KPMG Strategy: Macro Environment, Stakeholders, & Competitive Edge

VerifiedAdded on 2023/06/17

|16

|5465

|288

Report

AI Summary

This report provides a comprehensive analysis of KPMG's business strategies, focusing on the impact of the macro and micro environments. It includes a stakeholder analysis, a critical evaluation of macro environmental factors such as political, economic, social, technological, legal, and environmental (PESTEL) factors, and an interpretation of data related to competitive analysis and strategic management objectives. The report also delves into the internal environment and capabilities of KPMG, employing tools like the Ansoff Matrix and Porter’s Five Forces to understand the competitive landscape. Furthermore, it discusses appropriate strategies to improve KPMG's competitive edge and theories to devise strategic planning, culminating in a proposed strategic management plan with tangible objectives. The analysis considers factors like GDP, inflation, and employment rates, alongside KPMG's employment data and revenue generation to provide a holistic view of the company's strategic positioning.

Business strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

The impact of macro environment on KPMG and its business strategies:..................................3

Stakeholders analysis:..................................................................................................................3

Critical analysis of macro environment that impact the strategic decision-making:...................6

Data interpretation and competitive analysis to produce strategic management objectives:.......7

Internal environment analysis and capabilities of the business:..................................................8

Ansoff matrix...............................................................................................................................8

Porter’s Five Forces model of KPMG and the competitive forces............................................10

Appropriate strategies to improve competitive edge.................................................................13

Theories to interpret and devise strategic planning for KPMG.................................................13

Strategic management plan that has tangible and tactical strategic priorities and objectives.. .15

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

The impact of macro environment on KPMG and its business strategies:..................................3

Stakeholders analysis:..................................................................................................................3

Critical analysis of macro environment that impact the strategic decision-making:...................6

Data interpretation and competitive analysis to produce strategic management objectives:.......7

Internal environment analysis and capabilities of the business:..................................................8

Ansoff matrix...............................................................................................................................8

Porter’s Five Forces model of KPMG and the competitive forces............................................10

Appropriate strategies to improve competitive edge.................................................................13

Theories to interpret and devise strategic planning for KPMG.................................................13

Strategic management plan that has tangible and tactical strategic priorities and objectives.. .15

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

INTRODUCTION

Business strategy is moves and action that business make for smooth running of the

process. Business strategy outline how a business should attract customer, increase their

performance, accelerate the growth and to compete in highly competitive market. Successful

strategies help business to achieve specific goals and objectives, strategies are master plan that

made by entrepreneur (Afuah, 2020). Business strategy requires involvement of top-level

management with proper framework that help business to discover and analyse beneficial

opportunities and to meet threats and to ensure the smooth sunning of the business process.

This study is based on KPMG, the company was established in 1987 by Markwick

Mitchell and three others. KPMG is a international consultancy company which provide business

solution to their clients, the company tend to provide business related services such as

management strategies, development and innovation, financial and non financial solutions and

many more. In this report we will discuss business strategies and its impact on organization, later

we will critically analyse macro and micro environment. This report will analyse political and

other factors that impact the smooth running of the process, later we will also analyse the

strength and weakness of the business environment. Later in this report we will understand the

porter's five forces and strategic management of KPMG. At last, this report will interpret the

relevant data of the company.

MAIN BODY

The impact of macro environment on KPMG and its business strategies:

Macro environment: macro environment is condition which refer economy as a whole,

the macro environment of the business means effect business decision by specific market and its

condition such as speeding and investment of the business (Mbithi, Muturi and Rambo, 2017).

This environment can be understood by:

Stakeholders analysis:

Stakeholders analysis means the identification of people involved in the internal project of the

organization. This analysis helps business to examine the people before starting any project,

when the company analyses the stakeholders and their ability they often moved to create group

or team. There are certain steps to analyse the stakeholders such as:

Business strategy is moves and action that business make for smooth running of the

process. Business strategy outline how a business should attract customer, increase their

performance, accelerate the growth and to compete in highly competitive market. Successful

strategies help business to achieve specific goals and objectives, strategies are master plan that

made by entrepreneur (Afuah, 2020). Business strategy requires involvement of top-level

management with proper framework that help business to discover and analyse beneficial

opportunities and to meet threats and to ensure the smooth sunning of the business process.

This study is based on KPMG, the company was established in 1987 by Markwick

Mitchell and three others. KPMG is a international consultancy company which provide business

solution to their clients, the company tend to provide business related services such as

management strategies, development and innovation, financial and non financial solutions and

many more. In this report we will discuss business strategies and its impact on organization, later

we will critically analyse macro and micro environment. This report will analyse political and

other factors that impact the smooth running of the process, later we will also analyse the

strength and weakness of the business environment. Later in this report we will understand the

porter's five forces and strategic management of KPMG. At last, this report will interpret the

relevant data of the company.

MAIN BODY

The impact of macro environment on KPMG and its business strategies:

Macro environment: macro environment is condition which refer economy as a whole,

the macro environment of the business means effect business decision by specific market and its

condition such as speeding and investment of the business (Mbithi, Muturi and Rambo, 2017).

This environment can be understood by:

Stakeholders analysis:

Stakeholders analysis means the identification of people involved in the internal project of the

organization. This analysis helps business to examine the people before starting any project,

when the company analyses the stakeholders and their ability they often moved to create group

or team. There are certain steps to analyse the stakeholders such as:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stakeholders profile: stakeholders profile help business to identify who are the stakeholders and

what their position is in the organization. When the company is try to create a big project, they

first identify the role and ability of their stakeholders and often add them all together to create a

strong team or group.

