Factors Affecting Merger and Acquisition Evaluation in Banking Sector

VerifiedAdded on 2023/04/22

|48

|20043

|276

Thesis and Dissertation

AI Summary

This dissertation delves into the factors influencing merger and acquisition (M&A) evaluation strategies within the banking sector, highlighting the critical role of the banking industry in a country's economic stability. It explores how M&A serves as a vital tool for international market expansion within this sector. The study encompasses various sections, including an introduction outlining the research background, significance, aim, questions, hypotheses, and organizational structure. The literature review provides a theoretical evaluation of the research topic, drawing upon existing sources to identify factors impacting M&A success and different evaluation strategies. A deductive research approach is employed, testing hypotheses using statistical tools on data collected from 46 employees across different organizations, utilizing probability sampling to minimize bias. The research combines statistical data analysis and literature review to assess both conceptual and numerical data. The conclusion underscores the significant impact of both internal and external factors on M&A evaluation strategies in the banking sector.

Running Head: MERGER AND ACQUISITION

Factors affecting merger and acquisition evaluations strategies in the banking industry

Factors affecting merger and acquisition evaluations strategies in the banking industry

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION ii

Abstract

This study is emphasized on evaluating factors which affect acquisition and merger evaluations

strategies in banking sector. Banking industry could play an imperative role in affecting economic

situation of country. In the baking industry, merger and acquisition is an imperative tool to expand the

market at the international level. In this, many sections has been discussed, as it can be related to the

introduction, literature review, and research methodology, data analysis section, conclusion and

recommendation. The introduction chapters could consider certain elements named as research

background, research significance, research aim, and research questions, research hypothesis and

organizational structure. The research background section is imperative to comprehend the current

situation of merger and acquisition. This section is imperative to reach at the reliable conclusion. The

research questions is supporting to understand what will be covered in the study. A Literature review

section could support to theoretically evaluate research matter by entailing existing sources and

achieve the research aim. In this section, the many factors has been discussed that might affect to the

merger as well as acquisition. This section has also supports to understand different evaluation

strategies of the merger and acquisition in the banking sector that would be vital to increase success

of merger and acquisition implementation. Further, researcher has practised the deductive research

tool to conduct this study as it facilitates to develop the hypothesis and prove and reject them by

considering the statistical tool. This study has been conducted on the 46 employees of different

organization to get the data in the favour of research matter. Probability sampling tool is practised by

researcher due to eliminating the biases from the study. This study has considered statistical data

analysis tool and literature review method to evaluate conceptual as well as numerical data that would

be effective in completing the research aim in an appropriate way. Moreover, conclusion section

demonstrated that internal as well as external factors could affect to the merger and acquisition

evaluation strategies in the banking sector.

Abstract

This study is emphasized on evaluating factors which affect acquisition and merger evaluations

strategies in banking sector. Banking industry could play an imperative role in affecting economic

situation of country. In the baking industry, merger and acquisition is an imperative tool to expand the

market at the international level. In this, many sections has been discussed, as it can be related to the

introduction, literature review, and research methodology, data analysis section, conclusion and

recommendation. The introduction chapters could consider certain elements named as research

background, research significance, research aim, and research questions, research hypothesis and

organizational structure. The research background section is imperative to comprehend the current

situation of merger and acquisition. This section is imperative to reach at the reliable conclusion. The

research questions is supporting to understand what will be covered in the study. A Literature review

section could support to theoretically evaluate research matter by entailing existing sources and

achieve the research aim. In this section, the many factors has been discussed that might affect to the

merger as well as acquisition. This section has also supports to understand different evaluation

strategies of the merger and acquisition in the banking sector that would be vital to increase success

of merger and acquisition implementation. Further, researcher has practised the deductive research

tool to conduct this study as it facilitates to develop the hypothesis and prove and reject them by

considering the statistical tool. This study has been conducted on the 46 employees of different

organization to get the data in the favour of research matter. Probability sampling tool is practised by

researcher due to eliminating the biases from the study. This study has considered statistical data

analysis tool and literature review method to evaluate conceptual as well as numerical data that would

be effective in completing the research aim in an appropriate way. Moreover, conclusion section

demonstrated that internal as well as external factors could affect to the merger and acquisition

evaluation strategies in the banking sector.

MERGER AND ACQUISITION iii

Table of Content

Abstract.................................................................................................................................................. ii

Table of Content.................................................................................................................................... iii

Introduction, Research Aim, Objectives and Research Questions:.......................................................vi

Research background....................................................................................................................... vi

Research significance....................................................................................................................... vi

Aim of research................................................................................................................................. vi

Research questions.......................................................................................................................... vii

Research hypothesis........................................................................................................................ vii

Organizational structure................................................................................................................... vii

Literature review.................................................................................................................................... x

Introduction........................................................................................................................................ x

Factors affecting merger and acquisition evaluation strategies to the banking industry.....................x

Conclusion..................................................................................................................................... xviii

Research Design and Methodology.................................................................................................... xix

Rationality of research methodology............................................................................................... xix

Research Onion Framework............................................................................................................ xix

Research Approach......................................................................................................................... xx

Research Design............................................................................................................................. xxi

Research Strategy........................................................................................................................... xxi

Data Collection Method.................................................................................................................. xxii

Sampling Method........................................................................................................................... xxiv

Data Analysis Method.................................................................................................................... xxiv

Research Limitations...................................................................................................................... xxv

Store.............................................................................................................................................. xxvi

Ethnocentrism................................................................................................................................ xxvi

Ethical Consideration..................................................................................................................... xxvi

Survey through questionnaire....................................................................................................... xxvii

Findings/Results:................................................................................................................................ xxx

Conclusion and recommendation...................................................................................................... xlvii

Conclusion..................................................................................................................................... xlvii

Recommendations........................................................................................................................ xlviii

References............................................................................................................................................ lii

Gender

Age

Experience

Merger and acquisition is imperative way for increasing the external growth

Mergers and Acquisitions (M&A) is being major force in the changing atmosphere

Mergers and Acquisitions (M&A) could be used as the strategic plan in the organization

Table of Content

Abstract.................................................................................................................................................. ii

Table of Content.................................................................................................................................... iii

Introduction, Research Aim, Objectives and Research Questions:.......................................................vi

