The Cranberry Company: Capital Budgeting Analysis Report - FIN 4320

VerifiedAdded on 2022/08/28

|9

|1131

|17

Report

AI Summary

This report presents a capital budgeting analysis, addressing key concepts such as risk assessment, stand-alone risk, corporate risk, and market risk within the context of a finance case study. It explores the use of sensitivity analysis to gauge the impact of variable changes on NPV, and discusses the strengths and weaknesses of this method. The report further delves into scenario analysis and its comparison with simulation analysis, highlighting their respective strengths and weaknesses in providing a comprehensive understanding of project outcomes. The Cranberry Company case is used for the analysis, including the evaluation of a new product line, with calculations of NPV at different discount rates, and a coefficient of variation to assess the project's risk profile. The analysis includes a discussion of the importance of subjective risks and the need for incorporating them into the decision-making process, in addition to the financial metrics.

Running head: FINANCE CAPITAL AND BUDGETING

FINANCE CAPITAL AND BUDGETING

Name of the Student

Name of the University

Author Note:

FINANCE CAPITAL AND BUDGETING

Name of the Student

Name of the University

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE CAPITAL AND BUDGETING

Table of Contents

Question 8..................................................................................................................................2

Question 9..................................................................................................................................2

Question 10................................................................................................................................3

Question 11................................................................................................................................5

Question 12................................................................................................................................5

Question 13................................................................................................................................6

Reference....................................................................................................................................7

Table of Contents

Question 8..................................................................................................................................2

Question 9..................................................................................................................................2

Question 10................................................................................................................................3

Question 11................................................................................................................................5

Question 12................................................................................................................................5

Question 13................................................................................................................................6

Reference....................................................................................................................................7

2FINANCE CAPITAL AND BUDGETING

Question 8

Throughout finance the uncertainty arising in the future events are considered as risk,

and in capital budgeting it implies the profit to be derived from a project in future. For a

particular sort of projects, it is conceivable to look back at the statistics and verifiable

information and statistically investigate the audaciousness of the investment. This is a regular

evident when the investment includes a development decision. For instance, decision taken

by the Standard Chartered bank to open a new branch, or decision taken by the General

Manager to expand its Jaguar plant. In such cases it is possible to take decision based on the

past information, be that as it may, there are times when it is difficult to acquire authentic

information with regards to proposed investment. For instance, General Manager considering

advancement of an electric auto, in such cases past information are not available to assess the

risk involved in the project and therefore GM would rely on the decision of the executives,

who would rely on the experience with respect to creating, manufacturing and marketing new

products. Hence one should perceive at the beginning that a portion of the information

utilized in the examination will fundamentally be founded on subjective judgments instead of

on hard factual perceptions, apart from quantifying risk analysis (Weber, Staub-Bisang and

Alfen 2016).

Question 9

Risk that are noteworthy in capital budgeting are of three types (Sadgrove 2016):

Stand-alone risk: This are the total risk of a project if such project is operated

independently. This risk overlooks both the firm’s divergence among project and

investors divergence amid firms. The stand-alone risk is measured by the standard

deviation NPV. Other related methods such as IRR and MIRR can also be used to

estimate the stand-alone risk.

Question 8

Throughout finance the uncertainty arising in the future events are considered as risk,

and in capital budgeting it implies the profit to be derived from a project in future. For a

particular sort of projects, it is conceivable to look back at the statistics and verifiable

information and statistically investigate the audaciousness of the investment. This is a regular

evident when the investment includes a development decision. For instance, decision taken

by the Standard Chartered bank to open a new branch, or decision taken by the General

Manager to expand its Jaguar plant. In such cases it is possible to take decision based on the

past information, be that as it may, there are times when it is difficult to acquire authentic

information with regards to proposed investment. For instance, General Manager considering

advancement of an electric auto, in such cases past information are not available to assess the

risk involved in the project and therefore GM would rely on the decision of the executives,

who would rely on the experience with respect to creating, manufacturing and marketing new

products. Hence one should perceive at the beginning that a portion of the information

utilized in the examination will fundamentally be founded on subjective judgments instead of

on hard factual perceptions, apart from quantifying risk analysis (Weber, Staub-Bisang and

Alfen 2016).