Power interest grid: power girding mean company often try to collect all the powers of

stakeholders together and form a powerful team. The KPMG thinks that higher the power, higher

the interest, which allow company to select the power and start the project.

Stakeholders matrix: stakeholders matrix help business to identify the impact of stakeholders

on the particular project and provide idea how to map such ability of their stakeholders. Power

may be important in a big project but ability of stakeholders plays a vital role in the project of the

company.

Stakeholders mapping: stakeholders mapping is the most important part in the project building, ,

mapping help business to use the power and ability of the stakeholders in the completion of the

project. Stakeholders mapping have various parts such as:

Building a product: after the successfully building the team the next and very first step of the

mapping is building the product which means in what purpose a team is been made, this team all

together provide idea and their experience in developing a project.

Penetrating the market: to penetrate the market it requires stakeholders to deign a new product

which can be launched in the market. In this mapping, stakeholders identify the key important

things to win the market such as new customer, new suppliers and new retailers or distributors.

Start the project: after doing all the analysis of the stakeholders, the next step falls is starting the

project. This requires the ability and skills of the stakeholders to handle and manage the project.

PESTEL Analysis

PESTEL analysis help business to identify political and other factors which might impact the

smooth running of the process, these factors plays significant role in growth of the business.

Political factors: political factors means interference of the government and its policy in the

business strategic decision-making. Government keep changing the rules and regulation such as

taxation policy and duty that might slow down the process and even business have to change

accordingly. For KPMG, government interference have a huge role in its strategic decision-

making such as new fiscal policy of the government instructed the business to change their

consultancy policy and levy rates according to the size of the clients business. Government now

what their position is in the organization. When the company is try to create a big project, they

first identify the role and ability of their stakeholders and often add them all together to create a

strong team or group.

Power interest grid: power girding mean company often try to collect all the powers of

stakeholders together and form a powerful team. The KPMG thinks that higher the power, higher

the interest, which allow company to select the power and start the project.

Stakeholders matrix: stakeholders matrix help business to identify the impact of stakeholders

on the particular project and provide idea how to map such ability of their stakeholders. Power

may be important in a big project but ability of stakeholders plays a vital role in the project of the

company.

Stakeholders mapping: stakeholders mapping is the most important part in the project building, ,

mapping help business to use the power and ability of the stakeholders in the completion of the

project. Stakeholders mapping have various parts such as:

Building a product: after the successfully building the team the next and very first step of the

mapping is building the product which means in what purpose a team is been made, this team all

together provide idea and their experience in developing a project.

Penetrating the market: to penetrate the market it requires stakeholders to deign a new product

which can be launched in the market. In this mapping, stakeholders identify the key important

things to win the market such as new customer, new suppliers and new retailers or distributors.

Start the project: after doing all the analysis of the stakeholders, the next step falls is starting the

project. This requires the ability and skills of the stakeholders to handle and manage the project.

PESTEL Analysis

PESTEL analysis help business to identify political and other factors which might impact the

smooth running of the process, these factors plays significant role in growth of the business.

Political factors: political factors means interference of the government and its policy in the

business strategic decision-making. Government keep changing the rules and regulation such as

taxation policy and duty that might slow down the process and even business have to change

accordingly. For KPMG, government interference have a huge role in its strategic decision-

making such as new fiscal policy of the government instructed the business to change their

consultancy policy and levy rates according to the size of the clients business. Government now

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

have new tariff rules to strict the flow of foreign investment which impacted the KPMG foreign

clients. Political factors can impact the business to greater extent.

Economic factors: economic factors means components of a country's economy and how these

component impact the business strategic decision-making. Economic stability of the country

plays a significant role in growth of the business such if the economy of the country is not stable

then the demand of the customer keep shifting and disturb the supply chain of the business so its

very important for business to look for economy which is more stable, stable economy refers to

good income level of the people and their buying behaviour (Adesi, Owusu-Manu and Murphy,

2018). For KPMG, economic stability is crucial role because they are consultancy providers and

if the clients business is stable then it is easy to provide professional advice and service to them.

Foreign direct investment is tend to increase if the economy is stable.

Social factors: social factors means trends in the market, these trend can be cultural, taste and

preference of the customer, buying behaviour of the consumer and demand of new product by

the customer. Social trends help business to change according to the change in the social culture

of the people, trend keep changing day by day so its is very important for business to keep the

supply flow of the product according to demand of the customer for example if the market is

demanding new concept car then the car manufacturer have to fulfil the demand of the market.

For KPMG, the social trend have great impact of sales of their service such as buying trend of

their clients is changing, they are now preferring other consultancy service provider who is read

to provide same service in low rates.

Technological factors: technological factors means how technical advancement impact the

business. Technical advancement refers to innovation that affect the operation strategies of the

business, when an organization is having advance technology to operate business and advance

automation in production of goods then it leads business to competitive in high competitive

market and generate good amount of revenue by fulfilling the demand of the customer. For

KPMG, technological factors is very important because their whole business operation runs on

technology, the company is service provider, so they do not have any production unit. KPMG

have advanced IT network which help them to make business strategies smoothly, the company

tend to use new advance technology and keep up grading their exiting technology for better flow

of business (Ghemawat, 2016).

clients. Political factors can impact the business to greater extent.

Economic factors: economic factors means components of a country's economy and how these

component impact the business strategic decision-making. Economic stability of the country

plays a significant role in growth of the business such if the economy of the country is not stable

then the demand of the customer keep shifting and disturb the supply chain of the business so its

very important for business to look for economy which is more stable, stable economy refers to

good income level of the people and their buying behaviour (Adesi, Owusu-Manu and Murphy,

2018). For KPMG, economic stability is crucial role because they are consultancy providers and

if the clients business is stable then it is easy to provide professional advice and service to them.