Research background....................................................................................................................... vi

Research significance....................................................................................................................... vi

Aim of research................................................................................................................................. vi

Research questions.......................................................................................................................... vii

Research hypothesis........................................................................................................................ vii

Organizational structure................................................................................................................... vii

Literature review.................................................................................................................................... x

Introduction........................................................................................................................................ x

Factors affecting merger and acquisition evaluation strategies to the banking industry.....................x

Conclusion..................................................................................................................................... xviii

Research Design and Methodology.................................................................................................... xix

Rationality of research methodology............................................................................................... xix

Research Onion Framework............................................................................................................ xix

Research Approach......................................................................................................................... xx

Research Design............................................................................................................................. xxi

Research Strategy........................................................................................................................... xxi

Data Collection Method.................................................................................................................. xxii

Sampling Method........................................................................................................................... xxiv

Data Analysis Method.................................................................................................................... xxiv

Research Limitations...................................................................................................................... xxv

Store.............................................................................................................................................. xxvi

Ethnocentrism................................................................................................................................ xxvi

Ethical Consideration..................................................................................................................... xxvi

Survey through questionnaire....................................................................................................... xxvii

Findings/Results:................................................................................................................................ xxx

Conclusion and recommendation...................................................................................................... xlvii

Conclusion..................................................................................................................................... xlvii

Recommendations........................................................................................................................ xlviii

References............................................................................................................................................ lii

Gender

Age

Experience

Merger and acquisition is imperative way for increasing the external growth

Mergers and Acquisitions (M&A) is being major force in the changing atmosphere

Mergers and Acquisitions (M&A) could be used as the strategic plan in the organization

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERGER AND ACQUISITION iv

Successful competition in the global market could be relied on the abilities got in the timely as well as

well-organized fashion by Merger as well as Acquisitions

which method is more suitable for the business performance

Merger and acquisition is used to maximize shareholder value

Strategies of Merger and acquisition is used for operating the business

Mergers and Acquisitions could affected to the overall performance of employees

factors affect more to merger and acquisition

Gender

Age

Experience

Merger and acquisition is imperative way for increasing the external growth

Mergers and Acquisitions (M&A) is being major force in the changing atmosphere

Mergers and Acquisitions (M&A) could be used as the strategic plan in the organization

Successful competition in the global market could be relied on the abilities got in the timely as well as

well-organized fashion by Merger as well as Acquisitions

which method is more suitable for the business performance

Merger and acquisition is used to maximize shareholder value

Strategies of Merger and acquisition is used for operating the business

Merger and acquisition affect to the business performance

Mergers and Acquisitions could affected to the overall performance of employees

factors affect more to merger and acquisition

Successful competition in the global market could be relied on the abilities got in the timely as well as

well-organized fashion by Merger as well as Acquisitions

which method is more suitable for the business performance

Merger and acquisition is used to maximize shareholder value

Strategies of Merger and acquisition is used for operating the business

Mergers and Acquisitions could affected to the overall performance of employees

factors affect more to merger and acquisition

Gender

Age

Experience

Merger and acquisition is imperative way for increasing the external growth

Mergers and Acquisitions (M&A) is being major force in the changing atmosphere

Mergers and Acquisitions (M&A) could be used as the strategic plan in the organization

Successful competition in the global market could be relied on the abilities got in the timely as well as

well-organized fashion by Merger as well as Acquisitions

which method is more suitable for the business performance

Merger and acquisition is used to maximize shareholder value

Strategies of Merger and acquisition is used for operating the business

Merger and acquisition affect to the business performance

Mergers and Acquisitions could affected to the overall performance of employees

factors affect more to merger and acquisition

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION v

Introduction, Research Aim, Objectives and Research Questions:

Title: Main title of the research is “Factors affecting Acquisitions and mergers evaluation strategies in

the banking industry”.

Research background

In current business era, banking sector could need to gain their understanding of the research matter.

Merger and acquisitions could have direct impact on productivity of organisation. Different kinds of

factors that are considered by the firm as it might affect the merger and acquisition named cultural,

human resource, economic, and technological factors. The merger could facilitate to two firms to

combine with each other for operating their business at a large scale and make higher competitive

advantages (Bauer and Matzler, 2014). The acquisition method could enable one big organization to

purchase another organization that has a less net profit. It is stated that the Mergers and acquisitions

tool are different from each other but the motive of both methods is to make higher competitive

advantages (Cevik Onar, et al., 2014). It is addressed that merger and acquisitions are an imperative

technique as it facilitates to the firm to operate their business at the large scale and make their unique

image in the marketplace (Thompson, et al., 2015). It is illustrated that the firm could gain their depth

knowledge which method will be more effective for the firm before implying it in the organization. It is

illustrated that depth evaluation of the tool could enable to get benefits. It is also examined a merger is

an effective tool for the organization to meet its organizational purpose (Garzella and Fiorentino,

2014).

Research significance

This research is effective for gaining understanding about merger and acquisition that will be

imperative in operating business process and make their career in the HRM. It could be effective for

increasing depth data towards different factors that might affect a merger as well as acquisitions. This

report will lead to comprehending strategies that might be practiced by the firm for eliminating issues

that will be occurred during implementation of merger and acquisition. This study will also be

imperative for the researcher as it supports to make the career of the researcher in the HRM

department wherein the merger and acquisition are possible.

Aim of research

Key aim of this investigation is to analyse and evaluate imperative issues in current banking business

firms that are related with strategic planning of acquisitions and mergers. In order to attain research

aim, research scholar would achieve certain objectives, which are described as below:

To discover the conceptual understanding of the merger and acquisition

To critically evaluates factors that affecting the merger and acquisition strategies in banking

strategies

To recommended strategies for effectively implementing the merger and acquisition in the

banking industry

Research questions

What are the factors that are affecting the strategic planning of the mergers and acquisitions

in contemporary banking business organizations?

Introduction, Research Aim, Objectives and Research Questions:

Title: Main title of the research is “Factors affecting Acquisitions and mergers evaluation strategies in

the banking industry”.

Research background

In current business era, banking sector could need to gain their understanding of the research matter.

