DIPMB1 Written Assignment: Case Studies and Lending Process Analysis

VerifiedAdded on 2022/12/28

|55

|10804

|47

Homework Assignment

AI Summary

This document presents a comprehensive solution to a written assignment focused on the lending process within the context of financial services. The assignment is structured around three case studies involving potential borrowers, analyzing their financial situations, and evaluating their loan applications. It covers key aspects such as client information gathering, assessing borrowing options, and conducting reasonable inquiries. Furthermore, the document delves into responsible lending obligations, self-employed considerations, and strategies for advising clients. The assignment also addresses financial services legislation, industry codes of practice, and principles of professional practice, providing a holistic view of the lending landscape and the responsibilities of financial professionals. The assignment is designed to demonstrate competency in preparing loan applications, identifying client needs, presenting broking options, and complying with financial services regulations.

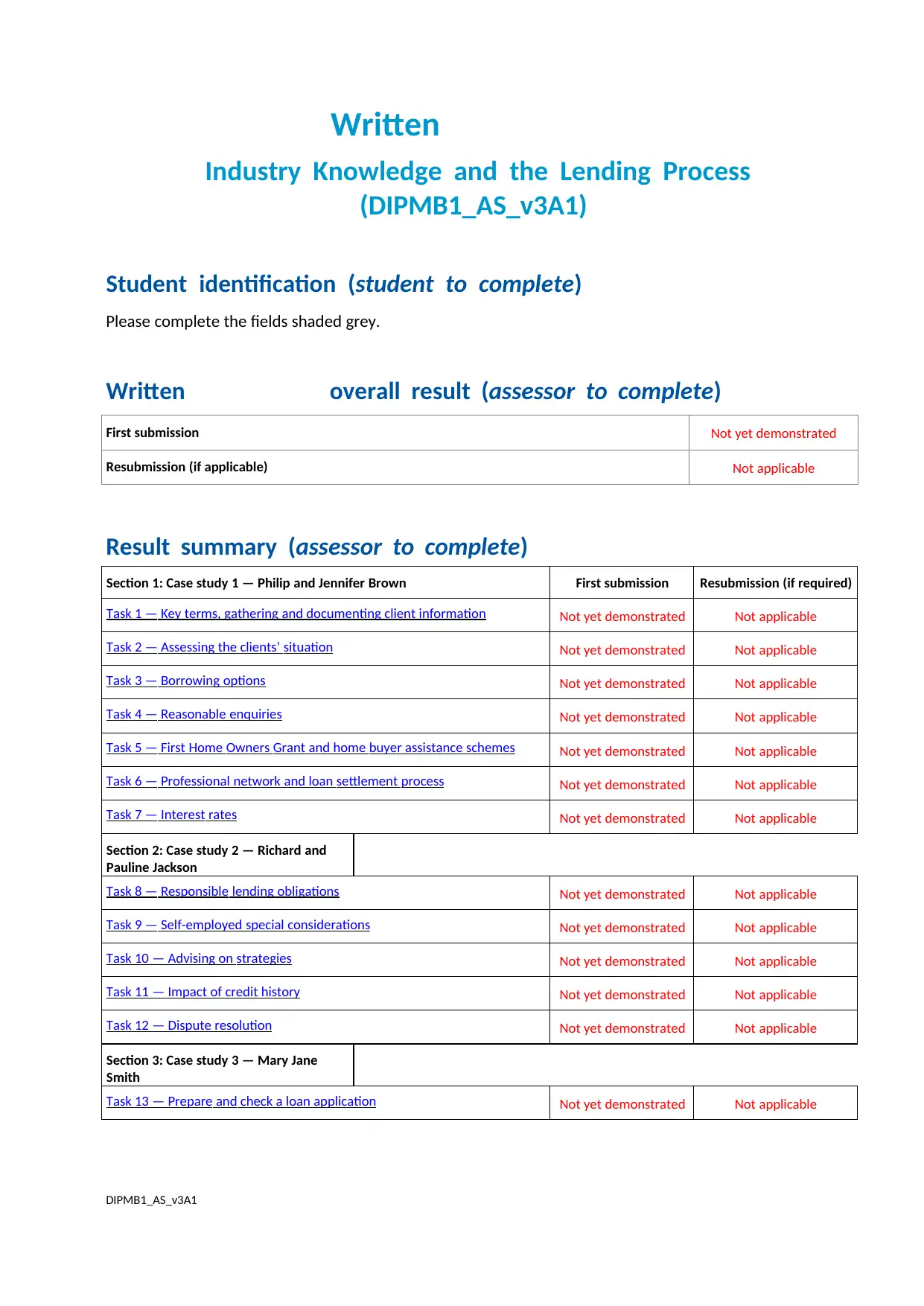

Written

Industry Knowledge and the Lending Process

(DIPMB1_AS_v3A1)

Student identification (student to complete)

Please complete the fields shaded grey.

