Macroeconomics Assignment: Economic Models and Policy Analysis

VerifiedAdded on 2022/08/18

|13

|880

|22

Homework Assignment

AI Summary

This macroeconomics assignment analyzes an economic scenario, covering various aspects of macroeconomic principles. It begins with consumption function and equilibrium income calculations, followed by an analysis of aggregate expenditure (AE) and aggregate demand-aggregate supply (AD-AS) models. The assignment explores the impact of unplanned inventory investment, the effects of fiscal policy, and the role of monetary policy in closing a GDP gap. It also examines the exchange rate market, illustrating the effects of interest rate changes and their implications on exports, employment, and overall economic expansion. The solution includes calculations, graphical representations, and explanations of economic concepts, referencing relevant academic literature to support the analysis.

Running head: MACROECONOMICS

Macroeconomics

Name of the Student

Name of the University

Student ID

Macroeconomics

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS

Table of Contents

Section A.........................................................................................................................................2

Section B..........................................................................................................................................7

Reference.......................................................................................................................................13

Table of Contents

Section A.........................................................................................................................................2

Section B..........................................................................................................................................7

Reference.......................................................................................................................................13

2MACROECONOMICS

Section A

Part 1

Marginal propensity ¿ consume ( c ) =1−Marginal Porpensity ¿ save (s)

¿ , Marginal propensity ¿ consume ( c )=1−0.42

¿ , Marginal propensity ¿ consume ( c ) =0.58

Consumption is given by

Consumption=a+c (Y −T )

¿ , 171701.1=a+¿

¿ , 171701.1=a+ 150575.3

¿ , a=$ 21125.8million

Where a= autonomous consumption and Y= income.

Part 2

Income tax=Taxrate × Income

¿ , Income tax=0.175× 466312.6

¿ , Income tax=$ 81604.7 million

Therefore,

Total taxation= Autonomous tax+ Income tax

¿ , Total taxation=206700.0+81604.7

Section A

Part 1

Marginal propensity ¿ consume ( c ) =1−Marginal Porpensity ¿ save (s)

¿ , Marginal propensity ¿ consume ( c )=1−0.42

¿ , Marginal propensity ¿ consume ( c ) =0.58

Consumption is given by

Consumption=a+c (Y −T )

¿ , 171701.1=a+¿

¿ , 171701.1=a+ 150575.3

¿ , a=$ 21125.8million

Where a= autonomous consumption and Y= income.

Part 2

Income tax=Taxrate × Income

¿ , Income tax=0.175× 466312.6

¿ , Income tax=$ 81604.7 million

Therefore,

Total taxation= Autonomous tax+ Income tax

¿ , Total taxation=206700.0+81604.7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS

¿ , Totaltaxation=$ 288304.7 million

Part 3

Income=Unintended inventory investmnet + 466312.6

On the other hand, at equilibrium unintended inventory investment is zero. Therefore, income is

Income=Consumption expenditure+ Planned investmnet +Government expenditure+ Net export− Autonomous tax

¿ , Unintended inventory investmnet +466312.6=171701.1+ 119020.5+ 48621.7+(840223.9−720695.8)

-206700.0

¿ , Unintended inventory investmnet +466312.6=171701.1+119020.5+48621.7+119528.1-

206700.0

¿ , Unintended inventory investmnet (UII )=−$ 214141.2 million

Now,

Actualinvestment =Planned investment +Changes Unintended invetory investment

Actualinvestment =119020.5+214141.2

¿ , Actual investment =$ 333161.7 million

Part 4

Import expenditure= Autonomousimports+(0.08 ×Y )

¿ , 720695.8= Autonomous imports+[0.08 × ( 466312.6−206700.0 ) ]

¿ , 720695.8= Autonomous imports+[0.08 ×259612.6]

¿ , Autonomous imports=720695.8−20769.0

¿ , Totaltaxation=$ 288304.7 million

Part 3

Income=Unintended inventory investmnet + 466312.6

On the other hand, at equilibrium unintended inventory investment is zero. Therefore, income is

Income=Consumption expenditure+ Planned investmnet +Government expenditure+ Net export− Autonomous tax

¿ , Unintended inventory investmnet +466312.6=171701.1+ 119020.5+ 48621.7+(840223.9−720695.8)

-206700.0

¿ , Unintended inventory investmnet +466312.6=171701.1+119020.5+48621.7+119528.1-

206700.0

¿ , Unintended inventory investmnet (UII )=−$ 214141.2 million

Now,

Actualinvestment =Planned investment +Changes Unintended invetory investment

Actualinvestment =119020.5+214141.2

¿ , Actual investment =$ 333161.7 million

Part 4

Import expenditure= Autonomousimports+(0.08 ×Y )

¿ , 720695.8= Autonomous imports+[0.08 × ( 466312.6−206700.0 ) ]

¿ , 720695.8= Autonomous imports+[0.08 ×259612.6]

¿ , Autonomous imports=720695.8−20769.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS

¿ , Autonomous imports=$ 699926.8million

Part 5

Marginal propensity ¿ export=1−Marginal propensity ¿ import

¿ , Marginal propensity ¿ export=1−0.08

¿ , Marginal propensity ¿ export=0.92

Now,

Export expenditure= Autonomous exports+(0.92× 259612.6)

