LAWS20060 Taxation Law: Detailed Analysis and Application of Laws

VerifiedAdded on 2022/12/28

|21

|4006

|65

Report

AI Summary

This assignment provides a comprehensive analysis of various aspects of Australian taxation law. It addresses key areas such as the Commissioner's views on small business entities, deductions related to gifts and contributions, marginal tax rates, CGT assets, and the tax-free threshold. The assignment also differentiates between ordinary and statutory income, Medicare Levy and Medicare Levy Surcharge, and discusses the concepts of 'usual place of abode' and 'permanent place of abode' in determining residency. Furthermore, it evaluates the deductibility of various expenses, including HECS-HELP, travel, books, childcare, fridge repair, and clothing, referencing relevant sections of the Income Tax Assessment Act and case law. This document is available on Desklib, a platform offering study tools and solved assignments for students.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Couse ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Couse ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:......................................................................................................................3

Requirement A:............................................................................................................................3

Requirement B:............................................................................................................................3

Requirement C:............................................................................................................................3

Requirement D:............................................................................................................................3

Requirement E:............................................................................................................................4

Requirement F:............................................................................................................................4

Requirement G:............................................................................................................................4

Requirement H:............................................................................................................................5

Requirement I:.............................................................................................................................6

Answer to question 2:......................................................................................................................6

Answer to question 3:......................................................................................................................8

Answer to question 4:....................................................................................................................12

Answer to A:..............................................................................................................................12

Answer to B:..............................................................................................................................12

Answer to C:..............................................................................................................................13

Answer to D:..............................................................................................................................14

Answer to question 5:....................................................................................................................15

Answer A:..................................................................................................................................15

Table of Contents

Answer to question 1:......................................................................................................................3

Requirement A:............................................................................................................................3

Requirement B:............................................................................................................................3

Requirement C:............................................................................................................................3

Requirement D:............................................................................................................................3

Requirement E:............................................................................................................................4

Requirement F:............................................................................................................................4

Requirement G:............................................................................................................................4

Requirement H:............................................................................................................................5

Requirement I:.............................................................................................................................6

Answer to question 2:......................................................................................................................6

Answer to question 3:......................................................................................................................8

Answer to question 4:....................................................................................................................12

Answer to A:..............................................................................................................................12

Answer to B:..............................................................................................................................12

Answer to C:..............................................................................................................................13

Answer to D:..............................................................................................................................14

Answer to question 5:....................................................................................................................15

Answer A:..................................................................................................................................15

2TAXATION LAW

Answer B:..................................................................................................................................15

Answer to C:..............................................................................................................................16

Answer to D:..............................................................................................................................16

Answer to E:..............................................................................................................................17

References:....................................................................................................................................18

Answer B:..................................................................................................................................15

Answer to C:..............................................................................................................................16

Answer to D:..............................................................................................................................16

Answer to E:..............................................................................................................................17

References:....................................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Answer to question 1:

Requirement A:

The commissioner’s view was laid down by the ruling of TR 2019/1. It was happened

when the business was conducted by its business inside the connation of small business entity

which was under the “sec-25, ITRA 1986”, applied in 2015-16 and 206-17 years of income and

“sec-328-110, ITAA 1997”1.

Requirement B:

The deductions connecting to gifts or contributions have been explained under “Division

30, ITAA 1997”2.

Requirement C:

In the current tax year of 2019-20 where a person reports chargeable earnings of

$180,000 or more, an uppermost amount of marginal tax rate that is imposed on that person is

45% for each $1 above $180,000.

Requirement D:

As per the judicial setting up of Sec-108-20, IITA 1997 the motorcycle or car is viewed

as the non-exempted CGT assets, it is detained as the private usage asset3.

1 Taxation Ruling of TR 2019/1

2 Division 30, Income Tax Assessment Act 1997 (Cth).

3 Sec-108-20, Income Tax Assessment Act 1997 (Cth).

Answer to question 1:

Requirement A:

The commissioner’s view was laid down by the ruling of TR 2019/1. It was happened

when the business was conducted by its business inside the connation of small business entity

which was under the “sec-25, ITRA 1986”, applied in 2015-16 and 206-17 years of income and

“sec-328-110, ITAA 1997”1.