Written overall result (assessor to complete)

First submission Not yet demonstrated

Resubmission (if applicable) Not applicable

Result summary (assessor to complete)

Section 1: Case study 1 — Philip and Jennifer Brown First submission Resubmission (if required)

Task 1 — Key terms, gathering and documenting client information Not yet demonstrated Not applicable

Task 2 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 3 — Borrowing options Not yet demonstrated Not applicable

Task 4 — Reasonable enquiries Not yet demonstrated Not applicable

Task 5 — First Home Owners Grant and home buyer assistance schemes Not yet demonstrated Not applicable

Task 6 — Professional network and loan settlement process Not yet demonstrated Not applicable

Task 7 — Interest rates Not yet demonstrated Not applicable

Section 2: Case study 2 — Richard and

Pauline Jackson

Task 8 — Responsible lending obligations Not yet demonstrated Not applicable

Task 9 — Self-employed special considerations Not yet demonstrated Not applicable

Task 10 — Advising on strategies Not yet demonstrated Not applicable

Task 11 — Impact of credit history Not yet demonstrated Not applicable

Task 12 — Dispute resolution Not yet demonstrated Not applicable

Section 3: Case study 3 — Mary Jane

Smith

Task 13 — Prepare and check a loan application Not yet demonstrated Not applicable

DIPMB1_AS_v3A1

Industry Knowledge and the Lending Process

(DIPMB1_AS_v3A1)

Student identification (student to complete)

Please complete the fields shaded grey.

Written overall result (assessor to complete)

First submission Not yet demonstrated

Resubmission (if applicable) Not applicable

Result summary (assessor to complete)

Section 1: Case study 1 — Philip and Jennifer Brown First submission Resubmission (if required)

Task 1 — Key terms, gathering and documenting client information Not yet demonstrated Not applicable

Task 2 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 3 — Borrowing options Not yet demonstrated Not applicable

Task 4 — Reasonable enquiries Not yet demonstrated Not applicable

Task 5 — First Home Owners Grant and home buyer assistance schemes Not yet demonstrated Not applicable

Task 6 — Professional network and loan settlement process Not yet demonstrated Not applicable

Task 7 — Interest rates Not yet demonstrated Not applicable

Section 2: Case study 2 — Richard and

Pauline Jackson

Task 8 — Responsible lending obligations Not yet demonstrated Not applicable

Task 9 — Self-employed special considerations Not yet demonstrated Not applicable

Task 10 — Advising on strategies Not yet demonstrated Not applicable

Task 11 — Impact of credit history Not yet demonstrated Not applicable

Task 12 — Dispute resolution Not yet demonstrated Not applicable

Section 3: Case study 3 — Mary Jane

Smith

Task 13 — Prepare and check a loan application Not yet demonstrated Not applicable

DIPMB1_AS_v3A1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

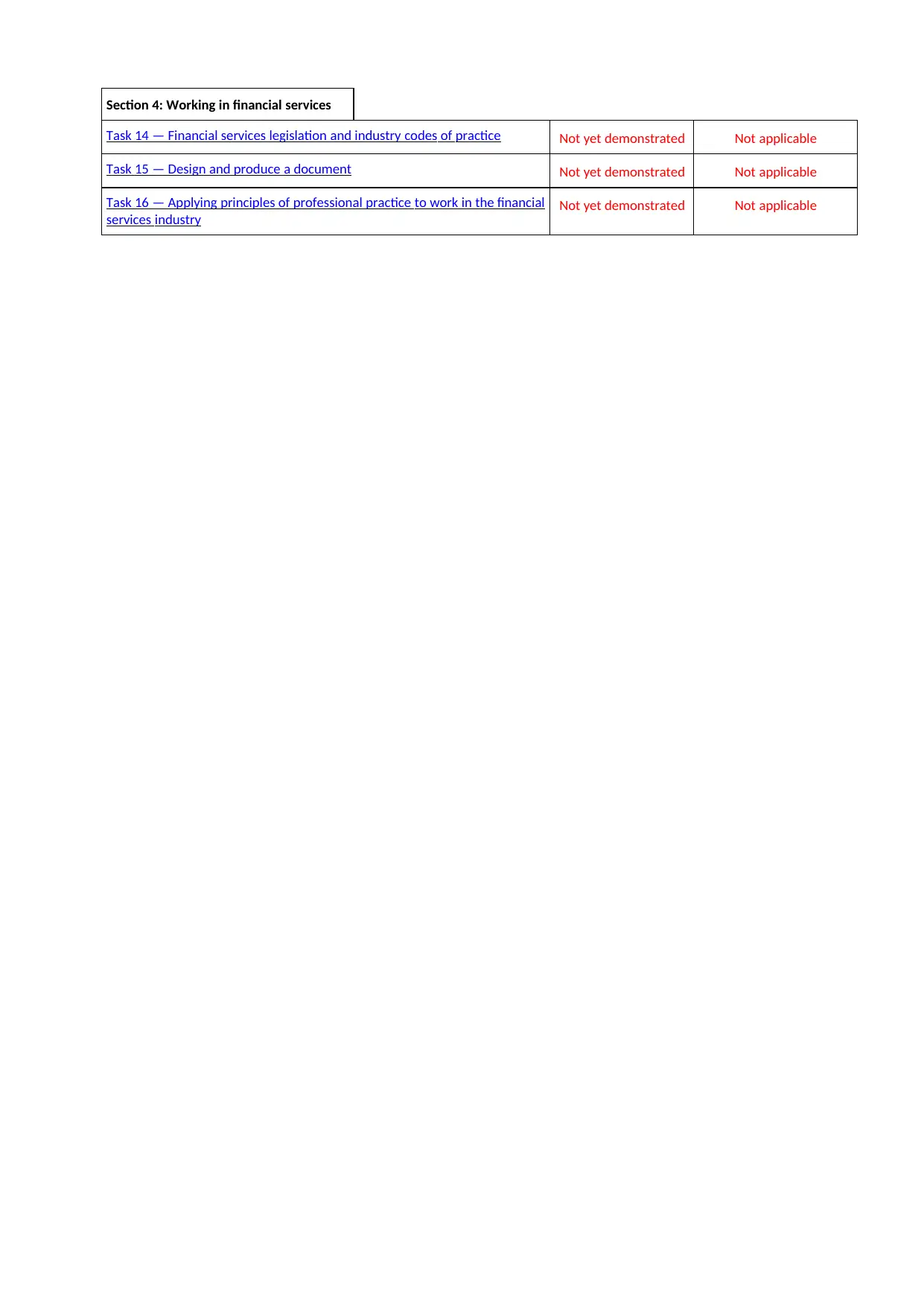

Section 4: Working in financial services

Task 14 — Financial services legislation and industry codes of practice Not yet demonstrated Not applicable