¿ , Autonomous exports=840223.9−238843.6

¿ , Autonomous exports=$ 601380.3 million

Therefore,

Autonomous net exports=Autonomous exports− Autonomous imports

¿ , Autonomous net exports=601380.3−699926.8

¿ , Autonomous net exports=$−98546.5 million

Part 6

Autonomous planned expenditure=Autonomous consumption+ Autonomous investmnet +Governmnet expenditure

¿ , Autonomous planned expenditure=21125.8+9983.2+48621.7−206700.0

¿ , Autonomous planned expenditure=−$ 126969.3million

Part 7

¿ , Autonomous imports=$ 699926.8million

Part 5

Marginal propensity ¿ export=1−Marginal propensity ¿ import

¿ , Marginal propensity ¿ export=1−0.08

¿ , Marginal propensity ¿ export=0.92

Now,

Export expenditure= Autonomous exports+(0.92× 259612.6)

¿ , Autonomous exports=840223.9−238843.6

¿ , Autonomous exports=$ 601380.3 million

Therefore,

Autonomous net exports=Autonomous exports− Autonomous imports

¿ , Autonomous net exports=601380.3−699926.8

¿ , Autonomous net exports=$−98546.5 million

Part 6

Autonomous planned expenditure=Autonomous consumption+ Autonomous investmnet +Governmnet expenditure

¿ , Autonomous planned expenditure=21125.8+9983.2+48621.7−206700.0

¿ , Autonomous planned expenditure=−$ 126969.3million

Part 7

5MACROECONOMICS

At income level of $466312.6million the economy is not in equilibrium since there is

existence unintended inventory investment. The equilibrium level of income is

Equilibrium income level=466312.6−214141.2

¿ , Equilibrium income level=$ 252171.4 million

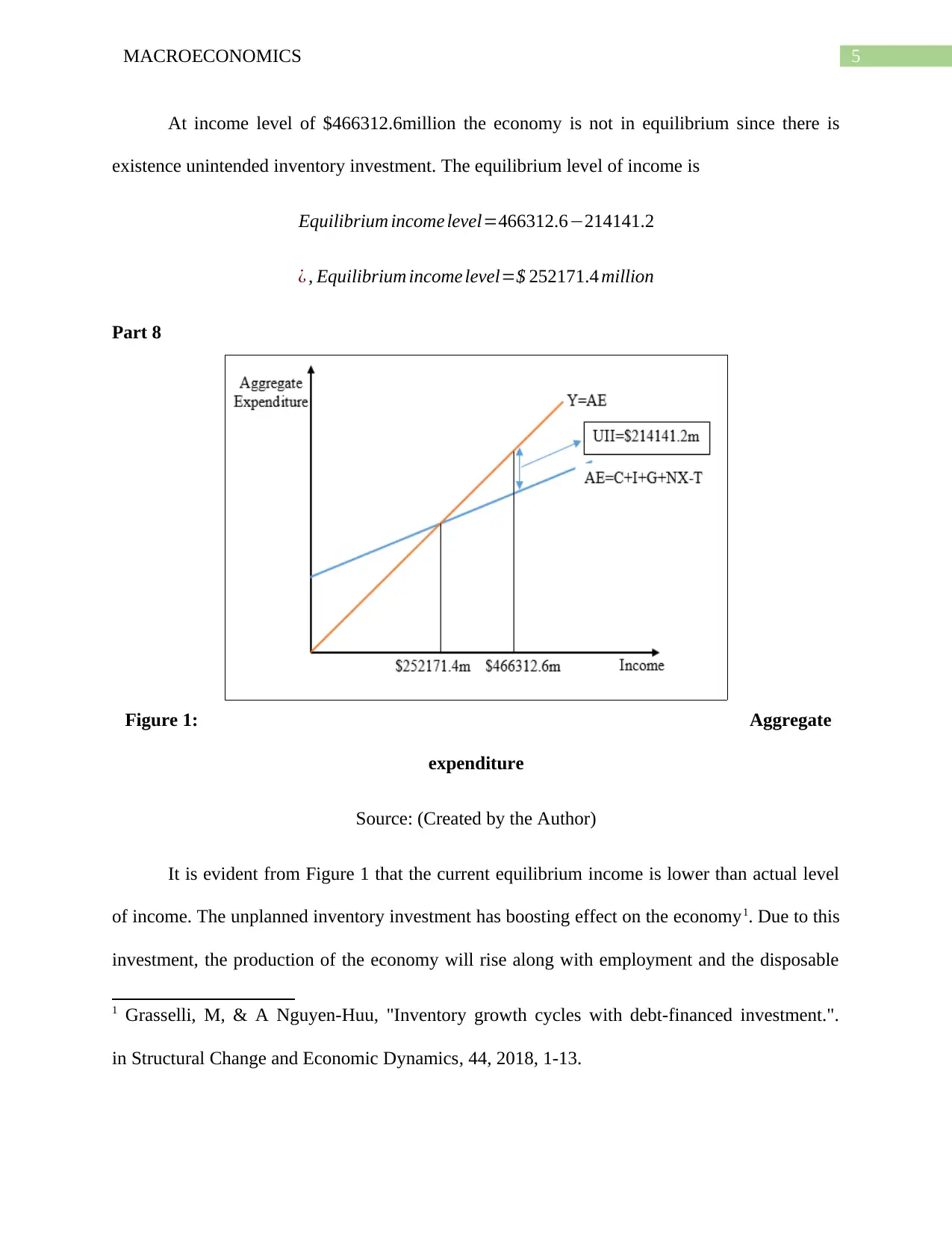

Part 8

Figure 1: Aggregate

expenditure

Source: (Created by the Author)

It is evident from Figure 1 that the current equilibrium income is lower than actual level

of income. The unplanned inventory investment has boosting effect on the economy1. Due to this

investment, the production of the economy will rise along with employment and the disposable

1 Grasselli, M, & A Nguyen-Huu, "Inventory growth cycles with debt-financed investment.".

in Structural Change and Economic Dynamics, 44, 2018, 1-13.

