A Detailed Analysis of Global Corporate Strategy: Lloyds Banking Group

VerifiedAdded on 2019/12/03

|16

|4776

|180

Report

AI Summary

This report provides a comprehensive analysis of Lloyds Banking Group's global corporate strategy, examining its competitiveness within the financial services industry. The report delves into key strategic issues, including the impact of globalization, opportunities and threats faced by the company, and the bargaining power of financial service providers. It explores the role of e-banking, strategic alliances, mergers, and acquisitions in enhancing digital capabilities. Furthermore, the report addresses corporate governance, CSR, and leadership, alongside a personal reflection on the learning experience. The report concludes with an overview of customer needs and requirements in the global financial services industry, offering insights into how Lloyds Banking Group can adapt and succeed in a dynamic market. The report is structured to provide a clear understanding of the challenges and opportunities in the global financial services sector.

Global Corporate Strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1 FIRM'S COMPETITIVENESS IN THE GLOBAL FINANCIAL SERVICES

INDUSTRY.....................................................................................................................................1

TASK 2 E-BANKING- THE ROLE OF ALLIANCES, MERGERS AND ACQUISITIONS......6

TASK 3 CORPORATE GOVERNANCE, CSR, LEADERSHIP AND COMPETITIVENESS....8

TASK 4 PERSONAL REFLECTIONS ON LEARNING AND OVERALL REPORT

PRESENTATION..........................................................................................................................10

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

TASK 1 FIRM'S COMPETITIVENESS IN THE GLOBAL FINANCIAL SERVICES

INDUSTRY.....................................................................................................................................1

TASK 2 E-BANKING- THE ROLE OF ALLIANCES, MERGERS AND ACQUISITIONS......6

TASK 3 CORPORATE GOVERNANCE, CSR, LEADERSHIP AND COMPETITIVENESS....8

TASK 4 PERSONAL REFLECTIONS ON LEARNING AND OVERALL REPORT

PRESENTATION..........................................................................................................................10

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

ILLUSTRATION INDEX

Illustration 1: Most preferred methods of banking..........................................................................5

Illustration 1: Most preferred methods of banking..........................................................................5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In the era of globalization, it is essential for businesses to obtain international expansion

by adopting effectual strategy. However, if business is still focusing on local markets then it is

significant for them to target outside home market i.e. called global marketing. Moreover,

international corporate strategy requires business to coordinate their product and pricing

strategies across international markets and thus achieve customer satisfaction. Also, business is

required to focus on competitor’s marketing and sales strategy with the aim to overcome it and

target both domestic and international clients (Hillier, Grinblatt and Titman, 2011).

The purpose of the report is to develop knowledge and skills regarding understanding the

key strategic issues in regard to Global Financial Services Industry. Therefore, Lloyds Banking

Group had been undertaken which is a leading financial service provider to both individual and

business clients within UK (Peng, 2013). The main business activities of organization is retail

and commercial banking, general insurance and long term savings etc.

TASK 1 FIRM'S COMPETITIVENESS IN THE GLOBAL FINANCIAL

SERVICES INDUSTRY

Through reviewing the annual report of Lloyd Banking Group 2014 it can be assessed

that, main aim of business is to become the best bank for both individual and business customers.

They are serving around 25 million customers in UK. However, business faces tough

competition from other similar financial services providing industry such as Citigroup and ICBC.

It can be ascertained that as compared to such industry business is heavily involved in providing

retail and commercial finance and investments to individual and business customers. By

adopting effectual global corporate strategy, it assists Lloyd Banking Group to provide effectual

financial services and satisfy requirements of clients. Businesses such as Lloyds (Park, 2014),

Citigroup and ICBC faces serious competitiveness

Globalization can be stated as the way through which businesses expand its operations

within different countries together with the aim to only set the national identity but become the

part of the world as a whole (Altuntas and Turker, 2015). The advantages and disadvantages of

globalization are as follows-

Advantages

1

In the era of globalization, it is essential for businesses to obtain international expansion

by adopting effectual strategy. However, if business is still focusing on local markets then it is

significant for them to target outside home market i.e. called global marketing. Moreover,

international corporate strategy requires business to coordinate their product and pricing

strategies across international markets and thus achieve customer satisfaction. Also, business is

required to focus on competitor’s marketing and sales strategy with the aim to overcome it and

target both domestic and international clients (Hillier, Grinblatt and Titman, 2011).