Foreign direct investment is tend to increase if the economy is stable.

Social factors: social factors means trends in the market, these trend can be cultural, taste and

preference of the customer, buying behaviour of the consumer and demand of new product by

the customer. Social trends help business to change according to the change in the social culture

of the people, trend keep changing day by day so its is very important for business to keep the

supply flow of the product according to demand of the customer for example if the market is

demanding new concept car then the car manufacturer have to fulfil the demand of the market.

For KPMG, the social trend have great impact of sales of their service such as buying trend of

their clients is changing, they are now preferring other consultancy service provider who is read

to provide same service in low rates.

Technological factors: technological factors means how technical advancement impact the

business. Technical advancement refers to innovation that affect the operation strategies of the

business, when an organization is having advance technology to operate business and advance

automation in production of goods then it leads business to competitive in high competitive

market and generate good amount of revenue by fulfilling the demand of the customer. For

KPMG, technological factors is very important because their whole business operation runs on

technology, the company is service provider, so they do not have any production unit. KPMG

have advanced IT network which help them to make business strategies smoothly, the company

tend to use new advance technology and keep up grading their exiting technology for better flow

of business (Ghemawat, 2016).

Legal factors: legal factors means business get effected by both internal and external

environment such as government's law and its impact on business whereas there are various law

of business internal working as well. Legal rules and regulation of the government means

guideline which help business to stay on legal track, these laws may include consumer law,

safety law and labour law. For KPMG legal factors have crucial role because they tend to

undertake others business strategies, they know how difficult is to improve the business

strategies of other organization. They have to keep in mind about certain laws that might right

for them but wrong in the eye of the government. Consumer law have huge impact on the

business strategies of the KPMG.

Environmental factors: environmental factors means how nature plays an important role

growth of the business. Environmental factors is broad term, it involves all the activities of the

nature. Activities refer affect of climate, weather and global pandemic. These factors mainly

affect the tourism and agriculture and farming industry, they are more concern about the

environmental factors as compare to other business industries. For KPMG, the environmental

factors include the impact of COVID-19 on the growth of the business, they have faces huge loss

in the time of lock down due to COVID-19. This badly affect the business strategies of KPMG

and result in failure of the up coming business strategies.

Critical analysis of macro environment that impact the strategic decision-making:

Gross domestic product: gross domestic product help country to measure the output and

production of products. GDP provide analyse of goods and service and their output in al sectors

of the economy (Omitogun and Al-Adeem, 2019). Low GDP rate of the country impact the

business strategic decision-making in negative way but high GDP rate help business to grow

with their new business strategies which include production of new products.

Inflation: inflation is the most important factor to measure market, this help both business and

consumer in understand the conditions of the currency. Inflation rate means the purchasing

power of the consumer in references to power of the currency they used to purchase the goods

and services. Higher the inflation rate higher the purchasing power of the consumer.

Employment: employment in the economy is measured by movement in the labour market.

Business produce more employment opportunities if the conditions of the economy is more

stable. Strategic management decision of the company changed according to the movement of

the labour market.

environment such as government's law and its impact on business whereas there are various law

of business internal working as well. Legal rules and regulation of the government means

guideline which help business to stay on legal track, these laws may include consumer law,

safety law and labour law. For KPMG legal factors have crucial role because they tend to

undertake others business strategies, they know how difficult is to improve the business

strategies of other organization. They have to keep in mind about certain laws that might right

for them but wrong in the eye of the government. Consumer law have huge impact on the

business strategies of the KPMG.

Environmental factors: environmental factors means how nature plays an important role

growth of the business. Environmental factors is broad term, it involves all the activities of the

nature. Activities refer affect of climate, weather and global pandemic. These factors mainly

affect the tourism and agriculture and farming industry, they are more concern about the

environmental factors as compare to other business industries. For KPMG, the environmental

factors include the impact of COVID-19 on the growth of the business, they have faces huge loss

in the time of lock down due to COVID-19. This badly affect the business strategies of KPMG

and result in failure of the up coming business strategies.

Critical analysis of macro environment that impact the strategic decision-making:

Gross domestic product: gross domestic product help country to measure the output and

production of products. GDP provide analyse of goods and service and their output in al sectors

of the economy (Omitogun and Al-Adeem, 2019). Low GDP rate of the country impact the

business strategic decision-making in negative way but high GDP rate help business to grow

with their new business strategies which include production of new products.

Inflation: inflation is the most important factor to measure market, this help both business and

consumer in understand the conditions of the currency. Inflation rate means the purchasing

power of the consumer in references to power of the currency they used to purchase the goods

and services. Higher the inflation rate higher the purchasing power of the consumer.

Employment: employment in the economy is measured by movement in the labour market.

