Taxation Law Assignment - University, LAWS20060, Term 2, 2019

VerifiedAdded on 2023/01/05

|18

|3675

|50

Homework Assignment

AI Summary

This taxation law assignment provides a comprehensive analysis of Australian tax principles, covering various aspects of income tax, capital gains tax (CGT), and relevant legal cases. The assignment addresses key concepts such as determining whether a company is conducting business activities, computation of deductions for gifts, and the application of marginal tax rates for residents. It delves into the specifics of CGT events, including the loss or destruction of CGT assets, and clarifies the distinction between ordinary and statutory income, as well as the differences between Medicare Levy and Medicare Levy Surcharge. The assignment also explores the concept of residency, differentiating between the "usual place of abode" and "permanent place of abode." Further, it assesses the deductibility of various expenses, including HECS-HELP, travel, books, childcare, and home repairs, referencing relevant legislation and rulings. The assignment concludes by discussing capital gains tax events, including the impact of specific events on CGT liabilities. The assignment is based on the provided assignment brief for LAWS20060, Term 2, 2019.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................5

Answer to question 3:.................................................................................................................7

Answer to question 4:...............................................................................................................10

Answer to question 5:...............................................................................................................12

References:...............................................................................................................................16

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................5

Answer to question 3:.................................................................................................................7

Answer to question 4:...............................................................................................................10

Answer to question 5:...............................................................................................................12

References:...............................................................................................................................16

2TAXATION LAW

Answer to question 1:

Answer A:

Denoting the explanation in “taxation ruling of TR 2019/1” it is associated with

determining when actually a company is conducting its business activities1. This ruling

involves the view of commissioner when the company is carrying its business within the

purview of small business entity stated in “s-23, ITRA 1986” as effective from 2015-16 and

2016-17 income years and inside “s328-110, ITAA 1997”.

Answer B:

The most important rules regarding the manner of computing the deduction for gifts

and contribution has been explained under the “Division 30, ITAA 1997”2.

Answer C:

A person who is a tax resident of Australia and have reported an income of beyond

$180,001 a maximum extent of marginal tax of 45% is applied on them for the income year

of 2019-20.

Answer D:

From the regimes of capital gains tax generally motorcycle and car are not exempted

from the capital gains tax3. They are considered as the personal use asset under “Sec-108-20,

1 Taxation Ruling of TR 2019/1

2 Division 30, Income Tax Assessment Act 1997 (Cth).

3 Sec-108-20, Income Tax Assessment Act 1997 (Cth).

Answer to question 1:

Answer A:

Denoting the explanation in “taxation ruling of TR 2019/1” it is associated with

determining when actually a company is conducting its business activities1. This ruling

involves the view of commissioner when the company is carrying its business within the

purview of small business entity stated in “s-23, ITRA 1986” as effective from 2015-16 and

2016-17 income years and inside “s328-110, ITAA 1997”.

Answer B:

The most important rules regarding the manner of computing the deduction for gifts

and contribution has been explained under the “Division 30, ITAA 1997”2.

Answer C:

A person who is a tax resident of Australia and have reported an income of beyond

$180,001 a maximum extent of marginal tax of 45% is applied on them for the income year

of 2019-20.

Answer D:

From the regimes of capital gains tax generally motorcycle and car are not exempted

from the capital gains tax3. They are considered as the personal use asset under “Sec-108-20,

1 Taxation Ruling of TR 2019/1

2 Division 30, Income Tax Assessment Act 1997 (Cth).

3 Sec-108-20, Income Tax Assessment Act 1997 (Cth).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

IITA 1997”. An exemption is only allowed for CGT when the cost base of the motor cycles

and car is below the $10,000.

Answer E:

Under the “s 104-20 (1), ITAA 1997” the GGT event C1 is largely related to end of

CGT asset. The CGT event C1 follows when the taxpayer that owns the CGT asset is lost or

destroyed. Under this event time plays a vital role4. This comprises of when the first

compensation was received by the taxpayer for loss or destruction or if no compensation is

received by the taxpayer following the loss or destruction of CGT asset.

Answer F:

When an individual is viewed as Australian resident then in such case their first

$18,200 annual income is not considered for tax. The sum of $18,200 is viewed as tax-free

amount.

Answer G:

The federal courts judgement in “Hayes v FCT (1956)” denoted that receipts that are

not found to be the produce or reward for service then it is not held as taxable ordinary

returns. The case is viewed as vital because it explains that a gift which is received by the

taxpayer for their personal relation is not treated assessable as ordinary earnings5. While

differentiating amid the non-assessable private gifts and taxable voluntary receipt associated

to service, it is necessary to focus on the type or character of receipts in the hands of

recipient.