Requirement B:

The deductions connecting to gifts or contributions have been explained under “Division

30, ITAA 1997”2.

Requirement C:

In the current tax year of 2019-20 where a person reports chargeable earnings of

$180,000 or more, an uppermost amount of marginal tax rate that is imposed on that person is

45% for each $1 above $180,000.

Requirement D:

As per the judicial setting up of Sec-108-20, IITA 1997 the motorcycle or car is viewed

as the non-exempted CGT assets, it is detained as the private usage asset3.

1 Taxation Ruling of TR 2019/1

2 Division 30, Income Tax Assessment Act 1997 (Cth).

3 Sec-108-20, Income Tax Assessment Act 1997 (Cth).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

Requirement E:

Under the CGT event C1, Loss or demolition of the CGT asset is explained. If the CGT

event C1 occurs at the time when tax payer that possesses the asset is destroyed or lost; it was

explained under “Sec-104-20, IITA 1997”4. The tax payer will receive the compensation

involving to the destruction or loss during the time of event arises and when the loss is

discovered or the destruction happens.

Requirement F:

If it is proved that a person for the tax purpose in the present income year of 2019-20 is a

resident, then the initial $18,200 of their yearly earnings is not levied for tax. The amount of

$18,200 is viewed as tax-free amount.

Requirement G:

If a previous employer who established the company, gifts the shares of that public

company to the accountant; this consideration of the decision was made in “Hayes v FCT

(1956)”. The accountant was hired on a casual basis to the previous employer which provides a

small unpaid services and unpaid advice5. There was a genuine friendship between the taxpayer

and his employer’s families. According to the court, as it was not related to any kind of revenue

producing activity and there was a personal relationship between them, thus the gift cannot be

treated as income. However, the donor might intend of making gift their motive is hardly

determined.

4 Sec-104-20, Income Tax Assessment Act 1997 (Cth).

5 Hayes v Federal Commissioner of Taxation (1956) 96 CLR 47

Requirement E:

Under the CGT event C1, Loss or demolition of the CGT asset is explained. If the CGT

event C1 occurs at the time when tax payer that possesses the asset is destroyed or lost; it was

explained under “Sec-104-20, IITA 1997”4. The tax payer will receive the compensation

involving to the destruction or loss during the time of event arises and when the loss is

discovered or the destruction happens.

Requirement F:

If it is proved that a person for the tax purpose in the present income year of 2019-20 is a

resident, then the initial $18,200 of their yearly earnings is not levied for tax. The amount of

$18,200 is viewed as tax-free amount.

Requirement G:

If a previous employer who established the company, gifts the shares of that public

company to the accountant; this consideration of the decision was made in “Hayes v FCT

(1956)”. The accountant was hired on a casual basis to the previous employer which provides a

small unpaid services and unpaid advice5. There was a genuine friendship between the taxpayer

and his employer’s families. According to the court, as it was not related to any kind of revenue

producing activity and there was a personal relationship between them, thus the gift cannot be

treated as income. However, the donor might intend of making gift their motive is hardly

determined.