Business produce more employment opportunities if the conditions of the economy is more

stable. Strategic management decision of the company changed according to the movement of

the labour market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

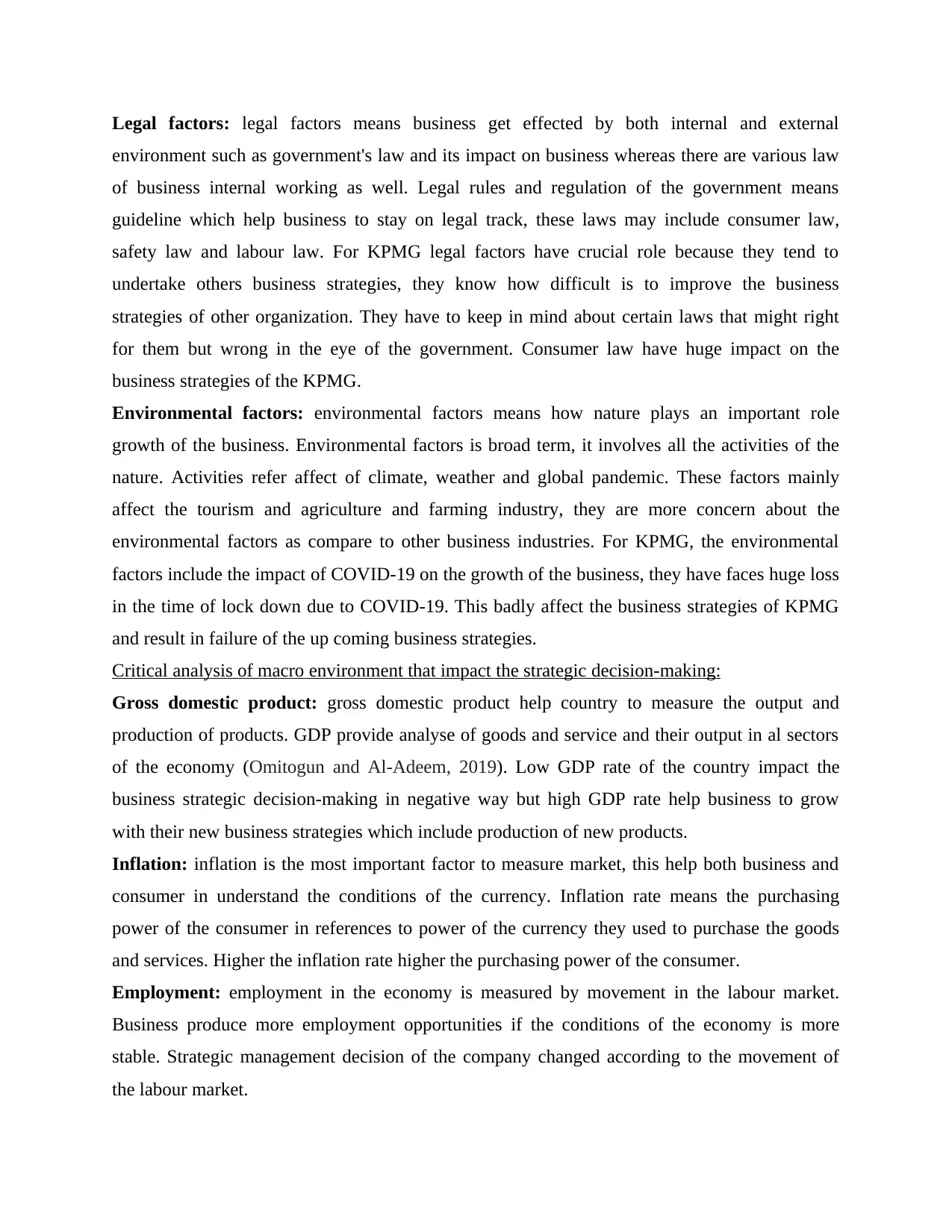

Data interpretation and competitive analysis to produce strategic management objectives:

Big data can be either opportunities or challenges for the business. Data interpretation of

KPMG analyse the information about company's strategies operations and management

practices. The data of KPMG show:

Employment data of KPMG: employment rate of KPMG has increase by the decades from

2010 to 2020 (Data analytics, 2021). The company tend to hire more people in its initial stage,

they have almost 22700 employees worldwide. Most of the employee of the KPMG are

European as company is situated in London. The middle east and Africa employees are more

than 15500 resided. There are 64000 employees of KPMG in America and more than 4700 in

Asia region. They have 79% of employees as highly professional. Other remaining 22% of

employee are administration and 16% as partners.

Revenue generation: KPMG is one of the largest consultancy service provider in the world

according to data of 2019 audit report. KPMG have generated more than 29.75 billion USD. But

in this race Deloitte was the winner with almost 46.2 billion USD revenue. Such companies tend

to offer more service than any other consultancy company. They even provide corporate finance

and generate the largest amount of revenue.

Despite the reputation of the company, KPMG ranked ninth in the list of most prestigious

consultancy companies. The largest share of business was conducted in middle east and africa

region with over 43.6% revenue was generated.

Big data can be either opportunities or challenges for the business. Data interpretation of

KPMG analyse the information about company's strategies operations and management

practices. The data of KPMG show:

Employment data of KPMG: employment rate of KPMG has increase by the decades from

2010 to 2020 (Data analytics, 2021). The company tend to hire more people in its initial stage,

they have almost 22700 employees worldwide. Most of the employee of the KPMG are

European as company is situated in London. The middle east and Africa employees are more

than 15500 resided. There are 64000 employees of KPMG in America and more than 4700 in

Asia region. They have 79% of employees as highly professional. Other remaining 22% of

employee are administration and 16% as partners.

Revenue generation: KPMG is one of the largest consultancy service provider in the world

according to data of 2019 audit report. KPMG have generated more than 29.75 billion USD. But

in this race Deloitte was the winner with almost 46.2 billion USD revenue. Such companies tend

to offer more service than any other consultancy company. They even provide corporate finance

and generate the largest amount of revenue.

