Macroeconomics Assignment: Economic Equilibrium, Policies, and Impacts

VerifiedAdded on 2022/10/01

|14

|1088

|18

Homework Assignment

AI Summary

This macroeconomics assignment analyzes various economic concepts and policies. Section A covers the consumption function, equilibrium income, investment, and import functions. It also delves into the conditions for equilibrium income, the concept of marginal leakage rate, and different multipliers. Section B focuses on calculating equilibrium income, identifying a deflationary gap, and discussing expansionary fiscal policy. It further explores the crowding out effect and how monetary policy, including interest rate adjustments and open market operations, can address the GDP gap. The assignment also examines the impact of monetary policy on exchange rates and the effects of currency depreciation on net exports, GDP, and employment. The document concludes with a list of relevant references for further study and research.

Running head: MACROECONOMICS

Macroeconomics

Name of the Student

Name of the University

Author note

Macroeconomics

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS

Table of Contents

Section A.........................................................................................................................................2

Answer 1......................................................................................................................................2

Answer 2......................................................................................................................................3

Answer 3......................................................................................................................................3

Answer 4......................................................................................................................................4

Answer 5......................................................................................................................................5

Answer 6......................................................................................................................................5

Answer 7......................................................................................................................................5

Answer 8......................................................................................................................................6

Answer 9......................................................................................................................................6

Section B..........................................................................................................................................8

Answer 10....................................................................................................................................8

Answer 11....................................................................................................................................9

Answer 12....................................................................................................................................9

Answer 13..................................................................................................................................10

Answer 14..................................................................................................................................11

Answer 15..................................................................................................................................12

List of References..........................................................................................................................13

Table of Contents

Section A.........................................................................................................................................2

Answer 1......................................................................................................................................2

Answer 2......................................................................................................................................3

Answer 3......................................................................................................................................3

Answer 4......................................................................................................................................4

Answer 5......................................................................................................................................5

Answer 6......................................................................................................................................5

Answer 7......................................................................................................................................5

Answer 8......................................................................................................................................6

Answer 9......................................................................................................................................6

Section B..........................................................................................................................................8

Answer 10....................................................................................................................................8

Answer 11....................................................................................................................................9

Answer 12....................................................................................................................................9

Answer 13..................................................................................................................................10

Answer 14..................................................................................................................................11

Answer 15..................................................................................................................................12

List of References..........................................................................................................................13

2MACROECONOMICS

Consumption Expenditure: $262,619.0 million

Planned investment: $86,227.0 million

Government expenditure: $113,601.0 million

Export expenditure: $99,804.0 million

Import expenditure: $97,424.0 million

Autonomous taxes: $56,700.0 million

Income tax: 28%

Marginal propensity to save: 0.4

Marginal propensity to import: 0.1

Section A

Answer 1

Marginal Propensity ¿ Consume ( MPC )=1−MPS−MPT −MPM

¿ 1−0.4−0.28−0.1

¿ 1−0.78

¿ 0.22

The standard consumption function can be given as

C=a+ b Y d

Consumption Expenditure: $262,619.0 million

Planned investment: $86,227.0 million

Government expenditure: $113,601.0 million

Export expenditure: $99,804.0 million

Import expenditure: $97,424.0 million

Autonomous taxes: $56,700.0 million

Income tax: 28%

Marginal propensity to save: 0.4

Marginal propensity to import: 0.1

Section A

Answer 1

Marginal Propensity ¿ Consume ( MPC )=1−MPS−MPT −MPM

¿ 1−0.4−0.28−0.1

¿ 1−0.78

¿ 0.22

The standard consumption function can be given as

C=a+ b Y d

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS

C = Consumption, a = Autonomous consumption, b = Marginal Propensity to Consume, Yd =

Disposable income.

Disposable income ( Y d ) =Income− Autonomoustaxes

¿ ( $ 450 , 179.0−$ 56,700.0 ) Million

¿ $ 393,479.0 Million

Autonomous consumption=Consumption− ( b× Disposable income )

¿ $ 262,619.0− ( 0.22 × $ 393 , 479.0 ) Million

¿ ( $ 262,619.0−$ 86,565.4 ) Million

¿ $ 176 , 053.6 Million

Answer 2

Level of Saving=Income−Consumption expenditure−Government expenditure

¿ ( $ 450 , 179−$ 262,619.0−$ 113 , 601.0 ) Million

¿ $ 73959.0 Million

Answer 3

The condition of equilibrium income

Y =C + I+ G+( X−M )

Y: Income

I: Investment expenditure

C = Consumption, a = Autonomous consumption, b = Marginal Propensity to Consume, Yd =

Disposable income.