4 Sec-104-20, Income Tax Assessment Act 1997 (Cth).

5 Hayes v Federal Commissioner of Taxation (1956) 96 CLR 47

5TAXATION LAW

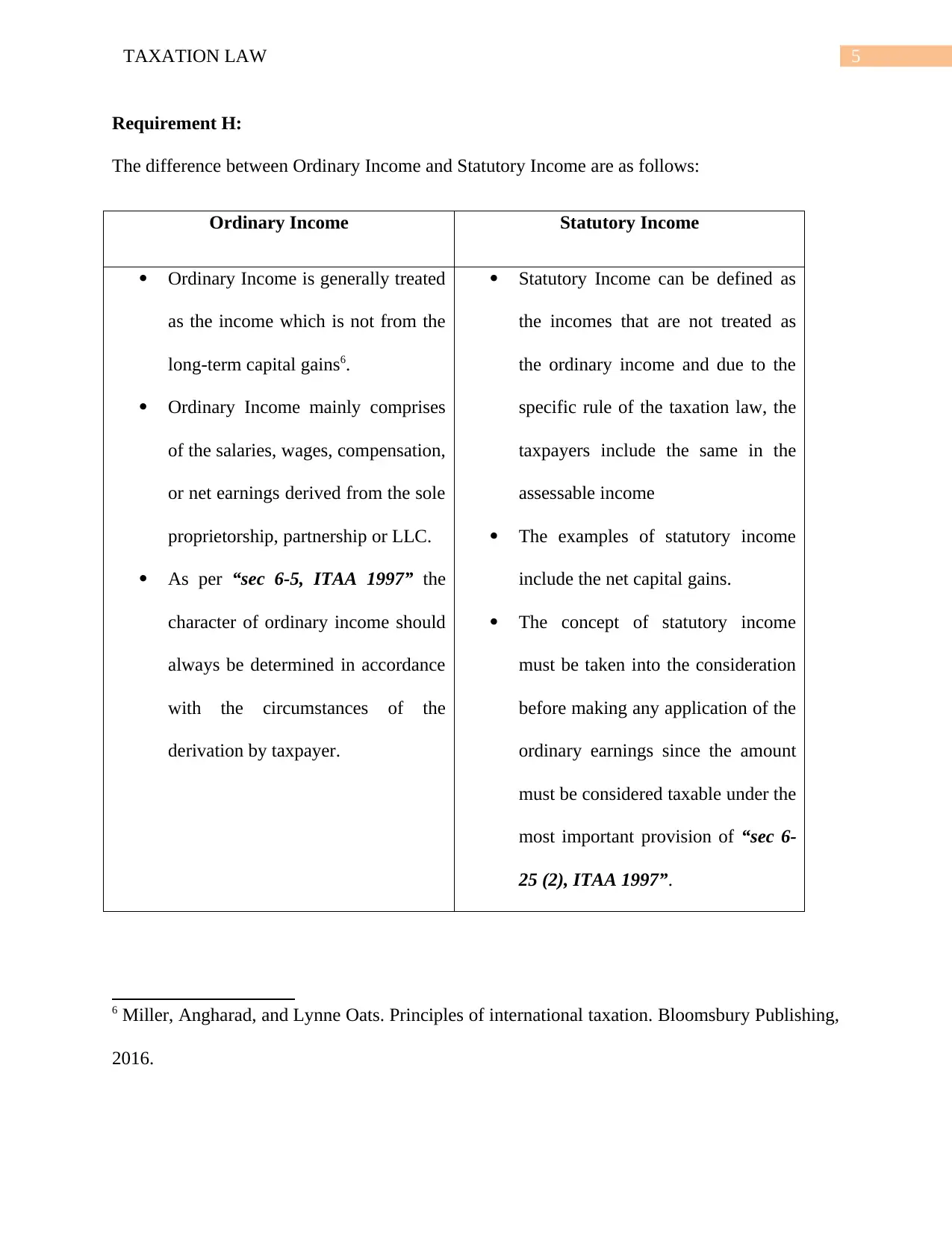

Requirement H:

The difference between Ordinary Income and Statutory Income are as follows:

Ordinary Income Statutory Income

Ordinary Income is generally treated

as the income which is not from the

long-term capital gains6.

Ordinary Income mainly comprises

of the salaries, wages, compensation,

or net earnings derived from the sole

proprietorship, partnership or LLC.

As per “sec 6-5, ITAA 1997” the

character of ordinary income should

always be determined in accordance

with the circumstances of the

derivation by taxpayer.

Statutory Income can be defined as

the incomes that are not treated as

the ordinary income and due to the

specific rule of the taxation law, the

taxpayers include the same in the

assessable income

The examples of statutory income

include the net capital gains.

The concept of statutory income

must be taken into the consideration

before making any application of the

ordinary earnings since the amount

must be considered taxable under the

most important provision of “sec 6-

25 (2), ITAA 1997”.

6 Miller, Angharad, and Lynne Oats. Principles of international taxation. Bloomsbury Publishing,

2016.

Requirement H:

The difference between Ordinary Income and Statutory Income are as follows:

Ordinary Income Statutory Income

Ordinary Income is generally treated

as the income which is not from the

long-term capital gains6.

Ordinary Income mainly comprises

of the salaries, wages, compensation,

or net earnings derived from the sole

proprietorship, partnership or LLC.