Task 15 — Design and produce a document Not yet demonstrated Not applicable

Task 16 — Applying principles of professional practice to work in the financial

services industry Not yet demonstrated Not applicable

Task 14 — Financial services legislation and industry codes of practice Not yet demonstrated Not applicable

Task 15 — Design and produce a document Not yet demonstrated Not applicable

Task 16 — Applying principles of professional practice to work in the financial

services industry Not yet demonstrated Not applicable

Please note:To pass this written you will need to be assessed as DEMONSTRATED in

either your first submission or your resubmission in all tasks above.

Task feedback

Please refer to the assessor’s detailed feedback found at the end of each task so that you know what

to do for any tasks you need to resubmit.

either your first submission or your resubmission in all tasks above.

Task feedback

Please refer to the assessor’s detailed feedback found at the end of each task so that you know what

to do for any tasks you need to resubmit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Before you begin

Read everything in this document before you start your written for Industry Knowledge and the

Lending Process (DIPMB1v3) subject.

About this document

This document is the written — half of the overall Written and Oral

This document includes the following parts:

•Instructions for com pleting and submitting this

•Section 1: Case study 1 — Philip and Jennifer Brown

A case study with a series of short-answer questions:

– Task 1 — Key terms, gathering and documenting client information

– Task 2 — Assessing the clients’ situation

– Task 3 — Borrowing options

– Task 4 — Reasonable enquiries

– Task 5 — First Home Owners Grant and home buyer assistance schemes

– Task 6 —Professional network and loan settlement process

– Task 7 — Interest rates

•Section 2: Case study 2 — Richard and Pauline Jackson

A case study and a series of short-answer questions:

– Task 8 — Responsible lending obligations

– Task 9 — Self-employed special considerations

– Task 10 — Advising on strategies

– Task 11 — Impact of credit history

– Task 12 — Dispute resolution

•Section 3: Case study 3 — Mary Jane Smith

A case study and a series of short-answer questions:

– Task 13 — Prepare and check a loan application

•Section 4: Working in financial services

– Task 14 — Financial services legislation and industry codes of practice

– Task 15 — Design and produce a document

– Task 16 — Applying principles of professional practice to work in the financial services industry

•Appendix 1:Key terms

•Appendix 2:Client information collection tool/Fact finder

•Appendix 3:Loan application.

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to

complete the written within your enrolment period. Your study plan is in the KapLearn Industry

Knowledge and the Lending Process (DIPMB1v3) subject room.

Read everything in this document before you start your written for Industry Knowledge and the

Lending Process (DIPMB1v3) subject.

About this document

This document is the written — half of the overall Written and Oral

This document includes the following parts:

•Instructions for com pleting and submitting this

•Section 1: Case study 1 — Philip and Jennifer Brown

A case study with a series of short-answer questions:

– Task 1 — Key terms, gathering and documenting client information

– Task 2 — Assessing the clients’ situation

– Task 3 — Borrowing options

– Task 4 — Reasonable enquiries

– Task 5 — First Home Owners Grant and home buyer assistance schemes

– Task 6 —Professional network and loan settlement process

– Task 7 — Interest rates

•Section 2: Case study 2 — Richard and Pauline Jackson

A case study and a series of short-answer questions:

– Task 8 — Responsible lending obligations

– Task 9 — Self-employed special considerations

– Task 10 — Advising on strategies

– Task 11 — Impact of credit history

– Task 12 — Dispute resolution

•Section 3: Case study 3 — Mary Jane Smith

A case study and a series of short-answer questions:

– Task 13 — Prepare and check a loan application

•Section 4: Working in financial services

– Task 14 — Financial services legislation and industry codes of practice

– Task 15 — Design and produce a document

– Task 16 — Applying principles of professional practice to work in the financial services industry

•Appendix 1:Key terms

•Appendix 2:Client information collection tool/Fact finder

•Appendix 3:Loan application.

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to

complete the written within your enrolment period. Your study plan is in the KapLearn Industry

Knowledge and the Lending Process (DIPMB1v3) subject room.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Instructions for completing and submitting the

written

Completing the written

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these .

• Name your file as follows: Studentnumber SubjectCode versionnumber Submissionnumber

(e.g. 12345678_DIPMB1_AS_v3A1_Submission1).

• Include your student ID on the first page of the .

Before you submit your work, please do a spell check and proofread your work to ensure that everything

is clear and unambiguous.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding

the suggested word count. Please do not include additional information which is outside the scope of

the question.

Additional research

When completing the ‘Client information collection tool’ in Appendix 2, assumptions are permitted,

although they must not be in conflict with the information provided in the Case study.

Throughout the you will also be required to research additional information from

other organisations in the finance industry to find the right products or services to meet your

client’s requirements or to calculate any service fees that may be applicable.

written

Completing the written

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these .

• Name your file as follows: Studentnumber SubjectCode versionnumber Submissionnumber

(e.g. 12345678_DIPMB1_AS_v3A1_Submission1).

• Include your student ID on the first page of the .