Disposable income ( Y d ) =Income− Autonomoustaxes

¿ ( $ 450 , 179.0−$ 56,700.0 ) Million

¿ $ 393,479.0 Million

Autonomous consumption=Consumption− ( b× Disposable income )

¿ $ 262,619.0− ( 0.22 × $ 393 , 479.0 ) Million

¿ ( $ 262,619.0−$ 86,565.4 ) Million

¿ $ 176 , 053.6 Million

Answer 2

Level of Saving=Income−Consumption expenditure−Government expenditure

¿ ( $ 450 , 179−$ 262,619.0−$ 113 , 601.0 ) Million

¿ $ 73959.0 Million

Answer 3

The condition of equilibrium income

Y =C + I+ G+( X−M )

Y: Income

I: Investment expenditure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS

G: Government expenditure

X: Export

M: Import

Actual Investment ( I )=Y −C−G− ( X −M )

¿ $ 450,179.0−$ 262 , 619.0−$ 113 , 601.0− ( $ 99,804.0−$ 97 , 424 ) Million

¿ ( $ 450 , 179.0−$ 262 , 619.0−$ 113 , 601.0−$ 2380.0 ) Million

¿ $ 71579.0 Million

Planned investment = $86, 227.0 Million

Unintended inventory investment= Actual investment−Planned investment

¿ ( $ 71579.0−$ 86 , 227.0 ) Million

¿−14 , 648.0 Million

Answer 4

Import=c +dY

c = Autonomous import, b = Marginal Propensity to import, Y = Income

Autonomousimport=Import expenditure−dY

¿ $ 97 , 424.0− ( 0.1× $ 450 , 179 ) Million

¿ ( $ 97 , 424.0−$ 45017.9 ) Million

¿ $ 52, 406.1 Million

G: Government expenditure

X: Export

M: Import

Actual Investment ( I )=Y −C−G− ( X −M )

¿ $ 450,179.0−$ 262 , 619.0−$ 113 , 601.0− ( $ 99,804.0−$ 97 , 424 ) Million

¿ ( $ 450 , 179.0−$ 262 , 619.0−$ 113 , 601.0−$ 2380.0 ) Million

¿ $ 71579.0 Million

Planned investment = $86, 227.0 Million

Unintended inventory investment= Actual investment−Planned investment

¿ ( $ 71579.0−$ 86 , 227.0 ) Million

¿−14 , 648.0 Million

Answer 4

Import=c +dY

c = Autonomous import, b = Marginal Propensity to import, Y = Income

Autonomousimport=Import expenditure−dY

¿ $ 97 , 424.0− ( 0.1× $ 450 , 179 ) Million

¿ ( $ 97 , 424.0−$ 45017.9 ) Million

¿ $ 52, 406.1 Million

5MACROECONOMICS

Answer 5

Net Export=A + BY

A = Autonomous net export, B = Marginal Propensity to import, Y = Income

Net Export =Export expenditure−Import expenditure

¿ ( $ 99 , 804.0−$ 97 , 424.0 ) Million

¿ $ 2380.0 Million

Autonomous net export=Net export−BY

¿ $ 2380.0− ( 0.1 × $ 450 ,179.0 ) Million

¿ ( $ 2380.0−$ 45017.9 ) Million

¿−42,637.9 Million

Answer 6

Autonomous planned expenditure=Autonomous consumption+ Planned investment + Autonomous net export

¿ ( $ 176053.6+$ 86,227.0−$ 42 , 637. 9 ) Million

¿ $ 219 ,642.7 Million

Answer 7

Given the scenario, it can be said that the economy is not in equilibrium since actual

investment is lower than planned investment indicating a negative unintended inventory

investment.

Answer 5

Net Export=A + BY

A = Autonomous net export, B = Marginal Propensity to import, Y = Income

Net Export =Export expenditure−Import expenditure

¿ ( $ 99 , 804.0−$ 97 , 424.0 ) Million

¿ $ 2380.0 Million

Autonomous net export=Net export−BY

¿ $ 2380.0− ( 0.1 × $ 450 ,179.0 ) Million

¿ ( $ 2380.0−$ 45017.9 ) Million

¿−42,637.9 Million

Answer 6

Autonomous planned expenditure=Autonomous consumption+ Planned investment + Autonomous net export

¿ ( $ 176053.6+$ 86,227.0−$ 42 , 637. 9 ) Million

¿ $ 219 ,642.7 Million

Answer 7

Given the scenario, it can be said that the economy is not in equilibrium since actual

investment is lower than planned investment indicating a negative unintended inventory

investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMICS

The condition of equilibrium income

Y =C + I +G+ ( X−M )