As per “sec 6-5, ITAA 1997” the

character of ordinary income should

always be determined in accordance

with the circumstances of the

derivation by taxpayer.

Statutory Income can be defined as

the incomes that are not treated as

the ordinary income and due to the

specific rule of the taxation law, the

taxpayers include the same in the

assessable income

The examples of statutory income

include the net capital gains.

The concept of statutory income

must be taken into the consideration

before making any application of the

ordinary earnings since the amount

must be considered taxable under the

most important provision of “sec 6-

25 (2), ITAA 1997”.

6 Miller, Angharad, and Lynne Oats. Principles of international taxation. Bloomsbury Publishing,

2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

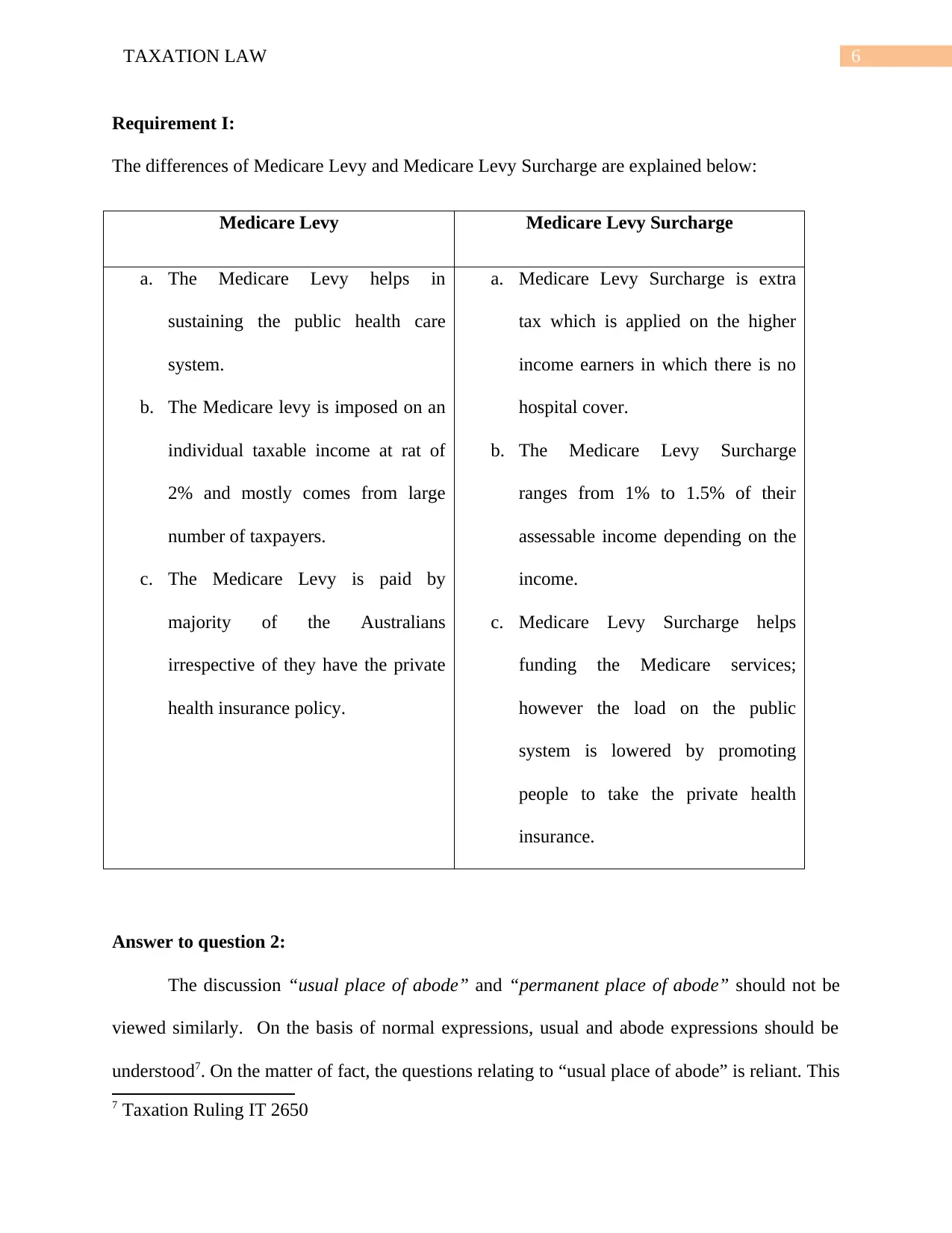

Requirement I:

