Kohler Co. (A) Case Study: Evaluating Share Price and Tax Implications

VerifiedAdded on 2023/04/23

|6

|678

|385

Case Study

AI Summary

This case study solution analyzes the Kohler Co. (A) case, focusing on corporate finance aspects such as share valuation using the Discounted Cash Flow (DCF) method and the Multiple method. It evaluates the discrepancies in share price valuation resulting from these different methods and discus...

Running head: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................3

Question 3:.......................................................................................................................................3

Question 4:.......................................................................................................................................4

Bibliography:...................................................................................................................................5

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................3

Question 3:.......................................................................................................................................3

Question 4:.......................................................................................................................................4

Bibliography:...................................................................................................................................5

2CORPORATE FINANCE

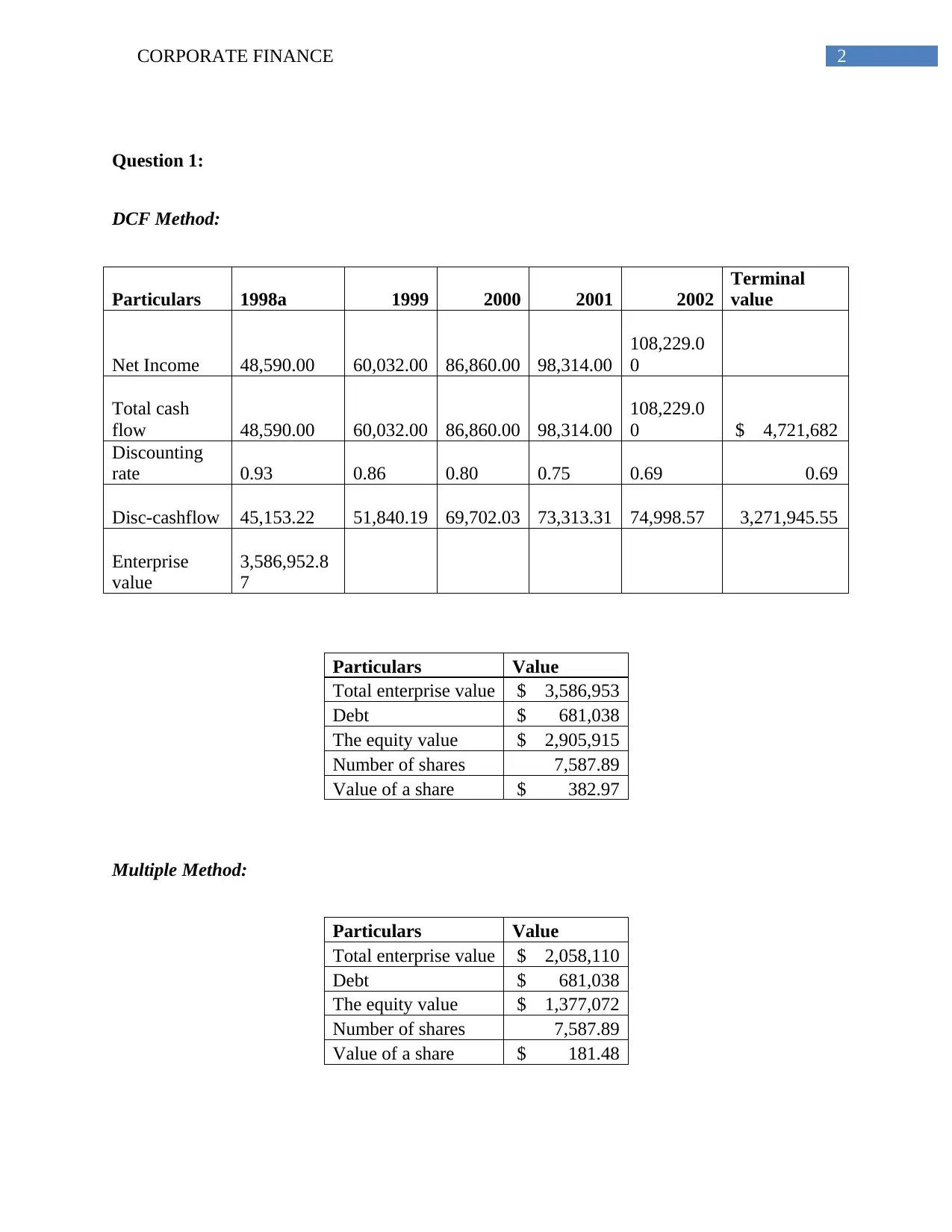

Question 1:

DCF Method:

Particulars 1998a 1999 2000 2001 2002

Terminal

value

Net Income 48,590.00 60,032.00 86,860.00 98,314.00

108,229.0

0

Total cash

flow 48,590.00 60,032.00 86,860.00 98,314.00

108,229.0

0 $ 4,721,682

Discounting

rate 0.93 0.86 0.80 0.75 0.69 0.69

Disc-cashflow 45,153.22 51,840.19 69,702.03 73,313.31 74,998.57 3,271,945.55

Enterprise

value

3,586,952.8

7

Particulars Value

Total enterprise value $ 3,586,953

Debt $ 681,038

The equity value $ 2,905,915

Number of shares 7,587.89

Value of a share $ 382.97

Multiple Method:

Particulars Value

Total enterprise value $ 2,058,110

Debt $ 681,038

The equity value $ 1,377,072

Number of shares 7,587.89

Value of a share $ 181.48

Question 1:

DCF Method:

Particulars 1998a 1999 2000 2001 2002

Terminal

value

Net Income 48,590.00 60,032.00 86,860.00 98,314.00

108,229.0

0

Total cash

flow 48,590.00 60,032.00 86,860.00 98,314.00

108,229.0

0 $ 4,721,682

Discounting

rate 0.93 0.86 0.80 0.75 0.69 0.69

Disc-cashflow 45,153.22 51,840.19 69,702.03 73,313.31 74,998.57 3,271,945.55

Enterprise

value

3,586,952.8

7

Particulars Value

Total enterprise value $ 3,586,953

Debt $ 681,038

The equity value $ 2,905,915

Number of shares 7,587.89

Value of a share $ 382.97

Multiple Method:

Particulars Value

Total enterprise value $ 2,058,110

Debt $ 681,038

The equity value $ 1,377,072

Number of shares 7,587.89

Value of a share $ 181.48

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

The calculations conducted under DCF method and Multiple method has mainly

evaluated different level of share price for the organization. The difference in the share price

valuation is due to the alternative methods that is being used for evaluating the current position

of the organization.