Merger and acquisitions could have direct impact on productivity of organisation. Different kinds of

factors that are considered by the firm as it might affect the merger and acquisition named cultural,

human resource, economic, and technological factors. The merger could facilitate to two firms to

combine with each other for operating their business at a large scale and make higher competitive

advantages (Bauer and Matzler, 2014). The acquisition method could enable one big organization to

purchase another organization that has a less net profit. It is stated that the Mergers and acquisitions

tool are different from each other but the motive of both methods is to make higher competitive

advantages (Cevik Onar, et al., 2014). It is addressed that merger and acquisitions are an imperative

technique as it facilitates to the firm to operate their business at the large scale and make their unique

image in the marketplace (Thompson, et al., 2015). It is illustrated that the firm could gain their depth

knowledge which method will be more effective for the firm before implying it in the organization. It is

illustrated that depth evaluation of the tool could enable to get benefits. It is also examined a merger is

an effective tool for the organization to meet its organizational purpose (Garzella and Fiorentino,

2014).

Research significance

This research is effective for gaining understanding about merger and acquisition that will be

imperative in operating business process and make their career in the HRM. It could be effective for

increasing depth data towards different factors that might affect a merger as well as acquisitions. This

report will lead to comprehending strategies that might be practiced by the firm for eliminating issues

that will be occurred during implementation of merger and acquisition. This study will also be

imperative for the researcher as it supports to make the career of the researcher in the HRM

department wherein the merger and acquisition are possible.

Aim of research

Key aim of this investigation is to analyse and evaluate imperative issues in current banking business

firms that are related with strategic planning of acquisitions and mergers. In order to attain research

aim, research scholar would achieve certain objectives, which are described as below:

To discover the conceptual understanding of the merger and acquisition

To critically evaluates factors that affecting the merger and acquisition strategies in banking

strategies

To recommended strategies for effectively implementing the merger and acquisition in the

banking industry

Research questions

What are the factors that are affecting the strategic planning of the mergers and acquisitions

in contemporary banking business organizations?

MERGER AND ACQUISITION vi

Research hypothesis

There is a positive relationship between factors affecting evaluation strategies Acquisitions

and mergers evaluation strategies and performance of the banking industry

There is no relationship between factors affecting evaluation strategies Acquisitions and

mergers strategies and performance of the banking industry

Organizational structure

The organizational structure can be essential for comprehending issues of research study in depth.

The organizational structure could entail certain elements that were described as below:

Chapter 1: Introduction

Chapter 1 is introduction part of the organizational structure that is effective for gaining the

understanding about certain elements, which might be necessary for conducting any study named as

the background of research, question of research, aim and objectives of research, structure of

dissertation (Cartwright, and Cooper, 2014). In this, it is founded that aim and objective of research

might an essential section for investigation as it offers a path to the investigator to conduct their

investigator in directing and work on effectively. It is stated that the research question could also be

essential for gaining theoretical data with respect to research dilemma. Research questions can also

supports investigator to find a solution on the specified concern (Cavusgil, et al., 2014). The research

background support to comprehend what is the concern in depth. It could increase the awareness of

the investigator towards the research dilemma that would be effective in getting a positive result

towards the research matter. It could facilitates the investigator to know perspective of doing

business. It can be illustrated that the last section of the introduction could demonstrate the

organizational structure that supports to understand what we will be covered in the study. Thus, it can

be evaluated that the interdiction section is effective to get higher competitive advantages (Ansoff, et

al., 2018).

Chapter 2: a Literature review

Literature review section is the second section of study that is effective to comprehend the opinion as

well as a researcher of the different authors on the same topic. It could also be imperative to

comprehend how the literature review data is collected (Gamache, et al., 2015). For completing this

section, the literature review sector could consider different sources such as academic publication,

journal articles, authentic websites and other sources. Further, researcher has entailed such sources

and collects the data related to current research concern (Galpin, 2014). Data is gathered by entailing

reliable sources of the research result. It is evaluated that the investigator is deeply evaluated factors

that might be affected by outcome of research. Researcher should have proper understanding of

methods and ways that would be effective for attaining appropriate outcome with respect to research

concern. It is also examined that this section mandates to comprehend the different authors and

researcher and consider it in investigation for increasing reliability of firm (Lasserre, 2017).

Chapter 3: Research methodology

Third chapter of study is research methodology as this section facilitates the researcher to

comprehend different methods, which might be practiced in the study to pool feasible data about

research concern and obtain higher competitive benefits. These tools were known as the approaches

Research hypothesis

There is a positive relationship between factors affecting evaluation strategies Acquisitions

and mergers evaluation strategies and performance of the banking industry

There is no relationship between factors affecting evaluation strategies Acquisitions and

mergers strategies and performance of the banking industry

Organizational structure

The organizational structure can be essential for comprehending issues of research study in depth.

The organizational structure could entail certain elements that were described as below:

Chapter 1: Introduction

Chapter 1 is introduction part of the organizational structure that is effective for gaining the

understanding about certain elements, which might be necessary for conducting any study named as

the background of research, question of research, aim and objectives of research, structure of

dissertation (Cartwright, and Cooper, 2014). In this, it is founded that aim and objective of research

might an essential section for investigation as it offers a path to the investigator to conduct their

investigator in directing and work on effectively. It is stated that the research question could also be

essential for gaining theoretical data with respect to research dilemma. Research questions can also

supports investigator to find a solution on the specified concern (Cavusgil, et al., 2014). The research

background support to comprehend what is the concern in depth. It could increase the awareness of

the investigator towards the research dilemma that would be effective in getting a positive result

towards the research matter. It could facilitates the investigator to know perspective of doing

business. It can be illustrated that the last section of the introduction could demonstrate the

organizational structure that supports to understand what we will be covered in the study. Thus, it can

be evaluated that the interdiction section is effective to get higher competitive advantages (Ansoff, et

al., 2018).

Chapter 2: a Literature review

Literature review section is the second section of study that is effective to comprehend the opinion as

well as a researcher of the different authors on the same topic. It could also be imperative to

comprehend how the literature review data is collected (Gamache, et al., 2015). For completing this

section, the literature review sector could consider different sources such as academic publication,

journal articles, authentic websites and other sources. Further, researcher has entailed such sources

and collects the data related to current research concern (Galpin, 2014). Data is gathered by entailing

reliable sources of the research result. It is evaluated that the investigator is deeply evaluated factors

that might be affected by outcome of research. Researcher should have proper understanding of

methods and ways that would be effective for attaining appropriate outcome with respect to research

concern. It is also examined that this section mandates to comprehend the different authors and

researcher and consider it in investigation for increasing reliability of firm (Lasserre, 2017).