The differences of Medicare Levy and Medicare Levy Surcharge are explained below:

Medicare Levy Medicare Levy Surcharge

a. The Medicare Levy helps in

sustaining the public health care

system.

b. The Medicare levy is imposed on an

individual taxable income at rat of

2% and mostly comes from large

number of taxpayers.

c. The Medicare Levy is paid by

majority of the Australians

irrespective of they have the private

health insurance policy.

a. Medicare Levy Surcharge is extra

tax which is applied on the higher

income earners in which there is no

hospital cover.

b. The Medicare Levy Surcharge

ranges from 1% to 1.5% of their

assessable income depending on the

income.

c. Medicare Levy Surcharge helps

funding the Medicare services;

however the load on the public

system is lowered by promoting

people to take the private health

insurance.

Answer to question 2:

The discussion “usual place of abode” and “permanent place of abode” should not be

viewed similarly. On the basis of normal expressions, usual and abode expressions should be

understood7. On the matter of fact, the questions relating to “usual place of abode” is reliant. This

7 Taxation Ruling IT 2650

Requirement I:

The differences of Medicare Levy and Medicare Levy Surcharge are explained below:

Medicare Levy Medicare Levy Surcharge

a. The Medicare Levy helps in

sustaining the public health care

system.

b. The Medicare levy is imposed on an

individual taxable income at rat of

2% and mostly comes from large

number of taxpayers.

c. The Medicare Levy is paid by

majority of the Australians

irrespective of they have the private

health insurance policy.

a. Medicare Levy Surcharge is extra

tax which is applied on the higher

income earners in which there is no

hospital cover.

b. The Medicare Levy Surcharge

ranges from 1% to 1.5% of their

assessable income depending on the

income.

c. Medicare Levy Surcharge helps

funding the Medicare services;

however the load on the public

system is lowered by promoting

people to take the private health

insurance.

Answer to question 2:

The discussion “usual place of abode” and “permanent place of abode” should not be

viewed similarly. On the basis of normal expressions, usual and abode expressions should be

understood7. On the matter of fact, the questions relating to “usual place of abode” is reliant. This

7 Taxation Ruling IT 2650

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

expression is generally treated as customary abode or when an individual is generally present in

that state it is commonly used. They must exhibit the qualities of residence to live on contrary

to an overnight stay, weekly or periodic housing of a traveller, the person should have a fixed

place of abode. Thus, it derives that a fixed relation with the assured places of residence rather

than those where an individual usually an inhabitant or those that has their “usual place of

abode” in Australia.

It would be viewed as transitory; if a person in Australia has the “usual place of abode”,

apart from that there is no fixed or usual place of abode in foreign country, but moves from one

country to another or frequently shifts inside the nation or has any kind of relation with the

certain place in overseas. Thus the person would be treated as having adopted another residence

of their choice or “permanent place of abode”.

A person can be indicated that has a home in Australia is by the expression “permanent

place of abode”. The description of the “resident” denoted by “subparagraph (a) (i)” required

the taxation office to be satisfied that an individual’s “permanent place of abode” is not outside

Australia. The expression “place of abode” denotes that the tax payer should have a home where

he or she stays with the family. The judgement which was made on “Levene v IRC (1928)”,

states that the tax payer’s “place of abode” constitutes the resident of the individual where he or

she lives8.

The judgement that was made on “FCT v Applegate (1979)” states that the taxpayer had

the residence in Australia, went to New Hebrides in Villa to set up an office for his company9.

8 Levene v IRC (1928) AC 217

9 Federal Commissioner of Taxation v Applegate (1979) 82 ATR 899

expression is generally treated as customary abode or when an individual is generally present in

that state it is commonly used. They must exhibit the qualities of residence to live on contrary

to an overnight stay, weekly or periodic housing of a traveller, the person should have a fixed

place of abode. Thus, it derives that a fixed relation with the assured places of residence rather

than those where an individual usually an inhabitant or those that has their “usual place of

abode” in Australia.

