KOI Trimester 1, 2019 FIN700 - Financial Management Group Assignment 2

VerifiedAdded on 2023/01/10

|11

|1855

|98

Homework Assignment

AI Summary

This document provides a comprehensive solution to a Financial Management assignment (FIN700) from KOI, Trimester 1, 2019. The assignment covers seven problems, including calculating Karina Adams' dividend income and loan requirements, EMI and amortization for a house loan, present value of cash flows and investment decisions, bond pricing and sensitivity analysis, Altron's share valuation using the dividend growth model, Annual Equivalent Cost (AEC) comparison of investment quotes, and capital budgeting decisions involving NPV, payback period, and present value index. Each question is solved with detailed formulas, step-by-step calculations, and relevant explanations, providing a complete guide for understanding the financial concepts and problem-solving techniques required for the assignment. The document references several financial management texts to support the solutions and recommendations.

FINANCIAL MANAGEMENT

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

PAT for AAR Ltd for year 2018 = $ 500,000

Ownership of Karina Adams in AAR Ltd = 10%

Dividend payout = 60%

Hence, total dividend paid by the company in 2018 = PAT*Dividend Payout = 500,000*0.6 =

$300,000

Dividend income for Karina Adams on June 1 2019 = (10/100)*300,000 = $ 30,000

Total expenditure expected by Karina in 2019 = 5,000 (Furniture) + 35,000(Billings) = $ 40,000

Since Karina does not have any savings and the dividend income in 2019 is only $ 30,000, hence

for meeting the expenditure of $ 40,000, a loan of $ 10,000 would be taken.

Expected PAT for AAR Ltd for year 2019 = $500,000*1.2 = $600,000

The dividend payout remains the same and hence dividend income expected by Karina on June

1, 2020 = (10/100)*(60/100)*(600,000) = $ 36,000

Interest levied on the loan assumed in 2019 = (8/100)*10,000 = $ 800

Amount available for consumption in June 2020 = 36,000 – 10,000 (repayment of loan) – 800

(payment of interest) = $ 25,600

Question 2

a) Cost price of house = $ 750,000

Down payment required = 20%

Hence, quantum of loan required = 750,000*(1-0.2) = $ 600,000

The EMI (Equal Monthly Installment) can be computed using the following formula.

PAT for AAR Ltd for year 2018 = $ 500,000

Ownership of Karina Adams in AAR Ltd = 10%

Dividend payout = 60%

Hence, total dividend paid by the company in 2018 = PAT*Dividend Payout = 500,000*0.6 =

$300,000

Dividend income for Karina Adams on June 1 2019 = (10/100)*300,000 = $ 30,000

Total expenditure expected by Karina in 2019 = 5,000 (Furniture) + 35,000(Billings) = $ 40,000

Since Karina does not have any savings and the dividend income in 2019 is only $ 30,000, hence

for meeting the expenditure of $ 40,000, a loan of $ 10,000 would be taken.

Expected PAT for AAR Ltd for year 2019 = $500,000*1.2 = $600,000

The dividend payout remains the same and hence dividend income expected by Karina on June

1, 2020 = (10/100)*(60/100)*(600,000) = $ 36,000

Interest levied on the loan assumed in 2019 = (8/100)*10,000 = $ 800

Amount available for consumption in June 2020 = 36,000 – 10,000 (repayment of loan) – 800

(payment of interest) = $ 25,600

Question 2

a) Cost price of house = $ 750,000

Down payment required = 20%

Hence, quantum of loan required = 750,000*(1-0.2) = $ 600,000

The EMI (Equal Monthly Installment) can be computed using the following formula.