4 Sec-104-20, Income Tax Assessment Act 1997 (Cth).

5 Hayes v Federal Commissioner of Taxation (1956) 96 CLR 47

IITA 1997”. An exemption is only allowed for CGT when the cost base of the motor cycles

and car is below the $10,000.

Answer E:

Under the “s 104-20 (1), ITAA 1997” the GGT event C1 is largely related to end of

CGT asset. The CGT event C1 follows when the taxpayer that owns the CGT asset is lost or

destroyed. Under this event time plays a vital role4. This comprises of when the first

compensation was received by the taxpayer for loss or destruction or if no compensation is

received by the taxpayer following the loss or destruction of CGT asset.

Answer F:

When an individual is viewed as Australian resident then in such case their first

$18,200 annual income is not considered for tax. The sum of $18,200 is viewed as tax-free

amount.

Answer G:

The federal courts judgement in “Hayes v FCT (1956)” denoted that receipts that are

not found to be the produce or reward for service then it is not held as taxable ordinary

returns. The case is viewed as vital because it explains that a gift which is received by the

taxpayer for their personal relation is not treated assessable as ordinary earnings5. While

differentiating amid the non-assessable private gifts and taxable voluntary receipt associated

to service, it is necessary to focus on the type or character of receipts in the hands of

recipient.