Question 9

Risk that are noteworthy in capital budgeting are of three types (Sadgrove 2016):

Stand-alone risk: This are the total risk of a project if such project is operated

independently. This risk overlooks both the firm’s divergence among project and

investors divergence amid firms. The stand-alone risk is measured by the standard

deviation NPV. Other related methods such as IRR and MIRR can also be used to

estimate the stand-alone risk.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE CAPITAL AND BUDGETING

Corporate risk: This risk reflects the project’s consequence on the earning stability of

the firm. This risk contemplates the other asset of the firm and hinge on Beta with

returns on the other asset of the firm. It is the function of project’s standard deviation

of NPV.

Market risk: It replicates the risk in project’s outcome on the well-diversified stock

portfolio. This risk is calculated by the project’s market beta, which is a slope or

regression line formatted by plotting returns on the project against yields on the

market.

Question 10

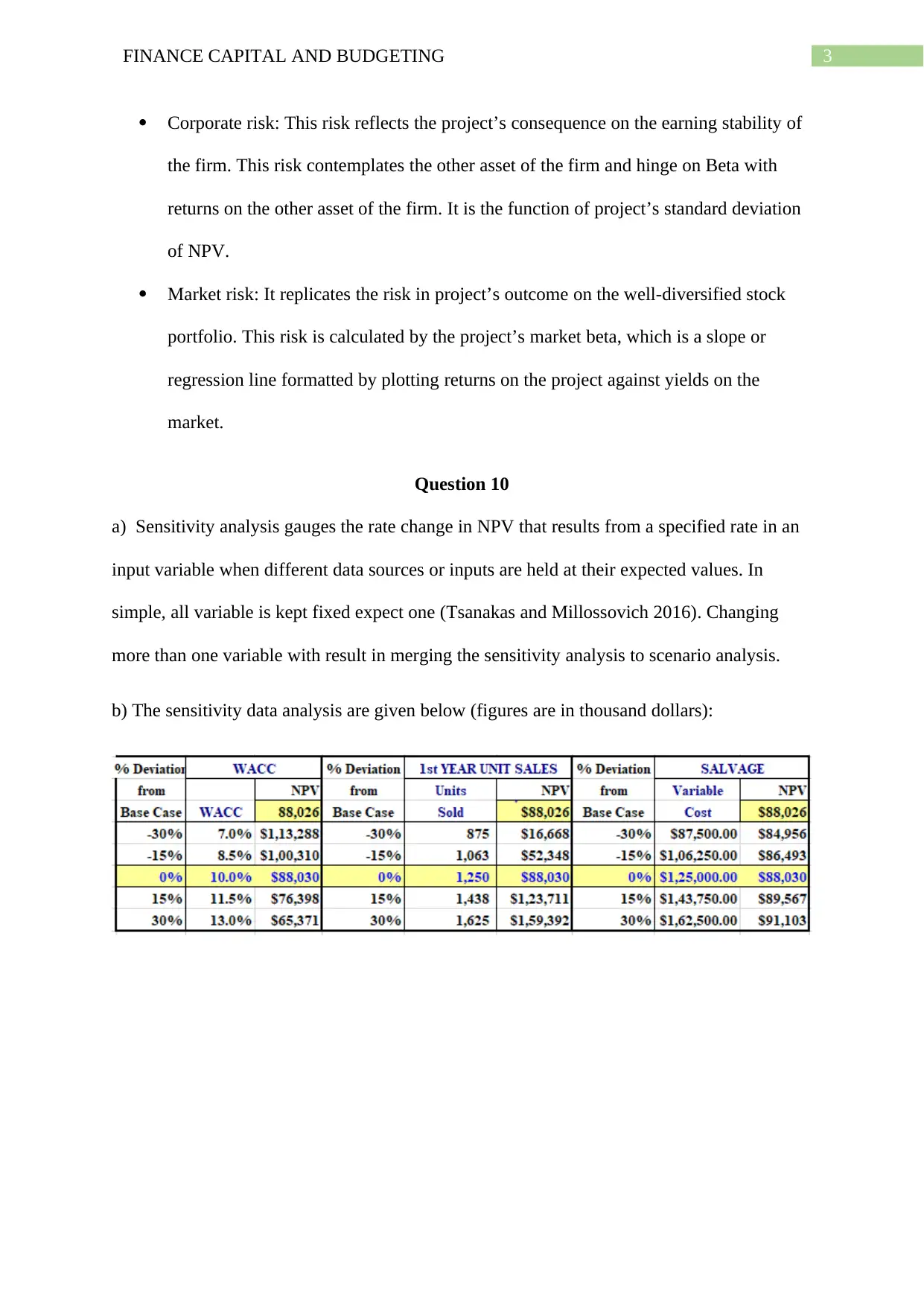

a) Sensitivity analysis gauges the rate change in NPV that results from a specified rate in an

input variable when different data sources or inputs are held at their expected values. In

simple, all variable is kept fixed expect one (Tsanakas and Millossovich 2016). Changing

more than one variable with result in merging the sensitivity analysis to scenario analysis.

b) The sensitivity data analysis are given below (figures are in thousand dollars):

Corporate risk: This risk reflects the project’s consequence on the earning stability of

the firm. This risk contemplates the other asset of the firm and hinge on Beta with

returns on the other asset of the firm. It is the function of project’s standard deviation

of NPV.

Market risk: It replicates the risk in project’s outcome on the well-diversified stock

portfolio. This risk is calculated by the project’s market beta, which is a slope or

regression line formatted by plotting returns on the project against yields on the

market.

Question 10

a) Sensitivity analysis gauges the rate change in NPV that results from a specified rate in an

input variable when different data sources or inputs are held at their expected values. In

simple, all variable is kept fixed expect one (Tsanakas and Millossovich 2016). Changing

more than one variable with result in merging the sensitivity analysis to scenario analysis.

b) The sensitivity data analysis are given below (figures are in thousand dollars):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE CAPITAL AND BUDGETING