Chapter 3: Research methodology

Third chapter of study is research methodology as this section facilitates the researcher to

comprehend different methods, which might be practiced in the study to pool feasible data about

research concern and obtain higher competitive benefits. These tools were known as the approaches

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERGER AND ACQUISITION vii

of research, strategies of research, data gathering tool, data analysis technique, research

philosophies, ethical consideration, and limitation of research (Nelson, 2018). These are essential

aspects that support in completing the task of research study by using existing sources. Research

methodology section will mandate to the investigator which strategies, methods, and tools could be

effective for the study. It also facilitates to know the depth evaluation of each tool that supports to

make a decision toward the research selection of investigation tool for running a business and

increase possibilities of getting a higher outcome. This section will also be imperative to operate the

overall business in one direction and get positive responses (Hryckiewicz, 2014).

Chapter 4: Data analysis and findings

In the data analysis and findings section, the research scholar would be capable to analyze pooled

data by considering different sources named as literature review and statistical data analysis tool. In

this investigation, a statistical data analysis tool is a prominent tool to assess numerical data of

investigation that will be collected by utilizing a survey through questionnaire method. Literature

review method would be used to analyze the non-factual data of the study and obtain the targeted aim

of investigation (Jaberidoost, et al., 2015). It is illustrated that the researcher has considered normally

both when an investigation has subjective nature. This study has needed factual information hence

both statistical and non-statistical data analysis tool will be practiced as it would be significant for the

functioning of business in one direction and meeting the aim of the study effectively. It can also be

illustrated that this section could present the data by graphs chart, and table and it could be done by

considering MS-excel software program. This software could support to save the cost and time of the

study and effective for getting a reliable outcome (Berger, et al., 2014).

Chapter 5: Conclusion and recommendation

Conclusion and recommendation is the last section of investigation as it is practiced to present overall

study in a concise form. This chapter can be essential for gaining knowledge of different methods,

which might be imperative to obtain higher competitive benefits (Kim, et al., 2015). It is examined that

the conclusion section concise overall report that will be effective to comprehend which it entails in

this study what was the outcome of doing this study. The recommendation section is also imperative

as it facilitates the researcher for obtaining research outcome. In the research, the recommendation

part of the study is vital for conducting an investigation in upcoming period (Grant, 2016).

of research, strategies of research, data gathering tool, data analysis technique, research

philosophies, ethical consideration, and limitation of research (Nelson, 2018). These are essential

aspects that support in completing the task of research study by using existing sources. Research

methodology section will mandate to the investigator which strategies, methods, and tools could be

effective for the study. It also facilitates to know the depth evaluation of each tool that supports to

make a decision toward the research selection of investigation tool for running a business and

increase possibilities of getting a higher outcome. This section will also be imperative to operate the

overall business in one direction and get positive responses (Hryckiewicz, 2014).

Chapter 4: Data analysis and findings

In the data analysis and findings section, the research scholar would be capable to analyze pooled

data by considering different sources named as literature review and statistical data analysis tool. In

this investigation, a statistical data analysis tool is a prominent tool to assess numerical data of

investigation that will be collected by utilizing a survey through questionnaire method. Literature

review method would be used to analyze the non-factual data of the study and obtain the targeted aim

of investigation (Jaberidoost, et al., 2015). It is illustrated that the researcher has considered normally

both when an investigation has subjective nature. This study has needed factual information hence

both statistical and non-statistical data analysis tool will be practiced as it would be significant for the

functioning of business in one direction and meeting the aim of the study effectively. It can also be

illustrated that this section could present the data by graphs chart, and table and it could be done by

considering MS-excel software program. This software could support to save the cost and time of the

study and effective for getting a reliable outcome (Berger, et al., 2014).

Chapter 5: Conclusion and recommendation

Conclusion and recommendation is the last section of investigation as it is practiced to present overall

study in a concise form. This chapter can be essential for gaining knowledge of different methods,

which might be imperative to obtain higher competitive benefits (Kim, et al., 2015). It is examined that

the conclusion section concise overall report that will be effective to comprehend which it entails in

this study what was the outcome of doing this study. The recommendation section is also imperative

as it facilitates the researcher for obtaining research outcome. In the research, the recommendation

part of the study is vital for conducting an investigation in upcoming period (Grant, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION viii

Literature review

Introduction

Introduction chapter is imperative for pooling suitable data in the context of research matter. Current

paper is supportive to gain an understanding of the meaning and concept of the merger and

acquisition. This report is also effective for comprehending different strategies that might be used by

the banking industry to overcome the factor affecting merger and acquisition. IT could be effective for

working in the HRM department in the upcoming period and support to have a decision in favor of the

study issue. It is also essential for accomplishing task of organization.

Factors affecting merger and acquisition evaluation strategies to the banking industry

According to Zhang et al. (2015) organization has started to work hard for accomplishing their

specified work in the least time and cost. Each organization has made a basic goal for meeting the

aim of the study and increase profitability. The organization has also decided on the possible growth

that will be accomplished in the upcoming period. Ahammad (2016) stated that a firm could value the

internal as well as the external factor for increasing the possibilities of getting positive responses. The

internal development could be accomplished either by introducing procedure and innovate fresh

goods and services through increasing the ability to expand the business and enlarging the business

size to enhance the capability of business organization. It is evaluated that the firm could improve the

sale of the firm in the least time and cost. It is illustrated that the external growth could be

accomplished by the merger as well as acquisition.

In support of this, Molle (2017) illustrated that Merger and acquisition is an imperative way of

increasing external growth. In the recent international economy, acquisition and merger are being

increasingly practiced the world over as approach in accomplishing the larger asset base caused of

entering into new markets. It will also be effective for effectively entering into the new market and

getting higher competitive benefits. It could be effective in creating higher benefits by implying this

method in the business process.