4 Sec-104-20, Income Tax Assessment Act 1997 (Cth).

5 Hayes v Federal Commissioner of Taxation (1956) 96 CLR 47

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

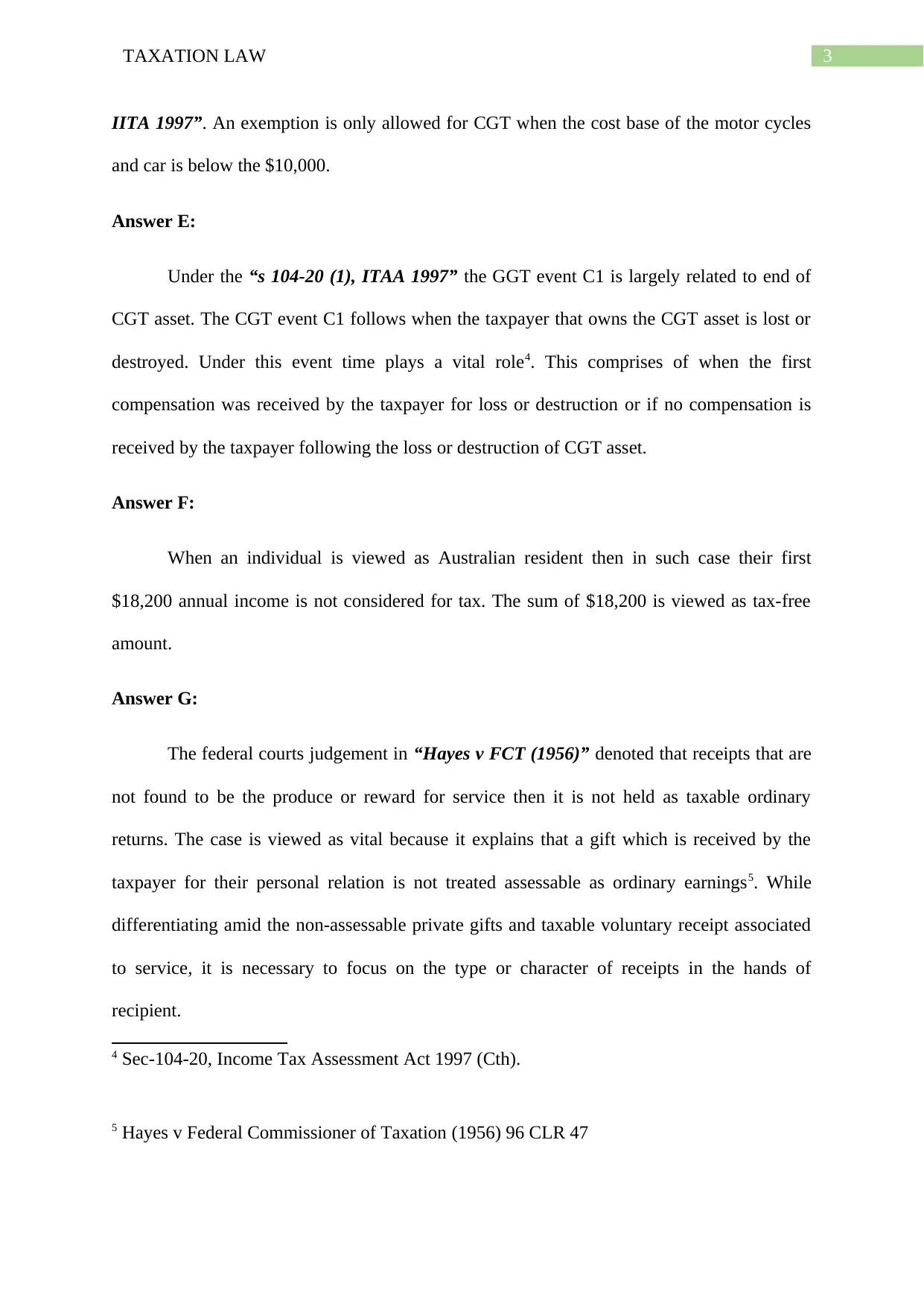

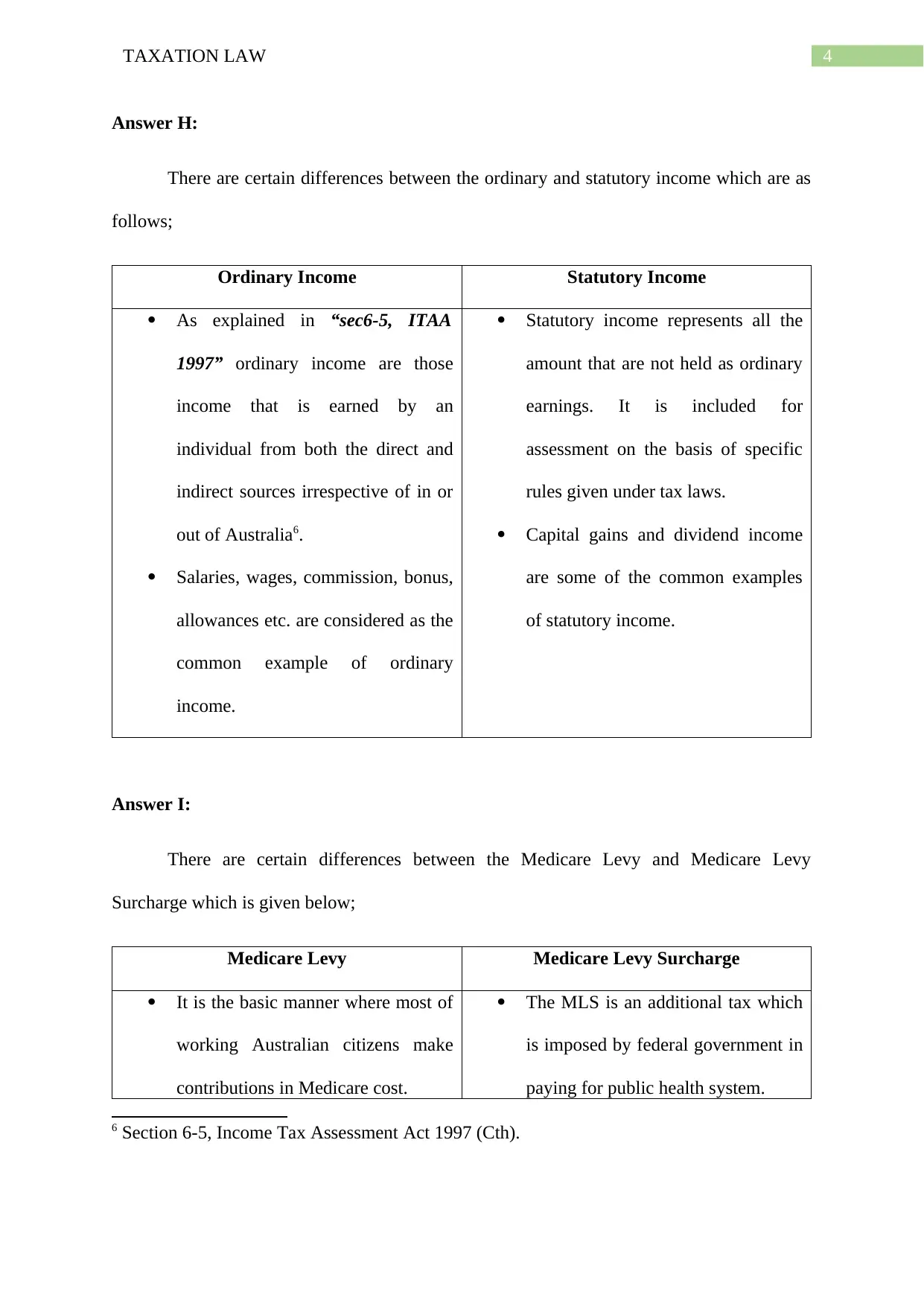

Answer H:

There are certain differences between the ordinary and statutory income which are as

follows;

Ordinary Income Statutory Income

As explained in “sec6-5, ITAA

1997” ordinary income are those

income that is earned by an

individual from both the direct and

indirect sources irrespective of in or

out of Australia6.