Before you submit your work, please do a spell check and proofread your work to ensure that everything

is clear and unambiguous.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding

the suggested word count. Please do not include additional information which is outside the scope of

the question.

Additional research

When completing the ‘Client information collection tool’ in Appendix 2, assumptions are permitted,

although they must not be in conflict with the information provided in the Case study.

Throughout the you will also be required to research additional information from

other organisations in the finance industry to find the right products or services to meet your

client’s requirements or to calculate any service fees that may be applicable.

Submitting the written

Only Microsoft Office compatible written submitted in the template file will be accepted for

marking by Kaplan Professional Education. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed as a PDF.

The written must becomp leted before submitting it to Kaplan Professional Education.

Incomplete written will be returned to you unmarked. The written must be

submitted together with the oral . If you do not submit both completed at the

one time it will be returned to you unmarked.

The written marking process

You have 12 weeks from the date of your enrolment in this subject to submit your completed

If you reach the end of your initial enrolment period and have been deemed ‘Not yet demonstrated’ in

one or more assessment items, then an additional four (4) weeks will be granted, provided you attempted

all assessment tasks during the initial enrolment period.

Your assessor wi l mark your written and oral and return it to you in the Industry Know edge

and the Lending Process (DIPMB1v3) subject room in KapLearn under the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written . Failure to do so will mean that your will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit yourcomp leted written and oral.

Only Microsoft Office compatible written submitted in the template file will be accepted for

marking by Kaplan Professional Education. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed as a PDF.

The written must becomp leted before submitting it to Kaplan Professional Education.

Incomplete written will be returned to you unmarked. The written must be

submitted together with the oral . If you do not submit both completed at the

one time it will be returned to you unmarked.

The written marking process

You have 12 weeks from the date of your enrolment in this subject to submit your completed

If you reach the end of your initial enrolment period and have been deemed ‘Not yet demonstrated’ in

one or more assessment items, then an additional four (4) weeks will be granted, provided you attempted

all assessment tasks during the initial enrolment period.

Your assessor wi l mark your written and oral and return it to you in the Industry Know edge

and the Lending Process (DIPMB1v3) subject room in KapLearn under the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written . Failure to do so will mean that your will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit yourcomp leted written and oral.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

How your written is graded

tasks are used to determine your competence in demonstrating the required knowledge and/or

skills for each subject. As a result, you will be graded as either Demonstrated or Not yet demonstrated.

Your assessor will follow the below process when marking your :

• Assess your responses to each question, and sub-parts if applicable, and then determine whether

you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral .

‘Not yet demonstrated’ and resubmissions

Should sections of your be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required

level.

You must address the assessor’s feedback in your amended responses. You only need amend those sections

where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission. Your

assessor will be in a better position to gauge the quality and nature of your changes. Ensure you leave your

first assessor’s comments in your , so your second assessor can see the instructions that were

originally provided for you.Do not change any comments made by a Kaplan assessor.

Units of competency

This written is your opportunity to demonstrate your competency against these units:

FNSFMB401 Prepare loan application on behalf of finance or mortgage broking clients

FNSFMB402 Identify client needs for broking services

FNSFMB403 Present broking options to client

FNSFMK505 Comply with financial services regulation and industry codes of practice

FNSINC401 Apply principles of professional practice to work in the financial services industry

Note that thewritten and orali assessments re quired to meet the requirements of

the units of competency.

We are here to help

If you have any questions about this written you can post your query at the ‘Ask your

Tutor’ forum in your subject room. You can expect an answer within 24 hours of your posting from one

of our technical advisers or student support staff.

tasks are used to determine your competence in demonstrating the required knowledge and/or

skills for each subject. As a result, you will be graded as either Demonstrated or Not yet demonstrated.

Your assessor will follow the below process when marking your :

• Assess your responses to each question, and sub-parts if applicable, and then determine whether

you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral .

‘Not yet demonstrated’ and resubmissions

Should sections of your be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required

level.

You must address the assessor’s feedback in your amended responses. You only need amend those sections

where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission. Your

assessor will be in a better position to gauge the quality and nature of your changes. Ensure you leave your

first assessor’s comments in your , so your second assessor can see the instructions that were

originally provided for you.Do not change any comments made by a Kaplan assessor.

Units of competency

This written is your opportunity to demonstrate your competency against these units:

FNSFMB401 Prepare loan application on behalf of finance or mortgage broking clients

FNSFMB402 Identify client needs for broking services

FNSFMB403 Present broking options to client

FNSFMK505 Comply with financial services regulation and industry codes of practice

FNSINC401 Apply principles of professional practice to work in the financial services industry

Note that thewritten and orali assessments re quired to meet the requirements of

the units of competency.

We are here to help

If you have any questions about this written you can post your query at the ‘Ask your

Tutor’ forum in your subject room. You can expect an answer within 24 hours of your posting from one

of our technical advisers or student support staff.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1: Case study 1 — Philip and Jennifer Brown

Background

Philip and Jennifer Brown are a young couple about to buy their first home. They have been married for

five years and during that time have rented an apartment while saving for their own home.

Following a personal referral from Glenn Brown, Philip’s brother you have already had a first meeting with

Philip and Jennifer to discuss their objectives and needs. They admitted they have little time to do much

research of lenders, have limited knowledge of the loan products available and have approached you to

guide them through the process as they are confused.

During (and subsequent) to your first meeting, Philip and Jennifer have provided the basic information

documents — pay slips, tax returns, bank statements, property details for review/verification. You have

now undertaken your preliminary assessment and need to discuss and present to them the proposal

covering the options and your recommendations. It is important to get the proposal moving quickly,

as the agent has indicated other parties are interested in the property.

