Comparative Analysis: Change Agents at QBE and Allianz Insurance

VerifiedAdded on 2021/12/17

|16

|1204

|80

Report

AI Summary

This report provides a comparative analysis of change agents and their impact on QBE and Allianz Insurance. It examines the roles of change agents in initiating and managing change within these organizations, focusing on leadership styles, HR transformations, and offshoring strategies. The analysis explores the episodic and transformational approaches to change, highlighting key initiatives such as the appointment of new leadership at QBE and the implementation of an idea management platform at Allianz. The report also discusses the challenges and successes of these change initiatives, including cultural concerns related to offshoring and the importance of employee engagement in driving innovation. The conclusion summarizes the key arguments and points, offering insights into how these companies have adapted to various challenges through effective change management.

Change in

Insurance

The role of change agents at QBE and Allianz

Insurance

Change?

Change drivers?

• Technology

• Customers

• Regulations

• Competition

(PwC, 2018)

Insurance

Industry worth

US$21 trillion

(OECD, 2018)

Insurance

The role of change agents at QBE and Allianz

Insurance

Change?

Change drivers?

• Technology

• Customers

• Regulations

• Competition

(PwC, 2018)

Insurance

Industry worth

US$21 trillion

(OECD, 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

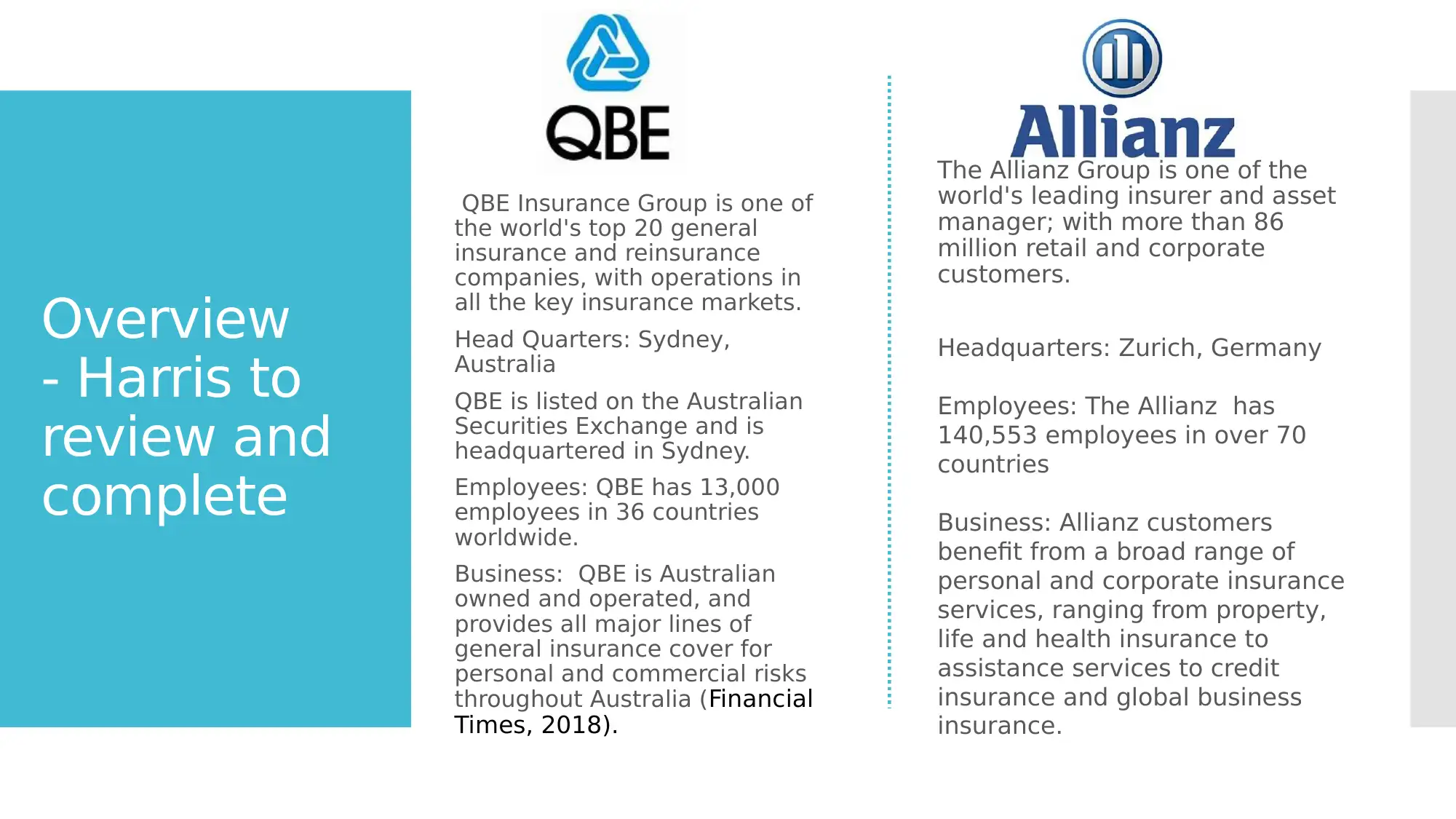

Overview

- Harris to

review and

complete

QBE Insurance Group is one of

the world's top 20 general

insurance and reinsurance

companies, with operations in

all the key insurance markets.