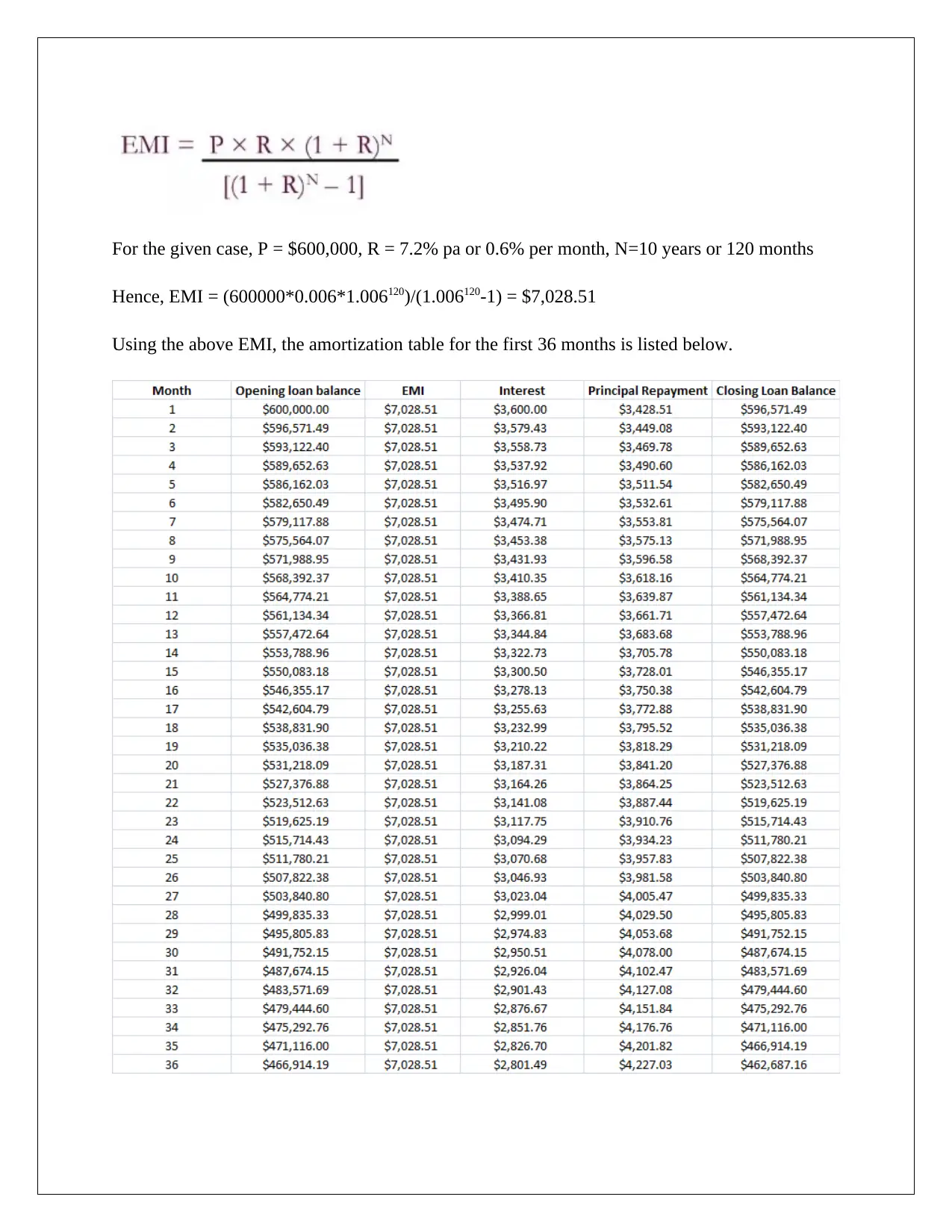

For the given case, P = $600,000, R = 7.2% pa or 0.6% per month, N=10 years or 120 months

Hence, EMI = (600000*0.006*1.006120)/(1.006120-1) = $7,028.51

Using the above EMI, the amortization table for the first 36 months is listed below.

Hence, EMI = (600000*0.006*1.006120)/(1.006120-1) = $7,028.51

Using the above EMI, the amortization table for the first 36 months is listed below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Relevant Explanation:

1) Closing loan balance = Opening loan balance – Principal repayment

2) Principal repayment = EMI – Interest

3) Interest = Opening loan balance * Interest rate per month

Loan amount outstanding at the end of three year = $ 462,687.16

New interest rate applicable = 9.6% p.a. or 0.8% per month

Loan amount = $ 462,687.16

Time period remaining =7 years or 7*12 =84 months

The following formula can be used to estimate the new EMI.

New EMI = (462,687.16*0.008*1.00884)/(1.00884-1) = $7,585.87

b) Assuming now the EMI remains the same, then the value of N needs to be found for

discharging the loan using the following formula.

Here, EMI = $7,058.21, R=9.6% p.a. or 0.8% per month, P = $ 462,687.16

7058.21 = (462,687.16*0.008*1.008N)/(1.008N-1)

Solving the above N = 94 months

Since three years had already passed, thus the pending loan without any increase in rate would

have been discharged in 84 months. Thus, additional payments required = 94-84 = 10 months

1) Closing loan balance = Opening loan balance – Principal repayment

2) Principal repayment = EMI – Interest

3) Interest = Opening loan balance * Interest rate per month

Loan amount outstanding at the end of three year = $ 462,687.16

New interest rate applicable = 9.6% p.a. or 0.8% per month

Loan amount = $ 462,687.16

Time period remaining =7 years or 7*12 =84 months

The following formula can be used to estimate the new EMI.