¿ $ 262 ,619.0+ $ 86 , 227.0+ $ 113 , 601.0+ ( $ 99,804−$ 97 , 424 ) Million

¿ ( 262,619.0+86,227.0+113,601.0+ $ 2380.0 ) Million

¿ $ 464 ,827.0 Million

Answer 8

Marginal leakage rate=MPS+ MPT +MPM

¿ 0.4+ 0.28+0.1

¿ 0.78

Marginal leakage rate in the economy symbolizes portion of income that is not spent on

domestic consumption. This part of the income presents income that is excluded from the

iterative process of the circular process (Burda and Wyplosz 2013). Saving, income tax and

import together constitute total leakages of the economy.

Answer 9

Expenditure Multiplier Expenditure Multiplier= 1

Total Leakages

¿ 1

MPS+MPT + MPM

¿ 1

0.4+0.28+ 0.1

The condition of equilibrium income

Y =C + I +G+ ( X−M )

¿ $ 262 ,619.0+ $ 86 , 227.0+ $ 113 , 601.0+ ( $ 99,804−$ 97 , 424 ) Million

¿ ( 262,619.0+86,227.0+113,601.0+ $ 2380.0 ) Million

¿ $ 464 ,827.0 Million

Answer 8

Marginal leakage rate=MPS+ MPT +MPM

¿ 0.4+ 0.28+0.1

¿ 0.78

Marginal leakage rate in the economy symbolizes portion of income that is not spent on

domestic consumption. This part of the income presents income that is excluded from the

iterative process of the circular process (Burda and Wyplosz 2013). Saving, income tax and

import together constitute total leakages of the economy.

Answer 9

Expenditure Multiplier Expenditure Multiplier= 1

Total Leakages

¿ 1

MPS+MPT + MPM

¿ 1

0.4+0.28+ 0.1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMICS

¿ 1

0.78

¿ 1.28

Autonomous Tax Multiplier

Autonomoustax multipler = −MPC

1−MPC

¿ −0.22

1−0.22

¿ −0.22

0.78

¿−0.28

Income tax multiplier

Tax multiplier= −1

1−MPC ( 1−t )

¿ −1

1−0.22 ( 1−0.28 )

¿ −1

1− ( 0.22 ×0.72 )

¿ −1

1−0.16

¿ −1

0.84

¿−1.19

¿ 1

0.78

¿ 1.28

Autonomous Tax Multiplier

Autonomoustax multipler = −MPC

1−MPC

¿ −0.22

1−0.22

¿ −0.22

0.78

¿−0.28

Income tax multiplier

Tax multiplier= −1

1−MPC ( 1−t )

¿ −1

1−0.22 ( 1−0.28 )

¿ −1

1− ( 0.22 ×0.72 )