Head Quarters: Sydney,

Australia

QBE is listed on the Australian

Securities Exchange and is

headquartered in Sydney.

Employees: QBE has 13,000

employees in 36 countries

worldwide.

Business: QBE is Australian

owned and operated, and

provides all major lines of

general insurance cover for

personal and commercial risks

throughout Australia (Financial

Times, 2018).

The Allianz Group is one of the

world's leading insurer and asset

manager; with more than 86

million retail and corporate

customers.

Headquarters: Zurich, Germany

Employees: The Allianz has

140,553 employees in over 70

countries

Business: Allianz customers

benefit from a broad range of

personal and corporate insurance

services, ranging from property,

life and health insurance to

assistance services to credit

insurance and global business

insurance.

- Harris to

review and

complete

QBE Insurance Group is one of

the world's top 20 general

insurance and reinsurance

companies, with operations in

all the key insurance markets.

Head Quarters: Sydney,

Australia

QBE is listed on the Australian

Securities Exchange and is

headquartered in Sydney.

Employees: QBE has 13,000

employees in 36 countries

worldwide.

Business: QBE is Australian

owned and operated, and

provides all major lines of

general insurance cover for

personal and commercial risks

throughout Australia (Financial

Times, 2018).

The Allianz Group is one of the

world's leading insurer and asset

manager; with more than 86

million retail and corporate

customers.

Headquarters: Zurich, Germany

Employees: The Allianz has

140,553 employees in over 70

countries

Business: Allianz customers

benefit from a broad range of

personal and corporate insurance

services, ranging from property,

life and health insurance to

assistance services to credit

insurance and global business

insurance.

Overview

- Harris to

review and

complete

Performance History:

QBE has a history of

sustained and consistent

performance over 120

years

The excellent

performance can be

attributed to competent

management and

prudent risk

management credent

Excellent customer

service (QBE, 2018)

Performance History:

Allianz is one of the

world’s largest

investors,

The company manages

over 650 billion euros

on behalf of its

insurance customers

The company also hold

billions in investments

on behalf of its clients

(Allianz, 2018)

- Harris to

review and

complete

Performance History:

QBE has a history of

sustained and consistent

performance over 120

years

The excellent

performance can be

attributed to competent

management and

prudent risk

management credent

Excellent customer

service (QBE, 2018)

Performance History:

Allianz is one of the

world’s largest

investors,

The company manages

over 650 billion euros

on behalf of its

insurance customers

The company also hold

billions in investments

on behalf of its clients

(Allianz, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Allianz. (2018). Allianz Australia Limited. Retrieved from https://www.allianz.com.au/

Allianz. (2018). Insurance Business UK. Retrieved from

https://www.insurancebusinessmag.com/uk/industry-news/allianz/2017-performance-reflect

s-the-underlying-strength-of-the-allianz-business-92750.aspx

Financial Times. (2018). Equities, QBE Insurance Group Ltd. Retrieved from

https://markets.ft.com/data/equities/tearsheet/summary?s=QBE:ASX

QBE. (2018). Retrieved from https://www.qbe.com/

Allianz. (2018). Allianz Australia Limited. Retrieved from https://www.allianz.com.au/

Allianz. (2018). Insurance Business UK. Retrieved from

https://www.insurancebusinessmag.com/uk/industry-news/allianz/2017-performance-reflect