It would be viewed as transitory; if a person in Australia has the “usual place of abode”,

apart from that there is no fixed or usual place of abode in foreign country, but moves from one

country to another or frequently shifts inside the nation or has any kind of relation with the

certain place in overseas. Thus the person would be treated as having adopted another residence

of their choice or “permanent place of abode”.

A person can be indicated that has a home in Australia is by the expression “permanent

place of abode”. The description of the “resident” denoted by “subparagraph (a) (i)” required

the taxation office to be satisfied that an individual’s “permanent place of abode” is not outside

Australia. The expression “place of abode” denotes that the tax payer should have a home where

he or she stays with the family. The judgement which was made on “Levene v IRC (1928)”,

states that the tax payer’s “place of abode” constitutes the resident of the individual where he or

she lives8.

The judgement that was made on “FCT v Applegate (1979)” states that the taxpayer had

the residence in Australia, went to New Hebrides in Villa to set up an office for his company9.

8 Levene v IRC (1928) AC 217

9 Federal Commissioner of Taxation v Applegate (1979) 82 ATR 899

8TAXATION LAW

The verdict as per the federal court was that the permanent place of abode of tax payer was out

of Australia and was considered as the non-resident of Australia in the relevant income year.

Another example of “FCT v Jenkins (1982)” states that the tax payer was the bank officer, who

was related to New Hebrides for a period of three years and ultimately came back after 18

months due to poor health10. The decision which was made by Queensland Supreme Court states

that the “permanent place of abode” of the tax payer was not in Australia through this period of

his overseas stay despite the fact he does not have any material time developed at any intention

of remaining for indefinitely in New Hebrides. A tax payer’s “permanent place of abode”

cannot be determined by imposing any immediate rules, as per the case of “Applegate” and

“Jenkins”.

The above mentioned discussion explains that a person would not be satisfied if the

“usual place of abode” is outside Australia. In the meantime the first statutory needs an

individual to satisfy their “permanent place of abode” is out of Australia.

Answer to question 3:

HECS-HELP: $850:

A taxpayer would get income deduction if his expenses are related to self-education. Self-

education is the process of upgrading qualification which is allowed the employee to enhance

earnings. This further results in the improvement of current employment status. Notwithstanding,

no income tax deduction is allowed in relation to the expenses undertaken for the HECS-HELP.

Therefore, cost of $850 made by a taxpayer for the HESC-HELP is not permitted for income

deduction.

10 Federal Commissioner of Taxation v Jenkins (1982) 12 ATR 745

The verdict as per the federal court was that the permanent place of abode of tax payer was out

of Australia and was considered as the non-resident of Australia in the relevant income year.

Another example of “FCT v Jenkins (1982)” states that the tax payer was the bank officer, who

was related to New Hebrides for a period of three years and ultimately came back after 18

months due to poor health10. The decision which was made by Queensland Supreme Court states

that the “permanent place of abode” of the tax payer was not in Australia through this period of

his overseas stay despite the fact he does not have any material time developed at any intention

of remaining for indefinitely in New Hebrides. A tax payer’s “permanent place of abode”

cannot be determined by imposing any immediate rules, as per the case of “Applegate” and

“Jenkins”.

The above mentioned discussion explains that a person would not be satisfied if the

“usual place of abode” is outside Australia. In the meantime the first statutory needs an

individual to satisfy their “permanent place of abode” is out of Australia.

Answer to question 3:

HECS-HELP: $850:

A taxpayer would get income deduction if his expenses are related to self-education. Self-

education is the process of upgrading qualification which is allowed the employee to enhance

earnings. This further results in the improvement of current employment status. Notwithstanding,

no income tax deduction is allowed in relation to the expenses undertaken for the HECS-HELP.

Therefore, cost of $850 made by a taxpayer for the HESC-HELP is not permitted for income

deduction.

10 Federal Commissioner of Taxation v Jenkins (1982) 12 ATR 745

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Travel – work to university $110:

A taxpayer can get income tax deduction if he incurs travel expenses due to place of

education. Travel expense is considerable when the taxpayer needs to stay outside the home for

one or more than one night11. Moreover, daily expense incurred due to travel from workplace to

educational institute can be claimed by the taxpayer12. In this context, the statutory provision of

“section 8-1, ITAA 1997” is worth to be mention as it allows the deduction in relation to the

travel expense from work to academy.