New EMI = (462,687.16*0.008*1.00884)/(1.00884-1) = $7,585.87

b) Assuming now the EMI remains the same, then the value of N needs to be found for

discharging the loan using the following formula.

Here, EMI = $7,058.21, R=9.6% p.a. or 0.8% per month, P = $ 462,687.16

7058.21 = (462,687.16*0.008*1.008N)/(1.008N-1)

Solving the above N = 94 months

Since three years had already passed, thus the pending loan without any increase in rate would

have been discharged in 84 months. Thus, additional payments required = 94-84 = 10 months

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

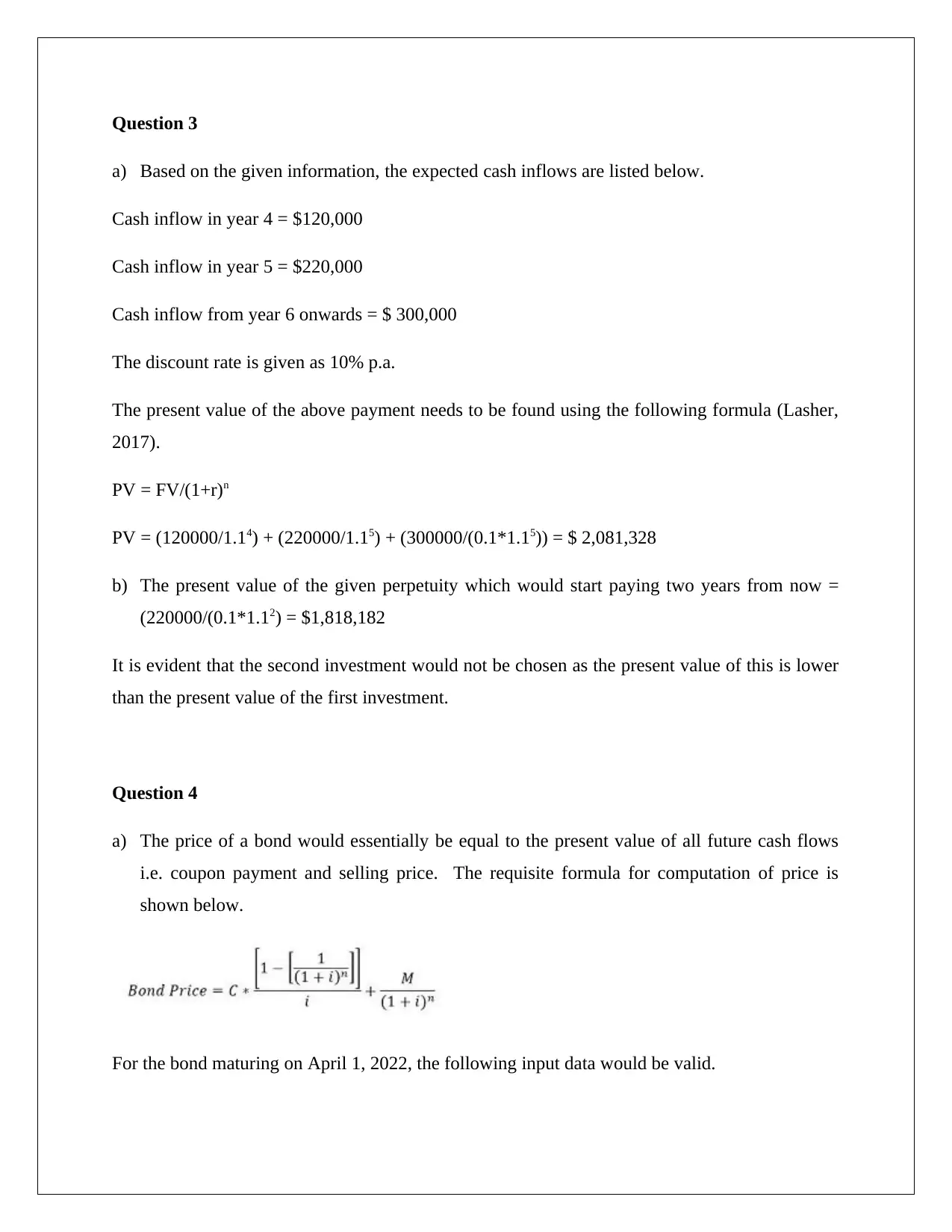

Question 3

a) Based on the given information, the expected cash inflows are listed below.