s-the-underlying-strength-of-the-allianz-business-92750.aspx

Financial Times. (2018). Equities, QBE Insurance Group Ltd. Retrieved from

https://markets.ft.com/data/equities/tearsheet/summary?s=QBE:ASX

QBE. (2018). Retrieved from https://www.qbe.com/

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

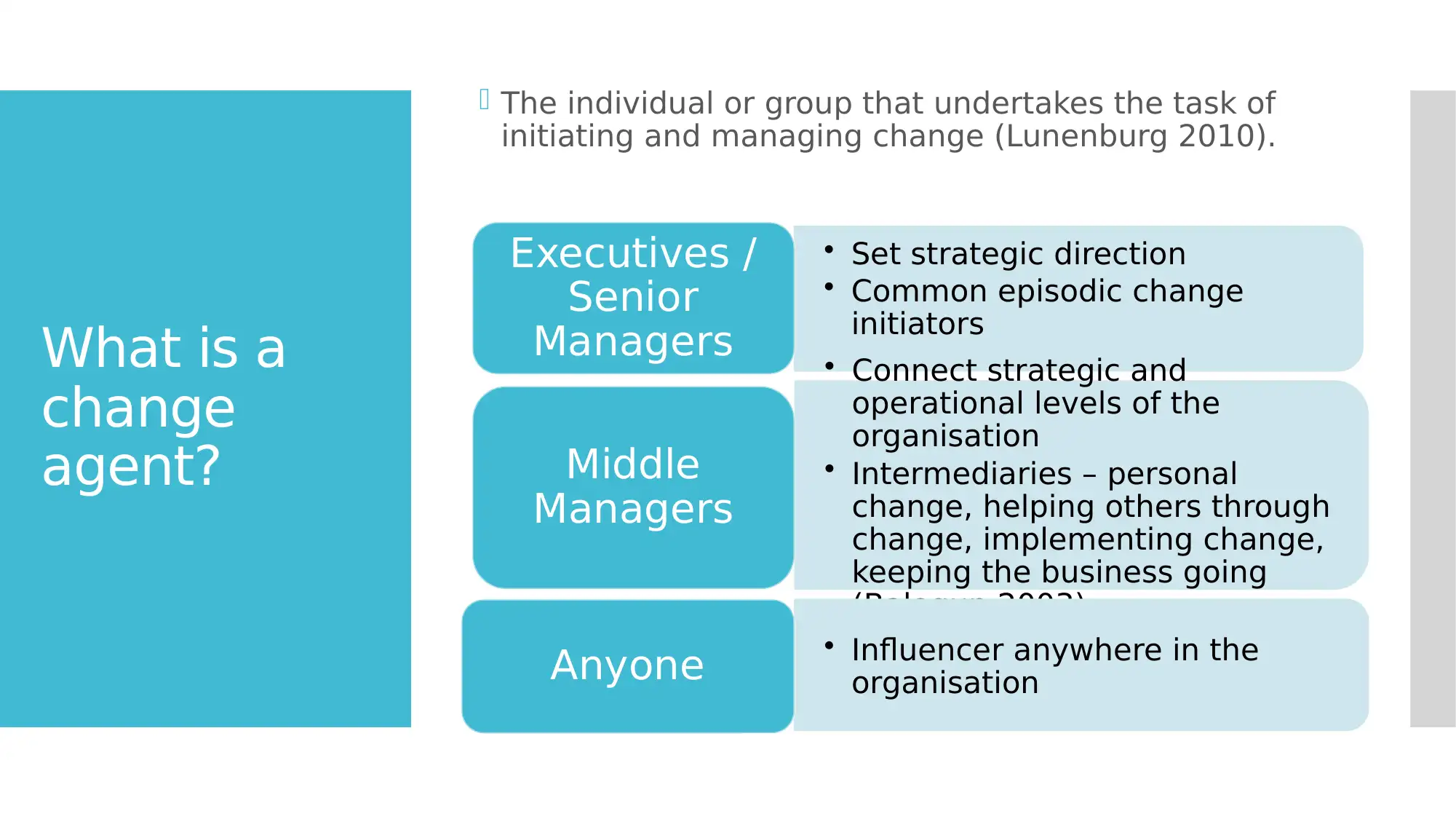

What is a

change

agent?

The individual or group that undertakes the task of

initiating and managing change (Lunenburg 2010).

• Set strategic direction

• Common episodic change

initiators

Executives /

Senior

Managers • Connect strategic and

operational levels of the

organisation

• Intermediaries – personal

change, helping others through

change, implementing change,

keeping the business going

(Balogun 2003)

Middle

Managers

• Influencer anywhere in the

organisationAnyone

change

agent?

The individual or group that undertakes the task of

initiating and managing change (Lunenburg 2010).

• Set strategic direction

• Common episodic change

initiators

Executives /

Senior

Managers • Connect strategic and

operational levels of the

organisation

• Intermediaries – personal

change, helping others through

change, implementing change,

keeping the business going

(Balogun 2003)