Salaries, wages, commission, bonus,

allowances etc. are considered as the

common example of ordinary

income.

Statutory income represents all the

amount that are not held as ordinary

earnings. It is included for

assessment on the basis of specific

rules given under tax laws.

Capital gains and dividend income

are some of the common examples

of statutory income.

Answer I:

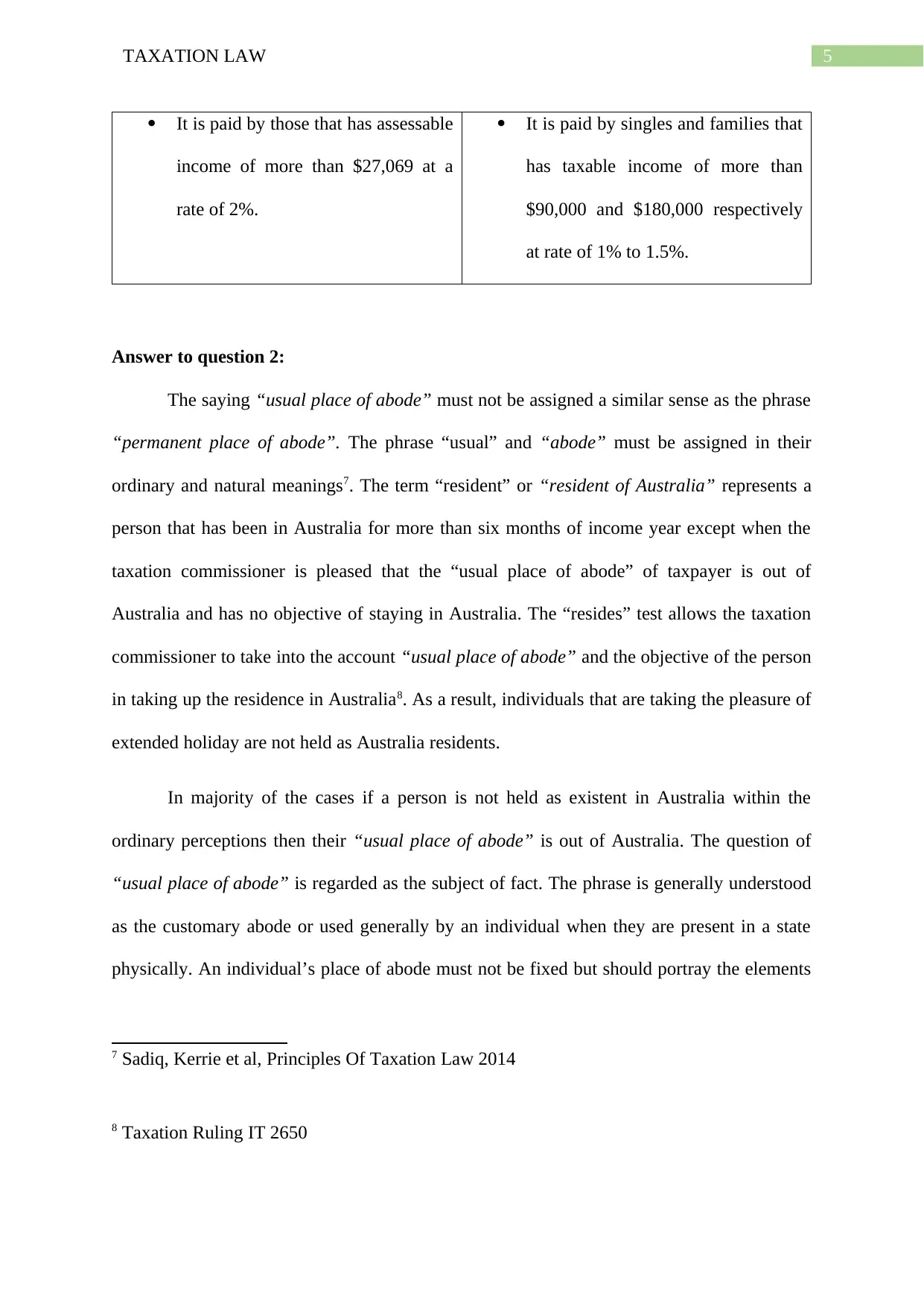

There are certain differences between the Medicare Levy and Medicare Levy

Surcharge which is given below;

Medicare Levy Medicare Levy Surcharge

It is the basic manner where most of

working Australian citizens make

contributions in Medicare cost.