¿ −1

1−0.16

¿ −1

0.84

¿−1.19

8MACROECONOMICS

Section B

Answer 10

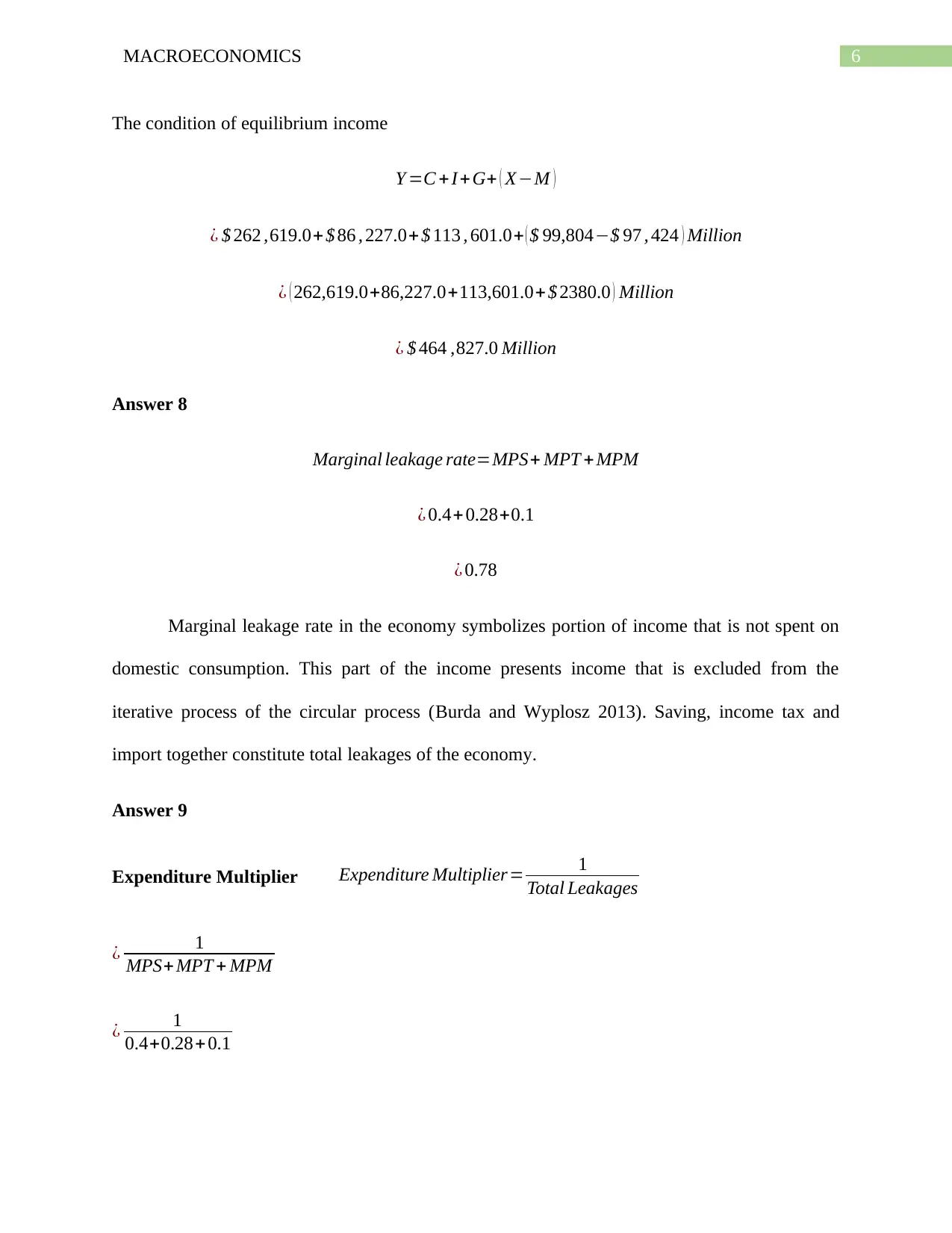

Equilibrium income for the given economy is obtained as $464,827.0 Million. The

natural level of income for this economy is $490, 000 Million. The equilibrium GDP is less than

natural income meaning existence of deflationary gap in the economy (Rochon and Rossi 2016).

The estimated deflationary gap for the economy is ($490, 000 - $464, 827) Million = -$25, 173

Million.

Figure 1: AD-AS model and GDP gap

Section B

Answer 10

Equilibrium income for the given economy is obtained as $464,827.0 Million. The

natural level of income for this economy is $490, 000 Million. The equilibrium GDP is less than

natural income meaning existence of deflationary gap in the economy (Rochon and Rossi 2016).

The estimated deflationary gap for the economy is ($490, 000 - $464, 827) Million = -$25, 173

Million.