Middle

Managers

• Influencer anywhere in the

organisationAnyone

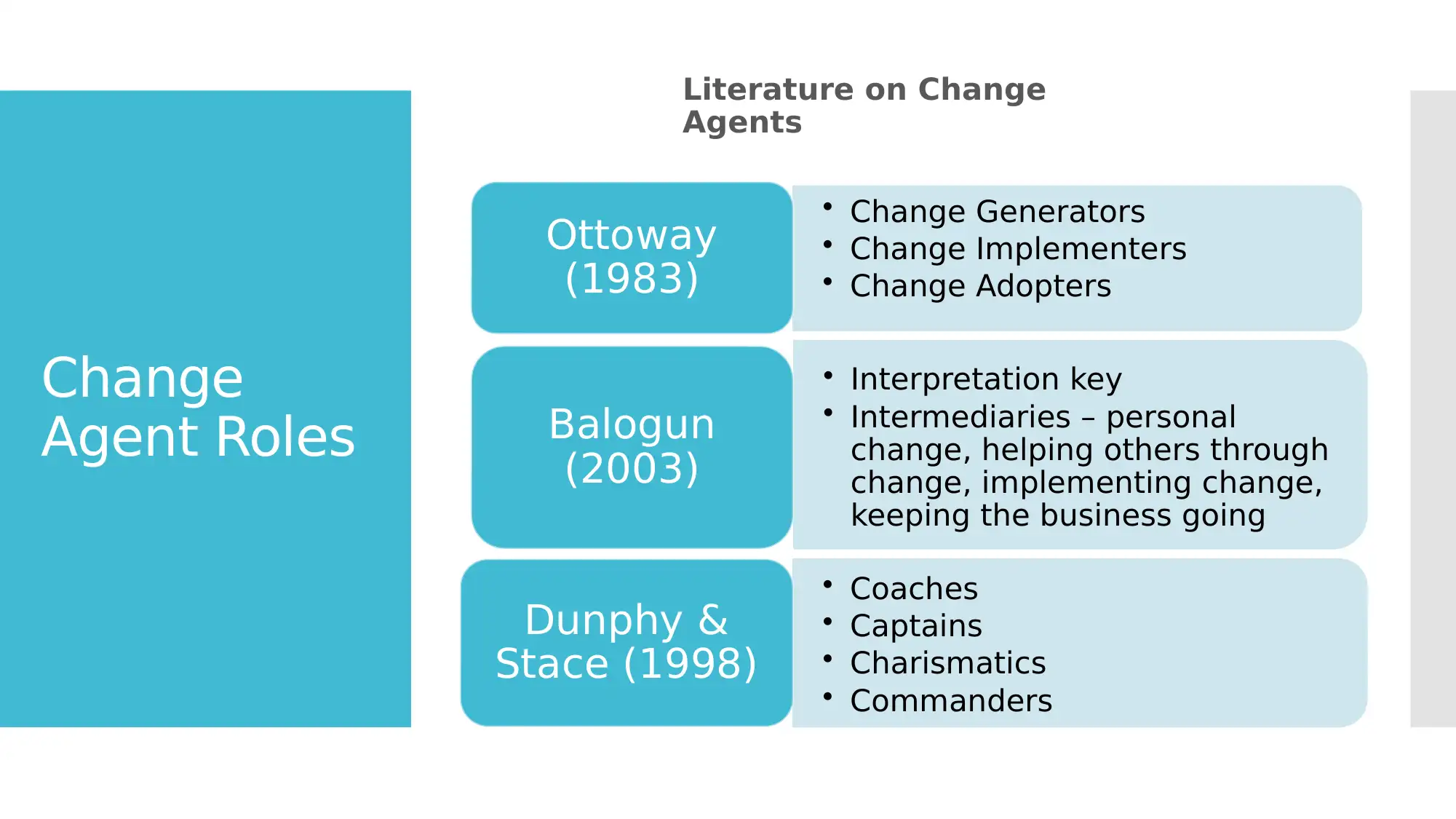

Change

Agent Roles

Literature on Change

Agents

• Change Generators

• Change Implementers

• Change Adopters

Ottoway

(1983)

• Interpretation key

• Intermediaries – personal

change, helping others through

change, implementing change,

keeping the business going

Balogun

(2003)

• Coaches

• Captains

• Charismatics

• Commanders

Dunphy &

Stace (1998)

Agent Roles

Literature on Change

Agents

• Change Generators

• Change Implementers

• Change Adopters

Ottoway

(1983)

• Interpretation key

• Intermediaries – personal

change, helping others through

change, implementing change,

keeping the business going

Balogun

(2003)

