Macroeconomics Assignment Report - University Name

VerifiedAdded on 2021/12/20

|6

|411

|49

Report

AI Summary

This report presents a solution to a macroeconomics assignment. It begins with an analysis of the Average Variable Cost (AVC) function, including regression results and the statistical significance of the intercept and coefficients. The report then delves into the conditions for a firm to shut down in a competitive market, comparing the market price to the minimum AVC. Finally, it determines the profit-maximizing output level using the estimated Short-Run Marginal Cost (SMC) function derived from the regression analysis, providing a comprehensive overview of cost functions and market behavior in the short run. References to relevant economic literature are also included.

Running head: MACROECONOMICS

Macroeconomics

Name of the Student

Name of the University

Course ID

Macroeconomics

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS

Table of Contents

Answer 1..........................................................................................................................................2

Answer a......................................................................................................................................2

Answer b......................................................................................................................................2

Answer 2..........................................................................................................................................3

Answer b......................................................................................................................................4

References........................................................................................................................................5

Table of Contents

Answer 1..........................................................................................................................................2

Answer a......................................................................................................................................2

Answer b......................................................................................................................................2

Answer 2..........................................................................................................................................3

Answer b......................................................................................................................................4

References........................................................................................................................................5

2MACROECONOMICS

Answer 1

Answer a

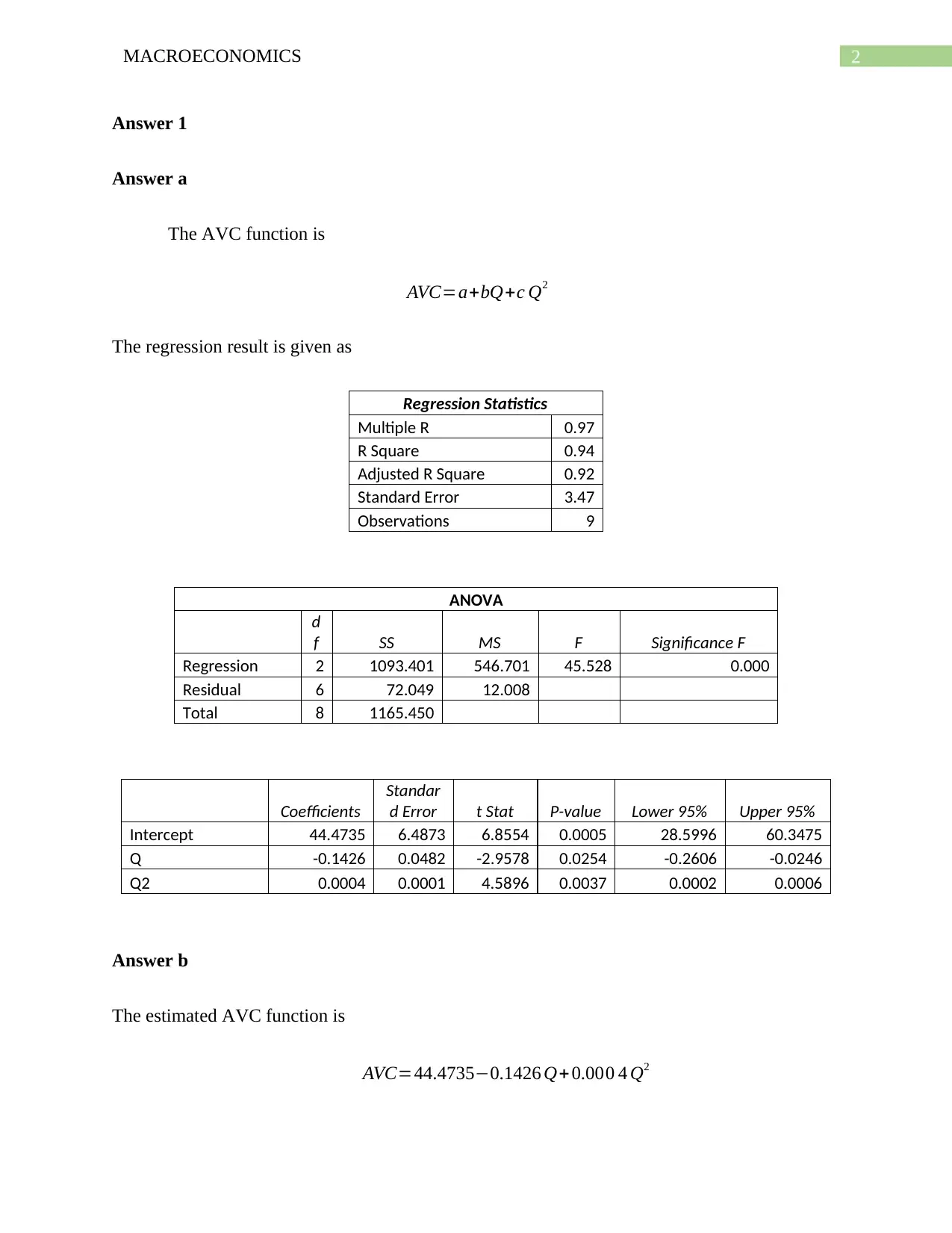

The AVC function is

AVC=a+bQ+c Q2

The regression result is given as

Regression Statistics

Multiple R 0.97

R Square 0.94

Adjusted R Square 0.92

Standard Error 3.47

Observations 9

ANOVA

d

f SS MS F Significance F

Regression 2 1093.401 546.701 45.528 0.000

Residual 6 72.049 12.008

Total 8 1165.450

Coefficients

Standar

d Error t Stat P-value Lower 95% Upper 95%

Intercept 44.4735 6.4873 6.8554 0.0005 28.5996 60.3475

Q -0.1426 0.0482 -2.9578 0.0254 -0.2606 -0.0246

Q2 0.0004 0.0001 4.5896 0.0037 0.0002 0.0006

Answer b

The estimated AVC function is

AVC=44.4735−0.1426 Q+ 0.000 4 Q2

Answer 1

Answer a

The AVC function is

AVC=a+bQ+c Q2

The regression result is given as

Regression Statistics

Multiple R 0.97

R Square 0.94

Adjusted R Square 0.92

Standard Error 3.47

Observations 9

ANOVA

d

f SS MS F Significance F

Regression 2 1093.401 546.701 45.528 0.000

Residual 6 72.049 12.008

Total 8 1165.450

Coefficients

Standar

d Error t Stat P-value Lower 95% Upper 95%

Intercept 44.4735 6.4873 6.8554 0.0005 28.5996 60.3475

Q -0.1426 0.0482 -2.9578 0.0254 -0.2606 -0.0246