Figure 1: AD-AS model and GDP gap

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMICS

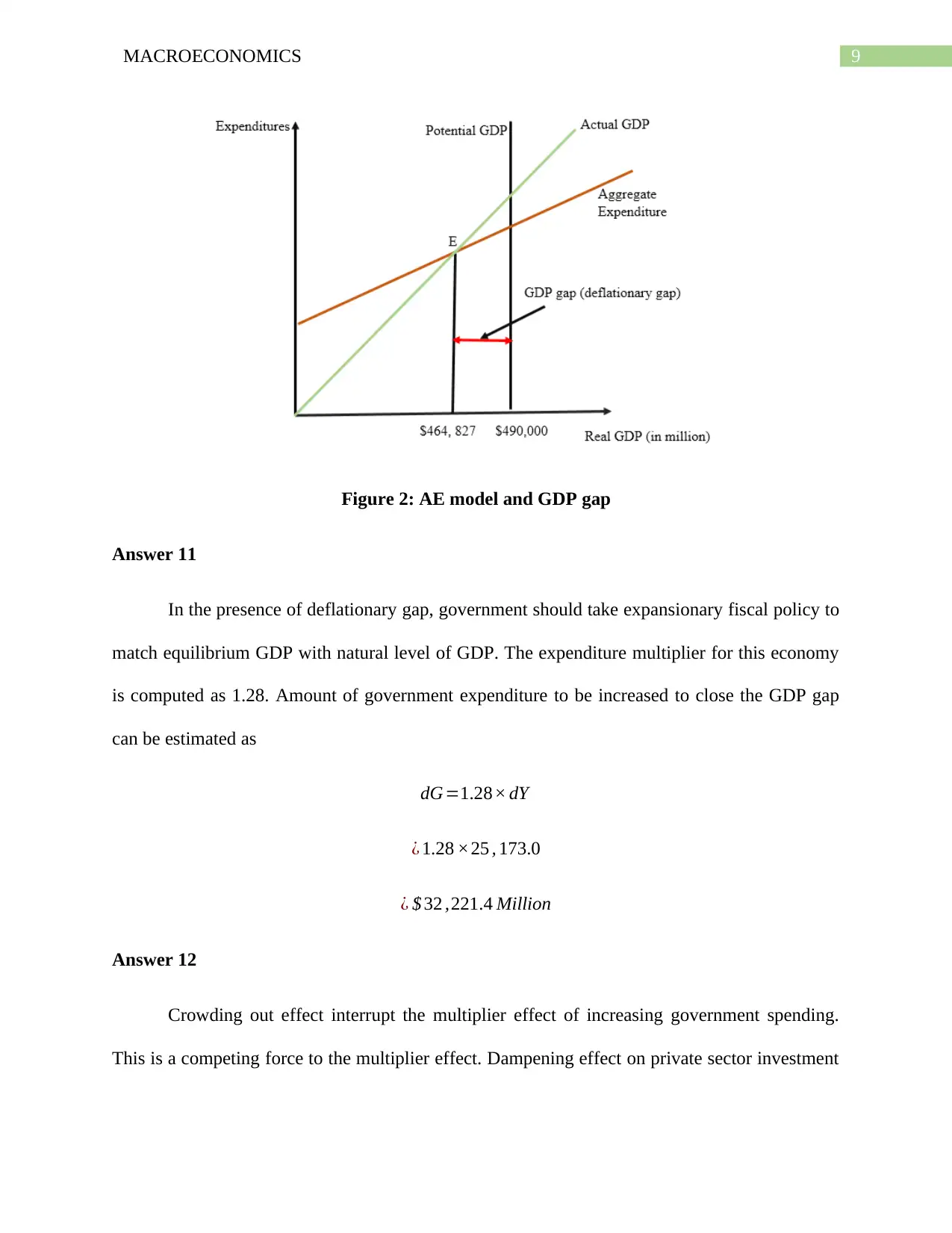

Figure 2: AE model and GDP gap

Answer 11

In the presence of deflationary gap, government should take expansionary fiscal policy to

match equilibrium GDP with natural level of GDP. The expenditure multiplier for this economy

is computed as 1.28. Amount of government expenditure to be increased to close the GDP gap

can be estimated as

dG=1.28× dY

¿ 1.28 ×25 , 173.0

¿ $ 32 ,221.4 Million

Answer 12

Crowding out effect interrupt the multiplier effect of increasing government spending.

This is a competing force to the multiplier effect. Dampening effect on private sector investment

Figure 2: AE model and GDP gap

Answer 11

In the presence of deflationary gap, government should take expansionary fiscal policy to

match equilibrium GDP with natural level of GDP. The expenditure multiplier for this economy

is computed as 1.28. Amount of government expenditure to be increased to close the GDP gap