The purpose of the report is to develop knowledge and skills regarding understanding the

key strategic issues in regard to Global Financial Services Industry. Therefore, Lloyds Banking

Group had been undertaken which is a leading financial service provider to both individual and

business clients within UK (Peng, 2013). The main business activities of organization is retail

and commercial banking, general insurance and long term savings etc.

TASK 1 FIRM'S COMPETITIVENESS IN THE GLOBAL FINANCIAL

SERVICES INDUSTRY

Through reviewing the annual report of Lloyd Banking Group 2014 it can be assessed

that, main aim of business is to become the best bank for both individual and business customers.

They are serving around 25 million customers in UK. However, business faces tough

competition from other similar financial services providing industry such as Citigroup and ICBC.

It can be ascertained that as compared to such industry business is heavily involved in providing

retail and commercial finance and investments to individual and business customers. By

adopting effectual global corporate strategy, it assists Lloyd Banking Group to provide effectual

financial services and satisfy requirements of clients. Businesses such as Lloyds (Park, 2014),

Citigroup and ICBC faces serious competitiveness

Globalization can be stated as the way through which businesses expand its operations

within different countries together with the aim to only set the national identity but become the

part of the world as a whole (Altuntas and Turker, 2015). The advantages and disadvantages of

globalization are as follows-

Advantages

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Countries like UK, Germany are rich and thus they can sell their products and services

to poorer countries.

Globalization assists individuals to learn varied things and also deal with people across

boundaries (Walker-Said and Kelly, 2015).

Due to globalization imported goods are available within the country and thus people

can utilize it in order to enhance satisfaction.

It helps in creating and offering varied jobs to people so that they can improve their

standard of living.

It provides opportunities to local industries to work hard and compete with international

businesses (Garriga and Melé, 2013).

It utilizes resources from varied countries for producing products and services so that

they are able to carry out work efficiently.

Through globalization clients get benefits as they get wide variety of products from

which they can choose the best.

Businesses get access to much broad markets. Here, investors get much wider opportunities to invest in different businesses (Arbogast,

Thornton and Bradley, 2012).

Disadvantages

Globalization affects the local businesses and brands as they can go bankrupt because

large multinational corporations are providing their services and dominating the world

economy.

It also affects the local traditions and culture of people (Milne and Gray, 2013).

Local industries get affected because people are moving towards international firms for

buying products and services.

High interference of political parties and thus it raises conflicts among them (Torres and

et. al., 2012).

Globalization affects under developed countries.

It affects companies as they get much greater competition. Thus, it can put smaller

industries at a disadvantage as they do not have resources to compete at worldwide scale

(Ghemawat, 2013).

2

to poorer countries.

Globalization assists individuals to learn varied things and also deal with people across

boundaries (Walker-Said and Kelly, 2015).

Due to globalization imported goods are available within the country and thus people

can utilize it in order to enhance satisfaction.

It helps in creating and offering varied jobs to people so that they can improve their

standard of living.

It provides opportunities to local industries to work hard and compete with international

businesses (Garriga and Melé, 2013).

It utilizes resources from varied countries for producing products and services so that

they are able to carry out work efficiently.

Through globalization clients get benefits as they get wide variety of products from

which they can choose the best.

Businesses get access to much broad markets. Here, investors get much wider opportunities to invest in different businesses (Arbogast,

Thornton and Bradley, 2012).

Disadvantages

Globalization affects the local businesses and brands as they can go bankrupt because

large multinational corporations are providing their services and dominating the world

economy.

It also affects the local traditions and culture of people (Milne and Gray, 2013).

Local industries get affected because people are moving towards international firms for

buying products and services.

High interference of political parties and thus it raises conflicts among them (Torres and

et. al., 2012).

Globalization affects under developed countries.

It affects companies as they get much greater competition. Thus, it can put smaller

industries at a disadvantage as they do not have resources to compete at worldwide scale

(Ghemawat, 2013).

2

There are varied key opportunities and threats which is faced by Lloyds Banking Group

which are as follows-

Opportunities

Lloyd's have varied former competitors such as Bradford & Bingley which makes easier

for financial service providers to win over UK businesses. However, it provides

opportunities to enhance profitability of Lloyd's (Kuratko, Hornsby and Hayton, 2015).

Financial service provider has the opportunity to enhance it mobile banking usage so that

they can provide satisfaction to customers. There are wide number of British consumers

who are using mobile phone to manage their financial accounts. However, increasing

usage of mobile banking will help bank to minimize its operational cost per branch and

satisfy needs of clients (Erkens, Hung and Matos, 2012).