Cash inflow in year 4 = $120,000

Cash inflow in year 5 = $220,000

Cash inflow from year 6 onwards = $ 300,000

The discount rate is given as 10% p.a.

The present value of the above payment needs to be found using the following formula (Lasher,

2017).

PV = FV/(1+r)n

PV = (120000/1.14) + (220000/1.15) + (300000/(0.1*1.15)) = $ 2,081,328

b) The present value of the given perpetuity which would start paying two years from now =

(220000/(0.1*1.12) = $1,818,182

It is evident that the second investment would not be chosen as the present value of this is lower

than the present value of the first investment.

Question 4

a) The price of a bond would essentially be equal to the present value of all future cash flows

i.e. coupon payment and selling price. The requisite formula for computation of price is

shown below.

For the bond maturing on April 1, 2022, the following input data would be valid.

a) Based on the given information, the expected cash inflows are listed below.

Cash inflow in year 4 = $120,000

Cash inflow in year 5 = $220,000

Cash inflow from year 6 onwards = $ 300,000

The discount rate is given as 10% p.a.

The present value of the above payment needs to be found using the following formula (Lasher,

2017).

PV = FV/(1+r)n

PV = (120000/1.14) + (220000/1.15) + (300000/(0.1*1.15)) = $ 2,081,328

b) The present value of the given perpetuity which would start paying two years from now =

(220000/(0.1*1.12) = $1,818,182

It is evident that the second investment would not be chosen as the present value of this is lower

than the present value of the first investment.

Question 4

a) The price of a bond would essentially be equal to the present value of all future cash flows

i.e. coupon payment and selling price. The requisite formula for computation of price is

shown below.

For the bond maturing on April 1, 2022, the following input data would be valid.

M = $100,000, i =10% p.a. or 5% per half year, n = 3 years or 6 half years, C =

(8/100)*(100000) = $ 8000 per year or $ 4000 per half year

Hence, bond price = 4000*(1-(1/1.056))/0.05 + (100000/1.056) = $94,924.31

For the bond maturing on April 1, 2026, the following input data would be valid.

M = $100,000, i =10% p.a. or 5% per half year, n = 7 years or 14 half years, C =

(8/100)*(100000) = $ 8000 per year or $ 4000 per half year

Hence, bond price = 4000*(1-(1/1.0514))/0.05 + (100000/1.0514) = $90,101.36

b) It is apparent that the deterioration in price is more for the bond with the longer maturity

period in comparison to the bond with lower maturity period. Typically for duration for the

longer maturity bond is higher which makes the underlying bond price more sensitive to

changes in the interest rate as compared to bonds with shorter maturity periods (Damodaran,

2015).

Question 5

a) The relevant formula to be used is stated as follows.

Dt=D0× ( 1+g ) t

The timeline for the expected dividends is shown below.

(8/100)*(100000) = $ 8000 per year or $ 4000 per half year

Hence, bond price = 4000*(1-(1/1.056))/0.05 + (100000/1.056) = $94,924.31

For the bond maturing on April 1, 2026, the following input data would be valid.

M = $100,000, i =10% p.a. or 5% per half year, n = 7 years or 14 half years, C =

(8/100)*(100000) = $ 8000 per year or $ 4000 per half year

Hence, bond price = 4000*(1-(1/1.0514))/0.05 + (100000/1.0514) = $90,101.36

b) It is apparent that the deterioration in price is more for the bond with the longer maturity

period in comparison to the bond with lower maturity period. Typically for duration for the

longer maturity bond is higher which makes the underlying bond price more sensitive to

changes in the interest rate as compared to bonds with shorter maturity periods (Damodaran,

2015).

Question 5

a) The relevant formula to be used is stated as follows.

Dt=D0× ( 1+g ) t

The timeline for the expected dividends is shown below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b) The value of Altron’s share can be estimated using the above dividends and the dividend

growth model suggested by Gordon.

Considering that after year 7, the dividend growth rate would be 5% forever, hence the following

formula would be used.

P0= D0× ( 1+ g )

( RE−g ) = D1

( RE−g )

Terminal value of all dividends after year 7 = (1.77/(0.13-0.05)) = $22.125

The present value of the share can be estimated by the present value of all dividends and the

terminal value with 13% as the discount rate.

Price of Altron’s share = (1.62/1.13) + (1.46/1.132) + (1.31/1.133) + (1.39/1.134) + (1.47/1.135) +

(1.58/1.136) + (1.69/1.137) + (22.125/1.137) = $ 16.02

Question 6

The relevant formula for computation of AEC is shown below.