The MLS is an additional tax which

is imposed by federal government in

paying for public health system.

6 Section 6-5, Income Tax Assessment Act 1997 (Cth).

Answer H:

There are certain differences between the ordinary and statutory income which are as

follows;

Ordinary Income Statutory Income

As explained in “sec6-5, ITAA

1997” ordinary income are those

income that is earned by an

individual from both the direct and

indirect sources irrespective of in or

out of Australia6.

Salaries, wages, commission, bonus,

allowances etc. are considered as the

common example of ordinary

income.

Statutory income represents all the

amount that are not held as ordinary

earnings. It is included for

assessment on the basis of specific

rules given under tax laws.

Capital gains and dividend income

are some of the common examples

of statutory income.

Answer I:

There are certain differences between the Medicare Levy and Medicare Levy

Surcharge which is given below;

Medicare Levy Medicare Levy Surcharge

It is the basic manner where most of

working Australian citizens make

contributions in Medicare cost.

The MLS is an additional tax which

is imposed by federal government in

paying for public health system.

6 Section 6-5, Income Tax Assessment Act 1997 (Cth).

5TAXATION LAW

It is paid by those that has assessable

income of more than $27,069 at a

rate of 2%.

It is paid by singles and families that

has taxable income of more than

$90,000 and $180,000 respectively

at rate of 1% to 1.5%.

Answer to question 2:

The saying “usual place of abode” must not be assigned a similar sense as the phrase

“permanent place of abode”. The phrase “usual” and “abode” must be assigned in their

ordinary and natural meanings7. The term “resident” or “resident of Australia” represents a

person that has been in Australia for more than six months of income year except when the

taxation commissioner is pleased that the “usual place of abode” of taxpayer is out of

Australia and has no objective of staying in Australia. The “resides” test allows the taxation

commissioner to take into the account “usual place of abode” and the objective of the person

in taking up the residence in Australia8. As a result, individuals that are taking the pleasure of

extended holiday are not held as Australia residents.

In majority of the cases if a person is not held as existent in Australia within the

ordinary perceptions then their “usual place of abode” is out of Australia. The question of

“usual place of abode” is regarded as the subject of fact. The phrase is generally understood

as the customary abode or used generally by an individual when they are present in a state

physically. An individual’s place of abode must not be fixed but should portray the elements

7 Sadiq, Kerrie et al, Principles Of Taxation Law 2014

8 Taxation Ruling IT 2650

It is paid by those that has assessable

income of more than $27,069 at a

rate of 2%.

It is paid by singles and families that

has taxable income of more than

$90,000 and $180,000 respectively

at rate of 1% to 1.5%.

Answer to question 2:

The saying “usual place of abode” must not be assigned a similar sense as the phrase

“permanent place of abode”. The phrase “usual” and “abode” must be assigned in their

ordinary and natural meanings7. The term “resident” or “resident of Australia” represents a

person that has been in Australia for more than six months of income year except when the

taxation commissioner is pleased that the “usual place of abode” of taxpayer is out of

Australia and has no objective of staying in Australia. The “resides” test allows the taxation

commissioner to take into the account “usual place of abode” and the objective of the person

in taking up the residence in Australia8. As a result, individuals that are taking the pleasure of

extended holiday are not held as Australia residents.

In majority of the cases if a person is not held as existent in Australia within the

ordinary perceptions then their “usual place of abode” is out of Australia. The question of

“usual place of abode” is regarded as the subject of fact. The phrase is generally understood

as the customary abode or used generally by an individual when they are present in a state

physically. An individual’s place of abode must not be fixed but should portray the elements

7 Sadiq, Kerrie et al, Principles Of Taxation Law 2014

8 Taxation Ruling IT 2650

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

of a particular place where he or she lives, in contrast to a mere overnight stay, weekly or

monthly accommodation as visitor9.

The expression “permanent place of abode” represents that a person that has his or

her domicile in Australia with respect to the meaning given under “subparagraph (a)(i)” of

residence. It also needs the contentment of commissioner that the person’s “permanent place

of abode” is out of the country. What amounts to a “permanent place of abode” is given in

“Applegate v FCT (1979)”. The federal law court noticed that in spite of the fact that

Applegate has retained his domicile in Australia but has established a “permanent place of

abode” out of the country10. The court noticed that “permanent” under this background was

somewhat less than eternal, and was either a fixed or the habitual place of abode.

