LAW6001 Taxation Law: Exploring the History of Income Tax in Australia

VerifiedAdded on 2023/06/10

|13

|1179

|263

Presentation

AI Summary

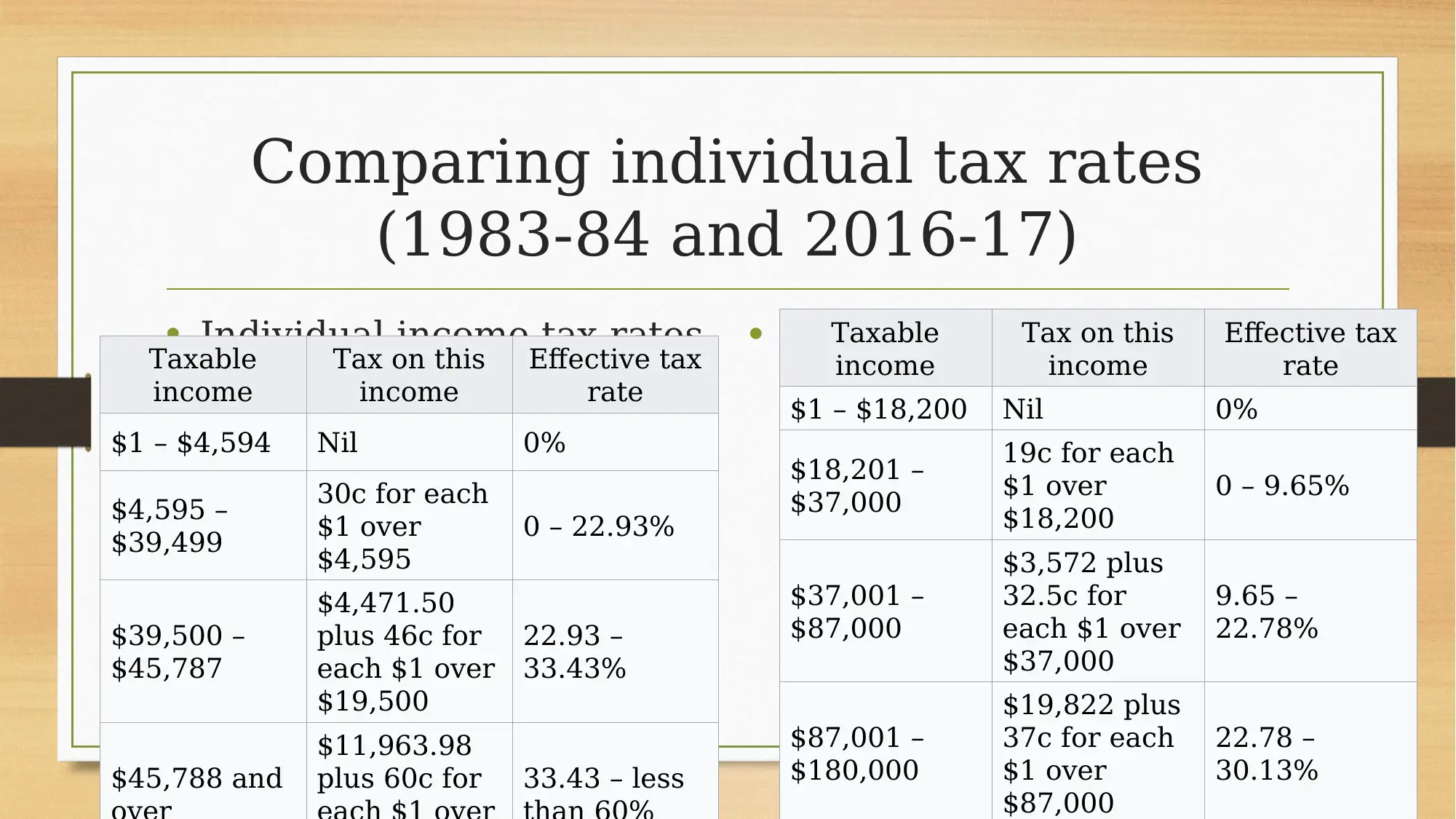

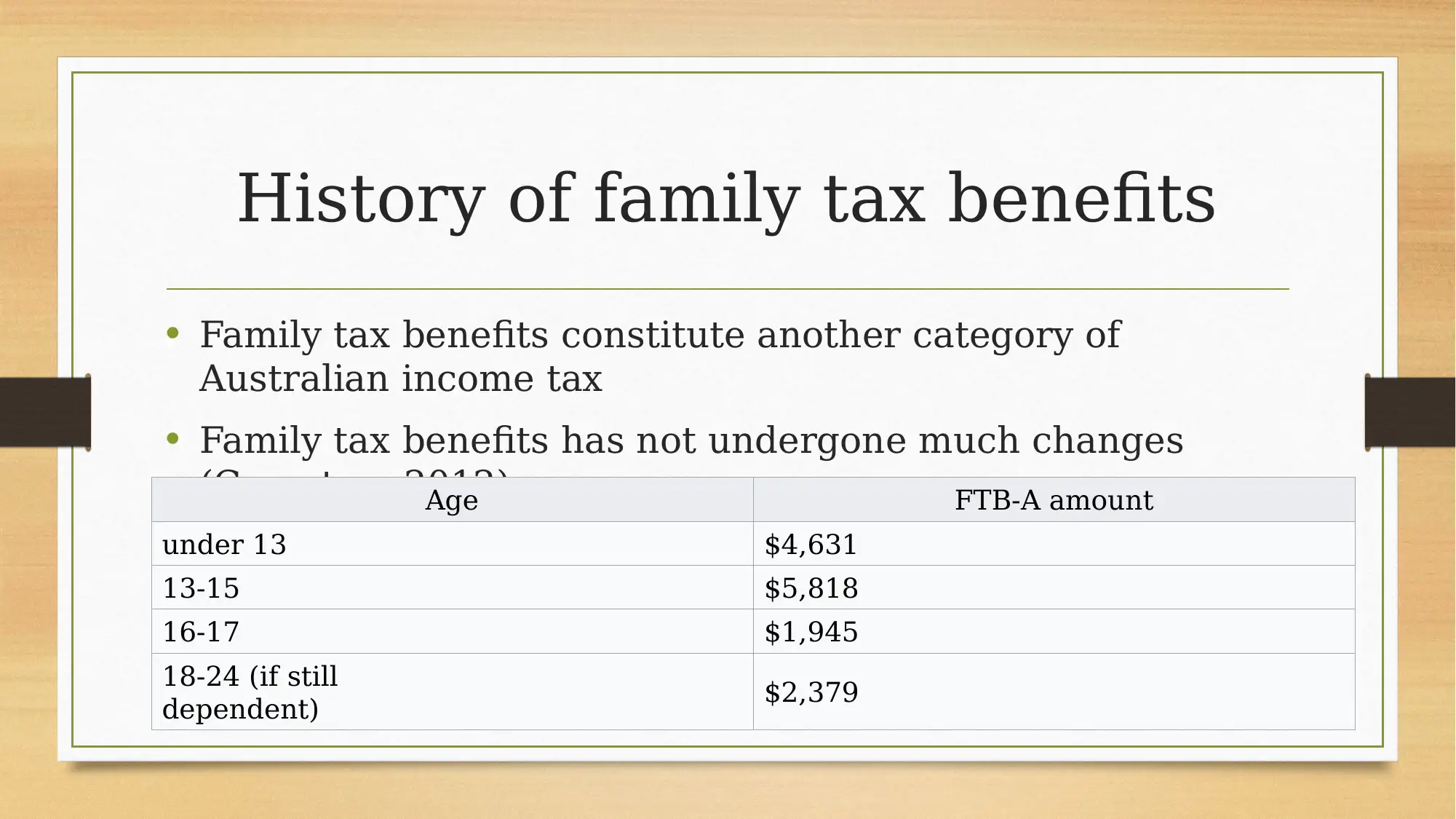

This presentation provides a comprehensive overview of the history of income tax in Australia, highlighting major historical landmarks such as the introduction of income tax in Queensland in 1902 and its expansion to the federal level during wartime in 1915. It details the evolution of various income tax categories, including personal income tax, company tax, capital gains tax, and family tax benefits, noting the progressive nature of personal income tax and adjustments to rates and brackets to accommodate economic conditions. The presentation compares individual tax rates from 1983-84 and 2016-17, discusses the introduction of the medical levy in 1984, and outlines the history of company tax, including the Australian dividend imputation system and tax rates for small businesses. It also covers the introduction of capital gains tax in 1985 and provides a brief overview of family tax benefits, concluding that each category of income tax in Australia has undergone unique historical developments. Desklib provides access to similar presentations and study resources for students.

1 out of 13

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)