First Quote

Asset price = $100,000

Annual maintenance cost = $ 3,000

Number of time periods = 3 years

Discount rate = 9% p.a.

Hence, AEC = 100,000*(0.09/(1-1.09-3)) + 3000 = $ 42,505.48

growth model suggested by Gordon.

Considering that after year 7, the dividend growth rate would be 5% forever, hence the following

formula would be used.

P0= D0× ( 1+ g )

( RE−g ) = D1

( RE−g )

Terminal value of all dividends after year 7 = (1.77/(0.13-0.05)) = $22.125

The present value of the share can be estimated by the present value of all dividends and the

terminal value with 13% as the discount rate.

Price of Altron’s share = (1.62/1.13) + (1.46/1.132) + (1.31/1.133) + (1.39/1.134) + (1.47/1.135) +

(1.58/1.136) + (1.69/1.137) + (22.125/1.137) = $ 16.02

Question 6

The relevant formula for computation of AEC is shown below.

First Quote

Asset price = $100,000

Annual maintenance cost = $ 3,000

Number of time periods = 3 years

Discount rate = 9% p.a.

Hence, AEC = 100,000*(0.09/(1-1.09-3)) + 3000 = $ 42,505.48

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

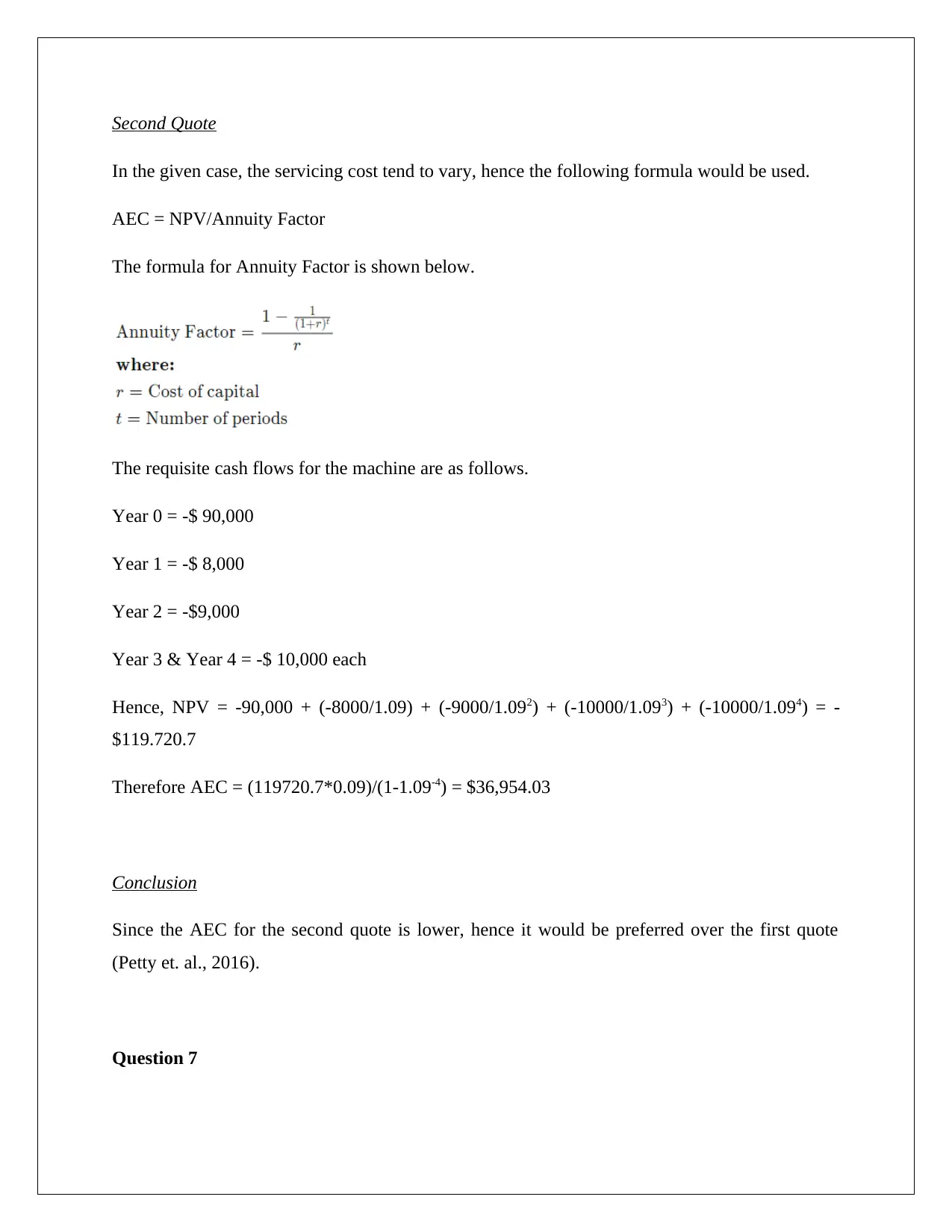

Second Quote

In the given case, the servicing cost tend to vary, hence the following formula would be used.