• Coaches

• Captains

• Charismatics

• Commanders

Dunphy &

Stace (1998)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

QBE

Insurance

Group

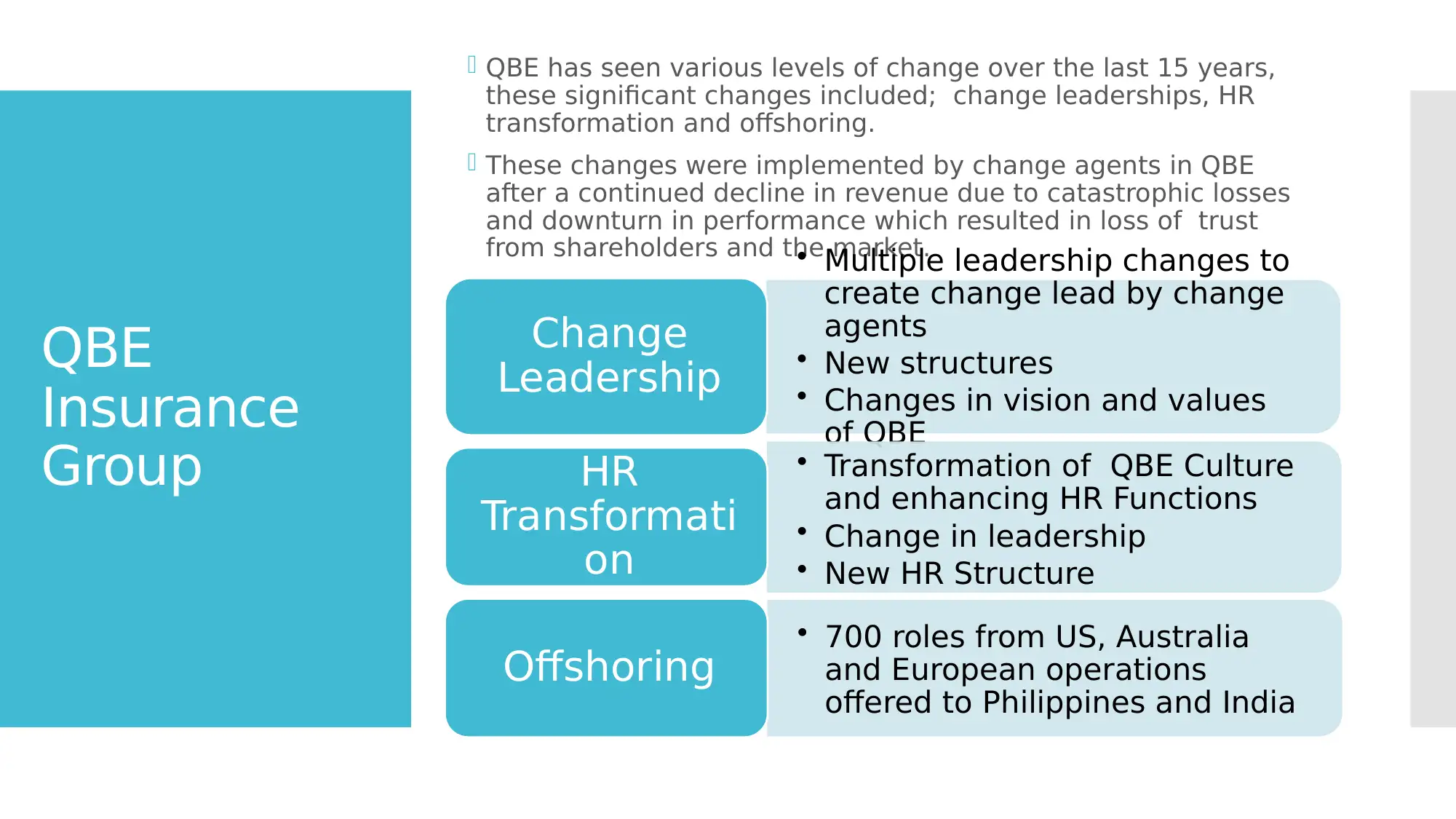

QBE has seen various levels of change over the last 15 years,

these significant changes included; change leaderships, HR

transformation and offshoring.

These changes were implemented by change agents in QBE

after a continued decline in revenue due to catastrophic losses

and downturn in performance which resulted in loss of trust

from shareholders and the market.• Multiple leadership changes to

create change lead by change

agents

• New structures

• Changes in vision and values

of QBE

Change

Leadership

• Transformation of QBE Culture

and enhancing HR Functions

• Change in leadership

• New HR Structure

HR

Transformati

on

• 700 roles from US, Australia

and European operations

offered to Philippines and India

Offshoring

Insurance

Group

QBE has seen various levels of change over the last 15 years,

these significant changes included; change leaderships, HR

transformation and offshoring.

