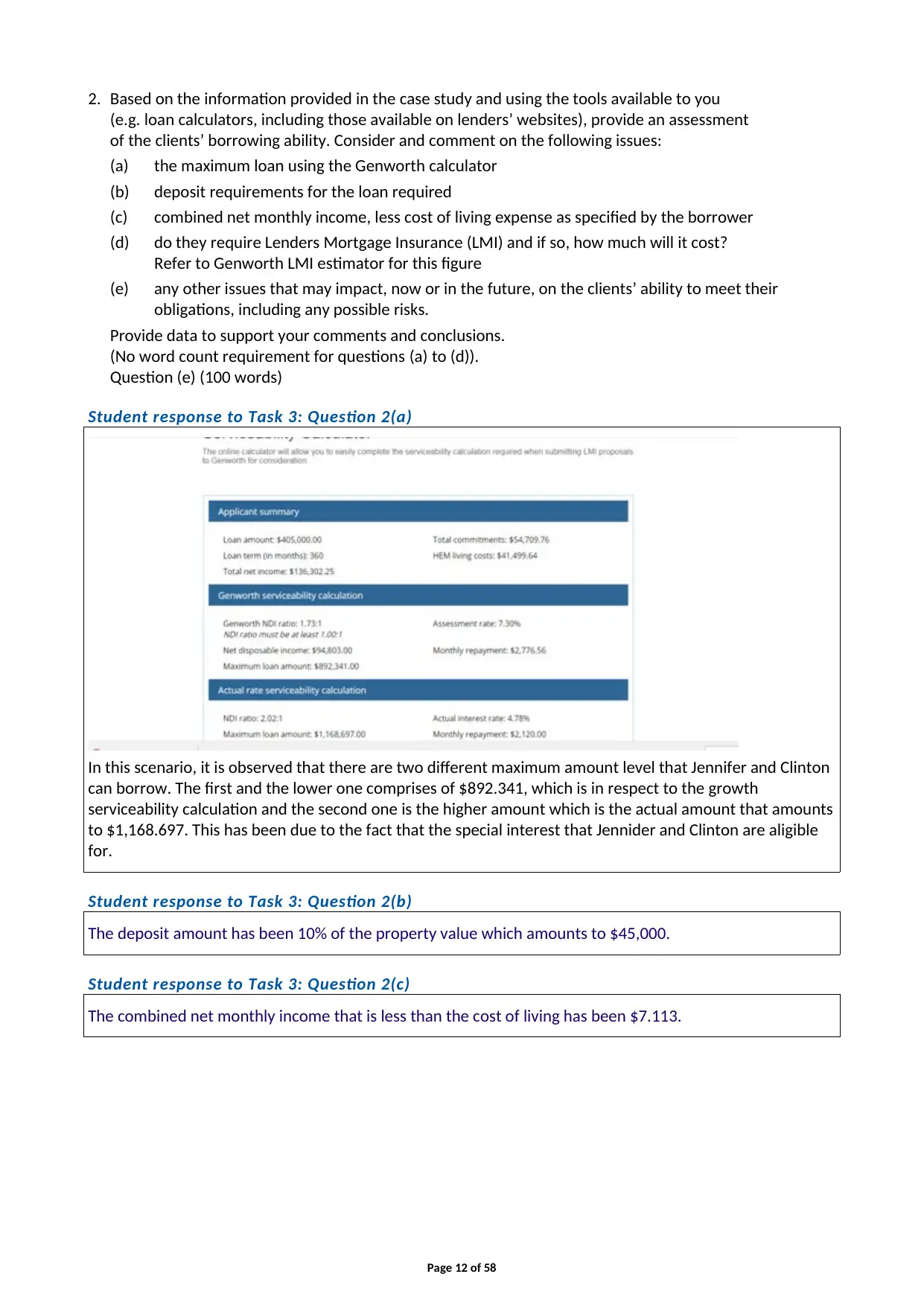

Student response to Task 3: Question 2(a)

In this scenario, it is observed that there are two different maximum amount level that Jennifer and Clinton

can borrow. The first and the lower one comprises of $892.341, which is in respect to the growth

serviceability calculation and the second one is the higher amount which is the actual amount that amounts

to $1,168.697. This has been due to the fact that the special interest that Jennider and Clinton are aligible

for.

Student response to Task 3: Question 2(b)

The deposit amount has been 10% of the property value which amounts to $45,000.

Student response to Task 3: Question 2(c)

The combined net monthly income that is less than the cost of living has been $7.113.

Page 12 of 58

(e.g. loan calculators, including those available on lenders’ websites), provide an assessment

of the clients’ borrowing ability. Consider and comment on the following issues:

(a) the maximum loan using the Genworth calculator

(b) deposit requirements for the loan required

(c) combined net monthly income, less cost of living expense as specified by the borrower

(d) do they require Lenders Mortgage Insurance (LMI) and if so, how much will it cost?

Refer to Genworth LMI estimator for this figure

(e) any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions.

(No word count requirement for questions (a) to (d)).

Question (e) (100 words)

Student response to Task 3: Question 2(a)

In this scenario, it is observed that there are two different maximum amount level that Jennifer and Clinton

can borrow. The first and the lower one comprises of $892.341, which is in respect to the growth

serviceability calculation and the second one is the higher amount which is the actual amount that amounts

to $1,168.697. This has been due to the fact that the special interest that Jennider and Clinton are aligible

for.

Student response to Task 3: Question 2(b)

The deposit amount has been 10% of the property value which amounts to $45,000.

Student response to Task 3: Question 2(c)

The combined net monthly income that is less than the cost of living has been $7.113.

Page 12 of 58

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 58

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.