In opposed to this, Ferreira (2014) addressed that Mergers and Acquisitions tool is a tool that assists

to the organization to emerge the business and support the company to conduct processing of

business and attain more competitive benefits. In addition, mergers and acquisitions are practiced to

meet sustainable benefits at the corporate level. It is evaluated M&A (Mergers and Acquisitions) is

being a chief source to alter the atmosphere. It could support the organization for competing with the

domestic as well as an internal level. Merger and acquisition are one of the vital methods as it assists

to improve the company structure and facilitates getting a higher competitive outcome.

Malik (2014) argued that the Merger and acquisition also emerge as one of the imperative technique

for the business which has a direct impact on the entire performance of business. Further, Indian

organizations are practicing Merger and acquisition as one of the growth strategies. In modern era of

business, this tool is imperative for an organisation to implement acquisition, a merger in order to

operate the business and get a reliable outcome. Consequently, these methods might be prominent

for operating the activity of business and making a reliable outcome.

In support of this, Jordao (2014) illustrated that the organization could decline the probability of

turnover from the working place. It is evaluated that Mergers, Acquisitions strategy could be effective

Literature review

Introduction

Introduction chapter is imperative for pooling suitable data in the context of research matter. Current

paper is supportive to gain an understanding of the meaning and concept of the merger and

acquisition. This report is also effective for comprehending different strategies that might be used by

the banking industry to overcome the factor affecting merger and acquisition. IT could be effective for

working in the HRM department in the upcoming period and support to have a decision in favor of the

study issue. It is also essential for accomplishing task of organization.

Factors affecting merger and acquisition evaluation strategies to the banking industry

According to Zhang et al. (2015) organization has started to work hard for accomplishing their

specified work in the least time and cost. Each organization has made a basic goal for meeting the

aim of the study and increase profitability. The organization has also decided on the possible growth

that will be accomplished in the upcoming period. Ahammad (2016) stated that a firm could value the

internal as well as the external factor for increasing the possibilities of getting positive responses. The

internal development could be accomplished either by introducing procedure and innovate fresh

goods and services through increasing the ability to expand the business and enlarging the business

size to enhance the capability of business organization. It is evaluated that the firm could improve the

sale of the firm in the least time and cost. It is illustrated that the external growth could be

accomplished by the merger as well as acquisition.

In support of this, Molle (2017) illustrated that Merger and acquisition is an imperative way of

increasing external growth. In the recent international economy, acquisition and merger are being

increasingly practiced the world over as approach in accomplishing the larger asset base caused of

entering into new markets. It will also be effective for effectively entering into the new market and

getting higher competitive benefits. It could be effective in creating higher benefits by implying this

method in the business process.

In opposed to this, Ferreira (2014) addressed that Mergers and Acquisitions tool is a tool that assists

to the organization to emerge the business and support the company to conduct processing of

business and attain more competitive benefits. In addition, mergers and acquisitions are practiced to

meet sustainable benefits at the corporate level. It is evaluated M&A (Mergers and Acquisitions) is

being a chief source to alter the atmosphere. It could support the organization for competing with the

domestic as well as an internal level. Merger and acquisition are one of the vital methods as it assists

to improve the company structure and facilitates getting a higher competitive outcome.

Malik (2014) argued that the Merger and acquisition also emerge as one of the imperative technique

for the business which has a direct impact on the entire performance of business. Further, Indian

organizations are practicing Merger and acquisition as one of the growth strategies. In modern era of

business, this tool is imperative for an organisation to implement acquisition, a merger in order to

operate the business and get a reliable outcome. Consequently, these methods might be prominent

for operating the activity of business and making a reliable outcome.

In support of this, Jordao (2014) illustrated that the organization could decline the probability of

turnover from the working place. It is evaluated that Mergers, Acquisitions strategy could be effective

MERGER AND ACQUISITION ix

to make sound business development and higher business progress. It is stated that effectively entry

into a new market and make a higher profit for the long-term. It is effective for the successful

competition that the organization needed to improve their capabilities towards the implication of

merger and Acquisitions (M&A).

Angwin et al. (2016) stated that a merger could enhance efficiency and productivity of the firm. This

could be effective for increasing the shareholder value mere as it would lead to obtaining the higher

profitability of the organization. It is illustrated that the merger can be vital for accomplishment of

organizational activities. This is quite difficult for the organization to directly achieving targeted aim of

research matter. Moreover, Mergers, Acquisitions tool could be used as strategic concepts

incorporate to have decision effectively. Combination of business elements is an overall wonder. One

of the devices for solidification is mergers and acquisitions.

In support to this, Yan and Luo (2016) stated that the mergers and acquisitions in money related area

of India have all the earmarks of being driven by target of utilizing cooperative energies emerging out

of M&A process outcomes. Nonetheless, such supplementary changes in money related framework

might have some suggestions of exposed approach. It is obvious from different mergers and

amalgamations did by the Bank after its beginning in 1994. In any case, it is very clear by their activity

that it is a way of development for them. In oppose to this, Helfat and Martin (2015) illustrated that in

view of this announcement, we might want to display the applied structure for mergers and

acquisitions in India's unique situation. Systems for the merger, procurement, and amalgamation of

banking organizations are plainly characterized in segment 44(A) of the Banking Regulation Act 1949.

As per the Act, a financial organization should put a draft before its investors and the draft should be

endorsed by a goals gone by a greater part in number, speaking to 66% in estimation of the investors

of every one of the said organizations, present either face to face or as a substitute at a gathering

required the reason.

Paulet et al. (2015) stated that Vertical merger (VM) is a merger where one firm supplies its items to

the next. A vertical merger results in the solidification of firms that have genuine or potential purchaser

dealer connections. Level merger HM is the merger of at least two organizations working in a similar

field and in similar phases of procedure of achieving a similar ware or administration. It is also

founded that merger is could offer an best opportunity to the firm for giving an effective way to the

organization to leads their business function in one direction and sustain their position in the

marketplace for the long-term. Hence, an organization has tried to considered the merger as well as

acquisition in their business process.

to make sound business development and higher business progress. It is stated that effectively entry

into a new market and make a higher profit for the long-term. It is effective for the successful

competition that the organization needed to improve their capabilities towards the implication of

merger and Acquisitions (M&A).