can be estimated as

dG=1.28× dY

¿ 1.28 ×25 , 173.0

¿ $ 32 ,221.4 Million

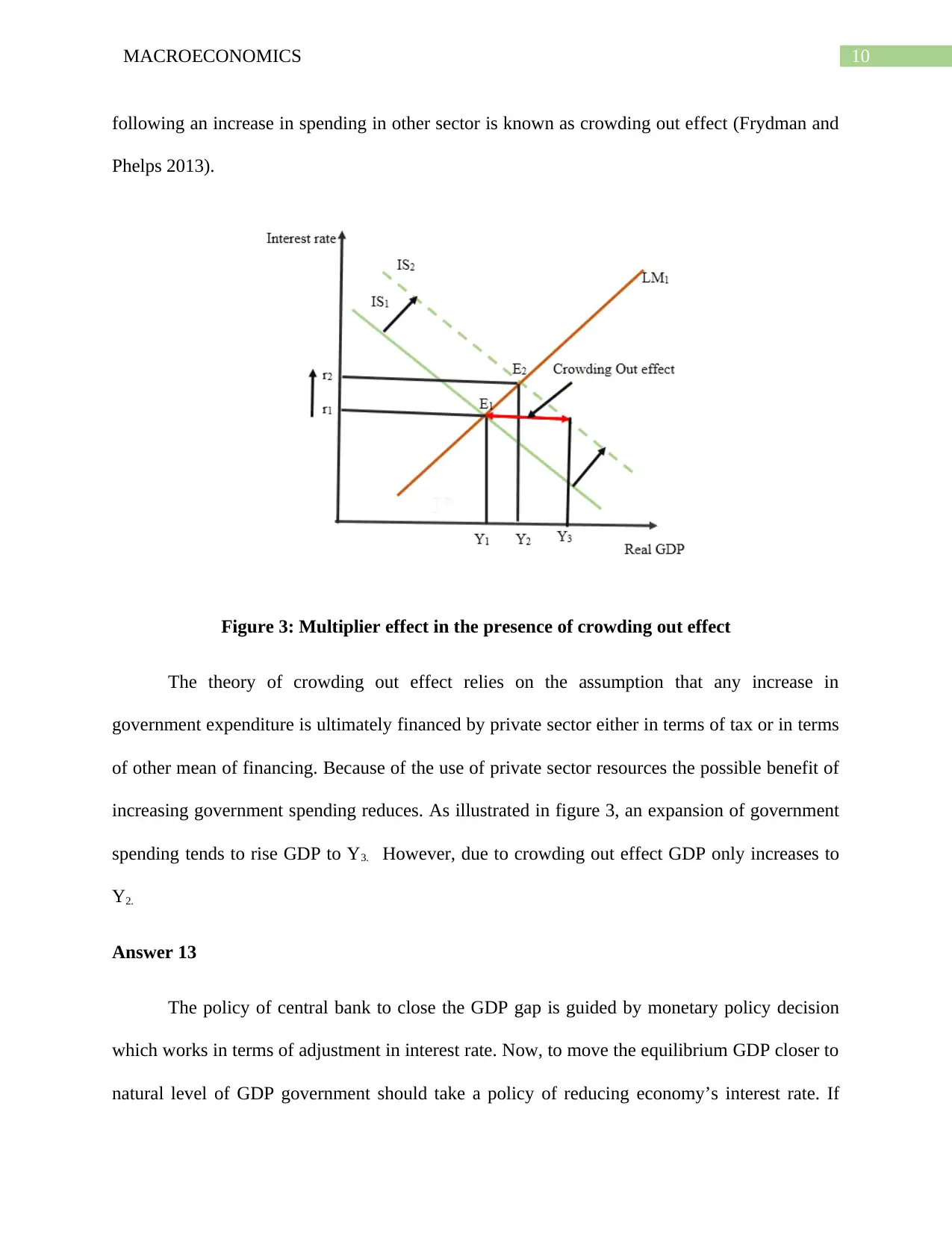

Answer 12

Crowding out effect interrupt the multiplier effect of increasing government spending.

This is a competing force to the multiplier effect. Dampening effect on private sector investment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMICS

following an increase in spending in other sector is known as crowding out effect (Frydman and

Phelps 2013).