Despite the reputation of the company, KPMG ranked ninth in the list of most prestigious

consultancy companies. The largest share of business was conducted in middle east and africa

region with over 43.6% revenue was generated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Internal environment analysis and capabilities of the business:

Internal environment: internal environment means components of environment within the

business structure (GURL, 2017). These components all together make a strong structure of the

business, these are the components which impact the success of business strategy decision-

making. Internal environment components include strength and weakness of the business:

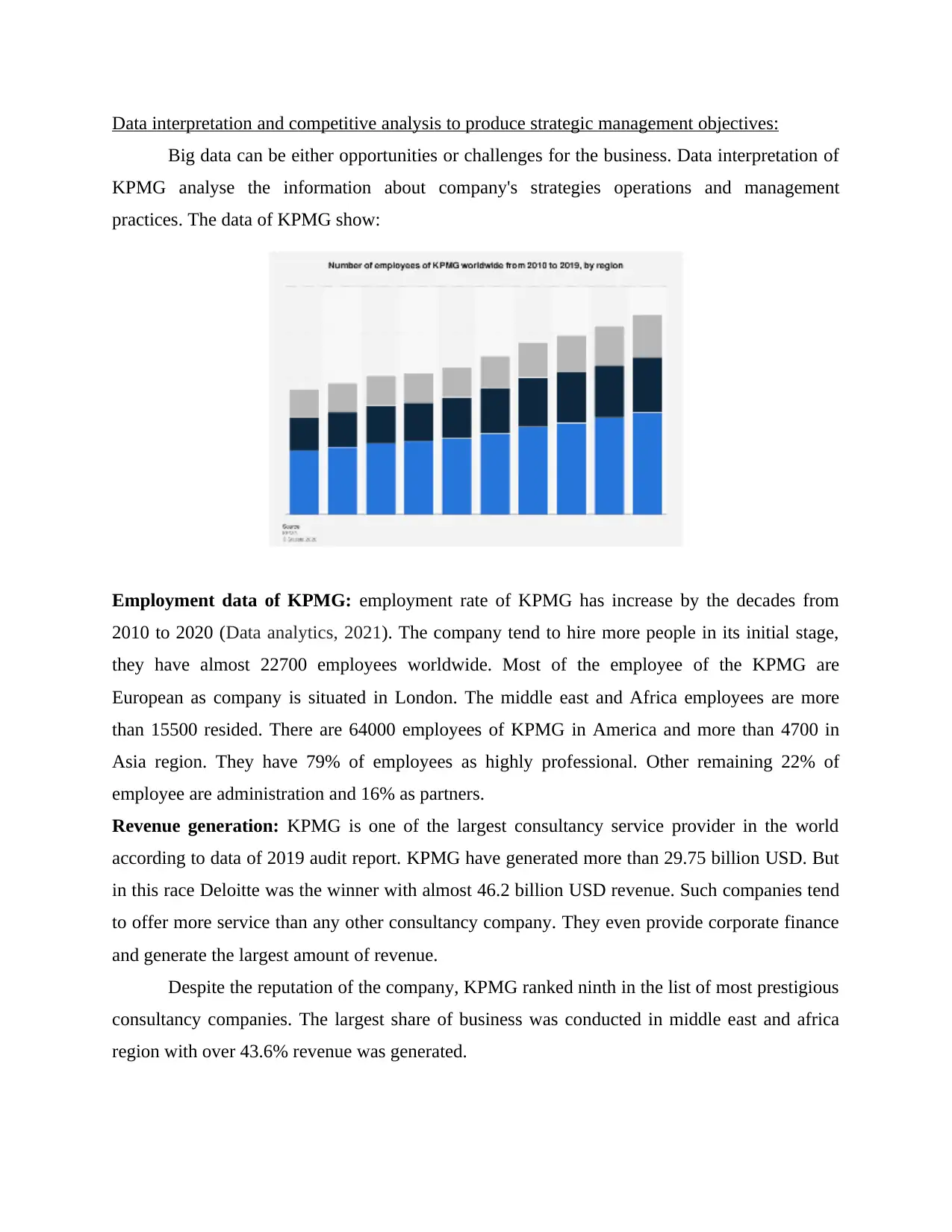

Ansoff matrix

This matrix develops a understanding of risk factor in the organization who try to grow. This has

four stages;

Market penetration:- that uses for the existing products in the market and business try to grow

with a new innovation and creativeness in a market with a existing product.

Product development:- in this business produce a new product. That determine the new

investment and acquire or merger with the competitor's or make partnership.

Market development:- in this business enter with a existing product in a new market. In context

to promote their product and expand the business.

Diversification:- in this business enter into a new market with a new product. This can be risky

strategy for both of the segment market or the product line. With this business generate a good

revenue that also beneficial for the economy.

Internal environment: internal environment means components of environment within the

business structure (GURL, 2017). These components all together make a strong structure of the

business, these are the components which impact the success of business strategy decision-

making. Internal environment components include strength and weakness of the business:

Ansoff matrix

This matrix develops a understanding of risk factor in the organization who try to grow. This has

four stages;

Market penetration:- that uses for the existing products in the market and business try to grow

with a new innovation and creativeness in a market with a existing product.

Product development:- in this business produce a new product. That determine the new

investment and acquire or merger with the competitor's or make partnership.

Market development:- in this business enter with a existing product in a new market. In context

to promote their product and expand the business.

Diversification:- in this business enter into a new market with a new product. This can be risky

strategy for both of the segment market or the product line. With this business generate a good

revenue that also beneficial for the economy.

SWOT Analysis: SWOT Analysis is a tool to measure the strength and weakness of the

organization. This help business to understand the opportunities and threats that revolve around

the business environment. SWOT Analysis is one of the most important analysis for business to

identify the strength and other elements of the business. By observing SWOT analysis a business

can grow effectively with increasing the overall performance.