AEC = NPV/Annuity Factor

The formula for Annuity Factor is shown below.

The requisite cash flows for the machine are as follows.

Year 0 = -$ 90,000

Year 1 = -$ 8,000

Year 2 = -$9,000

Year 3 & Year 4 = -$ 10,000 each

Hence, NPV = -90,000 + (-8000/1.09) + (-9000/1.092) + (-10000/1.093) + (-10000/1.094) = -

$119.720.7

Therefore AEC = (119720.7*0.09)/(1-1.09-4) = $36,954.03

Conclusion

Since the AEC for the second quote is lower, hence it would be preferred over the first quote

(Petty et. al., 2016).

Question 7

In the given case, the servicing cost tend to vary, hence the following formula would be used.

AEC = NPV/Annuity Factor

The formula for Annuity Factor is shown below.

The requisite cash flows for the machine are as follows.

Year 0 = -$ 90,000

Year 1 = -$ 8,000

Year 2 = -$9,000

Year 3 & Year 4 = -$ 10,000 each

Hence, NPV = -90,000 + (-8000/1.09) + (-9000/1.092) + (-10000/1.093) + (-10000/1.094) = -

$119.720.7

Therefore AEC = (119720.7*0.09)/(1-1.09-4) = $36,954.03

Conclusion

Since the AEC for the second quote is lower, hence it would be preferred over the first quote

(Petty et. al., 2016).