-40% -30% -20% -10% 0% 10% 20% 30% 40%

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

$180,000

Sensitivity Analysis

WACC

Units

Sold

Salvage

Deviation from Base-Case Value

NPV

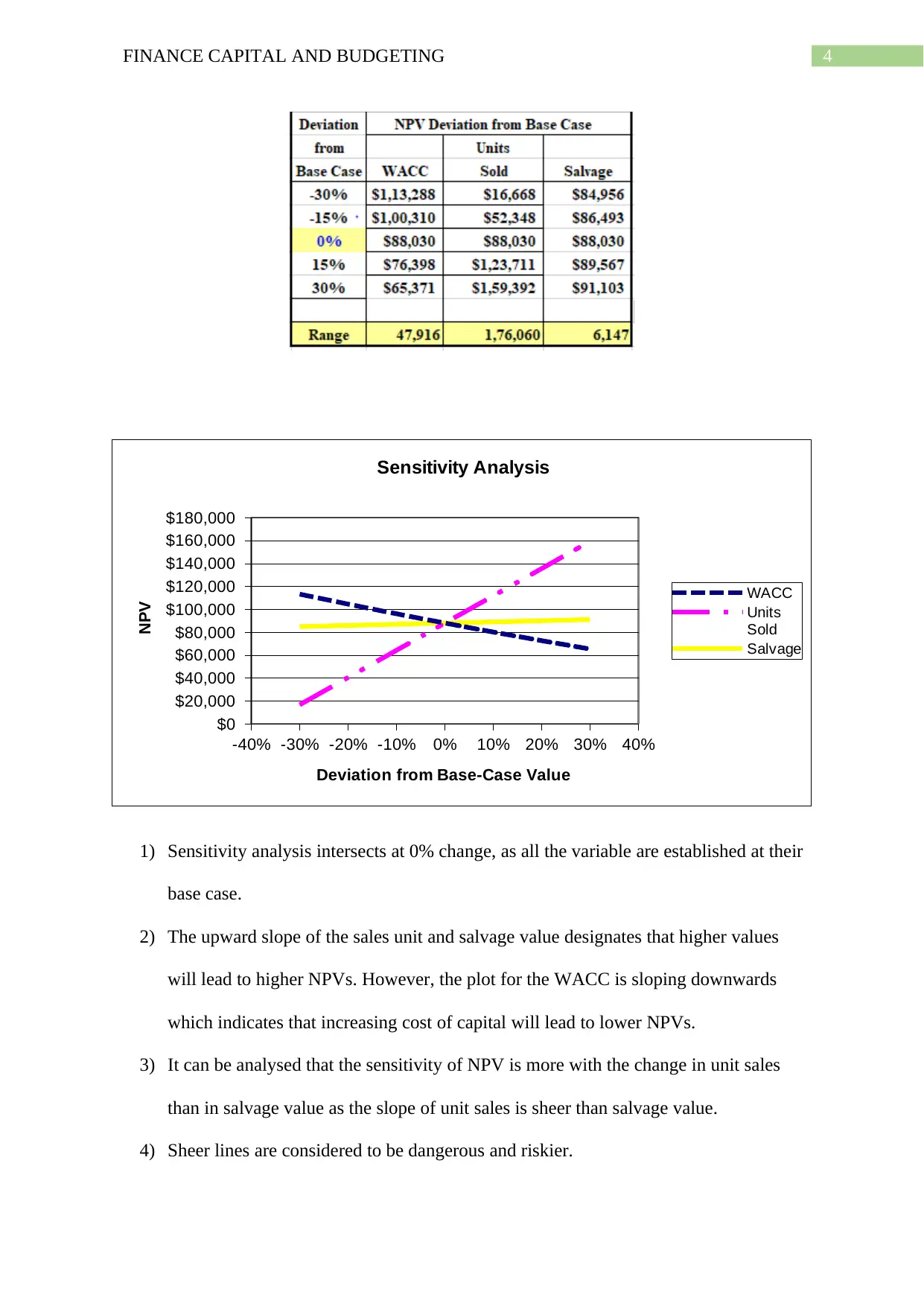

1) Sensitivity analysis intersects at 0% change, as all the variable are established at their

base case.

2) The upward slope of the sales unit and salvage value designates that higher values

will lead to higher NPVs. However, the plot for the WACC is sloping downwards

which indicates that increasing cost of capital will lead to lower NPVs.

3) It can be analysed that the sensitivity of NPV is more with the change in unit sales

than in salvage value as the slope of unit sales is sheer than salvage value.

4) Sheer lines are considered to be dangerous and riskier.

-40% -30% -20% -10% 0% 10% 20% 30% 40%

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

$180,000

Sensitivity Analysis

WACC

Units

Sold

Salvage

Deviation from Base-Case Value

NPV

1) Sensitivity analysis intersects at 0% change, as all the variable are established at their

base case.

2) The upward slope of the sales unit and salvage value designates that higher values

will lead to higher NPVs. However, the plot for the WACC is sloping downwards

which indicates that increasing cost of capital will lead to lower NPVs.

3) It can be analysed that the sensitivity of NPV is more with the change in unit sales

than in salvage value as the slope of unit sales is sheer than salvage value.

4) Sheer lines are considered to be dangerous and riskier.

5FINANCE CAPITAL AND BUDGETING

c) Main weakness of the sensitivity analysis:

Effects of diversification are neglected

Relationship between the variables are ignored, such as unit sales and price.

Key usefulness of the sensitivity analysis:

It assists the management to focus on the important areas which are highly

sensitive.