These changes were implemented by change agents in QBE

after a continued decline in revenue due to catastrophic losses

and downturn in performance which resulted in loss of trust

from shareholders and the market.• Multiple leadership changes to

create change lead by change

agents

• New structures

• Changes in vision and values

of QBE

Change

Leadership

• Transformation of QBE Culture

and enhancing HR Functions

• Change in leadership

• New HR Structure

HR

Transformati

on

• 700 roles from US, Australia

and European operations

offered to Philippines and India

Offshoring

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Responsible

Change

Leadership

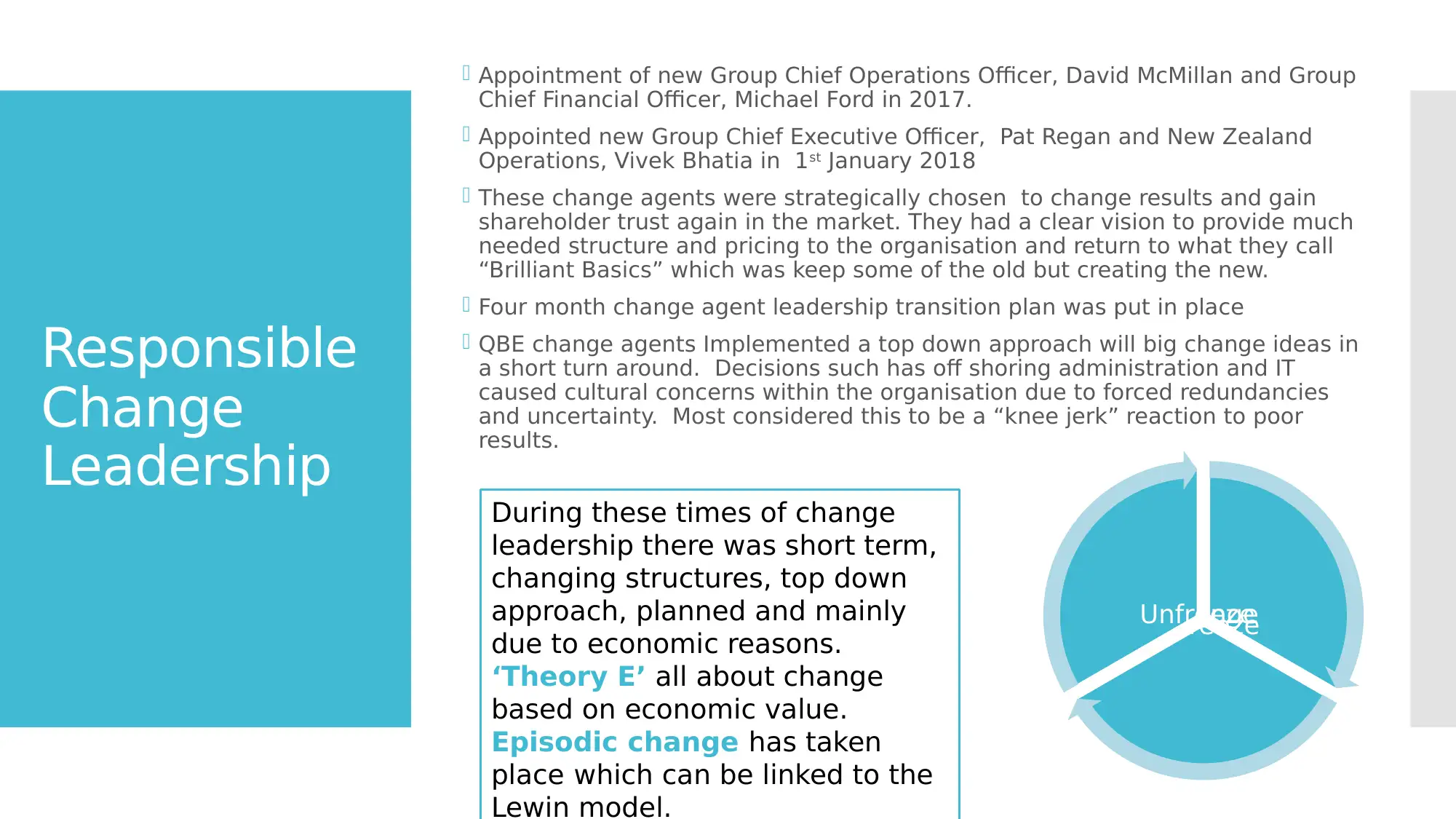

Appointment of new Group Chief Operations Officer, David McMillan and Group

Chief Financial Officer, Michael Ford in 2017.

Appointed new Group Chief Executive Officer, Pat Regan and New Zealand

Operations, Vivek Bhatia in 1st January 2018

These change agents were strategically chosen to change results and gain

shareholder trust again in the market. They had a clear vision to provide much

needed structure and pricing to the organisation and return to what they call

“Brilliant Basics” which was keep some of the old but creating the new.

Four month change agent leadership transition plan was put in place

QBE change agents Implemented a top down approach will big change ideas in

a short turn around. Decisions such has off shoring administration and IT

caused cultural concerns within the organisation due to forced redundancies

and uncertainty. Most considered this to be a “knee jerk” reaction to poor

results.

ChangeRefreezeUnfreeze

During these times of change

leadership there was short term,

changing structures, top down

approach, planned and mainly

due to economic reasons.

‘Theory E’ all about change

based on economic value.

Episodic change has taken

place which can be linked to the

Lewin model.

Change

Leadership

Appointment of new Group Chief Operations Officer, David McMillan and Group

Chief Financial Officer, Michael Ford in 2017.

Appointed new Group Chief Executive Officer, Pat Regan and New Zealand

Operations, Vivek Bhatia in 1st January 2018

These change agents were strategically chosen to change results and gain

shareholder trust again in the market. They had a clear vision to provide much

needed structure and pricing to the organisation and return to what they call

“Brilliant Basics” which was keep some of the old but creating the new.

Four month change agent leadership transition plan was put in place

QBE change agents Implemented a top down approach will big change ideas in

a short turn around. Decisions such has off shoring administration and IT

caused cultural concerns within the organisation due to forced redundancies

and uncertainty. Most considered this to be a “knee jerk” reaction to poor

results.

ChangeRefreezeUnfreeze

During these times of change

leadership there was short term,

changing structures, top down

approach, planned and mainly

due to economic reasons.

‘Theory E’ all about change

based on economic value.

Episodic change has taken

place which can be linked to the

Lewin model.