Lloyd group is planning to focus on launching Islamic banking services in order to

become strong. Further, business open Islamic Nostro Account and allows different other

banks to move money around the world and assist the business clients in keeping with

Shariah law. However, it provides great opportunity for bank to enhance its market

penetration by providing Islamic banking services to Muslim clients (Wintoki, Linck and

Netter, 2012).

Further, the UK Islamic banking market is divided between HSBC, the Islamic Bank of

Britain and West Bromwich Building Society. Thus, it provides enough space for Lloyd's

bank to share the emerging growth opportunities in such segment of banking and provide

financial services to its customers (Aoki, 2013). It has been assessed that, The Bank of England is planning to extend Quantitative Easing

program. Further, it helps firm to decrease the interest rate and thus improve monetary

growth in the economy. Moreover, the monetary base of UK is likely to grow and thus it

aids banks such as Lloyds to enhance mortgage loan production. With the assistance of

this, it provides loan to varied UK customers and thus satisfy their needs (Nini, Smith and

Sufi, 2012).

Threats

Business faces varied challenges and threats of fines and costs if found guilty in fixing of

exchange rate.

3

which are as follows-

Opportunities

Lloyd's have varied former competitors such as Bradford & Bingley which makes easier

for financial service providers to win over UK businesses. However, it provides

opportunities to enhance profitability of Lloyd's (Kuratko, Hornsby and Hayton, 2015).

Financial service provider has the opportunity to enhance it mobile banking usage so that

they can provide satisfaction to customers. There are wide number of British consumers

who are using mobile phone to manage their financial accounts. However, increasing

usage of mobile banking will help bank to minimize its operational cost per branch and

satisfy needs of clients (Erkens, Hung and Matos, 2012).

Lloyd group is planning to focus on launching Islamic banking services in order to

become strong. Further, business open Islamic Nostro Account and allows different other

banks to move money around the world and assist the business clients in keeping with

Shariah law. However, it provides great opportunity for bank to enhance its market

penetration by providing Islamic banking services to Muslim clients (Wintoki, Linck and

Netter, 2012).

Further, the UK Islamic banking market is divided between HSBC, the Islamic Bank of

Britain and West Bromwich Building Society. Thus, it provides enough space for Lloyd's

bank to share the emerging growth opportunities in such segment of banking and provide

financial services to its customers (Aoki, 2013). It has been assessed that, The Bank of England is planning to extend Quantitative Easing

program. Further, it helps firm to decrease the interest rate and thus improve monetary

growth in the economy. Moreover, the monetary base of UK is likely to grow and thus it

aids banks such as Lloyds to enhance mortgage loan production. With the assistance of

this, it provides loan to varied UK customers and thus satisfy their needs (Nini, Smith and

Sufi, 2012).

Threats

Business faces varied challenges and threats of fines and costs if found guilty in fixing of

exchange rate.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main threat to the company involves regulatory requirements that affect the market

share of firm. The increase in divestments will affect group's market share and its

competitive positioning (Boone and Ivanov, 2012). There are varied proposed regulations which are likely to affect the banking industry of

UK. However, there are different potential changes in UK financial standards and if these

are implemented then, it may affect the banking business (Fang, 2011).

Bargaining power of Financial Service Providers

The bargaining power of financial service providers is high as they have less competition

among providing banking services in UK. Thus, they have the power to charge high interest rates

from consumers and also adjust the quality of products or services and delivery time lines.

However, if financial service provider has such type of bargaining power than, they can affect

the competitive environment and thus directly influence profitability of business. Lloyd's

provides effectual financial services to both individual and business clients so that, they can

demand for high interest rates (Marks and Mirvis, 2012). Also, the clients are ready to pay high

interests on mortgage because firm owns goodwill in the market and they have minimum

competition who is serving a large base of customers in UK. There are various factors which

affects the bargaining power of financial service providers such as change in policies by the

Bank of England. Also, fluctuation in interest rates affects bargaining power of banks.

