Macroeconomics Report: Analyzing Economic Impacts of a Credit Squeeze

VerifiedAdded on 2020/03/16

|4

|523

|35

Report

AI Summary

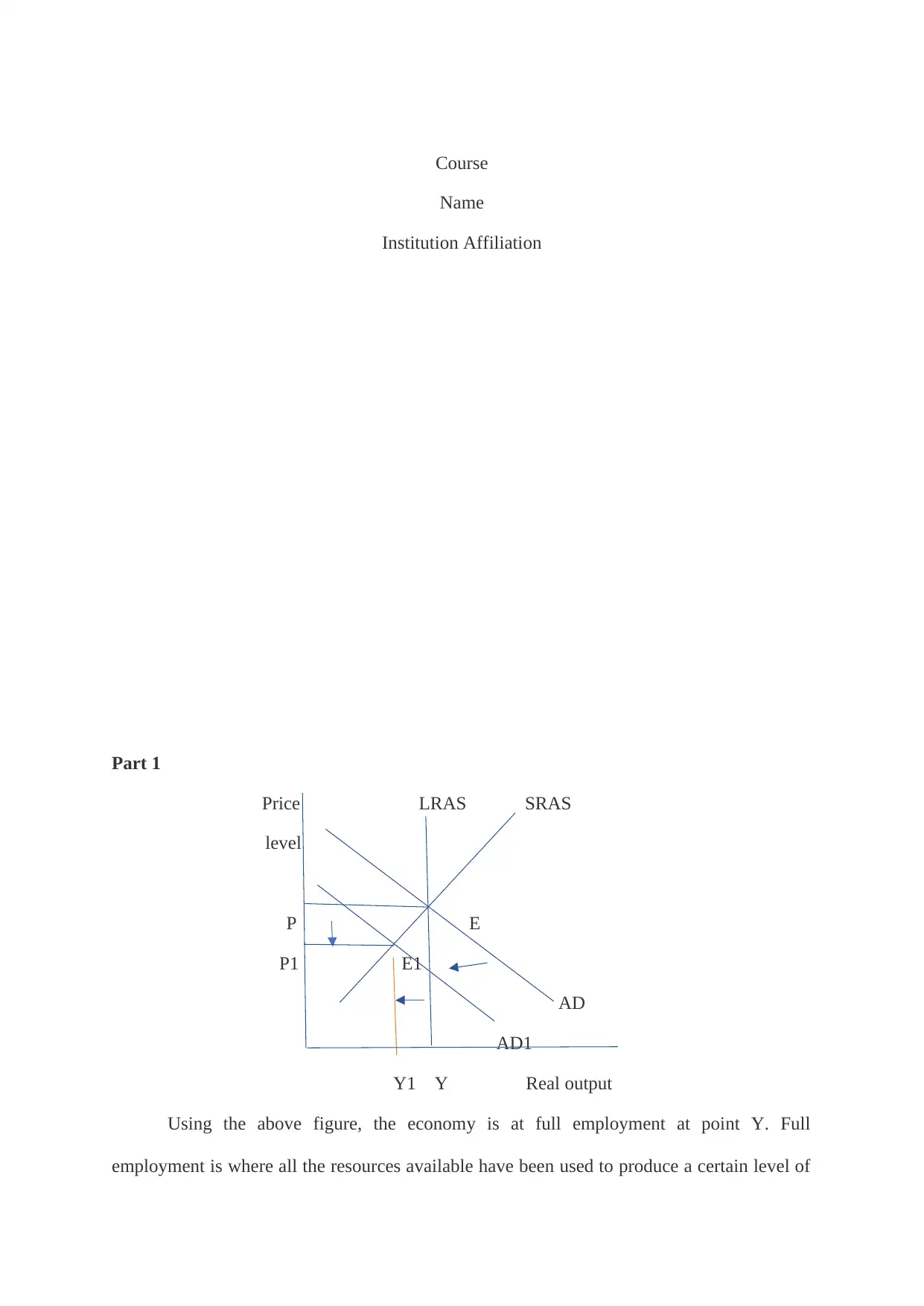

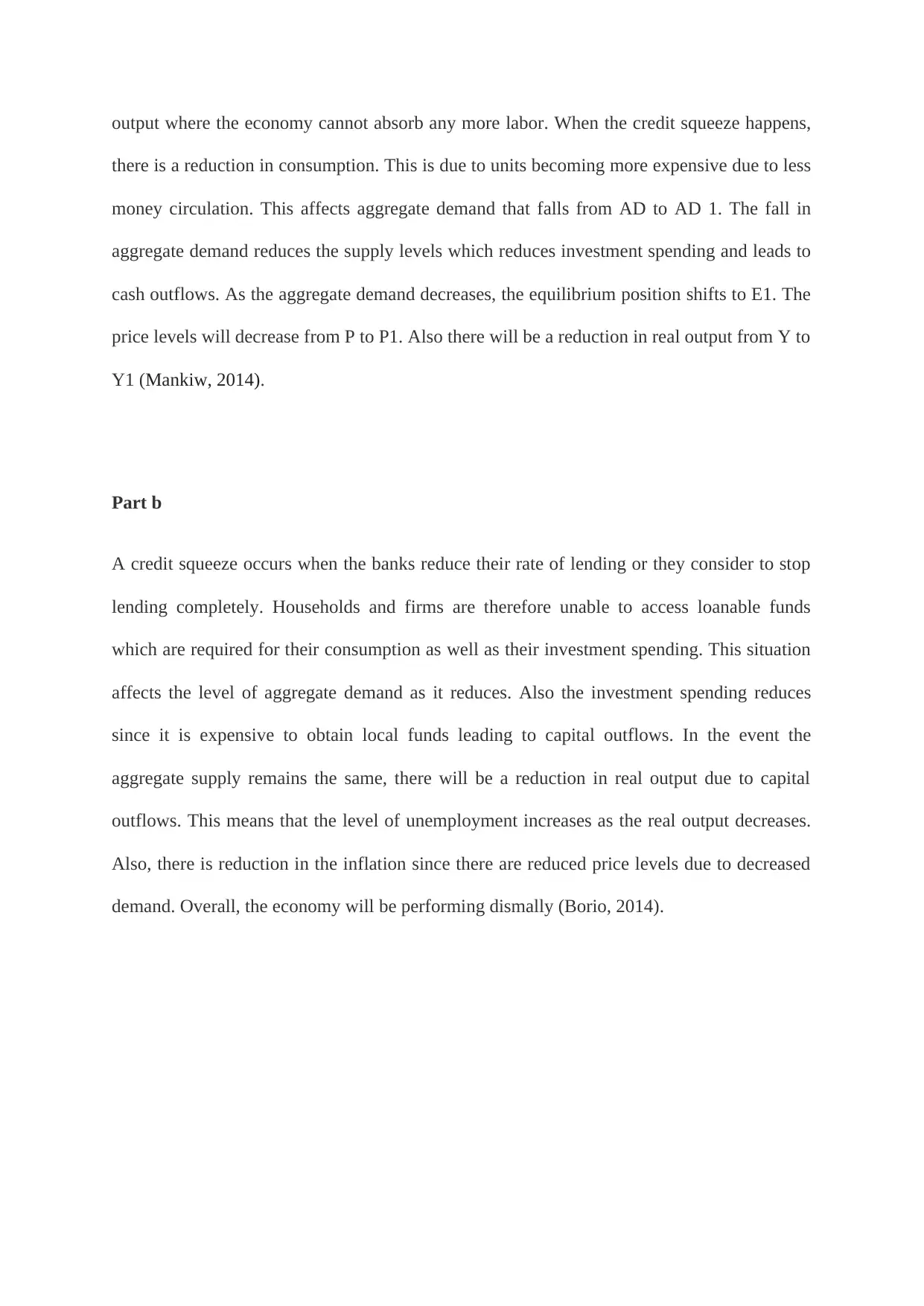

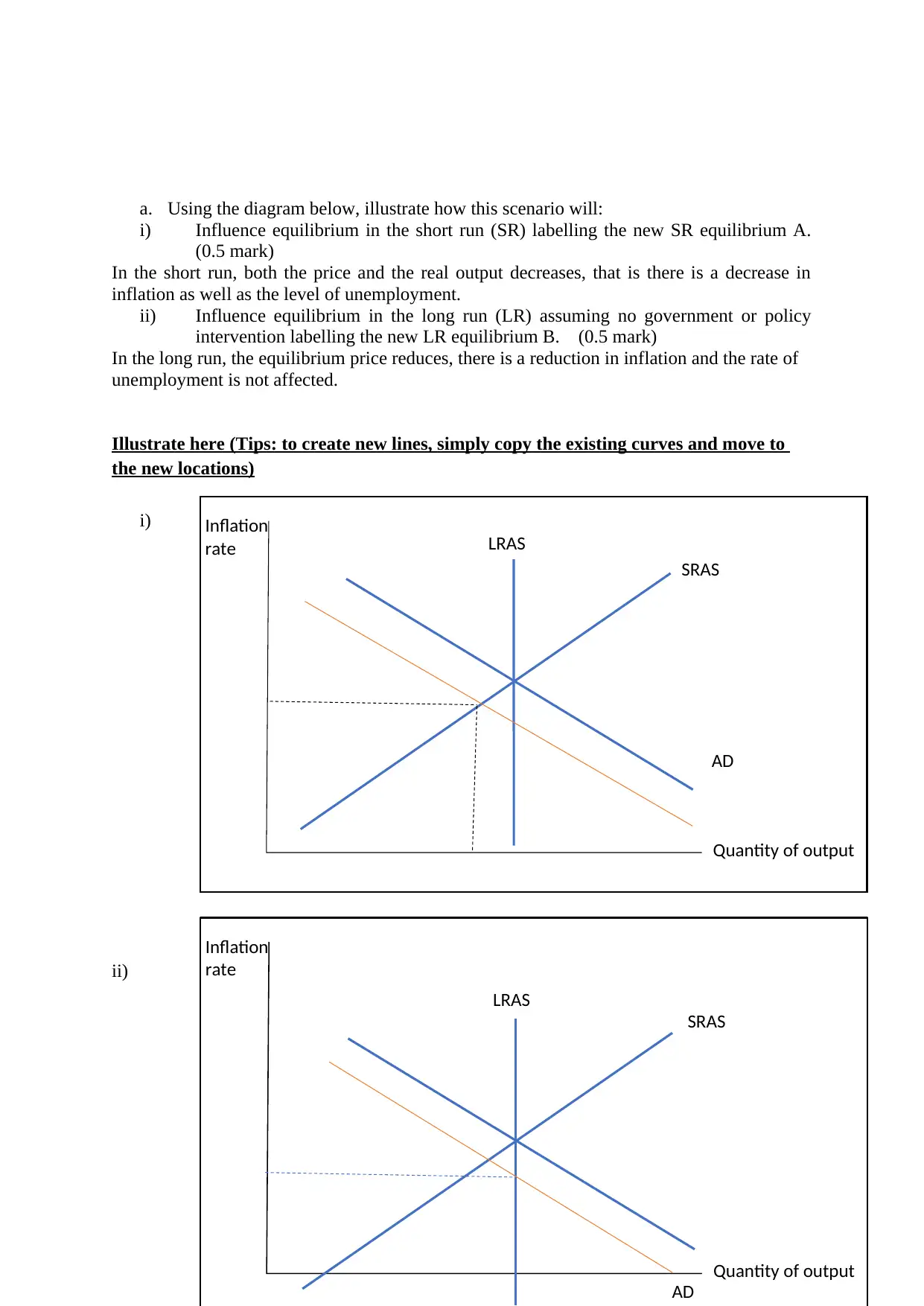

This report examines the macroeconomic effects of a credit squeeze. It begins by outlining the initial impact of a credit squeeze on aggregate demand, leading to a reduction in consumption and investment, and a subsequent decrease in real output and price levels. The report then delves into the short-run and long-run implications, illustrating how a credit squeeze affects inflation and unemployment, with the short-run effects including decreased prices and real output. In the long run, the analysis suggests a reduction in the equilibrium price with no impact on the unemployment rate. The report utilizes graphical representations to illustrate these shifts in aggregate supply and demand, using the aggregate demand/aggregate supply model. The report references key macroeconomic concepts and relevant literature to support its analysis.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)