At income level of $466312.6million the economy is not in equilibrium since there is

existence unintended inventory investment. The equilibrium level of income is

Equilibrium income level=466312.6−214141.2

¿ , Equilibrium income level=$ 252171.4 million

Part 8

Figure 1: Aggregate

expenditure

Source: (Created by the Author)

It is evident from Figure 1 that the current equilibrium income is lower than actual level

of income. The unplanned inventory investment has boosting effect on the economy1. Due to this

investment, the production of the economy will rise along with employment and the disposable

1 Grasselli, M, & A Nguyen-Huu, "Inventory growth cycles with debt-financed investment.".

in Structural Change and Economic Dynamics, 44, 2018, 1-13.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMICS

income. Consequently, the consumption demand will increase and thereby increases the

aggregate demand. With rise in aggregate demand the price level will rise2. Owing to increased

chance of profitability the aggregate supply further increases by the amount of rise is aggregate

demand. As a result, the income of the economy rises and reaches actual level. (100 words)

Part 9

Expenditure multiplier= 1

MPS

¿ , Expenditure multiplier = 1

0.42

¿ , Expenditure multiplier =2.4

Again,

Tax multiplier= MPC

MPS

¿ , Tax multiplier= 0.58

0.42

¿ , Tax multiplier=1.4

Section B

Part 10

GDP gap=450000.0−252171.4

2 Leduc, S, & Z Liu, "Uncertainty shocks are aggregate demand shocks.". in Journal of Monetary

Economics, 82, 2016, 20-35.

income. Consequently, the consumption demand will increase and thereby increases the

aggregate demand. With rise in aggregate demand the price level will rise2. Owing to increased

chance of profitability the aggregate supply further increases by the amount of rise is aggregate

demand. As a result, the income of the economy rises and reaches actual level. (100 words)

Part 9

Expenditure multiplier= 1

MPS

¿ , Expenditure multiplier = 1

0.42

¿ , Expenditure multiplier =2.4

Again,

Tax multiplier= MPC

MPS

¿ , Tax multiplier= 0.58

0.42

¿ , Tax multiplier=1.4

Section B

Part 10

GDP gap=450000.0−252171.4

2 Leduc, S, & Z Liu, "Uncertainty shocks are aggregate demand shocks.". in Journal of Monetary

Economics, 82, 2016, 20-35.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMICS

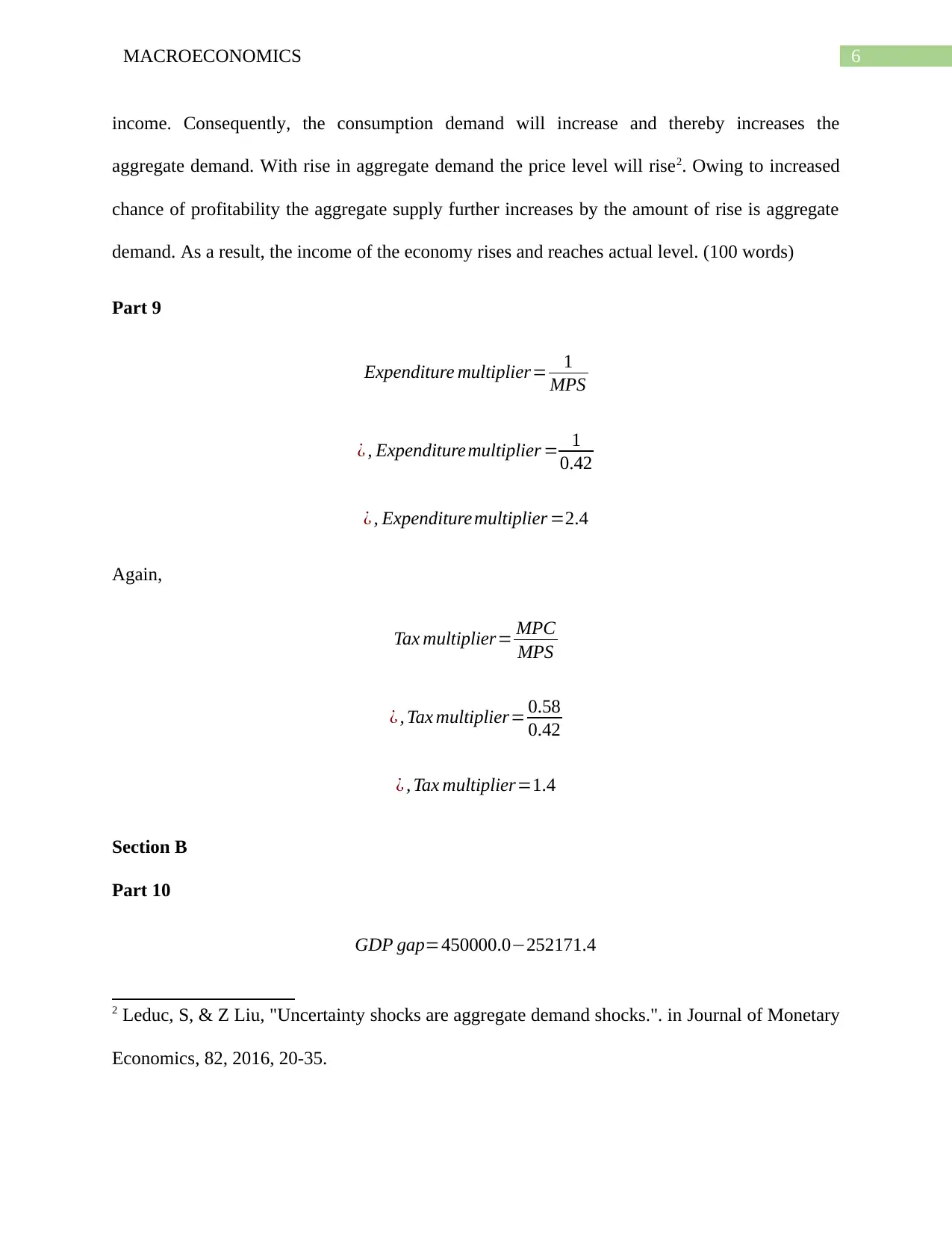

¿ , GDP gap=$ 197828.6 million

Figure 2: AD- AS model

Source: (Created by the Author)

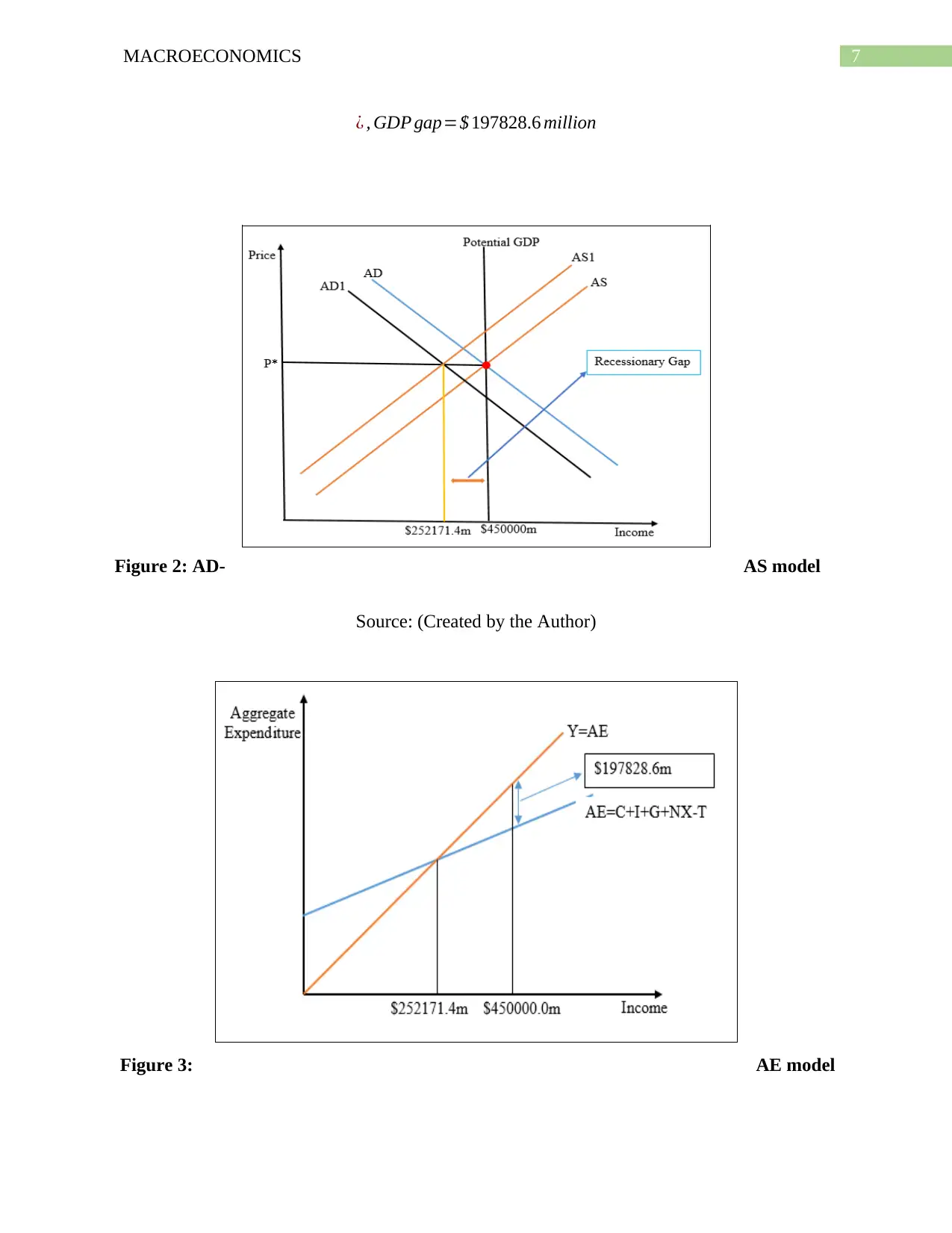

Figure 3: AE model

¿ , GDP gap=$ 197828.6 million

Figure 2: AD- AS model

Source: (Created by the Author)

Figure 3: AE model

8MACROECONOMICS

Source: (Created by the Author)

Part 11

Change in spending required to close the existing gap is

Change∈spending=197828.6

2.4

Change∈spending=$ 82428.6 million

Part 12

288304.7−197828.6= Autonomous taxation+(0.175 ×450000.0)

¿ , 90476.1= Autonomous taxation+78750.0

¿ , Autonomous taxation=$ 11726.1 million

Therefore,

Change∈ Autonomous taxation=11726.1−206700.0

¿ , Change∈ Autonomous taxation=−$ 194973.9 million

Therefore, it is found that to close the gap the autonomous taxation need to decrease by -

$194973.9million.