Strength: strength business provide competitive advantage, this help business to grow more

smoothly even after the impact of highly competitive market. Strength is the most important

factor for the business, strength lies in unique selling point of the company and other factors of

the business (Sarsby, 2016). For KPMG, their strength lies in reputation and brand image of the

company. KPMG is one of the biggest consultancy firm which provide professional consultancy

service to their clients. Their clients are more satisfied with their service as compared to

competitors in the market. Company have diversified revenue sources which helps them to

capture more geographic locations. Strength of the KPMG allow them to make effective strategic

decision for themselves as well as for their clients.

Weakness: weakness of the company slow down the overall speed of the business, weakness are

barriers of the business strategic process. When a company is unable to identify the weakness,

they tend to lose the grip of the market and later results in ending of the firm. Weakness can be

found at every level of the organization such as less productive or inactive staff, low budget,

poor infrastructure and less effective business management strategies (Yuliansyah, Gurd and

Mohamed, 2017). For KPMG, their weakness lies in their own reputation because their

reputation is so high which makes their rate of service unacceptable for various small business.

Being on top sometimes shift the customer to other service provider. There are various other

service providers which tend to provide same business management service in low and

reasonable rates.

Opportunities: opportunities are booster of the growth for the business, manay opportunities

lies in weakness of the business. If the business identify their weakness their will find the

opportunities also, these opportunities not only provide the solution for the problem, but they

also provide advantage to business strategic decision-making. For KPMG, their opportunities lies

in infrastructure of the business (Yeganeh, 2021). They tend to have enormous growth prospects

and expansion opportunities in emerging markets. KPMG can build their technology according

organization. This help business to understand the opportunities and threats that revolve around

the business environment. SWOT Analysis is one of the most important analysis for business to

identify the strength and other elements of the business. By observing SWOT analysis a business

can grow effectively with increasing the overall performance.

Strength: strength business provide competitive advantage, this help business to grow more

smoothly even after the impact of highly competitive market. Strength is the most important

factor for the business, strength lies in unique selling point of the company and other factors of

the business (Sarsby, 2016). For KPMG, their strength lies in reputation and brand image of the

company. KPMG is one of the biggest consultancy firm which provide professional consultancy

service to their clients. Their clients are more satisfied with their service as compared to

competitors in the market. Company have diversified revenue sources which helps them to

capture more geographic locations. Strength of the KPMG allow them to make effective strategic

decision for themselves as well as for their clients.

Weakness: weakness of the company slow down the overall speed of the business, weakness are

barriers of the business strategic process. When a company is unable to identify the weakness,

they tend to lose the grip of the market and later results in ending of the firm. Weakness can be

found at every level of the organization such as less productive or inactive staff, low budget,

poor infrastructure and less effective business management strategies (Yuliansyah, Gurd and

Mohamed, 2017). For KPMG, their weakness lies in their own reputation because their

reputation is so high which makes their rate of service unacceptable for various small business.

Being on top sometimes shift the customer to other service provider. There are various other

service providers which tend to provide same business management service in low and

reasonable rates.

Opportunities: opportunities are booster of the growth for the business, manay opportunities

lies in weakness of the business. If the business identify their weakness their will find the

opportunities also, these opportunities not only provide the solution for the problem, but they

also provide advantage to business strategic decision-making. For KPMG, their opportunities lies

in infrastructure of the business (Yeganeh, 2021). They tend to have enormous growth prospects

and expansion opportunities in emerging markets. KPMG can build their technology according

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to the solution provided to the clients, they have opportunity to expand in advisory segment.

Company is so reputed that they can acquire small consultancy firms to increase the strength of

the company.

Threats: threats are barriers of the company, they slow down the process and sometimes create

dangerous situation. For every business, their main threat is competition, competition and their

activity create threats for business such activities include new product with better features, low

rates of same products, new marketing management strategies and use of latest technology. For

KPMG, threats faced by them are regulatory restriction of the government and increase in

competition in consultancy market cut half of their market share. Recession of the economy,

hinder the growth and smooth running of the process. The biggest threat for KPMG is four other

reputed consultancy company which have same market value as KPMG.