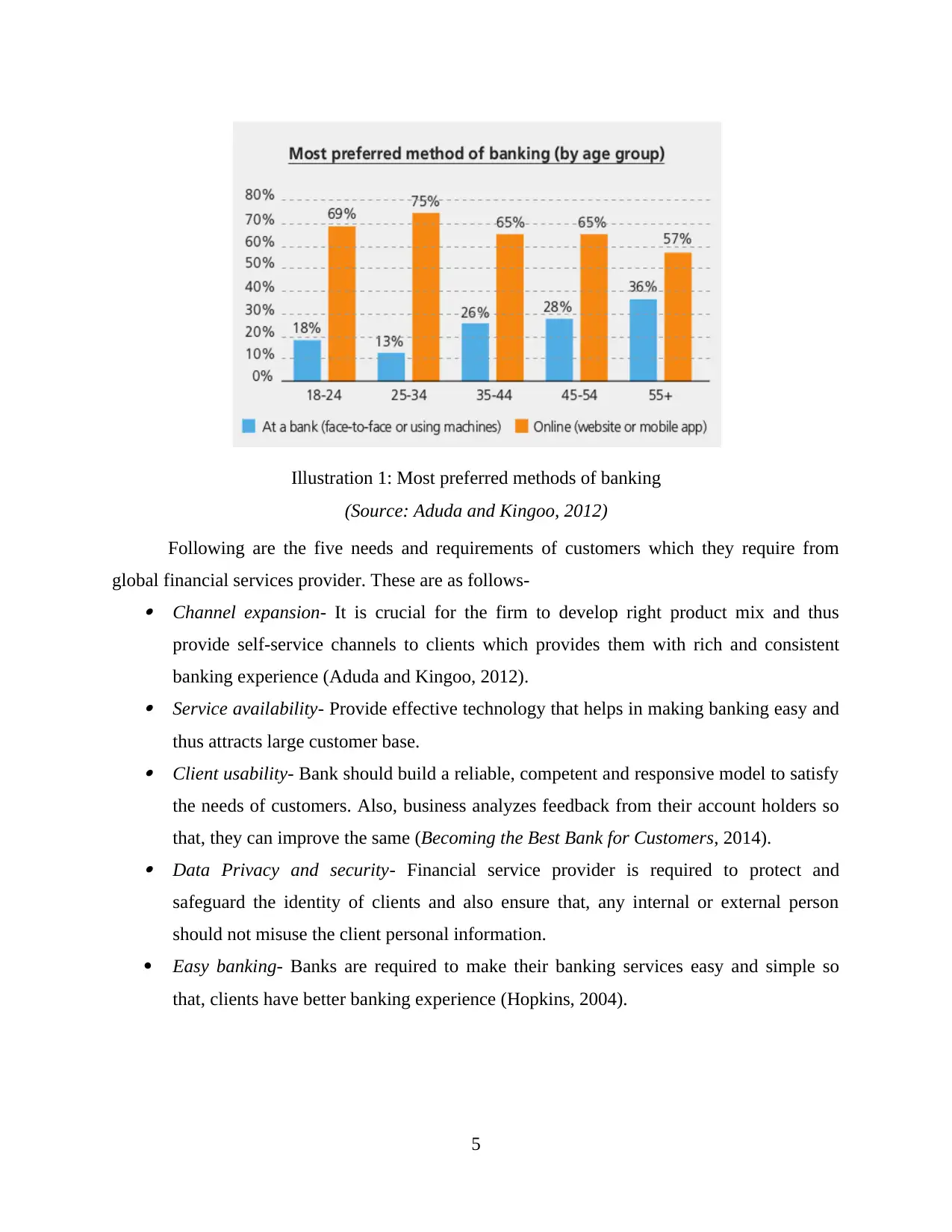

Change in needs and expectations of customers in the global financial services industry

As per the today's era, customers require modification in services and products of banks.

Thus, there are varied financial service providers who are focusing on enhancing its services to

satisfy the needs of clients. Banks are required to redesign their processes as per expectations of

customers so that, more number of customers can be attracted. Now-a-days varied customers

prefer to use mobile application to carry out or manage their finances so it is crucial for business

to set its internet banking facility to enhance the banking services worldwide (Boschma and

Hartog, 2014).

4

share of firm. The increase in divestments will affect group's market share and its

competitive positioning (Boone and Ivanov, 2012). There are varied proposed regulations which are likely to affect the banking industry of

UK. However, there are different potential changes in UK financial standards and if these

are implemented then, it may affect the banking business (Fang, 2011).

Bargaining power of Financial Service Providers

The bargaining power of financial service providers is high as they have less competition

among providing banking services in UK. Thus, they have the power to charge high interest rates

from consumers and also adjust the quality of products or services and delivery time lines.