Angwin et al. (2016) stated that a merger could enhance efficiency and productivity of the firm. This

could be effective for increasing the shareholder value mere as it would lead to obtaining the higher

profitability of the organization. It is illustrated that the merger can be vital for accomplishment of

organizational activities. This is quite difficult for the organization to directly achieving targeted aim of

research matter. Moreover, Mergers, Acquisitions tool could be used as strategic concepts

incorporate to have decision effectively. Combination of business elements is an overall wonder. One

of the devices for solidification is mergers and acquisitions.

In support to this, Yan and Luo (2016) stated that the mergers and acquisitions in money related area

of India have all the earmarks of being driven by target of utilizing cooperative energies emerging out

of M&A process outcomes. Nonetheless, such supplementary changes in money related framework

might have some suggestions of exposed approach. It is obvious from different mergers and

amalgamations did by the Bank after its beginning in 1994. In any case, it is very clear by their activity

that it is a way of development for them. In oppose to this, Helfat and Martin (2015) illustrated that in

view of this announcement, we might want to display the applied structure for mergers and

acquisitions in India's unique situation. Systems for the merger, procurement, and amalgamation of

banking organizations are plainly characterized in segment 44(A) of the Banking Regulation Act 1949.

As per the Act, a financial organization should put a draft before its investors and the draft should be

endorsed by a goals gone by a greater part in number, speaking to 66% in estimation of the investors

of every one of the said organizations, present either face to face or as a substitute at a gathering

required the reason.

Paulet et al. (2015) stated that Vertical merger (VM) is a merger where one firm supplies its items to

the next. A vertical merger results in the solidification of firms that have genuine or potential purchaser

dealer connections. Level merger HM is the merger of at least two organizations working in a similar

field and in similar phases of procedure of achieving a similar ware or administration. It is also

founded that merger is could offer an best opportunity to the firm for giving an effective way to the

organization to leads their business function in one direction and sustain their position in the

marketplace for the long-term. Hence, an organization has tried to considered the merger as well as

acquisition in their business process.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERGER AND ACQUISITION x

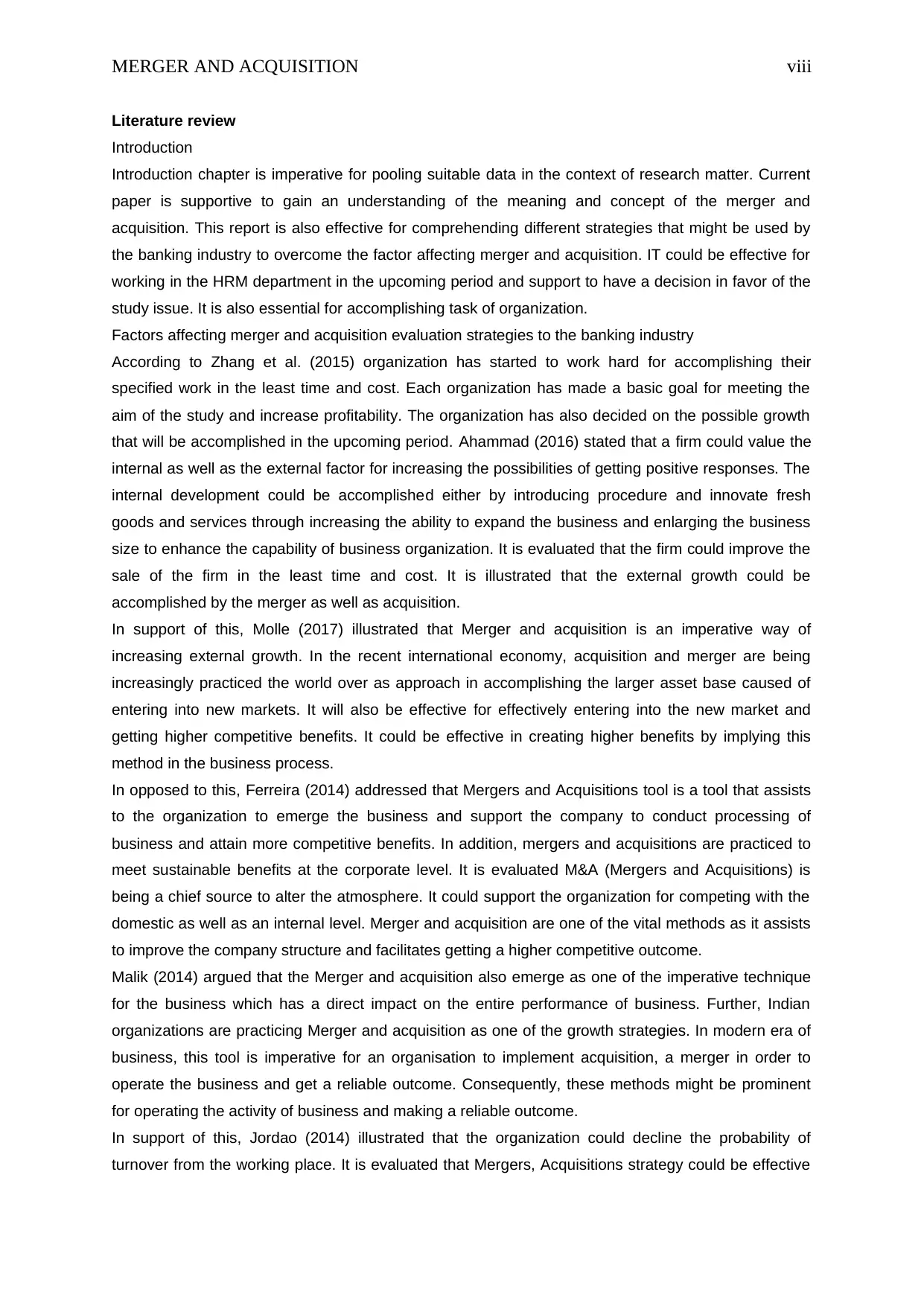

(Sources: Waemustafa and Sukri, 2015).

(Sources: Waemustafa and Sukri, 2015).

On the other side, Waemustafa and Sukri (2015) there are certain elements that are considered in

controlling of merger as well as acquisitions procedure. The communication is a factor that might

directly affect to management performance as it plays a vital role in dealing with others. Hence, this

factor might affect to result of merger and acquisitions. It could be effective for eliminating the stress

level from the organization. It is stated that communication is effective aspect as it facilitates to

decline skills of employees caused by mitigating the conflict and another issue.