Similarly, in “Harding v FC of T (2019)” in allowing the appeal of the taxpayer the

federal court at the time of assessing stated that while determining a person’s residency the

expression “permanent place of abode” must not be understood by referring to only a

person’s specific dwelling11. As a substitute, adequate emphasis must be placed to take into

account whether a person is residing permanently in a chosen state or nation.

The explanations above from Applegate and Harding’s makes it clear that

“permanent place of abode” cannot be determined by applying any hard and fast rules. It is

only the matter of fact that needs to be ascertained in every instance.

9 Woellner, R. H, Australian Taxation Law 2016 (CCH Australia, 2016)

10 Applegate v Federal Commissioner of Taxation (1979) ATC 4307

11 Harding v Federal Commissioner of Taxation (2019) FCAFC 29

of a particular place where he or she lives, in contrast to a mere overnight stay, weekly or

monthly accommodation as visitor9.

The expression “permanent place of abode” represents that a person that has his or

her domicile in Australia with respect to the meaning given under “subparagraph (a)(i)” of

residence. It also needs the contentment of commissioner that the person’s “permanent place

of abode” is out of the country. What amounts to a “permanent place of abode” is given in

“Applegate v FCT (1979)”. The federal law court noticed that in spite of the fact that

Applegate has retained his domicile in Australia but has established a “permanent place of

abode” out of the country10. The court noticed that “permanent” under this background was

somewhat less than eternal, and was either a fixed or the habitual place of abode.

Similarly, in “Harding v FC of T (2019)” in allowing the appeal of the taxpayer the

federal court at the time of assessing stated that while determining a person’s residency the

expression “permanent place of abode” must not be understood by referring to only a

person’s specific dwelling11. As a substitute, adequate emphasis must be placed to take into

account whether a person is residing permanently in a chosen state or nation.

The explanations above from Applegate and Harding’s makes it clear that

“permanent place of abode” cannot be determined by applying any hard and fast rules. It is

only the matter of fact that needs to be ascertained in every instance.

9 Woellner, R. H, Australian Taxation Law 2016 (CCH Australia, 2016)

10 Applegate v Federal Commissioner of Taxation (1979) ATC 4307

11 Harding v Federal Commissioner of Taxation (2019) FCAFC 29

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Answer to question 3:

HECS-HELP: $850:

As explained in the “sec 26-20, ITAA 1997” a deduction is prohibited to the taxpayer

for certain study-associated payment such as the HECS-HELP. Evident here suggest that the

trainee accountant has undertaken self-education and has occurred a sum of $850 as the

HECS-HELP expenses. Under “sec 26-20, ITAA 1997” a deduction will be denied to trainee

accountant12.

Travel – work to university $110:

An individual that has undertaken the self-education and occurs travel expenses to

travel between work place and university or place of education is allowed as general

deduction under “sec 8-1, ITAA 1997”13. The trainee accountant here incurred travel

expenses of $110 for travelling between his work place to place of education. The expenses

will be acceptable for deduction under “sec 8-1, ITAA 1997”.

Books $200:

Referring to “Taxation Ruling of TR 98/9” expenses related to self-education such as

textbooks, stationaries, calculators are allowable for tax deduction under “sec 8-1, ITAA

1997”.14. The judgement denoted in “FCT v Studert (1982) ATC 4463” stated that an

allowable income tax deduction is permitted to the taxpayer to claim the expenses for travel,

12 Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2016 (Lawbook

Co./Thomson Reuters, 2016)

13 Section 8-1, Income Tax Assessment Act 1997 (Cth)

14 Taxation Ruling of TR 98/9

Answer to question 3:

HECS-HELP: $850:

As explained in the “sec 26-20, ITAA 1997” a deduction is prohibited to the taxpayer

for certain study-associated payment such as the HECS-HELP. Evident here suggest that the

trainee accountant has undertaken self-education and has occurred a sum of $850 as the

HECS-HELP expenses. Under “sec 26-20, ITAA 1997” a deduction will be denied to trainee

accountant12.

Travel – work to university $110:

An individual that has undertaken the self-education and occurs travel expenses to

travel between work place and university or place of education is allowed as general

deduction under “sec 8-1, ITAA 1997”13. The trainee accountant here incurred travel

expenses of $110 for travelling between his work place to place of education. The expenses

will be acceptable for deduction under “sec 8-1, ITAA 1997”.