However, if financial service provider has such type of bargaining power than, they can affect

the competitive environment and thus directly influence profitability of business. Lloyd's

provides effectual financial services to both individual and business clients so that, they can

demand for high interest rates (Marks and Mirvis, 2012). Also, the clients are ready to pay high

interests on mortgage because firm owns goodwill in the market and they have minimum

competition who is serving a large base of customers in UK. There are various factors which

affects the bargaining power of financial service providers such as change in policies by the

Bank of England. Also, fluctuation in interest rates affects bargaining power of banks.

Change in needs and expectations of customers in the global financial services industry

As per the today's era, customers require modification in services and products of banks.

Thus, there are varied financial service providers who are focusing on enhancing its services to

satisfy the needs of clients. Banks are required to redesign their processes as per expectations of

customers so that, more number of customers can be attracted. Now-a-days varied customers

prefer to use mobile application to carry out or manage their finances so it is crucial for business

to set its internet banking facility to enhance the banking services worldwide (Boschma and

Hartog, 2014).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Illustration 1: Most preferred methods of banking

(Source: Aduda and Kingoo, 2012)

Following are the five needs and requirements of customers which they require from

global financial services provider. These are as follows- Channel expansion- It is crucial for the firm to develop right product mix and thus

provide self-service channels to clients which provides them with rich and consistent

banking experience (Aduda and Kingoo, 2012). Service availability- Provide effective technology that helps in making banking easy and

thus attracts large customer base. Client usability- Bank should build a reliable, competent and responsive model to satisfy

the needs of customers. Also, business analyzes feedback from their account holders so

that, they can improve the same (Becoming the Best Bank for Customers, 2014). Data Privacy and security- Financial service provider is required to protect and

safeguard the identity of clients and also ensure that, any internal or external person

should not misuse the client personal information.

Easy banking- Banks are required to make their banking services easy and simple so

that, clients have better banking experience (Hopkins, 2004).

5

(Source: Aduda and Kingoo, 2012)

Following are the five needs and requirements of customers which they require from

global financial services provider. These are as follows- Channel expansion- It is crucial for the firm to develop right product mix and thus

provide self-service channels to clients which provides them with rich and consistent

banking experience (Aduda and Kingoo, 2012). Service availability- Provide effective technology that helps in making banking easy and

thus attracts large customer base. Client usability- Bank should build a reliable, competent and responsive model to satisfy

the needs of customers. Also, business analyzes feedback from their account holders so

that, they can improve the same (Becoming the Best Bank for Customers, 2014). Data Privacy and security- Financial service provider is required to protect and

safeguard the identity of clients and also ensure that, any internal or external person

should not misuse the client personal information.

Easy banking- Banks are required to make their banking services easy and simple so

that, clients have better banking experience (Hopkins, 2004).

5

TASK 2 E-BANKING- THE ROLE OF ALLIANCES, MERGERS AND

ACQUISITIONS

Strategic alliance can be stated as the contract among two or more parties to pursue a set

of agreed objectives which is needed at the time of remaining independent business firms. As per

the in strategic alliance, two businesses mutually agree to share their resources to achieve

common objectives. Financial service providers start strategic alliances to expand its business in

the global marketplace. Merger and acquisitions can be defined as the term used for

consolidation of businesses (Hillier, Grinblatt and Titman, 2011). Merger can be stated as the

combination of two different companies to form a new enterprise. Moreover, acquisition is the

purchase of one company by another and forming a new company. It is generally done by firms

when they found themselves less profitable or competition in market is high.

Furthermore, it can be assessed that strategic alliance, mergers and acquisitions assists

Lloyds Banking Group in order to develop their digital capabilities in the area of insurance,

customer finance, retail and commercial banking markets. Thus, financial service provider

undertakes such consolidation methods such as merger and acquisition and acquires other

banking firm which is facing challenges in overcoming its debts. It helps Lloyds to expand its

market share and thus provide varied products and services in the area of insurance and customer

finance for education loan, holiday loan etc. Further, business can also merge with similar

financial service provider and thus carry out its operations on large scale and attract varied

customers (Peng, 2013). Thus, through merging with other banking firms, Lloyds can provide

varied diversified services to clients. Also, they can determine needs and expectations of

customers and provide them with mobile banking usage facility so that, customer satisfaction can

be attained.