It identifies variables which makes the greatest impact on the profit.

c) Main weakness of the sensitivity analysis:

Effects of diversification are neglected

Relationship between the variables are ignored, such as unit sales and price.

Key usefulness of the sensitivity analysis:

It assists the management to focus on the important areas which are highly

sensitive.

It identifies variables which makes the greatest impact on the profit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE CAPITAL AND BUDGETING

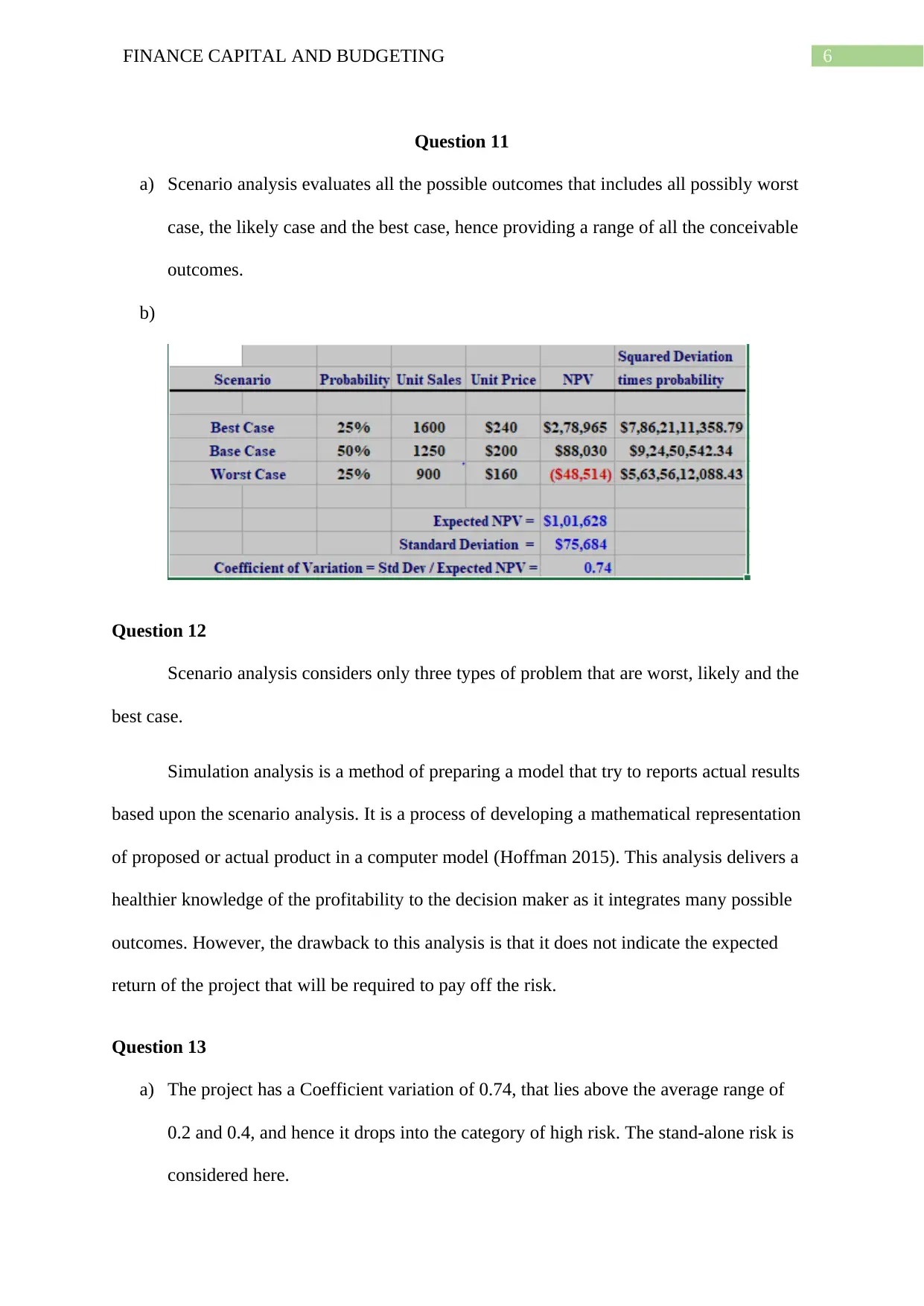

Question 11

a) Scenario analysis evaluates all the possible outcomes that includes all possibly worst

case, the likely case and the best case, hence providing a range of all the conceivable

outcomes.