Books $200:

Referring to “Taxation Ruling of TR 98/9” expenses related to self-education such as

textbooks, stationaries, calculators are allowable for tax deduction under “sec 8-1, ITAA

1997”.14. The judgement denoted in “FCT v Studert (1982) ATC 4463” stated that an

allowable income tax deduction is permitted to the taxpayer to claim the expenses for travel,

12 Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2016 (Lawbook

Co./Thomson Reuters, 2016)

13 Section 8-1, Income Tax Assessment Act 1997 (Cth)

14 Taxation Ruling of TR 98/9

8TAXATION LAW

course fees and accommodation since the self-education expenses were taken for increasing

the future income prospect in his present job.

The trainee here occurs expenses of $200 for books related to self-education. Citing

“FCT v Studert (1982) ATC 4463” a deduction is permitted under “sec 8-1, ITAA 1997”

since the self-education expenses were taken for increasing the future income prospect in his

present job.

Childcare during the course of evening classes $80:

A deduction is not permitted for child care expenses incurred to taxpayers under

negative limbs of “sec8-1 (2)(b), ITAA 1997”. Denoting the conclusion made in “Lodge v

FCT (1972)” the law court has denied the taxpayer with the tax deduction for child care

expenses incurred to mind her child while she is on work. The court held the expenses to be

irrelevant in production of assessable wages.

The childcare expenses of $80 for attending the evening class is not permitted for

deduction under negative limbs of “sec8-1 (2)(b), ITAA 1997”15. Referring to decision of

“Lodge v FCT (1972)” the expenses are irrelevant in production of taxable income.

Fridge repair cost of $250 at home:

Denoting the description of “sec25-10, ITAA 1997” a taxpayer is only permitted to

obtain deduction for expenses which is sustained on repairs to depreciating asset held

completely for producing assessable income. No deduction is permitted under this provision

for capital or private expenses16. Likewise the expense of $250 incurred for repairing the

15 Lodge v Federal Commissioner of Taxation (1972) HCA 49

16 Section 25-10, Income Tax Assessment Act 1997 (Cth).

course fees and accommodation since the self-education expenses were taken for increasing

the future income prospect in his present job.

The trainee here occurs expenses of $200 for books related to self-education. Citing

“FCT v Studert (1982) ATC 4463” a deduction is permitted under “sec 8-1, ITAA 1997”

since the self-education expenses were taken for increasing the future income prospect in his

present job.

Childcare during the course of evening classes $80:

A deduction is not permitted for child care expenses incurred to taxpayers under

negative limbs of “sec8-1 (2)(b), ITAA 1997”. Denoting the conclusion made in “Lodge v

FCT (1972)” the law court has denied the taxpayer with the tax deduction for child care

expenses incurred to mind her child while she is on work. The court held the expenses to be

irrelevant in production of assessable wages.

The childcare expenses of $80 for attending the evening class is not permitted for

deduction under negative limbs of “sec8-1 (2)(b), ITAA 1997”15. Referring to decision of

“Lodge v FCT (1972)” the expenses are irrelevant in production of taxable income.

Fridge repair cost of $250 at home:

Denoting the description of “sec25-10, ITAA 1997” a taxpayer is only permitted to

obtain deduction for expenses which is sustained on repairs to depreciating asset held

completely for producing assessable income. No deduction is permitted under this provision

for capital or private expenses16. Likewise the expense of $250 incurred for repairing the

15 Lodge v Federal Commissioner of Taxation (1972) HCA 49

16 Section 25-10, Income Tax Assessment Act 1997 (Cth).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

fridge at home is a private expenses and non-deductible under “sec25-10, ITAA 1997” as the

expenses is not occurred in making assessable returns.

Black trousers and shirt purchase cost of $145 for official purpose:

No general deduction is permitted for ordinary items of clothing in “sec 8-1, ITAA

1997”. Similarly in “Westcott v FCT (1997)” the judgement stated that no permissible

deduction relating expenses incurred for office suits and ordinary clothing was allowed since

it is not associated to the production of assessable income17.

The sum of $145 for black trousers and shirts for official purpose is non-allowable

deduction under “sec 8-1, ITAA 1997”. Applying the decision of “Westcott v FCT (1997)”

no permissible deduction relating expenses incurred for office suits is allowed since it is not

associated to the production of assessable income18.

Legal expenses incurred in writing up new employment contract with new employer

$300:

As explained in positive limbs of “sec 8-1, ITAA 1997” no deduction is permitted for

outgoings arose in procurement of new employment. The conclusion in “Maddalena v FCT

(1971)” held that the taxpayer was the footballer who occurred expenses on travelling to new

club for negotiating employment contract19. Likewise, citing the judgement of “Maddalena v

17 Westcott v Federal Commissioner of Taxation (1997) ATC 2129

18 Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

19 Maddalena v Federal Commissioner of Taxation (1971) 45 ALJR 426

fridge at home is a private expenses and non-deductible under “sec25-10, ITAA 1997” as the

expenses is not occurred in making assessable returns.