All these consolidated methods help Lloyd’s banks to execute internet banking in their

system and thus attracting customers to utilize the online banking. Through determining the

needs and expectations of customers, business plans strategic alliance with other financial

service providers and deliver mobile banking facility to gain customer satisfaction. Merger and

acquisition helps Lloyds Banking Group to expand its operations in different markets such as

providing customer finance, retail and commercial banking with the aim to satisfy customer

needs (Park, 2014). Thus, by undertaking such consolidated methods it might assists banks to

encourage its digital abilities and provide customized services to clients as per their

6

ACQUISITIONS

Strategic alliance can be stated as the contract among two or more parties to pursue a set

of agreed objectives which is needed at the time of remaining independent business firms. As per

the in strategic alliance, two businesses mutually agree to share their resources to achieve

common objectives. Financial service providers start strategic alliances to expand its business in

the global marketplace. Merger and acquisitions can be defined as the term used for

consolidation of businesses (Hillier, Grinblatt and Titman, 2011). Merger can be stated as the

combination of two different companies to form a new enterprise. Moreover, acquisition is the

purchase of one company by another and forming a new company. It is generally done by firms

when they found themselves less profitable or competition in market is high.

Furthermore, it can be assessed that strategic alliance, mergers and acquisitions assists

Lloyds Banking Group in order to develop their digital capabilities in the area of insurance,

customer finance, retail and commercial banking markets. Thus, financial service provider

undertakes such consolidation methods such as merger and acquisition and acquires other

banking firm which is facing challenges in overcoming its debts. It helps Lloyds to expand its

market share and thus provide varied products and services in the area of insurance and customer

finance for education loan, holiday loan etc. Further, business can also merge with similar

financial service provider and thus carry out its operations on large scale and attract varied

customers (Peng, 2013). Thus, through merging with other banking firms, Lloyds can provide

varied diversified services to clients. Also, they can determine needs and expectations of

customers and provide them with mobile banking usage facility so that, customer satisfaction can

be attained.

All these consolidated methods help Lloyd’s banks to execute internet banking in their

system and thus attracting customers to utilize the online banking. Through determining the

needs and expectations of customers, business plans strategic alliance with other financial

service providers and deliver mobile banking facility to gain customer satisfaction. Merger and

acquisition helps Lloyds Banking Group to expand its operations in different markets such as

providing customer finance, retail and commercial banking with the aim to satisfy customer

needs (Park, 2014). Thus, by undertaking such consolidated methods it might assists banks to

encourage its digital abilities and provide customized services to clients as per their

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

requirements. Through merger and acquisition, it helps in maximizing the value of financial

capabilities. Such consolidated methods assist in benefiting the banking group to enhance the

productivity and improving the client satisfaction. It also aid banks to minimize the cost and risks

by distributing them across the members of the alliance. However, sometimes banks form

strategic alliance in order to gain political advantage. With the assistance of this, banks can

alliance with a local foreign business in order to gain entry in the international market and

overcome local barriers. Thus, it helps in expanding the operations in worldwide market and

enhances the performance of the firm (Arbogast, Thornton and Bradley, 2012).

It can be assessed that as per my opinion, the business model undertaken by Lloyds is

best fit for the aim of providing real differentiation and positioning in the fast changing era of

globalization. The purpose of business is to provide customer satisfaction and fair return to their

shareholders. Thus, in such fast changing internet and mobile banking market, business evaluates

the needs and requirements of clients and put their demands on first priority so that they can

create goodwill and make a difference together (Garriga and Melé, 2013). Lloyds possess the

best business model i.e. they are leading financial service group which provides low cost,

minimum risk and client focused UK retail and commercial banking business model. It operates

to provide banking services to both individual and business clients. Furthermore, business also

creates value for our clients by developing strengths and developing distinct image of firm in

market. It also provides superior customer insight and thus focuses on maintaining relationship.

Thus, it can be assessed that Lloyds business model is the best suitable and provides

differentiation and positioning of brand in the fast changing internet and mobile banking market.

Also, firm should determine the needs of customers and develop mobile usage because in Britain

there are various customers who are using mobile banking to manage their finances. Thus,

Financial Banking Group is required to focus on maintaining relationship with customers and

satisfy their needs and wants to build trust among them. In the current era of globalization, it is

crucial for business to undertake online banking method because if they do not adopt this then

customers have varied choices available in the form of competitors (Ghemawat, 2013). Hence,

business is required to improve its services and products by adopting innovative technology in

the form of online banking so that, they can attract large number of clients. However, the UK

financial services market remains one of the largest in the world and thus Lloyd’s business

7

capabilities. Such consolidated methods assist in benefiting the banking group to enhance the

productivity and improving the client satisfaction. It also aid banks to minimize the cost and risks

by distributing them across the members of the alliance. However, sometimes banks form

strategic alliance in order to gain political advantage. With the assistance of this, banks can

alliance with a local foreign business in order to gain entry in the international market and

overcome local barriers. Thus, it helps in expanding the operations in worldwide market and

enhances the performance of the firm (Arbogast, Thornton and Bradley, 2012).