Part 13

Source: (Created by the Author)

Part 11

Change in spending required to close the existing gap is

Change∈spending=197828.6

2.4

Change∈spending=$ 82428.6 million

Part 12

288304.7−197828.6= Autonomous taxation+(0.175 ×450000.0)

¿ , 90476.1= Autonomous taxation+78750.0

¿ , Autonomous taxation=$ 11726.1 million

Therefore,

Change∈ Autonomous taxation=11726.1−206700.0

¿ , Change∈ Autonomous taxation=−$ 194973.9 million

Therefore, it is found that to close the gap the autonomous taxation need to decrease by -

$194973.9million.

Part 13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMICS

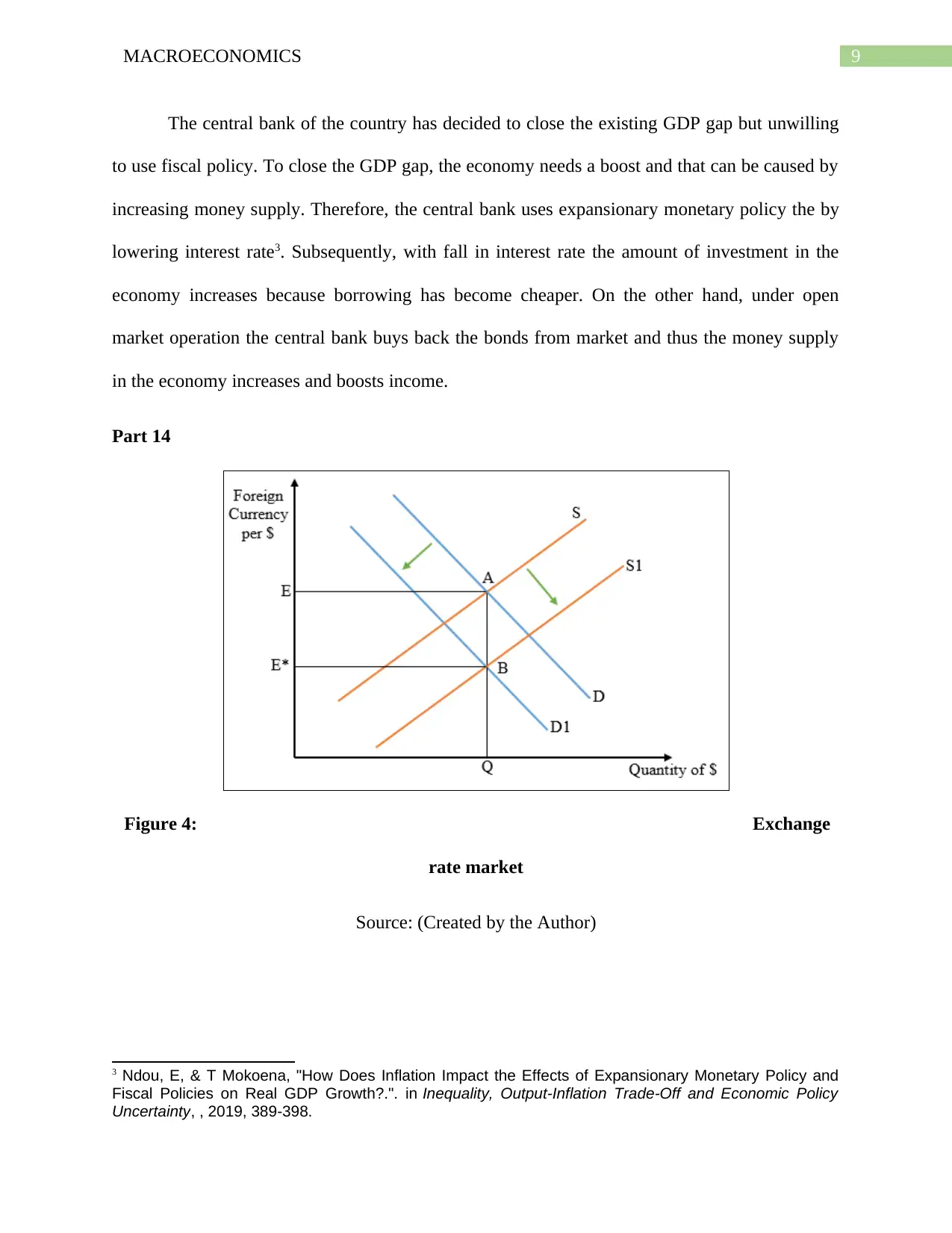