They have been looking at properties for the past three months and have found a 10 year old established

apartment that has really caught their eye, although they have some concern over the kitchen which

requires some minor renovations.

They have not paid a deposit at this stage, but the Real Estate Agent has provided some guidance on

additional fees and charges.

Following is a summary of the details of the property they wish to purchase, the couple’s financial and

employment details, and the loan features they require.

The property

Address Unit 1, 92 Seaside Lane Edgartown (Your state)

Purchase price $490,000

Description 2 bedroom, 2 bathroom Strata Title apartment

Agent details Stephanie Jones

Phone 8123 1113

Mobile 0412 880 088

The couple

Current address Unit 12, 22 Wentworth Lane, Highville, (Your state)

Philip and Jennifer have lived there since March 2012

Home phone 9123 2121

Background

Philip and Jennifer Brown are a young couple about to buy their first home. They have been married for

five years and during that time have rented an apartment while saving for their own home.

Following a personal referral from Glenn Brown, Philip’s brother you have already had a first meeting with

Philip and Jennifer to discuss their objectives and needs. They admitted they have little time to do much

research of lenders, have limited knowledge of the loan products available and have approached you to

guide them through the process as they are confused.

During (and subsequent) to your first meeting, Philip and Jennifer have provided the basic information

documents — pay slips, tax returns, bank statements, property details for review/verification. You have

now undertaken your preliminary assessment and need to discuss and present to them the proposal

covering the options and your recommendations. It is important to get the proposal moving quickly,

as the agent has indicated other parties are interested in the property.

They have been looking at properties for the past three months and have found a 10 year old established

apartment that has really caught their eye, although they have some concern over the kitchen which

requires some minor renovations.

They have not paid a deposit at this stage, but the Real Estate Agent has provided some guidance on

additional fees and charges.

Following is a summary of the details of the property they wish to purchase, the couple’s financial and

employment details, and the loan features they require.

The property

Address Unit 1, 92 Seaside Lane Edgartown (Your state)

Purchase price $490,000

Description 2 bedroom, 2 bathroom Strata Title apartment

Agent details Stephanie Jones

Phone 8123 1113

Mobile 0412 880 088

The couple

Current address Unit 12, 22 Wentworth Lane, Highville, (Your state)