It can be assessed that as per my opinion, the business model undertaken by Lloyds is

best fit for the aim of providing real differentiation and positioning in the fast changing era of

globalization. The purpose of business is to provide customer satisfaction and fair return to their

shareholders. Thus, in such fast changing internet and mobile banking market, business evaluates

the needs and requirements of clients and put their demands on first priority so that they can

create goodwill and make a difference together (Garriga and Melé, 2013). Lloyds possess the

best business model i.e. they are leading financial service group which provides low cost,

minimum risk and client focused UK retail and commercial banking business model. It operates

to provide banking services to both individual and business clients. Furthermore, business also

creates value for our clients by developing strengths and developing distinct image of firm in

market. It also provides superior customer insight and thus focuses on maintaining relationship.

Thus, it can be assessed that Lloyds business model is the best suitable and provides

differentiation and positioning of brand in the fast changing internet and mobile banking market.

Also, firm should determine the needs of customers and develop mobile usage because in Britain

there are various customers who are using mobile banking to manage their finances. Thus,

Financial Banking Group is required to focus on maintaining relationship with customers and

satisfy their needs and wants to build trust among them. In the current era of globalization, it is

crucial for business to undertake online banking method because if they do not adopt this then

customers have varied choices available in the form of competitors (Ghemawat, 2013). Hence,

business is required to improve its services and products by adopting innovative technology in

the form of online banking so that, they can attract large number of clients. However, the UK

financial services market remains one of the largest in the world and thus Lloyd’s business

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

model is required to be formulated as per the UK economy. Thus, it provides real differentiation

and positioning for future regulatory reform and attains desired objectives.

TASK 3 CORPORATE GOVERNANCE, CSR, LEADERSHIP AND

COMPETITIVENESS

Corporate governance can be defined as the processes and mechanisms through which

businesses are controlled and directed. Here, the board members and managers of firm have the

rights and responsibilities that involve rules and procedures in order to make decisions in the

corporate affairs. Further, business is also required to undertake corporate social responsibility

(CSR) in order to develop regulations and take initiative to protect the social environment. Also,

company is required to carry out various CSR activities with the aim to integrate regulation into

business model (Nini, Smith and Sufi, 2012). Moreover, there are various relevant management

and leadership concepts available with firm which helps them to focus on customer satisfaction.

It also rebuilds their colleague’s pride of working in their group by undertaking best CSR and

corporate governance practices. Further, Lloyd undertakes such business model which puts

customers at their heart and provides them with quality products and services in order to develop

long term view through making the most emerging digital channels.

The main strategy developed by Financial Banking Group is that, they provide low cost,

minimum risk and customer focused UK retail and commercial banking business model. Thus,

keeping in mind such objectives business focuses on client needs and expectations in order to

deliver them the best quality products and services. Further, in the coming year’s business is

required to bring varied changes in their technology, customer behavior and improving

regulatory requirements (Fang, 2011).

Developing the best customer experience- Clients are the heart of business and thus

bank is focusing on building customer experience by providing them with multi-brand

products and services. Further, business is required to develop its digital presence by

providing internet banking facilities to clients and delivering high quality services (Aoki,

2013).

Becoming simplified and easy- Business creates operational capability to enhance and

integrate as per the change in customer needs and requirements through becoming cost

leadership among UK financial services providers. However, by such cost leadership it

8

and positioning for future regulatory reform and attains desired objectives.

TASK 3 CORPORATE GOVERNANCE, CSR, LEADERSHIP AND

COMPETITIVENESS

Corporate governance can be defined as the processes and mechanisms through which

businesses are controlled and directed. Here, the board members and managers of firm have the

rights and responsibilities that involve rules and procedures in order to make decisions in the

corporate affairs. Further, business is also required to undertake corporate social responsibility

(CSR) in order to develop regulations and take initiative to protect the social environment. Also,

company is required to carry out various CSR activities with the aim to integrate regulation into

business model (Nini, Smith and Sufi, 2012). Moreover, there are various relevant management

and leadership concepts available with firm which helps them to focus on customer satisfaction.

It also rebuilds their colleague’s pride of working in their group by undertaking best CSR and

corporate governance practices. Further, Lloyd undertakes such business model which puts

customers at their heart and provides them with quality products and services in order to develop

long term view through making the most emerging digital channels.