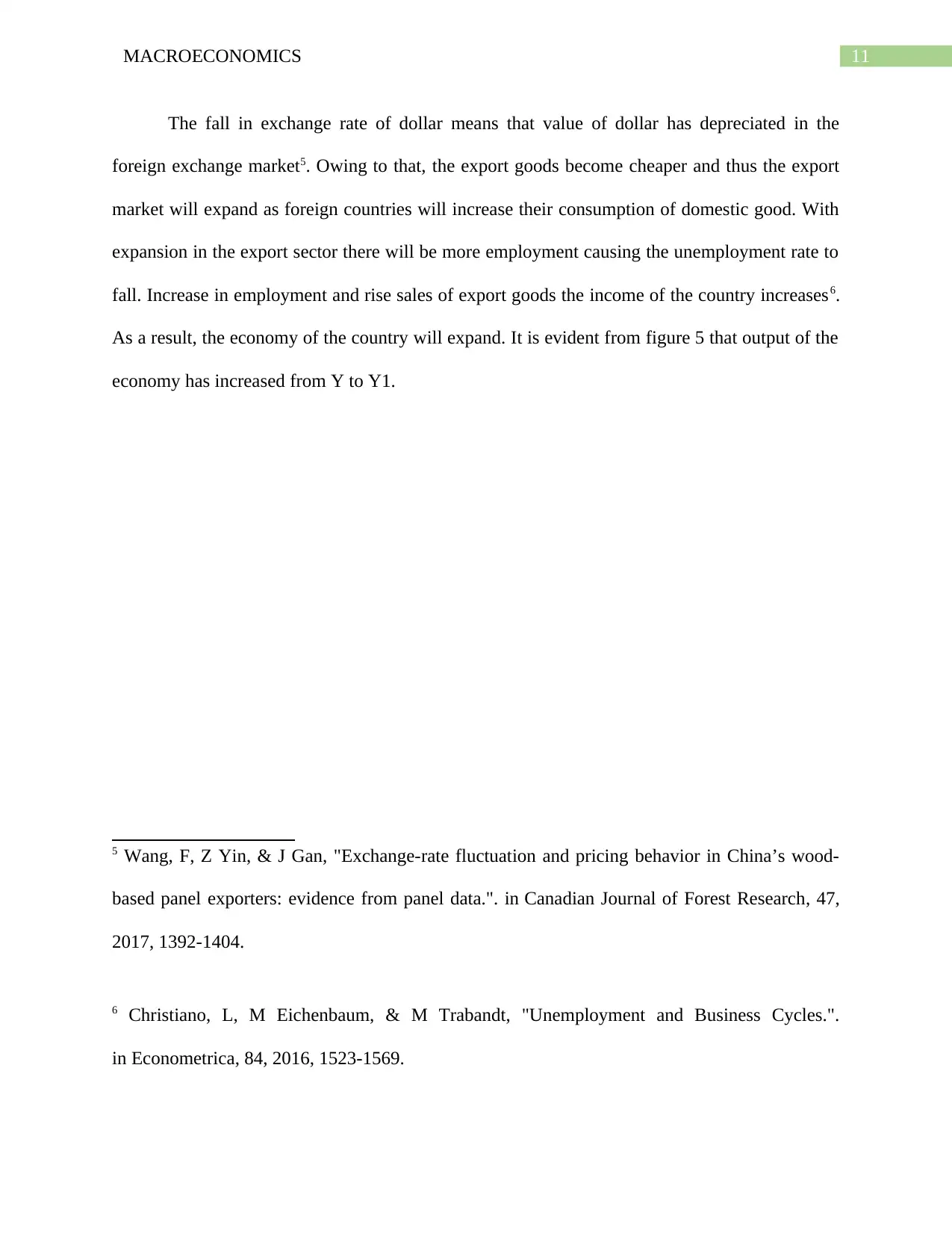

The central bank of the country has decided to close the existing GDP gap but unwilling

to use fiscal policy. To close the GDP gap, the economy needs a boost and that can be caused by

increasing money supply. Therefore, the central bank uses expansionary monetary policy the by

lowering interest rate3. Subsequently, with fall in interest rate the amount of investment in the

economy increases because borrowing has become cheaper. On the other hand, under open

market operation the central bank buys back the bonds from market and thus the money supply

in the economy increases and boosts income.