HR

Transformatio

n

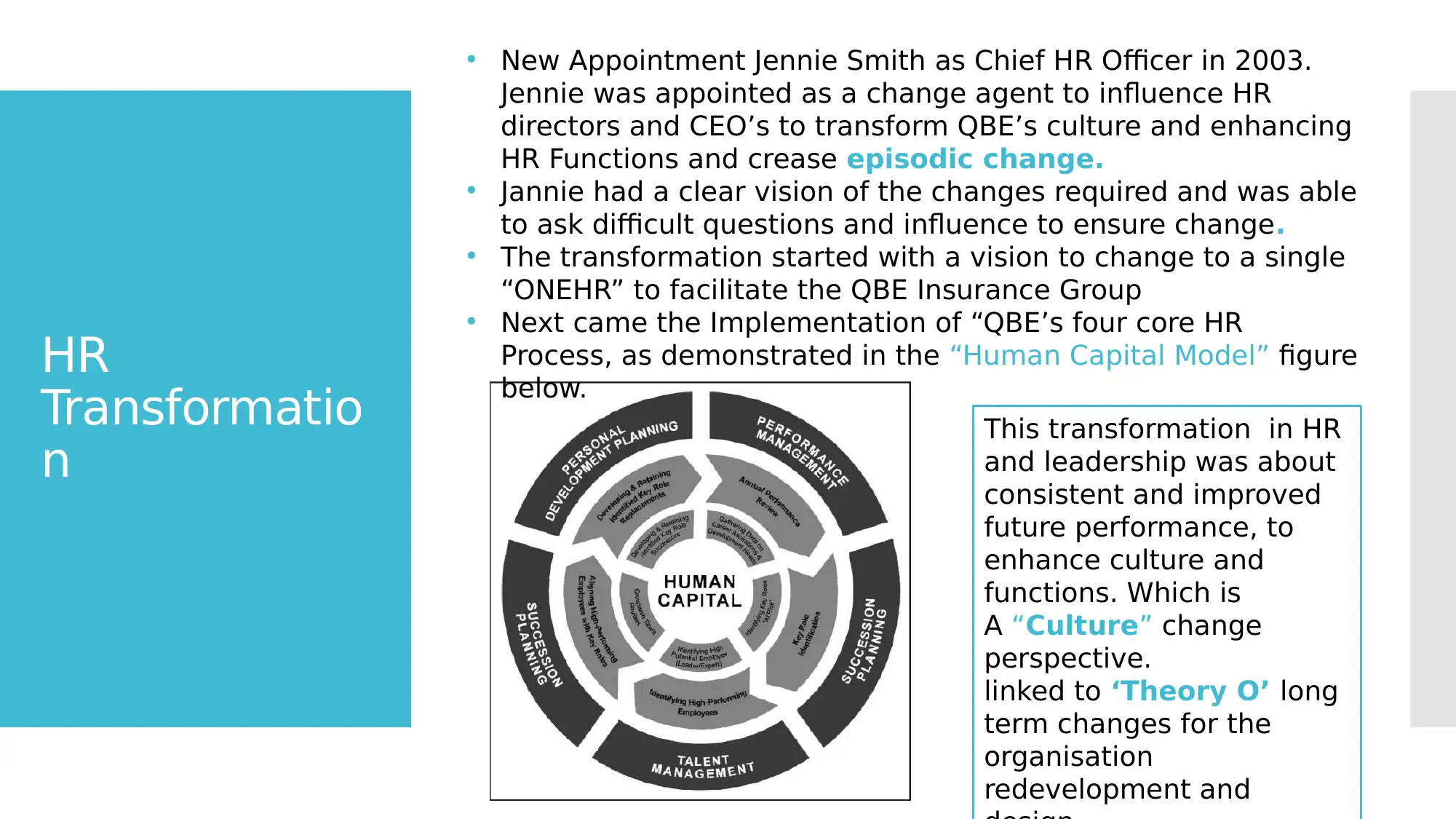

• New Appointment Jennie Smith as Chief HR Officer in 2003.

Jennie was appointed as a change agent to influence HR

directors and CEO’s to transform QBE’s culture and enhancing

HR Functions and crease episodic change.

• Jannie had a clear vision of the changes required and was able

to ask difficult questions and influence to ensure change.

• The transformation started with a vision to change to a single

“ONEHR” to facilitate the QBE Insurance Group

• Next came the Implementation of “QBE’s four core HR

Process, as demonstrated in the “Human Capital Model” figure

below.

This transformation in HR

and leadership was about

consistent and improved

future performance, to

enhance culture and

functions. Which is

A “Culture” change

perspective.

linked to ‘Theory O’ long

term changes for the

organisation

redevelopment and

Transformatio

n

• New Appointment Jennie Smith as Chief HR Officer in 2003.

Jennie was appointed as a change agent to influence HR

directors and CEO’s to transform QBE’s culture and enhancing

HR Functions and crease episodic change.

• Jannie had a clear vision of the changes required and was able

to ask difficult questions and influence to ensure change.

• The transformation started with a vision to change to a single

“ONEHR” to facilitate the QBE Insurance Group

• Next came the Implementation of “QBE’s four core HR

Process, as demonstrated in the “Human Capital Model” figure

below.

This transformation in HR

and leadership was about

consistent and improved

future performance, to

enhance culture and

functions. Which is

A “Culture” change

perspective.