Philip and Jennifer have lived there since March 2012

Home phone 9123 2121

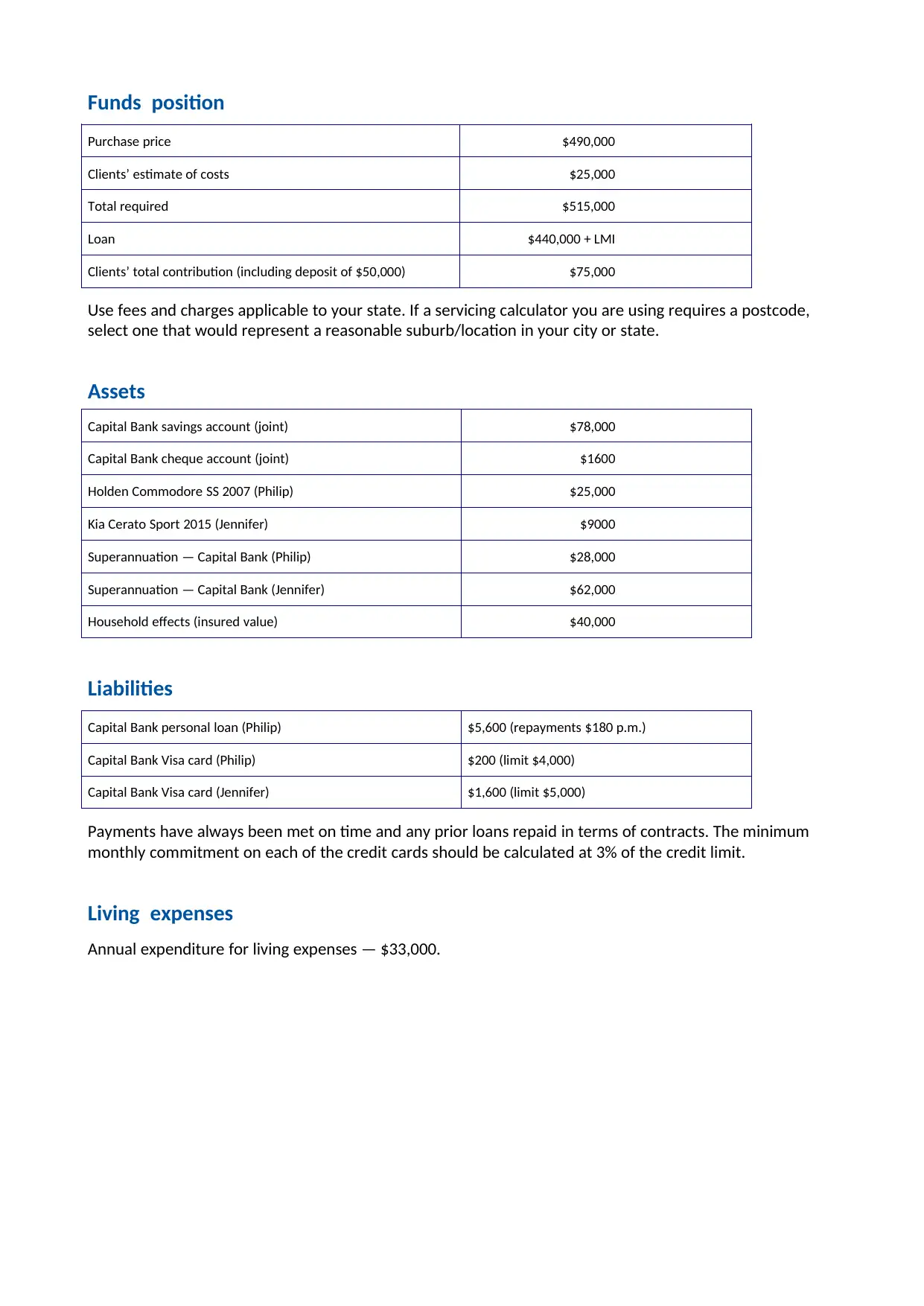

Funds position

Purchase price $490,000

Clients’ estimate of costs $25,000

Total required $515,000

Loan $440,000 + LMI

Clients’ total contribution (including deposit of $50,000) $75,000

Use fees and charges applicable to your state. If a servicing calculator you are using requires a postcode,

select one that would represent a reasonable suburb/location in your city or state.

Assets

Capital Bank savings account (joint) $78,000

Capital Bank cheque account (joint) $1600

Holden Commodore SS 2007 (Philip) $25,000

Kia Cerato Sport 2015 (Jennifer) $9000

Superannuation — Capital Bank (Philip) $28,000

Superannuation — Capital Bank (Jennifer) $62,000

Household effects (insured value) $40,000

Liabilities

Capital Bank personal loan (Philip) $5,600 (repayments $180 p.m.)

Capital Bank Visa card (Philip) $200 (limit $4,000)

Capital Bank Visa card (Jennifer) $1,600 (limit $5,000)

Payments have always been met on time and any prior loans repaid in terms of contracts. The minimum

monthly commitment on each of the credit cards should be calculated at 3% of the credit limit.

Living expenses

Annual expenditure for living expenses — $33,000.

Purchase price $490,000

Clients’ estimate of costs $25,000

Total required $515,000

Loan $440,000 + LMI

Clients’ total contribution (including deposit of $50,000) $75,000

Use fees and charges applicable to your state. If a servicing calculator you are using requires a postcode,

select one that would represent a reasonable suburb/location in your city or state.

Assets

Capital Bank savings account (joint) $78,000

Capital Bank cheque account (joint) $1600

Holden Commodore SS 2007 (Philip) $25,000

Kia Cerato Sport 2015 (Jennifer) $9000

Superannuation — Capital Bank (Philip) $28,000

Superannuation — Capital Bank (Jennifer) $62,000

Household effects (insured value) $40,000

Liabilities

Capital Bank personal loan (Philip) $5,600 (repayments $180 p.m.)

Capital Bank Visa card (Philip) $200 (limit $4,000)

Capital Bank Visa card (Jennifer) $1,600 (limit $5,000)

Payments have always been met on time and any prior loans repaid in terms of contracts. The minimum

monthly commitment on each of the credit cards should be calculated at 3% of the credit limit.

Living expenses

Annual expenditure for living expenses — $33,000.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