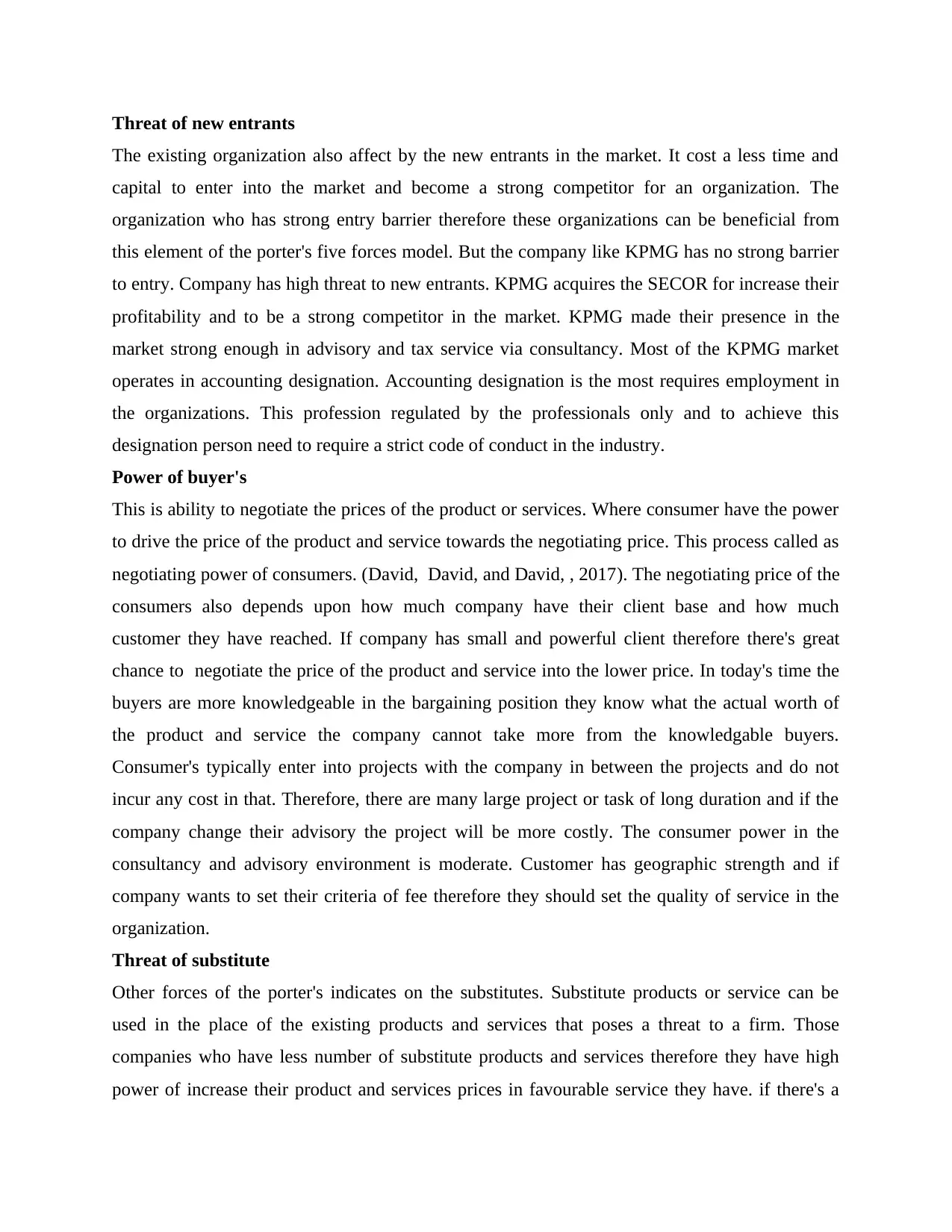

Porter’s Five Forces model of KPMG and the competitive forces

Porter's five forces model identify the company competitive forces and shape. To

determine the standards of the organization in the market. Porter's five forces model help to

determine to evaluate company strength and weakness. This model applied to understand the

company competitive environment and to enhance the weak point of the company (Velikorossov,

and et.al 2020). Porter's five forces model can guide company towards increasing the competitive

advantages and their business strategy. This model includes both internal and external

environment of the company. KPMG has very strong competitive industry like, Deloitte, PWC

etc. therefore, these are the five elements of the porter's five forces model that describe below.

Company is so reputed that they can acquire small consultancy firms to increase the strength of

the company.

Threats: threats are barriers of the company, they slow down the process and sometimes create

dangerous situation. For every business, their main threat is competition, competition and their

activity create threats for business such activities include new product with better features, low

rates of same products, new marketing management strategies and use of latest technology. For

KPMG, threats faced by them are regulatory restriction of the government and increase in

competition in consultancy market cut half of their market share. Recession of the economy,

hinder the growth and smooth running of the process. The biggest threat for KPMG is four other

reputed consultancy company which have same market value as KPMG.

Porter’s Five Forces model of KPMG and the competitive forces

Porter's five forces model identify the company competitive forces and shape. To

determine the standards of the organization in the market. Porter's five forces model help to

determine to evaluate company strength and weakness. This model applied to understand the

company competitive environment and to enhance the weak point of the company (Velikorossov,

and et.al 2020). Porter's five forces model can guide company towards increasing the competitive

advantages and their business strategy. This model includes both internal and external

environment of the company. KPMG has very strong competitive industry like, Deloitte, PWC

etc. therefore, these are the five elements of the porter's five forces model that describe below.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Threat of new entrants

The existing organization also affect by the new entrants in the market. It cost a less time and

capital to enter into the market and become a strong competitor for an organization. The

organization who has strong entry barrier therefore these organizations can be beneficial from

this element of the porter's five forces model. But the company like KPMG has no strong barrier

to entry. Company has high threat to new entrants. KPMG acquires the SECOR for increase their

profitability and to be a strong competitor in the market. KPMG made their presence in the

market strong enough in advisory and tax service via consultancy. Most of the KPMG market

operates in accounting designation. Accounting designation is the most requires employment in

the organizations. This profession regulated by the professionals only and to achieve this

designation person need to require a strict code of conduct in the industry.

Power of buyer's

This is ability to negotiate the prices of the product or services. Where consumer have the power

to drive the price of the product and service towards the negotiating price. This process called as

negotiating power of consumers. (David, David, and David, , 2017). The negotiating price of the

consumers also depends upon how much company have their client base and how much

customer they have reached. If company has small and powerful client therefore there's great

chance to negotiate the price of the product and service into the lower price. In today's time the

buyers are more knowledgeable in the bargaining position they know what the actual worth of

the product and service the company cannot take more from the knowledgable buyers.

Consumer's typically enter into projects with the company in between the projects and do not

incur any cost in that. Therefore, there are many large project or task of long duration and if the

company change their advisory the project will be more costly. The consumer power in the

consultancy and advisory environment is moderate. Customer has geographic strength and if

company wants to set their criteria of fee therefore they should set the quality of service in the

organization.