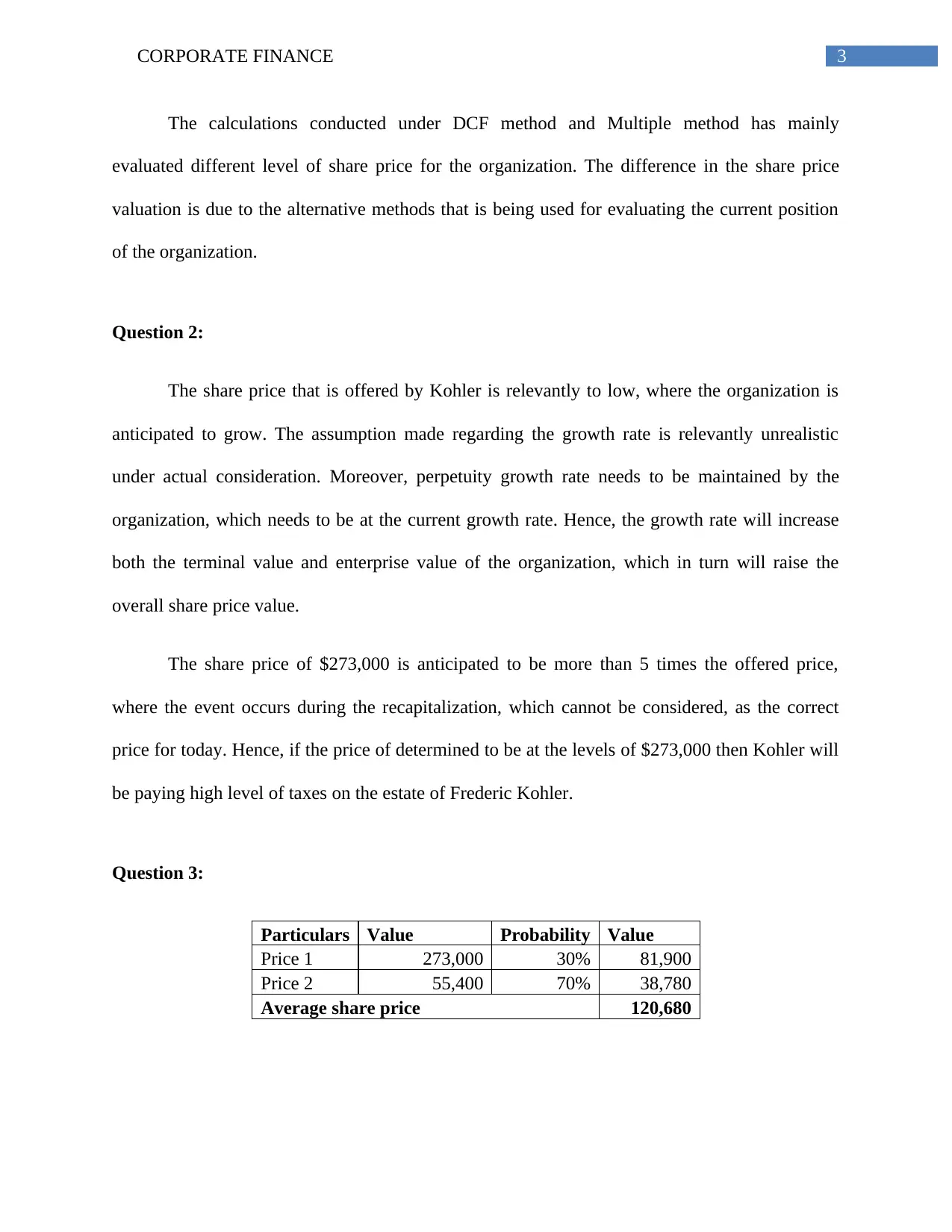

Question 2:

The share price that is offered by Kohler is relevantly to low, where the organization is

anticipated to grow. The assumption made regarding the growth rate is relevantly unrealistic

under actual consideration. Moreover, perpetuity growth rate needs to be maintained by the

organization, which needs to be at the current growth rate. Hence, the growth rate will increase

both the terminal value and enterprise value of the organization, which in turn will raise the

overall share price value.

The share price of $273,000 is anticipated to be more than 5 times the offered price,

where the event occurs during the recapitalization, which cannot be considered, as the correct

price for today. Hence, if the price of determined to be at the levels of $273,000 then Kohler will

be paying high level of taxes on the estate of Frederic Kohler.

Question 3:

Particulars Value Probability Value

Price 1 273,000 30% 81,900

Price 2 55,400 70% 38,780

Average share price 120,680

The calculations conducted under DCF method and Multiple method has mainly

evaluated different level of share price for the organization. The difference in the share price

valuation is due to the alternative methods that is being used for evaluating the current position

of the organization.

Question 2:

The share price that is offered by Kohler is relevantly to low, where the organization is

anticipated to grow. The assumption made regarding the growth rate is relevantly unrealistic

under actual consideration. Moreover, perpetuity growth rate needs to be maintained by the

organization, which needs to be at the current growth rate. Hence, the growth rate will increase

both the terminal value and enterprise value of the organization, which in turn will raise the

overall share price value.

The share price of $273,000 is anticipated to be more than 5 times the offered price,

where the event occurs during the recapitalization, which cannot be considered, as the correct

price for today. Hence, if the price of determined to be at the levels of $273,000 then Kohler will

be paying high level of taxes on the estate of Frederic Kohler.

Question 3:

Particulars Value Probability Value

Price 1 273,000 30% 81,900

Price 2 55,400 70% 38,780

Average share price 120,680

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCE

After evaluating the probability conditions and share price value the average share price

value is mainly evaluated at the levels of 120,680. Hence, it could be assumed that the maximum

share price that is anticipated for the company is mainly at the levels of 120,680.