Books $200:

The self-education expenses related to taxpayer’s skill enhancement program is allowed

for deduction. An employer wants to develop skill owing to get development either in income or

professional knowledge. According to the provision of “FCT v Finn (1961)”, an architecture

can avail tax deduction facility for abroad study expense as this cost is related to career progress

and better pay scale13. Likewise, expenditure incurred by an accountant for buying books is also

considered as a permissible deduction as suggested by the endowment made in “section 8-1,

ITAA 1997”. This expense comes into consideration as it will generate future revenue to the

taxpayer.

Childcare during the course of evening classes $80:

11 Section 8-1, Income Tax Assessment Act 1997 (Cth).

12 Section 8-1, Income Tax Assessment Act 1997 (Cth).

13 Federal Commissioner of Taxation v Finn (1961) 106 CLR 60

Travel – work to university $110:

A taxpayer can get income tax deduction if he incurs travel expenses due to place of

education. Travel expense is considerable when the taxpayer needs to stay outside the home for

one or more than one night11. Moreover, daily expense incurred due to travel from workplace to

educational institute can be claimed by the taxpayer12. In this context, the statutory provision of

“section 8-1, ITAA 1997” is worth to be mention as it allows the deduction in relation to the

travel expense from work to academy.

Books $200:

The self-education expenses related to taxpayer’s skill enhancement program is allowed

for deduction. An employer wants to develop skill owing to get development either in income or

professional knowledge. According to the provision of “FCT v Finn (1961)”, an architecture

can avail tax deduction facility for abroad study expense as this cost is related to career progress

and better pay scale13. Likewise, expenditure incurred by an accountant for buying books is also

considered as a permissible deduction as suggested by the endowment made in “section 8-1,

ITAA 1997”. This expense comes into consideration as it will generate future revenue to the

taxpayer.

Childcare during the course of evening classes $80:

11 Section 8-1, Income Tax Assessment Act 1997 (Cth).

12 Section 8-1, Income Tax Assessment Act 1997 (Cth).

13 Federal Commissioner of Taxation v Finn (1961) 106 CLR 60

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

The second part of “section 8-1 (2) (b), ITAA 1997” suggests that expenses related to

“domestic or private” purposes may not be considered for tax deduction. This decision is allowed

to be considered as household expense are not always capable to bring positive outcome in the

growth prospect14. In this context, income tax deduction in relation to the child care costs are not

permissible to obtain tax deduction facility, stated in the verdict of “section 8-1 (2)(b), ITAA

1997”.. This sort of outgoing is neither related to the productive work nor enhances income of

the taxpayer. For an example, outgoings of $80 associated with the child care facility is non-

permissible under “section 8-1 (2) (b), ITAA 1997” as the taxpayer has incurred this cost owing

to attain the evening class. Further, this expenses has no relevance with the revenue generation15.

Fridge repair cost of $250 at home:

The legal provision of “section 8-1 2) (b), ITAA 1997” affirms that private or domestic

expenses are not deductible item from income tax policy. Any kind of residential shifting cost

due to job reallocation will not provide tax relief to the taxpayers16. The outgoings related to

domestic reallocation does not enhance income growth. Similarly, fridge repairing cost of $20 at

resident is considered as a part of domestic expenses, resulting in that this is a non-deductible

item under “section 8-1 (2) (b), ITAA 1997”.

Black trousers and shirt purchase cost of $145 for official purpose:

14 Schenk, Deborah H. Federal Taxation of S Corporations. Law Journal Press, 2017.

15 Lodge v Federal Commissioner of Taxation (1972) HCA 49

16 Brownlee, W. Elliot. Federal Taxation in Australia. Cambridge University Press, 2016.

The second part of “section 8-1 (2) (b), ITAA 1997” suggests that expenses related to

“domestic or private” purposes may not be considered for tax deduction. This decision is allowed

to be considered as household expense are not always capable to bring positive outcome in the

growth prospect14. In this context, income tax deduction in relation to the child care costs are not

permissible to obtain tax deduction facility, stated in the verdict of “section 8-1 (2)(b), ITAA

1997”.. This sort of outgoing is neither related to the productive work nor enhances income of

the taxpayer. For an example, outgoings of $80 associated with the child care facility is non-

permissible under “section 8-1 (2) (b), ITAA 1997” as the taxpayer has incurred this cost owing

to attain the evening class. Further, this expenses has no relevance with the revenue generation15.