linked to ‘Theory O’ long

term changes for the

organisation

redevelopment and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

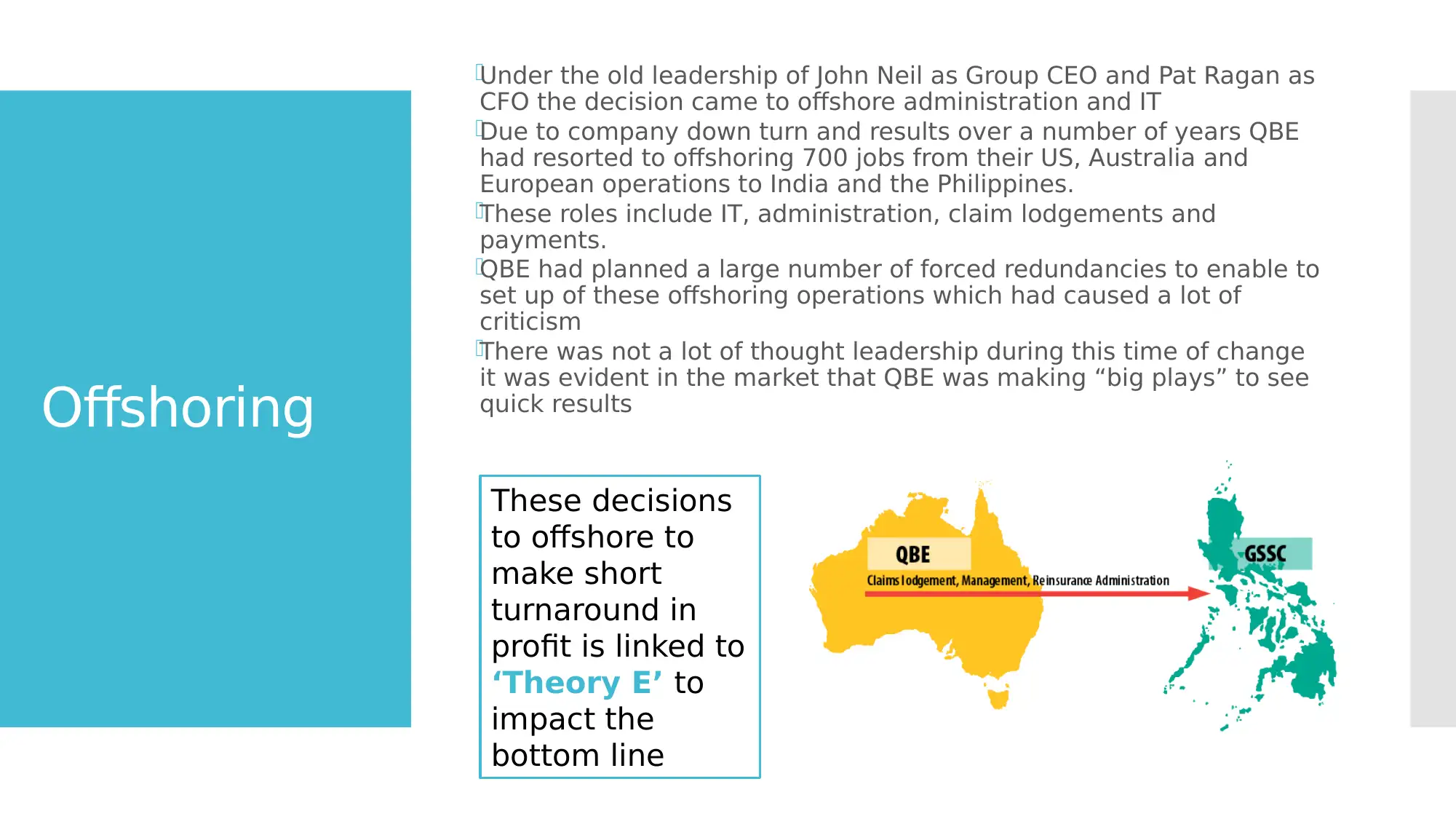

Offshoring

Under the old leadership of John Neil as Group CEO and Pat Ragan as

CFO the decision came to offshore administration and IT

Due to company down turn and results over a number of years QBE

had resorted to offshoring 700 jobs from their US, Australia and

European operations to India and the Philippines.

These roles include IT, administration, claim lodgements and

payments.

QBE had planned a large number of forced redundancies to enable to

set up of these offshoring operations which had caused a lot of

criticism

There was not a lot of thought leadership during this time of change

it was evident in the market that QBE was making “big plays” to see

quick results

These decisions

to offshore to

make short

turnaround in

profit is linked to

‘Theory E’ to

impact the

bottom line

Under the old leadership of John Neil as Group CEO and Pat Ragan as

CFO the decision came to offshore administration and IT

Due to company down turn and results over a number of years QBE

had resorted to offshoring 700 jobs from their US, Australia and

European operations to India and the Philippines.

These roles include IT, administration, claim lodgements and

payments.

QBE had planned a large number of forced redundancies to enable to

set up of these offshoring operations which had caused a lot of

criticism

There was not a lot of thought leadership during this time of change

it was evident in the market that QBE was making “big plays” to see

quick results

These decisions

to offshore to

make short

turnaround in

profit is linked to

‘Theory E’ to

impact the

bottom line

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Allianz

Change was historically implemented at Allianz in an

episodic manner through multiple leadership

changes an new business venture and innovation team

• Much like QBE Allianz has seen it’s fair

share of leadership change

• Structure changes

Change

Leadership

• Enquiring new business

• Culture shift

New

Business

• New technology platforms

• Change agents shift culture with innovationInnovation

Change was historically implemented at Allianz in an

episodic manner through multiple leadership

changes an new business venture and innovation team

• Much like QBE Allianz has seen it’s fair

share of leadership change

• Structure changes

Change

Leadership

• Enquiring new business

• Culture shift

New

Business

• New technology platforms

• Change agents shift culture with innovationInnovation

Responsible

Change

Leadership

With the arrival of a new CEO, things began to change. Group CEO

Michael Diekmann took a more continuous and collaborative

approach to change

Diekmann’s implemented an idea management platform for the

company in 2006. This intended purpose of this platform was to

harness innovation across the company, and accordingly make all

employees change agents. This is an example of transformational

leadership, but

Diekmann’s intention was to entrench this into Allianz’s culture, so

innovation would be ‘the way we do things here.’

Leadership Team acquired Dresdner Bank in early 2000s. At this

time the Leader ship team did not engage properly with the

business at large. There was a significant cultural issue between

Allianz and the acquired company that was not considered in their

change management. Consequently mistrust grew amongst senior

managers who had not been consulted

This is an example of their episodic

change the acquired Dresdner Bank and

new approaches from the CEO

Change

Leadership

With the arrival of a new CEO, things began to change. Group CEO

Michael Diekmann took a more continuous and collaborative

approach to change

Diekmann’s implemented an idea management platform for the

company in 2006. This intended purpose of this platform was to

harness innovation across the company, and accordingly make all

employees change agents. This is an example of transformational

leadership, but

Diekmann’s intention was to entrench this into Allianz’s culture, so

innovation would be ‘the way we do things here.’

Leadership Team acquired Dresdner Bank in early 2000s. At this

time the Leader ship team did not engage properly with the

business at large. There was a significant cultural issue between

Allianz and the acquired company that was not considered in their

change management. Consequently mistrust grew amongst senior

managers who had not been consulted

This is an example of their episodic

change the acquired Dresdner Bank and

new approaches from the CEO

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.