Part 14

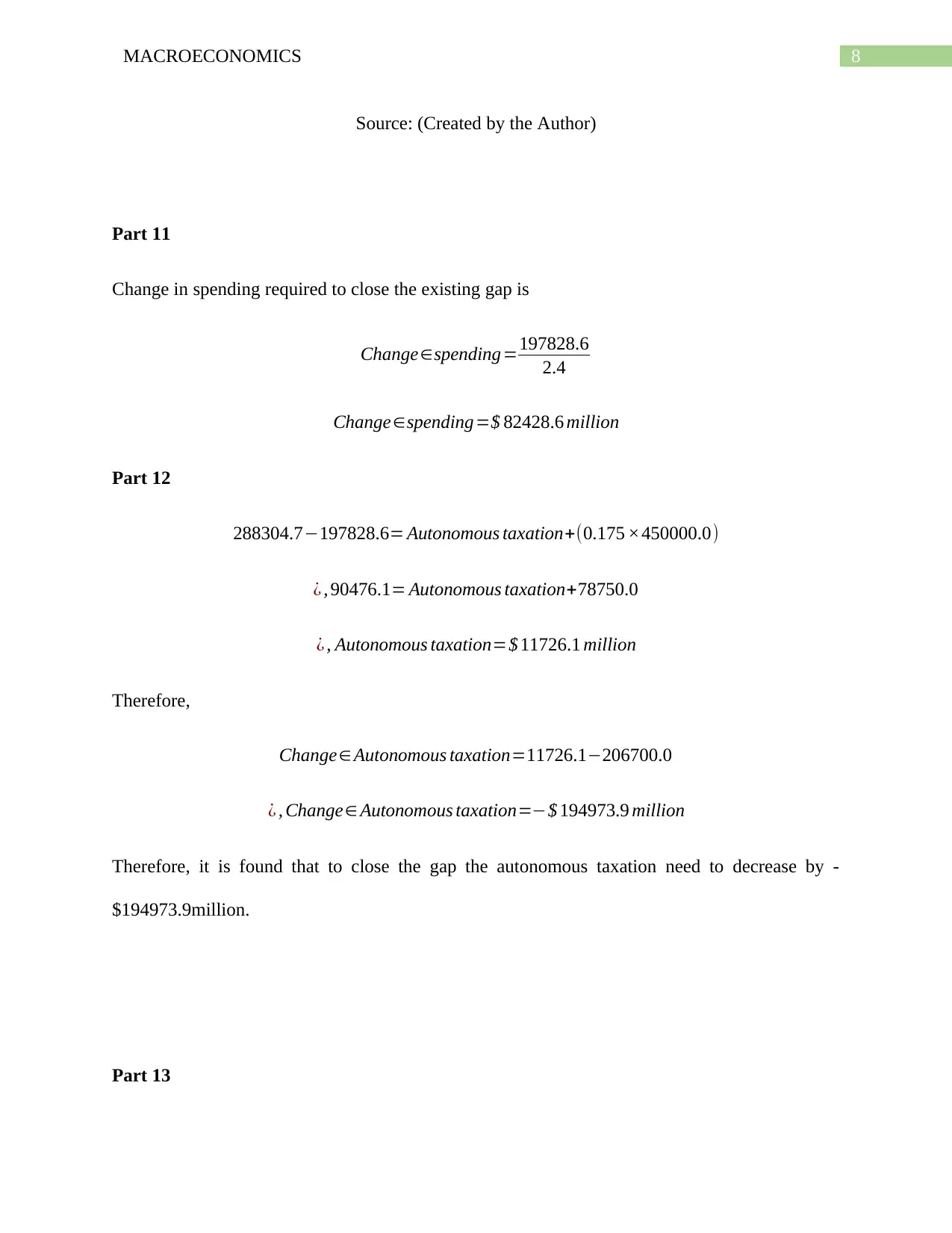

Figure 4: Exchange

rate market

Source: (Created by the Author)

3 Ndou, E, & T Mokoena, "How Does Inflation Impact the Effects of Expansionary Monetary Policy and

Fiscal Policies on Real GDP Growth?.". in Inequality, Output-Inflation Trade-Off and Economic Policy

Uncertainty, , 2019, 389-398.

The central bank of the country has decided to close the existing GDP gap but unwilling

to use fiscal policy. To close the GDP gap, the economy needs a boost and that can be caused by

increasing money supply. Therefore, the central bank uses expansionary monetary policy the by

lowering interest rate3. Subsequently, with fall in interest rate the amount of investment in the

economy increases because borrowing has become cheaper. On the other hand, under open

market operation the central bank buys back the bonds from market and thus the money supply

in the economy increases and boosts income.

Part 14

Figure 4: Exchange

rate market

Source: (Created by the Author)

3 Ndou, E, & T Mokoena, "How Does Inflation Impact the Effects of Expansionary Monetary Policy and

Fiscal Policies on Real GDP Growth?.". in Inequality, Output-Inflation Trade-Off and Economic Policy

Uncertainty, , 2019, 389-398.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMICS

Fall in interest rate reduces the return on deposit and thus holding money is less

beneficial than previous scenario4. Owing to this, the foreign investors are less interested to hold

dollar and withdraw their investment from the economy. Following this, the demand for dollar

decreases and due to that the dollar demand curve moved inward to D1 from D. Given the

condition the supply of dollar in the economy rises and the supply curve moved to S1 from S.

Owing to this the supply of dollar in exchange rate market remains the same with lower

exchange rate at E*. (99 words)

Part 15

Figure 5: Impact on

economy and unemployment

Source: (Created by the Author)

4 Engel, C, "Exchange Rates, Interest Rates, and the Risk Premium.". in American Economic

Review, 106, 2016, 436-474.

Fall in interest rate reduces the return on deposit and thus holding money is less

beneficial than previous scenario4. Owing to this, the foreign investors are less interested to hold

dollar and withdraw their investment from the economy. Following this, the demand for dollar

decreases and due to that the dollar demand curve moved inward to D1 from D. Given the

condition the supply of dollar in the economy rises and the supply curve moved to S1 from S.

Owing to this the supply of dollar in exchange rate market remains the same with lower

exchange rate at E*. (99 words)

Part 15

Figure 5: Impact on

economy and unemployment

Source: (Created by the Author)

4 Engel, C, "Exchange Rates, Interest Rates, and the Risk Premium.". in American Economic

Review, 106, 2016, 436-474.