Paulet et al. (2015) stated that merger is the process that encourages to the firm to operate the

business process in an effective way. The organization has used a prevention strategy for eliminating

stress by declining merger stress. It is evaluated that review of workforces that consists of modifying

the initial perception appraisal of the condition. It is examined that professional support could decline

the stress level. It is stated that merger activity could lead to comprehending the psychology of an

employee to identify the act essence.

(Sources: Waemustafa and Sukri, 2015).

(Sources: Waemustafa and Sukri, 2015).

On the other side, Waemustafa and Sukri (2015) there are certain elements that are considered in

controlling of merger as well as acquisitions procedure. The communication is a factor that might

directly affect to management performance as it plays a vital role in dealing with others. Hence, this

factor might affect to result of merger and acquisitions. It could be effective for eliminating the stress

level from the organization. It is stated that communication is effective aspect as it facilitates to

decline skills of employees caused by mitigating the conflict and another issue.

Paulet et al. (2015) stated that merger is the process that encourages to the firm to operate the

business process in an effective way. The organization has used a prevention strategy for eliminating

stress by declining merger stress. It is evaluated that review of workforces that consists of modifying

the initial perception appraisal of the condition. It is examined that professional support could decline

the stress level. It is stated that merger activity could lead to comprehending the psychology of an

employee to identify the act essence.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION xi

In support of this, Koenig et al. (2014) illustrated that the favorable relation in the people combination

as well as fusion of cultures of organization. It is evaluated that the post mergers could support to

eliminate possibilities of mental health. The merger is an act that creates the stress in life of human

that could be eliminated by the acceptance of merger organizational culture for expanding the

business.

Goetz et al. (2016) argued that there are certain elements that affect to the merger process and

multiple organizational factors, which directly affect a merger as well as the merger process. It is

evaluated that the communication issue as well as their significance throughout the acquisition as well

as merger process. Moreover, the corporate culture their impact on the workforces if two organization

merge, the structural change as well as workforces reaction. Moreover, the stress issues could

directly impact on the merger and acquisition process in the environmental as well as higher stress

level. There are certain elements that might be considered by the firm named as corporate culture,

managing/strategy, change, stress, and communications. There are certain subsections named as

pre-merger and post-merger.

On the other side, Koenig et al. (2014) stated that three-stage model of the acquisition and mergers

which systematically that determined different human resources acts and problems. It is examined

that there are certain acts that are entailed in three stages. It is also illustrated that the department of

human resources, as well as leaders, are an imperative part of the business atmosphere with respect

to the obtain higher competitive advantages. It is also illustrated that the HR potential could bring

effectiveness in the dealing of the merger.

In oppose to this, Knechel and Salterio (2016) stated that organization could consider certain

elements named as swap ratio valuation, an announcement of swap ratio, fluctuation of share price,

and the announcement of merger decision, merger decision in the process of share due to getting

higher competitive benefits. It is also examined that the merger and acquisition could increase the

market share of organizational performance. It could increase the interest of shareholders towards

organizational performance. There are cetin elements that could be considered to improve the

financial; performance of the firm. It is also illustrated that mergers are generated by the organization

to increase the capability of a firm. There are different factors that might be considered by the

organization named as branch network, rural reach, better technology, customer base, and financial

ability. It is evaluated that controlling of the human resources as well as rural branches might be

challenging for the different culture of work.

Trichterborn et al. (2016) stated that the acquisition process is affected by different factors that could

affect the overall outcome. It is examined that the corporate approaches could be imperative for

avoiding uncertainty of the organization and support to get higher outcome. It is stated that knowledge

acquisition, as well as the subsequent organisational learning, were the effective desirable results by

considering the acquisition processes of the firm.

On the other side, Alessandri et al (2014) examined that corporate acquisitions could be affected to

the overall productivity of the research outcome. The acquisitions process could affect the overall

performance of the research outcome. From the above data, it is illustrated that the acquisition

process could positively impact on the performance of the organization. Moreover, post-acquisition

In support of this, Koenig et al. (2014) illustrated that the favorable relation in the people combination

as well as fusion of cultures of organization. It is evaluated that the post mergers could support to

eliminate possibilities of mental health. The merger is an act that creates the stress in life of human

that could be eliminated by the acceptance of merger organizational culture for expanding the

business.

Goetz et al. (2016) argued that there are certain elements that affect to the merger process and

multiple organizational factors, which directly affect a merger as well as the merger process. It is

evaluated that the communication issue as well as their significance throughout the acquisition as well

as merger process. Moreover, the corporate culture their impact on the workforces if two organization

merge, the structural change as well as workforces reaction. Moreover, the stress issues could

directly impact on the merger and acquisition process in the environmental as well as higher stress

level. There are certain elements that might be considered by the firm named as corporate culture,

managing/strategy, change, stress, and communications. There are certain subsections named as

pre-merger and post-merger.

On the other side, Koenig et al. (2014) stated that three-stage model of the acquisition and mergers

which systematically that determined different human resources acts and problems. It is examined

that there are certain acts that are entailed in three stages. It is also illustrated that the department of

human resources, as well as leaders, are an imperative part of the business atmosphere with respect

to the obtain higher competitive advantages. It is also illustrated that the HR potential could bring

effectiveness in the dealing of the merger.

In oppose to this, Knechel and Salterio (2016) stated that organization could consider certain

elements named as swap ratio valuation, an announcement of swap ratio, fluctuation of share price,

and the announcement of merger decision, merger decision in the process of share due to getting

higher competitive benefits. It is also examined that the merger and acquisition could increase the

market share of organizational performance. It could increase the interest of shareholders towards

organizational performance. There are cetin elements that could be considered to improve the

financial; performance of the firm. It is also illustrated that mergers are generated by the organization

to increase the capability of a firm. There are different factors that might be considered by the

organization named as branch network, rural reach, better technology, customer base, and financial

ability. It is evaluated that controlling of the human resources as well as rural branches might be

challenging for the different culture of work.