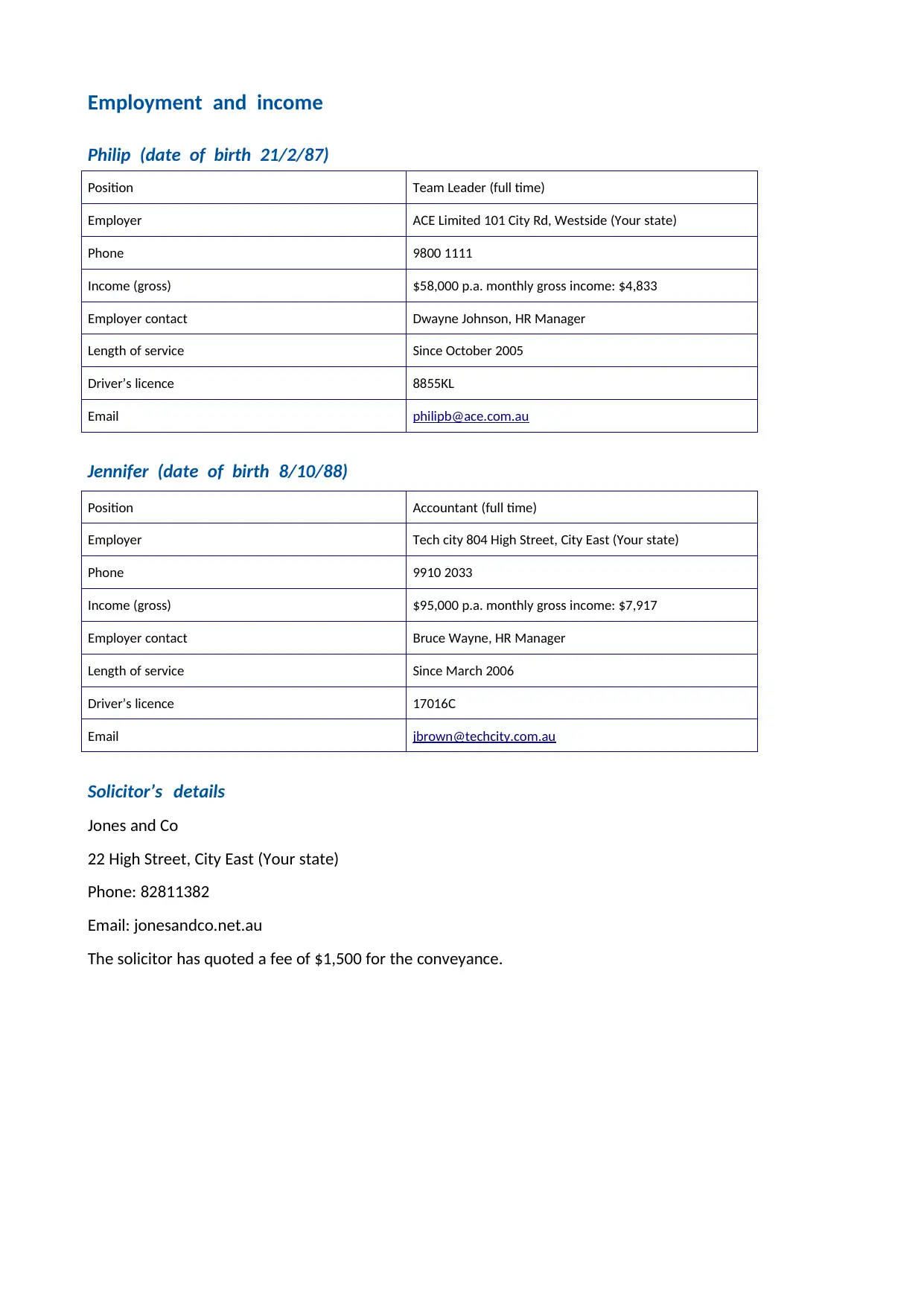

Employment and income

Philip (date of birth 21/2/87)

Position Team Leader (full time)

Employer ACE Limited 101 City Rd, Westside (Your state)

Phone 9800 1111

Income (gross) $58,000 p.a. monthly gross income: $4,833

Employer contact Dwayne Johnson, HR Manager

Length of service Since October 2005

Driver’s licence 8855KL

Email philipb@ace.com.au

Jennifer (date of birth 8/10/88)

Position Accountant (full time)

Employer Tech city 804 High Street, City East (Your state)

Phone 9910 2033

Income (gross) $95,000 p.a. monthly gross income: $7,917

Employer contact Bruce Wayne, HR Manager

Length of service Since March 2006

Driver’s licence 17016C

Email jbrown@techcity.com.au

Solicitor’s details

Jones and Co

22 High Street, City East (Your state)

Phone: 82811382

Email: jonesandco.net.au

The solicitor has quoted a fee of $1,500 for the conveyance.

Philip (date of birth 21/2/87)

Position Team Leader (full time)

Employer ACE Limited 101 City Rd, Westside (Your state)

Phone 9800 1111

Income (gross) $58,000 p.a. monthly gross income: $4,833

Employer contact Dwayne Johnson, HR Manager

Length of service Since October 2005

Driver’s licence 8855KL

Email philipb@ace.com.au

Jennifer (date of birth 8/10/88)

Position Accountant (full time)

Employer Tech city 804 High Street, City East (Your state)

Phone 9910 2033

Income (gross) $95,000 p.a. monthly gross income: $7,917

Employer contact Bruce Wayne, HR Manager

Length of service Since March 2006

Driver’s licence 17016C

Email jbrown@techcity.com.au

Solicitor’s details

Jones and Co

22 High Street, City East (Your state)

Phone: 82811382

Email: jonesandco.net.au

The solicitor has quoted a fee of $1,500 for the conveyance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