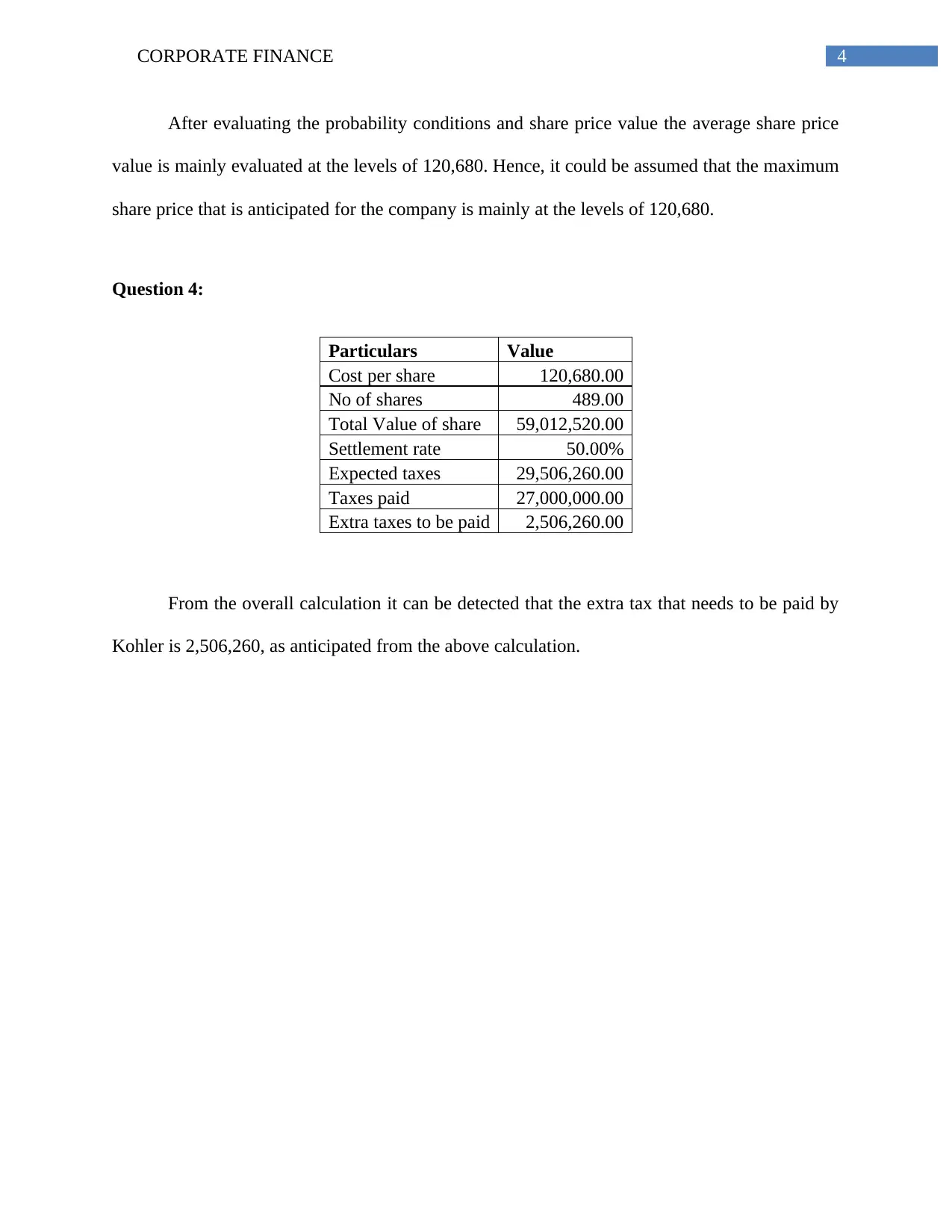

Question 4:

Particulars Value

Cost per share 120,680.00

No of shares 489.00

Total Value of share 59,012,520.00

Settlement rate 50.00%

Expected taxes 29,506,260.00

Taxes paid 27,000,000.00

Extra taxes to be paid 2,506,260.00

From the overall calculation it can be detected that the extra tax that needs to be paid by

Kohler is 2,506,260, as anticipated from the above calculation.

After evaluating the probability conditions and share price value the average share price

value is mainly evaluated at the levels of 120,680. Hence, it could be assumed that the maximum

share price that is anticipated for the company is mainly at the levels of 120,680.

Question 4:

Particulars Value

Cost per share 120,680.00

No of shares 489.00

Total Value of share 59,012,520.00

Settlement rate 50.00%

Expected taxes 29,506,260.00

Taxes paid 27,000,000.00

Extra taxes to be paid 2,506,260.00

From the overall calculation it can be detected that the extra tax that needs to be paid by

Kohler is 2,506,260, as anticipated from the above calculation.

5CORPORATE FINANCE

Bibliography:

Atanasov, V.A. and Black, B.S., 2016. Shock-based causal inference in corporate finance and

accounting research. Critical Finance Review, 5, pp.207-304.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Dang, C., Li, Z.F. and Yang, C., 2018. Measuring firm size in empirical corporate

finance. Journal of Banking & Finance, 86, pp.159-176.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Foley, C.F. and Manova, K., 2015. International trade, multinational activity, and corporate

finance. economics, 7(1), pp.119-146.

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

Bibliography:

Atanasov, V.A. and Black, B.S., 2016. Shock-based causal inference in corporate finance and

accounting research. Critical Finance Review, 5, pp.207-304.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Dang, C., Li, Z.F. and Yang, C., 2018. Measuring firm size in empirical corporate

finance. Journal of Banking & Finance, 86, pp.159-176.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Foley, C.F. and Manova, K., 2015. International trade, multinational activity, and corporate

finance. economics, 7(1), pp.119-146.

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.