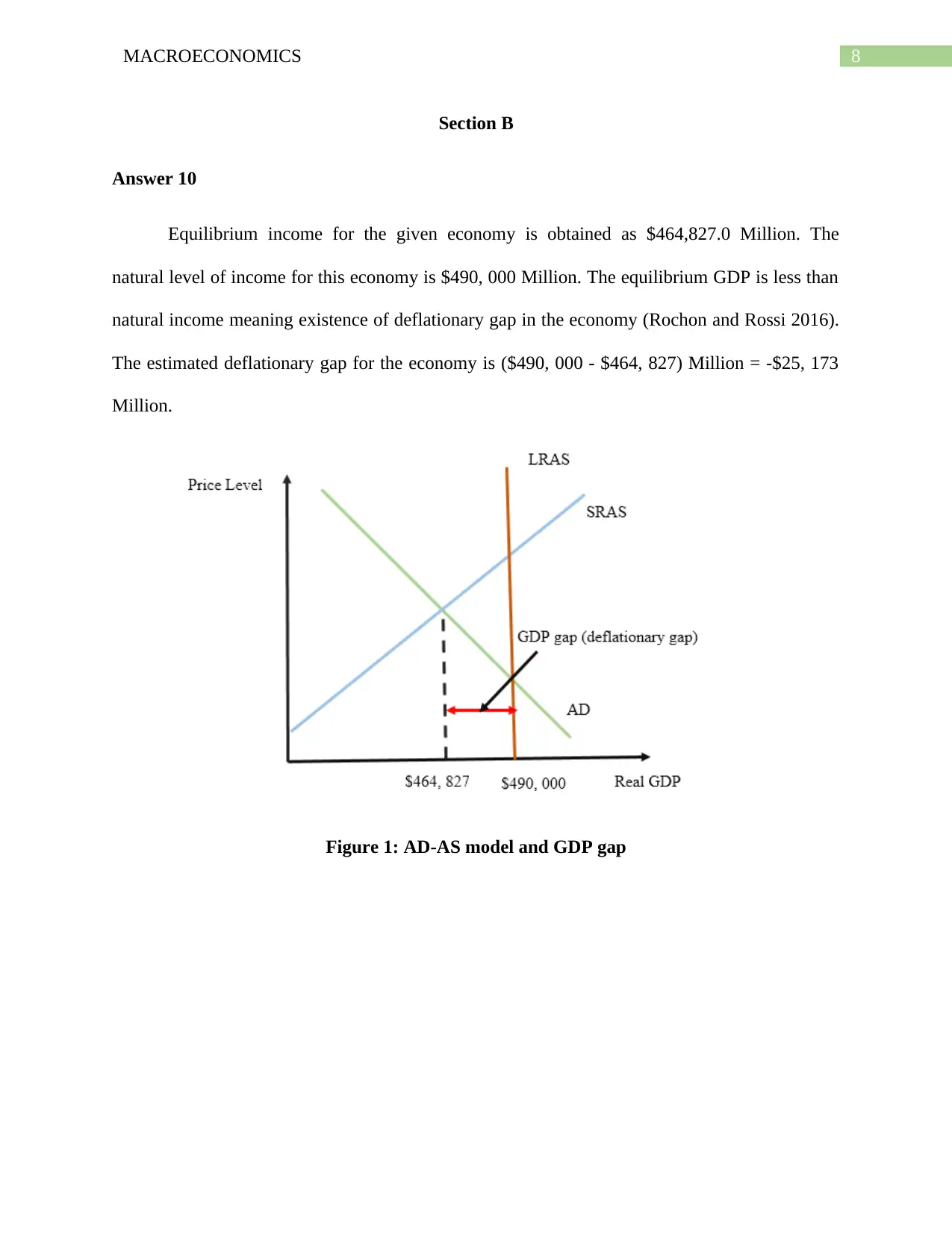

Figure 3: Multiplier effect in the presence of crowding out effect

The theory of crowding out effect relies on the assumption that any increase in

government expenditure is ultimately financed by private sector either in terms of tax or in terms

of other mean of financing. Because of the use of private sector resources the possible benefit of

increasing government spending reduces. As illustrated in figure 3, an expansion of government

spending tends to rise GDP to Y3. However, due to crowding out effect GDP only increases to

Y2.

Answer 13

The policy of central bank to close the GDP gap is guided by monetary policy decision

which works in terms of adjustment in interest rate. Now, to move the equilibrium GDP closer to

natural level of GDP government should take a policy of reducing economy’s interest rate. If

following an increase in spending in other sector is known as crowding out effect (Frydman and

Phelps 2013).

Figure 3: Multiplier effect in the presence of crowding out effect

The theory of crowding out effect relies on the assumption that any increase in

government expenditure is ultimately financed by private sector either in terms of tax or in terms

of other mean of financing. Because of the use of private sector resources the possible benefit of

increasing government spending reduces. As illustrated in figure 3, an expansion of government

spending tends to rise GDP to Y3. However, due to crowding out effect GDP only increases to

Y2.

Answer 13

The policy of central bank to close the GDP gap is guided by monetary policy decision

which works in terms of adjustment in interest rate. Now, to move the equilibrium GDP closer to

natural level of GDP government should take a policy of reducing economy’s interest rate. If

11MACROECONOMICS

interest rate is to be lowered using open market operation then government should purchase

government securities from the open market (Ehnts 2016). When government buys government

securities there is a resulted increase in money supply which in turn lowers the interest rate.