Question 7

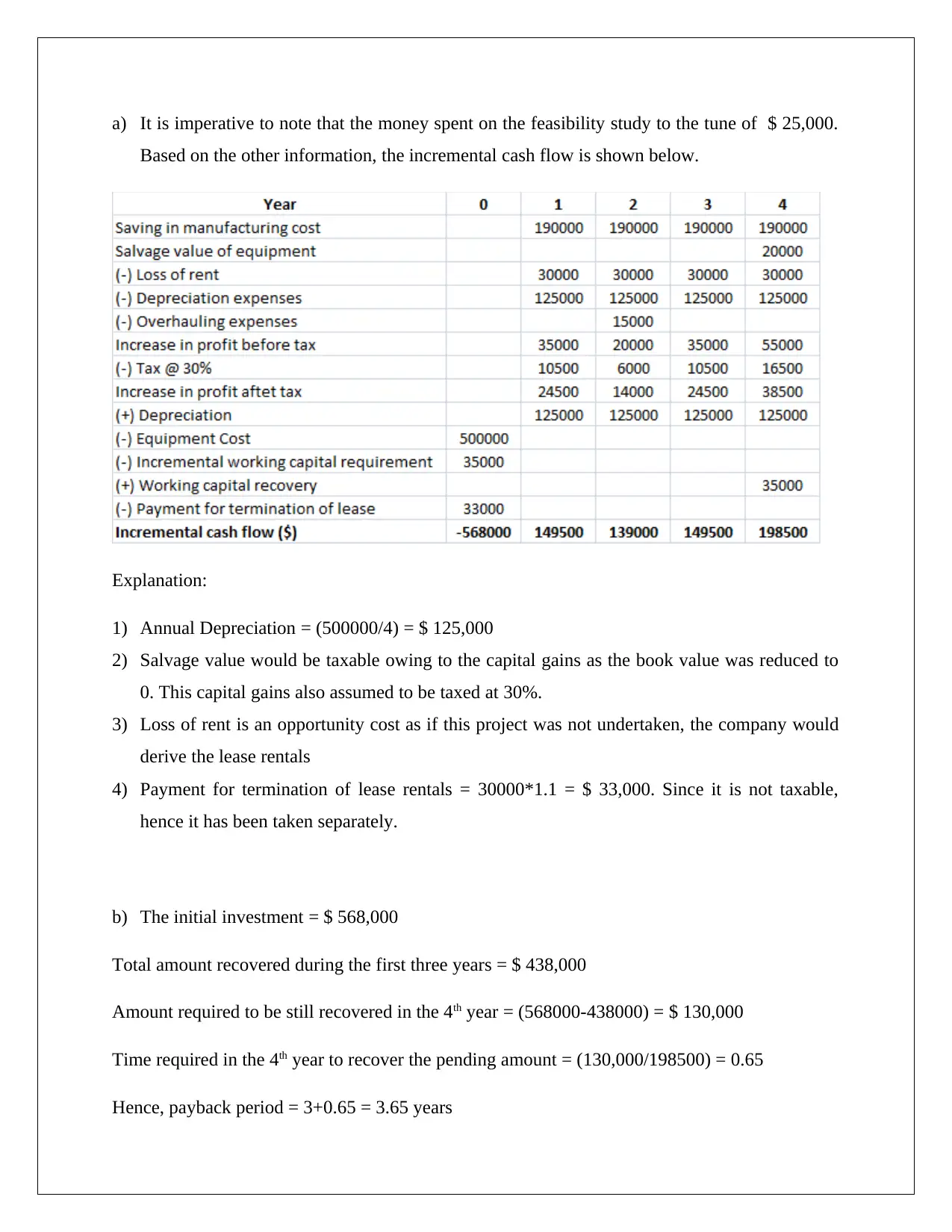

a) It is imperative to note that the money spent on the feasibility study to the tune of $ 25,000.

Based on the other information, the incremental cash flow is shown below.

Explanation:

1) Annual Depreciation = (500000/4) = $ 125,000

2) Salvage value would be taxable owing to the capital gains as the book value was reduced to

0. This capital gains also assumed to be taxed at 30%.

3) Loss of rent is an opportunity cost as if this project was not undertaken, the company would

derive the lease rentals

4) Payment for termination of lease rentals = 30000*1.1 = $ 33,000. Since it is not taxable,

hence it has been taken separately.

b) The initial investment = $ 568,000

Total amount recovered during the first three years = $ 438,000

Amount required to be still recovered in the 4th year = (568000-438000) = $ 130,000

Time required in the 4th year to recover the pending amount = (130,000/198500) = 0.65

Hence, payback period = 3+0.65 = 3.65 years

Based on the other information, the incremental cash flow is shown below.

Explanation:

1) Annual Depreciation = (500000/4) = $ 125,000

2) Salvage value would be taxable owing to the capital gains as the book value was reduced to

0. This capital gains also assumed to be taxed at 30%.

3) Loss of rent is an opportunity cost as if this project was not undertaken, the company would

derive the lease rentals

4) Payment for termination of lease rentals = 30000*1.1 = $ 33,000. Since it is not taxable,

hence it has been taken separately.

b) The initial investment = $ 568,000

Total amount recovered during the first three years = $ 438,000

Amount required to be still recovered in the 4th year = (568000-438000) = $ 130,000

Time required in the 4th year to recover the pending amount = (130,000/198500) = 0.65

Hence, payback period = 3+0.65 = 3.65 years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