Q2 0.0004 0.0001 4.5896 0.0037 0.0002 0.0006

Answer b

The estimated AVC function is

AVC=44.4735−0.1426 Q+ 0.000 4 Q2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS

The p value corresponding to a is 0.0005. The p value is lower than 5% level of

significance. As the p value is less than the significance level, the null hypothesis that intercept is

not significantly different from zero is rejected. The intercept therefore is statistically significant.

The p value corresponding to Q is 0.0254. Here again p value is than the significance value of

0.05. The null hypothesis of no significant relation between Q and AVC is rejected implying the

coefficient is statistically significant (Chatterjee & Hadi, 2015) The p value for c is 0.0037. The

coefficient is also statistically significant following the same reasoning.

Answer 2

The estimated AVC function is

AVC=44.4735−0.1426 Q+ 0.000 4 Q2

Firm in the competitive market shuts down if the price is below the minimum of average variable

cost (Baumol & Blinder, 2015)

The first order condition for minimization is

d ( AVC )

dQ =0

¿ , d ( 44.4735−0.1426 Q+0.00 0 4 Q2 )

dQ =0

¿ ,−0.1426+0.0008 Q=0

¿ , 0.0008 Q=0.1426

¿ , Q= 0.1426

0.0008

¿ , Q=178.25

The p value corresponding to a is 0.0005. The p value is lower than 5% level of

significance. As the p value is less than the significance level, the null hypothesis that intercept is

not significantly different from zero is rejected. The intercept therefore is statistically significant.

The p value corresponding to Q is 0.0254. Here again p value is than the significance value of

0.05. The null hypothesis of no significant relation between Q and AVC is rejected implying the

coefficient is statistically significant (Chatterjee & Hadi, 2015) The p value for c is 0.0037. The

coefficient is also statistically significant following the same reasoning.

Answer 2

The estimated AVC function is

AVC=44.4735−0.1426 Q+ 0.000 4 Q2

Firm in the competitive market shuts down if the price is below the minimum of average variable

cost (Baumol & Blinder, 2015)

The first order condition for minimization is

d ( AVC )

dQ =0

¿ , d ( 44.4735−0.1426 Q+0.00 0 4 Q2 )

dQ =0

¿ ,−0.1426+0.0008 Q=0

¿ , 0.0008 Q=0.1426

¿ , Q= 0.1426

0.0008

¿ , Q=178.25

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS

The minimum of AVC thus is

AVC=44.4735−0.1426 Q+0.000 4 Q2

¿ 44.4735− ( 0.1426 ×178.25 ) + ( 0.004 ×178.25 )

¿ 30.56

The price in the market is given as $50

At price exceeds the minimum of AVC, the firm should not shut down in the short run.

Answer b

^SMC= ^a+2 ^b Q+3 ^c Q2

Using coefficient value from the regression the SMC function can be written as

SMC=44.4735−0.2852Q+ 0.012Q2

Profit maximization condition in the short run,

P=SMC

¿ , 50=44.4735−0.2852Q+0.012 Q2

¿ , 0.012Q2−0.2852Q−5.5265=0

Solving for Q,

Q = 36.41

The profit maximizing output level for firm thus is 36.41 or 36.

References

The minimum of AVC thus is

AVC=44.4735−0.1426 Q+0.000 4 Q2

¿ 44.4735− ( 0.1426 ×178.25 ) + ( 0.004 ×178.25 )

¿ 30.56

The price in the market is given as $50

At price exceeds the minimum of AVC, the firm should not shut down in the short run.

Answer b

^SMC= ^a+2 ^b Q+3 ^c Q2

Using coefficient value from the regression the SMC function can be written as

SMC=44.4735−0.2852Q+ 0.012Q2

Profit maximization condition in the short run,

P=SMC

¿ , 50=44.4735−0.2852Q+0.012 Q2

¿ , 0.012Q2−0.2852Q−5.5265=0

Solving for Q,

Q = 36.41

The profit maximizing output level for firm thus is 36.41 or 36.

References

5MACROECONOMICS

Baumol, W. J., & Blinder, A. S. (2015). Microeconomics: Principles and policy. Nelson

Chatterjee, S., & Hadi, A. S. (2015). Regression analysis by example. John Wiley & Sons.

Baumol, W. J., & Blinder, A. S. (2015). Microeconomics: Principles and policy. Nelson

Chatterjee, S., & Hadi, A. S. (2015). Regression analysis by example. John Wiley & Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.