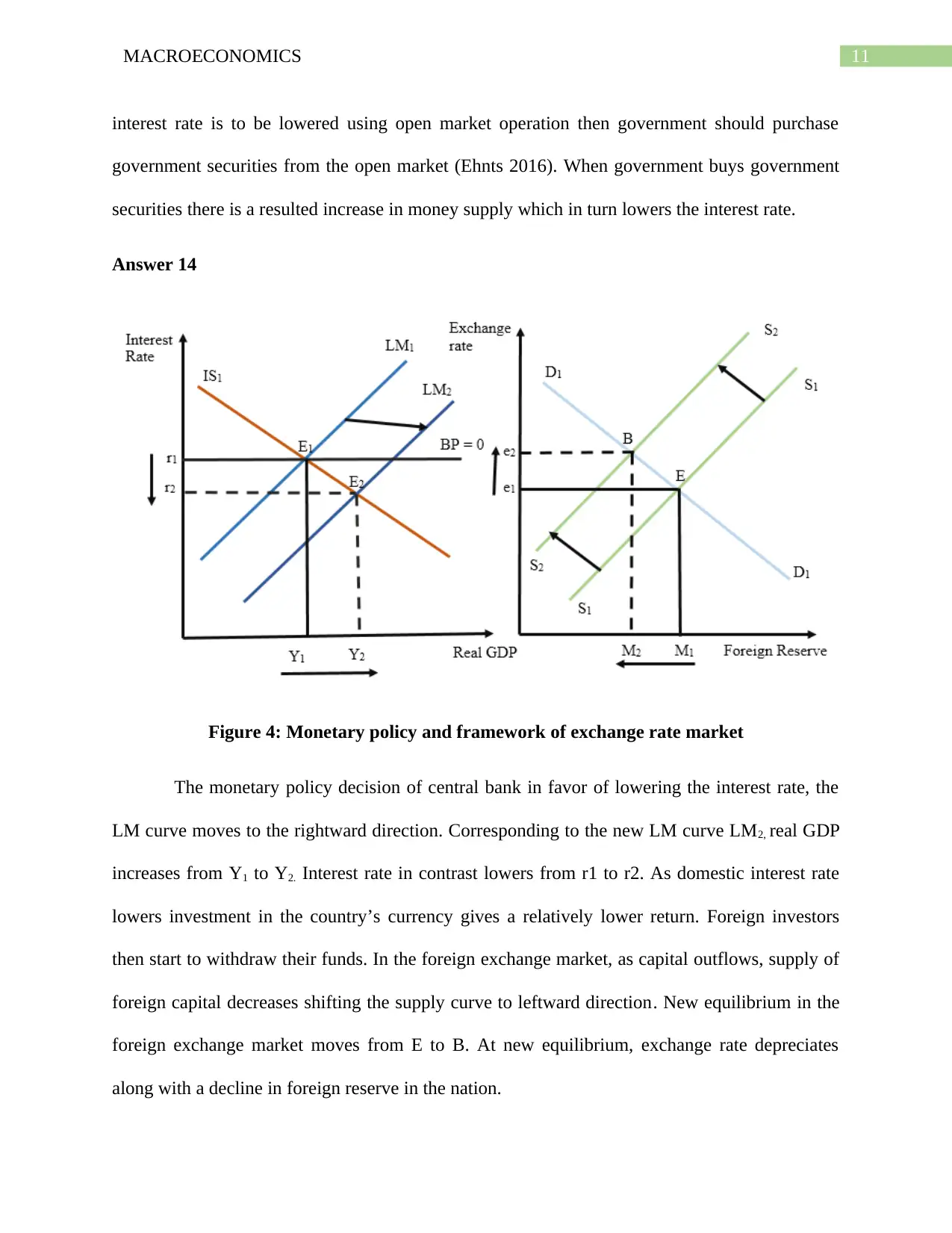

Answer 14

Figure 4: Monetary policy and framework of exchange rate market

The monetary policy decision of central bank in favor of lowering the interest rate, the

LM curve moves to the rightward direction. Corresponding to the new LM curve LM2, real GDP

increases from Y1 to Y2. Interest rate in contrast lowers from r1 to r2. As domestic interest rate

lowers investment in the country’s currency gives a relatively lower return. Foreign investors

then start to withdraw their funds. In the foreign exchange market, as capital outflows, supply of

foreign capital decreases shifting the supply curve to leftward direction. New equilibrium in the

foreign exchange market moves from E to B. At new equilibrium, exchange rate depreciates

along with a decline in foreign reserve in the nation.

interest rate is to be lowered using open market operation then government should purchase

government securities from the open market (Ehnts 2016). When government buys government

securities there is a resulted increase in money supply which in turn lowers the interest rate.

Answer 14

Figure 4: Monetary policy and framework of exchange rate market

The monetary policy decision of central bank in favor of lowering the interest rate, the

LM curve moves to the rightward direction. Corresponding to the new LM curve LM2, real GDP

increases from Y1 to Y2. Interest rate in contrast lowers from r1 to r2. As domestic interest rate

lowers investment in the country’s currency gives a relatively lower return. Foreign investors

then start to withdraw their funds. In the foreign exchange market, as capital outflows, supply of

foreign capital decreases shifting the supply curve to leftward direction. New equilibrium in the

foreign exchange market moves from E to B. At new equilibrium, exchange rate depreciates

along with a decline in foreign reserve in the nation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.