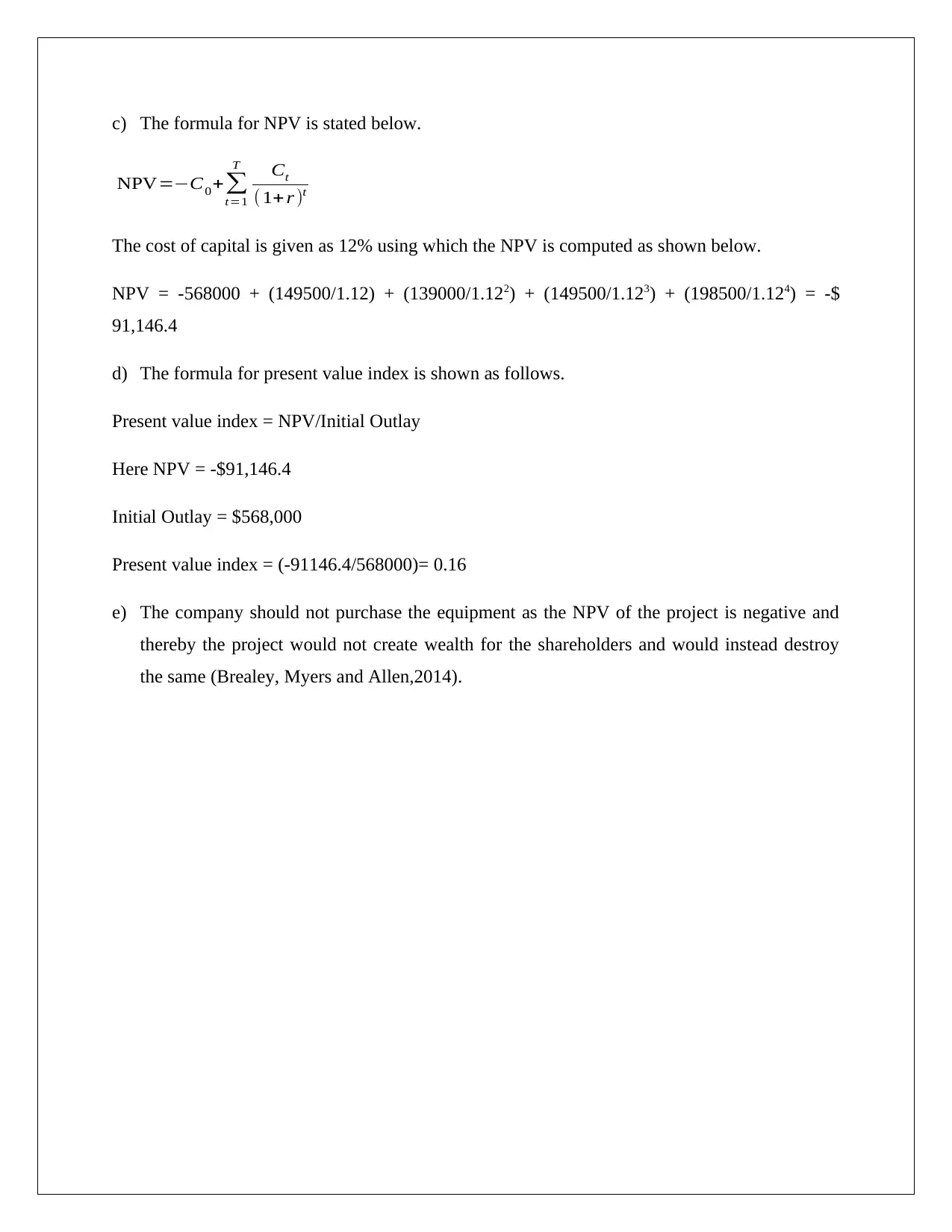

c) The formula for NPV is stated below.

NPV=−C0+∑

t=1

T Ct

( 1+ r )t

The cost of capital is given as 12% using which the NPV is computed as shown below.

NPV = -568000 + (149500/1.12) + (139000/1.122) + (149500/1.123) + (198500/1.124) = -$

91,146.4

d) The formula for present value index is shown as follows.

Present value index = NPV/Initial Outlay

Here NPV = -$91,146.4

Initial Outlay = $568,000

Present value index = (-91146.4/568000)= 0.16

e) The company should not purchase the equipment as the NPV of the project is negative and

thereby the project would not create wealth for the shareholders and would instead destroy

the same (Brealey, Myers and Allen,2014).

NPV=−C0+∑

t=1

T Ct

( 1+ r )t

The cost of capital is given as 12% using which the NPV is computed as shown below.

NPV = -568000 + (149500/1.12) + (139000/1.122) + (149500/1.123) + (198500/1.124) = -$

91,146.4

d) The formula for present value index is shown as follows.

Present value index = NPV/Initial Outlay

Here NPV = -$91,146.4

Initial Outlay = $568,000

Present value index = (-91146.4/568000)= 0.16

e) The company should not purchase the equipment as the NPV of the project is negative and

thereby the project would not create wealth for the shareholders and would instead destroy

the same (Brealey, Myers and Allen,2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Brealey, R.A., Myers, S.C. and Allen, F. (2014) Principles of corporate finance. 2nd ed. New

York: McGraw-Hill Inc, pp. 176

Damodaran, A. (2015) Applied corporate finance: A user’s manual. 3rd ed. New York: Wiley,

John & Sons, pp.155

Lasher, W. R., (2017) Practical Financial Management. 5th ed. London: South- Western

College Publisher, pp. 191

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia, pp. 178

Brealey, R.A., Myers, S.C. and Allen, F. (2014) Principles of corporate finance. 2nd ed. New

York: McGraw-Hill Inc, pp. 176

Damodaran, A. (2015) Applied corporate finance: A user’s manual. 3rd ed. New York: Wiley,

John & Sons, pp.155

Lasher, W. R., (2017) Practical Financial Management. 5th ed. London: South- Western

College Publisher, pp. 191

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia, pp. 178

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.