b)

Question 12

Scenario analysis considers only three types of problem that are worst, likely and the

best case.

Simulation analysis is a method of preparing a model that try to reports actual results

based upon the scenario analysis. It is a process of developing a mathematical representation

of proposed or actual product in a computer model (Hoffman 2015). This analysis delivers a

healthier knowledge of the profitability to the decision maker as it integrates many possible

outcomes. However, the drawback to this analysis is that it does not indicate the expected

return of the project that will be required to pay off the risk.

Question 13

a) The project has a Coefficient variation of 0.74, that lies above the average range of

0.2 and 0.4, and hence it drops into the category of high risk. The stand-alone risk is

considered here.

Question 11

a) Scenario analysis evaluates all the possible outcomes that includes all possibly worst

case, the likely case and the best case, hence providing a range of all the conceivable

outcomes.

b)

Question 12

Scenario analysis considers only three types of problem that are worst, likely and the

best case.

Simulation analysis is a method of preparing a model that try to reports actual results

based upon the scenario analysis. It is a process of developing a mathematical representation

of proposed or actual product in a computer model (Hoffman 2015). This analysis delivers a

healthier knowledge of the profitability to the decision maker as it integrates many possible

outcomes. However, the drawback to this analysis is that it does not indicate the expected

return of the project that will be required to pay off the risk.

Question 13

a) The project has a Coefficient variation of 0.74, that lies above the average range of

0.2 and 0.4, and hence it drops into the category of high risk. The stand-alone risk is

considered here.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE CAPITAL AND BUDGETING

b) Since the cost of capital for an average project is 10% and addition of 3% will make

the cost of capital to 13%. Hence at this discount rate the NPV will be $60541 so it is

acceptable. However, at 7% cost of capital, the NPV will be $113288, and this will be

more lucrative project on the basis of risk adjusted.

c) The above analysis may not encapsulate all the inherent risk in the project that may be

required for decision-making process. Some subjective risk associated are the

possibility of the project that it can bring on harmful law-suits.

b) Since the cost of capital for an average project is 10% and addition of 3% will make

the cost of capital to 13%. Hence at this discount rate the NPV will be $60541 so it is

acceptable. However, at 7% cost of capital, the NPV will be $113288, and this will be

more lucrative project on the basis of risk adjusted.

c) The above analysis may not encapsulate all the inherent risk in the project that may be

required for decision-making process. Some subjective risk associated are the

possibility of the project that it can bring on harmful law-suits.

8FINANCE CAPITAL AND BUDGETING

Reference

Hoffman, L., 2015. Longitudinal analysis: Modeling within-person fluctuation and change.

Routledge.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

Tsanakas, A. and Millossovich, P., 2016. Sensitivity analysis using risk measures. Risk

Analysis, 36(1), pp.30-48.

Weber, B., Staub-Bisang, M. and Alfen, H.W., 2016. Infrastructure as an asset class:

investment strategy, sustainability, project finance and PPP. John wiley & sons.

Reference

Hoffman, L., 2015. Longitudinal analysis: Modeling within-person fluctuation and change.

Routledge.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

Tsanakas, A. and Millossovich, P., 2016. Sensitivity analysis using risk measures. Risk

Analysis, 36(1), pp.30-48.

Weber, B., Staub-Bisang, M. and Alfen, H.W., 2016. Infrastructure as an asset class:

investment strategy, sustainability, project finance and PPP. John wiley & sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.