11MACROECONOMICS

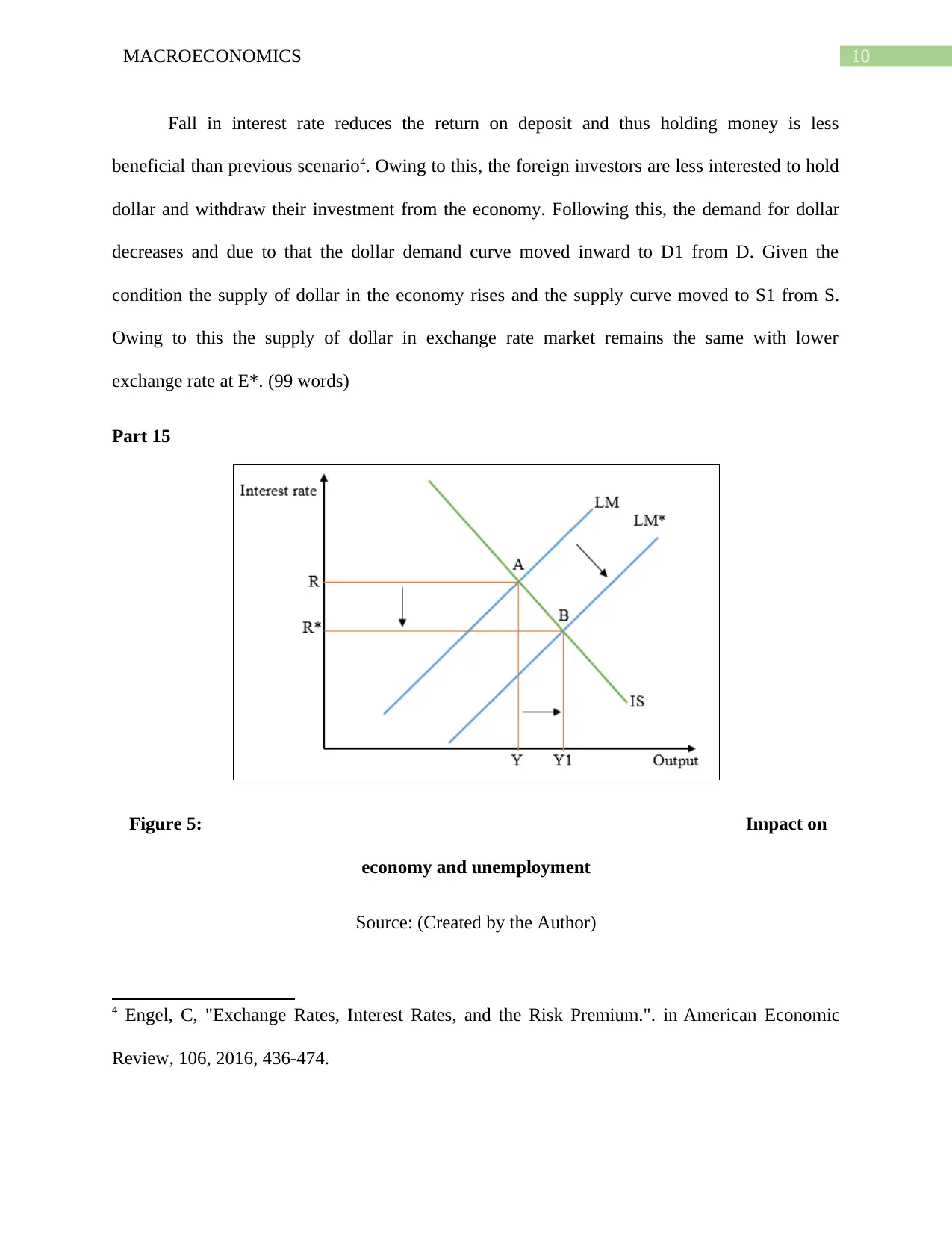

The fall in exchange rate of dollar means that value of dollar has depreciated in the

foreign exchange market5. Owing to that, the export goods become cheaper and thus the export

market will expand as foreign countries will increase their consumption of domestic good. With

expansion in the export sector there will be more employment causing the unemployment rate to

fall. Increase in employment and rise sales of export goods the income of the country increases6.

As a result, the economy of the country will expand. It is evident from figure 5 that output of the

economy has increased from Y to Y1.

5 Wang, F, Z Yin, & J Gan, "Exchange-rate fluctuation and pricing behavior in China’s wood-

based panel exporters: evidence from panel data.". in Canadian Journal of Forest Research, 47,

2017, 1392-1404.

6 Christiano, L, M Eichenbaum, & M Trabandt, "Unemployment and Business Cycles.".

in Econometrica, 84, 2016, 1523-1569.

The fall in exchange rate of dollar means that value of dollar has depreciated in the

foreign exchange market5. Owing to that, the export goods become cheaper and thus the export

market will expand as foreign countries will increase their consumption of domestic good. With

expansion in the export sector there will be more employment causing the unemployment rate to

fall. Increase in employment and rise sales of export goods the income of the country increases6.

As a result, the economy of the country will expand. It is evident from figure 5 that output of the

economy has increased from Y to Y1.

5 Wang, F, Z Yin, & J Gan, "Exchange-rate fluctuation and pricing behavior in China’s wood-

based panel exporters: evidence from panel data.". in Canadian Journal of Forest Research, 47,

2017, 1392-1404.

6 Christiano, L, M Eichenbaum, & M Trabandt, "Unemployment and Business Cycles.".

in Econometrica, 84, 2016, 1523-1569.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.