Threat of substitute

Other forces of the porter's indicates on the substitutes. Substitute products or service can be

used in the place of the existing products and services that poses a threat to a firm. Those

companies who have less number of substitute products and services therefore they have high

power of increase their product and services prices in favourable service they have. if there's a

The existing organization also affect by the new entrants in the market. It cost a less time and

capital to enter into the market and become a strong competitor for an organization. The

organization who has strong entry barrier therefore these organizations can be beneficial from

this element of the porter's five forces model. But the company like KPMG has no strong barrier

to entry. Company has high threat to new entrants. KPMG acquires the SECOR for increase their

profitability and to be a strong competitor in the market. KPMG made their presence in the

market strong enough in advisory and tax service via consultancy. Most of the KPMG market

operates in accounting designation. Accounting designation is the most requires employment in

the organizations. This profession regulated by the professionals only and to achieve this

designation person need to require a strict code of conduct in the industry.

Power of buyer's

This is ability to negotiate the prices of the product or services. Where consumer have the power

to drive the price of the product and service towards the negotiating price. This process called as

negotiating power of consumers. (David, David, and David, , 2017). The negotiating price of the

consumers also depends upon how much company have their client base and how much

customer they have reached. If company has small and powerful client therefore there's great

chance to negotiate the price of the product and service into the lower price. In today's time the

buyers are more knowledgeable in the bargaining position they know what the actual worth of

the product and service the company cannot take more from the knowledgable buyers.

Consumer's typically enter into projects with the company in between the projects and do not

incur any cost in that. Therefore, there are many large project or task of long duration and if the

company change their advisory the project will be more costly. The consumer power in the

consultancy and advisory environment is moderate. Customer has geographic strength and if

company wants to set their criteria of fee therefore they should set the quality of service in the

organization.

Threat of substitute

Other forces of the porter's indicates on the substitutes. Substitute products or service can be

used in the place of the existing products and services that poses a threat to a firm. Those

companies who have less number of substitute products and services therefore they have high

power of increase their product and services prices in favourable service they have. if there's a

close substitute available in the market customer have more option to buy from their chosen

option. With this company power will be weakened because of the diverseness of the consumer's

Company should have maintained their brand factor for no shifting of the customer in the

market. KPMG has low threat of substitute(Dg, 2019,). Because consumer can use the substitute

like internal factor they can appoint a person in their firm for an accounting or advisory other

than that the large number of company appoint a different-different firm for doing their

consultancy and tax advisory. Therefore, there's a high range of elements in the market which

company needed to understand from the firm like KPMG. Company could have major issue in

substitute in the emergence of technology and the service and the output of the quality and

combination of the capability that company has.

Power of suppliers

This model of five forces of porter's indicates that how the supplier easily increase their cost of

inputs. Power of supplier affected by how many supplier markets have and their goods and

services. How unique supplier goods and services are and how does it cost to the company to

move to the other supplier. Power of supplier increases with how qualified employees they have

and how flexible their environment in case of developing their career. If company wants to

increase their power of supply their services to the company therefore, they need to tightly

couples their core processes and work efficiency in the company to drive up their cost of supply

in goods and services. Also comp[any should have to maintain their quality of services.

Competition in the market

This force of the porter's model indicates the ability of the organization to undercut their

competitive organization. The large number of competitor's firm have the less their power is . If

the competitor of the company give more goods and services from them therefore their power to

stand in the market will weaken. If company able to offer a best quality of goods and services to

their customer therefore they will be sought out a competition in the market. KPMG has main 4

big firm rivalry with that the company only focus on their quality of the goods and services they

provided to their customers. The industry in which company is origin have no high entry of

barriers with that anyone can enter into the market with new technologies and idea. KPMG has

extensive professionals network from hat they bring the professionalism in their firm from other

companies.

option. With this company power will be weakened because of the diverseness of the consumer's

Company should have maintained their brand factor for no shifting of the customer in the

market. KPMG has low threat of substitute(Dg, 2019,). Because consumer can use the substitute

like internal factor they can appoint a person in their firm for an accounting or advisory other

than that the large number of company appoint a different-different firm for doing their

consultancy and tax advisory. Therefore, there's a high range of elements in the market which

company needed to understand from the firm like KPMG. Company could have major issue in

substitute in the emergence of technology and the service and the output of the quality and

combination of the capability that company has.

Power of suppliers

This model of five forces of porter's indicates that how the supplier easily increase their cost of

inputs. Power of supplier affected by how many supplier markets have and their goods and

services. How unique supplier goods and services are and how does it cost to the company to

move to the other supplier. Power of supplier increases with how qualified employees they have

and how flexible their environment in case of developing their career. If company wants to

increase their power of supply their services to the company therefore, they need to tightly

couples their core processes and work efficiency in the company to drive up their cost of supply

in goods and services. Also comp[any should have to maintain their quality of services.

Competition in the market

This force of the porter's model indicates the ability of the organization to undercut their

competitive organization. The large number of competitor's firm have the less their power is . If

the competitor of the company give more goods and services from them therefore their power to

stand in the market will weaken. If company able to offer a best quality of goods and services to

their customer therefore they will be sought out a competition in the market. KPMG has main 4

big firm rivalry with that the company only focus on their quality of the goods and services they

provided to their customers. The industry in which company is origin have no high entry of

barriers with that anyone can enter into the market with new technologies and idea. KPMG has

extensive professionals network from hat they bring the professionalism in their firm from other

companies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.