Black trousers and shirt purchase cost of $145 for official purpose:

No general deduction is permitted for ordinary items of clothing in “sec 8-1, ITAA

1997”. Similarly in “Westcott v FCT (1997)” the judgement stated that no permissible

deduction relating expenses incurred for office suits and ordinary clothing was allowed since

it is not associated to the production of assessable income17.

The sum of $145 for black trousers and shirts for official purpose is non-allowable

deduction under “sec 8-1, ITAA 1997”. Applying the decision of “Westcott v FCT (1997)”

no permissible deduction relating expenses incurred for office suits is allowed since it is not

associated to the production of assessable income18.

Legal expenses incurred in writing up new employment contract with new employer

$300:

As explained in positive limbs of “sec 8-1, ITAA 1997” no deduction is permitted for

outgoings arose in procurement of new employment. The conclusion in “Maddalena v FCT

(1971)” held that the taxpayer was the footballer who occurred expenses on travelling to new

club for negotiating employment contract19. Likewise, citing the judgement of “Maddalena v

17 Westcott v Federal Commissioner of Taxation (1997) ATC 2129

18 Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

19 Maddalena v Federal Commissioner of Taxation (1971) 45 ALJR 426

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

FCT (1971)”, the legal fees occurred for writing up new employment contract to new

employer is not allowed as tax deductible expenses under “sec8-1, ITAA 1997”.

Answer to question 4:

Answer to A:

There are several capital gains tax events which can be applied on the lease of land. A

CGT event F1 happens if they grant the lease of land to someone or they decide to extend or

renew the lease which they held it earlier. The sum of capital gains or loss arising from the

CGT event F1 constitute the differences between any kind of premium that they get for

granting the lease and the expenses occurred by the taxpayer in granting the lease20. The

taxpayer should understand that CGT discount is not eligible for applicable in case of CGT

event F1.

John grants the lease of land which he held to David for seven years. The premium

received for granting of lease stood $7000. As John grants the lease of land to David, a CGT

event F1 happened. Consequently a CGT discount is not eligible for John in this case.

Answer B:

20 Barkoczy, Stephen, Foundations Of Taxation Law, 2016

FCT (1971)”, the legal fees occurred for writing up new employment contract to new

employer is not allowed as tax deductible expenses under “sec8-1, ITAA 1997”.

Answer to question 4:

Answer to A:

There are several capital gains tax events which can be applied on the lease of land. A

CGT event F1 happens if they grant the lease of land to someone or they decide to extend or

renew the lease which they held it earlier. The sum of capital gains or loss arising from the

CGT event F1 constitute the differences between any kind of premium that they get for

granting the lease and the expenses occurred by the taxpayer in granting the lease20. The

taxpayer should understand that CGT discount is not eligible for applicable in case of CGT

event F1.

John grants the lease of land which he held to David for seven years. The premium

received for granting of lease stood $7000. As John grants the lease of land to David, a CGT

event F1 happened. Consequently a CGT discount is not eligible for John in this case.

Answer B:

20 Barkoczy, Stephen, Foundations Of Taxation Law, 2016

11TAXATION LAW

Answer C:

No tax on capital gains is applicable on the main residence of the taxpayer. In other

words, the main dwelling is generally tax exempt. Where a taxpayer uses the house for

making income or using it for any business then they can claim a partial main residence21.

The case facts obtained suggest that a home was bought by Li on March for 200,000

and she converted a portion of her for physiotherapy business before selling the house in

2019 for $700,000. To determine the taxable capital gains for Li the portion of floor area used

for producing income has been considered.

Assessable portion = Capital gain x Percentage of floor area

$700,000 – $400,000 = $300,000 (net capital gain)

300,000 x 20% = $60,000 (Taxable Portion)

21 Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, Principles Of Business

Taxation. 2014

Answer C:

No tax on capital gains is applicable on the main residence of the taxpayer. In other

words, the main dwelling is generally tax exempt. Where a taxpayer uses the house for

making income or using it for any business then they can claim a partial main residence21.

The case facts obtained suggest that a home was bought by Li on March for 200,000

and she converted a portion of her for physiotherapy business before selling the house in

2019 for $700,000. To determine the taxable capital gains for Li the portion of floor area used

for producing income has been considered.

Assessable portion = Capital gain x Percentage of floor area

$700,000 – $400,000 = $300,000 (net capital gain)

300,000 x 20% = $60,000 (Taxable Portion)

21 Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, Principles Of Business

Taxation. 2014

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.