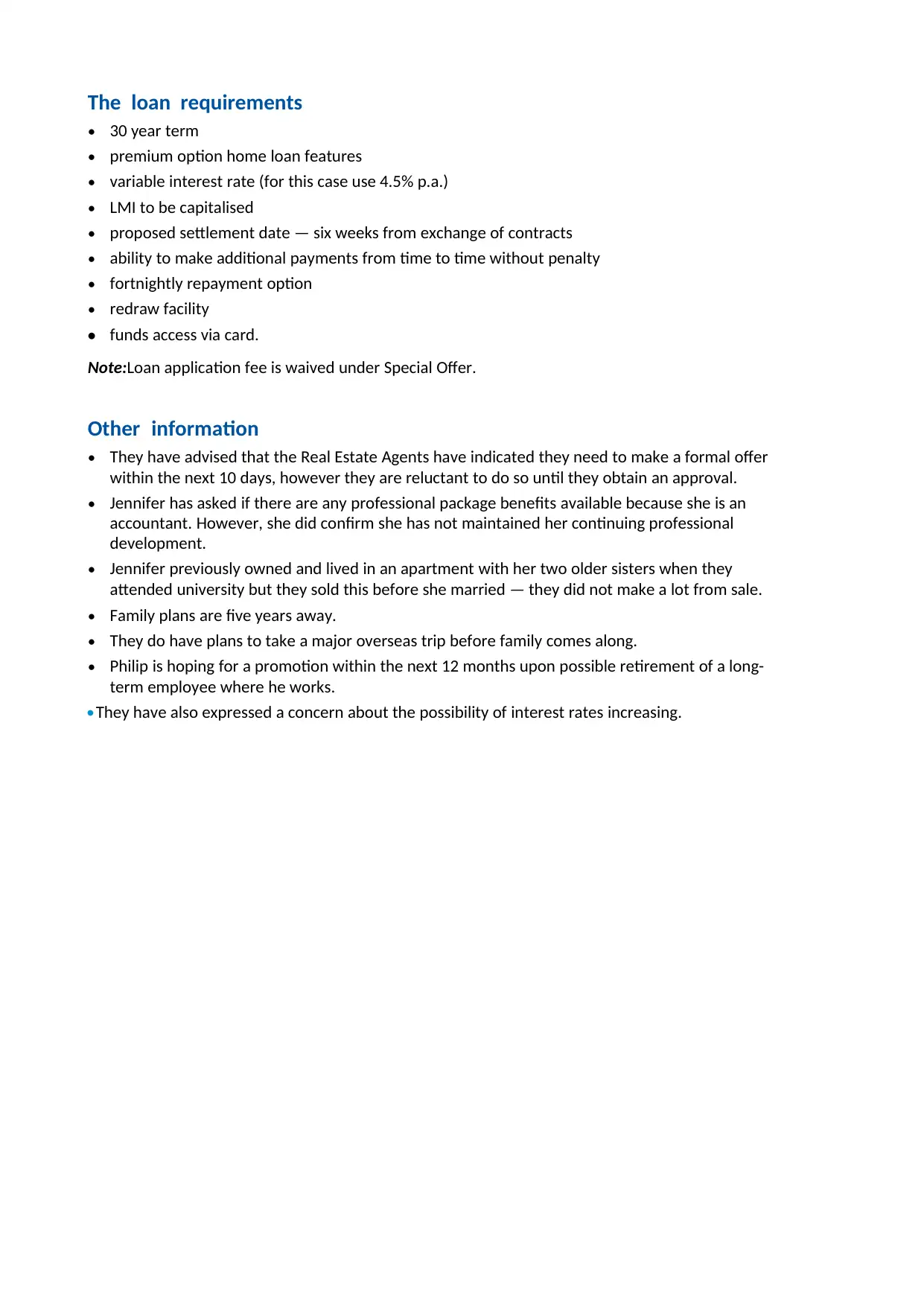

The loan requirements

• 30 year term

• premium option home loan features

• variable interest rate (for this case use 4.5% p.a.)

• LMI to be capitalised

• proposed settlement date — six weeks from exchange of contracts

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• funds access via card.

Note:Loan application fee is waived under Special Offer.

Other information

• They have advised that the Real Estate Agents have indicated they need to make a formal offer

within the next 10 days, however they are reluctant to do so until they obtain an approval.

• Jennifer has asked if there are any professional package benefits available because she is an

accountant. However, she did confirm she has not maintained her continuing professional

development.

• Jennifer previously owned and lived in an apartment with her two older sisters when they

attended university but they sold this before she married — they did not make a lot from sale.

• Family plans are five years away.

• They do have plans to take a major overseas trip before family comes along.

• Philip is hoping for a promotion within the next 12 months upon possible retirement of a long-

term employee where he works.

They have also expressed a concern about the possibility of interest rates increasing.

• 30 year term

• premium option home loan features

• variable interest rate (for this case use 4.5% p.a.)

• LMI to be capitalised

• proposed settlement date — six weeks from exchange of contracts

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• funds access via card.

Note:Loan application fee is waived under Special Offer.

Other information

• They have advised that the Real Estate Agents have indicated they need to make a formal offer

within the next 10 days, however they are reluctant to do so until they obtain an approval.

• Jennifer has asked if there are any professional package benefits available because she is an

accountant. However, she did confirm she has not maintained her continuing professional

development.

• Jennifer previously owned and lived in an apartment with her two older sisters when they

attended university but they sold this before she married — they did not make a lot from sale.

• Family plans are five years away.

• They do have plans to take a major overseas trip before family comes along.

• Philip is hoping for a promotion within the next 12 months upon possible retirement of a long-

term employee where he works.

They have also expressed a concern about the possibility of interest rates increasing.

tasks (student to complete)

Task 1 — Key terms, gathering and documenting client information

1. Complete the ‘Key terms’ (located at the end of the written in Appendix 1).

2. Using the information provided inCase study 1, complete the ‘Client information collection

tool’ (located at the end of the written in Appendix 2).

3. You will also need to complete the Genworth Serviceability Calculator to assess the security,

debt service and borrowing capacity for Jennifer and Phillip Brown. To do this, follow these steps:

(a) Use the details in Case study 1.

(b) Read the Genworth Calculator Supplementary Material Guide available in the

Kaplearn DIPMB1v3 subject room.

(c) Process the loan application using the Genworth Serviceability Calculator accessible here:

<https://www.genworth.com.au/lenders/lmi-tools/serviceability-calculator>.

(d) Once you have processed it, download a copy of the PDF and save it to your desktop.

Note:You will need to upload a copy of this pdf with your written and oral submission.

This will assist your assessor with providing feedback on your written and oral submission.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback for Task 1 — Key terms, gathering and documenting client information

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Task 1 — Key terms, gathering and documenting client information

1. Complete the ‘Key terms’ (located at the end of the written in Appendix 1).

2. Using the information provided inCase study 1, complete the ‘Client information collection

tool’ (located at the end of the written in Appendix 2).

3. You will also need to complete the Genworth Serviceability Calculator to assess the security,

debt service and borrowing capacity for Jennifer and Phillip Brown. To do this, follow these steps:

(a) Use the details in Case study 1.

(b) Read the Genworth Calculator Supplementary Material Guide available in the

Kaplearn DIPMB1v3 subject room.

(c) Process the loan application using the Genworth Serviceability Calculator accessible here:

<https://www.genworth.com.au/lenders/lmi-tools/serviceability-calculator>.

(d) Once you have processed it, download a copy of the PDF and save it to your desktop.

Note:You will need to upload a copy of this pdf with your written and oral submission.

This will assist your assessor with providing feedback on your written and oral submission.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback for Task 1 — Key terms, gathering and documenting client information

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 55

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.