Fridge repair cost of $250 at home:

The legal provision of “section 8-1 2) (b), ITAA 1997” affirms that private or domestic

expenses are not deductible item from income tax policy. Any kind of residential shifting cost

due to job reallocation will not provide tax relief to the taxpayers16. The outgoings related to

domestic reallocation does not enhance income growth. Similarly, fridge repairing cost of $20 at

resident is considered as a part of domestic expenses, resulting in that this is a non-deductible

item under “section 8-1 (2) (b), ITAA 1997”.

Black trousers and shirt purchase cost of $145 for official purpose:

14 Schenk, Deborah H. Federal Taxation of S Corporations. Law Journal Press, 2017.

15 Lodge v Federal Commissioner of Taxation (1972) HCA 49

16 Brownlee, W. Elliot. Federal Taxation in Australia. Cambridge University Press, 2016.

11TAXATION LAW

In terms of the legal provision of “section 8-1, ITAA 1997”, expense related to purchase

of ordinary apparel will not be considered as a non-deductible income tax object17. As per the

verdict made in Mansfield v FCT (1996)” outgoings incurred for ordinary clothing purchase is

non-deductible even if this incurs due to the maintaining the proper appearance policy at an

office. Likewise, outgoings of $145 due to purchase of black trousers and shirts to maintain the

official outfit norms is non-allowable deduction under the provision of “section 8-1, ITAA

1997” since this counts as a usual attire18.

Legal expenses for writing up a new employment with a new employer $300:

Expenses incurred during the course of revenue generating program at initial stage will

not be considered as a non-deductible income tax item under the provision of “section 8-1, ITAA

1997”. As per the statement made in “Maddalena v FCT (1971)” by the federal court, outgoings

incurred by the employers during the process of new employment generation is not permissible

for income tax deduction as the expenses cannot stimulate quantifiable income19.

Answer to question 4:

Answer to A:

A CGT comes in presence where an individual has been granted with a lease of if they

extend or renews the lease which was previously owned by the Tax payer. No deduction is

permitted to the tax payers, which should be denoted by the taxpayers when CGT event F1

17 Section 8-1, Income Tax Assessment Act 1997 (Cth)

18 Mansfield v Federal Commissioner of Taxation (1996) ATC 4001

19 Maddalena v Federal Commissioner of Taxation (1971) ATC 4161

In terms of the legal provision of “section 8-1, ITAA 1997”, expense related to purchase

of ordinary apparel will not be considered as a non-deductible income tax object17. As per the

verdict made in Mansfield v FCT (1996)” outgoings incurred for ordinary clothing purchase is

non-deductible even if this incurs due to the maintaining the proper appearance policy at an

office. Likewise, outgoings of $145 due to purchase of black trousers and shirts to maintain the

official outfit norms is non-allowable deduction under the provision of “section 8-1, ITAA

1997” since this counts as a usual attire18.

Legal expenses for writing up a new employment with a new employer $300:

Expenses incurred during the course of revenue generating program at initial stage will

not be considered as a non-deductible income tax item under the provision of “section 8-1, ITAA

1997”. As per the statement made in “Maddalena v FCT (1971)” by the federal court, outgoings

incurred by the employers during the process of new employment generation is not permissible

for income tax deduction as the expenses cannot stimulate quantifiable income19.

Answer to question 4:

Answer to A:

A CGT comes in presence where an individual has been granted with a lease of if they

extend or renews the lease which was previously owned by the Tax payer. No deduction is

permitted to the tax payers, which should be denoted by the taxpayers when CGT event F1

17 Section 8-1, Income Tax Assessment Act 1997 (Cth)

18 Mansfield v Federal Commissioner of Taxation (1996) ATC 4001

19 Maddalena v Federal Commissioner of Taxation (1971) ATC 4161

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.