Trichterborn et al. (2016) stated that the acquisition process is affected by different factors that could

affect the overall outcome. It is examined that the corporate approaches could be imperative for

avoiding uncertainty of the organization and support to get higher outcome. It is stated that knowledge

acquisition, as well as the subsequent organisational learning, were the effective desirable results by

considering the acquisition processes of the firm.

On the other side, Alessandri et al (2014) examined that corporate acquisitions could be affected to

the overall productivity of the research outcome. The acquisitions process could affect the overall

performance of the research outcome. From the above data, it is illustrated that the acquisition

process could positively impact on the performance of the organization. Moreover, post-acquisition

MERGER AND ACQUISITION xii

could affect to the codification. It is examined that the integration of two firms could effectively improve

the performance of the firm as well as it could also negatively affect the overall performance of the

firm. It is illustrated that there are two kind of approaches that are considered by the organization

named as corporate strategy as well as knowledge-based approach.

Zhu and Zhu (2016) stated that the international post-merger could affect the private sector of banks.

The organization could also manage the business process and support to make higher competitive

advantages. It is evaluated that effective integration management could consider certain elements

named as change management, communication, and organization. It is evaluated that the Integration

Manager could also be affected by the overall outcome of the research outcome. It is stated that the

integration manager could be affected by the overall outcome of the business process. It could affect

the firm for getting a positive result in favor of the research outcome.

In support of this, Sarala et al. (2016) illustrated that human resources practices could manage to the

cultural integration procedure in the post-acquisition as well as merger culture. It is also stated that

pervasiveness and growth of merger and acquisition could affect to the failure and success rate of the

firm. It is examined that human resources practices in the process of management as well as the

human resources practices to the merger and acquisition success.

According to Poulfelt et al. (2017), the key cause of company that enters into merger and acquisition

is to merge their control as well as, authority over the market. Furthermore, a merger is beneficial in

the context of synergy where, authority permits to increase the efficiency of the new entity as well as,

it creates the shape of return enhancement with cost savings. Moreover, economies of scale are

developed by sharing the resources as well as services. Union of two company leads in overall cost

reduction that gives competitive benefits. It could be appropriate as a consequence of increasing

purchasing power as well as, longer production runs. In support of this, Stiglitz and Rosengard (2015)

stated that risk can be declined by using innovative techniques to control financial uncertainty. A

company should consider technological development as well as, their dealing functions. Through

merger and acquisition of a small business with the unique technologies, a large corporation would

retain and grow the aggressive edge. The key benefit of a merger and acquisition is tax benefits.

Moreover, financial benefits may initiate mergers as well as, companies would highly develop the use

of tax-shields, use alternative tax advantageous, and gain monetary leverage.

On the other side, Erel et al. (2015) stated that the benefits and limitation of the merger as well as the

acquisition are relied on new short-term together with, long-term approaches with efforts. Since, there

are some factors like market environment, acquirement expenses, and shifts in business culture, and

transformations to financial power surrounding of capturing the business.

As per the view of Stiglitz and Rosengard (2015), merger and acquisition are disadvantageous in

terms of loss the proficient employees excepting employees in the position of leadership. This type of

loss unavoidably entails understanding about the business loss as well as, it would disturb the

exchange and would exclusively get replaced at a higher worth. Consequences of merger and

acquisition, workforces of the small merging company would need extensive re-competencies.

In contrast to this, Moeller and Brady (2014) stated that corporation would face different complexities

related to frictions as well as, an internal rivalry that can exist between employees of a united

could affect to the codification. It is examined that the integration of two firms could effectively improve

the performance of the firm as well as it could also negatively affect the overall performance of the

firm. It is illustrated that there are two kind of approaches that are considered by the organization

named as corporate strategy as well as knowledge-based approach.

Zhu and Zhu (2016) stated that the international post-merger could affect the private sector of banks.

The organization could also manage the business process and support to make higher competitive

advantages. It is evaluated that effective integration management could consider certain elements

named as change management, communication, and organization. It is evaluated that the Integration

Manager could also be affected by the overall outcome of the research outcome. It is stated that the

integration manager could be affected by the overall outcome of the business process. It could affect

the firm for getting a positive result in favor of the research outcome.

In support of this, Sarala et al. (2016) illustrated that human resources practices could manage to the

cultural integration procedure in the post-acquisition as well as merger culture. It is also stated that

pervasiveness and growth of merger and acquisition could affect to the failure and success rate of the

firm. It is examined that human resources practices in the process of management as well as the

human resources practices to the merger and acquisition success.

According to Poulfelt et al. (2017), the key cause of company that enters into merger and acquisition

is to merge their control as well as, authority over the market. Furthermore, a merger is beneficial in

the context of synergy where, authority permits to increase the efficiency of the new entity as well as,

it creates the shape of return enhancement with cost savings. Moreover, economies of scale are

developed by sharing the resources as well as services. Union of two company leads in overall cost

reduction that gives competitive benefits. It could be appropriate as a consequence of increasing

purchasing power as well as, longer production runs. In support of this, Stiglitz and Rosengard (2015)

stated that risk can be declined by using innovative techniques to control financial uncertainty. A

company should consider technological development as well as, their dealing functions. Through

merger and acquisition of a small business with the unique technologies, a large corporation would

retain and grow the aggressive edge. The key benefit of a merger and acquisition is tax benefits.

Moreover, financial benefits may initiate mergers as well as, companies would highly develop the use

of tax-shields, use alternative tax advantageous, and gain monetary leverage.

On the other side, Erel et al. (2015) stated that the benefits and limitation of the merger as well as the

acquisition are relied on new short-term together with, long-term approaches with efforts. Since, there

are some factors like market environment, acquirement expenses, and shifts in business culture, and

transformations to financial power surrounding of capturing the business.

As per the view of Stiglitz and Rosengard (2015), merger and acquisition are disadvantageous in

terms of loss the proficient employees excepting employees in the position of leadership. This type of

loss unavoidably entails understanding about the business loss as well as, it would disturb the

exchange and would exclusively get replaced at a higher worth. Consequences of merger and

acquisition, workforces of the small merging company would need extensive re-competencies.

In contrast to this, Moeller and Brady (2014) stated that corporation would face different complexities

related to frictions as well as, an internal rivalry that can exist between employees of a united

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 48

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.