The main strategy developed by Financial Banking Group is that, they provide low cost,

minimum risk and customer focused UK retail and commercial banking business model. Thus,

keeping in mind such objectives business focuses on client needs and expectations in order to

deliver them the best quality products and services. Further, in the coming year’s business is

required to bring varied changes in their technology, customer behavior and improving

regulatory requirements (Fang, 2011).

Developing the best customer experience- Clients are the heart of business and thus

bank is focusing on building customer experience by providing them with multi-brand

products and services. Further, business is required to develop its digital presence by

providing internet banking facilities to clients and delivering high quality services (Aoki,

2013).

Becoming simplified and easy- Business creates operational capability to enhance and

integrate as per the change in customer needs and requirements through becoming cost

leadership among UK financial services providers. However, by such cost leadership it

8

enables the business to provide increased value to our clients and competitive

differentiation.

Delivering sustainable development- UK economy provides growth opportunities to

businesses in order to become market leadership in providing varied products and

services to consumers (Erkens, Hung and Matos, 2012).

Colleagues- Lloyd bank is trying to focus on their employees and provide them with

proper training so that they can focus on customer requirements in becoming the best

financial service provider.

Helping Britain prospers- It states that business is regularly focusing on satisfying the

needs of UK clients by providing them with best financial products and services (Boone

and Ivanov, 2012).

Through, the above objectives it can be assessed that; it helps Lloyds in developing its

ability in order to satisfy the needs and requirements of clients. Thus, financial banking group

undertakes effectual corporate governance scheme, CSR and varied leadership and

competitiveness theories to give tough competition to rivals. All these strategies assists business

to target clients and develop long term relationship with them by providing them with quality

financial products and services (Marks and Mirvis, 2012). Hence, the ability of the Lloyds

Chairman and senior management team to target customers and satisfy their requirements. All

the senior management and employees of organization are focusing to make Lloyd the best bank

for all its stakeholders. Thus, such objective can be attained by the firm through developing

strategic objective and providing low cost, minimum risk and improving customer behavior

within firm.

As per the corporate governance report of 2014, the Chairman states that they are

focusing in developing best financial services in order to develop trust among clients as well as

proving to be the best bank for shareholders. Firm has taken varied crucial decisions in order to

become best bank for customers. Hence, corporate governance framework enables strategic,

accountable and responsible decision developed by the colleagues. Also, the team of bank

supports colleagues in order to fulfill business objectives of CSR and corporate governance

(Boschma and Hartog, 2014). Lloyd's Chairman and senior management helps business to put

forward to satisfy customers and shareholders. With the assistance of such business model, it

puts clients at the heart which is based on traditional attributes such as prudence and long term

9

differentiation.

Delivering sustainable development- UK economy provides growth opportunities to

businesses in order to become market leadership in providing varied products and

services to consumers (Erkens, Hung and Matos, 2012).

Colleagues- Lloyd bank is trying to focus on their employees and provide them with

proper training so that they can focus on customer requirements in becoming the best

financial service provider.

Helping Britain prospers- It states that business is regularly focusing on satisfying the

needs of UK clients by providing them with best financial products and services (Boone

and Ivanov, 2012).

Through, the above objectives it can be assessed that; it helps Lloyds in developing its

ability in order to satisfy the needs and requirements of clients. Thus, financial banking group

undertakes effectual corporate governance scheme, CSR and varied leadership and

competitiveness theories to give tough competition to rivals. All these strategies assists business

to target clients and develop long term relationship with them by providing them with quality

financial products and services (Marks and Mirvis, 2012). Hence, the ability of the Lloyds

Chairman and senior management team to target customers and satisfy their requirements. All

the senior management and employees of organization are focusing to make Lloyd the best bank

for all its stakeholders. Thus, such objective can be attained by the firm through developing

strategic objective and providing low cost, minimum risk and improving customer behavior

within firm.

As per the corporate governance report of 2014, the Chairman states that they are

focusing in developing best financial services in order to develop trust among clients as well as

proving to be the best bank for shareholders. Firm has taken varied crucial decisions in order to

become best bank for customers. Hence, corporate governance framework enables strategic,

accountable and responsible decision developed by the colleagues. Also, the team of bank

supports colleagues in order to fulfill business objectives of CSR and corporate governance

(Boschma and Hartog, 2014). Lloyd's Chairman and senior management helps business to put

forward to satisfy customers and shareholders. With the assistance of such business model, it

puts clients at the heart which is based on traditional attributes such as prudence and long term

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.